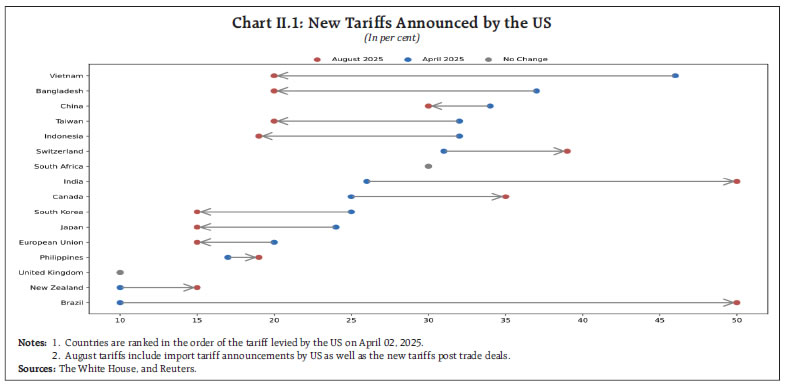

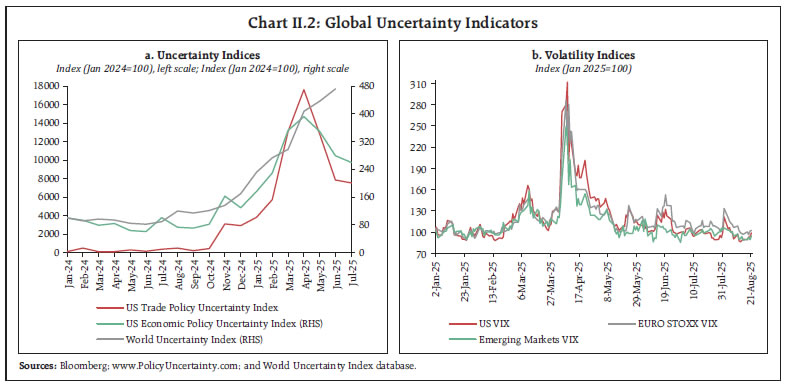

Continuing uncertainty on US trade policies shaped the global macroeconomic environment during July and August. Domestic economic activity remained mixed across sectors in July. Timely progress of monsoon has boosted kharif sowing. While industrial activity remained subdued, manufacturing sector expanded, along with services sector sustaining the growth momentum. Headline inflation fell for the ninth consecutive month in July. Financial conditions remained congenial and supportive of domestic economic activity. India’s sovereign rating upgrade by S&P bodes well for capital inflows and sovereign yields, going forward. Introduction Continuing uncertainty on US trade policies shaped the global macroeconomic environment during July and August. While the EU, South Korea and Japan have entered into trade deals with the US, steeper tariffs were levied on Brazil, Canada, India and Switzerland in August. In its July 2025 World Economic Outlook (WEO) update, the IMF highlighted that the risks to global growth outlook were tilted to the downside notwithstanding the upward revision in global growth projections. High frequency indicators for global manufacturing activity returned to contractionary zone in July. As per the latest available information, the world trade volume also contracted. Nevertheless, global economic activity, aided by a strong expansion of the services sector, held up. Reflecting uncertain demand conditions, industrial metal prices remained subdued, with crude oil prices exhibiting volatility on geo-political developments and OPEC plus deciding to increase crude oil production. Inflation remained sticky across many advanced economies, leading many central banks to pause on policy rates in July. Subsequently in August, growth concerns led some central banks to reduce their policy rates. Global equity markets showed divergent trends. The equity market rallies in the US and China continued into August. While the Japanese equity indices registered a significant jump following trade deals with the US, those for Europe moved rangebound. The US treasury yields edged up in July on fiscal debt concerns. In August so far, yields exhibited a two-way movement reacting to the weak employment numbers, lower than anticipated consumer price index (CPI) inflation, significant pick-up in wholesale inflation and release of minutes of the July meeting of the Federal Open Market Committee. Various high frequency indicators of domestic economic activity showed a mixed trend in July, with goods and services tax (GST) e-way bills scaling a record high and GST collections registering a robust growth, but electricity demand remained subdued. Demand in rural areas continued to show resilience. Timely progress of southwest monsoon has helped boost kharif sowing. Industrial activity remained subdued in June, dragged down by mining and electricity. Lead indicators for manufacturing and services activity showed sustained expansion in July. Merchandise trade deficit widened in July 2025 due to higher oil deficit with non-oil deficit remaining steady. Uncertainty surrounding the India-US trade deal persists. While the current exemptions from tariff alleviate the immediate impact, exports in some sectors may get negatively impacted. Headline inflation fell for the ninth consecutive month in July and to its lowest level after June 2017, as deflation in food accentuated and core inflation (CPI excluding food and fuel inflation) softened. Vegetable price deflation, in the wake of a muted seasonal uptick in prices and favourable base effects, drove food price dynamics. Other food subgroups such as meat and fish, pulses, and spices continued to record a deflation and cereals experienced a notable fall in inflation. The softening of core inflation was driven by a sharp moderation in the services component. Overall financial conditions remained benign during July and August (till August 21). Amidst surplus liquidity, the weighted average call rate – the operating target of monetary policy – hovered in the lower half of the corridor. Overnight rates in the money market moved in tandem with the weighted average call rate. In the fixed income segment, 10-year G-sec yields hardened during mid-July to early August amidst uncertainties over India-US trade negotiations and subsequent tariff imposition by the US. The S&P’s upgrade of India’s sovereign rating on August 14, 2025 led to a brief easing.1 Thereafter, yields hardened during the third week of August. On the credit side, bank credit growth exhibited a modest improvement in June 2025, driven by an uptick in credit to micro, small and medium enterprises. The total flow of resources to the commercial sector registered an increase. Large corporates increasingly met their funding requirements through market-based instruments such as commercial paper and corporate bonds. Domestic equity markets were negatively influenced by subdued corporate earnings and announcement of significantly higher US import tariffs on Indian exports during July and early August, but revived thereafter amidst optimism surrounding India’s sovereign credit rating upgrade and the announcement of GST reforms. Steady inflows from domestic institutional investors, notably mutual funds, helped cushion the impact from net selling by foreign portfolio investors (FPIs). Gross inward foreign direct investment (FDI) reached a four-year high in June. Even so, net FDI inflows remained muted due to an increase in both repatriation of FDI and outward FDI. India’s external sector remained resilient with a modest current account deficit and forex reserves covering 11 months of imports. The S&P’s sovereign rating upgrade for India – underpinned by buoyant economic growth, enhanced monetary policy credibility and government’s commitment to fiscal consolidation – could potentially lead to a reduction in borrowing costs, greater investor confidence and higher foreign capital inflows, going forward. Set against this backdrop, the remainder of the article is structured into four sections. Section II covers the rapidly evolving developments in the global economy. Section III provides an assessment of domestic macroeconomic conditions. Section IV encapsulates financial conditions in India, while Section V presents the concluding observations. II. Global Setting In July, the global macroeconomic environment was largely shaped by trade tariff announcements and the continuing uncertainties on US import tariffs rates relating to some major economies and sectors. While the EU, South Korea and Japan have entered into trade deals with the US, steeper tariffs were levied on Brazil, Canada, India and Switzerland in August (Chart II.1). In its July 2025 update of the World Economic Outlook (WEO), the IMF revised its global GDP growth forecasts for 2025 and 2026 upwards vis-à-vis its April projections. Growth forecasts were increased for advanced economies (AEs) by 0.1 percentage points led by the US, the UK, and the Euro area, while growth of emerging market and developing economies (EMDEs) was revised upwards by 0.4 percentage points, driven by stronger projections for China and India (Table II.1). Considering the lingering uncertainties on US trade policy stance, the balance of risks to global growth outlook was perceived to be tilted to the downside.  Global uncertainty remained elevated in July on account of US tariff related uncertainty and geo-political tensions. The economic and trade policy uncertainty indices in the US have retreated from their all-time high levels in April, but the pace of decline has moderated somewhat.2 Despite some temporary pick-up in AEs in end July, financial market volatility eased in August reflecting improved market sentiment (Chart II.2a and II.2b). | Table II.1: IMF’s GDP Growth Projections – Select AEs and EMDEs | | Projection for | 2025 | 2026 | | Month of Projection | July 2025 | April 2025 | July 2025 | April 2025 | | World | 3.0 | 2.8 | 3.1 | 3.0 | | Advanced Economies | 1.5 | 1.4 | 1.6 | 1.5 | | US | 1.9 | 1.8 | 2.0 | 1.7 | | UK | 1.2 | 1.1 | 1.4 | 1.4 | | Euro area | 1.0 | 0.8 | 1.2 | 1.2 | | Japan | 0.7 | 0.6 | 0.5 | 0.6 | | Emerging Market and Developing Economies | 4.1 | 3.7 | 4.0 | 3.9 | | Emerging and Developing Europe | 1.8 | 2.1 | 2.2 | 2.1 | | Russia | 0.9 | 1.5 | 1.0 | 0.9 | | Emerging and Developing Asia | 5.1 | 4.5 | 4.7 | 4.6 | | India# | 6.4 | 6.2 | 6.4 | 6.3 | | China | 4.8 | 4.0 | 4.2 | 4.0 | | Latin America and the Caribbean | 2.2 | 2.0 | 2.4 | 2.4 | | Mexico | 0.2 | –0.3 | 1.4 | 1.4 | | Brazil | 2.3 | 2.0 | 2.1 | 2.0 | | Middle East and North Africa | 3.2 | 2.6 | 3.4 | 3.4 | | Sub-Saharan Africa | 4.0 | 3.8 | 4.3 | 4.2 | | South Africa | 1.0 | 1.0 | 1.3 | 1.3 | Note: #: India’s data is on a fiscal year basis (April-March), while for all other countries it is for calendar years.

