Presentation

Mr. Robert Sheehy, Mr. Coskun Cangoz, Mr Jin Myung Kim, Mr Otavio Ladeira de Medeiros, Mr. Thordur Jonasson and distinguished participants. It is a great pleasure to be in the city of Doha and share my thoughts with such a distinguished gathering in the Conference jointly organized by the Qatar Central Bank and the International Monetary Fund. I am particularly thankful to Mr Abdulla Bin Saud Al-Thani, Governor, Qatar Central Bank and Mr. Ananthakrishnan Prasad of the International Monetary Fund, for having invited me in the Conference. The importance of debt markets in catalyzing the growth of economy is well recognized and accepted. Therefore, State, and by State I mean both the government and central bank, has an interest in developing debt markets. In pursuit of this interest, the state has a critical role to play in fostering a sound and diversified debt market, which efficiently performs the function of financial intermediation. The increased role of the State in the financial markets and, particularly, in the debt markets was evident across several countries during the recent global financial crisis and European sovereign debt crisis. For example, in the backdrop of heightened volatility and dysfunctional of collateral markets, the central banks bought large scale assets (government bonds, corporate bonds, securitized bonds, etc) to calm down the markets and bring back normalcy.

Historical perspective

2. A survey of the world's major developed bond markets reveals diverse paths of development. Therefore, I would start by briefly discussing the state’s role in the debt markets from a historical perspective. State’s involvement in debt markets has a long history. The State started borrowing in the Middle Ages in Europe. The earliest loans of medieval times were either forced loans or personal borrowing by the sovereign, usually to finance wars. It is interesting to note that lending to the sovereign entailed significant credit risk in those times. The extensive use of loans by governments became possible only after the ruler had become differentiated from the state and after the fact of the continuity of the state had been separated from the persons of the rulers. Other factors which facilitated borrowings were: the development of a regular revenue source to provide funds for repayment of loans, a monetary system, and an organized money market.

3. Since the late Middle Ages, governments began to raise money through long- and short-term loans. Initially, indebtedness was intended to finance war budgets, but gradually money was channelled towards civil purposes such as public works or food supply. Public debt became a trusted tool of political economy and financed expenditure in place of levying unpopular taxes. In the main European cities, government bonds became freely marketable. Trading procedures, guarantees and techniques became well known to investors at a national and international level. The increasing efficiency of financial markets allowed governments to raise money at decreasing costs whilst savers could use long term public loans as a an assured alternative to traditional investments in land. State has recognized the efficacy of a developed debt market and modern governments continue to borrow because of inevitable mismatches in revenue and spending. Other reasons include supporting inter-generational fairness, stabilizing tax rates, implementing macroeconomic management, and finally, for political expediency in running the desired programmes for achieving socio-economic and political objectives.

Objectives of debt market development

4. The objective of debt market development in a broad sense is to aid economic growth and development. The principle role of debt markets is to transfer capital from savers to borrowers / investors, and allocate them in an efficient manner among competing uses in the economy, thereby contributing to growth both through increased investment and through enhanced efficiency in resource use. As debt markets link issuers having long-term financing needs with investors willing to place funds in long-term, interest-bearing securities, a developed domestic bond market offers a wide range of opportunities for funding the government and the private sector. The debt markets also specialize in transferring, pooling as well as sharing risks. The debt market, especially Government securities market serves, as a benchmark for pricing other financial assets and thereby helps the monetary policy transmission. In the Indian context, the transmission from shorter to longer end of the yield curve is a function of, inter alia, changes in monetary policy rates, inflation levels, international interest rates and, liquidity conditions including the SLR stipulation.

Bond market in India and Asia

5. Indian bond market has made rapid strides in the last few years due to several initiatives undertaken by the state, central bank and other stake holders. Although activities in corporate bonds market have picked up, the Indian bonds market continues to be dominated by Government bonds market. One of the landmark initiatives in this regard was phasing out of automatic monetization of fiscal deficit through issue of ad hoc Treasury Bills with effect from April 1, 1997 through a supplemental agreement signed between Government of India (GoI) and RBI on March 26, 1997. This agreement paved the way for funding the fiscal deficit of GoI through market loans and thereby, need to develop the Government bonds market. Another landmark initiative was Fiscal Responsibility and Budget Management (FRBM) Act, 2003 prohibiting RBI’s subscription to the Government bonds in the primary auction with effect from April 1, 2006. This initiative resulted in issuance of all Government bonds in the market and improved the depth of both primary and secondary segments of the Government bonds market.

6. Some of the other important initiatives taken with respect to the Government bonds market were (i) State governments’ fund raising shifting to market through an auction system; (ii) introduction of primary dealers (PDs) network; (iii) introduction of When Issued market; (iv) issuance of half-yearly auction calendars covering quantum, timing & tenor of securities for providing transparency and certainty to the market participants; (v) setting up electronic platforms for primary auctions, namely, the Negotiated Dealing System Auction (NDS-Auction); and (vi) setting up electronic Order Matching (OM) platform for secondary market trade, namely, the NDS-OM. Consequently, the volume in Government bonds market increased significantly (Table 1).

Table 1: Volume in Government Bonds Market |

(` billion) |

Year |

Primary

Issuances* |

Secondary

Market

Trade$ |

2005-06 |

1,527 |

8,648 |

2006-07 |

1,668 |

10,215 |

2007-08 |

2,238 |

16,539 |

2008-09 |

3,911 |

21,602 |

2009-10 |

5,821 |

29,139 |

2010-11 |

5,410 |

28,710 |

2011-12 |

6,686 |

34,882 |

| *Gross for Central and State Governments.

