The global financial ecosystem is going through structural transformations marked by uncertainties surrounding tariffs, trade negotiations, and geopolitical frictions. In the backdrop of this, regulators worldwide are striving to strengthen regulatory frameworks in areas such as the assessment of globally systemically important banks, bank–NBFI interconnectedness, liquidity risk management, and the regulation of crypto and digital assets. Similarly in the domestic space, regulators have continued to reinforce transparency frameworks, enhance customer and investor protection, and improve the ease of doing business. The Financial Stability and Development Council and its Sub-Committee has also remained focused on financial sector resilience while maintaining a close watch on emerging risks and challenges. Introduction 3.1 Amid escalating economic uncertainty and structural shifts in global finance, regulators worldwide continue to prioritise strengthening the resilience of the financial system. International standard-setting bodies are actively advancing measures to enhance the system's capacity to withstand rapid technological change, intensifying cyber threats, and evolving climate-related risks. Since the June 2025 Financial Stability Report, significant regulatory initiatives have been implemented in non-bank financial intermediation (NBFI), decentralised finance (DeFi), and climate risk management. 3.2 Against this backdrop, this chapter reviews the recent regulatory initiatives, both international and domestic, aimed at enhancing the stability and resilience of the financial system. III.1 Global Regulatory Developments III.1.1 Banking 3.3 The global systemically important banks (G-SIB) assessment framework is aimed at enhancing global financial stability, with identified banks facing stricter regulatory framework and supervisory attention given their systemic importance. The Financial Stability Board (FSB) published the 2025 list of G-SIBs based on the methodology designed by the Basel Committee on Banking Supervision (BCBS). Out of the 29 banks identified1, two banks moved to a higher capital requirement bucket and one bank moved to a lower bucket. In conjunction, BCBS published further information2 related to the 2025 assessment with the intention to improve transparency of the assessment methodology. 3.4 The Financial Stability Board (FSB) published an implementation status3 of the main G20 financial reforms4 along with initial assessment of how FSB's implementation monitoring could be improved. The interim report notes that the revised Basel guidelines issued in 2017 helped shield the global banking system from a more severe banking crisis during the 2023 banking turmoil. However, implementation differences across jurisdictions could pose risks and could be a source of vulnerability itself. On the positive side, several jurisdictions have implemented legal and regulatory changes related to compensation practices in large financial institutions (one of the contributing factors to the excessive risk-taking seen in the run up to the 2008 crisis). 3.5 The Basel Committee on Banking Supervision (BCBS) issued a horizon scanning report aimed at investigating banks' interconnections with non-bank financial intermediaries (NBFI). The report5 notes that expansion of the NBFI sector over the past decade has increased the mutual dependence of banks and NBFIs. Banks provide leverage, clearing, market-making and underwriting services to NBFIs and in some cases, even own NBFIs. These interconnections expose banks to credit, counterparty, liquidity, operational and market risks. However, their central role in providing these services to NBFIs may make the banking system vulnerable to procyclical reactions during market stress. The report builds on several case studies to formulate stylised scenarios of NBFI failures and the resultant impact on broader financial stability. In all the scenarios, it is found that distress in the NBFI sector may prompt banks to reduce their risk via margin calls, loan cutbacks and asset sales. While such actions reduce banks' risk and regulatory metrics in the short term, they may amplify shocks and transmit them across the financial system. The report suggests supervisors to collect granular, timely, high-frequency data to understand and monitor bank-NBFI linkages. III.1.2 Non-Bank Financial Intermediation 3.6 The progress report6 on non-bank financial intermediation (NBFI) by FSB indicated a shift from policy development to monitoring implementation after completing initial work following the March 2020 market turmoil. Key policy deliverables have focused on enhancing money market fund resilience (2021); addressing liquidity mismatch in open ended funds (2023); enhancing non-bank market participants' liquidity preparedness for margin and collateral calls (2024); and enhancing the monitoring of and addressing financial stability risks created by leverage in NBFI (2025). The report notes that future deliverables (planned from 2025-2028) will concentrate on ongoing monitoring and in-depth assessment, addressing data challenges, information sharing among authorities, and evaluating the implementation and effects of policies. 3.7 Further, FSB has set up a high-level task force7 called the 'Non-bank Data Task Force' to enhance the monitoring of vulnerabilities in the non-bank financial intermediation (NBFI) sector. Key priority areas for the task force include (i) trading strategies, such as sovereign bond cash-futures basis trades and carry trades, which often rely on high leverage and (ii) private finance and private credit. The key deliverables of the task force include improving the ability of FSB member authorities to identify and assess vulnerabilities stemming from non-bank sectors, improve the ability of authorities to assess and calibrate related policies and explore information sharing mechanism, if feasible. 3.8 FSB also published policy recommendations8 to address financial stability risks created by leverage in non-bank financial intermediation. The recommendations relate to risk identification and monitoring, leverage in core financial markets and counterparty credit risk management and have been designed keeping in mind the role played by non-banks in facilitating hedging, enhance efficiency and support liquidity in financial markets. For these reasons, the recommendations provide authorities with flexibility to tailor their policy response to the domestic circumstances. III.1.3 Financial Markets 3.9 IOSCO has revised its 2018 liquidity risk management recommendations to provide a more robust global framework. Market events had demonstrated that many open-ended funds (OEFs) continued to offer daily redemptions against portfolios of illiquid assets, creating dilution effects, first-mover advantages, and systemic spillovers. The updated recommendations9 strengthen requirements on fund design, encourage wider use of both anti-dilution and quantity-based liquidity management tools, and expand expectations for stress testing, governance, and disclosures. The aim is to better align redemption terms with actual asset liquidity and reduce liquidity mismatch risks. 3.10 IOSCO also issued a report10 examining the global single-name credit default swaps11 market in the context of episodes of volatility (such as during the 2023 banking sector stress) exposing weaknesses in market transparency and liquidity. The market for single-name CDS is illiquid, dominated by bilateral trading, with sparse post-trade data can lead to information asymmetries. IOSCO emphasises that increased post-trade transparency, including public access to transaction prices and volumes, would benefit market participants and observers. Importantly, IOSCO reports no evidence that current transparency requirements have harmed market liquidity. It recommends that regulators enhance post-trade transparency cautiously, taking into account the specific characteristics of their markets. 3.11 Recognising the surge of financial scams propagated through digital platforms, IOSCO has launched the IOSCO International Securities and Commodities Alerts Network (I-SCAN), a global database of unlicensed firms providing investment services or engaging in illegal financial activities. The objective is to create a global database of unlicensed entities, promote automated detection of fraudulent offerings, and encourage best practices in content moderation, advertiser verification and compliance with local regulatory obligations. Platform Providers now can play a crucial role in the protection of investors' interests by connecting automatically to I-SCAN to block, warn against or eliminate illegal investment offerings from their platforms. 3.12 IOSCO issued a report12 on 'Finfluencers', recognising their dual role as educators and potential sources of biased, promotional, or misleading content. The key risks stem from inconsistent disclosure standards, cross-border enforcement challenges, and the blurring of lines between regulated advice and online commentary. The report tries to outline good practices for defining finfluencer frameworks, improving disclosure of conflicts, enhancing oversight of intermediaries engaging them, and strengthening investor education to help retail users critically assess online financial content. Similarly, IOSCO's report13 on Digital Engagement Practices (DEPs) responds to the increased use of in-app nudges, gamification, and behavioural design techniques by intermediaries to influence investor decisions. The objective of the report is to build a common understanding of DEPs, identify conduct and conflict-of-interest concerns, and guide regulators in supervising their use to safeguard retail investors. 