DRAFT FOR COMMENTS RBI/2025-26/--

DOR.CRE.REC.No./00-00-000/2025-26 XX, 2025 Reserve Bank of India (Commercial Banks - Concentration Risk Management) Directions, 2025 Introduction The concentration of a bank’s exposures to a single counterparty or a group of connected counterparties poses significant risks. The Reserve Bank of India (RBI), recognizing the imperative of robust risk management, therefore introduced prudential exposure limits in March 1989. These limits restricted banks’ exposures to individual borrower and group exposures to a certain percentage of capital funds, laying the foundation for mitigating concentration risk on assets side of their balance sheets. Cognizant of the concentration risk on the liability side of the balance sheet, the RBI introduced Prudential Limits for Inter-Bank Liabilities in 2007 further strengthening its comprehensive approach on concentration risk management. Subsequently, guided by evolving international standards, including the Basel Committee on Banking Supervision’s (BCBS) guidance on ‘Measuring and Controlling Large Credit Exposures’ (1991) and subsequent Core Principles for Effective Banking Supervision (2006, revised 2024), the RBI aligned its framework with global best practices. This culminated in the adoption of the BCBS’s ‘Supervisory Framework for Measuring and Controlling Large Exposures’ (2014), which was extended to Indian Scheduled Commercial Banks (excluding Regional Rural Banks, Small Finance Banks, and Payments Banks) and later adapted for AIFIs and upper-layer NBFCs. In addition to the prudential measures on concentrations to counterparties, and recognizing the need for sectoral diversification, the RBI has also mandated statutory exposure limits for capital market exposures and advised banks to establish their own sector-specific thresholds for other sectors. Accordingly, in exercise of the powers conferred by Sections 21 and 35A of the Banking Regulation Act, 1949, and all the powers enabling Reserve Bank on this behalf, the RBI being satisfied that it is necessary and expedient in the public interest to do so, hereby, issues the Directions hereinafter specified. Chapter I - Preliminary A. Short Title and Commencement 1. These Directions shall be called the Reserve Bank of India (Commercial Banks - Concentration Risk Management) Directions, 2025. 2. These Directions shall become effective from the date of issue. B. Applicability 3. These Directions shall be applicable to commercial banks (hereinafter collectively referred to as 'banks' and individually as a 'bank') excluding Small Finance Banks (SFBs), Local Area Banks (LABs), Payments Banks (PBs) and Regional Rural Banks (RRBs). In this context, the commercial bank shall mean all banking companies, corresponding new banks and State Bank of India as defined under subsections (c), (da) and (nc) of section 5 of the Banking Regulation Act,1949. C. Definitions 4. In these Directions, unless the context states otherwise, the terms herein shall bear the meaning assigned to them in the ensuing paragraphs. 5. “Aggregate Sanctioned Credit Limit” or “ASCL” means the aggregate of the fund-based credit limits sanctioned or outstanding, whichever is higher, to a borrower by the banking system. ASCL would also include unlisted privately placed debt with the banking system. A borrower is free to raise its funding needs from any source at any level and will not have any restriction on tapping the market mechanism for its funding needs before it reaches the ASCL. Provided that ECB and Trade Credit raised from overseas branches of an Indian bank will count towards ASCL. 6. “Banking system” means all banks in India, including RRBs and co-operative banks and branches of Indian banks abroad. 7. “Capital Funds for exposure norms” shall comprise Tier I and Tier II capital as defined in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025, and as per the published accounts as on March 31 of the previous year. However, the infusion of capital under Tier I and Tier II, either through domestic or overseas issue (in the case of branches of a foreign bank operating in India, capital funds received by it from its Head Office in accordance with the provisions of the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025, as amended from time to time), after the published balance sheet date will also be taken into account for determining the exposure ceiling. Other accretions to capital funds by way of quarterly profits, etc., would not be eligible to be reckoned for determining the exposure ceiling. Banks are also prohibited from taking exposure in excess of the ceiling in anticipation of infusion of capital at a future date. 8. “Credit Exposure” comprises all types of funded and non-funded credit limits, and facilities extended by way of equipment leasing, hire purchase finance and factoring services. 9. “Credit Exposure of Derivative Products” is the credit exposure arising on account of the interest rate and foreign exchange derivative transactions and gold. For the purpose of exposure norms, a bank shall compute its credit exposure of derivative products using the 'Current Exposure Method', as detailed below. Bilateral netting of Mark-To-Market (MTM) values arising on account of such derivative contracts shall not be permitted. Accordingly, a bank shall count its gross positive MTM value of such contracts for the purposes of capital adequacy as well as for exposure norms. 10. Current Exposure Method (1) The credit equivalent amount of a market related off-balance sheet transaction calculated using the current exposure method is the sum of current credit exposure and potential future credit exposure of these contracts. While computing the credit exposure banks may exclude 'sold options', provided the entire premium / fee or any other form of income is received / realized. (2) Current credit exposure is defined as the sum of the positive mark-to-market value of these contracts. The Current Exposure Method requires periodical calculation of the current credit exposure by marking these contracts to market, thus capturing the current credit exposure. (3) Potential future credit exposure is determined by multiplying the notional principal amount of each of these contracts irrespective of whether the contract has a zero, positive or negative mark-to-market value by the relevant add-on factor indicated below according to the nature and residual maturity of the instrument. | CCF for market related off-balance sheet items | | Residual Maturity | Credit Conversion Factors | | Interest Rate Contract | Exchange Rate Contracts and Gold | | One year or less | 0.50 percent | 2.00 percent | | Over one year to five years | 1.00 percent | 10.00 percent | | Over five years | 3.00 percent | 15.00 percent | (4) For contracts with multiple exchanges of principal, the add-on factors are to be multiplied by the number of remaining payments in the contract. (5) For contracts that are structured to settle outstanding exposure following specified payment dates and where the terms are reset such that the market value of the contract is zero on these specified dates, the residual maturity would be set equal to the time until the next reset date. However, in the case of interest rate contracts which have residual maturities of more than one year and meet the foregoing criteria, the CCF or ‘add-on factor’ applicable shall be subject to a floor of one percent. (6) No potential future credit exposure would be calculated for single currency floating / floating interest rate swaps; the credit exposure on these contracts would be evaluated solely on the basis of their mark-to-market value. (7) Potential future exposures shall be based on effective rather than apparent notional amounts. In the event that the stated notional amount is leveraged or enhanced by the structure of the transaction, a bank shall use the effective notional amount when determining potential future exposure. For example, a stated notional amount of USD 1 million with payments based on an internal rate of two times the Base Rate would have an effective notional amount of USD 2 million. 11. “Eligible capital base” for the purpose of LEF is the effective amount of Tier 1 capital fulfilling the criteria defined in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025, as per the last audited balance sheet. However, the infusion of capital under Tier I after the published balance sheet date may also be taken into account for the purpose of LEF. A bank shall obtain an external auditor’s certificate on completion of the augmentation of capital and submit the same to the RBI (DOS, CO) before reckoning the additions to capital funds. Further, for an Indian bank, profit accrued during the year, subject to provisions contained in Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025, shall also be reckoned as Tier I capital for the purpose of LEF. 12. “Exposure” shall include credit exposure (funded and non-funded credit limits) and investment exposure (including underwriting and similar commitments). The sanctioned limits or outstanding, whichever are higher, shall be reckoned for arriving at the exposure limit. However, in the case of fully drawn term loans, where there is no scope for re-drawal of any portion of the sanctioned limit, banks may reckon the outstanding as the exposure. 13. “Group” (1) For the purpose of intragroup transactions and exposures, Group shall have the following definition: (i) “Group” shall be defined as an arrangement involving two or more entities related to each other through any of the following relationships (subsidiary, associate, joint venture and related party as defined in the applicable accounting standards) and a 'group entity' as any entity involved in this arrangement. (ii) Entities considered under the definition of ‘Group Entities’ -

