Himanshu

Joshi*

Devoted to the analysis of housing market in India,

the paper employs a special decomposition scheme for the structural VAR

proposed by Blanchard and Quah (1989) to study the impact of permanent shocks

to housing prices attributed to monetary variables and income growth - and, in

the process, attempts to identify speculative price bubbles in

the housing market. Based on the monthly data, the empirical evidence obtained

in the paper suggests that the housing market in India at present

remains fairly well equilibrated if seen in terms of the proximity of the actual

housing prices and the estimated long run equilibrium housing prices. This implies

that the risk of speculation in the market is not yet materially significant.

However, as a mark of caution, since the empirical results indicate that housing

prices are significantly much more sensitive to permanent interest rate shocks

than shocks to credit growth, the stance of monetary policy particularly

that reflected by the setting of the policy rate appears to be the single most

important arbiter of the future growth of the housing market. Needless to mention,

it is therefore necessary to take this factor into due account while developing

policy approaches in relation to the housing sector. Besides, as income growth

explains quite little about variations in housing prices, the possibility of some

adverse selection in overall bank financing of the housing sector cannot be completely

ruled out.

JEL Classification : E58, R31

Keywords : Structural

VAR, decomposition, forecast error variance, asset prices, permanent shocks.

Introduction

The rapid growth of the housing

market in India in the recent years has raised concerns about its sustainability

and implications for financial and macroeconomic stability. In the history of

economic development, housing price bubbles have been recorded and studied with

great interest. With the hindsight of documented experience, the bursting of asset

bubbles in the housing market has often been associated with severe economic crises,

especially, recessions caused by sharp reduction in spending as a result of loss

in the consumers’ power to leverage against capital gains. International

Monetary Fund (IMF) research reported in the World Economic Outlook (April, 2003)

indicated that output losses after house-price crashes in developed countries

have, on average, been twice as large as those after stock market crashes, usually

resulting in lasting recessions. The pace of housing sector growth can be gauged

by the fact that the total value of residential property in developed economies

increased by an estimated US $ 20 trillion to over US$ 60 trillion in the last

three years which is even higher than the increase in global share values (Vedpuriswar,

2005). The surge in value of the stock of housing supported by an equally strong

upturn in prices has led analysts to wonder if this boom is really sustainable

or is merely a large financial bubble ready to burst. The recent surge in housing

prices globally has gone hand-in-hand with a much larger jump in household debt

than in previous booms. It is understood that not only that new buyers engaged

bigger mortgages, but even existing owners increased their mortgages to turn capital

gains into cash thereby causing a rally in housing prices.

Although the

surge in the housing market in India is relatively a recent phenomenon, the rapid

growth in bank financing in this sector requires attention in the light of the

experience in other countries. The paper is divided into five sections. Sections

I and II provide a review of international experience and the development of the

Indian housing market, respectively. Section III discusses data and methodology.

Sections IV and V include empirical evidence and concluding observations,

respectively.

Section I

Housing Markets: An International Perspective In

a recently released review of the housing market, OECD Economic Outlook No.78

(2005) offers a detailed analysis of recent house price developments in the OECD

countries in the backdrop of the experience of the past 35 years and in the context

of the role of fundamentals. The OECD Outlook mentions that of the 37 large

upturn phases between 1970 and the mid-1990s, 24 ended in downturns in which anywhere

from one-third to well over 100 per cent of the previous real term gains were

wiped out. This, in turn, had negative implications for activity, particularly

consumption. It also observed that the current upswing in OECD countries

is more generalised than in the past with a combination of factors, such as, low

interest rates coupled with development of new and innovative financial products

playing an important role. In regard to fundamental determinants of housing prices,

while price-to-income ratio is considered a ready measure of affordability, it

is by itself not a reliable measure since the cost of carrying mortgages varies

over time. An assessment of a more useful measure namely, the debt servicing ratio

for the OECD countries indicates that the general increase in indebtedness has

been mostly offset by the decline in borrowing rates, and with the exception of

Australia, the Netherlands and New Zealand, households do not seem to devote greater

