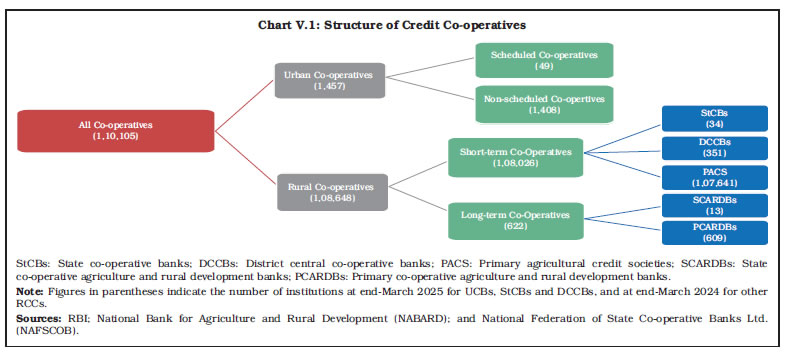

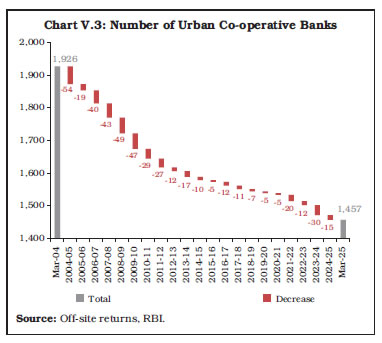

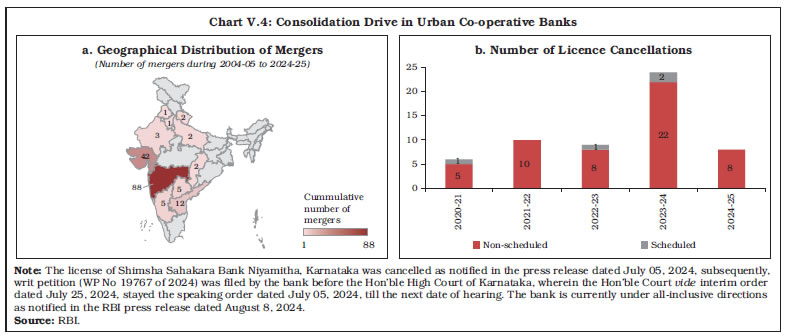

Urban co-operative banks’ balance sheet expanded during 2024-25 on higher credit growth supported by deposits and borrowings. Their financial performance remained robust on the back of improved profitability, better asset quality and strong capital buffers. These gains were aided by ongoing consolidation and regulatory measures to strengthen resilience under the four-tier framework. Rural co-operatives continued to support agricultural credit delivery, although their performance varied across short-term and long-term institutions. Introduction V.1. Co-operative banks play an important role in India’s financial system by extending last-mile credit and supporting localised financial intermediation. In recent years, urban co-operative banks are witnessing a steady consolidation through voluntary mergers and regulatory rationalisation under the four-tier regulatory framework. They recorded balance sheet expansion during 2024-25, supported by improved credit growth and higher deposit mobilisation. Their profitability improved on account of lower provisioning and higher non-interest income, while capital buffers and asset quality strengthened further. Among rural co-operatives, short-term credit institutions — comprising state and district central co-operative banks and primary agricultural credit societies — continue to play a pivotal role in agricultural finance. Both state co-operative banks and district central co-operative banks reported profits with improvement in asset quality during 2024-25. Performance of long-term cooperatives remains mixed with variation observed across states. V.2. Against this backdrop, the rest of the chapter focuses on analysing the performance of urban and rural co-operative banks during the period under review.1 Section 2 outlines the evolving structure of the co-operative banking sector, followed by an assessment of profitability, asset quality and capital adequacy of urban co-operative banks in Section 3. Financial performance of short-term and long-term rural co-operatives is examined in Section 4, which is followed by an overall assessment in Section 5. 2. Structure of the Co-operative Banking Sector V.3. Co-operative banking structure in India includes urban co-operative banks (UCBs) and rural credit co-operatives (RCCs). While UCBs primarily serve the credit needs of urban and semi-urban areas, RCCs mainly cater to the agricultural and allied sectors in rural areas. UCBs are classified as scheduled or non-scheduled, based on (i) whether they are included in the second schedule of the Reserve Bank of India Act, 19342; and (ii) their geographical outreach in terms of single-state or multi-state presence. RCCs, on the contrary, are classified into short-term and long-term institutions. During the period under review, there were 1,457 UCBs and 1,08,648 RCCs (Chart V.1).3  V.4. Regulation and supervision of these entities follow a differentiated framework. UCBs are regulated and supervised by the Reserve Bank, whereas state co-operative banks (StCBs) and district central co-operative banks (DCCBs) are regulated by the Reserve Bank but supervised by the National Bank for Agriculture and Rural Development (NABARD). Primary agricultural credit societies (PACS), state co-operative agriculture and rural development banks (SCARDBs) and primary co-operative agriculture and rural development banks (PCARDBs) lie outside the purview of the Banking Regulation Act, 1949. V.5. The consolidated assets of the co-operative sector stood at ₹ 24.5 lakh crore at end-March 2024. RCCs accounted for 71.2 per cent of the assets of the total co-operative sector, with 68.6 per cent contributed by short-term co-operatives and 2.5 per cent by long-term co-operatives (Chart V.2). 3. Urban Co-operative Banks V.6. The Reserve Bank initiated the process of consolidation of UCBs in 2004-05, including amalgamation of unviable UCBs with their viable counterparts, closure of non-viable UCBs, and suspension of issuance of new licenses. Consequently, the number of UCBs declined steadily from 1,926 at end-March 2004 to 1,457 at end-March 2025 (Chart V.3). V.7. During 2024-25, seven mergers of UCBs— six in Maharashtra and one in Telangana—were effected. With this, the total number of mergers since 2004-05 rose to 163, of which more than half were in Maharashtra (Chart V.4a). In addition, licenses of eight non-scheduled UCBs—two each in Uttar Pradesh and Andhra Pradesh, and one each in Bihar, Maharashtra, Assam and Tamil Nadu—were cancelled during the year. With this, the total number of license cancellations since 2020-21 increased to 57, concentrated mainly in the non-scheduled category (Chart V.4b).  V.8. Given the heterogeneity in the co-operative sector, the Reserve Bank, on December 1, 2022, adopted a four-tiered regulatory framework for UCBs in line with the recommendations of the Expert Committee on Urban Co-operative Banks (Chairman: Shri N. S. Vishwanathan).4 The regulation aimed to balance the spirit of mutuality and co-operation that is more prevalent in smaller banks with limited area of operation vis-à-vis the growth ambitions of the large-sized UCBs through geographical spread and diverse business activities. At end-March 2025, 57.5 per cent of the UCBs were classified as Tier 1. Tier 3 and Tier 4 UCBs, together with less than 6 per cent share in the total number of UCBs, dominated the sector, accounting for more than half of deposits, advances and total assets (Table V.1).

| Table V.1: Tier-wise Distribution of Urban Co-operative Banks | | (At end-March 2025) | | (Amount in ₹ crore, share in per cent) | | Tier Type | No. of Banks | Deposits | Advances | Total Assets | | Number | Share | Amount | Share | Amount | Share | Amount | Share | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 1 | 838 | 57.5 | 65,760 | 11.3 | 43,991 | 11.9 | 89,089 | 12.1 | | 2 | 535 | 36.7 | 1,78,433 | 30.5 | 1,09,980 | 29.7 | 2,24,705 | 30.4 | | 3 | 78 | 5.4 | 2,01,311 | 34.4 | 1,22,712 | 33.1 | 2,48,549 | 33.6 | | 4 | 6 | 0.4 | 1,38,910 | 23.8 | 93,542 | 25.3 | 1,76,386 | 23.9 | | All UCBs | 1,457 | 100.0 | 5,84,415 | 100.0 | 3,70,225 | 100.0 | 7,38,729 | 100.0 | Notes: 1. Data are provisional.