3.13 The rapid expansion of online imitation trading, such as copy trading, mirror trading and social trading, prompted IOSCO to publish a report14 examining the resulting risks to retail investors. The report emphasises that although these trading strategies are frequently marketed to retail investors to help them participate in financial markets without needing extensive market knowledge or active management, they entail significant risks and involve complex, volatile products. The report is aimed at highlighting conduct and suitability risks, recommending good practices for intermediaries providing such services, and encouraging investor education initiatives to mitigate potential harm. 3.14 The report15 on 'Neo-Brokers' issued by IOSCO notes that emergence of online trading platforms and mobile trading apps have made trading and stock markets more accessible to retail investors with minimal physical touch points. The aim of the report is to provide a comprehensive set of recommendations as guidance for securities regulators. The report acknowledges that while neo-brokers' main activities are the same as other broker dealers, their approach and the conflicts of interest that arise from their business model distinguish them from other broker-dealers. Key recommendations include upholding of honesty and fairness with their dealings with retail and appropriate disclosure of fees and charges to retail investors. III.1.4 Decentralised Finance 3.15 The IOSCO published a report16 on tokenisation of financial assets outlining the adoption and current use cases of asset tokenization in capital markets and identifying the potential implications from tokenisation activities on market integrity and investor protection. The report notes that most risks arising from asset tokenisation fall into existing risk taxonomies. However, risks which are unique to the technology itself may require special attention and necessitate introduction of new or additional controls. Regulators need to be cognisant of possible changes in market activities and market structure, and the possible spill-over effects from increased interlinkages of tokenised asset classes with the crypto asset markets. 3.16 A thematic review17 of progress being made in implementation of the key elements of the 18 policy recommendations for the regulation of crypto and digital assets (CDA Recommendations) in accordance with principle of 'same activity, same risk, same regulation/regulatory outcome was published by IOSCO. Many jurisdictions were found to have made progress, yet gaps persisted in conflict of interest-management frameworks, disclosure practices, and the safeguarding of client assets. The review notes that new crypto-asset business models are being developed, existing risks are changing, and various new risks are emerging. 3.17 FSB has also undertaken a thematic peer review focussing on financial stability risks of crypto assets and stablecoins. The FSB review18 notes that gaps remain in addressing financial stability risks arising from crypto-asset activities, especially in case of potentially higher risk activities, such as borrowing, lending, and margin trading. While financial stability risks from crypto assets appear limited at present, growing interlinkages with the traditional financial system highlight the need for close monitoring of developments and activity and robust regulatory oversight. In case of stablecoins, the review notes that while stablecoins are not yet widely used to facilitate real economic activities, stablecoin issuers are becoming significant players in traditional financial markets via their substantial reserve holdings. Moreover, relatively few jurisdictions have established comprehensive regulatory frameworks for global stablecoins, leaving critical gaps in areas such as robust risk management practices, capital buffers, and recovery and resolution planning (including insolvency frameworks). III.1.5 Climate Finance 3.18 The Network for Greening the Financial System (NGFS) 'Declaration on the Economic Cost of Climate Inaction', issued at COP3019, focused on renewing commitment to mitigating the impending economic and financial risks from climate inaction. The declaration, supported by a coalition of 146 central banks and financial supervisors estimates that the three-year delay in climate action could cause the costs of the transition to a low-carbon economy to rise from 0.5 per cent to 1.3 per cent of global GDP by 2030. It also highlights that vulnerable economies will be disproportionately affected. In an adverse scenario focused purely on physical risk, regional GDP losses could reach 6 per cent in Asia and up to 12.5 per cent in Africa. The NGFS calls for a whole-of-economy effort, with both public and private actors contributing. It urges financial institutions to integrate climate and nature-related risks into their operations and strategies through scenario analysis, climate disclosure standards and transition planning. 3.19 The BCBS released a report20 outlining a voluntary disclosure framework for climate-related financial risks. The disclosure templates are designed as part of Pillar 321 of Basel framework and are expected to a provide a comprehensive picture of banks' exposure to climate related financial risks. The templates contain a mix of qualitative and quantitative disclosures regarding the physical and transition risks impacting banking sector. Transition risks include the societal changes arising from a transition to a low-carbon economy and arise through changes in public sector policies, innovation, and changes in the affordability of existing technologies or investor and consumer sentiment towards sustainable consumption and production practices. Physical risks result from acute and/or chronic climatic trends or events, such as rising sea levels, wildfires, storms, floods, and droughts. 3.20 The FSB published an update of its roadmap for addressing climate-related financial risks22. The report notes that companies are developing their climate-related disclosures using International Sustainability Standards Board (ISSB) Standards. Further, global data initiatives have sought to make available data, which is more forward-looking, to better account for the potential growing impacts of climate change, and to address limitations of historical data and past trends in capturing such dynamics. Climate risk dashboards such as IMF's climate change indicators dashboard have also been set up to disseminate data on the impact of climate change on the financial system. For improving vulnerability analysis, global regulatory bodies have been working to assess how climate shocks may transmit to the financial system and give rise to domestic stability risks. For e.g., World Bank is actively supporting over 40 emerging market and developing economies, including low-income countries, and small island states, with climate risk assessments. 3.21 IOSCO published its report23 on ESG indices used as financial benchmarks to address the issue of ESG indices being developed with highly divergent methodologies, inconsistent data inputs, insufficient transparency, and significant reliance on qualitative or forward-looking judgments. These inconsistencies risk confusing investors, enable greenwashing, and undermine confidence in sustainable products. The report notes that IOSCO's objective is to align ESG benchmark administration with its 'Principles for Financial Benchmarks', improve governance, ensure methodological clarity, enhance disclosures around data sources and expert judgment, and strengthen oversight of index providers to support credible ESG investing. 3.22 IOSCO published a report24 on sustainable bonds outlining the key considerations, which are to improve clarity in the regulatory framework, better classify sustainable bonds, enhance transparency and ongoing disclosure requirements to promote public accountability, encourage the use of independent and credible external reviewers, and strengthen capacity building, collaboration, and knowledge sharing. The report also highlights India's initiatives, including the launch of a social stock exchange and the development of innovative financial instruments, such as zero-coupon zero-principal instruments and development impact bonds, which are outcome-oriented. 3.23 A report25 released by the International Association of Insurance Supervisors (IAIS) noted that significant protection gaps exist in case of natural catastrophe events with at least 57 per cent of associated economic losses remaining uninsured in 2024. Protection gaps arise from a combination of factors, including the uninsurability of certain risks, affordability issues and lack of risk awareness. IAIS has recommended strengthening insurance markets, enhancing resilience and fostering collaboration among stakeholders to help mitigate the economic, financial and societal impacts of natural catastrophe events. III.1.6 Artificial Intelligence 3.24 As a follow-up to its 2024 report on the 'Financial Stability Implications of Artificial Intelligence (AI)', FSB released a monitoring report26 on how financial authorities can monitor AI adoption and assess related vulnerabilities. The report found that surveys remained the most used data collection approach which financial authorities use to gather data on AI adoption, followed by research using publicly available data. The report encourages authorities to adopt a risk-based and proportionate approach to prioritising indicators most relevant for monitoring AI adoption. Further, mapping these indicators to specific vulnerabilities, ensuring regular data collection, and addressing gaps in monitoring critical areas such as third-party dependencies, market correlations, and cyber risks will help to manage financial stability risks arising from increased AI adoption in the financial sector. 