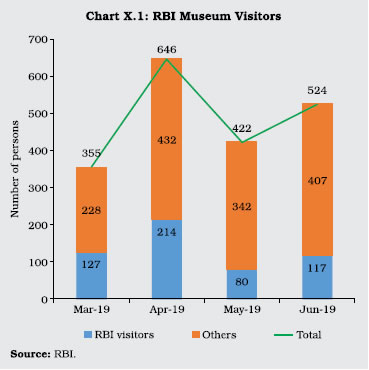

The Reserve Bank strengthened its communication channels, improved research, statistics and information management and deepened international relations during the year. Efforts were also made for effective cash management on behalf of state governments and the management of foreign exchange reserves. Legislative initiatives/amendments, were also pursued during the year to fortify the legal framework for a sound and efficient financial sector in the economy. X.1 This chapter discusses the implementation status of the annual agenda of 2018-19 and other important developments in the areas of research, statistics, communication, international relations, banking services, forex reserves management, and the legal infrastructure for the financial system. It also outlines the agenda set for 2019-20 in these functional areas. Section 2 presents major initiatives of the Reserve Bank with regard to its communication strategy and processes. Section 3 covers the activities of the Strategic Research Unit. Section 4 discusses the Reserve Bank’s international relations, including with international organisations and multilateral bodies. Section 5 dwells on the activities of the Reserve Bank as the banker to governments and banks. Section 6 reviews the conduct of foreign exchange reserves management with focus on safety, liquidity and returns. Section 7 sets out research activities of the Reserve Bank, including statutory reports and frontline research publications. Section 8 profiles the activities of the Department of Statistics and Information Management. Section 9 presents the activities of the Legal Department. 2. COMMUNICATION PROCESSES X.2 The Reserve Bank’s Department of Communication (DoC) strengthened two-way communication with the public, anchored by transparency, timeliness and credibility. These strategic objectives guided the dissemination of policy developments/initiatives and their rationale through multiple tools and channels as well as tried to obtain continuous feedback on the policies and initiatives. Agenda for 2018-19: Implementation Status The Website X.3 In its continuous endeavour to make the Reserve Bank’s website (www.rbi.org.in) user-friendly, the search functionality on the website was strengthened to facilitate user access. Areas about research on the website were streamlined and placed in a single ‘Research’ tab. Mail box clarification services were also rationalised. Up to June 30, 2019, the Reserve Bank’s app available for Android and iOS platforms enabled 190,580 downloads on the Play Store and 19,550 downloads on the App Store. The Reserve Bank’s Twitter account had 430,000 followers and its YouTube channel had 30,000 subscribers by that date. Monetary Policy Communication X.4 Under the new monetary policy framework introduced in October 2016, the Reserve Bank communicated the bi-monthly resolutions of the monetary policy committee (MPC) through a press release, followed by a press conference which was disseminated through YouTube as well as by live streaming on the Reserve Bank’s website and business television channels. During the year, three press conferences were also broadcast live on Twitter. Teleconferences with researchers and analysts are also conducted on the day of the policy announcement, with audio recording feeds and transcripts uploaded on the Reserve Bank’s website. The minutes of MPC meetings are uploaded on the website on the 14th day after every meeting of the MPC, in pursuance of Section 45ZL of the RBI Act, 1934. Mint Street Memos (MSMs) X.5 MSMs initiated on August 11, 2017 are in the form of brief reports and analyses on contemporary and relevant topics for public consumption. Twelve MSMs were published on the website by June 2018. In the current year, since July 2018 seven MSMs were published (till June 2019). Workshops for Regional Media X.6 During the year, the DoC conducted four workshops at Ahmedabad, Kolkata, Ranchi and Bhopal as a part of its awareness programme for regional media across the country. Structured in the form of interactive sessions on central banking functions, the range of topics covered in the workshops included monetary policy, regulation and supervision of banks, customer education and protection, currency management, payment and settlement systems, structure of the Reserve Bank’s website, the data warehouse of the Reserve Bank called ‘Database on Indian Economy (DBIE)’, foreign exchange management, press releases and media relations, and local issues of relevance. Public Awareness Campaign X.7 During 2018-19, the Reserve Bank undertook a multi-media multilingual public awareness initiative called RBI Kehta Hai to educate the public about banking regulations and practices (Box X.1). The RBI Museum X.8 The RBI Museum located at 6, Council House Street, Kolkata was opened to the public on March 11, 2019. It evinced considerable public interest as was evident from the steady flow of visitors (Chart X.1). The museum1 is replete with fascinating stories of money, gold and the genesis of the Reserve Bank, succinctly told through artefacts and interactive exhibits. The mezzanine floor of the museum houses an interactive gaming zone, which purveys financial learning messages to the younger visitors through simple games, like ‘snakes and ladders’ and ‘carrom’. Box X.1

Public Awareness Campaign The public awareness campaign of the Reserve Bank started in 2017 and gathered steam in 2018. Advertisements on Basic Savings Bank Deposit Account (BSBDA), Safe Digital Banking, Limited Liability and Ease of Banking for Senior Citizens were released in popular events such as the Indian Premier League (IPL), the 2018 FIFA World Cup, Asian Games, Kaun Banega Crorepati (KBC), Pro Kabbadi League, Pro Badminton League and India-New Zealand One Day International. A film on BSBDAs explains how opening of this account obviates the requirement of minimum balance. A film on Safe Digital Banking cautions the public about sharing card and PIN details while carrying out digital transactions. Another film on Limited Liability explains the recourse available in the event of card fraud. A film on ‘Ease of Banking for Senior Citizens’ elucidates facilities like doorstep banking available for senior citizens. These films, using cricketers and badminton players, who are employees of the Reserve Bank, were widely disseminated in media advertisements. A unique feature of the public awareness campaign is the missed call element: upon giving a missed call to the number 14440, the caller will receive information through a pre-recorded Interactive Voice Response System (IVRS), avoiding the miscommunication or over-communication of a call centre approach. In the non-Hindi speaking regions, mobile phone subscribers receive messages in English and regional languages (Table 1). | Table 1: The Campaign Reach (SMSs sent during the year) | | (in million) | | Details | SMS 1 (June 14 to July 9, 2018) | SMS 2 (August 1 to August 18, 2018) | SMS 3 (August 30 to September 13, 2018) | Ease of Banking for Senior Citizens (February 17 to March 19, 2019) | SMS 4: Banking Ombudsman Scheme (June 10 to June 28, 2019) | Total | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Total Messages Sent | 553.57 | 575.50 | 606 | - | 682.31 | 2,417.38 | | Total Messages Delivered | 408.79 | 420.84 | 425.66 | - | 412.63 | 1,667.92 | | Total Missed Calls Received | 5.22 | 3.31 | 2.58 | 0.25 | 2.71 | 14.07 | | Total Successful Call Backs | 3.69 | 2.32 | 1.79 | 0.15 | 1.14 | 9.09 | - : No SMS was sent

