I. Macroeconomic Outlook

The broad-based decline in retail inflation since September 2014, plans announced in the Union Budget to step up

infrastructure investment, depressed commodity prices and upbeat financial market conditions have improved the

prospects for growth in 2015-16. Retail inflation is projected to remain below 6 per cent in 2015-16, within the

target set for January 2016. Persisting slack in the economy and restrained input costs should sustain disinflationary

impulses, unless disrupted by reversal in global commodity prices and/or deficiency in the south-west monsoon.

Since the first Monetary Policy Report (MPR) of

September 2014, tectonic shifts in the global and

domestic environment drastically changed the initial

conditions that had underpinned staff’s outlook at

that time. The most significant shock to forecasts

has been the collapse of international commodity

prices, particularly those of crude1. For the Indian

economy, this translated into a sizable softening of

prices of both raw materials and intermediates. Their

pass-through, given the persisting slack in economic

activity, weakened pricing power and fed into a faster

than anticipated easing of output price pressures.

Another factor vitiating staff’s baseline assumptions

has been the different speeds at which global activity

evolved across geographies. With several emerging

market economies (EMEs) slowing down alongside

sluggish advanced economies – barring the United

States (US) – external demand fell away and sent

prices of tradables into contraction. For India, import

prices declined faster than export prices, conferring

unexpected gains in net terms of trade as well as an

appreciable easing of imported inflationary pressures.

As data from the US allayed fears of early monetary

policy normalisation and ultra accommodative

monetary policies took hold in Europe, Japan and

China as also elsewhere, risk appetite roared into

financial markets and India became a preferred

destination for capital flows. The appreciating bias

imparted to the exchange rate of the rupee brought

with it a disinflation momentum.

Domestically, prices of fruits and vegetables ebbed

from September after supply disruptions induced

spikes in July-August. Aided by proactive supply

management strategies and moderation in the pace

of increase in minimum support prices, food inflation

eased more than expected2. Another favourable but

unanticipated development that restrained cost-push pressures has been the sharp deceleration in rural

wage growth to below 6 per cent by January 2015 from

16 per cent during April-October 20133. The confluence

of these factors fortified the anti-inflationary stance

of monetary policy and reinforced the impact of the

policy rate increases effected between September 2013

to January 2014. In the event, CPI inflation4 retreated

below the January 2015 target of 8 per cent by close to

300 basis points.

Going forward, staff’s assessment of initial conditions

and consequent revisions to forecasts in this MPR will

be fundamentally shaped by these developments.

The outlook will also likely be influenced by the new

monetary policy framework put in place in February

2015, marking a watershed in India’s monetary

history.

The Government of India and the Reserve Bank

have committed to an institutional architecture that

accords primacy to price stability as an objective of

monetary policy. The Monetary Policy Framework

Agreement envisages the conduct of monetary

policy around a nominal anchor numerically defined

as below 6 per cent CPI inflation for 2015-16 (to be

achieved by January 2016) and 4 +/- 2 per cent for

all subsequent years, with the mid-point of this band,

i.e., 4 per cent to be achieved by the end of 2017-18.

Failure to achieve these targets for three consecutive

quarters will trigger accountability mechanisms,

including public statements by the Governor on

reasons for deviation of inflation from its target,

remedial actions and the time that will be taken to

return inflation to the mid-point of the inflation target

band. This flexible inflation targeting (FIT) framework

greatly enhances the credibility and effectiveness of monetary policy, and particularly, the pursuit of the

inflation targets that have been set. The commitment

of the Government to this framework enhances

credibility significantly since it indicates that the

Government will do its part on the fiscal side and on

supply constraints to reduce the burden on monetary

policy in achieving price stability.

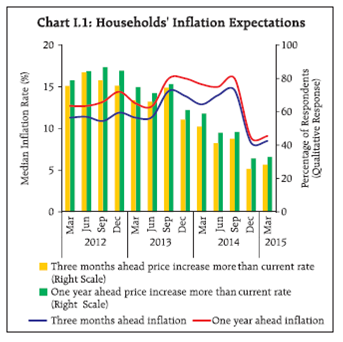

Inflation expectations of various economic agents

polled in forward looking surveys have been easing,

partly reflecting the adaptation of expectations to

the decline in inflation as well as growing credibility

around the Reserve Bank’s inflation targets. Although

households’ expectations of inflation three months

ahead as well as one year ahead appear to have firmed

up modestly in March 2015 in response to the uptick

in retail inflation in January – February 2015, the

softening of food and fuel inflation will likely temper

those expectations going forward (Chart I.1 and

Box I.1). This is borne out by the survey of professional forecasters for March 2015 in which five years ahead

inflation expectations have dropped by 50 basis points to 5.3 per cent. Professional forecasters expect

CPI inflation to average between 5.0 and 6.0 per cent

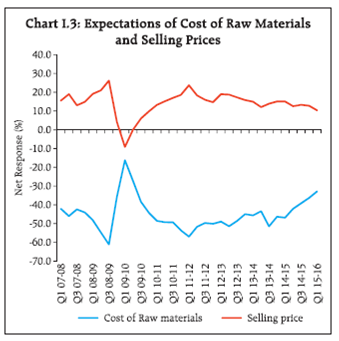

in 2015-16 (Chart I.2). The industrial outlook survey of the Reserve Bank indicates that manufacturers

expect softer input prices in the near-term, which

could transmit to output prices with a lag in view of

the slack in economic activity (Chart I.3).

Box I.1: What is Driving Inflation Expectations?

Understanding the dynamic interaction between

inflation and inflation expectations is important for

setting monetary policy. Inflation is sensitive to change

in the output gap and inflation expectations, both of

which monetary policy can influence by modulating

aggregate demand. In countries where inflation

expectations are well anchored, inflation has become

less sensitive to variations in the output gap, leading to

a flattening of the Phillips curve. In these countries,

inflation has even become less sensitive to major supply

shocks (Bernanke, 2007).

Survey-based gauges of expectations tend to be

somewhat backward-looking for the near term –

responding to changes in actual inflation, Price

movements of frequently bought food products have a

significant bearing on inflation expectations. Fuel prices

also move inflation expectations quickly: despite having

lower weights in the consumption basket, their price

changes get wide publicity in the media and influence

expectations faster than their actual impact on the

consumption basket. Longer-term expectations are

typically more stable. Empirical analysis using data for

the period September 2008 to December 2014 shows

that 3 months ahead inflation expectations move largely

in response to changes in prices of vegetables/fruits and

petrol – which together explain almost 60 per cent of the change in inflation expectations. These findings are

robust, i.e., even if the last quarter (October-December

2014) – when inflation expectations declined sharply

– is excluded from the sample, the estimated coefficients

remain stable.

The experience of inflation targeting countries suggests

that a credible monetary policy framework with clarity

about the objective function of the central bank helps in

anchoring inflation expectations. In the UK for example,

just the announcement of instrument independence for

the Bank of England in May 1997 led to an immediate

fall in inflation expectations by 50 basis points along the

entire term structure (Haldane, 2000). In this context,

the Monetary Policy Framework Agreement in India

should be able to reinforce the disinflationary forces

currently at work and anchor inflation expectations

around the medium-term inflation target.

References:

Bernanke, Ben S. (2007), “Inflation Expectations and

Inflation Forecasting”, July 10, 2007. <http://www.federalreserve.gov/newsevents/speech/bernanke20070710a.htm>

Haldane, Andrew (2000) “Targeting Inflation: The United

Kingdom in Retrospect”, <https://www.imf.org/external/pubs/ft/seminar/2000/targets/strach7.pdf>

I.1 Outlook for Inflation

Turning to inflation forecasts, large and unanticipated

changes in initial conditions referred earlier warrant

revised baseline assumptions (Table I.1). Updated

estimates of structural models and information yielded

by surveys and market-based gauges indicate that CPI

inflation will remain below the target of 6 per cent set

for January 2016, hovering around 5 per cent in the

first half of 2015-16, and a little above 5.5 per cent in the second half (Chart I.4). Uncertainties surrounding

commodity prices, monsoon and weather-related

disturbances, volatility in prices of seasonal items

and spillovers from external developments through

exchange rate and asset price channels are reflected

in a 70 per cent confidence interval of 3.7 per cent to

7.9 per cent around the baseline inflation projection of 5.8 per cent for Q4 of 2015-16. Medium-term

projections derived from model estimates assuming

an unchanged economic structure, fiscal consolidation

in line with the recalibrated path, a normal monsoon

and no major exogenous or policy shocks indicate that

CPI inflation in 2016-17 could be around 5.0 per cent

in Q4 of 2016-17, with risks evenly balanced around it.

| Table I.1: Baseline Assumptions for Near-Term Projections |

| September 2014 MPR |

Current Assumptions |

• Indian crude oil basket price at US$ 100 per barrel for the remaining part of the year.

• Exchange rate at about Rs. 60 per US$ for the remaining part of the year.

• No increase in diesel prices from September 2014 onwards.

• No increase in administered liquefied petroleum gas (LPG) and kerosene prices in the remaining part of the year.

• Global growth picking up in the second half of the year, as projected in the World Economic Outlook (WEO) July 2014 update, IMF.

• Achievement of fiscal deficit targets as outlined in the Union Budget for 2014-15.

• No major change in domestic macroeconomic/structural policies during the forecast horizon. |

• Indian crude oil basket* price at US$ 60 per barrel in the first half and US$ 63 per barrel in the second half of FY 2015-16.

