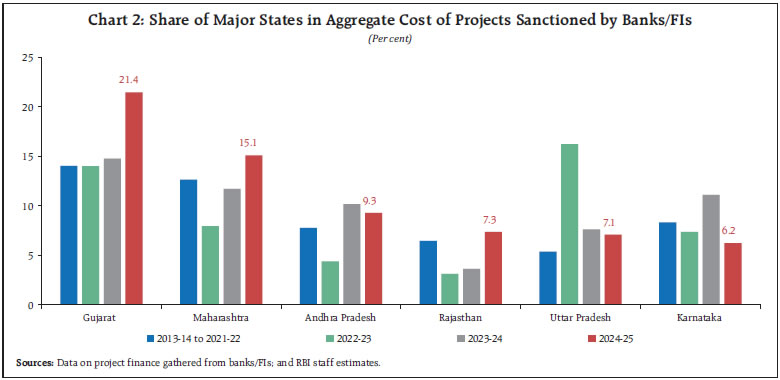

by Snigdha Yogindran, Sukti Khandekar, Rajesh B Kavediya and Aloke Ghosh^ This article examines private corporate investment intentions in India during 2024–25 and the outlook for 2025-26, based on projects sanctioned by banks and financial institutions (FIs). The total cost of projects sanctioned by banks/FIs at ₹3.68 lakh crore for 2024-25, lower than the previous year, points to tepid investment optimism of private corporates. Based on pipeline projects, financed through all channels, capital expenditure is expected to rise to ₹2.67 lakh crore in 2025–26, aided by robust macroeconomic fundamentals, improved balance sheets, rising capacity utilisation, easy liquidity conditions, infrastructure push, and a 100-bps policy rate cut starting from February 2025. Lower investment announcements amid uncertain demand conditions along with higher cash buffer points to cautiously optimistic outlook for private investment activity. Introduction Private corporate investment remained as one of the vital contributors to India’s long-term growth trajectory. After a period of subdued activity during the pandemic years, the investment cycle is being rejuvenated by a confluence of supportive factors. In 2024–25, the macroeconomic backdrop is characterised by robust GDP growth, sustained disinflation, and a consequent conducive monetary policy stance. The domestic economy continues to demonstrate resilience, with real GDP growth of 6.5 per cent in 2024–25, making India the fastest-growing major economy, underpinned by robust domestic demand, and steady progress on public infrastructure investments. Over the past few years, Indian corporates have undergone a phase of balance sheet repair, aided by deleveraging, improved cash flows, and strong profitability across several sectors (RBI, FSR, June 2025). The banking sector’s improved asset quality and abundant liquidity have further enhanced the credit environment, translating into easier access to financing for capacity expansion. Recent trends in high-frequency indicators—such as rising imports of capital goods, improved capacity utilisation, and increased flows in corporate bond markets—signal renewed investment appetite among firms. Additionally, sector-specific policies, such as the Production-Linked Incentive (PLI) schemes, energy transition investments, and digital infrastructure expansion, are incentivising corporates to undertake fresh investments. Amid this recovery, a key motivation for this article is to assess the evolving landscape of private corporate investment and its near-term prospects. Several questions guide this analysis: Have investment intentions rebounded meaningfully? Which sectors and regions are leading this recovery? What is the role of alternative financing channels beyond traditional bank credit? As finalisation of corporate balance sheet takes time, many countries adopt survey-based approach to assess the near-term outlook on corporate investment and perspective planning. Such surveys provide lead information on quantum and timing of investment for direct assessment of firms’ investment intentions that are expected to materialise in the near to medium-term. In the Indian context, the Reserve Bank has been tracking private capex plans through monitoring of the projects that are funded by banks/financial institutions (FIs) for assessing investment outlook. This article analyses the characteristics, funding patterns, sectoral and regional distribution, and phasing profile of capex projects undertaken by private corporates in 2024–25. Capital expenditure envisaged from pipeline projects1, which refers to the projects already undertaken for implementation, are also estimated for 2024-25. The article draws on multiple sources like bank/FI sanctions, external commercial borrowings, and equity issuances, to present a holistic view of investment intentions. By focusing on the timing and composition of proposed capex, the article provides valuable forward-looking insights into the investment cycle and its macroeconomic implications for 2025–26. The article is structured into five sections. Section II outline the methodology and assumption. Section III discusses the key features of projects sanctioned by banks/FIs during 2024-25, including the funding pattern and sectoral/regional distribution. Evaluation of the phasing profile and estimates the investment growth outlook are presented in section IV, while section V concludes the study. II. Methodology and Assumptions To assess the short-to medium-term outlook of private corporate investment, this study adopts the methodological framework developed by Rangarajan (1970)2. The analysis draws on three main data sources reflecting diverse financing routes for capital projects: (i) private corporates’ capex projects sanctioned by banks and FIs, (ii) capex-related external commercial borrowings (ECBs), including foreign currency convertible bonds (FCCBs) and rupee-denominated bonds (RDBs), and (iii) funds raised through initial public offerings (IPOs), follow-on public offerings (FPOs), and rights issues for capex purpose. To avoid double counting and consequent overestimation of capital investment, meticulous efforts have been made to ensure that each project is included in the dataset only once. This is achieved by utilising internal databases of the Reserve Bank and incorporating information supplied by the Securities and Exchange Board of India (SEBI), even when a project is funded through multiple sources. This study focuses exclusively on projects that receive funding from the aforementioned sources, having a project cost exceeding ₹10 crore, and majority ownership stake of project with private corporates. Projects having majority stake holding with the Central and/ or State governments, and projects initiated by trusts and educational institutions are excluded from the scope of this study. The estimates are derived under the assumption that companies adhere to their ex-ante capital expenditure plans. However, it is important to note that these estimates may differ from actual investments due to various reasons such as (a) modifications in timing or scale of planned investments, (b) shifts in funding patterns—e.g., substitution of debt or equity financing with internal accruals or FDI, which are not being captured in the project finance data collected by the RBI, and (c) emergence of new projects or cancellation of earlier ones. Further, it needs to be recognised that the analysis presented in the article is based only those capex projects for which private corporates approached banks/FIs for funding and accordingly, these estimates serve as a leading indicator of investment activity and may differ from national accounts-based estimates of private corporate fixed capital formation. III. Characteristics of Projects Sanctioned/ Contracted During 2024-25, about 907 projects got assistance from banks/FIs with total cost of projects of ₹3,67,973 crore, as compared to 944 projects sanctioned during the previous year having total cost of ₹3,91,003 crore (Annex Table A1). During 2024-25, 448 private companies, which did not avail of any financing from banks/FIs for capex