| Kaushik Bhattacharya and Abhiman

Das* The

paper examines the nature and the extent of changes in the market concentration

in the Indian banking sector and their possible implications on prices and output

of banking services. The first part of the paper attempts to measure market concentration

in banking in India in alternative ways from 1989-90 to 2000-01. In contrast to

earlier empirical applications on banking, it focuses on both static and dynamic

measures of market concentration. The paper finds a strong evidence of change

in the market structure in banking in India. Interestingly, results reveal that

a major part of the change in market structure occurred during the early 1990s.

Despite a spate of mergers during the late 1990s, market concentration was not

significantly affected. It is also observed that the different concentration ratios

rank the changes similarly over time. The

second part of the paper analyses the possible impact of changes in banking market

structure on prices and output of this sector during the same period. It is demonstrated

that measurement problem of real output pertaining to banking sector in the national

income data could be severe. The implied inflation as obtained through the GDP

deflator for the banking sector in India led to unbelievable measures of inflation

for banking services, casting some doubt on the methodology adopted. Alternatively,

proxy price measures based on the spread appear to be more consistent with the

changes in market structure in India during the late 1990s. The paper argues that

the favourable market structure in India could be one important factor that led

to a reduction in the ‘prices’ of banking services after the administered interest

regime was lifted. JEL Classification

: D40, G21, L11, L89 Key Words : Concentration,

Competition, Banking *

The authors are working as Assistant Advisers in the Monetary Policy Department

and Department of Statistical Analysis and Computer Services, respectively. The

authors wish to express their sincere thanks to Prof. Esfandiar Maasoumi, Department

of Economics, Southern Methodist University, Dallas, Texas, and Prof. Mark Flannery,

University of Florida, Department of Finance, Gainesville, for their insightful

comments, which led to substantial improvement of the exposition of an earlier

draft. The views expressed in this paper are the authors’ own. The authors bear

full responsibility for any errors that remain. Introduction The

role of competition in ushering economic efficiency has been extensively examined

in the literature. In

view of globalisation and renewed interest in shaping appropriate competition

policies in many countries, the issue has once again become germane (Neumann,

2001). A major requirement for enhancing competition in an economy is the removal

or minimisation of entry barriers. An important source of removing them is to

ensure the availability of cheap finances, which inter alia, is easier

to meet in the presence of a thriving and competitive banking sector. Theoretical

results demonstrate that monopolistic market power of banks raises the opportunity

costs of capital and thus, tends to make financing more expensive (Smith, 1998).

Lack of adequate competition in banking could thus, adversely affect economic

development. To analyse

competitiveness in any sector, an in-depth analysis of the structure of the market

is essential. While highly concentrated markets do not necessarily imply lack

of competitive behaviour, it is generally agreed that market concentration is

one of the most important determinants of competitiveness (Nathan and Neavel,

1989). For banking sector, the relationship between market concentration and competitiveness

has been examined in detail for many countries and the results indicated that

a high concentration tends to reduce competitiveness in this sector (Gilbert,

1984). Most of the empirical evidences in the literature are, however, based on

developed economies. The financial structures in many developing countries being

sharply different from the developed ones, it is necessary to examine to what

extent the established empirical findings in the developed economies apply to

these countries, especially in an environment where financial structures are undergoing

rapid and swift changes. This paper

examines the nature and the extent of changes in the structure of banking in India

during the 1990s and analyses the possible impact of these changes on prices and

output of banking services during the same period. The concepts of price and real

output in the banking sector being fuzzy, an analytical discussion on these aspects

has also been attempted. Currently, a detailed examination of these issues is

relevant because the economic reforms in India during the 1990s ushered in phenomenal

changes in the Indian banking sector. The new regime, in sharp contrast to the

earlier regime that thrived on banking through public sector, is perceived as

more accommodative towards competition. A fundamental change in this context during

the second half of the 1990s had been the liberalisation of the earlier administered

interest rate regime. Besides that, other significant policy measures included

reduction in reserve ratio, relaxation of quantitative restrictions assets/liability

composition and removal of some of the major barriers to entry into the financial

system. The new policy framework also entailed considerable institutional reforms,

including new laws and regulations governing the financial sector, the restructuring

and privatisation of banks, and the adoption of indirect instruments of monetary

policy. In the current regime, banks enjoy almost full freedom in pricing their

products. Furthermore, a spate of new entries of private Indian and foreign banks

and mergers among some of the existing players during the second half of the 1990s

is expected to usher in significant changes in the structure of the banking sector

in India. The changes in the market

structure of firms could be examined through alternative measures. Recent survey

of Bikker and Haaf (2001a) lists 10 such measures proposed and used in the literature.

Among these, the more popularly used ones are k-Bank Concentration Ratios

and Herfindahl-Hirschman Index (HHI). The Lorenz Ratio (Gini Coefficient), a popular

measure in the literature on income inequality, is also used to measure industrial

concentration. In India, some of these measures have been used by the official

agencies to address similar problems.1 It may, however, be noted that

the scope of these popular measures is somewhat limited. For example, the HHI

and the Gini coefficient are based on the variance of market shares. So far as

market concentration is concerned, policy makers are in most cases not interested

in the variance per se, but at the tails of the distribution of market

shares. Although some of the measures listed by Bikker and Haaf (2001a) attempt

to address these problems, all of them ignore the inherent dynamics associated

in this process. To analyse competitiveness in an industry, specification of a

full dynamic framework is necessary to gain sufficient hold on the market in the

long run, while firms may initiate price wars, resulting in apparently misleading

changes in the short-run concentration profiles. Although the dynamic aspects

of concentration have been addressed in the literature, earlier studies focussed

primarily on a descriptive analysis of the changes in indices of concentration

from year to year in specific industries and related it to 'competitiveness' measured

in alternative ways. Recent advances

in the literature have, however, explicitly focussed on the dynamic aspects of

concentration measures. Borrowing concepts from the related literature on income

mobility, Maasoumi and Slottje (2002) have classified measures of industrial concentration

based on generalised entropies, obtained asymptotic distributions for these measures

and applied them on the US steel industries. Empirical results reveal that the

incorporation of the dynamic aspects could lead to changes in inferences drawn

from more traditional static measures. As this development is a nascent one, the

empirical relevance of these developments in the banking sector is yet to be examined. So

far as banking sector is concerned, our study is different from the earlier studies

in two respects. First, we examine the changes in concentration in the banking

sector in India in both static and dynamic framework and compare them empirically.

While the static framework employs standard measures of concentration, in the

dynamic frameworks, we measure these changes through generalised entropy measures

as developed by Maasoumi (1986) and Maasoumi and Zandvakili (1990). Wherever possible,

results are compared to those obtained for other countries. Second, while examining

the implications of changes in the concentration profiles on competitiveness and

on the prices and output of the banking sector, we demonstrate that standard measures

of prices and output as per the national accounts statistics could provide a distorted

picture. We argue that alternative proxies of ‘price’ based on the spread between

the lending and the deposit rates appear to be more consistent with the changes

in the concentration profiles of banks in India during this period. The

plan of the paper is as follows: Section I presents a brief review of literature

on measuring concentration, with special reference to dynamic measures of concentration.

Section II describes the empirical evidence on changes in the structure of banking

sector in India. Section III attempts to analyse the possible impact of these

changes on prices and quantities of the financial intermediation services. Finally,

Section IV concludes the paper with some critical comments, focussing on policy

aspects. Section

I A Brief Review of Literature So far as measur ement

of market concentration is concerned, many of the existing results on income inequality

could be readily translated. Drawing analogies from the literature on income inequality,

the ‘inequality’ in the share of sales (or output or share of industry employees)

of individual firms in an industry has been specified as appropriate empirical

measure of market concentration. These measures have been estimated and related

them to competitiveness measured in alternative ways. In

the income inequality literature, inequality has also been examined in a dynamic

framework. These mobility studies have been compared to videotapes on inequality

as against a spot picture provided by the static measures. Recently, attempts

have been made to translate the framework to measure market concentration. Accordingly,

Subsection I.1 reviews the static measures of concentration and Subsection I.2

does that for the dynamic measures. I.1 Static Measures of Concentration In

the static inequality literature, different inequality measures do not necessarily

imply the same ordering of distributions. Either explicitly or implicitly, almost

all these measures or orderings are based on a weighted average of the income

(or, wealth) vector of individuals (or, households). The disagreement occurs in

the specification of the weights. The disagreement is irrelevant, if there are

‘good’ reasons to demonstrate the superiority of one measure over others. The

‘good’ reasons could be specified in alternative ways. One way is to identify

a few desirable properties that a measure on inequality should satisfy. Some of

these properties are symmetry, continuity, invariance to scalar multiplication,

additive decomposability and satisfaction of transfer principle (Shorrocks, 1984).

