|

ACKNOWLEDGEMENTS

We are deeply indebted to Dr. Rakesh Mohan, former Deputy

Governor, for giving us the opportunity to undertake this project.

We are also very grateful to Dr. R.K. Pattnaik, former Adviser,

Department of Economic Analysis and Policy (DEAP), for insightful

discussions and support throughout the project. We are thankful to DRG for

the excellent support rendered to us during the course of the study.

The authors also gratefully acknowledge insightful inputs and

suggestions from Sangita Misra, Harendra Behera, Binod B. Bhoi, Vijay

Raina and Meena Ravichandran from the Reserve Bank of India. Special

thanks are also due to Ganesh Manjhi, Chhanda Mandal and Reetika Garg

for competent research assistance.

We also gratefully acknowledge constructive comments and suggestions

from two anonymous referees. The external expert also acknowledges a

research grant from the Research and Development Programme of the

University of Delhi awarded in the preliminary stages of this research.

A large part of the research was conducted when the external expert

was Visiting Professor at the Dayalbagh Educational Institute (Deemed

University), Agra. The external expert gratefully acknowledges support from

the Institute during the course of this study.

Finally, we acknowledge that we are solely responsible for errors,

if any.

Pami Dua and Rajiv Ranjan

ABBREVIATIONS

VAR |

Vector Autoregressive |

BVAR |

Bayesian vector autoregressive |

ADs |

Authorised Dealers |

FERA |

Foreign Exchange Regulations Act |

LERMS |

Liberalized Exchange Rate Management System |

FEMA |

Foreign Exchange Management Act |

CCIL |

Clearing Corporation of India Limited |

MSS |

Market Stabilisation Scheme |

KYC |

Know-Your-Customer |

ECB |

External Commercial Borrowings |

FEDAI |

Foreign Exchange Dealers’ Association of India |

CCIL |

Clearing Corporation of India Ltd. |

MCX-SX |

Multi Commodity Exchange – Stock Exchange |

RMDS |

Reuters Market Data System |

OTC |

Over The Counter |

BIS |

Bank for International Settlements |

IOC |

Indian Oil Corporation |

NDF |

Non Deliverable Forward |

EMEs |

Emerging Market Economies |

FIIs |

Foreign Institutional Investors’ |

FDI |

Foreign Direct Investment |

LAF |

Liquidity Adjustment Facility |

OMO |

Open Market Operations |

MSS |

Market Stabilisation Scheme |

FCA |

Foreign Currency Assets |

PPP |

Purchasing Power Parity |

PBM |

Portfolio Balance Model |

VECM |

Vector Error Correction Model |

MSIH |

Markov Switching Intercept Heteroscedastic |

RMSE |

Root Mean Square Error |

EXECUTIVE SUMMARY

The exchange rate is a key financial variable that affects decisions

made by foreign exchange investors, exporters, importers, bankers,

businesses, financial institutions, policymakers and tourists in the

developed as well as developing world. Exchange rate fluctuations affect

the value of international investment portfolios, competitiveness of exports

and imports, value of international reserves, currency value of debt

payments, and the cost to tourists in terms of the value of their currency.

Movements in exchange rates thus have important implications for the

economy’s business cycle, trade and capital flows and are therefore crucial

for understanding financial developments and changes in economic policy.

The study covers two main topics: first, various aspects of economic

policy with respect to the exchange rate, and second, modeling and

forecasting the exchange rate. Accordingly, the study analyses India’s

exchange rate story and discusses the structure of the foreign exchange

market in India in terms of participants, instruments and trading platform

as also turnover in the Indian foreign exchange market and forward

premia. The Indian foreign exchange market has evolved over time as a

deep, liquid and efficient market as against a highly regulated market

prior to the 1990s. The market participants have become sophisticated,

the range of instruments available for trading has increased, the turnover

has also increased, while the bid–ask spreads have declined. This study

also covers the exchange rate policy of India in the background of large

capital flows,

The study then attempts to develop a model for the rupee-dollar

exchange rate taking into account variables from monetary and micro

structure models as well as other variables including intervention by the

central bank. The focus is on the exchange rate of the Indian rupee vis-àvis

the US dollar, i.e., the Re/$ rate. To model the exchange rate, the monetary

model is expanded to include variables that may have been important in

determining exchange rate movements in India such as forward premia,

capital flows, order flows and central bank intervention.

Exchange Rates and Exchange Rate Policy in India: A Review

India’s exchange rate policy has evolved over time in line with the

gradual opening up of the economy as part of the broader strategy of

macroeconomic reforms and liberalization since the early 1990s. In the

post independence period, India’s exchange rate policy has seen a shift

from a par value system to a basket-peg and further to a managed float

exchange rate system. With the breakdown of the Bretton Woods System in

1971, the rupee was linked with pound sterling. In order to overcome the

weaknesses associated with a single currency peg and to ensure stability of

the exchange rate, the rupee, with effect from September 1975, was pegged

to a basket of currencies till the early 1990s.

The initiation of economic reforms saw, among other measures, a two

step downward exchange rate adjustment by 9 per cent and 11 per cent

between July 1 and 3, 1991 to counter the massive draw down in the

foreign exchange reserves, to install confidence in the investors and to

improve domestic competitiveness. The Liberalised Exchange Rate

Management System (LERMS) was put in place in March 1992 involving

the dual exchange rate system in the interim period. The dual exchange

rate system was replaced by a unified exchange rate system in March 1993.

The experience with a market determined exchange rate system in India

since 1993 is generally described as ‘satisfactory’ as orderliness prevailed

in the Indian market during most of the period. Episodes of volatility were

effectively managed through timely monetary and administrative measures.

An important aspect of the policy response in India to the various

episodes of volatility has been market intervention combined with monetary

and administrative measures to meet the threats to financial stability while

complementary or parallel recourse has been taken to communications

through speeches and press releases. In line with the exchange rate policy,

it has also been observed that the Indian rupee is moving along with the

economic fundamentals in the post-reform period. Moving forward, as India

progresses towards full capital account convertibility and gets more and

more integrated with the rest of the world, managing periods of volatility is bound to pose greater challenges in view of the impossible trinity of

independent monetary policy, open capital account and exchange rate

management. Preserving stability in the market would require more

flexibility, adaptability and innovations with regard to the strategy for

liquidity management as well as exchange rate management. With the likely

turnover in the foreign exchange market rising in future, further

development of the foreign exchange market will be crucial to manage the

associated risks.

Structure of the Indian Foreign Exchange Market and Turnover

Prior to the 1990s, the Indian foreign exchange market (with a pegged

exchange rate regime) was highly regulated with restrictions on transactions,

participants and use of instruments. The period since the early 1990s has

witnessed a wide range of regulatory and institutional reforms resulting in

substantial development of the rupee exchange market as it is observed

today. Market participants have become sophisticated and have acquired

reasonable expertise in using various instruments and managing risks.

The foreign exchange market in India today is equipped with several

derivative instruments. Various informal forms of derivatives contracts have

existed since time immemorial though the formal introduction of a variety

of instruments in the foreign exchange derivatives market started only in

the post reform period, especially since the mid-1990s. These derivative

instruments have been cautiously introduced as part of the reforms in a

phased manner, both for product diversity and more importantly as a risk

management tool. Recognising the relatively nascent stage of the foreign

exchange market then with the lack of capabilities to handle massive

speculation, the ‘underlying exposure’ criteria had been imposed as a

prerequisite.