share of their income to debt service than in the recent past. According to the

OECD Economic Outlook another approach to evaluating housing prices is based on

asset pricing which uses measures, such as, price-to-rent ratio and user

cost of housing. Taking these two measures, the review reports that housing prices

in the UK, Ireland, the Netherlands, Spain, Australia and Norway were considered

overvalued while those in France, Canada, Denmark, Sweden, Finland, Italy

and New Zealand were not significantly overvalued. Housing prices are also

impacted by other factors such as supply conditions, demographic changes and speculative

pressures. Furthermore, housing cycles can influence economic activity through

wealth effects on consumption and private residential investment due to changes

in the profitability and the impact on employment and demand in property related

sectors. Shocks to housing prices also have implications for financial stability

as financial institutions with large exposures in the housing sector could find

themselves with inadequate cushions to absorb the losses leading to deterioration

in overall credit delivery. In regard to policy implications, views differ on

how the monetary authorities should respond to housing price developments. The

choice between using regulatory/tax actions or monetary policy actions is contextual

but useful so long as the measures are appropriately designed with reference

to the size of the actual shock. In the United States economy, which is

at present experiencing a strong cycle in the housing market, prices in certain

regions have risen sharply if measured against the yardstick of affordability

calculated as the ratio of housing prices to annual income reflecting a build

up of the asset bubble. In fact, at present, the median price of new house in

the US is almost five times the median household income. More importantly, even

as housing prices have risen, the rental values have remained subdued suggesting

presence of speculative forces. Thus, with the rise in house prices relative

to rental rates, the house price/rental ratio in the US moved above its long run

average, suggesting that house prices were indeed high relative to rents (Krainer,

2003). The strong upsurge in the housing market in the US is a source of concern,

especially, for the global financial stability should the market suffer a sharp

downturn. In the context of the present conditions in the global housing

markets where the mortgage financing rates have fallen significantly since the

last few decades, the IMF has cautioned that, just as the upswing in house prices

has been an international phenomenon, so any downturn is likely to be synchronised,

causing widespread effects. Section II

Development of Housing Market in India : A Review

In a country with a vast population, the problem of providing shelter to all has

been an issue of great concern to the civil society and the governments

of various times. It has, therefore, generally been subsumed that state intervention

is necessary to meet the housing requirements of the vulnerable sections and to

create an enabling environment to achieve the providing of shelter for all on

a self-sustainable basis. Concrete governmental initiatives began in the early

1950s as a part of the First Five Year Plan (1951-56) with a focus on institution-building

and housing for weaker sections of society. In the subsequent five year plans,

government action ranged from strengthening the provision of housing for the poor

and the introduction of several schemes for housing in the rural and urban regions

of the country. During the early years of housing development in India, initiatives

were taken mostly by the government, and it is only in the recent years

that private construction activity has made significant contributions mainly in

urban or semi- urban regions in the area of housing/real estate development. It

may be mentioned that the current surge in housing demand is generally limited

to large urban metropolitan regions, although smaller towns near these centers

have also seen some good growth alongside. In the history of housing development,

the Second Five Year Plan (1956-61) saw the enactment of legislations for

orderly town and country planning including the setting up of relevant organisations

and for the preparation of master plans for important towns. In 1959 the central

government announced a scheme to offer assistance in the form of loans to state

governments for a period of 10 years for acquisition and development of land in

order to make available building sites in sufficient numbers. During this period

master plans for major cities were also prepared. The Third Plan (1961-66)

led to the coordination of various programmes to help housing for low-income groups.

The Fourth Plan (1969-74) took a pragmatic view on the need to prevent the growth

of population in large cities and decongestion and dispersal of population through

the creation of smaller townships. The Housing & Urban Development Corporation

(HUDCO) was established to fund housing and urban development programmes. A scheme

for improvement of infrastructure was also undertaken to provide basic amenities

in cities across the country. In order to reduce the pressure of urbanisation

the Fifth Plan (1974-79) yet again reiterated the policy of promoting smaller

towns in new urban centres, while emphasising on the improvement of civic amenities

in urban and metropolitan regions. The Urban Land (Ceiling & Regulation) Act

was enacted to prevent concentration of land holdings in urban areas and to make

urban land available for construction of houses for the middle- and low-income

groups. The Sixth Plan (1980-85) refocused attention on the provision of services

along with shelter, particularly for the poor. The programme of Integrated Development

of Small and Medium Towns was launched in small towns for development of roads,

pavements, minor civic works, bus-stands, markets, shopping complexes, etc.

