Against the backdrop of asset quality concerns in the banking sector, guidelines on loan systems for delivery of bank credit were issued in order to enhance credit discipline among large borrowers. To further the efforts of resolution of stressed assets, and in light of the judgment of the Hon’ble Supreme Court of India declaring the then existing framework as ultra vires, the revised prudential guidelines for resolution of stressed assets were issued. Alignment of the Statutory Liquidity Ratio (SLR) with the Liquidity Coverage Ratio (LCR), new guidelines on implementation of liquidity standards and capital regulation under Basel III, strengthening of data protection and cyber security norms, Ombudsman Scheme for Digital Transactions (OSDT) and harmonisation of regulations of various categories of non-banking financial companies (NBFCs) were carried out during the year. Regulatory and supervisory policies for cooperative banks were harmonised with those of scheduled commercial banks (SCBs). VI.1 The chapter discusses the regulatory and supervisory measures undertaken during the year to strengthen the banking system, and the priorities for 2019-20. Pursuant to the judgment of the Hon’ble Supreme Court of India, which found the then existing framework for resolution of stressed assets ultra vires, the revised framework has been put in place. During the year under review, the focus was on improving transparency in financial statements of banks, enhancing credit discipline among large borrowers, alignment of the SLR with the LCR requirements along with new guidelines on implementation of liquidity standards and capital regulation under Basel III norms and strengthening of data protection and cyber security norms. OSDT was implemented during the year. VI.2 Turning to other areas, harmonisation of regulations for various categories of NBFCs, revision of the extant guidelines on liquidity risk management by NBFCs, risk weighting of exposures to NBFCs as per the ratings assigned by the rating agencies, bringing all government-owned non-deposit taking systemically important NBFCs (NBFC-ND-SIs) and government-owned deposit taking NBFCs under the Reserve Bank’s on-site inspection framework and off-site surveillance, engaged policy attention. VI.3 In the cooperative banking space, voluntary transition of Primary (Urban) Cooperative Banks (UCBs) into Small Finance Banks (SFBs); and country-wide awareness campaigns through print and electronic media (including Reserve Bank’s SMS handle ‘RBISAY’) on various topics such as fictitious offers, the Basic Savings Bank Deposit Account (BSBDA), banking facilities for senior citizens and differently abled persons and safe digital banking for banking sector as whole, became priorities. VI.4 The rest of this chapter is further divided into four sections. Section 2 deals with the mandate and functions of Financial Stability Unit. Section 3 provides various regulatory measures undertaken by the Department of Banking Regulation, the Department of Cooperative Bank Regulation and the Department of Non-Banking Regulation during the year. Section 4 covers several supervisory measures undertaken by the Department of Banking Supervision, the Department of Cooperative Bank Supervision and the Department of Non-Banking Supervision and enforcement actions carried out by the Enforcement Department during the year. Section 5 highlights the role played by the Consumer Education and Protection Department and the Deposit Insurance and Credit Guarantee Corporation in protecting consumer interests, spreading awareness and upholding consumer confidence. These departments have also set out their agenda for 2019-20 in their respective sections. 2. FINANCIAL STABILITY UNIT (FSU) VI.5 The mandate of the Financial Stability Unit (FSU) is to monitor the stability and soundness of the financial system by examining risks to financial stability, undertaking macro-prudential surveillance through systemic stress tests, financial network analysis (Box VI.1) and by disseminating information and analysis through the Financial Stability Report (FSR). It also functions as a secretariat to the Sub-Committee of the Financial Stability and Development Council (FSDC), a co-ordination council of regulators for maintaining financial stability and monitoring macro-prudential regulation in the country. Box VI.1

Risk Propagation through Financial Networks In a world of interconnected financial entities, network studies are assuming importance in order to understand the propagation of risks. A complex interplay of factors is involved: (a) network topology; (b) node characteristics populating the network; and (c) nature of shocks. a) Network Topology Network topology refers to the arrangement of the financial entities in a network. Network topology can be undirected or directed. In an undirected network topology, if the nodes i and j are connected, it implies that the node i can be reached from j or vice versa. In a directed network the direction of connection matters. Friendship/ partnership are illustrations of undirected network while credit exposure is an illustration of a directed network. Network topology is usually defined as a set of nodes {1, … , N} and links that connect pairs of nodes. To keep the analysis tractable, it is usually assumed that the nodes are the same in other respects such as size, leverage and asset quality. The degree distribution is the number of links with other nodes, a simple measure of the node’s importance; eigenvalue centrality1 of the adjacency and liability matrix are other measures. b) Node Characteristics Node characteristics refer to features such as size, leverage, and asset quality (Glasserman and Young, 2015). In the run-up to the global financial crisis, banks that failed had high leverage, low capital buffers, excessive reliance on short-term funding, and exposure to complex derivative products whose risks were not properly understood. These spread contagion irrespective of network topology and, therefore, an independent analysis of their influence is important. c) Nature of Shocks Another key factor affecting contagion is what triggers a financial crisis in the first place - a solvency shock (e.g., caused by a loss in real assets such as downturn in an industrial sector to which a bank is highly exposed); a liquidity shock (e.g., caused by a funding run on the bank by depositors); an idiosyncratic shock; or a macroeconomic shock. A solvency shock will be transmitted by causing spill-over of losses. A liquidity shock may lead to a fire-sale, thus spreading contagion. Transmission Models Data on node characteristics and network topology and information on the nature of shock are fed into a transmission model with feedback mechanisms and accounting for difference in seniority of payments. A discerning interpretation of the results can help in drilling down into the sources of instability to develop an appropriate policy response. References: Glasserman, P., and Young, H. P. (2015), “How likely is contagion in financial networks?”, Journal of Banking & Finance, 50, 383-399. | Agenda for 2018-19: Implementation Status VI.6 The FSR was published in December 2018 and June 2019. A contagion analysis for major NBFCs was also undertaken in the FSR of June 2019. VI.7 The FSDC Sub-Committee held one meeting in 2018-19 and discussed various issues impinging on financial stability including challenges of the quality of credit ratings and inter-linkages between housing finance companies and housing developers. A thematic study on financial inclusion and financial stability, and the National Strategy for Financial Inclusion (NSFI) were also discussed. VI.8 The Inter-Regulatory Technical Group (IRTG), which is a sub-group of the FSDC Sub-Committee, held two meetings during the year and deliberated on technical standards for account aggregators and issues relating to Credit Rating Agencies (CRAs). Issues relating to the know your customer (KYC) processes consequent upon amendments in the Prevention of Money Laundering (PML) rules, implementation of risk-based supervision in the National Pension Scheme (NPS) Architecture of Pension Fund Regulatory and Development Authority (PFRDA), systemic risk of open-ended debt mutual funds and application of the accredited investor framework of SEBI to peer to peer (P2P) lending platform, also engaged the IRTG. Agenda for 2019-20 VI.9 In the year ahead, FSU will continue to conduct macro-prudential surveillance, publish the FSR and conduct meetings of the FSDC Sub-Committee. In addition, the current stress testing framework/methodology will be strengthened to adopt evolving best practices. 3. REGULATION OF FINANCIAL INTERMEDIARIES Commercial Banks: Department of Banking Regulation (DBR) VI.10 The Department of Banking Regulation (DBR) is the nodal department for regulation of commercial banks for ensuring a healthy and competitive banking system dispensing cost effective and inclusive banking services. The regulatory framework is fine-tuned as per the requirements of the Indian economy while adapting to the international best practices. Agenda for 2018-19: Implementation Status Resolution of Stressed Assets – Prudential Framework VI.11 The Reserve Bank had put in place a framework for resolution of stressed assets vide circular dated February 12, 2018, which had the Insolvency and Bankruptcy Code (IBC), 2016 as the lynchpin. Specifically, the framework required banks to cure the default in respect of large borrowers (those to whom the exposure of the banking system was ₹20 billion or above as of then) within 180 days of default, failing which insolvency proceedings had to be initiated against such borrowers. The above framework was found to be ultra vires as per the Section 35AA of Banking Regulation (BR) Act, 1949 by the Hon’ble Supreme Court vide judgment dated April 2, 2019. Consequently, a revised prudential framework for resolution of stressed assets was put in place on June 7, 2019. VI.12 In line with the judgment of the Hon’ble Supreme Court, the revised prudential framework replaces the mandatory insolvency proceedings upon failure to implement a resolution plan with a system of disincentives in the form of additional provisioning for delay in implementation of resolution plan or initiation of insolvency proceedings. The prudential framework also incorporates the following fundamental principles underlying the regulatory approach for resolution of stressed assets: -