Another way is to derive an inequality measure or an ordering from a social welfare

function (SWF). The SWF is specified as a function of the income (or, wealth)

vector of all individuals (or, households). Thus, different income distributions

can be ordered based on the SWF pertaining to them. This approach often involves

specifying an axiomatic structure that such a SWF should satisfy. Subsequent task

involves characterising indices or orderings that would satisfy such axioms. Like

indices of inequality, different indices of concentration put different weights

over different parts of the distribution of market shares across firms and may

give contradictory evidence. Let there be n firms in an industry with market

shares s1, s2, …, sn. A simple but general linear form of

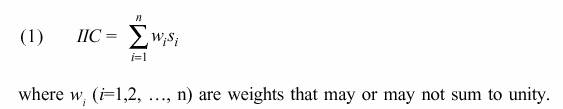

an index of industrial concentration (IIC ) is:

Following the taxonomy

of Marfels (1971), there could be four broad classes of weighing schemes: (i)

unity to top k firms and zero to the rest, (ii) individual ranks of firms,

(iii) firms’ own market shares or their power, and (iv) the negative of the logarithm

of market shares. The weighing scheme reflects different

assessment regarding the relative impact of larger and smaller firms. Depending

upon the weighing scheme, the individual measures may vary, but they may lead

to similar orderings.2 As in the inequality

literature, there are two ways to deal with the problem of lack of robustness

with respect to weights. One way is to report 'complete rankings’’ through a class

of concentration measures that reflect the sensitivity to concentration in all

parts of the share distribution. Another approach is to consider 'partial but

uniform’’ orderings that evaluate concentration over a restricted part, but over

a larger class of evaluative functions. Whatever be the strategy, Maasoumi and

Slottje (2002) argue that for transparency’s sake, it is imperative for the policymakers

and analysts to declare the 'weights’’ they attach to a reduction in concentration

over various parts of a distribution. The most common measure

used in the literature on market concentration has been a simple concentration

index, aggregating such shares of a few top firms (say, k). These measures

for banking firms are called k-Bank Concentration Ratios. There is no rule

for choosing an appropriate value of k. So, the number of firms included

in the concentration index is an ad hoc and an arbitrary decision. The

index ranges from zero to unity. The index approaches zero for an infinite number

of equally sized banks and it equals unity, if the firms included in the calculation

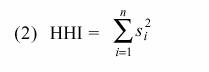

of the concentration ratio make up the entire industry. Another popularly

used measure is the Hirfendahl-Hirschman index (HHI)3 . For

n firms in an industry with market shares si ,(i=1,2,

... , n), the HHI is defined as:

HHI can be written as an increasing

function of the population variance of market shares. The more 'equal' the firm’s

size is, the smaller is the HHI. HHI also satisfies the well known 'transfers’’

property. By definition (1/n) <1, where n is the number of

firms in an industry. The maximum concentration of unity occurs when one firm

has all the sales, output, etc. Minimum of concentration (1/n) occurs

when each firm has an equal share of 1/n. Despite

its popularity, HHI suffers from a few limitations. A major limitation is that

distributions of market shares with radically different tail properties may have

HHI of similar magnitude (Rhoades, 1995). Recently, Maasoumi and Slottje (2002)

have argued that common economic phenomena like mergers between a strong and a

weak firm or entries and exits only change certain parts of the distribution of

market share – often the tails only. Indices based solely on 'dispersion’’ or

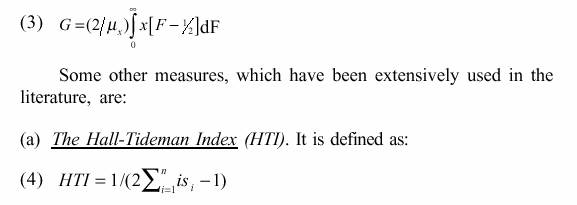

variance, (e.g., HHI, Gini, etc.) may miss such changes. Another popular

measure that shares most of the properties of HHI is the Gini ratio. The Gini

ratio, in a continuous variable framework, is defined as:

where

the market share of each bank is weighted by its ranking in order to ensure that

the emphasis is on the absolute number of banks, and that the largest bank receives

weight i=l. This index includes the number of banks in the calculation

of a concentration index, because it reflects to some extent the conditions of

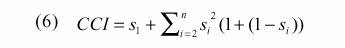

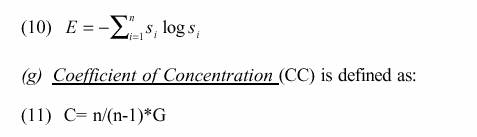

entry into a particular industry. (b) The Rosenbluth Index (RI) is

defined as: (5) RI=1/(n(1-G)), where G is the Gini-coefficient. (c)

The Comprehensive Industrial Concentration Index (CCI) is defined as :

It

is the sum of the proportional share of the leading bank and the summation of

the squares of the proportional sizes of each bank, weighted by a multiplier,

reflecting the proportional size of the rest of the industry.

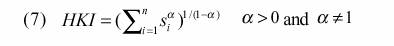

(d) The Hannah and Kay Index (HKI) is defined as :

where

a is an elasticity parameter to be specified and intended to reflect their

ideas about changes in concentration as a result of the entry or exit of banks,

and the sales transfer among the different banks in the market. The freedom to

choose a allows for alternative views on: what is the appropriate weighting

scheme and for the option to emphasise either the upper or the lower segment of

the bank size distribution. Therefore, in addition to the distribution of the

banks in the market, the value of the index is sensitive to the parameter a.

For ????0 , the index approaches the number of banks in the industry,

and for ?????, it converges towards the reciprocal of the market

share of the largest bank. (e) The

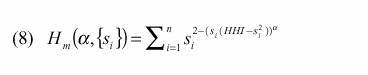

Hause Indices i) The multiplicatively modified Hause Index takes

the form:

where

HHI is the Herfindahl-Hirschman Index and a is the parameter capturing

the degree of collusion. ii) Hause furthermore

proposes the additively adjusted measure of concentration, which is defined as:

(f)

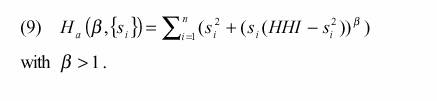

Entropy Measure The

Entropy measure has its theoretical foundations in information theory and measures

the ex-ante expected information content of a distribution. It takes the

form:

Indices

(a) to (g) are discussed in detail in Bikker and Haaf (2001a). It

may be noted that some of the indices are based on higher moments of market shares.

For example, the Comprehensive Concentration Index (CCI) could be associated with

the third moment of market shares. In some cases, they are functions of market

shares as well as the HHI. Some of the measures, in fact, represent broad classes.

The values of a specific measure within that class will depend on specific values

of certain parameters. In an empirical exercise, the choices of the values of

these parameters are often not clear. Researchers typically specify a set of 'plausible'

values of these parameters and examine the robustness of the obtained results.

Availability of so many indices implies that in any specific exercise, it is

important to specify the underlying axiomatic structure under which the corresponding

index becomes the 'best' index. In their various incarnations, axiomatic structures

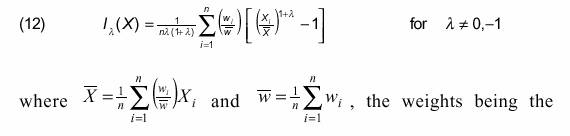

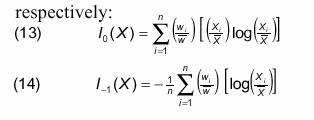

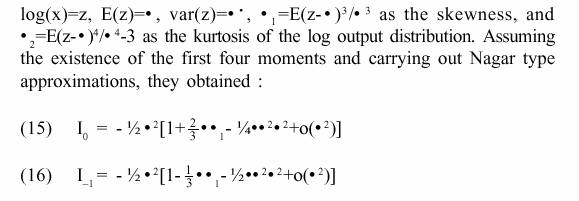

identify the generalised entropy (GE) as an 'ideal' family of indices. For a weighted

random vector X=(X1,…,Xn)' with weights w=(w1,…,wn)' the GE concentration

measure is defined as:

reciprocal

inclusion probabilities. This family includes HHI, variance of logarithms, square

of the coefficient of variation, and for l=0, -1, this index converges

to the first and second Theil measures of information

It

has been shown that Theil's second measure (l = -1) provides the most unambiguous

answer to such fundamental questions as: How much of the overall concentration

is due to the concentration within the rt h group? The groups could

be with respect to type of product, technology, location, or the size itself.