Subsidiary – Parent. -

Associate. -

Joint Venture. -

Related Party (including also include structures such as SPV / SIV / conduits based upon the actual ownership / control / significant influence / beneficial interest). -

Direct or indirect ownership of 20 percent or more interest in the voting power of the enterprise. If exercise of voting power is restricted by statutory / regulatory provisions or other arrangements, then the actual ownership will be the determining factor. -

Common brand name. -

Promoters of bank (Promoters and Promoter Group as defined in Reserve Bank of India (Commercial Banks – Licensing) Guidelines, 2025). -

Non-Operative Financial Holding Company (NOFHC) of bank. -

An entity which has any of the first six relations, as above, with the promoters / NOFHC and their step-down entities. (iii) Entities Exempted from the Definition of ‘Group Entities’ (a) As the ownership of Public Sector Banks (PSBs) lies with the Government of India, all PSBs could be treated as group entities. However, the Government being a sovereign, its role as promoter and owner of the PSBs would not cause these entities to be treated as group entities. The other relationships as defined in the paragraphs 13 (1) (i) and (ii) may, however, be applicable for identifying entities of each public sector banking group separately. (b) Entities that are promoted by a financial sector intermediary including a bank to undertake financial market infrastructure activities would not be treated as group entities. Such institutions could be depositories, exchanges, clearing and settlement agencies, etc. that are supervised and regulated by the respective financial sector regulators. Exposures of a bank to these entities shall be subject to the extant exposure limits stipulated by the RBI. (c) The branches in other jurisdictions being part of a parent bank’s operations shall not be covered under the intra-group exposure limits stipulated in paragraph 136. Accordingly, an Indian bank’s exposure to its overseas branches and a foreign bank’s (operating as branches in India) exposure to its Head Office and overseas branches of the parent bank, except for proprietary derivative transactions undertaken with them, shall not be covered under the exposure norms. Exposures of a foreign bank (operating as branches) to its Head Office and other overseas branches of the parent bank would however continue to be subject to compliance with the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. 14. “Investment Exposure” comprises the investments in shares and debentures of companies, PSU bonds, and Commercial Papers (CPs). 15. A bank’s investment in debentures / bonds / security receipts / pass-through certificates (PTCs) issued by an Securitisation Company (SC) / Reconstruction Company (RC) as compensation consequent upon sale of financial assets shall constitute exposure on the SC / RC. In view of the extraordinary nature of the event, banks / FIs will be allowed, in the initial years, to exceed the prudential exposure ceiling on a case-to-case basis. 16. The investment made by a bank in bonds and debentures of corporates which are guaranteed by a Public Finance Institution (PFI) (as per list given in Annex I) will be treated as an exposure by the bank on the PFI and not on the corporate. 17. Guarantees issued by the PFI to the bonds of corporates will be treated as an exposure by the PFI to the corporates to the extent of 50 percent, being a non-fund facility, whereas the exposure of the bank on the PFI guaranteeing the corporate bond will be 100 percent. The PFI before guaranteeing the bonds / debentures should, however, take into account the overall exposure of the guaranteed unit to the financial system. 18. “Large Exposure” or “LE” is the sum of all exposure values of a bank (measured as specified in paragraphs 52 to 105 of this Chapter) to a counterparty or a group of connected counterparties (as defined in paragraphs 39 to 51), if it is equal to or above 10 percent of the bank’s eligible capital base. 19. “Market instruments” shall include bonds, debentures, redeemable preference shares and any other non-credit liability, other than equity. 20. “Net worth” shall comprise Paid-up capital plus Free Reserves including Share Premium but excluding Revaluation Reserves, plus Investment Fluctuation Reserve and credit balance in Profit & Loss account, less debit balance in Profit and Loss account, Accumulated Losses and Intangible Assets. No general or specific provisions should be included in computation of net worth. Infusion of capital through equity shares, either through domestic issues or overseas floats after the published balance sheet date, may also be taken into account for determining the ceiling on exposure to capital market. Banks should obtain an external auditor’s certificate on completion of the augmentation of capital and submit the same to the RBI (Department of Supervision) before reckoning the additions, as stated above. 21. “Normally Permitted Lending Limit” or “NPLL” means 50 percent of the incremental funds raised by the specified borrower over and above its ASCL as on the reference date, in the financial years (FYs) succeeding the FY in which the reference date falls. For this purpose, any funds raised by way of equity shall be deemed to be part of incremental funds raised by the specified borrower (from outside the banking system) in the given year. Provided that where a specified borrower has already raised funds by way of market instruments and the amount outstanding in respect of such instruments as on the reference date is 15 percent or more of ASCL on that date, the NPLL will mean 60 percent of the incremental funds raised by the specified borrower over and above its ASCL as on the reference date, in the financial years (FYs) succeeding the FY in which the reference date falls. Explanation: If a borrower becomes a 'specified borrower' during the last quarter of the FY 2016-17, say on March 31, 2017, then the disincentive mechanism will be applicable from April 1, 2017, for any borrowing from the banking system beyond the NPLL. 22. “Qualifying Central Counterparty” or “QCCP” is an entity that is licensed to operate as a central counterparty (CCP), including a license granted by way of confirming an exemption, and is permitted by the appropriate regulator / overseer to operate as such with respect to the products offered. This is subject to the provision that the CCP is based and prudentially supervised in a jurisdiction where the relevant regulator / overseer has established, and publicly indicated that it applies to the CCP on an ongoing basis, domestic rules and regulations that are consistent with the CPSS-IOSCO Principles for Financial Market Infrastructures. The definition of QCCP for the purpose of this Framework is the same as that used for risk-based capital requirement purposes. 23. “Reference date” means the date on which a borrower becomes a ‘specified borrower’. 24. “Specified borrower” means a borrower having an ASCL of more than ₹10,000 crore at any time. 25. All other expressions unless defined herein shall have the same meaning as have been assigned to them under the Banking Regulation Act, 1949 or the Reserve Bank of India Act, 1934 or any statutory modification or re-enactment thereto or as used in commercial parlance, as the case may be. Chapter II – Role of the Board 26. A list of the Board approved policies / limits to be formulated / set by the bank as well as reviews to be carried out by / put up to the Board are given below, with the details outlined in the ensuing paragraphs. (1) Board-approved policies and limits -

Policy for permitting an additional five percent exposure of the bank’s available eligible capital base beyond regulatory prescribed ceiling for exposure values of a bank to a single counterparty, in exceptional cases. -

Policy for determining connectedness among counterparties. -

Limits in respect of various sub-segments under consumer credit, particularly limits for unsecured consumer credit exposures. -

Policy fixing intra-day exposure limits to the capital markets. -

Limits for outstanding lending transactions in the call / notice / term money market within the large exposure limits prescribed for single counterparty / group of connected counterparties under LEF. -

Policy on monitoring and management of intra-group transactions and exposures (ITEs). -

Internal Ceiling, within the regulatory prescribed ceilings, for capital market exposure. -

Country exposure limits in relation to the bank’s regulatory capital (Tier I + Tier II) with sub-limits, if considered necessary for products, branches, maturity, etc. -

Regional exposure limits for country groups, at the discretion of its Board. (2) Review by / reporting to the Board - The following reviews and reporting shall be put up to the Board: -

Material ITEs. -

Dealings with group entities inconsistent with benchmarks set for third party / non-group entities. -

An annual review of the implementation of exposure management measures before the end of June. Chapter III - Large Exposure Framework A. Scope of Application 27. Large Exposure Framework (LEF) shall be applied by a Commercial Bank at the same level as the risk-based capital requirements are required to be applied i.e., at the following two levels: -