Early recognition and reporting of default in respect of large borrowers by banks, FIs and NBFCs; -

Complete discretion to lenders with regard to design and implementation of resolution plans, in supersession of earlier resolution schemes (S4A, SDR, 5/25 etc.), subject to the specified timeline and independent credit evaluation; -

Withdrawal of asset classification dispensations on restructuring. Future upgrades to be contingent on a meaningful demonstration of satisfactory performance for a reasonable period; -

For the purpose of restructuring, the definition of ‘financial difficulty’ to be aligned with the guidelines issued by the Basel Committee on Banking Supervision (BCBS); and, -

Signing of inter-creditor agreement (ICA) by all lenders to be mandatory, which will provide for a majority decision-making criteria. VI.13 Notwithstanding anything contained in the above framework, wherever necessary, the Reserve Bank will issue directions to banks for initiation of insolvency proceedings against borrowers for specific defaults so that the momentum towards effective resolution remains uncompromised. It is expected that the current circular will sustain the improvements in credit culture that have been ushered in by the efforts of the Government of India and the Reserve Bank, and that it will go a long way in promoting a strong and resilient financial system in India. Credit Discipline VI.14 Guidelines on loan system for delivery of bank credit were issued on December 5, 2018, in order to enhance the credit discipline among large borrowers. For borrowers with aggregate fund-based working capital limit of ₹1,500 million and above from the banking system, a minimum level of ‘loan component’ of 40 per cent of the sanctioned limit was made effective from April 1, 2019. Further, the undrawn portion of cash credit/overdraft limits sanctioned to the aforesaid large borrowers, irrespective of whether unconditionally cancellable or not, shall attract a credit conversion factor of 20 per cent, effective April 1, 2019. One-Time Restructuring of Existing Loans to Micro, Small and Medium Enterprises (MSMEs) VI.15 A one-time restructuring of existing loans to MSMEs that are in default but with loan quality as ‘standard’ as on January 1, 2019, was permitted without an asset classification downgrade. The scheme is available to MSMEs qualifying with objective criteria including, inter alia, a cap of ₹250 million on the aggregate exposure of banks and NBFCs as on January 1, 2019. The restructuring will have to be implemented by March 31, 2020 and an additional provision of 5 per cent will have to be maintained in respect of accounts restructured under this scheme. Risk Weights for Exposure to NBFCs VI.16 Exposures to all NBFCs, excluding Core Investment Companies (CICs), were risk weighted as per the ratings assigned by the rating agencies registered with Securities and Exchange Board of India (SEBI) and accredited by the Reserve Bank, in a manner similar to exposures to corporates under the extant regulations to facilitate flow of credit to high-rated NBFCs and to harmonise risk weights under the standardised approach for credit risk management. Exposures to CICs, rated as well as unrated, will continue to be risk-weighted at 100 per cent. Banking Operations by Foreign Banks through Wholly Owned Subsidiary (WOS) VI.17 SBM Bank (India) Limited (subsidiary of SBM Group, Mauritius) and DBS Bank India Limited (subsidiary of DBS Bank Ltd., Singapore) were issued licenses on December 6, 2017 and October 4, 2018, respectively, for carrying on banking business in India through the Wholly Owned Subsidiary (WOS) mode. They have commenced their operations as WOSs from December 1, 2018 and March 1, 2019, respectively. Compensation Guidelines for Banks VI.18 The Reserve Bank had issued guidelines for compensation of Whole Time Directors, Chief Executive Officers and control function staff of private sector and foreign banks in 2012. Based on the experience gained as well as evolving international best practices, these guidelines were reviewed and a Discussion Paper was released in February 2019, inviting comments of stakeholders. The comments received are under examination and revised guidelines will be issued shortly. External Benchmarking of Loans VI.19 It was announced in the Statement on Developmental and Regulatory Policies of December 5, 2018 that all new floating rate personal or retail loans (housing, auto, etc.) and floating rate loans to micro and small enterprises extended by banks from April 1, 2019 shall be benchmarked to one of external benchmarks viz., the Reserve Bank repo rate or any other benchmark market interest rate published by the Financial Benchmark India Private Ltd. (FBIL). As announced in the Statement on Developmental and Regulatory Policies of April 4, 2019, it has been decided to hold further consultations with stakeholders and work out an effective mechanism for transmission of rates. Bulk Deposits VI.20 The definition of bulk deposits has been revised as ‘Single Rupee term deposits of Rupees two crore and above’ for SCBs, excluding Regional Rural Banks (RRBs) and SFBs with effect from February 22, 2019, with a view to enhance the operational freedom of banks in raising bulk deposits. Valuation of State Development Loans (SDLs) VI.21 On July 27, 2018, banks were advised that SDLs shall be valued objectively, reflecting their value based on observed prices/yields, which would be made available by FBIL. The price/yield of SDLs is now being published by FBIL based on the new methodology with effect from April 15, 2019. Partial Credit Enhancement to Bonds Issued by NBFCs and Housing Finance Companies (HFCs) VI.22 On November 2, 2018 banks were permitted to provide partial credit enhancement (PCE) to bonds issued by the NBFC-ND-SIs registered with the Reserve Bank and HFCs registered with National Housing Bank (NHB). Alignment of SLR with LCR VI.23 As per the existing roadmap, SCBs under Basel III norms had to reach the minimum LCR of 100 per cent by January 1, 2019. In order to align the SLR with the LCR, it was decided to reduce SLR, which was 19.5 per cent of NDTL, by 25 basis points every calendar quarter starting from January 5, 2019, till it reaches 18 per cent of NDTL. Filing of Security Interest Relating to Immovable, Movable and Intangible Assets in Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) VI.24 All SCBs (including RRBs), SFBs, Local Area Banks (LABs), Cooperative Banks, NBFCs and All India Financial Institutions (AIFIs) were advised on December 27, 2018 to complete filing the charges pertaining to subsisting transactions by March 31, 2019 and all current transactions on an ongoing basis with CERSAI. Basel III Framework on Liquidity Standards – LCR/Facility to Avail Liquidity for Liquidity Coverage Ratio (FALLCR) against Credit Disbursed to NBFCs and HFCs – Facility till March 31, 2019 VI.25 In October 2018, banks were permitted to reckon government securities (G-secs) as Level 1 High Quality Liquid Assets (HQLAs) under FALLCR, within the mandatory SLR requirement up to 0.5 per cent of the bank’s NDTL, in respect of their incremental lending to NBFCs and HFCs after October 19, 2018. This facility, which was available up to December 31, 2018, was extended till March 31, 2019 to enable banks to lend up to an additional amount of ₹600 billion to NBFCs and HFCs. The single borrower limit for NBFCs (not financing infrastructure), which had been increased from 10 per cent to 15 per cent of capital funds till December 31, 2018 was made available till March 31, 2019. Gold Monetisation Scheme VI.26 In line with modifications to the Gold Monetisation Scheme (GMS), 2015 by Government of India, the SCBs (excluding RRBs) were advised on January 9, 2019, that ‘Charitable Institutions, central government, state government or any other entity owned by central government or state government’ were included as persons eligible to make deposits under the Scheme. Review of Transitional Arrangement under Basel III Capital Regulation VI.27 The Capital Conservation Buffer (CCB), currently 1.875 per cent, being phased in from March 31, 2016 at the rate of 0.625 per cent every year and was targeted to reach 2.50 per cent by March 31, 2019. Since several banks were going through a period of stress as reflected in their weak financials, it was decided in January 2019 to extend the transition period for implementing the last tranche of 0.625 per cent by one year, i.e., up to March 31, 2020. The increase in the trigger level of Common Equity Tier 1 (CET1) capital for write-down/conversion of Additional Tier 1 (AT1) instruments, from 5.50 per cent to 6.125 per cent effective March 31, 2019, was also postponed to March 31, 2020. Interest Equalisation Scheme on Pre-Shipment & Post-Shipment Rupee Export Credit to Cover Merchant Exports VI.28 From November 2, 2018, the Government of India increased the interest equalisation rate from 3 per cent to 5 per cent in respect of exports by manufacturers in the MSME sector under the Interest Equalisation Scheme on Pre and Post Shipment Rupee Export Credit. The same was conveyed to banks for effective implementation. Implementation of Ind AS VI.29 As per the Statement on Developmental and Regulatory Policies of April 5, 2018, implementation of Ind AS for SCBs (excluding RRBs) was deferred by one year pending necessary legislative amendments to the BR Act, 1949 as also the level of preparedness of many banks. As the legislative amendments are under consideration with the Government of India, implementation of Ind AS for banks was deferred till further notice. Disclosure in the ‘Notes to Accounts’ to the Financial Statements VI.30 Banks were advised on April 18, 2017 to disclose details of divergence from Income Recognition, Asset Classification and Provisioning (IRACP) norms wherever, either (a) the additional provisioning requirements assessed by the Reserve Bank exceeded 15 per cent of the published net profits after tax for the reference period, or (b) the additional gross non-performing assets (NPAs) identified by the Reserve Bank exceeded 15 percent of the published incremental gross NPAs for the reference period, or both. In terms of circular dated April 1, 2019, the disclosure requirement is linked to the reported profit before provisions and contingencies, instead of reported net profit. Banks were required to make disclosure of divergence when either or both of the following conditions are satisfied: (a) the additional provisioning for NPAs assessed by the Reserve Bank exceeds 10 per cent of the reported profit before provisions and contingencies for the reference period, and (b) the additional gross NPAs identified by the Reserve Bank exceed 15 per cent of the published incremental gross NPAs for the reference period. Basel III Framework on Liquidity Standards VI.31 The assets allowed as the Level 1 HQLAs for the purpose of computing the LCR of banks, inter alia, include: (a) G-secs in excess of the minimum SLR requirement, and (b) within the mandatory SLR requirement: (i) G-secs to the extent allowed by the Reserve Bank under the Marginal Standing Facility (MSF) (2 per cent of the bank’s NDTL), and (ii) under FALLCR (11 per cent of the bank’s NDTL). Both these rates are effective from June 25, 2018. The carve out from SLR under FALLCR was subsequently increased by 2 per cent from October 1, 2018. Banks were advised to reckon an additional 2 per cent G-secs held by them under FALLCR within the mandatory SLR requirement as Level 1 HQLA for the purpose of computing LCR, effective from April 4, 2019 till April 1, 2020 (an increase of 50 basis points every four months raising the rate of FALLCR from 13 per cent of NDTL to 15 per cent and the total HQLA carve out from SLR from 15 per cent to 17 per cent of NDTL). Amendment to Master Direction on KYC VI.32 Consequent to notification of amendments to PML (Maintenance of Records) Rules, 2005 by Government of India in February 2019 and of “Aadhaar and other Laws (Amendment) Ordinance, 2019”, amending PML Act, 2002, changes were carried out in the master direction on KYC vide circular dated May 29, 2019. Major changes included: (i) allowing banks to carry out Aadhaar authentication/offline verification for individuals using their Aadhaar number for identification purpose voluntarily; (ii) addition of ‘Proof of Possession of Aadhaar Number’ to the list of Officially Valid Documents (OVD); (iii) obtaining customer’s Aadhaar number for e-KYC authentication, for those receiving any benefit or subsidy under direct benefit transfer (DBT); and (iv) provision of identification of customers by regulated entities other than banks, through offline verification under Aadhaar Act if provided on voluntary basis. Further, additional certifying authorities for certifying the OVDs of Non-Resident Indians (NRI) and Persons of Indian Origin (PIO) customers were specified in the master direction. Acquisition of IDBI Bank Ltd. VI.33 In August 2018, the Government of India conveyed to IDBI Bank Ltd. that it had no objection to reduce its shareholding in the bank to below 50 per cent, thereby relinquishing management control. It also approved acquisition of controlling stake by Life Insurance Corporation of India Ltd. (LIC) as promoter in the bank. LIC completed the acquisition on January 21, 2019 with capital infusion of ₹216.24 billion, whereupon IDBI Bank Ltd. was classified as a private sector bank for regulatory purposes by the Reserve Bank. Amalgamation of Dena Bank and Vijaya Bank with Bank of Baroda VI.34 With a view to facilitate consolidation among public sector banks (PSBs), Government of India sanctioned a scheme entitled ‘The Amalgamation of Vijaya Bank and Dena Bank with Bank of Baroda Scheme, 2019’, with Bank of Baroda as the transferee bank and Vijaya Bank and Dena Bank as transferor banks. The Scheme came into force on April 1, 2019. Disclosure on Exposure to Infrastructure Leasing & Financial Services Limited (IL&FS) and its Group Entities VI.35 In view of the restraint placed by National Company Law Appellate Tribunal (NCLAT) vide order dated February 25, 2019 on Financial Institutions for classifying the accounts of IL&FS or its entities as NPA without its prior permission, banks and AIFIs were advised vide circular dated April 24, 2019 to disclose in their notes to accounts, amount which was NPA as per Income Recognition and Asset Classification (IRAC) norms but had not been classified as such, as well as provisions required to be made as per IRAC norms therefor. These instructions were withdrawn subsequent to the NCLAT orders dated May 2, 2019 lifting the previous orders. Rationalisation of Branch Authorisation Policy-RRBs VI.36 The revised instructions on Rationalisation of Branch Authorisation Policy dated May 31, 2019 has introduced the concept of Banking Outlet (BO) for RRBs on the lines of instructions issued to SCBs. As per the revised instructions, RRBs can open branches in Tier 1 to 4 centres (as per census 2011) only with the prior approval, subject to the compliance of prescribed eligibility criteria. Large Exposures Framework (LEF) – Amendments VI.37 The circular dated June 3, 2019 subsumed and superseded earlier circulars dated December 1, 2016 and April 1, 2019 on LEF. In order to capture exposures and concentration risk more accurately and to align the framework with international norms, the following amendments were incorporated in the circular: (i) Exclusion of entities connected with the sovereign from definition of group of connected counterparties, if not connected otherwise, (ii) Introduction of economic interdependence criteria in definition of connected counterparties with effect from April 1, 2020, for entities where a bank has an exposure greater than 5 per cent of its eligible capital base in respect of each entity, and (iii) Mandatory application of look-through approach (LTA) in determination of relevant counterparties in case of collective investment undertakings, securitisation vehicles and other structures. Further, as a transition measure, non-centrally cleared derivatives have been kept outside the purview of LEF till March 31, 2020. Also, for the purpose of LEF, Indian branches of foreign Global Systemically Important Banks (G-SIBs) shall not be treated as G-SIBs (Box VI.2). Prudential Norms for Classification, Valuation and Operation of Investment Portfolio by Banks- Sale of Investments held under Held to Maturity (HTM) Category VI.38 As per the extant master circular on prudential norms for classification, valuation and operation of investment portfolio by banks, shifting of investments to/from HTM is allowed with the approval of the Board of Directors once a year, normally at the beginning of the accounting year and no further shifting to/from HTM is permissible during the remaining part of that accounting year, except when explicitly permitted by the Reserve Bank. Apart from five types of transactions that are already exempted from inclusion in the 5 per cent cap, it was decided that repurchase of State Development Loans (SDLs) by the concerned state government shall also be exempted. Financial Inclusion-Access to Banking Services – BSBDA VI.39 The facilities associated with BSBDA have been reviewed and certain improvements have been made vide circular dated June 10, 2019. Additional value-added services, over and above the minimum facilities permitted, can be provided by banks with or without charge. These additional facilities provided will not make the account a non-BSBDA. Banks have to obtain a declaration from the customer that he/she has no BSBDA in any other bank. The instructions come into force from July 1, 2019. Box VI.2