Source: IMF’s World Economic Outlook update, July 2025. |

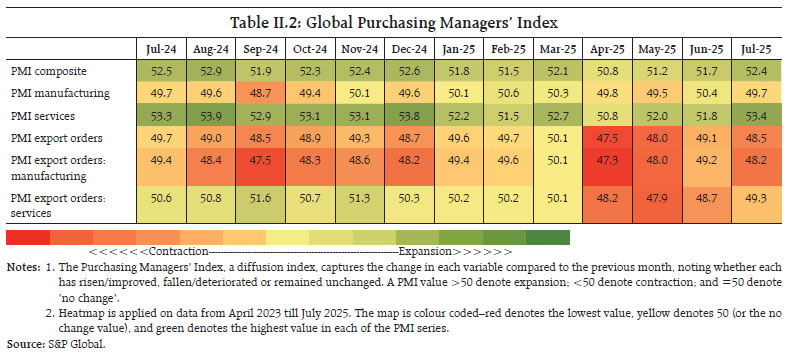

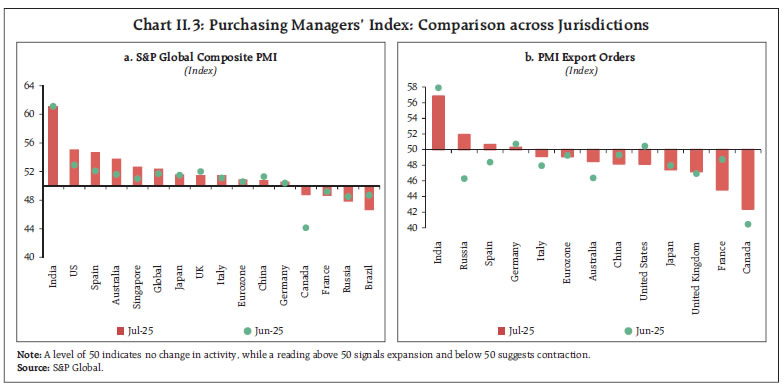

The global composite purchasing managers’ index (PMI) rose to a seven-month high in July, reflecting continued expansion in output and new business. This was primarily driven by expansion in services, with the sector’s PMI rising to its highest level since December 2024. Global manufacturing PMI turned contractionary, indicating a deterioration in output as the impact of front-loading of production in anticipation of higher tariff receded and firms awaited clarity on trade policies (Table II.2). PMI readings in July remained in expansionary zone for major AEs and EMDEs. Among major EMDEs, India continued to register strong expansion in business activity. In contrast, Brazil and Russia continued to contract (Chart II.3a). Major economies, including the US, China, Japan and Eurozone witnessed, in general, a contraction in new export orders but India registered a strong expansion (Chart II.3b). The global supply chain pressure index moderated to a level close to its historical average (Annex chart A1).

