The Reserve Bank has been conducting the quarterly Survey of Professional Forecasters since September 2007. The results of the survey represent views of the respondent forecasters and in no way reflect the views or forecasts of the Reserve Bank of India.

Twenty six professional forecasters participated in the latest survey round relating to Q4:2013-14. The results of the survey are presented in the Annex.

Highlights:

1. Annual Forecasts:

-

Forecast^ of real GDP growth rate (at factor cost) for 2013-14 has been revised down to 4.7 per cent from 4.8 per cent in the previous round.

-

Real GDP growth rate forecast for 2014-15 has been revised down to 5.5 per cent from 5.6 per cent in the previous round. The growth forecast for Industry has been revised down to 3.5 per cent from 3.6 per cent and for Services to 6.9 per cent from 7.0 per cent (Table 1).

-

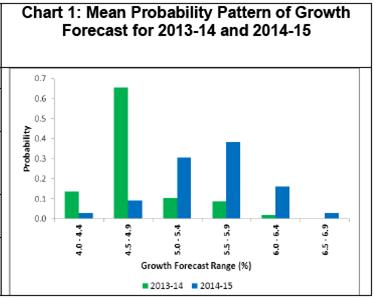

The forecasters assigned maximum probability of 0.38 to the range of 5.5-5.9 per cent for GDP growth in 2014-15 (Chart 1).

Table 1: Median Forecast of Real GDP (Growth Rate) for 2013-14 and 2014-15 |

|

2013-14 |

2014-15 |

Real GDP |

4.7

(-0.1) |

5.5

(-0.1) |

Agriculture and Allied Activities |

4.0

(-0.1) |

3.0

(+0.1) |

Industry |

0.6

(-0.9) |

3.5

(-0.1) |

Services |

6.5

(+0.3) |

6.9

(-0.1) |

Note: 1. Growth rates are in per cent.

2. Figures in parentheses are change in forecasts from the previous survey round.

3. These footnotes are valid for all tables. |

-

Private final consumption expenditure at current prices is expected to grow by 12.0 per cent in 2014-15 (Table 2).

-

For 2013-14 and 2014-15, Gross Fixed Capital Formation rate is projected at 29.2 per cent and 30.5 per cent, respectively (Table 2).

Table 2: Median Forecast of PFCE and Capital Formation |

|

2013-14 |

2014-15 |

Private final consumption expenditure |

10.0

(-0.3) |

12.0

(+0.2) |

Gross Fixed Capital Formation Rate (per cent of GDP) |

29.2

(-0.3) |

30.5

(+0.2) |

-

Forecast for money supply (M3) growth for 2013-14 remained the same at 14.0 per cent and is expected to improve to 14.5 per cent in 2014-15. Bank credit growth forecast for 2014-15, has been revised down to 15.5 per cent from 16.0 per cent in the previous round (Table 3).

-

Yield of 91-Days Treasury Bills is expected to be at 9.1 per cent and 8.5 per cent at end March 2014 and 2015, respectively (Table 3).

Table 3: Median Projections for Select Financial Market Variables |

|

2013-14 |

2014-15 |

Money Supply (M3) |

14.0

(0.0) |

14.5

(-0.5) |

Bank Credit |

14.8

(-0.2) |

15.5

(-0.5) |

Yield of 91-Days Treasury Bills (per cent) |

9.1

(+0.6) |

8.5

(+0.7) |

Table 4: Median Forecast for Fiscal Deficit |

|

2013-14 |

2014-15 |

Central Government Gross Fiscal Deficit (per cent of GDP) |

4.6

(-0.4) |

4.3

(-0.4) |

Combined Gross Fiscal Deficit (per cent of GDP) |

6.9

(-0.4) |

6.6

(-0.6) |

- Forecasts for exports growth, imports growth, current account balance and capital account balance for 2013-14 and 2014-15 are given in Annex Table A.1 and Table A.2.

2. Quarterly Forecasts:

-

Real GDP growth is predicted to improve gradually from Q4:2013-14 to Q4:2014-15 (Annex Table A.3).

