RBI/DOR/2025-26/300

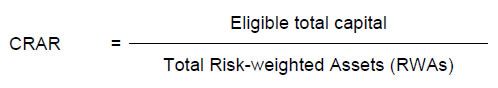

DOR.CAP.REC.219/09-18-201/2025-26 November 28, 2025 Reserve Bank of India (Rural Co-operative Banks - Prudential Norms on Capital Adequacy) Directions, 2025 In exercise of the powers conferred by Section 35A read with Section 56 of the Banking Regulation Act (BR Act), 1949 the Reserve Bank of India being satisfied that it is necessary and expedient in the public interest and in the interest of banking policy so to do, hereby, issues the Directions hereinafter specified. Chapter I Preliminary A Short Title and Commencement 1. These Directions shall be called the Reserve Bank of India (Rural Co-operative Banks - Prudential Norms on Capital Adequacy) Directions, 2025. 2. These Directions shall come into effect immediately upon issuance. B Applicability 3. These Directions shall be applicable to Rural Co-operative Banks (hereinafter collectively referred to as ‘banks’ or ‘RCBs’ and individually as a ‘bank’ or ‘RCB’). For the purpose of these Directions, Rural Co-operative Banks shall mean State Co-operative Banks and Central Co-operative Banks, as defined in the National Bank for Agriculture and Rural Development Act, 1981. C Definitions 4. In these Directions, unless the context states otherwise, the terms herein shall bear the meanings assigned to them below: (1) ‘Credit Risk’ is defined as the potential that a bank's borrower or counterparty may fail to meet its obligations in accordance with agreed terms. It is also the possibility of losses associated with diminution in the credit quality of borrowers or counterparties; (2) ‘Deferred Tax Assets’ and ‘Deferred Tax Liabilities’ shall have the same meaning as assigned under the applicable Accounting Standards; (3) ‘Derivative’ shall have the same meaning as assigned to it in Section 45U(a) of the Reserve Bank of India Act, 1934; (4) ‘Other Approved Securities’ shall have the same meaning as defined under Reserve Bank of India (Rural Co-operative Banks – Cash Reserve Ratio and Statutory Liquidity Ratio) Directions, 2025; (5) ‘Subordinated’ refers to the status of the debt. In the event of the bankruptcy or liquidation of the debtor, subordinated debt only has a secondary claim on repayments, after depositors and other debt has been repaid; (6) ‘Public Financial Institution’ shall have the same meaning as defined under sub-section 2(72) of the Companies Act, 2013. 5. All other expressions unless defined herein shall have the same meaning as have been assigned to them under the BR Act, 1949, or the RBI Act, 1934, or respective State Co-operative Societies Act and rules / regulations made thereunder, or any statutory modification or re-enactment thereto or as used in commercial parlance, as the case may be. Chapter II Regulatory Capital A Capital Requirements A.1 Statutory Requirements 6. In terms of the provisions contained in Section 11 read with Section 56 of the BR Act, 1949, no co-operative bank shall commence or carry-on banking business unless the aggregate value of its paid-up capital and reserves is not less than one lakh of rupees. For the purpose of this Section, ‘value’ means the real or exchangeable value and not the nominal value which may be shown in the books of the co-operative bank concerned. In terms of the provisions contained in Section 42(6)(a)(i) of the RBI Act, 1934, inter alia, a scheduled state co-operative bank is required to maintain paid-up capital and reserves of an aggregate value of not less than five lakh rupees. In addition, under Section 22(3)(d) read with Section 56 of the BR Act, 1949, the Reserve Bank prescribes the minimum entry point capital (entry point norms) from time to time, for setting-up of a new RCB. A.2 Minimum Regulatory Capital 7. An RCB shall maintain a minimum Capital to Risk Weighted Assets Ratio (CRAR) of 9 per cent on an ongoing basis. A.3 Composition of capital 8. The computation of CRAR shall be as under:

