Empirical literature is divided on whether financial stability should be adopted by an inflation targeting central bank as an explicit policy objective. While arguments on both sides permeate, cross-country evidence suggests that there are only a few inflation-targeting central banks committing to such an explicit target, although all of them strive to achieve the financial stability goal. In the Indian context, analysis using vector autoregression (VAR) framework suggests that while monetary policy has been most effective in containing inflation risks, macroprudential policies were efficaciously deployed to contain financial stability concerns. The present article argues that since their inception in early 2000s in India, macroprudential policies have generally complemented monetary policy and it is important to continue with the same approach. I. Introduction Mainstream economic literature in the pre-global financial crisis (GFC) period agreed that financial stability concerns should not influence monetary policy decisions and macroprudential policies are the best devices to tackle such considerations. Post- GFC, however, plurality of views emerged, and the literature is now far from unanimous on whether financial stability should be pursued as an explicit mandate of monetary policy. The modified Jackson Hole consensus questions the effectiveness of monetary policy instruments for addressing financial imbalances and suggests the use of macroprudential tools instead. On the other hand, the ‘lean against the wind’ argument professes that macroprudential policies cannot fully address financial cycles and it is possible to pursue financial stability objective under flexible inflation targeting (FIT) (Borio and Lowe, 2002; Woodford, 2011). Concomitantly, another strand of literature suggests that financial stability is sine qua non for price stability as the two objectives are intimately interlinked (Brunnermeier and Sannikov, 2016)1. The present article empirically evaluates whether monetary and macroprudential policies in India have worked in tandem to achieve explicit price stability goals while also implicitly addressing the financial stability issues. The cross-country evidence, based on a select sample, suggests that while almost all central banks implement policies to ensure financial stability, only a few FIT central banks e.g., Bank of Korea, Bank of Thailand (BoT), Bank of Ghana and National Bank of Ukraine specify that as an explicit mandate of monetary policy. The Reserve Bank of India was one of the first central banks to harness macroprudential tools and over the years, it has used them successfully to target build-up of risks arising from cyclical fluctuations in sectoral credit supply, interlinkages across financial institutions and sectors, as also cross-border spill-overs. In this article, we construct an aggregate macroprudential policy (MPP) index using risk weights and provisioning for standard assets in housing, commercial real estate (CRE), consumer loans and capital market, loan-to-value (LTV) ratio and cash reserve ratio (CRR). A vector autoregression (VAR) analysis using macroeconomic variables for the period June 1997 to March 2020 suggests that monetary policy does exert influence over inflation and business cycles but, at the same time, does not intensely influence financial cycles. Financial cycles are influenced by credit cycles, which in turn are impacted by macroprudential policies. Juxtaposing the MPP index with the repo rate shows that macroprudential policies in India have moved generally in sync with the monetary policy. From the empirical analysis, the article concludes that the approach of using monetary and macroprudential policies in a co-ordinated manner with the aim of simultaneously pursuing price and financial stability objectives has served the economy well, even after adoption of FIT. Financial sector reforms are a continuous process, which are implemented incrementally in India. This process, along with effective use of macroprudential tools, is helping in reinforcing the financial stability goal. The literature in this arena is vast and a bird’s eye view of the same is presented in section II, while section III reviews cross-country practices followed by FIT central banks in pursuance of financial stability objective. Section IV explores whether the macroprudential policies have been complementary or contradictory to the monetary policy operations in India. Section V presents data and empirical evidence, while section VI concludes. II. Review of Literature Complementarities and conflicts between price stability and financial stability have been a well-researched area in the macro-finance literature. While there is no consensus on the intensity of interaction between these two variables, it is often pointed out that price stability reduces uncertainty and helps in efficient pricing in financial markets (Yellen, 2014; Billi and Vredin, 2014). Similarly, the lack of financial stability can pose hindrance to the effective transmission of monetary policy, impacting price stability (Bordo et al., 2000). On the contrary, several empirical and theoretical studies show that financial imbalances may build up even in a low inflation environment owing to the impact of monetary policy on risk-taking (Blinder, 1999; Borio and Lowe, 2002; Borio, English and Filardo, 2003; and Shirakawa, 2012). The policy debate thus boils down to whether inflation targeting central banks should explicitly incorporate financial stability objectives. The narrative of this debate has changed significantly after the GFC of 2008. Prior to the GFC, the mainstream perspective was that considerations of financial stability should play no significant role in the conduct of monetary policy. However, the GFC showed that price stability alone will not ensure financial stability and ‘mopping up’ after the crisis is not an