$ Single-side volume. |

7. The bond markets across the Asian region have witnessed substantial progress after the Asian crisis in the second half of 1990s. The Asian Bonds Funds (ABF) structured by the Bank for International Settlement (BIS) in response to a proposal by the East Asia and Pacific Central Banks (EMEAP) group in June 2003 has also played a role in the development of the Government bonds market in the Asian region. ABF allows its members to invest in bonds issued by Asian sovereign issuers in EMEAP economies. The progress made by the Indian Government bonds market is comparable to its peers in the Asian region. The turnover ratio (in terms of total volume divide by average outstanding of Govt securities) of the Indian Government bonds market during the quarter ending March 2012 was close to the Government bonds market of several Asian countries (Chart 1).

Chart 1: Turnover ratio in Government Bonds Market

(quarter ending March 2012)

Attributes of a developed bond market

8. The main features of a well developed debt market are depth, breadth, resilience and wide choice of instruments to cater to the requirements of market participants. "Depth" connotes the extent to which it can handle large transactions without causing sharp changes in price. "Breadth" connotes the diversity of participants and the heterogeneity of their responses to new information while the “resilience” determines the speed with which price fluctuations due to some shocks finally dissipate. The developed markets also have a bouquet of instruments (bonds and derivatives) to cater to requirements of market participants. Large set of domestic institutional investors and active interest from foreign investors can create a large and heterogeneous group that is necessary for an efficient bond market. For example, the traditional investor base for G-Sec in India comprised banks, provident funds, and insurance companies. With the entry of co-operative banks, regional rural banks, pension funds, mutual funds and non-banking finance companies and foreign institutional investors including foreign central banks; the institutional investor base has been diversified (Chart 2). Deep, broad markets are generally more resilient and tend to display greater stability in responding to financial and economic disturbances.

Chart 2: Share of market participants in Government securities in India

(end-June 2012)

Role of State/Central Bank

9. The continued integration and deepening of financial markets is a significant issue for the policy-makers, and, particularly for the central banks, entrusted with the formulation and implementation of monetary policy, since well-integrated and efficient financial markets are crucial in ensuring a smooth transmission of monetary impulses to the economy. Besides the state (government) having a ‘market-completion’ role, its role in the development of the debt market stems from the fact that well developed debt market is essential for providing stable and cost effective funding to the various sectors, including public sector, of the economy. The Reserve Bank of India, like many other Central Banks has taken a proactive role in the development of debt markets. In performing this function, the RBI played multifarious roles as central bank, debt manager to the government and regulator of debt markets. In the above backdrop, the role of state in developing the debt market can be analysed through following three channels:

- Issuer of debt

- Debt management strategy and framework

- Developer of bond markets

- Institutional framework- market infrastructure- investor and instrument universe

- Regulator of bond markets

- Systemic stability- market integrity- consumer protection

Issuer of debt

10. The first major bond market to develop is usually the market in government obligations. In many countries, the government has the largest stock of issues outstanding in its name. Government bond prices serve as a basis for pricing the issues of other borrowers who are subject to credit risk. In most countries, governments issue debt to fund the gap between tax receipts and current expenditures, and sometimes to finance some extraordinary current expenditure. The US bond market, for example, took flight after the issuance of Liberty Bonds to finance US participation in World War I. The favorable experience investors had with these bonds left them willing to invest in securities issued by corporations. This gave fillip to the corporate bond market and made possible the significant expansion of these markets.

11. This does not mean that fiscally conservative governments that do not run deficits cannot nurture a robust debt market. Hong Kong and Singapore have issued bonds despite running surplus budgets. Hong Kong developed a benchmark yield curve in Hong Kong dollars through issues of Exchange Fund Bills and Notes, the proceeds of which are used primarily to invest in international markets, not to fund government spending. Australia and Norway are other countries which issued debt even though they ran surplus / balanced budgets.

Debt management strategy & framework

12. Investors’ confidence in the quality, safety and integrity of the public debt management is the pre-condition for the development of the Government bonds market and credible debt management strategy (DMS) is one of the factors that create this confidence. DMS, comprising of objectives, various benchmarks and portfolio indicators and yearly issuance plan (external and domestic funding, instruments, maturity structure, etc.) provides requisite information and transparency, certainty and enables market participants (investors) to chalk out their investment strategy in Government bonds market. Further, DMS, which ensure that both level and rate of growth in public debt is fundamentally sustainable over time and can be serviced under a wide range of scenarios while meeting cost and risk objectives, gives fillip to the confidence of the investors and, thereby, help in development of the Government bonds market. In essence, DMS revolves around three broad pillars viz., cost minimization, risk mitigation (e.g. roll-over risk, cash flows risk, etc.), and market development.

