DRAFT FOR COMMENTS RBI/2025-26/

DoR.FIN.REC.No./ 00-00-000/2025-26 XX, 2025 Reserve Bank of India (Commercial Banks – Forthcoming Instructions) Directions, 2025 In exercise of the powers conferred by Section 35A the Banking Regulation Act, 1949 (hereinafter called the ‘BR Act’), and all other provisions / laws enabling Reserve Bank of India (‘RBI’) in this regard, RBI being satisfied that it is necessary and expedient in the public interest to do so, hereby issues the Directions hereinafter specified. Chapter I - Preliminary A. Short title and commencement 1. These Directions shall be called the Reserve Bank of India (Commercial Banks – Forthcoming Instructions) Directions, 2025. 2. The effective date of implementation of these Directions shall be communicated separately. B. Applicability 3. These Directions shall be applicable to commercial banks (hereinafter collectively referred to as 'banks' and individually as a 'bank') excluding Small Finance Banks (SFBs), Local Area Banks (LABs), Payments Banks (PBs), and Regional Rural Banks (RRBs). In this context, the commercial bank shall mean all banking companies, corresponding new banks and State Bank of India as defined under subsections (c), (da) and (nc) of section 5 of the Banking Regulation Act,1949. C. Definitions 4. Some definitions have been provided in the respective chapters as per the applicability. 5. All other expressions, unless defined in the corresponding chapter, shall have the same meaning as have been assigned to them under the Reserve Bank of India Act, 1934, or the Banking Regulation Act, 1949, or any statutory modification or re-enactment thereto, or Glossary of Terms published by the RBI, or as used in commercial parlance, as the case may be. D. Scope 6. To align Basel III prudential norms applicable to scheduled commercial banks with the latest standards issued by Basel Committee on Banking Supervision (BCBS), RBI from time to time has issued guidelines / instructions / directives on different aspects of the Basel III standards such as the standardised approach for measuring counterparty credit risk exposures, exposures to Central Counterparties, minimum capital requirements for operational risk, and Interest Rate Risk in Banking Book. The implementation dates for these guidelines, however, have not yet been notified by RBI. Accordingly, these Directions consolidate the guidelines / instructions / directives issued earlier on the aforementioned subjects. Chapter II - Computing Exposure for Counterparty Credit Risk arising from Derivative Transactions A. Standardised Approach for Counterparty Credit Risk (SA-CCR) for computing default risk capital charge 7. The SA-CCR shall be used for computing exposure for default risk capital charge for OTC derivatives (whether centrally cleared or not), exchange-traded derivatives and long settlement transactions. SA-CCR shall not be used for Securities Financing Transactions (SFTs) which are covered under Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. Explanation: Long settlement transactions are transactions where a counterparty undertakes to deliver a security, or a foreign exchange amount against cash, other financial instruments, or vice versa, at a settlement or delivery date that is contractually specified as more than the lower of the market standard for this particular instrument and five business days after the date on which the bank enters into the transaction. 8. When a bank purchases credit derivative protection against a banking book exposure, or against a counterparty credit risk exposure, it shall determine its capital requirement for the hedged exposure subject to the criteria and general rules for the recognition of credit derivatives, i.e., substitution or double default rules as appropriate. Where these rules apply, the exposure amount for counterparty credit risk from such instruments is zero. The exposure amount for counterparty credit risk is zero for sold credit default swaps in the banking book where they are treated as a guarantee provided by the bank in the framework and subject to a credit risk charge for the full notional amount. 9. Computation of exposure The SA-CCR shall be used for computing Exposure at Default (EAD) for OTC derivatives, exchange-traded derivatives, and long settlement transactions. Exposure shall be calculated separately for each netting set. However, in cases where bilateral netting is not permitted, each and every trade shall be its own netting set. The exposure shall be determined as follows: EAD = 1.4 * (RC + PFE) where: RC = the replacement cost calculated according to methodology given in paragraph 11, and FE = the amount for potential future exposure calculated according to the methodology given in paragraph 12. 10. Determination of netting set (1) Under SA-CCR, determination of netting set is critical in computing EAD as replacement cost shall be calculated at the netting set level, whereas PFE add-ons shall be calculated for each hedging set of an asset class within a given netting set and then aggregated. Explanations: -

A netting set is a group of transactions with a single counterparty that are subject to a legally enforceable bilateral netting arrangement and for which netting is recognised for regulatory capital purposes under the provisions of the requirements under paragraph 21(2). These requirements have to be satisfied on an on-going basis. -

A hedging set is a set of transactions within a single netting set within which partial or full offsetting is recognised for the purpose of computing PFE add-on under these guidelines. (2) A bank may net transactions for the purpose of these Directions (e.g., when determining the RC component of a netting set) subject to novation under which any obligation between a bank and its counterparty to deliver a given currency on a given value date is automatically amalgamated with all other obligations for the same currency and value date, legally substituting one single amount for the previous gross obligations. A bank may also net transactions subject to any legally valid form of bilateral netting not covered in the preceding sentence, including other forms of novation. Wherever netting is applied, a bank shall satisfy that the requirements laid down under paragraph 21(2) are met. (3) Different set of computations for margined and unmargined netting sets: The computation of RC is dependent on whether the trades with a counterparty are subject to a margin agreement or not, i.e., whether the netting set is margined or unmargined. Where a margin agreement exists, the formulation could apply both to bilateral transactions and central clearing relationships. Where collateral other than variation margin (e.g., initial margin) is taken, it is treated as unmargined netting set. Bilateral transactions with a one-way margining agreement in favour of the bank’s counterparty (i.e., where a bank posts, but does not collect collateral) shall be treated as unmargined transactions. The RC and PFE components shall be calculated differently for margined and unmargined netting sets. The EAD for a margined netting set is capped at the EAD of the same netting set calculated on an unmargined basis. Explanation: By margining agreement it is meant that both the counterparties have agreed to exchange periodic variation margins. 11. Computation of Replacement Cost (RC) Computation of RC for unmargined netting sets: (1) For unmargined transactions, RC is defined as the greater of: (a) the current market value of the derivative contracts less net haircut collateral held by the bank (if any), and (b) zero. Mathematically: RC = max {V - C; 0} where: V = the market value of the derivative transactions in the netting set, and C = the haircut value of net collateral held, which is calculated in accordance with the Net Independent Collateral Amount (NICA) methodology defined in paragraph 11(5) below. For this purpose, the value of non-cash collateral posted by the bank to its counterparty is increased and the value of the non-cash collateral received by the bank from its counterparty is decreased using haircuts (which are the same as those that apply to repo-style transactions). (2) Impact of excess collateral held In the above formulation, it is assumed that the RC representing today’s exposure to the counterparty cannot go less than zero. However, a bank sometimes holds excess collateral (even in the absence of a margin agreement) or have out-of-the-money trades which can further protect the bank from the increase of the exposure. Such over-collateralisation and negative mark-to market value shall be allowed to reduce PFE but shall not affect RC. Computation of RC for margined netting sets: (3) The RC for margined transactions in the SA-CCR is defined as the greatest exposure that would not trigger a call for Variation Margin (VM), taking into account the mechanics of collateral exchanges in margining agreements. Such mechanics include, for example, ‘Threshold’, ‘Minimum Transfer Amount’ and ‘Independent Amount’ in the standard industry documentation, which are factored into a call for VM. A defined, generic formulation has been created to reflect the variety of margining approaches used and those being considered by supervisors internationally. Explanation: For example, in the ISDA Master Agreement, the term ‘Credit Support Amount’, or the overall amount of collateral that must be delivered between the parties, is defined as the greater of (a) the Secured Party’s Exposure plus the aggregate of all Independent Amounts applicable to the Pledger minus all Independent Amounts applicable to the Secured Party, minus the Pledger’s Threshold and (b) zero. (4) Independent Collateral Amount (ICA) represents (a) collateral (other than VM) posted by the counterparty that the bank may seize upon default of the counterparty, the amount of which does not change in response to the value of the transactions it secures and / or (b) the Independent Amount (IA) parameter as defined in standard industry documentation. ICA can change in response to factors such as the value of the collateral or a change in the number of transactions in the netting set. (5) Because both a bank and its counterparty may be required to post ICA, NICA describes the amount of collateral that a bank may use to offset its exposure on the default of the counterparty. NICA does not include collateral that a bank has posted to a segregated, bankruptcy remote account, which presumably would be returned upon the bankruptcy of the counterparty. That is, NICA represents any collateral (segregated or unsegregated) posted by the counterparty less the unsegregated collateral posted by the bank. With respect to IA, NICA takes into account the differential of IA required for the bank minus IA required for the counterparty. (6) For margined trades, the replacement cost is: RC=max {V - C; TH+ MTA-NICA; 0} where, V and C are as defined in the unmargined formulation, TH = positive threshold before the counterparty must send the bank collateral, and MTA = minimum transfer amount applicable to the counterparty. (7) TH + MTA – NICA represents the largest exposure that would not trigger a VM call, and it contains levels of collateral that need always to be maintained. For example, without initial margin or IA, the greatest exposure that would not trigger a variation margin call is the threshold plus any minimum transfer amount. In the adapted formulation, NICA is subtracted from TH + MTA. This makes the calculation more accurate by fully reflecting both the actual level of exposure that would not trigger a margin call and the effect of collateral held and / or posted by a bank. The calculation is floored at zero, recognising that the bank may hold NICA in excess of TH + MTA, which could otherwise result in a negative replacement cost. 12. Computation of PFE add-ons (1) The following steps shall be followed for calculation of PFE of a netting set: -