Implementation of Large Exposures Framework (LEF) with effect from April 1, 2019 Global Financial Crisis has showed that banks did not always consistently measure, aggregate and control exposures to single counterparties or to groups of connected counterparties across their books and operations. Taking proactive forward-looking steps, the Reserve Bank had put in place prudential regulations way back in 1989 by stipulating exposure norms. Under the exposure norms, a bank’s exposure to a single borrower and a borrower group was restricted to 15 per cent and 40 per cent of capital funds (Tier 1+ Tier 2 capital), respectively. The norms also stipulated ceilings for certain sectors like capital market exposure, exposure to NBFCs and intra-group exposures. In order to foster convergence among widely divergent national regulations on dealing with large exposures, the Basel Committee on Banking Supervision issued the Standards on ‘Supervisory Framework for Measuring and Controlling Large Exposures’ in April 2014. The Reserve Bank decided to suitably adopt these standards for banks in India and, accordingly, the instructions on banks’ Large Exposures were issued in December 2016, with implementation date of April 1, 2019. Timeline and Salient Features Revised guidelines were issued on LEF vide circular dated June 3, 2019 which subsumes and supersedes earlier circulars. The revised LEF introduces economic interdependence criteria for identifying group of connected counterparties, with effect from April 1, 2020, mandates look-through approach, and excludes entities connected with the sovereign from definition of group of connected counterparties, if not connected otherwise. The guidelines align the Indian framework with international best practices and improve measurement, aggregation and monitoring of concentration risk. Salient features of LEF are as follows: • Exposure limit on single borrower is capped at 20 per cent of Tier 1 capital which can be extended up to 25 per cent of Tier 1 capital under exceptional circumstances with the approval of banks’ Boards. • Exposure limit for group of connected counterparties is capped at 25 per cent of Tier 1 Capital. • The framework requires group of connected counterparties to be identified based on the control criteria which is based on factors like ownership, voting rights, voting agreements, significant influence on the appointment or dismissal of an entity’s administrative, management or supervisory body and significant influence on senior management. Additionally, banks will be required to incorporate economic interdependence criteria in identifying group of connected counterparties starting April 1, 2020. • Interbank exposures are subject to limit of 25 per cent of Tier 1 capital with constrained limits on exposures to global systemically important banks (G-SIBs); Indian branches of foreign G-SIBs will not be reckoned as G-SIBs under the framework and interbank exposure limit will also apply to exposure of Indian branches of foreign banks on their head-office including overseas branches/subsidiaries. • Exposure limit for all types of NBFCs is capped at 15 per cent of Tier 1 capital. • Considering the critical role played by Central Counterparties (CCPs), clearing related exposure to Qualified Central Counterparties (QCCPs) are exempt from the framework. • The framework envisages Look-through approach for aggregating exposure to counterparties through structures like mutual funds and securitisation. • Exposure measurement is aligned with Basel III regulations by permitting use of Credit Risk Mitigation (CRM) and Credit Conversion Factors (CCFs). • Banks can reckon capital infusion and quarterly profits during the year, consistent with Basel III guidelines for calculating the eligible capital base. • Entities connected with the sovereign are excluded from definition of group of connected counterparties, if not connected otherwise (either by control criteria and/or by economic interdependence criteria, which is effective April 1, 2020). • Non-centrally cleared derivatives are exempt from the framework till March 31, 2020. | FinTech development and Regulatory initiatives VI.40 One of the key recommendations of the report of the IRTG on FinTech and Digital Banking (Chairman: Shri Sudarshan Sen) released on February 8, 2018, was to introduce a framework for “regulatory sandbox/innovation hub” within a well-defined space and duration where the financial sector regulator would provide the requisite regulatory guidance. Accordingly, the draft ‘Enabling Framework for Regulatory Sandbox’ was placed on the Reserve Bank’s website on April 18, 2019 for comments of stakeholders. The feedback obtained is currently under examination and the Framework will be finalised soon. Basel III Capital Regulations – Implementation of Leverage Ratio for Banks VI.41 With a view to moving further towards harmonisation with Basel III standards, instructions were issued on June 28, 2019, advising banks that the minimum leverage ratio shall be 4 per cent for Domestic Systemically Important Banks (D-SIBs) and 3.5 per cent for other banks. Both the capital measure and the exposure measure along with leverage ratio are to be disclosed on a quarter-end basis. Banks must, however, meet the minimum leverage ratio requirement at all times and these guidelines shall be effective from the quarter commencing October 1, 2019. Revision in Proforma and Reporting of Banks/Banking Outlets (BOs) Details under Central Information System for Banking Infrastructure (CISBI) VI.42 The Master Office File (MOF) system maintained by the Reserve Bank for the directory of all BOs/Offices of banks in India through which Basic Statistical Returns (BSR) code is allotted, has been replaced by a new web-based reporting system viz., CISBI (https://cisbi.rbi.org.in) with a single proforma. All the past information has been migrated to CISBI and reporting henceforth shall be done by all entities/banks in the new system, which has the provision to maintain complete details of banks/AIFIs with a time stamp. Wholesale and Long-Term Finance (WLTF) Banks VI.43 In the first bi-monthly monetary policy statement, 2016-17 (April 5, 2016), it was announced that the Reserve Bank would explore the possibilities of licensing other differentiated banks such as WLTF banks. A Discussion Paper on the subject was released on Reserve Bank’s website on April 7, 2017. After considering various suggestions/feedback and discussions held with multinational banks and financial institutions, it emerged that there are challenges in evolving a sustainable and viable model for WLTF banks. It was, therefore, decided not to pursue the proposal. Agenda for 2019-20 VI.44 The Department will continue to work towards aligning the prudential regulatory framework with evolving BCBS and global standards/practices, including implementation of Ind AS for banks, subject to necessary legislative amendments. In order to align the current regulatory framework with global best practices, the Reserve Bank will issue draft guidelines on corporate governance in banks. Further, revised standardised approach for calculating minimum capital requirement for operational risk and draft revised guidelines on credit risk will be issued. The regulatory framework for securitisation as well as interest rate risk in banking book will be finalised. VI.45 Final prudential regulations will be issued to the AIFIs, covering revised instructions on exposure norms, investment norms, risk management framework and select elements of Basel III capital framework. The implementation of Ind AS for AIFIs has been deferred and will be synchronised with the implementation of the same for the SCBs. In the emerging FinTech area, focus will be on operationalisation of Regulatory Sandbox. VI.46 Guidelines on minimum balance requirements for savings bank accounts and penalty for non-maintenance will be reviewed. Automated data flow in eXtensible Business Reporting Language (XBRL) platform will be used for settlement of claims relating to interest equalisation scheme. Further, a Discussion Paper will be released on implementation of macro-prudential policies for addressing incipient credit risk in the system. For the purpose of implementation of a framework for credit supply to large borrowers through market mechanism, a study would be undertaken based on the data from banks/Central Repository of Information on Large Credits (CRILC). Digital onboarding of bank customers would be facilitated, enabling video-based KYC for individuals under the provisions of PML Rules. Cooperative Banks: Department of Cooperative Bank Regulation (DCBR) VI.47 The Reserve Bank continues to play a key role in strengthening the cooperative banking sector by fortifying the regulatory and supervisory framework. In this context, the Department of Cooperative Bank Regulation (DCBR), which is in charge of prudential regulations of cooperative banks, took several initiatives in 2018-19. Agenda for 2018-19: Implementation Status Unlicensed District Central Cooperative Banks (DCCBs) in Jammu and Kashmir VI.48 A Memorandum of Understanding (MoU) was signed by the state government, the Government of India and NABARD on the three unlicensed DCCBs in Jammu and Kashmir. Accordingly, the state government released its share of ₹2.56 billion in March 2018 (the same is held with the cooperative department of Jammu and Kashmir government for onward transmission). The state government sanctioned the constitution of Professional Boards of the three unlicensed DCCBs in terms of Sub-Section (1)(a) of Section 30-B of Jammu & Kashmir Cooperative Societies (Amendment) Ordinance, 2018 for the implementation of revival package(s) sanctioned by the Government of India/state government/ NABARD. Issue of licenses to these three DCCBs will be considered after the DCCBs comply with the condition in respect of their achieving the required CRAR. Voluntary Transition of UCBs into SFBs VI.49 The High Powered Committee (HPC) on UCBs (Chairman: Shri R. Gandhi), had, inter alia, recommended the voluntary conversion of large Multi-State UCBs into Joint Stock Companies and other UCBs meeting certain criteria into SFBs. Guidelines were issued on November 27, 2018 for allowing this voluntary transition for UCBs with a minimum net worth of ₹500 million, maintaining CRAR of 9 per cent and meeting other eligibility criteria. Implementation of Core Banking Solution (CBS) in UCBs VI.50 As on June 30, 2019, 1,436 UCBs out of 1,545 UCBs have implemented CBS. Scheduling, Licensing and Mergers of Cooperative Banks VI.51 Tripura State Cooperative Bank Ltd., Tripura and Delhi State Cooperative Bank were included in the Second Schedule of the RBI Act, 1934 in January 2019 and May 2019, respectively. During 2018-19, six proposals for mergers of UCBs were processed by the Department. Of these, two merger proposals were approved and are awaiting final approval of the concerned Registrars of cooperative societies and one was rejected. The remaining three merger proposals are presently under process. The licenses of 4 weak UCBs were cancelled during the period of review. Agenda for 2019-20 VI.52 The milestones for 2019-20 include issuance of revised guidelines on supervisory action framework for UCBs, formulation of policy framework for promoting consolidation in UCB sector and establishment of an Umbrella Organisation (UO) for UCBs (Box VI.3). Regulatory approval has been accorded to the National Federation of Urban Cooperative Banks and Credit Societies Ltd. (NAFCUB) for setting up the UO as a non-deposit taking NBFC (NBFC-ND). NBFCs: Department of Non-Banking Regulation (DNBR) VI.53 NBFCs play an important role in providing credit by complementing commercial banks and catering to niche sectors. The Department of Non-Banking Regulation (DNBR) is entrusted with the responsibility of regulating the NBFC sector. Agenda for 2018-19: Implementation Status Standalone Primary Dealers (SPDs) VI.54 SPDs were permitted to offer forex services to their foreign portfolio investor (FPI) clients as part of their non-core activities, effective July 27, 2018, subject to compliance with prudential regulations and specific permission from the Reserve Bank. NBFCs: Minimum Holding Period (MHP) for Securitisation Transactions VI.55 In order to encourage NBFCs to securitise/assign their eligible assets, the MHP requirement for originating NBFCs was relaxed in November 2018 in respect of loans of original maturity above five years. The MHP relaxation is in respect of receipt of repayment of six monthly instalments or two quarterly instalments (as applicable), subject to the prudential requirement that minimum retention requirement (MRR) for such securitisation/assignment transactions shall be 20 per cent of the book value of the loans being securitised or 20 per cent of the cash flows from the assets being assigned. This dispensation was given initially for a period of six months, i.e., up to May 2019, which has been further extended till December 31, 2019. Box VI.3