These two measures in (13) and (14) were further studied by Maasoumi and Theil

(1979) with a view to determine their characteristics in terms of the moments

of distributions. Let:

When

z has a lognormal distribution, both indices equal - (1/2)s2.

HHI can be shown to be a simple function of s2, but not of the

higher moments. Thus, it can fail with departures from lognormality. The above

approximate formulae can be used when the underlying distribution is not known.

They allow us to see that positive skewness and leptokurtosis increase concentration,

and that is more sensitive to positive skewness I 0(high sales/output

groups) and fat tails (large extreme sales groups) than I-1 .

As these entropy measures appear more general and relatively

easy to implement, their use in the context of measuring market concentration

has often been suggested. This is because entropy is shown as a much richer function

of all the moments of a distribution, and more closely identifies it than any

single moment such as variance or HHI. I.2 Dynamic Measures of Concentration The

dynamic measures of concentration emerge from the realisation that it is misleading

to consider states of a market at only single points in time. Transitory conditions

may mislead and become difficult to disentangle when looking at several periods/situations.

It is thus, desirable to consider market concentration over several periods, and

to develop a dynamic concentration profile, following the concepts of mobility

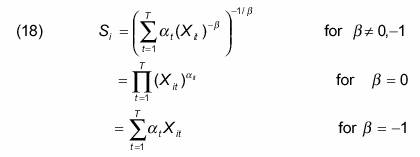

as in Maasoumi and Zandvakili (1990). Let denote sales/output of firm i,

(i=1,…,N), in period t=1,…,T.XitWe denote the vector

,....Xt =(X1t ,X2t ,XNt)¢. Let Si=Si (Xi1,…, XiT)

be the ‘permanent’ or 'aggregate’’ sales of firm i over T periods.

Of course, one can define the aggregates over periods 1 to T¢£

T, say, and develop a mobility profile as T¢ approaches T.

Then(17)S =(S1,…, Sn)¢is the vector of

aggregate sales for a chosen time frame. Following Maasoumi (1986), the following

type of aggregation functions are justified on the basis that they minimize the

generalized entropy distance between S and all of the T 'sales’’ distributions:

where at

is the weight attached to sales in period t, Sa t=1. The elasticity

of substitution of sales/output across time is constant at a=1/ (1+b).

The case b = –1 corresponds to perfect inter-temporal substitution, which

subsumes Shorrocks’ analysis for certain weights. This case is also the most common

formulation of the 'permanent income’’ concept in economics. In this context,

we can think of the concept as 'permanent output’’, or 'expected sales’’. Mobility

is measured as the ratio of 'long run’’ concentration occurring when the period

of examination is extended, and a measure of short run concentration. The latter

may be represented by any one period of interest, or a weighted average of the

single period concentrations. We might think of this as a notion of 'competition

enhancing’’ mobility, a welfare theoretic base in favour of large, non-concentrated

markets.4 The extension of the time interval is meant to reflect the

dynamics and smooth out the transitory or business cycle effects in the industry.

Shorrocks (1978) proposed the following mobility measures:

where

I() is the 'inequality’’ measure. For convex inequality measures I(), 0£M£1

is easily verified when S is the linear 'permanent output’’ function. For

other aggregator functions see Maasoumi and Zandvakili (1990). A priori,

there would be no reason for an analyst to give unequal weights to different years

under study. Nevertheless, Shorrocks (1978) suggests the ratio of year t

income to total income over the T periods as suitable values for at

s. We consider both weighting schemes here.5

Section II Empirical Analysis Compared

to many other developing countries, India has an extensive banking network. Before

an empirical analysis, a brief discussion on the taxonomy and the historical development

of the structure of the Indian banking market would be essential.6

Accordingly, Subsection II.1 presents such a review in brief. Subsections II.2

and II.3 present results based on static and dynamic measures, respectively. II.1

Taxonomy and Historical Development The scheduled banking

structure in India consists of banks that are included in the Second Schedule

of the Reserve Bank of India Act, 1934. These scheduled banks are divided in two

groups, viz., scheduled commercial banks and scheduled co-operative banks. This

study is restricted to scheduled commercial banks that account for more than 90

per cent of banking business in India. For analytical purposes, the scheduled

commercial banks could be further classified into four groups, viz., public

sector banks, Indian private sector banks, regional rural banks and foreign banks.

Among the public sector banks, official reports generally indicate results separately

for State Bank of India (SBI) and its Associates and Other Nationalized Banks,

due to the large size of the former. So far as banking is

concerned, the year 1969 marked a watershed, during which fourteen major banks

in India were nationalised. At that time, there were 73 scheduled commercial banks

in India, of which 15 were foreign banks. Due to strong emphasis on increasing

the savings rate of the economy, the 1970s and 1980s experienced phenomenal growth

in the banking network that spanned the entire country. As a result, though the

absolute number of scheduled commercial banks (other than regional rural banks)

did not increase much (78 as at end-March 1990, of which 22 were foreign banks),

the number of bank branches increased from 8,262 in 1969 to 59,752 as at end-March

1990, resulting in a very high annual compound growth rate of 18.8 per cent in

deposit mobilisation, from Rs.4,646 crore as at end-March 1969 to Rs.1,73,515

crore as at end-March 1990. The Indian Government has historically undertaken

a number of extensive and elaborate policy initiatives to extend the outreach

of formal credit systems to the rural population. One of the major initiatives

taken was the establishment of Regional Rural Banks (RRBs) in 1975. These policy

initiatives during 1970-90 had a far-reaching impact on the functional reach and

geographical spread of banking in India. However, this period is also characterised

by widespread control, limiting the scope of competition. Interest rates were

strictly administered and had multiple layers. On the lending side, the focus

was on priority sectors. The banking market during this period was also highly

segmented. Following the balance of payments crisis in India

during the early 1990s, the earlier regime experienced a radical change. A major

change was to shift away from the earlier administered rates towards market determined

ones. On the lending side, the deregulation began in 1994 with emphasis on the

development of money, Government securities and foreign exchange markets. The

conduct of monetary policy also slowly moved away from the use of direct instruments

of monetary control to indirect measures such as open market operations. Banks

were given freedom to set their Prime Lending Rates and to devise their own lending

policies. On the liabilities side, the entire gamut of deposit rates – except

on savings deposits – were deregulated, and the banks were given freedom to offer

different interest rates for different maturities/ size-groups. Interest rates

on Government securities were made market-determined. The refinance facility of

Reserve Bank of India (RBI) was also rationalised and sector specific refinance

facilities were de-emphasised. During 1997, another overriding development with

far reaching implications was, however, the reactivation of the Bank Rate, which

was linked to other interest rates including the Reserve Bank’s refinance rate.

During this period, banks were also permitted to rationalise their existing branch

network viz., to shift their existing branches within the same locality,

open certain type of specialised branches, convert the existing non-viable rural

branches into satellite offices, etc. Table 1 presents

the movement of select banking indicators during last two decades. It is observed

that the decade 1992-02 is marked with significant increase in the banking business

by Indian private banks. While the deposits of Indian public sector banks grew

at an annual compound growth rate of around 15.55 per cent during 1992-02, the

same for Indian private banks grew at an annual compound growth for around 28.57

per cent. In the case of bank credit also, a similar pattern is observed.

|

Table 1: Movement of Select Banking

Indicators during 1982-92 to 1992-02 |

| Bank-groups |

Growth in number |

Compound growth |

Compound growth |

| |

of branches |

of deposits |

of bank credit | | |

1982-92 |

1992-02 |

1982-92 |

1992-02 |

1982-92 |

1992-02 |

| State Bank of India & its |

| | | |

| | |

Associates | 26.54 |

7.69 |

16.18 |

15.48 |

14.64 |

15.32 | |

Nationalised Banks |

32.64 |

3.41 |

15.15 |

15.59 |

13.81 |

15.23 | |

Regional Rural Banks |

60.09 |

-1.82 |

27.46 |

23.07 |

21.64 |

16.52 | |

Indian Private Banks |

-5.87 |

23.67 |

15.57 |

28.57 |

17.85 |

28.23 | |

Foreign Banks |

12.58 |

17.93 |

25.91 |

13.46 |

21.53 |

19.29 | |

Total | 35.33 |

4.80 |

16.12 |

16.75 |

14.83 |

17.00 |

The liberalisation measures adopted

during the beginning of the study period, attempted to reduce entry barriers by

discarding the earlier licence-permit regime. As a consequence, there were a number

of new entrants in the banking business during this period. Table 2 lists the

new arrivals of banks in India between 1989-90 and 2000-01 chronologically. It

is interesting to note that during the first few years, there were no new arrivals.

