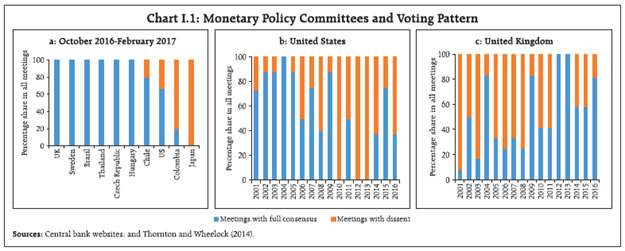

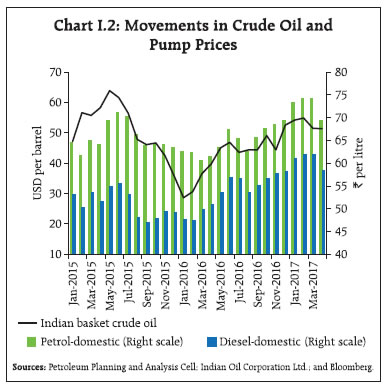

| I. Macroeconomic Outlook Underneath current benign inflation conditions, there are broad-based inflation pressures, which make the inflation outlook for 2017-18 challenging. Growth in real gross value added is expected to accelerate in 2017-18, underpinned by strong consumption demand even as investment activity remains muted and external demand uncertain. Under the monetary policy framework ushered in by amendments to the Reserve Bank of India (RBI) Act, the monetary policy decision has been vested in a six member monetary policy committee (MPC). Following its decision to lower the policy repo rate by 25 basis points (bps) at the time of the October 2016 Monetary Policy Report (MPR), the MPC decided to hold the policy rate in the December 2016 and February 2017 meetings of its bi-monthly schedule. Four features distinguish these initial decisions under the new regime. First, there was a calibrated shift in the policy stance from accommodative to neutral. Second, there was an overwhelming preference for waiting out the transitory effects of demonetisation and the unsettled political climate globally. Third, each decision was taken by unanimity. Fourth, within the consensus, members’ decisions appear to have been driven by individualistic approaches to arriving at them, as revealed in their written public statements. The recent experience of MPCs in the UK, Sweden, Brazil, Thailand, Czech Republic and Hungary suggests that rate decisions have been based on unanimity (Chart I.1). Other recent cases in point are the decisions of the US Federal Open Market Committee (FOMC) in its December 2016 and February 2017 meetings, and the Bank of England’s MPC in its meetings during October-February. Differences have been typically confined to the size of the change in the policy rate rather than contesting the overarching policy stance.1 Existing research on monetary policy decision making suggests that divergences stem mainly from (i) MPC members’ policy preferences – the relative weight on price stability and output stabilisation – in their reaction functions, and (ii) assessment of expected economic conditions – the evolution of inflation and output gaps.2,3 Does the formative experience of the MPC in India suggest similar policy preferences and assessments of the outlook? It is too early to tell.  The analysis of macroeconomic developments presented in chapters II and III explains why both inflation and output growth have undershot the forecasts set out in the October 2016 MPR. In part, these deviations reflect the impact of demonetisation. Turning to the outlook, recent domestic and global events warrant revisions to the baseline assumptions on initial conditions set out in the October 2016 MPR (Table I.1). First, international crude oil prices have fluctuated widely over the last six months, hardening initially on the back of the agreement by Organisation of the Petroleum Exporting Countries (OPEC) to curtail production becoming credible.4 More recently, these prices have eased with shale production stepping up, US inventories rising sizeably and a vast amount of past supply.5 Nonetheless, oil prices are now ruling around 10 per cent above the level (US$ 46 per barrel) assumed in October 2016. Domestic petrol and diesel prices increased by around ₹5.5 per litre and ₹4.2 per litre, respectively, between November 2016 and February 2017 and were cut by around ₹4.9 per litre and ₹3.5 per litre, respectively, effective April 1, 2017 (Chart I.2). | Table I.1: Baseline Assumptions for Near-Term Projections | | Variable | October 2016 MPR | Current (April 2017) MPR | | Crude oil (Indian basket) | US$ 46 per barrel during FY 2016-17:H2 | US$ 50 per barrel during FY 2017-18 | | Exchange rate | ₹67/US$ | Current level | | Monsoon | Normal for 2016 | Normal for 2017 | | Global growth | 3.1 per cent in 2016

3.4 per cent in 2017 | 3.4 per cent in 2017

3.6 per cent in 2018 | | Fiscal deficit | To remain within BE 2016-17 (3.5 per cent) | To remain within BE 2017-18 (3.2 per cent) | | Domestic macroeconomic/ structural policies during the forecast period | No major change | No major change | Notes: 1. Crude oil (Indian basket) represents a derived basket comprising sour grade (Oman and Dubai average) and sweet grade (Brent) crude oil processed in Indian refineries in the ratio of 71:29.

2. The exchange rate path assumed here is for the purpose of generating RBI staff’s baseline growth and inflation projections and does not indicate any ‘view’ on the level of the exchange rate. The Reserve Bank is guided by the need to contain undue volatility in the foreign exchange market and not by any specific level/band around the exchange rate.