Establishment of Umbrella Organisation for Primary (Urban) Cooperative Banks (UCBs) UCBs lack avenues for raising capital funds since they can neither raise capital through public issue nor can they issue shares at a premium. They also have limited avenues for meeting short-term liquidity requirements as only scheduled banks have direct access to the Reserve bank’s liquidity support windows. Cooperative bonding and a mutual support system in the form of an Umbrella Organisation (UO) would contribute to the strength and vibrancy of the sector, as borne out by the international experiences. The UO would be expected to extend liquidity and capital support to the member banks. The UO would also be expected to set up Information Technology (IT) infrastructure for shared use of members to enable them to widen their range of services at a relatively lower cost. The UO can also offer fund management and other consultancy services and contribute to the capacity building in the member UCBs. The idea of an UO for the UCB sector was first mooted in 2006 by the Reserve Bank’s Working Group on Augmentation of Capital of UCBs (Chairman: Shri N. S. Vishwanathan). Later in 2008, the Reserve Bank set up a Working Group on Umbrella Organisation and Constitution of Revival Fund for Urban Cooperative Banks (Chairman: Shri V. S. Das). The Expert Committee on Licensing of New Urban Cooperative Banks (Chairman: Shri Y. H. Malegam) also recommended setting up of an UO in the year 2011 and the same was endorsed in 2015 by the High-Powered Committee on UCBs. | Interest Subvention Scheme for MSMEs VI.56 The Government of India extended the Interest Subvention Scheme for MSMEs, 2018 to all NBFC-ND-SIs, who were advised to take appropriate action for implementation of the Scheme and approach the nodal implementation agency, the Small Industries Development Bank of India (SIDBI). Harmonisation of NBFCs VI.57 Regulations governing Asset Finance Companies (AFCs), Loan Companies (LCs) and Investment Companies (ICs) were harmonised and they were merged into a new category called NBFC-Investment and Credit Companies (NBFC-ICCs), effective February 22, 2019, in order to move towards activity-based regulation rather than entity-based regulation so as to provide more operational flexibility to NBFCs. Fit and Proper Criteria for Sponsors of ARCs VI.58 On October 25, 2018, the Reserve Bank issued directions on fit and proper criteria for sponsors of ARCs in order to strengthen the ARCs. Permission to ARCs for Acquisition of Assets from Other ARCs VI.59 In view of the amendment to the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act, 2002, ARCs have been permitted to acquire assets from other ARCs, subject to compliance with certain conditions. Eligible NBFC-ND-SIs as Authorised Dealers (ADs)–Category II VI.60 The Reserve Bank allowed non-deposit taking systemically important NBFC-ICCs to obtain AD-Category II license, effective April 16, 2019, in order to increase accessibility and efficiency of the services extended to the members of the public for their day-to-day non-trade current account transactions. Eligible NBFCs will have to satisfy certain conditions and seek specific permission from the Reserve Bank. Appointment of Chief Risk Officer (CRO) for NBFCs VI.61 To augment risk management practices of the NBFC sector, NBFCs with asset size of more than ₹50 billion have been advised to appoint a CRO, with clearly specified role and responsibilities, who would be required to function independently so as to ensure highest standards of risk management. Liquidity Framework for NBFCs VI.62 The guidelines on liquidity risk management framework for NBFCs, including non-deposit taking systemically important Core Investment Companies (CIC-ND-SIs) with asset size of ₹1 billion and above and all deposit taking NBFCs irrespective of asset size, were reviewed in order to strengthen the Asset-Liability Management (ALM) framework for NBFCs and a draft liquidity risk management framework for NBFCs was placed on the Reserve Bank’s website for public comments in May 2019 (Box VI.4). Agenda for 2019-20 Disclosure Requirements VI.63 In order to bring in more transparency and provide an effective and robust disclosure framework for NBFCs, the extant disclosure requirements for NBFCs will be reviewed. Harmonisation of NBFC Categories VI.64 The exercise of harmonising the regulatory framework for various categories of NBFCs, initiated during the year, will be pursued with a view to further bringing down the number of categories of NBFCs, thereby facilitating better implementation of activity based regulation. Fair Practices Code (FPC) for ARCs VI.65 A set of principles in the form of FPC will be issued for ARCs to encourage them to follow fair practices while dealing with stakeholders. 4. SUPERVISION OF FINANCIAL INTERMEDIARIES Department of Banking Supervision (DBS) VI.66 The Department of Banking Supervision (DBS) is entrusted with the responsibility of supervising SCBs (excluding RRBs), LABs, Payments Banks (PBs), SFBs, Credit Information Companies and AIFIs based on supervisory inputs received through off-site monitoring and on-site inspections. Agenda for 2018-19: Implementation Status Recommendations of Expert Committee VI.67 The Expert Committee (Chairman: Shri Y. H. Malegam), constituted in February 2018 to look into: high divergence in asset classification and provisioning by banks vis-à-vis the Reserve Bank’s supervisory assessment; increasing incidence of frauds in banks (including IT interventions); and the role and effectiveness of various types of audits, submitted its report in July 2018. Action in respect of wherever necessary, is being initiated. Box VI.4