Trading volumes in the Indian foreign exchange market has grown

significantly over the last few years. The daily average turnover has seen

almost a ten-fold rise during the 10 year period from 1997-98 to 2007-08

from US $ 5 billion to US $ 48 billion. The pickup has been particularly sharp from 2003-04 onwards since when there was a massive surge in

capital inflows. It is noteworthy that the increase in foreign exchange market

turnover in India between April 2004 and April 2007 was the highest

amongst the 54 countries covered in the latest Triennial Central Bank Survey

of Foreign Exchange and Derivatives Market Activity conducted by the Bank

for International Settlements (BIS). According to the survey, daily average

turnover in India jumped almost 5-fold from US $ 7 billion in April 2004

to US $ 34 billion in April 2007; global turnover over the same period rose

by only 66 per cent from US $ 2.4 trillion to US $ 4.0 trillion. Reflecting

these trends, the share of India in global foreign exchange market turnover

trebled from 0.3 per cent in April 2004 to 0.9 per cent in April 2007. With

the increasing integration of the Indian economy with the rest of the world,

the efficiency in the foreign exchange market has improved as evident from

low bid-ask spreads. It is found that the spread is almost flat and very low.

In India, the normal spot market quote has a spread of 0.25 paisa to 1

paise while swap quotes are available at 1 to 2 paise spread. Thus, the

foreign exchange market has evolved over time as a deep, liquid and efficient

market as against a highly regulated market prior to the 1990s.

Capital Flows and Exchange Rates: The Indian Experience

In the recent period, external sector developments in India have been

marked by strong capital flows, which had led to an appreciating tendency

in the exchange rate of the Indian rupee up to January 2008. The movement

of the Indian rupee is largely influenced by the capital flow movements

rather than traditional determinants like trade flows. Though capital flows

are generally seen to be beneficial to an economy, a large surge in flows

over a short span of time in excess of the domestic absorptive capacity

can, however, be a source of stress to the economy giving rise to upward

pressures on the exchange rate, overheating of the economy, and possible

asset price bubbles.

In India, the liquidity impact of large capital inflows was traditionally

managed mainly through the repo and reverse repo auctions under the day-to-day Liquidity Adjustment Facility (LAF). The LAF operations were

supplemented by outright open market operations (OMO), i.e. outright sales

of the government securities, to absorb liquidity on an enduring basis. In

addition to LAF and OMO, excess liquidity from the financial system was

also absorbed through the building up of surplus balances of the

Government with the Reserve Bank, particularly by raising the notified

amount of 91-day Treasury Bill auctions, and forex swaps. In view of the

large capital flows during the past few years, relaxations were effected in

regard to outflows, both under the current and capital accounts. In addition,

changes in policies are made from time to time to modulate the debt-creating

capital flows depending on the financing needs of the corporate sector and

vulnerability of the domestic economy to external shocks.

In the face of large capital flows coupled with declining stock of

government securities, the Reserve Bank of India introduced a new instrument

of sterilisation, viz., the Market Stabilisation Scheme (MSS) to sustain market

operations. Since its introduction in April 2004, the MSS has served as a

very useful instrument for medium term monetary and liquidity management.

The cost of sterilisation in India is shared by the Central Government (the

cost of MSS), Reserve Bank (sterilization under LAF) and the banking system

(in case of increase in the reserve requirements).

With the surge in capital flows to EMEs, issues relating to management

of those flows have assumed importance as they have bearings on the

exchange rates. Large capital inflows create important challenges for

policymakers because of their potential to generate overheating, loss of

competitiveness, and increased vulnerability to crisis. Reflecting these

concerns, policies in EMEs have responded to capital inflows in a variety

of ways. While some countries have allowed the exchange rate to appreciate,

in many cases monetary authorities have intervened heavily in forex markets

to resist currency appreciation. EMEs have sought to neutralize the

monetary impact of intervention through sterilization. Cross-country

experiences reveal that in the recent period most of the EMEs have adopted

a more flexible exchange rate regime.

In view of the importance of capital flows, foreign exchange intervention

and turnover in determination of exchange rates, these variables are

included in the modeling exercise undertaken to analyze the behaviour of

the exchange rate.

Modelling and Forecasting the Re/$ Exchange Rate: Economic Theory

and Review of Literature

In the international finance literature, various theoretical models are

available to analyze exchange rate determination and behaviour. Most of

the studies on exchange rate models prior to the 1970s were based on the

fixed price assumption1. With the advent of the floating exchange rate regime

amongst major industrialized countries in the early 1970s, an important

advance was made with the development of the monetary approach to

exchange rate determination. The dominant model was the flexible-price

monetary model that has been analyzed in many early studies like Frenkel

(1976), Mussa (1976, 1979), Frenkel and Johnson (1978), and more

recently by Vitek (2005), Nwafor (2006), Molodtsova and Papell, (2007).

Following this, the sticky price or overshooting model by Dornbusch (1976,

1980) evolved, which has been tested, amongst others, by Alquist and Chinn

(2008) and Zita and Gupta (2007). The portfolio balance model also

developed alongside2 , which allowed for imperfect substitutability between

domestic and foreign assets, and considered wealth effects of current

account imbalances.

With liberalization and development of foreign exchange and assets

markets, variables such as capital flows, volatility in capital flows and

forward premium have also became important in determining exchange

rates. Furthermore, with the growing development of foreign exchange

markets and a rise in the trading volume in these markets, the micro level

dynamics in foreign exchange markets increasingly became important in determining exchange rates. Agents in the foreign exchange market have

access to private information about fundamentals or liquidity, which is

reflected in the buying/selling transactions they undertake, that are termed

as order flows (Medeiros, 2005; Bjonnes and Rime, 2003). Microstructure

theory evolved in order to capture the micro level dynamics in the foreign

exchange market (Evans and Lyons, 2001, 2005, 2007). Another variable

that is important in determining exchange rates is central bank intervention

in the foreign exchange market.

Non-linear models have also been considered in the literature. Sarno

(2003), Altaville and Grauwe (2006) are some of the recent studies that

have used non-linear models of the exchange rate.

Overall, forecasting the exchange rates has remained a challenge for

both academicians as well as market participants. In fact, Meese and Rogoff’s

seminal study (1983) on the forecasting performance of the monetary models

demonstrated that these failed to beat the random walk model. This has

triggered a plethora of studies that test the superiority of theoretical and

empirical models of exchange rate determination vis-a-vis a random walk.

In sum, several exchange rate models available in the literature have

been tested during the last two and a half decades. No particular model

seems to work best at all times/horizons. Monetary models based on the

idea of fundamentals’ driven exchange rate behaviour work best in the

long-run, but lose their predictability in the short-run to naïve random

walk forecasts. The volatility of exchange rates also substantially exceeds

that of the volatility of macroeconomic fundamentals, thus providing further

evidence of weakening fundamental-exchange rate link. A combination of

the different monetary models, however, at times gives better results than

the random walk. Order flows also play an important role in influencing

the exchange rate. Keeping in view all the above results of the literature,

this study attempts to develop a model for the rupee-dollar exchange rate

taking into account all the different monetary models along with the

microstructure models incorporating order flow, as well as capital flows,

forward premium and central bank intervention.

Modelling and Forecasting the Exchange Rate: Econometric

Methodology, Estimation, Evaluation and Findings

This study attempts to gauge the forecasting ability of economic models

with respect to exchange rates with the difference that this is done in the

context of a developing country that follows a managed floating (as opposed

to flexible) exchange rate regime. Starting from the naïve model, this study

examines the forecasting performance of the monetary model and various

extensions of it in the vector autoregressive (VAR) and Bayesian vector

autoregressive (BVAR) framework. Extensions of the monetary model

considered in this study include the forward premium, capital inflows,

volatility of capital flows, order flows and central bank intervention. The

study therefore examines, first, whether the monetary model can beat a

random walk. Second, it investigates if the forecasting performance of the

monetary model can be improved by extending it. Third, the study evaluates

the forecasting performance of a VAR model vs a BVAR model. Lastly, it

considers if information on intervention by the central bank can improve

forecast accuracy. The main findings are as follows :

(i) The monetary model generally outperforms the naïve model. This

negates the findings of the seminal study by Meese and Rogoff (1983)

that finds that models which are based on economic fundamentals

cannot outperform a naive random walk model.