Note: 1. SMS 1: Fraudulent transactions in your bank account? Limit your loss. Notify your bank immediately. For more details, give a missed call to 14440.

2. SMS 2: Banking electronically? Register yourself for SMS/email alerts and immediately inform your bank in case of any fraud. To know more, give a missed call on 14440.

3. SMS 3: Online Banking? Only use sites with https; avoid banking on free networks; regularly change and do not share password/PIN. For more, give missed call on 14440.

4. SMS 4: Complaint for deficiency in service by bank unresolved for a month? Visit Banking Ombudsman/ bankingombudsman@rbi.org.in for help. Give a miss call to 14440.

Source: RBI. | |

Agenda for 2019-20 X.9 The DoC will continue to hold workshops for national and regional media on important regulatory and banking-related issues in regional centres not covered in the previous year, and in metropolitan centres like Mumbai and Delhi. The website will be made more informative and easy to navigate by modifying certain features and by adding new ones. X.10 The public awareness campaign is expected to grow further during 2019-20, using 360 degree mass media awareness programmes. Going forward, popular social media channels such as Twitter and Facebook will be used for two-way communication to ensure wider dissemination, lengthening of the life of each campaign and to engage with the youth. X.11 Town Hall events in which economic editors meet with the top management will be conducted during 2019-20. The Reserve Bank’s Communication Policy would also be revised during the course of the year. 3. STRATEGIC RESEARCH UNIT X.12 The Strategic Research Unit (SRU), which was set up in February 2016, is vested with the responsibility of conducting research across various verticals of the Reserve Bank. During the year, SRU studied key macroeconomic indicators, conducted research on various issues relevant to the Reserve Bank, and presented their findings to the top management. Researchers from this unit also made regular presentations of their research findings in national and international seminars and published in reputed journals. Agenda for 2018-19: Implementation Status X.13 SRU regularly presents a bi-monthly economic monitor in the Monetary Policy Strategy (MPS) meetings. This monitor covered a coincident economic indicator for India and provided inputs on financial markets and external sector. The Unit also initiated short-term research in various areas that was published as box items in the Reserve Bank’s Annual Report and MSMs. Some of the MSMs were, ‘The Impact of Crude Price Shock on India’s Current Account Deficit, Inflation and Fiscal Deficit’ and ‘What Drives Automobile Sales? It’s not Credit’. X.14 SRU also conducted several mid-term projects on issues related to the Union Budget, effect of minimum support price on inflation, external sector vulnerability, the effects of global headwinds on trade and foreign investments, price deficiency payment on crop prices, dynamics of asset accumulation of households, effect of inflation targeting on financial markets, GDP nowcasting, and tracking food price inflation using high frequency data. The findings of these research studies were presented to the top management. Some of these studies were also presented in national and international conferences. For example, ‘Farm Support and Market Distortions’ was presented at the Indian Statistical Institute’s Annual Conference in December 2018, and ‘Do Households Care about Cash?’ was presented at the ADB Seminar on Asia and Pacific Economies in Suzhou, China in June 2019. X.15 Researchers from this unit are constantly striving to publish their research in reputed academic journals. For instance, a paper titled, ‘Tax Policy and Food Security’ has been published in Macroeconomic Dynamics in 2019. Also, there are papers, such as ‘Cash and the Economy’ and ‘Divisia Monetary Models of Exchange Rate Determination’, which are under review in reputed journals. X.16 SRU has been coordinating with other departments/groups in undertaking research activities and its dissemination. During 2018-19, officers from SRU actively collaborated/ contributed in Inter-departmental Working Groups (IDWG) research relating to Basel III Implementation and Operational Risk Modelling. They were also involved with research relating to construction of a Financial Vulnerability Index for India. X.17 With an aim to deepen research capability, SRU organised a Research Orientation Program in August 2018, where researchers from SRU, along with external eminent academicians, presented their ongoing research. SRU is also organising a monthly seminar series from January 2019 wherein external academicians from reputed institutions are invited to present papers on topics relevant to the Reserve Bank. The topics covered so far relate to New Keynesian Model, Financial Networks, Plant Level Productivity, Credit Misallocation and Productivity Loss, etc. Feedback reports for all such seminars are also submitted to the top management for policy purposes. SRU has initiated an outreach program to disseminate relevant information about some of the recent research activities within the Reserve Bank. Under this, SRU officers visited a university during June 2019 and conducted a one-day workshop to interact with young students and researchers. In order to deepen research collaboration and promote in-house research, SRU had jointly organised a series of brown-bag seminars with CAFRAL. A few of the papers presented in the brown-bag series of 2018-19 were, ‘Household Finance in Developing Countries’, ‘Gains from Trade with Heterogeneous Agents under Financial Constraints’, and ‘Congestion and Commute Scheduling in a Monocentric City’. Agenda for 2019-20 X.18 In the year ahead, the SRU is expected to address policy research questions, continue to monitor macroeconomic developments, take deep dives into contemporary issues of importance, and provide relevant policy inputs. In terms of its long-term agenda, SRU intends to use state-of-the-art data-intensive policy research and disseminate research outcomes through internal and external presentations and publication in peer-reviewed international journals. 4. INTERNATIONAL RELATIONS X.19 During 2018-19, the Reserve Bank strengthened its international relations, especially with international organisations and multilateral bodies through its International Department (ID). It also engaged in several bilateral and multilateral dialogues, focusing on central bank cooperation and regional initiatives undertaken by the Reserve Bank. Agenda for 2018-19: Implementation Status G20 and its Working Groups X.20 Representing the Reserve Bank, the ID coordinated with the central government and participated in various G20 Working Groups such as the International Financial Architecture (IFA), the Framework Working Group (FWG) and the Infrastructure Working Group (IWG). It provided inputs on India’s position in the Finance Ministers and Central Bank Governors and the Deputies Meetings of the G20 under the Argentinian Presidency, culminating in the G20 Leaders Declaration in November 2018. The issues included the future of work, development of infrastructure as an asset class, risks related to crypto-assets, taxonomy of macroprudential measures (MPM), capital flow management (CFM) measures, digital economy, financial inclusion, and observations on the Report of G20 Eminent Persons Group (EPG) on Global Financial Governance. X.21 Under the Japanese Presidency of the G20 that followed, the department provided inputs on issues such as global current account imbalances, aging and its policy implications, quality infrastructure investment, market fragmentation, and financial innovation. The G20 Osaka Leaders’ Declaration welcomed India associating voluntarily with the Paris Club to cooperate in its work on a case-by-case basis. All the six Inter-Departmental Working Groups (IDWGs) on G20/FSB/BIS-related regulatory issues set up by the ID completed their reports during 2018-19. These related to (i) FinTech and Digital Innovations; (ii) Basel III implementation and finalisation of remaining elements of Basel III; (iii) Effects of Global Financial Regulatory Reforms; (iv) Resolution and Deposit Insurance Framework for Financial Firms; (v) Over-the-Counter (OTC) Derivative Reforms; and (vi) Institutionalising Macroeconomic Framework in India. The work of the IDWG on FinTech which followed the Report of the Working Group on FinTech and Digital Banking (Chairman: Shri Sudarshan Sen), 2017, also included a companion paper on ‘Draft Regulatory Framework on FinTech Regulatory Sandbox’. The Department of Banking Regulation of the Reserve Bank worked out the final, ‘Enabling Framework for Regulatory Sandbox’, and placed it in public domain in August 2019. In addition, the department had also set up an IDWG to examine issues related to foreign direct investment (FDI) in India, which has completed its work. International Financial Architecture Issues X.22 The department continued to work on the IFA issues relating to the IMF and the World Bank, including the IMF’s 2018 Article IV mission. With respect to the 15th General Review of Quotas (GRQ) of the IMF, requisite progress could not be made in the absence of necessary support in terms of voting shares needed as the US expressed the view at the IMF Spring 2019 meetings that they did not see a need for a quota increase. As for the architecture relating to capital flows, the OECD Codes have since been revised, particularly with respect to use of macro-prudential measures (MPMs). Bank for International Settlements (BIS) Meetings X.23 On taking over as RBI Governor, Shri Shaktikanta Das, accepted the offer of a position on the 18-member Board of the BIS. The BIS has 60 central banks as its members. The department provided analytical inputs for the Governors’ bi-monthly meetings of the BIS and other meetings such as those of the Committee on the Global Financial System (CGFS) on topics such as unconventional monetary policy, banknote counterfeiting risks and procurement issues, the future of Legal Entity Identifier (LEI), monitoring fast-paced electronic markets, and benefits and risks of emergence of BigTech. The department provided Indian perspectives on key risk factors and associated challenges for the Asia-Pacific region. It also coordinated the Reserve Bank’s contributions to surveys conducted by the BIS under the aegis of the Central Bank Governance Group (CBGG). The ID actively contributed to the CGFS’s second Working Group on ‘Establishing Viable Capital Markets’ (Co-chair: Dr. Viral V. Acharya) (Box X.2). Financial Stability Issues X.24 Deputy Governor, Shri N. S. Vishwanathan took over as a Co-chair of the Financial Stability Board (FSB) Regional Consultative Group (RCG) for Asia, mandated with exchanging views amongst financial authorities from FSB member and non-member countries on vulnerabilities affecting financial systems and initiatives to promote financial stability in the Asian region. The department prepared inputs for formulating India’s stance on the issues deliberated in FSB meetings and conference calls. It provided inputs to FSB surveys such as Implementation of Monitoring Network (IMN) for FSB/G20 reforms, evaluation of effects of financial regulatory reforms on SME financing, progress in implementing OTC derivatives market reforms, and compensation monitoring. X.25 The department also contributed to the ongoing FSB thematic peer review on implementation of resolution planning standards in relation to global and domestic systemically important banks and provided information on progress relating to the LEI implementation. X.26 The department contributed to the FSB’s annual monitoring exercise to assess global trends and risks from non-bank financial intermediation (NBFI) and provided data/inputs for its 2018 report. Box X.2