Liquidity Risk Management Framework for NBFCs NBFCs have developed significant inter-linkages with the rest of the financial sector in terms of access to public funds and participation in credit intermediation, with implications for systemic risks. This has warranted a review of the liquidity risk management for NBFCs. The extant ALM guidelines are applicable to non-deposit taking NBFCs with an asset size of ₹1 billion and above, and deposit taking NBFCs having a deposit base of ₹200 million and above: • Instructions on the three pillars of ALM framework, viz., ALM information systems, ALM organisation (including formation of Asset-Liability Committee (ALCO), its constitution, etc.) and ALM processes. • Monitoring of structural and short-term dynamic liquidity and interest rate sensitivity. • Maturity gap analysis across time buckets with main focus on 30/31 days time bucket in which the negative gap is not supposed to exceed 15 per cent of the cash out flow. • CICs with asset size of ₹5 billion and above to disclose the maturity pattern of assets and liabilities. Proposed Changes a. Augmentation of the General Framework for Management of Liquidity Risk i) ALM Guidelines: ALM guidelines have been recast on the lines of those applicable to banks, incorporating (a) off-balance sheet and contingent liabilities; (b) stress testing; (c) contingency funding plan; (d) intra-group fund transfers; (e) collateral position management; and (f) diversification of funding. ii) Maturity Buckets Revised: Maturity buckets have been made granular by trifurcating the 1 to 30/31 days bucket into 1-7 days, 8-14 days and 15 to 30 days, with cumulative gap limits set at 10 per cent, 10 per cent and 20 per cent of the respective outflows. Cash flow stress will be captured at an early stage and mitigation is expected to be timely. iii) Liquidity Risk Monitoring Tools: NBFCs will be required to monitor (a) concentration of funding (by counterparty, instrument, currency); (b) available unencumbered assets (that can be used as collateral for raising funds); and (c) market related monitoring information (equity prices, coupon on debts raised, regulatory penalty and the like). iv) Stock Approach to Liquidity Risk Management: Boards of NBFCs are required to identify critical ratios and monitor them against internally prescribed ceilings [an illustrative list could include short-term liabilities to total assets; short-term liabilities to long-term assets; commercial papers to total assets, non-convertible debentures (NCDs) of original maturity less than one year to total assets; short term liabilities to total liabilities; long term assets to total assets]. b. Introduction of the Liquidity Coverage Ratio (LCR) for Large NBFCs The proposed LCR framework will apply to all deposit taking NBFCs and NBFC-ND-SIs with asset size of ₹50 billion and above. It will be implemented in a phased manner. • LCR is defined as: Stock of High Quality Liquid Assets (HQLAs)

