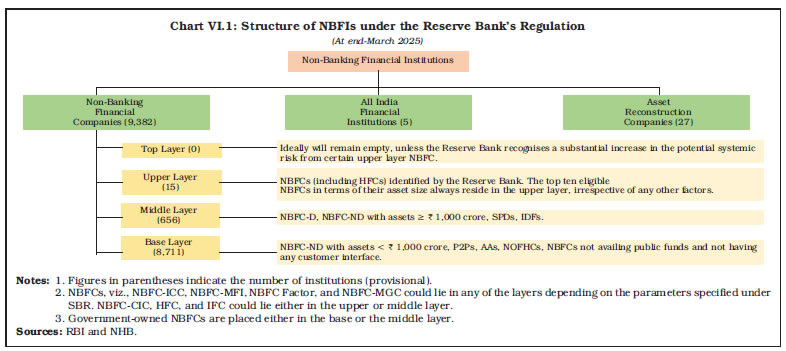

Non-banking financial companies continued to record a robust performance in 2024-25, primarily driven by strong credit growth. They continued to maintain sound key indicators, such as asset quality and capital adequacy, albeit with some moderation in return on assets. Housing finance companies exhibited double-digit credit growth, accompanied by an improvement in their asset quality during the same period. All India financial institutions showed a robust balance sheet and credit growth. Introduction VI.1 Non-banking financial institutions (NBFIs) are an important constituent of India’s financial system. Within NBFIs, the Reserve Bank regulates non-banking financial companies (NBFCs)1, housing finance companies (HFCs)2, all India financial institutions (AIFIs)3, and standalone primary dealers (SPDs). VI.2 NBFCs are financial institutions (FIs) which play a vital role in complementing the banking sector by extending credit to diverse sectors and customer segments, including small businesses, microfinance borrowers, and underserved segments of the population. NBFCs have emerged as key drivers of financial inclusion and growth of India’s financial ecosystem. HFCs are specialised FIs that focus on housing loans and related financing services to individuals, builders, and developers. AIFIs are apex-level FIs which provide long-term development finance to sectors like agriculture; micro, small and medium enterprises (MSMEs); infrastructure; international trade; and housing. Primary Dealers (PDs) are FIs which act as underwriters and market makers in the Government securities (G-sec) market (Chart VI.1). VI.3 At end-March 2025, the balance sheet of NBFCs continued to expand, driven by robust growth in loans and advances. Key indicators, such as capital adequacy and asset quality of NBFCs continued to remain at robust levels albeit some moderation in return on assets. Although the share of borrowing from banks in total borrowing of NBFCs moderated, it continued to be significant. During the same period, the balance sheet of HFCs also expanded in double digits. A major development in the HFC segment was the conversion of two HFCs into NBFC-IFC and NBFC-ICC in 2024-25. There has been an improvement in profitability indicators and asset quality of the sector. The consolidated balance sheet of AIFIs continued to grow in double digit at end-March 2025, thus playing an important role in financing economic activity. In 2024-25, SPDs maintained a sound financial position, with strong capital buffers, healthy profitability, and enhanced capacity to fulfil its role of underwriting and providing liquidity in the G-sec market. VI.4 This chapter covers the performance of NBFIs in 2024-25 and the first half of 2025-26. Section 2 provides an assessment of the NBFC sector, with a focus on the NBFCs in the upper and the middle layers. Section 3 discusses the performance of the HFCs. Sections 4 and 5 evaluate the performance of AIFIs and PDs, respectively. The overall assessment is provided in Section 6. 2. Non-Banking Financial Companies VI.5 NBFCs are regulated by the Reserve Bank under the scale-based regulation (SBR) framework4 wherein differential regulations are applied proportionate to scale and systemic importance of NBFCs. As on end-March 20255, 15 NBFCs (including four HFCs) were identified for the upper layer (NBFC-UL), which are subject to more stringent regulations as compared to NBFCs in middle (NBFC-ML) and base (NBFC-BL) layers (Chart VI.1). VI.6 NBFCs, a heterogeneous set of FIs, are involved in a range of activities which also form a basis of classification (Table VI.1). RBI is encouraging self-regulation which is expected to complement the statutory framework for better compliance, innovation, transparency, fair competition, and consumer protection. In October 2025, RBI recognised a self-regulatory organisation for NBFCs6, which shall frame necessary best practices/ standards/ codes within the regulatory framework prescribed by RBI for voluntary adoption by its members. VI.7 A noteworthy development on the regulatory front was the release of Digital Lending Directions in May 20257 by the Reserve Bank to address concerns around the methods of designing, delivering, and servicing of digital credit products. This was necessitated by the rise of fintech, digital lending and ‘digital-first’ approach adopted by the NBFC sector in enabling the credit flow to the economy. These directions are aimed at strengthening the digital lending practices while ensuring greater transparency, accountability, and consumer trust in the digital credit ecosystem.

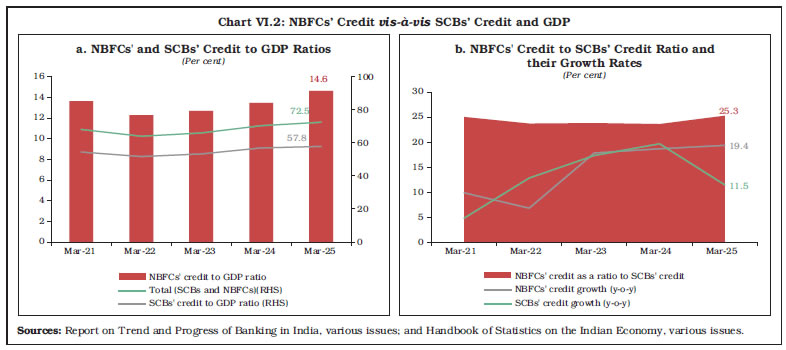

| Table VI.1: Classification of NBFCs by Activity under the Scale-Based Regulatory Framework | | S.No. | Classification | Activity | Layer | | 1 | 2 | 3 | 4 | | 1. | Investment and Credit Company (NBFC-ICC) | Lending which supports productive/ economic activities, offer consumption/ personal finance and acquisition of securities for investment. | Any layer, depending on the parameters of the SBR. | | 2. | NBFC-Infrastructure Finance Company (NBFC-IFC) | Infrastructure loans. | Middle or upper layer, as the case may be. | | 3. | Core Investment Company (CIC) | Investment in equity shares, preference shares, debt, or loans to group companies. | Middle or upper layer, as the case may be. | | 4. | NBFC-Infrastructure Debt Fund (NBFC-IDF) | Refinance post commencement operations date infrastructure projects which have completed at least one year of commercial operations and finance toll operate transfer projects as the direct lender. | Middle layer. | | 5. | NBFC-Micro Finance Institution (NBFC-MFI) | Providing collateral free small ticket loans to economically disadvantaged groups. | Any layer, depending on the parameters of SBR. | | 6. | NBFC-Factors | Acquisition of receivables of an assignor by way of assignment or extending loans against such assignment. | Any layer, depending on the parameters of SBR. | | 7. | NBFC-Non-Operative Financial Holding Company (NBFCNOFHC) | Facilitation of promoters/ promoter groups in setting up new banks. | Base layer. | | 8. | Mortgage Guarantee Company (MGC) | Undertaking of mortgage guarantee business. | Any layer, depending on the parameters of SBR. | | 9. | NBFC-Account Aggregator (NBFC-AA) | Collecting and providing specified financial information pertaining to a customer in a consolidated, organised, and retrievable manner to the customer or regulated entity as specified by the customer. | Base layer. | | 10. | NBFC–Peer to Peer Lending Platform (NBFC-P2P) | Providing an online marketplace or platform to facilitate lending between lenders and borrowers. | Base layer. | | 11. | Housing Finance Company (HFC) | Financing for purchase/ construction/ reconstruction/ renovation/ repairs of residential dwelling units. | Middle or upper layer, as the case may be. | | 12. | Standalone Primary Dealer (SPD) | Underwrites issuances of government-dated securities and participates in primary auctions. | Middle layer. | VI.8 The NBFC sector is dominated by 15 NBFCs (including four HFCs) which are in the upper layer with a share of 30.2 per cent of total assets as at end-March 2025. NBFC-ML accounted for the largest share of 64.6 per cent due to the presence of government-owned NBFCs, while NBFC-BL had a meagre share of 5.2 per cent in total assets although it is the largest segment in terms of number of entities (Table VI.2). VI.9 The credit extended by NBFCs8 has been rising over the years, underscoring their growing importance in financial intermediation. It increased to 14.6 per cent of gross domestic product at end-March 2025 from 13.5 per cent a year ago (Chart VI.2a). NBFCs’ credit as a share of outstanding credit of scheduled commercial banks (SCBs) increased to 25.3 per cent at end-March 2025 from 23.6 per cent a year ago (Chart VI.2b). Emerging co-lending arrangements between banks and NBFCs has the potential to promote greater credit flow by NBFCs to underserved sectors like MSMEs, agriculture and retail borrowers. In view of this, the Reserve Bank released comprehensive revised Directions9 with the objective of broadening the scope of co-lending and providing specific regulatory clarity on the permissibility of such arrangements, while addressing some of the prudential as well as conduct-related aspects. | Table VI.2: Composition of NBFCs | | (At end-March 2025) | | (Share in per cent) | | Layer | Number | Assets | | 1 | 2 | 3 | | NBFC-UL | 0.2 | 30.2 | | NBFC-ML | 7.0 | 64.6 | | NBFC-BL | 92.8 | 5.2 | | Total | 100.0 | 100.0 | Note: NBFCs refer to all NBFCs regulated by the Reserve Bank, including CICs, HFCs and SPDs.