• Current level of the exchange rate.**

• No change in LPG and kerosene prices.

• Normal monsoons during 2015-16.

• Global economy expected to grow at 3.5 per cent in 2015 (weaker by 0.3 percentage point from earlier projections) as per the WEO January 2015 update, IMF.

• Achievement of fiscal deficit targets as indicated in the Union Budget for 2015-16.

• No major change in domestic macroeconomic/structural policies during the forecast horizon. |

* The Indian basket of crude oil represents a derived basket comprising

sour grade (Oman and Dubai average) and sweet grade (brent) crude oil

processed in Indian refineries in the ratio of 72.04:27.96 during 2013-14.

**The exchange rate path assumed here is for the purpose of generating

staff’s baseline growth and inflation projections and does not indicate any ‘view’ on the level of the exchange rate. The Reserve Bank is guided by the

need to contain volatility in the foreign exchange market and not by any

specific level/ band around the exchange rate.

|

I.2 Outlook for Growth

Real Gross Domestic Product (GDP) growth for 2014-

15 was projected by the Reserve Bank at 5.5 per

cent. The CSO’s provisional estimates of GDP (base:

2004-05) tracked staff’s projected path well up to Q2

of 2014-15. The new GDP data (rebased to 2011-12)

released by the Central Statistics Office (CSO) at the

end of January 2015 and on February 9, however,

came as a major surprise as it produced significantly

higher growth at constant prices. The divergence

between the new series and the old series in the pace

of growth of the manufacturing sector has turned

out to be stark; in particular, the robust expansion

of manufacturing portrayed in the new series is not

validated by subdued corporate sector performance

in Q3 and still weak industrial production5. In the

financial and real estate sub-sector, the high growth of

13.7 per cent at constant prices is not corroborated by

the observed sluggishness in key underlying variables

such as credit and deposit growth, housing prices,

rent and most importantly, the subdued performance of real estate companies in terms of sales growth and

earnings. Data revisions and their after-effects are

not unique to India, but the magnitude of the gap in

real GDP growth rates between the old and the new

series for 2013-14 and 2014-15 has complicated the

setting of monetary policy. Undoubtedly, the new

GDP data embody better coverage and improved

methodology as per international best practices. Yet

these data cloud an accurate assessment of the state

of the business cycle and the appropriate monetary

policy stance; particularly, they render forecasting

tenuous. Projections based on the new series are also

handicapped by the lack of sufficient history in terms

of backdated data amenable to modelling.

The macroeconomic environment is expected to

improve in 2015-16, with fiscal policy gearing to an

investment-led growth strategy6 and monetary policy

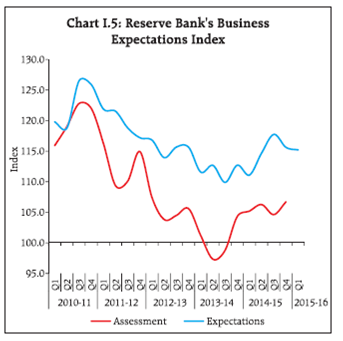

using available room for accommodation. Business

conditions in Indian manufacturing assessed in

the Reserve Bank’s Business Expectations Index

(BEI) developed from its industrial outlook survey

indicates that Q1 of 2015-16 may see some tempering

of the improvement in the second half of 2014-15

(Chart I.5). This is corroborated by some of the surveys

polled by other agencies (Table I.2). It is important to recognise though that most of these surveys were

conducted before the presentation of the Union

Budget and the easing of monetary policy on March

4. The Reserve Bank’s consumer confidence survey (CCS) points to growing consumer optimism since

June 2014, reflecting purchasing power gains arising

from lower inflation as well as improved perception of

income, spending and employment growth (Chart I.6).

| Table I.2: Business Expectations Surveys |

| |

NCAER

Business

Confidence

Index

Q4: 2014-15 |

FICCI

Overall

Business

Confidence

Index

February 2015 |

Dun and

Bradstreet

Business

Optimism

Index

Q1: 2015 |

CII Business

Confidence

Index

Q3: 2014-15 |

| Current level of the index |

148.4 |

70.5 |

129.4 |

56.4 |

| Index as per previous survey |

142.5 |

70.4 |

137.6 |

56.2 |

| Index levels one year back |

122.3 |

60.8 |

157.2 |

49.9 |

| % change (q-o-q) sequential |

4.1 |

0.1 |

-6.0 |

0.4 |

| % change (y-o-y) |

21.3 |

16.0 |

-17.7 |

13.0 |

Large declines in commodity prices and the benign

inflation outlook for the near-term should provide a

boost to growth (Box I.2).

Nevertheless, there are downside risks to growth

which could restrain growth prospects if they

materialise. The ongoing downturn in the international

commodity price cycle, which commenced in 2012, could reverse, given occasional signs of oil prices

reviving ahead of global economic activity. In fact,

the volatile geopolitical environment could even

hasten the reversal. The consequent resurgence of

inflation pressures could overwhelm the nascent

conditions setting in for recovery. Risks to budgetary

forecasts from tax shortfalls, subsidy overshoots and

disinvestment under-realisation could impact the

level of budgeted allocation for capital expenditure.

Early warnings on the south-west monsoon,

given the probability of about 50 per cent

currently being assigned to an El Nino event,

could dent the outlook for agriculture. Finally, if

the decline in the gross saving as percentage of

Gross National Disposable Income (GNDI) from

33 per cent in 2011-12 to 30 per cent in 2013-14

continues into the medium-term, it could tighten

the financial constraint to growth unless productivity

improves significantly.

Box I.2: Decline in Oil Prices – Impact on Growth and Inflation

For a large net importer of crude oil like India, the decline

in crude prices since June 2014 by about 50 per cent is

a favourable external shock. Going forward, this could

work towards improving growth prospects and easing

inflation pressures further. Crude prices could impact

economic activity and inflation in India through several

channels: (i) higher real incomes for consumers; (ii)

lower input costs, boosting corporate profitability and

inducing investment; (iii) lower current account deficit

(CAD); and (iv) improved market sentiment. These

favourable effects could, however, be offset by weak

global demand.

In India, a US$ 50 per barrel decline in oil prices (Indian

basket) sustained over one year could give rise to higher

real income equivalent of about 4 per cent of total private

consumption demand and about 2.9 per cent of nominal

GDP. Assuming 50 per cent pass-through to domestic

prices of petroleum products, the real income gain could

enhance aggregate consumption demand by about 2 per

cent and output by more than 1 per cent. For the

corporate sector in India, particularly non-oil producing

firms (such as cement, electricity, iron and steel, chemicals, textiles and transportation), with more than

5 per cent of their total costs in the form of fuel, panel

regressions show a statistically significant inverse

relationship between profitability and oil prices. Model

estimates suggest that for a 10 per cent decline in oil

prices (under alternative assumptions of pass-through

to CPI) output growth could improve in the range of

0.1-0.3 percentage points, while CPI inflation could

decline by about 20-25 basis points below the baseline.

A caveat is in order though. The estimates presented

under the balance of risks in this Chapter may differ due

to different dynamics captured in different models and

varying assumptions on pass-through. For instance in

India, the entire decline in crude prices was not fully

passed on because of the increase in excise duty on

petroleum products by the Government. This suggests

that model-based estimates at best could be indicative

rather than precise.

Reference:

World Bank (2015). “Global Economic Prospects”, January

2015.

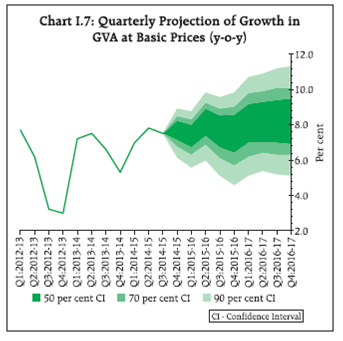

Growth projections combining these forward looking

assessments and model-based forecasts, including

time series forecasts such as autoregressive integrated

moving average (ARIMA) and Bayesian vector auto

regressions (BVAR), point to a gradual pick-up in

growth. Quarterly projections relate to gross value

added (GVA) at basic prices, because of more robust

estimation relative to expenditure side GDP and also

due to better clarity on key indicators that are used

in the compilation of data by the CSO. Growth in

GVA at basic prices for 2015-16 is projected at 7.8 per

cent, with risks evenly balanced around this baseline

forecast. Possible revision to CSO’s estimates for

2014-15 is a key risk to the forecast, with the revisions

expected to be in the downward direction (please

see Chapter III) and consequently an upside bias gets

built in (Chart I.7)7. For 2016-17, real growth in GVA

at basic prices is projected at 8.1 per cent, assuming

gradual cyclical recovery on the back of a supportive

policy environment, but without any policy induced

structural change or any major supply shock. If the

GDP growth for 2014-15 is revised down by the CSO,

the trajectory will change accordingly. The Reserve

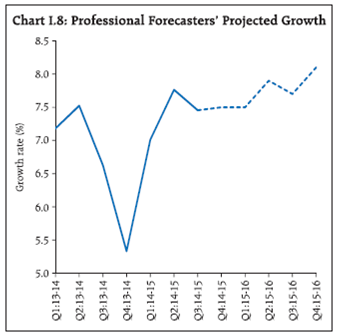

Bank’s professional forecasters’ survey indicates an average GVA growth of 7.9 per cent for 2015-16 (Chart

I.8 and Table I.3).