3. Global growth projections are based on July 2016 and January 2017 updates of the IMF’s World Economic Outlook.

4. BE: Budget Estimates. |

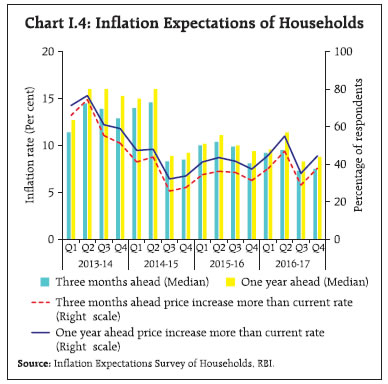

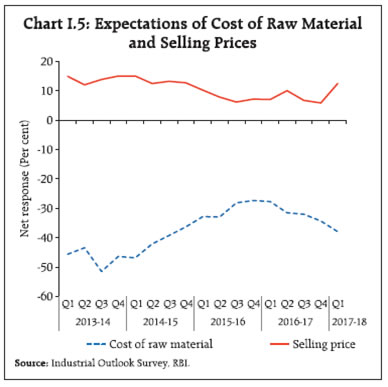

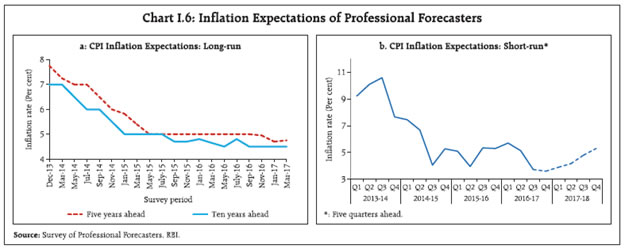

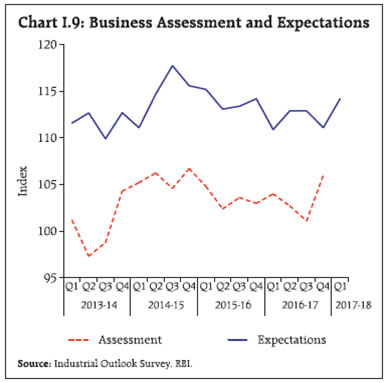

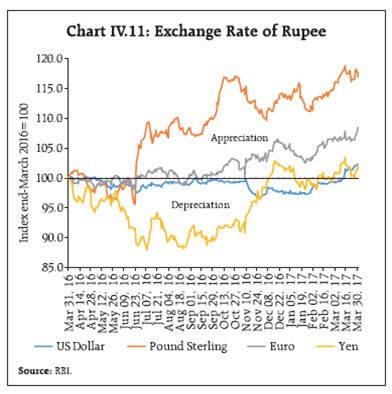

Second, the foreign exchange market has experienced bouts of volatility triggered by international developments. The Indian rupee depreciated sharply vis-à-vis the US dollar during November 8-28, 2016 in the aftermath of the US presidential election results. Since then, the rupee has recovered lost ground and appreciated beyond the October 2016 level (₹67 per USD). Third, global growth and trade have evolved at a sluggish pace, as expected. Looking ahead, their pace is expected to accelerate modestly in 2017, benefitting from the expected fiscal stimulus in the US and the strengthening recovery from recent macroeconomic strains in major emerging market and developing economies (EMDEs). A sobering thought, however, is that global growth has repeatedly disappointed initial expectations in the past few years (Chart I.3). Consequently, downside risks suffuse the domestic outlook for 2017-18. I.1 The Outlook for Inflation Headline inflation declined to significantly low levels during November 2016-February 2017, much lower than projected in the October 2016 MPR. Yet, the persistence of inflation excluding food and fuel poses a challenge to the inflation outlook. Also, there is considerable uncertainty as to how prices will pan out over the coming months. As vegetable price declines were likely on account of demonetisationdriven distress sales in addition to seasonal factors,6 remonetisation could fuel a sharp reversal in vegetable prices, going forward. This development imparts uncertainty to the near-term outlook for inflation.  Households largely form inflation expectations adaptively, based on past movements in salient prices, especially those of food and fuel. The March 2017 round of the Reserve Bank’s survey of urban households indicated an increase of 20-50 bps in inflation expectations over the December round, reversing partly the sharp decline of 2-3 percentage points recorded in the previous (i.e., December) round. Three months and one year ahead inflation expectations were 7.5 per cent and 8.8 per cent, respectively. The proportion of respondents expecting the general price level to increase by more than the current rate also edged higher (Chart I.4).  The hardening of global oil, metal and other commodity prices that is driving the recent surge in India’s wholesale inflation is imparting input price pressures for firms. Pricing power is also expected to improve, as reflected by manufacturing firms surveyed in the Reserve Bank’s industrial outlook survey in its January-March 2017 round (Chart I.5). Staff costs in the manufacturing sector are also expected to increase in Q1:2017-18. Nominal wage growth in rural areas decelerated in December- January, partly on account of demonetisation. Manufacturing and services sector firms in Nikkei’s purchasing managers’ survey for March 2017 reported pressures from both input prices and output prices.  Professional forecasters surveyed by the Reserve Bank in March 2017 expected CPI inflation to pick up from its current level to 5.3 per cent by Q4:2017-18 (Chart I.6). Their medium-term inflation expectations (five years ahead) increased marginally by 10 bps to 4.8 per cent. Their longer-term inflation expectations (10 years ahead) remained unchanged at 4.5 per cent, close to the Reserve Bank’s medium-term inflation target of four per cent.  Taking into account the revised baseline assumptions, signals from the various forward-looking surveys and estimates from structural and other models (Box I.1), RBI staff’s baseline path for headline CPI inflation is expected to take it from its current level of 3.7 per cent (February 2017) to 4.2 per cent in Q1:2017-18, and 4.7 per cent in Q2. It is then forecast to edge higher to 5.1 per cent in Q3 on account of the demonetisationinduced base effect before moderating to 4.9 per cent in Q4:2017-18, with risks evenly balanced around this trajectory (the 50 per cent confidence interval for inflation in Q4:2017-18 is in a range of 3.4-6.4 per cent and the 70 per cent confidence interval is in a range of 2.6-7.2 per cent) (Chart I.7). Forecasts from the structural model indicate that inflation may evolve in a stable manner through 2018-19 and reach 4.6 per cent in Q4:2018-19 under the baseline scenario, with the monetary policy stance remaining unchanged. There are three major upside risks to the baseline inflation path – uncertainty in crude oil prices; exchange rate volatility due to global financial market developments, especially if political risks materialise; and implementation of the house rent allowances under the 7th Central Pay Commission (CPC) award. The likely impact of these shocks to headline inflation is explored in Section I.3. The proposed introduction of the goods and services tax (GST) in 2017-18 also poses some uncertainty for the baseline inflation path, particularly on account of oneoff but somewhat uncertain duration of price effects that are typically associated with the introduction of taxes on value added in the cross-country experience (see the October 2016 MPR for a review). Box I.1: Inflation Forecast Combinations Timely and reliable forecasts of inflation are critical inputs for setting forward-looking monetary policy. Forecasting inflation is challenging in all countries, both advanced and emerging, but it is rendered tenuous in emerging economies on account of recurrent supply shocks. Most central banks, therefore, use a suite of models, supplemented with informed judgement, for obtaining reasonably robust forecasts. Underlying this preference is a tacit recognition that all models are misspecified in some dimension and at some time points. In this context, a forecast combination approach – combining forecasts from alternative models through a judicious weighting system – finds favour among practitioners. Forecast combinations can act as a useful hedge against bad forecast performance of individual models, especially when inflation is volatile (Hubrich and Skudelny, 2017). In order to empirically validate if a forecast combination approach in the Indian context shows promising results vis-à-vis individual models, the following eight time series models are analysed: (i) a random walk (RW) model; (ii) a first-order autoregression (AR) model; (iii) a Phillips curve (PC) model; (iv) a moving average model with stochastic volatility (MA-SV); (v) a three-variable vector autoregression (VAR) model; (vi) a three-variable VAR with one exogenous variable (VARX) model; (vii) a Bayesian VAR (BVAR) model; and (viii) a Bayesian VARX (BVARX) model.7 Three approaches are used for combining the forecasts of the individual models: (i) a simple average of individual model forecasts; (ii) a performance-based weighted average, based on time varying weights (TVW) derived from the individual forecast performance of the past three years; and (iii) time varying geometrically backward decaying weights (TV-GDW) (i.e., a larger weight is given to the model’s recent performance). Quarterly data from Q1:2000 to Q3:2016 are used to estimate these models.  Forecast performance is measured by the inverse of the root mean square errors (RMSEs) of individual models and their combinations (relative to the benchmark RW model) for two alternative forecasting horizons (one quarter ahead and four quarters ahead) (Chart 1). The results suggest that (a) performance-based forecast combinations improve over both individual models and simple averaging; (b) the relative forecasting performance improves considerably as the horizon is extended from one quarter to four quarters, a feature especially helpful from the monetary policy perspective, given transmission lags. Overall, the results suggest that combining forecasts from a range of models outperforms an individual model. This is the approach that RBI staff adopts, as explained in the September 2015 MPR. Reference: Hubrich, K. and F. Skudelny (2017), “Forecast Combination for Euro Area Inflation: A Cure in Times of Crisis?”, Journal of Forecasting, DOI: 10.1002/for.2451. I.2 The Outlook for Growth With the effects of demonetisation turning out to be short-lived and modest relative to some doomsday expectations, the outlook for 2017-18 has been brightened considerably by a number of factors. First, with the accelerated pace of remonetisation, discretionary consumer spending held back by demonetisation is expected to have picked up from Q4:2016-17 and will gather momentum over several quarters ahead. The recovery will also likely be aided by the reduction in banks’ lending rates due to large inflows of current and savings accounts (CASA) deposits, although the fuller transmission impact might be impeded by stressed balance sheets of banks and the tepid demand for bank credit. Second, various proposals in the Union Budget 2017-18 are expected to be growth stimulating: stepping up of capital expenditure; boosting the rural economy and affordable housing; the planned roll-out of the GST; and steps to attract higher foreign direct investment (FDI) through initiatives like abolishing the Foreign Investment Promotion Board (FIPB). Third, global trade and output are expected to expand at a stronger pace in 2017 and 2018 than in recent years, easing the external demand constraint on domestic growth prospects. However, the recent increase in the global commodity prices, if sustained, could have a negative impact on our net commodity importing domestic economy. Finally, the pace of economic activity would critically hinge upon the outturn of the south-west monsoon, especially in view of the rising probability being assigned to an el niño event in July-August, 2017. Turning to forward-looking surveys, the consumer confidence moderated in the March 2017 round of Reserve Bank’s survey (Chart I.8). Respondents were less optimistic about the prospects for economic conditions, employment, and income a year ahead. Sentiment in the corporate sector improved during January-March 2017, according to the Reserve Bank’s industrial outlook survey (Chart I.9). The improvement was led by optimism on future production, order books, exports, employment, financial situation, selling prices and profit margin. Amounts mobilised through initial public offerings (IPOs) in recent months and filings of red herring prospectuses with the Securities and Exchange Board of India (SEBI) have been higher, which suggest investment optimism in the period ahead. Both manufacturing and services firms expected output to be higher a year from now, according to the purchasing managers’ survey for March 2017. Surveys conducted by other agencies indicate a decline in optimism over their previous rounds (Table I.2).

| Table I.2: Business Expectations Surveys | | Item | NCAER Business Confidence Index

(January 2017) | FICCI Overall Business Confidence Index

(January 2017) | Dun and Bradstreet Composite Business Optimism Index

(January 2017) | CII Business Confidence Index

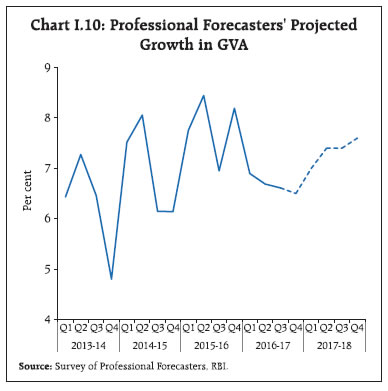

(January 2017) | | Current level of the index | 112.0 | 58.2 | 65.4 | 56.5 | | Index as per previous Survey | 133.3 | 67.3 | 80.0 | 58.0 | | % change (q-o-q) sequential | -16.0 | -13.5 | -18.3 | -2.6 | | % change (y-o-y) | -14.0 | 2.6 | -23.9 | 4.8 | Professional forecasters surveyed by the Reserve Bank in March 2017 expected real GVA growth to accelerate from 6.5 per cent in Q4:2016-17 to 7.6 per cent in Q4:2017-18, led by growth in services and industry (Chart I.10 and Table I.3).

| Table I.3: Reserve Bank's Baseline and Professional Forecasters' Median Projections | | (Per cent) | | | 2016-17 | 2017-18 | 2018-19 | | Reserve Bank’s Baseline Projections | | | | | Inflation, Q4 (y-o-y) | 3.6 | 4.9 | 4.6 | | Real Gross Value Added (GVA) Growth | 6.7 | 7.4 | 8.1 | | Assessment of Survey of Professional Forecasters@ | | | | | Inflation, Q4 (y-o-y) | 3.6 | 5.3 | | | GVA Growth | 6.7 | 7.3 | | | Agriculture and Allied Activities | 4.2 | 3.5 | | | Industry | 6.1 | 7.0 | | | Services | 7.6 | 8.5 | | | Gross Domestic Saving (per cent of GNDI) | 31.5 | 31.8 | | | Gross Fixed Capital Formation (per cent of GDP) | 27.0 | 28.8 | | | Money Supply (M3) Growth | 7.5 | 10.5 | | | Credit Growth of Scheduled Commercial Banks | 6.0 | 10.0 | | | Combined Gross Fiscal Deficit (per cent of GDP) | 6.5 | 6.3 | | | Central Government Gross Fiscal Deficit (per cent of GDP) | 3.5 | 3.2 | | | Repo Rate (end period) | 6.25 | 6.00 | | | CRR (end period) | 4.00 | 4.00 | | | Yield of 91-day Treasury Bills (end period) | 6.0 | 6.3 | | | Yield of 10-year Central Government Securities (end period) | 6.8 | 6.7 | | | Overall Balance of Payments (US $ bn.) | 20.8 | 32.2 | | | Merchandise Exports Growth | 2.8 | 5.9 | | | Merchandise Imports Growth | -2.0 | 7.1 | | | Merchandise Trade Balance (per cent of GDP) | -5.0 | -5.1 | | | Current Account Balance (per cent of GDP) | -0.9 | -1.2 | | | Capital Account Balance (per cent of GDP) | 1.8 | 2.4 | | @: Median forecasts; GNDI: Gross National Disposable Income.