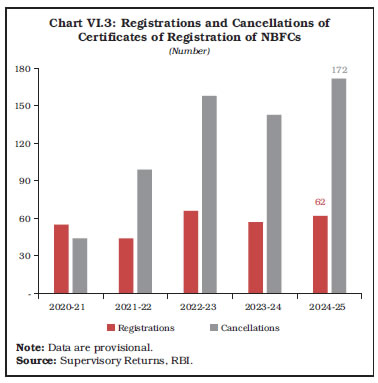

Sources: RBI and NHB. | VI.10 The number of registrations and cancellations of certificates of registration (CoR) of NBFCs have increased in 2024-25 (Chart VI.3). The reasons for the surrender or cancellations of CoRs, inter alia, include voluntary exits, legal dissolution, mergers, change in status as well as regulatory non-compliance. 2.1. Ownership Pattern VI.11 Government-owned NBFCs (primarily NBFC-IFCs) hold a substantial asset share of 36.5 per cent of the NBFC sector and 51.5 per cent of the aggregate assets of NBFC-ML. Non-government public and private limited companies had shares of 30.6 per cent and 33.0 per cent, respectively, in the total assets of the NBFC sector (Table VI.3). Following identification as NBFC-UL, NBFCs are required to get listed within three years, i.e., to become a public limited company, if they are not already listed. 2.2. Balance Sheet VI.12 At end-March 2025, the balance sheet of NBFCs maintained double-digit expansion, surpassing the growth recorded in the previous year. On the liabilities side, NBFCs’ growth in borrowings from banks moderated with NBFC-ML experiencing a deceleration in growth compared to NBFC-UL, which recorded a marginal expansion (Table VI.4). NBFCs compensated this moderation by increasing their reliance on market borrowings, driven by NBFC-ML. The increase in risk weights on bank lending to NBFCs, which was introduced in November 2023, was intended to moderate the dependency of NBFCs on bank borrowings. Effective from April 01, 2025, the risk weights were restored to the levels prior to the increase in November 202310. Borrowings via debentures picked up at end-September 2025 as compared with the level at end-March 2025 (Appendix Table VI.1).

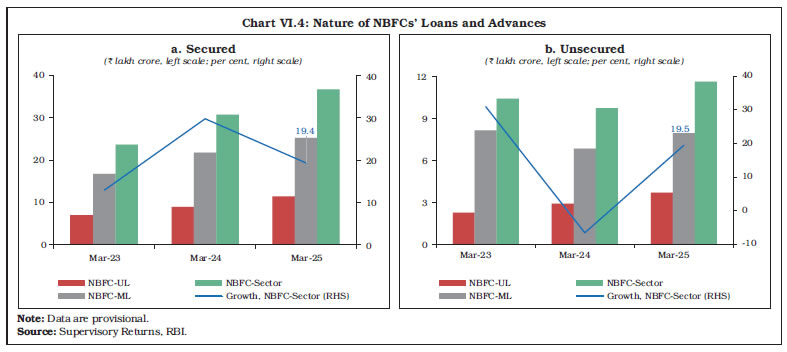

VI.13 On the asset side, loans and advances expanded by 19.4 per cent at end-March 202511, with upper-layer NBFCs recording higher growth than NBFC-ML. Unsecured lending by NBFCs rose largely due to the base effect, while the growth of secured lending moderated during the same period (Chart VI.4). This moderation was primarily driven by NBFC-ML, whose secured credit growth dropped to 15.8 per cent at end-March 2025 from 29.9 per cent a year ago (Appendix Tables VI.2 and VI.3). VI.14 Three categories of NBFCs, viz. ICCs, IFCs and MFIs together accounted for 98.8 per cent of the outstanding credit of the NBFC sector at end-March 2025. NBFC-ICCs, the largest classification in terms of asset size and primarily involved in retail lending, witnessed a credit growth of 21.2 per cent. NBFC-Factors continued to experience rapid credit growth. NBFC-IFCs, which provide financing to infrastructure, such as power, recorded double-digit credit growth compared with 9.6 per cent in the previous year. NBFC-MFIs witnessed a decline in credit growth (Table VI.5). The sector adopted measures such as limiting the number of microfinance lenders to a client to three and capping the total microfinance loans (including unsecured retail loan) to a client to ₹ 2 lakh12. The sector also witnessed tighter funding conditions along with rising competition, and state-specific regulations for this segment. | Table VI.3: Ownership Pattern of NBFCs | | (At end-March 2025) | | (Amount in ₹ crore; share in per cent) | | Type | NBFC-Sector | NBFC-UL | NBFC-ML | | Number | Asset Size | Asset share | Number | Asset Size | Asset share | Number | Asset Size | Asset share | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | A. Government Companies | 26 | 22,28,097 | 36.5 | 0 | 0 | 0 | 26 | 22,28,097 | 51.5 | | B. Non-government Companies (1+2) | 405 | 38,81,029 | 63.5 | 10 | 17,81,991 | 100.0 | 395 | 20,99,038 | 48.5 | | 1. Public Limited Companies | 56 | 18,67,476 | 30.6 | 7 | 13,43,366 | 75.4 | 49 | 5,24,110 | 12.1 | | 2. Private Limited Companies | 349 | 20,13,553 | 33.0 | 3 | 4,38,625 | 24.6 | 346 | 15,74,929 | 36.4 | | C. Total (A+B) | 431 | 61,09,126 | 100.0 | 10 | 17,81,991 | 100.0 | 421 | 43,27,135 | 100.0 | Notes: 1. Data are provisional.

2. Figures may not add up due to rounding-off.

Source: Supervisory Returns, RBI. |

| Table VI.4: Abridged Balance Sheet of NBFCs | | (₹ crore) | | Items | At end-March 2024 | At end-March 2025 | At end-September 2025 | | NBFCs | NBFC-UL | NBFC-ML | NBFCs | NBFC-UL | NBFC-ML | NBFCs | NBFC-UL | NBFC-ML | | 1 | 2(3+4) | 3 | 4 | 5(6+7) | 6 | 7 | 8(9+10) | 9 | 10 | | 1. Share Capital and Reserves | 11,95,847 | 2,54,221 | 9,41,625 | 13,96,260 | 3,31,545 | 10,64,715 | 14,68,161 | 3,86,518 | 10,81,643 | | | (21.8) | (27.6) | (20.3) | (16.8) | (30.4) | (13.1) | (11.3) | (41.3) | (3.5) | | 2. Public Deposits | 1,02,959 | 83,102 | 19,858 | 1,21,178 | 1,00,653 | 20,525 | 1,31,730 | 1,10,124 | 21,607 | | | (21.2) | (28.2) | (-1.6) | (17.7) | (21.1) | (3.4) | (17.1) | (18.8) | (9.1) | | 3. Debentures | 12,32,999 | 2,71,444 | 9,61,555 | 14,76,698 | 3,46,807 | 11,29,891 | 16,20,223 | 4,20,755 | 11,99,468 | | | (11.3) | (20.4) | (9.0) | (19.8) | (27.8) | (17.5) | (21.4) | (35.3) | (17.1) | | 4. Bank Borrowings | 13,38,088 | 4,13,073 | 9,25,015 | 15,56,648 | 5,32,289 | 10,24,360 | 16,59,501 | 5,79,808 | 10,79,692 | | | (18.8) | (27.0) | (15.5) | (16.3) | (28.9) | (10.7) | (18.6) | (25.9) | (14.9) | | 5. Commercial Papers | 1,05,439 | 54,146 | 51,293 | 1,35,232 | 61,305 | 73,928 | 1,56,199 | 71,165 | 85,034 | | | (26.1) | (36.9) | (16.4) | (28.3) | (13.2) | (44.1) | (34.4) | (32.5) | (36.1) | | 6. Others | 11,64,138 | 2,83,535 | 8,80,603 | 14,23,109 | 4,09,392 | 10,13,717 | 15,15,342 | 4,30,490 | 10,84,853 | | | (15.9) | (30.8) | (11.8) | (22.2) | (44.4) | (15.1) | (18.1) | (36.0) | (12.3) | | Total Liabilities/ Assets | 51,39,470 | 13,59,521 | 37,79,949 | 61,09,126 | 17,81,991 | 43,27,135 | 65,51,157 | 19,98,860 | 45,52,297 | | | (17.1) | (26.9) | (13.9) | (18.9) | (31.1) | (14.5) | (17.7) | (32.6) | (12.2) | | 1. Loans and Advances | 40,52,732 | 11,85,621 | 28,67,111 | 48,38,744 | 15,16,011 | 33,22,733 | 52,05,544 | 17,16,579 | 34,88,965 | | | (18.7) | (29.1) | (14.9) | (19.4) | (27.9) | (15.9) | (20.5) | (30.6) | (16.1) | | 2. Investments | 6,66,796 | 95,189 | 5,71,606 | 7,84,621 | 1,35,253 | 6,49,368 | 8,18,990 | 1,53,493 | 6,65,497 | | | (25.0) | (26.1) | (24.8) | (17.7) | (42.1) | (13.6) | (6.4) | (57.3) | (-0.9) | | 3. Cash and Bank Balances | 1,73,559 | 43,228 | 1,30,332 | 2,30,508 | 80,973 | 1,49,535 | 2,41,021 | 65,829 | 1,75,192 | | | (0.8) | (-7.9) | (4.1) | (32.8) | (87.3) | (14.7) | (16.4) | (13.0) | (17.7) | | 4. Other Current Assets | 89,928 | 24,747 | 65,181 | 1,22,877 | 36,672 | 86,205 | 1,43,967 | 47,219 | 96,748 | | | (-12.0) | (12.5) | (-18.7) | (36.6) | (48.2) | (32.3) | (29.1) | (76.1) | (14.2) | | 5. Other Assets | 1,56,455 | 10,736 | 1,45,719 | 1,32,377 | 13,083 | 1,19,294 | 1,41,635 | 15,740 | 1,25,895 | | | (-6.5) | (29.1) | (-8.4) | (-15.4) | (21.9) | (-18.1) | (-10.4) | 39.9 | (-14.2) | Notes: 1. Data are provisional.

2. Figures in parentheses indicate y-o-y growth in per cent.

3. Data for end-March 2025 onwards includes two HFCs converted to NBFC-ICC and NBFC-IFC. Data for end-September 2025 includes one more HFC which converted into NBFC-ICC in April 2025.