2. Components may not add up to the total due to rounding off.

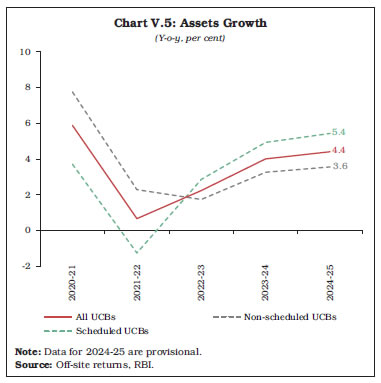

Source: Off-site returns, RBI. | 3.1. Balance Sheet V.9. The consolidated balance sheet of UCBs grew by 4.4 per cent during 2024-25, marginally higher than 4.0 per cent in the previous year (Table V.2). Within UCBs, the growth was higher for scheduled UCBs (5.4 per cent) compared with non-scheduled UCBs (3.6 per cent) (Chart V.5). | Table V.2: Balance Sheet of Urban Co-operative Banks | | (At end-March) | | (Amount in ₹ crore) | | Items | Scheduled UCBs | Non-scheduled UCBs | All UCBs | All UCBs (y-o-y growth rate in per cent) | | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 1) Capital | 4,293 | 4,271 | 10,828 | 11,217 | 15,120 | 15,489 | 2.8 | 2.4 | | | (1.3) | (1.3) | (2.8) | (2.8) | (2.1) | (2.1) | | | | 2) Reserves and Surplus | 25,290 | 27,029 | 29,383 | 32,276 | 54,673 | 59,305 | 13.3 | 8.5 | | | (7.9) | (8.0) | (7.6) | (8.1) | (7.7) | (8.0) | | | | 3) Deposits | 2,54,479 | 2,70,209 | 3,00,931 | 3,14,207 | 5,55,410 | 5,84,415 | 4.1 | 5.2 | | | (79.1) | (79.7) | (78.0) | (78.6) | (78.5) | (79.1) | | | | 4) Borrowings | 5,082 | 5,534 | 293 | 243 | 5,375 | 5,776 | -13.9 | 7.5 | | | (1.6) | (1.6) | (0.1) | (0.1) | (0.8) | (0.8) | | | | 5) Other Liabilities and Provisions | 32,579 | 32,158 | 44,382 | 41,586 | 76,961 | 73,744 | -0.7 | -4.2 | | | (10.1) | (9.5) | (11.5) | (10.4) | (10.9) | (10.0) | | | | Total Liabilities/ Assets | 3,21,723 | 3,39,200 | 3,85,816 | 3,99,529 | 7,07,539 | 7,38,729 | 4.0 | 4.4 | | | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | | | | 1) Cash in Hand | 1,759 | 1,764 | 4,424 | 4,194 | 6,183 | 5,958 | 5.1 | -3.6 | | | (0.5) | (0.5) | (1.1) | (1.0) | (0.9) | (0.8) | | | | 2) Balances with RBI | 13,778 | 13,687 | 4,544 | 4,688 | 18,322 | 18,375 | 12.0 | 0.3 | | | (4.3) | (4.0) | (1.2) | (1.2) | (2.6) | (2.5) | | | | 3) Balances with Banks | 24,701 | 30,263 | 47,756 | 50,374 | 72,457 | 80,637 | 8.6 | 11.3 | | | (7.7) | (8.9) | (12.4) | (12.6) | (10.2) | (10.9) | | | | 4) Money at Call and Short Notice | 2,367 | 2,908 | 1,033 | 1,370 | 3,401 | 4,278 | -1.1 | 25.8 | | | (0.7) | (0.9) | (0.3) | (0.3) | (0.5) | (0.6) | | | | 5) Investments | 86,626 | 86,619 | 1,07,018 | 1,06,851 | 1,93,644 | 1,93,471 | 1.6 | -0.1 | | | (26.9) | (25.5) | (27.7) | (26.7) | (27.4) | (26.2) | | | | 6) Loans and Advances | 1,59,553 | 1,71,391 | 1,87,300 | 1,98,833 | 3,46,853 | 3,70,225 | 5.0 | 6.7 | | | (49.6) | (50.5) | (48.5) | (49.8) | (49.0) | (50.1) | | | | 7) Other Assets | 32,939 | 32,568 | 33,741 | 33,218 | 66,679 | 65,786 | 0.1 | -1.3 | | | (10.2) | (9.6) | (8.7) | (8.3) | (9.4) | (8.9) | | | Notes: 1. Data for 2025 are provisional.

2. Figures in parentheses are the proportion to total liabilities/assets (in per cent).

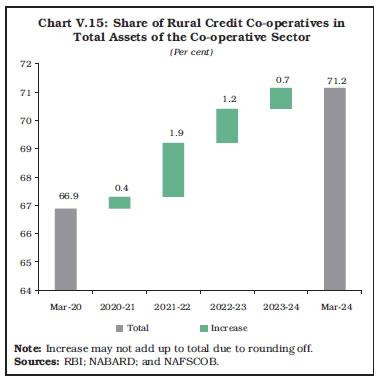

3. Components may not add up to the total due to rounding off.

Source: Off-site returns, RBI. |

V.10. Deposit growth of UCBs improved to 5.2 per cent during 2024-25 from 4.1 per cent a year ago (Chart V.6a). Credit growth of UCBs also accelerated to 6.7 per cent, highest in six years, with improvement across both the scheduled and the non-scheduled UCBs (Chart V.6b). At end-September 2025, deposit growth and credit growth of UCBs stood at 6.8 per cent and 6.4 per cent, respectively.

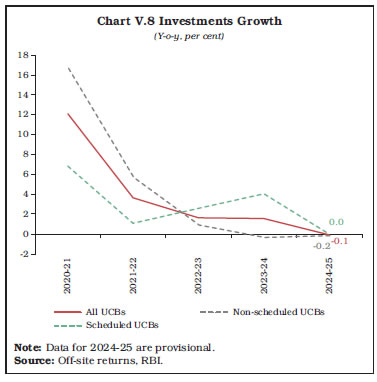

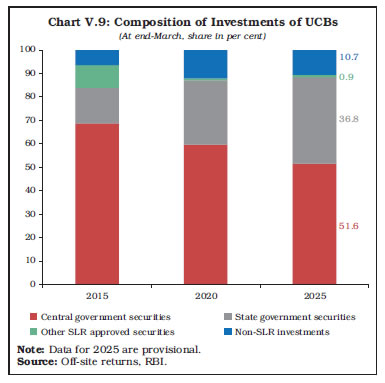

V.11. On account of higher credit growth relative to deposit growth, the credit-deposit (CD) ratio of UCBs improved to 63.3 per cent at end-March 2025 from 62.4 per cent at end-March 2024 (Chart V.7). V.12. UCBs rely predominantly on deposits for funding, with borrowings accounting for only 0.8 per cent of total liabilities at end-March 2025. During 2024-25, investments growth of UCBs moderated for the fourth consecutive year and turned negative, partly reflecting their strategy to reallocate funds from investments to loans and advances (Chart V.8). V.13. Over the last decade, on an average, SLR investments accounted for around 89 per cent of the total investments of UCBs. The composition of SLR investments, however, is shifting towards state government securities with their share rising from 15.2 per cent at end-March 2015 to 36.8 per cent at end-March 2025 (Table V.3 and Chart V.9). V.14. At end-March 2025, 46.3 per cent of UCBs had advances less than ₹50 crore, while largest 57 UCBs accounted for 53.9 per cent of total advances of UCBs. In terms of assets, 23.9 per cent of UCBs had assets size less than ₹50 crore while UCBs with assets more than ₹1000 crore accounted for 65.5 per cent of total assets of UCBs (Table V.4). A similar pattern was observed for deposits, with concentration of deposits continuing in the higher size brackets. The increasing share of large UCBs reflects the ongoing consolidation and scaling-up within the sector.

| Table V.3: Investments by Urban Co-operative Banks | | (Amount in ₹ crore) | | Item | Amount outstanding

(At end-March) | Variation

(in per cent) | | 2024 | 2025 | 2023-24 | 2024-25 | | Total Investments (A + B) | 1,93,644 | 1,93,471 | 1.6 | -0.1 | | | (100.0) | (100.0) | | | | A. SLR Investments | 1,74,332 | 1,72,799 | 1.5 | -0.9 | | [(i) + (ii)+ (iii)] | (90.0) | (89.3) | | | | (i) Central Government Securities | 1,06,270 | 99,916 | -0.4 | -6.0 | | (54.9) | (51.6) | | | | (ii) State Government Securities | 67,673 | 71,213 | 4.6 | 5.2 | | (34.9) | (36.8) | | | | (iii) Other Approved Securities | 389 | 1,670 | 27.9 | 329.5 | | (0.2) | (0.9) | | | | B. Non-SLR Investments | 19,312 | 20,672 | 1.9 | 7.0 | | (10.0) | (10.7) | | | Notes: 1. Data for 2025 are provisional.