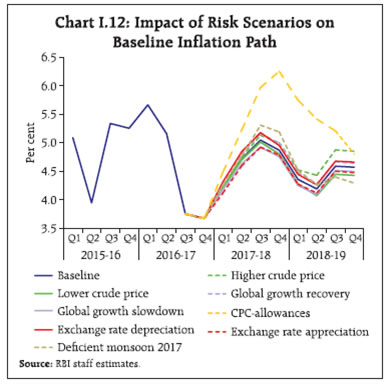

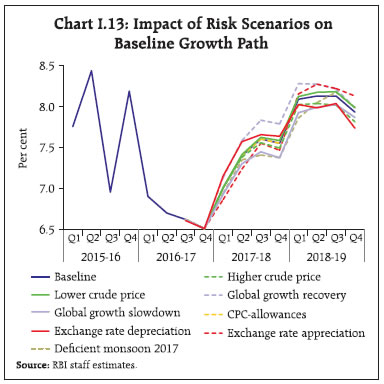

Sources: RBI staff estimates; and Survey of Professional Forecasters (March 2017). | Considering the baseline assumptions, the fast pace of remonetisation, survey indicators and updated model forecasts, RBI staff’s baseline scenario projects that real GVA growth will improve from 6.6 per cent in Q3:2016-17 and 6.5 per cent in Q4 to 7.0 per cent in Q1:2017-18 and 7.4-7.6 per cent in the remaining three quarters of 2017-18, with risks evenly balanced around this baseline path (Chart I.11). Looking beyond 2017-18 and assuming a normal monsoon, a congenial global environment, no policy induced structural change and no supply shocks, structural model estimates yield real GVA growth of 8.1 per cent in 2018-19. I.3 Balance of Risks The baseline projections of growth and inflation presented in the preceding section are based on the assumptions set out in Table I.1. As usual, there are uncertainties surrounding these assumptions which could produce deviations from baseline projections. This section assesses the sensitivity of the projected baseline paths of growth and inflation to plausible alternate scenarios. (i) International Crude Oil Prices The September 2016 announcement by OPEC of agreement on production cuts by members was met with scepticism. The signing of the agreement in end-November, however, led to a sharp jump in global crude oil prices. If OPEC sticks to the agreed production cuts of 1.2 mb/day till the next review of the agreement in May 2017, and the global crude oil production balance moves to a deficit by Q1:2017-18,8 upside risk to the crude oil trajectory over baseline estimates will heighten. Any supply disruptions due to geo-political developments could accentuate these upside risks. Assuming that crude prices increase to around US$ 60 per barrel under this scenario, inflation could be higher by around 30 bps and growth could be weaker by around 10 bps (Charts I.12 and I.13).  Conversely, if some of the OPEC members do not adhere to the agreed production cuts and/or the shale gas producers continue to ramp up production, global prices could soften below the baseline. Should crude prices slip under this scenario to around US$ 45 per barrel by 2017-18, inflation could moderate by around 15 bps with growth benefitting by around 5 bps. (ii) Global Demand The baseline scenario assumes that global growth will accelerate during 2017 and 2018. Risks to the baseline could emanate from: (a) US fiscal expansion being less than expected or marked by delays; (b) the Federal Reserve’s monetary policy response to expansionary fiscal policy being larger than expected, especially in the context of a recent assessment that the US economy is “closing in on full employment”; (c) the now pervasive spectre of protectionism affecting global trade; (d) continued concerns over the Chinese credit cycle; (e) volatile global crude oil and commodity prices; and (f) the implications of all these factors for international financial markets. Feedback loops can exaggerate the impact of several of these factors on global growth.9  Assuming that global growth in 2017 and 2018 remains the same as was recorded in 2016 (i.e., 30-50 bps below the baseline assumption), real GVA growth and inflation could turn out to be around 20 bps and 10 bps, respectively, below the baseline. The pace of global economic activity could be higher if the policy stimulus in the US turns out to be larger than currently expected. In this scenario, assuming global growth is 50 bps higher, domestic growth could turn out to be around 25 bps above the baseline. Inflation could be higher by around 10 bps on the back of higher domestic demand as also imported impulses from higher global commodity prices. (iii) Seventh Central Pay Commission Allowances The 7th CPC recommended an increase in house rent allowance (HRA) of 8-24 per cent of basic pay. The higher HRA would have a direct and immediate impact on headline CPI through an increase in housing inflation. Assuming a rate of increase in the HRA as proposed by the 7th CPC is implemented from early 2017-18 onwards and the State Governments implement a similar order of increase with a lag of one quarter, CPI inflation could be 100-150 bps higher than the baseline for 2017-18.10 The HRA impact on inflation is expected to persist for 6-8 quarters, with the peak effect occurring around 3-4 quarters from implementation. In addition, indirect effects could occur from elevated inflation expectations. (iv) Exchange Rate Recognising that the domestic foreign exchange market witnessed heightened volatility in the aftermath of the US presidential elections, the risk of renewed turbulence in global financial markets on account of global downsides materialising and associated volatility in domestic financial markets remains a clear and present danger to the Indian economy. A five per cent depreciation of the Indian rupee, relative to the baseline assumption, could push up inflation by 10-15 bps in 2017-18. The depreciation, however, could have a favourable impact on growth in 2017-18 through a boost to net exports. In contrast, the combination of a benign global macroeconomic and financial environment, the expected acceleration in domestic growth and the policy initiatives to attract FDI flows can lead to an appreciation of the domestic currency, with a soothing impact on domestic inflation. A five per cent appreciation of the Indian rupee, relative to the baseline assumption, could soften inflation by 10-15 bps in 2017-18. (v) Deficient Monsoon Rainfall dependence of Indian agriculture makes the broader economy vulnerable to monsoon outcomes. The India Meteorological Department (IMD) is yet to release its forecast of the south-west monsoon for 2017. Hence, the baseline scenario assumes a normal south-west monsoon. However, the occurrence of el niño is assuming a rising probability, as stated earlier, dampening the prospects of agricultural production.11 Assuming the growth of output of agriculture and allied activities suffers by one percentage point, overall GVA growth could be lower by around 20 bps in 2017-18. The concomitant increase in food prices could result in headline inflation rising 30 bps above the baseline. To sum up, economic activity should recover in 2017- 18 on the back of the fast pace of remonetisation and the government’s focus on capital expenditure, rural economy and housing. The global economic environment may improve modestly, albeit amidst several uncertainties. Headline inflation is projected to increase during 2017-18, calling for close vigilance and readiness for an appropriate monetary policy response, if warranted.

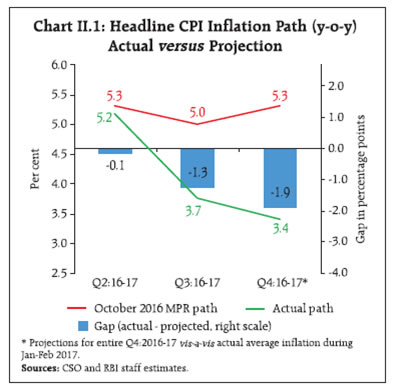

II. Prices and Costs Consumer price inflation has eased significantly, mainly due to the large decline in food inflation, especially vegetables. Excluding food and fuel, however, inflation has remained sticky. Input costs have firmed up and pose upside risks to the path of inflation going forward. The MPR of October 2016 had projected CPI inflation1 moving in a narrow range of 5.0 to 5.3 per cent during Q3 and Q4 of 2016-17, on expectations of food inflation moderating and crude prices remaining benign. Food inflation came off its July 2016 peak and eased during August-October 2016. The shock of demonetisation, however, veered the inflation trajectory sharply below its projected path, essentially on account of an abrupt compression in food inflation. Prices of vegetables sank into deflation and pulled down headline inflation during November 2016-January 2017. Notwithstanding the hardening of global crude oil prices in the wake of the agreement on production cuts by OPEC in late November, the negative wedge between actual and projected inflation widened through the second half of 2016-17 (Chart II.1). II.1 Consumer Prices Headline inflation fell off its July cliff and was already traversing a declining trajectory during August through October when demonetisation hit in November. It triggered a downward spiral that took inflation down to 3.2 per cent in January 2017, an all-time low in the history of all India CPICombined (Chart II.2). The entire fall in inflation during November 2016 to January 2017 can be explained by the deflation in prices of vegetables and pulses. As a result, unfavourable base effects, which should have raised headline inflation during December 2016 to January 2017, were overwhelmed by a collapse in the month-on-month (m-o-m) momentum, bringing down headline inflation by around 100 basis points (Chart II.3). In February, however, the drag from these transitory effects began to ebb and headline inflation edged up on a pickup in food and fuel price pressures.  Despite the sharp fall in food inflation in the second half of the year, the distribution of inflation across all categories was largely centred around 4.5 per cent with continuing high kurtosis and a positive skew (Chart II.4). Diffusion indices for goods, services and the overall CPI were all well above 50 over the financial year, suggesting that even as headline inflation fell to a historic low, it was not broad-based (Chart II.5).

II.2 Drivers of Inflation In retrospect, a historical decomposition shows that it was the large shock delivered by demonetisation and the associated wage shock that explained much of the overall change in the inflation trajectory in the second half of 2016-17. Past monetary policy tightening continued to have visceral effects in containing inflation (Chart II.6a). In contrast, firmer crude prices and gradually closing output gap turned out to be sources of upside pressures, masked by the size of the demonetisation shock. Non-food inflation remained stubbornly sticky, hardened by the unchanging contribution of durable goods and services to overall inflation for much of the financial year (Chart II.6b). Inflation in the food and beverages category (with a weight of 46 per cent of CPI) turned out to be the active component of overall inflation in the second half of 2016-17.