Consolidated (Group) level: A bank shall apply LEF at the consolidated group level, after consolidating the assets and liabilities of its subsidiaries / joint ventures / associates (including overseas operations through bank’s branches), excluding those engaged in insurance and any non-financial activities. The exposures of all entities within the banking group that are under regulatory scope of consolidation shall be considered and the aggregate of such exposures shall be compared with the banking group’s eligible consolidated capital base. -

Solo level: A bank shall apply LEF at the standalone level also (including overseas operations through branches), which should measure the exposures to a counterparty based on its standalone capital strength and risk profile. B. Scope of Counterparties and Exemptions 28. Under the LEF, a bank’s exposure to all its counterparties and groups of connected counterparties, excluding the exposures listed below, will be considered for exposure limits. The exposures that are exempted from the LEF for a bank are listed below: (1) exposures to the Government of India and State Governments which are eligible for zero percent Risk Weight under the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025; (2) exposures to the RBI; (3) exposures where the principal and interest are fully guaranteed by the Government of India; (4) exposures secured by financial instruments issued by the Government of India, to the extent that the eligibility criteria for recognition of the credit risk mitigation (CRM) are met in terms of paragraph 57 ; (5) exposures to foreign sovereigns or their central banks that are: -

subject to a zero percent risk weight under the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025 ; and -

denominated in the domestic currency of that sovereign and met out of resources of the same currency. (6) intra-day interbank exposures; (7) intra-group exposures (as governed by paragraphs 135 to 148); (8) borrowers, to whom limits are authorised for food credit; (9) clearing activities related exposures to Qualifying Central Counterparties (QCCPs), as detailed in paragraphs 93 to 98 of this Direction; and (10) contribution to deposits / funds maintained with NABARD, NHB, SIDBI, MUDRA Ltd., or any other entity specified by RBI, on account of shortfall in achievement of targets for priority sector lending; 29. Where two (or more) entities that are outside the scope of the sovereign exemption are controlled by or are economically dependent on an entity that falls within the scope of the sovereign exemption [paragraphs 28 (1) and (2) ], and are otherwise not connected, those entities will not be deemed to constitute a group of connected counterparties. 30. However, a bank’s exposure to an exempted entity which is hedged by a credit derivative shall be treated as an exposure to the counterparty providing the credit protection notwithstanding the fact that the original exposure is exempted. 31. All exempted exposures shall be reported by a bank as required under regulatory reporting specified in paragraph 34, if these exposures meet the criteria for definition of a ‘Large Exposure’ as per paragraph 18. 32. Lending under Consortium Arrangements: The exposure limits shall also be applicable to lending under Consortium / Multiple Banking / Syndication Arrangements. 33. Bills discounted under Letter of Credit (LC): In cases where the bills discounting / purchasing / negotiating bank and LC issuing bank are different entities, bills purchased / discounted / negotiated under LC (where the payment to the beneficiary is not made ‘under reserve'), may be treated as an exposure on the LC issuing bank and not on the third party / borrower. However, in cases where the bills discounting / purchasing / negotiating bank and LC issuing bank are part of the same bank, i.e. where LC is issued by the Head Office or branch of the same bank, then the exposure should be taken on the third party / borrower and not on the LC issuing bank. In the case of negotiations ‘under reserve', the exposure should be treated as on the borrower. C. Reporting 34. A bank shall report its large exposure to the RBI, Department of Supervision, Central Office, (DOS, CO), as per the reporting template given in Annex – II. The reporting, inter-alia, shall include the following: -

all exposures, measured as specified in paragraphs 52 to 105 of this Chapter with values equal to or above 10 percent of the bank’s eligible capital (i.e., meeting the definition of a large exposure as per paragraph 18); -

all other exposures, measured as specified in paragraphs 52 to 105 of this Chapter without the effect of the CRM, with values equal to or above 10 percent of the bank’s eligible capital base; -

all the exempted exposures (except intra-day inter-bank exposures) with values equal to or above 10 percent of the bank’s eligible capital base; and -

20 largest exposures included in the scope of application, irrespective of the values of these exposures relative to the bank’s eligible capital base. D. The Large Exposure limits D.1 Single Counterparty 35. The sum of all the exposure values of a bank to a single counterparty shall not be higher than 20 percent of the bank’s available eligible capital base at all times. In exceptional cases, the Board of the bank may allow an additional five percent exposure of the bank’s available eligible capital base. The bank shall lay down a Board approved policy in this regard. D.2 Group of Connected Counterparties: 36. The sum of all the exposure values of a bank to a group of connected counterparties (as defined in paragraphs 39 to 51) shall not be higher than 25 percent of the bank’s available eligible capital base at all times. 37. The exposures shall be measured as specified in paragraphs 52 to 105 of these Directions. It may be noted that the LE limits will be modulated in case of certain counterparties as mentioned in paragraphs 93 to 105 of these Directions. 38. Any breach of the LE limits prescribed in paragraphs 35 and 36 above shall be under exceptional conditions beyond the control of the bank, and shall be reported to the RBI (DOS, CO) immediately and rapidly rectified. E. Definition of Connected counterparties 39. In some cases, a bank may have exposures to a group of counterparties with specific relationships or dependencies such that, were one of the counterparties to fail, all of the counterparties would very likely fail. A group of this sort, referred to in this Chapter as a group of connected counterparties, shall be treated as a single counterparty. In this case, the sum of the bank’s exposures to all the individual entities included within a group of connected counterparties is subject to the large exposure limit, as mentioned at paragraph 36, and to the regulatory reporting requirements as specified above. 40. Two or more natural or legal persons shall be deemed to be a group of connected counterparties if at least one of the following criteria is satisfied: (1) Control relationship Criteria: where one of the counterparties, directly or indirectly, has control over the other(s) or the counterparties are, directly or indirectly, controlled by a third party (a bank may or may not have exposure towards this third party). (i) Explanation: In case of financial problems of the controlling entity, it is highly likely that the controlling entity could make use of its ability to extract capital and / or liquidity from the controlled entity, thereby weakening the financial position of the latter. Financial problems could be transferred to the controlled entity, with the result that both the controlling entity and the controlled entity would experience financial problems (domino effect). From prudential perspective, these types of clients (connected by control) form a single risk. (2) Economic interdependence Criteria: If one of the counterparties were to experience financial problems, in particular funding or repayment difficulties, the other(s), as a result, would also be likely to encounter funding or repayment difficulties. 41. A bank shall assess the relationship amongst counterparties with reference to paragraphs 40 (1) and 40 (2) in order to establish the existence of a group of connected counterparties. In assessing whether there is a control relationship between counterparties, the bank shall automatically consider that the control relationship criterion [paragraph 40(1) ] is satisfied if one entity owns more than 50 percent of the voting rights of the other entity. In addition, the bank shall assess connectedness between counterparties based on control using the following evidences: -

voting agreements (e.g., control of a majority of voting rights pursuant to an agreement with other shareholders); -

significant influence on the appointment or dismissal of an entity’s administrative, management or supervisory body, such as the right to appoint or remove a majority of members in those bodies, or the fact that a majority of members have been appointed solely as a result of the exercise of an individual entity’s voting rights; -

significant influence on senior management, e.g., an entity has the power, pursuant to a contract or otherwise, to exercise a controlling influence over the management or policies of another entity (e.g., through consent rights over key decisions, to decide on the strategy or direct the activities of an entity, to decide on crucial transactions such as transfer of profit or loss); and -