13. A well developed bond market will ensure a stable and sustainable source of financing for governments to meet their investment needs while preserving debt sustainability. On the other hand, a shallow domestic market is often the most important constraint limiting the access to local currency funding at long maturities and fixed interest rates. In India, DMS is reviewed on half-yearly basis in the joint Monitoring Group on Cash & Debt Management of the Government of India and the Reserve Bank of India and it is disseminated to public through release of half yearly indicative calendar for issuances of Central Government dated securities. This half yearly calendar provides comprehensive information on issuance strategy, viz. date of auction, total amount, maturity bucket-wise amount, nature of instruments (floating or/and fixed instruments). Further, a week prior to the auction, individual securities along with their issuance size is notified to the public. This strategy of sharing information about debt management has enhanced transparency of debt management operations and greatly helped the development of the Government bonds market. The formulation of the DMS should follow some intuitive guidelines, especially in order to improve depth and breadth of the government bonds market and these guidelines should favor cost minimization over medium term subject to prudent degree of risk, achieving a stable mix of borrowings in domestic and foreign currency, issuance of variety of instruments (fixed rate bonds, floating rate bonds, inflation indexed bonds, bonds with call and put options, etc.) to cater to investors’ interest, buyback and switching operations of the issuers, etc.

14. The cost minimization attempted over short-term by the debt managers may create sub-optimal debt structures, which may create stress for issuer as well as market during uncertain and volatile times and thereby hamper the sustainable development of the bonds market. Otherwise also, exploiting the evolving market conditions in an effort to minimize the cost over the short-term could distort the shape of the yield curve and create demand for bonds only at certain points. Hence, DMS pursuing cost minimization over medium-term and issuing bonds across the maturity points is considered to be a better option for the development of the bonds market. DMS in India has stressed on elongation of maturity whenever possible and, in turn, cost minimization over the medium term (Table 2).

Table 2: Central Government Market Borrowing through Dated Securities |

Year |

Borrowings |

Outstanding Stocks |

Weighted

average

maturity

(Years) |

Weighted average

yield

(%) |

Weighted

average

maturity

(Years) |

Weighted

average

coupon

(%) |

2001-02 |

14.30 |

9.44 |

8.20 |

10.84 |

2002-03 |

13.80 |

7.34 |

8.90 |

10.44 |

2003-04 |

14.94 |

5.71 |

9.78 |

9.30 |

2004-05 |

14.13 |

6.11 |

9.63 |

8.79 |

2005-06 |

16.90 |

7.34 |

9.92 |

8.75 |

2006-07 |

14.72 |

7.89 |

9.97 |

8.55 |

2007-08 |

14.90 |

8.12 |

10.59 |

8.50 |

2008-09 |

13.80 |

7.69 |

10.45 |

8.23 |

2009-10 |

11.16 |

7.23 |

9.82 |

7.89 |

2010-11 |

11.62 |

7.92 |

9.78 |

7.81 |

2011-12 |

12.66 |

8.52 |

9.60 |

7.88 |

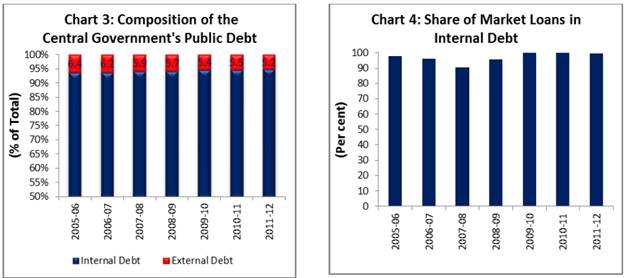

15. Next, achieving appropriate and stable mix of domestic –foreign currency debt in portfolio is essential. Raising debt in foreign currency could bring down interest costs and provide a wide and varied investor base. A country with largely foreign-currency denominated liabilities is, however, exposed to “sudden stops” of capital inflows and may not be able to accommodate balance of payment shocks. Moreover, cost of carry (interest rate parity) needs to be taken into account rather than interest rate, while deciding the extent of foreign funding. There could be increase in debt servicing costs on foreign currency which could create macro economic imbalances. DMS needs to factor these risks. Sizeable share of funding in domestic currency is necessary to ensure ample supply of Government bonds in the domestic bonds market which is a very critical ingredient for development of the domestic bonds market. Incidentally, funding fiscal deficit through external debt has been very low in India and external debt as percentage of Central Government’s public debt has come down from 6.4 per cent in 2005-06 to 5.2 per cent during 2011-12 (Chart 3). The external debt in Indian context is entirely bilateral and multilateral loans. In Internal debt, large share is raised through market loans which constituted almost entire internal debt of the Central Government (Chart 4) and all the market loans have been raised from the domestic bond markets. This demonstrates that Government bond markets have become instrumental for funding a large part of the Central Government fiscal deficit over the last few years and, in turn, this large dependence on the domestic bonds markets helped in further improving the breadth and width of the later.

16. DMS involving issuance of variety of instruments of varying maturities add to the diversity of the Government bonds markets as well as expand the investors’ base. For example, some investors (banks and financial institutions) like to invest in floating rate bonds (FRBs) for their duration management. Similarly, institutional investors, such as, insurance companies, provident funds, pension funds, etc. would prefer to buy zero coupon bonds and inflation indexed bonds (IIBs) for their liability management. Governments in most of the advanced countries and emerging market economies (EMEs) have issued a significant portion of domestic bonds through instruments other than conventional fixed rate bonds (Table 3).

