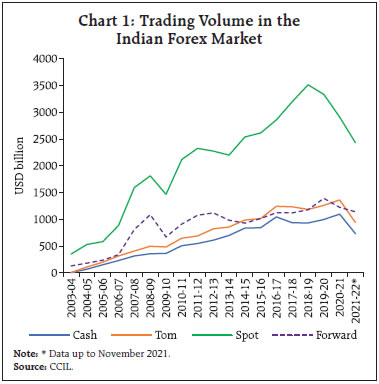

The forward premium encapsulates lead information on evolving economic and financial market developments and is determined by the interplay of institutional and regulatory features with market microstructure and flow factors, apart from macroeconomic fundamentals. Using a machine learning technique and based on monthly data since 2010, interest rate differential, global policy uncertainty, domestic banking system liquidity and RBI’s intervention in forward markets were found to be the principal determinants of the forward premia across the term structure in both the pre-flexible inflation targeting (pre-FIT) period and during the FIT regime. Regression analysis suggests that surplus liquidity has a sobering impact while greater uncertainty hardens the forward premia, more so in the short term. Introduction The collapse of the Bretton Woods System and the gradual transition towards a flexible exchange rate regime since the 1980s has seen greater and faster capital mobility across borders globally. The diffusion of the information technology revolution and the resulting advances in payments and settlements systems worldwide have further intensified movements in capital flows, posing severe challenges for central banks and national authorities. In addition to the above, emerging market economies (EMEs) had to contend with the fallout of global spillovers resulting from policies pursued in advanced economies (AEs). These spillovers – largely in the form of volatile capital flows – resulted in fluctuations in the exchange rate which often necessitated forex market intervention by the central bank, the latter, in turn, having implications for liquidity management. Theoretically, the role of foreign exchange intervention in an inflation targeting (IT) framework is contestable as exchange rate flexibility is an intrinsic feature of IT. In practice, however, IT central banks in EMEs closely monitor the exchange rate because sharp exchange rate movements may pose financial stability risks, beside its attendant implications for inflation. As such, foreign exchange intervention is a widely used instrument in the policy toolkit of EME centralbanks1 (following IT) although they encounter some challenges, viz., (i) tensions between interventions and monetary policy actions; (ii) whether policy responses are symmetric to appreciation/depreciation pressures, (iii) the costs of intervention; and (iv) intervention under currency mismatches (Chamon et al., 2019). Therefore, transparency of objectives and its clear articulation and communication are key in strengthening the effectiveness of interventions while preserving monetary policy credibility. Akin to several other EMEs, India has experienced episodic bouts of surges and sudden stops/reversals in capital inflows with the progressive deregulation of the capital account since the initiation of external sector reforms in the early 1990s. While capital inflows are required to finance a sustainable current account deficit in an ex-ante sense, they have often exceeded the financing requirement because of favourable interest rate differentials and / or more promising domestic growth outlook. Given the objective of avoiding excess volatility in the exchangerate of the Indian Rupee (INR) and any potential loss of external competitiveness,2 the Reserve Bank of India’s (RBI’s) intervention through forex purchases results in an accretion to foreign exchange reserves. The consequential injection of rupee liquidity, unless neutralised, pose challenges for liquidity management and the conduct of domestic monetary policy (Raj et al., 2018). Repeated intervention can lead to discrete changes in system liquidity making short-term interest rates volatile. Large or frequent unsterilised interventions can lead to a surfeit of liquidity which may stoke inflation; consequently, policy rate hikes may be warranted to quell such pressures. Policy rate increases, however, widen the interest rate differential that could trigger further inflows. Thus, interventions on a regular basis often undo their very objective; hence, central banks generally conduct sterilisation operations to neutralise the monetary impact of their foreign exchange market operations. Sterilised intervention through continuous open market sale of securities, however, keeps interest rates elevated; moreover, there are limits to intervention as the availability of adequate collateral could act as a binding constraint on central banks for liquidity management operations. As a result, several other instruments including forex swaps have been used with varying degree of effectiveness (BIS, 2013). After the outbreak of the COVID-19 pandemic, the Reserve Bank deployed several conventional andunconventional3 tools to assuage fears of illiquidity and market disruption. In this regard, large liquidity injections through extended lending operations and asset purchase programmes were undertaken to unfreeze markets, revive trading activity and restore financial market sentiment. Thus, banking system liquidity turned into a large surplus in consonance with the accommodative stance of monetary policy. In this milieu, capital inflows further gained impetus since October 2020, which required forex marketintervention.4 Intervention in the forward market may affect the foward premia – the proportion by which the forward exchange rate of a currency exceeds its spot rate (Copeland, 2014) which are determined by the interplay of institutional and regulatory features with market microstructure and flow factors, apart from macroeconomic fundamentals (RBI, 2021a). In this background, this article presents an analytical review of the forward premia in the Indian context and is organised in the following manner. Section II presents a synoptic overview of the theoretical underpinnings and empirical literature followed by a discussion of stylised facts and recent developments in the forward premia market in Section III. An empirical assessment of the determinants of the