the above criteria may also be assessed with respect to a common third party (such as holding company), irrespective of whether the bank has an exposure to that entity or not. 42. A bank is also expected to refer to criteria specified in the extant accounting standards for further qualitative guidance when determining control. 43. While determining control relationship, a bank shall also examine cases where clients have common owners, shareholders or managers; for example, horizontal groups where an undertaking is related to one or more other undertakings because they all have the same shareholder structure without a single controlling shareholder or because they are managed on a unified basis. This management may be pursuant to a contract concluded between the undertakings, or to provisions in the memoranda or articles of association of those undertakings, or if the administrative management or supervisory bodies of the undertaking and of one or more other undertakings consist, for the major part, of the same persons. 44. Where control has been established based on any of the above criteria, a bank may still demonstrate to the RBI in exceptional cases (e.g., existence of control between counterparties due to specific circumstances and corporate governance safeguards) that such control does not necessarily result in the entities concerned constituting a group of connected counterparties. (1) Explanation: For example, in specific cases where a special purpose entity (SPE) that is controlled by another client (e.g. an originator) is fully ring-fenced and bankruptcy remote (i.e., arrangements exist to the effect that assets of SPE are not available to lenders of parent undertaking in the event of insolvency of the parent undertaking) – so that there is no possible channel of contagion. Hence, no single risk exists between the SPE and the controlling parent entity. 45. In establishing connectedness based on economic interdependence, a bank shall consider, at a minimum, the following criteria: -

where 50 percent or more of one counterparty's gross receipts or gross expenditures (on an annual basis) is derived from transactions with the other counterparty; -

where one counterparty has fully or partly guaranteed the exposure of the other counterparty, or is liable by other means, and the exposure is so significant that the guarantor is likely to default if a claim occurs; -

where a significant part of one counterparty’s production / output is sold to another counterparty, which cannot easily be replaced by other customers; -

when the expected source of funds to repay the loans of both counterparties is the same and neither counterparty has another independent source of income from which the loan may be serviced and fully repaid; -

where it is likely that the financial problems of one counterparty would cause difficulties for the other counterparties in terms of full and timely repayment of liabilities; -

where the insolvency or default of one counterparty is likely to be associated with the insolvency or default of the other(s); and -

when two or more counterparties rely on the same source for the majority of their funding and, in the event of the common provider’s default, an alternative provider cannot be found - in this case, the funding problems of one counterparty are likely to spread to another due to a one-way or two-way dependence on the same main funding source. 46. The illustrative examples of economic interdependence criteria are given below: (1) Requirement: Both A and B are customers of a bank and the exposure of the bank to each of them is more than five percent of its eligible capital base (i.e. Tier-1 capital). (i) Where 50 percent or more of one counterparty's gross receipts or gross expenditures (on an annual basis) is derived from transactions with the other counterparty; Illustrative Example: Company A is a commercial space provider and company B utilises a major portion of this space and accounts for more than 50 percent of gross receipts for Counterparty A. (ii) Where one counterparty has fully or partly guaranteed the exposure of the other counterparty, or is liable by other means, and the exposure is so significant that the guarantor is likely to default if a claim occurs; Illustrative Example: Company A fully or partly guarantees the loans undertaken by company B and the guarantee is so large that it could result in default in payments for A if it is invoked. The bank may consider parameters like networth, EBITDA, liquid assets, etc., to assess whether the guarantor will be in a position to honour the claim on an on-going basis. (iii) Where a significant part of one counterparty’s production / output is sold to another counterparty, which cannot easily be replaced by other customers; Illustrative Example: When a significant part of product / output / services of Company A is sold to Company B and there are no alternate buyers who can be approached if B fails to buy, in such a case goods may remain unsold and could lead to default in loan repayment by A. An auto part supplier and auto manufacturing firm could be part of the same economically dependent group based on this criteria. For deciding if the criteria would be applicable to the counterparties under consideration, the bank may use financial criteria like unsold inventory leading to operating loss / default in repayment as well as subjective criteria like ability of the seller to find alternate buyer / market, R&D capability of the seller, etc. (iv) When the expected source of funds to repay the loans of both counterparties is the same and neither counterparty has another independent source of income from which the loan may be serviced and fully repaid; Illustrative Example: Two auto component manufacturers i.e. company A and company B are suppliers to a commercial vehicle manufacturer i.e. company C. Source of funds for repayment of loans taken by A and B is dependent on sales to C. In this case, A and B are connected to each other based on the criteria of economic interdependence. Important factors to consider would be extent of dependence of A and B on C, ability of A and B to find another buyer, etc. (v) Where it is likely that the financial problems of one counterparty would cause difficulties for the other counterparties in terms of full and timely repayment of liabilities; Illustrative Example: Company A supplies intermediate goods to Company C. Company C processes these goods and then sells it to company B. In such cases, difficulties at A could lead to difficulties for B. In such cases A and B are economically dependent. The bank may consider factors like financial strength of counterparty B to withstand the shock, its ability to find alternate supplier in place of C, etc. to decide on applicability of the criteria. (vi) Where the insolvency or default of one counterparty is likely to be associated with the insolvency or default of the other(s); Illustrative Example: Examples would include all such cases where insolvency or default of one company may lead to the insolvency or default of the other companies. The bank may use criteria such as intercorporate liabilities, significant trade receivables, etc. to decide on applicability of the criteria. (vii) When two or more counterparties rely on the same source for the majority of their funding and, in the event of the common provider's default, an alternative provider cannot be found - in this case, the funding problems of one counterparty are likely to spread to another due to a one-way or two-way dependence on the same main funding source; Illustrative Example: Company A and Company B rely on the same non-bank source for their funding requirements and may not have access to alternative sources of funds. In such cases, difficulties at common source could lead to difficulties at both the companies and thus these companies are interconnected based on economic interdependence. Important factors to consider would be strength of A and B to decide alternate source of funds, likelihood of failure of the non-bank source, etc. (2) Economic interdependence with two different entities: If an entity (C) is economically dependent on two (or more) other entities (A and B) then payment difficulty of any one of the entities (A or B) may cause payment difficulties to dependent entity (C). Thus, C needs to be added in two different groups (A and C; B and C). Since exposure to C is considered as single risk for two separate groups, it does not amount to double counting of exposure of C. 47. There may, however, be circumstances where some of these criteria do not automatically imply an economic dependence that results in two or more counterparties being connected. Provided that the bank can demonstrate that a counterparty which is economically closely related to another counterparty may overcome financial difficulties, or even the second counterparty’s default, by finding alternative business partners or funding sources within an appropriate time period, the bank does not need to combine these counterparties to form a group of connected counterparties. 48. In order to avoid cases where a thorough investigation of economic interdependencies will not be proportionate to the size of the exposures, a bank is expected to identify possible connected counterparties on the basis of economic interdependence in all cases where the sum of all exposures to one individual counterparty exceeds five percent of the eligible capital base, and not in other cases. 49. Relation between interconnectedness through control and interconnectedness through economic dependency: Group of counterparties based on control and economic interdependence shall be assessed separately. However, there may be situations where the two types of dependencies are interlinked and could therefore exist within one group of connected counterparties in such a way that all relevant clients constitute a single risk. Risk of contagion is present irrespective of type of connectedness (i.e. control or economic interdependence) between counterparties. The chain of contagion leading to possible default of all entities concerned is the relevant factor for the grouping and needs to be assessed in each individual case. 50. The following examples provide illustrations for formulation of groups in case of one-way dependency and two-way dependencies. (1) One way Dependency: Consider A controls A1 and A2, and B controls B1, and B1 is economically dependent on A2 (one-way dependency only i.e. financial difficulties at A2 could impact B1 but not vice versa). In this case, B1 should be part of two separate groups of A and B. (i) Three different groups of (a) A, A1, A2, (b) B, B1, (c) A2, B1, may not be sufficient as financial difficulties of A2 is likely to cause difficulties for B1 also which is economically dependent on A2 (which in turn is dependent on A). (2) Two Way Dependency: Consider that A2 and B1 have two-way economic dependency i.e. both are economically dependent on each other, which means that financial difficulty at either entity could impact the other entity. (i) Downstream Contagion: Downstream contagion should be assumed when an entity is economically dependent on another entity and is itself the head of a ‘control group’. If the other entity is part of a group of connected clients, the control group of the economically dependent entity should then be included in the group of connected counterparties to which the economic dependency relationship exists. To overcome its own pending payment difficulties, the economically dependent entity is likely to withdraw resources from controlled entities, thus extending the risk of contagion downstream. Consider A controls A1 and A2, and B controls B1, and B1 controls B2 and B3. Further, consider B1 has one-way economic dependency on A2. If A2 faces financial difficulty, it may impact B1 adversely, which then is likely to withdraw resources from its controlled entities B2 and B3. (ii) Upstream Contagion: On the other hand, upstream contagion of entities that control the economically dependent entity should be assumed only when the controlling entity is also economically dependent on the entity that constitutes the economic link between the two controlling groups. For instance, in the above example of downstream contagion, if B1 is so important to B that in a sense B is also dependent on B1, then contagion at A could also spread to B, through A→A2→B1→B and all these entities would form a single group.  (iii) Limitations in formulating groups of connected counterparties: If a bank is not having exposure to all the entities, it may be difficult to accurately form group of connected counterparties. Such groups shall be formed on best efforts basis and the bank should take reasonable steps to collect and use relevant information; this includes publicly available information (e.g. annual financial statements), information beyond institutions’ clients and also soft information that typically exists at the level of individual loan officers and relationship managers. If there are interconnections among entities that are not clients of the bank, it may be difficult for the bank to formulate correct groupings. However, the bank should incorporate any information that may be available to it publicly or through other clients or entities outside its clientele. For instance, in illustration shown below, if a bank has exposure to A and B5 only, then it may be difficult to formulate correct groupings. 51. The bank shall frame a Board-approved policy for determining connectedness using the criteria mentioned above. The policies are subject to supervisory scrutiny. F. Values of exposures F.1 General measurement principles 52. Under LEF, an exposure to a counterparty shall constitute both on and off-balance sheet exposures included in either the banking or trading book and instruments with counterparty credit risk. F.2 Exposure values under the LEF 53. Banking book on-balance sheet non-derivative assets: The exposure value is defined as the accounting value of the exposure (net of specific provisions and value adjustments). As an alternative, a bank may consider the exposure value gross of specific provisions and value adjustments. 54. Banking book and trading book OTC derivatives (and any other instrument with counterparty credit risk): The exposure value for instruments which give rise to counterparty credit risk and are not securities financing transactions, should be determined as per the RBI’s extant instructions for the counterparty credit risk contained in Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. 55. Securities financing transactions (SFTs): A bank shall use the method they currently use for calculating its risk-based capital requirements against SFTs. 56. Banking book ‘traditional’ off-balance sheet commitments: Off-balance sheet items will be converted into credit exposure equivalents through the use of credit conversion factors (CCFs) by applying the CCFs set out for the Standardised Approach for credit risk for risk-based capital requirements, with a floor of 10 percent. F.3 Eligible CRM techniques 57. Eligible CRM techniques for LEF purposes are those that meet the minimum requirements and eligibility criteria for the recognition of unfunded credit protection and financial collateral that qualify as eligible financial collateral under the Standardised Approach for credit risk for risk-based capital requirement purposes. Explanation: Unfunded credit protection refers collectively to credit derivatives and guarantees described in (The standardised approach – credit risk mitigation) of the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. 58. Other forms of collaterals that are only eligible under the Internal-Ratings based (IRB) Approach (receivables, commercial and residential real estate, and other collateral) are not eligible to reduce exposure values for LEF purposes. 59. A bank shall recognise an eligible CRM technique in the calculation of an exposure whenever it has used this technique to calculate the risk-based capital requirements, provided it meets the conditions for recognition under the LEF. 60. Treatment of maturity mismatches in CRM: In accordance with provisions set out in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025, hedges with maturity mismatches shall be recognised only when their original maturities are equal to or greater than one year and the residual maturity of a hedge is not less than three months. 61. If there is a maturity mismatch in respect of credit risk mitigants (collateral, on-balance sheet netting, guarantees and credit derivatives) recognised in the risk-based capital requirement, the adjustment of the credit protection for the purpose of calculating large exposures shall be determined using the same approach as in the risk-based capital requirement mentioned in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. 62. On-balance sheet netting: Where a bank has in place legally enforceable netting arrangements for loans and deposits, it may calculate the exposure values for LE purposes according to the calculation it uses for capital requirements purposes – i.e., on the basis of net credit exposures subject to the conditions set out in the approach to on-balance sheet netting in the risk-based capital requirement mentioned in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. 63. Indian branches of foreign banks (1) The Indian branches of foreign banks shall be permitted to reckon cash / unencumbered approved securities, the source of which is interest-free funds from Head Office or remittable surplus retained in Indian books (reserves), held with RBI under Section 11(2)(b)(i) of the Banking Regulation Act,1949 (‘BR Act’) as CRM, for offsetting the gross exposure of the foreign bank branches in India to the Head Office (including overseas branches) for the calculation of LEF limit, subject to the following conditions: -