Table 3: Composition of Domestic Bonds issued by Central Government in 2011: Cross Country |

(as percentage of outstanding) |

Country |

Floating Rate |

Fixed Rate |

Inflation Indexed |

Exchange Rate linked |

Others |

Argentina |

14.8 |

0.8 |

49.2 |

34.6 |

0.7 |

Brazil |

31.9 |

37.5 |

30.0 |

0.6 |

0.0 |

Chile |

0.0 |

19.2 |

80.8 |

0.0 |

0.0 |

India |

2.4 |

97.6 |

0.0 |

0.0 |

0.0 |

Indonesia |

22.2 |

77.8 |

0.0 |

0.0 |

0.0 |

Canada |

0.0 |

92.5 |

7.5 |

0.0 |

0.0 |

Germany |

10.9 |

85.8 |

2.9 |

0.4 |

0.0 |

United Kingdom |

0.0 |

77.6 |

22.4 |

0.0 |

0.0 |

United States |

0.0 |

91.2 |

8.8 |

0.0 |

0.0 |

| Source: Bank for International Settlement (BIS) |

17. In India, although funds for the Central Government have been raised through issuing variety of instruments (such as, fixed rate conventional bonds, FRBs, Zero Coupon Bonds, CIBs), the contribution of linkers (FRBs, IIBs, etc.) has remained small except for the year 2003-04 and 2004-05 (Chart 5).Therefore, DMS for India also needs to increase the share of linkers in gross issuance of dated securities to further improve the breadth and width of the Government bonds market. Towards this end, new version of the IIBs, on the pattern of Canadian model, has been designed and it is expected to be launched in the near future.

Chart 5: Composition of Central Governments' market borrowings through dated Securities

18. A policy of passive consolidation through reissuance/ re-openings is being followed to improve liquidity and to facilitate consolidation of debt. The larger stock size of securities has significantly improved market liquidity and helped the emergence of benchmark securities in the market. Active consolidation has not been resorted to (except a few buy-backs) in view of fiscal considerations. However, to promote liquidity, process of active consolidation consisting of issuance of securities at various maturity points in conjunction with further steps like buyback and switches is needed.

Market determined pricing

19. For market development, it is crucial that the interest rate on government bonds be market-determined. If the government attempts to manipulate the bond market to reduce the cost of government borrowing, important information will be lost which may lead to distortions in the allocation of capital. In India, The RBI had undertaken a phased programme of reforms to make a transition to market determined interest rates based on auctions. This has significantly improved price discovery process.

Benchmark yield curve

20. The absence of a risk-free term structure of interest rates makes it difficult to price credit risk of instruments issued by the private sector and other issuers. Inefficiencies caused by mispricing credit risk result in distortions in the economy. Without a government bond market that establishes benchmark risk free rates at critical maturities, it will be very difficult to establish a corporate bond market, much less a market for high yield debt or securitized assets. If the government’s objective is to nurture a robust bond market, then it should aim at establishing a benchmark yield curve that can serve as the risk-free rate for the pricing of other securities. This means committing to a programme of regular issues at the appropriate maturities. Over the last two decades, sustained budget deficits have necessitated large issuance of government securities in India. The increasing share of market borrowings in financing fiscal deficits of the Central government, from 21 per cent in 1991-92 to nearly 100 per cent in 2011-12 ensured steady supply of securities to the market. The issuance volumes have increased, thereby attaining critical mass to enable robust trading. Taking advantage of this, we were able to develop a reasonably deep and liquid government securities market. We could extend the risk-free yield curve up to thirty years with regular auctions of securities. The bench mark is being used by other markets for pricing and valuation purposes The Indian yield curve today compares well with peers in emerging economies as well as the developed world.

Institutional arrangements for debt management

21. Institutional arrangements for sovereign debt management play an important role in the debt market. With regard to the location of sovereign debt management functions, multiplicity of arrangements exists around the world: in the ministry of finance, central bank or autonomous debt management agency. Cross country experience shows that there is no international best practice and the adoption of any particular model could depend on country specific circumstances.

22. In the nineties, several OECD countries entrusted debt management to separate agencies with the objective of providing monetary policy independence to central banks in order to enable them to concentrate on inflation management. It was also perceived that independent DMOs would improve operations of debt management through improved accountability and professional debt management. The Reserve Bank of India (RBI) has been entrusted with public debt management by statute, especially debt denominated in the domestic currency. In line with the global trends in early years of this century, the Government of India has announced that a separate debt management agency would be statutorily created to take over debt management from the Central Bank.

23. There is a strong view that the issue of separation of debt management from Central Bank needs to be revisited, especially in the wake of global financial crisis and taking into account the Indian context. In India, the Fiscal Responsibility and Budget Management (FRBM) Act 2003, which has precluded RBI from participating in the primary auction of the Government bonds, has resolved the perceived conflict of interest with the monetary policy. Further, monetary signaling in India is currently done by the repo rate (i.e. the policy rate) under the Liquidity Adjustment Facility (LAF) and not through the bond yields which are market driven. In India, the Reserve Bank of India has recognized the paramount importance of inflation management and has taken all the steps necessary in this regard. The Reserve Bank of India has increased policy rate on several occasions in the past couple of years in spite of substantial increase in government’s market borrowings. In spite of heightened uncertainty and volatility in financial markets, the Reserve Bank was able to complete the significantly increased size of the Government’s borrowing programme in a non-disruptive manner during the recent global financial crisis period.