-

Forecasters expect average CPI-Combined inflation in Q4:2013-14 at 8.3 per cent. CPI-Combined inflation is expected to decline gradually till Q3:2014-15 and expected to increase to 8.4 per cent in Q4:2014-15 (Annex Table A.4).

-

Inflation based on WPI is expected at 5.8 per cent in Q1:2014-15 and at 6.0 per cent in Q4:2014-15 (Annex Table A.4).

-

The forecasters assigned highest probability of 0.35 that CPI-Combined inflation will fall in the range of 8.0-8.9 per cent in March 2015 (Chart 2).

-

The forecasters assigned highest probability of 0.36 that WPI inflation will be in the range 5.0-5.9 per cent in March 2015 (Chart 3).

3. Long Term Forecasts:

- Average real GDP growth for the next five years (2013-14 to 2017-18) and the next ten years (2013-14 to 2022-23), are expected to be 6.5 per cent and 7.25 per cent, respectively. Over the next five years, inflation based on CPI-Combined and WPI is expected to be 7.25 per cent and 5.5 per cent, respectively. Over the next ten years, inflation based on CPI-Combined and WPI is expected to be around 7.0 per cent and 5.5 per cent, respectively. (Annex Table A.8).

Annex

Table A.1: Annual Forecasts for 2013-14 |

Key Macroeconomic Indicators |

Annual Forecasts for 2013-14 |

Mean |

Median |

Max |

Min |

1 |

Real GDP at factor cost (growth rate in per cent) |

4.7 |

4.7 |

5.2 |

4.5 |

a |

Agriculture & Allied Activities (growth rate in per cent) |

4.1 |

4.0 |

5.0 |

3.3 |

b |

Industry (growth rate in per cent) |

0.6 |

0.6 |

1.6 |

-0.4 |

c |

Services (growth rate in per cent) |

6.4 |

6.5 |

7.1 |

5.3 |

2 |

Private Final Consumption Expenditure at current market price (growth rate in per cent) |