Positive incentives were offered for setting up new industries and commercial

and professional hubs in small, medium and intermediate towns.

The

Seventh Plan (1985-90) made a marked departure in the focus given to the government-led

housing development stressing on the need to place major responsibility of housing

construction to the private sector. To augment the flow of institutional finance

to the housing sector and promoting and regulating housing finance institutions,

the National Housing Bank (NHB) was set under the aegis of the Reserve Bank of

India in 1988. The Seventh Plan clearly also recognised the problems of the urban

poor and for the first time an Urban Poverty Alleviation Scheme known as Urban

Basic Services for the Poor (UBSP) was introduced. This was also the period when

private builders were offered incentives to participate and contribute in building

mass housing projects.

The Eighth Plan (1992-97), for the first time,

recognised the role and importance of the urban sector for the national economy.

The Plan identified the key issues in the emerging urban areas, viz.,

the widening gap between demand and supply of infrastructural services, the increased

growth of urban population and deterioration of city environments. The new

Housing and Habitat Policy unveiled in 1998 aimed at ensuring “shelter for

all” and better quality of life to all citizens by using the unused

potential in public, private and household sectors. The key objective of the policy

was on creating strong public–private partnership for tackling the housing.

Under the new policy, government proposed to offer fiscal concessions, carry out

legal and regulatory reforms and create an enabling environment for the development

of the housing sector. The policy emphasised the role of the private sector, as

the other partner, to be encouraged to take up the land assembly, housing construction

and invest in infrastructure facilities.

Ever since the added emphasis

was given to private initiative in housing development, there has been a rapid

growth in private investment in housing with the emergence of real estate developers

mainly in metropolitan centres and other fast growing townships. The growth has

been fuelled by rising business opportunities in new and emerging enterprises,

increasing income levels, low interest rates, employment generation and demographic

changes. However, even as significant changes in laws, regulations have encouraged

housing development, policy analysts believe that further reforms

such as tax/stamp duty rationalisation that provide a level playing field to the

housing sector may need to be carried forward to tap the unmet demand for housing

stock. In the recent years for example, the scrapping of the Urban Land (Ceiling

& Regulation) Act by the central government, amendment of the NHB Act to provide

for easy foreclosure and permission for foreign direct investment to make

investments in real estate have provided an encouraging investment climate. An

Advisory Board with professionals has also been constituted to advice the government

on matters relating to the development of the housing sector. In any case,

introduction of measures mentioned above, the easing of monetary policy stance

and the priority given to the housing sector in RBI’s credit policies and

the recent Union Budgets have all provided incentives to both financial institutions

and buyers of residential property.

Housing market in India, as evidenced

by the growth in bank exposures to the sector took off mainly since the year 2001.

For example, the retail loan portfolios of banks including housing and real estate

advances expanded at rates ranging between 22-41 per cent since 2001-02

and accounted for 26.7 per cent of the incremental non-food credit in 2005-06.

As per the RBI’s Annual Policy Statement for the year 2006-07, the incremental

growth in the loans to commercial real estate and housing clocked rates of 84.4

per cent and 29.1 per cent, respectively, in 2005-06. The rapid growth

in housing loan market has been supported, inter alia, by the growth

in the middle class population, favourable demographic structure, rising job opportunities

in the metropolitan centres, emergence of a number of second tier cities as upcoming

business centres, IT and ITES related boom and rise in disposable incomes.

