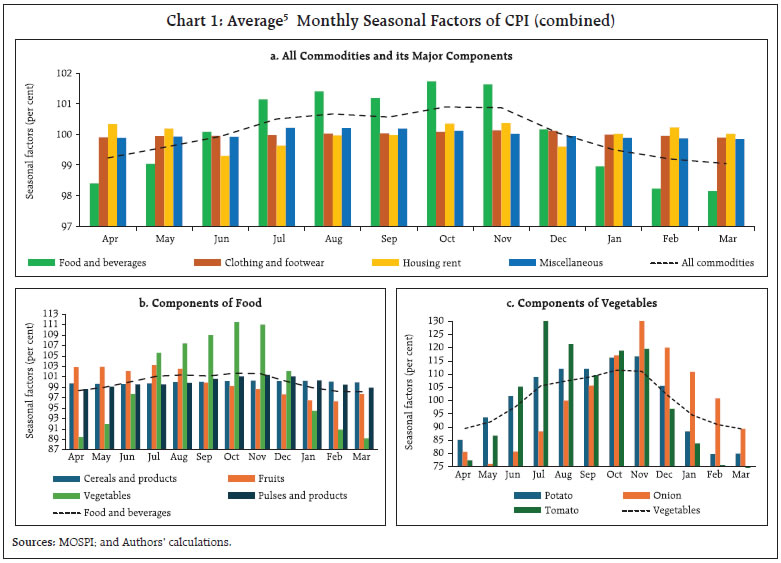

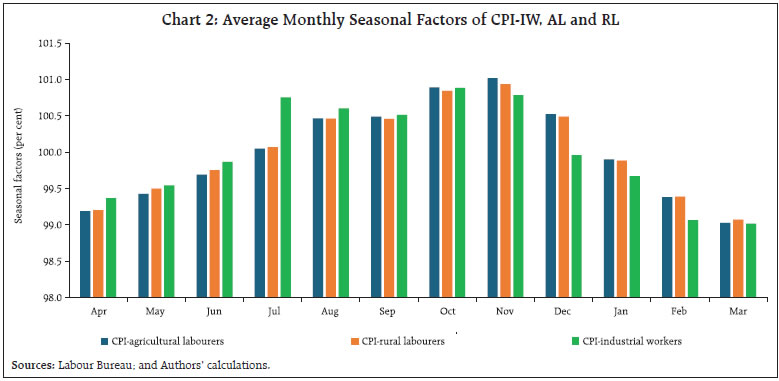

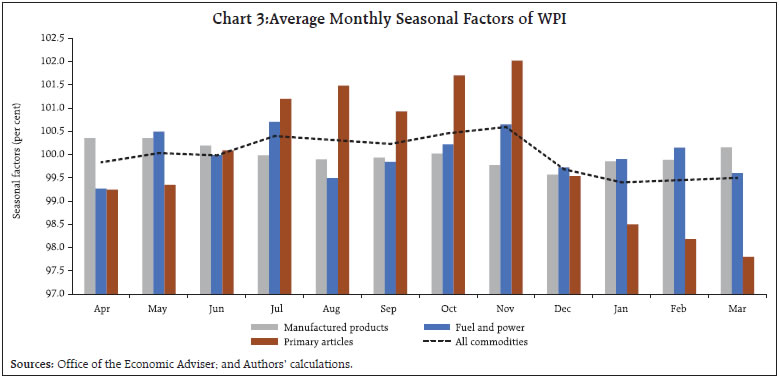

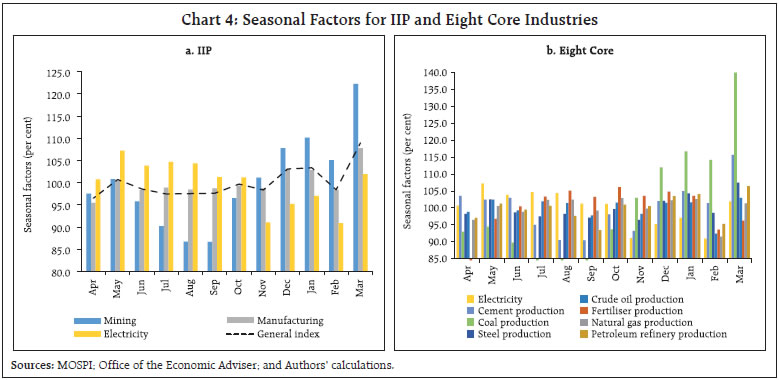

by Shivangee Misra, Anirban Sanyal and Sanjay Singh^ This article examines seasonal factors of key economic indicators in India, analysing 78 monthly indicators across six sectors—monetary and banking, payment systems, prices, industrial production, merchandise trade, and services—along with 25 quarterly indicators. There are pronounced seasonal variations in several indicators, including cash balances with the RBI, demand deposits, prices of onions, potatoes, and tomatoes, as well as production in various sectors and merchandise exports. Quarterly data highlight increased seasonal variation in real GDP, especially in government expenditure, with agriculture showing the most significant seasonal effects. Capacity utilisation in manufacturing peaks in the January–March quarter, which also coincides with a rise in services exports. Introduction Seasonality in macroeconomic indicators refers to the recurring and predictable patterns that occur within a year. It represents a key component of time series analysis alongside trend, cyclical variation, and random fluctuations. Seasonal changes arise due to factors like weather conditions, production cycles, the nature of economic activities, holidays, and vacation trends. Seasonal adjustment is the process of eliminating these seasonal and calendar influences from time series data to study the underlying long-term trends, cycles, as well as short-term changes, enabling a clearer assessment of economic conditions. Since 1980, the Reserve Bank has been publishing monthly seasonal factors for key macroeconomic variables.1 This article provides estimates of seasonal patterns of key economic indicators in India. Economic activity faced significant volatility in 2020 due to disruptions from the COVID-19 pandemic, followed by a gradual normalisation, which was also reflected in key macroeconomic variables. Given this period of extreme volatility, the seasonal factor analysis considers potential changes in the temporal properties of these economic series. Additionally, the stability of the seasonal patterns is cross-validated with pre-pandemic data to ensure the robustness of the seasonal factors.2 The rest of the article is organised as follows: Section II describes the data and methodology. Section III illustrates the seasonal factor estimates and discusses the seasonal variations in the selected economic series. The article concludes by summarising the findings in Section IV. II. Data and Methodology Historically, previous editions of this article has focused exclusively on monthly economic indicators. In this edition, its coverage is extended to key economic indicators published quarterly for the first time. The monthly variables cover six major thematic areas - monetary and banking statistics, price indices, industrial production statistics, services sector indicators, merchandise trade and payment system indicators. The complete list of 78 indicators covered under these broad categories is given in Table A1-M1 (Annex I). The seasonal factors are estimated using a multiplicative time series model with the X13-ARIMA-SEATS software of the US Census Bureau3, which is adapted to fit Indian conditions, including adjustments for Diwali and Indian trading day effects. The quarterly series covers national accounts, capacity utilisation and new orders from order books, inventories and capacity utilisation survey (OBICUS), business assessment and expectation indices, the components series from the industrial outlook survey (IOS) and external trade in services from balance of payment (BoP) statistics.4 The complete list of 25 quarterly series selected for the analysis of seasonality is provided in Table A2-Q1 (Annex II). The pandemic-infused volatility in the economic series is adjusted using an automatic outlier detection mechanism through three types of outliers, namely additive outliers (AO), temporary changes (TC) and level shifts (LS), which are checked to justify their economic interpretation. Recognising that the lack of longer time series data for the post-pandemic period may influence outlier detection and, thereby, influence seasonal factor estimates, robustness checks are carried out by comparing the seasonal factor estimates of the pre-COVID sample (Technical Annex). III. Seasonality in Major Economic Variables in India III.a. Seasonality in Monthly Series Most of the economic variables analysed in the study has exhibited seasonal patterns (Tables A1-M2 and A1-M3, Annex I). 10 out of the 14 selected monetary and banking indicators exhibit seasonal peaks either in March or April, whereas five out of 14 indicators have seasonal troughs during August. Seasonal peaks happen in March for reserve money and narrow money, whereas broad money exhibits a seasonal peak during April. Aggregate deposits of the scheduled commercial banks (SCBs) experience a seasonal peak during April, while bank credit increases during March. The seasonal troughs in aggregate deposits and bank credit are recorded during February and August, respectively. Within aggregate deposits, demand deposits record a seasonal increase during March, while time deposits touch a seasonal peak during April. Loans, cash credits, and overdrafts of SCBs hit seasonal highs in March and bottom out in August. A similar seasonal pattern is also observed in the non-food credit. SCBs’ investment remains elevated in August and slows down in March. Currency in circulation increases during May and moderates in September due to seasonal variations. Among the monetary and banking indicators, the seasonal variations are high in demand deposits, SCBs’ cash in hand and balances with RBI, and narrow money. The range of the seasonal variations in demand deposits at 7.5 percentage points in 2023-24 is lower than its last ten years average. On the other hand, the range of seasonal variations in the SCBs’ cash in hand and balances with RBI gradually increased over time and it stood at 7.7 percentage points during 2023-24. Seasonal variations declined in aggregate deposits, time deposits and bank credit to the commercial sector during 2023-24 (Tables A1-M3, Annex-I). The seasonal pattern in the consumer price index (CPI) indicates that CPI reaches its seasonal peak in October and eases in March, mainly driven by the seasonal pattern of the food prices. CPI food items experience high seasonal variations driven by vegetables which experience the highest seasonal price variations during a year. Seasonal variations in the prices of TOP (tomato, potato, and onion) are more pronounced. Prices of potatoes and onions increase in November and the seasonal pressures ease in February and May, respectively. Tomato prices increase during July and moderate by March (Chart 1 and Table A1-M2). The other major groups (viz., clothing and footwear, housing, and miscellaneous), on the other hand, experience lower seasonal variations (Table A1-M3).  Among the other major price indices, CPI for industrial workers (CPI-IW) attain a seasonal peak in October, contrary to the consumer prices of agricultural labourers (AL) and rural labourers (RL), which peak in November. All three consumer price indices experience seasonal moderation in March. The seasonal variations in CPI-IW, AL, and RL were approximately at the same level as the CPI headline index during 2023-24 (Chart 2 and Tables A1-M2, A1-M3). Wholesale prices, in general, reach a seasonal high in November and ease in January and February (Chart 3). WPI for primary articles witnessed a seasonal variation of 3.7 percentage points in 2023-24, primarily led by WPI food articles (SF Range 5.4 percentage points), followed by fuel & power at 1.6 percentage points (Table A1-M3). Industrial output seasonality, reflected in the index of industrial production (IIP), intensifies during March and moderates in April, mainly reflecting the seasonal pattern of the manufacturing sector. Mining activities peak during March, but the seasonal trough happens in September. Electricity output touches a seasonal peak in May and moderates in February. Within manufacturing, the seasonal peaks and troughs of different sectors happen during different months. Manufacturing of food products intensifies during December, whereas beverage production touches a seasonal high during May. The seasonal troughs in the production of food and beverages happen during June and August, respectively. Among the use-based classification, the production of consumer durables attains a seasonal peak during October, driven by the major festivals in India, whereas the peak in non-durable goods production happens during December. The production activity peaks for all the other major categories peak during March. The seasonal trough in capital goods and consumer goods occurs during April. Primary and intermediate good production face seasonal moderation during September and February, respectively. Infrastructure goods production moderates in November. Within the eight core industries, most record seasonal peaks during March except fertilisers and natural gas. Fertiliser and natural gas production touches seasonal highs during October (Chart 4 and Table A1-M2).  The seasonal variations, measured by the range of seasonal factors, remained high in IIP and its component series. Among the major sectors of IIP, the mining sector demonstrated the highest seasonal variations, followed by electricity. IIP capital goods demonstrated very high seasonal variations among the use-based classification, followed by primary goods. Within the components of the eight core industries, the range of seasonal factors is the highest in coal production, whereas the seasonal variation is lowest in crude oil (Table A1-M3).

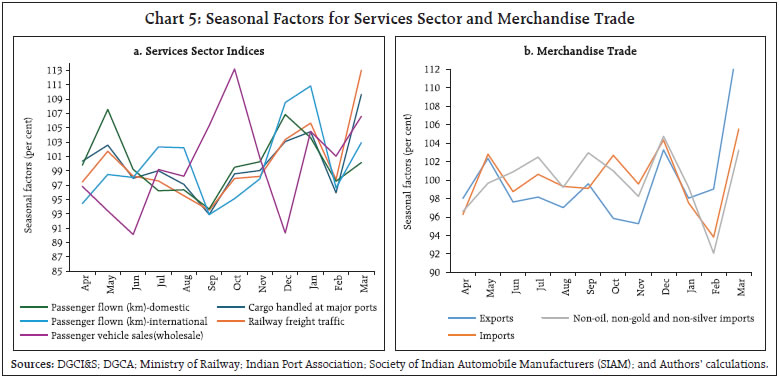

With regard to high-frequency services sector indicators, the seasonal peak in passenger vehicle sales happens during October, mainly reflecting the higher demand during the festival season. Cargo and railway traffic face seasonal increases during March. Domestic air passenger traffic increases during May and international air passenger traffic registers a high seasonal volume in January (Chart 5a and Table A1-M2). Major high-frequency services sector indicators experience seasonal troughs during September, except passenger vehicle sales (wholesale), which have a seasonal trough during June. Regarding the seasonal variations, the seasonal factors varied widely in passenger vehicle sales, having a range of 25.8 percentage points in 2023-24. Railway and cargo traffic also demonstrated higher seasonal variations than air passengers (Table A1-M3).