I.3 Balance of Risks

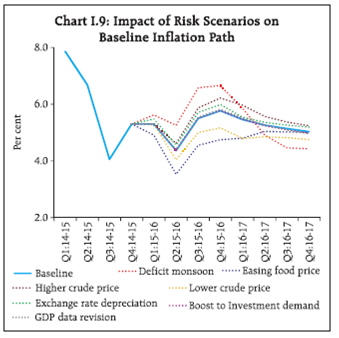

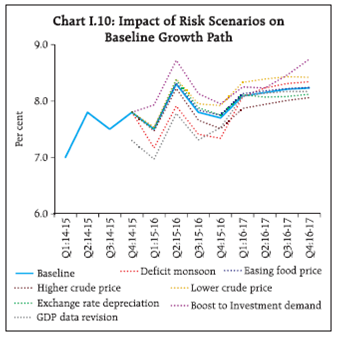

The baseline paths projected for growth and inflation

are subject to realisation of a set of underlying

assumptions (Table I.1). The likely paths relative to

the baseline that may evolve under plausible risk

scenarios are set out below (Charts I.9 and I.10).

(a) Sharp Increase in Crude Oil Prices

Global crude oil prices are assumed to increase

gradually over the forecast horizon in the baseline

projections. There is, however, a non-trivial risk of a sharp increase in international crude prices triggered

by the materialisation of geo-political tensions and

other supply disruptions. In the event of such a shock pushing crude oil prices up by about US$ 15-20 per

barrel above the baseline, inflation could be higher

by about 40-60 basis points (bps) by the end of 2015-16 (on account of both direct and indirect effects).

Growth could weaken by 10-30 bps over the next two

years as the direct impact of higher input costs would

be reinforced by spillover effects from lower world

demand.

| Table I.3: Reserve Bank's Baseline and Professional Forecasters' Median Projections |

| Reserve Bank’s Baseline |

2014-15 |

2015-16 |

2016-17 |

| Inflation (Y-o-Y) in Q4 |

5.3 |

5.8 |

5.0 |

| Output Growth (per cent) – GVA at basic prices |

7.5 |

7.8 |

8.1 |

| Fiscal Deficit (per cent of GDP) |

4.1 |

3.9 |

3.5 |

| Current Account Balance (per cent of GDP) |

-1.3 |

|

|

| Assessment of Survey of Professional Forecasters |

| Key Macroeconomic Indicators* |

2014-15 |

2015-16 |

|

| Growth rate of GVA at basic prices at constant prices (2011-12) (per cent) |

7.5 |

7.9 |

|

| Agriculture & Allied Activities |

1.1 |

3.4 |

|

| Industry |

5.9 |

6.3 |

|

| Services |

10.6 |

10.1 |

|

| Private Final Consumption Expenditure growth rate at current prices (per cent) |

12.9 |

13.0 |

|

| Gross Saving (per cent to Gross National Disposable Income) |

30.0 |

31.0 |

|

| Gross Fixed Capital Formation (per cent of GDP) |

28.6 |

29.3 |

|

| Money Supply (M3) (growth rate in per cent) (end period) |

12.3 |

13.5 |

|

| Bank Credit of all scheduled commercial banks (growth rate in per cent) |

12.0 |

14.0 |

|

| Combined Gross Fiscal Deficit (per cent to GDP) |

6.5 |

6.3 |

|

| Central Govt. Fiscal Deficit (per cent to GDP) |

4.1 |

3.9 |

|

| Repo Rate (end-period) |

7.50 |

7.00 |

|

| CRR (end-period) |

4.00 |

4.00 |

|

| T-Bill 91 days Yield (end-period) |

8.2 |

7.5 |

|

| YTM of Central Govt. Securities 10-years (end-period) |

7.8 |

7.3 |

|

| Overall Balance of Payments (US $ bn.) |

49.6 |

49.4 |

|

| Merchandise Exports (US $ bn.) |

323.5 |

339.9 |

|

| Merchandise Exports (growth rate in per cent) |

2.0 |

3.4 |

|

| Merchandise Imports (US $ bn.) |

466.7 |

478.2 |

|

| Merchandise Imports (growth rate in per cent) |

0.3 |

2.0 |

|

| Trade Balance as per cent of GDP at current prices |

-6.9 |

-6.3 |

|

| Net Invisibles Balance (US $ bn.) |

115.8 |

119.2 |

|

| Current Account Balance (US $ bn.) |

-25.0 |

-20.0 |

|

| Current Account Balance as per cent to GDP at current prices |

-1.2 |

-1.0 |

|

| Capital Account Balance (US $ bn.) |

76.3 |

66.5 |

|

| Capital Account Balance as per cent to GDP at current prices |

3.5 |

2.9 |

|

Source: 33rd Round of Survey of Professional Forecasters (March 2015).

* : Median of forecasts. |

(b) Below Normal Monsoon in 2015-16

As against the normal monsoon assumption in the

baseline, there is a risk of monsoon turning out to be

deficient in 2015. This could lead to a lower agriculture

output which, in turn, would lower the overall GVA

growth by around 40 bps in 2015-16. Food prices could

consequently increase, leading to inflation rising

above the baseline by 80-100 bps in 2015-16. Factors

like spatial and temporal distribution of monsoon,

policies relating to food stocks, procurement and

minimum support prices (MSPs) may moderate or

accentuate the impact of rainfall deficiency.

(c) Depreciation of the Rupee

Uncertainties surrounding the exchange rate persist.

The key risk is that normalisation of monetary

policy by the US Fed which may spark off safe haven

capital flows into US treasuries and spur further

appreciation of the US dollar. On the other hand,

deflation risks in some of the advanced economies

could warrant further monetary accommodation.

A depreciation of the rupee by around 10 per cent,

relative to the baseline assumption of the current

level of exchange rates continuing, could raise

inflation by around 20 -30 bps in 2015-16. On average,

growth would be higher by about 10 bps in 2015-16

due to an improvement in the external trade balance

while it could turn out to be marginally weaker in

2016-17, assuming tightness in financial conditions

intensifying further on materialisation of risks in

the external environment.

(d) Easing of Food Inflation

Headline inflation could also undershoot from the

baseline if food inflation moderates by more than what

is envisaged. This could be brought about by positive

supply shocks, especially through improvements in

the supply chain, reforms in market infrastructure

and a step-up in investment in agriculture. In such a

scenario, headline inflation may be lower by around

100 bps than the baseline by the end of 2015-16.

(e) Crude Oil Price Declining Further

If crude oil prices decline below the baseline by

US$ 15-20 per barrel in the near-term as a result of

excess supply conditions/low global demand in a

stable geo-political environment, inflation could turn

out to be 30-60 bps below the baseline by the end of

2015-16. Such a decline in crude prices would also

raise GVA growth by 10-30 bps above the baseline in

the next two years under different pass-through

scenarios.

(f) Revision in CSO’s GDP Estimates

Considerable uncertainty surrounds the advance

estimates of GDP growth for 2014-15 and information

on real economic activity relating to Q4 is expected to

be better captured in the revised estimates, which

would be released around the end of May 2015. If GVA

growth (at constant prices) gets revised downwards by

50 bps in the subsequent release(s), it would alter the

assessment of demand conditions and a decline in the

inflation trajectory for the medium-term by 10-30 bps

could result.

(g) Pick-up in Investment Demand

If the boost to investment expenditure announced in

the Union Budget for 2015-16 helps in crowding in

private investment, and correspondingly, if

investment demand picks up, GDP growth may turn

out to be over 50 bps above the baseline in 2015-16.

With augmentation of capacity but a still negative

output gap, the impact of higher investment demand

on inflation in 2015-16 could be minimal.

The balance of risks and possible deviations of

inflation and growth paths from their projected

baselines warrant a careful appraisal of forward

guidance, especially the underlying conditions that

drive such guidance (Box I.3).

The outlook for growth and inflation is informed by

the assessment of macroeconomic and financial

conditions presented in Chapters II to V. Barring

unforeseen shocks, the near-term appears to be

characterised by continuing slack in the economy.

Fiscal consolidation intentions and weak rural

consumption demand are likely to keep demand side

risks to inflation contained. From the supply side,

risks in the form of reversal in global commodity

prices, uncertainty surrounding monsoon outcomes,

and possible exchange market pressures arising from volatility in capital flows associated with US monetary

policy normalisation would need to be monitored

carefully and continuously, given the past experience

with spillovers from taper talk. The room for accommodating supply shocks in the conduct of

monetary policy remains limited, even as supporting

the revival of investment demand assumes high

importance.

Box I.3: Forward Guidance under Uncertainty

Forward guidance acquired prominence in the

communication of monetary policy of central banks

of both advanced and emerging economies after the

global crisis, particularly on confronting the zero

lower bound (ZLB) constraint. Traditionally, forward

guidance before the global crisis used to be in the form

of “forecast but do not promise”; but at ZLB it became

a policy instrument – investment demand could be

conditioned by expectations about the future path

of short-term interest rates. Thus, forward guidance

at ZLB potentially amplified the easing impact of

unconventional monetary policy.

The use of forward guidance as an instrument of policy

in normal times shifts the burden of understanding

risks and uncertainty primarily to central banks who,

in turn, face the trade-off between “credibility” and

“flexibility”. Four broad variants of forward guidance

have been used by central banks in the post-crisis

period: (a) qualitative guidance on the likely stance

of policy without linking it to any explicit end date,

threshold value of any goal variable or key parameters;

(b) qualitative guidance linked to evolution of specific

state variables; (c) calendar-based forward guidance

specifying the exact period over which the same

policy stance will prevail; and (d) outcome-based

forward guidance linked to threshold values of state

variables. While the first two variants are somewhat

open-ended, the third is time-contingent and the last

one is state-contingent. Time and state-contingent

forward guidance provides greater certainty, but strong

commitment may limit flexibility. Balance of risks

assessments often assume specific identifiable risks

and the manner in which these could be transmitted.