projects, raised ₹96,966 crore through ECBs for capex purpose, while 229 other companies raised ₹32,295 crore through domestic equity issuances under the initial public offering (IPO) route for funding their capex needs. Overall, investment plans of 1,584 projects were made during 2024-25, with investment intentions of ₹4,97,235 crore, as against 1500 projects in 2023-24 with investment intentions of ₹5,47,734 crore (Annex Table A1 - A4). i) Size-wise During 2024-25, ten mega projects (with project cost ₹5,000 crore and above) and 75 large projects (₹1000 crore-₹5000 crore), got sanctioned by banks/FIs, having share of 25.8 per cent and 37.2 per cent in the total project costs, respectively. Deviation from phasing plans of capex of these mega/large projects may affect the overall capex pattern in the medium-term (Annex Table A5). ii) Purpose-wise Investment in green field (new) projects accounted for the lion share of about 92 per cent in the total cost of projects financed by banks/FIs during 2024-25, in line with the trend seen in the past. Greenfield investment generally brings new and additional resources and assets to the firms and leads to gross fixed capital formation (GFCF). Higher investment in green filed projects thus points to likely capacity expansion by private corporates going forward. Investment in expansion and modernisation of existing projects3 accounted for 7.8 per cent share in the total project cost (Annex Table A6). iii) Industry-wise Industry-wise distribution of projects sanctioned during 2024-25 indicates that the infrastructure sector4 remained the major sector accounting for 50.6 per cent share in the total cost of projects, primarily driven by investment in ‘Power’, followed by ‘Road & bridges’ (Annex Table A7). However, the share of infrastructure related projects in the total cost of projects was lowest in the last ten years. Beside infrastructure, among the other major industries, chemicals & pesticides, construction, electrical equipments, and metal & metal products also accounted for the sizable share in the total cost of projects (Chart 1 and Annex Table 7). iv) State-wise The regional factors, for instance, accessibility of raw materials, availability of suppliers, availability of skilled labour, presence of adequate infrastructure, size of the market, growth potential, and demand conditions remained crucial in destination choice for the investment. For the analysis purpose, in this article, the projects which are spread across multiple states have been classified as “multi-state” projects. The state-wise distribution of projects sanctioned revealed that the top five states viz., Gujarat, Maharashtra, Andhra Pradesh, Rajasthan and Uttar Pradesh, together accounts for about 60 per cent share in total cost of projects during 2024-25. Share of Gujarat, Maharashtra and Rajasthan improved significantly from the previous year (Chart 2 and Annex Table A8). IV. Phasing Profile of Investment Intentions Phasing profile of capital expenditures of projects sanctioned by banks/FIs till end of the financial year 2024-25 provides near-term (one year ahead) investment outlook of private corporates. The phasing from the cohort of projects sanctioned in 2024-25 indicates that 39.3 per cent (₹1,44,782 crore) of the total proposed capital expenditure was planned to be invested by the year-end 2024-25, while 35.2 per cent (₹1,29,591 crore) is planned to be spent in 2025-26 and another 25.4 per cent (₹93,600 crore) in the subsequent period. Based on the phasing profile of projects sanctioned by banks/FIs till 2024-25, the envisaged capex recorded a marginal increase of 0.4 per cent to ₹2,95,234 crore during 2024-25 over the previous year (Annex Table A1).  Resources raised through the ECB and IPO route by private corporates supplement the financing of their investment activities. From the fund raised through the ECB route for capex purpose during 2024-25 and prior period, capital expenditure planned to be made during 2024-25 remained robust at ₹1,00,747 crore, though remained lower than the previous year. Also, planned capital expenditure from the fund raised through the IPO route for capex purpose increased significantly to ₹18,943 crore in 2024-25, though its share in total envisaged capital expenditure remained miniscule (Annex Table A2 and A3). Overall, based on the various channels of fundings, as alluded earlier, total capital investment of ₹4,14,923 crore was intended to be made by the private corporate sector in 2024-25, broadly similar to the planned capex during the previous year. The phasing profile of the envisaged capex, based on the pipeline projects sanctioned by the banks/ FIs in the previous years prior to the reference year, indicate that envisaged capital investment increased from ₹1,68,204 crore in 2024-25 to ₹1,91,073 crore in 2025-26; while based on all channels of financing taken together, it stood at ₹2,67,432 crore in 2025-26 as against ₹2,20,132 crore in 2024-25 (Annex Table A1 and A4). V. Conclusion The analysis of project finance data points to lower investment optimism as reflected in tepid total cost of projects during 2024–25 as compared to previous year. Infrastructure sector continued to attract the major share of envisaged capital investment, led by ‘Power’ sector. Of the total cost of projects sanctioned by banks/FIs during 2024-25, 39.3 per cent was planned to be invested by the end of financial year 2024-25, 35.2 per cent is provided for 2025-26 and the remaining 25.4 per cent is envisaged to be invested in the subsequent years. The phasing profile of pipeline projects financed through all the three channels suggests that the envisaged capex could increase substantially to ₹2,67,432 crore in 2025-26 from ₹2,20,132 crore in 2024-25. Despite global uncertainties, Indian firms are entering the new fiscal year with healthier balance sheets, higher cash buffer, improved profitability, and greater access to diversified funding sources. The continued policy push for infrastructure, sustained disinflation, combined with lower interest rates, easy liquidity conditions, and rising capacity utilisation, is fostering an environment conducive to private investment. Looking ahead, the investment outlook remains cautiously optimistic. While external risks such as geopolitical tensions, global uncertainty and demand slowdown may influence investment sentiment, the domestic fundamentals appear robust. Importantly, the composition of investments—driven largely by greenfield infrastructure projects—signals not only cyclical recovery but also structural capacity building. The ability of firms to convert intentions into execution will be critical in shaping the next phase of India’s growth. Thus, sustained monitoring of project implementation and supportive policy measures will be vital to translating this momentum into durable economic gains. References: C Rangarajan (1970). Forecasting Capital Expenditure in the Corporate Sector. Economic and Political Weekly (EPW), Volume No. 5, Issue No. 51, Page 2049-2051. RBI (2025). Financial Stability Report, June. Retrieved from https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/0FSRJUNE20253006258AE798B4484642AD861CC35BC2CB3D8E.PDF