forward premia across the term structure using the machine learning technique of Random Forest is undertaken in Section IV. The concluding observations are presented in Section V. II. Received Literature While central banks frequently resort to forex market intervention to maintain a specific exchange rate between two currencies in a fixed exchange rate regime, the case for intervention is less clear under flexible exchange rates. Standard macroeconomic models suggest that intervention should not impact the exchange rate, i.e., intervention would have no traction. Open economy models (Fleming, 1962; Mundell, 1963; Dornbusch, 1976) typically assume perfect capital mobility for which the uncovered interest parity principle has become a cornerstone, as discussed below. In an open economy with perfect capital mobility, the interest rate parity condition ensures that domestic and foreign assets denominated in different currencies but similar risk profile yield the same return when measured in the same currency, thus making the investor indifferent between the two alternative investment proposals – the no-arbitrage condition. Thus, the interest rate parity condition equates the difference between foreign and domestic interest rates with difference in spot and future exchange rates. This relationship is commonly known as the uncovered interest rate parity (UIRP) condition and is defined as:  where r and r* stands for domestic and foreign interest rates, respectively, S represents the prevailing exchange rate while S* is the exchange rate expected to prevail at the end of the period. From equation (1), it is noted that the domestic interest rate must be higher (lower) than the foreign interest rate by an amount equal to the expected depreciation (appreciation) of the domestic currency. If investors are risk-neutral and have rational expectations, any interest rate differential is equalised by the corresponding adjustment in the exchange rate. Thus, UIRP implies that the exchange rate will respond only to (i) changes in the interest rate differential; or (ii) the expected change in the exchange rate. Quantitatively, the hypothesis of the UIRP means that projection of the change in exchange rate on the interest rate differential should reveal a regression coefficient of one (Bansal and Shaliastovic, 2006); however, empirical evidence rejects UIRP with various studies presenting evidence of negative and statistically significant slope coefficients (Fama, 1984; Bansal, 1997; Bansal and Dahlquist, 2000; Backus et al., 2001; Lustig and Verdelhan, 2007). Such empirical irregularity with high interest-bearing currencies showing tendencies to appreciate (rather than depreciate) relative to lower interest-bearing ones has offered opportunities for investors to engage in carry trade and earn arbitrage returns. This aberration from UIRP in the short run is popularly referred as the Forward Premium Puzzle and reflects deviations from the assumptions of risk neutrality and rational expectations embedded in the UIRP. As risk neutrality does not hold given there is an element of risk involved in foreign currency investments, a part of the risk is eliminated through hedging in forward markets which establishes the covered arbitrage condition – the covered interest rate parity (CIRP) condition. According to CIRP, interest rates on two otherwise identical assets in two different currencies should be equal once the foreign currency risk is hedged. For the CIRP condition, S* in equation (1) is replaced by F which represents the forward rate appearing in the contract to exchange one currency for the other in the future:  CIRP relies on few assumptions which are unrelated to the behaviour of agents in terms of their expectation formation and utility maximisation. For CIRP to hold, three conditions are required, viz., (i) sufficient funds are available for speculation; (ii) the presence of organised forward exchange markets with information on exchange rates publicly available to traders; and (iii) low or negligible transaction costs (Chamon et al., op cit). Numerous studies have shown that arbitrage opportunities under CIRP generally do arise and are attributed to (i) transaction costs (Frenkel and Levich, 1975); (ii) credit risk (Aliber, 1973); (iii) taxes (Levi, 1977); (iv) data imperfections (Agmon and Bronfeld, 1975); (v) capital controls (McCormick, 1979); (vi) market microstructure (Stoll, 1978); (vii) capital market imperfections (Blenman, 1991); and (viii) international capital mobility (Frankel, 1992). On sterilised intervention, the literature emphasises two main channels through which purchases / sales of foreign exchange can affect the exchange rate: the portfolio balance and the signalling channels. The portfolio balance channel works through the change in the relative supply of domestic and foreign currency assets (Kouri, 1977). If both types of assets were perfect substitutes (i.e., if UIRP hold), then the change in relative supply would not matter. To the extent that assets are imperfect substitutes, however, investors will demand a premium for holding more of the asset whose supply has increased, thus depreciating the currency of that asset. This portfolio balance channel may indeed have played a small quantitative role in AEs, where the magnitude of interventions was very small compared to their large bond markets. In many EMEs, however, the size of foreign exchange reserves is similar to the stock of domestic currency assets of central banks. The magnitudes involved suggest that the cumulative quantitative effects on asset prices through this portfolio channel could be significant, even if the channel has limited traction. The impact could also be higher if the emerging markets are not as well integrated into the global financial system as their advanced counterparts (local and foreign currency assets not being perfect substitutes). While UIRP implicitly assumes that capital flows would immediately move to arbitrage away any expected return differential, foreign exchange