Source: Supervisory Returns, RBI. |

| Table VI.5: Major Components of Liabilities and Assets of NBFCs by Classification | | (₹ crore) | | Items | At end-March 2024 | At end-March 2025 | At end-September 2025 | | Borrowings | Loans and Advances | Total Liabilities/ Assets | Borrowings | Loans and Advances | Total Liabilities/ Assets | Borrowings | Loans and Advances | Total Liabilities/ Assets | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 1. NBFC-ICCs | 19,63,800 | 23,71,662 | 32,65,085 | 24,55,516 | 28,74,859 | 39,55,691 | 26,43,186 | 30,94,569 | 42,10,961 | | | (21.0) | (24.5) | (20.6) | (25.0) | (21.2) | (21.2) | (21.7) | (19.6) | (16.6) | | 2. NBFC-Factors | 2,560 | 3,425 | 3,880 | 3,643 | 4,639 | 5,048 | 3,821 | 4,788 | 5,011 | | | (95.8) | (67.3) | (45.6) | (42.3) | (35.4) | (30.1) | (34.2) | (24.7) | (17.8) | | 3. NBFC-IDFs | 40,122 | 44,612 | 48,310 | 48,387 | 52,518 | 57,674 | 53,153 | 57,602 | 63,039 | | | (25.4) | (22.2) | (23.8) | (20.6) | (17.7) | (19.4) | (19.8) | (19.1) | (18.8) | | 4. NBFC-IFCs | 13,40,429 | 14,99,348 | 16,60,542 | 15,73,379 | 17,89,856 | 19,46,048 | 16,99,185 | 19,35,856 | 21,28,021 | | | (9.0) | (9.6) | (9.5) | (17.4) | (19.4) | (17.2) | (22.6) | (24.8) | (22.3) | | 5. NBFC-MFIs | 1,19,373 | 1,33,685 | 1,61,653 | 1,00,290 | 1,16,871 | 1,44,666 | 1,00,082 | 1,12,728 | 1,44,124 | | | (27.6) | (30.5) | (30.3) | (-16.0) | (-12.6) | (-10.5) | (-10.0) | (-12.0) | (-7.7) | | Total | 34,66,283 | 40,52,732 | 51,39,470 | 41,81,214 | 48,38,744 | 61,09,126 | 44,99,426 | 52,05,544 | 65,51,157 | | | (16.3) | (18.7) | (17.1) | (20.6) | (19.4) | (18.9) | (21.0) | (20.5) | (17.7) | Notes: 1. Data are provisional.

2. Figures in parentheses indicate y-o-y growth in per cent.

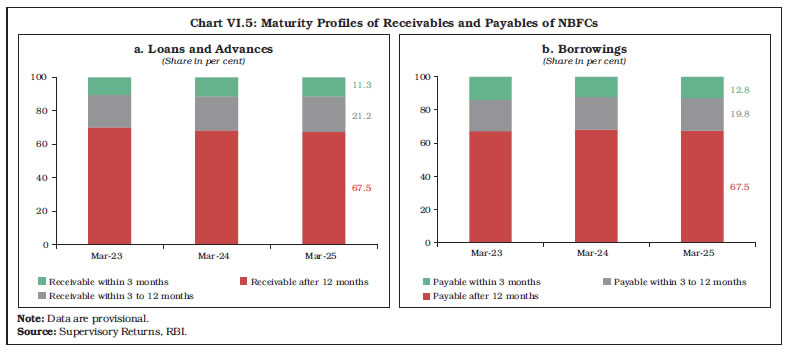

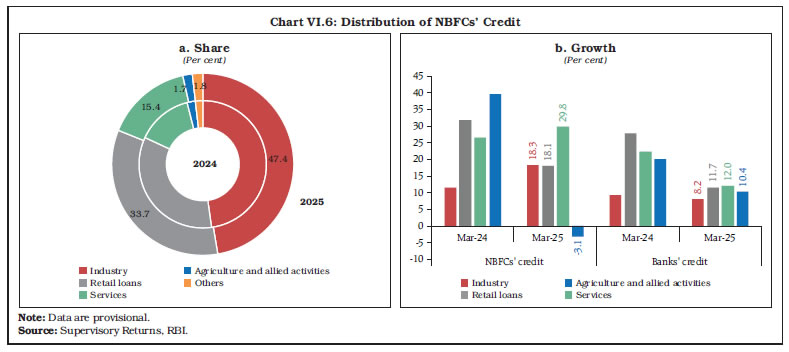

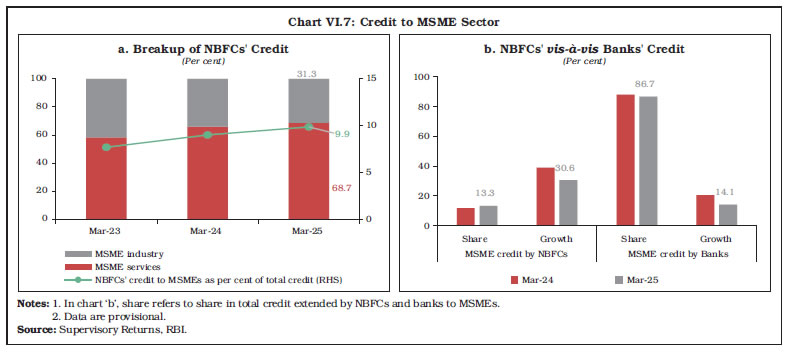

Source: Supervisory Returns, RBI. | VI.15 At end-March 2025, over two-thirds of loans and advances extended by NBFCs as well as their borrowings had a maturity period beyond 12 months, implying a lower degree of asset-liability mismatch and thereby avoiding liquidity stress (Chart VI.5). 2.3. Sectoral Credit of NBFCs VI.16 An examination of the credit extended by NBFCs at end-March 2025 suggests that industry and retail segments accounted for 81.1 per cent of total credit followed by services at 15.4 per cent. Credit to services recorded a significant increase of 29.8 per cent followed by industry and retail loans exhibiting double digit growth during the same period. Power sector, which accounts for the largest share of credit to industry recorded some moderation in its share to 56.1 per cent at end-March 2025 from 58.2 per cent a year ago. Within services, sub-sectors like trade and loans to transport operators grew at rapid pace. Retail credit continued to grow at double digits albeit at a slower pace on the back of increase in risk weights on select retail loans in November 202313. The growing role of NBFCs is reflected in their credit growth which surpassed that of banks in all segments except in case of agriculture and allied activities during the same period. At end-September 2025, aggregate credit growth continued to expand in double digits (Chart VI.6, Table VI.6, and Appendix Table VI.5).  VI.17 In lending to the MSME sector, NBFCs are increasingly establishing their presence by offering customised products and leveraging digital lending platforms. NBFCs’ lending to MSMEs in services-sector accounted for a larger share as compared to lending to MSME-industries. The proportion of credit to MSMEs in the total credit extended by NBFCs has been on the rise, reaching nearly 10 per cent by end-March 2025, highlighting its growing role in catering to the needs of MSMEs (Chart VI.7a). As compared to banks, NBFCs recorded a higher credit growth, and their share in lending to the MSME sector increased during 2024-25 (Chart VI.7b). | Table VI.6: Sectoral Credit Deployment by NBFCs | | (₹ crore) | | Items | End-March | End-March | End-September | | 2024 | 2025 | 2025 | | 1 | 2 | 3 | 4 | | 1. Agriculture and Allied Activities | 84,712 | 82,059 | 87,840 | | 2. Industry, of which | 19,37,033 | 22,91,605 | 23,94,110 | | 2.1 Power | 11,26,554 | 12,85,589 | 13,21,790 | | 3. Services, of which | 5,73,198 | 7,44,181 | 8,01,470 | | 3.1 Transport Operators | 1,32,778 | 1,61,937 | 1,66,426 | | 3.2 Trade | 95,149 | 1,27,923 | 1,33,648 | | 4. Retail Loans, of which | 13,82,146 | 16,31,900 | 18,38,897 | | 4.1 Vehicle/ Auto Loans | 4,77,135 | 5,71,954 | 6,11,714 | | 4.2 Advances to Individuals against Gold | 1,54,315 | 2,08,482 | 2,61,728 | | 4.3 Micro Finance Loan/SHG Loan | 1,50,750 | 1,33,186 | 1,24,089 | | 5. Others | 75,643 | 88,998 | 83,227 | | Gross Advances (1 to 5) | 40,52,732 | 48,38,744 | 52,05,544 | Note: Data are provisional.