The early 1990s was the period of consolidation after the economic debacle following

the balance of payments crisis experienced by India during the year 1990-91. The

arrivals started during early 1994 after the crisis was effectively tackled and

in consequence, the pace of liberalisation in the Indian financial sector accelerated.

Table 2 reveals the arrival of 33 new banks during this period, among which 24

are of foreign origin. It is also interesting to note that the arrival of the

foreign banks accelerated during the later period.

| Table

2: Entry of New Banks during 1990-2001 | |

| | | |

| | |

BankName | Dateof |

Ownership |

BankName | Dateof |

Ownership | |

| Opening |

Category | |

Opening |

Category | |

Barclays Bank | 8/10/90 |

Foreign Bank |

Bank of Ceylon | 30/10/95 |

Foreign Bank | |

Sanwa Bank |

20/12/90 | Foreign

Bank | Commerz Bank |

1/12/95 |

Foreign Bank | |

UTIBank | 28/02/94 |

IndianPrivate |

Siam Commercial | 14/12/95 |

Foreign Bank | |

| | Bank |

Bank | |

| | IndusIndBank |

2/04/94 |

IndianPrivate | Bank

International | 6/04/96 |

Foreign Bank | |

| | Bank |

Indonesia | |

| | ICICI Bank |

17/05/94 |

IndianPrivate | Arab

Bangladesh | 6/04/96 |

Foreign Bank | |

| | Bank |

Bank | |

| | INGBank |

1/06/94 |

Foreign Bank | Chinatrust |

8/04/96 |

Foreign Bank | | |

| | Commercial

Bank | | | |

Global Trust Bank |

6/09/94 | IndianPrivate |

Cho Hung Bank |

6/05/96 | Foreign

Bank | | | |

Bank | |

| | |

Chase Manhattan Bank |

21/09/94 | Foreign

Bank | Fuji Bank |

20/05/96 |

Foreign Bank | |

State Bank of Mauritius |

1/11/94 | Foreign

Bank | Krung Thai Bank |

6/01/97 |

Foreign Bank | |

HDFC Bank | 5/01/95 |

IndianPrivate |

Overseas Chinese | 31/01/97 |

Foreign Bank | |

| | Bank |

Bank | |

| | Centurion Bank |

13/01/95 |

IndianPrivate | Commercial

Bank | 12/03/97 |

Foreign Bank | |

| | Bank |

of Korea | |

| | DBS Bank |

15/03/95 |

Foreign Bank | Sumitomo

Bank | 20/06/97 |

Foreign Bank | |

Bank of Punjab |

5/04/95 | IndianPrivate |

Hanil Bank |

5/07/97 | Foreign

Bank | | | |

Bank | |

| | |

TimesBank | 8/06/95 |

IndianPrivate |

Toronto-Dominion | 25/10/97 |

Foreign Bank | |

| | Bank |

Bank | |

| | Dresdner Bank |

21/08/95 |

Foreign Bank | Bank

Muscat | 9/09/98 |

Foreign Bank | |

| | |

International | | |

| IDBI Bank |

28/09/95 |

IndianPrivate | Morgan

Guaranty | 24/12/98 |

Foreign Bank | |

| | Bank |

Trust K. B. C. Bank |

15/02/99 |

Foreign Bank |

The

new environment in banking demanded restructuring and reorienting the policy goals

of banks. One way to adapt to the new environment was through mergers. It may

be noted that though bank mergers were common phenomenon in many developed and

developing countries, they were comparatively new in India during the 1990s.7

Table 3 presents the list of mergers and acquisitions among the banks. It lists

18 such mergers. Once again, it may be noted that 10 of the mergers and restructuring

took place during the second half of the 1990s. To understand the nature of these

mergers in detail, the type of merger has also been indicated in Table 3. Most

of the mergers took place either between two private sector banks or two public

sector banks. Among the public sector banks, generally a 'weak' bank had been

merged with a 'strong' bank. Thus, if one considers public sector or private sector

as a group, the effect of merger on bank performance may not be very significant.

In one or two cases, it is observed that a non-banking

financial company had been merged with a bank.

| Table

3 : Mergers and Acquisitions of Banks: 1985-2002 | |

Name of the merging entity |

No. of |

Name of the merged entity |

Date/Year of | | |

Branches | |

merger | |

| | | |

| United Industrial Bank |

145 |

Allahabad Bank | 31/10/89 |

| Bank of Tamil Nadu |

99 |

Indian Overseas Bank |

20/02/90 | |

Bank of Thanjavur | 156 |

Indian Bank |

20/02/90 | |

Parur Central Bank |

51 | Bank of India |

20/02/90 | |

Purbachal Bank |

40 | Central Bank

of India | 29/08/90 |

| Bank of Karad |

48 |

Bank of India | 2/05/92 |

| New Bank of India |

591 |

Punjab National Bank |

1993 | | BCCI

(Mumbai) | 1 |

State Bank of India |

1993 | |

Kashinath Seth Bank |

11 | State Bank of

India | 1/01/96 |

| Bari Doab Bank |

10 |

Oriental Bank of Commerce |

8/04/97 | |

Punjab Co-operative Bank |

9 | Oriental Bank

of Commerce | 8/04/97 |

| 20th Century Finance |

| Centurion Bank |

1/01/98 | |

Bareilly Corporation Bank |

65 |

Bank of Baroda | 3/06/99 |

| Sikkim Bank |

7 |

Union Bank of India |

22/12/99 | |

Times Bank | 10 |

HDFC Bank |

26/02/00 | |

Bank of Madura | 270 |

ICICI Bank |

10/03/01 | |

Sakura Bank | 2 |

Sumitomo Bank |

1/04/01 | |

Morgan Gurantee Trust |

1 | Chase Manhattan

Bank | 10/11/01 |

II.2 Changes in the Market Structure

in Indian Banking: Static Measures The evidences in

Tables 1–3 reflect the changes in the structure of Indian banking. We now attempt

to examine these changes in detail by measuring the changes in different concentration

indices over the years. We estimated the measures of concentration at industry

as well as at bank-group level with respect to total assets, total deposits and

total income. However, for the sake of brevity, we have presented the values at

industry level based on total assets.8 From an

analytical point of view, before discussing the trends of the various concentration

measures in the post-reform period, we present a brief statistical profile of

various concentration measures (Table 4).9 The first impression demonstrates

the diverging results yielded by the various concentration measures when applied

to the same underlying market. Even a short glance reveals the wide spread in

these values. The results show clearly that not only does the range of possible

values differ strongly across the indices, but so do the values of the indices

within this range. For instance, the value is high for the CRk

and low for the HHI and Rosenbluth index. Table

5 presents the trends in various concentration measures during 1989-90 to 2000-01.

Note that as these figures are population figures (scheduled co-operative banks

are excluded, we interpret scheduled commercial banks as the ‘population’), computations

of standard errors are not necessary. In general, concentration indices, as presented

in Table 5, appear to be inversely related to the number of banks. This is owing

to the well-known weakness of concentration indices, namely, their dependency

on the size of the banking market. The value of the k-bank concentration

ratios (for various values of k) always exceeds the value of HHI, since

the latter gives less prominence to the markets shares (the weights again being

market shares) than the former (unit weights). Irrespective of the choice of the

concentration index, measures of concentration have declined in

| Table

4: Average Measures of Concentration: 1989-90 to 2000-01 |

| | | |

| | | |

| | | |

Index |

Range | |

| Parameters |

Typical features |

Avg. |

Std. | CV |

| type |

| | | |

| | Value |

Dev. | |

| GINI |

| | | |

| | 0.736 |

0.012 |

1.631 | | | |

| | | |

Takes only large banks |

0.250 |

0.020 | 7.931 |

| CR1 |

| | | |

| | | |

| | |

0 < | |

1 | | |

into account; |

0.311 | 0.025 |

8.160 | |

CR2 |

CR |

k£ |

| | | |

| | | |

| | | |

| | arbitrary

cut off | 0.472 |

0.032 |

6.690 | | CR5 |

| | | |

| | | |

| | | |

| | | |

| 0.628 |

0.044 |

6.940 | | CR10 |

| | | |

| | | |

| | HHI |

1/n £ HHI |

£ |

1 | |

Considers all banks; sensitive |

0.085 | 0.012 |

13.835 | | |

| | | |

| to entrance of new banks |

| | | |

HTI |

0 < HTI |

£ | 1 |

| Emphasis on absolute |

0.050 |

0.005 | 9.805 |

| | | |

| | |

number of banks | | |

| | Rosen- |

0 < RI |

£ | 1 |

| | Sensitive

to changes in | 0.044 |

0.007 |

15.753 | |

bluth | | |

| | |

the size distribution of | |

| | | |

| | | |

| small banks |

| | | |

CCI |

0 < CCI £ |

1 | |

| Addresses relative dispersion |

0.293 |

0.023 | 7.810 |

| | | |

| | |

and absolute magnitude; | |

| | | |

| | | |

| suitable for cartel markets |

| | | |

CI | |

| | | |

| 0.745 |

0.013 |

1.700 | |

HKI | HKI£ |

n | a

= 0.005 | Stresses influence

small banks | 86.880 |

11.292 |

12.998 | | |

(1/s 1)