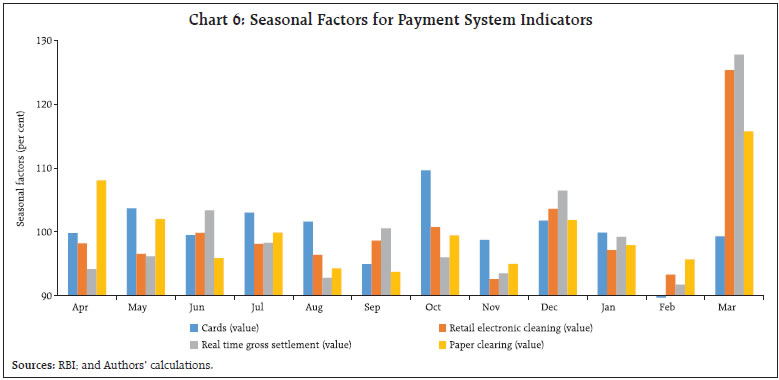

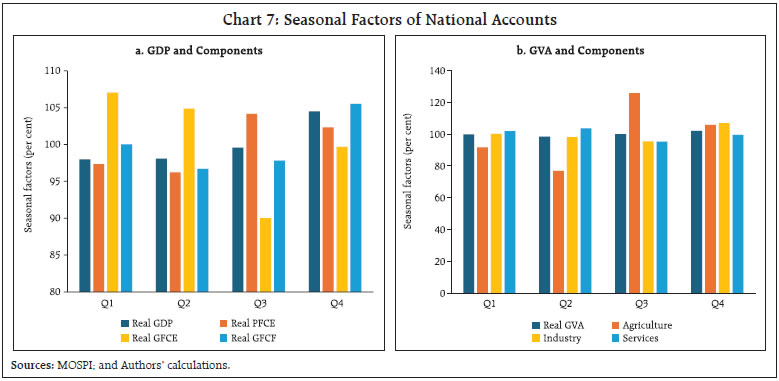

Merchandise trade peaks during March with both exports and imports recording a seasonal high. Export troughs during November while import moderates seasonally in February. Non-oil, non-gold, and non-silver imports register a seasonal peak during December and a decline during February (Chart 5b and Table A1-M2). The seasonal variations are higher in merchandise exports compared to imports. Non-oil, non-gold and non-silver imports showed relatively higher seasonal variations in comparison with overall imports during 2023-24 (Table A1-M3). Seasonal peak in the payment system indicators happens during March, except for card payments. Real Time Gross Settlement (RTGS) payments record a seasonal decline in February whereas paper clearing registers seasonal bottoming out in September. Retail electronic payments decrease during November, whereas card payments observe seasonal moderation during February (Chart 6 and Table A1-M2). Among the payment indicators, RTGS transactions and retail electronic payments demonstrate the highest seasonal variations, with seasonal factors varying in the range of 30.8 percentage points and 28.5 percentage points, respectively, in 2023-24 (Table A1-M3). III.b. Seasonality in Quarterly Series6 The quarterly gross domestic product (GDP) and gross value added (GVA) estimates show seasonal peaks during Q4, while seasonal troughs are observed in Q1 and Q2, respectively. Among the components of GDP, the Government final consumption expenditure (GFCE) increases seasonally during Q1 but moderates during Q3. The seasonal peaks of gross fixed capital formation (GFCF) happen during Q4, whereas troughs are observed in Q2, which is the monsoon season. The Private Final Consumption Expenditure (PFCE) remains elevated during Q3 – the major festival season, after seasonal moderation during Q2. On the supply side, output (value added) in agriculture registers a seasonal moderation during Q2, which is the major kharif sowing period, whereas it records a seasonal peak during Q3 with the harvesting of the kharif crops. The seasonal peak and trough in the industrial output occur during Q4 and Q3, respectively, whereas the services activities intensify during Q2 but moderate in Q3 (Chart 7 and Table A2-Q2).  The extent of seasonal variations, measured by the range of seasonal factors, is higher in GDP than GVA, possibly on account of the variations in net taxes, which influence market prices. The seasonal fluctuations in GVA are higher in 2023-24 than the last 10 years’ average. GFCE exhibits the highest seasonal variations among the expenditure-side components of GDP. The seasonal fluctuations of GFCF and PFCE are approximately closer to each other (Table A2-Q3). Manufacturing companies’ capacity utilisation (CU) as measured in the order books, inventory and capacity utilisation survey (OBICUS) peaks during Q4 and troughs during Q1. Further, the seasonal variations in capacity utilisation are range-bound, with an average range of 3.7 per cent in the last 10 years. The business assessment and expectation index, derived from the RBI’s industrial outlook survey (IOS) inputs, peaked during Q4 and Q3, respectively. The seasonal troughs in these two series happen during Q2 and Q1, respectively. The order book assessment and expectation touch seasonal peaks during Q4. However, the order book assessment troughs during Q2, while the order book expectation is lower during Q1. The manufacturers’ assessment of CU peaks in Q4, and the expectation of CU peaks in Q3. On the pricing outlook, the manufacturers’ assessment of the selling price is higher during Q1, and it moderates during Q2. The expectation on selling prices increases during Q1 but moderates in Q4. Manufacturers assess their profitability on the higher side in Q4, but their expectations about future profitability peak in Q2 (Chart 8 and Table A2-Q2). The business assessment and expectation indices show relatively lower seasonal fluctuations, with the seasonal factors hovering within an average range of 1.7 - 2.1 percentage points. However, the assessment and expectations of production and capacity utilisation show higher seasonal variations (Table A2-Q3). Overall services exports peak in Q4 and trough in Q1. Telecommunications, computer, and information services exports, however, are seasonally high during Q3, and travel services exports are high in Q4. Imports of travel services peak during Q1 (Chart 9 and Table A2-Q2). On a comparative basis, services exports show high seasonal fluctuations with a ten-year average range of 6.3 percentage points. Travel exports and imports show high seasonal fluctuations within services trade (Table A2-Q3). III.c. Stability of Seasonality The stability of the seasonal variations is checked using parametric and non-parametric tests. The diagnostics of the seasonal factor analysis are presented in Table A1-M4 and Table A2-Q4. Further, the stability of the seasonal factor estimates is checked by comparing the range of estimated seasonal factors for FY: 2023-24 with the 5-year average seasonal factor from the pre-COVID period for monthly and quarterly series. The scatter plot of the seasonal factor variations shows that the seasonal variations in FY: 2023-24 are almost similar to the average seasonal variations from the pre-pandemic period across all monthly series. A similar pattern is observed among the quarterly series except for GFCE and exports of travel, where the range of seasonal variations has increased recently (Chart 10 and Tables A1-M5 and A2-Q5). IV. Conclusion This article provides updated estimates of seasonal factors for major economic time series data for India. Overall, seasonal pattern remains mostly stable across the variables although seasonal variations have become more pronounced across several indicators such as cash in hand and balances with the RBI, demand deposits, prices of major vegetables, industrial production, passenger vehicle sales, and merchandise exports. Some of the indices and banking and monetary aggregate also witnessed a shift in their peak and trough months. Banking indicators such as bank credit, non-food credit, and demand deposits typically record their year-end peak in March. CPI faces seasonal pressure from July to November, mainly driven by rising vegetable prices during the monsoon season, while fruit prices tend to peak in the summer months. In industrial production, most items reach their highest levels in March, whereas consumer durables see a peak in October, coinciding with the festive season. Both exports and imports also peak in March, with exports exhibiting more pronounced seasonal fluctuations compared to imports. Among the quarterly series, real GDP and GVA continue to record their seasonal peak during Q4. The seasonal variations in the national accounts aggregates have increased since the onset of the pandemic, even after adjusting for the pandemic-induced volatilities as indicated in the technical annex. The seasonal trough of GDP happens in Q1, whereas GVA falls during Q2. Among the national accounts statistics (NAS), most indicators observed a trough in Q2 except for GFCE, GVA industry and services. In most indicators of the industrial outlook survey, manufacturers assess high seasonality in Q3 and Q4 and low in Q1 and Q2, except for the selling price assessment and expectations. Services exports increase during Q4. Exports of telecommunications, computer and information services were high during Q3. The pandemic caused significant disruptions in economic activity, leading to unusual data patterns. The post-pandemic data span remains limited, which may influence the stochastic seasonality estimates through the seasonal ARIMA model. The changes in the data-generating process cannot be ascertained with the limited availability of data. The seasonal factor estimates this article reports are derived by taking suitable precautions and robustness checks. The seasonal factors, however, can be subject to further changes as more data become available from the post-pandemic period. References: Shiskin, J., Young, A. H., and Musgrave, J. C. (1967). The X-11 variant of the census method II seasonal adjustment program. U.S. Department of Commerce, Bureau of the Census. Gómez, Victor and Maravall, Agustin (1996). Programs TRAMO and SEATS, Instruction for User (Beta Version: September 1996). Working Papers, Banco de España.

Technical Annex Seasonal patterns in economic data refer to regular fluctuations that occur at specific times of the year, influenced by factors like weather, holidays, and cultural events. X13-ARIMA-SEATS is a widely used statistical program developed by the U.S. Census Bureau for seasonal adjustment and trend extraction in time series data. It combines two approaches: RegARIMA modelling and SEATS (Signal Extraction in ARIMA Time Series). The RegARIMA component forecasts and models the time series, while SEATS handles the decomposition of the series into seasonal, trend, and irregular components. The decomposition is achieved by repeatedly applying centred moving averages filter and refining the separation of components with each iteration. In this process, different filters and moving averages are used to extract the time series components from the series. There are now two seasonal adjustment modules contained in the program. One uses the X-11 seasonal adjustment method detailed in Shiskin, Young, and Musgrave (1967). The program has all the seasonal adjustment capabilities of the X-11 and X-11-ARIMA programs. The same seasonal and trend moving averages are available, and the program still offers the X-11 calendar and holiday adjustment routines. The second seasonal adjustment module uses the ARIMA model based seasonal adjustment procedure from the SEATS seasonal adjustment program developed by Victor Gomez and Agustin Maravall at the Bank of Spain. All the capabilities of SEATS are included in this version of X-13 ARIMA-SEATS, which can generate stability and spectral diagnostics for SEATS seasonal adjustments in the same way as X-11 seasonal adjustments. In this article, the first seasonal adjustment module was used to extract seasonal factors. X-13 ARIMA-SEATS provides four other types of regression variables to deal with abrupt changes in the level of a series of a temporary or permanent nature: additive outliers (AOs), level shifts (LSs), temporary changes (TCs) and ramps. AOs affect only one observation in the whole series and hence this effect is removed by a dummy variable, which takes ‘0’ at break and ‘1’ for other period. LSs increases or decreases all observations from a certain time point onward by some constant amount, this LS effect is removed by introducing a dummy variable which takes value ‘-1’ for all the time point up-to the break point and ‘0’ for all the time points afterwards. TCs allow for an abrupt increase or decrease in the level of the series that returns to its previous level exponentially, this effect is captured by a variable which takes value ‘0’ for all observation before the change point and αt (O<α0 - t1). Ramps are smoothed out by introducing a variable which take, three values ‘-1’ for time t0, (t-t0)/((t1- t0)–1) for t0 < t 1, and ‘0’ after the time point t > t1. X-13 ARIMA uses SARIMA models to determine the seasonal pattern in the economic series. The order of the SARIMA models is determined based on the in-sample goodness of fit of different models and the best model is selected using suitable information criteria. The selected model, therefore, represents the underlying data-generating process through average parameter estimates. The occurrence of COVID-19 pandemic posed a challenge in this process. The COVID-19 pandemic may have fundamentally altered the economic data-generating process across many sectors. The economic data-generating process now reflects greater uncertainty and variability, requiring more adaptive and flexible approaches to analysis. The changes brought about during the COVID-19 period and the subsequent post-COVID normalization may have affected the seasonal patterns. However, the limited data from the past 2-3 years is insufficient to fully capture these shifts through SARIMA models. To account for potential alterations in seasonal patterns since COVID, the stability of seasonal adjustments is ensured through outlier adjustments, comparison with pre-COVID estimates, and yearly updates to seasonal factors for the most recent period. Outlier adjustments in the X-13 ARIMA model, specifically for the COVID period, are made using three types of outliers—AO, TC and LS. These outliers are automatically detected following guidelines from the US Census Bureau, and their relevance is confirmed by aligning them with economic events in India. To ensure stability, the seasonal patterns are checked by comparing the range of seasonal factors from the latest period with the average range of seasonal factors from the pre-pandemic period.

Annex - I | Table A1-M1: Time Period Used for Estimating Monthly Seasonal Factors | | Name of Sectors/Variables | Time Period | Name of Sectors/Variables | Time Period | | Monetary and Banking Indicators (14 series) | Industrial Production (23 series) | A.1.1 Broad Money (M3)

A.1.1.1 Net Bank Credit to Government

A.1.1.2 Bank Credit to Commercial Sector

A.1.2 Narrow Money (M1)

A.1.3 Reserve Money (RM)

A.1.3.1 Currency in Circulation

A.2.1 Aggregate Deposits (SCBs)

A.2.1.1 Demand Deposits (SCBs)

A.2.1.2 Time Deposits (SCBs)

A.3.1 Cash in Hand and Balances with RBI (SCBs)

A.3.2 Bank Credit (SCBs)

A.3.2.1 Loans, Cash Credits and Overdrafts (SCBs)

A.3.2.2 Non-Food Credit (SCBs)

A.3.3 Investments (SCBs) | April 1994 to

March 2024 | E. IIP (Base 2011-12 = 100) General Index | April 1994 to

March 2024 | E.1.1 IIP - Primary goods

E.1.2 IIP - Capital goods

E.1.3 IIP - Intermediate goods

E.1.4 IIP - Infrastructure/ construction goods

E.1.5 IIP - Consumer goods

E.1.5.1 IIP - Consumer durables

E.1.5.2 IIP - Consumer non-durables | April 2012 to

March 2024 | E.2.1 IIP - Mining

E.2.2 IIP - Manufacturing | April 1994 to

March 2024 | E.2.2.1 IIP - Manufacture of food products

E.2.2.2 IIP - Manufacture of beverages

E.2.2.3 IIP - Manufacture of textiles

E.2.2.4 IIP - Manufacture of chemicals and chemical products

E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | April 2012 to

March 2024 | | Price Indices[CPI: 21 series and WPI: 8 series] | B. CPI (Base: 2012 = 100) All Commodities

B.1 CPI - Food and beverages

B.1 .1 CPI - Cereals and products

B.1 .2 CPI - Meat and fish

B.1 .3 CPI – Egg

B.1 .4 CPI - Milk and products

B.1 .5 CPI – Fruits

B.1 .6 CPI - Vegetables

B.1 .6.1 CPI – Potato

B.1 .6.2 CPI – Onion

B.1 .6.3 CPI – Tomato

B.1 .7 CPI - Pulses and products

B.1 .8 CPI – Spices

B.1 .9 CPI - Non-alcoholic beverages

B.1 .10 CPI - Prepared meals, snacks, sweets etc.