Total Net Cash Outflows over the next 30 calendar days • NBFCs to maintain LCR of minimum 60 per cent from April 1, 2020, progressively increasing in equal steps till it reaches the required level of 100 per cent, by April 1, 2024 and maintaining it at minimum 100 per cent on an on-going basis with effect from April 1, 2024. • NBFCs to hold HQLAs to cover the net cash outflow over the next 30 day period under a situation of stress. • Computation of HQLAs to be based on prescribed haircuts applied on the eligible assets. • For computation of net cash outflow in the 30 day period, the stress scenario is built by overestimating outflows by 15 per cent and underestimating inflows by 25 per cent. | Cyber Security VI.68 Fifty-seven banks, including six cooperative banks, were subjected to IT examinations to assess their level of cyber security preparedness and compliance with the circulars, advisories and alerts on cyber security issued by the Reserve Bank from time to time. Targeted thematic examinations were also carried out, focusing on applications, infrastructure and systems used by the banks. During the year, three cyber drills were conducted on hypothetical scenarios as table top exercises for informing banks’ prospective reviews of Cyber Crisis Management Plans/Incident Response Mechanisms. VI.69 During the year, key risk indicators were revised to ensure that banks provide a more accurate quantitative indication of cyber risk posture and adequacy of cyber controls implemented by banks. Banks were advised to ensure that members of the Board, senior management and CXOs (viz., Chief Information Officer, Chief Technology Officer, Chief Risk Officer and Chief Information Security Officer) undergo mandatory certification in IT and cyber security. Other Developments Frauds Analysis VI.70 The number of cases of frauds reported by banks increased by 15 per cent in 2018-19 on a year-on-year basis (Table VI.1), with the amount involved rising by 73.8 per cent, though mostly related to occurrences in earlier years. The average lag between the date of occurrence and its detection by banks was 22 months. The average lag for large frauds, i.e. ₹1 billion and above, amounting to ₹522 billion reported during 2018-19, was 55 months. Among bank groups, PSBs, which constitute largest market share in bank lending, have accounted for the bulk of frauds reported in 2018-19. It was followed by private sector banks and foreign banks. VI.71 In terms of area of operations, frauds related to advances constituted the preponderant share of the total amount involved in frauds in 2018-19, while the share of frauds in off-balance sheet items declined from a year ago (Table VI.2). In terms of the number of frauds too, those related to advances were predominant followed by card/internet related frauds and deposits related frauds. Frauds relating to card/internet and deposits constituted only 0.3 per cent of the total value of frauds in 2018-19. VI.72 Cheating and forgery was the major component, followed by misappropriation and criminal breach of trust. Fraud cases involving an amount of less than ₹0.10 million (i.e., small value frauds) were only 0.1 per cent of the total amount involved in 2018-19. Cross-Border Supervision VI.73 The Reserve Bank established agreements for supervisory cooperation with 48 banking supervisory authorities from various jurisdictions. In order to strengthen cross border supervisory processes, meetings of Supervisory Colleges for State Bank of India, Punjab National Bank, Axis Bank, Bank of Baroda, Bank of India and ICICI Bank were held during the year with host supervisors and domestic regulators. Risk Based Supervision (RBS) VI.74 Under the Supervisory Programme for Assessment of Risk and Capital (SPARC), RBS has been successfully implemented for banks operating in India over six supervisory cycles. The supervisory framework for SFBs was developed and rolled out on a pilot basis. Sensitisation sessions were conducted for Board members and Senior Management of banks during the year. Statutory Central Auditors (SCAs) VI.75 The Reserve Bank has put in place a system of structured meetings between the Reserve Bank supervisors and SCAs of supervised banks at quarterly intervals in order to improve the effectiveness of the relationship between supervisors and auditors for exchange of information, concerns and broader discussions. | Table VI.1: Fraud Cases - Bank Group-wise | | Bank Group/Institution | 2017-18 | 2018-19 | | Number of Frauds | Amount Involved

(₹ million) | Number of Frauds | Amount Involved

(₹ million) | | 1 | 2 | 3 | 4 | 5 | | Public Sector Banks | 2,885 | 382,608.7 | 3,766 | 645,094.3 | | | (48.8) | (92.9) | (55.4) | (90.2) | | Private Sector Banks | 1,975 | 24,782.5 | 2,090 | 55,151.4 | | | (33.4) | (6.0) | (30.7) | (7.7) | | Foreign Banks | 974 | 2,560.9 | 762 | 9,553.0 | | | (16.5) | (0.6) | (11.2) | (1.3) | | Financial Institutions | 12 | 1,647.0 | 28 | 5,534.1 | | | (0.2) | (0.4) | (0.4) | (0.8) | | Small Finance Banks | 65 | 61.9 | 115 | 75.2 | | | (1.1) | (0.0) | (1.7) | (0.0) | | Payment Banks | 3 | 9.0 | 39 | 21.1 | | | (0.1) | (0.0) | (0.6) | (0.0) | | Local Area Banks | 2 | 0.4 | 1 | 0.2 | | | (0.0) | (0.0) | (0.0) | (0.0) | | Total | 5,916 | 411,670.4 | 6,801 | 715,429.3 | | | (100.0) | (100.0) | (100.0) | (100.0) | Note: 1. Figures in parentheses represent the percentage share of the total.

2. The above data is in respect of frauds of ₹0.1 million and above reported during the period. The ‘Amount Involved’ does not equate with loss suffered by banks. In case of some frauds, in foreign exchange transactions for instance, there may not be any loss suffered.

Source: RBI Supervisory Returns. |

| Table VI.2: Fraud Cases - Area of Operations | | | 2017-18 | 2018-19 | | Area of Operation | Number of Frauds | Amount Involved

(₹ million) | Number of Frauds | Amount Involved

(₹ million) | | 1 | 2 | 3 | 4 | 5 | | Advances | 2,525 | 225,583.2 | 3,606 | 645,481.7 | | | (42.7) | (54.8) | (53.0) | (90.2) | | Off-balance Sheet | 20 | 162,876.7 | 33 | 55,375.2 | | | (0.3) | (39.6) | (0.5) | (7.7) | | Foreign Exchange Transactions | 9 | 14,258.0 | 13 | 6,953.8 | | | (0.2) | (3.5) | (0.2) | (1.0) | | Card/Internet | 2,059 | 1,095.6 | 1,866 | 713.8 | | | (34.8) | (0.3) | (27.4) | (0.1) | | Deposits | 697 | 4,622.7 | 596 | 1,483.1 | | | (11.8) | (1.1) | (8.8) | (0.2) | | Inter-Branch Accounts | 6 | 11.9 | 3 | 1.1 | | | (0.1) | (0.0) | (0.0) | (0.0) | | Cash | 218 | 403.4 | 274 | 555.4 | | | (3.7) | (0.1) | (4.0) | (0.1) | | Cheques/Demand | 207 | 341.2 | 189 | 336.6 | | Drafts, etc. | (3.5) | (0.1) | (2.8) | (0.0) | | Clearing Accounts, etc. | 37 | 56.2 | 24 | 2,088.1 | | | (0.6) | (0.0) | (0.4) | (0.3) | | Others | 138 | 2,421.5 | 197 | 2,440.5 | | | (2.3) | (0.6) | (2.9) | (0.3) | | Total | 5,916 | 411,670.4 | 6,801 | 715,429.3 | | | (100.0) | (100.0) | (100.0) | (100.0) | Note: 1. Figures in parentheses represent the percentage share of the total.