intervention can impact the exchange rate if capital flows respond to return differentials at a slower pace. Despite imperfect capital mobility, the foreign exchange market can always clear, provided that a sufficiently large adjustment in asset prices equilibrates demand and supply. This adjustment, however, may require very large swings in asset prices – including the exchange rate – which may be undesirable for several reasons. Central bank purchases or sales of foreign exchange assets can modulate the magnitude of this adjustment by reducing the amount of excess supply or demand that needs to be accommodated by the private market. The signalling or expectation channel affects the exchange rate through a change in market expectations about fundamentals (Mussa, 1981). If the central bank has more information about macroeconomic fundamentals (including its future monetary policy stance) than the market, it can use intervention to signal that information. To the extent that it provides signals about the future monetary policy stance, such an intervention would have traction on the exchange rate when announced, even if UIRP holds (since future interest rates would impact today’s exchange rate via their effect on the expected future exchange rate). Currency markets are incredibly complex, and it is impossible to completely enumerate all the factors that determine exchange rates. Nevertheless, the exchange rate and the forward premia is broadly dependent on five important factors, viz., (i) macro-fundamentals such as GDP, inflation etc.; (ii) financial market prices and traded volumes; (iii) international trade indicators – trade deficits/surpluses, global oil prices; (iv) political stability; and (v) actions of leading central banks (Chamon et al., op cit). In this regard, given the thin trading volume in EME markets, there are a host of additional factors that determine forward premia of EME currencies vis-à-vis their advanced counterparts. In the Indian context, demand and supply factors viz., foreign institutional investor (FII) flows and current account balance play a dominant role in determining the forward premia on USD/ INR rather than the usual interest rate differential (Sharma and Mitra, 2006). A subsequent study, however, suggested that the behaviour of the forward premium varied across the term structure – while the behaviour of one-month premium was in conformity with international trends in corroborating the forward premium puzzle, those of longer maturity were found to be contrary (Lingareddy, 2008). Moreover, the interest rate differential between India and the US, RBI intervention and foreign investment inflows were found to be important in determining the forward premium. Furthermore, evidence from a questionnaire-based survey suggested that qualitative attributes such as market sentiments, expectations, political stability and financial news play a vital role in determination of the forward premia apart from quantitative factors such as interest rate differential, crude oil price, net intervention of RBI, lagged values of forward premia and foreign exchange market turnover (Srikanth and Chittedi, 2014). A recent study, however, reported that while exchange rate volatility positively impacts monthly changes in the forward premia, RBI’s forward market intervention does not have any significant impact for the period 2001 to 2016 (Biswas et al., 2018). III. Stylised Facts III.1 Forex Market – Overview In India, the forex market is well-developed with various products being available – both over the counter (OTC) and exchange traded – in spot and derivatives segments. The spot market transactions cater to immediate delivery of currencies wherein settlement happens on T+2 basis (T being the trade date). Cash (settling today) and Tom trades (settlement date being one business day after the trade date) also form part of the spot market. Among the derivatives segment, forwards and swaps are OTC products whereas futures and options are exchange traded. In the forward market, contracts are made to buy or sell currencies for future delivery directly between two counterparties in an OTC (or exchange) market. Options contract, on the other hand, gives the buyer right but not the obligation to buy or sell a currency at pre-agreed exchange rate on a specified date. A forex swap involves exchange of one currency for another and is settled in two parts – the first part being the near-leg where the currencies are switched at the prevailing exchange rate (usually the spot rate); the second part is the far-leg when they are again swapped at a prior-contracted mutually agreed exchange rate. With the increasing openness of the economy, the trading volume in the Indian forex market increased steadily over the years but was subdued in 2020-21 and 2021-22, reflecting the impact of the pandemic on market activity. The spot market is the most active segment with volumes increasing faster than in other segments (Chart 1). Major participants in the forex market usually include merchants/firms, commercial banks, arbitrageurs and central banks. During normal business operations, merchants, customers buy/sell foreign exchange to hedge their exposures from future exchange rate movements. Banks, on the other hand, are the market makers as they channelise the merchant flows in the interbank market; they may also trade among themselves by taking positions based on their own assessment of premia movements. Foreign banks are the dominant players followed by public-sector and private bankswith their shares being about 45 per cent, 28 per cent and 26 per cent, respectively5, in all four segments (i.e. cash, tom, spot and forward) of the forex market. Arbitrageurs are market participants who tend to exploit the price differential between swap premium in the forward market and other interest rates prevailing across other market segments at any given point of time. As discussed earlier, central banks also actively participate in the forex market, using forex swaps as a sterilisation tool.