B.2 CPI - Clothing and footwear

B.3 CPI – Housing

B.4 CPI - Miscellaneous | January 2011 to

March 2024 | E.2.3 IIP - Electricity | April 1994 to

March 2024 | E.3 Cement Production

E.4 Steel Production

E.5 Coal Production

E.6 Crude Oil Production

E.7 Petroleum Refinery Production

E.8 Fertiliser Production

E.9 Natural Gas Production | April 2004 to

March 2024 | | Service Sector Indicators (5 series) | F.1 Cargo handled at Major Ports

F.2 Railway Freight Traffic

F.3 Passenger flown (Km) - Domestic

F.4 Passenger flown (Km) - International | April 1994 to

March 2024 | | F.5 Passenger Vehicle Sales (wholesale) | April 2004 to

March 2024 | | Merchandise Trade (3 series) | G.1 Exports

G.2 Imports

G.3 Non-Oil Non-Gold and Non-Silver Imports | April 1994 to

March 2024 | C.1 Consumer Price Index for Industrial Workers

(Base: 2001=100)

C.2 Consumer Price Index for Agricultural Labourers

(Base: 1986-87=100)

C.3 Consumer Price Index for Rural Labourers

(Base: 1986-87=100) | January 2000 to

March 2024 | Payment System Indicators (4 Series) | | H.1 Real Time Gross Settlement | April 2004 to

March 2024 | | H.2 Paper Clearing | April 2005 to

March 2024 | D. WPI (Base: 2011-12=100) All Commodities

D.1 WPI - Primary Articles

D.1.1 WPI - Food Articles

D.2 WPI – Fuel & Power

D.3 WPI – Manufactured Products

D.3.1 WPI - Manufacture of Food Products

D.3.2 WPI - Manufacture of Chemicals & Chemical Products

D.3.3 WPI - Manufacture of Basic Metals | April 1994 to

March 2024 | H.3 Retail Electronic Clearing (REC)

H.4 Cards | April 2004 to

March 2024 | | | | April 2012 to

March 2024 |

| Table A1-M2: Average* Monthly Seasonal Factors of Selected Economic Time Series (Per cent) | | SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 101.0 | 100.6 | 100.1 | 100.3 | 99.9 | 99.7 | 99.7 | 99.3 | 99.5 | 99.6 | 99.7 | 100.6 | | A.1.1.1 Net Bank Credit to Government | 101.1 | 100.8 | 100.5 | 101.6 | 101.3 | 99.9 | 99.6 | 99.9 | 97.9 | 98.9 | 99.3 | 99.3 | | A.1.1.2 Bank Credit to Commercial Sector | 100.6 | 100.0 | 99.9 | 99.7 | 99.2 | 99.5 | 99.7 | 99.3 | 100.1 | 100.0 | 100.1 | 101.9 | | A.1.2 Narrow Money (M1) | 101.8 | 101.3 | 100.9 | 99.7 | 99.0 | 99.0 | 98.6 | 98.3 | 98.9 | 99.0 | 100.2 | 103.4 | | A.1.3 Reserve Money (RM) | 101.4 | 101.9 | 101.5 | 100.3 | 99.1 | 98.5 | 98.3 | 98.8 | 99.2 | 99.1 | 99.0 | 102.8 | | A.1.3.1 Currency in Circulation | 102.5 | 102.7 | 102.0 | 100.3 | 99.2 | 98.1 | 98.3 | 98.6 | 98.7 | 99.2 | 99.9 | 100.5 | | A.2.1 Aggregate Deposits (SCBs) | 100.7 | 100.1 | 99.9 | 100.2 | 99.8 | 100.3 | 99.9 | 99.6 | 99.8 | 99.6 | 99.5 | 100.5 | | A.2.1.1 Demand Deposits (SCBs) | 100.7 | 98.5 | 99.4 | 98.3 | 97.8 | 103.2 | 98.8 | 98.7 | 100.6 | 98.5 | 98.8 | 106.8 | | A.2.1.2 Time Deposits (SCBs) | 100.6 | 100.2 | 100.0 | 100.3 | 100.0 | 100.1 | 100.1 | 99.8 | 99.7 | 99.7 | 99.6 | 99.8 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 100.6 | 100.2 | 101.8 | 99.6 | 101.0 | 100.9 | 99.8 | 100.7 | 102.3 | 98.5 | 97.3 | 97.1 | | A.3.2 Bank Credit (SCBs) | 100.6 | 100.0 | 99.9 | 99.4 | 99.0 | 100.0 | 99.6 | 99.5 | 100.3 | 100.1 | 100.1 | 101.6 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 100.5 | 100.0 | 99.9 | 99.4 | 99.0 | 100.1 | 99.6 | 99.6 | 100.3 | 100.1 | 100.1 | 101.4 | | A.3.2.2 Non-Food Credit (SCBs) | 100.7 | 99.9 | 99.9 | 99.5 | 99.1 | 100.0 | 99.7 | 99.4 | 100.2 | 99.9 | 100.1 | 101.6 | | A.3.3 Investments (SCBs) | 99.5 | 100.1 | 100.4 | 101.3 | 101.4 | 101.2 | 100.9 | 100.1 | 99.0 | 98.9 | 99.1 | 98.2 | | Price Indices [ CPI: 21 series and WPI: 8 series] | | B. CPI (Base: 2012 = 100) All Commodities | 99.2 | 99.6 | 99.9 | 100.5 | 100.7 | 100.6 | 100.9 | 100.9 | 100.0 | 99.5 | 99.2 | 99.0 | | B.1 CPI - Food and beverages | 98.4 | 99.0 | 100.1 | 101.1 | 101.4 | 101.2 | 101.7 | 101.6 | 100.2 | 98.9 | 98.2 | 98.1 | | B.1 .1 CPI - Cereals and products | 99.8 | 99.7 | 99.6 | 99.8 | 100.0 | 100.1 | 100.2 | 100.3 | 100.2 | 100.3 | 100.1 | 100.0 | | B.1 .2 CPI - Meat and fish | 99.4 | 100.8 | 102.7 | 102.2 | 100.4 | 100.1 | 99.8 | 99.2 | 98.7 | 99.0 | 98.8 | 98.8 | | B.1 .3 CPI - Egg | 96.6 | 96.7 | 99.0 | 100.5 | 98.8 | 98.5 | 99.1 | 101.6 | 103.9 | 104.3 | 102.2 | 98.9 | | B.1 .4 CPI - Milk and products | 99.8 | 100.0 | 100.1 | 100.1 | 100.2 | 100.1 | 100.1 | 100.1 | 99.9 | 99.9 | 99.9 | 99.8 | | B.1 .5 CPI - Fruits | 102.9 | 102.9 | 102.1 | 103.3 | 102.6 | 99.9 | 99.2 | 98.7 | 97.7 | 96.5 | 96.3 | 97.7 | | B.1 .6 CPI - Vegetables | 89.5 | 91.9 | 97.7 | 105.6 | 107.4 | 109.1 | 111.5 | 111.1 | 102.1 | 94.5 | 90.9 | 89.2 | | B.1 .6.1 CPI - Potato | 85.2 | 93.6 | 101.7 | 108.9 | 112.1 | 112.0 | 116.3 | 116.8 | 105.6 | 88.4 | 79.7 | 79.9 | | B.1 .6.2 CPI - Onion | 80.6 | 76.1 | 80.7 | 88.4 | 100.0 | 105.7 | 117.1 | 132.2 | 120.0 | 110.8 | 100.8 | 89.4 | | B.1 .6.3 CPI - Tomato | 77.4 | 86.7 | 105.3 | 131.6 | 121.4 | 109.7 | 118.9 | 119.6 | 96.9 | 83.8 | 75.5 | 74.5 | | B.1 .7 CPI - Pulses and products | 98.7 | 99.1 | 99.6 | 99.6 | 99.9 | 100.6 | 101.1 | 101.4 | 101.1 | 100.4 | 99.5 | 99.0 | | B.1 .8 CPI - Spices | 99.5 | 99.6 | 99.5 | 99.9 | 100.1 | 100.3 | 100.4 | 100.5 | 100.5 | 100.3 | 99.9 | 99.5 | | B.1 .9 CPI - Non-alcoholic beverages | 99.9 | 99.9 | 99.9 | 100.0 | 100.0 | 100.1 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 99.9 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 99.9 | 99.9 | 99.9 | 100.0 | 100.1 | 100.0 | 100.0 | 100.1 | 100.1 | 100.0 | 100.0 | 100.0 | | B.2 CPI - Clothing and footwear | 99.9 | 99.9 | 99.9 | 100.0 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 99.9 | 99.9 | | B.3 CPI - Housing | 100.3 | 100.2 | 99.3 | 99.6 | 100.0 | 100.0 | 100.3 | 100.4 | 99.6 | 100.0 | 100.2 | 100.0 | | B.4 CPI - Miscellaneous | 99.9 | 99.9 | 99.9 | 100.2 | 100.2 | 100.2 | 100.1 | 100.0 | 99.9 | 99.9 | 99.9 | 99.8 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 99.4 | 99.5 | 99.9 | 100.8 | 100.6 | 100.5 | 100.9 | 100.8 | 100.0 | 99.7 | 99.1 | 99.0 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 99.2 | 99.4 | 99.7 | 100.0 | 100.5 | 100.5 | 100.9 | 101.0 | 100.5 | 99.9 | 99.4 | 99.0 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 99.2 | 99.5 | 99.8 | 100.1 | 100.5 | 100.5 | 100.8 | 100.9 | 100.5 | 99.9 | 99.4 | 99.1 | | D. WPI (Base: 2011-12=100) All Commodities | 99.8 | 100.0 | 100.0 | 100.4 | 100.3 | 100.2 | 100.5 | 100.6 | 99.7 | 99.4 | 99.4 | 99.5 | | D.1 WPI – Primary Articles | 99.2 | 99.4 | 100.1 | 101.2 | 101.5 | 100.9 | 101.7 | 102.0 | 99.5 | 98.5 | 98.2 | 97.8 | | D.1.1 WPI - Food Articles | 98.7 | 98.9 | 100.3 | 101.2 | 101.6 | 101.5 | 102.8 | 102.8 | 99.5 | 98.4 | 97.4 | 97.0 | | D.2 WPI – Fuel & Power | 99.3 | 100.5 | 100.0 | 100.7 | 99.5 | 99.8 | 100.2 | 100.7 | 99.7 | 99.9 | 100.2 | 99.6 | | D.3 WPI – Manufactured Products | 100.4 | 100.4 | 100.2 | 100.0 | 99.9 | 99.9 | 100.0 | 99.8 | 99.6 | 99.9 | 99.9 | 100.2 | | D.3.1 WPI - Manufacture of Food Products | 100.2 | 100.1 | 100.2 | 100.1 | 100.5 | 100.5 | 100.2 | 100.0 | 99.7 | 99.5 | 99.4 | 99.5 |