Source: Supervisory Returns, RBI. |

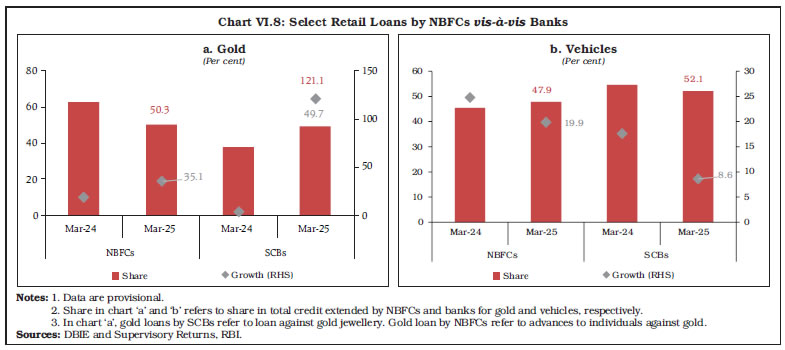

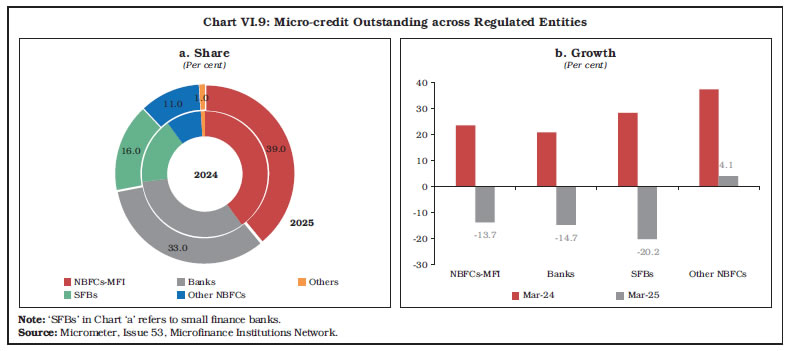

VI.18 In the retail loan segment, NBFCs maintained a strong position in vehicle financing, gold loans14, and microfinance, as these three segments together accounted for 56 per cent of their retail loan portfolio. NBFCs are facing competition from banks in the gold loan segment, leading to a significant drop in their share in aggregate gold loans extended by banks and NBFCs at end-March 2025 (Chart VI.8a). NBFCs have managed to increase their market share in vehicle financing attaining a growth more than twice that of banks at end-March 2025 (Chart VI.8b). The Reserve Bank revised directions on lending against gold and silver collaterals in June 202515 aimed at designing a more principle-based and harmonised regulatory framework, while also addressing gaps in potential, prudential and conduct-related aspects across the regulated entities.  VI.19 The revised regulatory framework for microfinance loans16 introduced in 2022, by eliminating interest rate caps while introducing standardised rules, laid the foundation for systemic and sustainable growth of the sector. The guardrails17 introduced by Microfinance Institutions Network (MFIN) and Sa-Dhan further prioritised steady and calibrated growth of the sector. The microfinance sector, however, experienced stress, with all lenders - excluding other NBFCs (NBFCs excluding NBFC-MFIs) - recording contraction in credit as at end-March 2025 (Chart VI.9). Going ahead, regulated entities need to monitor the build-up of stress in the segment. 2.4. Resource Mobilisation VI.20 NBFCs mobilise resources from both banks and markets. There has been a modicum of diversification of sources of funding by NBFCs in recent years, mainly towards borrowings from foreign sources along with loan sales and securitisation. 2.4.1. Borrowings VI.21 Bank borrowings and debentures have continued to be the predominant source of funding for NBFCs. The combined share of these sources, however, has declined marginally from 74.2 per cent at end-March 2024 to 72.9 per cent at end-September 2025 (Chart VI.10). NBFCs also borrow through inter-corporate borrowings, commercial papers, financial institutions and subordinated debts (Table VI.7). VI.22 Banks, besides extending direct credit, invest in debentures and commercial papers issued by NBFCs. The share of aggregate borrowings from banks in total borrowings of NBFCs continued to be significant although it has shown some moderation in recent years (Chart VI.11a). Bank lending to NBFCs accounted for 8.5 per cent of total bank credit at end-March 2025 as compared with 8.9 per cent in the preceding year (Chart VI.11b).

| Table VI.7: Sources of Borrowings of NBFCs | | (₹ crore) | | Items | End-March 2024 | End-March 2025 | End-September 2025 | Percentage Variation | | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | | 1. Debentures | 12,32,999 | 14,76,698 | 16,20,223 | 11.3 | 19.8 | | | (35.6) | (35.3) | (36.0) | | | | 2. Bank borrowings | 13,38,088 | 15,56,648 | 16,59,501 | 18.8 | 16.3 | | | (38.6) | (37.2) | (36.9) | | | | 3. Borrowings from FIs | 1,17,157 | 1,40,199 | 1,44,859 | 30.8 | 19.7 | | | (3.4) | (3.4) | (3.2) | | | | 4. Inter-corporate borrowings | 1,05,415 | 1,37,537 | 1,59,401 | 5.9 | 30.5 | | | (3.0) | (3.3) | (3.5) | | | | 5. Commercial papers | 1,05,439 | 1,35,232 | 1,56,199 | 26.1 | 28.3 | | | (3.0) | (3.2) | (3.5) | | | | 6. Borrowings from government | 18,282 | 18,442 | 18,566 | -2.7 | 0.9 | | | (0.5) | (0.4) | (0.4) | | | | 7. Subordinated debts | 75,399 | 93,040 | 97,529 | 5.5 | 23.4 | | | (2.2) | (2.2) | (2.2) | | | | 8. Other borrowings | 4,73,503 | 6,23,418 | 6,43,147 | 23.7 | 31.7 | | | (13.7) | (14.9) | (14.3) | | | | Total borrowings | 34,66,283 | 41,81,214 | 44,99,426 | 16.3 | 20.6 | Notes: 1. Data are provisional.

2. Figures in parentheses indicate share in total borrowings.

Source: Supervisory Returns, RBI. | VI.23 Both secured and unsecured borrowings by NBFCs rose steeply at end-March 2025 (Chart VI.12). Unsecured borrowings rose on the back of rising issuance of commercial papers and inter-corporate borrowing. 2.4.2. Public Deposits VI.24 Public deposits provide an alternative source of funds for deposit-taking NBFCs (NBFC-D) accounting for 12.5 per cent of total liabilities of NBFC-D at end-March 2025 (Appendix Table VI.4). Although the number of NBFC-D declined, their deposits registered a robust double-digit growth in 2024-25 mainly due to competitive interest rates (Chart VI.13a). There is a concentration of deposits in five major NBFC-D accounting for 96.9 per cent of aggregate deposits (Chart VI.13b). Deposits mobilised by NBFC-D are not insured by the Deposit Insurance and Credit Guarantee Corporation. As per the extant regulatory requirements for acceptance of public deposits, these NBFCs should have at least an investment-grade rating of ‘BBB–’ from any SEBI-registered credit rating agency. Furthermore, the quantum of deposits should not exceed 1.5 times their net owned funds for period ranging from 12 to 60 months and interest rates capped at 12.5 per cent per annum.

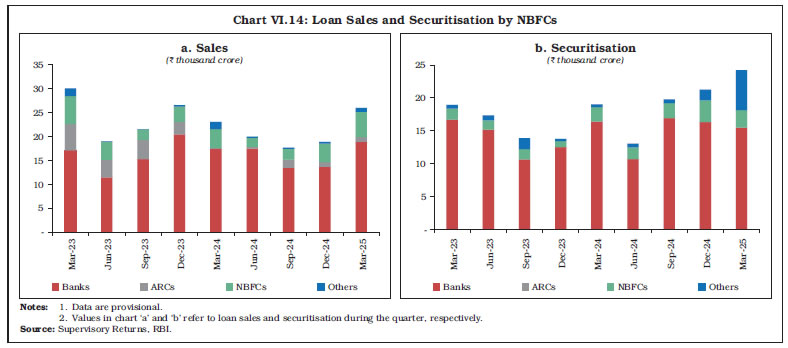

2.4.3. Loan Sales and Securitisation VI.25 Lending institutions generally undertake loan sales and securitisation as instrument for liquidity generation, rebalancing their exposures and for regulatory compliance. During 2024-25, while NBFCs mobilised larger volumes of funds through direct loan sales, their securitisation activity as a source of resource mobilisation has also been rising. Banks remained the dominant counterparty in both these segments as they utilise these arrangements to meet their commitments under the priority sector lending requirements18 (Chart VI.14). 2.4.4. Foreign Liabilities VI.26 NBFCs take recourse to funds from foreign sources also, primarily through borrowings and issuance of debentures (Table VI.8). The share of borrowings from foreign sources in total liabilities increased to 8.1 per cent at end-September 2025 from 7.7 per cent at end-March 2025 as compared with 5.0 per cent at end-March 2024, indicating modest diversification.

| Table VI.8: Foreign Liabilities of NBFCs | | (₹ crore) | | Items | End-March 2024 | End-March 2025 | End-September 2025 | Percentage Variation | | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | | 1. Equity shares | 48,777 | 48,811 | 49,797 | 19.4 | 0.1 | | i) Foreign Institutional Investors | 1,911 | 3,315 | 3,854 | 41.5 | 73.4 | | ii) Foreign Direct Investment | 46,865 | 45,496 | 45,943 | 18.7 | -2.9 | | 2. Borrowings | 2,56,790 | 4,69,636 | 5,32,375 | 26.5 | 82.9 | | 3. Bonds/ Debentures | 1,24,559 | 1,28,201 | 1,30,268 | -1.7 | 2.9 | | 4. Others | 19,234 | 24,229 | 28,846 | 34.8 | 26.0 | | Total Foreign Liabilities (1 to 4) | 4,49,359 | 6,70,876 | 7,41,286 | 16.8 | 49.3 | | Total Liabilities | 51,39,470 | 61,09,126 | 65,51,157 | 17.1 | 18.9 | Note: Data are provisional.