24. Debt management is much more than a mere resource raising exercise especially in a developing country context like ours. The size and dynamics of government market borrowing has a much wider influence on interest rate movements, systemic liquidity and credit growth through crowding out and an autonomous DMO, driven by specific objectives exclusively focusing on debt management alone, may not be able to manage this complex task involving various trade-offs. Internationally, the experience of coordination mechanisms between DMO and central bank, which are vital for economic management, are far from satisfactory and impacted debt management. There has been instances of failed auctions, e.g., in UK (March 2009), causing reputation risk for both the authorities. Mandatory policy coordination by way of statute may not be operationally effective as management of debt and money/liquidity requires seamless, continuous and ongoing coordination. In the above backdrop, particularly given the large size of the market borrowings in India due to persistence of high fiscal deficit, there is infact a confluence of interest between monetary policy and debt management in India. Internationally, there is rethinking on the issue of debt management by central banks, with scholars like Charles Goodhart articulating that debt management being a critical element in the overall conduct of macroeconomic policy, central banks should be encouraged to revert to their role of managing the national debt. There is, thus, a compelling need for wider debate on this issue of governance structure for public debt management, particularly in countries with high fiscal deficit instead of unbridled faith in the pre-crisis theology of “independent” debt management office (DMO).

Fiscal prudence

25. Fiscal prudence is a virtue that needs to be cultivated for effectively managing public finances. It is also an attribute that facilitates state to borrow at reasonable cost. Recent experiences of some Euro zone sovereigns underscore this fact. In India, the importance of fiscal consolidation is recognized and legally enshrined in FRBM legislation. Though there have been slippages with regard to targets in wake of global financial crisis and its aftermath, the Government has reaffirmed its commitment to fiscal consolidation. The medium-term fiscal policy statement of the Central Government has given the rolling targets for fiscal consolidation (Table 4).

Table 4: Rolling Targets for Fiscal Indicators of the Central Government |

(percentage of GDP) |

Indicator |

2012-13

(BE*) |

2013-14

(Target) |

2014-15

(Target) |

Revenue Deficit |

3.4 |

2.8 |

2.0 |

Fiscal Deficit |

5.1 |

4.5 |

3.9 |

Gross Tax Revenue |

10.6 |

11.1 |

11.7 |

Outstanding Liabilities |

45.5 |

44.0 |

41.9 |

*BE: Budget Estimates

Source: Union Budget 2012-13. |

26. The state as an issuer must be sensitive to the requirements of the other sectors of the economy while raising resources from the matter. Due to its status as issuer with highest credit quality and ability to find captive investors, there is always a possibility of crowding out private investment. In, India; the government’s issuance is planned in a manner so as to take care of the credit needs of the private sector. This is, for example, achieved by frontloading the borrowing in first half of the fiscal year when credit demand from private sector is lower.

Provider of high quality collateral

27. State, through its issue of debt securities, provides safe and liquid assets which, from the perspective of conservative investors, act as a store of value or type of insurance during financial distress. For institutions like banks, these safe assets are useful for asset-liability management and as collateral to raise resources for funding need. This function of debt securities is also essential for development of debt markets.

Developer of debt market

28. In an emerging market economy like India, market development also needs to be consistent with the objective of maintaining financial stability. The prerequisites for establishing an efficient debt market include sound fiscal and monetary policies, effective legal and tax systems, and a vibrant financial system with competing intermediaries and adequate infrastructure. Against the above backdrop, the development process of bonds market has to take into account the legal structure, institutional framework, and market infrastructure.

Legal framework

29. The legal framework is one of the major or one could say, the most important prerequisite for orderly development of debt markets. In fact, putting in place the legal framework for empowering government to borrow, role of central bank as agent for the government, the debt management framework for enforcement of creditor's rights, enforcement of contracts, rules governing issuance of government securities, and rules pertaining to the secondary market, creation of appropriate regulatory framework for debt securities is essential for bonds markets. In case of India, a well developed bouquet of laws such as RBI Act, Law of Contract, Securities Contracts (Regulation) (SCRA) Act, Government Securities (GS) Act, Payment and Settlement Systems Act, Depositories Act, etc. define the legal framework for debt markets. The RBI Act has made it incumbent upon RBI to manage the public debt and also on Government to entrust public debt management to RBI. SCRA Act governs all the contracts (transactions) in securities including Government securities. The GS Act applies to Government securities created and issued, whether before or after the commencement of the Act, by the Central or a State Government. This Act is aimed at facilitating widening and deepening of the Government securities market and its more effective regulation by the Reserve Bank in various ways.

Institutional framework

30. Institutional framework includes building up of various institutions viz., regulator, primary dealers and market makers, central counter parties (CCPs), etc. The primary dealers (PDs)’ network is paramount for the development of the primary segment of the Government bonds markets wherein Government issues the bonds to finance its gross fiscal deficit (GFD). The PDs are financial intermediaries, which agree to perform certain obligations or responsibilities in the Government bonds market subject to availability of some privileges (such as payment of underwriting commission, availability of liquidity from the Central Bank, etc.). PDs also perform the role of market maker in Government bonds market, which is essential part of the chain for development of any financial market as they provide liquidity through giving quotes for both buy and sell of the financial assets. Against the above backdrop, PDs’ role in the Government bonds market could be categorized as (i) a financial intermediary between debt manager and investors in the primary market through participating in the auction; (ii) to provide liquidity both in primary and secondary markets; (iii) to provide market making services by willing to hold inventories of Government bonds; (iv) to promote efficient price discovery through aggressively participating both in primary and secondary market; and (v) to create awareness and educate investors about Government bonds. Most of the advanced countries have primary dealers network, though the model varies from country to country.