10.7 |

10.0 |

14.0 |

9.0 |

3 |

Gross Domestic Saving (per cent of GDP) |

30.4 |

30.4 |

31.6 |

28.5 |

4 |

Gross Fixed Capital Formation (per cent of GDP) |

29.4 |

29.2 |

31.6 |

28.0 |

5 |

Money Supply (M3) (growth rate in per cent) |

14.0 |

14.0 |

17.0 |

12.5 |

6 |

Bank Credit (growth rate in per cent) |

14.5 |

14.8 |

15.5 |

13.5 |

7 |

Combined Gross Fiscal Deficit (per cent of GDP) |

6.8 |

6.9 |

7.5 |

4.6 |

8 |

Central Government Gross Fiscal Deficit (per cent of GDP) |

4.7 |

4.6 |

4.8 |

4.6 |

9 |

Repo Rate (end period) |

8.01 |

8.00 |

8.25 |

8.00 |

10 |

CRR (end period) |

4.00 |

4.00 |

4.00 |

4.00 |

11 |

Yield of 91-Days Treasury Bills (end period) |

9.1 |

9.1 |

9.5 |

8.3 |

12 |

YTM of Central Govt. Securities with term to maturity of 10-years (end period) |

8.7 |

8.8 |

8.9 |

8.4 |

13 |

Overall Balance of Payments (in US $ bn.) |

20.5 |

17.0 |

50.7 |

2.0 |

14 |

Merchandise Exports (in US $ bn.) |

316.4 |

315.9 |

328.1 |

308.0 |

15 |

Merchandise Exports (growth rate in per cent) |

4.2 |

4.0 |

11.7 |

1.8 |

16 |

Merchandise Imports (in US $ bn.) |

463.6 |

464.4 |

480.3 |

449.9 |

17 |

Merchandise Imports (growth rate in per cent) |

-7.3 |

-7.4 |

-4.4 |

-9.8 |

18 |

Merchandise Trade Balance (per cent of GDP) |

-8.0 |

-8.0 |

-7.3 |

-8.6 |

19 |

Net Invisible Balance (in US $ bn.) |

113.2 |

114.3 |

118.3 |

100.0 |

20 |

Current Account Balance (in US $ bn.) |

-34.8 |

-35.3 |

-23.8 |

-45.0 |

21 |

Current Account Balance (per cent of GDP) |

-2.0 |

-2.0 |

-1.3 |

-2.9 |

22 |

Capital Account Balance (in US $ bn.) |

56.4 |

54.3 |

90.0 |

35.0 |

23 |

Capital Account Balance (per cent of GDP) |

3.1 |

3.0 |

4.8 |

2.0 |

Table A.2: Annual Forecasts for 2014-15 |

Key Macroeconomic Indicators |

Annual Forecasts for 2014-15 |

Mean |

Median |

Max |

Min |

1 |

Real GDP at factor cost (growth rate in per cent) |

5.5 |

5.5 |

6.0 |

5.0 |

a |

Agriculture & Allied Activities (growth rate in per cent) |

3.0 |

3.0 |

4.4 |

2.0 |

b |

Industry (growth rate in per cent) |

3.2 |

3.5 |

4.5 |

1.3 |

c |

Services (growth rate in per cent) |

6.9 |

6.9 |

7.7 |

6.1 |

2 |

Private Final Consumption Expenditure at current market price (growth rate in per cent) |