advisable strategy (Issing, 2017). Emergence of Three Major Strands Three major strands of literature concerning financial stability remit of monetary policy have emerged after the GFC (Smets, 2014). The first one, termed as a Modified Jackson Hole consensus, maintained that monetary policy should keep its narrow focus on price stability whereas macroprudential tools should pursue financial stability, with each having separate instruments. It is based on the assessment that the interaction between monetary policy and macroprudential instruments is limited, that the monetary policy stance did not significantly contribute to the building up of imbalances before GFC, and when compared to macroprudential policies, the short-term interest rate is not a very effective instrument to deal with those imbalances (Collard et al., 2017; Adrian et al., 2014). The second one, termed as the strategy of leaning against the wind, acknowledged that financial cycles cannot be fully addressed through macroprudential policies and monetary policy stance may affect risk taking. It, therefore, suggested that central banks should lean aggressively against the growing financial imbalances, if any, rather than merely focusing on the short-term inflation outlook. Considering financial stability as another objective would also imply lengthening of the policy horizon of the monetary authorities, as the financial cycle is typically longer than the business cycle (Borio and Lowe, 2002; Aydin and Volkan, 2011). Literature also suggests that over and above employing regulatory and supervisory tools and micro and macroprudential policies, inflation targeting frameworks can and should be adapted to account for intermittent disruptions of the kind that occurred during GFC (Woodford, 2011). Along similar lines, it is argued that macroprudential policies are more effective when reinforced by monetary policy (Caruana, 2011; Brunoa, Shimb and Shin, 2017; Gambacorta and Murcia, 2017). The third one, which argues that financial stability is price stability, suggests drastic changes to the conduct of monetary policy by showing that financial stability and price stability are closely intertwined (Brunnermeier and Sannikov, 2016). It puts financial frictions at the centre of monetary policy transmission mechanism. The suitability and optimality of the three approaches depends on the empirical evidence on three broad issues: the effectiveness of macroprudential policies; the extent to which monetary policy leads to risk taking; and the likelihood of financial stability mandate undermining the price stability objectives (Smets, 2014). Inter-linkages between FIT and Financial Stability: Indian Experience In the Indian context, while the Reserve Bank used both micro and macroprudential measures to limit the risks to financial stability from asset price cycles, it refrained from using policy interest rates with the specific intention of influencing asset prices. Empirical evidence established that the monetary policy (which already catered to multiple objectives at that point of time) should not be assigned any explicit role to stabilise asset prices (Singh and Pattanaik, 2012). Research indicates that financial stability, growth and inflation can share a medium to longer term relationship. Financial stability can promote growth without posing much threat to price stability and can enhance the effectiveness of monetary policy transmission. Further, with financial stability, growth could be more persistent and inflation less persistent. Therefore, financial stability goal can be pursued along with conventional objectives in the Indian context (Dhal, Kumar and Ansari, 2011). Recent evidence suggested that health of the banking system, measured by gross non-performing assets (NPAs) had significant impact on net interest margins (NIMs) and credit growth of commercial banks, implying that deterioration in asset quality impedes monetary policy transmission through the interest rate and credit channel (John et al., 2016; Raj et al., 2020). III. Financial Stability Mandates of FIT Central Banks Historically, with or without being specifically mandated to do so, most central banks implement measures to ensure financial stability in their jurisdictions. Among the FIT central banks, Bank of Korea and BoT have financial stability as explicit mandates of their monetary policies (Table 1). The South Korean law specifies that, for the national economy to achieve stable growth, it should be supported not only by price stability, but also by financial stability. The BoT has been targeting inflation since the turn of the century. Its statute relating to central bank objective was, however, amended in 2008 as a policy response to the east Asian financial crisis to specify stability of the financial system and payments system along with monetary stability as explicit mandates. Additionally, in 2020, BoT adopted a target range (1-3 per cent), replacing their earlier point target with a tolerance band (2.5+/- 1.5 per cent). It is believed that the adoption of target range (i.e., without midpoint) helps enhance monetary policy flexibility in supporting growth and preserving financial stability more effectively under volatile and uncertain circumstances. | Table 1: Major FIT Countries with Explicit Financial Stability Mandate of Monetary Policy | | Central Bank | Monetary Policy Objective | Institutional Structure for Financial Stability | | Bank of Korea | Maintain financial stability while pursuing price stability | Monetary Policy Board takes decision on maintaining financial stability. | | Bank of Thailand (BoT) | Price stability alongside preserving economic growth and financial stability | Financial Institutions Policy Committee (FIPC), headed by the Governor, is responsible for setting prudential policy, regulations and supervisory practices to ensure safety and soundness of financial institutions.