(ii) The result that it is possible to beat the naïve model may be due to the

fact that the intervention by the central bank may help to curb volatility

arising due to demand-supply mismatch and stabilize the exchange

rate. The exchange rate policy of the RBI is guided by the need to

reduce excess volatility. The Reserve Bank has been prepared to make

sales and purchases of foreign currency in order to even out lumpy

demand and supply in the relatively thin foreign exchange market and

to smoothen jerky movements.

(iii) Forecast accuracy can be improved by extending the monetary model

to include forward premium, volatility of capital inflows and order flow.

(iv) Information on intervention by the central bank helps to improve

forecasts at the longer end.

(v) Bayesian vector autoregressive models generally outperform their

corresponding VAR variants.

(vi) Turning points are difficult to predict as illustrated using Model 4

with predictions made in February 2008.

Thus, availability of information on certain key variables at regular

intervals that affect the exchange rate can lead to a more informed view

about the behavior of the future exchange rates by the market participants,

which may allow them to plan their foreign exchange exposure better by

hedging them appropriately. Such key variables could include past data on

exchange rates, forward premia, capital flows, turnover, and intervention

by central banks etc. As regards availability of data on key variables relating

to the Indian foreign exchange market, most of the data are available in

public domain and can easily be accessed by market participants,

academicians and professional researchers. Using these variables skillfully

will help them to gain sound insight into future exchange rate movements.

In this context, it is important to recognize that the Indian approach

in recent years has been guided by the broad principles of careful monitoring

and management of exchange rates with flexibility, without a fixed target or

a pre-announced target or a band, coupled with the ability to intervene if

and when necessary, while allowing the underlying demand and supply

conditions to determine the exchange rate movements over a period in an

orderly way. Subject to this predominant objective, the exchange rate policy

is guided by the need to reduce excess volatility, prevent the emergence of

establishing speculative activities, help maintain adequate level of reserves,

and develop an orderly foreign exchange market.

1 See e.g. Marshall (1923), Lerner (1936), Nurkse (1944), Harberger (1950), Mundell (1961, 1962, 1963)

and Fleming (1962).

2 See e.g. Dornbusch and Fischer (1980), Isard (1980), Branson (1983, 1984).

EXCHANGE RATE POLICY AND MODELLING

IN INDIA

Pami Dua, Rajiv Ranjan*

SECTION I

Introduction

The exchange rate is a key financial variable that affects decisions

made by foreign exchange investors, exporters, importers, bankers,

businesses, financial institutions, policymakers and tourists in the

developed as well as developing world. Exchange rate fluctuations affect

the value of international investment portfolios, competitiveness of

exports and imports, value of international reserves, currency value of

debt payments, and the cost to tourists in terms of the value of their

currency. Movements in exchange rates thus have important implications

for the economy’s business cycle, trade and capital flows and are therefore

crucial for understanding financial developments and changes in

economic policy. Timely forecasts of exchange rates can therefore provide

valuable information to decision makers and participants in the spheres

of international finance, trade and policy making. Nevertheless, the

empirical literature is skeptical about the possibility of accurately

predicting exchange rates.

In the international finance literature, various theoretical models

are available to analyze exchange rate behaviour. While exchange rate

models existed prior to 1970s (Nurkse, 1944; Mundell, 1961, 1962,

1963), most of them were based on the fixed price assumption. With

the advent of the floating exchange rate regime amongst major

industrialized countries in the early 1970s, a major advance was made

with the development of the monetary approach to the exchange rate

determination. The dominant model was the flexible price monetary

model that gave way to the sticky price and portfolio balance model.

While considerable amount of empirical work was devoted to testing

these monetary models, most of them focused on in-sample tests that

do not really give the true predictive accuracy of the models. Following

this, the sticky price or overshooting model by Dornbusch (1976, 1980) evolved, which has been tested, amongst others, by Alquist and Chinn

(2008) and Zita and Gupta (2007). The portfolio balance model also

developed alongside , which allowed for imperfect substitutability

between domestic and foreign assets, and considered wealth effects of

current account imbalances.

With liberalization and development of foreign exchange and assets

markets, variables such as capital flows, volatility in capital flows and

forward premium have also became important in determining exchange

rates. Furthermore, with the growing development of foreign exchange

markets and a rise in the trading volume in these markets, the micro

level dynamics in foreign exchange markets have increasingly became

important in determining exchange rates. Agents in the foreign exchange

market have access to private information about fundamentals or

liquidity, which is reflected in the buying/selling transactions they

undertake, that are termed as order flows (Medeiros, 2005; Bjonnes

and Rime 2003). Thus microstructure theory evolved in order to capture

the micro level dynamics in the foreign exchange market (Evans and

Lyons, 2001, 2005, 2007). Another variable that is important in determining

exchange rates is central bank intervention in the foreign exchange

market.

Non-linear models have also been considered in the literature. Sarno

(2003), Altaville and Grauwe (2006) are some of the recent studies that

have used non-linear models of the exchange rate.

This study attempts to develop a model for the rupee-dollar exchange

rate taking into account the different monetary models along with the

micro structure models incorporating order flow as well as other variables

including intervention by the central bank. The focus is on the exchange

rate of the Indian rupee vis-à-vis the US dollar, i.e., the Re/$ rate.

India has been operating on a managed floating exchange rate regime

from March 1993, marking the start of an era of a market determined

exchange rate regime of the rupee with provision for timely intervention by the central bank1

. India’s exchange rate policy has evolved overtime in

line with the global situation and as a consequence to domestic

developments. 1991-92 represents a major break in policy when India

harped on reform measures following the balance of payments crisis and

shifted to a market determined exchange rate system. As has been the

experience with the exchange rate regimes the world over, the Reserve Bank

as the central bank of the country has been actively participating in the

market dynamics with a view to signaling its stance and maintaining orderly

conditions in the foreign exchange market. The broad principles that have

guided India’s exchange rate management have been periodically articulated

in the various Monetary Policy Statements. These include careful monitoring

and management of exchange rates with flexibility, no fixed target or a preannounced

target or a band and ability to intervene, if and when necessary.

Based on the preparedness of the foreign exchange market and India’s

position on the external front (in terms of reserves, debt, current account

deficit etc), reform measures have been progressively undertaken to have a

liberalized exchange and payments system for current and capital account

transactions and further to develop the foreign exchange market.

This study covers two main topics: first, various aspects of economic

policy with respect to the exchange rate, second, modelling and forecasting

the exchang rate. Accordingly, this study analyses India’s exchange rate

story, with particular focus on the policy responses during difficult times

and the reforms undertaken to develop the rupee exchange market during

relatively stable times. This study also discusses the structure of the

foreign exchange market in India in terms of participants, instruments

and trading platform as also turnover in the Indian foreign exchange market and forward premia. The Indian foreign exchange market has

evolved over time as a deep, liquid and efficient market as against a

highly regulated market prior to the 1990s. The market participants

have become sophisticated, the range of instruments available for trading

has increased, the turnover has also increased, while the bid–ask spreads

have declined. This study also covers the exchange rate policy of India in

the background of large capital flows, in terms of their magnitude,

composition and management. In the recent period, up to 2007-08,

external sector developments in India have been marked by strong capital

inflows. Capital flows to India, which were earlier mainly confined to

small official concessional finance, gained momentum from the 1990s

after the initiation of economic reforms.

After studying the analytics of foreign exchange market and the factors

affecting the exchange rate in the first part of the study (Sections II, III

and IV), this study then in the second part attempts to gauge the

forecasting ability of economic models with respect to exchange rates in

the context of a developing country that follows a managed floating (as

opposed to flexible) exchange rate regime. Starting from the naïve model,

this study examines the forecasting performance of the monetary model

and various extensions of it in the vector autoregressive (VAR) and

Bayesian vector autoregressive (BVAR) framework. Extensions of the

monetary model considered in this study include the forward premium,

capital inflows, volatility of capital flows, order flows and central bank

intervention. The study therefore examines, first, whether the monetary

model can beat a random walk. Second, it investigates if the forecasting

performance of the monetary model can be improved by extending it.