Furthermore, attractive tax advantages for housing loans make them ideal vehicles

for tax planning for salary earners. The real estate market has also grown rapidly

recording an annual price appreciation in excess of 10 per cent or more depending

on regional importance. The real estate market has been boosted by the proposal

to permit 100 per cent FDI in the sector. For banks and other housing finance

institutions, the regulatory framework enabled expansion in house loan portfolios

given the helpful prescriptions on risk weights for housing exposures and the

benefit of compliance with the targets mandated for priority sector lending. Besides,

housing loans growth by financial institutions has been assisted by the comfort

of relative safety of such assets given the tangible nature of the primary security

and the comfort obtained from the SARFAESI Act, 2002.

As

alluded to earlier, one of the most significant factor that drove

the growth of housing market in India in the recent years was the easy availability

of bank finance at affordable interest rates owing to surplus liquidity

with the banking sector coupled with the softening of interest rate

environment on the back of lower inflationary expectations. It may be mentioned

that the reductions in interest rates in the housing market have been far more

noteworthy as has been the case of in respect of other retail and corporate

advances because of low risk perception and favorable fiscal and regulatory dispensations.

Concerns regarding the sustainability of increasing growth in housing and

other retail financing by financial institutions now appear to be arising given

the increasing load of household debt as reflelected by the wide gap between borrowings

and repayments as reported by the latest round of decade-wise NSSO survey. The

situation calls for caution on the dangers of building up of systemic credit risk

and the instability of the financial system as a whole.

The sharp growth

in the housing and the real estate markets has nevertheless been of concern to

policy makers especially in the context of its implications for macroeconomic

and financial stability in the event of a sudden downturn. Being a recent phenomenon,

the recorded history of financial markets in India has so far not experienced

the pangs caused by bursting of bubbles in the housing sector, although

the need to take pre-emptive policy actions can hardly be overemphasised in the

light of the experience in other countries. It may be mentioned that as a part

of calibrated policy response, the Reserve Bank has been gradually nudging financial

institutions to exercise due diligence in the assessment of credit risks for exposures

in the housing sector, while increasing the regulatory risk weights/ provisioning

for housing and real estate loans. As a preemptive measure the Reserve Bank in

its Annual Policy Statement for the year 2006-07 increased general provisioning

for residential housing beyond Rs 20 lakh and commercial real estate from 0.40

per cent to 1.0 per cent. The risk weight on bank exposure to commercial real

estate has also been increased from 125 per cent to 150 per cent. While

all round development of the housing sector is a welcome objective, it is also

important to take note of the pace of the cyclical growth in recognition of the

risks of build up of asset price bubbles. Of the several factors that contribute

to the occurrence of bubbles, high credit growth backed by low interest rates

is considered equally more important. It may, therefore, be useful to have some

empirical analysis devoted to the assessment of the current conditions in the

housing market from the point of view of developing policy choices in regard to

the housing market. The empirical research on housing market in India is

scarce due to the paucity of information. With the objective of filling the void,

this paper attempts a technical analysis of housing price bubbles in India - particularly

aiming at separating the real from speculative price elements by focusing on the

relevant monetary aggregates that have a bearing on the growth of the housing

market. There are a number of factors which appear to be important for the growth

of housing market consisting of income growth, mix of monetary policy, tax and

regulatory incentives and procedural ease of loan disbursals, etc. The

speculative factors, on the other hand, may depend on the hype built around advertising,

asymmetric information and speculative or herd behavior causing prices to rise

to unsustainable levels and beyond that determined by relevant factors mentioned

above. Although it is difficult to identify a house price bubble which occurs

due to a deviation of market price from the fundamental value of the house, a

number of eclectic approaches for identification have been used. Section

III

Data and Empirical Methodology

Although the housing sector of the economy has received considerable attention

in the recent years given its core importance in the developmental goals of the

Indian economy, its significance in sustaining financial stability has been recognised

rather recently following the significant credit growth at low rates of interest

in the recent past. The data in respect of aggregate credit disbursed to the housing

sector and national price index for housing output is not easily available on

monthly frequency at which data is used in this study for the period from April

2001 to June 2005. As a result, this study is based on data which may be

considered good proxies although this might be considered as an extent of limitation.