Unanticipated risks and model errors, however, could make the evolution of inflation and growth paths

quite different from either the baseline or the risk

scenarios. Financial market frictions could complicate

risk assessment further, especially if they are either

not explicitly modelled or their dynamic interactions

with the real economy are not captured properly in

models. When benefits of commitment under forward

guidance are assessed against benefits of changing the

policy stance not fully consistent with the guidance,

occasionally the latter may be preferred because of

developments that were hard to anticipate at the time

of giving the forward guidance. This has led to the

view that forward guidance should be a tool that must

be reserved for use only under the ZLB constraint:

“...For the policy practitioner, uncertainty is not abstract,

it is a daily preoccupation. Uncertainty and the policy

errors it can foster must not only be embedded in our

decision-making processes ex ante, they must be worn

like an ill-fitting suit ex post, that is, with humility”

(Poloz, 2014).

In India, forward guidance has served the purpose of

guiding market expectations around monitoring the

sources of and risks to inflation. Given the uncertainties

surrounding time varying output gap estimates, the

evolution of exogenous factors driving the inflation

process, global spillovers, and the nature, size and

timing of measures undertaken by the Government

to contain inflation, forward guidance has to be

conditioned by incoming data.

Reference:

Poloz, Stephen S. (2014). “Integrating Uncertainty and

Monetary Policy-Making: A Practitioner’s Perspective”,

Bank of Canada Discussion Paper 2014-6.

II. Prices and Costs

The trajectory of headline inflation in the second half of 2014-15 turned out to be substantially lower than staff ’s

assessment set out in the MPR of September 2014, aided by a sharp fall in global commodity prices and domestic

food inflation. Cost pressures eased with falling raw material prices and slowdown in wage growth.

Three major developments that followed the first

Monetary Policy Report (MPR) of September 2014 have

dramatically altered the evolution of underlying price/

cost conditions. First, the pass-through of the 28 per

cent plunge in international commodity prices1 into

domestic food, fuel and services prices worked in

conjunction with the disinflationary stance of monetary

policy to bring down inflation to 5.4 per cent in February

2015. Second, the Central Statistics Office (CSO)

unveiled data revisions relating to consumer price

index (CPI) and national accounts in January-February

2015 that updated the base years/weighting schemes

and also brought in methodological improvements to align with international best practices (Boxes II.1 and

III.1). Going forward, these information upgrades will

have a bearing on staff’s assessment of inflation

formation and forecasts. Third, the Government of

India and the Reserve Bank formalised a landmark

agreement on the monetary policy framework alluded

to in Chapter I.

These institutional changes will condition the future

path of inflation to which the Reserve Bank and the

Government of India are committing, if fiscal targets

are adhered to and administrative interventions in the

formation of key prices, wages and interest rates are

minimised.

Box II.1: Revision of the Consumer Price Index (CPI)

Beginning January 2015, the CSO revised the base year

of the CPI to 2012 (from 2010=100). The weighting

pattern of the revised series is based on the 2011-

12 Consumer Expenditure Survey (CES) of the

National Sample Survey Office (NSSO), which is more

representative and recent than the CES 2004-05 used

for the old series (Table II.B.1). A number of

methodological improvements have also been

undertaken by the CSO in the new series, which

include:

i. weighting diagrams use the modified mixed

reference period* (MMRP) data of CES 2011-12 as

against a uniform reference period (URP) of 30 days

used in the earlier series;

ii. geometric mean of the price relatives with respect

to base prices is used to compile elementary/item

indices, instead of the arithmetic mean used in

the old series, thereby reducing the impact of large

discrete change in prices over different markets;

iii. in case of items sold through the public distribution

system (PDS), prices of items covered under the

antyodaya anna yojana (AAY) have also been included in addition to those items covered by

above poverty line (APL) and below poverty line

(BPL) categories; and

iv. the sample size for collection of house rent data has

been doubled from 6,684 in the old series to 13,368

in the revised series.

| Table II.B.1: Comparison of Weighting Diagrams–Previous and Revised CPI |

| (Per cent) |

| |

Rural |

Urban |

Combined |

| 2010

Base |

2012 Base |

2010

Base |

2012

Base |

2010

Base |

2012

Base |

| Food and beverages |

56.59 |

54.18 |

35.81 |

36.29 |

47.58 |

45.86 |

| Pan, tobacco and intoxicants |

2.72 |

3.26 |

1.34 |

1.36 |

2.13 |

2.38 |

| Clothing and footwear |

5.36 |

7.36 |

3.91 |

5.57 |

4.73 |

6.53 |

| Housing |

-- |

-- |

22.54 |

21.67 |

9.77 |

10.07 |

| Fuel and light |

10.42 |

7.94 |

8.40 |

5.58 |

9.49 |

6.84 |

| Miscellaneous |

24.91 |

27.26 |

28.00 |

29.53 |

26.31 |

28.32 |

| Total |

100 |

100 |

100 |

100 |

100 |

100 |

| Excluding Food and Fuel |

32.99 |

37.88 |

55.79 |

58.13 |

42.93 |

47.30 |

*Under MMRP, data on expenditure incurred are collected for frequently

purchased items – edible oil, eggs, fish, meat, vegetables, fruits, spices, beverages,

processed foods, pan, tobacco and intoxicants – during the last seven days; for

clothing, bedding, footwear, education, medical (institutional), durable goods,

during the last 365 days; and for all other food, fuel and light, miscellaneous goods

and services including non-institutional medical services; rents and taxes during

the last 30 days. |

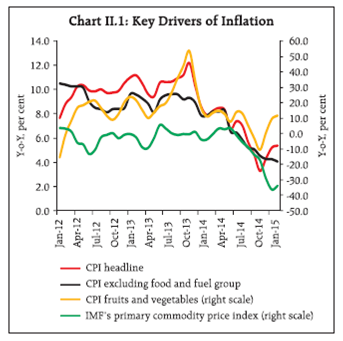

II.1. Consumer Prices

The MPR of September 2014 had noted that the

receding of inflationary pressures, guided by the

monetary policy stance set out in January 2014, halted

in the first half of 2014-15. While fuel inflation and

inflation excluding food and fuel underwent steady

moderation, headline inflation was propped up by food

inflation, which experienced bouts of weather-induced

short-lived surges. In September, however, inflation

eased by 140 basis points. From September to

November, disinflation gathered momentum and

turned out to be faster than initially anticipated under

the combined influence of a large decline in global

commodity prices, softening of prices of fruits and

vegetables domestically, continuing slack in the

economy and the favourable ‘base effect’ of higher

inflation a year ago (Chart II.1).

The role of this base effect in inflation outcomes during

2014-15 turned out to be non-trivial. Just as it shaped

the rapid disinflation until November, its reversal from

December produced an upturn, despite still benign

international commodity prices and moderate domestic

food and input prices. Sequential changes in headline

inflation reflect the combined impact of month-on-month

(m-o-m) changes in prices – which provide an

indication of the speed at which prices are evolving –

and base effects. The momentum of headline inflation

has been weak through December-February, mostly due

to the prices of non-durable goods, especially perishable

food (Chart II.2a). M-o-M price changes embodied in a diffusion index also point to weak momemtum;

however, broad-based price pressures persist across

items within the CPI (Chart II.2b). Going forward, base

effects are likely to exert a downward pull on headline

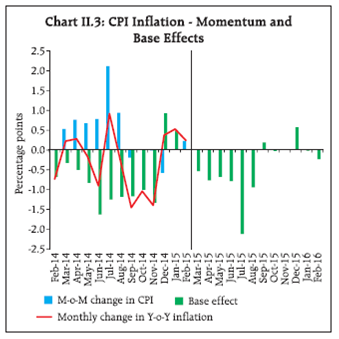

inflation up to August 2015 (Chart II.3).

II.2 Drivers of Inflation

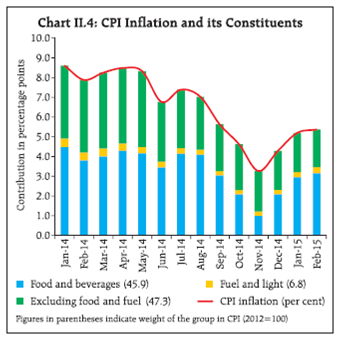

The intra-year path of headline inflation in 2014-15

exhibited higher volatility than in past years,

essentially reflecting the contributions of its

constituents (Chart II.4). The contribution of the food

category weighted by its share in the CPI underwent

large variations – accounting for more than half of

headline inflation in the first half of 2014-15, but declining to about a third in November before

increasing to close to 60 per cent by February. By

contrast, the contribution of the category excluding

food and fuel has been relatively stable, with some

decline in recent months.