| Table A1: Phasing of Capex of Projects Sanctioned by Banks/FIs | | Year of sanction ↓ | No of Projects | Project Cost in the Year of San ction (₹ crore) | Project Cost due to Revi sion/ Cancell ation^ (in ₹ crore) | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | Beyond | | 2025-26 | | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | | upto | | | | 1,70,603 | 93658 | 34172 | 14421 | 4722 | 1472 | | | | | | | | | | 2013-14 | | | | | | | | | | | | | | | | | | | 2014-15 | 326 | 87,601 | 87,253 (0.4) | 14,920 | 34,589 | 25,765 | 9,535 | 1,246 | 162 | 1,036 | | | | | | | | | 2015-16 | 346 | 95,371 | 91,781 (3.8) | 3,787 | 7,434 | 37,517 | 28,628 | 8,079 | 4,964 | 1,152 | 220 | | | | | | | | 2016-17 | 541 | 1,82,807 | 1,79,249 (2.0) | 1,352 | 3,952 | 25,388 | 71,186 | 41,075 | 21,643 | 8,566 | 4,001 | 2,086 | | | | | | | 2017-18 | 485 | 1,72,831 | 1,68,239 (2.6) | | 620 | 15,184 | 12,445 | 63,001 | 41,436 | 22,767 | 10,202 | 2,342 | 242 | | | | | | 2018-19 | 409 | 1,76,581 | 1,59,189 (9.8) | | | 569 | 6,862 | 11,000 | 59,973 | 47,080 | 21,248 | 9,759 | 2,663 | 35 | | | | | 2019-20 | 320 | 2,00,038 | 1,75,83 (12.1) | | | | | 4,049 | 14,524 | 53,978 | 58,556 | 28,116 | 14,114 | 2,299 | 194 | | | | 2020-21 | 220 | 75,558 | 75,558 (0.0) | | | | | | 2,491 | 3,709 | 29,013 | 26,166 | 9,711 | 3,867 | 601 | | | | 2021-22 | 401 | 1,43,314 | 1,42,111 (0.8) | | | | | | | 3,610 | 10,543 | 59,622 | 44,306 | 18,447 | 3,541 | 1,646 | 396 | | 2022-23 | 547 | 2,66,547 | 2,66,621 (0.0) | | | | | | | 1,127 | 2,150 | 16,663 | 87,996 | 92,539 | 47,942 | 15,338 | 2,865 | | 2023-24 | 944 | 3,90,978 | 3,91,003 (0.0) | | | | | | | | 2,235 | 6,783 | 39,455 | 1,63,608 | 1,15,926 | 44,499 | 18,497 | | 2024-25 | 907 | 3,67,973 | | | | | | | | | | 1,476 | 3,073 | 13,204 | 1,27,029 | 1,29,591 | 93,600 | | Grand Total& | | | | 1,90,662 | 1,40,253 | 1,38,595 | 1,43,077 | 1,33,172 | 1,46,665 | 1,43,025 | 1,38,169 | 1,53,013 | 2,01,561 | 2,93,999 | 2,95,234 | 1,91,073 | 1,15,358 | | Percentage change | | | | | -26.4 | -1.2 | 3.2 | -6.9 | 10.1 | -2.5 | -3.4 | 10.7 | 31.7 | 45.9 | 0.4 | # | | &: Column totals indicate envisaged capex in a particular year covering the projects which received financial assistance in various years. The estimate is ex ante incorporating only envisaged investments. They are different from those actually realised/utilised.

#: Per cent change for 2025-26 is not worked out as capex from proposal that are likely to be sanctioned in 2025-26 is not yet available.

^: Figures in bracket are percentage of revision/cancellation. |

| Table A2: Phasing of Capex Projects* Funded through ECBs/ FCCBs/RDBs** | | Year of sanction ↓ | No of LRNs issued | Total loan contr acted

(₹ crore) | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | Beyond 2025-26 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | | upto 2013-14 | | | 78,864 | 27,376 | 4,896 | | | | | | | | | | | | | 2014-15 | 478 | 57,327 | | 36,791 | 16,806 | 3,151 | 575 | 2 | 2 | | | | | | | | | 2015-16 | 314 | 38,885 | | | 28,998 | 7,311 | 2,572 | 4 | | | | | | | | | | 2016-17 | 346 | 22,154 | | | | 14,953 | 6,005 | 1,192 | 2 | 2 | | | | | | | | 2017-18 | 419 | 37,896 | | | | | 17,822 | 13,054 | 6,484 | 529 | 7 | | | | | | | 2018-19 | 515 | 72,490 | | | | | | 46,221 | 17,725 | 1,236 | 5,398 | 1,844 | 66 | | | | | 2019-20 | 495 | 95,491 | | | | | | | 65,367 | 17,157 | 11,717 | 965 | 285 | | | | | 2020-21 | 362 | 40,564 | | | | | | | | 21,865 | 13,574 | 3,219 | 1,675 | 231 | | | | 2021-22 | 363 | 51,059 | | | | | | | | 13 | 29,315 | 16,554 | 5,089 | 89 | | | | 2022-23 | 393 | 81,101 | | | | | | | | | | 33,927 | 31,785 | 14,438 | 950 | | | 2023-24 | 433 | 1,50,421 | | | | | | | | | | | 76,336 | 34,178 | 21,169 | 18,738 | | 2024-25 | 448 | 96,966 | | | | | | | | | | | 12 | 51,811 | 40,660 | 4,483 | | Grand Total& | | | 78,864 | 64,167 | 50,700 | 25,415 | 26,974 | 60,473 | 89,580 | 40,802 | 60,011 | 56,509 | 1,15,248 | 1,00,747 | 62,779 | 23,221 | | Percentage change | | | | -18.6 | -21.0 | -49.9 | 6.1 | 124.2 | 48.1 | -54.5 | 47.1 | -5.8 | 103.9 | -12.6 | # | | *: Projects which did not receive assistance from banks/FIs.