The amount so held shall be over and above the other regulatory and statutory requirements and shall be certified by the statutory auditors. -

The amount so held shall not be included in regulatory capital (i.e., no double counting of the fund placed under Section 11(2)(b)(i) of BR Act as both capital and CRM). Accordingly, while assessing the capital adequacy of a bank, the amount will form part of regulatory adjustments made to Common Equity Tier 1 Capital. -

The bank shall furnish an undertaking as on March 31 every year to the RBI (DOS, CO) that the balance reckoned as CRM for the purpose will be maintained on a continuous basis. -

The CRM shall be compliant with the principles / conditions prescribed the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. (2) The amount held under Section 11(2)(b)(i) of the BR Act and earmarked as CRM shall be disclosed by way of a note in Schedule 1: Capital to the Balance Sheet as outlined in Master Direction (Financial Statements - Presentation and Disclosures): “An amount of ₹… (previous year: ₹…. ) out of the amount held as deposit under Section 11(2) of the Banking Regulation Act, 1949 has been designated as credit risk mitigation (CRM) for offsetting of non-centrally cleared derivative exposures to Head Office (including overseas branches), and is not reckoned for regulatory capital and any other statutory requirements.” (3) Excess amount over and above the CRM requirements shall be permitted to be withdrawn subject to certification by the Statutory Auditor and approval of the RBI (DOS). The onus of compliance with the LEF limit at all times shall be on the bank. (4) A foreign bank shall be permitted to exclude derivative contracts executed prior to April 1, 2019 while computing the derivative exposures on its Head Office (including overseas branches). F.4 Recognition of CRM techniques in reduction of original exposure 64. Under the LEF, a bank may reduce the value of the exposure to the original counterparty by the amount of the eligible CRM technique (except for cases mentioned in paragraph 67 below) recognised for risk-based capital requirements purposes. 65. This recognised amount is: -

the value of the protected portion in the case of unfunded credit protection; -

the value of the collateral as recognized in calculation of the counterparty credit risk exposure value for any instruments with counterparty credit risk, such as OTC derivatives; and -