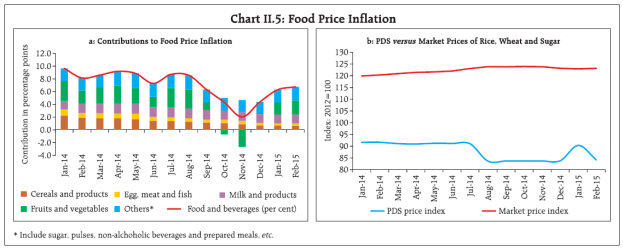

Within the food group, different drivers have propelled

individual elements (Chart II.5a). For cereals, moderation

in inflation is attributable to lower increases in MSPs

in 2014-152, active supply management policies in the

form of increased allocation under the public

distribution system (PDS) as well as open market sales

of wheat. Moreover, an index of prices of PDS items (rice, wheat and sugar) captured within the CPI shows

that PDS prices have fallen significantly even as market

prices of these items have risen (Chart II.5b). In the

case of vegetables and fruits, prices declined faster than

expected in response to policy actions to discourage

stockpiling3. Sugar prices moderated in consonance

with global prices. However, prices of protein-rich items

(eggs, fish, meat, milk and pulses) exhibited downward

rigidity, reflecting structural mismatches between

demand and supply.

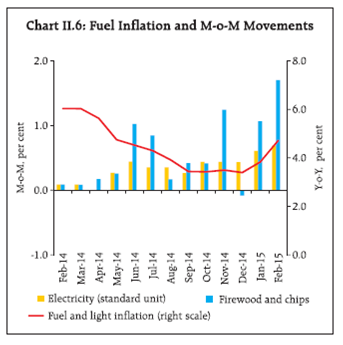

In the absence of revisions in administered prices of

coal and cooking gas, fuel group inflation declined during the year, but rose to 4.7 per cent in February,

mainly on account of increase in firewood and

electricity prices (Chart II.6). The still large under-recovery

on account of kerosene and cooking gas

impeded the pass-through of lower international prices

to administered prices of these items. During April-

December 2014, under-recoveries of oil marketing

companies (OMCs) in respect of sale of kerosene and

cooking gas accumulated to `562 billion, amounting to

potential outgoes under subsidies in spite of the drastic

fall in international prices.

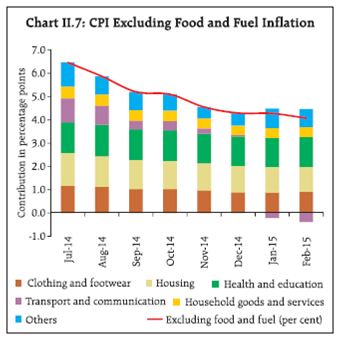

With the pass-through of monetary policy actions into

the economy, inflation excluding food and fuel ebbed

steadily during 2014-15, reaching 4.1 per cent in

February (Chart II.7). The decline in housing inflation

(rentals) has been pronounced in the new base series

relative to the old series in part due to methodological

improvements set out in Box II.1. Inflation in prices of

services such as health, education and household

services showed some moderation in recent months,

reflecting the slowdown in wage growth.

For the transport and communication sub-group,

deflation has set in from January 2015 under the impact

of a sharp decline in international crude oil prices

which affected prices of fuels included in this subgroup.

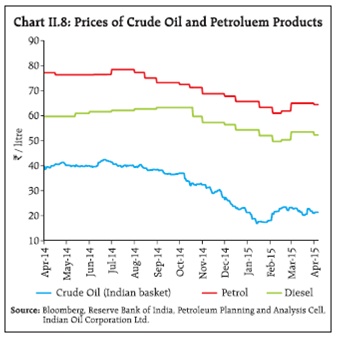

Between June 2014 and January 2015, crude oil

prices (Indian basket, rupee terms) declined by around

55 per cent, with 90 per cent of this fall occurring during

October to January. In response, retail prices of petrol softened. Diesel prices, on the other hand, were

increased step-wise till August in order to eliminate

under-recoveries of OMCs; thereafter, there was a

reduction during October to January (Chart II.8). The

decline in domestic pump prices, however, was much

lower than the downward movement in international

crude oil prices on account of increases in excise duty

cumulatively by `7.75 per litre on petrol and by `6.50

on diesel starting November 2014. Global crude prices

remained volatile during February-March, tracking

geopolitical and other global supply side developments

referred to earlier.

Other Measures of Inflation

All measures of inflation generally co-moved with the

headline CPI inflation since the last MPR. The decline

in inflation in terms of the wholesale price index (WPI),

however, has been most significant with a contraction

of 2.1 per cent in the month of February 2015

(Table II.1).

II.3 Costs

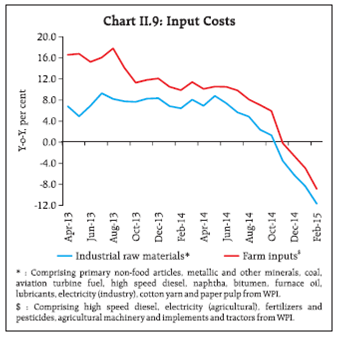

Since the MPR of September 2014, cost-push pressures

in the Indian economy have eased significantly. As

shown in the foregoing section, external cost conditions

associated with imports of commodities, particularly

crude and petroleum products, have declined on a large

scale. This is directly reflected in the drop in wholesale

price inflation into negative territory. Domestically too,

input cost pressures have been abating on a sustained

basis since June. However, the existence of supply

constraints in various sectors of the economy is

impeding a fuller response of output prices to these

developments.

Input costs for both farm and industrial sectors have

contracted since Q3 of 2014-15 (Chart II.9).

Manufacturing firms participating in the Reserve Bank’s

industrial outlook survey also indicated sizable declines

in raw material costs, with the lowest cost pressures

since the January-March 2010 round (Table II.2). They

have also been reporting improvement in pass-through

into selling prices, including in the January-March 2015

round. Purchasing managers’ surveys for both

manufacturing and services corroborate these

assessments – the narrowing of the gap between input and output prices is indicating weakening pricing

power.

| Table II.1: Measures of Inflation |

| (Y-o-Y, per cent) |

| Quarter/

Month |

GDP

deflator |

WPI |

CPI |

CPI-

IW |

CPI-

AL |

CPI-

RL |

| Q1: 2013-14 |

5.3 |

4.8 |

9.5 |

10.7 |

12.6 |

12.4 |

| Q2: 2013-14 |

6.7 |

6.6 |

9.7 |

10.8 |

12.9 |

12.7 |

| Q3: 2013-14 |

7.9 |

7.1 |

10.4 |

10.6 |

12.4 |

12.3 |

| Q4: 2013-14 |

5.1 |

5.4 |

8.2 |

6.9 |

8.5 |

8.7 |

| Q1: 2014-15 |

5.9 |

5.8 |

7.8 |

6.9 |

8.1 |

8.3 |

| Q2: 2014-15 |

4.3 |

3.9 |

6.7 |

6.8 |

7.3 |

7.6 |

| Q3: 2014-15 |

1.4 |

0.3 |

4.1 |

5.0 |

5.4 |

5.7 |

| Jan-15 |

-- |

-0.4 |

5.2 |

7.2 |

6.2 |

6.5 |

| Feb-15 |

-- |

-2.1 |

5.4 |

6.3 |

6.1 |

6.2 |

| IW: Industrial Workers, AL: Agricultural Labourers and RL: Rural Labourers. |

Wage growth, another key determinant of costs, has

been decelerating, albeit from high levels, across

various sectors of the economy in recent years. The

slowdown in rural wage growth has been particularly

noteworthy. The Labour Bureau revised data on rural

wages in November 2013 to incorporate a number of

new occupations besides reclassification of the existing

occupations. It estimates that average annual growth

in rural wages was 5.5 per cent for all occupations

(agricultural and non-agricultural) for male workers in

January 2015, substantially lower than the annual

average growth of 15 per cent during the six-year period

(2007-13) reported in the old series (Chart II.10). The

slowdown in wage growth has been more pronounced in the case of unskilled labourers, presumably reflecting

catch-up of low-wage states, sustained decline in rural

inflation and emphasis towards productive asset

creation relative to employment in public schemes such

as under the Mahatma Gandhi National Rural

Employment Guarantee Act (MGNREGA). These

developments suggest that high real wage growth

without commensurate improvements in productivity

is not sustainable.

| Table II.2: Input Costs and Selling Prices |

| (Net response in per cent) |

| |

Total Response

(Number) |

Cost of Raw

Materials |

Selling Prices |

| Jan-Mar 13 |

1301 |

-53.5 |

9.1 |

| Apr-Jun 13 |

1321 |

-49.9 |

7.3 |

| Jul-Sep 13 |

1207 |

-62.2 |

11.3 |

| Oct-Dec 13 |

1223 |

-55.3 |

7.8 |

| Jan-Mar 14 |

1114 |

-54.1 |

9.6 |

| Apr-Jun 14 |

1293 |

-49.5 |

9.8 |

| Jul-Sep 14 |

1225 |

-44.7 |

6.8 |

| Oct- Dec 14 |

2083 |

-41.5 |

5.9 |

| Jan-Mar 15 |

1533 |

-32.8 |

2.6 |

| Source: Industrial Outlook Survey, RBI. |

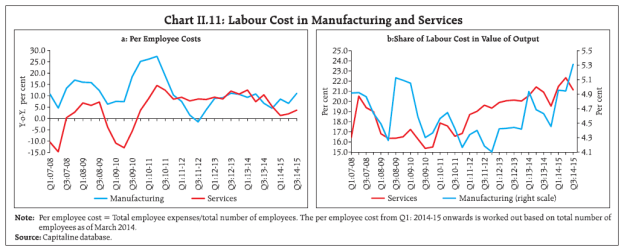

Unit labour costs4 in manufacturing and services have

picked up recently after moderating since 2013 (Chart II.11a). There was also a rise in the share of

labour cost in total output, especially for the

manufacturing sector (Chart II.11b).