9. The capital funds (eligible total capital) for capital adequacy purposes shall consist of Tier 1 and Tier 2 capital as defined below. RWAs shall be calculated as per Paragraph 17 given below. B Tier 1 Capital 10. Tier 1 Capital shall include the following: (i) Paid up share capital collected from regular members of an RCB having voting powers; (ii) Contributions received from associate / nominal members where the bye-laws permit allotment of shares to such members and provided there are restrictions on withdrawal of such shares as applicable to regular members; (iii) Contribution / non-refundable admission fees collected from the nominal and associate members which are held separately as 'Reserves' under appropriate head since these are not refundable; (iv) Free Reserves; (v) Capital Reserve representing surplus arising out of sale proceeds of assets; (vi) Balance in Profit and Loss Account after appropriation, if any; (vii) Outstanding amount in ‘Special Reserve’ created under Section 36(1)(viii) of the Income Tax Act, 1961, if an RCB has created Deferred Tax Liabilities (DTL) on this Reserve as per applicable Accounting Standards; (viii) Perpetual Non-Cumulative Preference Shares (PNCPS) which comply with the regulatory requirements as specified in paragraph 11; (ix) Perpetual Debt Instruments (PDIs) which comply with the regulatory requirements as specified in paragraph 12; and (x) Revaluation Reserves, arising out of change in the carrying amount of an RCB’s property consequent upon its revaluation, may be reckoned as Tier 1 Capital at a discount of 55 per cent, subject to meeting the following conditions: (a) an RCB shall be able to sell the property readily at its own will and there is no legal impediment in selling the property; (b) the Revaluation Reserves are presented / disclosed separately under ‘Reserve Fund and Other Reserves’ in the Balance Sheet; (c) revaluations are realistic, in accordance with applicable Accounting Standards and norms; (d) valuations are obtained, from two independent valuers, at least once in every three years; (e) where the value of the property has been substantially impaired by any event, these are to be immediately revalued and appropriately factored into capital adequacy computations; (f) the external auditor(s) of an RCB have not expressed a qualified opinion on the revaluation of the property; and (g) the instructions on valuation of properties and other specific requirements as mentioned in the Reserve Bank of India (Rural Co-operative Banks – Credit Risk Management) Directions, 2025 are strictly adhered to. Revaluation Reserves which do not qualify as Tier 1 Capital shall also not qualify as Tier 2 Capital. An RCB may choose to reckon Revaluation Reserves in Tier 1 Capital or Tier 2 Capital at its discretion, subject to fulfilment of all the conditions specified above. Note - (1) Instructions for treatment of Bad and Doubtful Debt Reserve (BDDR) for prudential purposes: (i) With effect from the FY 2024-25, all provisions as per Income Recognition, Asset Classification and Provisioning (IRACP) norms, whether accounted for under the head ‘BDDR’ or any other head of account, shall be charged as an expense to the Profit and Loss account in the accounting period in which they are recognised. The eligibility of such provisions for regulatory capital purposes shall continue to be as defined in the extant guidelines on capital adequacy. (ii) After charging all applicable provisions as per IRACP norms and other extant regulations to the Profit and Loss account, an RCB shall make any appropriations of net profits below the line to BDDR, if required as per the applicable statutes or otherwise. (iii) As a one-time measure, with a view to facilitate rectification and smoother transition to an Accounting Standard compliant approach, the following regulatory treatment is prescribed: (a) Previously, an RCB may have created provisions required as per IRACP norms by appropriating from the net profit rather than recognizing the same as an expense in the Profit and Loss Account. The balances in BDDR as on March 31, 2024, representing such provisions as per IRACP norms (that have been created by directly appropriating from net profits instead of recognising as an expense in the Profit and Loss Account) in the previous years (hereafter referred to as ‘BDDR2024’) shall be identified and quantified; (b) As at March 31, 2025, to the extent of BDDR2024, an appropriation shall be made directly (i.e., ‘below the line’) from the Profit and Loss Account or General Reserves to provisions for Non-Performing Assets (NPA) (i.e., liability). Such provisions shall be permitted to be netted off from Gross NPAs (GNPA) to arrive at Net NPAs (NNPAs); (c) To the extent the balances in BDDR are not required as per applicable statute, the same can also be transferred to General Reserves / Balance in Profit and Loss Account below the line; and (d) After passing the above entries, the balances in the BDDR can be reckoned as Tier 1 Capital. However, balance in the BDDR shall not be reduced from GNPAs to arrive at NNPAs. (2) For a fund to be included in the Tier 1 Capital, the fund shall satisfy two criteria, viz., the fund shall be created as an appropriation of net profit and shall be a free reserve and not a specific reserve. However, if the same has been created not by appropriation of profit but by a charge to the Profit and Loss account then this fund is in effect a provision and hence shall be eligible for being reckoned only as Tier 2 Capital as defined below and subject to a limit of 1.25 per cent of RWAs provided it is not attributed to any identified potential loss or diminution in value of an asset or a known liability. (3) Outstanding Innovative Perpetual Debt Instruments (IPDIs) shall also be eligible to be reckoned as Tier 1 Capital subject to the ceilings prescribed in Paragraph 12. (4) Deductions from regulatory capital (i) Amount of intangible assets, losses in current year and those brought forward from previous periods, deficit in NPA provisions, income wrongly recognised on NPAs, provision required for liability devolved on bank, etc., shall be deducted from Tier 1 Capital. (ii) If a RCB’s contribution is in the form of subordinated units of any AIF scheme, then it shall deduct the entire investment from its capital funds – proportionately from both Tier-1 and Tier-2 capital (wherever applicable). Note - An RCB shall also refer to Reserve Bank of India (Rural Co-operative Banks – Undertaking of Financial Services) Directions, 2025 in this regard. (iii) An RCB shall be guided by the Reserve Bank of India (Rural Co-operative Banks – Transfer and Distribution of Credit Risk) Directions, 2025 for the prudential treatment of unrealised profits arising because of transfer of loan exposures and Security Receipts (SR) guaranteed by the Government of India. (iv) In terms of Reserve Bank of India (Rural Co-operative Banks – Credit Facilities) Directions, 2025, if an RCB is the Default Loss Guarantee (DLG) provider, it shall deduct full amount of the DLG, which is outstanding, from its capital. B.1 Guidelines on issuance of Perpetual Non-Cumulative Preference Shares (PNCPS) eligible for inclusion in Tier 1 Capital 11. PNCPS issued by an RCB shall adhere to the following guidelines for to be eligible for inclusion in Tier 1 capital: (1) An RCB is permitted to issue PNCPS at face value to its members or any other person residing within its area of operation, with the prior approval of the Reserve Bank. The RCB shall submit the application seeking permission, together with the prospectus / offer document / information memorandum, through the Pravaah Portal of the Reserve Bank. A certificate from a Chartered Accountant to the effect that the terms of the offer document are in compliance with these instructions shall also be submitted along with the application. The amounts raised through PNCPS shall comply with the following terms and conditions to qualify for inclusion as Tier 1 capital. (2) Limits The outstanding amount of PNCPS and PDI along with outstanding IPDI shall not exceed 35 per cent of total Tier 1 Capital at any point of time. The above limit shall be based on the amount of Tier 1 Capital after deduction of goodwill and other intangible assets, but before deduction of equity investment in subsidiaries, if any. PNCPS issued in excess of the overall ceiling of 35 per cent, shall be eligible for inclusion under upper Tier 2 Capital, subject to limits prescribed for Tier 2 Capital. However, investors' rights and obligations shall remain unchanged. (3) Amount The amount of PNCPS to be raised shall be decided by the Board of Directors of an RCB. (4) Maturity The PNCPS shall be perpetual. (5) Options (i) PNCPS shall not be issued with a 'put option' or 'step up option'. (ii) PNCPS may be issued with a ‘call option’, subject to following conditions: (a) The call option on the instrument is permissible after the instrument has run for at least ten years; and (b) Call option shall be exercised only with the prior approval of the Reserve Bank (Department of Regulation). While considering the proposals received from an RCB for exercising the call option, the Reserve Bank will, among other things, take into consideration of a bank’s CRAR position both at the time of exercise of the call option and after exercise of the call option. (6) Classification in the Balance Sheet These instruments shall be classified as 'Capital' and shown separately in the Balance Sheet. (7) Dividend The rate of dividend payable to the investors shall be a fixed rate or a floating rate referenced to a market determined rupee interest benchmark rate. (8) Payment of Dividend (i) The payment of dividend by an RCB shall be subject to availability of distributable surplus out of current year’s profits, and if: (a) the CRAR is above the minimum regulatory requirement prescribed by the Reserve Bank; (b) the impact of such payment does not result in a bank's CRAR falling below or remaining below the minimum regulatory requirement prescribed by the Reserve Bank; and (c) the balance sheet as at the end of the previous year does not show any accumulated loss. (ii) The dividend shall not be cumulative, i.e., dividend missed in a year shall not be paid in subsequent years even if adequate profit is available and the level of CRAR conforms to the regulatory minimum. When dividend is paid at a rate lesser than the prescribed rate, the unpaid amount shall not be paid in future years, even if adequate profit is available and the level of CRAR conforms to the regulatory minimum. (iii) All instances of non-payment of dividend / payment of dividend at a rate less than that specified shall be reported by the issuing RCB to the respective Regional Office of National Bank for Agriculture and Rural Development (NABARD) and Department of Regulation, Reserve Bank (latter at email: capdor@rbi.org.in). (9) Seniority of Claim The claims of the investors in PNCPS shall be senior to the claims of investors in equity shares and subordinated to the claims of all other creditors and the depositors. (10) Voting Rights The investors in PNCPS shall not be eligible for any voting rights. (11) Discount The PNCPS shall not be subjected to a progressive discount for capital adequacy purposes. (12) Other conditions (i) PNCPS shall be fully paid-up, unsecured, and free of any restrictive clauses. (ii) An RCB shall also comply with the terms and conditions, if any, stipulated by other regulatory authorities in regard to issue of the PNCPS, provided they are not in conflict with the terms and conditions specified in these guidelines. Any instance of conflict shall be brought to the notice of the Reserve Bank (Department of Regulation) for seeking confirmation of the eligibility of the instrument for inclusion in Tier 1 