Capital Market Convergence across Emerging and Advanced Economies The Committee on Global Financial System’s (CGFS’s) Working Group on Establishing Viable Capital Markets set up in 2018 published its report in January 2019. The report compared metrics on market size (Chart 1), access, liquidity and resilience of emerging and matured capital markets. In emerging market economies (EMEs), menu choices of instruments have improved, while government securities markets have gathered depth and liquidity. EME corporate securities markets have experienced a broad deepening. However, they remain, on average, smaller than those in advanced economies (AEs) and face issues of corporate governance and minority shareholder rights, especially in case of state-owned firms. The access to longer-maturity local currency debt securities is relatively smaller compared with AEs and fewer small firms access EME equity markets. In some countries, paternalistic management of stock prices through initial public offering quotas was seen to be a constraining factor. EME markets also face issues of vulnerability to volatility spillovers. The report recognises that openness can increase sensitivity of domestic capital markets to global spillovers. Deeper complementary markets, such as those for derivative, repo, and securities lending spur liquidity and broader participation by facilitating hedging and funding of capital market positions. Robust and efficient market infrastructures boost liquidity and make trading safer and cheaper. The report concludes with six broad policy recommendations: (i) greater market autonomy; (ii) strengthening legal and judicial systems for investor protection; (iii) enhancing regulatory independence and effectiveness; (iv) increasing the depth and diversity of the domestic institutional investor base; (v) broad and bi-directional opening of capital markets; and (vi) developing deep complementary markets for derivative, repo and securities lending. The report suggests that despite substantial catch-up, differences remain between AE and EM equity markets. EM’s share of investable global equity capitalisation (10.8 per cent) is materially smaller than their share of global GDP (40 per cent) (Bekeart and Harvey, 2017). EM Sharpe ratios (the measure of risk-adjusted return of a financial portfolio) were generally more than 50 per cent higher than AE Sharpe ratios. However, EM equities, that were once uncorrelated with global equities, now have a higher beta of about 1.25 (implying EME stock volatilities are higher than global stock market volatilities) and their cycles have aligned with AE equities. EM currency returns are positively correlated with EM equity returns, with correlations varying between 0.1 and 0.5. In contrast, on average for AEs, local currency equity returns and currency returns are uncorrelated, implying that currency risk is relevant for EM equities investors. Governance indicators have generally improved for EMs, but remain below those for AE markets. Openness has increased de jure but is not complete. Segmentation has declined significantly for EMs and is now close to where the AEs were 25 years ago. The report notes that mitigation of financial repression has played an important role in the development of the Indian bond markets. The bid-ask spreads and estimates of the price impact of trade are similar in some EMEs to those in the most liquid AE government bond markets. Though the bid-ask spreads are higher in most EMEs, those for 10-year benchmark government bonds in India were just 2 basis points, comparable to major AEs. References: 1. CGFS (2019), ‘Establishing Viable Capital Markets’, CGFS Papers No. 62, Available at https://www.bis.org/publ/cgfs62.pdf 2. Bekaert, Greet and Campbell R. Harvey (2017), ‘Emerging Equity Markets in a Globalising World’, Available at SSRN: https://ssrn.com/abstract=2344817 | BRICS, SAARC & Bilateral Cooperation X.27 The BRICS Presidency changed over from South Africa to Brazil in January 2019. The department continued to contribute towards the BRICS agenda through their Presidencies. As part of the deliverables under the South African Presidency, BRICS central banks successfully conducted the first Contingent Reserve Arrangement (CRA) test-run in July 2018 involving the delinked liquidity instrument with an actual transfer of funds that were reversed at the end of the test run. A stocktaking exercise was undertaken by BRICS central banks on FinTech and crypto-assets over July to early October 2018, for assessing the degree of convergence thereon as well as the scope for further collaboration. X.28 Under the South Asian Association for Regional Cooperation (SAARC), the Reserve Bank provided liquidity support to some SAARC central banks and contributed significantly to their capacity building. With the approval of the Government of India, an addendum on the Standby Swap Arrangement was also incorporated in the framework for providing additional swap amounts aggregating up to US$ 400 million, with the approval of the Finance Minister, beyond the specified limits for individual countries, by operating on the unutilised balance available within the overall size of the facility of US$ 2 billion. X.29 During the year, the following SAARCFINANCE collaborative studies were undertaken - (i) infrastructure financing in the SAARC region; (ii) regulatory regimes in the SAARC region; and (iii) reducing the cost of cross-border remittances across SAARC region. SAARCFINANCE scholarships were offered to two officials from Da Afghanistan Bank and Bangladesh Bank to pursue M.Phil./ doctorate studies in India. The fifth seminar and third meeting of the Working Group on SAARCFINANCE database was organised jointly by Nepal Rastra Bank and Reserve Bank on May 15-16, 2019 at Kathmandu. X.30 The Reserve Bank and European Central Bank conducted a joint seminar on ‘Financial Stability and Global Spillovers’ in Mumbai on November 20, 2018 as a part of their Memorandum of Understanding (MoU). A seminar was held under Mimansa, ID Seminar Series, on ‘Fintech and Global Financial Regulation’ on June 14, 2019. During the year 2018-19, the ID organised 45 exposure visits/ attachments for capacity building for foreign central banks/ regulatory authorities/ foreign ministries and universities of repute at the Reserve Bank. The ID also continued to maintain increasing interaction with the SEACEN Centre. Further, the ID provided pro-active support to the IMF SARTTAC in its capacity building and technical assistance mission requirements. Agenda for 2019-20 X.31 The ID would continue to strengthen international cooperation in the area of finance track under G20. During 2019-20, it will focus on issues on the agenda of international financial architecture. It will also ensure successful completion of Article IV 2019 discussions with the IMF. X.32 In the area of global financial regulatory reforms, the department will continue contributing its inputs for the FSB’s annual monitoring exercise in 2019 to assess global trends and risks from NBFIs in coordination with various departments and regulators. It will also follow-up on FSB’s market fragmentation update that are likely to be available in October 2019. X.33 The department will continue to provide analytical policy briefs at BIS and CGFS meetings. Regarding BRICS, macroeconomic research capacity of the BRICS CRA would be strengthened further. The second CRA test run will be conducted while incorporating certain elements that were not tested in the first test run. With India acquiring the SAARCFINANCE Chair in October 2019, the department would organise (in collaboration with the Department of External Investments and Operations) the SAARCFINANCE-ACU Governors’ Symposium. As the current Framework on Currency Swap Arrangement for SAARC countries expires in November 2019, a revised framework for the period 2019-22 will be considered in consultation with other SAARC central banks and the Government of India. The department would continue to carry forward the agenda under the SAARCFINANCE roadmap in terms of capacity building, providing technical support, undertaking collaborative studies, and developing a robust and comprehensive database for the SAARC region. 5. GOVERNMENT AND BANK ACCOUNTS X.34 The Department of Government and Bank Accounts (DGBA) oversees the functions of the Reserve Bank as banker to banks and banker to governments, besides formulating internal accounting policies of the Reserve Bank. Agenda for 2018-19: Implementation Status Integration of State Governments’ System with e-Kuber X.35 During the year, four state governments got newly integrated with the Reserve Bank’s core banking solution portal (e-Kuber) for e-payments and one state government for e-receipts. As on June 30, 2019, 16 states out of 28 states for which the Reserve Bank is the banker were integrated with e-Kuber for standardised e-receipts and 16 states for standardised e-payments. Further, four state governments also migrated to enhanced versions of e-payment. The remaining state governments are in different levels of technological preparedness for integration with RBI’s e-Kuber. The Reserve Bank is actively pursuing with the remaining state governments for integration of their systems with e-Kuber for enabling e-receipts and e-payments. Paper to Follow (P2F) Arrangement X.36 The Reserve Bank is impressing upon state governments to discontinue the use of cheques for P2F arrangements and so far, 13 states have expressed their willingness to discontinue P2F. In consultation with the National Payments Corporation of India (NPCI), a solution has been arrived at whereby discontinuation of P2F for state government cheques can be implemented in phases without waiting for readiness from all state governments. Necessary instructions in this regard have been issued to banks. X.37 The recommendations of the Committee on Cost of Government Banking as well as the recommendations of the Working Group on Business Process Re-engineering of Government Banking have been examined internally for feasibility of their implementation, and a circular has been issued on revised rates of agency commission. Agenda for 2019-20 X.38 The department would continue to pursue with the central government as well as remaining state governments/UTs for integrating their systems with e-Kuber and also to enhance the coverage of their transactions currently being processed through e-Kuber (Box X.3). Oversight on agency banks will be revamped and they will also be integrated with e-Kuber for online reporting of government receipts collected by them to the Reserve Bank. The Goods and Services Tax (GST) framework will be further strengthened by extending the current online Memorandum of Error process of the central government to all state governments. The P2F arrangement for state governments will be discontinued in a phased manner. Box X.3