£ | | |

| | | |

| | | |

| | | |

a

= 0.25 | |

62.355 | 8.264 |

13.253 | | |

| | | |

a

= 5 | |

5.686 | 0.542 |

9.529 | | |

| | | |

a

= 10 | Stresses influence

large banks | 4.688 |

0.399 |

8.501 | |

Hause | 0 < |

£ |

1 | | a

= 0.25 | Suitable for

highly collusive | 0.138 |

0.019 |

13.481 | | |

Hm |

| | | |

| | | |

| index |

| | | |

| markets |

| | | |

| | | |

| a

= 1 | |

0.085 | 0.012 |

13.947 | | |

| | | |

a

= 2 | Suitable for not

collusive | 0.085 |

0.012 |

13.837 | | | |

| | | |

markets | |

| | |

Entropy | 0 £

E £ |

log | n |

| Based on expected |

3.282 |

0.152 | 4.633 |

| | | |

| | |

information content of a | |

| | | |

| | | |

| distribution |

| | |

the post-reform period. Two different patterns are very clear:

(a) there exists a uniform ordering/trend across various measures, (b) although

reform process reduced concentration in the industry, the speed of reduction has

been noticeably slow. However, the role of financial liberalisation in lowering

concentration is clearly established. It is interesting to note that the major

part of the change in the structure had occurred during the early 1990s. Thus,

the spate of mergers during the late 1990s did not change the market structure

significantly. |

Table 5 : Movement of Various Measures

of Concentration: 1989-90 to 2000-01 |

| | | |

| | | |

| | | |

Year |

No. of |

GINI |

1-Bank |

HHI |

HTI |

RI |

CCI |

CC |

Entropy | | |

Banks |

| Ratio |

| | | |

| | |

1990 | 75 |

0.757 |

0.281 |

0.103 |

0.058 |

0.055 |

0.328 |

0.767 |

3.057 | |

1991 |

77 | 0.757 |

0.279 |

0.102 |

0.057 |

0.054 |

0.325 |

0.767 |

3.079 | |

1992 |

77 | 0.750 |

0.278 |

0.101 |

0.055 |

0.052 |

0.324 |

0.760 |

3.105 | |

1993 |

76 | 0.733 |

0.261 |

0.091 |

0.052 |

0.049 |

0.306 |

0.742 |

3.174 | |

1994 |

74 | 0.721 |

0.256 |

0.089 |

0.050 |

0.048 |

0.301 |

0.731 |

3.192 | |

1995 |

83 | 0.725 |

0.237 |

0.079 |

0.049 |

0.044 |

0.282 |

0.734 |

3.300 | |

1996 |

92 | 0.738 |

0.241 |

0.079 |

0.047 |

0.041 |

0.283 |

0.746 |

3.340 | |

1997 |

97 | 0.734 |

0.233 |

0.075 |

0.045 |

0.039 |

0.274 |

0.742 |

3.404 | |

1998 |

100 | 0.734 |

0.226 |

0.072 |

0.045 |

0.038 |

0.267 |

0.742 |

3.437 | |

1999 |

100 | 0.732 |

0.234 |

0.075 |

0.046 |

0.037 |

0.273 |

0.740 |

3.433 | |

2000 |

100 | 0.729 |

0.236 |

0.074 |

0.045 |

0.037 |

0.273 |

0.736 |

3.441 | |

2001 |

99 | 0.727 |

0.244 |

0.077 |

0.045 |

0.037 |

0.279 |

0.735 |

3.425 |

To establish the observed first

pattern, Table 6 presents product-moment correlations among various concentration

indices in India over time10. Results based on almost all the pairs

are similar, displaying a high degree of correlation. The strongest correlations

are found between CR1 and CR2, RI and CR3, CCI and CR1, HHI and CR1. These results

clearly demonstrate that, at least in the Indian context, the behaviour of various

concentration indices is very similar. Thus, our results indicate that though

a host of measures for market concentration are available, an empirical application

is unlikely to yield different rankings of a single economy over time. Our results

thus, compliment the results of Bikker and Haaf (2001a), who did a similar exercise

over space. The observed correlations are, however, not very strong when the measures

are based on either total deposits or total income , indicating that some differences

could exist across the variable, which is used to compute the size distribution

(e.g., asset, deposit and income)11. This is not unlikely because

the markets for different bank products could be sharply different and the largest

banks in one market may not be necessarily so in other ones. Finally,

we compare concentration measures of Indian banking industry to those in a few

other developed economies based on the results of Bikker and Haaf (2001a). Bikker

and Haaf (2001) observed high market concentration in Denmark, Greece, Netherlands

and Switzerland and low market concentration in France, Germany, Italy,

|

Table 6 : Product Moment Correlations

among Different | | |

| |

Measures of Concentration | |

| | | |

GINI |

HHI |

RI |

CR1 |

CR2 |

CR3 |

CR4 |

CCI |

CC |

ENT | |

GINI | 1.00 |

| |

| |

| |

| |

| |

HHI | 0.74 |

1.00 |

| |

| |

| |

| |

| RI |

0.66 |

0.97 |

1.00 |

| |

| |

| |

| |

CR 1 | 0.73 |

0.99 |

0.94 |

1.00 |

| |

| |

| |

| CR 2 |

0.76 |

0.99 |

0.97 |

0.99 |

1.00 |

| |

| |

| |

CR 3 | 0.72 |

0.98 |

0.99 |

0.95 |

0.98 |

1.00 |

| |

| |

| CR 4 |

0.70 |

0.95 |

0.99 |

0.91 |

0.95 |

0.99 |

1.00 |

| |

| |

CCI | 0.73 |

0.99 |

0.97 |

0.99 |

0.99 |

0.98 |

0.95 |

1.00 |

| |

| CC |

0.99 |

0.79 |

0.72 |

0.78 |

0.81 |

0.77 |

0.75 |

0.78 |

1.00 |

| |

ENT | -0.66 |

-0.98 |

-0.99 |

-0.95 |

-0.97 |

-0.99 |

-0.99 |

-0.98 |

-0.72 |

1.00 |

Luxembourg and the US. Table 7 juxtaposes

the HHI and CRk (for k=3, 5 and 10) measures based

on total assets for India along with similar measures for 20 countries during

the year 1997. It is interesting to observe that market oncentration in banking

in India appears to be low as compared to other countries. For example, India

ranks joint 8th (with Spain) with respect to HHI and joint 6th

(with UK) with respect to CR3 measure.