Capital. (13) Compliance with Reserve Requirements (i) The total amount raised by an RCB by issue of PNCPS shall not be reckoned as liability for calculation of Net Demand and Time Liabilities (NDTL) for the purpose of reserve requirements and, as such, shall not attract CRR / SLR requirements. (ii) However, the amount collected from members / prospective investors and held pending allotment of the PNCPS, shall be reckoned as liability for the purpose of calculating the NDTL and shall, accordingly, attract reserve requirements. Such amounts shall not be reckoned for calculation of capital funds. (14) Reporting Requirements An RCB issuing PNCPS shall submit a report to the concerned Regional Office of Department of Supervision, NABARD and Department of Regulation, Reserve Bank (latter at email: capdor@rbi.org.in) giving details of the capital raised, including the terms and conditions of issue together with a copy of the prospectus / offer document, soon after the issue is completed. (15) Investments in PNCPS and Advances for Purchase of PNCPS An RCB shall not grant any loan or advance to any person for purchasing its own PNCPS or the PNCPS of other banks. Further, the RCB shall not invest in PNCPS of other banks and shall not grant advances against the security of the PNCPS issued by them or other banks. However, a State Co-operative Bank may invest in PNCPS issued by Central Co-operative Banks affiliated to them, subject to the condition that the amount so invested shall be deducted from its Tier 1 Capital. B.2 Guidelines on issuance of Perpetual Debt Instruments (PDI) eligible for inclusion in Tier 1 Capital 12. PDIs issued by an RCB shall adhere to the following guidelines for to be eligible for inclusion in Tier 1 Capital: (1) An RCB may issue PDI as bonds or debentures to its members or any other person residing within its area of operation, with the prior approval of the Reserve Bank. The RCB shall submit the application seeking permission, together with the prospectus / offer document / information memorandum through the Pravaah Portal of the Reserve Bank. A certificate from a Chartered Accountant to the effect that the terms of the offer document are in compliance with these instructions shall also be submitted along with the application. (2) Limits The amount of PDI reckoned for Tier 1 Capital shall not exceed 15 per cent of total Tier 1 Capital. The outstanding IPDI shall also be covered in the aforementioned ceiling of 15 per cent and reckoned for capital purposes. The eligible amount shall be computed with reference to the amount of Tier 1 Capital as on March 31 of the previous year, after deduction of goodwill, and other intangible assets, but before deduction of equity investment in subsidiaries, if any. PDI in excess of the above limits shall be eligible for inclusion under Tier 2 Capital, subject to the limits prescribed for Tier 2 Capital. However, investors' rights and obligations shall remain unchanged. Note - Reference is invited to paragraph 11 as per which the outstanding amount of PNCPS and PDI along with outstanding IPDI shall not exceed 35 per cent of total Tier 1 Capital at any point of time. (3) Amount The amount of PDI to be raised shall be decided by the Board of Directors of an RCB. (4) Maturity These instruments shall be perpetual. (5) Options (i) The PDI shall not be issued with a 'put option' or ‘step-up’ option. (ii) However, PDI may be issued with a ‘call option’ subject to following conditions: (a) The call option on the instrument is permissible after the instrument has run for at least ten years; and (b) Call option shall be exercised only with the prior approval of Department of Regulation, Reserve Bank. While considering the proposals received from a bank for exercising the call option, the Reserve Bank will, among other things, take into consideration of an RCB’s CRAR position both at the time of exercise of the call option and after exercise of the call option. (6) Classification PDI shall be classified as 'Borrowings' and shown separately in the Balance Sheet. (7) Rate of Interest The interest payable to the investors may be either at a fixed rate or at a floating rate referenced to a market determined rupee interest benchmark rate. (8) Lock-in-Clause (i) PDI shall be subjected to a lock-in-clause in terms of which an issuing RCB shall not be liable to pay interest, if (a) the RCB's CRAR is below the minimum regulatory requirement prescribed by the Reserve Bank; or (b) the impact of such payment results in the RCB's CRAR falling below or remaining below the minimum regulatory requirement prescribed by the Reserve Bank. (ii) However, an RCB may pay interest with the prior approval of the Department of Regulation, Reserve Bank, when the impact of such payment may result in net loss or increase the net loss, provided the CRAR meets the regulatory norm. For this purpose, net loss is defined as either (a) the accumulated loss at the end of the previous financial year, or (b) the loss incurred during the current financial year. (iii) The interest shall not be cumulative. (iv) All instances of invocation of the lock-in-clause shall be reported by the issuing RCB to the concerned Regional Office of NABARD and Department of Regulation, Reserve Bank of India (latter at email: capdor@rbi.org.in). (9) Seniority of claim The claims of the investors of PDI shall be superior to the claims of investors in equity shares and PNCPS but subordinated to the claims of all other creditors and the depositors. Among investors in PDI and outstanding IPDI, the claims shall rank pari passu with each other. (10) Discount The PDI shall not be subjected to a progressive discount for capital adequacy purposes. (11) Other conditions (i) PDI shall be fully paid-up, unsecured, and free of any restrictive clauses. (ii) An RCB shall also comply with the terms and conditions, if any, stipulated by other regulatory authorities in regard to issue of the PDI, provided they are not in conflict with the terms and conditions specified in these directions. Any instance of conflict shall be brought to the notice of the Reserve Bank (Department of Regulation) for seeking confirmation of the eligibility of the instrument for inclusion in Tier 1 Capital. (12) Compliance with Reserve Requirements The total amount raised by an RCB through the issue of PDI shall not be reckoned as liability for calculation of NDTL for the purpose of reserve requirements and, as such, shall not attract CRR / SLR requirements. However, the amount collected from members / prospective investors and pending issue of PDI, shall be reckoned as liability for the purpose of calculating the NDTL and shall, accordingly, attract reserve requirements. Such amounts pending issue of PDI, shall not be reckoned for calculation of capital funds. (13) Reporting requirements An RCB issuing PDI shall submit a report to the concerned Regional Office of Department of Supervision NABARD and Department of Regulation, Reserve Bank (latter at email: capdor@rbi.org.in) giving details of the amount raised, including the terms and conditions of issue together with a copy of the prospectus / offer document, soon after the issue is completed. (14) Investments in PDI and advances for purchase of PDI An RCB shall not grant any loan or advance to any person for purchasing its PDI or PDI of other banks. The RCB shall not invest in PDI issued by other banks and shall not grant advances against the security of PDI issued by them or other banks. However, a State Co-Operative Bank may invest in PDI issued by the Central Co-Operative Bank affiliated to them subject to the condition that the amount so invested shall be deducted from Tier 1 Capital of the State Co-operative Bank. C Tier 2 Capital 13. Tier 2 Capital shall include the following: (i) General provisions and loss reserves These shall include such provisions of general nature appearing in the books of an RCB which are not attributed to any identified potential loss or a diminution in value of an asset or a known liability. Adequate care shall be taken to ensure that sufficient provisions have been made to meet all known losses and foreseeable potential losses before considering any amount of general provision as part of Tier 2 Capital as indicated above. To illustrate, excess provision in respect of bad and doubtful debts, general provision for standard assets etc., can be considered for inclusion under this category. Such provisions which are considered for inclusion in Tier 2 Capital shall be admitted up to 1.25 per cent of total RWAs. (ii) Investment Fluctuation Reserve (IFR) Balance in IFR shall be eligible for inclusion in Tier 2 Capital. (iii) Tier 2 Capital instruments An RCB may issue the following instruments to augment its Tier 2 Capital: (a) Perpetual Cumulative Preference Shares (PCPS), Redeemable Non-Cumulative Preference Shares (RNCPS) and Redeemable Cumulative Preference Shares (RCPS) which comply with the regulatory requirements as specified in paragraph 15. (b) Long Term Subordinated Bonds (LTSB) which comply with the regulatory requirements as specified in paragraph 16. Note - Outstanding Long Term (Subordinated) Deposits (LTD) shall also be eligible to be reckoned as Tier 2 Capital subject to the ceilings prescribed in Paragraph 14 and Paragraph 16. C.1 Limits on Tier 2 Capital 14. The total of Tier 2 Capital shall be limited to a maximum of 100 per cent of total Tier 1 Capital for the purpose of compliance with the capital adequacy framework. C.2 Guidelines on issuance of Perpetual Cumulative Preference Shares (PCPS), Redeemable Non-Cumulative Preference Shares (RNCPS) and Redeemable Cumulative Preference Shares (RCPS) eligible for inclusion in Upper Tier 2 Capital 15. PCPS / RNCPS / RCPS issued by RCBs shall adhere to following criteria to be eligible for inclusion in Upper Tier 2 Capital. (1) An RCB is permitted to issue PCPS / RNCPS / RCPS at face value, to its members or any other person residing within its area of operation, with the prior approval of the Reserve Bank. The RCB shall submit the application seeking permission, together with the prospectus / offer document / information memorandum through the Pravaah Portal of the Reserve Bank. A certificate from a Chartered Accountant to the effect that the terms of the offer document are in compliance with these instructions shall also be submitted along with the application. These three instruments, collectively referred to as Tier 2 preference shares, shall comply with the following terms and conditions, to qualify for inclusion as upper Tier 2 capital. (2) Limits The outstanding amount of these instruments along with other components of Tier 2 capital shall not exceed 100 per cent of Tier 1 capital at any point of time. The above limit shall be based on the amount of Tier 1 capital after deduction of goodwill and other intangible assets, but before deduction of equity investment in subsidiaries, if any. (3) Amount The amount to be raised may be decided by the Board of Directors of an RCB. (4) Maturity The Tier 2 preference shares could be either perpetual (PCPS) or dated (RNCPS and RCPS) instruments with a minimum maturity of 10 years. (5) Options (i) These instruments shall not be issued with a 'put option' or 'step up option'. (ii) These instruments may be issued with a ‘call option’, subject to following conditions: (a) The call option on the instrument is permissible after the instrument has run for at least ten years; and (b) Call option shall be exercised only with the prior approval of the Department of Regulation, Reserve Bank. While considering the proposals received from an RCB for exercising the call option, the Reserve Bank will, among other things, take into consideration of an RCB's CRAR position both at the time of exercise of the call option and after exercise of the call