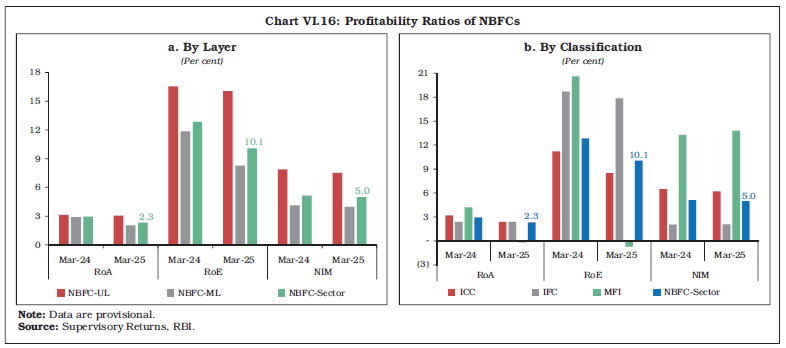

Source: Supervisory Returns, RBI. | 2.5. Asset Liability Profile of NBFCs VI.27 NBFCs maintained a net positive liquidity position at end-March 2025, reflecting an overall comfortable liquidity position for the sector. Liquidity mismatch19 is a key indicator of the liquidity position of NBFCs. Within the 1-30/ 31 days bucket, NBFCs had more than 100 per cent positive mismatch as a share of total outflows at end-March 2025, indicative of sufficient high-quality liquid assets buffers to manage stress. Further, all time buckets, except that of over six months to one year, over one to three years and over five years maturity, recorded an improvement (Chart VI.15). 2.6. Financial Performance VI.28 NBFCs derived 93.2 per cent of income from fund-based sources, viz., interest income and investment earnings, while the remaining is from fee-based sources. There was a moderation in total income growth of NBFCs at end-March 2025 due to deceleration in interest income growth, driven by NBFC-ML (Table VI.9 and Appendix Tables VI.6 and VI.7). Expenditure recorded an increase due to higher interest expenses, provisioning for NPAs, and write-offs of bad debts. Deceleration in income along with an increase in expenditure led to a higher cost-to-income ratio and contraction in net profits. Moderation in key performance indicators viz., return on asset (RoA), return on equity (RoE) and net interest margin (NIM) is discernible across the layers. Further, RoA and RoE of NBFC-MFI turned negative during 2024-25 (Chart VI.16). | Table VI.9: Financial Parameters of the NBFC Sector | | (₹ crore) | | Items | 2023-24 | 2024-25 | H1: 2025-26 | | NBFCs | NBFC-UL | NBFC-ML | NBFCs | NBFC-UL | NBFC-ML | NBFCs | NBFC-UL | NBFC-ML | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | A. Income | 5,93,747 | 1,82,115 | 4,11,632 | 6,85,545 | 2,38,342 | 4,47,203 | 3,88,433 | 1,42,597 | 2,45,836 | | | (26.8) | (28.9) | (25.9) | (15.5) | (30.9) | (8.6) | (15.3) | (29.8) | (8.3) | | B. Expenditure | 4,14,444 | 1,30,395 | 2,84,049 | 5,15,351 | 1,74,008 | 3,41,343 | 2,86,968 | 1,06,522 | 1,80,446 | | | (23.8) | (27.6) | (22.1) | (24.3) | (33.4) | (20.2) | (20.0) | (35.5) | (12.4) | | C. Net Profit | 1,40,959 | 38,618 | 1,02,341 | 1,32,286 | 48,873 | 83,412 | 79,970 | 27,012 | 52,958 | | | (30.8) | (34.3) | (29.5) | (-6.2) | (26.6) | (-18.5) | (1.0) | (14.9) | (-4.9) | | D. Total Assets | 51,39,470 | 13,59,521 | 37,79,949 | 61,09,126 | 17,81,991 | 43,27,135 | 65,51,157 | 19,98,860 | 45,52,297 | | | (17.1) | (26.9) | (13.9) | (18.9) | (31.1) | (14.5) | (17.7) | (32.6) | (12.2) | | E. Financial Ratios (as per cent of Total Assets) | | | | | | | | | | | (i) Income | 11.6 | 13.4 | 10.9 | 11.2 | 13.4 | 10.3 | 11.9 | 14.3 | 10.8 | | (ii) Expenditure | 8.1 | 9.6 | 7.5 | 8.4 | 9.8 | 7.9 | 8.8 | 10.7 | 7.9 | | (iii) Net Profit | 2.7 | 2.8 | 2.7 | 2.2 | 2.7 | 1.9 | 2.4 | 2.7 | 2.3 | | F. Cost to Income Ratio (per cent) | 48.8 | 52.7 | 47.1 | 55.2 | 54.2 | 55.9 | 53.2 | 56.8 | 50.9 | Cost to Income Ratio = (Operating Expenses)/ (Operating Income) *100.

Operating Expenses = Total expenditure-interest expenses; Operating Income = Total income-interest expenses.

Notes: 1. Data are provisional.

2. Figures in parentheses indicate y-o-y growth in per cent.

3. Financial ratios for H1: 2025-26 have been annualised.

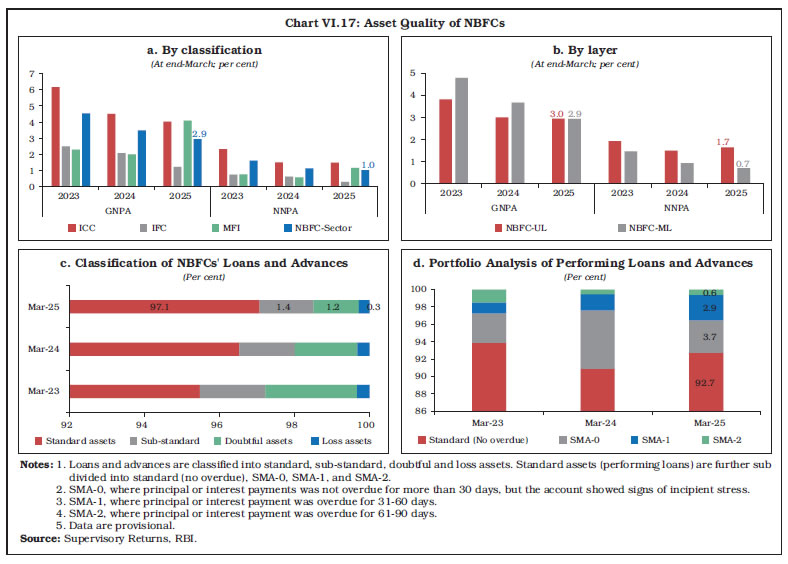

Source: Supervisory Returns, RBI. | 2.7. Soundness Indicators VI.29 The asset quality of the sector showed further improvement in 2024-25. GNPA ratio declined to 2.9 per cent at end-March 2025 from 3.5 per cent at end-March 2024. NNPA ratio also followed a downward trajectory, reflecting effective resolution of NPAs and adequate provisioning. The asset quality of all classification of NBFCs barring NBFC-MFIs has improved (Chart VI.17a). NBFC-MFIs showed deterioration in asset quality with GNPA ratio increasing to 4.1 per cent at end-March 2025 from 2.0 per cent at end-March 2024, and NNPA ratio rising to 1.2 per cent from 0.6 per cent during the same period. This was attributed to underlying stress in the sector along with recovery challenges. At end-September 2025, GNPA and NNPA ratios of the NBFC-sector stood at same levels as those at end-March 2025.

VI.30 GNPA ratio in case of NBFC-UL remained unchanged, although NNPA ratio recorded some deterioration at end-March 2025 primarily due to decline in provisions (Chart VI.17b). NBFC-ML witnessed an improvement in both GNPA and NNPA ratios. VI.31 The share of standard assets in aggregate credit extended by NBFCs increased, along with a decrease in the share of sub-standard and doubtful assets (Chart VI.17c). NBFCs need to be vigilant about the rising trend in Special Mention Accounts, i.e., SMA 1 and SMA 2 categories (Chart VI.17d). VI.32 Gross advances under large borrowal accounts (exposure of ₹5 crore and above) saw a growth of 23.3 per cent at end-March 2025 as compared to 16.8 per cent a year ago. Their asset quality exhibited significant improvement, as their GNPA declined from 5 per cent at end-March 2024 to 3.3 per at end-March 2025. VI.33 Sector-wise, the asset quality deteriorated in case of agriculture and allied activities, transport, retail trade, housing loans, consumer durables and credit card receivables, while it improved in case of overall industry, commercial real estate, vehicle loans and advances against gold (Chart VI.18). VI.34 As per the regulatory requirement, NBFCs need to maintain provisions for standard assets, sub-standard assets, loss assets and doubtful assets. Provisions made by NBFCs represented by provision coverage ratio stood at 66.6 per cent at end-March 2025 (Chart VI.19). VI.35 NBFCs continued to remain well-capitalised with capital to risk weighted assets ratio (CRAR) at 25.9 per cent at end-March 2025, well above the regulatory prescription of 15 per cent. NBFC-MFIs, as a precautionary measure, further raised their CRAR during 2024-25 (Chart VI.20). At end-September 2025 CRAR of the NBFC sector stood at 24.9 per cent. 2.8 Exposure to Sensitive Sectors VI.36 At end-March 2025, 25 per cent of NBFCs’ total assets were exposed to sensitive sectors20 (Chart VI.21). NBFCs’ exposure to real estate increased over time, reaching 26.8 per cent as a share of the total exposure to sensitive sectors during the same period. To reduce the cost of financing by NBFCs to high quality infrastructure projects, it was proposed to reduce the risk weights applicable on these projects21. Exposures to capital market declined during 2024-25, following internal limits under the SBR. 3. Housing Finance Companies VI.37 HFCs are specialised FIs that primarily focus on providing housing finance and are supervised by the National Housing Bank (NHB). The Reserve Bank, from August 2019, took over the regulation of HFCs from NHB. HFCs are classified as NBFC and are placed either in the middle layer or the upper layer under the SBR framework, depending on their specific characteristics and risk profile. The Reserve Bank has been harmonising regulations for HFCs and NBFCs by aligning norms on, inter alia, deposit acceptance, liquidity, credit ratings, and investment limits. VI.38 In 2024-25, two HFCs (one under government ownership) with a combined share of 15.2 per cent in the total asset size of the sector at end-March 2024, converted to NBFC-IFC and NBFC-ICC.22 This resulted in a reduction in the aggregate assets of the HFCs as at end-March 2025 (Table VI.10). | Table VI.10: Ownership Pattern of HFCs | | (At end-March) | | (₹ crore) | | Type | 2024 | 2025 | | Number | Asset Size | Number | Asset Size | | 1 | 2 | 3 | 4 | 5 | | A. Government Companies | 1 | 95,990 | 0 | 0 | | B. Non-Government Companies (1+2) | 92 | 9,78,455 | 91 | 10,58,279 | | 1. Public Ltd. Companies | 71 | 9,66,912 | 69 | 10,43,075 | | 2. Private Ltd. Companies | 21 | 11,542 | 22 | 15,204 | | Total (A+B) | 93 | 10,74,445 | 91 | 10,58,279 | | | (91) | (9,11,481) | | | Notes: 1. Data are provisional.