**: Rupee Denominated Bonds (RDBs) have been included since 2016-17.

#: Percent change for 2025-26 is not worked out as capex from proposals that are likely to be drawn in 2025-26 is not yet available.

&: The estimate is ex ante incorporating only envisaged investment. They are different from those actually realised/utilised.

LRN: Loan registration number |

| Table A3: Phasing of Capex of Projects Funded Through Equity Issues* | | Equity issued during ↓ | No. of Companies | Capex Envisaged

(₹ crore) | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | Beyond 2025-26 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | | upto 2013-14 | | | 494 | 492 | 70 | | | | | | | | | | | | | 2014-15 | 24 | 1,078 | | 189 | 557 | 332 | | | | | | | | | | | | 2015-16 | 40 | 4,511 | | 11 | 644 | 2,753 | 849 | 183 | 71 | | | | | | | | | 2016-17 | 29 | 1,159 | | | 14 | 471 | 368 | 163 | 143 | | | | | | | | | 2017-18 | 51 | 1,538 | | | | | 419 | 327 | 787 | 5 | | | | | | | | 2018-19 | 39 | 609 | | | | | | 506 | 90 | 13 | | | | | | | | 2019-20 | 12 | 53 | | | | | | 2 | 49 | 2 | | | | | | | | 2020-21 | 12 | 663 | | | | | | | | 139 | 421 | 84 | 19 | | | | | 2021-22 | 27 | 3,410 | | | | | | | | 10 | 757 | 1,304 | 939 | 400 | | | | 2022-23 | 42 | 3,629 | | | | | | | | | | 1,172 | 2,181 | 276 | | | | 2023-24 | 123 | 6,310 | | | | | | | | | | 58 | 2,999 | 2,316 | 937 | | | 2024-25 | 229 | 32,295 | | | | | | | | | | | 199 | 15,951 | 12,643 | 3,503 | | Grand Total& | | | 494 | 692 | 1,285 | 3,556 | 1,636 | 1,181 | 1,140 | 169 | 1,178 | 2,618 | 6,337 | 18,943 | 13,580 | 3,503 | | Percentage change | | | | 40.1 | 85.7 | 176.7 | -54.0 | -27.8 | -3.5 | -85.2 | 597.0 | 122.2 | 142.1 | 198.9 | # | | *: Projects which did not receive assistance from banks/FIs/ECBs/FCCBs/RDBs.

#: Per cent change for 2025-26 is not worked out as capex from proposals that are likely to be implemented in 2025-26 is not yet available.

&: The estimate is ex ante incorporating only envisaged investment, they are different from those actually realized / utilised. |

| Table A4: Phasing of Capex of Projects Funded Through Banks/FIs/IPOs/ECBs/FCCBs/RDBs*/IPOs | | Year of sanction ↓ | No of Companies or Banks/ FIs/ ECBs/ FCCBs / RDBs /IPOs | Project Cost | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | Beyond 2025-26 | | (₹ crore) | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | | upto 2013-14 | | | 2,49,961 | 1,21,526 | 39,138 | 14,421 | 4,722 | 1,472 | | | | | | | | | | 2014-15 | 828 | 1,46,006 | 14,920 | 71,569 | 43,128 | 13,018 | 1,821 | 164 | 1,038 | | | | | | | | | 2015-16 | 700 | 1,38,767 | 3,787 | 7,445 | 67,159 | 38,692 | 11,500 | 5,151 | 1,223 | 220 | | | | | | | | 2016-17 | 916 | 2,06,120 | 1,352 | 3,952 | 25,402 | 86,610 | 47,448 | 22,998 | 8711 | 4,003 | 2,086 | | | | | | | 2017-18 | 955 | 2,12,265 | | 620 | 15,184 | 12,445 | 81,242 | 54,817 | 30038 | 10,736 | 2,349 | 242 | | | | | | 2018-19 | 963 | 2,49,680 | | | 569 | 6,862 | 11,000 | 1,06,700 | 64895 | 22,497 | 15,157 | 4,507 | 101 | | | | | 2019-20 | 827 | 2,95,582 | | | | | 4,049 | 14,526 | 119,394 | 75,715 | 39,833 | 15,079 | 2,584 | 194 | | | | 2020-21 | 594 | 1,16,785 | | | | | | 2,491 | 3709 | 51,017 | 40,161 | 13,014 | 5,561 | 832 | | | | 2021-22 | 791 | 1,96,580 | | | | | | | 3,610 | 10,566 | 89,694 | 62,164 | 24,475 | 4,030 | 1,646 | 396 | | 2022-23 | 982 | 3,51,351 | | | | | | | 1,127 | 2,150 | 16,663 | 1,23,095 | 1,26,505 | 62,656 | 16,288 | 2,865 | | 2023-24 | 1,500 | 5,47,734 | | | | | | | | 2,235 | 6,783 | 39,513 | 2,42,943 | 1,52,420 | 66,604 | 37,235 | | 2024-25 | 1,584 | 4,97,235 | | | | | | | | | 1,476 | 3,073 | 13,415 | 1,94,791 | 1,82,895 | 1,01,586 | | Grand Total& | | | 270,020 | 2,05,112 | 1,90,580 | 1,72,048 | 1,61,782 | 2,08,319 | 2,33,745 | 1,79,139 | 2,14,202 | 2,60,688 | 4,15,583 | 4,14,923 | 2,67,432 | 1,42,082 | | Percentage change | | | | -24.0 | -7.1 | -9.7 | -6.0 | 28.8 | 12.2 | -23.4 | 19.6 | 21.7 | 59.4 | -0.2 | # | | *: Rupee Denominated Bonds (RDBs) have been included since 2016-17.

