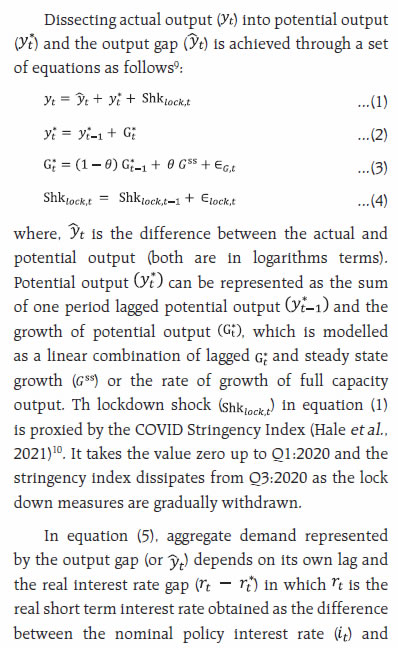

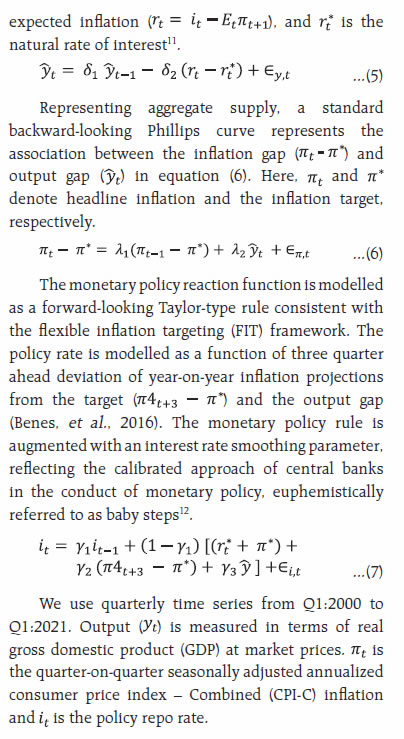

The Phillips curve postulates that unemployment can be lowered (output can be increased) but only at the cost of higher wages (inflation) or conversely, wage growth (inflation) can be lowered only at the cost of higher unemployment (lower output). The conduct of monetary policy hinges around this exploitable trade-off. Our results indicate that the Phillips curve is alive in India but recovering from a period of flattening over the past 6 years. The Phillips curve is convex, flattening with low and negative output gaps and steepening when the output gap is positive and high. In 1958, Alban William Housego Phillips detected a strong negative association between the money wage rate and the unemployment rate in the UK. His published work was to become one of the most widely cited ever in the economics profession1. What started out as an ‘empirical regularity’ without theoretical moorings was to become the most famous curve in the post-World War II period – the Phillips curve – as extraordinary as the man himself for whom a short historical tribute would be befitting2. Born in New Zealand into a farming family which could not afford to keep him in school, Phillips started working as an apprentice electrician at the age of 15. In 1937, still aged only 23 and wanting to explore the world, he boarded a Japanese ship to Shanghai, which was diverted to Yokohama because war broke out while it was at sea. From Japan, he made his way through Korea, Manchuria and crossed Russia on the Trans-Siberian railway, travelling on through Poland and Germany. He settled down in London where he graduated from the Institute of Electrical Engineers in 1938. When World War II broke out, he enlisted in the Royal Air Force and was sent as a flight Lieutenant to Singapore. In 1942, when Japanese forces captured Singapore, he boarded the last ship out of there. Attacked by Japanese fighter planes, it limped into Java where he was captured and spent the next three years as a prisoner of war. In 1945, he was repatriated to his family in New Zealand, emaciated, addicted to nicotine and deeply scarred. He chose to return to London and enroll at the London School of Economics to study sociology. There, he developed a hydraulic machine model of the UK economy, with the flow of liquid representing money3. The head of the department of economics, Sir Lionel Robbins, who would give the world the so-called ‘scarcity’ definition of economics4, found him to be ‘a wild man from New Zealand waving blueprints in one hand and queer shaped pieces of Perspex in the other’ and handed him to a junior colleague, James Meade, who would become his lifelong friend. The electrical engineer became an economist, the hydraulic machine gave way to systems of differential equations, application of dynamic control theory to macroeconomics and computer-based policy simulations. In 1958, he found that by grouping data on inflation and unemployment from 1861 to 1957 into sub-periods, he could observe an apparently robust relationship between the rates of change of money, wages and unemployment. The paper was published that year in Economica while he had proceeded on leave to the University of Melbourne and he was astounded on his return to find the outpouring of interest in his work. The rest, as it is said, is history. In its original form, the Phillips curve identifies an inverse correlation between unemployment and wage growth with powerful policy implications – unemployment can be lowered (output can be increased) but only at the cost of higher wages (inflation) or conversely, wage growth (inflation)5 can be lowered only at the cost of higher unemployment (lower output)6. Phillips postulated that this negative relationship should be highly non-linear due to downward wage rigidity – workers would be reluctant ‘to offer their services at less than the prevailing rates when the demand for labour is low and unemployment is high’ (Phillips, 1958). This implies that the policy maker’s ability to generate employment by lowering the wage rate slows after a point and then stops. In the closing years of the 1950s and in the 1960s, the Phillips curve7 appealed widely as empirical research turned in evidence of the existence of a negative correlation between inflation and unemployment in data for the US economy (Samuelson and Solow, 1960) and in numerous other developed countries. This opened up a range of exciting possibilities for policy intervention. It seemed to suggest that the policymaker has a menu of options from which she could select a preferred combination of unemployment and inflation. The term Phillips curve or PC proliferated in macroeconomic discussions and became the springboard for large-scale macroeconometric