| Table A1-M2: Average* Monthly Seasonal Factors of Selected Economic Time Series (Per cent) (Contd.) | | SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 100.3 | 100.6 | 100.3 | 100.2 | 100.0 | 99.8 | 99.9 | 99.8 | 99.6 | 99.5 | 99.8 | 100.1 | | D.3.3 WPI - WPI-Manufacture of Basic metals | 100.9 | 101.4 | 100.7 | 99.5 | 99.2 | 99.8 | 99.7 | 99.2 | 98.9 | 100.0 | 100.1 | 100.7 | | Industrial Production (23 series) | | E. IIP (Base 2011-12 =A51:A72 100) General Index | 96.5 | 100.7 | 98.6 | 97.4 | 97.4 | 97.6 | 99.7 | 98.3 | 103.1 | 103.3 | 98.4 | 108.9 | | E.1.1 IIP - Primary goods | 97.8 | 103.1 | 100.2 | 98.8 | 97.0 | 94.3 | 98.2 | 97.5 | 102.3 | 103.8 | 96.8 | 110.2 | | E.1.2 IIP - Capital goods | 89.4 | 97.3 | 99.7 | 95.4 | 96.7 | 102.4 | 98.1 | 97.2 | 100.9 | 100.3 | 101.5 | 120.6 | | E.1.3 IIP - Intermediate goods | 97.6 | 100.3 | 98.3 | 101.3 | 99.8 | 98.6 | 99.0 | 97.8 | 102.0 | 101.9 | 96.7 | 106.6 | | E.1.4 IIP - Infrastructure/ construction goods | 98.7 | 102.2 | 100.1 | 97.9 | 97.5 | 96.1 | 99.5 | 94.7 | 101.9 | 104.0 | 99.6 | 108.4 | | E.1.5 IIP - Consumer goods | 95.3 | 97.9 | 95.7 | 98.5 | 97.9 | 101.5 | 99.7 | 101.8 | 104.7 | 103.2 | 99.1 | 104.6 | | E.1.5.1 IIP - Consumer durables | 95.8 | 99.4 | 97.8 | 100.8 | 99.5 | 105.9 | 106.7 | 98.6 | 96.8 | 98.2 | 96.1 | 104.0 | | E.1.5.2 IIP - Consumer non-durables | 95.0 | 97.7 | 95.3 | 96.9 | 95.8 | 96.7 | 95.9 | 103.0 | 109.9 | 106.5 | 101.5 | 105.6 | | E.2.1 IIP - Mining | 97.5 | 100.8 | 95.8 | 90.2 | 86.7 | 86.7 | 96.5 | 101.1 | 107.7 | 110.1 | 105.1 | 122.2 | | E.2.2 IIP - Manufacturing | 95.5 | 100.3 | 98.3 | 98.9 | 98.4 | 98.7 | 99.3 | 98.7 | 103.0 | 102.8 | 98.4 | 107.7 | | E.2.2.1 IIP - Manufacture of food products | 96.0 | 89.0 | 86.3 | 90.8 | 89.5 | 89.2 | 93.6 | 105.8 | 121.2 | 118.3 | 110.7 | 108.7 | | E.2.2.2 IIP - Manufacture of beverages | 112.2 | 121.6 | 106.8 | 92.5 | 88.7 | 91.2 | 90.2 | 88.8 | 93.1 | 97.8 | 100.9 | 117.6 | | E.2.2.3 IIP - Manufacture of textiles | 97.7 | 98.9 | 98.3 | 100.5 | 101.2 | 100.9 | 100.9 | 99.9 | 102.7 | 101.2 | 96.4 | 101.7 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 95.0 | 101.0 | 100.0 | 104.0 | 101.7 | 101.0 | 100.3 | 97.7 | 101.0 | 101.1 | 93.5 | 103.4 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 98.3 | 100.5 | 97.1 | 100.8 | 98.7 | 100.4 | 102.3 | 99.6 | 94.2 | 100.7 | 100.3 | 107.3 | | E.2.3 IIP - Electricity | 100.7 | 107.2 | 103.9 | 104.7 | 104.3 | 101.3 | 101.2 | 91.0 | 95.2 | 97.0 | 90.9 | 101.9 | | E.3 Cement Production | 103.5 | 102.5 | 103.0 | 95.0 | 90.5 | 90.4 | 98.1 | 93.2 | 102.0 | 105.0 | 101.4 | 115.6 | | E.4 Steel Production | 98.2 | 102.5 | 98.7 | 97.5 | 98.3 | 97.1 | 99.6 | 96.4 | 102.0 | 104.2 | 98.5 | 107.5 | | E.5 Coal Production | 93.0 | 94.4 | 89.7 | 82.2 | 80.1 | 80.2 | 93.6 | 103.0 | 111.9 | 116.7 | 114.2 | 140.9 | | E.6 Crude Oil Production | 98.9 | 102.4 | 99.2 | 102.0 | 101.4 | 97.8 | 101.5 | 98.2 | 101.5 | 101.6 | 92.4 | 103.0 | | E.7 Petroleum Refinery Production | 97.1 | 101.2 | 99.5 | 100.6 | 97.7 | 93.4 | 100.9 | 100.5 | 103.4 | 104.1 | 95.3 | 106.4 | | E.8 Fertiliser Production | 83.0 | 96.7 | 100.5 | 103.4 | 105.1 | 103.2 | 106.2 | 103.5 | 104.8 | 103.5 | 93.6 | 96.2 | | E.9 Natural Gas Production | 96.4 | 100.5 | 98.8 | 102.4 | 102.4 | 99.2 | 102.9 | 99.8 | 102.2 | 102.6 | 91.5 | 101.4 | | Service Sector Indicators (5 series) | | F.1 Cargo handled at Major Ports | 100.3 | 102.6 | 97.9 | 99.0 | 97.1 | 92.9 | 98.6 | 99.0 | 103.1 | 104.4 | 95.9 | 109.6 | | F.2 Railway Freight Traffic | 97.4 | 101.7 | 98.3 | 97.6 | 95.5 | 93.5 | 97.9 | 98.2 | 103.3 | 105.6 | 97.8 | 113.0 | | F.3 Passenger flown (Km) - Domestic | 99.8 | 107.5 | 99.2 | 96.2 | 96.3 | 93.7 | 99.5 | 100.3 | 106.8 | 103.6 | 97.5 | 100.1 | | F.4 Passenger flown (Km) - International | 94.4 | 98.5 | 98.1 | 102.3 | 102.2 | 92.9 | 95.1 | 97.9 | 108.5 | 110.8 | 96.6 | 102.9 | | F.5 Passenger Vehicle Sales (wholesale) | 96.8 | 93.4 | 90.1 | 99.2 | 98.2 | 105.3 | 113.2 | 100.8 | 90.3 | 104.5 | 101.0 | 106.6 | | Merchandise Trade (3 series) | | G.1 Exports | 98.0 | 102.3 | 97.6 | 98.2 | 97.0 | 99.6 | 95.8 | 95.3 | 103.3 | 98.0 | 99.0 | 115.9 | | G.2 Imports | 96.3 | 102.8 | 98.7 | 100.6 | 99.3 | 99.1 | 102.7 | 99.6 | 104.3 | 97.5 | 93.8 | 105.5 | | G.3 Non-Oil Non-Gold and Non-Silver Imports | 96.6 | 99.7 | 100.9 | 102.5 | 99.2 | 103.0 | 101.0 | 98.2 | 104.7 | 99.2 | 92.1 | 103.2 | | Payment System Indicators (4 series) | | H.1 RTGS | 94.2 | 96.2 | 103.4 | 98.3 | 92.8 | 100.6 | 96.0 | 93.5 | 106.5 | 99.2 | 91.8 | 127.8 | | H.2 Paper Clearing | 108.1 | 102.0 | 95.9 | 99.9 | 94.3 | 93.7 | 99.5 | 95.0 | 101.8 | 97.9 | 95.7 | 115.8 | | H.3 REC | 98.2 | 96.6 | 99.9 | 98.1 | 96.4 | 98.6 | 100.8 | 92.6 | 103.6 | 97.1 | 93.3 | 125.3 | | H.4 Cards | 99.8 | 103.7 | 99.5 | 103.0 | 101.6 | 95.0 | 109.7 | 98.8 | 101.8 | 99.9 | 87.9 | 99.3 | | *: Average of last ten years’ monthly seasonal factors, in general. Here, the average monthly seasonal factors have been computed on the basis of last 10 years (i.e., April 2014 to March 2024). Numbers marked in ‘bold’ are peaks and troughs of respective series. |

| Table A1-M3: Range (Difference Between Peak and Trough) of Monthly Seasonal Factors | | (Percentage points) | | SERIES \ YEAR | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | Average Range | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | Monetary and Banking Indicators(14 series) | | A.1.1 Broad Money (M3) | 1.8 | 2.0 | 2.1 | 2.1 | 2.0 | 1.9 | 1.7 | 1.6 | 1.5 | 1.4 | 1.7 | | A.1.1.1 Net Bank Credit to Government | 3.7 | 3.8 | 3.9 | 4.1 | 4.1 | 4.1 | 3.8 | 3.5 | 3.4 | 3.6 | 3.7 | | A.1.1.2 Bank Credit to Commercial Sector | 3.0 | 3.2 | 3.4 | 3.6 | 3.5 | 3.2 | 2.6 | 2.0 | 1.4 | 1.2 | 2.7 | | A.1.2 Narrow Money (M1) | 4.1 | 4.5 | 5.3 | 5.9 | 6.2 | 6.1 | 5.6 | 5.1 | 4.8 | 4.6 | 5.1 | | A.1.3 Reserve Money (RM) | 4.6 | 4.8 | 4.8 | 4.8 | 4.7 | 4.6 | 4.5 | 4.4 | 4.3 | 4.4 | 4.6 | | A.1.3.1 Currency in Circulation | 5.0 | 5.0 | 5.0 | 4.9 | 4.7 | 4.4 | 4.1 | 4.1 | 4.2 | 4.3 | 4.5 | | A.2.1 Aggregate Deposits (SCBs) | 1.3 | 1.1 | 1.4 | 1.7 | 1.7 | 1.5 | 1.2 | 1.1 | 1.2 | 1.2 | 1.2 | | A.2.1.1 Demand Deposits (SCBs) | 5.6 | 7.4 | 9.5 | 11.5 | 12.2 | 11.6 | 10.1 | 8.8 | 7.8 | 7.5 | 9.1 | | A.2.1.2 Time Deposits (SCBs) | 1.3 | 1.1 | 1.0 | 1.0 | 1.0 | 1.1 | 1.1 | 1.1 | 1.1 | 1.2 | 1.0 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 3.6 | 4.7 | 5.5 | 5.5 | 5.8 | 6.2 | 6.7 | 6.4 | 7.1 | 7.7 | 5.2 | | A.3.2 Bank Credit (SCBs) | 2.6 | 2.8 | 3.2 | 3.4 | 3.5 | 3.2 | 2.6 | 2.0 | 1.5 | 1.4 | 2.6 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 2.5 | 2.7 | 3.0 | 3.2 | 3.2 | 3.0 | 2.5 | 1.9 | 1.4 | 1.4 | 2.4 | | A.3.2.2 Non-Food Credit (SCBs) | 2.5 | 3.0 | 3.5 | 3.8 | 3.9 | 3.5 | 2.8 | 1.9 | 1.2 | 1.4 | 2.6 | | A.3.3 Investments (SCBs) | 3.9 | 3.7 | 3.6 | 3.5 | 3.4 | 3.3 | 3.3 | 3.4 | 3.5 | 3.4 | 3.2 | | Price Indices [CPI: 21 series and WPI: 8 series] | | B. CPI (Base: 2012 = 100) All Commodities | 2.1 | 2.0 | 1.9 | 1.8 | 1.9 | 1.9 | 2.0 | 1.9 | 1.8 | 1.6 | 1.9 | | B.1 CPI - Food and beverages | 4.0 | 3.8 | 3.7 | 3.5 | 3.6 | 3.7 | 3.8 | 3.6 | 3.4 | 3.2 | 3.6 | | B.1 .1 CPI - Cereals and products | 0.7 | 0.7 | 0.7 | 0.6 | 0.6 | 0.6 | 0.7 | 0.8 | 0.9 | 1.1 | 0.7 | | B.1 .2 CPI - Meat and fish | 3.2 | 3.2 | 3.2 | 3.4 | 3.8 | 4.2 | 4.6 | 4.9 | 5.2 | 5.4 | 3.9 | | B.1 .3 CPI - Egg | 7.3 | 7.0 | 6.8 | 6.6 | 6.7 | 7.1 | 7.8 | 8.5 | 9.4 | 9.9 | 7.7 | | B.1 .4 CPI - Milk and products | 0.7 | 0.6 | 0.5 | 0.4 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | | B.1 .5 CPI - Fruits | 6.3 | 6.2 | 6.1 | 6.2 | 6.5 | 6.8 | 7.3 | 7.7 | 8.1 | 8.2 | 6.9 | | B.1 .6 CPI - Vegetables | 23.7 | 22.7 | 22.1 | 21.7 | 22.6 | 23.6 | 24.5 | 24.3 | 23.5 | 22.4 | 22.3 | | B.1 .6.1 CPI - Potato | 37.0 | 36.6 | 35.5 | 34.8 | 35.7 | 37.6 | 38.5 | 39.9 | 40.3 | 40.2 | 37.1 | | B.1 .6.2 CPI - Onion | 43.9 | 42.4 | 43.9 | 48.6 | 55.8 | 62.4 | 66.8 | 67.9 | 66.3 | 63.7 | 56.2 | | B.1 .6.3 CPI - Tomato | 63.7 | 62.5 | 60.9 | 59.7 | 57.9 | 56.4 | 55.4 | 54.1 | 52.2 | 53.9 | 57.2 | | B.1 .7 CPI - Pulses and products | 3.2 | 3.4 | 3.3 | 3.1 | 2.7 | 2.2 | 2.0 | 2.3 | 2.7 | 2.9 | 2.7 | | B.1 .8 CPI - Spices | 1.2 | 1.1 | 1.1 | 1.0 | 0.9 | 0.7 | 0.9 | 1.4 | 2.0 | 2.5 | 1.1 | | B.1 .9 CPI - Non-alcoholic beverages | 0.4 | 0.3 | 0.3 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 0.6 | 0.5 | 0.4 | 0.4 | 0.3 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.2 | | B.2 CPI - Clothing and footwear | 0.5 | 0.5 | 0.4 | 0.3 | 0.3 | 0.3 | 0.2 | 0.1 | 0.1 | 0.1 | 0.2 | | B.3 CPI - Housing | 1.1 | 1.1 | 1.2 | 1.1 | 1.1 | 1.1 | 1.1 | 1.1 | 1.0 | 1.0 | 1.1 | | B.4 CPI - Miscellaneous | 0.6 | 0.5 | 0.5 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.3 | 0.3 | 0.4 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 2.3 | 2.2 | 2.1 | 1.9 | 1.8 | 1.8 | 1.8 | 1.7 | 1.7 | 1.7 | 1.9 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 2.5 | 2.4 | 2.2 | 2.0 | 2.0 | 1.9 | 1.8 | 1.8 | 1.8 | 1.7 | 2.0 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 2.4 | 2.2 | 2.0 | 1.9 | 1.8 | 1.7 | 1.7 | 1.7 | 1.7 | 1.7 | 1.9 | | D. WPI (Base: 2011-12=100) All Commodities | 1.6 | 1.5 | 1.4 | 1.2 | 1.2 | 1.2 | 1.3 | 1.3 | 1.3 | 1.3 | 1.2 | | D.1 WPI – Primary Articles | 4.9 | 5.0 | 4.8 | 4.6 | 4.8 | 4.7 | 4.5 | 4.1 | 3.9 | 3.7 | 4.2 | | D.1.1 WPI - Food Articles | 5.6 | 5.5 | 5.5 | 5.8 | 6.3 | 6.6 | 6.6 | 6.2 | 5.8 | 5.4 | 5.8 | | D.2 WPI – Fuel & Power | 2.9 | 3.0 | 2.6 | 2.0 | 1.6 | 1.2 | 1.1 | 1.3 | 1.4 | 1.6 | 1.4 | | D.3 WPI – Manufactured Products | 0.8 | 0.7 | 0.6 | 0.6 | 0.6 | 0.8 | 1.0 | 1.1 | 1.2 | 1.2 | 0.8 | | D.3.1 WPI - Manufacture of Food Products | 1.7 | 1.5 | 1.3 | 1.2 | 1.1 | 1.1 | 1.2 | 1.3 | 1.5 | 1.5 | 1.2 |