Allocate derivative trades to asset classes -

Within each asset class, the trades to hedging sets -

For every derivative trade, calculate the effective notional based on parameters of that trade -

Calculate hedging set level PFE add-ons using effective notionals and supervisory factors -

Aggregate add-ons across all hedging sets and asset classes within the netting set (2) The PFE add-on shall therefore be multiplication of an aggregate add-on component, which consists of add-ons calculated for each asset class, and a multiplier that allows for the recognition of excess collateral or negative mark-to market value for the transactions. Mathematically: PFE= multiplier * AddOnaggregate where: AddOnaggregate = the aggregate add-on component, and multiplier = function of three inputs: V, C and AddOnaggregate Computation of multiplier (3) In cases where a bank holds collateral greater than the net market value of the derivatives contracts, this shall be allowed to reduce PFE add-on. Excess collateral may reduce the RC component of the exposure under the SA-CCR for both margined as well as unmargined trades / netting sets. The PFE component also reflects the risk-reducing property of excess collateral. (4) A multiplier to the PFE component shall be applied that decreases as excess collateral increases, without reaching zero (the multiplier is floored at 5% of the PFE add-on). When the collateral held is less than the net market value of the derivative contracts (‘under-collateralisation’), the current RC is positive and the multiplier is equal to one (i.e., the PFE component is equal to the full value of the aggregate add-on). Where the collateral held is greater than the net market value of the derivative contracts (‘over-collateralisation’), the current RC is zero and the multiplier is less than one (i.e., the PFE component is less than the full value of the aggregate add-on). (5) This multiplier shall also be activated when the current value of the derivative transactions is negative. This is because out-of-the-money transactions do not currently represent an exposure and have less chance to go in-the-money. Mathematically: where: exp (…) = exponential function, floor = 5%, V = value of the derivative transactions in the netting set, and C = the haircut value of net collateral held. Aggregation across asset classes (6) Diversification benefits across asset classes are not recognised. Instead, the respective add-ons for each asset class are simply aggregated. Mathematically: where the sum of each asset class add-on is taken. Allocation of derivative transactions to one or more asset classes (7) The designation of a derivative transaction to an asset class is to be made on the basis of its primary risk driver, that is, the market risk factor that most significantly affects its mark to market value. Most derivative transactions have one primary risk driver, defined by its reference underlying instrument (e.g., an interest rate curve for an interest rate swap, a reference entity for a credit default swap, a foreign exchange rate for a FX call option, etc.). When this primary risk driver is clearly identifiable, the transaction will fall into one of the asset classes described above. (8) Following table provides examples of the asset class allocation for a selection of derivative trades: | Table 1 | | Derivative Transaction | Primary Risk Driver | Asset Class | | Interest Rate Swap | Interest rate curve | Interest rate | | FX call option | FX rate | FX | | Credit Default Swap | Credit of reference entity | Credit | (9) For more complex trades that may have more than one risk driver (e.g. multi-asset or hybrid derivatives), a bank shall take sensitivities and volatility of the underlying into account for determining the primary risk driver. (10) In most cases, transactions will be assigned to only one asset class. However, RBI may also require more complex trades to be allocated to more than one asset class, resulting in the same position being included in multiple classes. In this case, for each asset class to which the position is allocated, a bank shall determine appropriately the sign and delta adjustment of the relevant risk driver. Allocation of derivative trades within asset class to hedging sets (11) Once derivative trades are assigned to asset classes, the next step is to allocate them to hedging sets. Offsetting across different hedging sets is not permitted under the SA-CCR. Offsetting is also not permitted in those cases where transactions are not covered under legally enforceable bilateral netting agreements. In such cases, each non-centrally cleared OTC derivative transaction shall be a netting set of its own. (12) The number of hedging sets available within an asset class, and the degree to which offsetting is allowed, varies across the different asset classes. This is required to account for differences in correlations between transactions within an asset class and basis risk. The table below details the hedging sets for each of the three asset classes: | Table 2 | | Asset Class | Number and Definition of Hedging Sets | | Interest Rate | A separate hedging set for transactions referencing the same currency | | FX | A separate hedging set for transactions referencing the same currency pair | | Credit | A single hedging set for all transactions in a netting set | General steps for calculating the add-on (13) For each transaction, the primary risk factor or factors shall be determined and attributed to one or more of the five asset classes: interest rate, foreign exchange, and credit. The add-on for each asset class shall be calculated using asset-class specific formulas. Although the add-on formulas are asset class-specific, they have a number of features in common. To determine the add-on, transactions in each asset class are subject to adjustment in the following general steps: -

an adjusted notional amount based on actual notional, or price shall be calculated at the trade level. For interest rate and credit derivatives, this adjusted notional amount also incorporates a supervisory measure of duration; -

a maturity factor MFi(type) reflecting the time horizon appropriate for the type of transaction is calculated at the trade level [refer paragraph below for details] and shall be applied to the adjusted notional. Two types of maturity factor are defined, one for margined transactions (MFi(margined)) and one for unmargined transactions (MFi(unmargined)); -

a supervisory delta adjustment shall be made to this trade-level adjusted notional amount based on the position (long or short) and whether the trade is an option, CDO tranche or neither, resulting in an effective notional amount; -

a supervisory factor shall be applied to each effective notional amount to reflect volatility; and -