the value of the collateral adjusted after applying the required haircuts, in the case of financial collateral. The haircuts used to reduce the collateral amount are the supervisory haircuts under the comprehensive approach as specified in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. F.5 Recognition of exposures to CRM providers 66. Where a bank reduces its exposure to the original counterparty on account of an eligible CRM instrument provided by another counterparty (CRM provider) with respect to that exposure, it shall also recognise an exposure to the CRM provider. The amount assigned to the CRM provider will be the amount by which the exposure to the original counterparty is reduced (except in the cases defined in paragraph 67). Note: Any CRM instrument (e.g. SBLC / BG from Head Office / other overseas branch) from which CRM benefits like shifting of exposure / risk weights, etc., are not derived, may not be counted as an exposure on the CRM provider. This proviso will also apply to non-fund based credit facilities provided to a person resident outside India i.e., the exposure can be reckoned on the person resident outside India instead of treating it as an exposure on Head Office / other overseas branch, provided the transaction is otherwise compliant with Foreign Exchange Management (Guarantees) Regulations, 2000 (FEMA 8). The exposures thus shifted to a person resident outside India, will attract a minimum risk weight of 150 percent. 67. When the credit protection takes the form of a credit default swap (CDS) and either the CDS provider or the referenced entity is not a financial entity, the amount to be assigned to the credit protection provider is not the amount by which the exposure to the original counterparty is reduced but will be equal to the counterparty credit risk exposure value calculated according to methodology prescribed in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. For the purpose of this paragraph, financial entities comprise: -

Regulated financial institutions, defined as a parent and its subsidiaries where any substantial legal entity in the consolidated group is supervised by a regulator that imposes prudential requirements consistent with international norms. These include, but are not limited to, prudentially regulated insurance companies, broker / dealers, banks; and -

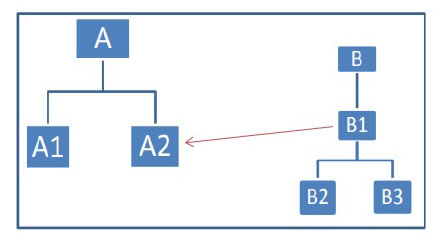

Unregulated financial institutions, defined as legal entities whose main business includes: the management of financial assets, lending, factoring, leasing, provision of credit enhancements, securitisation, investments, financial custody, central counterparty services, proprietary trading and other financial services activities identified by supervisors. F.6 Calculation of exposure value for Trading Book positions 68. A bank shall add any exposures to a counterparty arising in the trading book to any other exposures to that counterparty that lie in the banking book to calculate its total exposure to that counterparty. The exposures considered here correspond to concentration risk associated with the default of a single counterparty for exposures included in the trading book. Therefore, the bank’s exposures to financial instruments issued by counterparties not exempted under this Chapter shall be governed by the LE limit, but concentrations in a particular commodity or currency will not be. 69. The exposure value of straight debt instruments and equities shall be equal to the market value of the exposure as provided in Reserve Bank of India (Commercial Banks – Classification, Valuation and Operation of Investment Portfolio) Directions, 2025. 70. Instruments such as swaps, futures, forwards and credit derivatives shall be converted into positions following the risk-based capital requirements mentioned in the Reserve Bank of India (Commercial Banks – Prudential Norms on Capital Adequacy) Directions, 2025. These instruments should be decomposed into their individual legs. Only transaction legs representing a bank’s exposures to the counterparty within the scope of the LEF should be considered for calculating the bank’s total exposure to that counterparty. Explanation: -

CDS is the only credit derivative allowed under RBI’s extant guidelines and banks do not have direct exposures to the equity derivatives. The restrictions on dealing with certain type of instruments, assets and derivatives etc., which are currently in place shall continue to be applicable even if the guidelines contained in this circular contains references to the same. -

A future on stock X, for example, is decomposed into a long position in stock X and a short position in a risk-free interest rate exposure in the respective funding currency, or a typical interest rate swap is represented by a long position in a fixed and a short position in a floating interest rate exposure or vice versa. 71. In the case of credit derivatives that represent sold protection, the exposure will be to the referenced name, and it will be the amount due in case the respective referenced name triggers the instrument, minus the absolute value of the credit protection. Explanation: In the case that the market value of the credit derivative is positive from the perspective of the protection seller, such a positive market value shall be added to the exposure of the protection seller to the protection buyer (counterparty credit risk; see paragraph 54). Such a situation could typically occur if the present value of already agreed but not yet paid periodic premiums exceeds the absolute market value of the credit protection. 72. In the case of credit-linked notes (CLNs), the protection seller bank shall be required to consider its positions both in the bond of the note issuer and in the underlying referenced by the note. Currently, the issuance of CLNs by banks in India are not permitted under the extant RBI guidelines. The measures of exposure values of options (primarily meant for credit and equity options, where permitted) under this Chapter differ from the exposure values used for risk-based capital requirements. The exposure value of option under this Chapter shall be based on the change(s) in option prices that would result from a default of the respective underlying instrument. The exposure value for a simple long call option would therefore be its market value and for a short put option would be equal to the strike price of the option minus its market value. In the case of short call or long put options, a default of the underlying would lead to a profit (i.e., a negative exposure) instead of a loss, resulting in an exposure of the option’s market value in the former case and equal the strike price of the option minus its market value in the latter case. The resulting positions in all cases should be aggregated with those from other exposures. After aggregation, negative net exposures shall be treated as zero. 73. Exposure values of a bank’s investments in transactions (i.e., index positions, securitisations, hedge funds or investment funds) shall be calculated applying the same rules as for similar instruments in the banking book (see paragraphs 83 to 90). F.7 Offsetting long and short positions in the trading book 74. Offsetting between long and short positions in the same issue: A bank may offset long and short positions in the same issue (two issues are defined as the same if the issuer, coupon, currency and maturity are identical). Consequently, the bank may consider a net position in a specific issue for the purpose of calculating its exposure to a particular counterparty. 75. Offsetting between long and short positions in different issues: Positions in different issues from the same counterparty may be offset only when the short position is junior to the long position, or if the positions are of the same seniority. 76. Similarly, for positions hedged by credit derivatives, the hedge may be recognised provided the underlying of the hedge and the position hedged fulfil the provision of paragraph 75 (the short position is junior or of equivalent security to the long position). 77. In order to determine the relative seniority of positions, securities may be allocated into broad buckets of degrees of seniority (for example, ‘Equity’, ‘Subordinated Debt’, and ‘Senior Debt’). 78. If a bank finds it excessively burdensome to allocate securities to different buckets based on relative seniority, it shall not recognise offsetting of long and short positions in different issues relating to the same counterparty in calculating exposures. 79. Offsetting short positions in the trading book against long positions in the banking book: Netting across the banking and trading books is not permitted. 80. Net short positions after offsetting: When the result of the offsetting is a net short position with a single counterparty, this net exposure may not be considered as an exposure for the purposes of LEF. G. Treatment of specific exposure types 81. The ensuing paragraphs cover exposures for which a specific treatment is deemed necessary. G.1 Interbank Exposures 82. The interbank exposures, except intra-day interbank exposures, shall be subject to the large exposure limit of 25 percent of a bank’s Tier 1 capital (also refer to paragraphs 102-105). In stressed circumstances, the RBI may accept a breach of an interbank limit ex post, in order to help ensure stability in the interbank market. G.2 Collective Investment Undertakings (CIUs), securitisation vehicles and other structures - adoption of ‘Look Through Approach’ (LTA) 83. There are cases when a structure lies between a bank and its exposures, that is, the bank in structures which themselves have exposures to assets underlying the structures (hereafter referred to as the ‘underlying assets’). Such structures include funds (such as mutual funds, venture capital funds, alternative investment funds), securitisations and other structures (such as investment in security receipts, real estate investment trusts, infrastructure investment trusts) with underlying assets. The bank shall assign such exposure amount, i.e., the amount invested in a particular structure, to specific counterparties of the underlying assets following the LTA described below: (1) Look-Through Approach - a flow chart (2) Look-Through Approach - An Illustrative example (i) Bank’s eligible capital base: 1000 (ii) Corpus of structure: 500 (iii) Bank’s investment in structure: 100 (which is 10 percent of eligible capital base i.e. more than 0.25 percent of eligible capital base) (iv) Exposure values as per look-through approach: | | Investment of structure in that underlying | Bank's exposure to underlying through structure | Bank's other direct / indirect exposure to underlying | Total exposure to underlying | | | Amount | as percent of corpus | Amount | as percent of eligible capital base | Amount | as percent of eligible capital base | Amount | as percent of eligible capital base | | Underlying 1 | 125 | 25.00% | 25 | 2.50% | 200 | 20.00% | 225 | 22.50% | | Underlying 2 | 10 | 20.00% | 20 | 2.00% | 150 | 15.00% | 170 | 17.00% | | Underlying 3 | 90 | 18.00% | 18 | 1.80% | 100 | 10.00% | 118 | 11.80% | | Underlying 4 | 75 | 15.00% | 15 | 1.50% | 80 | 8.00% | 95 | 9.50% | | Underlying 5 | 50 | 10.00% | 10 | 1.00% | 70 | 7.00% | 80 | 8.00% | | Underlying 6 | 30 | 6.00% | 6 | 0.60% | 50 | 5.00% | 56 | 5.60% | | Underlying 7 | 20 | 4.00% | 4 | 0.40% | 100 | 10.00% | 104 | 10.40% | | Underlying 8 | 10 | 2.00% | 2 | 0.20% | 150 | 15.00% | 152 | 15.20% | (v) Note: -