| Table A1-M3: Range (Difference Between Peak and Trough) of Monthly Seasonal Factors (Contd.) | | (Percentage points) | | SERIES \ YEAR | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | Average Range | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 1.2 | 1.0 | 1.0 | 0.9 | 0.8 | 1.0 | 1.2 | 1.4 | 1.2 | 1.0 | 1.0 | | D.3.3 WPI - Manufacture of Basic Metals | 1.6 | 1.8 | 2.0 | 2.2 | 2.4 | 2.6 | 2.9 | 3.0 | 3.1 | 3.0 | 2.4 | | Industrial Production (23 series) | | E. IIP (Base 2011-12 = 100) General Index | 12.7 | 12.8 | 13.0 | 13.2 | 13.2 | 12.9 | 12.4 | 11.9 | 11.4 | 11.3 | 12.5 | | E.1.1 IIP - Primary goods | 13.5 | 13.8 | 14.2 | 15.1 | 16.0 | 16.7 | 17.2 | 17.5 | 17.6 | 17.4 | 15.9 | | E.1.2 IIP - Capital goods | 35.9 | 34.4 | 32.3 | 31.1 | 30.1 | 29.7 | 29.5 | 29.5 | 29.7 | 29.7 | 31.2 | | E.1.3 IIP - Intermediate goods | 10.4 | 10.5 | 10.4 | 10.3 | 10.4 | 10.2 | 9.9 | 9.5 | 9.2 | 8.9 | 9.9 | | E.1.4 IIP - Infrastructure/ construction goods | 12.3 | 12.6 | 13.2 | 13.8 | 14.2 | 14.2 | 14.3 | 14.3 | 14.3 | 14.1 | 13.7 | | E.1.5 IIP - Consumer goods | 10.8 | 10.3 | 9.8 | 9.5 | 9.5 | 9.4 | 10.1 | 10.7 | 11.2 | 11.3 | 9.5 | | E.1.5.1 IIP - Consumer durables | 13.5 | 12.9 | 11.8 | 11.0 | 11.0 | 10.7 | 10.3 | 9.9 | 9.9 | 10.1 | 10.8 | | E.1.5.2 IIP - Consumer non-durables | 13.2 | 13.0 | 13.5 | 14.2 | 14.7 | 15.3 | 15.9 | 16.6 | 18.5 | 20.1 | 14.9 | | E.2.1 IIP - Mining | 31.1 | 32.0 | 33.0 | 34.8 | 36.4 | 37.7 | 38.1 | 38.2 | 38.2 | 38.0 | 35.5 | | E.2.2 IIP - Manufacturing | 12.3 | 12.6 | 12.6 | 12.8 | 12.8 | 12.7 | 12.4 | 11.9 | 11.5 | 11.2 | 12.3 | | E.2.2.1 IIP - Manufacture of food products | 36.1 | 36.1 | 36.5 | 36.7 | 36.4 | 35.3 | 34.6 | 33.3 | 32.5 | 32.0 | 35.0 | | E.2.2.2 IIP - Manufacture of beverages | 51.3 | 46.0 | 39.6 | 34.7 | 31.2 | 28.9 | 28.8 | 26.9 | 26.2 | 26.4 | 32.9 | | E.2.2.3 IIP - Manufacture of textiles | 7.5 | 6.6 | 5.5 | 5.4 | 6.0 | 6.6 | 7.1 | 7.2 | 7.2 | 7.1 | 6.3 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 10.8 | 10.9 | 11.5 | 11.7 | 11.5 | 10.7 | 10.8 | 10.7 | 10.5 | 10.4 | 10.5 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 14.0 | 14.8 | 15.2 | 15.3 | 14.7 | 13.7 | 12.1 | 11.1 | 10.2 | 9.7 | 13.1 | | E.2.3 IIP - Electricity | 13.5 | 14.6 | 15.8 | 16.8 | 17.8 | 18.2 | 19.3 | 19.8 | 19.7 | 19.3 | 16.3 | | E.3 Cement Production | 22.5 | 22.4 | 22.9 | 24.3 | 26.0 | 27.7 | 28.7 | 28.5 | 28.1 | 27.4 | 25.2 | | E.4 Steel Production | 9.8 | 9.7 | 10.2 | 11.0 | 11.9 | 12.5 | 12.4 | 12.0 | 11.6 | 11.3 | 11.1 | | E.5 Coal Production | 55.1 | 56.4 | 58.8 | 61.9 | 64.1 | 64.9 | 64.1 | 62.8 | 61.4 | 60.1 | 60.7 | | E.6 Crude Oil Production | 10.3 | 10.5 | 10.6 | 10.7 | 10.7 | 10.7 | 10.7 | 10.7 | 10.7 | 10.6 | 10.6 | | E.7 Petroleum Refinery Production | 10.4 | 9.7 | 10.0 | 11.0 | 12.5 | 14.0 | 15.3 | 16.1 | 15.9 | 15.4 | 13.0 | | E.8 Fertiliser Production | 26.4 | 24.6 | 22.9 | 22.0 | 22.2 | 22.6 | 23.0 | 23.0 | 22.8 | 22.2 | 23.2 | | E.9 Natural Gas Production | 11.0 | 10.9 | 10.9 | 11.0 | 11.3 | 11.6 | 11.9 | 11.9 | 12.0 | 11.9 | 11.4 | | Service Sector Indicators (5 series) | | F.1 Cargo handled at Major Ports | 14.9 | 15.4 | 15.9 | 16.3 | 16.9 | 17.4 | 17.6 | 17.6 | 17.7 | 17.5 | 16.7 | | F.2 Railway Freight Traffic | 18.2 | 18.0 | 18.2 | 18.9 | 19.4 | 19.8 | 20.1 | 20.5 | 20.7 | 21.0 | 19.5 | | F.3 Passenger flown (Km) - Domestic | 19.7 | 17.3 | 14.9 | 12.9 | 11.8 | 11.7 | 12.3 | 13.0 | 13.8 | 14.4 | 13.9 | | F.4 Passenger flown (Km) - International | 19.4 | 20.0 | 20.2 | 20.6 | 20.2 | 19.4 | 18.4 | 17.5 | 16.2 | 15.2 | 17.9 | | F.5 Passenger Vehicle Sales (wholesale) | 18.8 | 19.0 | 20.3 | 21.8 | 24.5 | 26.4 | 27.1 | 26.4 | 25.4 | 25.8 | 23.1 | | Merchandise Trade (3 series) | | G.1 Exports | 19.1 | 18.4 | 18.5 | 20.1 | 21.5 | 22.4 | 22.3 | 22.2 | 21.6 | 21.5 | 20.6 | | G.2 Imports | 12.8 | 13.7 | 13.7 | 13.5 | 13.0 | 13.1 | 11.5 | 10.2 | 9.6 | 10.0 | 11.7 | | G.3 Non-Oil Non-Gold and Non-Silver Imports | 12.6 | 13.1 | 13.1 | 12.9 | 12.6 | 12.7 | 12.5 | 12.4 | 12.3 | 12.5 | 12.7 | | Payment System Indicators (4 series) | | H.1 RTGS | 43.3 | 42.7 | 40.6 | 38.8 | 37.1 | 35.3 | 33.2 | 32.7 | 31.8 | 30.8 | 36.0 | | H.2 Paper Clearing | 24.3 | 23.1 | 22.3 | 22.3 | 22.2 | 21.9 | 22.2 | 22.7 | 22.7 | 22.7 | 22.0 | | H.3 REC | 37.5 | 36.9 | 35.8 | 34.3 | 33.3 | 32.1 | 30.6 | 29.5 | 29.1 | 28.5 | 32.7 | | H.4 Cards | 19.6 | 20.1 | 20.5 | 21.2 | 21.7 | 22.5 | 22.9 | 23.1 | 23.0 | 22.9 | 21.7 | | Note: Average seasonal factor range is the range of average seasonal factors for last ten years; range is calculated as the difference between maximum and minimum of monthly seasonal factors. |

| Table A1-M4: Major Diagnostics of all the Monthly Indicators | | Name of variable | Seasonality in Original Series | Residual Seasonality | Quality Diagnostics | | F test p-value | KW test p-value | F test p-value | F test 3 yr p-value | M7 | Q | | A.1.1 Broad Money (M3) | 0.00 | 0.00 | 1.00 | 0.73 | 0.32 | 0.31 | | A.1.1.1 Net Bank Credit to Government | 0.00 | 0.00 | 1.00 | 0.74 | 0.39 | 0.33 | | A.1.1.2 Bank Credit to Commercial Sector | 0.00 | 0.00 | 1.00 | 1.00 | 0.39 | 0.30 | | A.1.2 Narrow Money (M1) | 0.00 | 0.00 | 0.96 | 0.02 | 0.28 | 0.26 | | A.1.3 Reserve Money (RM) | 0.00 | 0.00 | 0.45 | 0.99 | 0.28 | 0.22 | | A.1.3.1 Currency in Circulation | 0.00 | 0.00 | 0.58 | 0.46 | 0.20 | 0.16 | | A.2.1 Aggregate Deposits (SCBs) | 0.00 | 0.00 | 1.00 | 1.00 | 0.55 | 0.37 | | A.2.1.1 Demand Deposits (SCBs) | 0.00 | 0.00 | 0.76 | 0.36 | 0.48 | 0.57 | | A.2.1.2 Time Deposits (SCBs) | 0.00 | 0.00 | 1.00 | 1.00 | 0.57 | 0.33 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 0.00 | 0.00 | 0.86 | 0.22 | 1.46 | 0.93 | | A.3.2 Bank Credit (SCBs) | 0.00 | 0.00 | 1.00 | 1.00 | 0.44 | 0.30 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 0.00 | 0.00 | 1.00 | 1.00 | 0.43 | 0.31 | | A.3.2.2 Non-Food Credit (SCBs) | 0.00 | 0.00 | 1.00 | 1.00 | 0.71 | 0.46 | | A.3.3 Investments (SCBs) | 0.00 | 0.00 | 0.88 | 1.00 | 0.43 | 0.31 | | B. CPI (Base: 2012 = 100) All Commodities | 0.00 | 0.00 | 1.00 | 0.88 | 0.31 | 0.33 | | B.1 CPI - Food and beverages | 0.00 | 0.00 | 1.00 | 0.96 | 0.26 | 0.35 | | B.1 .1 CPI - Cereals and products | 0.00 | 0.00 | 1.00 | 0.96 | 0.87 | 0.50 | | B.1 .2 CPI - Meat and fish | 0.00 | 0.00 | 0.97 | 0.74 | 0.46 | 0.48 | | B.1 .3 CPI - Egg | 0.00 | 0.00 | 1.00 | 0.95 | 0.39 | 0.31 | | B.1 .4 CPI - Milk and products | 0.00 | 0.00 | 0.95 | 1.00 | 1.34 | 0.59 | | B.1 .5 CPI - Fruits | 0.00 | 0.00 | 0.99 | 0.99 | 0.26 | 0.27 | | B.1 .6 CPI - Vegetables | 0.00 | 0.00 | 0.99 | 0.87 | 0.26 | 0.32 | | B.1 .6.1 CPI - Potato | 0.00 | 0.00 | 1.00 | 0.85 | 0.23 | 0.33 | | B.1 .6.2 CPI - Onion | 0.00 | 0.00 | 0.85 | 1.00 | 0.43 | 0.36 | | B.1 .6.3 CPI - Tomato | 0.00 | 0.00 | 0.76 | 0.95 | 0.50 | 0.83 | | B.1 .7 CPI - Pulses and products | 0.00 | 0.00 | 1.00 | 1.00 | 0.70 | 0.53 | | B.1 .8 CPI - Spices | 0.00 | 0.00 | 0.99 | 0.96 | 1.16 | 0.71 | | B.1 .9 CPI - Non-alcoholic beverages | 0.00 | 0.00 | 1.00 | 0.04 | 1.04 | 0.51 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 0.00 | 0.00 | 0.95 | 0.93 | 1.57 | 0.73 | | B.2 CPI - Clothing and footwear | 0.00 | 0.00 | 0.97 | 1.00 | 1.39 | 0.75 | | B.3 CPI - Housing | 0.00 | 0.00 | 0.92 | 0.98 | 0.40 | 0.38 | | B.4 CPI - Miscellaneous | 0.00 | 0.00 | 1.00 | 0.84 | 1.02 | 0.49 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 0.00 | 0.00 | 0.98 | 0.87 | 0.23 | 0.23 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 0.00 | 0.00 | 1.00 | 0.94 | 0.26 | 0.31 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 0.00 | 0.00 | 1.00 | 0.90 | 0.26 | 0.28 | | D. WPI (Base: 2011-12=100) All Commodities | 0.00 | 0.00 | 1.00 | 1.00 | 0.46 | 0.44 | | D.1 WPI – Primary Articles | 0.00 | 0.00 | 0.99 | 1.00 | 0.33 | 0.39 | | D.1.1 WPI - Food Articles | 0.00 | 0.00 | 0.77 | 0.95 | 0.30 | 0.34 | | D.2 WPI – Fuel & Power | 0.00 | 0.00 | 1.00 | 1.00 | 1.49 | 0.74 | | D.3 WPI – Manufactured Products | 0.00 | 0.00 | 1.00 | 0.96 | 0.69 | 0.52 | | D.3.1 WPI - Manufacture of Food Products | 0.00 | 0.00 | 1.00 | 0.94 | 0.96 | 0.68 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 0.00 | 0.00 | 1.00 | 1.00 | 1.16 | 0.70 |