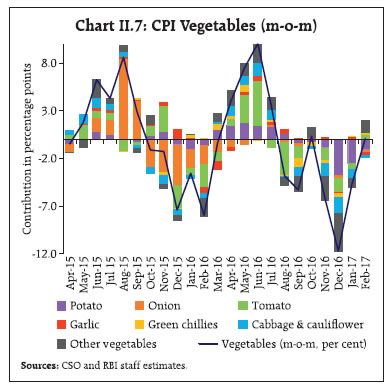

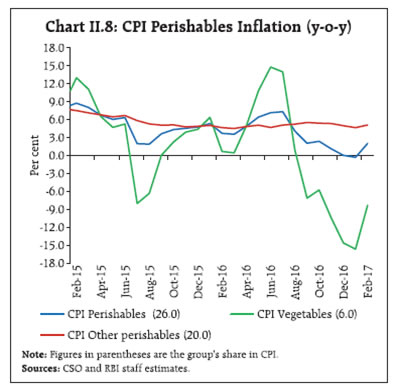

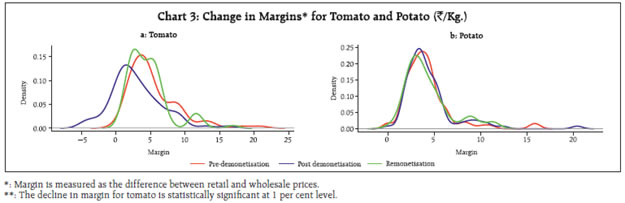

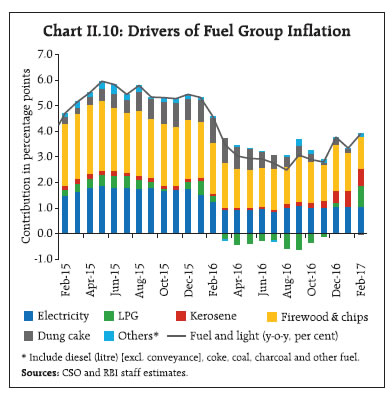

Four factors stand out in the recent experience: First, prices of perishables played the most decisive role, even during the three months preceding demonetisation. In the months immediately following demonetisation, perishables became even more prominent, with vegetable price movements becoming pivotal after a decline of 21 per cent during November 2016 to February 2017. Transactions in fruits and vegetables have always been cash intensive. Anecdotal evidence points to distress sales by farmers, given their perishable nature. Vegetable prices usually do exhibit a seasonal moderation during November- February every year; during the 2016-17 season, however, the decline in vegetable prices was more pronounced than in previous years. Second, the vegetable prices decline troughed in January 2017 and thereafter showed a m-o-m increase of 0.1 per cent in February. Third, the seasonal decline in prices of vegetables is typically driven by potato, onion and tomato prices, which together constitute close to 40 per cent of the vegetables index. This time around, potato and tomato prices did exhibit seasonal easing but what was noteworthy was the plunge in the prices of other vegetables – cabbage, cauliflower, palak/other leafy vegetables, brinjal, gourd, peas and beans – which usually contribute little to the observed seasonality (Chart II.7). Fourth, inflation in perishables excluding vegetables averaged 5 per cent since November, considerably above the average headline inflation (Chart II.8).2 The spatial and temporal dynamics of food prices post-demonetisation show that within the food group, the decline in vegetable prices was particularly large and seen across states and across wholesale and retail markets (Box II.1). Excluding vegetables, food inflation would have been higher by 2.7 percentage points and headline inflation by 1.3 percentage points during November 2016 to January 2017.  No commentary on inflation in the food and beverages category in the second half of 2016-17 would be complete without incorporating an analysis of the extraordinary developments in prices of pulses. With a weight of 5.2 per cent in the food group and only 2.4 per cent in the CPI, pulses contributed 13 per cent of the rising CPI inflation trajectory during the first half 2016-17. In the second half so far, prices of pulses turned into deflation and, with a contribution of (-) 2.5 per cent, aided in bringing down headline inflation to historic low in the CPI series. Inflation in arhar and urad, which had spiked pulses inflation during 2015-16 and the beginning of 2016-17, declined sharply during September 2016 to February 2017 so much so that arhar prices at the mandi level in the major producing states of Maharashtra, Madhya Pradesh, Gujarat and Karnataka dropped below the minimum support price (MSP). Gram prices, on the other hand, were an outlier, with inflation in this item rising dramatically before moderating in Q4:2016-17. After two consecutive years of production shortfall, adequate rainfall and better area coverage drove up pulses output during 2016-17 and mitigated price pressures considerably. Favourable supply side measures taken by the government such as imports at zero import duty3, extension in stock limit of pulses, raising MSPs in order to incentivise pulses production and maintaining buffer stocks also helped in reining in price pressures.  Box II.1: Anatomy of Food Deflation: Post Demonetisation State-wise CPI food inflation data for the period January 2013 to January 2017 were analysed at a monthly frequency in a panel framework in order to make a comparative assessment of spatial, temporal and intra-food group fixed effects in driving food inflation. Dynamic panel estimation1 was conducted on seasonally adjusted annualised m-o-m CPI food inflation. The results showed that while fixed effects were insignificant for most states, heterogeneity in inflation rates in sub-categories of food groups was significant. Even if the fiscal year 2016- 17 alone is considered, intra-food group fixed effects continued to remain significant for most groups. However, vegetables and pulses stood out in terms of magnitude and direction when compared with the usual patterns (Chart 1a and 1b). In the context of demonetisation, the panel analysis also showed significant time fixed effects for November 2016 brought about by vegetables, suggesting unusual decline in prices post demonetisation.  Furthermore, the fall in retail vegetable prices seemed to have broadly mirrored the fall in wholesale prices post demonetisation. Daily seasonally adjusted prices of potato and tomato, available for 88 centres across India, were used for analysing vegetable price margins post demonetisation (9 November - 31 December 2016), and remonetisation (January - February 2017). Using cluster analysis based on k-means clustering technique, the wholesale and retail prices were grouped into three major clusters – low, medium and high price clusters – based on the data of the pre-demonetisation period (September-October 2016). Post demonetisation, price moderation was observed across medium and high price clusters in the wholesale and retail markets. With progressive remonetisation, the prices in these vegetables started rising in both the wholesale and retail markets. The 45 degree line in Chart 2 represents the level where wholesale and retail prices are equal. In the case of tomato, retail prices fell even below wholesale prices for some centres, indicating a fall in retail margin post demonetisation. In the case of potato prices, the movement was mostly along and above the 45 degree line implying that margins were not impacted. The movement in margins* can also be seen from Chart 3. In the case of tomato, margins collapsed post demonetisation. As remonetisation progressed, margins rose again. These movements in margins were statistically significant**. In the case of potato, the analysis also showed that some centres experienced higher retail prices post demonetisation compared with wholesale prices, suggesting that in some cases the widening of retail-wholesale margins was centre-specific.  Within the food group, there were upside price pressure points in sugar, cereals and other food items such as prepared meals. Slippage in production during 2015-16 and 2016-17 caused double-digit inflation in sugar prices during the year (Chart II.9a and b). Under cereals, inflation in respect of rice has eased during October 2016 - January 2017, while inflation in wheat continued to firm up. A number of price control measures have been undertaken by the government for containing the price rise in the case of sugar and edible oil, including imposition of stockholding limits, discouraging exports, and reduction in import duty on certain edible oils. In the fuel group, the moderation in inflation in the first half of the financial year reversed and it picked up from December 2016, driven by LPG and kerosene. The rise in LPG broadly mirrored the turnaround in international LPG prices. In the case of kerosene, the uptick was driven by the increase in subsidised kerosene prices by a calibrated ₹0.25 per litre per month during July 2016 to February 2017, in addition to rising international prices. The weighted contribution of firewood and chips to overall fuel inflation remained broadly unchanged (Chart II.10), underscoring the persistence in fuel inflation across rural areas. CPI inflation excluding food and fuel remained sticky at around 5 per cent during most of the second half of 2016-17 (Chart II.11a). Housing and ‘clothing and footwear’ sub-groups were the main contributors, accounting for 36.2 per cent of inflation in the category as a whole. Other upside pressures in the group emanated from the firming up of international crude oil prices since December 2016 and the lagged pass-through to domestic prices of petrol and diesel that are embedded in transport and communication. With excise duty increase of around ₹12 per litre for both petrol and diesel under additional revenue mobilisation (ARM) measures, the mark-up of domestic over global prices has become more pronounced. With softening of international crude oil prices since early February 2017, domestic pump prices of petrol and diesel were reduced with a lag in the beginning of April 2017 (Chart II.12).  Excluding volatile components such as petrol and diesel, inflation in this group (CPI, excluding food and fuel) averaged 4.7 per cent between September 2016 and February 2017 (Chart II.11a). Some moderation in February came about on account of the goods component in this category – gold and silver in ‘personal care and effects’; pharmaceuticals in health; and garments in the clothing sub-groups – although more readings need to be monitored to assess whether this softening will endure (Chart II.13a). By contrast, the contribution of the services component in all these sub-groups remained sticky, especially housing and education services (Chart II.13b). Given the incidence of large and frequent supply shocks on food and non-food items, trimming the inflation distribution by removing specific portions of upper and lower tails of the distribution is widely used to assess underlying inflation movements, with the weighted median being a specific case of trimming. Trimmed means, the weighted median and exclusionbased measures of CPI inflation revealed a central tendency of 4.7 per cent during September 2016 to February 2017 (Chart II.11b). Notwithstanding some moderation in February, the downward inflexibility in inflation excluding food and fuel has infused significant upside risks into the near-term outlook. The direct and indirect impact on housing inflation of the 7th CPC house rent allowance award – once implemented by the Government – and the size and duration of the ‘GST effect’ are other upside risks to inflation in CPI in this category.

Other Measures of Inflation An important development in the second half of 2016-17 is the divergence that has set in between inflation measured by the CPI and by other measures. This conveys valuable insights into the profile of CPI inflation as it evolves in the months ahead. Inflation measured by the sectoral consumer price indices undershot headline CPI inflation, reflecting, inter alia, the higher weight of food in the former as also the absence of items such as gold and silver that were recent pressure points. Inflation in terms of the wholesale price index (WPI) was closely co-moving with CPI inflation during October-December 2016, but it shot up in January and further in February to close to three percentage points above CPI inflation, driven by a sharp pick-up in international commodity prices. GDP and GVA deflators rose in the beginning of the year, but edged down closer to CPI inflation from Q3:2016-17 (Chart II.14).

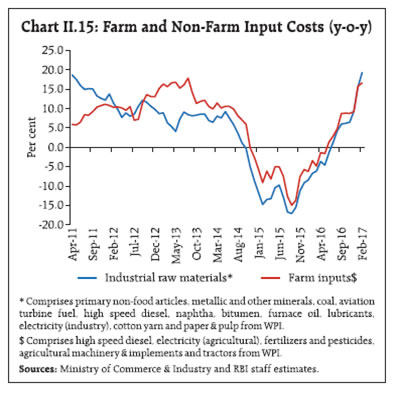

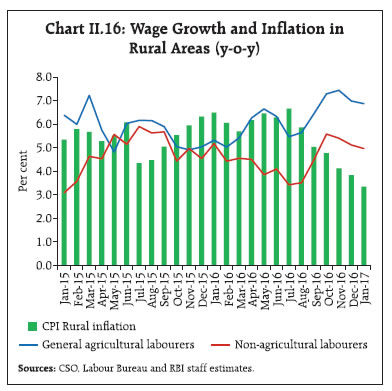

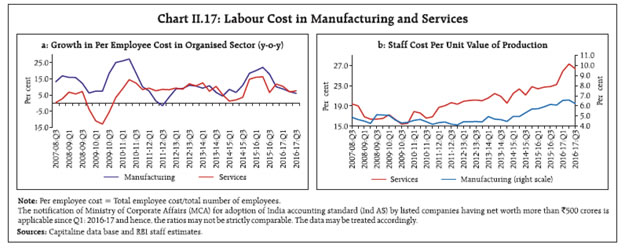

II.3 Costs Even as retail inflation and its measurement by other metrics has shrugged off the transitory drag of demonetisation and revealed its underlying trajectory in the February 2017 reading, cost push pressures appear to be coalescing. Domestic farm and non-farm input costs escalated significantly in the second half of 2016-17 on account of the rise in global crude oil prices, the firming up of metal prices and expectations of expansionary US fiscal spending (Chart II.15).  Coal inflation surged in January and February, with Coal India Limited linking its premium quality coal to international prices which hardened on account of supply disruptions in Australia and China towards the end of 2016. Substantial price pressures were also observed in high speed diesel, naphtha, furnace oil, cotton yarn and fibres all of which drove up inflation in industrial input costs to the highest level since early 2011. In the farm sector, price increases relating to high speed diesel and pesticides, particularly weedicides, largely contributed to the upturn in farm input costs. An analysis based on the Supply and Use Table (SUT) of the Central Statistics Office (CSO) comprising 140 products/services and 66 industries shows that a one per cent increase in crude oil, metals and coal prices could translate into an increase in WPI inflation by 15 bps, 20 bps and 5 bps, respectively, and in CPI inflation by 6 bps, 7 bps and 2 bps, respectively.4  Turning to wages and staff costs, rural wage growth for both agricultural and non-agricultural labourers picked up through October-November 2016 before moderating in December and January (Chart II.16). The divergence between agricultural and non-agricultural wage growth remains wide, reflecting the increase in demand for farm labour due to the invigoration of agricultural activity.  In the organised sector, corporate sector performance points to a moderation in per employee staff cost of listed private sector companies (Chart II.17a). A caveat in interpreting these developments is that the value of production grew at a slower pace than staff costs pushing up unit labour costs (i.e., the ratio of staff cost to value of production) for both manufacturing and services companies, notwithstanding the moderation seen in the latest reading (Chart II.17b). Firms polled in the Reserve Bank’s industrial outlook survey reported a sharp pick-up in the cost of raw materials as also in staff cost. Most of the firms expect to pass on the increase in costs into selling prices. Similar sentiments about acceleration in input costs were reported by both manufacturing firms and service providers in purchasing managers’ indices. Polled companies expect that the increase in costs will strengthen output price inflation. Going forward, the inflation path will be shaped by the implementation of house rent allowances under the 7th CPC award and the introduction of the GST; both these developments are likely to provide a push to headline inflation, the impact of which could last for 12-18 months. Moreover, several parts of the corporate sector, which have been struggling with balance sheet stress for a protracted period, await a recovery in demand that will rekindle pricing power of firms so that they can rebuild their bottom lines. While input costs have firmed up, the outlook for inflation will hinge upon a reasonably accurate assessment of the quantum of input price increases that the firms may pass through to their output prices. Further, should the recent softening in crude oil prices – caused by build-up in oil stocks in the US, legacy oversupply from OPEC last year, and possible failure of production controls by OPEC and Russia – continue, inflation trajectory could soften. Finally, with the rising probability of el niño, as discussed in Chapter 1, the path of food inflation may be impacted by the outcome of the monsoon in the coming year and in this regard, supply management measures that have successfully led to deceleration in food inflation from double digits in 2012-13 and 2013-14 to close to 5 per cent in 2016-17 so far, will play a crucial role.