| Table

7: Concentration Indices for 21 Countries, based on Total

Assets: 1997 | |

Countries | HHI |

| | |

No. of banks | | |

| CR3 |

CR5 |

CR10 |

| | Australia |

0.14 |

0.57 |

0.77 |

0.90 |

31 | |

Austria |

0.14 |

0.53 |

0.64 |

0.77 |

78 | |

Belgium | 0.12 |

0.52 |

0.75 |

0.87 |

79 | |

Canada |

0.14 |

0.54 |

0.82 |

0.94 |

44 | |

Denmark | 0.17 |

0.67 |

0.80 |

0.91 |

91 | |

France |

0.05 |

0.30 |

0.45 |

0.64 |

336 | |

Germany | 0.03 |

0.22 |

0.31 |

0.46 |

1803 | |

Greece |

0.20 |

0.66 |

0.82 |

0.94 |

22 | |

India | 0.08 |

0.34 |

0.43 |

0.62 |

97 | |

Ireland |

0.17 |

0.65 |

0.73 |

0.84 |

30 | |

Italy | 0.04 |

0.27 |

0.40 |

0.54 |

331 | |

Japan |

0.06 |

0.39 |

0.49 |

0.56 |

140 | |

Luxembourg | 0.03 |

0.20 |

0.30 |

0.49 |

118 | |

Netherlands |

0.23 |

0.78 |

0.87 |

0.93 |

45 | |

Norway | 0.12 |

0.56 |

0.67 |

0.81 |

35 | |

Portugal |

0.09 |

0.40 |

0.57 |

0.82 |

40 | |

Spain | 0.08 |

0.45 |

0.56 |

0.69 |

140 | |

Sweden |

0.12 |

0.53 |

0.73 |

0.92 |

21 | |

Switzerland | 0.26 |

0.72 |

0.77 |

0.82 |

325 | |

UK |

0.06 |

0.34 |

0.47 |

0.68 |

186 | |

US | 0.02 |

0.15 |

0.23 |

0.38 |

717 | |

Source : Except India, other figures have been taken

from Bikker and Haaf (2001a). |

II.3 Changes in the Market Structure in Indian Banking: Dynamic Measures In

the case of computing generalised entropy measures, the permanent assets (deposits/income)

are computed based on µ t weights. These weights used

here are the ratio of mean assets at µt time t

to the mean assets over the entire M periods. In our computations, the

substitutions parameter b is restricted by the relation -g

= 1 + b. We computed four different aggregator functions corresponding

to four inequality measures with -g = V = (2, 1, 0.5,

0.0). V = 0.0 and 1.0 correspond to Theil’s first and second inequality

measures, respectively, combined with the linear and the Cobb-Douglas forms of

the aggregator function. Table 8 provides the annual short-run inequalities, the

inequalities in the aggregated (long-run) assets, and the assets stability measures

RM. Decomposition of each ‘between’ and ‘within’ groups is also presented. Short-run

inequality in Table 8 has generally decreased. Surprisingly, the inequality has

not become greater with larger degrees of relative inequality aversion (V).

For V other than 2, the ‘within-group’ component of short-run inequalities

is dominant. However, the absolute values of both ‘within-group’ and ‘between-group’

inequality measures have recorded a significant decline over the 12 years period. The

long-run inequality has recorded relatively less volatility. In all the years,

the values of Ig(S) have decreased and in most cases they

are dominated by ‘within-group’ component measures. In some cases, the long-run

inequality measures are higher than the short-run component. It may be mentioned

that these relative values are somewhat sensitive to the size distribution. The

corresponding stability measures showed somewhat different pattern. Although,

the stability measures have fallen over the years, they have been highly dominated

by ‘between-group’ component and the impact of ‘within-group’ has been marginalised.

Thus, there is a tendency for the profiles of the banks to fall, and then level

off in the years to come. These patterns are robust with respect to the choice

of aggregation function, size-adjustment and inequality measure.

| Table

8: Empirical Values of Generalised Entropy Measures |

| Year |

| Shortrun |

Longrun |

| | Stability |

| | |

Overall |

Between |

Within |

Overall |

Between |

Within |

Overall |

Between |

Within | | |

| | | |

| | | |

| | | |

| Degree

of inequality aversion = 2.0 | |

| | |

1990-93 | 2.028 |

0.891 |

1.137 |

2.068 |

0.904 |

1.164 |

1.020 |

1.014 |

0.006 | |

1990-95 |

1.744 |

0.762 |

0.982 |

1.877 |

0.794 |

1.084 |

1.076 |

1.042 |

0.035 | |

1990-97 | 0.959 |

0.641 |

0.319 |

1.243 |

0.696 |

0.547 |

1.296 |

1.086 |

0.210 | |

1990-99 |

0.777 |

0.544 |

0.233 |

1.036 |

0.620 |

0.416 |

1.333 |

1.139 |

0.194 | |

1990-01 | 0.696 |

0.475 |

0.221 |

0.904 |

0.564 |

0.340 |

1.299 |

1.187 |

0.112 | |

1996-01 |

0.552 |

0.354 |

0.198 |

0.581 |

0.362 |

0.219 |

1.053 |

1.022 |

0.030 | | |

| |

Degree of inequality aversion = 1.0 |

| | | |

1990-93 |

1.333 |

0.507 |

0.826 |

1.141 |

0.375 |

0.766 |

0.856 |

0.740 |

0.116 | |

1990-95 | 1.254 |

0.460 |

0.794 |

1.074 |

0.348 |

0.727 |

0.856 |

0.755 |

0.102 | |

1990-97 |

1.175 |

0.409 |

0.766 |

1.016 |

0.311 |

0.705 |

0.865 |

0.759 |

0.105 | |

1990-99 | 1.134 |

0.364 |

0.770 |

0.982 |

0.276 |

0.706 |

0.866 |

0.758 |

0.108 | |

1990-01 |

1.112 |

0.328 |

0.784 |

0.972 |

0.246 |

0.726 |

0.874 |

0.750 |

0.124 | |

1996-01 | 1.052 |

0.273 |

0.780 |

0.956 |

0.232 |

0.724 |

0.909 |

0.852 |

0.057 |

| | | |

Degree of inequality aversion = 0.5 |

| | | |

1990-93 |

1.068 |

0.425 |

0.643 |

1.063 |

0.422 |

0.641 |

0.995 |

0.993 |

0.002 | |

1990-95 | 1.017 |

0.394 |

0.623 |

1.008 |

0.387 |

0.621 |

0.991 |

0.982 |

0.009 | |

1990-97 |

0.966 |

0.357 |

0.609 |

0.955 |

0.344 |

0.611 |

0.989 |

0.965 |

0.024 | |

1990-99 | 0.936 |

0.323 |

0.613 |

0.921 |

0.305 |

0.616 |

0.984 |

0.945 |

0.039 | |

1990-01 |

0.921 |

0.294 |

0.627 |

0.905 |

0.272 |

0.633 |

0.983 |

0.927 |

0.055 | |

1996-01 | 0.879 |

0.251 |

0.628 |

0.879 |

0.247 |

0.632 |

1.000 |

0.981 |

0.019 |

| | | |

Degree of inequality aversion = 0.0 |

| | | |

1990-93 |

1.147 |

0.438 |

0.709 |

1.331 |

0.506 |

0.825 |

1.160 |

1.155 |

0.006 | |

1990-95 | 1.093 |

0.397 |

0.696 |

1.262 |

0.458 |

0.804 |

1.155 |

1.153 |

0.001 | |

1990-97 |

1.041 |

0.358 |

0.683 |

1.194 |

0.405 |

0.789 |

1.147 |

1.132 |

0.015 | |

1990-99 | 1.011 |

0.333 |

0.678 | 1.143 |

0.358 |

0.785 | 1.131 |

1.075 |

0.055 | | 1990-01 |

0.997 |

0.324 | 0.673 |

1.115 |

0.320 | 0.795 |

1.118 |

0.988 | 0.130 |

| 1996-01 |

0.955 |

0.303 | 0.652 |

1.063 |

0.271 | 0.792 |

1.113 |

0.893 | 0.220 |

The fact that the profiles

are becoming flatter is an indication that, although there have been some transitory

movements in the size distribution of assets, there is a lack of any permanent

equalization. Further more, while some equalisation has taken place within each

group of banks, inequality between groups has been noticeably high.

Section III Impact on Prices and Quantities In

this section, we examine the possible impact of the changes in concentration on

the prices and output in the banking sector. It may be noted that as we have limited

observations (e.g., annual data only), the causal nature of market structure

and performance is difficult to establish. It is well known that even in a market

structure that is apparently monopolistic, competitive prices may exist due to

threat of entry. Our arguments in this section are, therefore, not definitive.

However, despite limitations, our observations in this section may turn out to

be useful in reconciling the conceptual anomalies and as a consequence, in forming

the suitable hypotheses. The literature

that discusses the relationship between market structure and competitiveness is

voluminous. The survey of Bikker and Haaf (2001a) also covers this area, focussing

on different theoretical and empirical approaches with special reference to banking.