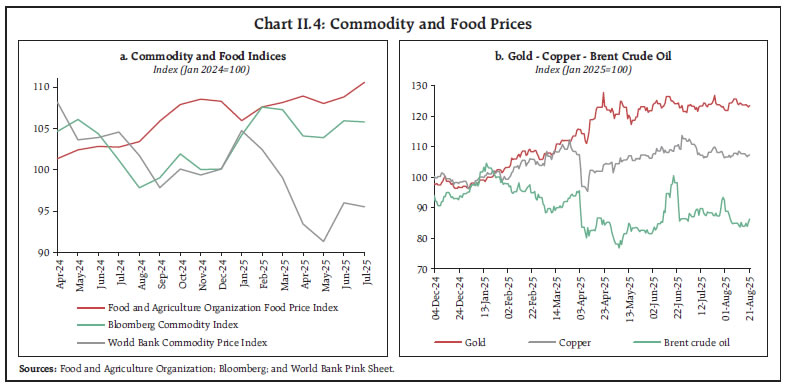

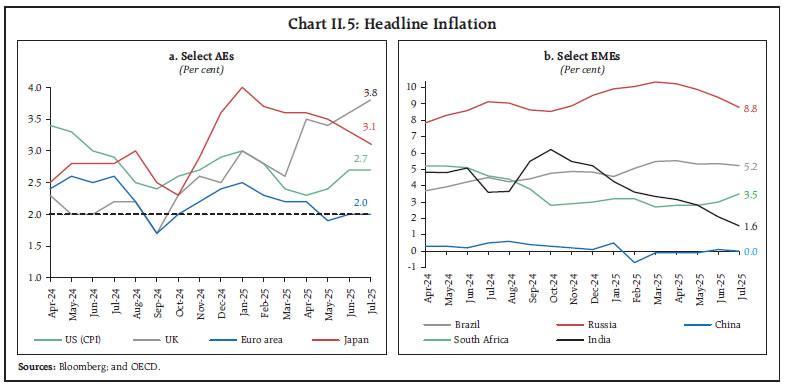

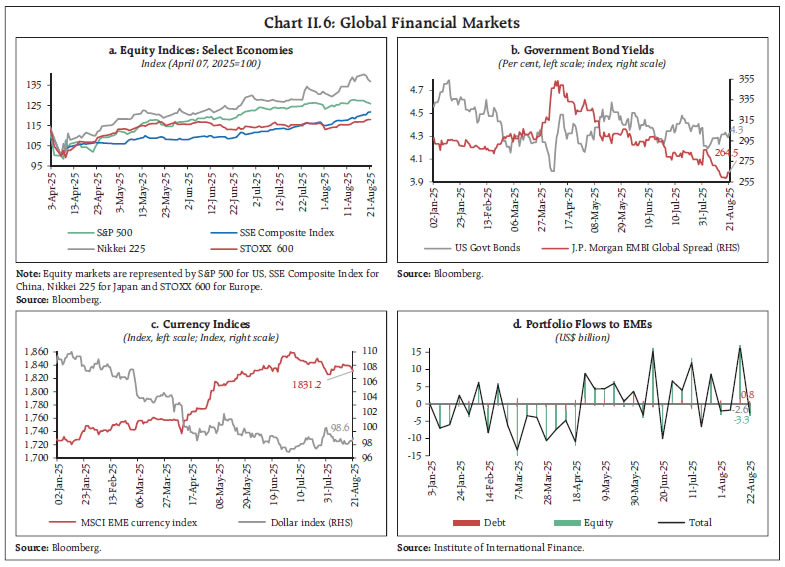

Commodity prices remained broadly unchanged in July on the back of adequate supply of energy and weak macro sentiment. Global food prices rose above its two-year high, with an increase in the prices of meat and vegetable oil, partially offset by cereals, dairy and sugar (Chart II.4a).3 Crude oil prices stabilised since July as fears of broader conflict eased and OPEC plus signalled potential supply increases in August. Crude prices also moderated on account of weak manufacturing activity in China and rising inventories in the US. Gold prices remained broadly stable in July but inched higher in early August in the wake of bullion tariff uncertainty and rising expectation of policy rate cut by the US Fed. It moderated thereafter, aided by clarity on exemption of gold bullion from import tariffs (Chart II.4a and 4b).  CPI inflation in the US and Euro area remained stable in July. CPI inflation in the US remained steady at 2.7 per cent in July, though core inflation reached a six-month high of 3.1 per cent. In the Euro area, headline inflation held steady at 2.0 per cent marking the second consecutive month that inflation has aligned with the European Central Bank’s official target. Inflation in the UK rose to its highest level since January 2024, while Japan’s inflation dropped to an eight-month low (Chart II.5a). Among major EMDEs, inflation softened in Brazil although remaining above target. Deflationary pressure persists in China while Russia continued to grapple with inflation well above the target. South Africa’s annual inflation rate inched up in July, marking the second consecutive monthly increase (Chart II.5b). Equity market movements in July-August tracked the corporate earnings results and progress in trade talks with the US, although uncertainty about the economic outlook imparted volatility. The US equity markets increased for most of July, supported by healthy corporate earnings in Q2:2025 and optimism about trade negotiations (Chart II.6a). Gains over the month were wiped out towards the end of July as weaker-than-expected US non-farm payroll data for July and substantial downward revision of the June data weighed on market sentiments. Stoxx Europe 600 lost momentum amidst muted corporate earnings in Europe. Though there was a pick-up following the European Union-US trade agreement, it was short-lived on account of lingering uncertainties on the real benefits of the deal for the European Union. In contrast, equity indices in Japan registered sharp gains following the trade deal with the US, and thereafter on robust GDP growth for Q2 and strong corporate results in August. The US 10-year Treasury yields rose in July on account of stronger-than-anticipated June inflation print and growing uneasiness in markets with the fiscal situation which reduced hopes of imminent rate cuts. In August, yields experienced two-way movements. Though they fell initially owing to weaker than expected US jobs data and lower than anticipated CPI inflation, yields firmed up thereafter following a higher-than-expected increase in the producer price inflation. Yields eased following the release of the minutes of the July meeting of the Federal Open Market Committee (Chart II.6b). Risk premium on emerging market bonds declined in July and August on resilient macroeconomic fundamentals of several economies, with a soft US dollar contributing further to the spread compression. The US dollar remained intermittently volatile and subdued, reflecting shifting expectations around Fed policy, incoming macro data and changing global risk perceptions (Chart II.6c). Concerns over the US fiscal dynamics, tighter global financial conditions, and an uneven global recovery contributed to heightened volatility in capital flows to emerging markets (Chart II.6d).