Leveraging Technology for Direct Handling of Government Transactions by the Reserve Bank of India In its statutory role of banker to central and state governments, the Reserve Bank facilitates government payments and collection of government receipts, either at its own offices or through agency banks appointed by it under the RBI Act, 1934. In this context, the Reserve Bank leverages on the growing adoption of technology to provide faster and efficient accounting for and settlement of government funds. This involves straight-through-processing (STP) based systems offering standardised models for transaction reporting and processing. Besides, direct handling of government transactions done in electronic mode, it enables the government to optimally use the funds it holds with the Reserve Bank by way of making just-in-time payments and direct collection of receipts on near real-time basis. These requirements are being met through end-to-end integration of various government systems with e-Kuber system of the Reserve Bank using standardised communication protocols and data security. On the payments side, the standardised e-payments model has been rolled out for both central government departments and ministries, and various state governments, enabling STP-based payments using ISO 20022 formats for data exchange as well as reporting of transaction status and accounting information. The Reserve Bank is using the National Electronic Funds Transfer (NEFT) system in making payments directly to the beneficiaries. Various central civil ministries are using the e-payments through e-Kuber integration with Public Funds Management System (PFMS), working under the aegis of the Office of Controller General of Accounts. Treasury systems of 16 state governments are currently integrated with e-Kuber for direct processing of their e-payments. On the receipts side, the standardised e-receipts model integrates government systems with e-Kuber on the one hand, and agency banks’ systems with e-Kuber on the other. This facilitates standardised online reporting of government receipts by these banks in an efficient manner so that consolidated inputs of these transactions can be provided to the concerned government departments. Treasury systems of 16 state governments are integrated with e-Kuber for e-receipts model. The Reserve Bank’s e-Kuber system plays a critical role in collection of government receipts under the Goods and Services Tax (GST) system. It functions as the ‘aggregator’ for pan-India collections of GST and is integrated with the central government, state governments, Union Territories and GST Network (GSTN). On the receipts side, it enables direct collection of government receipts into their account with the Reserve Bank using the NEFT/RTGS payment options. With this, customers can make payments directly to the government account with the Reserve Bank using NEFT or RTGS from any of the participating bank branches, including online remittance. This NEFT/RTGS-based payment option has been successfully rolled out to GST framework and for Bharat Kosh or Non-Tax Receipt Portal (NTRP) of the central government. Three state governments have also integrated their e-receipts systems with e-Kuber and provided the NEFT/RTGS payment option on their respective receipt portals for this. On the agenda for the future are the operationalisation of the Treasury Single Account framework for payments of Autonomous Bodies through PFMS for facilitating just-in-time payments to and by these entities; integration of pension system of Ministry of Defence for facilitating direct payments to defence pensioners; standardised protocols for sending of Inter-Government Adjustment Advices; integration with government systems for direct collection of residual indirect taxes; and extension of online Memorandum of Errors for GST to all state governments. | 6. MANAGING FOREIGN EXCHANGE RESERVES X.39 The Department of External Investments and Operations (DEIO) manages the country’s foreign exchange reserves (FER) with safety, liquidity and returns, in that order, as its strategic objectives. During the year under review, FER increased by 5.9 per cent in June 2019 as against an increase of 5.0 per cent in the corresponding period of the previous year, and gold was added to the FER in line with the broad diversification objectives followed in the management of FER (Box X.4). Box X.4

Gold in Foreign Exchange Reserves – Recent Trends The stock of global foreign exchange reserves (FER) stood at US$ 11.4 trillion in December 2018. In recent years, central banks have diversified their FER into different asset classes. Consequently, there has been a steady decline in the share of the US dollar, although with approximately 62 per cent of the allocated resources in Q4: 2018, it continues to dominate the currency composition of international reserves followed by the euro, sterling and yen. Gold remains an important constituent of the FER (Table 1). At the end of June 2018, central banks collectively owned US$ 1.36 trillion worth of gold, constituting around 10 per cent of global FER (WGC, 2018). The quantity of gold purchased in the world economy was steadily falling before the Global Financial Crisis (GFC) period. However, that trend has reversed and gold purchases have increased thereafter (Chart 1). The recent expansion in gold holding has been driven mainly by emerging market economies (EMEs), attributed to: (a) the general increase in the level of reserves in the aftermath of GFC; (b) diversification strategy that moved away from the US dollar; and (c) the use of gold as an alternative asset by those countries on which economic sanctions have been imposed (Amundi, 2019). | Table 1: Top Ten Countries in terms of World Official Gold Holdings | | | Tonnes | Share in Foreign Reserves