the trades within each asset class shall be separated into hedging sets and an aggregation method shall be applied to aggregate all the trade-level inputs at the hedging set level and finally at the asset-class level. For credit derivatives, this shall involve the application of a supervisory correlation parameter to capture important basis risks and diversification. Each of the above steps is described, generally and by asset class, in more detail in below paragraphs. Period or date parameters: Mi, Ei, Si and Ti There are four dates that appear in the computation of PFE: (14) For all asset classes, the maturity Mi of a contract is the latest date when the contract may still be active. This date appears in the maturity factor defined in paragraph 12(14) to paragraph 12(18), that scales down adjusted notional for unmargined trades for all asset classes. If a derivative contract has another derivative contract as its underlying (e.g., a swaption) and may be physically exercised into the underlying contract (i.e., a bank would assume a position in the underlying contract in the event of exercise), then maturity of the contract is the final settlement date of the underlying derivative contract. (15) For interest rate and credit derivatives, the start date Si of the time period referenced by an interest rate or credit contract. If the derivative references the value of another interest rate or credit instrument (e.g., swaption or bond option), the time period must be determined on the basis of the underlying instrument. This date appears in the definition of supervisory duration in paragraph 12(19). (16) For interest rate and credit derivatives, the end date Ei of the time period referenced by an interest rate or credit contract. If the derivative references the value of another interest rate or credit instrument (e.g., swaption or bond option), the time period shall be determined on the basis of the underlying instrument. This date appears in the definition of supervisory duration in paragraph 12(19) and also specifies the maturity category for an interest rate contract in paragraph 12(32)12(33). (17) For options in all asset classes, the latest contractual exercise date Ti as referenced by the contract. This period shall be used for the determination of the option delta in paragraph 12(21). (18) Table 3 includes example transactions and provides each transaction’s related maturity Mi, start date Si and end date Ei. In addition, the option delta in paragraph 12(21) depends on the latest contractual exercise date Ti (not separately shown in the table). | Table 3 | | Instrument | Mi | Si | Ei | | Interest rate or credit default swap maturing in 10 years | 10 years | 0 | 10 years | | 10-year interest rate swap, forward starting in 5 years | 15 years | 5 years | 15 years | | Forward rate agreement for time period starting in 6 months and ending in 12 months | 1 year | 0.5 year | 1 year | | Cash-settled European swaption referencing 5-year interest rate swap with exercise date in 6 months | 0.5 year | 0.5 year | 5.5 years | | Physically settled European swaption referencing 5year interest rate swap with exercise date in 6 months | 5.5 years | 0.5 year | 5.5 years | | 10-year Bermudan swaption with annual exercise dates | 10 years | 1 year | 10 years | | Interest rate cap or floor specified for semi-annual interest rate with maturity 5 years | 5 years | 0 | 5 years | | Option on a bond maturing in 5 years with the latest exercise date in 1 year | 1 year | 1 year | 5 years | | 3-month Eurodollar futures that matures in 1 year | 1 year | 1 year | 1.25 years | | Futures on 20-year treasury bond that matures in 2 years | 2 years | 2 years | 22 years | | 6-month option on 2-year futures on 20-year treasury bond | 2 years | 2 years | 22 years | Trade-level adjusted notional (for trade i of asset class a): di (a) (19) These parameters are defined at the trade level and take into account both the size of a position and its maturity dependency, if any. Specifically, the adjusted notional amounts shall be calculated as follows: (i) For interest rate and credit derivatives, the trade-level adjusted notional is the product of the trade notional amount, converted to the domestic currency, and the supervisory duration SDi which is given by the following formula: where: Si and Ei = the start and end dates, respectively, of the time period referenced by the interest rate or credit derivative (or, where such a derivative reference the value of another interest rate or credit instrument, the time period determined on the basis of the underlying instrument), floored by ten business days. If the start date has occurred (e.g., an on-going interest rate swap), Si shall be set to zero. Explanation: There is a distinction between the time period of the underlying transaction and the remaining maturity of the derivative contract. For example, a European interest rate swaption with expiry of 1 year and the term of the underlying swap of 5 years has Si = 1 year and Ei = 6 years. (ii) For foreign exchange derivatives, the adjusted notional is defined as the notional of the foreign currency leg of the contract, converted to the domestic currency. If both legs of a foreign exchange derivative are denominated in currencies other than the domestic currency, the notional amount of each leg is converted to the domestic currency and the leg with the larger domestic currency value is the adjusted notional amount. (20) In many cases the trade notional amount is stated clearly and fixed until maturity. When this is not the case, a bank shall use the following rules to determine the trade notional amount. -

For transactions with multiple payoffs that are state contingent such as digital options or target redemption forwards, a bank shall calculate the trade notional amount for each state and use the largest resulting calculation. -

Where the notional is a formula of market values, the bank shall enter the current market values to determine the trade notional amount. -

For variable notional swaps such as amortising and accreting swaps, a bank shall use the average notional over the remaining life of the swap as the trade notional amount. -

Leveraged swaps shall be converted to the notional of the equivalent unleveraged swap, that is, where all rates in a swap are multiplied by a factor, the stated notional shall be multiplied by the factor on the interest rates to determine the trade notional amount. -

For a derivative contract with multiple exchanges of principal, the notional is multiplied by the number of exchanges of principal in the derivative contract to determine the trade notional amount. -

For a derivative contract that is structured such that on specified dates any outstanding exposure is settled and the terms are reset so that the fair value of the contract is zero, the remaining maturity equals the time until the next reset date. Supervisory delta adjustments: δi (21) These parameters are also defined at the trade level and are applied to the adjusted notional amounts to reflect the direction of the transaction and its nonlinearity. More specifically, the delta adjustments for all derivatives are defined as follows: Explanations: (i) ‘Long in the primary risk factor’ means that the market value of the instrument increases when the value of the primary risk factor increases. (ii) ‘Short in the primary risk factor’ means that the market value of instrument decreases when the value of the primary risk factor increases. (iii) The symbol Φ in these equations represents the standard normal cumulative distribution function. (22) A bank shall ensure that delta adjustment under negative sign for short positions are relevant only for those transactions which are within the legally enforceable netting agreements. For those transactions which are not covered under such a netting agreement, the delta adjustment will be positive in all cases, i.e., for both long and short positions. Supervisory factors: SFi(a) (23) A factor or factors specific to each asset class is used to convert the effective notional amount into Effective Expected Positive Exposure (EPE) based on the measured volatility of the asset class. Each factor has been calibrated to reflect the Effective EPE of a single at-the-money linear trade of unit notional and one-year maturity. This includes the estimate of realised volatilities assumed by RBI for each underlying asset class. The Supervisory Factors have been provided in paragraph 12(44). Hedging sets (24) The hedging sets in the different asset classes are defined as follows, except for those described in paragraph 12(25) and paragraph 12(26) below. -

Interest rate derivatives consist of a separate hedging set for each currency; -

FX derivatives consist of a separate hedging set for each currency pair; -

Credit derivatives consist of a single hedging set; 25. Derivatives that reference the basis between two risk factors and are denominated in a single currency (basis transactions) shall be treated within separate hedging sets within the corresponding asset class. There is a separate hedging set for each pair of risk factors (i.e., for each specific basis). Examples of specific bases include three-month SOFR versus six-month SOFR, three-month SOFR versus three-month T-Bill, one-month SOFR versus OIS rate, Brent Crude oil versus Henry Hub gas. For hedging sets consisting of basis transactions, the supervisory factor applicable to a given asset class shall be multiplied by one-half. Explanation: Derivatives with two floating legs that are denominated in different currencies (such as cross-currency swaps) are not subject to this treatment; rather, they should be treated as non-basis foreign exchange contracts (26) Derivatives that reference the volatility of a risk factor (volatility transactions) shall be treated within separate hedging sets within the corresponding asset class. Volatility hedging sets shall follow the same hedging set construction outlined in paragraph 12(24). Examples of volatility transactions include variance and volatility swaps, options on realised or implied volatility. For hedging sets consisting of volatility transactions, the supervisory factor applicable to a given asset class shall be multiplied by a factor of five. Time Risk Horizons (27) The minimum time risk horizons for the SA-CCR include: The lesser of one year and remaining maturity of the derivative contract for unmargined transactions, floored at ten business days. Therefore, the adjusted notional at the trade level of an unmargined transaction shall be multiplied by a Maturity Factor (MF): where Mi = the transaction i remaining maturity floored by 10 business days. Explanation: Within a hedging set, long and short positions are determined with respect to the basis (28) For margined transactions, the minimum margin period of risk is determined as follows: -