2. Figures in parentheses for 2024 exclude data for the two HFCs converted to NBFCs.

Source: NHB. |

VI.39 The share of HFCs in total credit to the housing sector (banks, HFCs and NBFCs combined) decreased to 18.8 per cent as at end-March 2025, as the number of HFCs came down due to conversion of two HFCs into NBFCs (Chart VI.22). Housing loans accounted for 73.8 per cent of the credit extended by HFCs at end-March 2025. 3.1 Balance Sheet VI.40 At end-March 2025, the total assets of HFCs increased by 16.1 per cent23, primarily driven by a surge in loans and advances, which accounted for 90.7 per cent of total assets (Table VI.11). Rising urbanisation and demand for home ownership has sustained the growth in housing loans. On the liabilities side, growth was largely facilitated by debentures, share capital and reserves. | Table VI.11: Consolidated Balance Sheet of HFCs | | (At end-March) | | (₹ crore) | | Items | 2024 | 2025 | | HFCs | HFC-ML | HFC-UL | HFCs | HFC-ML | HFC-UL | | 1 | 2(3+4) | 3 | 4 | 5(6+7) | 6 | 7 | | 1. Share Capital and Reserves | 1,96,147 | 91,261 | 1,04,886 | 1,95,650 | 92,642 | 1,03,007 | | | (19.6) | (24.1) | (16.0) | (21.1) | (23.9) | (18.6) | | 2. Public Deposits | 24,764 | 5,076 | 19,689 | 25,685 | 5,358 | 20,327 | | | (3.3) | (3.5) | (3.2) | (3.8) | (5.8) | (3.2) | | 3. Debentures | 2,56,053 | 59,642 | 1,96,411 | 2,96,548 | 81,411 | 2,15,136 | | | (10.3) | (38.9) | (3.8) | (28.8) | (72.2) | (17.6) | | 4. Bank Borrowings | 3,63,598 | 1,86,614 | 1,76,984 | 3,37,445 | 1,80,747 | 1,56,698 | | | (17.8) | (28.8) | (8.0) | (8.0) | (17.9) | (-1.5) | | 5. Commercial Papers | 30,975 | 10,241 | 20,734 | 37,373 | 13,232 | 24,141 | | | (58.2) | (143.6) | (34.9) | (20.7) | (29.2) | (16.4) | | 6. Others | 2,02,908 | 1,22,007 | 80,901 | 1,65,578 | 88,952 | 76,626 | | | (1.5) | (3.7) | (-1.7) | (9.2) | (0.8) | (21.0) | | Total Liabilities/ Assets | 10,74,445 | 4,74,841 | 5,99,604 | 10,58,279 | 4,62,343 | 5,95,935 | | | (13.3) | (22.3) | (7.0) | (16.1) | (22.0) | (11.9) | | 1. Loans and Advances | 9,61,452 | 4,36,062 | 5,25,390 | 9,59,857 | 4,17,925 | 5,41,931 | | | (14.8) | (24.0) | (8.2) | (16.6) | (21.8) | (12.9) | | 2. Investments | 42,797 | 10,044 | 32,753 | 34,547 | 12,972 | 21,575 | | | (-3.7) | (-14.2) | (0.1) | (8.1) | (32.2) | (-2.6) | | 3. Cash and Bank Balances | 27,486 | 16,480 | 11,006 | 28,832 | 19,035 | 9,797 | | | (3.8) | (9.2) | (-3.3) | (24.2) | (17.7) | (39.0) | | 4. Other Assets | 42,710 | 12,255 | 30,455 | 35,043 | 12,410 | 22,632 | | | (6.5) | (28.6) | (-0.4) | (6.4) | (28.2) | (-2.7) | Notes: 1. Data are provisional.

2. Figures in parentheses indicate y-o-y growth in per cent.

3. The growth rates for end-March 2025 are calculated by excluding the two HFCs (which converted into NBFCs) from end-March 2024.

4. The growth rates for end-March 2024 are calculated by excluding the merged HFC from end-March 2023.

Source: NHB. |

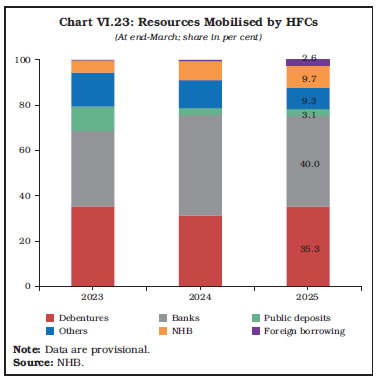

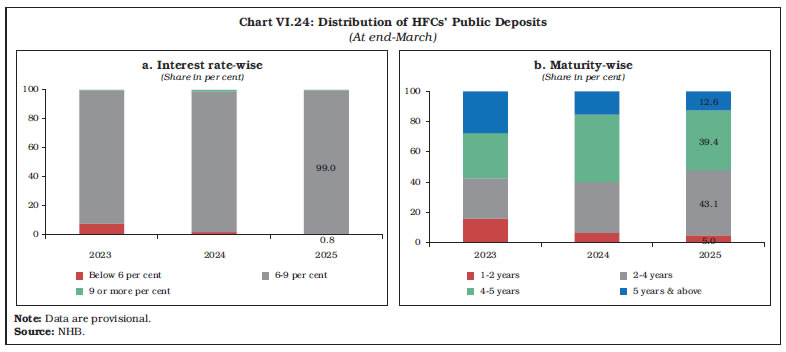

3.2. Resource Profile of HFCs VI.41 Borrowings from banks and debentures remained the major sources of funds for HFCs (75.3 per cent of total resources mobilised at end-March 2025) [Chart VI.23]. The share of bank borrowings decreased moderately while the share of debentures increased. HFCs’ foreign borrowings increased at end-March 2025 in line with the trend observed in the case of NBFCs. VI.42 Of the 91 HFCs, seven are permitted to accept public deposits. At end-March 2025, 99 per cent of deposits was concentrated in the interest rate range of 6 to 9 per cent. Public deposits with a maturity of 2-4 years have relatively higher share followed by 4-5 years at end-March 2025 (Chart VI.24). Going forward, deposits with maturity of 5 years and above are likely to decline due to extant regulatory restrictions, wherein all public deposits shall be repayable after a period of one year but not later than five years24. 3.3. Financial Performance VI.43 All key financial indicators for HFCs have shown a robust growth in 2024-25. With income growing faster than expenses, RoA improved during the same period (Table VI.12).

| Table VI.12: Financial Parameters of HFCs | | (₹ crore) | | Particulars | 2023-24 | 2024-25 | | 1 | 2 | 3 | | A. Total Income | 1,07,639 | 1,07,359 | | | (13.3) | (16.7) | | 1. Fund Income | 1,02,451 | 1,00,588 | | | (18.4) | (15.0) | | 2. Fee Income | 2,366 | 3,209 | | | (48.1) | (41.1) | | B. Total Expenditure | 85,292 | 82,087 | | | (14.3) | (11.5) | | 1. Financial Expenditure | 61,796 | 60,796 | | | (19.4) | (17.6) | | 2. Operating Expenditure | 14,733 | 16,603 | | | (24.7) | (19.8) | | C. Tax Provision | 826 | 882 | | | (-34.2) | (180.8) | | D. Net profit (PAT) | 18,139 | 19,637 | | | (45.7) | (29.4) | | E. Total Assets | 10,74,445 | 10,58,279 | | | (13.3) | (16.1) | | F. Financial Ratios as per cent of Total Assets | | | | (i) Income | 10.0 | 10.1 | | (ii) Expenditure | 7.9 | 7.8 | | (iii) Return on Assets (RoA) | 1.7 | 1.9 | | G. Cost to Income Ratio (per cent) | 79.2 | 76.5 | Cost to Income Ratio = (Total Expenditure / Total Income)*100;

Return on Assets (RoA) = PAT/ Total Assets.

Notes: 1. Data are provisional.

2. Figures in parentheses indicate y-o-y growth in per cent.

3. The growth rates for 2023-24 are calculated by excluding the merged HFC from 2022-23.

4. The growth rates for 2024-25 are calculated by excluding the two HFCs (which converted into NBFCs) from 2023-24.

Source: NHB. | 3.4. Soundness Indicators VI.44 The asset quality of HFCs recorded an improvement in terms of both GNPA and NNPA ratios at end-March 2025 (Chart VI.25). The aggregate CRAR of the sector stood at 28 per cent, well above the regulatory requirement of 15 per cent (Chart VI.26).

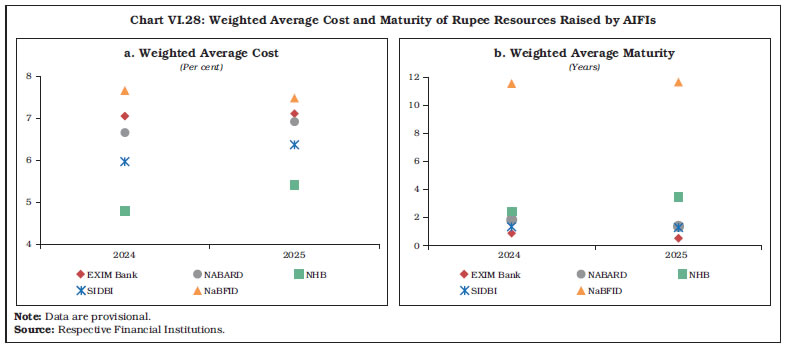

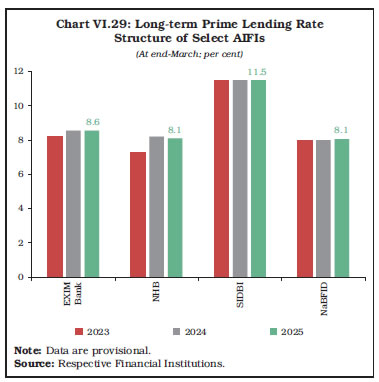

4. All India Financial Institutions VI.45 All India financial institutions (AIFIs), viz., NABARD, SIDBI, NHB, EXIM Bank, and NaBFID are specialised institutions regulated and supervised by the Reserve Bank to facilitate financing for key sectors and activities. NABARD is the largest AIFI, accounting for half of the aggregate assets of AIFIs, supporting agriculture and rural development. SIDBI focuses on the MSME sector; NHB supports housing finance; EXIM Bank provides financial assistance to exporters and importers to promote international trade; and NaBFID is dedicated to supporting infrastructure projects (Chart VI.27). 4.1. AIFIs’ Operations25 VI.46 Financial assistance sanctioned and disbursed by AIFIs grew marginally in 2024-25. All AIFIs, except SIDBI, recorded moderate increase in both sanctioned and disbursed amounts (Table VI.13 and Appendix Table VI.8).

| Table VI.13: Financial Assistance Sanctioned and Disbursed by AIFIs | | (₹ crore) | | Institutions | Sanctions | Disbursements | | 2023-24 | 2024-25 | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | | EXIM Bank | 1,06,312 | 1,39,871 | 89,073 | 1,28,272 | | NABARD | 4,42,649 | 4,52,819 | 4,36,584 | 4,49,044 | | NHB | 38,738 | 44,327 | 32,103 | 33,369 | | SIDBI | 3,02,590 | 2,45,989 | 2,94,942 | 2,35,258 | | NaBFID | 83,280 | 1,01,265 | 26,243 | 38,535 | | Total | 9,73,568 | 9,84,270 | 8,78,944 | 8,84,479 | Note: Data are provisional.