To link concentration and competitiveness empirically, one needs to specify and

estimate appropriate models based on panel data.1 2 In the panel data

models, disaggregated bank specific data on some ‘performance’ measures is regressed

on the bank’s own market share, market concentration at the aggregate level and

other ‘control’ factors. The ‘performance’ measures are typically based on profits

or prices. While data on profits are taken from the profit and loss accounts of

banks, appropriate bank specific interest rates are supposed to be a proxy for

the prices. Empirical findings suggest monopolistic competition; competition appears

to be weaker in the local markets and stronger in the international markets. The

relationship for the impact of market structure on competition seems to support

the conventional view that concentration impairs competitiveness. It

may be noted that whatever be the theoretical structure specified, the empirical

measures for ‘prices’ in banking are not very clear. As there is no clear common

methodology for measuring prices and output of financial intermediation services

and SNA 1993 recognizes this as a problem area, Subsection III.1 discusses a few

common conceptual problems in the literature, and in this context, emphasises

that the direct use of select interest rates as a ‘price’ measure may not be conceptually

appropriate. Arguing on the basis of the user cost approach, we suggest the use

of spread as ‘price’ measures for banking. Subsection III.2 reviews alternative

empirical estimates of prices and output for this sector in India during the reference

period, and attempts to relate it to our earlier findings. In particular, it compares

inflation measures for banking based on traditional GDP deflators and spread,

and finds the latter to be more consistent with the changing patterns of market

structure of banking in India. III.1 Conceptual

Problems in Measurement of Prices and Output of Financial Intermediation Services It

may be noted that measurements of prices and output of services are difficult

because services are produced and consumed at the same point of time. Also, prices

of services are more dispersed across regions because of their non-tradable nature

(Grilliches, 1992). Besides these common problems, measurements of prices and

output of financial services are further limited due to many conceptual problems

that have not yet been resolved satisfactorily. First, it is not clear whether

financial services are attached to the financial instruments, accompanying the

transactions or to the monetary units being transacted. Most of the activities

of a bank involve processing documents (such as cheques and loan payments) and

dealing with customers (Benston et al., 1982). Consequently, previous researchers

have used the average number of deposit and loan accounts serviced per month as

their unit of output to measure the customer related services. Alternatively,

Fixler (1993) has argued that the amount of financial services sold by a bank

can be more appropriately measured by the money balances in the various products.

Secondly, it is not clear which financial services are relevant to the measurement

of output: those attached to assets, liabilities or both? This question concerns

the precise identification of inputs and outputs. The

debate on measurement of bank output mainly revolves around the status of demand

deposit related financial services . Demand deposits have the characteristics

of both input and output. On one hand, they are like ‘raw materials’ in the financial

intermediation process and are used for ‘production’ of loans and investment;

on the other hand, a host of ‘final’ services (e.g., maintenance of money,

free cheque facilities, etc.) are attached to them. Till now, consensus

regarding the status of demand deposit has not emerged in the literature. Thirdly,

many of the financial services are jointly produced with a sequence of barter

transactions and are typically assigned to a bundle of financial services, the

‘pricing’ of which is difficult and is often apparently ‘free’ in nature. These

conceptual problems imply that any measurement of the services provided by banks

in real terms would be difficult. In the absence of precise measures of prices

and output in banking, researchers have attempted to resolve the problem indirectly

by developing certain indicators – either for production or for the prices. A

few common indicators have been used widely in official statistics, for conversion

of value added of the banking sector from current prices to constant prices. In

many cases, the indicators have focused on a single aspect related to the sector,

concentrating on a simple ratio-variable and hoping that other related variables

move proportionally to the one proposed. Till the end of

1980s, the United States’ (US) Bureau of Economic Analysis (BEA) used one such

indicator for conversion of gross product originating (GPO) in the banking sector

from current prices to constant prices. To do that, the benchmark value of GPO

at current prices was determined for a particular year. Output for subsequent

years was calculated by extrapolating the benchmark value by a factor based on

the ‘number of persons engaged in production’, the implicit assumption in the

method being that there had not been any growth in labour productivity in banking!

When applied, the estimates showed very small real output growth in the banking

sector, so small that many economists believed that the method underestimated

real output of the banking sector in the US economy (Fixler, 1993). So far as

the other countries are concerned, it is also not uncommon to find the movement

of value added at constant prices estimated by means of changes in the compensation

of employees at constant prices (SNA 93, page 397). The

conversion factor used in the National Accounts Statistics (NAS) in India is slightly

different. In India, the base year estimates of value added from the banking sector

are carried forward using an indicator based on the ratio of aggregate deposits

for the two years and the wholesale price index (WPI). The volume of activity

is measured in value terms, the indicator being the ratio of aggregate deposits.

To obtain the quantity index, the ratio of deposits for two years is deflated

by WPI. It may be noted that the

‘quantity index’ of banking used in the NAS in India covers only one aspect of

banking, i.e., deposits; other aspects like credit are totally neglected.

This may turn out to be a serious limitation because the different products of

banks are fairly heterogeneous in nature. A composite index based on activities

of a bank would perhaps be more preferable. Moreover, deflation by WPI to derive

the quantity index is tantamount to the assumption that ‘prices’ for banking move

parallel to that of the goods sector as a whole, which may not be valid in reality. Besides

these simple indicators, models of real banking activity and measures for ‘prices’

and ‘quantities’ of various products offered by banks have also been developed

in the bank regulation literature. To determine whether economies of scale exist

in banking, researchers have estimated explicit multioutput production or cost

functions. Typically, such functions include bank financial inputs and outputs,

and the usual capital, labour and material inputs. Though precise measures of

nominal and real outputs are absolutely crucial for such studies, a variety of

approaches have been followed, and a consensus on conceptual questions has not

yet emerged. In the literature, three distinct approaches,

viz., the asset approach, value added approach and user cost approach,

are available. The process of generation of output and the role of demand deposit

in all these three approaches are sharply different. Each of these approaches

has certain advantages and certain drawbacks and adoption of any one of them depends

on the objective of the study. A detailed discussion on all these approaches is

beyond the scope of the paper.1 4 The paper restricts

its attention on the user cost approach because a major focus in this approach

is on measuring the implicit prices of financial intermediation through user cost

(Hancock, 1985; Fixler and Zieschang, 1992; Fixler, 1993). The user cost approach

attempts to measure prices of financial intermediation from the interest rates

of different financial instruments. In traditional applications, prices of different

financial instruments have been measured as deviations of the rate of return associated

with them from a benchmark risk-free financial instrument (e.g., discount

rates of treasury bill, coupon rates of standard Government bonds, bank rates,

etc.). But the problem with this approach is that the estimates provided

by it would be crucially related to the profitability of the banking sector. If

the risk of default is high, banks might not be willing to disburse more credit

as the amount disbursed might turn into a non-performing asset (NPA). If NPAs

of banks increase, the effective returns from these assets would decrease. In

such situations, the banks might tend to allocate a substantial portion of their

funds in approved securities. Thus, if the profitability of the banking sector

decreases, returns from advances would become closer to the return from the benchmark

rates and for some periods, it might be less than these rates leading to zero

or negative prices for some instruments. Alternatively, the weighted average rates

of all asset and liability products of the banking sector have also been considered

as the ‘standard’ rate. In the Indian cont ext, Srimany

and Bhattacharya (1998) have obtained empirical estimates based on traditional

user cost approach and compared the results with alternative estimates. Samanta

and Bhattacharya (2000), on the other hand, highlight the role of spread in this

context. Their study demonstrates that under some simplifying conditions, the

spread between rates of interest charged by the bank to borrowers and depositors

could be given the interpretation of a price for financial intermediation. III.2

Empirical Estimates of Prices and Output of Banking Services in India In

this section, we examine the behaviour of ‘price’ and ‘output’ of the banking

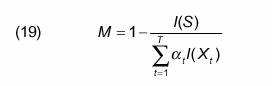

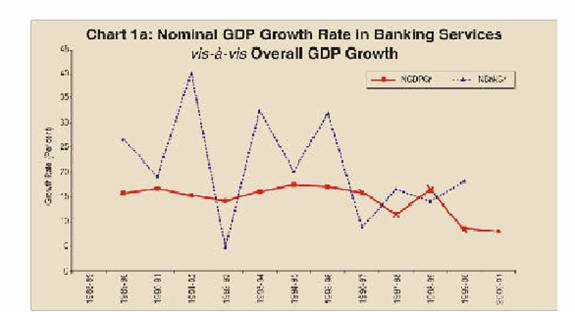

sector from the national income data. Figure 1 presents the nominal (Chart 1a)

and the real (Chart 1b) growth rates in GDP from the banking sector during the

period under study. To compare the sector’s relative performance, these figures

have been juxtaposed with the overall nominal and real growth of GDP in the respective

parts. In Chart 1a, the  curves

of NGDPGr and NBnkGr reflect the nominal overall GDP growth and GDP growth pertaining

to the banking sector, respectively. Similarly, In Chart 1b, the curves of RGDPGr

and RBnkGr show the corresponding values in real terms. Using

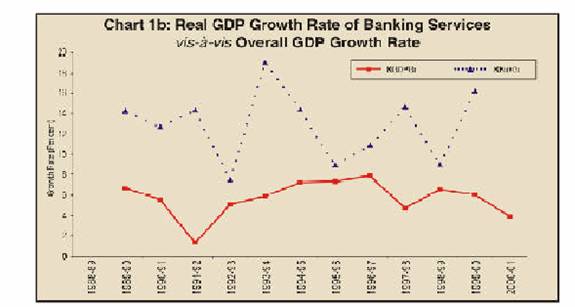

the nominal and real GDP figures, the implicit deflators in banking as well as

for the entire economy could be obtained. These deflators could be used to obtain

measures pertaining to sectoral and overall inflation. Chart 2 presents the implicit