(Per cent) | | 1 United States | 8,133.5 | 74.9 | | 2 Germany | 3,369.7 | 70.6 | | 3 Italy | 2,451.8 | 66.9 | | 4 France | 2,436.0 | 61.1 | | 5 Russian Federation | 2,150.5 | 19.1 | | 6 China, P.R.: Mainland | 1,874.3 | 2.5 | | 7 Switzerland | 1,040.0 | 5.5 | | 8 Japan | 765.2 | 2.5 | | 9 Netherlands | 612.5 | 65.9 | | 10 India | 608.7 | 6.4 | | Source: International Financial Statistics, April 2019, WGC. | The increase in the share of gold in foreign reserves has (Chart 2), mainly been on account of the steep increase in gold prices during 2009-12 (Chart 3). In terms of tonnage of gold purchased, the increase was, however, gradual from around 30,000 metric tonnes in 2009 to around 32,000 metric tonnes in 2012. In terms of gold purchase, the top five countries are – Russia, China, Kazakhstan, Turkey and India (Chart 4). References: 1. Market Update: ‘Central Bank Buying Activity’, World Gold Council (WGC), September, 2018. 2. Amundi Asset Management (2019), ‘Gold in Central Banks’ Asset Allocation, Investment Insights Blue Paper, March 2019.