2. Figures in parentheses are the proportion to total investments (in per cent).

3. Components may not add up to the total due to rounding off.

Source: Off-site returns, RBI. |

| Table V.4: Distribution of UCBs by Size of Deposits, Advances and Assets | | (At end-March 2025) | | (Amount in ₹ crore) | | Item | Deposits | Advances | Assets | | No. of UCBs | Amount | No. of UCBs | Amount | No. of UCBs | Amount | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 0 ≤ X < 10 | 76 | 426 | 161 | 894 | 43 | 250 | | 10 ≤ X < 25 | 158 | 2,772 | 240 | 4,024 | 107 | 1,901 | | 25 ≤ X < 50 | 236 | 8,741 | 273 | 9,777 | 198 | 7,201 | | 50 ≤ X < 100 | 289 | 20,811 | 253 | 17,978 | 297 | 21,542 | | 100 ≤ X < 250 | 320 | 52,010 | 267 | 41,517 | 360 | 58,874 | | 250 ≤ X < 500 | 167 | 59,779 | 137 | 48,504 | 193 | 68,858 | | 500 ≤ X < 1000 | 109 | 74,624 | 69 | 48,066 | 136 | 96,262 | | 1000 ≤ X | 102 | 3,65,252 | 57 | 1,99,464 | 123 | 4,83,841 | | Total | 1,457 | 5,84,415 | 1,457 | 3,70,225 | 1,457 | 7,38,729 | Notes: 1. Data are provisional.

2. ‘X’ indicates amounts of deposits, advances, and assets.

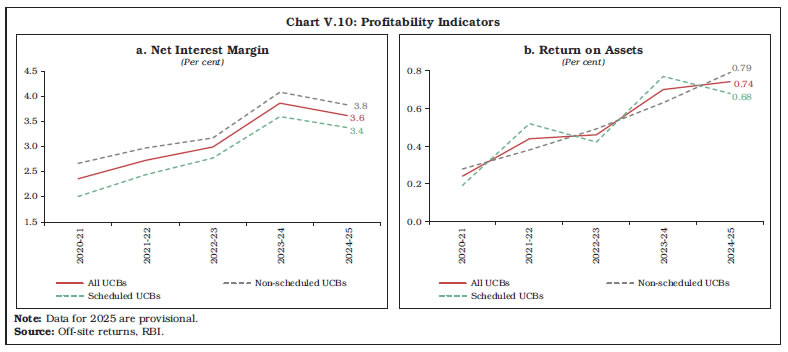

Source: Off-site returns, RBI. | 3.2. Financial Performance and Profitability V.15. The financial performance of UCBs improved during 2024-25, albeit with a variation across constituents. Operating profits of non-scheduled UCBs increased by 8.4 per cent, driven by growth in non-interest income.5 In contrast, operating profits of scheduled UCBs contracted by 5.5 per cent, reflecting a faster increase in total expenditure relative to total income (Table V.5 and Appendix Table V.1). V.16. Overall, UCBs’ net profits after tax grew by 14.2 per cent in 2024-25, on top of 52 per cent growth recorded in 2023-24, aided by reduced provisioning pressure on account of improved asset quality. Improvement in profitability was also evident in higher returns on assets (RoA) and returns on equity (RoE). Net interest margin (NIM) of UCBs, however, moderated due to faster growth of interest expenditure compared to interest income (Table V.6). Within UCBs, non-scheduled UCBs had higher NIM and RoA than scheduled UCBs (Chart V.10a and b). During H1: 2025-26, RoA and RoE of UCBs stood at 0.8 per cent and 8.2 per cent, respectively. | Table V.5: Financial Performance of Scheduled and Non-scheduled Urban Co-operative Banks | | (Amount in ₹ crore) | | Item | Scheduled UCBs | Non-scheduled UCBs | All UCBs | All UCBs (y-o-y growth in per cent) | | 2023-24 | 2024-25 | 2023-24 | 2024-25 | 2023-24 | 2024-25 | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | A. Total Income [i+ii] | 24,161 | 26,059 | 31,036 | 33,293 | 55,198 | 59,352 | 5.4 | 7.5 | | | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | | | | i. Interest Income | 21,476 | 23,065 | 29,223 | 30,296 | 50,698 | 53,361 | 6.5 | 5.3 | | | (88.9) | (88.5) | (94.2) | (91.0) | (91.8) | (89.9) | | | | ii. Non-interest Income | 2,686 | 2,993 | 1,814 | 2,997 | 4,499 | 5,990 | -5.9 | 33.1 | | | (11.1) | (11.5) | (5.8) | (9.0) | (8.2) | (10.1) | | | | B. Total Expenditure [i+ii] | 19,785 | 21,925 | 25,985 | 27,819 | 45,771 | 49,745 | 7.9 | 8.7 | | | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | | | | i. Interest Expenditure | 12,838 | 14,542 | 17,444 | 18,850 | 30,282 | 33,392 | 10.2 | 10.3 | | | (64.9) | (66.3) | (67.1) | (67.8) | (66.2) | (67.1) | | | | ii. Non-interest Expenditure | 6,947 | 7,383 | 8,541 | 8,969 | 15,488 | 16,352 | 3.7 | 5.6 | | | (35.1) | (33.7) | (32.9) | (32.2) | (33.8) | (32.9) | | | | of which: Staff Expenses | 2,999 | 3,288 | 4,367 | 4,785 | 7,365 | 8,073 | 2.1 | 9.6 | | C. Profits | | | | | | | | | | i. Operating Profits | 4,376 | 4,133 | 5,051 | 5,474 | 9,427 | 9,607 | -5.4 | 1.9 | | ii. Provision and Contingencies | 1,214 | 1,154 | 1,912 | 1,568 | 3,127 | 2,722 | -43.9 | -12.9 | | iii. Provision for Taxes | 752 | 737 | 868 | 803 | 1,620 | 1,540 | 22.8 | -4.9 | | iv. Net Profit before Taxes | 3,162 | 2,980 | 3,139 | 3,905 | 6,300 | 6,885 | 43.2 | 9.3 | | v. Net Profit after Taxes | 2,410 | 2,243 | 2,270 | 3,102 | 4,680 | 5,345 | 52.0 | 14.2 | Note: 1. Data for 2024-25 are provisional.

2. Figures in parentheses are the proportion to total income/expenditure (in per cent).

3. Components may not add up to the total due to rounding off.

Source: Off-site returns, RBI. |

| Table V.6: Select Profitability Indicators of UCBs | | (Per cent) | | Item | Scheduled UCBs | Non-scheduled UCBs | All UCBs | | 2023-24 | 2024-25 | 2023-24 | 2024-25 | 2023-24 | 2024-25 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Return on Assets | 0.77 | 0.68 | 0.63 | 0.79 | 0.70 | 0.74 | | Return on Equity | 8.54 | 7.37 | 6.18 | 7.40 | 7.18 | 7.39 | | Net Interest Margin | 3.60 | 3.38 | 4.08 | 3.83 | 3.86 | 3.62 | Note: Data for 2024-25 are provisional.

Source: Off-site returns, RBI. | 3.3. Penalties and DICGC Claims V.17. The number of instances of penalty imposition on co-operative banks (including UCBs) increased by 22.8 per cent to 264 during 2024-25. The total amount of penalty imposed also increased to ₹15.6 crore during 2024-25 from ₹12.1 crore in the previous year (Table IV.15 in Chapter IV). The Deposit Insurance and Credit Guarantee Corporation (DICGC) settled claims of ₹476 crore during 2024-25, which pertained entirely to the co-operative banks placed under liquidation/ all-inclusive directions (AID) of the Reserve Bank. | Table V.7: CRAR-wise Distribution of UCBs | | (At end-March 2025) | | (Number of banks) | | CRAR (in per cent) | Scheduled UCBs | Non-scheduled UCBs | All UCBs | | 1 | 2 | 3 | 4 | | CRAR < 3 | 1 | 28 | 29 | | 3 <= CRAR < 6 | 2 | 8 | 10 | | 6 <= CRAR < 9 | 0 | 10 | 10 | | 9 <= CRAR < 12 | 0 | 66 | 66 | | 12 <= CRAR | 46 | 1,296 | 1,342 | | Total | 49 | 1,408 | 1,457 | Note: Data are provisional.