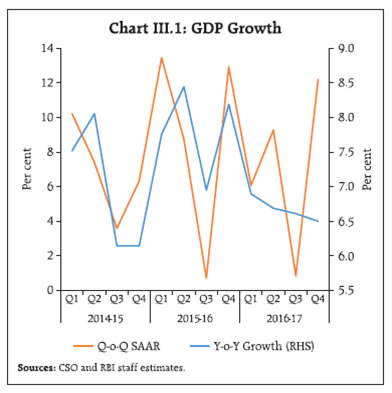

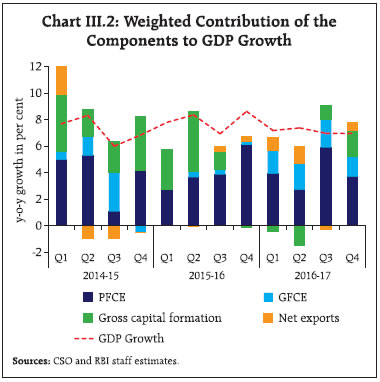

III. Demand and Output The slowdown in aggregate demand, which set in at the beginning of H2:2015-16, became accentuated in H2: 2016-17, although consumption demand remained resilient. Aggregate supply conditions were underpinned by the robust performance of agriculture and steady government expenditure. Economic activity has been losing momentum since H2:2015-16 on a combination of structural and cyclical factors; in H2:2016-17, this trajectory was dented further by the transient impact of demonetisation. Both private and government consumption demand have held up well against this slowdown, together accounting for 90 per cent of real gross domestic product (GDP) growth in H2:2016-17 on a weighted contribution basis. Investment demand, which had sunk into contraction in H1, recovered from Q3:2016- 17. Net exports have been growing strongly since Q3:2015-16 but in Q3:2016-17, they turned negative with imports starting to expand at a higher pace than exports as domestic demand strengthened. The ebullient rebound in agricultural activity on the back of normal monsoon and record foodgrains production have boosted rural incomes and supported consumption. In contrast, the modest pick-up in industry in H2:2016-17 and the slower growth in services suggests that investment demand is still sluggish. Going forward, implementation of the Goods and Services Tax (GST) and the measures taken in the Union Budget to boost the rural economy, infrastructure, micro, small and medium enterprises (MSMEs) and low cost housing should help invigorate domestic demand. However, a sustained revival of investment holds the key to stepping up the pace of economic activity closer to its medium-term potential. III.1. Aggregate Demand Aggregate demand measured by y-o-y changes in real GDP at market prices moderated through 2016-17, with the slowdown being pronounced in the second half of the year. Fiscal stimulus in the form of the 7th Central Pay Commission’s (7th CPC) award supported aggregate demand strongly; without the support of government final consumption expenditure (GFCE), GDP growth would have slumped to 5.9 per cent in H2:2016-17 as against the headline print of 7.0 per cent1. Private consumption remained the mainstay of domestic demand, notwithstanding some deceleration expected in the last quarter of the year. On a seasonally adjusted basis, however, q-o-q growth suggests that the slowdown in aggregate demand bottomed out in Q3 and an upturn commenced in Q4 on the back of a tentative recovery in exports and investment (Chart III.1, Table III.1). III.1.1 Private Final Consumption Expenditure Private final consumption expenditure remains the bedrock of domestic demand, contributing over half of overall GDP growth in H2:2016-17 (Chart III.2). Its underlying resilience stood out in the face of cash constraints of demonetisation, with data pointing to an acceleration of growth in this period on a sequential basis. The expansion of consumer purchasing power in this period can be explained by a combination of factors: improved rural consumption demand due to (i) robust agricultural activity; (ii) sharp uptick in Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) expenditure (15 per cent for 2016-17); and (iii) rural wages remaining steady; implementation of 7th CPC recommendations and One Rank One Pension (OROP) which buoyed already strong urban consumption demand and a significant fall in overall consumer inflation.

| Table III.1: Real GDP Growth | | (Per cent) | | Item | 2015-16 | 2016-17 (SAE) | Weighted contribution to growth in 2016-17 (percentage points)* | 2015-16 | 2016-17 | | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4# | | Private Final Consumption Expenditure | 7.3 | 7.2 | 4.0 | 4.9 | 6.7 | 6.8 | 10.6 | 7.2 | 5.1 | 10.1 | 6.5 | | Government Final Consumption Expenditure | 2.9 | 17.0 | 1.7 | 0.5 | 3.9 | 3.7 | 3.6 | 15.5 | 15.2 | 19.9 | 18.1 | | Gross Fixed Capital Formation | 6.1 | 0.6 | 0.2 | 9.6 | 12.4 | 3.2 | 0.0 | -2.2 | -5.3 | 3.5 | 6.5 | | Net Exports | 13.9 | 62.0 | 0.7 | -1.1 | -4.9 | 27.0 | 89.6 | 70.4 | 74.5 | -23.4 | - | | Exports | -5.4 | 2.3 | 0.5 | -5.7 | -4.3 | -9.0 | -2.5 | 2.1 | -0.9 | 3.4 | 4.4 | | Imports | -5.9 | -1.2 | -0.3 | -5.2 | -3.6 | -10.2 | -4.4 | -2.7 | -7.4 | 4.5 | 1.4 | | GDP at Market Prices | 7.9 | 7.1 | 7.1 | 7.8 | 8.4 | 6.9 | 8.6 | 7.2 | 7.4 | 7.0 | 7.0 | SAE: Second Advance Estimates. #: Implicit growth.

*: Component-wise contributions to growth do not add up to GDP growth in the table because change in stocks, valuables and discrepancies are not included.

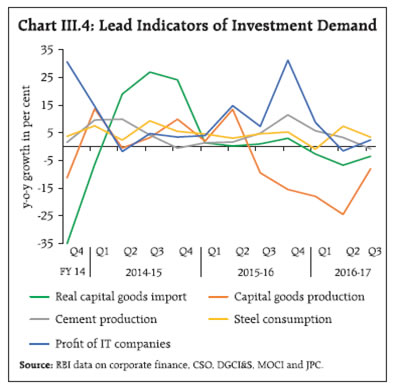

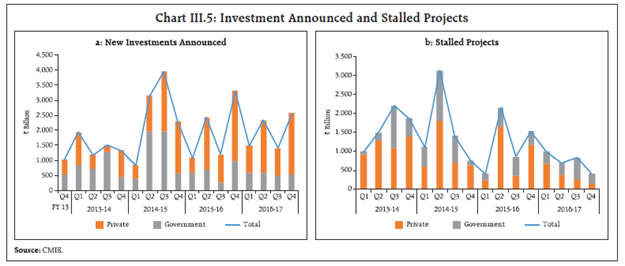

Source: Central Statistics Office (CSO). | In terms of lead indicators for estimating private final consumption expenditure, the surge in private consumption finds reflection in the acceleration in agriculture GVA, telephone connections, indirect tax collections and manufacturing index of industrial production (IIP) (Chart III.3). III.1.2 Gross Fixed Capital Formation After four consecutive quarters of either sharp deceleration or contraction, gross fixed capital formation turned around in Q3 and accelerated further in Q42. On the basis of lead indicators, this reversal in investment demand in spite of demonetisation effects can be explained by the pick-up in capital goods imports and moderation in the pace of contraction in domestic capital goods production as also improvement in profits of software companies (Chart III.4). Some momentum in investment activity is also visible in sectors such as electricity transmission, roads and renewable power.  Nonetheless, it may be premature to interpret these proximate developments as green shoots of durable revival of investment demand. A wider scan shows that capex spending, especially in large brownfield projects in sectors such as iron and steel, construction, textiles and power, remains weak amidst an environment of uncertainty surrounding growth, both global and domestic, and over-indebtedness as well as excess capacity in many sectors. According to the Centre for Monitoring Indian Economy (CMIE), new investment proposals, which capture the future pace of investment activity, has recovered in Q4 from its decadal low level in Q3, driven by government projects. The new investment projects increased to ₹2.57 trillion in Q4 as against an average of ₹2.16 trillion in the preceding nine quarters (Chart III.5a). The value of stalled projects decreased by 51 per cent during the quarter, mainly accounted for by government sector projects (Chart III.5b). The problem of stalled projects continues mainly because of lack of environmental and non-environmental clearances.