12.3 |

12.0 |

15.9 |

10.0 |

3 |

Gross Domestic Saving (per cent of GDP) |

30.9 |

31.0 |

32.0 |

29.0 |

4 |

Gross Fixed Capital Formation (per cent of GDP) |

30.7 |

30.5 |

32.2 |

28.1 |

5 |

Money Supply (M3) (growth rate in per cent) |

14.8 |

14.5 |

18.0 |

13.0 |

6 |

Bank Credit (growth rate in per cent) |

15.4 |

15.5 |

16.5 |

14.0 |

7 |

Combined Gross Fiscal Deficit (per cent of GDP) |

6.6 |

6.6 |

8.0 |

4.3 |

8 |

Central Government Gross Fiscal Deficit (per cent of GDP) |

4.4 |

4.3 |

5.5 |

4.1 |

9 |

Repo Rate (end period) |

7.73 |

7.75 |

8.25 |

7.00 |

10 |

CRR (end period) |

3.95 |

4.00 |

4.00 |

3.50 |

11 |

Yield of 91-Days Treasury Bills (end period) |

8.5 |

8.5 |

9.0 |

7.7 |

12 |

YTM of Central Govt. Securities with term to maturity of 10-years (end period) |

8.3 |

8.3 |

8.7 |

8.0 |

13 |

Overall Balance of Payments (in US $ bn.) |

15.1 |

15.4 |

33.0 |

3.0 |

14 |

Merchandise Exports (in US $ bn.) |

342.5 |

340.0 |

360.3 |

324.2 |

15 |

Merchandise Exports (growth rate in per cent) |

8.5 |

8.0 |

14.3 |

3.3 |

16 |

Merchandise Imports (in US $ bn.) |

508.4 |

504.1 |

538.1 |

485.0 |

17 |

Merchandise Imports (growth rate in per cent) |

8.2 |

8.7 |

15.0 |

-11.7 |

18 |

Merchandise Trade Balance (per cent of GDP) |

-8.4 |

-8.4 |

-7.4 |

-9.4 |

19 |

Net Invisible Balance (in US $ bn.) |

115.6 |

120.0 |

128.6 |

55.0 |

20 |

Current Account Balance (in US $ bn.) |

-43.3 |

-46.7 |

-3.1 |

-56.6 |

21 |

Current Account Balance (per cent of GDP) |

-2.4 |

-2.4 |

-1.5 |

-3.0 |

22 |

Capital Account Balance (in US $ bn.) |

63.1 |

62.6 |

80.1 |

53.0 |

23 |

Capital Account Balance (per cent of GDP) |

3.6 |

3.2 |

7.7 |

2.8 |

Table A.3: Quarterly Forecasts for Q4:2013-14 to Q4:2014-15 |

Key Macroeconomic Indicators |

Quarterly Forecasts |

Q4: 2013-14 |

Q1: 2014-15 |

Mean |

Median |

Max |

Min |

Mean |

Median |

Max |

Min |

1 |

Real GDP at factor cost (growth rate in per cent) |

4.9 |

4.9 |

5.7 |

4.2 |

5.0 |

5.0 |

6.3 |

4.2 |

a |

Agriculture & Allied Activities (growth rate in per cent) |

5.0 |

4.8 |

9.1 |

2.2 |

3.4 |

3.1 |

7.1 |

2.0 |

b |

Industry (growth rate in per cent) |

1.1 |

1.0 |

3.0 |

-1.0 |

2.1 |

2.0 |

4.4 |

0.2 |

c |

Services (growth rate in per cent) |

6.3 |

6.2 |

7.9 |

4.4 |

7.0 |

7.0 |

9.5 |

5.4 |

2 |

Index of Industrial Production (growth rate in per cent) |

0.5 |

0.5 |

1.3 |

-0.9 |

2.2 |

2.0 |

5.6 |

0.7 |

3 |

Private Final Consumption Expenditure (growth rate in per cent) |

11.0 |

11.3 |

13.0 |

9.5 |

12.2 |

11.5 |

18.7 |

9.2 |

4 |

Gross Fixed Capital Formation (per cent of GDP) |

29.1 |

29.5 |

30.8 |

27.0 |

29.9 |

30.0 |

30.8 |

29.0 |

5 |

` per US$ (RBI reference rate-end period) |

- |

- |

- |

- |

60.63 |

61.00 |

62.50 |

58.00 |

6 |

Repo Rate (end period) |

- |

- |

- |

- |

8.03 |

8.00 |

8.50 |

7.75 |

7 |

CRR (end period) |

- |

- |

- |

- |

3.95 |

4.00 |