31. In India, PDs network was set up in 1996 with the objectives of supporting the market borrowing programme of the Government, strengthening the securities market infrastructure and improving the secondary market liquidity in government securities. Thus, PDs, besides discharging the role of financial intermediary and market maker, have to compulsorily underwrite the Central Government’ bond issuances in the primary market. Presently, we have 21 PDs, out of which 8 are companies (called stand alone PDs) and 13 are commercial banks. To discharge their obligations effectively, PDs have been given privileges in terms of provision of current account and SGL facilities with the Reserve Bank. They also have access to the liquidity adjustment facility (LAF) of the Reserve Bank. In order to ensure that primary dealers bid aggressively and to discourage defensive bidding, the stipulation of a success ratio of 40 per cent of bidding commitments is mandated. The PD system was revamped to ensure a more dynamic and active participation of PDs in view of the provisions of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 whereby the Reserve Bank was prohibited from participating in the primary market effective April 1, 2006. A new incentive structure in the underwriting auctions has been put in place to ensure 100 per cent underwriting and to elicit competitive bidding from PDs.

Market infrastructure

32. Establishing infrastructure to facilitate clearing and settlement of Government securities and corporate bonds including central depository and a safe and sound payment system is an important pre-requisite. The market infrastructure essential for development of the bonds market, inter alia, include trading/ auction platform, payments and settlement system, and depository. As these facilities require huge investments, state plays a ‘trail blazer’ role in establishing the same. Trading platform could be in the form of over-the-counter (OTC) or exchange. To improve the facilities for trading and settlement in the Government securities market, an electronic Order Matching trading module for Government securities has been provided by Reserve Bank of India on its Negotiated Dealing System (NDS-OM). The platform is an anonymous order matching system with straight-through processing (STP) ensuring participant anonymity, price transparency and transaction efficiency. This facility has enhanced trading volumes. In order to improve retail participation, web-based platform both for primary and secondary markets have launched recently and trade volume on secondary market web-based platform has been significant.

33. A fast, transparent and efficient clearing and settlement system constitutes the basic foundation of a well-developed Government bonds market, while depository enables holding of in dematerialized form catalyzing the payments and settlement process. In India, CCIL was established with regulator’s initiative to act as the clearing house and as a central counterparty through novation for transactions in government bonds. The establishment of CCIL has ensured guaranteed settlement of trades in government securities, thereby imparting considerable stability to the markets. Through the multilateral netting arrangement, this mechanism has reduced funding requirements from gross to net basis, thereby reducing liquidity risk and greatly mitigating counterparty credit risk. All transactions in government securities concluded or reported on NDS as well as transactions on the NDS-OM have to be necessarily settled through the CCIL.

34. Recognizing the importance of the financial market infrastructure and our commitment to adhere to the international best practice, we endeavor to benchmark our institutions and practices. The CCP in India has been evaluated for governance and risk management by domestic and international auditors. Further, FSAP has also evaluated the CCP and found the system to be robust. In this regard, it is pertinent to note that CPSS-IOSCO has published the "Principles for Financial Market Infrastructures" (PFMI) in April 2012 which updated and reviewed the earlier principles covering (i) core principles for systemically important payment systems, (ii) recommendations for the securities settlement systems and (iii) recommendations for the central counterparties, and laid emphasis on credit risk and liquidity risk management. In view of the critical nature of PFMI, it is essential to do a SWOT analysis of the FMI risk management, rule and regulations. We have asked the CCP to undertake self assessment of compliance of the “Principles for Financial Market Infrastructures" (PFMI) finalized by CPSS-IOSCO in April 2012. The self assessment is being evaluated by us. It is essential that periodic assessments may be conducted in view of importance of these institutions for systemic stability.

35. In India, the central bank acts as registrar and depository of government securities. Dematerialized holding of government securities in the form of Subsidiary General Ledger (SGL) was introduced to enable holding of securities in an electronic book entry form by participants. The Delivery versus Payments (DvP) system in India was operationalised in 1995 to synchronise transfer of securities with cash payments, thereby eliminating settlement risk in securities transactions. The DvP system, which was initially on the basis of gross settlement for both securities and funds (DvP–I method), shifted to DvP-II method where settlement for securities was on a gross basis but settlement of funds was on a net basis. Both funds and securities are settled on a net basis (DvP-III method) since 2004. Each security is deliverable/ receivable on a net basis for a particular settlement cycle and securities are netted separately for SGL and CSGL transactions. Netting of funds is done on a multilateral basis.

Other financial products

36. Although all the institutions have critical role to play in the development of the bond market, regulator has got unique responsibility of regulation as well as introduction of various interest rate products which are catalyst for improving liquidity and depth the bonds market. New instruments like Floating Rate Bonds (FRBs), Cash Management Bills (CMB) and Separate Trading of Registered Interest and Principal of Securities (STRIPs) have been introduced in the debt market to provide investors choice to manage their portfolios. In India, Reserve Bank of India, the Central Bank regulates the fixed interest rate markets including Government bonds market and it has enabled introduction of interest rate products viz., interest rate swaps (IRS), and interest rate futures (IRF) which gave fillip to the development of the underlying Government bonds market.