| Agenda for 2018-19: Implementation Status X.40 The department took proactive steps to bolster IT security and protection against cyber risks in line with international best practices. A system for undertaking interest rate futures was developed to an advanced stage and is expected to be completed in 2019-20. Repo transactions were carried out on a regular basis for enhancing the returns on foreign reserves. Agenda for 2019-20 X.41 The department would undertake a review of risk management practices, which would include, inter alia, exploring alternate methods for measuring credit risk. Efforts will also be undertaken to enhance the repo and forex swap capabilities. Enhancement of IT infrastructure and security measures for cyber risks will also continue. 7. ECONOMIC AND POLICY RESEARCH X.42 As the knowledge centre of the Reserve Bank focussing on issues relating to the economy and the financial system, the Department of Economic and Policy Research (DEPR) strives to provide high quality research inputs and management information system (MIS) services for policy making. The department also generates important primary national level data, prepares the Reserve Bank’s statutory reports and frontline research publications, promotes collaborative policy-oriented research with external experts, and provides technical support to various operational departments and to technical groups/ committees constituted by the Reserve Bank. Agenda for 2018-19: Implementation Status X.43 During the year, the department brought out several flagship publications2, viz., the Annual Report, Report on Trend and Progress of Banking in India, Reserve Bank of India Bulletin, and the fourth edition of the Handbook of Statistics on Indian States in a timely manner while ensuring the highest quality of standards. The department also published ‘State Finances: A Study of Budgets of 2017-18 and 2018-19’ - an annual publication that provides information and analysis of the finances of state governments - and eliminated the time lag by covering budget estimates for 2018-19, besides the actual outcomes for 2015-16, 2016-17 and revised estimates of 2017-18. The monthly data of the Comptroller and Auditor General of India (CAG) on state finances were consolidated and published for the first time this year, with half yearly fiscal position of 24 states for 2018-19. The department also brought out two issues of the RBI Occasional Papers (Volume 38 & 39), the peer-reviewed research journal of the Reserve Bank. Compilation and dissemination of primary statistics on monetary aggregates, balance of payments, external debt, effective exchange rates, combined government finances, household financial savings and flow of funds on established timelines and quality standards engaged the department during the year. X.44 During 2018-19, the department published 45 research papers/articles, of which 16 were published outside the Reserve Bank in domestic and international journals. In addition, five working papers were published during the year. Furthermore, the DEPR Study Circle, an in-house discussion forum, organised 40 seminars/ presentations during the year on diverse research themes. X.45 The Central Library and the Reserve Bank of India Archives (RBIA) are the two key units of DEPR that provide necessary reference material on various subjects for conducting research and publishing reports, including the Reserve Bank’s history. The Library has a comprehensive collection of books/e-books including some of the rare books, journals/e-journals, and online databases on banking, economics and finance. The Library shifted all 200 print journals/23 magazines to an electronic version to facilitate easy access pan India. It has also digitised and scientifically preserved all RBI publications prior to 1997, viz., Committee Reports, Annual Reports, Bulletins, and other rare books for preservation and easy access. The RBIA is responsible for implementation of the Archival and Records Management Policy in the Reserve Bank. It also provides research facilities to scholars coming from different parts of the country and abroad. X.46 The department organised a number of events during the year, including four memorial lectures. The 2nd Suresh Tendulkar Memorial Lecture was delivered by Prof. Roberto Rigobon, Massachusetts Institute of Technology on August 2, 2018; the 5th P. R. Brahmananda Memorial Lecture was delivered by Prof. Devesh Kapur, Johns Hopkins University on October 19, 2018; the 16th L. K. Jha Memorial Lecture was delivered by Prof. Hélène Rey, London Business School on December 14, 2018 and the 17th C. D. Deshmukh Memorial Lecture was delivered by Mr. Agustín Carstens, General Manager, BIS on April 25, 2019. X.47 The other major events organised by the department during the year includes talks by Mr. Claudio Borio, head of the Monetary and Economic Department, BIS on ‘Monetary Policy in the Grip of a Pincer Movement’; Prof. Ramesh Chand, Member, NITI Aayog on ‘Current Issues in Agriculture Sector and the Outlook’; and Shri Rajeev Kher, Distinguished Fellow, Research and Information System for Developing Countries, New Delhi on ‘India’s Trade Policy: Emerging Challenges and Opportunities’. The department organised a workshop on India-KLEMS [capital (K), labour (L), energy (E), material (M) and services (S)] research project, in which presentations were made on studies using the KLEMS database. X.48 The annual research conference of the department was held at Jaipur during March 1-3, 2019. The conference included a panel discussion on ‘GDP Back-Series’ chaired by Prof. B. N. Goldar, Member, National Statistical Commission. Mr. David Lubin, Managing Director and head of emerging markets economics at Citi Bank, addressed the participants on ‘Is capital account fundamentalism dead?’. The fourth edition of the Handbook of Statistics on Indian States was also released at the conference. Agenda for 2019-20 X.49 Besides the standard statutory and non-statutory publications, and compilation and dissemination of primary and secondary data, focussed analysis and research during 2019-20 will follow the DEPR Vision 2022. The department will explore big data applications for improving inflation and growth projections. It will take up studies in the areas of contemporary relevance, for example, role of capital in bank’s lending behaviour; bank dependency of non-financial firms; payments system innovations and currency demand; global liquidity and impact of trade policy measures on exports; measures of financial cycles; determinants of total factor productivity in India; supply chain and food inflation dynamics; performance and implications of UDAY/UDAY bonds; and implication of guarantees for debt sustainability. The department will also generate new analytical information on the Indian economy such as economic and political uncertainty index, external vulnerability and a composite high frequency indicator of economic activity. X.50 The History of the Reserve Bank, Volume-V, for the period spanning 1997 to 2008, will be completed during 2019-20. The Central Library has planned to extend accessibility of digitised contents. The RBIA would establish an Archival Museum on the first floor of RBI Museum, Kolkata during the year ahead. 