The State of Aggregate Supply

Assessments of price/cost conditions in the economy,

juxtaposed with the results of empirical analysis,

provide useful insights into the state of aggregate

supply – the responsiveness of aggregate output to price

changes. Several factors determine the behaviour of

aggregate supply, including the time-varying price-setting

behaviour of firms in response to changes in

marginal cost; the nature of price-setting, whether

backward-looking or more flexible; the way inflation

expectations are formed; and random supply shocks5.

In technical terms, while price-setting behaviour

determines the slope of the aggregate supply curve, the

formation of inflation expectations and the incidence

of supply shocks can produce shifts in the aggregate

supply curve.

The empirical evidence suggests that the behaviour of

aggregate supply has been changing in recent years even

as inflation dynamics have been evolving into uncharted

territory. Price-setting behaviour of firms is now

reckoned as less backward-looking than before; also,

the response of inflation to demand and supply shocks

has declined. Internationally, this has led to a loose

consensus around the view that the aggregate supply

curve has flattened and is turning out to be less sensitive to price shocks6. What this implies in the

context of conducting monetary policy is that every

unit of disinflation is going to cost more in terms of

the sacrifice of output to rein in that amount of

inflation.

Empirical evidence available in the Indian context

suggests that the behaviour of aggregate supply has

undergone a change during the post-global crisis period

in a manner that is broadly consistent with the

international experience, but with country-specific

nuances. In particular, the responsiveness of retail

inflation to changes in marginal costs has declined.

Furthermore, the sacrifice ratio7 has increased markedly

relative to the international evidence. This has

implications for monetary policy: going forward, every unit of inflation lowered is going to mean larger output

foregone, and the state of the economy is going to weigh

on the choice. Every cloud has a silver lining though;

unlocking stalled investments, bridging gaps in the

availability of key inputs such as power, land,

infrastructure and human skill, and rebuilding

productivity and competitiveness will improve the

supply response and sustain the disinflation currently

underway. This scenario envisages monetary policy in

a steering rather than interventionist role in its

commitment to price stability as its primary objective.

Finally, as regards the impact of shocks, exchange rate

pass-through8 has declined significantly. On the other

hand, domestic shocks such as a deficient monsoon

leave progressively deeper imprints on retail inflation

and increase the persistence of inflation expectations.

III. Demand and Output

Domestic economic activity firmed up in 2014-15, spurred by a pick-up in manufacturing and services. Little

definitive evidence, however, is available on a clear ‘break-out’ of economic activity. Key macroeconomic indicators,

leading and coincident, point to the presence of considerable slack in the economy.

Recent upgrades to the national accounts by the CSO

indicate that a rebound in economic activity that

started in 2013-14 has gathered pace in the second

half of 2014-15. While these estimates have generated

considerable public scrutiny and debate, there is a

building optimism that an inflexion point in the

economic cycle is approaching. As inflation retreats in

an environment of macroeconomic and political

stability, confidence in setting a double-digit growth

trajectory for the Indian economy over the medium-term

is flooding back. Unleashing of these growth

impulses hinges around decisively cutting the Gordian

knot of binding supply constraints, investments

locked in stalled projects and shortfalls in the

availability of key inputs such as power, land,

infrastructure and human skill formation. Business

sentiment is also buoyed by investor-friendly tax

proposals, planned switches in public spending from

subsidies to investment that crowd in private

enterprise, structural reforms and the intention to

continue fiscal consolidation announced in the Union

Budget for 2015-16.

III. 1 Aggregate Demand

Advance estimates of the CSO indicate that the

growth of real GDP (market prices) picked up to 7.4 per cent in 2014-15 from 6.9 per cent a year ago

(Table III.1). Although official data for Q4 of 2014-15

will be available only by May 2015, implicit in

the advance estimates for the full year is a step-up in

the momentum of growth in the last quarter of the

year.

Driving this quickening of activity, the weighted

contribution of private final consumption expenditure

is estimated to have risen to 4.1 per cent in 2014-15

from 3.6 per cent in 2013-14. Quarterly data suggest,

however, that the growth of private final consumption

expenditure slowed down considerably in Q3 of

2014-15; it would need to have grown by around 12

per cent in Q4 to match advance estimates of 7.1 per

cent for the full year. Coincident and leading

indicators of consumption, however, point to

persisting fragility of private consumption demand.

Indicators of rural demand like sales of tractors and

two wheelers point to persisting weakness. Rural

income appears to have been adversely affected by

deficient monsoons and decelerating growth in rural

wages. Overall weakness in consumption demand is

also evident in the still depressed production of

consumer goods and significant deceleration in

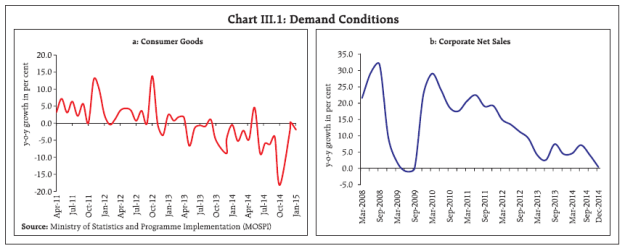

corporate sales growth (Chart III.1).

| Table III.1: Real GDP Growth (Base:2011-12) |

| (Per cent) |

| Item |

Weighted Contribution to growth (Percentage points) |

2013-14 |

2014-15 (AE) |

2013-14 |

2014-15 |

| 2013-14* |

2014-15* (AE) |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

| I. Private Final Consumption Expenditure |

3.6 |

4.1 |

6.2 |

7.1 |

7.7 |

5.6 |

4.6 |

7.0 |

4.3 |

8.7 |

3.5 |

| II. Government Final Consumption Expenditure |

0.9 |

1.1 |

8.2 |

10.0 |

27.3 |

5.3 |

11.0 |

-7.2 |

-2.0 |

5.8 |

31.7 |

| III. Gross Fixed Capital Formation |

0.9 |

1.3 |

3.0 |

4.1 |

2.3 |

6.3 |

5.3 |

-1.4 |

7.7 |

2.8 |

1.6 |

| IV. Net Exports |

4.4 |

0.4 |

69.0 |

19.5 |

25.6 |

55.8 |

90.0 |

91.0 |

68.7 |

-79.0 |

-115.4 |

| (i) Exports |

1.8 |

0.2 |

7.3 |

0.9 |

2.6 |

-1.6 |

15.7 |

14.1 |

9.3 |

-3.8 |

-2.8 |

| (ii) Imports |

-2.6 |

-0.1 |

-8.4 |

-0.5 |

-3.5 |

-8.4 |

-14.2 |

-7.0 |

-3.6 |

1.2 |

1.1 |

| V. GDP at Market Prices |

6.9 |

7.4 |

6.9 |

7.4 |

7.0 |

7.5 |

6.4 |

6.7 |

6.5 |

8.2 |

7.5 |

Note: AE: Advance estimates.

*Component-wise contributions do not add up to GDP growth in the table because change in stocks, valuables and

discrepancies are not included here.

Source: Central Statistics Office |

Government final consumption expenditure (which

includes consumption expenditure of the centre,

states, local bodies and autonomous bodies) rose by

10 per cent in 2014-15 as per the advance estimates,

mainly on account of faster expenditure growth by

the states1. The aggregate expenditure growth of the

Centre, however, moderated. The increase in

expenditure on subsidies was offset by a sharp cutback

in plan revenue expenditure and aggregate capital

expenditure in order to adhere to the budgeted deficit

target. Austerity in respect of various categories of expenditure was also necessitated by the shortfall in

non-debt capital receipts and sluggish indirect tax

collections. Non-tax revenues, however, exceeded the

budgetary targets due to higher receipts on account of

dividends and profits (Table III.2). Disinvestment

receipts were less than half the budgeted amount in

2014-15.

| Table III.2: Key Fiscal Indicators - Central Government Finances |

| Indicators |

As per cent of GDP |

| 2014-15

(BE) |

2014-15

(RE) |

2015-16

(BE) |

| 1. Revenue Receipts |

9.2 |

8.9 |

8.1 |

| a. Tax Revenue (Net) |

7.6 |

7.2 |

6.5 |

| b. Non-Tax Revenue |

1.7 |

1.7 |

1.6 |

| 2. Total Receipts |

13.9 |

13.3 |

12.6 |

| 3. Non-Plan Expenditure |

9.5 |

9.6 |

9.3 |

| a. On Revenue Account |

8.7 |

8.9 |

8.5 |

| b. On Capital Account |

0.8 |

0.7 |

0.8 |

| 4. Plan Expenditure |

4.5 |

3.7 |

3.3 |

| a. On Revenue Account |

3.5 |

2.9 |

2.3 |

| b. On Capital Account |

0.9 |

0.8 |

1.0 |

| 5. Total Expenditure |

13.9 |

13.3 |

12.6 |

| 6. Fiscal Deficit |

4.1 |

4.1 |

3.9 |

| 7. Revenue Deficit |

2.9 |

2.9 |

2.8 |

| 8. Primary Deficit |

0.8 |

0.8 |

0.7 |

| BE : Budget estimates RE : Revised estimates

Source: Union Budget, 2015-16 |

The Union Budget 2015-16 has provided for higher

allocations to infrastructure and a substantial

increase in the resource transfer to states, keeping in

view the two-fold objectives of promoting inclusive

growth and strengthening fiscal federalism. This has

necessitated a deviation from the fiscal consolidation

trajectory in 2015-16 and an extension of the period of

convergence to the 3 per cent target for the gross fiscal

deficit (GFD) as a proportion to GDP by one year. The

budgeted reduction in GFD in 2015-16 reflects the

combined impact of a compression in plan revenue

expenditure and an increase in non-debt capital

receipts.