2. The above data is in respect of frauds of ₹0.1 million and above reported during the period.

Source: RBI Supervisory Returns. | Agenda for 2019-20 VI.76 In order to understand the systemic linkage between banks (SCBs and cooperative banks) and NBFCs, and their interconnectedness, certain functions of supervisory departments are proposed to be integrated to enable: (a) holistic understanding of systemic risks; (b) understanding linkages, contagion and risk build-up across entities for effective off-site monitoring; and (c) identifying systemic early warning signals based on entity-agnostic thematic studies. It is also proposed to have a dedicated and specialised cadre of officers for ensuring a state-of-the-art supervisory framework for banks. Supervisory focus would be on effective risk discovery and better off-site monitoring through leveraging technology. VI.77 In view of the emergence of cyber risk among threats to financial stability, the DBS proposes to undertake cyber security related supervision of cooperative banks and NBFCs in a phased manner in addition to that of SCBs, FIs and CICs. VI.78 In line with the evolution of regulatory guidelines on the implementation of IFRS/Ind AS, the impact on quantitative and qualitative reporting by banks would be reviewed, aligned and integrated with the supervisory framework. VI.79 An Information Technology (IT) solution (ICMTS – Integrated Compliance Management and Tracking System) has been envisaged to have an integrated approach to managing inspection lifecycle and programmes under RBS, IT examination and the like. It will have capabilities such as built-in remediation workflows, time tracking, email-based notifications and alerts, Management Information System (MIS) reports and dashboards to gauge overall progress. VI.80 The Reserve Bank would coordinate with various agencies including Ministry of Corporate Affairs to examine the feasibility of interlinking various databases and information systems to improve the system of fraud monitoring and take necessary corrective regulatory and supervisory action. To improve the fraud risk management framework for banks: (a) the master directions on frauds shall be revised to incorporate new instructions in the light of experience gained; (b) workshops will be conducted on frauds for the bankers based on comprehensive reviews, to sensitise them on fraud prevention, prompt/ accurate reporting and follow up action; (c) fraud registry will be made more user-friendly; and (d) fraud analytics will be improved. Cooperative Banks: Department of Cooperative Bank Supervision (DCBS) VI.81 The primary responsibility of the Department of Cooperative Bank Supervision (DCBS) is supervising UCBs and ensuring the development of a safe and well-managed cooperative banking sector. To achieve this objective, DCBS undertakes periodic on-site and continuous off-site monitoring of the UCBs. At end-March 2019, 1,542 UCBs were operating in the country, out of which 46 UCBs had negative net worth and 26 UCBs were under directions of the Reserve Bank. Agenda for 2018-19: Implementation Status Efforts to Make UCBs CBS Compliant VI.82 The adoption of a technological platform for CBS system in a few UCBs was delayed due to reasons such as lack of expertise and/or capital or recurring losses. The Reserve Bank has taken measures and coordinated with the state governments to provide adequate support to such UCBs to enable them to implement CBS. Consequently, except for a few UCBs with negative net worth, all UCBs that were not on CBS till a year ago, have initiated the process of implementation of CBS. Inspection Process Review VI.83 The inspection process of UCBs was reviewed and revised to make it more focussed and to capture embedded risks in financial and functional parameters. The inspection rating model was also revised to reflect changes in the financial parameters in a precise manner. Cyber Security Policy VI.84 All UCBs were advised to put in place a Cyber Security Policy, duly approved by their Board/Administrator, containing a framework and strategy to check cyber threats, depending on the level of complexity of business and acceptable levels of risk. This policy has to be distinct from the IT/information systems (IS) policy of the UCB so that it highlights the risks emanating from cyber threats and the measures required to address/reduce these risks. A supervisory reporting framework has also been put in place for quick action on cyber-attack incidents (Box VI.5). Agenda for 2019-20 Implementation of Centralised Fraud Registry (CFR) VI.85 It is proposed to create a mechanism for sharing of fraud related information among UCBs on similar lines of CFR that is in place for commercial banks. This will enable sharing of information on frauds in a timely and uniform manner across the sector. Development of Prolific Reports for Early Assessment of Deficiencies and Timely Supervisory Action VI.86 In order to optimally utilise the available data for supervisory inputs, it has been planned to develop standardised reports based on revised incipient indicators derived from select financial parameters using off-site surveillance data for early assessment of deficiencies and timely supervisory action. Differentiated Supervision Mechanism for Select UCBs VI.87 It has been envisaged to introduce differentiated supervision framework for UCBs by having risk based assessment for scheduled UCBs. This initiative will entail improving the skill set of inspectors and introducing processes for assessing risk in banks. Box VI.5

Basic Cyber Security Framework for Primary (Urban) Cooperative Banks (UCBs) The UCB sector has adopted information technology (IT) in their day-to-day operations to improve the quality and ease of delivery of banking services, accounting and MIS. It has, however, exposed the UCBs to risks associated with IT and cyber threats. Keeping in view incidents of high profile cyber-attacks, theft of customer information, fraudulent use of net banking and skimming of debit/credit cards, putting in place a system to protect UCBs from risk arising out of cyber-threats has become imperative. In terms of the circular on Basic Cyber Security Framework for Primary (Urban) Cooperative Banks dated October 19, 2018, all UCBs were advised to frame a Cyber Security Policy covering guidelines on organisational arrangements, creating cyber security awareness among all stakeholders, ensuring protection of customer information and implementing basic Cyber Security Controls. The policy also mandated the need to have Inventory Management of Business IT Assets, Environmental Controls, Network Management and Security, Secure Configuration, User Access Control/Management, Vendor/Outsourcing Risk Management and Awareness Building for Users/Employee/Management in a time bound manner. A supervisory reporting framework has also been prepared for the UCBs to report any unusual cyber security incidents (including intrusion attempts) to the Reserve Bank. | NBFCs: Department of Non-Banking Supervision (DNBS) VI.88 The mandate of the Department of Non-Banking Supervision (DNBS) is to protect depositors and customers, while ensuring financial stability. Deposit taking NBFCs, depending upon their systemic importance, are subjected to close on-site and off-site monitoring. For ensuring customer protection, the Reserve Bank formulated a Fair Practices Code for NBFCs in 2006. The mandate to maintain financial stability is ensured through close supervision of systemically important NBFCs (i.e., with asset size of ₹5 billion and above), currently 276 in number and accounting for 85 per cent of the asset size of the sector. All four pillars of supervision (viz., on-site examination; off-site surveillance; market intelligence; and annual certificate received from statutory auditors) are used for monitoring deposit taking NBFCs and NBFC-ND-SIs. Smaller NBFCs are monitored through off-site surveillance, market intelligence and on-site scrutiny visits. From October 2018, the imposition of monetary penalty has been separated from the supervisory function with a view to ensuring independent and neutral assessment. Enforcement Department now decides monetary penalties in respect of NBFCs. Agenda for 2018-19: Implementation Status VI.89 As part of the ‘ownership-neutrality’ principle, adopted for supervision of NBFCs, all government-owned NBFC-ND-SIs (accounting for 30 per cent of assets of the sector) and government-owned deposit taking NBFCs (accounting for 1.4 per cent of assets of the sector) have been brought under the Reserve Bank’s on-site inspection framework and off-site surveillance from the inspection cycle 2018-19. All NBFCs including FinTech-based P2P NBFCs are also being brought under off-site reporting through XBRL platform of the Reserve Bank. VI.90 In the context of electronic transactions and their surveillance, monitoring of cyber security related incidents in the NBFC sector has gained traction and has been centralised in the Cyber Security and Information Technology Examination (CSITE) cell of the DBS with effect from April 1, 2019. All NBFCs have been advised to report all types of unusual cyber security related incidents in a specified format to the CSITE cell of the DBS through a generic e-mail id (cybersecuritynbfc@rbi.org.in). VI.91 As part of the efforts to weed out non-compliant weak NBFCs, Certificates of Registration of 1604 NBFCs were cancelled for non-fulfilment of the criterion of the minimum net owned fund requirement of ₹20 million. In preparation of the implementation of Ind AS, a seminar on the subject was conducted at Mumbai in February 2019. Agenda for 2019-20 VI.92 Concerted efforts would be made during 2019-20 towards further strengthening each of the four supervisory pillars of NBFCs. Onsite Supervision VI.93 Inspection of all regulated entities (i.e., banks/NBFCs) will be conducted together to facilitate better understanding of intra/inter-group transactions and exposures and to obtain a holistic view of an NBFC which has other NBFCs/ banks in the same group. The concept of Senior Supervisory Manager, as the central point of contact for a single large NBFC/group of NBFCs, will be implemented for focussed attention on large entities/groups. In addition, system of on-site inspection and off-site surveillance mechanism is being strengthened and a review of the supervisory/regulatory framework of CICs would be undertaken keeping in view the need for close monitoring of CICs, which tap funds from the market and invest in/lend to the group companies. Off-site Surveillance VI.94 Off-site returns for NBFCs are being revised and rationalised from 21 to 17 returns, while deepening and widening the information set being obtained. The returns are being developed in XBRL, with in-built validation checks. Various reports have been designed to check timely submission of data along with accuracy of reporting as well as to pick up early warning signals of weakness in the regulated entity. Market Intelligence VI.95 The Sachet portal was launched in 2016 in two languages (Hindi and English) for reporting unauthorised collection of deposits/Ponzi Schemes. The portal will be made available in 11 regional languages in 2019-20 in addition to Hindi and English, which are already available. This will facilitate receipt of information on Ponzi Schemes and deposit collection by unauthorised bodies. It will also help in spreading financial literacy as the portal also contains material on financial literacy in many languages. Submission of Annual Reports by Statutory Auditors (SAs) VI.96 A template will be designed for SAs to enable them to directly upload the audited data to the Reserve Bank’s database through XBRL, which will also provide a benchmark for comparing off-site data submitted by NBFCs. Interaction with Other Stakeholders VI.97 DNBS would work towards development of the fifth pillar of supervision i.e., engagement with stakeholders of the sector, including the NBFCs, their SAs, CRAs, other regulators and banks having large exposures to the sector so as to, inter alia, identify the emerging risks and developments in the sector and take prompt action. Enforcement Department (EFD) VI.98 The Enforcement Department (EFD) was set up in April 2017 to enforce regulations uniformly across the banks, with an objective to engender greater compliance by the regulated entities, within the overarching principle of ensuring financial stability, public interest and consumer protection. The enforcement policy and framework approved by the Board for Financial Supervision (BFS) emphasises the need to be objective, consistent and non-partisan in undertaking enforcement (Box VI.6). Agenda for 2018-19: Implementation Status VI.99 The enforcement work pertaining to cooperative banks and NBFCs was brought under the Department, with effect from October 3, 2018. During July 2018 to June 2019 (Chart VI.1), the Department undertook enforcement actions against 47 banks (including nine foreign banks, one payment bank and one cooperative bank), and imposed an aggregate penalty of ₹1,238.6 million for non-compliance with/contravention of directions on fraud classification and reporting; not adhering to discipline while opening current accounts; not reporting to CRILC platform under RBS; violations of directions/ guidelines issued by the Reserve Bank on KYC norms, IRAC norms, payment of compensation for delay in resolution of ATM-related customer complaints; violation of all-inclusive directions and specific directions prohibiting opening of new accounts; non-compliance with the directions on cyber security framework and time-bound implementation and strengthening of SWIFT-related operational controls; contravention of the directions pertaining to third party account payee cheques and non-compliance with directions on note sorting, directions contained in risk mitigation plan (RMP), directions to furnish information and directions on ‘Guarantees and Co-acceptances’. Box VI.6