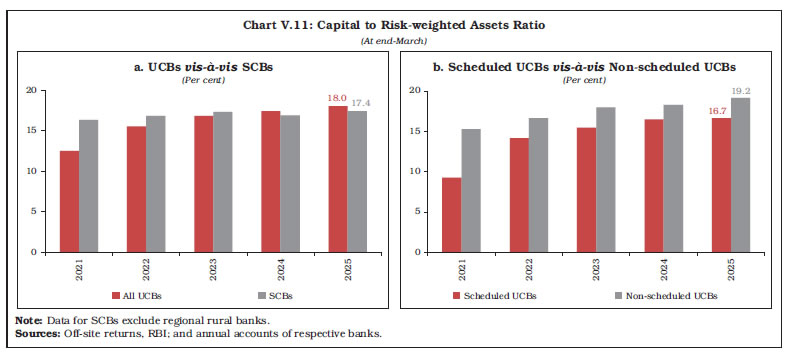

Source: Off-site returns, RBI. | 3.4. Capital Adequacy V.18. As per the revised regulatory framework effective from April 1, 2023, a minimum capital to risk-weighted assets ratio (CRAR) of 9 per cent for Tier 1 UCBs and 12 per cent for Tier 2 to 4 UCBs are to be maintained on an ongoing basis. At end-March 2025, 92.1 per cent of the UCBs maintained CRAR above 12 per cent (Table V.7 and Appendix Table V.2).

| Table V.8: Component-wise Capital Adequacy of UCBs | | (At end-March) | | (Amount in ₹ crore) | | Item | Scheduled UCBs | Non-scheduled UCBs | All UCBs | | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 1. Capital Funds | 25,966 | 28,320 | 32,560 | 36,782 | 58,526 | 65,101 | | i) Tier 1 Capital | 20,128 | 21,960 | 28,423 | 32,401 | 48,550 | 54,362 | | ii) Tier 2 Capital | 5,838 | 6,359 | 4,138 | 4,380 | 9,976 | 10,740 | | 2. Risk-weighted Assets | 1,57,720 | 1,69,923 | 1,78,224 | 1,91,098 | 3,35,944 | 3,61,022 | | 3. CRAR (1 as per cent of 2) | 16.5 | 16.7 | 18.3 | 19.2 | 17.4 | 18.0 | | Of which: | | | | | | | | Tier 1 | 12.8 | 12.9 | 15.9 | 17.0 | 14.5 | 15.1 | | Tier 2 | 3.7 | 3.7 | 2.3 | 2.3 | 3.0 | 3.0 | Notes: 1. Data for end-March 2025 are provisional.

2. Components may not add up to the total due to rounding off.

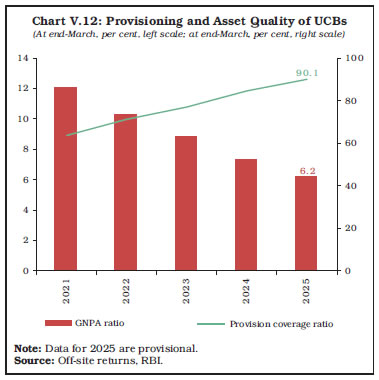

Source: Off-site returns, RBI. | V.19. During 2024-25, UCBs remained well capitalised, with CRAR improving to 18.0 per cent from 17.4 per cent a year ago, primarily on account of an improvement in Tier 1 capital ratio (Table V.8 and Chart V.11a). Within UCBs, non-scheduled UCBs have maintained a higher CRAR than scheduled UCBs (Chart V.11b). The CRAR remained stable at 18.0 per cent at end-September 2025. 3.5. Asset Quality V.20. The asset quality of UCBs, measured by gross non-performing assets (GNPA) ratio, improved for the fourth consecutive year with GNPA ratio at 6.2 per cent at end-March 2025, down from the peak of 12.1 per cent at end-March 2021 (Chart V.12). At end-September 2025, GNPA ratio of UCBs was 7.6 per cent as compared with 9.3 per cent a year ago. V.21. The improvement in asset quality during 2024-25 was broad based, with decrease in GNPA ratio observed in both scheduled and non-scheduled UCBs. Along with the fall in GNPAs, the provision coverage ratio (PCR) of UCBs improved further to 90.1 per cent. This improvement was partly due to the harmonisation of UCBs’ provisioning norms for standard advances.6 Net NPA ratio of UCBs decreased to 0.7 per cent at end-March 2025 from 1.2 per cent a year ago (Table V.9).

V.22. Exposure of UCBs to large borrowal accounts, defined as accounts with exposure of ₹5 crore and above, moderated during 2024-25. Its share in UCBs’ total lending decreased to 23.4 per cent at end-March 2025, though scheduled UCBs have a higher proportion (40.9 per cent) relative to non-scheduled UCBs (8.2 per cent). Large borrowal accounts contributed to about one-third of total GNPAs of UCBs, with wide variation between scheduled UCBs (64.8 per cent) and non-scheduled UCBs (16.6 per cent). For the sector as a whole, special mention accounts-1 (SMA-1) declined during the year, while SMA-0 accounts increased, mainly driven by scheduled UCBs (Chart V.13). | Table V.9: Non-Performing Assets of UCBs | | (At end-March 2025) | | Item | Scheduled UCBs | Non-scheduled UCBs | All UCBs | | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Gross NPAs (₹ crore) | 8,422 | 8,015 | 16,973 | 15,057 | 25,395 | 23,072 | | Gross NPA Ratio (Per cent) | 5.3 | 4.7 | 9.1 | 7.6 | 7.3 | 6.2 | | Net NPAs (₹ crore) | 1,960 | 1,561 | 1,954 | 711 | 3,914 | 2,273 | | Net NPA Ratio (Per cent) | 1.3 | 0.9 | 1.1 | 0.4 | 1.2 | 0.7 | | Provisioning (₹ crore) | 6,462 | 6,454 | 15,019 | 14,346 | 21,481 | 20,800 | | Provisioning Coverage Ratio (Per cent) | 76.7 | 80.5 | 88.5 | 95.3 | 84.6 | 90.1 | Note: Data for 2025 are provisional.

Source: Off-site returns, RBI. | 3.6. Priority Sector Lending V.23. As per the priority sector lending (PSL) guidelines of March 2025, the Reserve Bank revised the overall PSL target for UCBs to 60 per cent of adjusted net bank credit (ANBC) or credit-equivalent amount of off-balance sheet exposure (CEOBSE), whichever is higher, effective from 2024-25.7 During 2023-24, UCBs achieved the overall PSL target of 60 per cent, as well as the sub-targets of 7.5 per cent for micro enterprises and 11.5 per cent for weaker sections (Chart V.14).

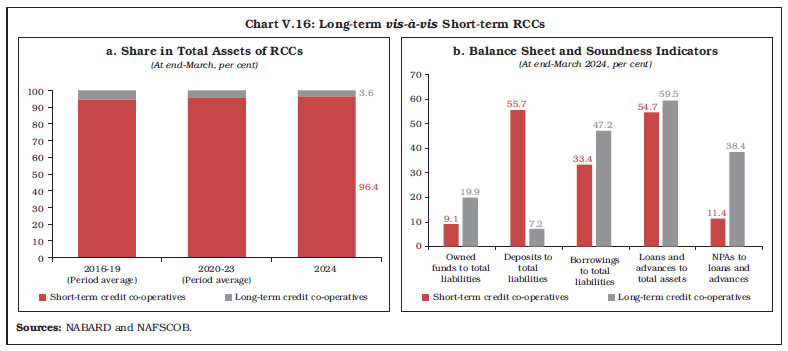

V.24. At end-March 2025, micro, small and medium enterprises (MSMEs) had the largest share of UCBs’ total advances, although it decreased marginally to 36.5 per cent driven by small enterprises. In contrast, the share of credit to micro enterprises increased, indicating improved credit flow to smaller borrowers. Priority lending in ‘others’ category declined, leading to moderation in the share of total priority sector lending in total advances during 2024-25 (Table V.10). 4. Rural Credit Co-operatives V.25. Rural credit co-operatives (RCCs) play an important role in agricultural credit delivery through their wide network at the grassroots level. They provide affordable and timely credit for farming and allied activities, supporting agricultural production and rural development. However, due to increasing reach of commercial banks via technology, branch expansion and business correspondents, the share of RCCs in total agriculture credit has moderated over the years (Table V.11). | Table V.10: Composition of Credit to Priority Sectors by UCBs | | (At end-March) | | (Amount in ₹ crore) | | Item | 2024 | 2025 | | Amount | Share in Total Advances

(per cent) | Amount | Share in Total Advances

(per cent) | | 1 | 2 | 3 | 4 | 5 | | 1. Agriculture [(i)+(ii)+(iii)] | 16,344 | 4.7 | 17,032 | 4.6 | | (i) Farm Credit | 12,343 | 3.6 | 13,203 | 3.6 | | (ii) Agriculture Infrastructure | 1,224 | 0.4 | 1,028 | 0.3 | | (iii) Ancillary Activities | 2,777 | 0.8 | 2,801 | 0.8 | | 2. Micro Small and Medium Enterprises [(i) + (ii) + (iii) + (iv)] | 1,29,130 | 37.2 | 1,35,228 | 36.5 | | (i) Micro Enterprises | 56,340 | 16.2 | 62,609 | 16.9 | | (ii) Small Enterprises | 48,653 | 14.0 | 47,791 | 12.9 | | (iii) Medium Enterprises | 23,554 | 6.8 | 24,407 | 6.6 | | (iv) Advances to Khadi and Village Industries (Including ‘Other Finance to MSMEs’) | 583 | 0.2 | 422 | 0.1 | | 3. Export Credit | 723 | 0.2 | 101 | 0.0 | | 4. Education | 3,226 | 0.9 | 3,526 | 1.0 | | 5. Housing | 29,269 | 8.4 | 30,688 | 8.3 | | 6. Social Infrastructure | 1,038 | 0.3 | 977 | 0.3 | | 7. Renewable Energy | 1,419 | 0.4 | 1,546 | 0.4 | | 8. Others | 25,288 | 7.3 | 17,091 | 4.6 | | 9. Total (1 to 8) | 2,06,438 | 59.5 | 2,06,189 | 55.7 | | of which, Loans to Weaker Sections | 42,771 | 12.3 | 44,227 | 11.9 | Notes: 1. Data for 2025 are provisional.