Third, the study evaluates the forecasting performance of a VAR model

versus a BVAR model. Lastly, it considers if information on intervention

by the central bank can improve forecast accuracy.

This study concentrates on the post March 1993 period and provides

insights into forecasting exchange rates for developing countries where

the central bank intervenes periodically in the foreign exchange market.

The alternative forecasting models are estimated using monthly data from July 1996

2

to December 2006 while out-of-sample forecasting

performance is evaluated from January 2007 to June 2008. This study

negates the finding of the seminal Study by Meese and Rogoff (1983) that

models which are based on economic fundamentals cannot outperform

a naive random walk model.

Against this backdrop, Section II of this study presents a review of

exchange rates and exchange rate policy in India during different phases.

In Section III, the structure of the foreign exchange market in India,

turnover and forward premia are discussed in detail. This is followed by

a discussion on capital flows and the foreign exchange market in Section

IV. The economic theory and review of literature are covered in Section

V, while the econometric methodology is discussed in Section VI. The

estimation and evaluation of forecasting models is done in Section VII.

The last Section VIII presents some concluding observations.

SECTION II

Exchange Rates and Exchange Rate Policy in India: A Review

India’s exchange rate policy has evolved over time in line with the

gradual opening up of the economy as part of the broader strategy of

macroeconomic reforms and liberalization since the early 1990s. This

change was also warranted by the consensus response of all major

countries to excessive exchange rate fluctuations that accompanied the

abolishment of fixed exchange rate system. The major changes in the

exchange rate policy started with the implementation of the

recommendations of the High Level Committee on Balance of Payments

(Chairman: Dr. C. Rangarajan, 1993) to make the exchange rate marketdetermined.

The Expert Group on Foreign Exchange Markets in India

(popularly known as Sodhani Committee, 1995) made several

recommendations with respect to participants, trading, risk management as well as selective market intervention by the Reserve Bank to promote

greater market development in an orderly fashion. Consequently, the

period starting from January 1996 saw wide-ranging reforms in the Indian

foreign exchange market. In essence, the exchange rate developments

changed in side-by-side with the reform in the external sector of India.

With the external sector reform, India stands considerably integrated

with the rest of the world today in terms of increasing openness of the

economy. As a result of calibrated and gradual capital account openness,

the financial markets, particularly forex market, in India have also

become increasingly integrated with the global network since 2003-04.

This is reflected in the extent and magnitude of capital that has flown

to India in recent years. Exchange rates exhibited considerable volatility

and increased capital mobility has posed several challenges before the

monetary authorities in managing exchange rates.

Against this backdrop, the following section analyses in retrospect

India’s exchange rate story, with particular focus on the policy responses

during difficult times and the reforms undertaken to develop the rupee

exchange market during relatively stable times.

1. Chronology of Reform Measures

In the post independence period, India’s exchange rate policy has

seen a shift from a par value system to a basket-peg and further to a

managed float exchange rate system. During the period 1947 till 1971,

India followed the par value system of the exchange rate whereby the

rupee’s external par value was fixed at 4.15 grains of fine gold. The RBI

maintained the par value of the rupee within the permitted margin of

±1% using pound sterling as the intervention currency. The devaluation

of the rupee in September 1949 and June 1966 in terms of gold resulted

in the reduction of the par value of rupee in terms of gold to 2.88 and

1.83 grains of fine gold, respectively. Since 1966, the exchange rate of

the rupee remained constant till 1971 (Chart 2.1).

|

With the breakdown of the Bretton Woods System, in December 1971,

the rupee was linked with pound sterling. Sterling being fixed in terms

of US dollar under the Smithsonian Agreement of 1971, the rupee also

remained stable against dollar. In order to overcome the weaknesses

associated with a single currency peg and to ensure stability of the

exchange rate, the rupee, with effect from September 1975, was pegged

to a basket of currencies (Table 2.1). The currencies included in the

basket as well as their relative weights were kept confidential by the

Reserve Bank to discourage speculation.

By the late ‘eighties and the early ‘nineties, it was recognised that

both macroeconomic policy and structural factors had contributed to

balance of payment difficulties. The current account deficit widened to

3.0 per cent of GDP in 1990-91 and the foreign currency assets depleted

to less than a billion dollar by July 1991. It was against this backdrop

that India embarked on stabilisation and structural reforms to generate

impulses for growth.

Table 2.1 : Chronology of the Indian Exchange Rate |

Year |

The Foreign Exchange Market and Exchange Rate |

1947-1971 |

Par Value system of exchange rate. Rupee’s external par value was fixed in

terms of gold with the pound sterling as the intervention currency. |

1971 |

Breakdown of the Bretton-Woods system and floatation of major currencies. Rupee was linked to the pound sterling in December 1971. |

1975 |

To ensure stability of the Rupee, and avoid the weaknesses associated with a single currency peg, the Rupee was pegged to a basket of currencies. Currency selection and weight assignment was left to the discretion of the RBI and not publicly announced. |

1978 |

RBI allowed the domestic banks to undertake intra-day trading in foreign exchange. |

1978-1992 |

Banks began to start quoting two-way prices against the Rupee as well as in other currencies. As trading volumes increased, the ‘Guidelines for Internal Control over Foreign Exchange Business’ were framed in 1981. The foreign exchange market was still highly regulated with several restrictions on external transactions, entry barriers and transactions costs. Foreign exchange transactions were controlled through the Foreign Exchange Regulations Act (FERA). These restrictions resulted in an extremely efficient unofficial parallel (hawala) market for foreign exchange. |

1990-1991 |

Balance of Payments crisis |

July 1991 |

To stabilize the foreign exchange market, a two step downward exchange rate adjustment was done (9% and 11%). This was a decisive end to the pegged exchange rate regime. |

March 1992 |

To ease the transition to a market determined exchange rate system, the Liberalized Exchange Rate Management System (LERMS) was put in place, which used a dual exchange rate system. This was mostly a transitional system. |

March 1993 |

The dual rates converged, and the market determined exchange rate regime was introduced. All foreign exchange receipts could now be converted at market determined exchange rates. |

Source : Reserve Bank of India |

The Report of the High Level Committee on Balance of Payments

(Chairman Dr. C. Rangarajan) laid the framework for a credible

macroeconomic, structural and stabilisation programme encompassing

trade, industry, foreign investment, exchange rate and the foreign exchange reserves. With regard to the exchange rate policy, the committee

recommended that consideration be given to (i) a realistic exchange rate,

(ii) avoiding use of exchange mechanisms for subsidization, (iii)

maintaining adequate level reserves to take care of short-term

fluctuations, (iv) continuing the process of liberalization on current

account, and (v) reinforcing effective control over capital transactions.

The key to the maintenance of a realistic and a stable exchange rate is

containing inflation through macro-economic policies and ensuring net

capital receipts of the scale not beyond the expectation. The Committee

further recommended that a decision be taken to unify the exchange

rate, as an important step towards full convertibility.

The initiation of economic reforms saw, among other measures, a

two step downward exchange rate adjustment by 9 per cent and 11 per

cent between July 1 and 3, 1991 to counter the massive draw down in

the foreign exchange reserves, to install confidence in the investors and to

improve domestic competitiveness. The two-step adjustment of July 1991

effectively brought to a close the period of pegged exchange rate. Following

the recommendations of Rangarajan Committee to move towards the marketdetermined

exchange rate, the Liberalised Exchange Rate Management

System (LERMS) was put in place in March 1992 involving dual exchange

rate system in the interim period. The dual exchange rate system was replaced

by unified exchange rate system in March 1993.