At least ten business days for non-centrally cleared derivative transactions subject to daily margin agreements. For transactions having re-margining agreements of N days, margin period of risk shall be 10+N-1. -

Five business days for centrally cleared derivative transactions subject to daily margin agreements that clearing members have with their clients. -

20 business days for netting sets consisting of 5,000 transactions that are not with a central counterparty. -

Margin period of risk (MPOR) shall be doubled for netting sets with outstanding disputes. If a bank has experienced more than two margin call disputes on a particular netting set over the previous two quarters and these disputes have lasted longer than the applicable MPOR, the MPOR to be used is double the applicable minimum MPOR. (29) Therefore, the adjusted notional for margined netting sets at the trade level of a margined transaction shall be multiplied by: where MPORi is the margin period of risk appropriate for the margin agreement containing the transaction i. Supervisory correlation parameters: ρi(a) 30) These parameters only apply to the PFE add-on calculation for credit derivatives. For credit derivatives, the supervisory correlation parameters are derived from a single-factor model and specify the weight between systematic and idiosyncratic components. This weight determines the degree of offset between individual trades, recognising that imperfect hedges provide some, but not perfect, offset. Supervisory correlation parameters do not apply to interest rate and foreign exchange derivatives. Add-on for interest rate derivatives (31) Hedging sets within the interest rate asset class are formed by grouping all trades referencing interest rates of the same currency. For example, all trades referencing INR will form a single hedging set. The supervisory factor as given in table 6 is 0.5% for entire interest rate asset class. (32) The PFE for each hedging set shall be equal to multiplication of SF and effective notional. The computation of effective notional captures the risk of interest rate derivatives of different maturities being imperfectly correlated. To address this risk, interest rate derivatives shall be divided into maturity categories (also referred to as ‘buckets’) based on the end date [as described in paragraph 12(16) to paragraph 12(18)] of the transactions. The three relevant maturity categories are: less than one year, between one and five years and more than five years. The SA-CCR allows full recognition of offsetting positions within a maturity category. Across maturity categories, the SA-CCR recognises partial offset. 33) The add-on for interest rate derivatives is the sum of the add-ons for each hedging set of interest rates derivatives transacted with a counterparty in a netting set. The add-on for a hedging set of interest rate derivatives shall be calculated in two steps. The effective notional Djk(IR) shall be calculated for time bucket k of hedging set (i.e., currency) j according to: Where notation iϵ{Ccyj, MBk} refers to trades of currency j that belong to maturity bucket k. That is, the effective notional for each time bucket and currency is the sum of the trade-level adjusted notional amounts [cf. paragraph 12(19)] multiplied by the supervisory delta adjustments [cf. paragraph 12(21) to paragraph 12(22)] and the maturity factor [cf. paragraph 12(27)12(28) to 12(29)]. (ii) Aggregation across maturity buckets for each hedging set shall be calculated according to the following formula: (34) However, for transactions which are not covered under bilateral netting agreements, there would be no recognition of offset across maturity buckets. In this case or in cases where a bank does not choose to recognise offset across maturity buckets, the relevant formula shall be: (35) The hedging set level add-on is calculated as the product of the effective notional and the interest rate supervisory factor: Aggregation across hedging sets is performed via simple summation: Add-on for foreign exchange derivatives (36) Hedging sets within the foreign currency asset class are formed by grouping all trades referencing the same FX currency pair. For instance, INR/USD, INR/EUR or INR/GBP trades will each form their own hedging set. The ordering of the currency pair is not relevant and so INR/USD and USD/INR transactions fall within the same hedging set. The add-on formula for foreign exchange derivatives shares many similarities with the add-on formula for interest rates. Similar to interest rate derivatives, the effective notional of a hedging set is defined as the sum of all the trade-level adjusted notional amounts multiplied by their supervisory delta. The addon for a hedging set is the product of the absolute value of its effective notional amount and the supervisory factor (same for all FX hedging sets). (37) In the case of foreign exchange derivatives, the adjusted notional amount is maturity-independent and given by the notional of the foreign currency leg of the contract, converted to the domestic currency. Mathematically: where the sum is taken over all the hedging sets HSj included in the netting set. (38) The add-on and the effective notional of the hedging set HSj are respectively given by: where i ∈HS j refers to trades of hedging set HSj. That is, the effective notional for each currency pair is the sum of the trade-level adjusted notional amounts [cf. paragraph 12(19)] multiplied by the supervisory delta adjustments [cf. paragraph 12(21) to paragraph 12(22)] and the maturity factor [cf. paragraph 12(27)12(28) to 12(29)]. In cases where transactions are not covered under legally enforceable bilateral netting agreements, the supervisory delta adjustment for linear transactions shall be positive 1 and shall invariably be positive for all non-linear transactions. Add-on for credit derivatives (39) There are two levels of offsetting benefits for credit derivatives. First, all credit derivatives referencing the same entity (either a single entity or an index) are allowed to offset each other fully to form an entity-level effective notional amount: where i ∈ Entityk refers to trades of entity k. That is, the effective notional for each entity is the sum of the trade-level adjusted notional amounts multiplied by the supervisory delta adjustments and the maturity factor. However, whenever these credit derivatives are not covered under legally enforceable Bilateral netting agreement, the supervisory delta adjustment shall be positive 1 for all transactions. (40) The add-on for all the positions referencing this entity is defined as the product of its effective notional amount and the supervisory factor SFk(Credit), ie:  For single name entities, SFk(Credit) is determined by the reference name’s credit rating. For index entities, SFk(Credit) is determined by whether the index is investment grade or speculative grade. Second, all the entity-level add-ons are simply added to compute the total add-on for the credit derivatives. However, in cases where these credit derivatives are covered by a legally enforceable bilateral netting agreement, they shall be grouped within a single hedging set (except for basis and volatility transactions) in which partial offsetting between two different entity-level add-ons is permitted. For this purpose, a single-factor model has been used to allow partial offsetting between the entity-level add-ons by dividing the risk of the credit derivatives asset class into a systematic component and an idiosyncratic component. (41) The entity-level add-ons are allowed to offset each other fully in the systematic component; whereas, there is no offsetting benefit in the idiosyncratic component. These two components are weighted by a correlation factor which determines the degree of offsetting / hedging benefit within the credit derivatives asset class. The higher the correlation factor, the higher the importance of the systemic component, hence the higher the degree of offsetting benefits. Derivatives referencing credit indices are treated as though they were referencing single names, but with a higher correlation factor applied. Mathematically: where ρk (Credit) represents appropriate correlation factor corresponding to the entity k. (42) A higher or lower correlation does not necessarily mean a higher or lower capital charge. For portfolios consisting of long and short credit positions, a high correlation factor would reduce the charge. For portfolios consisting exclusively of long positions (or short positions), a higher correlation factor would increase the charge. If most of the risk consists of systematic risk, then individual reference entities would be highly correlated and long and short positions should offset each other. If, however, most of the risk is idiosyncratic to a reference entity, then individual long and short positions would not be effective hedges for each other. (43) The use of a single hedging set for credit derivatives implies that credit derivatives from different industries and regions are equally able to offset the systematic component of an exposure, although they would not be able to offset the idiosyncratic portion. This approach recognises that meaningful distinctions between industries and / or regions are complex and difficult to analyse for global conglomerates. Specification of supervisory parameters Supervisory Factors (SF) and Option Volatility Factors: (44) Supervisory Factors (SFs) are an additional set of trade-level parameters used in the calculation of the PFE add-ons. These factors are intended to capture the potential fluctuations in the exposure value of a derivative trade stemming from the volatility of the primary risk factor. SFs are applied to the effective notional of individual transactions. SFs prescribed are as follows: | Table 6 | | Asset Class | Sub-Class | SF | Correlation parameter | Option Volatility Factor | | Interest Rate | | 0.50% | - | 50% | | Foreign Exchange | | 4.00% | - | 15% | | Credit, Single Name | AAA | 0.38% | 50% | - | | AA | 0.38% | 50% | - | | A | 0.42% | 50% | - | | BBB | 0.54% | 50% | - | | BB | 1.06% | 50% | - | | B | 1.60% | 50% | - | | CCC | 6.00% | 50% | - | | Credit, Index | Investment Grade | 0.38% | 80% | - | | Speculative | 1.06% | 80% | - | (45) For a basis transaction hedging set, the supervisory factor applicable to its relevant asset class shall be multiplied by one-half. For a volatility transaction hedging set, the supervisory factor applicable to its relevant asset class shall be multiplied by a factor of five. (46) For sold options, which are outside netting and margin agreements, the exposure amount can be taken as zero. 13. Treatment of multiple margin agreements and multiple netting sets (1) The netting set shall be divided into sub-netting sets that align with their respective margin agreement. This treatment applies to both RC and PFE components. (2) If a single margin agreement applies to several netting sets, replacement cost at any time shall be determined by the sum of two terms. The first term shall be equal to the unmargined current exposure of the bank to the counterparty aggregated across all netting sets within the margin agreement reduced by positive current net collateral (i.e. collateral is subtracted only when bank is a net holder of collateral). The second term shall be non-zero only when the bank is net poster of collateral: it shall be equal to the current net posted collateral (if there is any) reduced by the unmargined current exposure of the counterparty to the bank aggregated across all netting sets within the margin agreement. Net collateral available to the bank shall include both VM and NICA. RC for the entire margin agreement shall be: where: summation NS ∈ MA is across the netting sets covered by the margin agreement (hence the notation), VNS = the current mark to market value of the netting set NS, and CMA = the cash equivalent of all currently available collateral under the margin agreement. Chapter III – Capital Requirement for Exposures to Central Counterparties (CCPs) A. Scope of Application 14. Exposures to Central Counterparties (CCPs) arising from OTC derivatives transactions, exchange traded derivatives transactions, SFTs and long settlement transactions shall be subject to the counterparty credit risk treatment as indicated in the paragraphs below. 15. Exposures arising from the settlement of cash transactions (equities, fixed income, spot FX, commodity, etc.) are not subject to this treatment. The settlement of cash transactions remains subject to the treatment described in Reserve Bank of India (Commercial Banks - Prudential Norms on Capital Adequacy) Directions, 2025. 16. When the clearing member bank-to-client bank leg of an exchange traded derivatives transaction is conducted under a bilateral agreement, both the client bank and the clearing member bank shall capitalise that transaction as an OTC derivative. 17. For the purpose of capital adequacy framework, a CCP shall be considered as a financial institution. Accordingly, a bank’s investments in the capital of CCPs shall be guided in terms of Reserve Bank of India (Commercial Banks - Prudential Norms on Capital Adequacy) Directions, 2025. 18. Capital requirements shall be dependent on the nature of CCPs, viz., Qualifying CCPs (QCCPs) and non-Qualifying CCPs. A Qualifying CCP has been defined in Reserve Bank of India (Commercial Banks - Prudential Norms on Capital Adequacy) Directions, 2025. -