2. Percentages are with respect to the total credit of UCBs.

3. Components may not add up to the total due to rounding off.

Source: Off-site returns, RBI. | V.26. In the rural credit co-operative structure, at end-March 2025, there were 34 state co-operative banks (StCBs) with 2,146 branches and 351 district central co-operative banks (DCCBs) operating through 13,825 branches. At end-March 2024, within short-term co-operatives, the network of 1,07,641 primary agricultural credit societies (PACS) covered over 6.5 lakh villages (Table V.12). These short-term institutions primarily extend crop loans and provide working capital support to farmers and rural artisans. At end-March 2024, the long-term co-operative structure comprised 13 state co-operative agriculture and rural development banks (SCARDBs) with 695 branches, and 609 primary co-operative agriculture and rural development banks (PCARDBs). These long-term institutions cater to capital-intensive needs in agriculture, including land development, farm mechanisation, minor irrigation, rural industries and housing. | Table V.11: Share in Credit Flow to Agriculture | | (Per cent) | | Item | Rural Credit Co-operatives | Regional Rural Banks | Commercial Banks | | 1 | 2 | 3 | 4 | | 2021-22 | 13.1 | 11.0 | 75.9 | | 2022-23 | 11.0 | 11.2 | 77.8 | | 2023-24 | 9.5 | 11.1 | 79.4 | | 2024-25 | 9.0 | 10.8 | 80.2 | Note: Data for commercial banks exclude regional rural banks.

Source: NABARD (ENSURE portal). | V.27. RCCs are structurally different from UCBs in terms of their balance sheet composition. While UCBs mainly depend on deposits to raise funds, RCCs rely heavily on borrowings. At end-March 2024, deposits constituted 78.5 per cent of UCBs’ total liabilities as compared to 53.9 per cent for RCCs. In contrast, the share of borrowings was 33.9 per cent for RCCs as compared with 0.8 per cent in case UCBs. | Table V.12: A Profile of Rural Co-operatives | | (At end-March 2024) | | (Amount in ₹ crore) | | Item | Short-term | Long-term | Rural Credit Co-operatives | | StCBs | DCCBs | PACS | SCARDBsP | PCARDBsP | Mar-23 | Mar-24 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | A. Number of Co-operatives | 34 | 351 | 1,07,641 | 13 | 609 | 1,07,961 | 1,08,648 | | B. Balance Sheet Indicators | | | | | | | | | i. Owned Funds (Capital + Reserves) | 33,392 | 60,362 | 59,478 | 6,743 | 5,658 | 1,46,171 | 1,65,633 | | ii. Deposits | 2,56,819 | 4,76,610 | 2,03,532 | 2,679 | 1,804 | 8,77,263 | 9,41,444 | | iii. Borrowings | 1,73,116 | 1,61,728 | 2,27,931 | 12,517 | 16,840 | 5,32,778 | 5,92,132 | | iv. Loans and Advances | 2,94,577 | 4,13,161 | 2,12,601 | 21,048 | 15,922 | 8,73,466 | 9,57,310 | | v. Total Liabilities/Assets | 4,88,266 | 7,65,577 | 4,29,103^ | 28,851 | 33,324 | 16,18,761 | 17,45,121 | | C. Financial Performance | | | | | | | | | i. Institutions in Profits | | | | | | | | | a. No. | 32 | 312 | 49,238 | 9 | 345 | 48,492 | 49,936 | | b. Amount of Profit | 2,727 | 3,297 | 2,609 | 288 | 220 | 8,512 | 9,142 | | ii. Institutions in Loss | | | | | | | | | a. No. | 2 | 39 | 37,662 | 4 | 263 | 37,660 | 37,970 | | b. Amount of Loss | 35 | 1,403 | 3,524 | 563 | 421 | 4,989 | 5,947 | | iii. Overall Profits (+)/Loss (-) | 2,691 | 1,894 | -915 | -275 | -201 | 3,523 | 3,195 | | D. Non-performing Assets | | | | | | | | | i. Amount | 14,537 | 36,958 | 53,149^^ | 8,070 | 6,144 | 1,08,002 | 1,18,857 | | ii. As Percentage of Loans Outstanding | 4.9 | 8.9 | 26.2 | 38.3 | 38.6 | 12.4 | 12.4 | | E. Recovery of Loans to Demand Ratio* (Per cent) | 92.4 | 76.8 | 77.6 | 40.8 | 43.1 | - | - | StCBs: State Co-operative Banks, DCCBs: District Central Co-operative Banks, PACS: Primary Agricultural Credit Societies, SCARDBs: State Co-operative Agriculture and Rural Development Banks, PCARDBs: Primary Co-operative Agriculture and Rural Development Banks.

P: Data are provisional.

^: Working capital.

^^: Total overdue.

*: This ratio captures the share of outstanding demand amount (amount due) that has been recovered at end-June 2023.

-: Not available.

Notes: 1. Data for financial year 2023-24 are available in respect of 608 out of 609 PCARDBs.

2. Components may not add up to the total due to rounding off.

Sources: NABARD and NAFSCOB. | V.28. Owing to faster growth of credit, deposits and borrowing in RCCs relative to UCBs, the share of RCCs in total assets/liabilities of the co-operatives (urban and rural combined) expanded to 71.2 per cent at end-March 2024 (Chart V.15). V.29. Within rural co-operatives, the share of short-term credit co-operatives increased steadily over the years, reaching 96.4 per cent at end-March 2024 (Chart V.16a). Short-term and long-term credit co-operatives differ in terms of their balance sheet composition and soundness indicators. While short-term credit co-operatives depend primarily on deposits, long-term co-operatives rely more on borrowings and owned funds. The asset quality of long-term co-operatives remains relatively weak, with a higher NPA ratio compared to their short-term counterparts (Chart V.16b). RCCs continue to face the challenges of lending portfolio concentration compared to UCBs.  V.30. RCCs remained profitable, albeit with some moderation in net profits during 2023-24, driven by losses in PACS and long-term credit co-operatives. The number of profit-making RCCs as per cent of total RCCs improved to 46.0 per cent at end-March 2024, from 44.9 per cent a year ago. Asset quality of RCCs remained stable during the year, as improvement in StCBs, DCCBs, PCARDBs was offset by deterioration in that of PACS and SCARDBs.  V.31. In April 2025, the Reserve Bank accorded regulatory approval for setting up of a shared service entity (SSE) for rural co-operative banks. NABARD, in co-ordination with the Ministry of Cooperation, Government of India is establishing an SSE named Sahakar Sarathi Private Limited (SSPL), to provide centralised technological, operational, and support services for rural co-operative banks. The initiative is designed to enhance service quality, reduce costs, and enable the swift adoption of emerging technologies. Further, to enhance transparency and accountability in the co-operative banking sector, the Reserve Bank-Integrated Ombudsman Scheme has been extended to include StCBs and DCCBs from November 1, 2025. 4.1. Short-term Rural Credit Co-operatives V.32. Short-term rural credit co-operatives – comprising StCBs at the apex level, DCCBs at the district level, and PACS at the base level – play a pivotal role in meeting the short-term and seasonal credit needs of the agricultural sector and allied activities such as dairy and fisheries. Over time, their operations are expanding to cover non-farm activity and microfinance. The short-term co-operative structure operates in two, three or mixed-tier formats. Two-tier systems are largely prevalent in the north-eastern states where StCBs lend directly through their branches and PACS, while in the three-tier system, StCBs function as apex banks for DCCBs operating at the district level. In states with mixed-tier structure, StCBs function directly in some districts and through DCCBs in others. 4.1.1. State Co-operative Banks V.33. StCBs, positioned at the apex level of the short-term co-operative credit structure, play a crucial role in channelising resources to DCCBs and PACS. They provide refinance, liquidity support, and technical assistance to the lower tiers of the co-operative credit system, thereby facilitating the flow of short-term agricultural credit. Balance Sheet Operations V.34. During 2024-25, the balance sheet of StCBs expanded by 7.7 per cent as compared with 8.1 per cent a year ago. On the liability side, deposits growth accelerated to 6.8 per cent from 6.0 per cent in previous year (Table V.13). The share of current account and savings account (CASA) deposits in total deposits moderated to 17.4 per cent (from 18.6 per cent a year ago), reflecting their limited branch network. On the contrary, the share of borrowings increased to 36.1 per cent from 35.5 per cent a year ago, driven by borrowings from NABARD. | Table V.13: Liabilities and Assets of State Co-operative Banks | | (Amount in ₹ crore) | | Item | At end-March | Percentage Variation | | 2024 | 2025P | 2023-24 | 2024-25P | | 1 | 2 | 3 | 4 | 5 | | 1. Capital | 10,531 | 10,992 | 7.7 | 4.4 | | | (2.2) | (2.1) | | | | 2. Reserves | 22,861 | 26,220 | 11.3 | 14.7 | | | (4.7) | (5.0) | | | | 3. Deposits | 2,56,819 | 2,74,183 | 6.0 | 6.8 | | | (52.6) | (52.2) | | | | 4. Borrowings | 1,73,116 | 1,89,549 | 11.7 | 9.5 | | | (35.5) | (36.1) | | | | 5. Other Liabilities | 24,940 | 24,781 | 2.9 | -0.6 | | | (5.1) | (4.7) | | | | Total Liabilities/Assets | 4,88,266 | 5,25,725 | 8.1 | 7.7 | | | (100.0) | (100.0) | | | | 1. Cash and Bank Balances | 22,661 | 22,764 | 6.7 | 0.5 | | | (4.6) | (4.3) | | | | 2. Investments | 1,55,826 | 1,68,690 | 4.8 | 8.3 | | | (31.9) | (32.1) | | | | 3. Loans and Advances | 2,94,577 | 3,20,004 | 10.9 | 8.6 | | | (60.3) | (60.9) | | | | 4. Accumulated Losses | 1,146 | 1,185 | -15.0 | 3.4 | | | (0.2) | (0.2) | | | | 5. Other Assets | 14,057 | 13,081 | -6.3 | -6.9 | | | (2.9) | (2.5) | | | P: Provisional.