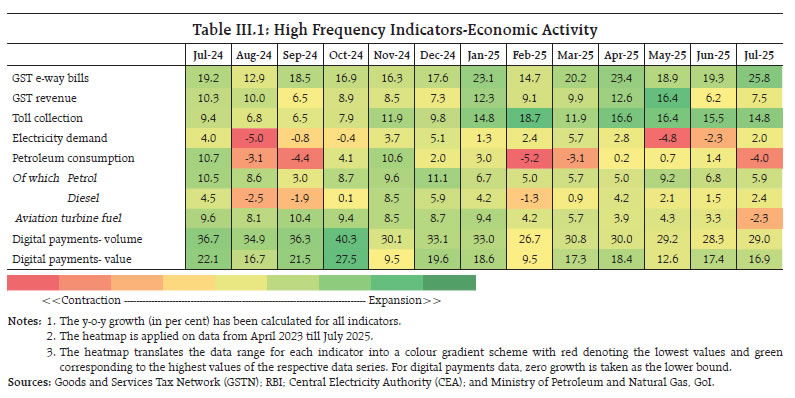

Policy decisions by central banks’ continued to be driven by the growth-inflation dynamics in respective jurisdictions amidst uncertainties surrounding global trade policies. Major advanced economies largely kept policy rates unchanged in July owing to sticky core and services inflation. In August, the UK, Australia and New Zealand reduced their policy rates by 25 bps each Sweden held its key policy rate steady amidst high trade uncertainty. Amongst the EMDEs, Indonesia, Mexico and Thailand also reduced key policy rates by 25 bps each in August. China held its benchmark lending rate steady for the third consecutive month (Chart II.7). III. Domestic Developments The Indian economy remained resilient amidst global uncertainties. Timely progress of southwest monsoon has helped increase kharif sowing. Growth in industrial sector remained uneven across segments in June, pulled down by electricity and mining. Manufacturing and services continued to expand in July. Forward-looking surveys of consumer sentiments show improvement in consumer confidence for the current period and improved optimism about the future (Annex chart A3). Headline inflation, driven by benign food prices and favourable base effects, is likely to soften further and remain below the 4 per cent target in Q2. In this context, the monetary policy committee unanimously voted to keep the repo rate unchanged at 5.5 per cent in its resolution of August 6, 2025, considering the current macroeconomic conditions, outlook and uncertainties, as well as the ongoing transmission of the cumulative 100 bps rate cut undertaken since February 2025. The monetary policy committee, while remaining vigilant on the incoming data and the evolving domestic growth-inflation dynamics, also unanimously decided to continue with the neutral stance while determining the appropriate monetary policy path. Aggregate Demand The high-frequency indicators for overall economic activity showed a mixed picture in July. GST e-way bills touched a record high in July, led by pre-festive inventory build-up and higher compliance. GST revenue picked-up and toll collections remained steady, although electricity demand and petroleum consumption recorded weakness in July. Digital payments, a key indicator of overall economic activity, registered robust double-digit growth in both volume and value terms (Table III.1) During July, urban demand moderated with domestic air passenger traffic weakening due to seasonal factors and runway maintenance. Retail sales of passenger vehicles also declined. Rural demand remained resilient supported by an uptick in real wages. Retail tractor sales posted robust growth, aided by a favourable monsoon. Two-wheeler retail sales declined due to kharif sowing operations and heavy rains. Sales are expected to pick up in the upcoming festive season. Household demand for employment under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) declined in July as kharif sowing picked up (Table III.2).  Employment conditions remained resilient in July. The all-India unemployment rate declined to 5.2 per cent, led by decline in rural unemployment. The labour force participation rate and worker population ratio edged up in both rural and urban areas.4 Job creation in organised sector remained strong as reflected in record net pay roll additions under Employees’ Provident Fund Organization in June. Growth in white-collar job listings, as per the Naukri JobSpeak index, was led by travel/hospitality, insurance, and education in July. PMI employment indices for both manufacturing and services expanded in July, albeit at a slower pace than in June (Table III.3).

The gross fiscal deficit of the union government for Q1:2025-26, as proportion of budget estimates for the financial year, was higher as compared with Q1 of last year (Chart III.1a).5 This was on account of larger capital and revenue expenditure, and lower net tax revenue.6 On account of front-loading of capital expenditure, 24.5 per cent of the budgetary target was completed in Q1.7 Gross fiscal deficit of states in Q1:2025-26, as proportion of budget estimates for the financial year, was also higher vis-a-vis Q1 of last year. This was on account of higher spending as well as lower revenue receipts (Chart III.1b). Lower revenue receipts resulted from slowdown in growth of states’ goods and services tax collections. Non-GST revenue streams such as state excise duties, stamp duties, and registration fees remained robust. On the expenditure side, both revenue and capital expenditure were strong. Trade Merchandise trade deficit widened to US$ 27.3 billion in July 2025 from US$ 24.8 billion a year ago due to higher oil deficit (Chart III.2). The share of oil in total trade deficit increased as compared to a year ago.8 Non-oil deficit remained roughly the same at US$ 16.1 billion. Merchandise exports expanded after declining in the previous two months (Annex chart A4).9 Engineering goods, electronic goods, gems and jewellery, drugs and pharmaceuticals, and organic and inorganic chemicals performed well while petroleum products, iron ore, and oil meals contributed negatively. Merchandise imports also expanded after declining in the previous two months (Annex chart A5).10 Electronic goods, petroleum crude and products, fertilisers, crude and manufactured, machinery, electrical and non-electrical, and gold supported import growth during the month while, coal, coke and briquettes, pulses, and leather and leather products dragged overall imports down. Services trade remained robust despite challenging global trade scenario. In June 2025, net services export earnings increased by 19.8 per cent (y-o-y) to US$ 16.2 billion. Services exports grew at a fast pace, underscoring the sustained strength of India’s services sector. At the same time, imports also rose rapidly, reflecting a rise in software services and transportation services imports (Chart III.3).11