Regardless of whether a CCP is classified as a QCCP or not, a bank retains the responsibility to ensure that it maintains adequate capital for its exposures. -

Under Pillar 2, a bank should consider whether it might need to hold capital in excess of the minimum capital requirements if, for example, (i) its dealings with a CCP give rise to more risky exposures or (ii) where, given the context of that bank’s dealings, it is unclear that the CCP meets the definition of a QCCP. -

A bank may be required to hold additional capital against its exposures to QCCPs via Pillar 2, if in the opinion of RBI, it is necessary to do so. -

Where a bank is acting as a clearing member, the bank shall assess through appropriate scenario analysis and stress testing whether the level of capital held against exposures to a CCP adequately addresses the inherent risks of those transactions. This assessment shall include potential future or contingent exposures resulting from future drawings on default fund commitments, and / or from secondary commitments to take over or replace offsetting transactions from clients of another clearing member in case of this clearing member defaulting or becoming insolvent. -

A bank shall monitor and report to senior management and the appropriate committee of the Board (e.g., Risk Management Committee) on a regular basis (quarterly or at more frequent intervals) all of its exposures to CCPs, including exposures arising from trading through a CCP and exposures arising from CCP membership obligations such as default fund contributions. -

Unless Reserve Bank (DoR) requires otherwise, the trades with a former QCCP shall continue to be capitalised as though they are with a QCCP for a period not exceeding three months from the date it ceases to qualify as a QCCP. After that time, the bank’s exposures with such a central counterparty shall be capitalised according to rules applicable for non-QCCP. B. Exposures to QCCPs 19. Trade exposures Clearing member exposures to QCCPs (1) Where a bank acts as a clearing member of a QCCP for its own purposes, a risk weight of two percent shall be applied to the bank’s trade exposure to the QCCP in respect of OTC derivatives transactions, exchange traded derivatives transactions, SFTs and long settlement transactions. Where the clearing member offers clearing services to clients, the two percent risk weight also applies to clearing members’ trade exposure to the CCP that arises when the clearing member is obligated to reimburse the client for any losses suffered due to changes in the value of its transactions in the event that CCP defaults. The risk weight applied to collateral posted to the CCP by the bank shall be determined in accordance with paragraphs under treatment of collateral posted. (2) The exposure amount for such trade exposure shall be calculated in accordance with the Standardised Approach for Counterparty Credit Risk (SA-CCR) for derivatives and rules as applicable for capital adequacy for Repo / Reverse Repo-style transactions. For this purpose, a minimum margin period of risk of 10 days has to be used for computation of trade exposures to CCPs for OTC derivatives. Where CCPs retain variation margin against certain trades and the collateral given is not protected against the insolvency of the CCP, the minimum time risk horizon applied to banks’ trade exposures on this trade shall be the lesser of one year and the remaining maturity of the transactions, with a floor of 10 business days. (3) Where settlement is legally enforceable on a net basis in an event of default and regardless of whether the counterparty is insolvent or bankrupt, the total replacement cost of all contracts relevant to the trade exposure determination can be calculated as a net replacement cost if the applicable close-out netting sets meet the requirements set out in paragraph 21. (4) A bank shall demonstrate that the conditions mentioned in paragraph 21 are fulfilled on an ongoing basis by obtaining independent and reasoned legal opinion as regards legal certainty of netting of exposures to QCCPs. A bank shall also obtain from the QCCPs, the legal opinion taken by the respective QCCPs on the legal certainty of their major activities such as settlement finality, netting, collateral arrangements (including margin arrangements); default procedures etc. If a bank cannot demonstrate that netting agreements meet these requirements, each single transaction shall be regarded as a netting set of its own for the calculation of trade exposure. Clearing member bank exposures to clients (5) The clearing member shall always capitalise its exposure (including potential CVA risk exposure) to clients as bilateral trades, irrespective of whether the clearing member guarantees the trade or acts as an intermediary between the client and the QCCP. However, to recognize the shorter close-out period for cleared transactions, clearing members can capitalize the exposure to their clients by applying a margin period of risk of at least five days while computing the trade exposure using the SA-CCR. (6) If a clearing member collects collateral from a client for client cleared trades and this collateral is passed on to the CCP, the clearing member shall recognise this collateral for both the CCP-clearing member leg and the clearing member-client leg of the client cleared trade. Therefore, initial margin posted by clients to their clearing member mitigates the exposure the clearing member has against these clients. The same treatment applies, in an analogous fashion, to multi-level client structures (between a higher level client and a lower level client). (7) For this purpose, a multi-level client structure is one in which a bank can centrally clear as indirect clients; that is, when clearing services are provided to the bank by an institution which is not a direct clearing member but is itself a client of a clearing member or another clearing client. For exposures between clients and clients of clients, these guidelines use the term ‘higher level client’ for the institution providing clearing services; and the term ‘lower level client’ for the institution clearing through that client. Client bank exposures to clearing member (8) Where a bank is a client of the clearing member, and enters into a transaction with the clearing member acting as a financial intermediary (i.e. the clearing member completes an offsetting transaction with a QCCP), the client’s exposures to the clearing member shall receive the treatment applicable to the paragraph 19(1) to 19(4) on ‘clearing member exposure to QCCPs’, if following conditions are met. Likewise, where a client enters into a transaction with the CCP, with a clearing member guaranteeing its performance, the client’s exposures to the CCP may receive the treatment mentioned in the paragraph 19(1) to 19(4) on ‘clearing member exposure to QCCPs’, if conditions below are met. This treatment shall also be applicable to exposures of lower level clients to higher level clients, provided that for client levels in between the conditions below are met. (i) The offsetting transactions are identified by the QCCP as client transactions and collateral to support them is held by the QCCP and / or the clearing member, as applicable, under arrangements that prevent any losses to the client due to: -