Notes: 1. Figures in parentheses are the proportion to total liabilities/assets (in per cent).

2. Components may not add up to the total due to rounding off.

Source: NABARD. | V.35. On the assets side, loans and advances increased by 8.6 per cent compared with 10.9 per cent a year ago. Agriculture loans accounted for 43.4 per cent of total loans and advances, of which 77.7 per cent were crop loans/ short-term loans. With credit growth surpassing deposit growth, the credit-deposit ratio of StCBs increased further to 116.7 per cent at end-March 2025 from 114.7 per cent a year ago. Due to higher growth in investments placed as term deposits with other banks, the share of SLR investments in total investments moderated to 45.8 per cent at end-March 2025 from 51.2 per cent a year ago. V.36. At end-March 2025, 24 out of the 34 StCBs were scheduled banks. The business growth of scheduled StCBs, both in terms of deposits and credit, decelerated during 2024-25 (Table V.14). | Table V.14: Select Balance Sheet Indicators of Scheduled State Co-operative Banks | | (At end-March) | | (Amount in ₹ crore) | | Item | 2024 | 2025 | | 1 | 2 | 3 | | Deposits | 2,15,540 | 2,19,976 | | | (5.4) | (2.1) | | Credit | 2,78,147 | 2,97,426 | | | (8.8) | (6.9) | | SLR Investments | 77,525 | 79,410 | | | (3.8) | (2.4) | | Credit plus SLR Investments | 3,55,671 | 3,76,836 | | | (7.6) | (6.0) | Notes: 1. Data pertain to the last reporting Friday of March of the financial year.

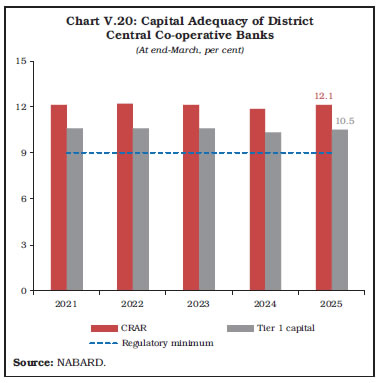

2. Figures in parentheses are growth rates over the previous year, in per cent.

Source: Form B under Section 42 of RBI Act. | Profitability V.37. During 2024-25, despite a fall in provisioning, net profits of StCBs declined as operating expenses increased, and growth in interest expended outpaced the growth in interest income (Table V.15). The increase in interest expended partly reflected a fall in the share of low-cost CASA deposits. V.38. During 2024-25, 32 out of 34 StCBs reported profits. StCBs in northern, north-eastern, and central regions reported improvement in profitability during the year, whereas profits of StCBs in eastern, western and southern region moderated (Chart V.17 and Appendix Table V.3). | Table V.15: Financial Performance of State Co-operative Banks | | Item | Amount

(in ₹ crore) | Variation

(in per cent) | | 2023-24 | 2024-25P | 2023-24 | 2024-25P | | 1 | 2 | 3 | 4 | 5 | | A. Income (i+ii) | 32,401 | 36,134 | 17.2 | 11.5 | | | (100.0) | (100.0) | | | | i. Interest Income | 30,974 | 34,329 | 16.2 | 10.8 | | | (95.6) | (95.0) | | | | ii. Other Income | 1,427 | 1,804 | 43.6 | 26.4 | | | (4.4) | (5.0) | | | | B. Expenditure (i+ii+iii) | 29,710 | 33,524 | 17.9 | 12.8 | | | (100.0) | (100.0) | | | | i. Interest Expended | 23,793 | 27,158 | 24.9 | 14.1 | | | (80.1) | (81.0) | | | | ii. Provisions and Contingencies | 1,979 | 1,810 | 3.0 | -8.6 | | | (6.7) | (5.4) | | | | iii. Operating Expenses | 3,938 | 4,557 | -6.8 | 15.7 | | | (13.3) | (13.6) | | | | Of which, Wage Bill | 2,077 | 2,178 | 0.8 | 4.9 | | | (7.0) | (6.5) | | | | C. Profits | | | | | | i. Net Interest Income | 7,181 | 7,171 | -5.7 | -0.1 | | ii. Operating Profits | 4,670 | 4,419 | 6.7 | -5.4 | | iii. Net Profits | 2,691 | 2,609 | 9.5 | -3.0 | P: Provisional.

Notes: 1. Figures in parentheses are the proportion to total income/expenditure (in per cent).