3.25 FSB submitted a report27 to G20 Finance Ministers and Central Bank Governors examining how central banks and other supervisory institutions are leveraging AI for policy purposes. The report states that central banks deploy AI in four main areas: (i) information collection and the compilation of official statistics; (ii) macroeconomic and financial analysis in support of monetary policy; (iii) oversight of payment systems; and (iv) supervision and financial stability analysis. However, the adoption of AI by central banks has been challenging due to concerns about interpretability and explainability of the models. Further, for generative AI28 models, the issue of explainability is compounded by the risk of hallucinations. The report concludes that central banks must manage the trade-off between using external versus internal AI models while rethinking their traditional roles as compilers, users and providers of data pertaining to the financial system. III.2 Initiatives from Domestic Regulators / Authorities 3.26 During the period under review, financial regulators undertook several initiatives to improve the resilience of the Indian financial system (major measures are listed in Annexure 2). III.2.1 Consolidated Master Directions (MDs) 3.27 The Reserve Bank of India recently undertook a major exercise to consolidate all the banking/non-banking instructions issued to its regulated entities over several decades. More than 9,000 instructions were screened and consolidated into 244 function-wise Master Directions, including seven new Master Directions on digital banking channel authorisation, organized across 11 types of Regulated Entities including Commercial Banks, Urban Cooperative Banks, Non-Banking Financial Companies, etc. Following the consolidation, 9445 circulars were repealed. The consolidation and consequent repeal of circulars is expected to significantly improve the accessibility of regulatory instructions for the regulated entities, thereby reducing their compliance cost, as well as to improve the clarity on applicability of each instruction to each type of entity. This also serves as a major push towards ease of doing business. III.2.2 Directions on Co-Lending Arrangements 3.28 The Reserve Bank has issued a comprehensive direction on co-lending arrangements (CLA) with the objective of providing specific regulatory clarity on the permissibility of such arrangements, while addressing some of the prudential as well as conduct related aspects. The directions have facilitated a more broad-based framework for co-lending with a wider participation of RBI's regulated entities in both priority sector lending (PSL) and non-PSL space. It mandates each RE to retain a minimum 10 per cent share of individual loans, requires blended interest rates reflecting proportional exposure, and stipulates that all transactions be routed through escrow accounts. The framework inter alia also mandates disclosures via Key Facts Statements (KFS) and robust grievance redressal mechanisms to safeguard borrowers. III.2.3 Know Your Customer (KYC) Directions - Amendments 3.29 KYC (Know Your Customer) is mandated under the Prevention of Money Laundering (PML) Act, 2002, to prevent the misuse of financial systems for illegal activities such as money laundering, terrorist financing, and fraud. The Reserve Bank of India (RBI) amended the Know Your Customer (KYC) Directions, 2016 to enhance consumer protection, streamline compliances, and address evolving operational challenges in KYC management. The key changes include: (i) permitting banks to leverage Business Correspondents (BCs) for KYC updates; (ii) mandating REs to issue three advance intimations (including one physical letter) before the KYC due date and three reminders post-due date; and (iii) extending KYC updation deadlines for low-risk customers to June 30, 2026, or one year from the due date, whichever is later. It is likely to benefit stakeholders by reducing customer dependency on bank branches through use of BCs, improving transparency, ensures timely compliance while minimizing disruption for low-risk customers. III.2.4 Non-Fund Based Credit Facilities 3.30 RBI has issued a comprehensive direction on non-fund based (NFB) facilities such as guarantees, letters of credit, co-acceptances, partial credit enhancement (PCE) etc. to harmonize and consolidate guidelines covering these facilities across the regulated entities (REs) and to broaden the funding sources for infrastructure financing. These directions lay down broad principles across regulated entities for assessment, issuance, monitoring, and disclosure of NFB facilities, with attendant prudential safeguards. Besides, it lays down detailed operational controls for issuance of electronic guarantees. Further, the norms related to issue of PCE have been rationalised to inter alia enable corporates access debt markets more efficiently. These measures are expected to broaden funding avenues for infrastructure and corporate financing, and ensure efficient credit flow in the economy. III.2.5 Investment in Alternative Investment Funds (AIFs) 3.31 The Reserve Bank has issued comprehensive directions on investment in AIFs by REs aiming to enhance transparency, improve risk management practices, and prevent the potential misuse of AIF structures for evergreening or circumventing exposure norms. The key changes include limits on investment where an individual RE may not invest more than 10 per cent of the corpus of an AIF scheme and collective investment by all REs capped at 20 per cent. Further, mandatory 100 per cent provisioning has been prescribed when a RE contributes more than 5 per cent to an AIF scheme that has downstream investment (excluding equity instruments) in its debtor companies, along with capital deduction requirements for investment in subordinated units. III.2.6 Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) 3.32 In order to encourage the responsible and ethical adoption of AI in the financial sector, the FREE-AI Committee was constituted by the Reserve Bank of India. The Committee formulated seven Sutras that represent the core principles to guide AI adoption in the financial sector. These are: (i) trust is the foundation; (ii) people first; (iii) innovation over restraint; (iv) fairness and equity; (v) accountability; (vi) understandable by design; and (vii) safety, resilience and sustainability. The Committee recommends an approach using the Sutras as guidance that fosters innovation and mitigates risks, achieved through a unified vision spread across six strategic Pillars that address the dimensions of innovation enablement (Infrastructure, Policy and Capacity) and as well as risk mitigation (Governance, Protection and Assurance). 3.33 To foster innovation, it recommends (a) the establishment of shared infrastructure to democratise access to data and compute; (b) the creation of an AI Innovation Sandbox; (c) the development of indigenous financial sector-specific AI models; (d) the formulation of an AI policy to provide necessary regulatory guidance; (e) institutional capacity building at all levels, including the board and the workforce of REs and other stakeholders; (f) the sharing of best practices and learnings across the financial sector; and (g) a more tolerant approach to compliance for low-risk AI solutions to facilitate inclusion and other priorities. To mitigate AI risks, it recommends the formulation of a board-approved AI policy by REs, the expansion of product approval processes, consumer protection frameworks and audits to include AI related aspects, the augmentation of cybersecurity practices and incident reporting frameworks, the establishment of robust governance frameworks across the AI lifecycle and making consumers aware when they are dealing with AI. III.2.7 Special Drive and Scheme to Refund Unclaimed Financial Assets to Rightful Owners 3.34 The Reserve Bank through its public awareness initiatives, has been encouraging members of public to activate their inoperative accounts and claim their unclaimed deposits from the banks. In this endeavour, to encourage the banks to actively pursue customers/ depositors for re-activation of their inoperative accounts and return of their unclaimed amounts lying with Depositor Education and Awareness (DEA) Fund, the Reserve Bank of India announced a 'Scheme for Facilitating Accelerated Payout - Inoperative Accounts and Unclaimed Deposits'. The Scheme aims to reduce both the stock of existing unclaimed deposits and fresh accretion of flows to the DEA Fund. It will run for a period of one year, viz., October 01, 2025 to September 30, 2026. Inoperative accounts reactivated and the unclaimed deposits settled by the banks to rightful claimants during the period of the Scheme, are eligible for payout from RBI at a differential rate based on the period the account remained inoperative and the amount of deposits in such accounts. 3.35 Further, the Government of India has also launched a nationwide three months campaign (October–December 2025) titled 'आपकी पूँजी, आपका अधिकार — Your Money, Your Right' to facilitate the settlement of unclaimed financial assets, including bank deposits to their rightful owners. III.2.8 Measures for Enhancing Trading Convenience and Strengthening Risk Monitoring in Equity Derivatives 3.36 The SEBI has put in place measures to improve risk metrics in the equity futures and options (F&O) market for the objectives of better monitoring and disclosure of risks in F&O segment, reduction in instances of spurious F&O ban periods in single stocks and better oversight over the possibility of concentration or manipulation risk in index options. These measures include rationalisation of position creation for single stocks during ban period, intraday monitoring by stock exchange of market wide position limit utilization for single stocks, introduction of position limits for index futures and options, additional eligibility criteria for derivatives on non-benchmark indices and recalibration of individual entity-level position limits for single stocks. Secondly, SEBI introduced a harmonised expiry-day framework that restricts all equity derivatives contracts' expiries on a stock exchange to either Tuesday or Thursday. By limiting excessive clustering of weekly expiries, which leads to expiry day hyperactivity, SEBI seeks to ensure orderly trading conditions while still allowing the stock exchanges product differentiation within a stable structure. Thirdly, SEBI prescribed the framework for 'Intraday Position Limits Monitoring for Equity Index Derivatives' in September 2025, specifying thresholds for intra-day position limits and manner of monitoring of the same by the stock exchanges. This further strengthens market