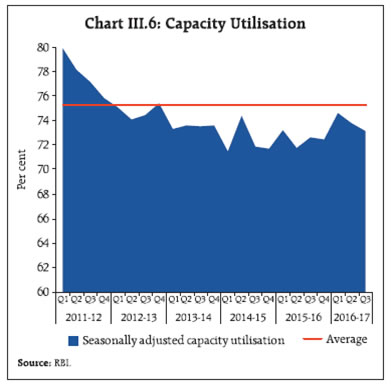

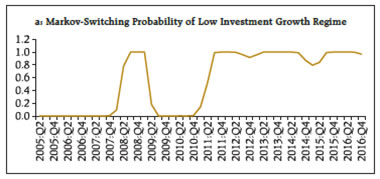

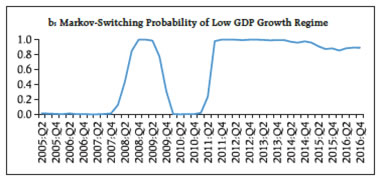

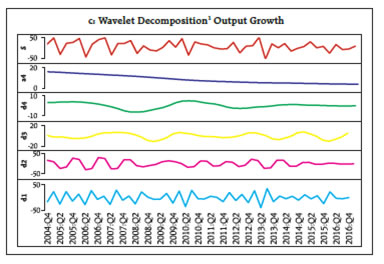

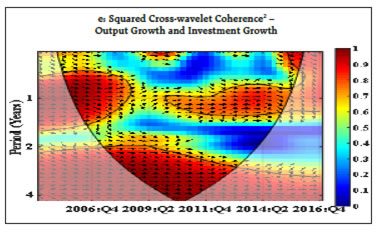

Seasonally adjusted capacity utilisation has remained below its average (since Q1:2013-14), reflecting weak demand and raising concerns on the sustainability of the recent pick-up in private investment (Chart III.6). Decomposition of time series into trend and cycles of various frequencies, juxtaposed with a Markov switching exercise to detect regime shifts also suggests that the recent upturn may not yet confirm a definitive reversal in investment demand (Box III.1). Going forward, an increase in allocation of capital expenditure by 10.7 per cent in the Union Budget 2017-18 is expected to generate some multiplier effects, but the catalytic effects of fiscal crowding in setting off a turnaround in the investment cycle is largely contingent on revival in private investment appetite. A binding constraint is the heightened risk aversion among banks, many laden with double-digit percentage of stressed assets to gross advances, to finance sectors that are excessively leveraged. Sectorspecific slack and demand substitution through cheaper imports in some segments due to excess global capacity are other drags on the revival in investment. Box III.1: Investment Cycle in India: Some Insights from Wavelet Analysis Gross domestic investment in India has been muted in a prolonged phase that set in during the post global financial crisis (GFC) period. Capacity utilisation has remained low and industrial activity depressed in an environment characterised by subdued global and domestic demand. Consequently, when gross fixed capital formation (GFCF) posted positive growth in Q3:2016-17 after three consecutive quarters of contraction, one question has evoked considerable interest: Is the recent upturn indicating a turning point in the investment cycle and what are the implications for growth? The Markov switching model of Hamilton (1989) was applied on growth rates (annualised seasonally adjusted q-o-q) of investment [chart (a)] to check whether the recent surge in the investment growth rate is, in fact, a turning point. Markov-switching probabilities suggest that the inflexion point in the investment cycle to a higher growth regime has still not materialised. Similar exercise on GDP growth rates [chart (b)] also does not suggest any turnaround. Furthermore, output and investment growth cycles (annualised q-o-q) are also examined using Wavelet analysis which offers the possibility of decomposing the time series data into several series of orthogonal sequences of scales representing different periodicities/ frequencies. Charts (c) and (d) present the wavelet transformation of GDP and GFCF growth rates [first panel in Charts (c) and (d)] into a low frequency scale that represents the long-run trend in the growth rates [second panel in Charts (c) and (d)] and four relatively higher frequency levels [third to sixth panel in Charts (c) and (d)]. The addition of these low frequency and high frequency decompositions produces the observed data. Long-term GDP and GFCF growth rates seem to have moderated in the years following the global financial crisis. The moderation in the long-term investment cycle has been much sharper than the output growth cycle. The lower frequency cycles (of periodicities 2-4 years) of output growth do not show any visible signs of a turnaround in the recent period. However, the investment cycle (of periodicity 2 years) indicates some increase [fourth panel in Chart (d)] consistent with the higher GFCF growth rates recorded in H2:2016-17.

Notes: 1. Using Daubechies 4 wavelet at level 4 (Smooth wavelets like the Daubechies 4 give better approximations to continuous functions). The first panel in Charts(a) and (b) are the annualised q-o-q changes of GFCF and GDP, respectively – represented by S = a4 + d4 + d3 + d2 + d1. 2. Cross wavelet and wavelet coherence software were provided by A. Grinsted http://www.glaciology.net/wavelet-coherence. The Morlet family of wavelet is used, as it provides a good balance between time and frequency localization. Horizontal axis shows time, while vertical axis shows period in years. The warmer the colour of region (more red), the higher the degree of coherence between investment and output growth cycles. Arrows indicate the relative phase relationship between the series (pointing right: in-phase; left: anti-phase; up: GFCF leading GDP). Black thick contour represents 5 per cent significance. The red coloured regions inside the black thick contours of the cross wavelet coherence in Chart (e) represent the high and significant co-movement between output and investment cycles at different time points (in x-axis) and at different cycle lengths represented by period (in y-axis). This indicates that output and investment cycles strongly co-moved in the 2-4 year cycle during the pre-crisis period, but co-moved only in the 3-4 year cycle in the recent period. Therefore, the uptick in the 2-year period cycle for investment might not immediately translate into higher output growth. References: Hamilton, James D (1989), “A New Approach to the Economic Analysis of Nonstationary Time Series and Business Cycle”, Econometrica, March, 57(2). Yogo, M. (2008), “Measuring Business Cycles: A Wavelet Analysis of Economic Time Series”. Economics Letters, 100(2), pp. 208-212. III.1.3 Government Expenditure Another key component of aggregate demand - government final consumption expenditure (GFCE) - continued to provide strong support to aggregate demand in H2:2016-17 due to the implementation of the 7th CPC award and OROP. Lower spending on all major subsidies - food, fertilisers and petroleum - contained Central Government’s revenue expenditure at the budgeted level for 2016-17. Although there was a shortfall in realisation of budgeted receipts from disinvestment and spectrum auctions, buoyant indirect tax collections and non-tax revenues helped in realising the fiscal deficit target even as capital expenditure did not experience any cutbacks, unlike in previous years (Table III.2). In fact, the revised estimates (RE) of capital expenditure were 13.3 per cent higher than budgeted estimates (BE), reflecting improvement in expenditure quality. Union excise duty collections grew by 34.5 per cent on a y-o-y basis on account of the upward revision in clean environment cess, imposition of infrastructure cess on certain motor vehicles, additional excise duty on jewellery articles and increase in excise duty on tobacco products. Receipts from the service tax grew by 17.1 per cent due to imposition of Krishi Kalyan cess at 0.5 per cent from June 1, 2016. Relatively robust indirect tax collections and lower spending on subsidies also entailed a wider divergence between GVA and GDP growth rates. The Union Budget, 2017-18 deferred the target for the gross fiscal deficit (GFD) to GDP ratio of 3.0 per cent to 2018-19 from 2017-18. Nevertheless, the government remained committed to the spirit of fiscal consolidation as the Centre’s GFD is budgeted to decline by 0.3 percentage point to 3.2 per cent in 2017-18 through an increase in non-debt receipts, particularly tax revenues and disinvestment proceeds. This makes room for enhanced budgetary allocation for the farm and rural sectors, social and physical infrastructure, and employment generation. Future fiscal consolidation is contingent upon efficient revenue mobilisation - broadening the tax base; and incentivising digital payments. | Table III.2: Key Fiscal Indicators - Central Government Finances | | Item | Per cent to GDP | 2016-17

(BE) | 2016-17

(RE) | 2017-18

(BE) | | 1. Revenue Receipts | 7.9 | 9.3 | 9.0 | | a. Tax Revenue (Net) | 6.3 | 7.1 | 7.3 | | b. Non-Tax Revenue | 1.7 | 2.2 | 1.7 | | 2. Non Debt Capital Receipts | 0.4 | 0.4 | 0.5 | | 3. Revenue Expenditure | 11.5 | 11.4 | 10.9 | | 4. Capital Expenditure | 1.6 | 1.8 | 1.8 | | 5. Total Expenditure | 13.1 | 13.2 | 12.7 | | 6. Gross Fiscal Deficit | 3.5 | 3.5 | 3.2 | | 7. Revenue Deficit | 2.3 | 2.0 | 1.9 | | 8. Primary Deficit | 0.3 | 0.3 | 0.1 | Source: Union Budget, 2017-18.

Note: BE: Budget Esitmates RE: Revised Estimates |

| Table III.3: Major Deficit Indicators of State Governments | | (Per cent of GSDP) | | Item | 2016-17

(BE) | 2016-17

(RE) | 2017-18

(BE) | | Revenue Deficit | -0.1 | 0.2 | -0.1 | | Gross Fiscal Deficit | 3.0 | 3.4 | 2.6 | | Gross Fiscal Deficit ( Excluding UDAY) | - | 3.0 | - | | Primary Deficit | 1.3 | 1.7 | 0.9 | Notes: 1. Negative (-) sign indicates surplus.

2. Data pertain to 21 out of 29 States.

3. UDAY data as per RBI records.

Source: Budget Documents of State Governments. | The latest available data in respect of 21 States suggest an increase in GFD to gross state domestic product (GSDP) ratio to 3.4 per cent in 2016-17 (RE) against 3.0 per cent budgeted. Net of Ujwal DISCOM Assurance Yojana (UDAY) bonds, however, the ratio was lower at 3.0 per cent. For 2017-18 (BE), The GFD-GSDP ratio of 21 states works out to 2.6 per cent (Table III.3). The deterioration in State finances during 2016-17 will impact the overall fiscal position of the general government. The Centre’s borrowing programme was conducted as per the planned issuance schedule within the overall contour of debt management strategy. Combined gross market borrowings of the Centre and States (dated securities) during 2016-17 increased by 9.6 per cent over the previous year (Table III.4). Increased borrowing by the state governments may exert pressure on the finite pool of investible resources and crowd out private investment. | Table III.4: Government Market Borrowings | | (₹ billion) | | Item | 2015-16 | 2016- 17 | | Centre | States | Total | Centre | States | Total | | Net Borrowings | 4,406.3 | 2,611.9 | 7,018.2 | 4,082.0 | 3,426.5 | 7,508.5 | | Gross Borrowings | 5,850.0 | 2,945.6 | 8,795.6 | 5,820.0 | 3,819.8 | 9,639.8 | III.1.4 External Demand After making positive contribution to GDP in the last four quarters, net exports contracted sharply and pulled down GDP growth in Q3:2016-17. Growth in merchandise exports as well as imports turned positive for the first time in eight quarters; however, a stronger pick-up in imports than in exports expanded the trade deficit in Q3 and the first two months of Q4. Notwithstanding the slowdown in global demand, evident in weak imports by advanced economies (AEs), India’s exports to AEs resisted this slowdown and actually increased in Q2 and Q3:2016-17 alongside the pick-up in exports to emerging market economies (EMEs) which had accounted for a large part of the decline in India’s exports over the last two years. In fact, export shipments to EMEs registered positive growth for the first time since Q3:2014-15. Significantly, the turnaround in India’s export growth in Q3 was led by non-oil exports with almost the entire increase in oil exports accounted for by the increase in international crude oil prices. Exports of some labourintensive sectors such as ready-made garments, gems and jewellery, and leather and products experienced transient pressures from demonetisation. All broad categories of imports, viz. oil, gold and non-oil non-gold imports, increased during October-February 2016-17 (Chart III.7). Gold imports, which rose in November after demonetisation and declined sharply in the next two months, increased in February 2017 due to domestic stockpiling ahead of festive (Akshaya Tritiya) and wedding season. Strong price effects caused by Organisation of the Petroleum Exporting Countries (OPEC) production cut pushed up the growth of oil imports in nominal terms even as import volumes declined in recent months.  Net services exports moderated in H2:2016-17 (October 2016 - January 2017) in relation to the corresponding period of 2015-16. Among services exports, India’s software exports face uncertainty from global headwinds, especially from the likely restrictions relating to the H1-B visas. A higher flow of tourist arrivals augured well for exports of travel services. The net outgo due to investment income payments in Q3, however, was marginally lower than in the corresponding period of 2015-16. Private transfer receipts, mainly representing remittances by Indians employed overseas, declined by 3.8 per cent in Q3 from their level a year ago. Despite a lower merchandise trade deficit, current account deficit at 1.4 per cent of GDP in Q3 was almost at the same level as a year ago, though higher than the preceding two quarters. While net FDI inflows at US$ 13.2 billion in H2:2016- 17 (October 2016 - January 2017) moderated from the level a year ago, net portfolio flows turned positive in Q4. On a cumulative basis, net FDI inflows, however, rose to US$ 33.9 billion in April-January 2016-17 as compared with US$ 31.6 billion a year ago, suggesting India is becoming a preferred investment destination. The bout of global risk aversion that caused net outflow of foreign portfolio investment (FPI) during November 2016 to January 2017 subsided subsequently as foreign portfolio investors turned net buyers in response to the Union Budget proposals and the change in the monetary policy stance of the Reserve Bank. FPIs in both the equity and debt segments recorded net inflow of US$ 11.6 billion in February and March 2017. FPIs have been more bullish about the continuance of the domestic reforms, especially after decisive outcomes in recent State elections. Inflows in the debt segment were largely influenced by domestic and global interest rate differentials. Higher repayments caused net outflow of external commercial borrowings during April-February of 2016-17. Net outflow of US$ 18.0 billion of non-resident deposits during October 2016 to January 2017 reflected the redemption of FCNR (B) deposits. III.1.5 Discrepancies in GDP In India, real economic activity gets more comprehensively captured through Gross Value Added (GVA) at basic prices across all the sectors of the economy. Real GDP at market prices is derived by adding net indirect taxes (product taxes minus product subsidies) to real GVA at basic prices. Independently estimated private and government final consumption, gross fixed capital formation and net exports do not add up to this total, resulting in discrepancies in GDP, especially in quarterly estimates. III.2 Aggregate Supply III.2.1 Output Growth Output growth in terms of GVA at basic prices decelerated in H2:2016-17 relative to H1 and a year ago, with the impact of demonetisation on manufacturing and services sector activity turning out to be smaller and transient relative to the underlying moderation that has been in evidence since H2:2015- 16 (Table III.5). The agriculture sector remained resilient and rebounded on the strength of a normal monsoon after two consecutive years of near drought conditions, vigorous sowing activity and effective supply management by the Government. Seasonally adjusted q-o-q annualised GVA movements also confirm the weakening of growth in H2:2016- 17vis-à-vis H1 (Chart III.8a). For H2, the October MPR had projected GVA growth of 7.7 per cent. It had noted that the actual outcome for Q1 had matched projections given in the April 2016 MPR. | Table III.5: Sector-wise Growth in GVA | | (Per cent) | | Sector | Contribution- Weighted 2016-17 | 2015-16 | 2016-17