Exposure to underlying 8 (which is less than 0.25 percent of eligible capital base) may be counted as exposure on structure itself. Consequently, for underlying 8 total exposure to underlying will be 15.00 percent or 15.20 percent at the option of the bank. -

Had the bank been not able to identify underlying exposures, entire exposure to the structure (i.e. 100, which is greater than 0.25 percent of eligible capital base) would be exposure on ‘unknown client’. All such unknown clients would be treated as a single counterparty and single counterparty limit would apply on aggregate exposure to all such unknown clients. 84. The bank may assign the exposure amount to the structure itself, defined as a distinct counterparty, if it can demonstrate that the bank’s exposure amount to each underlying asset of the structure is smaller than 0.25 percent of its eligible capital base, considering only those exposure to underlying assets that result from the investment in the structure itself and using the exposure value calculated according to paragraphs 89 and 90. In this case, a bank may not look through the structure to identify the underlying assets. 85. The bank shall look through the structure to identify those underlying assets for which the underlying exposure value is equal to or above 0.25 percent of its eligible capital base. In this case, the counterparty corresponding to each of the underlying assets shall be identified so that these underlying exposures can be added to any other direct or indirect exposure to the same counterparty. The bank’s exposure amount to the underlying assets that are below 0.25 percent of the bank’s eligible capital base may be assigned to the structure itself (i.e. partial look-through is permitted). 86. If a bank is unable to identify the underlying assets of a structure: -

Where the total amount of the bank’s exposures to a structure does not exceed 0.25 percent of its eligible capital base, it shall assign the total exposure amount to the structure itself, as a distinct counterparty. -

Otherwise (i.e., if the exposure to the structure equals or exceeds 0.25 percent of its eligible capital base), it shall assign this total exposure amount to the ‘unknown client’. The large exposure limit shall apply on the aggregate of all such exposures to ‘unknown clients’ as if they are a single counterparty. 87. Where the LTA is not required (paragraph 84), a bank shall nevertheless be able to demonstrate that regulatory arbitrage considerations have not influenced the decision whether to look through or not – e.g. that the bank has not circumvented the LE limit by investing in several individually immaterial transactions with identical underlying assets. 88. If LTA need not be applied, a bank’s exposure to the structure shall be the nominal amount it invests in the structure. 89. Any structure where all investors rank pari passu (e.g., CIU): When the LTA is required according to the paragraphs above, the exposure value assigned to a counterparty is equal to the pro rata share that the bank holds in the structure multiplied by the value of the underlying asset in the structure. Thus, a bank holding a ₹1 investment in a structure, which invests in 20 assets each with a value of ₹ 5, shall assign an exposure of ₹ 0.05 to each of the counterparties. An exposure to such counterparty shall be added to any other direct or indirect exposures the bank has to that counterparty. 90. Any structure with different seniority levels among investors (e.g. securitisation vehicles): When the LTA (in terms of paragraphs above) is required for an investment in a structure with different levels of seniority, the exposure value to a counterparty should be measured for each tranche within the structure, assuming a pro rata distribution of losses amongst investors in a single tranche. To compute the exposure value to the underlying asset, a bank shall: -

first, consider the lower of the value of the tranche in which the bank invests and the nominal value of each underlying asset included in the underlying portfolio of assets; and -

second, apply the pro rata share of the bank’s investment in the tranche to the value determined in the first step above. H. Identification of additional risks 91. While taking exposures to structures, a bank should identify such third parties which may constitute an additional risk factor, and which are inherent in the structure itself rather than in the underlying assets. Such a third party could be a risk factor for more than one structure that a bank invests in. Examples of roles played by third parties include originator, fund manager, liquidity provider and credit protection provider. RBI as a part of its pillar 2 supervisory review and evaluation process will look into this aspect and if required specify a specific course of action which may either include reduction in exposure or raising of additional capital. 92. The bank may consider multiple third parties to be potential drivers of additional risk. In this case, the bank shall assign the exposure resulting from the investment in the relevant structures to each of the third parties. I. Exposures to and among certain specific counterparties I.1 Exposures to Central Counterparties 93. A bank’s exposures to QCCPs related to clearing activities shall be exempted from the LEF. However, these exposures shall be subject to the regulatory reporting requirements as defined in paragraph 34. 94. In the case of non-QCCPs, a bank shall measure its exposure as a sum of both the clearing exposures described in paragraph 96 and the non-clearing exposures described in paragraph 98, and the same shall be subject to the LE limit of 25 percent of the eligible capital base. 95. The concept of connected counterparties described in paragraphs 39 to 51 shall not apply in the context of exposures to CCPs that are specifically related to clearing activities. I.1.1 Calculation of exposures related to clearing activities 96. A bank shall identify exposures to a CCP related to clearing activities and sum together these exposures. Exposures related to clearing activities are listed in the table below together with the exposure value to be used: | Trade exposures | The exposure value of trade exposures shall be calculated using the exposure measures prescribed in other parts of this framework for the respective type of exposures. | | Segregated initial margin | The exposure value is 0.