2. Foreign Exchange Intervention

In the post-Asian crisis period, particularly after 2002-03, capital

flows into India surged creating space for speculation on Indian rupee.

The Reserve Bank intervened actively in the forex market to reduce the

volatility in the market. During this period, the Reserve Bank made

direct interventions in the market through purchases and sales of the

US Dollars in the forex market and sterilised its impact on monetary

base. The Reserve Bank has been intervening to curb volatility arising

due to demand-supply mismatch in the domestic foreign exchange market

(Table 2.2).

Table 2.2: Reserve Bank’s Intervention in the Foreign Exchange Market |

(US$ billion) |

| |

Purchase |

Sale |

Net |

Outstanding Net

Forward Sales/

Purchase (end-March) |

1995-96 |

3.6 |

3.9 |

-0.3 |

- |

1996-97 |

11.2 |

3.4 |

7.8 |

- |

1997-98 |

15.1 |

11.2 |

3.8 |

-1.8 |

1998-99 |

28.7 |

26.9 |

1.8 |

-0.8 |

1999-00 |

24.1 |

20.8 |

3.2 |

-0.7 |

2000-01 |

28.2 |

25.8 |

2.4 |

-1.3 |

2001-02 |

22.8 |

15.8 |

7.1 |

-0.4 |

2002-03 |

30.6 |

14.9 |

15.7 |

2.4 |

2003-04 |

55.4 |

24.9 |

30.5 |

1.4 |

2004-05 |

31.4 |

10.6 |

20.8 |

0 |

2005-06 |

15.2 |

7.1 |

8.1 |

0 |

2006-07 |

26.8 |

0.0 |

26.8 |

0 |

2007-08 |

79.7 |

1.5 |

78.2 |

14.7 |

2008-09 |

26.6 |

61.5 |

-34.9 |

2.0 |

Source : Reserve Bank of India. |

Sales in the foreign exchange market are generally guided by excess

demand conditions that may arise due to several factors. Similarly, the

Reserve Bank purchases dollars from the market when there is an excess

supply pressure in market due to capital inflows. Demand-supply

mismatch proxied by the difference between the purchase and sale

transactions in the merchant segment of the spot market reveals a strong

co-movement between demand-supply gap and intervention by the

Reserve Bank (Chart 2.2)

3 .Thus, the Reserve Bank has been prepared

to make sales and purchases of foreign currency in order to even out

lumpy demand and supply in the relatively thin foreign exchange market and to smoothen jerky movements. However, such intervention is

generally not governed by any predetermined target or band around the

exchange rate (Jalan, 1999).

|

The volatility of Indian rupee remained low against the US dollar

than against other major currencies as the Reserve Bank intervened

mostly through purchases/sales of the US dollar. Empirical evidence in

the Indian case has generally suggested that in the present day managed

float regime of India, intervention has served as a potent instrument in

containing the magnitude of exchange rate volatility of the rupee

and the intervention operations do not influence as much the level of

rupee (Pattanaik and Sahoo, 2001; Kohli, 2000; RBI, RCF 2002-03,

2005-06).

The intervention of the Reserve Bank in order to neutralise the

impact of excess foreign exchange inflows enhanced the RBI’s Foreign

Currency Assets (FCA) continuously. In order to offset the effect of

increase in FCA on monetary base, the Reserve Bank had mopped

up the excess liquidity from the system through open market operation (Chart 2.3). It is, however, pertinent to note that Reserve

Bank’s intervention in the foreign exchange market has been relatively

small in terms of volume (less than 1 per cent during last few years),

except during 2008-09. The Reserve Bank’s gross market intervention

as a per cent of turnover in the foreign exchange market was the

highest in 2003-04 though in absolute terms the highest intervention

was US$ 84 billion in 2008-09 (Table 2.3). During October 2008

alone, when the contagion of the global financial crisis started

affecting India, the RBI sold US$ 20.6 billion in the foreign exchange

market. This was the highest intervention till date during any

particular month.

|

3. Trends in Exchange Rate

A look at the entire period since 1993 when we moved towards market

determined exchange rates reveals that the Indian Rupee has generally

depreciated against the dollar during the last 15 years except during the

period 2003 to 2005 and during 2007-08 when the rupee had appreciated on account of dollar’s global weakness and large capital inflows (Table 2.4). For the period as a whole, 1993-94 to 2007-08, the Indian Rupee has depreciated against the dollar. The rupee has also depreciated against

other major international currencies. Another important feature has been

the reduction in the volatility of the Indian exchange rate during last few

years. Among all currencies worldwide, which are not on a nominal peg,

and certainly among all emerging market economies, the volatility of the

rupee-dollar rate has remained low. Moreover, the rupee in real terms

generally witnessed stability over the years despite volatility in capital

flows and trade flows (Table 2.5).

Table 2.3 : Extent of RBI Intervention in Foreign exchange Market |

|

RBI Intervention in Foreign exchange

market ($ billion) |

Foreign exchange Market Turnover ($ billion) |

Column 2 over 3 (in per cent) |

1 |

2 |

3 |

4 |

2002-03 |

45.6 |

1,560 |

2.9 |

2003-04 |

80.4 |

2,118 |

3.8 |

2004-05 |

42.0 |

2,892 |

1.5 |

2005-06 |

15.8 |

4,413 |

0.4 |

2006-07 |

26.8 |

6,571 |

0.4 |

2007-08 |

81.2 |

12,249 |

0.7 |

2008-09P |

83.9 |

12,092 |

0.7 |

P: Provisional

Note : RBI Intervention includes both purchases and sales of US dollar by the RBI