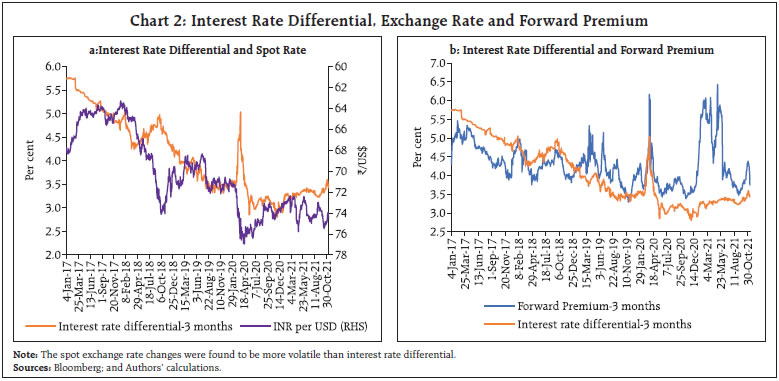

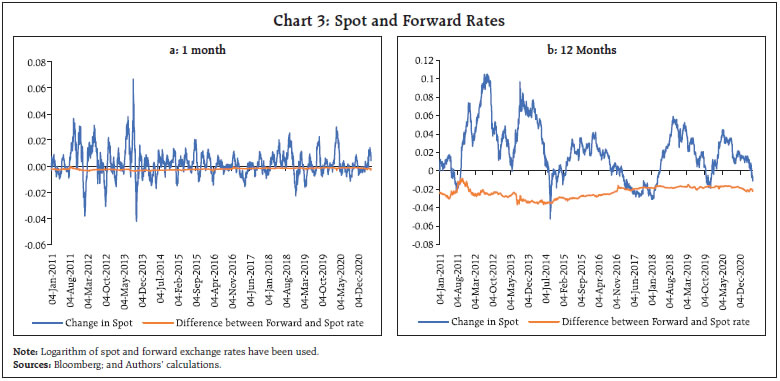

III.2 Spot and Forward Exchange Rate In the Indian context, the co-movement between interest rate differentials (based on three-month treasury bill rates in India and the US) and the INR per USD (Chart 2a) does not provide empirical support for the UIRP. The CIRP is more directly verifiable as evident from the behaviour of the forward premia (Chart 2b) (RBI 2021b). A well-known feature of the forward premia puzzle is noted for the one-month horizon (Chart 3a) – the change in the spot rate being extremely volatile while the forward premium remains virtually flat (Snaith et al., 2013). For the 12-months horizon, however, the relationship is different (Chart 3b). The contrast suggests that the puzzle or lack of support for unbiasedness is a short horizon phenomenon. According to the forward rate unbiasedness hypothesis (FRUH), the forward rate is an unbiased predictor of the corresponding expected future spot rate under conditions of risk neutrality and rational expectations (Snaith et al., op cit). Moreover, the hypothesis holds if the slope coefficient – estimated by regressing the change in spot prices on the forward premia – is equal to one. The slope coefficients thusestimated6 for select Asian EMEs suggest that while it is negative for China and Indonesia (statistically significant), it is positive for India and Philippines (but not significant) although all are less than one (Table 1). A negative slope coefficient implies that the risk premium is more volatile than the expected spot depreciation; however, the opposite is found to hold in the Indian context. Similar negative and insignificant coefficients have been reported in the literature for select economies over a short-term horizon (Chenn and Meredith, 2004). This is further investigated bymeans of a more disaggregated (period-wise) analysis7 based on rolling regression over a 30-months window, which suggest that although the slope coefficients have remained mostly negative for India, it turned positive during the pandemic (February 2020) tracking inter alia the movements in global uncertainty. On the other hand, the slope coefficients for Philippines oscillated from negative to positive, turning negative in the recent period.

| Table 1: Forward Premia Puzzle of Select Asian EMEs | | S.No. | Country | Coefficient | R-Squared | | 1 | India | 0.35 (0.63) | 0.003 | | 2 | China | -0.18 (0.46) | 0.001 | | 3 | Indonesia | -0.87*** (-30.15) | 0.866 | | 4 | Philippines | 0.002 (0.004) | 0.000 | Notes: ***, **, and * indicate 1 per cent, 5 per cent and 10 per cent levels of significance, respectively.

Figures in parenthesis are t-statistics.