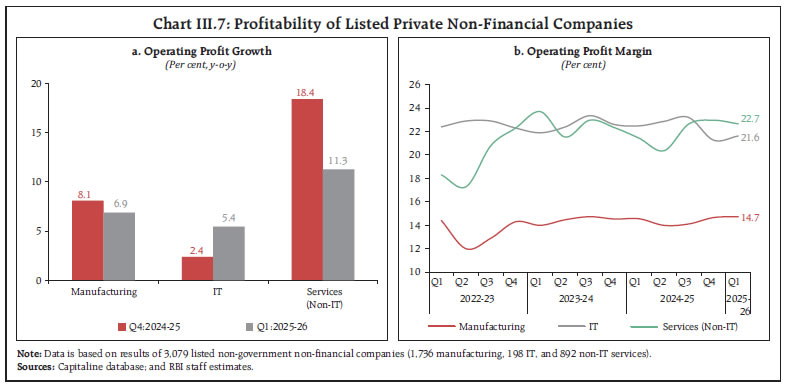

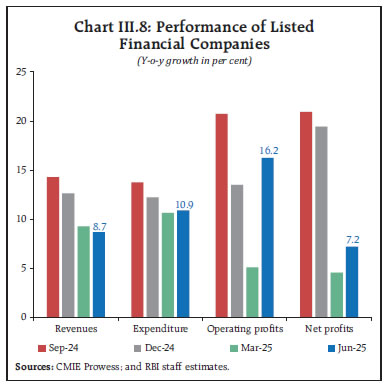

Aggregate Supply Agriculture Timely progress of the southwest monsoon has helped increase kharif sowing (Chart III.4).12 The increase in sown area was mainly in rice and maize, while the area under oilseeds and cotton declined. Tur, which accounts for 35 per cent of area under pulses, witnessed a decline as farmers shifted to more lucrative crops such as maize.13 The cumulative rainfall during June 1 - August 22, 2025 at the all-India level stands 2 per cent above normal. Reservoir levels stood well above the previous year and the decadal average (Chart III.5). The combined public stock of rice and wheat remained comfortable supported by strong procurement.14 Industry and Services Q1:2025-26 Results for Listed Companies Results of listed non-government non-financial companies15 for Q1:2025-26 indicated a subdued performance in the corporate sector. Sales growth of listed private manufacturing companies moderated further primarily due to a slowdown in petroleum industry, automobiles, electrical machinery, and food products.16 Following a period of steady improvement, sales growth of IT firms also declined during Q1, reflecting the impact of global headwinds. Sales growth of non-IT services companies also moderated (Chart III.6). Despite subdued sales growth, the operating profits and margins remained stable for manufacturing and services companies during Q1:2025-26 on account of slower increase in expenses (Chart III.7a & III.7b). During Q1:2025-26, listed Indian banking and financial sector companies17 underwent a moderation in both revenue and net profit growth (Chart III.8). Revenue continued to expand but at a slower pace. Costs rose on account of sequential increase in salary and wage expenses. Higher provisioning costs and deterioration in asset quality of some companies contributed to slower growth of net profits relative to operating profits.

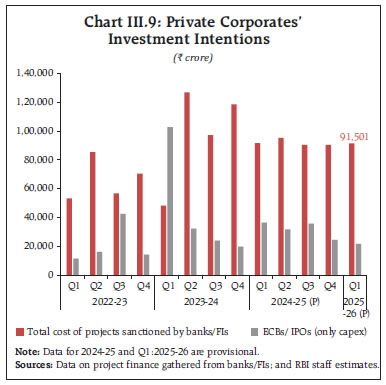

On the investment front, the total cost of capex projects sanctioned by select banks and financial institutions during Q1:2025-26 recorded a modest increase over the previous quarter. About 66 per cent of intended investment was concentrated in power, construction and IT software industries. Funds raised through external commercial borrowings and initial public offering for capex purposes were slightly lower than in the previous quarter. Overall, fund mobilisation for capex by private corporates through various channels indicated stable investment activity despite heightened uncertainties (Chart III.9). Monthly Indicators of Industrial Activity Growth in industrial activity, as measured by the year-on-year change in Index of Industrial Production (IIP), eased to a ten-month low in June 2025. While mining and electricity continued to experience contraction, manufacturing expanded. In July, growth in index of eight core industries remained subdued with four out of the eight sectors contracting, although steel and cement industries performed well.  Available high-frequency indicators for July point to expansion in manufacturing activity, with its PMI surging to a 16-month high. Automobile production recorded its fastest growth in a year, led by strong output of three-wheelers and two-wheelers. Conventional electricity generation remained subdued for the fourth consecutive month, driven by early rains and softer industrial output. In contrast, renewable energy generation sustained its pace. Import of capital goods rebounded in July (Table III.4). Supply chain pressures inched up in July 2025 but stayed below their historical average levels (Annex chart A6). India has emerged as the third-largest country in terms of solar power generation – a significant milestone in its pursuit of an energy-secure future.18 India’s installed solar power capacity has increased sharply in recent years (Chart III.10). Moreover, as a measure of accelerated e-mobility in India, the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme has been extended by two years till March 31, 2028.

Monthly Indicators of Services Activity India’s services sector sustained its growth momentum in July, with PMI services recording the highest expansion in 11 months, driven by new orders and output on the back of strong domestic and international demand. International air passenger traffic remained firm while retail commercial vehicles segment expanded. Port traffic rose for the eighth consecutive month led by higher growth in fertilisers, petroleum, oil and lubricants, and containerised cargo. Growth in construction sector indicators – steel consumption and cement production – remained robust (Table III.5). Inflation Headline inflation declined for the ninth consecutive month in July, reaching its lowest level since June 2017, driven by deeper food deflation and a softening of core inflation (CPI excluding food and fuel).19 The all-India CPI inflation was at 1.6 per cent in July 2025 as against 2.1 per cent in June (Chart III.11). Strong favourable base effects, which were partly offset by a positive price momentum, also contributed to the fall in headline inflation (Chart III.12).