Source : Reserve Bank of India. |

Table 2.4 : Movements of Indian Rupee 1993-94 to 2008-09 |

Year |

Range (Rs per US $) |

Average Exchange Rate

(Rs per US $) |

Daily average Appreciation/

Depreciation |

Coefficient of Variation (%) |

Standard Deviation

|

1 |

2 |

3 |

4 |

5 |

6 |

1993-94 |

31.21-31.49 |

31.37 |

0.03 |

0.1 |

0.05 |

1994-95 |

31.37-31.97 |

31.40 |

-0.11 |

0.3 |

0.12 |

1995-96 |

31.37-37.95 |

33.46 |

-6.17 |

5.8 |

0.56 |

1996-97 |

34.14-35.96 |

35.52 |

-5.77 |

1.3 |

0.21 |

1997-98 |

35.70-40.36 |

37.18 |

-4.47 |

4.2 |

0.37 |

1998-99 |

39.48-43.42 |

42.13 |

-11.75 |

2.1 |

0.24 |

1999-00 |

42.44-43.64 |

43.34 |

-2.79 |

0.7 |

0.10 |

2000-01 |

43.61-46.89 |

45.71 |

-5.19 |

2.3 |

0.15 |

2001-02 |

46.56-48.85 |

47.69 |

-4.15 |

1.4 |

0.13 |

2002-03 |

47.51-49.06 |

48.40 |

-1.48 |

0.9 |

0.07 |

2003-04 |

43.45-47.46 |

45.92 |

5.40 |

1.6 |

0.19 |

2004-05 |

43.36-46.46 |

44.95 |

2.17 |

2.3 |

0.31 |

2005-06 |

43.30-46.33 |

44.28 |

1.51 |

1.8 |

0.22 |

2006-07 |

43.14-46.97 |

45.28 |

-2.22 |

2.0 |

0.27 |

2007-08 |

39.26-43.15 |

40.24 |

12.53 |

2.1 |

0.38 |

2008-09 |

39.89-52.09 |

45.92 |

-12.36 |

7.8 |

0.73 |

Source : Reserve Bank of India. |

Table 2.5: Trend in External value of the Indian Rupee |

Year |

36 country REER (Trade Based): Base 1993-94=100 |

REER |

% Variation |

NEER |

% Variation |

1993-94 |

100.00 |

- |

100.00 |

- |

1994-95 |

104.32 |

4.3 |

98.91 |

-1.1 |

1995-96 |

98.19 |

-5.9 |

91.54 |

-7.5 |

1996-97 |

96.83 |

-1.4 |

89.27 |

-2.5 |

1997-98 |

100.77 |

4.1 |

92.04 |

3.1 |

1998-99 |

93.04 |

-7.7 |

89.05 |

-3.2 |

1999-00 |

95.99 |

3.2 |

91.02 |

2.2 |

2000-01 |

100.09 |

4.3 |

92.12 |

1.2 |

2001-02 |

100.86 |

0.8 |

91.58 |

-0.6 |

2002-03 |

98.18 |

-2.7 |

89.12 |

-2.7 |

2003-04 |

99.56 |

1.4 |

87.14 |

-2.2 |

2004-05 |

100.09 |

0.5 |

87.31 |

0.2 |

2005-06 |

102.35 |

2.3 |

89.85 |

2.9 |

2006-07 |

98.48 |

-3.8 |

85.89 |

-4.4 |

2007-08 |

104.81 |

6.4 |

93.91 |

9.3 |

2008-09 |

94.31 |

-10.0 |

84.66 |

-9.8 |

Source : Reserve Bank of India. |

The various episodes of volatility of exchange rate of the rupee have

been managed in a flexible and pragmatic manner. In line with the

exchange rate policy, it has also been observed that the Indian rupee is

moving along with the economic fundamentals in the post-reform period.

Thus, as can be observed maintaining orderly market conditions have

been the central theme of RBI’s exchange rate policy. Despite several

unexpected external and domestic developments, India’s exchange rate performance is considered to be satisfactory. The Reserve Bank has

generally reacted promptly and swiftly to exchange market pressures

through a combination of monetary, regulatory measures along with direct

and indirect interventions and has preferred to withdraw from the market

as soon as orderly conditions are restored.

Moving forward, as India progresses towards full capital account

convertibility and gets more and more integrated with the rest of the

world, managing periods of volatility is bound to pose greater challenges

in view of the impossible trinity of independent monetary policy, open

capital account and exchange rate management. Preserving stability in

the market would require more flexibility, adaptability and innovations

with regard to the strategy for liquidity management as well as exchange

rate management. Also, with the likely turnover in the foreign exchange

market rising in future, further development of the foreign exchange

market will be crucial to manage the associated risks.

SECTION III

Structure of the Indian Foreign Exchange Market and Turnover

Prior to the 1990s, the Indian foreign exchange market (with a pegged

exchange rate regime) was highly regulated with restrictions on transactions,

participants and use of instruments. The period since the early 1990s has

witnessed a wide range of regulatory and institutional reforms resulting in

substantial development of the rupee exchange market as it is observed today.

Market participants have become sophisticated and have acquired reasonable

expertise in using various instruments and managing risks. The range of

instruments available for trading has also increased. Against this background,

this Section discusses the structure of the foreign exchange market in India.

The first sub-section of the Section gives an overview of the structure of the

foreign exchange market in terms of participants, instruments and trading

platform followed by discussions on turnover and forward premia in

subsequent sections.

1. Current Rupee Market Structure

While analysing the exchange rate behavior, it is also important to have

a look at the market micro structure where the Indian rupee is traded. As in

case of any other market, trading in Indian foreign exchange market involves

some participants, a trading platform and a range of instruments for trading.

Against this backdrop, the current market set up is given below.

Market Segments and Players

The Indian foreign exchange market is a decentralised multiple

dealership market comprising two segments – the spot and the derivatives

market. In a spot transaction, currencies are traded at the prevailing

rates and the settlement or value date is two business days ahead. The

two-day period gives adequate time for the parties to send instructions

to debit and credit the appropriate bank accounts at home and abroad.

The derivatives market encompasses forwards, swaps, and options. As

in case of other Emerging Market Economies (EMEs), the spot market

remains an important segment of the Indian foreign exchange market.

With the Indian economy getting exposed to risks arising out of changes

in exchange rates, the derivative segment of the foreign exchange market

has also strengthened and the activity in this segment is gradually rising.

Players in the Indian market include (a) Authorised Dealers (ADs),

mostly banks who are authorised to deal in foreign exchange4 , (b) foreign

exchange brokers who act as intermediaries between counterparties,

matching buying and selling orders and (c) customers – individuals,

corporates, who need foreign exchange for trade and investment purposes.

Though customers are a major player in the foreign exchange market,

for all practical purposes they depend upon ADs and brokers. In the spot foreign exchange market, foreign exchange transactions were earlier

dominated by brokers, but the situation has changed with evolving market

conditions as now the transactions are dominated by ADs. The brokers

continue to dominate the derivatives market. The Reserve Bank like other

central banks is a market participant who uses foreign exchange to

manage reserves and intervenes to ensure orderly market conditions.

The customer segment of the spot market in India essentially reflects

the transactions reported in the balance of payments – both current and

capital account. During the decade of the 1980s and 1990s, current account

transactions such as exports, imports, invisible receipts and payments were

the major sources of supply and demand in the foreign exchange market.

Over the last five years, however, the daily supply and demand in the foreign

exchange market is being increasingly determined by transactions in the

capital account such as foreign direct investment (FDI) to India and by India,

inflows and outflows of portfolio investment, external commercial borrowings

(ECB) and its amortisations, non-resident deposit inflows and redemptions.

It needs to be observed that in India, with the government having no foreign

currency account, the external aid received by the Government comes directly

to the reserves and the RBI releases the required rupee funds. Hence, this

particular source of supply of foreign exchange e.g. external aid does not go

into the market and to that extent does not reflect itself in the true

determination of the value of the rupee.

The foreign exchange market in India today is equipped with several

derivative instruments. Various informal forms of derivatives contracts

have existed since time immemorial though the formal introduction of a

variety of instruments in the foreign exchange derivatives market started

only in the post reform period, especially since the mid-1990s. These

derivative instruments have been cautiously introduced as part of the

reforms in a phased manner, both for product diversity and more

importantly as a risk management tool. Recognising the relatively nascent

stage of the foreign exchange market then with the lack of capabilities to

handle massive speculation, the ‘underlying exposure’ criteria had been

imposed as a prerequisite.

2. Foreign Exchange Market Turnover

The depth and size of foreign exchange market is gauged generally

through the turnover in the market. Foreign exchange turnover considers

all the transactions related to foreign currency, i.e. purchases, sales,

booking and cancelation of foreign currency or related products. Forex

turnover or trading volume, which is also an indicator of liquidity in the

market, helps in price discovery. In the literature, it is held that the

foreign exchange market turnover may convey important private

information about market clearing prices, thus, it could act as a key

variable while making informed judgment about the future exchange rates.

Trading volumes in the Indian foreign exchange market has grown

significantly over the last few years. The daily average turnover has seen

almost a ten-fold rise during the 10 year period from 1997-98 to 2007-

08 from US $ 5 billion to US $ 48 billion (Table 3.1). The pickup has

been particularly sharp from 2003-04 onwards since when there was a

massive surge in capital inflows.