‘inflation’ in banking services as per the NAS in India (Inf_Bnk). Once again,

to compare its relative performance, these figures have been juxtaposed with (i)

the overall ‘inflation’ in all commodities and services as measured by the GDP

deflator (Inf_GDP), and (ii) inflation based on WPI (Inf_WPI). It

may be noted that the method adopted by India in preparing National Accounts Statistics

is fully consistent with the international conventions. Given this, the above

figures look strange. While it is expected that the growth rates in a services

sector may be erratic and may fluctuate from year to year, such high fluctuation

reveals the general methodological weakness in the convention adopted internationally.

Is it possible that when inflation rates in almost all the sectors in an economy

are on a declining trend, the banking sector experiences a more than 20 per cent

rise in the prices and in the very next year experiences a deflation? We argue

that the NAS is providing

a misleading picture because there is circularity in measurement of banking services.

The circularity occurs because of the use of WPI to deflate the ‘nominal’ figures

of the value added in the banking services, and that too based on solely the movements

in deposits. As an alternative, we examine the movements

in spread-based measures. Although the theoretical implications of spread have

been examined in detail, there is no unique empirical definition of spread. Brock

and Rojas-Saurez (2000) have suggested six alternative proxies for banks spread,

ranging from a narrow concept – one that includes

loans and investments in the assets side and deposits and borrowings in the liability

side – to a broad concept, where all interest earning assets and interest bearing

liabilities plus associated fees and commissions are included. In addition,

one may perhaps consider the simple difference of a standard lending rate and

the deposit rate as a proxy. In the Indian context, some of these measures have

been computed and examined, sometimes separately across bank groups. For example,

Chapter VII of the Report on Currency and Finance (1999-2000) defines spread as

net interest income to total assets and computes this measure separately across

bank groups from 1991-92 to 1999-00. The Report observes a gradual reduction of

spread and attributes this reduction to competitive pressures. The Report also

observes '…a tendency towards their convergence across all bank-groups, except

foreign banks …' (pp. VII-1) In addition to the measures

suggested by Brock and Rojas-Saurez (2000), in this paper, we have considered

three additional measures based on the simple differences between lending and

deposit rates. As the interest structure during the early 1990s in India was administered,

these measures are expected to reveal the extent of 'administered spread' in India

during the same period. The definitions of these measures are presented in Table

9. Table 10 presents estimates pertaining to the nine alternative

measures of spread from 1989-90 to 2001-02. From Table 10, it is observed that

there are strong correlations among many of the pairs of measures for spread.

In general, correlations for pairs within a broad group are high and sometimes

more than 0.95. However, in general correlations for pairs in different groups

are moderate. Interestingly, measures in Group 3 have negative correlations with

measures in other groups. A detailed examination of these

measures reveals that they are in general agreement with the observations of Reserve

Bank of India. Almost all the measures display a decreasing trend during the second

half of the 1990s. Thus, the spread appears to have decreased, implying a change

in the price for financial intermediation. In this context, it may be noted that

as during the early 1990s, interest rates in India were administered, the measures

for spread during these periods may not reflect market forces properly and thus,

may not be consistent with the existing

| | Table

9: Alternative Definitions of Spread | |

| Group 1 |

| | |

SPN1= | [(interest

earned on advances/advances)–(interest paid on deposits/ |

| | deposits)]*

100; | | |

SPN2 = | [(interest

earned on advances/advances)–(interest paid on deposits and |

| | borrowings)/(deposits+borrowings)]*

100; | | |

SPN3 = | [(interest

earned on advances and investments)/(advances+investments)– |

| |

(interest paid on deposits and borrowings)/(deposits+borrowings)]* 100; |

| | | |

| Group 2 |

| | |

SPB1 = | (interest

earned –interest paid)/(total assets)*100; | |

| SPB2 = |

[{(interest earned)/(interest earning assets15)}

– | | | |

{(interest paid)/(interest bearing liabilities16

)}]*100; | | |

SPB3 = |

[{(interest earned +commission, exchange and brokerage)/ |

| |

(interest earning assets)} – {( interest paid)/(interest bearing |

| | liabilities)}]*

100; | | |

Group 3 | | |

| SPI1 = |

Lending Rate – Time Deposit Rate for Less Than One

YearMaturity | |

SPI2 = | Lending Rate

– Time Deposit Rate for One to Three Years |

Maturity | |

SPI3 = | Lending Rate

– Time Deposit Rate for Beyond Five Years |

Maturity |

market

structure. However, it is interesting to observe that from 1995-96 onwards, all

the measures of spread pertaining to the first two groups reveal a strong downward

trend. Thus, it is logical to argue that as soon as the administered price regime

in banking in India was lifted, the

| Table

10 : Alternative Measures of Spread in the Banking Sector

in India: 1989-90 to 2001-02 | |

Year | SPN1 |

SPN2 |

SPN3 | SPB1 |

SPB2 |

SPB3 | SPI1 |

SPI2 |

SPI3 | |

1989-90 | | |

1.78 |

2.46 | 3.28 |

7.00 |

6.50 | 6.50 |

| | 1990-91 |

| | 1.77 |

2.43 |

3.32 | 7.00 |

5.50 |

5.50 | | |

1991-92 | 6.27 |

5.57 |

3.95 | 3.31 |

4.14 |

4.99 | 4.50 |

3.50 |

3.50 | | 1992-93 |

4.81 |

4.63 | 3.67 |

2.50 |

3.48 | 4.33 |

8.00 |

8.00 | 8.00 |

| 1993-94 |

5.22 |

5.14 | 3.71 |

2.54 |

3.32 | 4.22 |

9.00 |

9.00 | 9.00 |

| 1994-95 |

4.25 |

4.24 | 4.37 |

3.01 |

3.65 | 4.59 |

4.00 |

4.00 | 4.00 |

| 1995-96 |

5.43 |

5.37 | 4.90 |

3.15 |

3.82 | 4.85 |

4.50 |

3.50 | 3.50 |

| 1996-97 |

6.29 |

6.29 | 4.86 |

3.22 |

3.85 | 4.82 |

3.00 |

2.00 | 1.75 |

| 1997-98 |

4.60 |

4.60 | 4.21 |

2.95 |

3.38 | 4.28 |

3.25 |

2.25 | 2.25 |

| 1998-99 |

4.19 |

4.26 | 3.85 |

2.78 |

3.15 | 4.00 |

3.00 |

2.00 | 2.00 |

| 1999-00 |

3.59 |

3.61 | 3.58 |

2.72 |

3.13 | 3.94 |

3.00 |

1.75 | 1.75 |

| 2000-01 |

3.74 |

3.78 | 3.62 |

2.84 |

3.18 | 3.91 |

2.75 |

1.75 | 1.75 |

| 2001-02# |

3.05 |

3.22 | 3.15 |

2.81 |

3.10 | 3.82 |

3.25 |

2.87 | 2.87 |

| # : Provisional

for SPI1, SPI2 and SPI3. | | |

| | | |

favourable market structure

put a downward pressure on the prices through competition. The result once again

establishes that a favourable market structure alone may not be adequate for competitive

prices and other institutional features and policy measures also contribute significantly

towards it. Section IV Conclusion The

paper examined the nature and the extent of changes in the market concentration

in the Indian banking sector and their possible implications on competitiveness,

prices and outputs of banking services. The paper was logically divided into two

parts. The first part measured market concentration in banking in India in alternative

ways from 1989-90 to 2000-01. In contrast to earlier empirical applications on

banking, this paper focussed on both static and dynamic measures of market concentration.

The paper found strong evidence of change in market structure in banking in India.