#: Per cent change for 2025-26 is not worked out as capex from proposals that are likely to be sanctioned in 2025-26 is not yet available.

&: The estimate is ex ante incorporating only envisaged investment, they are different from those actually realised/utilised. |

| Table A5: Size-wise Distribution of Projects Sanctioned by Banks/FIs: 2013-14 to 2024-25 | | Period | Number and Share of Projects | Less than ₹100 crore | ₹100 crore to ₹500 crore | ₹500 crore to ₹1000 crore | ₹1000 crore to ₹5000 crore | ₹5000 crore & above | Total | | 2013-14 | No. of Projects | 306 | 115 | 25 | 21 | 5 | 472 | | Per cent Share | 8.3 | 20.0 | 13.9 | 29.1 | 28.7 | 100 (1,27,328) | | 2014-15 | No. of Projects | 223 | 65 | 18 | 19 | 1 | 326 | | Per cent Share | 9.0 | 16.6 | 14.6 | 47.8 | 12.0 | 100 (87,253) | | 2015-16 | No. of Projects | 214 | 76 | 34 | 21 | 1 | 346 | | Per cent Share | 8.6 | 20.9 | 26.0 | 38.5 | 5.9 | 100 (91,781) | | 2016-17 | No. of Projects | 287 | 180 | 29 | 40 | 5 | 541 | | Per cent Share | 5.8 | 23.3 | 11.9 | 41.7 | 17.4 | 100 (1,79,239) | | 2017-18 | No. of Projects | 263 | 149 | 28 | 42 | 3 | 485 | | Per cent Share | 5.2 | 21.0 | 10.8 | 43.8 | 19.1 | 100 (1,68,239) | | 2018-19 | No. of Projects | 220 | 110 | 39 | 36 | 4 | 409 | | Per cent Share | 4.8 | 17.0 | 17.0 | 39.6 | 21.6 | 100 (1,59,189) | | 2019-20 | No. of Projects | 150 | 84 | 45 | 36 | 5 | 320 | | Per cent Share | 3.3 | 11.9 | 18.6 | 37.4 | 28.8 | 100 (1,75,830) | | 2020-21 | No. of Projects | 128 | 52 | 15 | 24 | 1 | 220 | | Per cent Share | 5.5 | 16.8 | 14.2 | 53.5 | 10.0 | 100 (75,558) | | 2021-22 | No. of Projects | 201 | 125 | 37 | 36 | 2 | 401 | | Per cent Share | 5.6 | 19.7 | 20.0 | 46.9 | 7.9 | 100 (1,42,111) | | 2022-23 | No. of Projects | 267 | 158 | 50 | 64 | 8 | 547 | | Per cent Share | 3.9 | 13.8 | 13.9 | 41.3 | 27.1 | 100 (2,66,621) | | 2023-24 | No. of Projects | 484 | 265 | 107 | 77 | 11 | 944 | | Per cent Share | 4.6 | 16.6 | 20.0 | 37.1 | 21.7 | 100 (3,91,003) | | 2024-25 | No. of Projects | 502 | 234 | 86 | 75 | 10 | 907 | | Per cent Share | 5.2 | 14.8 | 17.1 | 37.2 | 25.8 | 100 (3,67,973) | Note: i. Figures in brackets are total cost of projects in ₹crore.

ii. Per cent share is the share in total cost of projects. Percentages may not total 100 due to rounding. |

| Table A6: Purpose-wise Distribution of Projects Sanctioned by Banks/FIs during 2013-14 to 2024-25 | | Period | Number and | New | Expansion & | Diversification | Others | Total | | Share of Projects | Modernisation | | 2013-14 | No. of Projects | 361 | 95 | 2 | 14 | 472 | | Percent Share | 65.2 | 20.1 | - | 14.7 | 100 (1,27,328) | | 2014-15 | No. of Projects | 203 | 92 | 2 | 29 | 326 | | Percent Share | 39.4 | 14.7 | 0.2 | 45.7 | 100 (87,253) | | 2015-16 | No. of Projects | 260 | 64 | 3 | 19 | 346 | | Percent Share | 73.6 | 14.3 | 0.1 | 12.0 | 100 (91,781) | | 2016-17 | No. of Projects | 429 | 97 | 4 | 11 | 541 | | Percent Share | 78.6 | 9.9 | 0.1 | 11.3 | 100 (1,79,249) | | 2017-18 | No. of Projects | 396 | 80 | 2 | 7 | 485 | | Percent Share | 89.0 | 9.5 | 0.1 | 1.5 | 100 (1,68,239) | | 2018-19 | No. of Projects | 309 | 80 | - | 20 | 409 | | Percent Share | 76.8 | 19.3 | - | 3.9 | 100 (1,59,189) | | 2019-20 | No. of Projects | 262 | 37 | 1 | 20 | 320 | | Percent Share | 79.8 | 13.7 | - | 6.4 | 100 (1,75,830) | | 2020-21 | No. of Projects | 181 | 38 | 1 | - | 220 | | Percent Share | 94.1 | 5.9 | - | - | 100 (75,558) | | 2021-22 | No. of Projects | 312 | 88 | 1 | - | 401 | | Percent Share | 89.1 | 10.8 | 0.1 | 0.0 | 100 (1,42,111) | | 2022-23 | No. of Projects | 440 | 101 | - | 6 | 547 | | Percent Share | 93.1 | 6.1 | - | 0.8 | 100 (2,66,621) | | 2023-24 | No. of Projects | 767 | 167 | 4 | 6 | 944 | | Percent Share | 89.1 | 8.7 | 0.1 | 2.2 | 100 (3,91,003) | | 2024-25 | No. of Projects | 734 | 162 | 5 | 6 | 907 | | Percent Share | 91.6 | 7.8 | 0.1 | 0.5 | 100 (3,67,973) | Note: i. Figures in brackets are total cost of projects in ₹crore.