However, given the fact that housing credit has formed a dominant share

of overall non-food growth in the recent years, the actual annual growth in housing

credit can be expected to be highly correlated with that of growth in non food

credit which can be considered a good measure of the former. In fact the

choice of proxy for housing credit is also supported by the fact that for the

time sample under consideration, the correlation coefficient between available

annual outstanding housing credit and non food credit is quite high. The price

of housing is represented by the index of housing prices for major metropolitan

centres compiled and provided by a bank. Although the price index for metropolitan

centres does not capture the country wide pricing conditions, the index nevertheless

provides a good guide to price developments since most of the price increase in

housing output in the recent years has been observed in metropolitan regions.

As for interest rate on housing finance, the weighted average call money rate

is taken as the proxy for interest rate on housing loans as the lack of information

on higher frequency weighted lending rate on housing loans limits the use of such

data. It may, however, be pointed out that among all other sector specific interest

rates, the movement in the interest rates on housing loans whether fixed or floating

have been by and large synchronous with the short term money market rate in the

recent years, as evidenced by the reduction of interest rate on housing loans

for a 20-year tenure from a high of 13-14 per cent per annum in 2000 to about

7-8 per cent in 2006 following the progressive reduction in RBI’s

policy interest rate. Finally, it is also necessary to include the income

variable in the system for assessing the impact on housing prices. The income

variable is taken as the annual growth rate in real GDP. The experimental

design is based on deflating all nominal variables by the rate of inflation based

on wholesale price index (1993-94=100) in order to have the system defined fully

in real terms.

The interpretation of the structural VAR considered

here is made in terms of four shocks, viz., interest rate (εint),

non food credit (εnfoodcredit), GDP growth (εgdpgrowth)

and housing prices (εhsgprice) shocks related to system equations

for changes in interest rate, housing credit, GDP growth and housing prices. The

analytical results from this experimental design would, therefore, throw light

on how the housing market could be affected by the monetary conditions, especially,

given the prevailing high growth in credit accompanied by low interest rates as

well as GDP or income growth. The specification is also meaningful as the increase

in housing prices are observed to have been noticed mainly in select metropolitan

centres and other urban regions where borrowers have easier access to bank credit

and those who gain relatively more from a rise in economic growth. The algebraic

form of the VAR model is based on the representation proposed by Blanchard and

Quah (1989) which enables the characterisation and study of the impact of permanent

shocks with respect to each of the variables included in the model.

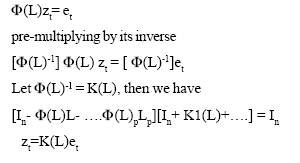

Including stationary variables in the structural VAR, and ordering the vector

as  ,

the model is as follows ,

the model is as follows

(1) where

K(L) is the vector of reduced where K(L) is of a finite order and where et

form independent white noise errors corresponding to the individual equations

in the structural VAR with a covariance matrix  .

Assuming that the orthogonal structural shocks (εt below) can

be written as linear et=Ro εt where

Ro is combinations of the structural errors (1) especially, et et a

non singular matrix. The moving average representation (MAR) of system (1) containing

the original residuals then can be written down terms in the orthogonal disturbances

with each of the et normalised to have unit variance .

Assuming that the orthogonal structural shocks (εt below) can

be written as linear et=Ro εt where

Ro is combinations of the structural errors (1) especially, et et a

non singular matrix. The moving average representation (MAR) of system (1) containing

the original residuals then can be written down terms in the orthogonal disturbances

with each of the et normalised to have unit variance

zt

= R(L) εt (2) where K(L)Ro

= R(L) and for positive definite matrix  .

Equation (2) forms the basis for obtaining Blanchard and Quah decomposition. In

particular if Ro is identified then the MA representation can be directly

derived from (2). However, since Ro is a four by four matrix, a total

of ten restrictions are required for identification. Since .