Source: Respective Financial Institutions. | 4.2. Balance Sheet VI.47 The consolidated balance sheet of AIFIs grew by 10.1 per cent at end-March 2025 compared to 20.1 per cent in the previous year. Loans and advances, which constitute 85.2 per cent of AIFIs’ assets, grew at a robust pace albeit lower than a year ago, as lending by all AIFIs, except the EXIM Bank, decelerated. AIFIs’ investments recorded a robust growth of 26.7 per cent at end-March 2025, despite a contraction in investments by EXIM Bank and NHB. On the liabilities side, while bonds and debentures and borrowings continued to record double digit growth, deposits contracted by 6.8 per cent as deposits mobilised by all the AIFIs declined (NaBFID does not accept deposits) during 2024-25 (Table VI.14). VI.48 Growth in aggregate resource mobilisation by AIFIs decelerated to 10.4 per cent in 2024-25 from 27.8 per cent in 2023-24. The share of short-term resources increased significantly to 69.6 per cent in 2024-25 from 51.7 per cent in the preceding year, while the share of long-term resources declined to 28.4 per cent in 2024-25 from 45.1 per cent in the previous year (Table VI.15). | Table VI.14: AIFIs’ Balance Sheet | | (At end-March) | | (₹ crore) | | Items | 2023 | 2024 | 2025 | | 1 | 2 | 3 | 4 | | 1. Capital | 55,008 | 55,008 | 55,008 | | | (0.0) | (0.0) | (0.0) | | 2. Reserves | 99,638 | 1,15,569 | 1,35,267 | | | (15.0) | (16.0) | (17.0) | | 3. Bonds & Debentures | 3,62,319 | 4,30,846 | 5,21,258 | | | (6.4) | (18.9) | (21.0) | | 4. Deposits | 4,94,762 | 5,58,894 | 5,20,630 | | | (13.5) | (13.0) | (-6.8) | | 5. Borrowings | 4,11,114 | 5,50,613 | 6,51,808 | | | (58.5) | (33.9) | (18.4) | | 6. Other Liabilities | 70,229 | 81,686 | 89,112 | | | (2.4) | (16.3) | (9.1) | | Total Liabilities/ Assets | 14,93,069 | 17,92,616 | 19,73,083 | | | (19.8) | (20.1) | (10.1) | | 1. Cash & Bank Balances | 46,041 | 87,710 | 90,500 | | | (6.2) | (90.5) | (3.2) | | 2. Investments | 1,00,426 | 1,32,375 | 1,67,760 | | | (-13.7) | (31.8) | (26.7) | | 3. Loans & Advances | 13,17,700 | 15,39,223 | 16,80,879 | | | (23.3) | (16.8) | (9.2) | | 4. Bills Discounted/ Rediscounted | 5,290 | 6,401 | 5,200 | | | (73.0) | (21.0) | (-18.8) | | 5. Fixed Assets | 1,260 | 1,282 | 1,260 | | | (-0.6) | (1.8) | (-1.7) | | 6. Other Assets | 22,353 | 25,624 | 27,484 | | | (69.2) | (14.6) | (7.3) | Notes: 1. Data are Provisional.

2. Figures in parentheses indicate y-o-y growth in per cent.

Source: Respective Financial Institutions. |

| Table VI.15: Resources Mobilised by AIFIs in 2024-25 | | (₹ crore) | | Institution | Total Resources Raised | Total Outstanding | | Long-Term | Short-Term | Foreign Currency | Total | | 1 | 2 | 3 | 4 | 5 | 6 | | EXIM Bank* | 12,850 | 84,531 | 19,432 | 1,16,813 | 1,79,181 | | NABARD | 1,17,392 | 3,96,613 | 0 | 5,14,005 | 8,07,766 | | NHB | 30,371 | 3,013 | 0 | 33,384 | 97,951 | | SIDBI | 88,389 | 1,95,468 | 614 | 2,84,471 | 5,12,939 | | NaBFID | 28,201 | 710 | 0 | 28,911 | 48,302 | | Total | 2,77,203 | 6,80,335 | 20,046 | 9,77,584 | 16,46,139 | *Long-term rupee resources comprise borrowings by way of bonds/debentures and term loans; while short-term resources comprise CPs, term deposits, CDs and borrowings from TREPS/ CROMS. Foreign currency resources largely comprise borrowings by way of bonds and bilateral loans in the international market and onshore funds by way of long term buy/ sell swaps.

Source: Respective Financial Institutions. | VI.49 AIFIs mobilise resources from the money market based on a specified umbrella limit, which is linked to their net owned funds. At end-March 2025, resources raised by AIFIs through short-term loans from banks accounted for 51.4 per cent of the total resources raised from the money market. AIFIs’ utilisation of umbrella limit rose to 69.3 per cent at end-March 2025 from 65.6 per cent a year ago (Table VI.16). 4.3. Sources and Uses of Funds VI.50 Funds raised and deployed by AIFIs increased by 42.7 per cent during 2024-25 as compared with 52.5 per cent a year ago. There was a notable shift towards internal sources of funding, primarily driven by NABARD. In 2024-25, 83.1 per cent of the AIFIs funds were used to repay past borrowings (Table VI.17). 4.4. Maturity Profile and Cost of Borrowings VI.51 During 2024-25, while the weighted average cost of rupee resources rose for NABARD, NHB and SIDBI, it decreased marginally in case of NaBFID (Chart VI.28a). The weighted average maturity of funds mobilised by all AIFIs declined marginally, except for NHB and NaBFID (Chart VI.28b). Long-term prime lending rates (PLRs) increased marginally for NaBFID, while it declined in case of NHB (Chart VI.29). | Table VI.16: Resources Raised by AIFIs from the Money Market | | (At end-March) | | (₹ crore) | | Instrument | 2024 | 2025 | Percentage Variation | | 1 | 2 | 3 | 4 | | A. Total | 3,60,150 | 4,15,161 | 15.3 | | i) Term Deposits | 12,632 | 14,491 | 14.7 | | ii) Term Money | 2,508 | 10 | -99.6 | | iii) Inter-corporate Deposits | 0 | 0 | - | | iv) Certificate of Deposits | 63,595 | 88,780 | 39.6 | | v) Commercial Papers | 1,00,446 | 98,425 | -2.0 | | vi) Short-term loans from banks | 1,80,969 | 2,13,455 | 18.0 | | Memo: | | | | | B. Umbrella Limit | 2,73,258 | 2,91,096 | 6.5 | | C. Utilisation of Umbrella limit [A (excluding vi) as percentage of B] | 65.6 | 69.3 | - | Note: The umbrella limit is applicable for five instruments–term deposits; term money borrowings; certificates of deposits (CDs); commercial papers; and inter-corporate deposits.

Source: Respective Financial Institutions. |

| Table VI.17: AIFIs’ Sources and Deployment of Funds | | (₹ crore) | | Items | 2023-24 | 2024-25 | Percentage Variation | | 1 | 2 | 3 | 4 | | A. Sources of Funds (i+ii+iii) | 88,34,046 | 1,26,03,881 | 42.7 | | i. Internal | 39,05,316 | 70,73,042 | 81.1 | | ii. External | 48,09,099 | 53,67,547 | 11.6 | | iii. Others@ | 1,19,632 | 1,63,291 | 36.5 | | B. Deployment of Funds (i+ii+iii) | 88,34,046 | 1,26,03,881 | 42.7 | | i. Fresh Deployment | 15,66,118 | 15,05,343 | -3.9 | | ii. Repayment of Past Borrowings | 63,65,147 | 1,04,79,021 | 64.6 | | iii. Other Deployment | 9,02,780 | 6,19,515 | -31.4 | | of which: Interest Payments | 73,783 | 73,974 | 0.3 | @: Includes cash and balances with banks and the Reserve Bank.

Sources of funds inter alia includes, short term rupee borrowings (including TREPS), sale/redemption of investments in MF / T-Bill / G-Sec, funds raised from money market. Deployment of Funds inter alia includes, repayment of short-term rupee borrowings (including TREPS), repayment of loans and advances, net deployments in money market.

Notes: 1. Data are provisional.

2. The figures represent sources and deployment during the year.

Source: Respective Financial Institutions. | 4.5. Financial Performance VI.52 Interest income across AIFIs continued to rise, while non-interest income of EXIM Bank, NABARD and NHB recorded a decline in 2024-25. Along with the rise in interest income, the interest expenses also increased for all AIFIs. At the aggregate level, operating expenses of AIFIs declined in 2024-25 mainly due to the reduction in SIDBI and NABARD. The operating profit and net profit continued to record robust growth during the year (Table VI.18).

| Table VI.18: Financial Performance of AIFIs | | (₹ crore) | | Items | 2022-23 | 2023-24 | 2024-25 | Percentage Variation | | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | | A) Income | 75,411 | 1,05,392 | 1,28,759 | 39.8 | 22.2 | | a) Interest Income | 73,982 | 1,03,922 | 1,27,147 | 40.5 | 22.3 | | b) Non-Interest Income | 1,429 | 1,470 | 1,611 | 2.9 | 9.6 | | B) Expenditure | 56,679 | 81,913 | 1,00,884 | 44.5 | 23.2 | | a) Interest Expenditure | 53,353 | 75,912 | 95,488 | 42.3 | 25.8 | | b) Operating Expenses | 3,326 | 6,001 | 5,396 | 80.5 | -10.1 | | of which Wage Bill | 1,991 | 3,914 | 3,499 | 96.6 | -10.6 | | C) Provisions | | | | | | | for Taxation | 3,230 | 4,631 | 5,808 | 43.4 | 25.4 | | for Contingencies | 2,935 | 2,936 | 3,357 | 0.0 | 14.3 | | D) Profit | | | | | | | Operating Profit (PBT) | 17,348 | 21,058 | 25,298 | 21.4 | 20.1 | | Net Profit (PAT) | 12,568 | 15,913 | 19,773 | 26.6 | 24.3 | Note: Data are provisional.

Source: Respective Financial Institutions. | VI.53 During 2024-25, the ratio of interest income to average working funds improved for all AIFIs, except for NaBFID. NaBFID’s net profit per employee decreased during 2024-25 due to the high initial capital costs for greenfield projects (Table VI.19). Profitability of all AIFIs, except NaBFID, improved in 2024-25 as reflected by their RoAs (Chart VI.30). 4.6. Soundness Indicators VI.54 All AIFIs maintained CRAR well above the regulatory minimum of nine per cent at end-March 2025, ensuring that their capital positions are strong and healthy to absorb potential financial shocks (Chart VI.31a). More than 99 per cent of the AIFIs’ loans and advances are classified as standard, except for EXIM Bank which has doubtful assets of 1.5 per cent (Chart VI.31b). All AIFIs, barring EXIM Bank, reported NNPA ratio close to nil at end- March 2025. | Table VI.19: AIFIs’ Select Financial Parameters | | Institution | As per cent of Average Working Funds | Net Profit per Employee

(₹ crore) | | Interest Income | Non-Interest Income | Operating Profit | | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | EXIM Bank | 9.0 | 9.4 | 0.3 | 0.3 | 2.3 | 1.9 | 7.1 | 9.1 | | NABARD | 6.1 | 6.6 | 0.01 | 0.01 | 1.1 | 1.2 | 1.9 | 2.4 | | NHB | 6.2 | 6.8 | 0.1 | 0.04 | 2.3 | 2.4 | 7.8 | 7.7 | | SIDBI | 6.7 | 7.0 | 0.1 | 0.1 | 1.5 | 1.6 | 3.7 | 4.4 | | NaBFID | 8.2 | 7.1 | 0.7 | 0.3 | 4.9 | 3.3 | 20.3 | 12.0 | Note: Data are provisional.