8. STATISTICS AND INFORMATION MANAGEMENT X.51 The Department of Statistics and Information Management (DSIM) is driven by two overarching goals, viz., to collect, process and disseminate national-level macroeconomic and financial statistics of the highest quality, with a focus on banking, monetary, corporate and external sectors; and to provide statistical and analytical support to all functions of the Reserve Bank through forward looking surveys, data management and applied statistical research. In pursuit of these objectives, DSIM maintains a centralised database for the Reserve Bank at par with international standards, manages the centralised submission of returns through the eXtensible Business Reporting Language (XBRL) platform, and provides a range of information management related support services. The department also actively engages in statistical and analytical research for meeting the policy and operational goals of the Reserve Bank. Agenda for 2018-19: Implementation Status X.52 During the year, the department brought out its regular publications, viz., Handbook of Statistics on the Indian Economy, 2017-18; Statistical Tables Relating to Banks in India, 2017-18; Basic Statistical Returns of SCBs in India, March 2018; Quarterly Outstanding Credit of SCBs (BSR 1); and Quarterly Statistics on Deposits and Credit of SCBs (BSR 7) for 2018-19. The Weekly Statistical Supplement (WSS) and the ‘Current Statistics’ portion of the Reserve Bank’s Bulletin were generated from the Database on Indian Economy (DBIE), the existing data warehouse, as per the prescribed frequency. Surveys used as inputs in monetary policy formulation were conducted as per schedule. Under the guidance of the Technical Advisory Committee on Surveys (TACS), testing the efficiency of weighted net responses (WNR), using size of the responding units and the sampling proportion as weights, was initiated to refine the analysis of the survey results. Two-stage probability sampling was introduced in place of quota sampling for Inflation Expectations Survey of Households (IESH) from the September 2018 round. City-wise sample size for IESH and Consumer Confidence Survey (CCS) were revised based on proportion of number of households in the city, leading to revision of estimation procedures. An Expert Group on IESH was formed to review the existing IESH questionnaire and suggest ways to expand the survey to rural and semi-urban areas in a phased manner. Pilot rounds of (i) Survey on Indian Start-up Sector (SISS) and (ii) Survey on Retail Payment Habits of Individuals (SRPHi) were conducted. X.53 A monitoring system for housing and personal loans on a quarterly basis was established using account level data (BSR 1). Information on (i) salary accounts maintained by select banks; (ii) tax deducted at source (TDS) data submitted by the employers; and (iii) salary payments made through National Electronic Funds Transfer (NEFT) and National Automated Clearing House (NACH) were used for creating an Employment Index on an exploratory basis. X.54 The implementation of the Centralised Information Management System (CIMS), the next generation data warehouse got underway. The Central Information System for Banking Infrastructure (CISBI) was web-deployed after vulnerability assessment and penetration testing and adequate risk assessment. A prototype for a geographic information system that plots banking units on India’s map has been developed for internal use. X.55 Under the guidance of the Implementation Task Force (ITF) for setting up a Public Credit Registry (PCR), the business requirements, information structure and high-level technical design were finalised. The selection of an agency to develop the technical platform, drafting of a comprehensive PCR Act and consultation with the Ministry of Corporate Affairs (MCA) and Central Board of Indirect Taxes and Customs (CBIC) towards linking of corporate database and GST data under the ambit of the PCR are in progress. X.56 Exploratory work on assessing food inflation behaviour using quantile regression; developing risk profile of the listed non-government non-financial companies based on suitably chosen stress scenarios; studies on Indian corporate sectors; and sentiment analysis of media articles (newsfeeds) using big data analytics and related statistical and machine learning techniques were also carried out. X.57 The SAARCFINANCE Database (SFDB) is hosted in the DBIE with a view to promote research and analysis on SAARC economies. A new web-portal, which also facilitates dynamic dashboards, was developed for timely submission of data by the member countries with quality checks as per the Data Release Calendar. X.58 In its efforts towards strengthening India’s external account statistics, a system to collect information on financial flows relating to trade in services as per the original source/ ultimate destination country was introduced, which would facilitate compilation of the related estimates as per the place of origin/final delivery of services. The reporting of annual census on Foreign Liabilities and Assets (FLA) has been further refined with the development of a web-based submission platform. Agenda for 2019-20 X.59 The implementation of CIMS will be taken forward towards its full operationalisation through system-to-system integration, data migration from the existing database and creation of element-based data repository. A metadata driven data maintenance and dissemination system, following the Statistical Data and Metadata eXchange (SDMX) standards would be implemented as part of the CIMS architecture. A Granular Data Access Lab (GDAL) (Box X.5) and a regulatory sandbox environment will also be made available through the CIMS. X.60 The coverage of the CISBI will be expanded by including cooperative banks along with their geographical locations. System development for creation of a PCR would be taken up in modular and phased manner. For streamlining flow of data pertaining to the annual financial statement of companies, the department is coordinating with the Ministry of Corporate Affairs for automating the transfer of data to the Reserve Bank. The project is expected to be completed by early 2019-20. Box X.5