the default or insolvency of the clearing member; -

the default or insolvency of the clearing member’s other clients; and -

the joint default or insolvency of the clearing member and any of its other clients. That is, upon the insolvency of the clearing member, there is no legal impediment (other than the need to obtain a court order to which the client is entitled) to the transfer of the collateral belonging to clients of a defaulting clearing member to the CCP, to one or more other surviving clearing members or to the client or the client’s nominee. (ii) The client shall have conducted a sufficient legal review (and undertake such further review as necessary to ensure continuing enforceability) and have a well-founded basis to conclude that, in the event of legal challenge, the relevant courts and administrative authorities would find that such arrangements mentioned above would be legal, valid, binding and enforceable under the relevant laws of the relevant jurisdiction(s). (iii) Relevant laws, regulations, rules, contractual, or administrative arrangements provide that the offsetting transactions with the defaulted or insolvent clearing member are highly likely to continue to be indirectly transacted through the QCCP, or by the QCCP, should the clearing member default or become insolvent. In such circumstances, the client positions and collateral with the QCCP shall be transferred at the market value unless the client requests to close out the position at the market value. (iv) Where a client is not protected from losses in the case that the clearing member and another client of the clearing member jointly default or become jointly insolvent, but all other conditions mentioned above are met and the concerned CCP is a QCCP, a risk weight of four percent shall apply to the client’s exposure to the clearing member. (v) Where the client bank does not meet the requirements in the above paragraphs, the bank shall be required to capitalize its exposure (including potential CVA risk exposure) to the clearing member as a bilateral trade. Treatment of posted collateral (9) In all cases, any assets or collateral posted shall, from the perspective of the bank posting such collateral, receive the risk weights that otherwise applies to such assets or collateral under the capital adequacy framework, regardless of the fact that such assets have been posted as collateral. Thus, collateral posted from banking book shall receive Banking book treatment and collateral posted from Trading book shall receive trading book treatment. In addition, this collateral is subject to the counterparty credit risk framework of the Basel rules, regardless of whether it is in the Banking Book or Trading Book. This includes the increase due to haircuts under either the standardised supervisory haircuts or own estimates. Where assets or collateral of a clearing member or client are posted with a QCCP or a clearing member and are not held in a bankruptcy remote manner, the bank posting such assets or collateral shall also recognise credit risk based upon the assets or collateral being exposed to risk of loss based on the creditworthiness of the entity holding such assets or collateral. Where the entity holding such assets or collateral is the QCCP, a risk-weight of two percent applies to collateral included in the definition of trade exposures. The relevant risk-weight of the QCCP shall apply to assets or collateral posted for other purposes. Collateral posted which is not held in the bankruptcy remote manner shall be accounted for in NICA while computing exposure using SA-CCR. (10) Collateral posted by the clearing member (including cash, securities, other pledged assets, and excess initial or variation margin, also called over-collateralisation), that is held by a custodian, and is bankruptcy remote from the QCCP, shall not be subject to a capital requirement for counterparty credit risk exposure to such bankruptcy remote custodian. Explanation: The word ‘custodian’ may include a trustee, agent, pledgee, secured creditor or any other person that holds property in a way that does not give such person a beneficial interest in such property and will not result in such property being subject to legally-enforceable claims by such persons, creditors, or to a court-ordered stay of the return of such property, should such person become insolvent or bankrupt. (11) Collateral posted by a client bank, that is held by a custodian, and is bankruptcy remote from the QCCP, the clearing member bank and other client banks, is not subject to a capital requirement for counterparty credit risk. If the collateral is held at the QCCP on a client’s behalf and is not held on a bankruptcy remote basis, a two percent risk weight shall be applied to the collateral if the conditions established in paragraph 19 (8) on ‘client bank exposures to clearing members’ are met. A risk weight of four percent shall be made applicable if a client is not protected from losses in the case that the clearing member and another client of the clearing member jointly default or become jointly insolvent, but all other conditions mentioned in paragraph 19 (8) on ‘client bank exposures to clearing members’ are met. If none of these requirements are fulfilled, capital requirements for the collateral posted shall be as applicable to an exposure to CCPs not covered under clearing exposure. Default Fund Exposures to QCCPs (12) Where a default fund is shared between products or types of business with only settlement risk (e.g., equities and bonds) and products or types of business which give rise to counterparty credit risk i.e., OTC derivatives, exchange-traded derivatives, SFTs or long settlement transactions, all of the default fund contributions shall receive the risk weight determined according to the formulae and methodology set forth below, without apportioning to different classes or types of business or products. However, where the default fund contributions from clearing members are segregated by product types and only accessible for specific product types, the capital requirements for those default fund exposures determined according to the formulae and methodology set forth below shall be calculated for each specific product giving rise to counterparty credit risk. In case the CCP’s prefunded own resources are shared among product types, the CCP shall have to allocate those funds to each of the calculations, in proportion to the respective product specific exposure. (13) Clearing member bank shall apply a risk weight to its default fund contributions to a QCCP determined according to a risk sensitive formula that considers (1) the size and quality of a qualifying CCP’s financial resources, (2) the counterparty credit risk exposures of such CCP, and (3) the application of such financial resources via the CCP’s loss bearing waterfall, in the case of one or more clearing member defaults. The clearing member bank’s risk sensitive capital requirement for its default fund contribution (KCMi) shall be calculated using the formulae and methodology set forth below. This calculation shall be performed by the QCCP by following the relevant provisions of this section, and the accuracy and integrity of the computation shall be reviewed by the concerned CCP’s supervisor at least on a quarterly basis. Failure to perform the required computation which is in accordance with this section and its review by the CCP’s supervisor shall make the CCP as non-QCCP. The required capital shall be calculated as follows: (i) The hypothetical capital requirement of the CCP due to its counterparty credit risk exposures to all of its clearing members and its clients shall be calculated. KCCP is a hypothetical capital requirement for a CCP, calculated on a consistent basis for the sole purpose of determining the capitalisation of clearing member default fund contributions; it does not represent the actual capital requirements for a CCP which may be determined by a CCP and its supervisor. KCCP shall be calculated using the formula: where, RW = risk weight of 20 percent. This risk weight may be increased if RBI considers it necessary to do so. EADi = the exposure amount of the CCP to Clearing Member (CM) ‘i’, including both the CM’s own transactions and client transactions guaranteed by the CM, and all values of the collateral held by the CCP (including the CM’s prefunded default fund contribution) against these transactions, relating to the valuation at the end of the regulatory reporting date before the margin called on the final margin call of that day exchanged. The sum is over all clearing member accounts. (ii) Where clearing members provide client clearing services, and client transactions and collateral are held in separate (individual or omnibus) sub-accounts to the clearing member’s proprietary business, each such client sub-account should enter the sum separately, i.e., the member EAD in the formula above is then the sum of the client subaccount EADs and any house sub-account EAD. This will ensure that client collateral cannot be used to offset the CCP’s exposures to clearing members’ proprietary activity in the calculation of KCCP. If any of these sub-accounts contains both derivatives and SFTs, the EAD of that sub-account is the sum of the derivative EAD and the SFT EAD. (iii) In the case that collateral is held against an account containing both SFTs and derivatives, the prefunded initial margin provided by the member or client shall be allocated to the SFT and derivatives exposures in proportion to the respective product specific exposures, calculated according to relevant provisions applicable for SFTs and other transactions. (iv) If the default fund contributions of the member (DFi) are not split with regard to client and house sub-accounts, they shall be allocated per sub-account according to the respective fraction the initial margin of that sub-account has in relation to the total initial margin posted by or for the account of the clearing member. (v) For derivatives, EADi shall be calculated as the bilateral trade exposure the CCP has against the clearing member using the SA-CCR. A margin period of risk of 10 days shall be used to calculate the CCP’s potential future exposure to its clearing members on derivative transactions. All collateral held by a CCP to which that CCP has a legal claim in the event of the default of the member or client, including default fund contributions of that member (DFi), shall be used to offset the CCP’s exposure to that member or client, through inclusion in the PFE multiplier in accordance with the provisions for computing multiplier under SA-CCR for computing aggregate PFE. (vi) For SFTs, EAD shall be equal to max (EBRMi – IMi – DFi; 0), where EBRMi = the exposure value to clearing member ‘i’ before risk mitigation; where, for the purposes of this calculation, variation margin that has been exchanged (before the margin called on the final margin call of that day) enters into the mark-to-market value of the transactions; IMi = the initial margin collateral posted by the clearing member with the CCP; and DFi = the prefunded default fund contribution by the clearing member that shall be applied upon such clearing member’s default, either along with or immediately following such member’s initial margin, to reduce the CCP loss. (vii) Any haircuts to be applied for SFTs shall be the standard supervisory haircuts prescribed under the credit risk mitigation provisions of this Master Direction. (viii) The netting sets that are applicable to regulated clearing members shall be the same as those referred to in the paragraph 19 (1) to 19 (4) on ‘clearing member exposure to QCCPs’. For all other clearing members, they need to follow the netting rules as laid out by the CCP based upon notification of each of its clearing members. The capital requirement for each clearing member shall be calculated (x) KCCP shall be calculated on a quarterly basis at a minimum. However, in cases where there are material changes like CCP, starting clearing of a new products, etc. the computation shall be done more frequently. (xi) The CCP shall make available to the supervisor of any bank clearing member sufficient aggregate information about the composition of the CCP’s exposures to clearing members and information provided to the clearing member for the purposes of the calculation. (xii) Such information shall be provided no less frequently than the bank supervisor would require for monitoring the risk of the clearing member that it supervises. KCCP and KCMi shall be recalculated at least quarterly and should also be recalculated when there are material changes to the number or exposure of cleared transactions or material changes to the financial resources of the CCP. (xiii) This approach directly computes capital requirements for default fund exposures to QCCPs. The capital requirement thus computed shall be converted into risk weighted assets by multiplying with a factor of 12.5. (xiv) Where the sum of a bank’s capital charges for exposures to a qualifying CCP due to its trade exposure and default fund contribution is higher than the total capital charge that would be applied to those same exposures if the CCP were for a non-qualifying CCP, the latter total capital charge shall be applied. C. Exposures to non-qualifying CCPs 20. A bank shall apply the Standardised Approach for credit risk in the main framework, according to the category of the counterparty, to its trade exposure to a nonqualifying CCP. Further, a risk weight of 1250 percent shall apply to its default fund contributions to a non-qualifying CCP. For the purposes of this paragraph, the default fund contributions of such a bank shall include both the funded and the unfunded contributions which are liable to be paid if the CCP so requires. Where there is a liability for unfunded contributions (i.e., unlimited binding commitments), RBI will review in its Pillar 2 assessments the amount of unfunded commitments to which a 1250 percent risk weight applies. D. Requirements for Recognition of Net Replacement Cost in Close-out Netting Sets 21. Requirements for recognition of net replacement cost in close-out netting sets are as under. (1) For repo-style transactions The effects of bilateral netting agreements covering repo-style transactions shall be recognised on a counterparty-by-counterparty basis if the agreements are legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of whether the counterparty is insolvent or bankrupt. In addition, netting agreements shall: -