Equation (2) forms the basis for obtaining Blanchard and Quah decomposition. In

particular if Ro is identified then the MA representation can be directly

derived from (2). However, since Ro is a four by four matrix, a total

of ten restrictions are required for identification. Since  and var( ε t ) are normalised to unit variance, matrix Ro

six additional restrictions for identification which can be obtained by imposing

restrictions on the long run multipliers in the matrix R(L). Each component of

the long run matrix R(L) namely Rij(1) represents the corresponding

dynamic long run multiplier (or the permanent component) which would need to be

subjected to economically meaningful restrictions for identification.

and var( ε t ) are normalised to unit variance, matrix Ro

six additional restrictions for identification which can be obtained by imposing

restrictions on the long run multipliers in the matrix R(L). Each component of

the long run matrix R(L) namely Rij(1) represents the corresponding

dynamic long run multiplier (or the permanent component) which would need to be

subjected to economically meaningful restrictions for identification. The

following restrictions needed for the identification of R(L) matrix are

placed on the long run multipliers to identify the structural shocks, viz.,

interest rate, nonfood credit, GDP and housing price shocks.

(a) policy interest rate shock is the only shock that can itself have a long run

effect on the interest rate.

(b) in the long run credit conditions will be

determined by supply conditions, namely, aggregate credit supply and interest

rate.

(c) GDP growth is affected by permanent shocks attributed to itself,

interest rate and credit growth, presuming in the monetarist tradition, that easy

credit availability in a low interest rate environment played a crucial role in

stimulating economic activity in the recent years.

(d) and finally, housing

prices are affected in the long run by permanent shocks in interest rate, credit

and GDP shocks and own innovations in housing prices.

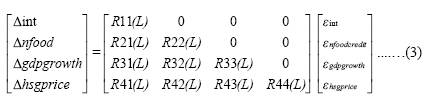

With

these identifying restrictions on the permanent effects, the long run matrix R(L)

appears as follows

From the above, it is straightforward to recover Ro as both K(1) and

are known. As R(1) is lower

triangular, it is also a unique Choleski factor of the long run representation

R(1) are known. As R(1) is lower

triangular, it is also a unique Choleski factor of the long run representation

R(1) R(1). R(1).

The

structural VAR is also used for obtaining forecast error variance decompositions

alongside a measure of the real equilibrium housing price index which is exhibited

in the form of a graph. Measure of misalignment is computed by comparing the actual

housing price index with the estimated trajectory for the housing price index

obtained from the model. Section IV

Empirical Evidence Table (I) presents

the forecast error variance decompositions for housing prices. According to Table

I, the majority of the explanation for the forecast error variance of housing

prices is explained by interest rate, implying that the interest rate conditions

have a significant role to play in determining housing prices. The impact

of non food credit is lesser than interest rate but taken together credit growth

and interest rate explain almost 72.3 percent of the forecast error variance of

annual change in housing prices.

Table I : Forecast Error

Variance Decomposition of Housing Prices (per cent, average for 12 months)

Accounted

for

by Interest Rate | Accounted

for

by Non

Food Credit | Accounted

for

by Housing

Prices themselves | Accounted

for

by GDP | 45.51 | 26.81 | 17.84 | 7.59 |

However as mentioned earlier, from the point of view of the

analysis, the objective of this paper is to distinguish between the real and speculative

price increases in the housing market. From expression (3), it is straight forward

to estimate the fundamental or long term equilibrium housing prices given the

monetary fundamentals especially, interest rate and credit growth which are taken

as the explanatory variables in the model and GDP growth which captures changes

in income. Chart 1 depicts the relative positioning of actual (flagged ‘HOUSING’

in the graph) and long run equilibrium housing price (flagged ‘BQESTHSG’)

indices. From Chart 1 it is noted that because of the close proximity of

the actual and equilibrium housing price indices, there is only a very a small

extent of misalignment.

Section V

Concluding

Observations The empirical findings recorded in

the study support the inference that amongst the various factors that have

a bearing on housing prices, monetary conditions, viz., interest

rate and credit growth play a critical role. Together they explain a very large

part of the forecast error variance of housing prices and can be considered as

primary drivers of growth. It is, however, somewhat alarming to find that real

income growth played only a minor role in determining housing prices, reflecting

an extent of adverse selection in overall bank financing. Another notable

factor is the low order of persistence of housing prices in India as borne out

by the little explanation offered in the model by own innovations in housing prices.