stability by preventing outsized speculative build-ups during the trading day. III.2.9 Framework for Environment, Social and Governance (ESG) Debt Securities (other than green debt securities) 3.37 To expand the scope of sustainable finance, SEBI introduced operational frameworks for social bonds29, sustainability bonds30, and sustainability-linked bonds31 in June 2025, complementing the existing green bond framework. The new framework defines eligible project categories, aligns issuances with globally recognised principles, mandates detailed disclosures, and requires independent third-party reviews to ensure integrity. The debt securities shall be labelled as 'social bonds' or 'sustainability bonds' or 'sustainability-linked bonds' only if the funds raised through the issuance of such debt securities are proposed to be utilised for financing or refinancing projects and/or assets aligned with the recognized standards viz., (a) International Capital Market Association (ICMA) Principles / Guidelines; (b) Climate Bonds Standard; (c) ASEAN Standards; (d) European Union Standards; and (e) any framework or methodology specified by any financial sector regulator in India or fall under the definitions specified in the guidelines. III.2.10 Accessibility and Inclusiveness of Digital KYC to Persons with Disabilities 3.38 To ensure accessibility of Digital KYC processes for persons with disabilities (PwDs), SEBI issued comprehensive directions that emphasise the need for equal and accessible inclusion of persons with disabilities in availing financial services and directing the intermediaries to ensure that the process of digital KYC is accessible to persons with disabilities. Accordingly, FAQs on account opening process by persons with disabilities were revised and it was mandated that intermediaries shall be guided by the said FAQs. Further, it was mandated that all digital platforms of intermediaries and MIIs shall be compliant with the provisions of the Rights of Persons with Disabilities Act, 2016 and that their digital platforms and content published shall strictly adhere to the accessibility standards and guidelines and shall conduct annual accessibility audits of their digital platforms, including websites, mobile apps, portals through International Association of Accessibility Professionals (IAAP) certified accessibility professionals. III.2.11 Review of the Regulatory Framework for Social Stock Exchange (SSE) 3.39 SEBI also undertook a major review of the Social Stock Exchange32 (SSE) framework to widen its reach and enhance its operational effectiveness. The revised framework expands the definition of not-for-profit organisations, introduces empaneled social impact assessment organisations to strengthen credibility of impact reporting, mandates fundraising within a defined period to maintain active registration, aligns eligible activities with the Corporate Social Responsibility (CSR) framework under Schedule VII of the Companies Act 2013, and rationalises disclosure timelines. These measures would enhance the overall effectiveness and accountability of the SSE mechanism. III.2.12 Investor Behaviour – Insights from SEBI Investor Survey 3.40 The Investor Survey 2025 commissioned by SEBI, revealed the following: (a) a vast majority of Indian households (80 per cent) are risk-averse, prioritizing capital preservation over returns. 79 per cent of Gen-Z households also display risk-averse behaviour; (b) 63 per cent of Indian households (~213 million) are aware of at least one securities market product, however, only 9.5 per cent (~32.1 million) have invested. Awareness and penetration are significantly higher in urban areas (15 per cent); (c) amongst securities, awareness is highest for mutual funds/ETFs (53 per cent) and stocks/shares (49 per cent), but penetration for these remains low at 6.7 per cent and 5.3 per cent, respectively. Products like corporate bonds, futures & options, REITs, and AIFs have awareness levels at or below 13 per cent and penetration below 1 per cent; (d) a significant knowledge gap exists as only 36 per cent of current investors possess moderate to high to moderate knowledge about the securities market; and (e) nearly 40 per cent of current investors are dormant. These insights have implications for public policies and financial education to further deepen a stable and sustainable securities market in India. III.2.13 Measures to Strengthen Investor Protection in the Securities Market 3.41 SEBI has reinforced investor protection in the rapidly digitising securities market through a structured, multi-pronged framework. Key initiatives include the introduction of standardized, NPCI-validated UPI IDs ('@valid' format) with a distinctive verification icon, complemented by the SEBI Check tool for real-time authentication of intermediary accounts, effective October 2025, to secure fund transfers. The Past Risk and Return Verification Agency (PaRRVA) has been operationalized to validate risk-return metrics disclosed by investment advisers, research analysts, and other regulated entities, ensuring transparency and credibility in market performance claims. Concurrently, mandatory verification of financial advertisers on major platforms like Google and Meta via SEBI's Intermediary Portal has tightened oversight of online promotions, mitigated deceptive practices and reinforced digital market integrity. III.2.14 Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Act, 2025 3.42 The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Act, 2025, has been enacted with the objective of accelerating the growth and development of the insurance sector, ensuring better protection of policyholders, improving the ease of doing business for insurance companies, intermediaries and other stakeholders and bringing greater transparency to regulation making alongside strengthened regulatory oversight. The Act envisages a series of forward looking reforms aimed at modernising the sector's institutional, regulatory and operational frameworks. A key element is to create better awareness about insurance among citizens, ensuring that the benefits of protection are clearly understood and that products are accessible to a wider cross-section of the population. These efforts are intended to close the gap between the sector's underlying potential and actual levels of penetration. 3.43 Some of the key amendments introduced by the Act, inter alia, includes (i) increase in the Foreign Direct Investment (FDI) limit in Indian Insurance companies from 74 per cent to 100 per cent of the paid-up equity capital; (ii) provision for establishing digital public infrastructure for insurance; (iii) reduction in the net-owned fund requirements for foreign entities engaged in the re-insurance business from ₹5,000 crore to ₹1,000 crore; (iv) flexibility for investment of assets; and (v) empowering IRDAI to approve the scheme of arrangement between an insurer and a company not engaged in insurance business, to supersede the board of directors of an insurer where it appoints an administrator, to specify regulations on remuneration, commission, or reward payable to insurance agents or intermediaries and to inspect and investigate insurance intermediaries. III.2.15 GST Reforms in the Insurance Sector 3.44 As part of the next generation reforms in the Goods and Services Tax (GST) framework, the premiums on individual health and life insurance policies, including reinsurance for those policies, have been exempted from GST. This measure of reduction in tax incidence from 18 per cent to nil effectively lowers the cost of risk protection and long-term savings products for households. Over time, it is expected to improve affordability and accessibility of such products enhancing insurance coverage. From a macro-financial perspective, the GST exemption is likely to strengthen the sector's premium-generation trajectory, providing insurers with a larger pool of long-duration liabilities that can be chanelled into sovereign and infrastructure assets. III.2.16 Financial Sector Cybersecurity Strategy 3.45 Recognising the growing cyber threats to financial stability arising from rapid digitalisation and highly interconnected financial systems, the Financial Stability and Development Council (FSDC) constituted an Inter-Ministerial Group in August 2025 to formulate a comprehensive Financial Sector Cybersecurity Strategy. The Inter-Ministerial Group comprises senior representatives from the Government and the Regulators.33 3.46 The Strategy seeks to establish a unified governance framework across financial sector authorities with a view to strengthen sector-wide cyber resilience. The core focus areas include protection of critical financial infrastructure, harmonisation of cybersecurity standards and incident reporting frameworks, incorporation of IMF Financial Sector Assessment Programme recommendations, strengthening oversight of third-party service providers and supply-chain risks, and development of outcome-based resilience capabilities across the financial sector. III.3 Other Developments III.3.1 Customer Protection 3.47 The number of complaints received by the Offices of the Reserve Bank of India Ombudsman (ORBIOs) for the previous two quarters indicates that majority of the complaints related to loans / advances and credit cards, constituting nearly 50 per cent of the complaints during Q1 and Q2 of 2025-26 (Table 3.1). 3.48 With respect to the Indian securities market, the number of complaints received during Jul-Sep 25 increased by 16.2 per cent over the previous quarter. Complaints related to stock brokers and listed companies (related to equity issue) accounted for 53.7 per cent of the total number of complaints received during the quarter (Table 3.2). 3.49 The status of the disputes on the Online Dispute Resolution portal set up by Market Infrastructure Institutions (MIIs) vide Circular dated July 31, 2023, on Smart Online Dispute Resolution is given in Table 3.3. | Table 3.1: Category of Complaints Received under the RB-IOS, 2021 | | Sr. No. | Grounds of Complaint | Apr-Jun 2025 | Jul-Sep 2025 | | Number | Share