ii. Per cent share is the share in total cost of projects. Percentages may not total 100 due to rounding.

iii. -: Nil/ Negligible. |

| Table A7: Industry-wise Distribution of Projects Sanctioned by Banks/FIs: 2013-14 to 2024-25 | | Industry | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | | Infrastructure | 87 | 39.7 | 74 | 48.9 | 108 | 72.0 | 204 | 62.5 | 150 | 51.7 | 122 | 60.3 | 99 | 61.5 | 63 | 74.3 | 95 | 56.3 | 135 | 60.0 | 245 | 55.5 | 207 | 50.6 | | i) Power | 70 | 35.1 | 65 | 42.2 | 92 | 57.1 | 170 | 45.4 | 117 | 36.5 | 78 | 26.8 | 47 | 32.9 | 35 | 49.3 | 58 | 29.0 | 53 | 20.3 | 139 | 24.4 | 146 | 39.7 | | ii) Telecom | 1 | - | 1 | 4.9 | 1 | 0.3 | 1 | - | - | - | - | - | - | - | - | - | - | - | - | - | 1 | 0.6 | - | - | | iii) Ports & Airports | 1 | 0.8 | - | - | 3 | 2.4 | 8 | 5.7 | 6 | 3.1 | 4 | 14.2 | 4 | 8.4 | 1 | 0.1 | 2 | 5.9 | 2 | 0.4 | 9 | 4.8 | 3 | 0.6 | | iv) Storage & Water Management | 5 | 1.1 | 2 | 0.6 | 4 | 4.2 | 6 | 3.7 | 2 | 0.4 | 13 | 5.7 | 4 | 0.4 | 5 | 1.2 | 2 | 0.2 | 3 | 0.8 | 4 | 0.0 | 8 | 0.2 | | v) SEZ, Industrial, Biotech and IT Park | 8 | 1.5 | 3 | 0.9 | 1 | 0.4 | 2 | 0.4 | 9 | 1.6 | 11 | 3.2 | 8 | 1.3 | 5 | 2.2 | 3 | 1.1 | 8 | 1.9 | 10 | 0.5 | 8 | 1.2 | | vi) Roads & Bridges | 2 | 1.2 | 3 | 0.3 | 7 | 7.6 | 17 | 7.3 | 16 | 10.1 | 16 | 10.4 | 36 | 18.5 | 17 | 21.5 | 30 | 20.2 | 69 | 36.5 | 82 | 25.2 | 42 | 8.9 | | Metal & Metal Products | 44 | 17.4 | 17 | 17.4 | 14 | 1.5 | 23 | 4.9 | 21 | 9.7 | 16 | 3.0 | 14 | 0.8 | 6 | 0.8 | 27 | 4.3 | 60 | 14.6 | 71 | 9.3 | 68 | 4.6 | | Construction | 27 | 2.1 | 29 | 4.0 | 26 | 1.8 | 60 | 12.0 | 39 | 5.3 | 26 | 2.3 | 44 | 11.4 | 27 | 4.8 | 22 | 7.4 | 35 | 4.0 | 56 | 8.0 | 57 | 5.6 | | Electrical & Electronics | 9 | 2.0 | 7 | 0.2 | 2 | 0.2 | 9 | 0.2 | 6 | 0.2 | 1 | 0.1 | 4 | - | 1 | 0.1 | 5 | 4.0 | 9 | 1.1 | 15 | 4.4 | 28 | 4.6 | | Food Products | 43 | 1.8 | 34 | 2.9 | 26 | 1.8 | 38 | 0.9 | 47 | 2.8 | 28 | 1.4 | 32 | 1.9 | 20 | 1.5 | 25 | 1.7 | 40 | 2.5 | 107 | 3.0 | 86 | 2.6 | | Chemicals & Pesticides | 15 | 1.0 | 7 | 2.6 | 11 | 1.6 | 10 | 2.1 | 23 | 11.4 | 19 | 2.9 | 12 | 1.3 | 9 | 1.6 | 20 | 3.4 | 16 | 2.3 | 33 | 2.9 | 24 | 7.9 | | Textiles | 58 | 10.3 | 50 | 4.1 | 49 | 4.8 | 57 | 4.1 | 54 | 3.7 | 27 | 3.4 | 11 | 0.5 | 15 | 1.8 | 56 | 4.5 | 42 | 2.8 | 58 | 2.2 | 38 | 1.2 | | Transport Services | 14 | 0.5 | 5 | 0.6 | 10 | 1.2 | 12 | 0.4 | 16 | 4.1 | 5 | 0.2 | 14 | 1.4 | 1 | 0.1 | 19 | 2.5 | 21 | 0.6 | 35 | 2.1 | 46 | 2.1 | | Coke and Petroleum Products | 1 | 0.5 | 1 | 3.4 | 2 | 2.0 | 2 | 0.5 | 1 | 0.4 | - | - | 3 | 8.0 | - | - | 7 | 1.0 | 17 | 1.1 | 28 | 1.6 | 23 | 1.8 | | Cement | 12 | 7.1 | 7 | 3.8 | 5 | 1.9 | 5 | 2.3 | 3 | 0.6 | 10 | 5.1 | 2 | 0.1 | 5 | 1.3 | 3 | 3.3 | 2 | 0.8 | 11 | 1.3 | 4 | 1.0 | | Transport Equipments and Parts | 14 | 1.0 | 7 | 5.3 | 4 | 2.5 | 9 | 3.6 | 10 | 0.3 | 5 | 0.8 | 5 | 0.4 | 2 | 0.3 | 5 | 0.4 | 16 | 0.6 | 12 | 1.2 | 16 | 1.8 | | Mining and quarrying | 1 | 0.6 | 2 | 0.1 | 10 | 2.7 | 4 | 0.4 | 1 | - | - | - | - | - | - | - | 1 | 0.1 | 7 | 1.8 | 11 | 1.2 | 9 | 2.2 | | Hotels and Restaurants | 22 | 2.2 | 15 | 1.1 | 16 | 1.1 | 12 | 0.8 | 29 | 2.9 | 26 | 1.9 | 16 | 1.7 | 4 | 2.9 | 12 | 0.9 | 13 | 0.4 | 58 | 1.1 | 61 | 1.5 | | Pharmaceuticals | 19 | 1.3 | 9 | 1.5 | 11 | 0.3 | 12 | 1.1 | 15 | 0.6 | 23 | 1.6 | 9 | 0.6 | 7 | 0.5 | 20 | 1.3 | 30 | 2.1 | 29 | 0.8 | 42 | 1.0 | | Hospitals & Health services | 10 | 0.7 | 2 | 0.1 | 1 | - | 22 | 1.1 | 18 | 1.8 | 15 | 2.6 | 12 | 0.7 | 7 | 0.3 | 19 | 2.3 | 20 | 1.1 | 25 | 0.7 | 34 | 1.5 | | Rubber & Plastic product | 9 | 0.3 | 8 | 0.8 | 4 | 0.5 | 8 | 0.2 | 10 | 2.5 | 5 | 0.5 | 5 | 0.3 | 17 | 2.1 | 12 | 0.8 | 13 | 0.8 | 24 | 0.7 | 35 | 1.9 | | IT Software | 3 | 0.1 | 1 | - | 1 | - | - | - | 1 | - | 2 | 0.7 | 1 | - | - | - | 2 | 0.6 | 4 | 1.2 | 4 | 0.6 | 10 | 3.9 | | Others* | 84 | 11.4 | 51 | 3.2 | 46 | 4.1 | 54 | 2.9 | 41 | 2.0 | 79 | 13.3 | 37 | 9.3 | 36 | 7.6 | 51 | 5.1 | 67 | 2.3 | 122 | 3.5 | 119 | 4.2 | | Total | 472 | 100 | 326 | 100 | 346 | 100 | 541 | 100 | 485 | 100 | 409 | 100 | 320 | 100 | 220 | 100 | 401 | 100 | 547 | 100 | 944 | 100 | 907 | 100 | | Total project cost in ₹ crore | 1,27,328 | 87,253 | 91,781 | 1,79,249 | 1,68,239 | 1,59,189 | 1,75,830 | 75,558 | 1,42,111 | 2,66,621 | 3,91,003 | 3,67,973 | *: Comprise industries like Paper & paper products, Agricultural & related activities, Manufacturing of electric and non-electric machinery, Glass & pottery, Sugar and allied products, Entertainment, Trading of services, Printing & publishing, other manufacturing and other services.