option. (6) Classification in the Balance Sheet These instruments shall be classified as 'Borrowings' and shown separately in the Balance Sheet. (7) Coupon The coupon payable to the investors shall be either at a fixed rate or at a floating rate referenced to a market determined rupee interest benchmark rate. (8) Payment of Coupon (i) The coupon payable on these instruments shall be treated as interest and accordingly debited to Profit and Loss Account. However, it will be payable only if: (a) an RCB’s CRAR is above the minimum regulatory requirement prescribed by the Reserve Bank. (b) the impact of such payment does not result in the bank’s CRAR falling below or remaining below the minimum regulatory requirement. (c) The RCB shall not have a net loss. For this purpose, the net loss is defined as either (a) the accumulated loss at the end of the previous financial year, or (b) the loss incurred during the current financial year. (ii) In the case of PCPS and RCPS, the unpaid / partly unpaid coupon shall be treated as a liability. The interest amount due and remaining unpaid may be allowed to be paid in later years subject to an RCB complying with the above requirements. (iii) In the case of RNCPS, deferred coupon shall not be paid in future years, even if adequate profit is available and the level of CRAR conforms to the regulatory minimum. An RCB can however pay a coupon at a rate lesser than the specified rate, if adequate profit is available and the level of CRAR conforms to the regulatory minimum, subject to conformity with paragraph 7. (iv) All instances of non-payment of coupon or payment of coupon at a rate lesser than the specified rate shall be reported by the issuing RCB to the concerned Regional Office of NABARD and Department of Regulation, Reserve Bank (latter at email: capdor@rbi.org.in). (9) Redemption / Repayment of Redeemable Tier 2 Preference Shares RNCPS and RCPS shall not be redeemable at the initiative of the holder. Redemption of these instruments at maturity shall be made only with the prior approval of the Department of Regulation, Reserve Bank subject, inter alia, to the following conditions: (i) An RCB’s CRAR is above the minimum regulatory requirement prescribed by the Reserve Bank; and (ii) the impact of such payment does not result in the RCB’s CRAR falling below or remaining below the minimum regulatory requirement. (10) Seniority of Claim The claims of the investors in these instruments shall be senior to the claims of investors in instruments eligible for inclusion in Tier 1 Capital and subordinate to the claims of all other creditors including those in lower Tier 2 Capital and the depositors. Amongst the investors of various instruments included in upper Tier 2 Capital, the claims shall rank pari passu with each other. (11) Voting Rights The investors in Tier 2 preference shares shall not be eligible for any voting rights. (12) Progressive discount for the purpose of computing CRAR The redeemable preference shares (both cumulative and non-cumulative) shall be subjected to progressive discount for capital adequacy purposes over the last five years of their tenor, as under: | Remaining Maturity of Instruments Tenor | Rate of Discount (%) | | Less than one year | 100 | | One year and more but less than two years | 80 | | Two years and more but less than three years | 60 | | Three years and more but less than four years | 40 | | Four years and more but less than five years | 20 | (13) Other Conditions (i) The Tier 2 preference shares shall be fully paid-up, unsecured, and free of any restrictive clauses. (ii) An RCB shall also comply with the terms and conditions, if any, stipulated by other regulatory authorities in regard to issue of the Tier 2 preference shares, provided they are not in conflict with any terms and conditions specified in these guidelines. Any instance of conflict shall be brought to the notice of the Reserve Bank (Department of Regulation) for seeking confirmation of the eligibility of the instrument for inclusion in Tier 2 capital. (14) Compliance with Reserve Requirements (i) The total amount raised by an RCB through the issue of these instruments shall be reckoned as liability for the calculation of NDTL for the purpose of reserve requirements and, as such, shall attract CRR / SLR requirements. (ii) The amount collected from members / prospective investors and held pending allotment shall not be reckoned for calculation of capital funds until the allotment process is over. (15) Reporting Requirements An RCB issuing these instruments shall submit a report to the concerned Regional Office of Department of Supervision, NABARD, and Department of Regulation, Reserve Bank (latter at email: capdor@rbi.org.in) giving details of the capital raised, including the terms and conditions of issue together with a copy of the prospectus / offer document soon after the issue is completed. (16) Investments in Tier 2 preference shares and advances for purchase of Tier 2 preference shares An RCB shall not grant any loan or advance to any person for purchasing its own Tier 2 preference shares or Tier 2 preference shares of other banks. The RCB shall not invest in Tier 2 preference shares issued by other banks and shall not grant advances against the security of Tier 2 preference shares issued by them or other banks. However, a State Co-operative Bank may invest in Tier 2 preference shares issued by a Central Co-operative Bank affiliated to them subject to the condition that the amount so invested shall be deducted from Tier 2 Capital of the State Co-operative Bank. C.3 Guidelines on issuance of Long Term Subordinated Bonds (LTSB) eligible for inclusion in Lower Tier 2 Capital 16. An RCB is permitted to issue LTSB to its members, or any other person residing within its area of operation. The amounts raised through LTSB shall comply with the following terms and conditions to be eligible for inclusion in Lower Tier 2 capital. (1) Eligibility (i) An RCB fulfilling the following criteria as per its latest audited financial statements is permitted to issue LTSB, without seeking specific permission of the Reserve Bank in this regard: (a) CRAR not less than 10 per cent. (b) Gross NPA less than 7 per cent and net NPA not more than 3 per cent. (c) Net profit for at least three out of the preceding four years subject to the bank not having incurred net loss in the immediate preceding year. (d) No default in maintenance of CRR / SLR during the preceding year. (e) The bank has at least two professional directors on its Board. (f) Core Banking Solution (CBS) is fully implemented. (g) No monetary penalty has been imposed on the bank for violation of the Reserve Bank’s directives / guidelines during the two financial years preceding the year in which the LTSB are being issued. (ii) Prior permission of the Reserve Bank is required for an RCB which do not comply with the above criteria. The RCB shall submit the application seeking permission, together with the prospectus / offer document / information memorandum through the Pravaah Portal of the Reserve Bank. A certificate from a Chartered Accountant to the effect that the terms of the offer document are in compliance with these instructions shall also be submitted along with the application. (2) Limit The amount of LTSB eligible to be reckoned as Tier 2 Capital shall be limited to 50 per cent of total Tier 1 Capital. The outstanding Long Term (Subordinated) Deposits (LTDs shall also be covered in the aforementioned ceiling of 50 per cent and reckoned for capital purposes, as hitherto. These instruments, together with other components of Tier 2 Capital shall not exceed 100 per cent of Tier 1 Capital. The aforementioned limit shall be based on the amount of Tier 1 Capital after deduction of goodwill and other intangible assets, but before the deduction of equity investments in subsidiaries, if any. (3) Amount The amount to be raised shall be decided by the Board of Directors of an RCB. (4) Maturity LTSB shall be issued with a minimum maturity of ten years. (5) Options (i) The LTSB shall not be issued with a 'put option' or ‘step-up’ option. (ii) However, LTSB may be issued with a ‘call option’ subject to following conditions: (a) The call option on the instrument is permissible after the instrument has run for at least ten years; and (b) Call option shall be exercised only with the prior approval of the Reserve Bank (Department of Regulation). While considering the proposals received from an RCB for exercising the call option, the Reserve Bank will, among other things, take into consideration of the bank’s CRAR position both at the time of exercise of the call option and after the exercise of the call option. (6) Classification in the Balance Sheet These instruments shall be classified as 'Borrowings' and shown separately in the Balance Sheet. (7) Interest Rate LTSB may bear a fixed rate of interest, or a floating rate of interest referenced to a market determined rupee interest benchmark rate. (8) Redemption / repayment Redemption / repayment at maturity shall be made only with the prior approval of the Department of Regulation, Reserve Bank. (9) Seniority of Claims LTSB shall be subordinated to the claims of depositors and other creditors but shall rank senior to the claims of investors in instruments eligible for inclusion in Tier 1 Capital and holders of preference shares (both Tier 1 and Tier 2). Among investors of instruments included in lower Tier 2 capital (i.e., including outstanding LTDs, if any), the claims shall rank pari passu with each other. (10) Progressive Discount These bonds shall be subjected to a progressive discount for capital adequacy purposes in the last five years of their tenor, as under: | Remaining maturity of instruments | Rate of discount (%) | | Less than one year | 100 | | One year and more but less than two years | 80 | | Two years and more but less than three years | 60 | | Three years and more but less than four years | 40 | | Four years and more but less than five years | 20 | (11) Other conditions (i) LTSB shall be fully paid-up, unsecured, and free of any restrictive clauses. (ii) An RCB shall also comply with the terms and conditions, if any, stipulated by other regulatory authorities in regard to issue of the LTSB, provided they are not in conflict with the terms and conditions specified in these guidelines. Any instance of conflict shall be brought to the notice of the Reserve Bank (Department of Regulation) for seeking confirmation of the eligibility of the instrument for inclusion in Tier 2 Capital. (12) Reserve Requirement The total amount raised through the issue of LTSB shall be reckoned as liability for the calculation of NDTL for the purpose of reserve requirements and, as such, shall attract CRR / SLR requirements. The amount collected by the RCB from members / prospective investors and held by it pending issue of LTSB, shall not be reckoned for calculation of capital funds. (13) Reporting Requirements An RCB issuing LTSB shall submit a report to the concerned Regional Office of NABARD and Department of Regulation, Reserve Bank (latter at email: capdor@rbi.org.in) giving details of the amount raised, including the terms and conditions of issue together with a copy of prospectus / offer document, soon after the issue is completed. (14) Investments in LTSB and advances for purchase of LTSB An RCB shall not grant any loan or advance to any person for purchasing its LTSB or LTSB of other banks. The RCB shall neither invest in LTSB issued by other banks nor it shall grant advances against the security of LTSB issued by them or other banks. However, a State Co-operative Bank may invest in LTSB issued by Central Co-operative Bank affiliated to them subject to the condition that the amount so invested shall be deducted from Tier 2 Capital of the State Co-operative Bank.