models that were in fashion in those days. From the late 1960s, however, there have been several assassination attempts. In 1968, Milton Friedman’s Presidential address to the American Economic Association challenged the PC. In his view that has come to be known as the monetary policy invariance hypothesis (Hall and Sargent, 2018), monetary policy had no ability to choose the unemployment rate or the interest rate because both have natural rates, the former determined by the structural characteristics of the labour market, including market imperfections, and the latter by factors such as demographics and the state of financial intermediation and technology8. The only variable that monetary policy can influence is the rate of inflation – “inflation is always and everywhere a monetary phenomenon” (Friedman, 1970). By creating unanticipated inflation through bursts of unplanned money creation, it can lower real wages temporarily below the natural rate and boost employment, but soon people will see through the increase in inflation and not be fooled. They will adjust their inflation expectations and demand higher nominal wages to account for inflation and the wage rate will gravitate to its natural rate. Thus at most, monetary policy can induce transitory deviations of the real interest rate and the unemployment from their natural rates. There is no trade-off between unemployment and inflation in the long run and hence, no role for monetary policy beyond avoiding unpleasant inflation surprises. Friedman brought in the role of expectations – people extrapolated recent behaviour in a fixed way to form expectations about the future. Influential work in the early 1970s employed rational expectations to produce a striking clarification and strengthening of the monetary policy invariance hypothesis (Lucas, 1972a; 1973). Based on the available information, people form expectations about future prices and quantities, and based on these expectations they act to maximize their expected lifetime utility. Accordingly, they can anticipate any systematic policy actions and build them into their wage negotiations, thus negating the purpose of these policies. Anticipated monetary policy cannot change real GDP in a predictable manner; this can only happen via price surprises referred to earlier. These declarations of war were well-timed – in the 1970s, the correlation between inflation and unemployment turned out to be positive – not negative – and the PC was consigned to the “wreckage... of that remarkable intellectual event called the Keynesian revolution” (Lucas and Sargent, 1978). Proponents of the PC had to reconcile with the absence of a long-run trade off and had to be content with an uneasy short-run trade-off subject to the longer-run adjustment to the natural rate of unemployment. Meanwhile, however, the invariance hypothesis was rejected empirically in view of little or no effects of monetary surprises on output and also because it was inconsistent with serial correlation of output and inflation persistence. Moreover, the Friedman- Phelps-Lucas position could not be developed into a systematic and symmetric explanation of output and price behaviour (Gordon, 2011). The PC survived these assaults of long run neutrality on short run exploitable trade-offs. The Volcker disinflation was followed by the re-emergence of a negative correlation between inflation and unemployment, reinforcing the rehabilitation of the PC in the 1970s by two strands of influential work. One is the ‘triangle model’ (Gordon 1975; Phelps, 1978) in which the inflation process is explained by inertia (lagged inflation representing backward-looking expectations formation and accommodating the Friedman-Lucas critique), demand reflected in the employment or output gap, and supply shocks that are explicitly modelled rather than being suppressed into the error term as in the second strand. While the triangle model seems to provide a coherent explanation of the phenomenon of stagflation, the Volcker disinflation was faster than suggested by forecasts from an expectation augmented PC with wage rigidity. Furthermore, the Fed’s monetary policy is credited to have become more credible from the late 1970s, resulting in lower sacrifices of output for every unit disinflation than what the triangle model would have predicted. The second strand resuscitated the PC and pitched it into the centre stage of the academic discourse on monetary policy as well as its operational conduct. It was termed as the new Keynesian revolution but was, in fact, a synthesis that incorporated the new classical (Lucas, 1972b) emphasis on rational expectations and market clearing. It differs from the first strand in the absence of backward-looking inflation inertia. Ahead of its advent, seminal work in the