4.00 |

3.50 |

8 |

BSE INDEX (end period) |

- |

- |

- |

- |

22,482 |

22,100 |

24,300 |

21,500 |

9 |

Merchandise Export (in US$ bn.) |

83.2 |

83.0 |

89.3 |

79.8 |

81.7 |

80.0 |

92.0 |

74.8 |

10 |

Merchandise Import (US$ bn.) |

109.8 |

111.5 |

123.3 |

80.6 |

118.0 |

122.5 |

132.5 |

78.8 |

11 |

Indian Crude Oil basket Price (in US$ per barrel) |

- |

- |

- |

- |

108.9 |

108.1 |

118.9 |

104.5 |

A.3 (contd.) |

Key Macroeconomic Indicators |

Quarterly Forecasts |

Q2: 2014-15 |

Q3: 2014-15 |

Q4: 2014-15 |

Mean |

Median |

Max |

Min |

Mean |

Median |

Max |

Min |

Mean |

Median |

Max |

Min |

1 |

Real GDP at factor cost (growth rate in per cent) |

5.2 |

5.3 |

6.1 |

4.5 |

5.7 |

5.7 |

6.5 |

5.1 |

5.9 |

5.9 |

6.4 |

5.4 |

a |

Agriculture & Allied Activities (growth rate in per cent) |

3.1 |

3.0 |

5.2 |

1.6 |

3.1 |

3.3 |

4.4 |

2.1 |

2.9 |

3.0 |

3.8 |

1.8 |

b |

Industry (growth rate in per cent) |

2.1 |

2.0 |

4.5 |

-0.5 |

3.4 |

3.5 |

5.3 |

1.2 |

3.7 |

3.9 |

5.1 |

1.4 |

c |

Services (growth rate in per cent) |

6.8 |

6.8 |

8.3 |

5.0 |

7.3 |

7.2 |

8.6 |

6.4 |

7.3 |

7.4 |

8.1 |

5.9 |

2 |

Index of Industrial Production (growth rate in per cent) |

2.7 |

2.5 |

6.4 |

-0.4 |

4.2 |

3.7 |

9.2 |

2.1 |

4.3 |

3.7 |

8.6 |

2.9 |

3 |

Private Final Consumption Expenditure (growth rate in per cent) |

12.0 |

11.2 |

16.4 |

8.5 |

12.0 |

11.9 |

14.6 |

9.3 |

12.8 |

12.7 |

14.6 |

11.0 |

4 |

Gross Fixed Capital Formation (per cent of GDP) |

30.7 |

30.5 |

31.6 |

30.0 |

29.6 |

29.6 |

31.7 |

27.6 |

31.3 |

31.3 |

32.4 |

30.3 |

5 |

` per US$ (RBI reference rate-end period) |

60.71 |

61.00 |

62.40 |

58.00 |

60.28 |

60.00 |

63.30 |

58.00 |

60.20 |

59.75 |

65.00 |

56.00 |

6 |

Repo Rate (end period) |

8.00 |

8.00 |

8.50 |

7.75 |

7.98 |

8.00 |

8.25 |

7.50 |

7.86 |

8.00 |

8.25 |

7.00 |

7 |

CRR (end period) |

3.98 |

4.00 |

4.00 |

3.75 |

3.96 |

4.00 |

4.00 |

3.75 |

3.94 |

4.00 |

4.00 |

3.75 |

8 |

BSE INDEX (end period) |

22,757 |

22,250 |

25,500 |

21,027 |

23,412 |

23,174 |

24,300 |

23,000 |

23,732 |

23,365 |

25,200 |

23,000 |

9 |

Merchandise Export (in US$ bn.) |

85.0 |

84.8 |

91.5 |

81.0 |

86.5 |

86.8 |

90.7 |

81.5 |

90.5 |

91.6 |

96.0 |

82.9 |

10 |

Merchandise Import (US$ bn.) |

116.4 |

122.3 |

129.1 |

79.6 |

120.3 |

129.3 |

134.4 |

81.8 |

124.1 |

130.5 |

141.1 |

83.9 |

11 |

Indian Crude Oil basket Price (in US$ per barrel) |

109.5 |

108.0 |

120.3 |

104.5 |

112.1 |

110.0 |

124.5 |

103.0 |

109.4 |

109.0 |

121.2 |

103.0 |

Table A.4: Forecasts of WPI and CPI-Combined Inflation |

|

CPI-Combined |

WPI |

WPI-Manufactured Products |

|

Mean |

Median |

Max |

Min |

Mean |

Median |

Max |

Min |

Mean |

Median |

Max |

Min |

Q4:2013-14 |

8.3 |

8.3 |

8.9 |

7.5 |

5.4 |

5.2 |

6.7 |

4.8 |

3.0 |

2.9 |

4.5 |

2.5 |

Q1:2014-15 |

8.2 |

8.2 |

9.5 |

6.2 |

5.9 |

5.8 |

7.2 |