Chapter III Computation of risk weighted asset (RWA) 17. RWAs shall be calculated by multiplying assigned risk-weights to (a) on balance sheet exposures, and (b) credit equivalent of off-balance sheet exposure. The credit equivalent of off-balance sheet exposure is calculated by multiplying notional amount of off-balance sheet exposure with credit conversion factors (CCFs). The risk weights allotted to each category of balance sheet items and CCF for off-balance sheet items are as under. (1) On balance sheet items | Items of assets | Risk weight

(%) | | I | Balances | | | 1 | Cash (including foreign currency notes) and balances with the Reserve Bank | 0 | | 2 | Balances in current account with other banks | 20 | | II | Investments | | | 1 | Investments in Government Securities | 2.5 | | 2 | Investment in other approved securities guaranteed by Central Government / State Governments | 2.5 | | 3 | Investments in other securities where payment of interest and repayment of principal are guaranteed by Central Government (include investment in Kisan Vikas Patras and investments in bonds and debentures where payment of interest and repayment of principal is guaranteed by Central Government / State Governments) | 2.5 | | 4 | Investments in other securities where payment of interest and repayment of principal are guaranteed by State Governments

Note - Investment in securities where payment of interest or repayment of principal is guaranteed by State Government and which has become a non-performing investment, shall attract risk weight of 102.5 per cent. | 2.5 | | 5 | Investments in other approved securities where payment of interest and repayment of principal are not guaranteed by Central / State Governments. | 22.5 | | 6 | Investments in government guaranteed securities of government undertakings which do not form part of the approved market borrowing program. | 22.5 | | 7 | Claims (such as fixed deposits, certificates of deposits, money at call and short notice) on commercial banks and RCBs. | 22.5 | | 8 | Investments in bonds issued by All India Public Financial Institutions | 102.5 | | 9 | Investments in bonds issued by Public Financial Institutions (PFIs) for their Tier 2 capital. | 102.5 | | 10 | All other investments