area of real business cycles distinguished between rules and discretion in conducting monetary policy (Kydland and Prescott, 1977; Barro and Gordon, 1983). It was shown that policy makers who reassess their response to inflation in each time period end up delivering higher inflation relative to those that adhere to a rule which holds across time periods. This phenomenon of ‘time inconsistency’ spawned a profusion in the literature on proximate solutions, including appointing a conservative central banker who places a large weight on inflation stabilisation relative to employment stabilisation (Rogoff, 1985); writing an optimal contract for the central banker that ties incentives to realised inflation (Walsh, 1995) and conducting rule-based monetary policy (Taylor, 1993; McCallum, 1987) which eventually led up to the formalised institution of inflation targeting as a monetary policy framework. The moot point that emerged from the identification of time inconsistency is that attempts to conduct monetary policy without knowledge of the position of the PC can lead to policy choices that yield persistently high inflation outcomes. Credibility is key – doubts among economic agents about the policy maker’s commitment to low and stable inflation can increase the output losses of reducing inflation, i.e., the sacrifice ratio. Over the 1980s and 1990s, the new Keynesian PC or NKPC became the central element of the workhorse model that is employed widely by modern central banks to evaluate the conduct of monetary policy and assess the outcomes versus goals. An important feature of the NKPC is its micro-foundations. Monopolistically competitive firms have control over their own prices due to product differentiation. They are, however, constrained in the setting of prices by frictions and so they change their prices only infrequently, having in the earlier adjustment set the price equal to the weighted average desired price set by all firms. As a consequence of this friction, monetary policy actions that seek to increase or reduce inflation will have short-run effects on output (employment). The main differences of the NKPC from the triangle model are (1) expectations are explicitly forward-looking; and (2) supply shocks are not explicitly taken into account and are instead suppressed into the error term. In real life, the NKPC fits the data poorly because of the phenomenon of inflation persistence in the form of dependence on the past. Accordingly, the hybrid NKPC has emerged as the more credible formulation in which the inflation expectations are both forward and backward looking (Gali and Gertler, 1999; Gali et al., 2005). Recent research has focused on time-varying properties of the NKPC and its non-linearities. From the late 1990s right upto the global financial crisis (GFC of 2007-08), global economic activity expanded continuously without any parallel acceleration in inflation. Also, the GFC did not produce the sharp disinflation that was widely expected - termed as the missing (dis) inflation (Coibion and Gorodnichenko, 2015). Also missing has been the reinflation that was expected since the 2010s (Constancio, 2015). The relative insensitivity of inflation to changes in employment or wider economic activity during these recent decades, backed by empirical estimates that the PC has flattened considerably during this period, has led many economists to suggest that the PC has either disappeared or is hibernating (Hazell, Herreno, Nakamura and Steinsson, 2021; Hooper, Mishkin and Sufi, 2020). An animated debate has ensued, dividing the profession under two views: the PC is dead (Summers, 2017; McLeay and Tenreyro, 2019; Gagnon and Collins, 2019; Ratner and Sim, 2020) and the PC is alive and well (Gordon, 2013; Ciccarelli, et al., 2017; Hindrayanto, Samarina and Stanga, 2019; Reinbold and Wen, 2020; Alexius, Lundholm and Nielsen, 2020; Jorgensen and Lansing, 2021). There is a consensus though, that the answer is empirical and country-specific, and it has to be sought for a wider objective assessment of the role of monetary policy. For India, the PC has stood the test of time, right up to early 2020 before the pandemic struck, providing a rationale for monetary policy in its stabilising counter-cyclical role. In the most recent experience, as the Indian economy enjoyed one of the longest expansions in recent history during 2012-16, inflation rose to an average of 7.5 per cent. In the period 2017-20, there was a cyclical downturn which was associated with inflation easing to an average of 3.9 per cent. And then came the pandemic! Even as the country locked down and people went into isolation, inflation surged in 2020-21 and the first quarter of 2021-22, breaching the upper tolerance band set under the flexible inflation targeting framework. In