(per cent) | Number | Share

(per cent) | | 1 | Loans and Advances | 26,058 | 32.86 | 27,198 | 33.06 | | 2 | Credit Card | 13,551 | 17.09 | 14,843 | 18.04 | | 3 | Opening/Operation of Deposit accounts | 13,640 | 17.20 | 13,024 | 15.83 | | 4 | Mobile / Electronic Banking | 11,706 | 14.76 | 11,943 | 14.52 | | 5 | Other products and services* | 7,668 | 9.67 | 8,980 | 10.92 | | 6 | ATM/CDM/Debit card | 3,955 | 4.99 | 3,764 | 4.58 | | 7 | Remittance and Collection of instruments | 1,012 | 1.28 | 952 | 1.16 | | 8 | Para-Banking | 965 | 1.22 | 819 | 1.00 | | 9 | Pension related | 641 | 0.81 | 645 | 0.78 | | 10 | Notes and Coins | 103 | 0.13 | 103 | 0.13 | | Total | 79,299 | 100.00 | 82,271 | 100.00 | Note: * includes bank guarantee/ letter of credit, customer confidentiality, premises and staff, grievance redressal, etc.

Source: RBI. |

| Table 3.2: Type/Category of Complaints | | Sr. No. | Category | Apr-Jun 2025 | Jul-Sep 2025 | | 1 | Stock Broker | 5,292 | 5,212 | | 2 | Listed Company- Equity Issue (Dividend/ Transfer/Transmission/Duplicate Shares/ Bonus Shares, etc.) | 2,713 | 3,588 | | 3 | Registrar and Share Transfer Agent | 2,205 | 3,113 | | 4 | Mutual Fund | 763 | 927 | | 5 | Depository Participant | 691 | 745 | | 6 | Research Analyst | 602 | 668 | | 7 | Stock Exchange | 448 | 418 | | 8 | Investment Advisers | 246 | 272 | | 9 | Depository | 232 | 253 | | 10 | Listed Company-IPO/Prelisting /Offer Document (Debenture and Bonds) | 168 | 208 | | 11 | Listed Company-IPO/Prelisting/Offer document (shares) | 161 | 305 | | 12 | Debenture Trustee | 103 | 58 | | 13 | Listed Company- Debt Issue (Interest/ Redemption/Transfer/Transmission etc.) | 72 | 76 | | 14 | Listed Company-Delisting of securities | 63 | 65 | | 15 | KYC Registration Agency | 57 | 66 | | 16 | Portfolio Manager | 57 | 68 | | 17 | Banker to the issue | 45 | 152 | | 18 | Clearing Corporation | 34 | 19 | | 19 | Mutual Fund Trading on Stock Exchange Platform | 26 | 19 | | 20 | Category 2 Alternative Investment Fund | 24 | 26 | | 21 | Merchant Banker | 19 | 39 | | 22 | Category 3 Alternative Investment Fund | 14 | 11 | | 23 | Listed Company- Buy Back of Securities | 14 | 12 | | 24 | Venture Capital Fund | 12 | 11 | | 25 | Small and Medium Real Estate Investment Trust (SM REIT) | 9 | 3 | | 26 | Category 1 Alternative Investment Fund | 9 | 7 | | 27 | Credit Rating Agency | 8 | 17 | | 28 | Infrastructure Investment Trust (InvIT) | 3 | 2 | | 29 | Share based Employee benefit | 1 | 6 | | 30 | Vault Manager | 1 | 1 | | 31 | Securitised Debt Instrument (SDI) | 1 | 3 | | 32 | Real Estate Investment Trust (REIT) | 1 | 4 | | Total | 14,094 | 16,374 | | Source: SEBI. |

| Table 3.3: Status of Disputes on SmartODR.in | | (Value in ₹ crore) | | Period (FY) | Opening Balance of Disputes | Disputes Received | Disputes Resolved | Outstanding Balance as at end of FY | | No. | Value | No. | Value | No. | Value | No. | Value | | Apr - Jun 2025 | 1,308 | 184.82 | 1,273 | 153.05 | 2,019 | 228.24 | 562 | 109.63 | | Jul - Sep 2025 | 562 | 109.63 | 1,252 | 102.80 | 1,244 | 148.61 | 570 | 63.82 | Note: The above data pertains to net complaints across all MIIs.