37. The corporate bonds market in India has made some progress in the recent past but activities as compared to the Government bonds markets continue to be benign. However, the government, RBI and the securities market regulator (Securities Exchange Board of India) have taken several measures to improve the activities in the corporate bonds markets. These measures, inter alia, included launching reporting platform for post-trade transparency; DvP in settlement of OTC trades to eliminate settlement risk; transitory pooling of accounts for settlement of corporate bonds in the books of the Reserve Bank of India allowing repo in corporate bonds to provide avenue for funding; introduction of Credit Default Swaps to facilitate hedging of credit risk by the holders of corporate bonds; and increasing limit of foreign institutional investors (FIIs) to USD 25 billion. As a consequence of these measures, net issuance of corporate bonds amounted to Rs. 1,621 billion during 2011-12, raising the outstanding corporate bonds to Rs. 10,516 billion on end-March 2012. The secondary market trading volumes in the corporate bonds market increased from Rs. 959 billion in 2007-08 to Rs. 5,938 billion during 2011-12.

Market access

38. There is merit in the fact that improved access to debt markets will facilitate financial inclusion. For the issuer, it provides opportunity to tap a wider investor base and for investors, it would provide additional avenues of investment. Notwithstanding the predominantly institutional character of the G-Sec market, Reserve Bank of India has recognized merit in promoting retail participation and has initiated certain policy measures such as “Scheme of Non-competitive Bidding” for participation in auctions, improving access to the market for mid-segment investors by permitting well-managed and financially sound Urban Cooperative Banks (UCBs) to become members of NDS-OM and revision of authorization guidelines for the Primary Dealers (PDs) mandating achievement of minimum retailing targets. To ease the process of investment by retail/mid-segment investors, a web-enabled platform which would seamlessly integrate their funds and securities accounts has also been provided.

Enhancing liquidity

39. Liquidity in debt markets is essential as it offers the comfort to the investors in terms of ease of transaction, helps issuers as liquidity makes financial instruments attractive investments and is also critical for the effectiveness of the monetary policy transmission. The state can improve liquidity by accessing the market regularly, building up volumes in benchmark issuances and pursuing an active buy-back programme. The market liquidity is also impacted by the risk preferences of the market participants, their ability to run short positions and the development of funding markets (such as repo markets) allowing them to take positions in the debt markets.

40. The Reserve Bank had recently constituted a Working Group on “Enhancing Liquidity in G-Sec and Interest Rate Derivatives Market” (Chairman: R. Gandhi). The major recommendations made by the Group, which submitted its report recently, with regard to improving liquidity in G-Sec are:

-

To consolidate the outstanding G-sec, for which a framework may be prepared for the next 3-4 years, beginning with the issuance of securities at various maturity points in conjunction with steps like issuance of benchmark securities over a longer term horizon, buybacks and switches, etc;

-

To come up with a roadmap to gradually bring down the upper-limit on the Held to Maturity (HTM) portfolio. While doing so, the possible impact of reduction in the limit on HTM classification on the balance sheet of banks/PDs and any measure aimed to address this issue should be calibrated appropriately to make it non-disruptive to the entities and other stakeholders;

-

To enable market making, allocation of specific securities to each PD and if required, rotation of the stock of securities among the PDs, by turn, at periodic intervals may be considered;

-

To encourage alternate investors, investment limit for FIIs in g-sec may be increased in gradual steps. The increase in the investment limit can be reviewed on a yearly basis keeping in view the country’s overall external debt position, current account deficit, size of GoI borrowing programme, etc. Measures to simplify access for investors like trusts, corporates etc. to the g-sec market may be examined and long-term gilt funds may be encouraged through appropriate incentives (like tax-breaks, liquidity support, etc.);

-

To improve repo markets, the restrictions on selling/repo of securities acquired under market repo may be reviewed to promote the term-repo market with suitable restrictions on ‘leverage’ and consider introducing an appropriate tripartite repo in g-sec.

Related markets

41. Debt market development is also dependent on development of related markets viz. money markets, repo markets and derivatives markets as these markets provide funding avenues and risk management tools. Reserve Bank made conscious efforts to develop an efficient, stable and liquid money market by creating a favourable policy environment through appropriate institutional changes, instruments, technologies and market practices. Call money market was developed into primarily an inter-bank market, and other market participants were encouraged to migrate towards collateralized segments of the market, thereby increasing overall market integrity. Necessary market infrastructure in form of safe trading and settlement system was developed. These measures enhanced the efficacy of funding markets and in turn improved trading in debt markets.

Widening the investor base

42. The countries that aim to widen investor-base and promote debt market liquidity look to encourage foreign investors’ participation in domestic securities markets. FIIs, by being global players, can provide much needed diversity of views in the market. However, the uncertainty and volatility attached to these investments, as seen in different countries during various crisis leads to concerns on capital flows. Accordingly, in India, FII investment in debt securities is restricted (subject to an overall cap) and the same is reviewed from time to time. The policy is oriented towards providing calibrated access keeping in view the potential benefits as well as possible effects of sudden exit of investors on capital flow and on market volatility.

Regulator of debt markets

43. The role of the regulator in is to address systemic stability issues and also support market development through regulation and supervision. Asymmetries in information (and also expertise, resources and power) between market participants, and the externalities stemming from the failure of financial agents to live up to their contractual obligations create a need for public regulation and supervision of markets and financial institutions. The issue of information asymmetry can be addressed through stipulating accounting and disclosure standards as well as regulatory reporting system. Emphasis of regulatory intervention lies in correcting market failures and dealing with externalities and distortions that prevent financial markets from developing. The key tasks for the regulator are development of an early warning system to detect systemic weakness and creation of a robust regulatory/supervisory framework. While it is desirable to allow market participants to trade and express their views, it is imperative to remain focused on financial stability needs.