particular, core inflation, which is perceived to be demand-driven and amenable to monetary policy action, is high and persistent. Headline inflation has eased more recently but widespread concerns remain that the Reserve Bank of India (RBI) will be forced to reverse its pandemic-fighting accommodative stance and tighten monetary policy sooner than later (Bhattacharya, 2021). Is there sizable slack in the economy induced by the pandemic, as high frequency indicators suggest? Or has the pandemic changed all that, pushing down potential output along with actual output, begging the question – what is the state of the output gap? Has the relationship between slack and inflation broken down? This seems to be corroborated by large forecast errors in inflation projections. These questions are best responded to by estimating the PC for India by including the period of the pandemic. We also investigate the time varying properties of the PC to examine if it is the ongoing recession that has flattened the slope of the PC, rather than pronouncing it as missing in action. The rest of the paper is organised into four sections. Section II sets out the methodology and the data to estimate the output gap and linear Phillips curve and discusses the results. Section III and Section IV present time-varying and convexity properties of the Phillips curve in India, respectively. Section V concludes the article and offers some policy perspectives. II. Palpating for the Phillips Curve in India The Indian economy was into a downturn when the pandemic struck. By 2019-20, real GDP growth had slowed to its lowest rate in the history of the national accounts based to 2011-12 and a negative output gap – with potential output measured by a combination of statistical filters - had opened up by the second quarter of the year. In 2020-21, the year of the pandemic’s first wave, GDP had declined by 24.4 per cent in the first quarter, and for the year as a whole, it contracted by 7.3 per cent, one of the steepest in the world. The suddenness, severity and scale of the first wave brought the economy to a halt under one of the strictest lockdowns anywhere. Supply disruptions and demand compression became indistinguishable and standard methodologies for estimating potential output failed because of extreme values and end-sample problems. The impact of the second wave of the pandemic on the economic activity was not as severe – in Q1:2021-22, GDP was 9 per cent below its level in the corresponding quarter of 2019-20 – and containment measures were localised with wider adaptation to pandemic protocols. On the other hand, supply and logistics disruptions brought in their train price pressures as supply-demand imbalances flared up, margins were increased to recoup lost incomes and taxes were levied on fuel consumption. While food and fuel prices suffered one-off spikes, core inflation acquired persistence and a generalised character. With core inflation unresponsive to the contraction in the economy, the exploitable trade-off between aggregate demand and core inflation broke down, leaving the conduct of monetary policy in no-man’s land and the very existence of the Phillips curve came into question. In these challenging circumstances, we sought to check the pulse of the Phillips curve by following the empirical literature into estimating a hybrid one in the new Keynesian tradition. While the canonical new Keynesian model is purely forward-looking, i.e., it incorporates only people’s expectations about future inflation, it does not fit the data well – evidently, people’s expectations formation is adaptive for a number of reasons such as indexation of wages and the fact that the average human being is probably not perfectly farsighted or ‘Ricardian’ as economists are prone to label them. Accordingly, the pragmatic approach is to incorporate both backward-looking and forward-looking expectations into the Phillips curve. Supply shocks are suppressed into the error term. The key issue is to estimate the output gap, which has been shown to be proportional to marginal cost - the main driver of inflation – under frictionless conditions such as flexible wages and prices (Woodford, 2001; Neiss and Nelson, 2001; Gali, 2002). We use a semi-structural multivariate filter approach to decompose observed output into its trend and cyclical components (Alichi, et al., 2017). The decomposition involves the simultaneous estimation of an aggregate demand or IS curve, an aggregate supply curve represented by the Phillips curve and a monetary policy reaction function that describes the central bank’s response to deviations of output from its potential and inflation from its target. This system of equations is based on the view that inflation possesses vital information regarding evolving demand and supply conditions. This approach also enables a structural explanation of the evolution of the output gap by extracting information about the output gap that is latent in monetary policy actions as well as in their interactions with changes in aggregate demand and supply (Alichi, et al., 2017).   