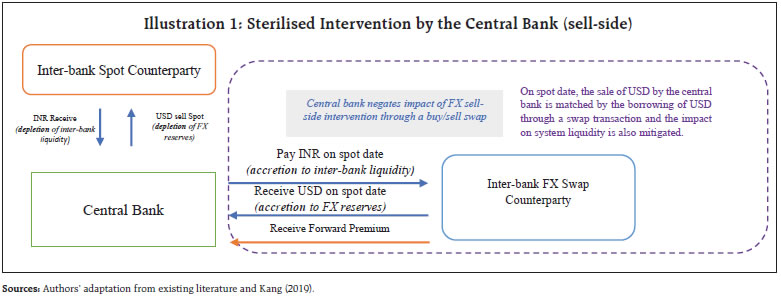

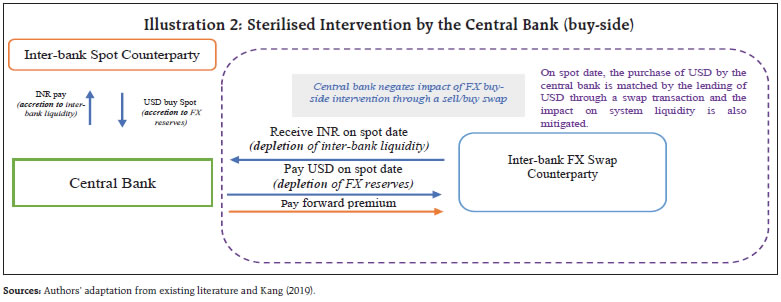

Sources: Bloomberg; CEIC; and Authors’ estimates. | III.3 RBI’s Intervention in the Forex Market Sterilisation strategy may differ over time contingent on the central bank’s stance of policy and its priorities. Depending upon these, a central bank may sometimes decide to neutralise the impact of its forex operations on domestic liquidity conditions through sterilised intervention, which has its attendant benefits and costs. As mentioned earlier, the central bank can undertake a buy/sell forex swap transaction (Illustration 1). For example, if the Reserve Bank has sold USD against INR in the spot market, it would pay dollars to the counterparty and receive INR on the day of settlement, thereby reducing banking system liquidity. To offset the liquidity impact, it can enter into a buy/sell swap with the same or another counterparty with the same settlement date. On the date of settlement, it will receive USD from the counterparty while paying in INR, effectively reversing the earlier spot (sale) transaction. The liquidity and forex reserve impact of the intervention would now be shifted to the far-leg swap settlement date. Similarly, the Reserve Bank can postpone the liquidity impact of forex purchases warranted by large capital inflows by combining sell-buy swap with spot purchases (Illustration 2).  As noted earlier, the forward premia have largely remained stable and closely aligned to the interest rate differential but experienced an uptrend since the beginning of 2021 – out of sync with the interest rate differential, particularly for the near month forwards. During the year 2021, the 1-month forward premium surged to as high as 8.44 per cent on May 3, 2021 surpassing its earlier peak of 7.50 per cent on March 23, 2021; however, premia have eased considerably since then. During the first half of 2021, forex markets experienced large capital inflows, particularly in the equity segment, including the initial public offering (IPO) related flows. This warranted intervention in the spot market followed by countervailing operations in the forward market through sell/buy swaps to neutralise the liquidity impact (Illustration 2). During 2021, RBI’s net forward position at end-March 2021 was placed at USD 72.8 billion - an accretion of nearly USD 58.9 billion over the preceding six months – as the central bank shifted to the forward market to manage the liquidity impact of spot intervention (Chart 4). At the same time, banks’ efforts to comply with the large exposure framework (LEF) norms entailed selling dollars for immediate delivery and purchasing them for a future date, which furthermaintained the pressure on premiums.8 A combination of all these factors altered the demand-supply balance in the forward market, contributing to the surge in premia across tenors. Since then, however, the market has stabilised with the forward premia moderating close to its long-term levels.

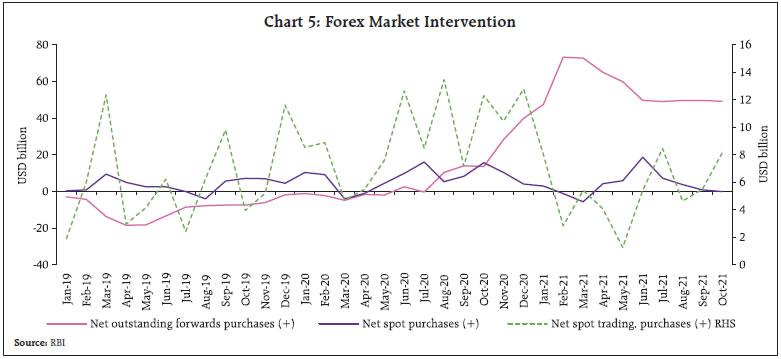

With a view to reducing the excess volatility and discourage speculative activities in the foreign exchange market arising from lumpy demand and supply as well as leads and lags in merchant transactions, the Reserve Bank undertakes sale and purchase operations in the foreign exchange market (Chart 5). While the intervention has been primarily in the spot segment, unprecedented circumstances caused by the COVID-19 pandemic warranted a combination of intervention in both market segments. In this regard, the RBI Governor’s statement of June 4, 2021 noted “………This has necessitated countervailing two sided interventions by the Reserve Bank in spot, forward and futures markets to stabilise financial market and liquidity conditions so that monetary policy retains its domestic orientation and the independence to pursue national objectives. Thus, the Reserve Bank actively engages in both purchases and sales in the foreign exchange market and its various segments”, which is illustrative of the inherent challenges posed to the conduct of monetary policy from management of capital flows.