(SAE) | 2015-16 | 2016-17 | | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4# | | Agriculture & Allied Activities | 0.7 | 0.8 | 4.4 | 2.6 | 2.3 | -2.2 | 1.7 | 1.9 | 3.8 | 6.0 | 5.0 | | Industry | 1.6 | 10.3 | 6.7 | 8.3 | 10.3 | 12.0 | 10.6 | 7.6 | 5.6 | 8.0 | 5.6 | | Mining & quarrying | 0.0 | 12.3 | 1.3 | 11.2 | 13.9 | 13.3 | 11.5 | -0.3 | -1.3 | 7.5 | -0.7 | | Manufacturing | 1.4 | 10.6 | 7.7 | 8.5 | 10.3 | 12.8 | 10.8 | 9 | 6.9 | 8.3 | 6.8 | | Electricity, gas, water supply and other utilities | 0.1 | 5.1 | 6.6 | 2.5 | 5.9 | 4.1 | 7.8 | 9.6 | 3.8 | 6.8 | 6.4 | | Services | 4.4 | 8.8 | 7.2 | 8.8 | 9 | 8.5 | 9.1 | 7.8 | 7.6 | 6.3 | 7.3 | | Construction | 0.3 | 2.8 | 3.1 | 4.8 | 0.0 | 3.2 | 3.0 | 1.7 | 3.4 | 2.7 | 4.8 | | Trade, hotels, transport, communication | 1.4 | 10.7 | 7.3 | 10.6 | 8.9 | 9.6 | 13.2 | 8.2 | 6.9 | 7.2 | 7.0 | | Financial, real estate & professional services | 1.4 | 10.8 | 6.5 | 10.2 | 13.1 | 10.4 | 8.9 | 8.7 | 7.6 | 3.1 | 5.9 | | Public administration, defence and other services | 1.4 | 6.9 | 11.2 | 6.3 | 7.2 | 7.5 | 6.7 | 9.9 | 11 | 11.9 | 11.7 | | GVA at Basic Prices | 6.7 | 7.8 | 6.7 | 7.8 | 8.4 | 7.0 | 8.2 | 6.9 | 6.7 | 6.6 | 6.5 | SAE: Second Advance Estimates. #: Implicit

Source: Central Statistics Office (CSO). | The CSO’s estimates for Q2: 2016-17 GVA at 6.7 per cent undershot RBI staff’s April projections sizeably, suggesting greater than expected loss of momentum (Chart III.8b). The projected pace of acceleration in agriculture on the back of favourable base effects did not materialise and output from allied activities slowed more than expected. Furthermore, the anticipation of an investment-driven boost to electricity generation and mining and quarrying was belied. Construction activity also weakened more than projected on weaker demand. The sharper loss of momentum was further evident in CSO’s subsequent data releases. The rise in crude oil prices, which adversely affected corporate bottom lines, also contributed. In addition, the knock-on effects of demonetisation, especially in the industrial sector and some sub-components of the services sector pulled down GVA growth out of alignment with the October MPR projections, but these effects were much more muted and transitory than the loss of momentum in Q2 on the more endemic factors described earlier. Moreover, large unanticipated data revisions relating to 2014-16 also contributed to the deviations from the October MPR projections. These developments were closely monitored and reassessments were made in the December 2016 and February 2017 MPC resolutions in which the annual GVA growth projection was pared to 7.1 and 6.9 per cent, respectively. The impact of demonetisation on the overall GVA growth was mitigated by a significantly higher growth in agriculture and public administration and defence and other services (PADO) components of the services sector. Even after excluding government spending, the momentum of GVA growth remained broadly unchanged in Q3: 2016-17 (Chart III.9).

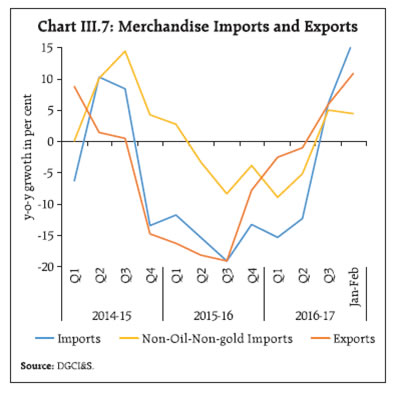

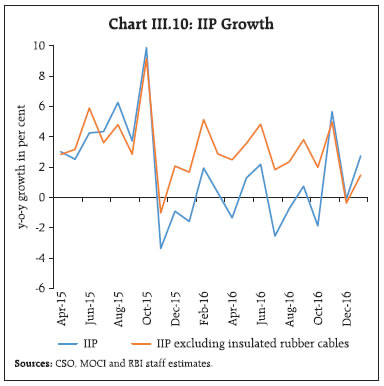

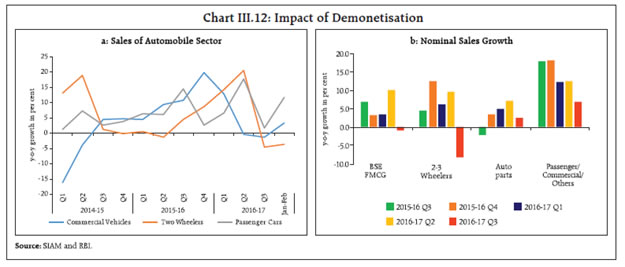

III.2.2 Agriculture The growth of agriculture and allied activities accelerated in H2: 2016-17 on a y-o-y basis as well as sequentially, reflecting the record foodgrains production. Furthermore, adequate soil moisture, a reasonable northeast monsoon in the initial part of the season and comfortable reservoir levels (above the 10-year average) resulted in an increase in sowing of rabi crops by 5.7 per cent over a year ago. Higher sowing, particularly in wheat, pulses and oilseeds, coupled with other factors such as timely announcement of minimum support prices (MSPs) (especially for pulses) and availability of key agricultural inputs supported agricultural activity. It is important to note that rabi sowing in all subsequent weeks after the announcement of demonetisation remained higher than a year ago - except for the week ended November 18, 2016 - suggesting that there was no impact on sowing activity per se. The dwindling of wheat stocks below the quarterly buffer norm during August 2016 till date prompted an increase in wheat imports. Import of pulses also grew significantly during the year. The record production of wheat and pulses in 2016-17 is expected to augment stocks substantially and keep prices under check. The strong performance in foodgrains was not, however, matched by the horticulture sector. Its growth decelerated during 2016-17 as per advance estimates. Yet, livestock, barring wool production, grew at a robust pace, providing an alternate source of income to the rural population and supporting GVA from agriculture and allied activities as a whole. III.2.3 Industrial Sector Value added in the industrial sector decelerated in H2:2016-17 on a y-o-y basis, led by manufacturing. Sequentially, however, activity in the sector gained momentum in the same period, buoyed mainly by the better performance of the mining and quarrying sectors. Organised industry remained largely resilient in the face of demonetisation. The deceleration in the industrial sector was discernible even before the demonetisation - the IIP contracted by 0.3 per cent in the period April-October 2016 as compared with a growth of 4.8 per cent in the same period of the previous year. This deceleration was partly on account of the negative base effect relating to insulated rubber cables, which pulled down IIP (Chart III.10). Trimmed off insulated rubber cables, IIP growth during April- October 2016 was 3.0 per cent. The subsequent waning of the negative base effect helped in propping up IIP, aided by a pick-up in momentum. The mining and quarrying segment slowed down from the beginning of 2016-17, mainly reflecting tepid coal production. Post demonetisation, the growth of the mining and quarrying sector, which is less cash intensive, accelerated sequentially. This was on account of improvement in coal production, although natural gas and crude oil production continued to contract.  The impact of demonetisation on the manufacturing sector was transient - after contracting in December 2016, manufacturing output bounced back in January 2017. The manufacturing PMI, which had slipped in the contractionary zone in December 2016, expanded in January-March 2017. The performance of listed private companies remained resilient as sales and net profit growth improved at the aggregate level, although the performance of non-information technology (non- IT) service sector companies continued to be lacklustre (Chart III.11). Sales in cash intensive sectors such as fast moving consumer goods (FMCG) and motor vehicles declined in Q3 vis-à-vis the previous quarter (Chart III.12a and b). However, lead indicators such as passenger car sales and consumer durables suggest that this impact was short-lived. The electricity sector recorded a sharp increase in H2:2016-17 on a y-o-y basis. Although thermal electricity production remained weak, nonconventional sources such as solar and wind energy have registered higher production while pulling down the price. With India taking significant strides in expanding non-conventional sources of energy, helped by an enabling policy environment, and with the expected improvement in the financial health of power distribution companies (DISCOMs) after implementation of the Ujwal DISCOM Assurance Yojana (UDAY) scheme, the outlook for electricity generation has brightened considerably. III.2.4 Services The slowdown in the services sector, which became evident from Q1:2016-17, was sharper in H2:2016- 17. Some services sectors were adversely impacted by demonetisation, albeit temporarily, especially construction and realty. The implicit CSO data for Q4, however, suggests that these effects to be waning. Steel consumption and cement production - lead indicators of construction activity - remained positive from Q2:2016-17, although there was a sharp decline in cement production since December (Chart III.13).