2. Components may not add up to the total due to rounding off.

Source: NABARD. |

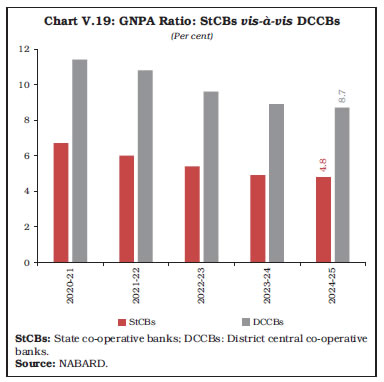

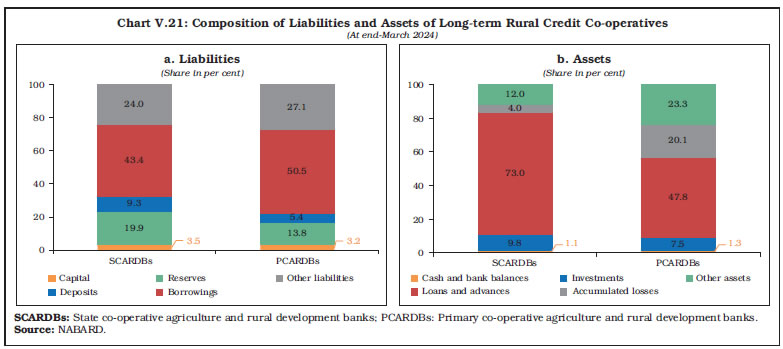

Asset Quality V.39. The asset quality of StCBs improved for the fourth consecutive year, with the GNPA ratio declining to 4.8 per cent at end-March 2025 from 6.7 per cent at end-March 2021. The share of doubtful assets in total NPAs reduced further to 50.5 per cent from 56.7 per cent a year ago (Table V.16). Reflecting the moderation in GNPA and the provision coverage ratio during the year, net NPA ratio remained stable at 2.0 per cent. Except the central region, the GNPA ratio declined across all other regions (Appendix Table V.3). Capital Adequacy V.40. At the consolidated level, StCBs remained well capitalised, with CRAR increasing to 13.6 per cent at end-March 2025 from 12.9 per cent a year ago (Chart V.18). At the bank level, only two StCBs reported a CRAR lower than the regulatory minimum of 9 per cent. 4.1.2. District Central Co-operative Banks V.41. DCCBs function as the second tier in the three-tier cooperative banking structure. They mobilise funds through public deposits, borrowings from StCBs, and refinance from NABARD. DCCBs have better access to CASA deposits compared to StCBs due to their larger branch network. Their total advances and agricultural advances are tilted towards PACS/societies. | Table V.16: Soundness Indicators of State Co-operative Banks | | (Amount in ₹ crore) | | Item | At end-March | Percentage Variation | | 2024 | 2025P | 2023-24 | 2024-25P | | 1 | 2 | 3 | 4 | 5 | | A. Total NPAs (i+ii+iii) | 14,537 | 15,407 | 1.7 | 6.0 | | i. Sub-standard | 4,974 | 5,980 | 7.9 | 20.2 | | | (34.2) | (38.8) | | | | ii. Doubtful | 8,237 | 7,782 | -0.7 | -5.5 | | | (56.7) | (50.5) | | | | iii. Loss | 1,326 | 1,645 | -4.9 | 24.1 | | | (9.1) | (10.7) | | | | B. Gross NPA Ratio (Per cent) | 4.9 | 4.8 | | | | C. Net NPA Ratio (Per cent) | 2.0 | 2.0 | | | | D. Provision Coverage Ratio (Per cent) | 68.5 | 64.1 | | | | E. Recovery to Demand Ratio (Per cent) | 92.4 | 87.5 | | | P: Provisional.

Notes: 1. Figures in parentheses are the proportion to total NPAs (in per cent).

2. Recovery-to-demand ratio captures the share of outstanding demand amount (amount due) that has been recovered at end-June 2024 and 2025.

Source: NABARD. |

Balance Sheet Operations V.42. During 2024-25, balance sheet growth of DCCBs decelerated mainly reflecting slowdown in deposits growth on the liabilities side, and loans and advances on the assets side (Table V.17). On the liabilities side, CASA deposits accounted for 40.5 per cent of total deposits. Borrowings from StCBs and NABARD constituted 89.3 per cent and 9.2 per cent, respectively, of total borrowings of DCCBs. V.43. On the assets side, growth in credit moderated as compared to last year, while growth in investment increased. Nonetheless, with credit growth outpacing deposit growth, the credit-deposit ratio increased to 87.6 per cent at end-March 2025 from 86.7 per cent a year ago. The share of agriculture loans in total loans and advances marginally decreased to 53.6 per cent from 54.6 per cent in the previous year. Investments of DCCBs were primarily placed as term deposits with other banks (57.0 per cent), while statutory liquidity ratio (SLR) investments constituted 38.4 per cent of total investments. | Table V.17: Liabilities and Assets of District Central Co-operative Banks | | (Amount in ₹ crore) | | Item | At end-March | Percentage Variation | | 2024 | 2025P | 2023-24 | 2024-25P | | 1 | 2 | 3 | 4 | 5 | | 1. Capital | 28,661 | 30,940 | 8.2 | 8.0 | | | (3.7) | (3.7) | | | | 2. Reserves | 31,701 | 36,472 | 10.3 | 15.1 | | | (4.1) | (4.4) | | | | 3. Deposits | 4,76,610 | 5,09,002 | 10.0 | 6.8 | | | (62.3) | (61.5) | | | | 4. Borrowings | 1,61,728 | 1,79,760 | 9.9 | 11.1 | | | (21.1) | (21.7) | | | | 5. Other Liabilities | 66,876 | 71,450 | 8.7 | 6.8 | | | (8.7) | (8.6) | | | | Total Liabilities/Assets | 7,65,577 | 8,27,625 | 9.8 | 8.1 | | | (100.0) | (100.0) | | | | 1. Cash and Bank Balances | 38,705 | 40,904 | 14.6 | 5.7 | | | (5.1) | (4.9) | | | | 2. Investments | 2,65,692 | 2,88,716 | 7.2 | 8.7 | | | (34.7) | (34.9) | | | | 3. Loans and Advances | 4,13,161 | 4,45,748 | 11.4 | 7.9 | | | (54.0) | (53.9) | | | | 4. Accumulated Losses | 9,405 | 10,576 | 12.5 | 12.5 | | | (1.2) | (1.3) | | | | 5. Other Assets | 38,615 | 41,681 | 6.1 | 7.9 | | | (5.0) | (5.0) | | | P: Provisional.

Notes: 1. Figures in parentheses are the proportion to total liabilities/assets (in per cent).

2. Components may not add up to the total due to rounding off.

Source: NABARD. | Profitability V.44. During 2024-25, growth in net interest income of DCCBs moderated as interest expenditure grew faster than interest income. However, net profits increased by 12.1 per cent, aided by lower provisioning requirements on account of improved asset quality and increase in other income (Table V.18). | Table V.18: Financial Performance of District Central Co-operative Banks | | Item | Amount

(in ₹ crore) | Percentage Variation | | 2023-24 | 2024-25P | 2023-24 | 2024-25P | | 1 | 2 | 3 | 4 | 5 | | A. Income (i+ii) | 52,408 | 58,181 | 13.2 | 11.0 | | | (100.0) | (100.0) | | | | i. Interest Income | 49,989 | 55,520 | 13.7 | 11.1 | | | (95.4) | (95.4) | | | | ii. Other Income | 2,420 | 2,661 | 3.3 | 10.0 | | | (4.6) | (4.6) | | | | B. Expenditure (i+ii+iii) | 50,515 | 56,057 | 13.7 | 11.0 | | | (100.0) | (100.0) | | | | i. Interest Expended | 32,731 | 37,543 | 18.6 | 14.7 | | | (64.8) | (67.0) | | | | ii. Provisions and Contingencies | 5,733 | 5,700 | 1.7 | -0.6 | | | (11.3) | (10.2) | | | | iii. Operating Expenses | 12,051 | 12,815 | 7.7 | 6.3 | | | (23.9) | (22.9) | | | | Of which, Wage Bill | 7,430 | 7,778 | 7.0 | 4.7 | | | (14.7) | (13.9) | | | | C. Profits | | | | | | i. Net Interest Income | 17,257 | 17,977 | 5.4 | 4.2 | | ii. Operating Profits | 7,627 | 7,823 | 1.4 | 2.6 | | iii. Net Profits | 1,894 | 2,124 | 0.7 | 12.1 | P: Provisional.

Notes: 1. Figures in parentheses are the proportion to total income/expenditure (in per cent).

2. Components may not add up to the total due to rounding off.

Source: NABARD. | V.45. During 2024-25, there were 301 profit-making DCCBs and 50 loss-making DCCBs. Profit-making DCCBs were geographically well-distributed across all regions, with a relatively higher concentration in Uttar Pradesh, Madhya Pradesh, Maharashtra, Tamil Nadu, and Karnataka. The number of loss-making DCCBs increased during the year. Of the 50 loss-making DCCBs, nearly 82 per cent were concentrated in five states, viz., Rajasthan, Madhya Pradesh, Punjab, Bihar and Maharashtra (Appendix Table V.4). Asset Quality V.46. The asset quality of DCCBs improved for the fifth consecutive year, with the GNPA ratio declining to 8.7 per cent at end-March 2025. The GNPA ratio, however, remained higher than that of StCBs (Chart V.19). The improvement in asset quality was broad-based with the GNPA ratio declining across all regions, except the western region (Appendix Table V.4). DCCBs in the central region have the highest GNPA ratio, followed by those in the western region. The fall in GNPA ratio along with the increased provision coverage ratio resulted in the moderation in net NPA ratio to 3.0 per cent at end-March 2025 from 3.4 per cent a year ago (Table V.19).

| Table V.19: Soundness Indicators of District Central Co-operative Banks | | (Amount in ₹ crore) | | Item | At end-March | Percentage Variation | | 2024 | 2025P | 2023-24 | 2024-25P | | 1 | 2 | 3 | 4 | 5 | | A. Total NPAs (i+ ii + iii) | 36,958 | 38,709 | 3.5 | 4.7 | | i) Sub-standard | 13,433 | 14,288 | 7.1 | 6.4 | | | (36.3) | (36.9) | | | | ii) Doubtful | 20,912 | 21,397 | 0.8 | 2.3 | | | (56.6) | (55.3) | | | | iii) Loss | 2,612 | 3,024 | 7.0 | 15.8 | | | (7.1) | (7.8) | | | | B. Gross NPA Ratio (Per cent) | 8.9 | 8.7 | | | | C. Net NPA Ratio (Per cent) | 3.4 | 3.0 | | | | D. Provision Coverage Ratio (Per cent) | 83.9 | 84.3 | | | | E. Recovery to Demand Ratio (Per cent) | 76.8 | 76.4 | | | P: Provisional.