Explanation: When the initial margin (IM) posted is bankruptcy-remote from the CCP – in the sense that it is segregated from the CCP’s own accounts, e.g., when the IM is held by a third-party custodian – this amount cannot be lost by the bank if the CCP defaults; therefore, the IM posted by the bank can be exempted from the large exposure limit. | | Non-segregated initial margin | The exposure value is the nominal amount of initial margin posted. | | Pre-funded default fund contributions | Nominal amount of the funded contribution | | Unfunded default fund contributions | The exposure value is 0 | 97. Regarding exposures subject to clearing services (the bank acting as a clearing member or being a client of a clearing member), the bank shall determine the counterparty to which exposures should be assigned by applying the provisions of the risk-based capital requirements. I.1.2 Other exposures 98. Other types of exposures that are not directly related to clearing services provided by the CCP, such as equity stake funding facilities, credit facilities, guarantees etc., shall be measured according to the rules set out in these Directions, as for any other type of counterparty. These exposures shall be added together and be subjected to the LE limit of 25 percent of the eligible capital base Provided that, if equity stakes in the CCP are deducted from the capital on which the large exposure limit is based, these shall not be included as exposure to the CCP. I.2 Exposures to NBFCs I.2.1 Exposure Ceilings proposed under LEF 99. Exposure to an NBFC excluding gold loan company: A bank’s exposure to a single NBFC will be restricted to 20 percent of its eligible capital base. However, based on the risk perception, more stringent exposure limits in respect of certain categories of NBFCs may be considered. 100. Exposure to an NBFC predominantly engaged in lending against collateral of gold jewellery: A bank’s exposure to a single NBFC which is predominantly engaged in lending against collateral of gold jewellery (hereafter referred to as ‘gold loans’) i.e. such loans comprising 50 percent or more of its financial assets, shall not exceed 7.5 percent of the bank’s capital funds (Tier I plus Tier II Capital). However, this exposure ceiling may go up by 5 percent, i.e., up to 12.5 percent of a bank’s capital funds if the additional exposure is on account of funds on-lent by such NBFCs to the infrastructure sector. 101. Exposure to connected NBFCs: A bank’s exposure to a group of connected NBFCs or group of connected counterparties having NBFCs in the group will be restricted to 25 percent of its Tier I Capital. I.3 Large exposures rules for global systemically important banks (G-SIBs) and domestic systemically important banks (D-SIBs) 102. The LE limit applied to a G-SIB’s exposure to another G-SIB is set at 15 percent of the eligible capital base. 103. The LE limit of a non G-SIB in India to a G-SIB in India or overseas will be 20 percent of the eligible capital base. 104. For above paragraphs, the limit applies to G-SIBs as identified by the Basel Committee and published annually by the FSB. When a bank becomes a G-SIB, it shall apply the 15 percent exposure limit to another G-SIB within 12 months from the date of becoming G-SIB, which is the same time frame within which a bank that has become a G-SIB would need to satisfy its higher loss absorbency capital requirement. Similarly, when a counterparty bank becomes G-SIB, the bank shall apply limits as indicated in paragraph 102 or 103, as applicable, within 12 months from the date of counterparty bank becoming G-SIB. For the purpose of computing exposure limits under LEF, Indian branches of foreign G-SIBs will not be considered as GSIBs. Accordingly, for Indian branches of foreign G-SIBs, exposure limit on their head office (including other overseas branches / subsidiaries of head office) and other G-SIBs will be 20 percent of eligible capital base and exposure limit on any other bank (i.e. not G-SIB) will be 25 percent of eligible capital base. Similarly, for Indian branches of foreign non-GSIBs, exposure limit on their head office (including other overseas branches / subsidiaries of head office) and other non-GSIBs will be 25 percent of eligible capital base and exposure limit on a G-SIB will be 20 percent of eligible capital base. 105. The RBI has issued the Framework for dealing with Domestic Systemically Important Banks (D-SIBs) on July 22, 2014 and discloses names of the banks classified as D-SIBs on an annual basis. There is no separate exposure limit applicable to D-SIBs and they will continue to be governed by interbank exposure limits under the LEF. Chapter IV - Enhancing Credit Supply for Large Borrowers through Market Mechanism A. Scope of application 106. The instructions provide a framework for addressing the concentration risk in the banking system arising from exposures to a single counterparty. The bank shall exercise due diligence while deciding the normally permitted lending limits for a single borrower to ensure that borrowers do not circumvent the aggregate sanctioned credit limit criteria by borrowing through dummy / fictitious group companies. B. Prudential Measures 107. Incremental exposure of the banking system to a specified borrower beyond NPLL shall be deemed to carry higher risk, which shall be recognised by way of additional provisioning and higher risk weights as under. However, additional risk weight on incremental exposure merely on account of a borrower being classified as a specified borrower, should not normally result in change in credit rating. (1) Additional provisions of three percentage points over and above the applicable provision on the incremental exposure of the banking system in excess of NPLL, which shall be distributed in proportion to each bank’s funded exposure to the specified borrower. (2) Additional Risk weight of 75 percentage points over and above the applicable risk weight for the exposure to the specified borrower. The resultant additional risk weighted exposure, in terms of risk weighted assets (RWA), shall be distributed in proportion to each bank’s funded exposure to the specified borrower. Note: For the purpose of determining exposure beyond NPLL, subscription by the banking system to market instruments shall be included. 108. Restructured accounts, where cut off ASCL is achieved / likely to be achieved due to additional finance extended under a restructuring scheme, in terms of the Reserve Bank of India (Commercial Banks – Resolution of Stressed Assets) Directions, 2025, should not be subjected to disincentive mechanism for the incremental exposure. Chapter V - Exposure Norms A. Exposure to Industry and certain Sectors A.1 Internal Exposure Limits A.1.1 Fixing of Sectoral Limits 109. In addition to limiting exposures to a single borrower or a group of borrowers, a bank shall consider fixing internal limits for aggregate commitments to specific sectors to ensure diversified sectoral exposure. These sectoral limits shall be fixed based on the bank’s assessment of sectoral performance and associated risk perceptions. The bank shall review and revise these limits periodically, as deemed appropriate. 110. A bank shall have Board approved limits in respect of various sub-segments under consumer credit as may be considered necessary by the Boards as part of prudent risk management. In particular, limits shall be prescribed for all unsecured consumer credit exposures. The limits so fixed shall be strictly adhered to and monitored on an ongoing basis by the Risk Management Committee. 111. All top-up loans extended by a bank against movable assets which are inherently depreciating in nature, such as vehicles, shall be treated as unsecured loans for credit appraisal, prudential limits and exposure purposes. A.1.2 Exposure to NBFC Sector 112. A bank may also consider fixing internal limits for its aggregate exposure to all NBFCs put together. 113. The bank should have an internal sub-limit on its aggregate exposures to all NBFCs, having gold loans to the extent of 50 percent or more of their total financial assets, taken together. This sub-limit should be within the internal limit, where fixed by the bank for its aggregate exposure to all NBFCs put together as mentioned in paragraph 112. A.1.3 Exposure to Real Estate 114. The bank shall be guided by the Reserve Bank of India (Commercial Banks – Credit Facilities) Directions, 2025. A.1.4 Bank’s Exposure to Capital Markets – Rationalisation of Norms A.1.4.1 Components of Capital Market Exposure (CME) 115. A bank’s capital market exposures shall include both its direct exposures and indirect exposures. The aggregate exposure (both fund and non-fund based) of the bank to capital markets in all forms shall include the following: -

direct investment in equity shares, convertible bonds, convertible debentures and units of equity-oriented mutual funds the corpus of which is not exclusively invested in corporate debt; -

advances against shares / bonds / debentures or other securities or on clean basis to individuals for investment in shares (including IPOs / ESOPs), convertible bonds, convertible debentures, and units of equity-oriented mutual funds; -

advances for any other purposes where shares or convertible bonds or convertible debentures or units of equity oriented mutual funds are taken as primary security; -

advances for any other purposes to the extent secured by the collateral security of shares or convertible bonds or convertible debentures or units of equity oriented mutual funds i.e. where the primary security other than shares / convertible bonds/convertible debentures / units of equity oriented mutual funds does not fully cover the advances; -

secured and unsecured advances to stockbrokers and guarantees issued on behalf of stockbrokers and market makers; -

loans sanctioned to corporates against the security of shares / bonds/ debentures or other securities or on clean basis for meeting promoter’s contribution to the equity of new companies in anticipation of raising resources; -

bridge loans to companies against expected equity flows / issues; -

underwriting commitments taken up by the bank in respect of primary issue of shares or convertible bonds or convertible debentures or units of equity oriented mutual funds; -

financing to stockbrokers for margin trading; -

all exposures to Alternate Investment Funds ; and -