Source: SEBI. | 3.50 The Life insurance sector has witnessed a notable improvement in grievance volumes and resolution efficiency. After peaking at over 1.5 lakh complaints annually in 2021-22, the number of grievances reported has structurally declined to around 1.2 lakh during 2022-23 to 2024-25. This stabilization in grievance volumes suggests improved market conduct and better alignment between product sales and customer expectations. In contrast, the non-life insurance sector is facing a significant escalation in consumer grievances with the number of reported grievances nearly tripling, surging from around 48,000 in 2020-21 to nearly 1.4 lakh in 2024-25. This increasing number of grievances underscores growing friction between policyholders and insurers, necessitating urgent intervention to address the root causes. III.3.2 Enforcement 3.51 During June 2025 – November 2025, the Reserve Bank undertook enforcement action against 134 REs (one PSBs; four PVBs; one PB; one foreign bank; one RRB; 113 co-operative banks; seven NBFCs; one PSO and five HFCs) and imposed an aggregate penalty of ₹6.99 crore for non-compliance with / contravention of statutory provisions and / or directions issued by the Reserve Bank. 3.52 During May 2025 - September 2025, prohibitive directions under Section 11 of the SEBI Act, 1992 were issued against 298 entities. Further, under SEBI (Intermediaries) Regulations, 2008, enforcement actions taken were cancellation of registration of 15 intermediaries, suspension of three intermediaries and warning issued against seven intermediaries. A total of 24 prosecution cases were filed during May 2025 - September 2025 against 90 entities. Penalties under Adjudication Proceedings have been imposed against 194 entities amounting to ₹10.8 crore during this period. III.3.3 Deposit Insurance 3.53 The Deposit Insurance and Credit Guarantee Corporation (DICGC) extends insurance cover to depositors of all the banks operating in India. As on September 30, 2025, the number of banks registered with the DICGC was 1,957, comprising 124 commercial banks (including 11 small finance banks, six payment banks, 28 regional rural banks, two local area banks) and 1,833 co-operative banks. 3.54 With the present deposit insurance limit of ₹5 lakh, 97.3 per cent of the total number of deposit accounts (298.9 crore) were fully insured and 42.1 per cent of the total value of all assessable deposits (₹253 lakh crore) were insured as on September 30, 2025 (Table 3.4). 3.55 The insured deposits ratio (i.e., the ratio of insured deposits to assessable deposits) was higher for co-operative banks (60.7 per cent) followed by commercial banks (41.2 per cent) (Table 3.5). Within commercial banks, PSBs had higher insured deposit ratio vis-à-vis PVBs. | Table 3.4: Coverage of Deposits | | (Amount in ₹ crore and No. of Accounts in crore) | | Sr. No. | Item | Sep 30, 2024 | Mar 31, 2025 | Sep 30, 2025* | Percentage Variation (y-o-y) | | Sep 30, 2024 | Sep 30, 2025 | | (A) | Number of Registered Banks | 1,989 | 1,982 | 1,957 | | | (B) | Total Number of Accounts | 293.7 | 293.8 | 298.9 | 2.0 | 1.8 | | (C) | Number of Fully Protected Accounts | 286.9 | 286.6 | 290.9 | 1.8 | 1.4 | | (D) | Percentage (C)/(B) | 97.7 | 97.6 | 97.3 | | | (E) | Total Assessable Deposits | 2,27,26,914 | 2,41,06,042 | 2,52,80,389 | 11.3 | 11.2 | | (F) | Insured Deposits | 96,74,623 | 1,00,12,065 | 1,06,54,673 | 7.1 | 10.1 | | (G) | Percentage (F)/(E) | 42.6 | 41.5 | 42.1 | | Note: *Provisional.

Source: DICGC. |

| Table 3.5: Bank Group-wise Deposit Protection Coverage | | (as on September 30, 2025) | | Bank Groups | As on March 31, 2025 | As on September 30, 2025* | Insured Banks

(number) | Insured Deposits

(₹ crore) | Assessable Deposits

(₹ crore) | IDR

(ID/AD, per cent) | Insured Banks

(number) | Insured Deposits

(₹ crore) | Assessable Deposits

(₹ crore) | IDR

(ID/AD, per cent) | | I. Commercial Banks | 139 | 92,39,260 | 2,28,57,103 | 40.4 | 124 | 98,86,939 | 2,40,16,485 | 41.2 | | (i) PSBs | 12 | 59,53,830 | 1,26,11,152 | 47.2 | 12 | 61,95,064 | 1,33,44,722 | 46.4 | | (ii) PVBs | 21 | 25,71,103 | 81,93,195 | 31.4 | 21 | 29,54,161 | 84,66,191 | 34.9 | | (iii) FBs | 44 | 52,084 | 10,91,743 | 4.8 | 44 | 51,686 | 12,02,752 | 4.3 | | (iv) SFBs | 11 | 1,07,719 | 2,70,601 | 39.8 | 11 | 1,15,177 | 2,87,621 | 40.0 | | (v) PBs | 6 | 26,142 | 26,294 | 99.4 | 6 | 29,465 | 29,676 | 99.3 | | (vi) RRBs | 43 | 5,27,364 | 6,62,709 | 79.6 | 28 | 5,40,334 | 6,84,048 | 79.0 | | (vii) LABs | 2 | 1,018 | 1,409 | 72.2 | 2 | 1,051 | 1,475 | 71.3 | | II. Co-operative Banks | 1,843 | 7,72,805 | 12,48,939 | 61.9 | 1,833 | 7,67,735 | 12,63,903 | 60.7 | | (i) UCBs | 1,457 | 3,80,142 | 5,84,450 | 65.0 | 1,447 | 3,80,862 | 5,93,324 | 64.2 | | (ii) StCBs | 34 | 66,285 | 1,57,076 | 42.2 | 34 | 65,323 | 1,60,967 | 40.6 | | (iii) DCCBs | 352 | 3,26,378 | 5,07,412 | 64.3 | 352 | 3,21,550 | 5,09,612 | 63.1 | | Total (I+II) | 1,982 | 1,00,12,065 | 2,41,06,042 | 41.5 | 1,957 | 1,06,54,673 | 2,52,80,389 | 42.1 | Notes: (1) IDR: Insured Deposit Ratio is calculated as Insured Deposit by Assessable Deposit.

(2) The insured deposits to assessable deposits ratio may not tally due to rounding off.

(3) *Provisional.

Source: DICGC | 3.56 Deposit insurance premium received by the DICGC grew by 9.6 per cent (y-o-y) to ₹14,382 crore during H1:2025-26 (Table 3.6), of which, commercial banks had a share of 94.8 per cent. 3.57 The Deposit Insurance Fund (DIF) with the DICGC is primarily built out of the premium paid by insured banks, investment income and recoveries from settled claims, net of income tax. DIF recorded a 15.4 per cent year on year increase to reach ₹2.46 lakh crore as on September 30, 2025. The reserve ratio (i.e., ratio of DIF to insured deposits) increased to 2.31 per cent from 2.21 per cent a year ago (Table 3.7). 3.58 Deposit Insurance and Credit Guarantee Corporation (DICGC), under the DICGC Act, 1961 has been operating the deposit insurance scheme since 1962 on a flat rate premium basis. At present, the banks are charged a premium of 12 paise per ₹100 of assessable deposits. While the existing system is simple to understand and administer, it does not differentiate between banks based on their soundness. It is, therefore, proposed to introduce a Risk Based Premium model which will help banks that are more sound to save significantly on the premium paid. | Table 3.6: Deposit Insurance Premium | | (₹ crore) | | Period | Commercial Banks | Co-operative Banks | Total | | 2024-25 | | H1 | 12,419 | 707 | 13,127 | | H2 | 12,932 | 704 | 13,637 | | Total | 25,352 | 1,412 | 26,764 | | 2025-26 | | H1 | 13,633 | 749 | 14,382 | Note: Constituent items may not add up to the total due to rounding off.