Table 3.1 : Turnover in the Foreign

Exchange Market |

Year |

Turnover in US $ billion |

Share of spot turnover in per cent |

Merchant |

Inter-bank |

Total |

Merchant |

Inter-bank |

Total |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

1997-98 |

210 |

1,096 |

1,305 |

57.5 |

50.4 |

51.6 |

1998-99 |

246 |

1,057 |

1,303 |

51.1 |

48.6 |

49.1 |

1999-00 |

244 |

898 |

1,142 |

60.6 |

49.2 |

51.6 |

2000-01 |

269 |

1,118 |

1,387 |

62.9 |

43.8 |

47.5 |

2001-02 |

257 |

1,165 |

1,422 |

61.8 |

38.1 |

42.4 |

2002-03 |

325 |

1,236 |

1,560 |

57.0 |

42.0 |

45.1 |

2003-04 |

491 |

1,628 |

2,118 |

52.5 |

48.2 |

49.2 |

2004-05 |

705 |

2,188 |

2,892 |

48.2 |

50.5 |

50.0 |

2005-06 |

1,220 |

3,192 |

4,413 |

45.0 |

52.6 |

50.5 |

2006-07 |

1,798 |

4,773 |

6,571 |

46.1 |

54.1 |

51.9 |

2007-08 |

3,545 |

8,704 |

12,249 |

45.9 |

51.2 |

49.7 |

2008-09 |

3,231 |

8,861 |

12,092 |

37.7 |

48.1 |

45.3 |

Source : Reserve Bank of India. |

It is noteworthy that the increase in foreign exchange market turnover

in India between April 2004 and April 2007 was the highest amongst the

54 countries covered in the latest Triennial Central Bank Survey of Foreign

Exchange and Derivatives Market Activity conducted by the Bank for

International Settlements (BIS). According to the survey, daily average

turnover in India jumped almost 5-fold from US $ 7 billion in April 2004

to US $ 34 billion in April 2007; global turnover over the same period

rose by only 66 per cent from US $ 2.4 trillion to US $ 4.0 trillion.

Reflecting these trends, the share of India in global foreign exchange

market turnover trebled from 0.3 per cent in April 2004 to 0.9 per cent

in April 2007.

Looking at some of the comparable indicators, the turnover in the

foreign exchange market has been an average of 7.6 times higher than

the size of India’s balance of payments during last five years (Table 3.2).

With the deepening of foreign exchange market and increased turnover,

income of commercial banks through treasury operations has increased

considerably.

Table 3.2: Foreign Exchange Market Turnover and BoP Size |

Year |

Foreign Exchange

Market-Annual

Turnover ($ billion) |

BoP size

($ billion) |

Foreign

Currency

Assets* ($ billion) |

Col 2 over Col 3 |

Col 2 over Col 4 |

1 |

2 |

3 |

4 |

5 |

6 |

2000-01 |

1,387 |

258 |

39.6 |

5.4 |

35.0 |

2001-02 |

1,422 |

237 |

51.0 |

6.0 |

27.9 |

2002-03 |

1,560 |

267 |

71.9 |

5.8 |

21.7 |

2003-04 |

2,118 |

361 |

107.3 |

5.9 |

19.7 |

2004-05 |

2,892 |

481 |

135.6 |

6.0 |

21.3 |

2005-06 |

4,413 |

663 |

145.1 |

6.7 |

30.4 |

2006-07 |

6,571 |

918 |

191.9 |

7.2 |

34.2 |

2007-08 |

12,249 |

1,405 |

299.2 |

8.7 |

40.9 |

2008-09 |

12,092 |

1,301 |

241.4 |

9.3 |

50.1 |

* As at end-March

Source: Reserve Bank of India. |

A look at the segments in the Indian foreign exchange market reveals

that the spot market remains the most important foreign exchange market

segment accounting for about 50 per cent of the total turnover (Table

3.3). However, its share has seen a marginal decline in the recent past

mainly due to a pick up in turnover in derivative segment. The merchant

segment of the spot market is generally dominated by the Government of

India, select public sector units, such as Indian Oil Corporation (IOC),

and the FIIs. As the foreign exchange demand on account of public sector

units and FIIs tends to be lumpy and uneven, resultant demand-supply

mismatches entail occasional pressures on the foreign exchange market,

warranting market interventions by the Reserve Bank to even out lumpy

demand and supply. However, as noted earlier, such intervention is not

governed by a predetermined target or band around the exchange rate.

Further, the inter-bank to merchant turnover ratio has almost halved

from 5.2 during 1997-98 to 2.8 during 2008-09 reflecting the growing

participation in the merchant segment of the foreign exchange market

associated with growing trade activity, better corporate performance and

increased liberalisation. Mumbai alone accounts for almost 80 per cent

of the foreign exchange turnover.

Table 3.3: Indicators of Indian Foreign Exchange Market Activity |

|

1997-98 |

2007-08 |

2008-09 |

1 |

2 |

3 |

4 |

Total annual turnover |

1,305 |

12,249 |

12,092 |

Average daily Turnover |

5 |

48 |

48 |

Average Daily Merchant Turnover |

1 |

14 |

13 |

Average Daily Inter-bank Turnover |

4 |

34 |

35 |

Inter-bank to Merchant ratio |

5.2 |

2.5 |

2.7 |

Spot/Total Turnover (%) |

51.6 |

49.7 |

45.3 |

Forward/Total Turnover (%) |

12.0 |

19.3 |

21.1 |

Swap/Total Turnover (%) |

36.4 |

31.1 |

33.6 |

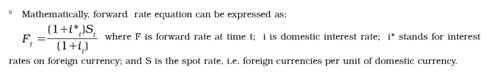

Behaviour of Forward Premia

Next to the spot exchange market, the transactions on forwards and

swaps are large in Indian context. Onshore deliverable forward contracts

are generally available for maturities ranging from one month to ten years;

however, the most common and liquid contracts have maturities of one

year or less, and these have a bid/offer spread of Rs.0.01. The forward

exchange rate5 is an important indicator of the future behavior of exchange

rates as it is determined in the foreign exchange market based on

expectations on the future exchange rates, which is expected to get

influenced by a set of variables. Given its very nature, the forward premia

is sensitive to any news having financial bearing. Thus, the information

content of forward premia is important in any forecasting exercise.

A swap transaction in the foreign exchange market is a combination

of a spot and a forward in the opposite direction. Foreign exchange

swaps account for the largest share of the total derivatives turnover in

India, followed by forwards and options. In the Indian context, the forward

price of the rupee is not essentially determined by the interest rate

differentials, but it is also significantly influenced by: (a) supply and

demand of forward US dollars; (b) interest differentials and expectations

of future interest rates; and (c) expectations of future US dollar-rupee

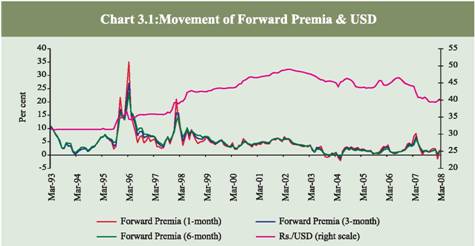

exchange rate (Chart 3.1).

Empirical studies in the Indian context reveal that forward premia

on US dollar is driven to a large extent by the interest rate differential in

the interbank market of the two economies combined with FII flows,

current account balance as well as changes in exchange rates of US dollar

vis-à-vis Indian rupee (Sharma and Mitra, 2006). Further empirical

analysis for the period January 1995-December 2006 have shown that the ability of forward rates in correctly predicting the future spot rates

has improved overtime and there is co-integration relationship between

the forward rate and the future spot rate (RCF, 2005-06).

|

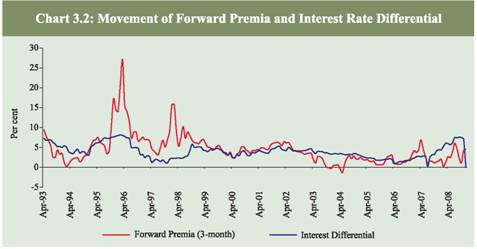

With the opening up of the capital account, the forward premia is

getting aligned with the interest rate differential reflecting market

efficiency (Chart 3.2). While free movement in capital account is only a

necessary condition for full development of forward and other foreign

exchange derivatives market, the sufficient condition is provided by a

deep and liquid money market with a well-defined yield curve in place.