Note - Intangible assets deducted from Tier 1 capital shall be assigned zero risk weight. | 102.5 | | 11 | Off-balance sheet (net) position in 'When Issued' securities, scrip-wise. | 2.5 | | III | Loans and advances including bills purchased and discounted and other credit facilities | | | 1 | Loans and advances guaranteed by the Government of India. | 0 | | 2 | Loans and advances guaranteed by the State Governments. | 0 | | 3 | State Government guaranteed loans and advances which have become a non-performing asset. | 100 | | 4 | Loans and advances granted to Public Sector Undertakings (PSUs) of Government of India. | 100 | | 5 | Loans and advances granted to PSUs of State Governments. | 100 | | 6 | (i) Housing Loans to individuals (fully secured by mortgage of residential properties) up to ₹ 30 lakhs - Loan to Value (LTV) ratio is equal to or less than 75 per cent

- LTV ratio is more than 75 per cent

| 50

100 | | | (ii) Housing Loan – others. | 100 | | | (iii) Commercial Real Estate - Residential Housing. | 75 | | | * LTV ratio shall be computed as a percentage of total outstanding in the account (viz. ‘principal + accrued interest + other charges pertaining to the loan’ without any netting) in the numerator and the realizable value of the residential property mortgaged to a bank in the denominator. | | | 7 | Consumer credit including personal loan. | 125 | | 8 | Loans up to ₹ 1 lakh against gold and silver ornaments.