5.0 |

3.4 |

3.3 |

4.5 |

2.9 |

Q2:2014-15 |

7.8 |

7.6 |

9.3 |

6.6 |

4.7 |

4.6 |

6.5 |

2.5 |

3.4 |

3.4 |

4.3 |

2.6 |

Q3:2014-15 |

7.4 |

7.3 |

9.0 |

6.2 |

4.8 |

4.9 |

6.4 |

2.5 |

3.4 |

3.3 |

5.0 |

2.0 |

Q4:2014-15 |

8.4 |

8.4 |

9.1 |

7.7 |

5.9 |

6.0 |

7.3 |

4.6 |

3.7 |

3.9 |

5.6 |

2.1 |

Table A.5: Mean probabilities attached to possible outcomes of

real GDP growth |

Growth Range |

Forecasts for 2013-14 |

Forecasts for 2014-15 |

Below 2.0 per cent |

0 |

0 |

2.0 to 2.4 per cent |

0 |

0 |

2.5 to 2.9 per cent |

0 |

0 |

3.0 to 3.4 per cent |

0.00 |

0 |

3.5 to 3.9 per cent |

0.00 |

0.00 |

4.0 to 4.4 per cent |

0.14 |

0.03 |

4.5 to 4.9 per cent |

0.66 |

0.09 |

5.0 to 5.4 per cent |

0.10 |

0.31 |

5.5 to 5.9 per cent |

0.09 |

0.38 |

6.0 to 6.4 per cent |

0 |

0.16 |

6.5 to 6.9 per cent |

0 |

0.03 |

7.0 to 7.4 per cent |

0 |

0 |

7.5 to 7.9 per cent |

0 |

0 |

8.0 to 8.4 per cent |

0 |

0 |

8.5 to 8.9 per cent |

0 |

0 |

9.0 to 9.4 per cent |

0 |

0 |

9.5 to 9.9 per cent |

0 |

0 |

10.0 per cent or more |

0 |

0 |

Table A.6: Mean probabilities attached to possible outcomes of

CPI-Combined inflation |

Inflation Range |

Forecasts for March 2014 |

Forecasts for March 2015 |

Below 0 per cent |

0 |

0 |

0 to 0.9 per cent |

0 |

0 |

1.0 to 1.9 per cent |

0 |

0 |

2.0 to 2.9 per cent |

0 |

0 |

3.0 to 3.9 per cent |

0 |

0 |

4.0 to 4.9 per cent |

0 |

0 |

5.0 to 5.9 per cent |

0 |

0.01 |

6.0 to 6.9 per cent |

0.01 |

0.17 |

7.0 to 7.9 per cent |

0.29 |

0.32 |

8.0 to 8.9 per cent |

0.54 |

0.35 |

9.0 to 9.9 per cent |

0.14 |

0.11 |

10.0 to 10.9 per cent |

0.03 |

0.03 |

11.0 to 11.9 per cent |

0.00 |

0.00 |

12.0 to 12.9 per cent |

0 |

0 |

13.0 to 13.9 per cent |

0 |

0 |

14.0 per cent or above |

0 |

0 |

Table A.7: Mean probabilities attached to possible outcomes of WPI inflation |

Inflation Range |

Forecasts for March 2014 |

Forecasts for March 2015 |

Below 0 per cent |

0 |

0 |

0 to 0.9 per cent |

0 |

0 |

1.0 to 1.9 per cent |

0 |

0 |

2.0 to 2.9 per cent |

0 |

0 |

3.0 to 3.9 per cent |

0 |

0 |

4.0 to 4.9 per cent |

0.28 |

0.21 |

5.0 to 5.9 per cent |

0.44 |

0.36 |

6.0 to 6.9 per cent |

0.24 |

0.32 |

7.0 to 7.9 per cent |

0.03 |

0.08 |

8.0 to 8.9 per cent |

0.00 |

0 |

9.0 to 9.9 per cent |

0 |

0 |

10.0 to 10.9 per cent |

0 |

0 |

11.0 to 11.9 per cent |

0 |

0 |

12.0 to 12.9 per cent |

0 |

0 |

13.0 to 13.9 per cent |

0 |

0 |

14.0 per cent or above |

0 |

0 |

Table A.8: Annual Average Percentage Change |

|

Annual average percentage change over the next five years |

Annual average percentage change over the next ten years |

Mean |

Median |

Max |

Min |

Mean |

Median |

Max |

Min |

Real GDP |

6.4 |

6.50 |

7.8 |

5.5 |

7.1 |

7.25 |

7.6 |

6.0 |

CPI-Combined Inflation |

7.3 |

7.25 |

8.0 |

6.5 |

6.9 |

7.00 |

8.0 |

6.0 |

WPI Inflation |

5.8 |

5.50 |

8.5 |

4.9 |

5.4 |

5.50 |

6.0 |

4.5 |

|