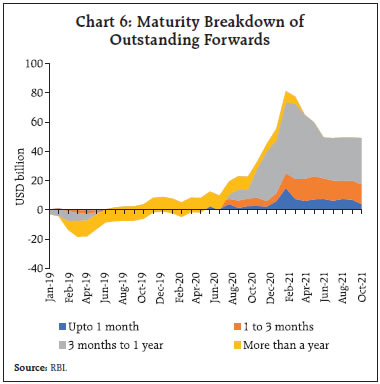

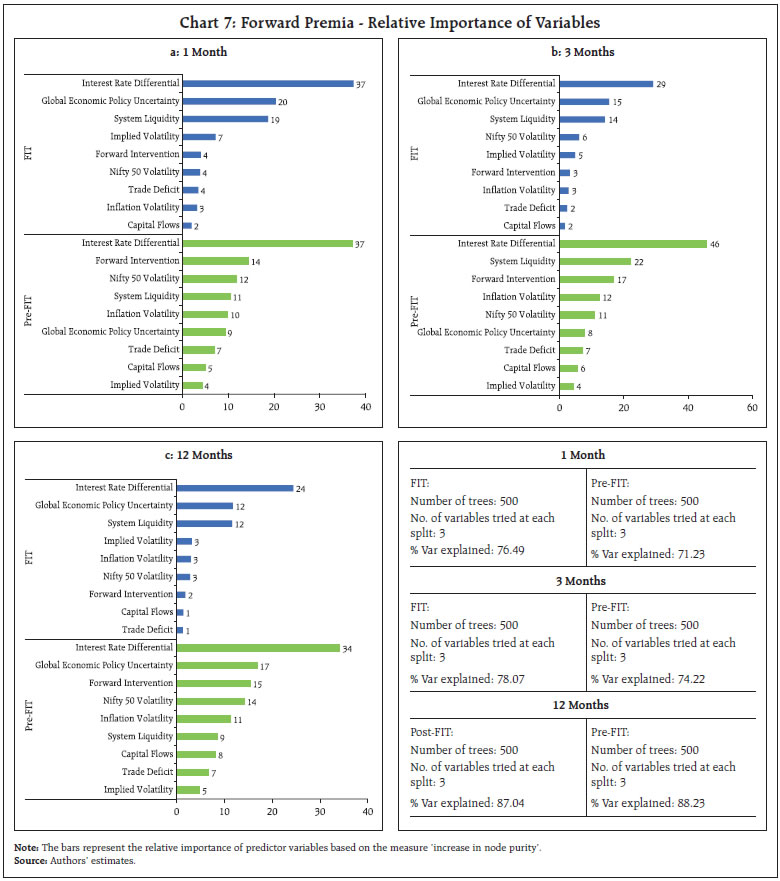

As of September 2021, the maturity profile of the Reserve Bank’s outstanding net purchases suggests greater concentration of forwards in the 3-months to 1-year horizon (Chart 6). IV. Empirical Analysis IV.1 Determinants of the Forward Premia The received literature suggests that the forward premia are influenced by macroeconomic and financial variables, central bank operations, financial and geo-political news, uncertainty, policy expectations and market sentiments. This section attempts to find the key determinants of the forward premia across the short, medium and long-term segments that are liquid (1-month, 3-months and 12-months). With the adoption of the flexible inflation targeting (FIT) framework, the relative importance of key macroeconomic and financial variables (detailed in Annex) in influencing the forward premia is also analysed separately for the period before and during FIT. For ranking the variables in terms of their relative importance, the Random Forest (RF) modelling approach is adopted. A random forest is a non-parametric supervised machine learning algorithm that is used for classification and regression constructed from a set of Classification and Regression Trees (Brieman, 2001). The methodology, which is based on decision tree algorithms, helps in measuring the relative importance of each variableon the prediction (Technical Appendix).9 The tree-based strategy used in the algorithm ranks the variables on how well they improve the purity of the node. The prediction accuracy is tested on the out-of-bag (oob) data that is left from the initial sample. The RF algorithm has gained popularity due to its advantage in handling missing data and its appropriateness for non-linear settings. As we expect non-linear effects and interactions among multiple high frequency financial market variables, the RF technique is expected to produce robust results by using a two-step randomisation procedure. The algorithm returns a measure termed as ‘Increase in Node Purity’ for each variable, which is based on total decrease in node impurities (residual sum of squares) from splitting on the variable, averaged over all trees. This is indicative of accuracy-based importance and provides insights on model selection/ ranking of variables. The findings for the periods before FIT (January 2010-December 2014) and FIT (January2015-October 2021)10 suggest that the interest rate differential emerges as the most important variable in determining the 1-month forward premia – both prior to and during FIT (Chart 7a). This is on expected lines; however, it is interesting to observe the increased impact of global uncertainty (basedon global economic policy uncertainty index)11 in the more recent period suggesting that the forward premia are partly reflective of the risk perceptions of market participants. The importance of banking system liquidity during FIT – a period in which liquidity was mostly in surplus – was found to be larger than in the preceding period. The impact of RBI’s forward intervention on the forward premia, however, was more evident in the pre-FIT period. Other macroeconomic fundamentals like trade deficit and capital flows rank much lower than global and domestic uncertainty, particularly in the FIT period, suggesting that sentiments often drive short-term investments in a globally integrated market. The key determinants for the 3-months tenor are not markedly different from that of the 1-month in both the FIT and pre-FIT periods; however, the relative importance of forward intervention was marginally lower vis-à-vis the 1-month tenor suggesting that RBI’s market interventions have a more near-term impact (Chart 7b). For 12-months tenor, it is interesting to observe the higher importance of ‘inflation volatility’ relative to RBI’s intervention operations in the FIT period. On the other hand, global uncertainty was seen to have a greater impact on long-term forward premia in the pre-FIT period, suggesting that markets factored in global risks in the longer tenor. As in the case of 3-months, RBI’s intervention operations were seen to have a larger influence in comparison to inflation volatility on the 12-months tenor in the pre-FIT period (Chart 7c). IV.2 Impact of RBI Operations In view of the importance of RBI’s forward intervention and system liquidity on the forward premia, we empirically examine the impact of forex market operations on the forward premia for the FIT period January-2015 to October-2021. To address potential endogeneity of the variables, we use the instrumental variable (IV) approach through two-stageleast squares (TSLS) regression analysis.12 In the first stage, we estimate forward intervention [net forward purchases as a percentage of Forex reserves (F_Int)] using the variables (i) forward premia of 1-month tenor (FP1); (ii) 1-month implied volatilityof INR per USD rate (Imp1)13; (iii) banking system liquidity (LAF) [absorption (+); injection (-)] as a percentage of net demand and time liabilities (NDTL); (iv) Indian VIX (VIX) as a proxy for domestic uncertainty; (v) capital flows as percentage of GDP (C_Flow); and(vi) lagged forward intervention.14 In the second regression, the actual interventions are replaced by fitted forward interventions estimated from the first regression. Forward premia are regressed on fitted intervention (F_Int_Fit) and system liquidity (LAF) with volatility in NIFTY 50 (Nifty_50_Vol) as a control variable for market sentiments based on the following equation:

| Table 2: Results of Two Stage Linear Regression | | Explanatory/Dependent Variables | Change in Forward Premia | | 1 month | 3 months | 12 months | | ΔF_Int_Fit | 0.21** (2.27) | 0.17**(2.81) | 0.13***(4.18) | | ΔLAF | -0.51***(-3.70) | -0.20**(-2.09) | -0.08(-1.56) | | Nifty_50_Vol | 0.02**(2.21) | 0.01(1.48) | 0.002(0.98) | | Constant | -0.22*(-1.87) | -0.13(-1.61) | -0.08*(-1.83) | | Adj_R-square | 0.23 | 0.15 | 0.23 | | Diagnostics | | Breusch-Godfrey LM test for autocorrelation p-value | 0.81 | 0.24 | 0.51 | | LM test for autoregressive conditional heteroscedasticity p-value | 0.32 | 0.18 | 0.25 | Notes: ***, **, and * indicate 1 per cent, 5 per cent and 10 per cent levels of significance, respectively.

Figures in parenthesis are t-statistics based on heteroscedasticity and autocorrelation consistent (HAC) corrected standard errors.

Δ is the difference operator.

Source: Authors’ estimates. | Based on the sample, the results suggest that RBI’s forward intervention has a positive impact on incremental change in forward premia (with varying statistical significance) across the term structure(Table 2).15 In terms of magnitude, the highest impact is on the near term (1-month tenor) as suggested to earlier while the most significant impact (statistically)is on the 12 months tenor.16 On the other hand, banking system liquidity has helped in reducing the forward premia across tenors; the maximum impact being on the near term. As seen in the more recent period, increase in surplus liquidity has resulted in softer interest rates, which, in turn, reduced the interest rate differential, thereby lowering the forward premia. The RBI’s conventional and unconventional measures after the outbreak of the pandemic have also reinforced this impact by boosting market sentiments and invigorating investor outlook. Finally, greater uncertainty had firmed up the forward premia albeit significantly in the near term. V. Conclusion As an indicator of market perceptions on future dynamics of the foreign exchange market, the forward premia play a key role in conveying signals to both market participants and the central bank. Therefore, it is apposite to recognise the main determinants of the forward premia across the term structure. Based on a machine learning technique and monthly data spanning more than a decade, the interest rate differential turns out to be the dominant determinant of the forward premia across maturities in both the pre-FIT period and during the FIT regime. While the second most important factor varied between RBI’s forward intervention (1-month tenor), system liquidity (3-months tenor) and global economic policy uncertainty (12-months tenor) in the pre- FIT period, the latter was unambiguously so during FIT. System liquidity has also gained importance during FIT. Regression analysis suggests that forward interventions have a positive impact, particularly on the near-term forward premia while surplus liquidity has a sobering effect across tenors during the FIT period. Finally, greater uncertainty hardens the forward premia, more so in the short term. Going forward, the effects of macroeconomic and financial variables on the forward premia needs to be assessed continuously as the findings are sensitive to sample periods and regime shifts. References Agmon, T., & Bronfeld, S. (1975). The International Mobility of Short-term Covered Arbitrage Capital. Journal of Business Finance & Accounting, 2(2), 269-278. Aliber, R. Z. (1973). The interest rate parity theorem: A reinterpretation. Journal of political economy, 81(6), 1451-1459. Backus, D. K., Foresi, S., & Telmer, C. I. (2001). Affine term structure models and the forward premium anomaly. The Journal of Finance, 56(1), 279-304. Bansal, R. (1997). An exploration of the forward premium puzzle in currency markets. The Review of Financial Studies, 10(2), 369-403. Bansal, R., & Dahlquist, M. (2000). The forward premium puzzle: different tales from developed and emerging economies. Journal of international Economics, 51(1), 115-144. Bansal, R., & Shaliastovich, I. (2006). Long-run risks explanation of forward premium puzzle. Manuscript, Duke University. Blenman, L. P. (1991). A model of covered interest arbitrage under market segmentation. Journal of Money, Credit and Banking, 23(4), 706-717. BIS. (2013). Triennial Central Bank Survey Foreign exchange turnover in April 2013: preliminary global results. September 2013. Biswas, D., Kumar, S., & Prakash, A. (2018). Do Spot Rate Volatility and Forward Market Intervention by the Central Bank Impact the Forward Premia in India?. Asian Journal of Economics, Finance and Management, 1-12. Breiman, L. (2001). Random forests. Machine learning, 45(1), 5-32. Chamon, M. M., Hofman, M. D. J., Magud, M. N. E., & Werner, A. M. (2019). Foreign exchange intervention in inflation targeters in Latin America. International Monetary Fund. Chinn, M. D., & Meredith, G. (2004). Monetary policy and long-horizon uncovered interest parity. IMF staff papers, 51(3), 409-430. Copeland, L.S., (2014). Exchange Rates and International Finance, Pearson. 6th edition. Domanski, D., Kohlscheen, E., & Moreno, R. (2016). Foreign exchange market intervention in EMEs: what has changed?. BIS Quarterly Review. September. Dornbusch, R. (1976). Expectations and exchange rate dynamics. Journal of political Economy, 84(6), 1161-1176. Fama, E. F. (1984). Forward and spot exchange rates. Journal of monetary economics, 14(3), 319-338. Fleming, J. M. (1962). Domestic financial policies under fixed and under floating exchange rates. IMF Staff Papers, 9(3), 369-380. Frankel, J. A. (1992). Measuring international capital mobility: a review. American Economic Review, 82(2), 197-202. Frenkel, J. A., & Levich, R. M. (1975). Covered interest arbitrage: Unexploited profits?. Journal of Political Economy, 83(2), 325-338. Kang, M. W. (2019). Currency Market Efficiency Revisited: Evidence from Korea. International Journal of Financial Studies, 7(3), 52. Kouri, P. J. (1977). The exchange rate and the balance of payments in the short run and in the long run: A monetary approach. In Flexible Exchange Rates and Stabilization Policy (pp. 148-172). Palgrave Macmillan, London. Levi, M. D. (1977). Taxation and” abnormal” international capital flows. Journal of Political Economy, 85(3), 635-646. Lingareddy, T. (2008). Factors influencing forward premia in Indian markets. Rakshitra, November. Lustig, H., & Verdelhan, A. (2007). The cross section of foreign currency risk premia and consumption growth risk. American Economic Review, 97(1), 89-117. McCormick, F. (1979). Covered interest arbitrage: Unexploited profits? Comment. Journal of Political Economy, 87(2), 411-417. Mundell, R. A. (1963). Capital mobility and stabilization policy under fixed and flexible exchange rates. Canadian Journal of Economics and Political Science, 29(4), 475-485. Mussa, M. (1981). The role of official intervention. New York: Group of Thirty. RBI. (2021a). Monetary Policy Report. October. RBI. (2021b). Report on Currency and Finance 2020-21. February. Raj, J., Pattanaik, S., Bhattacharyya, I. and Abhilasha (2018). Forex Market Operations and Liquidity Management. RBI Bulletin, August. Ratho, R.S., Rajput, V., Sarangi, S., (2020). Managing Exchange Rate Volatility in the time of COVID-19. RBI Bulletin, December. Sharma, A. K., & Mitra, A. (2006). What drives forward premia in Indian forex market. Reserve Bank of India Occasional Papers, 27(1-2), 119-139. Snaith, S., Coakley, J., & Kellard, N. (2013). Does the forward premium puzzle disappear over the horizon?. Journal of Banking & Finance, 37(9), 3681-3693. Srikanth, M., & Chittedi, K. R. (2014). Perspectives on Forward Premia in India Forex Market: A Study of USD/INR. Journal of Stock & Forex Trading, 3(4). Stoll, H. R. (1978). The pricing of security dealer services: An empirical study of NASDAQ stocks. The Journal of Finance, 33(4), 1153-1172. Talwar, B. A., Kushawaha, K.M., Bhattacharyya, I. (2021). Unconventional Monetary Policy in Times of COVID-19. RBI Bulletin, March.