BoT formulates policies and regulations after analytical studies and industry hearings. Further, Policies are also subject to scrutiny by the FIPC. Deputy Governor-in-charge of monetary stability (part of Monetary Policy Committee) is also part of the FIPC. | Note: Ghana and Ukarine are two more examples where financial stability is an explicit mandate of monetary policy. However, for sake of brevity, the two are not covered here.

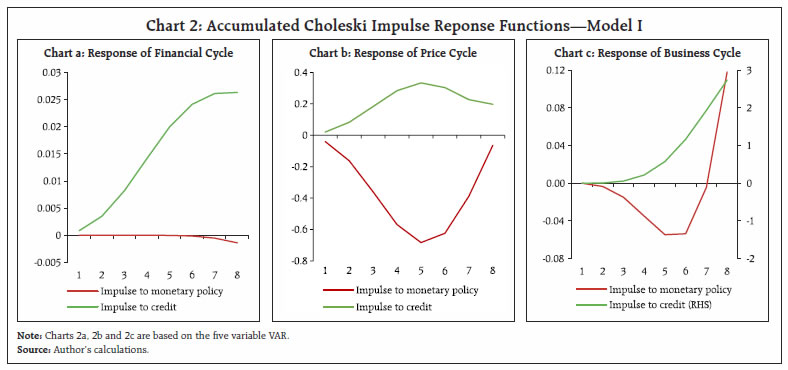

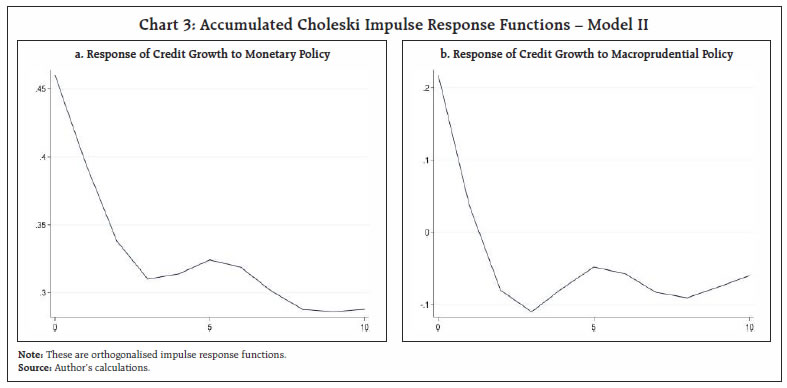

Source: Compiled from websites of respective central banks. | A few commonalities emerge between the practices followed by FIT central banks to ensure financial stability. All of them have well-developed stress testing frameworks and publish Financial Stability Reports or Reviews at regular intervals. Macroprudential regulation has become a part of the toolkit for many countries, while monitoring financial conditions, co-ordination with other regulators, overseeing financial infrastructure are other such measures. Some central banks, such as the Reserve Bank of New Zealand, also factor-in climate change in their strategies to maintain financial stability. During times of crisis, these central banks ensure financial stability by bailing out solvent but illiquid market players, managing failed financial institutions, enhancing overall liquidity to avoid spillover effects and reducing yield curve volatility, among others. However, the implementation structure to ensure financial stability differs across FIT jurisdictions (Annex A). In majority of the cases, the existence of a separate board or committee for maintaining financial stability is prevalent, which is mostly headed by governors of the respective central banks. These institutions act as coordinating bodies for regulatory agencies, while helping them to make decisions aimed at promoting the stability of the financial system. Alternatively, in Japan, the authority entrusted with setting monetary policy also votes on asset purchases to influence asset risk premia. IV. Macroprudential Policy and Monetary Policy in India The Reserve Bank has used an entire gamut of macroprudential tools2 for more than a decade without christening them so and was one of the first central banks to adopt these measures. Macroprudential tools are used to target the build-up of risks arising from (i) cyclical fluctuations in the credit supply; (ii) interdependence across financial institutions and sectors; and (iii) cross-border spill-overs. Countercyclical measures like pre-emptive countercyclical provisioning and differentiated risk weights across sectors can be used to gauge the direction of macroprudential policies for comparing them with the monetary policy stance of the period. Monetary policy was in tightening phase to contain the demand pressures when the macroprudential measures were first introduced in 2004 and the repo rate was raised by 300 basis points till August 2008. During the same period, provisioning on standard assets on housing loans and commercial real estate were raised by 75 basis points and 175 basis points, respectively (Annex B). Moreover, risk weights on various segments were also raised. Further, during the easing phase of October 2008 - April 2009, policy rates, risk weights and provisioning norms in various segments were loosened. The stance reversed after October 2009, when inflationary pressures warranted monetary tightening, while increased credit growth in some segments of the economy necessitated macroprudential tightening. Most of the later tightening and loosening phases of monetary policy were in sync with macroprudential policy. Since the introduction of FIT, macroprudential tools have not been used aggressively due to subdued credit conditions. The monetary easing phase from January 2015 to May 2018 was followed by a short phase of monetary tightening. In the subsequent monetary easing phase from February 2019 till date, while the policy rate was reduced by 250 basis points, the risk weights of certain sectors were also adjusted accordingly. In the Indian case, both monetary policy and macroprudential policy complement each