Market Efficiency

With the exchange rate primarily getting determined in the market,

the issue of foreign exchange6 market efficiency has assumed importance

for India in recent years. The bid-ask spread of Rupee/US$ market has

almost converged with that of other major currencies in the international market. On some occasions, in fact, the bid-ask spread of Rupee/US$

market was lower than that of some major currencies.

|

Besides maintaining orderly conditions, markets are perceived as efficient

when market prices reflect all available information, so that it is not possible

for any trader to earn excess profits in a systematic manner. The efficiency/

liquidity of the foreign exchange market is often gauged in terms of bid-ask

spreads. The bid-ask spread refers to the transaction costs and operating

costs involved with the transaction of the currency. These costs include phone

bills, cable charges, book-keeping expenses, trader salaries, etc. in the spot

segment, it may also include the risks involved with holding the foreign

exchange. These costs/bid-ask spread may reduce with the increase in the

volume of transaction of the currency.

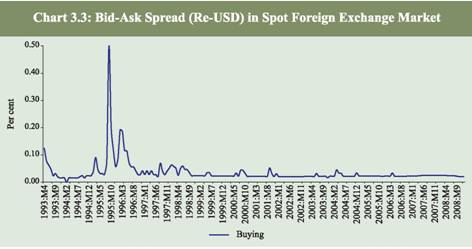

In the Indian context, it is found that the spread is almost flat and

very low. In India, the normal spot market quote has a spread of 0.25

paisa to 1 paise while swap quotes are available at 1 to 2 paise spread.

A closer look at the bid-ask spread in the rupee-US dollar spot market

reveals that during the initial phase of market development (i.e., till the mid 1990s), the spread was high and volatile due to thin market with

unidirectional behavior of market participants (Chart 3.3). In the later period,

with relatively deep and liquid markets, bid-ask spread has sharply declined

and has remained low and stable, reflecting efficiency gains.

|

Thus, the foreign exchange market has evolved over time as a deep,

liquid and efficient market as against highly regulated market prior to

the 1990s. The market participants have become sophisticated, the range

of instruments available for trading has increased, the turnover has also

increased, while the bid-ask spreads have declined. The next Section

discusses the dynamics of capital flows, which are also key variables in

the modelling exercise.

SECTION IV

Capital Flows and Exchange Rates: The Indian Experience

The capital inflows and outflows have implications for the conduct

of domestic monetary policy and exchange rate management. The emerging market economies including India had seen a very sharp rise

in capital flows in the past few years. The surge in the capital flows till

2007-08 had coincided mostly with a faster pace of financial liberalization,

particularly a move towards regulation free open economies. Moreover,

high interest rates prevailing in the emerging market economies had led

to a wider interest rate differential in favour of the domestic markets,

which stimulated a further surge of capital flows. In emerging markets,

capital flows are often relatively more volatile and sentiment driven, not

necessarily being related to the fundamentals in these markets. Such

volatility imposes substantial risks on the market agents, which they

may not be able to sustain or manage (Committee on the Global Financial

System, BIS, 2009). In the literature, several instruments have been

prescribed for sterilization purposes. Such tools include open market

operations, tightening the access of banks at the discount window,

adjusting reserve requirements or the placement of government deposits,

using a foreign exchange swap facility, easing restrictions on capital

outflows, pre-payment of external debt and promoting investment through

absorption of capital flows for growth purposes.

1. Capital Flows: Indian Context

In the recent period, external sector developments in India have been

marked by strong capital flows, which had led to an appreciating tendency

in the exchange rate of the Indian rupee up to January 2008. The

movement of the Indian rupee is largely influenced by the capital flow

movements rather than traditional determinants like trade flows (Chart

4.1). Capital flows to India, which were earlier mainly confined to small

official concessional finance, gained momentum from the 1990s after

the initiation of economic reforms. Apart from an increase in size, capital

flows to India have undergone a compositional shift from predominantly

official and private debt flows to non-debt creating flows in the post reform

period. Private debt flows have begun to increase again in the more recent

period. Though capital flows are generally seen to be beneficial to an

economy, a large surge in flows over a short span of time in excess of the domestic absorptive capacity can, however, be a source of stress to the

economy giving rise to upward pressures on the exchange rate,

overheating of the economy, and possible asset price bubbles.

The far reaching economic reforms in India in the 1990s, witnessed

a sharp increase in capital inflows as a result of capital account

liberalisation in India and a gradual decrease in home bias in asset

allocation in advanced economies. During 1990-91, it was clear that the

country was heading for a balance of payment crisis due to deficit financed

fiscal expansion of the 1980s and the trigger of oil price spike caused by

the Gulf War. The balance of payments crisis of 1991 led to the initiation

of reform process. The broad approach to reform in the external sector

was based on the recommendations made in the Report of the High Level

Committee on Balance of Payments (Chairman: Shri. C. Rangarajan),

1991. The objectives of reform in the external sector were conditioned

by the need to correct the deficiencies that led to payment imbalances in

1991. Recognizing that an inappropriate exchange rate regime,

unsustainable current account deficit and a rise in short term debt in

relation to the official reserves were amongst the key contributing factors to the crisis, a series of reform measures were put in place. The measures

included a swift transition to a market determined exchange rate regime,

dismantling of trade restrictions, moving towards current account

convertibility and gradual opening up of the capital account. While

liberalizing the private capital inflows, the Committee recommended,

inter alia, a compositional shift in capital flows away from debt to nondebt

creating flows; strict regulation of external commercial borrowings,

especially short term debt; discouraging volatile element of flows from

non-resident Indians; and gradual liberalization of outflows.

Among the components, since the 1990s, the broad approach towards

permitting foreign direct investment has been through a dual route, i.e.,

automatic and approval, with the ambit of automatic route progressively

enlarged to almost all the sectors, coupled with higher sectoral caps

stipulated for such investments. Portfolio investments are restricted to

institutional investors. The approach to external commercial borrowings

has been one of prudence, with self imposed ceilings on approvals and a

careful monitoring of the cost of raising funds as well as their end use.

In respect of NRI deposits, some modulation of inflows is exercised

through specification of interest rate ceilings and maturity requirements.

In respect of capital outflows, the approach has been to facilitate direct

overseas investment through joint ventures and wholly owned subsidiaries

and provision of financial support to exports, especially project exports

from India. Ceilings on such outflows have been substantially liberalized

over time. The limits on remittances by domestic individuals have also

been eased. With progressive opening up of its capital account since the

early 1990s, the state of capital account in India today can be considered

as the most liberalized it has ever been in its history since the late 1950s.

All these developments have ramifications on exchange rate management

(Mohan 2008b).

2. Management of Capital Flows and Exchange Rates

The recent episode of capital flows, which has occurred in the

backdrop of current account surplus in most of the emerging Asian economies, highlights the importance of absorption of capital flows. The

absorption of capital flows is limited by the extant magnitude of the

current account deficit, which has traditionally been low in India, and

seldom above 2 per cent of GDP. In India, with a view to neutralising the

impact of excess forex flows on account of a large capital account surplus,

the central bank has intervened in the foreign exchange market at regular

intervals. But unsterilised forex market intervention can result in

inflation, loss of competitiveness and attenuation of monetary control.

The loss of monetary control could be steep if such flows are large.

Therefore, it is essential that the monetary authorities take measures to

offset the impact of such foreign exchange market intervention, partly or

wholly, so as to retain the intent of monetary policy through such

intervention.

In India, the liquidity impact of large capital inflows was traditionally

managed mainly through the repo and reverse repo auctions under the

day-to-day Liquidity Adjustment Facility (LAF). The LAF operations were

supplemented by outright open market operations (OMO), i.e. outright

sales of the government securities, to absorb liquidity on an enduring

basis. In addition to LAF and OMO, excess liquidity from the financial

system was also absorbed through the building up of surplus balances

of the Government with the Reserve Bank, particularly by raising the

notified amount of 91-day Treasury Bill auctions, forex swaps and prepayment

of external loans,

The market-based operations led to a progressive reduction in the

quantum of securities with the Reserve Bank. This apart, as per those

operations, the usage of the entire stock of securities for outright open