| Table A1-M4: Major Diagnostics of all the Monthly Indicators (Contd.) | | Name of variable | Seasonality in Original Series | Residual Seasonality | Quality Diagnostics | | F test p-value | KW test p-value | F test p-value | F test 3 yr p-value | M7 | Q | | D.3.3 WPI - Manufacture of Basic Metals | 0.00 | 0.00 | 0.99 | 0.95 | 0.89 | 0.57 | | D.3.4 WPI - Manufacture of Machinery and Equipment | 0.07 | 0.04 | 1.00 | 0.97 | 1.90 | 0.85 | | E. IIP (Base 2011-12 = 100) General Index | 0.00 | 0.00 | 0.22 | 0.90 | 0.16 | 0.24 | | E.1.1 IIP - Primary goods | 0.00 | 0.00 | 0.20 | 0.73 | 0.27 | 0.74 | | E.1.2 IIP - Capital goods | 0.00 | 0.00 | 0.33 | 0.66 | 0.31 | 0.51 | | E.1.3 IIP - Intermediate goods | 0.00 | 0.00 | 0.37 | 0.50 | 0.37 | 0.43 | | E.1.4 IIP - Infrastructure/ construction goods | 0.00 | 0.00 | 0.34 | 0.61 | 0.47 | 0.49 | | E.1.5 IIP - Consumer goods | 0.00 | 0.00 | 0.43 | 0.75 | 0.50 | 0.59 | | E.1.5.1 IIP - Consumer durables | 0.00 | 0.00 | 0.14 | 0.44 | 0.41 | 0.44 | | E.1.5.2 IIP - Consumer non-durables | 0.00 | 0.00 | 0.44 | 0.88 | 0.40 | 0.73 | | E.2.1 IIP - Mining | 0.00 | 0.00 | 0.80 | 0.92 | 0.24 | 0.36 | | E.2.2 IIP - Manufacturing | 0.00 | 0.00 | 0.18 | 0.83 | 0.21 | 0.26 | | E.2.2.1 IIP - Manufacture of food products | 0.00 | 0.00 | 1.00 | 0.32 | 0.18 | 0.44 | | E.2.2.2 IIP - Manufacture of beverages | 0.00 | 0.00 | 0.52 | 0.96 | 0.54 | 0.46 | | E.2.2.3 IIP - Manufacture of textiles | 0.00 | 0.00 | 0.34 | 0.89 | 0.60 | 0.65 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 0.00 | 0.00 | 0.49 | 1.00 | 0.52 | 0.75 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 0.00 | 0.00 | 0.30 | 0.76 | 0.60 | 0.60 | | E.2.3 IIP - Electricity | 0.00 | 0.00 | 0.46 | 0.64 | 0.52 | 0.56 | | E.3 Cement Production | 0.00 | 0.00 | 0.42 | 0.34 | 0.23 | 0.34 | | E.4 Steel Production | 0.00 | 0.00 | 0.49 | 0.56 | 0.47 | 0.58 | | E.5 Coal Production | 0.00 | 0.00 | 0.61 | 0.90 | 0.12 | 0.29 | | E.6 Crude Oil Production | 0.00 | 0.00 | 0.88 | 1.00 | 0.17 | 0.28 | | E.7 Petroleum Refinery Production | 0.00 | 0.00 | 0.94 | 0.80 | 0.46 | 0.73 | | E.8 Fertiliser Production | 0.00 | 0.00 | 0.47 | 0.74 | 0.29 | 0.61 | | E.9 Natural Gas Production | 0.00 | 0.00 | 0.92 | 0.88 | 0.26 | 0.39 | | F.1 Cargo handled at Major Ports | 0.00 | 0.00 | 0.95 | 1.00 | 0.30 | 0.50 | | F.2 Railway Freight Traffic | 0.00 | 0.00 | 0.53 | 0.98 | 0.13 | 0.32 | | F.3 Passenger flown (Km) - Domestic | 0.00 | 0.00 | 0.22 | 0.72 | 0.30 | 0.32 | | F.4 Passenger flown (Km) - International | 0.00 | 0.00 | 0.64 | 0.88 | 0.36 | 0.53 | | F.5 Passenger Vehicle Sales (wholesale) | 0.00 | 0.00 | 0.79 | 0.34 | 0.40 | 0.39 | | G.1 Exports | 0.00 | 0.00 | 0.64 | 0.67 | 0.37 | 0.52 | | G.2 Imports | 0.00 | 0.00 | 0.99 | 0.86 | 0.83 | 0.80 | | G.3 Non-Oil Non-Gold and Non-Silver Imports | 0.00 | 0.00 | 1.00 | 0.99 | 0.59 | 0.71 | | H.1 RTGS | 0.00 | 0.00 | 0.56 | 0.78 | 0.39 | 0.37 | | H.2 Paper Clearing | 0.00 | 0.00 | 0.12 | 0.37 | 0.30 | 0.76 | | H.3 REC | 0.00 | 0.00 | 0.79 | 0.31 | 0.41 | 0.34 | | H.4 Cards | 0.00 | 0.00 | 0.04 | 0.39 | 0.37 | 0.43 | Notes: 1. Test for seasonality in original series: F-test for the presence of seasonality assuming stability and Kruskall and Wallis test (a nonparametric test for stable seasonality).

2. Test for seasonality in seasonally adjusted series: F-test for the presence of seasonality assuming stability for full sample and for latest 3 years.

3. M7 corresponds to the amount of moving seasonality present relative to the amount of stable seasonality (acceptable range is between 0 and 1).However, M Diagnostics are aggregated in a single quality control indicator - Q, which gives the overall assessment of the adjustment (acceptable range is between 0 and 1). |

| Table A1-M5: Monthly Seasonal Factors of Selected Economic Time Series for 2023-24 (Per cent) | | SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | Monetary and Banking Indicators (14 series) | | A.1.1 Broad Money (M3) | 100.7 | 100.2 | 99.9 | 100.7 | 100.0 | 99.5 | 99.5 | 99.4 | 100.2 | 99.8 | 99.8 | 100.3 | | A.1.1.1 Net Bank Credit to Government | 101.6 | 100.0 | 100.0 | 101.2 | 101.2 | 99.7 | 99.1 | 100.2 | 98.1 | 98.0 | 99.4 | 101.6 | | A.1.1.2 Bank Credit to Commercial Sector | 100.1 | 99.6 | 99.7 | 100.2 | 99.6 | 99.6 | 100.1 | 99.7 | 100.7 | 100.0 | 99.9 | 100.6 | | A.1.2 Narrow Money (M1) | 101.4 | 101.1 | 101.1 | 100.1 | 98.8 | 98.3 | 98.0 | 98.4 | 100.1 | 99.7 | 100.3 | 102.6 | | A.1.3 Reserve Money (RM) | 100.6 | 102.5 | 102.0 | 100.9 | 99.3 | 98.4 | 98.1 | 98.7 | 99.1 | 99.1 | 99.1 | 102.2 | | A.1.3.1 Currency in Circulation | 102.4 | 102.5 | 102.2 | 100.4 | 99.5 | 98.4 | 98.2 | 98.4 | 98.4 | 99.3 | 99.8 | 100.7 | | A.2.1 Aggregate Deposits (SCBs) | 100.6 | 99.8 | 100.0 | 100.5 | 99.9 | 100.6 | 99.9 | 99.6 | 100.3 | 99.5 | 99.5 | 99.8 | | A.2.1.1 Demand Deposits (SCBs) | 100.9 | 98.4 | 98.1 | 99.2 | 97.1 | 103.3 | 99.6 | 98.4 | 101.7 | 99.1 | 99.3 | 104.6 | | A.2.1.2 Time Deposits (SCBs) | 100.6 | 99.9 | 100.1 | 100.6 | 100.2 | 100.4 | 100.0 | 99.7 | 100.1 | 99.5 | 99.4 | 99.5 | | A.3.1 Cash in Hand and Balances with RBI (SCBs) | 100.6 | 100.8 | 100.9 | 100.8 | 103.1 | 102.4 | 100.1 | 100.2 | 101.4 | 98.6 | 95.4 | 95.6 | | A.3.2 Bank Credit (SCBs) | 100.2 | 99.5 | 99.5 | 99.9 | 99.3 | 100.4 | 100.0 | 100.1 | 100.7 | 100.0 | 99.9 | 100.4 | | A.3.2.1 Loans, Cash, Credits and Overdrafts (SCBs) | 100.2 | 99.5 | 99.5 | 99.8 | 99.3 | 100.3 | 100.0 | 100.1 | 100.7 | 100.1 | 99.9 | 100.4 | | A.3.2.2 Non-Food Credit (SCBs) | 100.1 | 99.2 | 99.6 | 100.3 | 99.7 | 100.2 | 100.3 | 100.3 | 100.6 | 99.8 | 99.7 | 100.0 | | A.3.3 Investments (SCBs) | 99.7 | 99.9 | 100.5 | 101.8 | 101.4 | 101.8 | 100.9 | 99.3 | 98.7 | 98.3 | 98.9 | 98.9 | | Price Indices [CPI: 21 series and WPI: 8 series] | | B. CPI (Base: 2012 = 100) All Commodities | 99.3 | 99.8 | 100.1 | 100.5 | 100.5 | 100.4 | 100.8 | 100.8 | 100.0 | 99.5 | 99.3 | 99.1 | | B.1 CPI - Food and beverages | 98.6 | 99.2 | 100.2 | 100.9 | 101.2 | 100.7 | 101.6 | 101.6 | 100.2 | 99.0 | 98.5 | 98.4 | | B.1 .1 CPI - Cereals and products | 99.7 | 99.7 | 99.4 | 99.6 | 99.9 | 100.0 | 100.2 | 100.4 | 100.4 | 100.4 | 100.3 | 100.1 | | B.1 .2 CPI - Meat and fish | 99.2 | 101.3 | 103.6 | 102.3 | 99.8 | 100.5 | 100.6 | 99.2 | 98.1 | 98.2 | 98.3 | 98.7 | | B.1 .3 CPI - Egg | 95.6 | 96.0 | 100.1 | 100.8 | 97.8 | 97.8 | 98.9 | 101.8 | 104.6 | 105.5 | 103.0 | 98.5 | | B.1 .4 CPI - Milk and products | 100.0 | 100.1 | 100.0 | 100.0 | 100.1 | 100.0 | 100.0 | 100.0 | 99.9 | 99.9 | 100.0 | 100.0 | | B.1 .5 CPI - Fruits | 103.6 | 103.2 | 101.8 | 104.0 | 103.0 | 100.1 | 99.5 | 98.5 | 97.4 | 95.8 | 95.8 | 97.4 | | B.1 .6 CPI - Vegetables | 89.2 | 91.9 | 98.6 | 104.1 | 106.2 | 107.9 | 111.5 | 111.5 | 102.3 | 94.4 | 91.4 | 90.2 | | B.1 .6.1 CPI - Potato | 83.0 | 94.1 | 102.5 | 111.3 | 114.1 | 113.4 | 117.3 | 116.1 | 104.2 | 87.4 | 77.0 | 78.2 | | B.1 .6.2 CPI - Onion | 79.7 | 74.9 | 79.7 | 88.9 | 95.4 | 100.4 | 115.3 | 138.7 | 122.7 | 110.1 | 102.6 | 89.8 | | B.1 .6.3 CPI - Tomato | 74.3 | 82.2 | 103.3 | 126.2 | 120.7 | 110.9 | 128.3 | 119.4 | 98.7 | 84.2 | 77.3 | 74.9 | | B.1 .7 CPI - Pulses and products | 99.0 | 99.2 | 99.4 | 99.3 | 99.4 | 100.8 | 101.4 | 101.7 | 101.3 | 100.4 | 99.4 | 98.8 | | B.1 .8 CPI - Spices | 99.1 | 99.3 | 99.1 | 99.7 | 100.4 | 101.0 | 101.1 | 101.2 | 100.8 | 100.4 | 99.5 | 98.6 | | B.1 .9 CPI - Non-alcoholic beverages | 99.9 | 99.9 | 100.0 | 99.9 | 100.0 | 100.0 | 100.0 | 100.1 | 100.1 | 100.1 | 100.0 | 99.9 | | B.1 .10 CPI - Prepared meals, snacks, sweets etc. | 99.9 | 100.0 | 100.0 | 100.0 | 100.1 | 100.1 | 100.0 | 100.0 | 99.9 | 100.0 | 100.0 | 100.0 | | B.2 CPI - Clothing and footwear | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.1 | 100.0 | 100.0 | 100.0 | 100.0 | | B.3 CPI - Housing | 100.5 | 100.4 | 99.4 | 99.7 | 100.1 | 99.8 | 100.4 | 100.4 | 99.6 | 99.8 | 100.2 | 99.8 | | B.4 CPI - Miscellaneous | 100.0 | 100.0 | 100.0 | 100.2 | 100.2 | 100.1 | 100.0 | 99.9 | 99.9 | 99.9 | 99.9 | 99.9 | | C.1 Consumer Price Index for Industrial Workers (Base: 2001=100) | 99.5 | 99.5 | 100.0 | 100.6 | 100.5 | 100.4 | 100.8 | 100.7 | 100.0 | 99.6 | 99.2 | 99.1 | | C.2 Consumer Price Index for Agricultural Labourers (Base: 1986-87=100) | 99.3 | 99.5 | 99.7 | 99.9 | 100.2 | 100.2 | 100.7 | 101.0 | 100.6 | 100.1 | 99.6 | 99.3 | | C.3 Consumer Price Index for Rural Labourers (Base: 1986-87=100) | 99.3 | 99.6 | 99.7 | 99.9 | 100.2 | 100.2 | 100.7 | 100.9 | 100.6 | 100.0 | 99.6 | 99.3 | | D. WPI (Base: 2011-12=100) All Commodities | 100.3 | 100.0 | 100.3 | 100.3 | 100.2 | 99.9 | 100.4 | 100.6 | 99.6 | 99.3 | 99.3 | 99.7 | | D.1 WPI – Primary Articles | 100.0 | 99.6 | 100.2 | 100.6 | 101.0 | 100.0 | 101.5 | 102.0 | 99.4 | 98.7 | 98.2 | 98.7 | | D.1.1 WPI - Food Articles | 99.4 | 99.2 | 100.5 | 100.5 | 101.0 | 101.0 | 103.0 | 102.8 | 99.2 | 98.2 | 97.6 | 97.6 | | D.2 WPI – Fuel & Power | 100.0 | 100.1 | 99.9 | 100.3 | 99.5 | 99.5 | 99.9 | 101.0 | 100.1 | 99.5 | 100.1 | 100.2 |