Food inflation dipped to its lowest level in 78 months driven by a deflation in vegetables, pulses, spices, and meat and fish sub-groups.20 Inflation in cereals, eggs, milk and products, sugar and confectionery moderated, while that in oils and fats, non-alcoholic beverages, fruits, and prepared meals edged up (Chart III.13). Fuel and light inflation inched up in July with inflation remaining elevated for LPG while moderating for electricity.21 Kerosene prices continued to record deflation, though at a slower pace. Core inflation eased to 3.9 per cent in July 2025 from 4.4 per cent in June. The decline in inflation was mostly driven by transport and communication and education sub-groups, while inflation in health and personal care and effects inched up. Clothing and footwear recorded a marginally lower inflation, while that in pan, tobacco and intoxicants, household goods and services, and housing remained unchanged. Both rural and urban inflation eased further to 1.2 per cent and 2.0 per cent, respectively, in July. While state-level inflation rates varied between (-) 0.61 per cent and 8.89 per cent, majority of the states experienced inflation of less than 2 per cent (Chart III.14).

High-frequency food price data for August so far (up to 22nd) indicate a pick-up in cereal prices. Pulses recorded a mixed trend, with a decline in tur/arhar dal prices, and an increase in gram dal price. Among edible oils, prices firmed up for mustard, sunflower, groundnut and soybean oils, while palm oil prices remained steady. Among key vegetables, tomato prices continued to increase. The prices of potatoes and onions remained steady (Chart III.15). Retail selling prices of petrol and diesel remained unchanged in August. Kerosene prices firmed up while LPG prices remained unchanged (Table III.6). The PMIs for July recorded a sequential pick-up in the rate of expansion of input prices for manufacturing and services. Selling prices also accelerated for both services and manufacturing firms (Annex chart A7).

| Table III.6: Petroleum Products Prices | | Item | Unit | Domestic Prices | Month-over-month (per cent) | | Aug-24 | Jul-25 | Aug-25^ | Jul-25 | Aug-25^ | | Petrol | ₹/litre | 100.97 | 101.12 | 101.12 | 0.0 | 0.0 | | Diesel | ₹/litre | 90.42 | 90.53 | 90.53 | 0.0 | 0.0 | | Kerosene (subsidised) | ₹/litre | 46.65 | 43.03 | 44.47 | 7.1 | 3.4 | | LPG (non-subsidised) | ₹/cylinder | 813.25 | 863.25 | 863.25 | 0.0 | 0.0 | Notes: 1. ^ : For the period August 1-22, 2025.

2. Other than kerosene, prices represent the average Indian Oil Corporation Limited (IOCL) prices in four major metros (Delhi, Kolkata, Mumbai and Chennai). For kerosene, prices denote the average of the subsidised prices in Kolkata, Mumbai and Chennai.

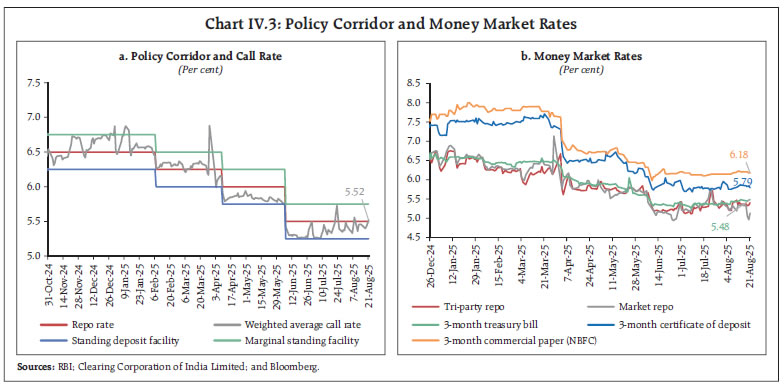

Sources: IOCL; Petroleum Planning and Analysis Cell (PPAC); and RBI staff estimates. | Rural labour wage growth remained largely stable in June 2025 as the non-agricultural sector wage edged up, while wage growth in the agricultural sector saw a modest moderation (Chart III.16). Increase in non-agricultural wage growth was primarily driven by occupations including sweeping/cleaning, light motor vehicle and tractor drivers, and mason workers. IV. Financial Conditions Overall financial conditions remained benign during July and August (till August 21) [Chart IV.1]. System liquidity remained in surplus during July and August (up to August 21), primarily driven by higher government spending. The average daily net absorption under the liquidity adjustment facility stood at ₹3.07 lakh crore during July 16 to August 21, 2025, marginally lower than in the preceding one-month period (Chart IV.2). During this period, to absorb excess liquidity which was exerting downward pressure on the overnight money market rates, the Reserve Bank conducted 12 variable rate reverse repo (VRRR) auctions (overnight to 8-day).23 To tide over temporary liquidity tightness due to tax related outflows, the Reserve Bank also conducted three variable rate repo (VRR) auctions of 2-day and overnight maturity. The banks’ recourse to the marginal standing facility remained low on easy liquidity conditions.24 Money Market Amidst ample liquidity, the weighted average call rate – the operating target of monetary policy – hovered in the lower half of the corridor. The rate, however, briefly inched towards the marginal standing facility rate during July 21 to July 23 on account of large GST outflows. Consequent to surplus liquidity absorption through VRRR auctions, the spread between the weighted average call rate and the policy repo rate narrowed (Chart IV.3a).25 Overnight rates in the collateralised segments − the triparty and market repo – and the benchmark secured overnight rupee rate largely moved in tandem with the uncollateralised rate.26 Recently, an Internal Working Group to review the Reserve Bank’s extant liquidity management framework has recommended the continuation of weighted average call rate as the operating target of monetary policy.27