Source: DICGC. | III.3.4 Corporate Insolvency Resolution Process (CIRP) 3.59 Since the provisions relating to the corporate insolvency resolution process (CIRP) came into force in December 2016, a total of 8659 CIRPs have been initiated till September 30, 2025 (Table 3.8), out of which 6761 (78.1 per cent of total) have been closed. Out of the closed CIRPs, around 19.8 per cent have been closed on appeal or review or settled, 18.1 per cent have been withdrawn, around 42.8 per cent have ended in orders for liquidation and 19.2 per cent have ended in approval of resolution plans (RPs). A total of 1898 CIRPs (21.9 per cent of total) are ongoing. The sectoral distribution of corporate debtors (CDs) under CIRP is presented in Table 3.9. | Table 3.7: Deposit Insurance Fund and Reserve Ratio | | (₹ crore) | | As on | Deposit Insurance Fund (DIF) | Insured Deposits (ID) | Reserve Ratio (DIF/ID) (Per cent) | | Mar 31, 2024 | 1,98,753 | 94,12,705 | 2.11 | | Sep 30, 2024 | 2,13,513 | 96,74,623 | 2.21 | | Mar 31, 2025 | 2,28,933 | 1,00,12,065 | 2.29 | | Sep 30, 2025 | 2,46,292 | 1,06,54,673* | 2.31* | Note: *Provisional.

Source: DICGC. |

| Table 3.8: Status of Corporate Insolvency Resolution Process | | (as on September 30, 2025) | | Year/Quarter | CIRPs at the beginning of the Period | Admitted | Closure by | CIRPs at the end of the Period | | Appeal/ Review/ Settled | Withdrawal under Section 12A | Approval of RP | Commencement of Liquidation | | 2016 - 17 | 0 | 37 | 1 | 0 | 0 | 0 | 36 | | 2017 - 18 | 36 | 707 | 96 | 0 | 18 | 91 | 538 | | 2018 - 19 | 538 | 1157 | 162 | 97 | 75 | 305 | 1056 | | 2019 - 20 | 1056 | 1991 | 351 | 221 | 132 | 537 | 1806 | | 2020 - 21 | 1806 | 536 | 92 | 168 | 119 | 348 | 1615 | | 2021 - 22 | 1615 | 892 | 130 | 203 | 141 | 340 | 1693 | | 2022 - 23 | 1693 | 1262 | 195 | 231 | 186 | 405 | 1938 | | 2023 - 24 | 1938 | 1003 | 164 | 168 | 262 | 442 | 1905 | | 2024 - 25 | 1905 | 733 | 118 | 86 | 262 | 291 | 1881 | | Apr – Jun, 2025 | 1881 | 187 | 14 | 28 | 63 | 75 | 1888 | | Jul – Sep, 2025 | 1888 | 154 | 19 | 21 | 42 | 62 | 1898 | | Total | NA | 8659 | 1342 | 1223 | 1300 | 2896 | 1898 | Notes: (1) The numbers are subject to change due to constant data updates and reconciliation.

(2) This excludes 1 CD which has moved directly from Board for Industrial and Financial Reconstruction (BIFR) to resolution.

Source: Insolvency and Bankruptcy Board of India (IBBI). |

| Table 3.9: Sectoral Distribution of CIRPs | | (as on September 30, 2025) | | Sector | No. of CIRPs | | Admitted | Closed | Ongoing | | Appeal/ Review/ Settled | Withdrawal under Section 12 A | Approval of RP | Commencement of Liquidation | Total | | Manufacturing | 3183 | 447 | 454 | 574 | 1162 | 2637 | 546 | | Food, Beverages & Tobacco Products | 415 | 51 | 59 | 73 | 156 | 339 | 76 | | Chemicals & Chemical Products | 350 | 56 | 68 | 60 | 109 | 293 | 57 | | Electrical Machinery & Apparatus | 223 | 26 | 26 | 31 | 102 | 185 | 38 | | Fabricated Metal Products | 172 | 26 | 28 | 28 | 52 | 134 | 38 | | Machinery & Equipment | 345 | 64 | 59 | 43 | 115 | 281 | 64 | | Textiles, Leather & Apparel Products | 538 | 64 | 79 | 74 | 235 | 452 | 86 | | Wood, Rubber, Plastic & Paper Products | 374 | 49 | 54 | 75 | 132 | 310 | 64 | | Basic Metals | 521 | 67 | 46 | 139 | 192 | 444 | 77 | | Others | 245 | 44 | 35 | 51 | 69 | 199 | 46 | | Real Estate, Renting & Business Activities | 1903 | 348 | 296 | 223 | 540 | 1407 | 496 | | Real Estate Activities | 543 | 112 | 82 | 75 | 87 | 356 | 187 | | Computer and related activities | 249 | 32 | 43 | 22 | 94 | 191 | 58 | | Research and Development | 12 | 2 | 4 | 1 | 2 | 9 | 3 | | Other Business Activities | 1099 | 202 | 167 | 125 | 357 | 851 | 248 | | Construction | 1052 | 206 | 173 | 157 | 228 | 764 | 288 | | Wholesale & Retail Trade | 862 | 119 | 83 | 87 | 385 | 674 | 188 | | Hotels & Restaurants | 176 | 37 | 30 | 32 | 43 | 142 | 34 | | Electricity & Others | 234 | 30 | 25 | 55 | 92 | 202 | 32 | | Transport, Storage & Communications | 236 | 26 | 27 | 24 | 99 | 176 | 60 | | Others | 1013 | 129 | 135 | 148 | 347 | 759 | 254 | | Total | 8659 | 1342 | 1223 | 1300 | 2896 | 6761 | 1898 | Note: The distribution is based on the CIN of corporate debtors and as per National Industrial Classification (NIC 2004).