The CSO’s advance estimates of gradual pick-up in the

growth of gross fixed capital formation in 2014-15 do

not appear to be supported by its quarterly estimates

which indicate deceleration in Q2 and Q3 (Table III.1).

Although production of capital goods and non-oil nongold

imports gathered some momentum in Q4, a big

push in investment is essential for the economy to

break out of the vicious cycle of supply constraints,

stranded investments, stressed bank balance sheets,

risk aversion and weak demand (Chart III.2). Progress

on speedier project clearances is, however, yet to

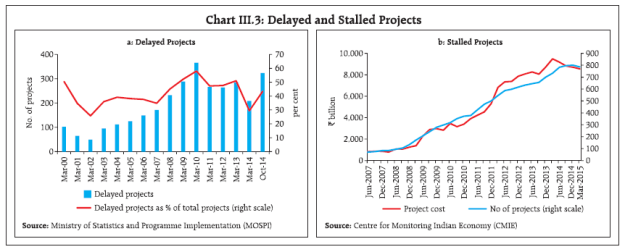

materalise (Chart III.3).

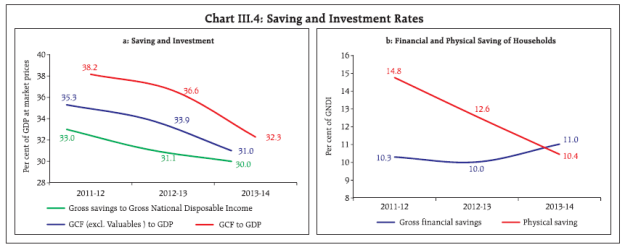

The gross domestic saving rate in the economy

has declined sharply over the last two years. The

decline was on account of lower savings in physical

assets by the household sector, mainly construction

(Chart III.4).

The contribution of net exports to overall GDP growth

turned negative since Q2 on contraction in exports

and some pick-up in imports. Exports shrank in Q3 on

weak global demand and the sharp fall in international

crude oil prices which affected exports of petroleum

products (POL) [accounting for around 19 per cent of

total merchandise exports]. Non-oil exports also

added to overall contraction as price realisation

declined considerably with the fall in international

commodity prices (Chart III.5). With imports growing

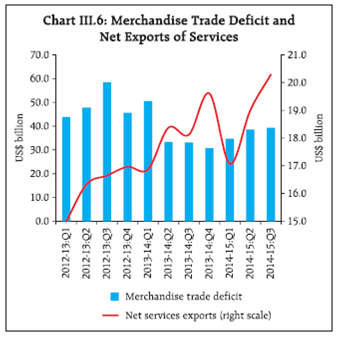

at a modest pace, the trade deficit widened in Q3 of

2014-15, though it was partly offset by improved net

services exports (Chart III.6). During January and February 2015, the faster decline in imports relative to

exports significantly reduced the trade deficit. Net

services exports during January 2015 were, however,

lower than in the preceding month as well as a year

ago.

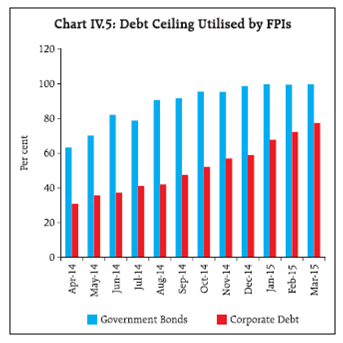

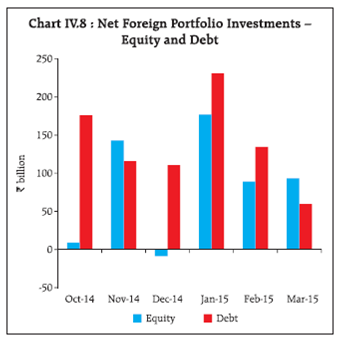

In the financial account of India’s balance of payments,

capital flows remained strong during Q3. Though

equity flows weakened during the quarter, it was more

than offset by the large accretion under banking

capital as banks liquidated their overseas foreign

currency assets. In Q4, the improved investment

climate revived portfolio and foreign direct

investment, which dominated net capital flows.

Portfolio investment flows rose sharply to US$ 13.6

billion during Q4 from a relatively subdued level of

about US$ 6 billion in the preceding quarter. A surge

was evident in equity as well as debt investment by

foreign institutional investors (FIIs). Similarly, foreign direct investment rose to US$ 5.5 billion during

January 2015, more than twice the monthly average in

the preceding quarter. With net capital flows being

significantly larger than the external financing

requirement, foreign exchange reserves rose to a peak

level of US$ 343.0 billion by April 03, 2015.

In terms of traditional metrics of foreign exchange

reserve adequacy – import cover and the Greenspan-

Guidotti rule for short-term debt cover – India has

exhibited steady improvement. The import cover of

reserves went up to 8.1 months at end-December 2014

from 7.8 months at end-March 2014 while the ratio of

short-term debt to reserves improved to 26.7 per cent

at end-December 2014 from 30.1 per cent at end-

March 2014 (Table III.3). Further, net forward purchases of US$ 5.6 billion and bilateral swap

arrangements with Japan and among the BRICS

provide additional cover against external shocks.

III.2 Output

The CSO’s new series of national accounts aligns with

internationally recognised best standards in terms of

the United Nations’ Systems of National Accounts

(SNA, 2008) and also improves data coverage. Output

measured by gross value added (GVA) at basic prices is,

however, in dissonance with various metrics tracked

as either coincident or leading indicators in terms of

both level and growth rates (Box III.1). In particular,

the conventional indicators of corporate performance

that are used to reflect movements in output and

Per cent which closely tracked the series in the old base, have

disconnected from the new series even after

accounting for the differences between the

‘establishment approach’ (old series) and ‘enterprise

approach’ (new series).

| Table III.3: External Sector Vulnerability Indicators |

| Indicator |

end-Mar

2001 |

end-Mar

2006 |

end-Mar

2011 |

end-Mar

2012 |

end-Mar

2013 |

end-Mar

2014 |

end-Dec

2014 |

| 1. External Debt to GDP ratio (%) |

22.5 |

16.8 |

18.2 |

20.9 |

22.3 |

23.7 |

23.2 |

| 2. Ratio of Short-term to Total Debt (Original Maturity) (%) |

3.6 |

14 |

20.4 |

21.7 |

23.6 |

20.5 |

18.5 |

| 3. Ratio of Short-term to Total Debt (residual maturity) (%) |

10.3 |

18.3 |

40.6 |

40.9 |

42.1 |

39.6 |

NA |

| 4. Ratio of Concessional Debt to Total Debt (%) |

35.4 |

28.4 |

14.9 |

13.3 |

11.1 |

10.4 |

9.2 |

| 5. Ratio of Reserves to Total Debt (%) |

41.7 |

109 |

95.9 |

81.6 |

71.3 |

68.1 |

69.4 |

| 6. Ratio of Short-term Debt to Reserves (%) |

8.6 |

12.9 |

21.3 |

26.6 |

33.1 |

30.1 |

26.7 |

| 7. Ratio of Short-term Debt (residual maturity) to Reserves (%) |

24.6 |

16.8 |

42.3 |

50.1 |

59 |

57.4 |

NA |

| 8. Reserves Cover of Imports (in months) |

8.8 |

11.6 |

9.5 |

7.1 |

7.0 |

7.8 |

8.1 |

| 9. Debt Service Ratio (Debt Service Payments to Current Receipts) (%) |

16.6 |

10.1 |

4.4 |

6 |

5.9 |

5.9 |

8.6 |

| 10. External Debt (US$ billion) |

101.3 |

139.1 |

317.9 |

360.8 |

409.4 |

446.5 |

461.9 |

| 11. Net International Investment Position (NIIP) (US$ billion) |

-76.2 |

-60 |

-207.0 |

-264.7 |

-326.7 |

-337.0 |

-356.5 |

| 12. NIIP/GDP ratio*(%) |

-16.5 |

-7.2 |

-12.1 |

-14.4 |

-17.7 |

-17.9 |

-17.6 |

| 13. CAD/GDP ratio |

0.6 |

1.2 |

2.8 |

4.2 |

4.8 |

1.7 |

1.7 |

| N.A. : Not available *Calculated based on US $ terms. |

From the supply side, agricultural activity slowed

down through 2014-15, as the delayed onset of southwest

monsoon, its uneven distribution and deficiency–

especially in the early part of the season–affected

kharif crops. GDP from agriculture and allied activities

contracted by 0.4 per cent in Q3 (Table III.4). Initial

expectations that the shortfall in the kharif harvest

may be compensated by rabi crops did not materialise

due to inadequate replenishing of soil moisture and

reservoirs by Q3 and Q4, aggravated by a deficient and

unevenly distributed north-east monsoon. Reflecting

these factors, the second advance estimates of the

Ministry of Agriculture indicate that the production of

foodgrains declined by 3.2 per cent, and oilseeds by

8.9 per cent in 2014-15. Within foodgrains, the

production of rice declined by 3.4 per cent and pulses

by 6.8 per cent. Furthermore, unseasonal rains and

hailstorms in early March are likely to affect agriculture

production adversely. Even though the performance

of allied activities is expected to remain stable, it

remains to be seen whether they can compensate for

the shortfall in agricultural production.