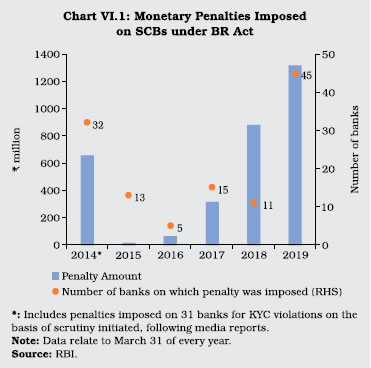

Enforcement Policy and Framework An effective, consistent and predictable enforcement framework is a sine qua non for a credible banking regulatory and supervisory framework. Enforcement action has a deterrent effect in terms of money and reputation for the regulated entity (RE) and the demonstration effect of an enforcement action has been well documented. Studies have suggested that enforcement action leads to better behaviour not only in case of sanctioned banks but also modifies the behaviour of non-sanctioned banks favourably (Delis, Staikouras and Tsoumas, 2016) Enforcement can be formal, ex post in the form of obtaining compliance as part of the supervisory process or imposing penalty on the banks/ individuals; or, informal, ex ante in terms of clarifications/cautionary advices issued by the regulator. A balanced approach to enforcement involves elements of both, with persisting /recurring non-compliance attracting exemplary formal action. International Experiences In the United States, the Federal Deposit Insurance (FDI) Act and Federal Deposit Insurance Corporation (FDIC) Rules and Regulations, Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), 1989 and US Civil Code are some of the laws that regulate the financial sector. Supervisory and enforcement powers are divided between various agencies at the federal and state level and four agencies, viz., Board of Governors of the Federal Reserve System (Federal Reserve), FDIC, Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB).2 In addition, the Department of Justice (DoJ) enforces misconduct related to criminal offences and anti-competitive conduct. On the basis of gravity, the violations are classified as Tier 1, Tier 2 and Tier 3 and enforcement action may include non-monetary action like public statements, cease and desist orders, withdrawal of authorisation and temporary bans on the management, monetary fine and criminal penalties. In the European Union (EU), banking supervision is carried out by a Single Supervisory Mechanism, one of the two pillars of the EU Banking Union, the other being Single Resolution Mechanism, and comprises the European Central Bank (ECB) and the national competent authorities (NCAs) of participating Member States. The supervisory domain of ECB and NCAs is determined on the basis of classification of an institution, viz., significant institutions are supervised by ECB and the less significant institutions by the NCAs. Monetary penalties can be imposed on significant institutions and less significant institutions by ECB or by the NCAs depending on the nature of breach (of EU Law, ECB regulation and decisions or national law), up to twice the amount of the profits gained or losses avoided because of the breach, or up to 10 per cent of the significant institution’s total annual turnover in the preceding business year, based on the principles of effectiveness, proportionality and dissuasiveness, taking into account severity of the infringement and also any aggravating and mitigating circumstances of the case. The period of limitation (from the date of infringement) within which the decision to impose penalty is to be taken as well as the period within which the penalty is to be recovered is also provided by the Regulation. India The Reserve Bank has the powers to impose penalties under the various laws affecting the banking and financial sector3. While the Reserve Bank has been taking penal action under these statutes, the process was spread across various supervisory/regulatory departments and was not in line with the international best practice of separating enforcement action from the supervisory process. Accordingly, with a view to separate identification of violations and enforcement action from supervisory process, and to put in place a sound framework and process for enforcement action and undertake enforcement, Enforcement Department (EFD) was set up within the Reserve Bank in April 2017. Enforcement Policy and Objective The objective of the policy is to engender greater compliance with statutes and regulations/directions issued by the Reserve Bank thereunder, within the overarching principle of ensuring financial stability, public interest and consumer protection. It envisages enforcement action to be initiated on the basis of inspection reports and scrutiny reports finalised by the supervisory departments (evidence based), based on well-defined principles of materiality, proportionality and intent applied uniformly across all entities to minimise arbitrariness and discretion (objective, consistent and predictable) with violations of higher incidence and greater systemic impact attracting sterner action (responsive, risk focussed and proportionate). Scope of Enforcement While various statutes empower the Reserve Bank to take penal action, both monetary and non-monetary, Enforcement Policy addresses violations attracting imposition of monetary penalty. Violations inviting non-monetary penalties or imposition of penal interest would be enforced by the respective regulatory and supervisory departments. The Policy neither envisages dealing with individual consumer grievances nor is enforcement a mechanism for grievance redressal. Enforcement action is also not a substitute for the supervisory compliance process. Basis of Enforcement Actionable violations are determined on the basis of (a) fact of violation, and (b) materiality of the violation. Fact of the violation is determined on the basis of the existence of statutory provision and directive/guideline issued thereunder and violation thereof. Materiality of the violation is determined on the basis of the extent4, frequency5 and seriousness of the violation. Seriousness of the violation is determined on the basis of the amount involved in the violation in an absolute number or as a proportion to business size. Aggravating factors like repeat/persisting violations and false compliance, if any, are also factored in to determine materiality. Adjudication Process The process of enforcement action entails issuance of a show cause notice to the RE and providing it with a reasonable opportunity of being heard, in writing, and also, if requested, orally. A three member Committee6 adjudicates the matter and issues to the RE a reasoned speaking order, indicating therein the enforcement action being taken and the reasons therefor. While the maximum amount that can be levied as penalty for a violation has been stipulated in respective statutes, the amount of penalty to be imposed in each case within that limit is assessed on its merits based on the principle of proportionality, intent and mitigating factors, if any. The penalty imposed is payable by the RE within the period specified in the respective statutes. At present, statutes enable the Reserve Bank to impose penalty only on the RE and not on the individual in charge of the entity or those apparently responsible for the violation. The Reserve Bank is not empowered to entertain any appeal against or review the order of the Executive Directors’ Committee (EDC), except in cases where monetary penalty has been imposed under the SARFAESI Act, 2002. References: 1. Caiazza, S., Cotugno, M., Fiordelisi, F., and Stefaneli, V. (2018) “The spillover effect of enforcement actions on bank risk-taking”, Journal of Banking and Finance, 91, 146-159. 2. Delis, M. D., Staikouras, P., and Tsoumas, C. (2016) “Formal Enforcement Actions and Bank Behaviour”, Management Science, 63(4). 3. Delis, M. D., and Staikouras, P. (2011) “Supervisory Effectiveness and Bank Risk” Review of Finance, 15(3), 511-543. 4. Carletti, E. (2017) “Fines for misconduct in the banking sector – what is the situation in the EU?” March. (available at http://www.europarl.europa.eu//committees/en/ECON/home.html) 5. RBI (2017), “Statement on Developmental and Regulatory Policies”, February. |