provide the non-defaulting party the right to terminate and close-out in a timely manner all transactions under the agreement upon an event of default, including in the event of insolvency or bankruptcy of the counterparty; -

provide for the netting of gains and losses on transactions (including the value of any collateral) terminated and closed out under it so that a single net amount is owed by one party to the other; -

allow for the prompt liquidation or setoff of collateral upon the event of default; and -

be, together with the rights arising from the provisions required in (a) to (c) above, legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of the counterparty's insolvency or bankruptcy. (2) For Derivatives transactions A bank shall net transactions for the purpose of these guidelines (e.g., when determining the RC component of a netting set) subject to novation under which any obligation between a bank and its counterparty to deliver a given currency on a given value date is automatically amalgamated with all other obligations for the same currency and value date, legally substituting one single amount for the previous gross obligations. A bank shall also net transactions subject to any legally valid form of bilateral netting not covered in the preceding sentence, including other forms of novation. In every such case where netting is applied, a bank shall satisfy that it has: (i) A netting contract with the counterparty or other agreement which creates a single legal obligation, covering all included transactions, such that the bank would have either a claim to receive or obligation to pay only the net sum of the positive and negative mark-to-market values of included individual transactions in the event a counterparty fails to perform due to any of the following: default, bankruptcy, liquidation or similar circumstances; (the netting contract must not contain any clause which, in the event of default of a counterparty, permits a non-defaulting counterparty to make limited payments only, or no payments at all, to the estate of the defaulting party, even if defaulting party is a net creditor). (ii) Written and reasoned legal reviews that, in the event of a legal challenge, the relevant courts and administrative authorities would find the bank’s exposure to be such a net amount under: -

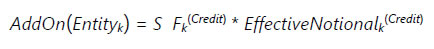

The law of the jurisdiction in which the counterparty is incorporated and, if the foreign branch of a counterparty is involved, then also under the law of the jurisdiction in which the branch is located; -