Note - Where the loan amount exceeds ₹ 1 lakh, the entire loan amount has to be assigned the risk weight applicable for the purpose for which the loan has been sanctioned. | 50 | | 9 | All other loans and advances including education loan. | 100 | | 10 | Loans extended against primary collateral security of shares / debentures. | 125 | | 11 | Leased assets. | 100 | | 12 | Advances covered by Deposit Insurance and Credit Guarantee Corporation (DICGC) / Export Credit Guarantee Corporation of India (ECGC).

Note - The risk weight of 50 per cent shall be limited to the amount guaranteed and not the entire outstanding balance in the accounts. In other words, the outstanding in excess of the amount guaranteed, shall carry risk weight of 100 per cent. | 50 | | 13 | Advances against term deposits, life policies, National Saving certificates (NSCs) and Kisan Vikas Patra (KVPs) where adequate margin is available. | 0 | | 14 | Loans and advances granted by an RCB to its own staff, which are fully covered by superannuation benefits and mortgage of flat / house. | 20 | Notes: While calculating the aggregate of funded and non-funded exposure of a borrower for the purpose of assignment of risk weight, a bank may 'net-off' following items against the total outstanding exposure of the borrower: - advances collateralised by cash margins or deposits;

- credit balances in current or other accounts of the borrower which are not earmarked for specific purposes and free from any lien;

Note - A State co-operative bank in two tier structure / central co-operative bank in three tier structure may extend the benefit of netting off to credit balances in current or other accounts of primary agriculture credit societies (PACS) which are not earmarked for specific purposes and free from any lien while calculating the RWAs. - in respect of any assets where provisions for depreciation or for bad debts have been made;

- claims received from DICGC / ECGC and kept in a separate account pending adjustment in case these are not adjusted against the dues outstanding in the respective accounts;

- Subsidies received under various schemes and kept in a separate account.

| | IV | Other Assets | | 1 | Premises, furniture, and fixtures | 100 | | 2 | Interest due on the Government securities | 0 | | 3 | Accrued interest on CRR balances maintained with the Reserve Bank and claims on the Reserve Bank on account of Government transactions (net of claims of government / Reserve Bank on a bank on account of such transactions) | 0 | | 4 | Interest subvention amount receivable from the Government of India (GoI)

Note - ‘Interest Subvention Amount Receivable' being a direct claim from GoI shall attract zero percent risk weight. Further, the 'Interest Subvention Amount Receivable' shall be reported under 'Other Assets' with a separate sub-head as ‘Interest Subvention receivable from Gol’ with a risk weight of zero percent. | 0 | | 5 | Interest receivable on staff loans | 20 | | 6 | Interest receivable from banks | 20 | | 7 | All other assets | 100 | | V | Market risk on open position | | 1 | Market risk on foreign exchange open position (Applicable to Authorised Dealers only) | 100 | | 2 | Market risk on open gold position | 100 | Note - In case of investment in securitisation exposures, an RCB shall keep capital charge equal to the actual exposure and will be subjected to supervisory scrutiny and suitable action. (2) Off-balance sheet items An RCB shall use following CCFs to calculate credit equivalent of off-balance sheet items. | Sr. No | Instruments | CCF