Granular Data Access Lab (GDAL) An additional service proposed to be provided by the Centralised Information Management System (CIMS) is a Granular Data Access Lab (GDAL), to facilitate research on granular level data (with masking of identity particulars for protection of privacy/confidentiality), within a secure computing environment. A Standing Committee has been formed by the Reserve Bank to streamline and control this process. It will identify the data series which could be released/shared through the GDAL environment. The motivation for the GDAL initiative is rooted in the 2009 G20 meeting of Finance Ministers and Central Bank Governors which endorsed the first Data Gaps Initiative (DGI-1) to promote actions to close data gaps related to the financial crisis. The Data Gaps Initiative II (DGI-2) (2015) aims to promote the exchange of data as well as metadata and access to granular data. Such facilities are already provided by the Deutsche Bundesbank’s Research Data and Service Centre (RDSC), the Banco de Portugal, and the International Network for Exchanging Experience on Statistical Handling of Granular Data (INEXDA) - launched by five central banks in 2017 viz., Banca d’ Italia, Banco de Portugal, Bank of England, Banque de France, and Deutsche Bundesbank. The latter was joined by the European Central Bank, Banco de España, Banco Central de Chile, and Central Bank of the Republic of Turkey in 2018. Granular data research will provide policy inputs backed by data. References: 1. Bender, Stefan and Patricia Staab, (2015). ‘Gateway to Treasures of Micro Data on the German Financial System’, The Bundesbank’s Research Data and Service Centre (RDSC) -. Available at: https://www.bis.org/ifc/publ/ifcb41l.pdf 2. Prof. Claudia Buch, Vice-President of the Deutsche Bundesbank (2018). ‘Can Technology and Innovation Help? New Data Generating Possibilities’, Speech prepared for the European Central Bank Conference on Statistics. Available at: https://www.bundesbank.de/en/press/speeches/can-technology-and-innovationhelp-new-data-generating-possibilities-750868. 3. Banco de Portugal’s Annual Report, 2017. Available at: https://www.bportugal.pt/sites/default/files/anexos/pdf-boletim/relatorio_atividade_contas_2017_en.pdf 4. Members of the INEXDA Network (2018). IFC Working Papers No 18: INEXDA – the Granular Data Network. Available at: https://www.bis.org/ifc/publ/ifcwork18.pdf | X.61 A web-based reporting platform for enterprise surveys will be implemented. The historical unit-level data of CCS prior to March 2015 will be disseminated through the DBIE to encourage research. An Expert Group is examining the issue of extending the coverage of IESH to rural and semi-urban areas. Under the guidance of the TACS, further rationalisation of existing surveys and estimation procedures will be reviewed for enhancing the precision of survey outcomes. X.62 Implementation of Digital Signature for the statutory returns submitted through the XBRL platform would be rolled out. Data collection system for Non-Banking Financial Intermediaries (DCS-NBFI) and Central Fraud Registry (CFR) database for urban cooperative banks would be developed, leveraging on the DBIE’s infrastructure. Efforts will also be made to archive GST receipts data in the Reserve Bank’s data warehouse for analytical purpose. X.63 The department will continue to refine the methodologies used for nowcasting, forecasting, and assessment of macroeconomic developments towards policy input on an ongoing basis. Research and analysis using big data analytics and machine learning techniques to carry out sentiment analysis for macro-economic indicators, would be further strengthened. 9. LEGAL ISSUES X.64 The Legal Department is an advisory department established for examining and advising on legal issues, and for facilitating the management of litigation on behalf of the Reserve Bank. The department vets circulars, directions, regulations and agreements for various departments of the Reserve Bank with a view to ensuring that the decisions of the Reserve Bank are legally sound. The department provides the secretariat to the First Appellate Authority under the Right to Information Act and represents in the hearing of cases before the Central Information Commission, with the assistance of operational departments. The department also extends legal support and advice to the Deposit Insurance and Credit Guarantee Corporation (DICGC), CAFRAL, and other RBI-owned institutions on legal issues, litigation and court matters. Agenda for 2018-19: Implementation Status X.65 Several important legislations/regulations concerning the financial sector were brought in/ amended during the year. The Fugitive Economic Offenders Act, 2018, which came into force on April 21, 2018, provides measures to deter fugitive economic offenders from evading the process of law in India by staying outside the jurisdiction of Indian courts. The Act would be applicable to a person involved in economic offences involving at least ₹100 crores and who has fled from India to escape legal action. The Banning of Unregulated Deposit Schemes Ordinance, 2019 was promulgated on February 21, 2019 to provide for a comprehensive mechanism to ban unregulated deposit schemes and to protect the interest of depositors. X.66 The Insolvency and Bankruptcy Code (IBC, 2016) provides a time-bound process for resolution of insolvency among corporate persons, partnership firms and individuals. This Act was amended in 2018 to clarify that allottees under a real estate project should be treated as financial creditors. Section 12 of IBC, 2016 was also amended to change the voting threshold from 75 per cent to 66 per cent for extension of corporate insolvency resolution process period by the committee of creditors. The central government is also empowered to direct by notification in public interest that any provisions of IBC, 2016 shall not apply or apply with modifications to micro, small and medium enterprises. X.67 The Reserve Bank has notified the Ombudsman Scheme for Digital Transactions, 2019 under Section 18 of the Payment and Settlement Systems Act, 2007 to provide for a mechanism of Ombudsman for redressal of complaints against deficiency in services related to digital transactions. X.68 The Supreme Court by majority upheld the constitutional validity of the Aadhaar Act 2016, subject to certain limitations. Agenda for 2019-20 X.69 In 2019-20, the Legal Department will continue to advise various departments of the Reserve Bank on legal matters and furnish specific legal opinions whenever sought. It will also continue its efforts at managing litigation on behalf of the Reserve Bank and function as a secretariat to the Appellate Authority under the Right to Information Act. Amendments to various acts administered by the Reserve Bank will be pursued during the year, taking note of the country’s international commitments and to provide clarity to the existing provisions.

|