| Table A1-M5: Monthly Seasonal Factors of Selected Economic Time Series for 2023-24 (Per cent) (Contd.) | | SERIES NAME | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | JAN | FEB | MAR | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | D.3 WPI – Manufactured Products | 100.7 | 100.6 | 100.2 | 99.8 | 99.9 | 99.8 | 99.8 | 99.7 | 99.5 | 99.8 | 99.9 | 100.3 | | D.3.1 WPI - Manufacture of Food Products | 100.7 | 100.5 | 100.5 | 100.1 | 100.5 | 100.3 | 99.8 | 99.9 | 99.4 | 99.4 | 99.2 | 99.8 | | D.3.2 WPI - Manufacture of Chemicals & Chemical Products | 100.5 | 100.6 | 100.2 | 100.0 | 99.8 | 99.7 | 100.0 | 99.8 | 99.7 | 99.6 | 99.9 | 100.2 | | D.3.3 WPI - WPI-Manufacture of Basic metals | 101.2 | 101.9 | 100.3 | 99.1 | 99.4 | 99.6 | 99.5 | 99.0 | 98.8 | 99.8 | 100.4 | 101.0 | | Industrial Production (23 series) | | E. IIP (Base 2011-12 =A51:A72 100) General Index | 97.1 | 100.0 | 99.1 | 97.9 | 97.2 | 96.9 | 98.9 | 98.3 | 103.8 | 104.0 | 98.2 | 108.2 | | E.1.1 IIP - Primary goods | 98.4 | 103.9 | 100.5 | 99.1 | 96.7 | 93.4 | 96.9 | 96.1 | 102.0 | 104.0 | 98.2 | 110.8 | | E.1.2 IIP - Capital goods | 89.1 | 97.0 | 100.3 | 96.8 | 97.9 | 103.6 | 98.9 | 96.7 | 98.9 | 101.4 | 100.1 | 118.9 | | E.1.3 IIP - Intermediate goods | 97.8 | 101.0 | 98.6 | 101.1 | 99.8 | 98.0 | 99.5 | 98.0 | 102.1 | 102.8 | 96.0 | 105.0 | | E.1.4 IIP - Infrastructure/ construction goods | 98.2 | 100.2 | 97.7 | 97.1 | 98.5 | 97.5 | 100.4 | 94.4 | 102.7 | 105.1 | 99.5 | 108.5 | | E.1.5 IIP - Consumer goods | 96.0 | 97.1 | 95.6 | 100.2 | 98.2 | 101.0 | 97.3 | 103.0 | 106.9 | 103.4 | 97.7 | 103.7 | | E.1.5.1 IIP - Consumer durables | 95.9 | 99.0 | 99.1 | 102.2 | 99.9 | 106.0 | 105.3 | 98.2 | 96.0 | 97.8 | 96.3 | 104.4 | | E.1.5.2 IIP - Consumer non-durables | 97.1 | 95.5 | 95.8 | 98.5 | 95.5 | 95.2 | 93.9 | 105.7 | 114.0 | 106.7 | 98.7 | 103.1 | | E.2.1 IIP - Mining | 97.9 | 101.3 | 95.5 | 89.8 | 85.7 | 84.9 | 96.3 | 100.8 | 107.6 | 110.5 | 106.6 | 122.9 | | E.2.2 IIP - Manufacturing | 95.7 | 99.8 | 98.5 | 99.3 | 98.7 | 98.2 | 98.2 | 98.9 | 104.0 | 103.7 | 97.9 | 107.0 | | E.2.2.1 IIP - Manufacture of food products | 99.5 | 90.2 | 86.9 | 90.6 | 90.7 | 87.2 | 91.9 | 107.5 | 118.9 | 117.2 | 110.5 | 109.0 | | E.2.2.2 IIP - Manufacture of beverages | 105.2 | 115.4 | 109.4 | 98.1 | 91.4 | 91.6 | 89.0 | 90.1 | 92.9 | 99.5 | 102.3 | 114.6 | | E.2.2.3 IIP - Manufacture of textiles | 98.0 | 98.6 | 98.4 | 100.1 | 99.7 | 99.9 | 101.0 | 100.0 | 103.7 | 102.0 | 96.6 | 102.1 | | E.2.2.4 IIP - Manufacture of chemicals and chemical products | 96.1 | 102.5 | 102.1 | 104.1 | 101.6 | 100.3 | 99.8 | 97.0 | 100.6 | 100.4 | 93.7 | 101.3 | | E.2.2.5 IIP - Manufacture of motor vehicles, trailers and semi-trailers | 96.7 | 99.8 | 97.8 | 102.1 | 98.6 | 100.5 | 102.8 | 99.8 | 94.8 | 102.1 | 100.2 | 104.5 | | E.2.3 IIP - Electricity | 101.4 | 107.2 | 106.2 | 105.0 | 105.5 | 101.4 | 100.3 | 87.9 | 93.6 | 97.3 | 91.6 | 102.6 | | E.3 Cement Production | 103.4 | 101.2 | 104.2 | 94.0 | 90.9 | 89.3 | 97.7 | 92.5 | 102.7 | 104.5 | 102.2 | 116.7 | | E.4 Steel Production | 98.4 | 100.0 | 96.9 | 96.4 | 98.7 | 98.0 | 100.2 | 96.2 | 103.1 | 106.0 | 98.7 | 107.5 | | E.5 Coal Production | 94.2 | 94.8 | 90.8 | 83.7 | 80.5 | 79.5 | 92.6 | 101.2 | 110.9 | 117.4 | 114.0 | 139.6 | | E.6 Crude Oil Production | 99.1 | 102.7 | 99.3 | 102.1 | 101.2 | 97.7 | 101.2 | 98.0 | 101.3 | 101.8 | 92.5 | 103.1 | | E.7 Petroleum Refinery Production | 99.4 | 101.8 | 98.8 | 99.5 | 96.2 | 92.3 | 97.2 | 100.5 | 105.3 | 104.4 | 96.7 | 107.7 | | E.8 Fertiliser Production | 83.6 | 98.8 | 101.0 | 103.7 | 104.2 | 101.6 | 105.8 | 104.3 | 105.3 | 104.3 | 92.9 | 94.1 | | E.9 Natural Gas Production | 95.8 | 100.0 | 98.7 | 102.7 | 103.1 | 100.0 | 103.2 | 99.5 | 101.9 | 102.4 | 91.4 | 101.4 | | Service Sector Indicators (5 series) | | F.1 Cargo handled at Major Ports | 100.7 | 101.2 | 98.5 | 97.5 | 96.0 | 91.8 | 99.1 | 99.8 | 103.8 | 104.8 | 97.2 | 109.4 | | F.2 Railway Freight Traffic | 98.0 | 102.8 | 98.8 | 97.0 | 95.4 | 92.8 | 97.0 | 97.3 | 103.5 | 105.5 | 98.2 | 113.7 | | F.3 Passenger flown (Km) - Domestic | 100.4 | 107.1 | 98.2 | 93.8 | 95.9 | 93.4 | 99.0 | 100.4 | 107.8 | 103.1 | 98.9 | 102.2 | | F.4 Passenger flown (Km) - International | 91.8 | 98.5 | 100.3 | 104.4 | 102.9 | 94.2 | 96.4 | 97.6 | 106.4 | 106.9 | 96.8 | 102.7 | | F.5 Passenger Vehicle Sales (wholesale) | 95.0 | 93.6 | 90.8 | 101.0 | 100.2 | 106.0 | 113.4 | 99.9 | 87.6 | 106.4 | 102.3 | 102.9 | | Merchandise Trade (3 series) | | G.1 Exports | 100.2 | 101.4 | 98.1 | 100.2 | 96.5 | 95.9 | 94.0 | 93.9 | 103.9 | 99.4 | 101.0 | 115.4 | | G.2 Imports | 95.4 | 102.0 | 96.8 | 100.9 | 100.6 | 99.1 | 105.4 | 97.9 | 103.7 | 95.8 | 97.1 | 104.8 | | G.3 Non-Oil Non-Gold and Non-Silver Imports | 96.2 | 99.6 | 99.5 | 102.5 | 99.0 | 101.7 | 103.4 | 98.3 | 104.9 | 98.5 | 92.4 | 103.7 | | Payment System Indicators (4 series) | | H.1 RTGS | 91.2 | 95.0 | 101.0 | 97.8 | 93.9 | 100.9 | 99.2 | 96.6 | 110.3 | 98.6 | 93.1 | 122.0 | | H.2 Paper Clearing | 109.4 | 102.3 | 95.7 | 99.7 | 93.3 | 95.3 | 98.2 | 94.9 | 102.3 | 96.6 | 96.7 | 115.9 | | H.3 REC | 95.0 | 97.6 | 97.7 | 99.9 | 96.0 | 96.7 | 101.4 | 94.8 | 103.1 | 98.4 | 96.3 | 123.2 | | H.4 Cards | 99.3 | 102.8 | 99.0 | 103.7 | 101.4 | 95.6 | 111.6 | 98.1 | 101.0 | 98.7 | 88.7 | 100.6 |

Annex - II | Table A2-Q1: Time Period Used for Estimating Quarterly Seasonal Factors | | Quarterly Series | Industrial Outlook Survey (12 series) | | National Accounts Statistics (8 series) | L.1 Production Assessment

L.2 Production Expectation

L.3 Order Books Assessment

L.4 Order Books Expectation

L.5 Capacity Utilisation Assessment

L.6 Capacity Utilisation Expectation

L.7 Selling Price Assessment

L.8 Selling Price Expectation

L.9 Profit Margin Assessment

L.10 Profit Margin Expectation

L.11 Business Assessment Index

L.12 Business Expectation Index | Q1:2000-01 to

Q4:2023-2024 | I.1 Real Gross Domestic Product (GDP)

I.2 Real Gross Value Added (GVA)

I.3 Real PFCE

I.4 Real GFCE

I.5 Real GFCF

I.6 GVA of Agriculture

I.7 GVA of Industry

I.8 GVA of Services | Q1:2011-12 to

Q4:2023-2024 | | Balance of Payments (4 series) | J.1 Exports of Services

J.2 Exports in Travel

J.3 Exports in Telecommunications, Computer and Information Services

J.4 Imports in Travel | Q1:2011-12 to

Q4:2023-2024 | | | | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | Q1:2008-09 to