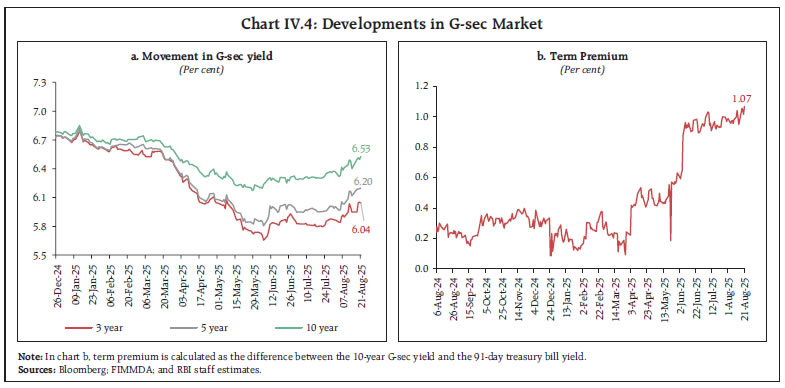

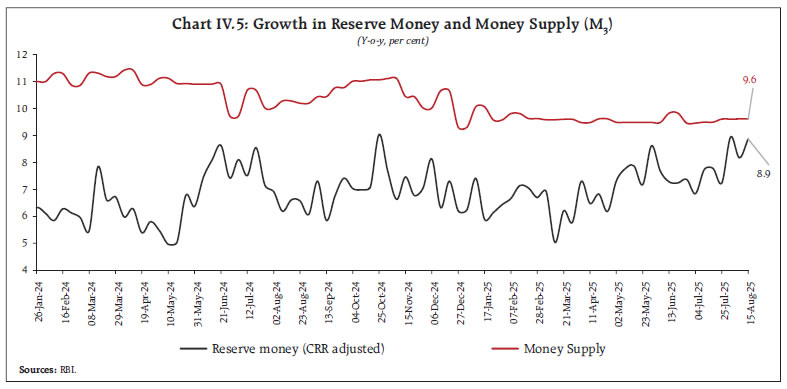

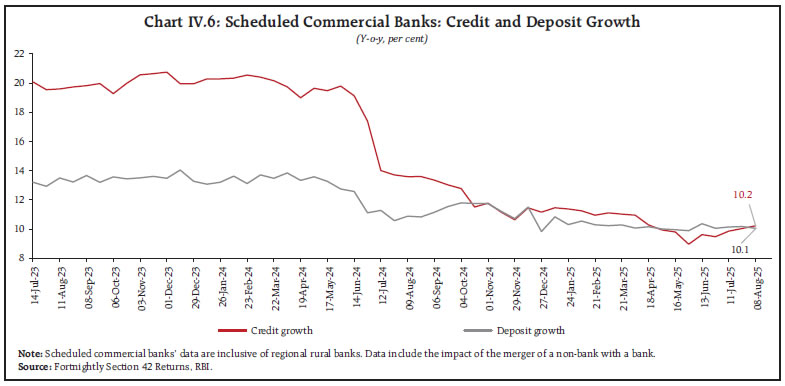

Overall, interest rates in the term money market remained broadly stable (Chart IV.3b).28 The average yields hardened marginally for treasury bills while commercial papers and certificates of deposit rates softened.29 Government Securities (G-sec) Market In the fixed income segment, 10-year G-sec yields firmed up during mid-July to early August, amidst uncertainties over India-US trade negotiations and receding expectations of further monetary policy easing. Following the announcement of S&P’s upgrade of India’s sovereign rating on August 14, 2025 the 10-year G-sec yields eased briefly. Thereafter, yields hardened during the third week of August. The average term premium (the difference between the 10-year G-sec yield and the 91-day treasury bill yield) increased by 3 bps during July 16 to August 21, 2025 as compared to June 16 to July 15, 2025 (Charts IV.4a and IV.4b). Corporate Bond Market Corporate bond yields as well as their spreads over the corresponding risk-free rates generally rose across tenors and rating spectrum (Table IV.1).30 Money and Credit Reserve money growth, adjusted for the first-round impact of changes in the cash reserve ratio, increased during the month, tracking growth in currency in circulation. Currency in circulation grew ahead of the festive season and waning impact of withdrawal of ₹2000 denominated banknotes. The growth in money supply (M3) remained broadly stable during July (Chart IV.5).31,32  Scheduled commercial banks’ credit growth continued to remain subdued in July, despite a marginal uptick compared to the previous month, with deposit growth remaining steady (Chart IV.6 and Annex Chart A9).33 During 2025-26 so far, while the flow of non-food bank credit declined, this reduction was more than offset by higher inflows from non-bank sources. Consequently, the total flow of financial resources to the commercial sector registered an increase, notwithstanding slower growth in bank credit. With faster monetary policy transmission to money markets, large corporates have increasingly turned to market-based instruments such as commercial paper and corporate bonds for funding, thereby reducing the demand for bank credit. | Table IV.1: Corporate Bonds - Rates and Spread | | | Interest Rates (Per cent) | Spread (bps) | | (Over Corresponding Risk-free Rate) | | Instrument | June 16, 2025 – July 15, 2025 | July 16, 2025 – August 20, 2025 | Variation (bps) | June 16, 2025 – July 15, 2025 | July 16, 2025 – August 20, 2025 | Variation (bps) | | 1 | 2 | 3 | (4 = 3-2) | 5 | 6 | (7 = 6-5) | | Corporate Bonds | | | | | | | | (i) AAA (1-year) | 6.55 | 6.54 | -1 | 95 | 92 | -3 | | (ii) AAA (3-year) | 6.91 | 6.97 | 6 | 95 | 97 | 2 | | (iii) AAA (5-year) | 7.13 | 7.13 | 0 | 96 | 93 | -3 | | (iv) AA (3-year) | 7.84 | 8.03 | 19 | 188 | 203 | 15 | | (v) BBB- (3-year) | 11.49 | 11.66 | 17 | 553 | 566 | 13 | Note: Yields and spreads are computed as averages for the respective periods.