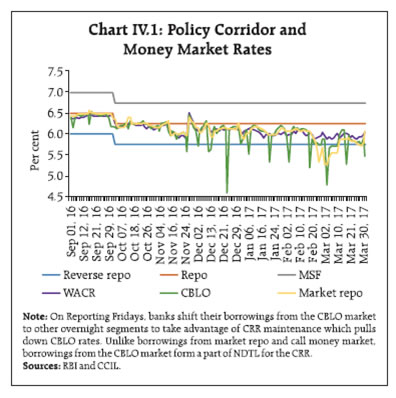

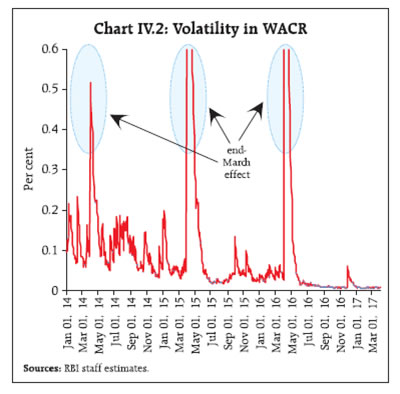

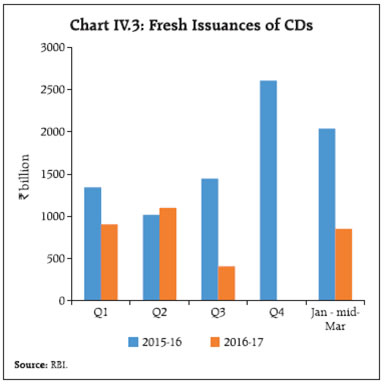

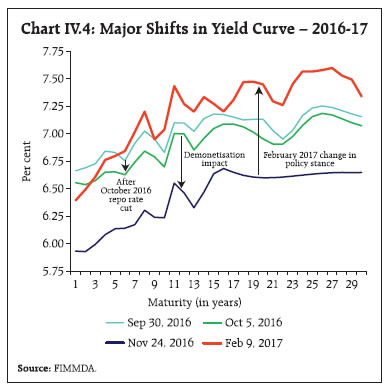

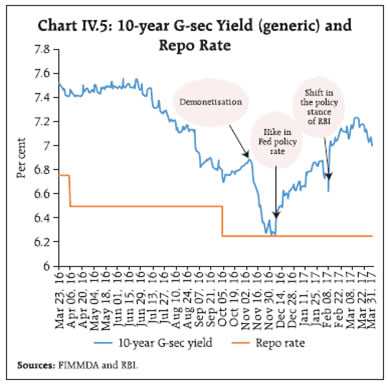

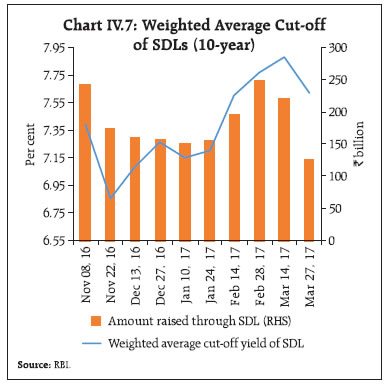

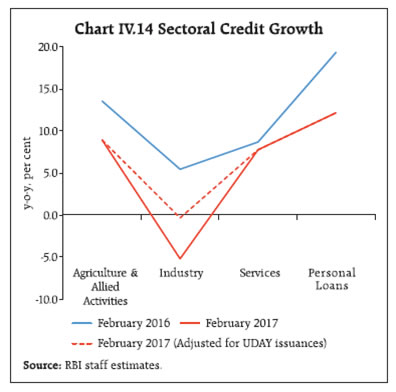

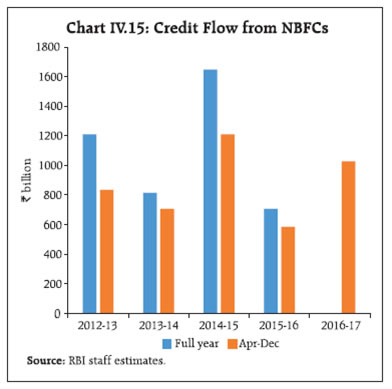

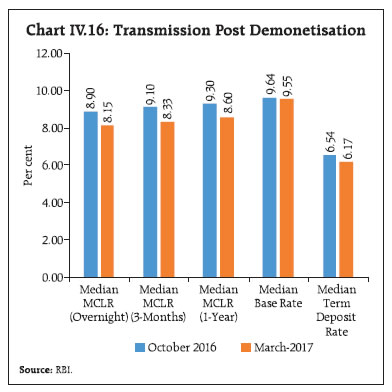

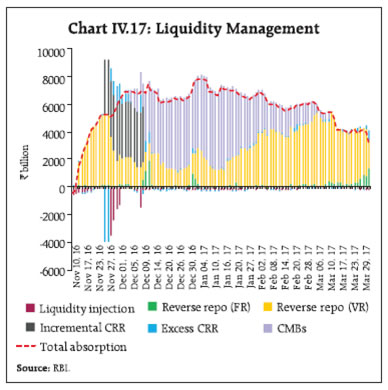

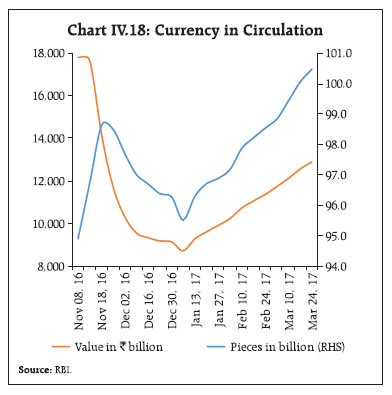

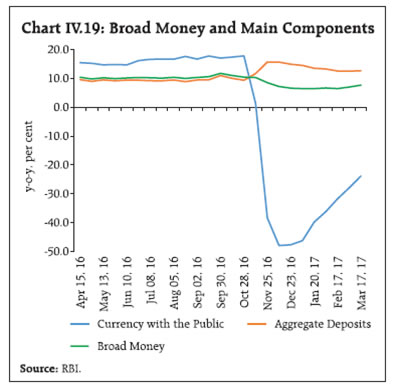

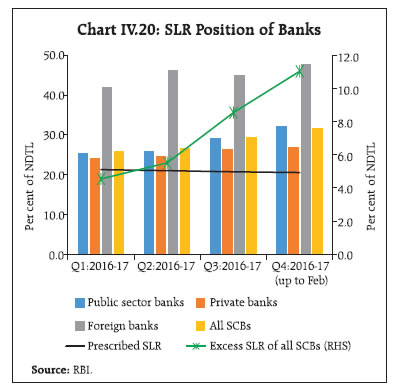

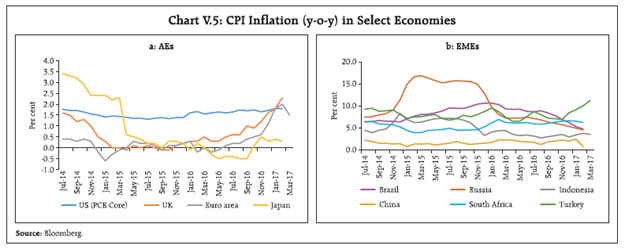

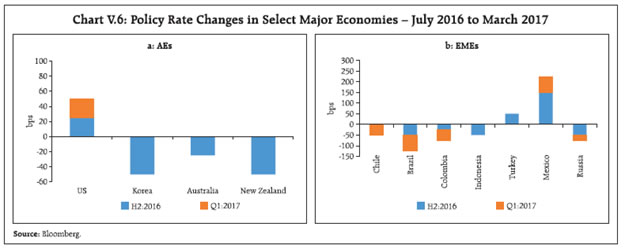

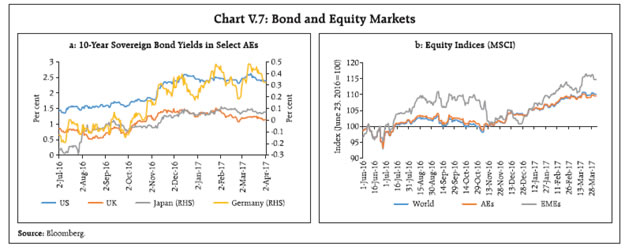

The government’s continuing thrust on building infrastructure - as evident from a significant increase in both road projects awarded and constructed - and rural housing, should revive the construction sector in the period ahead. Trade, hotels, transport and communication are the other sectors, which are shrugging off the effects of demonetisation and gearing up for a revival. Tourist arrivals have picked up strongly in recent months. In the transport segment, major lead indicators such as commercial and passenger vehicles sales have revived from the lows of November/December 2016. Financial, real estate and business services have faced subdued conditions for the past four quarters as constraints on account of slowing bank credit pulled down its growth. Credit growth has continued to remain tepid, although insurance premiums witnessed a surge. The real estate segment, which largely reflects value addition by listed real estate companies, was impacted by demonetisation as evident in a sharp fall in the BSE realty index. Subsequently, these losses have been recouped as these transitory effects wore off. The business services segment largely reflects the performance of IT companies. Sales and profit of these companies remained robust. Nonetheless, the outlook for this segment is clouded by uncertainty in view of growing protectionist and anti-globalisation sentiments in the US. As alluded to earlier, public administration and defence continued to exhibit robust growth throughout 2016-17 due to higher expenditure on account of the 7th CPC award and OROP. Given the commitment to fiscal consolidation, however, double digit growth in these segments may not sustain in 2017-18. Overall, for the services sector, lead/coincident indicators suggest some recovery in Q4 from a prolonged downturn and the more immediate hit from demonetisation. III.3 Output Gap The efficacy of monetary policy critically depends on an accurate assessment of resource utilisation. In this context, a good fix on potential output is vital but challenging since it is unobservable. Estimation of potential output has to deal with uncertainty as real time measures of aggregate activity contain a considerable amount of noise and are often subject to significant revisions. The introduction of a new base year for national accounts (2011-12) and the continuing unavailability of a time series for previous years for ensuring appropriate degrees of freedom in econometric estimation are major impediments in this endeavour. Demonetisation added some uncertainty to the growth outlook, but its impact was transitory. For a fair assessment of the output gap for India, which indicates deviation of actual output from its potential level and expressed as percentage of potential output, the revised GVA data were augmented with forecasts applying different univariate filters such as the Hodrick-Prescott filter, the Baxter-King filter, the Christiano-Fitzgerald filter and a Multivariate Kalman (MKV) filter4. A MKV filter is particularly useful as it juxtaposes demand conditions with movements in inflationary pressures. The estimated output gap measures were aggregated by using principal components to get a composite measure, which indicates that the output gap (actual minus potential), is gradually closing (Chart III.14). Growth prospects are expected to strengthen in 2017-18 on account of several factors. First, discretionary consumer demand held down by demonetisation is expected to bounce back. Second, economic activity in cash-intensive sectors such as retail trade, hotels and restaurants, transportation as well as in the unorganised sector is getting rapidly restored. Third, demonetisation-induced ease in bank funding conditions has led to a sharp improvement in transmission of past policy rate reductions into marginal cost-based lending rates, and in turn, to lending rates for healthy borrowers, which should spur a pick-up in both consumption and investment demand. Fourth, the emphasis in the Union Budget for 2017-18 on the rural economy and affordable housing should also be positive for growth.