We estimate the system of equations (1-7) in a Bayesian framework13 with relatively weak priors (i.e., we allow the parameters to vary in a wide range as we are less confident of the value of the parameters a priori). The steady states are solved by applying a Newton-type algorithm14,15. We assume that all parameters follow normal distributions and standard deviations of the shocks follow inverse gamma distributions, following the literature. The posterior distributions of the parameters are simulated by using the adaptive random walk Metropolis (ARWM)16 posterior simulator with 1,00,000 draws (Table 1). The slope coefficient (λ2 ) of the linear Phillips curve is estimated at 0.18 with a 95 per cent credible interval, indicating that the slope has 95 per cent probability of falling within 0.06 and 0.34. | Table 1: Posterior Estimates of Model Coefficients | | Parameter | Mean | Standard Deviation | 95 Per cent Lower Credible Interval17 | 95 Per cent Upper Credible Interval17 | | θ | 0.11 | 0.06 | 0.03 | 0.26 | | ρ | 0.32 | 0.08 | 0.15 | 0.47 | | δ1 | 0.61 | 0.06 | 0.47 | 0.69 | | δ2 | 0.08 | 0.03 | 0.05 | 0.15 | | λ1 | 0.44 | 0.12 | 0.22 | 0.70 | | λ2 | 0.18 | 0.08 | 0.06 | 0.34 | | γ1 | 0.97 | 0.01 | 0.94 | 0.99 | | γ2 | 1.16 | 0.41 | 0.53 | 1.94 | | γ3 | 0.51 | 0.15 | 0.24 | 0.78 | The output gap and potential output estimates are obtained by using a multivariate Kalman filter in a two-step approach. First, we estimate and filter out potential output and the output gap from the data on GDP for the period Q1:2000 to Q1:2020 (pre-COVID period). In the second step, we use these filtered output gap and potential output estimates as observed variables and re-estimate the model for the full sample. The estimated potential output18 moves closely with actual output, with intermittent deviations (Chart 1). During the pandemic period, however, actual GDP deviated significantly from its potential, mainly reflecting the effects of the lockdown, and resulted in a negative output gap of about 4-6 per cent per quarter during Q2:2020 through Q1:2021. The slope parameter (λ1) represents the average estimates for the full sample period obtained from a linear Phillips curve. It is, however, unable to capture non-linearities (nominal wage and price rigidities) and time variations (structural shifts). In the subsequent two sections, therefore, we examine (a) how the Phillips curve has evolved over time and (b) how the state of the economy is conditioning the Phillips curve relationship. III. Time-varying Phillips Curve Estimates A time-varying parameter formulation enables us to track whether the structure of the Phillips curve has undergone a change during the sample period (Q1:2000 to Q1:2021). We estimate the following hybrid formulation of the Phillips curve in a time-varying parameter regression framework with stochastic volatility (TVP-SV) (Stock and Watson, 2007; Cogley, Primiceri and Sargent, 2010): where the time-varying coefficient αt, the sensitivity of inflation to the output gap, is the parameter of our interest. Inflation expectations are model consistent inflation trend estimates which are assumed to follow a random walk process19 with time-varying volatility20: The time varying parameters are estimated by using the Bayesian Markov Chain Monte Carlo (MCMC) method. The convergence diagnostics are found to be satisfactory (Annex Chart 1 and Table 1). The estimated time-varying output gap coefficient has seen a steady decline in the past 6 years, roughly coinciding with the RBI’s de facto adoption of the FIT regime (Chart 2). Inflation persistence has declined over this period and the sensitivity of inflation to inflation expectations has increased, as reflected in a rise in the value of the (1 – ρt) parameter. In fact, the relationship between the time varying coefficients of the output gap and inflation expectations shows a strong and statistically significant negative correlation (- 0.69, p-value = 0.00). Another interesting result is the positive and statistically significant relationship between the coefficient of the output gap and the output gap itself (0.65, p-value = 0.00) implying that a rise in output gap increases its sensitivity to inflation. This suggests convexity of the Phillips curve in India to which we now turn. IV. Convexity of Phillips Curve Following the empirical literature, an exponential formulation for the output gap term is used to estimate a convex Phillips curve (Benes, et al., 2016) in the specification given below.