Source: Respective Financial Institutions. | 5. Primary Dealers VI.55 As at end-March 2025, there were 21 Primary Dealers (PDs), 14 functioning departmentally as bank PDs and seven as Standalone PDs (SPDs) [registered as NBFCs under section 45-IA of the RBI Act, 1934].

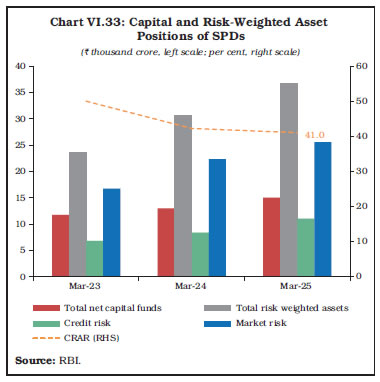

5.1 Operations and Performance of PDs VI.56 PDs are mandated to underwrite issuances of central government dated securities and participate in primary auctions. They are also mandated to achieve a minimum success ratio26 of 40 per cent in primary auctions of treasury-bills and cash management bills (CMBs), assessed on a half-yearly basis. In 2024-25, all PDs achieved their minimum success ratio and subscribed to 74.8 per cent of the total quantum of treasury-bills issued during the year. PDs’ share in allotment in the primary issuance of central government dated securities also increased during the same period (Table VI.20). VI.57 The underwriting commission (excluding GST) paid to PDs during 2024-25 was ₹14.5 crore as compared to ₹41.1 crore in the previous year. The average rate of underwriting commission decreased to 0.1 paise/ ₹100 in 2024-25 from 0.3 paise/ ₹100 a year ago. The average rate of underwriting commission increased to 0.6 paise/₹100 in H1:2025-26, reflecting increased market volatility (Chart VI.32). VI.58 The turnover target27 to be achieved by PDs in the secondary market is fixed as a specific percentage of the average of the previous three years’ overall outright market turnover in central government dated securities. During 2024-25, the target for each PD was raised to two per cent as compared to 1.5 per cent in the previous year. Majority of the PDs individually achieved the minimum stipulated turnover ratio, reflecting their active participation in the secondary market. The turnover target for 2025-26 has been fixed at 2.5 per cent. | Table VI.20: Performance of PDs in the Primary Market | | (₹ crore) | | Items | 2023-24 | 2024-25 | H1:2025-26 | | 1 | 2 | 3 | 4 | | Treasury Bills and CMBs | | (a) Bidding commitment | 16,40,785 | 12,54,920 | 5,90,820 | | (b) Bids submitted | 35,46,730 | 28,91,668 | 16,34,102 | | (c) Bids accepted | 9,96,891 | 8,19,806 | 3,68,577 | | (d) Success ratio (c)/ (a) (per cent) | 60.8 | 65.3 | 62.4 | | (e) Share of PDs in total allotment (per cent) | 69.6 | 74.8 | 71.4 | | Central Government Dated Securities | | (f) Notified Amount | 15,43,000 | 14,11,000 | 8,00,000 | | (g) Bids submitted | 29,79,456 | 30,33,221 | 16,94,328 | | (h) Bids accepted | 9,79,036 | 9,08,789 | 4,47,073 | | (i) Share of PDs in total allotment (per cent) | 63.5 | 64.9 | 56.2 | Note: Share in total allotment is calculated with respect to total issued amount.

Source: RBI. |

5.2. Performance of Standalone PDs VI.59 SPDs’ secondary market turnover in central government dated securities increased during 2024-25, however, their share as per cent of total market turnover declined marginally (Table VI.21). | Table VI.21: Performance of SPDs in the Secondary Market for Central Government Dated Securities | | (₹ crore) | | Items | 2023-24 | 2024-25 | H1:2025-26 | | 1 | 2 | 3 | 4 | | Turnover of SPDs | 43,93,097 | 51,51,124 | 29,38,197 | | Market turnover | 2,18,03,213 | 2,70,23,416 | 1,64,67,920 | | Share of SPDs (per cent) | 20.1 | 19.1 | 17.8 | Note: 1. Turnover of SPDs has been arrived at by including their buy and sell volumes in the outright segment.

2. Market turnover is twice of the total volume in the outright segment.

Source: CCIL. | 5.3. Sources and Application of SPDs’ Funds VI.60 The balance sheet size of SPDs expanded at a slower pace in 2024-25, after recording a robust growth in the previous year. This was mainly due to deceleration in the growth of current assets (primarily, G-secs and other marketable securities), which is the largest item on the assets side. Fixed assets of SPDs are negligible given the nature of business which is not branch or infrastructure oriented. On the liability side, the growth of secured loans (outstanding secured borrowing) slowed down, whereas, unsecured loans (outstanding unsecured borrowing) gained momentum, leading to a rise in the proportion of unsecured loans within the overall loan (outstanding borrowing) portfolio (Table VI.22). 5.4. Financial Performance of SPDs VI.61 SPDs’ income and expenditure expanded in double-digits in 2024-25 albeit, at a lower rate than the previous year. Interest and discount income, the principal revenue stream for SPDs, remained robust. Profits expanded at a healthy pace which resulted in improvement in return on assets and net worth. With income growing faster than expenses, cost to income ratio declined during the same period (Table VI.23 and Appendix Table VI.9). The combined CRAR of SPDs remained above 40 per cent, much above the stipulated norm of 15 per cent (Chart VI.33 and Appendix Table VI.10). | Table VI.22: Sources and Applications of SPDs’ Funds | | (₹ crore) | | Items | End-March 2024 | End-March 2025 | End-September 2025 | Percentage Variation | | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | | 1. Capital | 2,368 | 2,512 | 2,512 | 0.0 | 6.1 | | 2. Reserves and surplus | 11,243 | 13,354 | 14,199 | 15.6 | 18.8 | | 3. Loans (a+b)* | 1,45,057 | 1,58,563 | 1,54,007 | 28.3 | 9.3 | | (a) Secured | 1,25,026 | 1,31,973 | 1,25,915 | 29.7 | 5.6 | | (b) Unsecured | 20,031 | 26,590 | 28,092 | 20.4 | 32.7 | | Liabilities/ Assets | 1,58,667 | 1,74,429 | 1,70,717 | 26.8 | 9.9 | | 1. Fixed assets | 104 | 96 | 90 | 14.1 | -8.1 | | 2. HTM investments (a+b) | 5,151 | 5,511 | 5,014 | -17.9 | 7.0 | | (a) Government securities | 4,904 | 5,258 | 4,733 | -19.4 | 7.2 | | (b) Others | 248 | 254 | 281 | 29.7 | 2.6 | | 3. Current assets | 1,54,122 | 1,73,220 | 1,68,542 | 30.2 | 12.4 | | 4. Loans and advances | 4,526 | 4,298 | 10,166 | -6.5 | -5.0 | | 5. Deferred tax | -141 | -116 | 14 | - | - | | 6. Others | -18 | -22 | -3 | - | - | | 7. Current liabilities | 5,077 | 8,558 | 13,107 | 16.0 | 68.6 | * Outstanding borrowing of SPDs; – denotes not applicable.

Notes: 1. Data are provisional.

2. Assets = [Σ (1 to 6) – 7].

Source: RBI. |

| Table VI.23: Financial Performance of SPDs | | (₹ crore) | | Items | 2023-24 | 2024-25 | H1: 2025-26 | Percentage Variation | | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | | A. Income | 10,270 | 12,055 | 5,974 | 90.8 | 17.4 | | (a) Interest and discount | 9,158 | 10,635 | 5,535 | 57.5 | 16.1 | | (b) Trading profits | 1,060 | 1,330 | 391 | - | 25.5 | | (c) Other income | 52 | 90 | 48 | -14.8 | 74.6 | | B. Expenses | 8,422 | 9,602 | 4,468 | 66.0 | 14.0 | | (a) Interest | 7,897 | 9,002 | 4,139 | 69.3 | 14.0 | | (b) Other* | 524 | 601 | 329 | 28.0 | 14.5 | | C. Profit before tax | 2,237 | 2,831 | 1,507 | 361.6 | 26.6 | | D. Profit after tax | 1,663 | 2,113 | 1,117 | 385.9 | 27.1 | | E. Average assets | 1,41,916 | 1,66,548 | 1,72,573 | | | | F. Financial Ratios (per cent) | | | | | | | (a) Return on average assets | 1.2 | 1.3 | 1.3 | | | | (b) Return on net worth | 12.9 | 14.3 | 13.7 | | | | (c) Cost to income ratio | 22.1 | 19.7 | 17.9 | | | * Expenses including establishment and administrative costs.

– denotes not applicable.

Note: Figures may not add up to total due to rounding-off.

Source: RBI. | 6. Overall Assessment VI.62 At end-March 2025, NBFCs accounted for around a quarter of the credit extended by SCBs, underscoring the growing importance of NBFCs in meeting the credit requirements of the economy. They recorded improvement in asset quality and remained well capitalised. Rising urbanisation and demand for dwellings have sustained the growth in credit by HFCs. The consolidated balance sheet of AIFIs recorded double digit growth. SPDs maintained sound financial position and carried out their function of underwriting and supplying liquidity in the G-sec market efficiently during the same period.  VI.63 Going forward, the performance of microfinance loans needs to be closely monitored. Regulatory measure to restore back the lower risk weights for bank lending to NBFCs along with easing of monetary policy is helping NBFCs in expanding their footprint. NBFCs should continue their diversification of funding sources and balance their growth aspirations with sound and fair practices to ensure inclusive growth and financial stability. They need to be vigilant about emerging technological and cyber challenges, besides promptly addressing customer grievances.

|