The industrial sector shrugged off stagnation and

grew for the second consecutive year in 2014-15. An

analysis of the quarterly data, however, suggests deceleration in growth of mining and quarrying and

manufacturing. This implies that the industrial sector

would have to have grown by about 9 per cent and

manufacturing by around 11 per cent in Q4 to meet

the CSO’s projections for 2014-15 as a whole, which

looks ambitious on the basis of information available

so far. Core industries, which supply crucial inputs to

other industries and have a weight of nearly 38 per

cent in the index of industrial production (IIP), have

been decelerating since December 2014, underlining

the weakness in the growth drivers. Structural

constraints have led to persistent declines in the

production of core industries such as steel, natural

gas, crude oil and fertilizers. The contraction in mining

and quarrying and slowdown in electricity generation

in the IIP highlight these constraints.

As per the use-based classification, the growth in

industrial production was driven by basic goods and

capital goods. Lumpy and fluctuating capital goods

production imparted volatility to industrial

production. As discussed earlier in the chapter, the

slowdown in consumer goods points to weak demand

reflected in private final consumption expenditure.

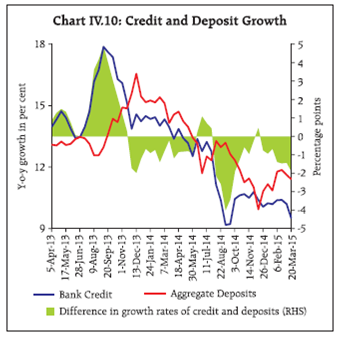

The revival in overall growth in 2014-15 hinged

primarily around the services sector, which is

estimated to have grown by 9.8 per cent. Quarterly

analysis suggests that growth picked up steam from

Q2 and strengthened further in Q3 led by ‘financial,

real estate and professional services’ and ‘public

administration and defence’. However, in an environment of deceleration in bank credit and

deposit growth, coupled with stagnation in the real

estate sector and slowdown in demand for professional

services, the high growth of the ‘financial, real estate

and professional services’ appears puzzling. Given the

centre and state governments’ resolve on fiscal

consolidation, the ‘public administration and defence’

services may not serve as a durable growth driver,

going forward.

Box III.1: New Series of National Accounts

The National Statistical Commission (NSC) had

recommended a change in base year for all key economic

data every five years to account for structural changes

in the economy. In line with this recommendation, the

base year for national accounts in India was recently

revised to 2011-12 (from 2004-05 earlier), as the year

2009-10 was not considered a normal year in view of

the global financial crisis. In the new series, GDP at

market prices – instead of GDP at factor cost - is the

headline number reported as a measure of economic

activity in line with international practices.

Furthermore, ‘Gross Value Added (GVA) at basic prices’

– instead of GDP at factor cost – is the headline measure

of activity from the supply side. Other changes in the

series include, inter alia, comprehensive coverage of

the corporate sector in both manufacturing and services

as per the database available in the e-governance

initiative viz. MCA-21 of the Ministry of Corporate

Affairs (MCA), improved coverage of rural and urban

local bodies, and incorporation of recent National

Sample Surveys (NSS).

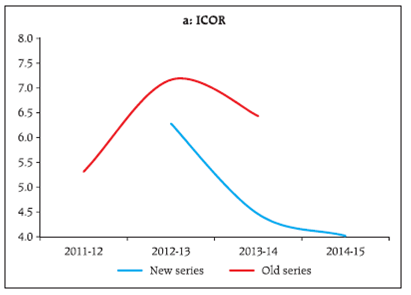

Consequent upon these changes, nominal levels of

GDP on the new base are lower relative to the old base.

Growth rates of both nominal and real GDP on the new

base are higher for each year. In terms of commonly

used indicators of productivity – the incremental

capital output ratio (ICOR) – the new series reveals a

significant improvement, but this is not corroborated

by the behaviour of other indicators, especially in an

environment characterized by declining national

savings, investment and general concerns about stalled

projects (Chart a).

In the manufacturing sector, GVA growth is much

higher in the new series than in the earlier series. The growth of this sector appears to have been driven by

the unorganised sector, which grew by 23.3 per cent in

2012-13. Data for subsequent year, however, suggests a

slowdown of the unorganised sector, with

manufacturing growth driven mainly by the organised

sector (Table III.B.1). While the use of MCA-21 database

could explain differences up to 2013-14, the advance

estimates for 2014-15 have used corporate sector data

– from the Reserve Bank of India (RBI) and the Bombay

Stock Exchange (BSE) – in four key components of GDP,

namely manufacturing, trade, hotels and restaurant,

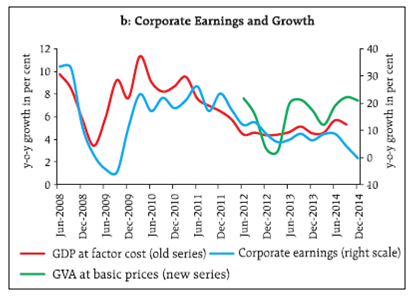

and real estate. An analysis of sequential flow of

information on corporate earnings for Q3 of 2014-15

indicates that earnings growth has been much weaker

than what is implied in the new series (Chart b).

Services tax collection has also remained weak. A high

growth of 13.7 per cent (at constant prices) in “financial,

real estate and business services” reflects a possible

upward bias in estimation. It is expected that the

revised estimates for 2014-15 to be released by

end-May 2015 will incorporate better information

covering the second half of the year and provide greater

clarity on the state of economic activity at the aggregate

level.

| Table III.B.1: Manufacturing Sector Growth |

| Y-o-y growth of |

2012-13 |

2013-14 |

2014-15 |

| GVA at constant prices (base 2004-05) |

1.1 |

-0.7 |

N.A. |

| IIP |

1.3 |

-0.8 |

1.7* |

| GVA at constant prices (base 2011-12) |

6.2 |

5.3 |

6.8 |

| Organised sector |

2.5 |

6.8 |

N.A. |

| Unorganised sector |

23.3 |

0.8 |

N.A. |

| N.A. : Not available

*Pertains to April-January. |

| Table III.4: Growth in Gross Value Added at Basic Prices (Base:2011-12) |

| (Per cent) |

| |

2012-13 |

2013-14 |

2014-15 (AE) |

2013-14 |

2014-15 |

| Growth |

Share |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

| I. Agriculture, forestry & fishing |

1.2 |

3.7 |

1.1 |

16.2 |

2.7 |

3.6 |

3.8 |

4.4 |

3.5 |

2.0 |

-0.4 |

| II. Industry |

5.1 |

5.3 |

6.5 |

23.2 |

5.9 |

4.2 |

5.5 |

5.5 |

6.5 |

5.5 |

4.6 |

| (i) Mining & quarrying |

-0.2 |

5.4 |

2.3 |

2.9 |

0.8 |

4.5 |

4.2 |

11.5 |

5.1 |

2.4 |

2.9 |

| (ii) Manufacturing |

6.2 |

5.3 |

6.8 |

18.0 |

7.2 |

3.8 |

5.9 |

4.4 |

6.3 |

5.6 |

4.2 |

| (iii) Electricity, gas, water supply & other utilities |

4.0 |

4.8 |

9.6 |

2.4 |

2.8 |

6.5 |

3.9 |

5.9 |

10.1 |

8.7 |

10.1 |

| III. Services |

6.0 |

8.1 |

9.8 |

60.6 |

8.9 |

9.7 |

8.3 |

5.6 |

8.1 |

9.8 |

11.7 |

| (i) Construction |

-4.3 |

2.5 |

4.5 |

8.0 |

1.5 |

3.5 |

3.8 |

1.2 |

5.1 |

7.2 |

1.7 |

| (ii) Trade, hotels, transport, communication and services related to broadcasting |

9.6 |

11.1 |

8.4 |

18.9 |

10.3 |

11.9 |

12.4 |

9.9 |

9.4 |

8.7 |

7.2 |

| (iii) Financial, real estate & professional services |

8.8 |

7.9 |

13.7 |

20.9 |

7.7 |

11.9 |

5.7 |

5.5 |

11.9 |

13.8 |

15.9 |

| (iv) Public administration, defence and other services |

4.7 |

7.9 |

9.0 |

12.8 |

14.4 |

6.9 |

9.1 |

2.4 |

1.9 |

6.0 |

20.0 |

| IV. GVA at basic price |

4.9 |

6.6 |

7.5 |

100.0 |

7.2 |

7.5 |

6.6 |

5.3 |

7.0 |

7.8 |

7.5 |

| Source: Central Statistics Office. AE: Advanced Estimates |

III.3 Output Gap

Uncertainty about the true value of macroeconomic

variables is a formidable challenge for policy-making,

particularly when data revisions result in information

on the same variable for the same year computed at

different times conveying different trends. The recent

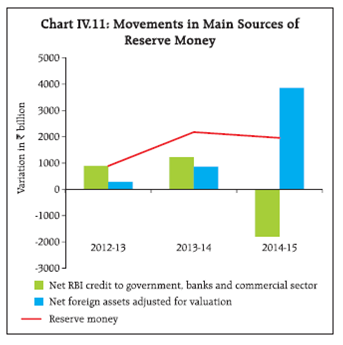

revisions in national accounts pose a challenge in