| Table 2: Regression Estimates (Convex Phillips Curve) | | | Coeff. | SE | t | p-value | | (1 – ρ) | 0.84 | 0.11 | 7.68 | 0.00 | | α1 | 1.48 | 0.86 | 1.72 | 0.09 | | α2 | 0.50 | 0.14 | 3.66 | 0.00 | | β | 0.00 | 0.01 | 0.74 | 0.46 | Diagnostics:

Portmanteau test for white noise for residuals p-value = 0.64

Adj R-squared = 0.83 | The change in crude oil prices is used to control for volatile supply side shocks. The formulation in equation (10) is estimated by using non-linear least squares (NLLS). Statistically significant α values (α1 and α2) provide evidence of the convexity of the Phillips curve in India (Table 2). This indicates that with low and negative output gaps, the Phillips curve flattens as inflation becomes less sensitive to aggregate demand. When the output gap is positive and high, inflation responds more strongly to demand and the Phillips curve steepens (Chart 3). The residuals are found to be white noise, validating the results. V. Conclusion The conduct of monetary policy hinges around the premise that there exists an exploitable trade-off between economic activity, measured by output or employment, and inflation. The Phillips curve embodies that trade-off, although the debate about its existence has a history that is as old as the curve itself. In the years following the global financial crisis, the world has been saddled with sizable amounts of slack in activity, irrespective of jurisdiction, and the coincident long phase of low and even negative inflation has obscured the Phillips curve from our view, even to the point that some have questioned its existence. The answer, as we said when we began this exploration, is to be found by soiling one’s hands with country-specific data. Our results indicate that the Phillips curve is alive in India but recovering from a period of flattening lasting more than six years, i.e., from 2014. Seen linearly, inflation is sensitive to the output gap and this finding is statistically significant, confirming the existence of the Phillips curve in India. Relaxing time invariance, however, the plot thickens, and a steady decline in the coefficient on the output gap becomes evident. The inflation process in India has become increasingly sensitive to forward-looking expectations. The slope of the Phillips curve has been declining with the anchoring of inflation expectations. This phenomenon coincides with the institution of inflation targeting de facto and de jure from 2016. Inflation persistence has also declined over this period. Our results also point to threshold effects – as the output gap becomes positive, inflation becomes increasingly sensitive to it. Under current macroeconomic conditions, still weak demand conditions are flattening the Phillips curve in India, providing some manoeuvring room for monetary policy to support the recovery without being hemmed in by demand-driven inflation concerns. There is need for vigilance, however, as the curve steepens with the output gap closing and moving into positive territory, causing upside risks on the inflation front to rise. References Alexius, A., Lundholm, M., and Nielsen, L. (2020). Is the Phillips Curve Dead?: International Evidence (No. 2020: 1). Stockholm University, Department of Economics. Alichi, A., Bizimana, O., Laxton, M. D., Tanyeri, K., Wang, H., Yao, J., and Zhang, F. (2017). Multivariate Filter Estimation of Potential Output for the United States. IMF Working Paper No. 17/106. Barr, N. (2000). The History of the Phillips Machine. Chapter 11 in A. W. H. Phillips: Collected