Q3:2023-2024 |

| Table A2-Q2: Average* Quarterly Seasonal Factors of Selected Economic Time Series | | (Per cent) | | SERIES NAME | Q1 | Q2 | Q3 | Q4 | | 1 | 2 | 3 | 4 | 5 | | National Accounts Statistics (8 series) | | I.1 Real Gross Domestic Product (GDP) | 98.0 | 98.1 | 99.6 | 104.5 | | I.2 Real Gross Value Added (GVA) | 99.8 | 98.4 | 100.0 | 102.0 | | I.3 Real PFCE | 97.3 | 96.2 | 104.2 | 102.3 | | I.4 Real GFCE | 107.1 | 104.9 | 90.0 | 99.7 | | I.5 Real GFCF | 100.0 | 96.7 | 97.8 | 105.5 | | I.6 GVA of Agriculture | 91.7 | 76.9 | 125.6 | 105.8 | | I.7 GVA of Industry | 100.2 | 98.1 | 95.3 | 106.8 | | I.8 GVA of Services | 101.9 | 103.6 | 95.3 | 99.5 | | Balance of Payments (4 series) | | J.1 Exports of Services | 96.6 | 98.4 | 102.2 | 102.9 | | J.2 Exports in Travel | 86.1 | 96.1 | 108.0 | 110.3 | | J.3 Exports in Telecommunications, Computer and Information Services | 99.1 | 100.8 | 101.2 | 98.9 | | J.4 Imports in Travel | 109.7 | 106.5 | 90.8 | 92.8 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | 98.5 | 99.3 | 100.0 | 102.2 | | Industrial Outlook Survey (12 series) | | L.1 Production Assessment | 99.0 | 98.1 | 99.8 | 103.1 | | L.2 Production Expectation | 98.8 | 100.7 | 101.0 | 99.3 | | L.3 Order Books Assessment | 100.2 | 98.7 | 98.9 | 102.1 | | L.4 Order Books Expectation | 99.5 | 100.1 | 100.0 | 100.3 | | L.5 Capacity Utilisation Assessment | 99.3 | 98.1 | 99.4 | 103.3 | | L.6 Capacity Utilisation Expectation | 99.2 | 99.6 | 101.2 | 100.0 | | L.7 Selling Price Assessment | 102.6 | 98.4 | 98.6 | 100.4 | | L.8 Selling Price Expectation | 100.7 | 100.1 | 99.9 | 99.3 | | L.9 Profit Margin Assessment | 100.6 | 99.2 | 98.7 | 101.3 | | L.10 Profit Margin Expectation | 99.1 | 101.4 | 100.6 | 98.8 | | L.11 Business Assessment Index | 100.1 | 99.2 | 99.6 | 101.2 | | L.12 Business Expectation Index | 99.2 | 99.4 | 101.0 | 100.3 | | Note: *: Average of last ten years’ quarterly seasonal factors, in general. Here, the average quarterly seasonal factors have been computed on the basis of last 10 years (i.e., Q1:2014-15 to Q4: 2023-24). Numbers marked in ‘bold’ are peaks and troughs of respective series. |

| Table A2-Q3: Range (Difference Between Peak and Trough) of Quarterly Seasonal Factors | | (Percentage points) | | SERIES \ YEAR | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | Average Range | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | National Accounts Statistics (8 series) | | I.1 Real Gross Domestic Product (GDP) | 5.5 | 5.1 | 5.1 | 5.5 | 6.1 | 6.7 | 7.2 | 7.9 | 8.5 | 8.8 | 6.5 | | I.2 Real Gross Value Added (GVA) | 2.3 | 1.7 | 1.7 | 2.1 | 2.7 | 3.6 | 4.6 | 5.4 | 6.0 | 6.2 | 3.6 | | I.3 Real PFCE | 7.9 | 7.2 | 6.8 | 6.8 | 7.3 | 7.9 | 8.4 | 8.8 | 9.1 | 9.4 | 7.9 | | I.4 Real GFCE | 30.3 | 31.0 | 29.7 | 25.0 | 16.8 | 18.0 | 19.5 | 26.9 | 33.6 | 37.6 | 17.0 | | I.5 Real GFCF | 6.6 | 6.5 | 6.8 | 7.7 | 8.9 | 10.0 | 10.7 | 10.9 | 10.6 | 10.2 | 8.8 | | I.6 GVA of Agriculture | 54.8 | 52.2 | 50.2 | 48.8 | 48.0 | 47.3 | 46.9 | 46.5 | 46.4 | 46.4 | 48.8 | | I.7 GVA of Industry | 9.6 | 10.0 | 10.3 | 10.4 | 10.6 | 11.1 | 11.8 | 12.7 | 13.6 | 14.1 | 11.4 | | I.8 GVA of Services | 10.3 | 10.3 | 10.0 | 9.6 | 8.9 | 8.2 | 7.3 | 6.6 | 6.0 | 5.6 | 8.3 | | Balance of Payments (4 series) | | J.1 Exports of Services | 5.4 | 5.5 | 5.7 | 5.8 | 6.1 | 6.6 | 6.8 | 7.0 | 7.1 | 7.2 | 6.3 | | J.2 Exports in Travel | 24.0 | 20.9 | 18.7 | 17.5 | 18.5 | 21.7 | 26.4 | 30.2 | 32.0 | 33.4 | 24.2 | | J.3 Exports in Telecommunications, Computer and Information Services | 3.2 | 3.0 | 2.9 | 2.5 | 2.2 | 2.0 | 2.0 | 1.9 | 1.7 | 1.6 | 2.3 | | J.4 Imports in Travel | 17.2 | 19.2 | 19.5 | 19.4 | 19.9 | 19.6 | 19.3 | 19.8 | 21.0 | 22.4 | 18.8 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | 5.0 | 4.4 | 3.9 | 3.5 | 3.2 | 3.1 | 3.2 | 3.3 | 3.5 | 3.6 | 3.7 | | Industrial Outlook Survey (12 series) | | L.1 Production Assessment | 4.9 | 4.6 | 4.7 | 4.9 | 5.0 | 5.1 | 5.1 | 5.2 | 5.0 | 4.9 | 4.9 | | L.2 Production Expectation | 3.8 | 3.2 | 2.8 | 2.5 | 2.2 | 2.4 | 3.1 | 3.6 | 3.5 | 3.0 | 2.2 | | L.3 Order Books Assessment | 4.3 | 4.4 | 4.3 | 4.1 | 4.0 | 3.6 | 3.2 | 2.7 | 2.0 | 1.3 | 3.3 | | L.4 Order Books Expectation | 2.1 | 1.5 | 0.9 | 0.8 | 1.0 | 0.8 | 0.4 | 1.0 | 1.4 | 1.6 | 0.8 | | L.5 Capacity Utilisation Assessment | 5.0 | 4.7 | 4.7 | 4.9 | 5.1 | 5.2 | 5.4 | 5.6 | 5.6 | 5.6 | 5.2 | | L.6 Capacity Utilisation Expectation | 3.9 | 3.1 | 2.3 | 1.4 | 1.3 | 1.8 | 2.4 | 2.7 | 3.4 | 3.3 | 2.0 | | L.7 Selling Price Assessment | 3.3 | 3.6 | 4.4 | 5.0 | 5.3 | 5.3 | 5.1 | 4.5 | 3.4 | 2.1 | 4.2 | | L.8 Selling Price Expectation | 1.2 | 1.2 | 1.3 | 1.5 | 1.9 | 2.0 | 1.9 | 2.0 | 2.4 | 2.2 | 1.4 | | L.9 Profit Margin Assessment | 3.6 | 3.6 | 3.5 | 3.4 | 3.1 | 2.6 | 2.3 | 2.1 | 1.8 | 1.3 | 2.6 | | L.10 Profit Margin Expectation | 1.7 | 1.8 | 1.8 | 2.2 | 3.1 | 3.8 | 4.3 | 4.3 | 3.7 | 2.7 | 2.6 | | L.11 Business Assessment Index | 2.9 | 2.5 | 2.4 | 2.3 | 2.2 | 1.9 | 1.7 | 1.6 | 1.5 | 1.7 | 2.1 | | L.12 Business Expectation Index | 1.4 | 1.5 | 1.5 | 1.5 | 1.7 | 1.8 | 2.0 | 2.0 | 2.2 | 2.3 | 1.7 | | Note: Average seasonal factor range is the range of average seasonal factors for last ten years; range is calculated as the difference between maximum and minimum of quarterly seasonal factors. |

| Table A2-Q4: Major Diagnostics of all the Quarterly Indicators | | Name of variable | Seasonality in Original Series | Residual Seasonality | Quality Diagnostics | | F test p-value | KW test p-value | F test p-value | F test 3 yr p-value | M7 | Q | | I.1 Real Gross Domestic Product (GDP) | 0.00 | 0.00 | 0.06 | 0.17 | 0.24 | 0.29 | | I.2 Real Gross Value Added (GVA) | 0.00 | 0.00 | 0.04 | 0.09 | 0.56 | 0.57 | | I.3 Real PFCE | 0.00 | 0.00 | 0.04 | 0.09 | 0.20 | 0.52 | | I.4 Real GFCE | 0.00 | 0.00 | 0.47 | 0.11 | 0.76 | 1.07 | | I.5 Real GFCF | 0.00 | 0.00 | 0.13 | 0.14 | 0.36 | 0.69 | | I.6 GVA of Agriculture | 0.00 | 0.00 | 0.77 | 0.90 | 0.08 | 0.11 | | I.7 GVA of Industry | 0.00 | 0.00 | 0.10 | 0.43 | 0.26 | 0.45 | | I.8 GVA of Services | 0.00 | 0.00 | 0.03 | 0.10 | 0.32 | 0.60 | | J.1 Exports of Services | 0.00 | 0.00 | 0.44 | 0.38 | 0.31 | 0.36 | | J.2 Exports in Travel | 0.00 | 0.00 | 0.94 | 0.58 | 0.44 | 0.46 | | J.3 Exports in Telecommunications, Computer and Information Services | 0.00 | 0.00 | 0.06 | 0.42 | 0.56 | 0.45 | | J.4 Imports of Services | 0.03 | 0.00 | 0.98 | 0.93 | 1.12 | 0.85 | | J.5 Imports in Travel | 0.00 | 0.00 | 0.19 | 0.35 | 0.33 | 0.32 | | J.6 Imports in Telecommunications, Computer and Information Services | 0.01 | 0.04 | 0.55 | 0.42 | 1.14 | 1.39 | | K.1 Capacity Utilisation of manufacturing companies | 0.00 | 0.00 | 0.16 | 0.28 | 0.34 | 0.44 | | L.1 Production Assessment | 0.00 | 0.00 | 0.17 | 0.30 | 0.32 | 0.46 | | L.2 Production Expectation | 0.00 | 0.00 | 0.95 | 0.90 | 0.58 | 0.64 | | L.3 Order Books Assessment | 0.00 | 0.00 | 0.16 | 0.27 | 0.59 | 0.66 | | L.4 Order Books Expectation | 0.00 | 0.00 | 0.31 | 0.56 | 0.84 | 0.96 | | L.5 Employment Assessment | 0.40 | 0.07 | 0.31 | 0.40 | 2.38 | 1.13 | | L.6 Employment Expectation | 0.03 | 0.05 | 0.65 | 0.64 | 1.37 | 1.10 | | L.7 Capacity Utilisation Assessment | 0.00 | 0.00 | 0.09 | 0.31 | 0.29 | 0.45 | | L.8 Capacity Utilisation Expectation | 0.00 | 0.00 | 0.89 | 0.79 | 0.73 | 1.07 | | L.9 Selling Price Assessment | 0.00 | 0.00 | 0.36 | 0.42 | 0.59 | 0.83 | | L.10 Selling Price Expectation | 0.01 | 0.00 | 0.50 | 0.82 | 1.16 | 1.21 | | L.11 Cost of External Finance Assessment | 0.35 | 0.42 | 0.24 | 0.45 | 2.02 | 1.00 | | L.12 Cost of External Finance Expectation | 0.02 | 0.01 | 0.22 | 0.33 | 1.24 | 0.77 | | L.13 Profit Margin Assessment | 0.00 | 0.00 | 0.18 | 0.53 | 0.77 | 1.08 | | L.14 Profit Margin Expectation | 0.00 | 0.00 | 0.91 | 0.52 | 1.05 | 0.90 | | L.15 Business Assessment Index | 0.00 | 0.00 | 0.30 | 0.38 | 0.53 | 0.78 | | L.16 Business Expectation Index | 0.00 | 0.00 | 0.92 | 0.63 | 0.60 | 0.94 | | Notes: Please see notes to Table A1-M4. |

| Table A2-Q5: Quarterly Seasonal Factors of Selected Economic Time Series for 2023-24 | | (Per cent) | | SERIES NAME | Q1 | Q2 | Q3 | Q4 | | 1 | 2 | 3 | 4 | 5 | | National Accounts Statistics (8 series) | | I.1 Real Gross Domestic Product (GDP) | 97.0 | 97.4 | 99.9 | 105.8 | | I.2 Real Gross Value Added (GVA) | 98.5 | 97.7 | 100.0 | 103.9 | | I.3 Real PFCE | 96.1 | 96.5 | 105.5 | 102.0 | | I.4 Real GFCE | 103.0 | 92.5 | 83.8 | 121.4 | | I.5 Real GFCF | 99.2 | 97.1 | 96.7 | 106.9 | | I.6 GVA of Agriculture | 91.2 | 77.2 | 123.6 | 108.3 | | I.7 GVA of Industry | 98.1 | 98.1 | 94.9 | 109.0 | | I.8 GVA of Services | 100.4 | 102.0 | 96.3 | 101.4 | | Balance of Payments (4 series) | | J.1 Exports of Services | 95.9 | 98.6 | 102.4 | 103.1 | | J.2 Exports in Travel | 81.1 | 91.2 | 114.6 | 113.3 | | J.3 Exports in Telecommunications, Computer and Information Services | 99.3 | 100.4 | 100.9 | 99.5 | | J.4 Imports in Travel | 112.1 | 103.1 | 89.7 | 94.7 | | OBICUS (1 series) | | K.1 Capacity Utilisation of manufacturing companies | 98.5 | 99.6 | 99.9 | 102.1 | | Industrial Outlook Survey (12 series) | | L.1 Production Assessment | 98.7 | 98.1 | 100.2 | 103.0 | | L.2 Production Expectation | 99.5 | 101.3 | 101.1 | 98.3 | | L.3 Order Books Assessment | 100.0 | 99.5 | 99.5 | 100.8 | | L.4 Order Books Expectation | 99.1 | 100.6 | 100.7 | 99.6 | | L.5 Capacity Utilisation Assessment | 98.6 | 97.9 | 99.9 | 103.5 | | L.6 Capacity Utilisation Expectation | 99.0 | 99.6 | 102.3 | 99.4 | | L.7 Selling Price Assessment | 101.6 | 99.5 | 99.5 | 99.6 | | L.8 Selling Price Expectation | 99.8 | 101.3 | 100.0 | 99.0 | | L.9 Profit Margin Assessment | 100.3 | 100.3 | 99.0 | 100.4 | | L.10 Profit Margin Expectation | 99.2 | 101.8 | 100.1 | 99.1 | | L.11 Business Assessment Index | 99.7 | 99.5 | 99.7 | 101.2 | | L.12 Business Expectation Index | 99.0 | 99.7 | 101.3 | 100.0 |

|