(%) | | 1 | Direct credit substitutes, e.g., general guarantees of indebtedness (including standby Letter of Credit serving as financial guarantees for loans and securities) and acceptances (including endorsements with character of acceptance). | 100 | | 2 | Certain transaction related contingent items (e.g., performance bonds, bid bonds, warranties and standby Letter of Credits related to particular transactions). | 50 | | 3 | Short-term self-liquidating trade-related contingencies (such as documentary credits collateralised by the underlying shipments). | 20 | | 4 | Sale and repurchase agreement and asset sales with recourse, where the credit risk remains with a bank. | 100 | | 5 | Forward asset purchase, forward deposit and partly paid shares and securities, which represent commitments with certain draw down. | 100 | | 6 | Note issuance facilities and revolving underwriting facilities. | 50 | | 7 | Other commitments (e.g., formal standby facilities and credit lines) with an original maturity of over one year. | 50 | | 8 | Similar commitments with an original maturity up to one year, or which can be unconditionally cancelled at any time. | 0 | | 9 | Guarantees issued by a bank against the counter guarantees of other banks. | 20 | | Rediscounting of documentary bills accepted by a bank (Bills discounted by a bank which have been accepted by another bank shall be treated as a funded claim on a bank). | 20 | | Note - In these cases, a bank shall be fully satisfied that the risk exposure is, in fact, on the other bank. Bills purchased / discounted / negotiated under Letter of credit (where the payment to the beneficiary is not made 'under reserve') shall be treated as an exposure on the Letter of credit issuing bank and not on the borrower. All clean negotiations as indicated above, shall be assigned the risk weight normally applicable to inter-bank exposures, for capital adequacy purposes. In the case of negotiations 'under reserve' the exposure shall be treated as on the borrower and risk weight assigned accordingly. | | | 10 | Aggregate outstanding foreign exchange contracts of original maturity* – | | | (a) less than 14 calendar days | 0 | | (b) more than 14 days but less than one year | 2 | | (c) for each additional year or part thereof | 3 | | | Notes: | | | | While calculating the aggregate of funded and non-funded exposure of a borrower for the purpose of assignment of risk weight, a bank may 'net-off' against the total outstanding exposure of the borrower credit balances in current or other accounts which are not earmarked for specific purposes and free from any lien. | | | | After applying the conversion factor as indicated above, the adjusted off-balance sheet value shall again be multiplied by the weight attributable to the relevant counterparty as specified. | | Note - At present, an RCB may not be undertaking most of the off-balance sheet transactions. However, keeping in view its potential for expansion, risk weights are indicated against various off-balance sheet items, which, perhaps a bank may undertake in future. (3) Additional risk weights [applicable to Authorised Dealers (AD) only] (i) Foreign exchange contracts (a) Foreign exchange contracts include the following: (i) Cross currency swaps (ii) Forward foreign exchange contracts (iii) Currency futures (iv) Currency options purchased (v) Other contracts of a similar nature (b) As in the case of other off-balance sheet items, a two-stage calculation prescribed below shall be applied: (i) Step 1 - The notional principal amount of each instrument is multiplied by the conversion factor given below: | Original Maturity | Conversion factor | | Less than one year | 2% | | One year and less than two years | 5% (i.e., 2% + 3%) | | For each additional year | 3% | (ii) Step 2 - The adjusted value thus obtained shall be multiplied by the risk weight allotted to the relevant counterparty as given in the paragraph 17(1). (ii) Interest rate contracts (a) Interest rate contracts include the following: (i) Single currency interest rate swaps (ii) Basis swaps (iii) Forward rate agreements (iv) Interest rate futures (v) Interest rate options purchased (vi) Other contracts of a similar nature (b) As in the case of other off-Balance Sheet items, a two-stage calculation prescribed below shall be applied: (i) Step 1 - The notional principal amount of each instrument is multiplied by the percentages given below: | Original Maturity | Conversion Factor | | Less than one year | 0.5% | | One year and less than two years | 1.0% | | For each additional year | 1.0% | (ii) Step 2 - The adjusted value thus obtained shall be multiplied by the risk weight allotted to the relevant counterparty as given in paragraph 17 (1). Note - At present, most of the RCBs are not carrying out forex transactions. However, those who have been given AD’s license may undertake transactions mentioned above. Chapter IV Other instructions A Refund of Share Capital 18. In terms of Section 12(2)(ii) read with Section 56 of the BR Act, 1949, a co-operative bank shall not withdraw or reduce its share capital, except to the extent and subject to such conditions as the Reserve Bank may specify in this behalf. Accordingly, an RCB shall refund the share capital to its members, or nominees / heirs of deceased members, on demand, subject to the following conditions: (i) An RCB’s CRAR is 9 per cent or above, both as per the latest audited financial statements and the last CRAR as assessed by NABARD during statutory inspection. (ii) Such refund does not result in the CRAR of an RCB falling below regulatory minimum of 9 per cent. 19. For computing CRAR for above-mentioned purpose, accretion to capital funds after the balance sheet date, other than by way of profits, may be taken into account. Any reduction in capital funds, including by way of losses, during the aforesaid period shall also be considered. B Protection of Investors in Regulatory Capital Instruments 20. An RCB, while issuing regulatory capital instruments specified in paragraphs 10 and paragraph 13, shall adhere to the following conditions: (i) For floating rate instruments, an RCB shall not use its fixed deposit rate as benchmark; (ii) In the common application form of the proposed issue, an RCB shall incorporate following specific sign-off from investor for having understood the features and risks of the instrument. "By making this application, I / we acknowledge that I / we have understood the terms and conditions of the issue of [Name of the share / security] being issued by [Name of the RCB] as disclosed in the Prospectus and Offer Document"; and (iii) An RCB shall ensure that all the publicity material, offer document, application form, and any other communication with the investor shall clearly state in bold letters (Arial font, Size 14, equivalent size in English / Vernacular version) how a PNCPS / PCPS / RNCPS / RCPS / PDI / LTSB, as the case may be, is different from a Fixed Deposit, and that these instruments are not covered by Deposit Insurance. (iv) The procedure for transfer to legal heirs in the event of death of the subscriber of the instrument shall also be specified. C Reporting 21. An RCB shall furnish an annual return to the Department of Supervision of the respective NABARD Regional Office, indicating CRAR, in the format given in Annex I. The return shall be signed by two officials who are authorised to sign the statutory returns submitted to the Reserve Bank. The statement shall be furnished as soon as the annual accounts a particular financial year are finalised. Chapter V Repeal provisions A Repeal and Saving 22. With the issue of these Directions, the existing Directions, instructions, and guidelines relating to Prudential Norms on Capital Adequacy as applicable to Rural Co-operative Banks stand repealed, as communicated vide circular DOR.RRC.REC.302/33-01-010/2025-26 dated November 28, 2025. The Directions, instructions and guidelines repealed prior to the issuance of these Directions shall continue to remain repealed. 23. Notwithstanding such repeal, any action taken or purported to have been taken, or initiated under the repealed Directions, instructions, or guidelines shall continue to be governed by the provisions thereof. All approvals or acknowledgments granted under these repealed lists shall be deemed as governed by these Directions. Further, the repeal of these directions, instructions, or guidelines shall not in any way prejudicially affect: (i) any right, obligation or liability acquired, accrued, or incurred thereunder; (ii) any, penalty, forfeiture, or punishment incurred in respect of any contravention committed thereunder; (iii) any investigation, legal proceeding, or remedy in respect of any such right, privilege, obligation, liability, penalty, forfeiture, or punishment as aforesaid; and any such investigation, legal proceedings or remedy may be instituted, continued, or enforced and any such penalty, forfeiture or punishment may be imposed as if those directions, instructions, or guidelines had not been repealed. B Application of other laws not barred 24. The provisions of these Directions shall be in addition to, and not in derogation of the provisions of any other laws, rules, regulations or directions, for the time being in force. C Interpretations 25. For the purpose of giving effect to the provisions of these Directions or in order to remove any difficulties in the application or interpretation of the provisions of these Directions, the Reserve Bank̥ may, if it considers necessary, issue necessary clarifications in respect of any matter covered herein and the interpretation of any provision of these Directions given by the Reserve Bank shall be final and binding. (Sunil T S Nair)

Chief General Manager |