The law that governs the individual transactions; and -

The law that governs any contract or agreement necessary to effect the netting. Explanation: If RBI is not satisfied about enforceability under relevant laws, the benefit of netting while computing exposure amount cannot be obtained. It is clarified that the membership agreement together with relevant netting provisions contained in QCCP’s bye laws, rules and regulations are a type of netting agreement. (iii) Procedures in place to ensure that the legal characteristics of netting arrangements are kept under review in light of the possible changes in relevant law. (iv) Contracts containing walkaway clauses shall not be eligible for netting for the purpose of calculating capital requirements under these directions. A walkaway clause is a provision which permits a non-defaulting counterparty to make only limited payments or no payment at all, to the estate of a defaulter, even if the defaulter is a net creditor. Chapter IV – Minimum Capital Requirements for Operational Risk A. Interim arrangement 22. The existing Basic Indicator Approach (BIA) for measuring minimum operational risk capital (ORC) requirements shall be replaced by the new Standardised Approach (hereafter referred to as the ‘Basel III Standardised Approach’ or ‘Basel III SA’) with coming into effect of these Directions. 23. Until then, the minimum operational risk regulatory capital requirements shall be computed in accordance with the instructions contained Reserve Bank of India (Commercial Banks - Prudential Norms on Capital Adequacy) Directions, 2025. Explanation: A bank is not required to undertake a parallel run with respect to Basel III SA. Accordingly, a comparison of ORC requirements calculated using Basel III SA and the discontinued approaches including BIA shall not be required. B. Scope 24. The scope of application shall be in accordance with the Reserve Bank of India (Commercial Banks - Prudential Norms on Capital Adequacy) Directions, 2025. C. Definitions 25. In this chapter, unless the context otherwise requires, the terms herein shall bear the meanings assigned to them below: (1) ‘Gross loss’ means a loss before recoveries of any type. (2) ‘Net loss’ means the loss after taking into account the impact of recoveries. (3) ‘Operational risk’ means the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. This includes legal risk, but excludes strategic and reputational risk. Explanation: Legal risk shall include, but not limited to, exposure to fines, penalties, or punitive damages resulting from supervisory actions, as well as private settlements. (4) ‘Recovery’ is an in dependent occurrence, related to the original loss event, separate in time, in which funds or inflows of economic benefits are received from a third party. Examples of recoveries include payments received from insurers, repayments received from perpetrators of fraud, and recoveries of misdirected transfers. D. Components of Basel III Standardised Approach (Basel III SA) 26. Basel III SA calculation methodology is based on the following components: (1) the Business Indicator (BI), which is a financial-statement-based proxy for operational risk; (2) the Business Indicator Component (BIC), which is calculated by multiplying the BI by a set of marginal coefficients (αi); and (3) the Internal Loss Multiplier (ILM), which is a scaling factor that is based on a bank’s average historical losses and the BIC. D.1 Business Indicator (BI) 27. The BI shall be the summation of the following three constituents, BI = ILDC+SC+FC where, ILDC = the Interest, Lease and Dividend Component; SC = the Services Component; and FC = the Financial Component. D.1.1 Computation of ILDC, SC and FC 28. The ILDC, SC and FC shall be computed as per the formula below, where a bar above a term indicates that it is calculated as the average over three years: t, t-1 and t-2, and: where, Max = Maximum, Min = Minimum, and Abs = Absolute value of sub-components irrespective of their signs (+ or -) Explanations: (i) The absolute value of net items (e.g., interest income – interest expense) shall be calculated first year-by-year. Only after this year-by-year calculation should the average of the three years be calculated. Illustration: The values of items of BI sub-components for three years period for a particular bank are given below: | Table 7 | | (Amount in ₹ crore) | | Year | Interest Income | Interest Expense | Abs (Interest Income-Interest Expense) | | Jan 2018- Dec 2018 | 3,000 | 3,500 | 500 | | Jan 2019- Dec 2019 | 3,500 | 3,200 | 300 | | Jan 2020- Dec 2020 | 4,000 | 3,600 | 400 | In this illustration, the average of absolute value of the above item of BI sub-component shall be ₹400 crore ((500+300+400)/3) (ii) BI components considered in the ORC calculations should be higher of those calculated on a (i) rolling quarter basis, and (ii) financial year (FY) basis. Illustration: Suppose a bank is calculating the ORC requirements for November 2022. It has higher BI on an FY basis considering financials of FY 2021-22, FY 2020-21, and FY 2019-20 than on a rolling quarter basis considering financials for the 12 months period each ending September 22, September 21, and September 20. The bank should hold ORC requirements considering the financials of FY 2021-22, FY 2020-21, and FY 2019-20 for BI computation. 29. The description for each of these constituents of the BI (i.e. ILDC, SC and FC) is provided in Table 8. An indicative mapping of BI items with schedules and line items of the prescribed financial statements format shall be given in due course. | Table 8 | | BI constituents | P&L or balance sheet items | Description | Typical sub-items | | Interest, lease and dividend Component (ILDC) | Interest income | Interest income from all financial assets and other interest income (includes interest income from financial and operating leases and profits from leased assets) | • Interest income from loans and advances, assets available for sale, assets held to maturity, trading assets, financial leases and operating leases

• Interest income from hedge accounting derivatives

• Other interest income

• Profits from leased assets | | Interest expenses | Interest expenses from all financial liabilities and other interest expenses (includes interest expense from financial and operating leases, losses, depreciation and impairment of, and losses from, operating leased assets) | • Interest expenses from deposits, debt securities issued, financial leases, and operating leases

• Interest expenses from hedge accounting derivatives

• Other interest expenses

• Losses from leased assets

• Depreciation and impairment of operating leased assets | | Interest earning assets (balance sheet item) | Total gross outstanding loans and advances, interest bearing securities including government securities, and leased assets (i.e. all outstanding credit obligations in the balance sheet, including credit obligations on non-accrued status e.g. non-performing assets shall be included in interest earning assets) measured at the end of each financial year. | | Dividend income | Dividend income from investments in stocks and funds not consolidated in the bank’s financial statements, including dividend income from non-consolidated subsidiaries, associates and joint ventures. | | Services Component (SC) | Fee and commission income | Income received from providing advice and services. Includes income received by the bank as an outsourcer of financial services. | Fee and commission income from:

• Securities (issuance, origination, reception, transmission, execution of orders on behalf of customers)

• Clearing and settlement; Asset management; Custody; Fiduciary transactions; Payment services; Structured finance; Servicing of securitisations; Loan commitments and guarantees given; and foreign transactions | | Fee and commission expenses | Expenses paid for receiving advice and services. Includes outsourcing fees paid by the bank for the supply of financial services, but not outsourcing fees paid for the supply of non-financial services (e.g. logistical, IT, human resources) | Fee and commission expenses from:

• Clearing and settlement; Custody; Servicing of securitisations; Loan commitments and guarantees received; and Foreign transactions | | Other operating income | Income from ordinary banking operations not included in other BI items but of similar nature (income from operating leases shall be excluded) | • Rental income from investment properties

• Gains from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations | | Other operating expenses | Expenses and losses from ordinary banking operations not included in other BI items but of similar nature and from operational loss events (expenses from operating leases shall be excluded) | • Losses from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations

• Losses incurred as a consequence of operational loss events (e.g. fines, penalties, settlements, replacement cost of damaged assets), which have not been provisioned / reserved for in previous years

• Expenses related to establishing provisions / reserves for operational loss events | | Financial Component (FC) | Net profit (loss) on the trading book | • Net profit / loss on trading assets and trading liabilities (derivatives, debt securities, equity securities, loans and advances, short positions, other assets and liabilities)

• Net profit / loss from hedge accounting

• Net profit / loss from exchange differences. | | Net profit (loss) on the banking book | • Net profit / loss on financial assets and liabilities measured at fair value through profit and loss

• Realised gains / losses on financial assets and liabilities not measured at fair value through profit and loss (loans and advances, assets available for sale, assets held to maturity, financial liabilities measured at amortised cost)

• Net profit / loss from hedge accounting