Source: Insolvency and Bankruptcy Board of India (IBBI). | 3.60 The outcome of CIRPs as on September 30, 2025, shows that out of the operational creditor initiated CIRPs that were closed, around 52 per cent were closed on appeal, review or withdrawal (Table 3.10). Such disclosures accounted for more than 68 per cent of all closures by appeal, review or withdrawal. 3.61 The primary objective of the Insolvency and Bankruptcy Code (hereinafter referred as 'Code') is rescuing CDs in distress. The Code has rescued 187 CDs during the period of April to September 2025, totaling to 3865 CDs cumulatively (1300 through resolution plans, 1342 through appeal or review or settlement and 1223 through withdrawal) from inception till September 2025. Several initiatives are being taken to improve the outcomes of the Code. Cumulatively till September 30, 2025, creditors have realised ₹3.99 lakh crore under the resolution plans, which is around 170.1 per cent of liquidation value and 93.79 per cent of fair value (based on 1177 cases where fair value has been estimated). In terms of percentage of admitted claims, the creditors have realised more than 32.4 per cent. 3.62 Till September 2025, the total number of CIRPs ending in liquidation was 2896, of which final reports have been submitted for 1529 CDs. These corporate debtors together had outstanding claims of ₹4.44 lakh crore, but the assets were valued at only ₹0.17 lakh crore. The liquidation of these companies resulted in realisation of 90.7 per cent of the liquidation value. The 1300 CIRPs which have yielded resolution plans till September 2025 took an average of 603 days for conclusion of process, while incurring an average cost of 1.1 per cent of liquidation value and 0.6 per cent of resolution value. Similarly, the 2896 CIRPs, which ended up in orders for liquidation, took an average 518 days for conclusion. | Table 3.10: Outcome of CIRPs, Initiated Stakeholder-wise | | (as on September 30, 2025) | | Outcome | Description | | CIRPs initiated by | | Financial Creditor | Operational Creditor | Corporate Debtor | FiSPs | Total | | Status of CIRPs | Closure by Appeal/Review/Settled | 430 | 899 | 13 | 0 | 1342 | | Closure by Withdrawal u/s 12A | 378 | 837 | 8 | 0 | 1223 | | Closure by Approval of RP | 800 | 406 | 90 | 4 | 1300 | | Closure by Commencement of Liquidation | 1363 | 1218 | 315 | 0 | 2896 | | Ongoing | 1125 | 662 | 110 | 1 | 1898 | | Total | 4096 | 4022 | 536 | 5 | 8659 | | CIRPs yielding RPs | Realisation by Creditors as per cent of Liquidation Value | 186.16 | 128.64 | 146.89 | 134.9 | 170.09 | | Realisation by Creditors as per cent of their Claims | 32.83 | 24.90 | 18.24 | 41.4 | 32.44 | | Average time taken for Closure of CIRP (days) | 729 | 739 | 627 | 677 | 725 | | CIRPs yielding Liquidations | Liquidation Value as per cent of Claims | 5.42 | 8.33 | 7.48 | - | 6.08 | | Average time taken for order of Liquidation (days) | 526 | 527 | 454 | - | 518 | Note: FiSPs = Financial service providers. A "Financial service provider" means a person engaged in the business of providing financial services (other than banks) in terms of authorisation issued or registration granted by a financial sector regulator.

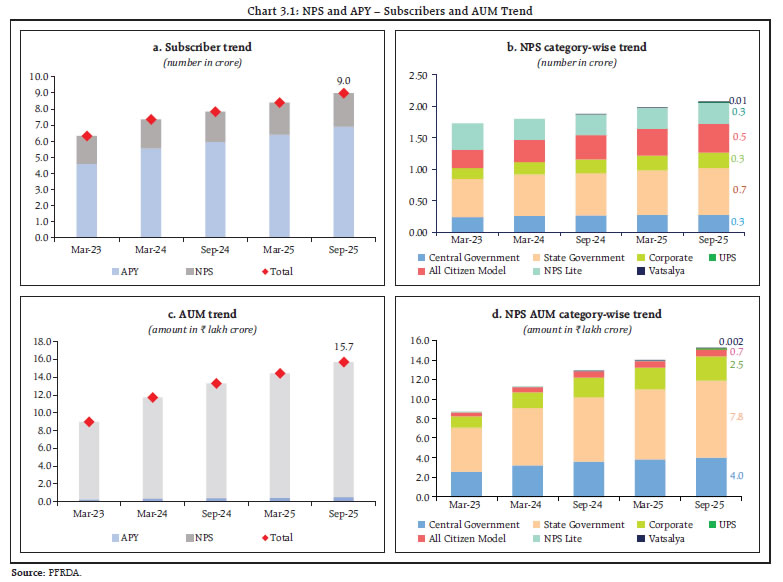

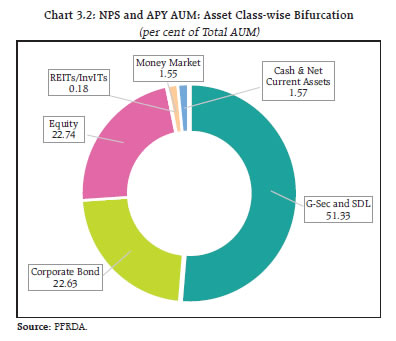

Source: Insolvency and Bankruptcy Board of India (IBBI). | III.3.5 Developments in International Financial Services Centre (IFSC) 3.63 The International Financial Services Centres Authority (IFSCA) has notified more than 30 new regulations and 15 frameworks since 2021 which are aligned with international best practices. As of end-September 2025, the total number of registrations/authorisations given by IFSCA reached 1027 (865 as of end-March 2025). 3.64 Nearly 194 Fund Management Entities (FMEs) have registered in IFSC as on Sep-25, up 51.5 per cent y-o-y from Sep-24. These FMEs have launched 310 Funds (including AIFs and retail schemes) since inception with cumulative investments of US$ 13.1 billion till date, up 155 per cent since Sept-24. In terms of exchanges at IFSCA, the monthly turnover on GIFT IFSC Exchanges was US$ 88.7 billion in September 2025, whereas the average daily turnover of NIFTY derivative contracts on NSE International Exchange (NSE IX) was US$ 4.02 billion in the same period. A total of US$ 66.6 billion debt securities has been listed on the IFSC exchanges including US$ 15.73 billion of green bonds, social bonds, sustainable bonds and sustainability-linked bonds till September 2025. 3.65 The banking ecosystem at GIFT-IFSC comprises 32 banks (IFSC Banking Units), including 15 foreign banks and 17 domestic banks offering a wide spectrum of banking and financial services. In addition to the Banking Units, two Global Administrative Offices (GAOs) are already operational in IFSC. The total banking asset size has grown from US$ 14 billion in September 2020 to US$ 100.14 billion in September 2025. As on September 2025, a total of 12,517 retail deposit accounts have been opened with IBUs with a total deposit of US$ 1.22 billion in which majority of deposits were held by persons resident outside India. 3.66 The India International Bullion Exchange (IIBX), a vibrant gold trading hub, has seen transactions and imports amounting to 101.64 tonnes of Gold (equivalent to US$ 8.48 billion) and 1,147.98 Tonnes of Silver (equivalent to US$ 927 million). The registered aircraft leasing entities in GIFT-IFSC have grown to 37, which have leased a total of 303 assets till September 2025. The total registered ship leasing/ ship financing entities in GIFT IFSC has grown to 34 till September 2025. III.3.6 Pension Funds 3.67 The National Pension System (NPS) and Atal Pension Yojana (APY) continued to grow in 2025 with the total number of subscribers under NPS & APY together reaching 8.98 Crore and the AUM touching ₹15.81 lakh crore. NPS and APY have witnessed a y-o-y growth both in the number of subscribers at 14.7 per cent as well as in assets under management at 18.2 per cent. The highest contribution is from the state govt sector (₹7.8 lakh crore) while the highest number of subscribers are under the APY (6.90 Crore) (Chart 3.1 a, b, c and d), which is primarily invested in fixed income instruments (Chart 3.2).

3.68 Recognizing the need to strengthen India's pension landscape and to bring within its ambit a wider spectrum of contributors, the PFRDA introduced the Multiple Scheme Framework (MSF). MSF is built upon a new architecture where a subscriber, identified uniquely through the PAN across central recordkeeping agencies (CRAs), will be able to hold and manage multiple schemes within the NPS through permanent retirement account number (PRAN) at each CRA. This framework removes constraints on diversification and provides subscribers with greater scope for aligning their investments with their evolving retirement and wealth building goals. The reform is a significant step forward in expanding the outreach of NPS in the Non-Government Sector (NGS), allowing greater flexibility, more personalized retirement solutions, and alignment with global best practices in pension system design while building safeguards for subscribers.

|