other. This has been demonstrated by a coordinated approach to the conduct of monetary and macroprudential policies with the aim of simultaneously pursuing price and financial stability. Such coordinated responses were facilitated by the Reserve Bank’s wide regulatory ambit. Policies such as higher provisioning to CRE and housing sector were able to curb the disproportionate increase in sectoral credit without jeopardising or disrupting the flow of credit to other productive areas and priority sectors. The Indian experience, so far, has demonstrated broad cohesion between financial stability and price stability. V. Empirical Analysis Data and Methodology In the present section, the interactions between monetary policy, business cycles, financial cycles / credit cycles and macroprudential policies in the Indian context are analysed, following the works of Bernanke and Blinder (1992), Peersman and Smets (2001) and Miyao (2002), among others. The VAR is a popular technique to estimate these types of interactions consisting of all endogenous variables. It comprises one equation per variable where the right-hand side of each equation includes a constant and lags of all other variables in the system. Two reduced form VAR models are constructed with common lag-length. The first one is a four-variable model comprising real GDP growth, CPI inflation, call money rate, financial cycle / credit cycle. The second model additionally includes the MPP index3. While the former is intended to examine the monetary policy transmission mechanism, the latter has been undertaken to gain insights into the policy debate of whether macroprudential policies are effective in influencing credit growth. The time period considered for the analysis is June 1997 to March 2020 at a quarterly frequency, covering two monetary policy regimes, i.e., the multiple indicators approach (1997-2016) and the flexible inflation targeting (2016-2020). The growth in real GDP, CPI inflation, call money rate and credit growth of scheduled commercial banks (SCBs) (excluding regional rural banks) are treated with asymmetric band pass filters to create proxies for business cycle, price cycle, monetary policy cycle and credit cycle, respectively. Financial cycle is constructed as an average of normalised values of term spread, credit to GDP ratio, corporate bond spread and equity return volatility for the purpose of this analysis. To examine the general trend in macroprudential policies, an aggregate qualitative MPP index was constructed at quarterly frequency using risk weights and provisioning for standard assets for housing, CRE, consumer loans, capital market, LTV ratio and CRR. The methodology for construction of MPP index is based on Akinci and Olmstead-Rumsey (2018). The first step to derive the aggregate MPP index was to construct individual indices for each of these macroprudential measures. Starting with zero in the base year 1999-2000 (designated as 2000 in Chart 1), a value of one was added to the index if any macroprudential measure was introduced or tightened to contain credit or asset price growth. Similarly, a value of one was subtracted if the macroprudential measures were loosened. If the macroprudential measure was tightened or relaxed multiple times during the year, one was added or subtracted as many times. If no action was taken in a year, there was no change in the value of the index. Thus, by construction, tightening of macroprudential measures would indicate a higher value of the index and vice versa4. In the final stage, these individual indices were aggregated horizontally to construct the MPP index, which was scaled up by 10 to remove negative values. A visual analysis of the MPP index reveals that the macroprudential policy has generally moved in sync with the monetary policy in India. The contractionary effect of tighter macroprudential policies on credit growth is visible with a lag. However, ability to uplift credit growth through macroprudential policies during downturns has been limited (Chart 1). Thus, their effectiveness in various phases of the credit cycle have been found to be asymmetric. This suggests that reviving the