This finding is in contrast to the stylised feature of housing markets in other

parts of the world where housing prices display strong persistence because of

the time taken in clearing the market in the aftermath of a shock. Lower persistence

implies that the risk of relatively quicker reversal in housing prices in the

event of a shock cannot be completely ruled out. The results

of forecast error variance decompositions also indicate that housing prices

are significantly much more sensitive to interest rate changes than

credit supply. Therefore, as advised by Bernanke (2002), there is a need to carefully

evaluate the consequences of monetary policy actions especially when the housing

market is seized by price bubbles, since a pre-emptive hike in interest

rates (over and above what is judged necessary for overall price stability purposes),

may well be counterproductive. Moreover a tighter policy to prick a housing bubble

(if one could be safely identified) could also be potentially damaging for

other sectors. In the recent period, as the graphical analysis

shows, the long run equilibrium housing prices are observed to closely trail the

actual level of prices implying that the extent of misalignment between the actual

and long run equilibrium housing prices has remained low during the period under

consideration. This means that the extent of speculation in the market is subdued,

and the market is primarily supported by the existing configuration of monetary

variables, viz., lower interest rates and easy availability of credit.

Taken together the key implication of the these findings is that

monetary policy is expected to exert a significant impact on the housing

market as monetary conditions undergo changes either in the form of a rise in

interest rates or a reduction in supply of credit. Since the variance decompositions

show that changing monetary conditions especially interest rate, have particularly

large impact on housing prices, it is necessary that measured policy adjustments

are taken to avoid adverse effects on the balance sheet of banks, particularly

of those having large exposures to the housing/real estate

sector. The empirical inference in regard to the role of

monetary policy is also consistent with the international evidence as reported

in the IMF’s World Economic Outlook (2003) suggesting that housing price

bursts during the late 1970s and the early 1980s actually followed the tightening

of monetary policy which was aimed at reducing inflation. It, therefore, appears

that sectoral measures in the regulatory domain that help in soft landing,

such as, for example, withdrawing or reducing regulatory accommodation may be

more worthwhile than direct measures taken for demand compression. According to

the OECD’s Economic Outlook, while the monetary authorities can have many

choices to respond to asset price developments including housing prices, the policy

response to housing prices should be related only to the extent that they contain

information about future output growth and inflation, and that, if desired, it

would be more appropriate to use alternative policy instruments (taxes and regulations)

to stabilise housing cycles. On the future prospects of housing market,

it may be considered that while the market has been working close to its potential

as elicited from the convergence of the actual housing prices and long term equilibrium

prices during the time sample under consideration, its performance nevertheless

would continue to be tightly governed by monetary conditions defined predominantly

in terms of configuration of interest rates and ease/ tightness of credit

supply. References

Bernanke, B.(2002), “Asset-Price

Bubbles and Monetary Policy”, Remarks before the New York Chapter of the

National Association for Business Economics, October, New York.

Blanchard,

O. and D. Quah (1989), “The Dynamic Effects of Aggregate Demand and

Supply Disturbances”, American Economic Review 79, 655-673

International Monetary Fund (IMF) (2003), “Growth and Institutions”,

World Economic Outlook, April.

Krainer, J (2003), “House

Price Bubbles”, Federal Reserve Bank of San Fransisco (FRBSF) Economic

Letter, Number 2003-06, March.

Organisation for Economic Co-operation

and Development (OECD) (2005), “Recent House Price Developments: The Role

of Fundamentals”, OECD Economic Outlook, No. 78, Preliminary Edition.

Government of India, Five Year Plan Documents, Planning Commission.

Reserve Bank of India (2006), “Annual Policy Statement for the Year

2006-07”, April.

Vedpuriswar, A.V(2005)., “Globally, Housing

Set for a Crash !”, ICFAI, Hyderabad.

* Director, Monetary

Policy Department, Reserve Bank of India. The views expressed in the

paper are based on empirical findings and are strictly personal and not

those of the Reserve Bank of India. The usual disclaimer applies. |