ANNEX | Details of Variables | | S.No. | Variable Name | Description | Source | | 1 | Interest Rate Differential | Difference between 3-months treasury bill rates in India and the US | Bloomberg; Authors’ calculations | | 2 | Global Economic Policy Uncertainty | GDP-weighted average of national EPU indices for 21 countries: | https://www.policyuncertainty.com/global_monthly.html | | 3 | System Liquidity | Banking system liquidity (LAF) (absorption +; injection -) as a proportion of net demand and time liabilities (NDTL) | Reserve Bank of India; Authors’ calculations | | 4 | Implied Volatility | 1-month implied volatility of INR per USD rate | Bloomberg | | 5 | Forward Intervention | Net forward purchases as a percentage of Forex reserves | Reserve Bank of India; Authors’ calculations | | 6 | Nifty 50 Volatility | Realised volatility of NIFTY 50 | CEIC | | 7 | Trade Deficit | Trade deficit as a percentage of GDP | CEIC; Authors’ calculations | | 8 | Inflation Volatility | 12-months rolling standard deviation of CPI inflation | MOSPI; Authors’ calculations | | 9 | Capital Flows | Net capital inflows (FDI+FPI) as a percentage of GDP | CEIC; Authors’ calculations | Technical Appendix: Random Forest Algorithm The algorithm involves the following steps: Step 1: B bootstrap samples are drawn from the original sample. On the average, bootstrap samples exclude 37 per cent of the data known as out-of-bag (oob) data. Step 2: A tree is grown based on the data of each of the bootstrap samples, i.e. b=1,…, B. At each node, a subset of predictors is selected randomly to find the best split among all binary splits as per the splitting criterion. The process is repeated until a stopping criterion is met. Step 3: To obtain a prediction ensemble, information obtained from the nodes of the B trees with no further split (terminal nodes) is aggregated. New data is predicted by aggregating the prediction of all trees.

|