Works in Contemporary Perspective, ed. Robert Leeson. Cambridge: Cambridge University Press. Barro, R. J., and Gordon, D. B. (1983). Rules, Discretion and Reputation in a Model of Monetary Policy. Journal of Monetary Economics, 12(1), 101-121. Benes, J., Clinton, K., George, A. T., Gupta, P., John, J., Kamenik, O., ... and Zhang, F. (2016). Quarterly Projection Model for India: Key Elements and Properties. RBI Working Paper, No. 08, November. Bhattacharya, S. (2021). RBI’s Monetary Policy Stance will Balance Growth Revival. Mint, August 5. Bollard, A. E. (2011). Man, Money and Machines: The Contributions of AW Phillips. Economica, 78(309), 1-9. Ciccarelli, M., Osbat, C., Bobeica, E., Jardet, C., Jarocinski, M., Mendicino, C., ... and Stevens, A. (2017). Low Inflation in the Euro Area: Causes and Consequences. ECB Occasional Paper, No. 181. Coibion, O., & Gorodnichenko, Y. (2015). Is the Phillips Curve Alive and Well After All? Inflation Expectations and the Missing Disinflation. American Economic Journal: Macroeconomics, 7(1), 197-232. Constancio, V. (2015). Understanding Inflation Dynamics and Monetary Policy. In Speech at the Jackson Hole Economic Policy Symposium (Vol. 29), August. Cogley, T., Primiceri, G. E., and Sargent, T. J. (2010). Inflation-gap Persistence in the US. American Economic Journal: Macroeconomics, 2(1), 43-69. Friedman, M. (1970). Counter-Revolutifon in Monetary Theory. Wincott Memorial Lecture, Institute of Economic Affairs, Occasional Paper 33. Gagnon, J., and Collins, C. G. (2019). Low Inflation Bends the Phillips Curve. Peterson Institute for International Economics Working Paper, (19-6). Galí, J. (2002). New Perspectives on Monetary Policy, Inflation, and the Business Cycle. CEPR Discussion Paper No. 3210. Galı, J., and Gertler, M. (1999). Inflation Dynamics: A Structural Econometric Analysis. Journal of Monetary Economics, 44(2), 195-222. Gali, J., Gertler, M., and Lopez-Salido, J. D. (2005). Robustness of the Estimates of the Hybrid New Keynesian Phillips Curve. Journal of Monetary Economics, 52(6), 1107-1118. Gordon, R. J. (1975). Alternative Responses of Policy to External Supply Shocks. Brookings Papers on Economic Activity, 1975(1), 183-206. Gordon, R. J. (2011). The History of the Phillips Curve: Consensus and Bifurcation. Economica, 78(309), 10- 50. Gordon, R. J. (2013). The Phillips Curve is Alive and Well: Inflation and the NAIRU during the Slow Recovery. NBER Working Paper No. 19390, August. Hale, T., Angrist, N., Goldszmidt, R. et al. (2021). A Global Panel Database of Pandemic Policies (Oxford COVID-19 Government Response Tracker). Nature Human Behaviour, 5, 529–538. Hall, R. E., and Sargent, T. J. (2018). Short-run and Long-run Effects of Milton Friedman’s Presidential Address. Journal of Economic Perspectives, 32(1), 121-34. Hazell, J., Herreno, J., Nakamura, E., and Steinsson, J. (2021). The Slope of the Phillips Curve: Evidence from US States. url: https://eml.berkeley.edu/~enakamura/ papers/StateLevelCPIs.pdf Hindrayanto, I., Samarina, A., and Stanga, I. M. (2019). Is the Phillips Curve Still Alive? Evidence from the Euro Area. Economics Letters, 174, 149-152. Hooper, P., Mishkin, F. S., and Sufi, A. (2020). Prospects for Inflation in a High Pressure Economy: Is the Phillips Curve Dead or Is it just Hibernating?. Research in Economics, 74(1), 26-62. Jørgensen, P. L., and Lansing, K. J. (2021). Return of the Original Phillips Curve. FRBSF Economic Letter, 2021(21), 01-06. Kydland, F. E., and Prescott, E. C. (1977). Rules Rather than Discretion: The Inconsistency of Optimal Plans. Journal of Political Economy, 85(3), 473-491. Lucas Jr, R. E. (1972a). Econometric Testing of the Natural Rate Hypothesis. In The Econometrics of Price Determination: Conference, October 30–31, 1970, edited by Otto Eckstein. Washington, DC: Board of Governors of the Federal Reserve System. Lucas Jr, R. E. (1972b). Expectations and the Neutrality of Money. Journal of Economic Theory, 4(2): 103–24. Lucas Jr, R. E. (1973). Some International Evidence on Output–Inflation Tradeoffs. American Economic Review, 63(3): 326–34. Lucas, R. E., and Sargent, T. J. (1978). After Keynesian Macroeconomics. In After the Phillips Curve: Persistence of High Inflation and High Unemployment, Federal Reserve Bank of Boston Conference Series, No. 19, 49-72. McCallum, B. T. (1987). The Case for Rules in the Conduct of Monetary Policy: A Concrete Example. Review of World Economics, 123(3), 415-429. McLeay, M., and Tenreyro, S. (2020). Optimal Inflation and the Identification of the Phillips Curve. NBER Macroeconomics Annual, 34(1), 199-255. Neiss, K.S., and Nelson, E. (2001). The Real Interest Rate Gap as an Inflation Indicator. Bank of England Working Paper No. 130. Phelps, E. S. (1967). Phillips Curves, Expectations of Inflation and Optimal Unemployment Over Time. Economica, 34(135): 254–81. Phelps, E. S. (1968). Money-Wage Dynamics and Labor- Market Equilibrium. Journal of Political Economy, 76(4): 678–711. Phelps, E. S. (1978). Commodity-supply Shock and Full-employment Monetary Policy. Journal of Money, Credit and Banking, 10(2), 206-221. Phillips, A. W. H. (1958). The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861–1957. Economica, 25(100): 283–99. Ratner, D., and Sim, J. (2020). Who Killed the Phillips Curve? A Murder Mystery. Working Paper. https:// www. researchgate. net/publication/339384053_ Who_Killed_the_Phillips_Curve_A_Murder_Mystery. Reinbold, B., and Wen, Y. (2020). Is the Phillips Curve Still Alive?. Federal Reserve Bank of St. Louis Review, 102(2), 121-144. Rogoff, K. (1985). The Optimal Degree of Commitment to An Intermediate Monetary Target. The Quarterly Journal of Economics, 100(4), 1169-1189. Samuelson, P. A., and Solow, R. M. (1960). Analytical Aspects of Anti-inflation Policy. American Economic Review, 50(2), 177-194. Sleeman, A. G. (2011). Retrospectives: the Phillips Curve: A Rushed Job?. Journal of Economic Perspectives, 25(1), 223-38. Stock, J. H., and Watson, M. W. (2007). Why has US Inflation Become Harder to Forecast?. Journal of Money, Credit and Banking, 39, 3-33. Summers, L. (2017). America Needs its Unions More than Ever. Financial Times, September 3. Taylor, J. B. (1993). Discretion versus Policy Rules in Practice. In Carnegie-Rochester Conference Series on Public Policy, North-Holland, 39, 195-214. Walsh, C. E. (1995). Optimal Contracts for Central Bankers. The American Economic Review, 85(1), 150- 167. Woodford, M. (2001). The Taylor Rule and Optimal Monetary Policy. American Economic Review (Papers and Proceedings), 91, 232–237.

Annex

| Annex Table 1: Time Varying Parameter Estimation Results | | Parameter | Mean | Stdev | 95%U | 95%L | Geweke | | Sig11 | 0.0974 | 0.1467 | 0.0082 | 0.5065 | 0.278 | | Sig22 | 0.0097 | 0.0063 | 0.0029 | 0.0258 | 0.764 | | Sig33 | 0.0044 | 0.0026 | 0.0016 | 0.0112 | 0.939 | | phi | 0.9174 | 0.0791 | 0.7115 | 0.9965 | 0.240 | | siget | 0.2187 | 0.1023 | 0.0895 | 0.4753 | 0.401 | | gamma | 5.2718 | 2.9323 | 0.3796 | 11.6540 | 0.527 | | TVP regression with stochastic volatility; Iteration: 20000 |

|