Sources: Fixed Income Money Market and Derivatives Association of India; and Bloomberg. |

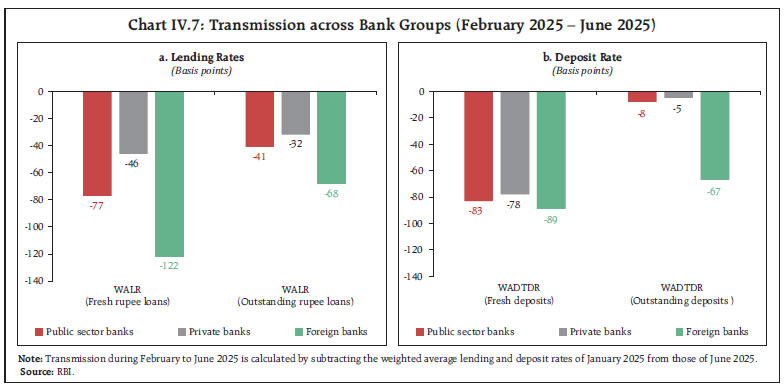

Across key sectors, bank credit growth recorded a modest improvement in June (Annex Chart A10).34,35 Personal loans, the primary driver of credit growth, registered a notable pick-up. It was largely supported by the housing segment, which accounts for nearly half of the loans extended under personal loans, along with an increase in vehicle loans and other personal loans. Services sector also recorded an uptick, as bank credit to NBFCs turned positive, reversing the contraction observed in the previous month. Nevertheless, these entities continued to access funds through money and capital market instruments. Industrial credit also witnessed an improvement. While there was continued contraction in infrastructure sector, credit to the MSMEs has been expanding at a strong pace. Deposit and Lending Rates The pass-through of the cumulative 100-bps reduction in the repo rate during February 2025 to June 2025 to lending and deposit rates, especially for fresh deposits and loans, has been strong. The weighted average lending rate on fresh and outstanding rupee loans of scheduled commercial banks declined. On the deposit side, the weighted average domestic term deposit rates on fresh and outstanding deposits also moderated (Table IV.2). The decline in the weighted average lending rate on fresh and outstanding rupee loans was higher in the case of public sector banks relative to private banks (Chart IV.7). Similarly, on the deposit side, transmission was higher for public sector banks compared to private banks. Equity Markets Equity markets declined in July amidst lingering tariff uncertainty and mixed corporate earnings results for Q1:2025-26. Steady inflows from domestic institutional investors, notably mutual funds, helped cushion the impact of FPI outflows from equities. A marginal recovery led by gains in automobile sector stocks in early August was wiped out by fresh uncertainty surrounding India-US trade negotiations. The markets recovered subsequently amidst optimism surrounding India’s sovereign credit rating upgrade and the announcement of GST reforms (Chart IV.8). External Sources of Finance Gross inward FDI reached a four-year high in June (Chart IV.9a). The US, Cyprus and Singapore together accounted for more than three-fourths of total FDI inflows. Computer services, manufacturing, and construction were the top recipient sectors. | Table IV.2: Transmission to Banks’ Deposit and Lending Rates | | (Variation in basis points) | | Period | | Term Deposit Rates | Lending Rates | | Repo Rate | WADTDR - Fresh Deposits | WADTDR - Outstanding Deposits | EBLR | 1-Year MCLR (Median) | WALR - Fresh Rupee Loans | WALR - Outstanding Rupee Loans | | Overall | Interest Rate Effect # | | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | Tightening Period

May 2022 to Jan 2025 | +250 | 259 | 206 | 250 | 175 | 181 | 193 | 115 | Easing Phase

Feb 2025 to Jul* 2025 | -100 | -87 | -10 | -100 | -25 | -71 | -55 | -39 | Notes: Data on EBLR pertain to 32 domestic banks.

*: Data on WADTDR and WALR pertain to June 2025. #: At constant share.

WALR: Weighted Average Lending Rate; WADTDR: Weighted Average Domestic Term Deposit Rate;

MCLR: Marginal Cost of Funds-based Lending Rate; EBLR: External Benchmark-based Lending Rate.

Source: RBI. |

However, both repatriation of FDI and outward FDI also increased. Top sectors for outward FDI included financial, manufacturing, insurance and business services, and the major destinations were Singapore, the US, the UK and the UAE (Chart IV.9b). As a result, net FDI inflows remained muted. FPI recorded net outflows in July and August, reversing two consecutive months of inflows, as equity outflows intensified amidst persistent global trade tensions and heightened risk-off sentiment following US tariff announcements (Chart IV.10). In contrast, the debt segment saw modest net inflows, supported by primary debt issuances and inflows in G-sec through fully accessible route.36

The registrations of external commercial borrowings moderated in Q1:2025-26, although inflows continued to outpace outflows, resulting in positive net inflows (Chart IV.11). Notably, nearly half of the total external commercial borrowings registered during this period were intended for capital expenditure. India’s foreign exchange reserves remained adequate, providing a cover for more than 11 months of goods imports and for more than 94 per cent of the external debt outstanding at end-March 2025 (Chart IV.12).37

Foreign Exchange Market The Indian rupee depreciated marginally against the US dollar in July, reflecting ongoing global trade uncertainties and FPI outflows (Chart IV.13). Despite such depreciation, the rupee remained one of the least volatile currencies among major EMDEs during the month. In August, the Indian rupee registered some gains against the US dollar following the announcement of S&P’s upgrade of India’s sovereign rating.

In real effective terms, the Indian rupee appreciated in July (Chart IV.14a). India’s inflation (on a m-o-m basis) was higher than the weighted average inflation of its major trading partners, outweighing depreciation of the Indian rupee in nominal effective terms (Chart IV.14b). V. Conclusion Favourable rainfall and temperature conditions bode well for the kharif agriculture season. An increase in real rural wages may support rural demand in the second half of the financial year.38 Coupled with the benign financial conditions, ongoing transmission of rate cuts, supportive fiscal measures and rising household optimism, the environment is conducive for holding up aggregate demand. On the other hand, persisting uncertainties related to India-US trade policies continue to pose downside risk. Inflation outlook for the near term has become more benign than anticipated earlier. Headline inflation, driven by muted food price pressures supported by favourable base effects, are likely to soften further below the 4 per cent target in Q2 before inching up in the last quarter of the financial year. Overall, the average headline inflation this year is expected to remain significantly below the target.39 Monetary policy, going forward, would continue to maintain a close vigil on the incoming data and the evolving domestic growth-inflation dynamics to chart out the appropriate monetary policy path.

Annex

|