Notes: 1. Figures in parentheses are the proportion to total NPAs (in per cent).

2. Recovery-to-demand ratio captures the share of outstanding demand amount (amount due) that has been recovered at end-June 2024 and 2025.

Source: NABARD. | Capital Adequacy V.47. Over the years, consolidated CRAR of DCCBs remained broadly stable at around 12 per cent (Chart V.20). During 2024-25, the number of DCCBs with CRAR less than the regulatory requirement of 9.0 per cent decreased to 38 from 39 a year ago. More than 75 per cent of these DCCBs were concentrated in four states/UTs, viz., Madhya Pradesh (14), Punjab (6), Rajasthan (5), and Maharashtra (4). 4.1.3. Primary Agricultural Credit Societies V.48. PACS are the grass root level arm of the short-term credit cooperatives.8 PACS are owned by member individuals, mostly farmers, and aim at promoting thrift and mutual help among the members. They cater to credit requirements of members and provide credit-linked services like input supply, storage and marketing of agricultural produce. At end-March 2024, PACS had 16.37 crore members, and they served 4.95 crore borrowers. Of the total membership, 44.2 per cent were small farmers and 24.9 per cent were from scheduled castes/ scheduled tribes. Borrower to member ratio – a metric to gauge credit penetration of PACS – was 30.2 per cent at end-March 2024 as compared to 30.7 per cent a year ago (Appendix Table V.5).  V.49. During 2023-24, growth in total resources of PACS decelerated to 9.8 per cent from 14.2 per cent a year ago. This was led by a slowdown in deposit growth, which accounted for 41.5 per cent of their total resources. More than 80 per cent of total loans and advances outstanding were for short duration and were extended for agriculture. A reduction in short term loans growth contributed to deceleration in growth of total loans and advances (Appendix Table V.6). V.50. The western region – with 29.4 per cent share in total number of PACS – dominates the sector. However, the southern region continued to dominate in terms of deposits, and loans and advances, with a share of 76.9 per cent and 49.6 per cent, respectively. During 2023-24, the number of PACS reporting profits increased to 49,238 from 47,794 a year ago. The number of loss-making PACS also increased slightly to 37,662, from 37,357 in the previous year. Overall, PACS recorded lower net losses in 2023-24 compared to the previous year. At the regional level, PACS in the northern, north-eastern and western regions reported net profits while the southern and central regions reported net losses (Appendix Table V.7). There was, however, a deterioration in the asset quality of PACS, with the GNPA ratio increasing to 26.2 per cent at end-March 2024 from 23.3 per cent at end-March 2023. V.51. Over the years, concerted efforts are being made to transform PACS into modern, multi-functional entities. The Government of India is administering a centrally sponsored scheme from 2022-23 to 2026-27 for computerisation of PACS to onboard nearly 80,000 PACS onto a unified enterprise resource planning (ERP) platform to strengthen accounting, supervision, and linkage with DCCBs and StCBs. The Government of India also launched a plan to establish 2 lakh new multipurpose PACS, dairy and fishery cooperatives within five years. PACS are also being integrated into the ‘Cooperative Stack’ digital ecosystem to deliver a wide range of rural services and financial products. Further, convergence initiatives enabled PACS to function as common service centres, jan aushadhi kendras, and LPG and fertiliser distribution points, expanding their role in last-mile delivery. These measures aim to deepen financial inclusion, improve operational viability, and reposition PACS as comprehensive rural service institutions within the cooperative credit structure. 4.2. Long-term Rural Credit Co-operatives V.52. Long-term rural credit co-operatives were set up to primarily cater to the long-term credit needs of the agriculture sector and the rural economy. The long-term structure consists of SCARDBs at the state level and PCARDBs at the district/taluka level in a few States/UTs.9 V.53. At end-March 2024, the long-term rural credit co-operatives were functional in 13 states/union territories, operating under unitary, federal, or mixed-tier structures.10 In the unitary structure, SCARDB functions through its own network of branches across the state, with customers directly linked to the bank through membership and receiving loans from its branches. Under the federal structure, SCARDB serves as the apex institution for all affiliated PCARDBs operating at the district or taluka level, which in turn, enroll members and extend credit to them. In some states, long-term rural credit co-operatives follow a mixed structure, wherein SCARDBs operate both through PCARDBs and their own branch network. V.54. The business model of SCARDBs and PCARDBs depends on borrowings, where SCARDBs primarily borrow from NABARD, while PCARDBs receive financial assistance from SCARDBs (Chart V.21a). Loans and advances constituted a larger share of assets in SCARDBs relative to PCARDBs (Chart V.21b). 4.2.1. State Co-operative Agriculture and Rural Development Banks V.55. At end-March 2024, SCARDBs were operational in 13 states with 695 branches, of which 46.5 per cent branches were in Uttar Pradesh. The consolidated balance sheet size of SCARDBs (net of accumulated losses) improved marginally during 2023-24, led by the increased loans and advances and other assets (Appendix Table V.8). The accumulated losses of SCARDBs increased during the year, driven by increase in losses incurred by SCARDBs in the northern region.  V.56. At the consolidated level, financial performance of SCARDBs weakened during 2023-24, with total income declining by 27.9 per cent following a growth of 38.9 per cent in the previous year (Appendix Table V.9). The decline was primarily on account of a fall in non-interest income. On the expenditure side, total expenses declined by 8.9 per cent, driven by a reduction in operating expenses, although interest expenditure and provisioning increased. Overall, operating profit declined by 54.4 per cent, and net profit turned negative (Appendix Table V.9). V.57. Asset quality of SCARDBs deteriorated during 2023-24, with the GNPA ratio increasing to 38.3 per cent at end-March 2024 from 36.5 per cent a year ago. In terms of composition of NPAs, the share of doubtful assets continued to dominate, accounting for 67.4 per cent of total NPAs at end-March 2024. The recovery-to-demand ratio declined to 40.8 per cent from 44.8 per cent a year earlier, indicating moderation in recovery performance (Appendix Table V.10). V.58. At the regional level, financial performance of SCARDBs exhibited wide variation during 2023-24 (Appendix Table V.11). Banks in the southern region reported higher profits, supported by relatively better asset quality and recovery performance, while those in the northern region recorded losses. 4.2.2. Primary Co-operative Agriculture and Rural Development Banks V.59. At end-March 2024, there were 609 PCARDBs operating in eight states/union territories. The consolidated balance sheet of PCARDBs (net of accumulated losses) expanded during 2023-24, led by the growth in investments and other assets on the assets side, and deposits and other liabilities on the liabilities side (Appendix Table V.12). V.60. During 2023-24, the consolidated income of PCARDBs declined, reflecting slower growth in interest income and contraction in other income. On the contrary, their total expenditure increased, led by a significant rise in operating expenses. Consequently, operating profits moderated during the year (Appendix Table V.13). PCARDBs in the northern region contributed to 74.6 per cent of the total losses while the southern region had the highest share in profits. V.61. The asset quality of PCARDBs showed an improvement during 2023-24, with the GNPA ratio moderating to 38.6 per cent from 39.7 per cent a year ago (Appendix Table V.14). PCARDBs in the northern region continued to record the highest GNPA ratio and the lowest recovery-to-demand ratio during 2023-24. In contrast, the southern region maintained the lowest GNPA ratio and the highest recovery-to-demand ratio (Appendix Table V.15). 5. Overall Assessment V.62. During 2024-25, UCBs continued to strengthen their balance sheets, with higher capital buffers, lower GNPA ratios and better provisioning outcomes. The introduction of the prompt corrective action framework for urban co-operative banks effective from April 2025, the four-tier regulatory structure, and calibrated supervisory interventions are expected to reinforce early risk recognition and strengthen assurance functions. Financial resilience is expected to strengthen further with the operationalisation of National Urban Co-operative Finance and Development Corporation, an umbrella organisation for UCBs, which focus on strengthening governance, ensuring liquidity, and promoting capacity building and risk management. V.63. Among rural co-operatives, both state co-operative banks and district central co-operative banks continued to remain profitable with improved capital adequacy and asset quality. Long-term credit co-operatives, however, continued to face challenges. Going forward, technology adoption, business diversification and improving operational efficiency will be important for supporting sustainable growth of the co-operative sector.

|