44. In India, the Reserve Bank of India, as regulator of government bond market, has followed a calibrated approach. Leverage in repo markets is managed by not allowing resale of repoed security by the lender of funds. Intraday short selling in G-Sec, which was permitted in 2006, was extended to five days in 2007 and upto three months in 2011. Activity in short selling is restricted to banks and PDs. Further, participant-level quantitative limits have also been prescribed on the amounts that can be short sold to obviate risk of ‘squeeze’ in the securities and to cap the overall risk in the market. Short-sale positions are reported and monitored to ensure that the risk is limited. The Reserve Bank follows a dynamic approach to regulation and review the limits based on the development of the markets and risk management capabilities of the market participants.

45. There is a need to ensure that disclosure standards embody the right incentives for all concerned and there is coordinated adoption of such standards. For instance, Reserve Bank of India has amended the repo accounting guidelines to reflect economic essence of the transaction, i.e., borrowing and lending of funds and avoid pitfalls like ‘Repo 105’ of Lehman Brothers.

46. The rationale for the regulatory framework for debt market is to have oversight over the securities markets and its professional participants so as to promote public confidence in securities and debt markets, provide basic investor protection (protect investors from fraud and manipulation) essential for creation of fair, efficient and orderly markets, protect the stability of the financial system by preventing failures in the market. The focus needs to be on market integrity and transparency. The need of the hour therefore is “right” regulation and not “less” or “more” regulation. In the context of recent developments following the global financial crisis, it is imperative that the regulator strikes a balance between financial innovation and systemic stability. Complex financial products need to be evaluated in relation to their usefulness to sustainable market development. For example, in Indian context, the innovation in government bond trading through a screen-based anonymous order matching system (NDS-OM) has been dovetailed under a Straight Through Process (STP) to the CCP (i.e. the Clearing Corporation of India Ltd) for mandated guaranteed settlement.

47. Reserve Bank has enabled a regulatory reporting structure which enhances transparency and improves disclosure. Nearly all the transactions in debt and derivatives in fixed income markets and money markets are reported. The market participants are regulated entities and this imposes market discipline. It has entrusted the market body, the Fixed Income Money Market and Derivatives Association of India (FIMMDA), with quasi-SRO responsibilities relating to formulation of model code of conduct for market participants, accreditation of brokers in the OTC interest rate derivatives market and also in arbitration between the market participants.

Concluding remarks

48. Importance of debt markets to the economy and the critical role state, meaning both the government and the central bank, plays in developing these markets are now well appreciated. In its three roles: as issuer, developer and regulator, state could influence the trajectory of progress of the debt markets. Investors’ confidence in the quality, safety and integrity of the public debt management is the pre-condition for the development of the Government bonds market and credible DMS is one of the important factors that create this confidence. DMS, however, should follow some intuitive guidelines, especially in order to improve depth and breadth of the government bonds market and these guidelines should favour cost minimization over medium term subject to prudent degree of risk, a stable mix of borrowings in domestic and foreign currency, issuance of variety of instruments (fixed rate bonds, floating rate bonds, inflation indexed bonds, bonds with call and put options, etc.) to cater to investors’ interest and active consolidation of outstanding securities through buybacks and switching operations for enhancing liquidity in the market. Benchmark yield curve which serves as the risk-free rate for the pricing of other securities needs to be developed. For developing a credible yield curve, a programme of regular issues at the appropriate maturities needs to be devised.

49. Institutional arrangements for sovereign debt management play an important role in the debt market. Cross country experience in this regard shows that there is no international best practice and the adoption of any particular model could depend on country specific circumstances. Debt management is much more than a mere resource raising exercise, especially in a developing or emerging country. As the size and dynamics of government market borrowing has a much wider influence financial markets, an autonomous DMO, driven by narrow mandate of exclusive focus on cost effective debt management alone, may not be able to manage this complex task. Given the large size of the market borrowings in many countries, there may be a confluence of interest between monetary policy and debt management, as is the case in India.

50. The prerequisites for a developed and efficient debt market would include effective legal and tax systems, institutional framework and a free & fair financial system with competing intermediaries and adequate infrastructure. Legal framework for empowering government to borrow, the debt management framework for enforcement of creditor's rights, rules governing issuance of government securities and secondary market trading are essential for safe and sound bond markets. Institutional framework would include building up of various institutions viz., regulator, primary dealers (PDs) and other market makers, central counter parties (CCPs), etc. Establishing efficient and safe market infrastructure to facilitate issuance and trading of government securities, clearing and settlement of Government securities and corporate bonds including central depository is equally critical for development of the bonds market.

51. State as the regulator has to address systemic stability issues and also support market development through regulation and supervision. Regulation needs to focus on correcting market failures and dealing with externalities and distortions that prevent financial markets from developing by striking a balance between financial innovation and systemic stability. The regulator’s role assumes importance in developing an early warning system to detect any weakness in financial system and creation of a robust regulatory/supervisory framework to deal with such weaknesses.

52. I hope the above exposition primarily based on Indian experience on role of state in developing debt market, particularly the government bond market, would provide some useful learning points for emerging countries like Qatar. I once again thank the Qatar Central Bank and the International Monetary Fund for giving me this opportunity of sharing our experience with such a distinguished audience.

Thank you.

|