Note: i. Per cent share is the share in total cost of project. Percentages may not total 100 due to rounding.

ii. -: Nil/Negligible. |

| Table A8: State-wise Distribution of Projects Sanctioned by Banks/FIs: 2013-14 to 2024-25 | | State | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | No.

of Proj ects | Per cent Sha re | No.

of Pro jects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | No.

of Proj ects | Per cent Sha re | | Gujarat | 66 | 14.5 | 71 | 9.5 | 61 | 15.1 | 102 | 23.0 | 71 | 8.0 | 56 | 11.1 | 47 | 15.1 | 54 | 17.1 | 82 | 11.7 | 82 | 14.0 | 154 | 14.7 | 152 | 21.4 | | Maharashtra | 76 | 19.7 | 38 | 14.8 | 36 | 9.4 | 57 | 8.8 | 65 | 23.3 | 34 | 11.5 | 41 | 6.9 | 13 | 8.5 | 44 | 9.6 | 48 | 7.9 | 93 | 11.7 | 111 | 15.1 | | Karnataka | 39 | 6.2 | 27 | 5.4 | 21 | 6.2 | 52 | 6.8 | 64 | 9.6 | 34 | 5.7 | 33 | 17.2 | 11 | 6.1 | 24 | 6.9 | 37 | 7.3 | 61 | 11.1 | 60 | 6.2 | | Andhra Pradesh | 37 | 4.0 | 24 | 8.1 | 33 | 12.3 | 47 | 8.0 | 22 | 9.9 | 29 | 11.1 | 12 | 4.0 | 7 | 15.0 | 11 | 2.1 | 27 | 4.4 | 51 | 10.1 | 28 | 9.3 | | Uttar Pradesh | 21 | 1.1 | 20 | 5.4 | 15 | 2.5 | 22 | 3.7 | 30 | 2.4 | 28 | 4.8 | 24 | 5.4 | 30 | 13.7 | 33 | 12.7 | 45 | 16.2 | 69 | 7.6 | 78 | 7.1 | | Odisha | 10 | 11.7 | 5 | 15.9 | 6 | 3.1 | 6 | 3.1 | 5 | 3.0 | 9 | 1.4 | 6 | 1.9 | 2 | 0.1 | 9 | 2.2 | 12 | 11.8 | 23 | 6.7 | 18 | 4.6 | | Telangana | - | - | - | - | 10 | 3.8 | 51 | 5.5 | 17 | 1.9 | 26 | 9.1 | 12 | 4.0 | 9 | 1.9 | 16 | 3.4 | 30 | 1.9 | 40 | 4.1 | 42 | 2.8 | | Rajasthan | 24 | 1.4 | 29 | 11.1 | 10 | 0.9 | 23 | 2.8 | 33 | 6.3 | 21 | 7.7 | 23 | 3.8 | 21 | 17.1 | 32 | 12.6 | 22 | 3.1 | 61 | 3.6 | 45 | 7.3 | | Jharkhand | 4 | 0.3 | 2 | 0.7 | 5 | 0.3 | 1 | 0.0 | 3 | 0.3 | 2 | 0.5 | 4 | 9.4 | 1 | 0.2 | 6 | 0.8 | 12 | 1.9 | 17 | 3.4 | 7 | 1.3 | | Madhya Pradesh | 30 | 6.1 | 14 | 3.9 | 21 | 7.0 | 18 | 7.5 | 10 | 0.7 | 12 | 1.6 | 10 | 1.2 | 19 | 2.8 | 18 | 4.2 | 35 | 5.0 | 56 | 3.4 | 41 | 2.7 | | Chhattisgarh | 16 | 10.7 | 8 | 7.4 | 8 | 4.6 | 15 | 4.0 | 7 | 4.8 | 6 | 0.9 | 6 | 0.2 | 3 | 1.2 | 4 | 0.8 | 8 | 1.4 | 26 | 3.3 | 24 | 1.1 | | Tamil Nadu | 33 | 5.4 | 27 | 2.9 | 26 | 9.3 | 23 | 4.4 | 28 | 6.6 | 32 | 12.8 | 28 | 8.3 | 7 | 0.7 | 40 | 8.8 | 44 | 4.7 | 83 | 3.0 | 73 | 4.7 | | Bihar | 6 | 0.2 | 4 | 0.1 | 6 | 0.2 | 4 | 0.2 | 3 | 0.1 | 6 | 0.4 | 6 | 3.4 | 1 | 0.0 | 5 | 3.4 | 6 | 1.6 | 13 | 2.6 | 11 | 0.9 | | West Bengal | 12 | 1.2 | 9 | 1.3 | 14 | 3.1 | 18 | 1.7 | 14 | 1.8 | 13 | 1.1 | 7 | 0.9 | 3 | 0.4 | 11 | 2.6 | 16 | 1.0 | 28 | 2.3 | 34 | 2.3 | | Jammu & Kashmir | 10 | 5.2 | 2 | 0.1 | 9 | 0.2 | 3 | 0.1 | 8 | 2.0 | 11 | 0.4 | 3 | 0.3 | 5 | 0.2 | 5 | 0.2 | 23 | 3.1 | 36 | 1.9 | 54 | 3.8 | | Punjab | 28 | 1.5 | 6 | 0.3 | 11 | 1.7 | 29 | 2.1 | 31 | 2.2 | 15 | 1.9 | 9 | 0.8 | 4 | 0.7 | 15 | 2.2 | 21 | 2.5 | 34 | 1.6 | 28 | 1.5 | | Haryana | 15 | 1.1 | 11 | 1.9 | 16 | 3.6 | 13 | 1.6 | 21 | 0.5 | 18 | 1.7 | 20 | 3.4 | 15 | 7.8 | 14 | 2.0 | 14 | 1.0 | 25 | 1.5 | 20 | 0.6 | | Delhi | 5 | 0.4 | 2 | 0.1 | 1 | 0.1 | 5 | 0.3 | 6 | 1.2 | 8 | 1.3 | 3 | 0.5 | 2 | 0.1 | 3 | 0.6 | 12 | 0.4 | 10 | 1.2 | 14 | 0.3 | | Assam | 4 | 0.3 | 2 | 0.2 | 4 | 0.4 | 10 | 0.6 | 5 | 0.8 | 4 | 0.2 | 1 | 0.3 | 3 | 4.4 | 2 | 0.0 | 6 | 0.7 | 13 | 0.9 | 14 | 1.2 | | Himachal Pradesh | 3 | 1.8 | 3 | 0.1 | 8 | 1.4 | 1 | 0.0 | 8 | 2.3 | 7 | 0.3 | 6 | 0.1 | 4 | 0.2 | 7 | 1.2 | 11 | 2.2 | 10 | 0.3 | 9 | 0.1 | | Kerala | 3 | 0.0 | 4 | 0.2 | 4 | 0.1 | 6 | 2.7 | 3 | 0.1 | 6 | 0.9 | 3 | 1.0 | - | - | 5 | 4.2 | 12 | 0.9 | 11 | 0.2 | 12 | 0.3 | | Goa | - | - | - | - | 1 | 0.0 | 3 | 0.6 | 2 | 1.9 | 3 | 1.8 | 2 | 0.1 | - | - | 3 | 3.0 | 3 | 0.8 | 4 | 0.1 | 3 | 0.6 | | Uttarakhand | 5 | 0.1 | 5 | 0.2 | 2 | 0.1 | 11 | 0.4 | 6 | 0.4 | 9 | 0.4 | 5 | 0.1 | 2 | 0.1 | 2 | 0.4 | 5 | 0.1 | 8 | 0.1 | 14 | 0.3 | | Multi-State # | 21 | 6.9 | 10 | 9.5 | 13 | 13.5 | 17 | 11.8 | 16 | 7.5 | 15 | 9.8 | 8 | 11.7 | 2 | 1.4 | 7 | 4.0 | 10 | 5.5 | 12 | 4.4 | 9 | 4.5 | | others* | 4 | 0.2 | 3 | 0.9 | 5 | 1.1 | 4 | 0.3 | 7 | 2.4 | 5 | 1.7 | 1 | 0.0 | 2 | 0.3 | 3 | 0.3 | 6 | 0.3 | 6 | 0.3 | 6 | 0.1 | | Total | 472 | 100 | 326 | 100 | 346 | 100 | 541 | 100 | 485 | 100 | 409 | 100 | 320 | 100 | 220 | 100 | 401 | 100 | 547 | 100 | 944 | 100 | 907 | 100 | | Total Cost of Projects (in ₹ crore) | 1,27,328 | 87,253 | 91,781 | 1,79,249 | 1,68,239 | 1,59,189 | 1,75,830 | 75,558 | 142,111 | 2,66,621 | 3,91,003 | 3,67,973 | #: Comprise projects over several states.

*: Comprise remaining states/union territories.

Note: i. Per cent share is the share in total cost of project. Percentages may not total 100 due to rounding.

ii. -: Nil/Negligible. |

|