depressed credit cycle requires some more innovative policy instruments. Results and Inferences As a preliminary step, we check for the presence of unit roots in the variables using the Augmented Dickey Fuller test and find that they are stationary, either at level or in first difference. The Granger causality tests reveal that the null hypothesis of no causality is almost always rejected with only two exceptions (Annex C). The presence of such bi-directional causalities may suggest prevalence of inter-linkages between the variables under consideration5. In the VAR framework, impulse response functions are used to trace the responses of a system’s variables to the system’s shocks. We analyse the accumulated Choleski impulse responses of two VAR models discussed above to assess the impact of monetary policy and credit growth on other variables, viz., output, prices and financial cycle (Model I) and MPP on credit growth (Model II) over the short and medium-term horizons. The impulse responses suggest that financial cycle is sensitive to credit shocks, whereas it may not be impacted by monetary policy immediately. In the long run though, the financial cycle could be influenced by the monetary policy through credit cycle channel (Chart 2a). Change in monetary policy affects inflation, i.e., a unit positive shock to monetary policy pulls down the CPI inflation and it takes a few quarters for it to retrace. A positive credit shock, on the contrary, leads to an uptick in inflation, as expected (Chart 2b). A positive shock to monetary policy initially increases costs of finance, thereby causing downturn in business cycle in the short term, before it starts recovering. The impact of credit growth on business cycle (on right hand scale) is that of gradual increase (Chart 2c).  The impulse response of aggregate credit growth to tightened macroprudential measures, as indicated by a positive shock to MPP index, is negative for up to three periods. These policies are found to be more effective than monetary policy in restraining excessive credit growth, as monetary policy makes an impact indirectly through the credit channel, while macroprudential policy impacts credit flow directly (Chart 3a & b). Two important inferences come out of the above analysis. First, a positive shock to monetary policy has not been influential in taming the financial cycle. This finding is in line with the argument that short-term interest rate is probably not the best tool to achieve financial stability (Svensson, 2012; Yellen, 2014; Evans, 2014; and Adrian et al., 2018). Second, macroprudential policies have been successful in containing credit exuberance, and through that, in ensuring financial stability. This finding is consistent with Verma (2018), who documented effectiveness of macroprudential policies in curtailing credit growth in sensitive sectors. In sum, the empirical evidence justifies the current framework of employing monetary policy primarily for price stability and macroprudential policies for financial stability. As has been observed, the sync between monetary policy stance and macroprudential policies seems to have helped the latter in effectively containing credit booms6.  VI. Conclusions In India, financial stability is an implicit goal of the central bank, which harnesses the benefits of intimate interaction between the monetary and macroprudential policies conducted under one roof. Against the backdrop of the recent review of inflation targeting regime in India, this article empirically establishes that this collaborative approach has served well. Constructing an index of macroprudential measures, evidence presented in this article suggests that macroprudential measures taken by the Reserve Bank were effective in restraining excessive credit growth during 2004-2011. At the same time, it has not demonstrated any major conflict between stance on financial stability, price stability and growth objective so far. Rather, most of the time, monetary policy and macroprudential tools have been found to be complementary to each other. The present FIT regime in India envisages policy action to ensure price stability, ‘while being mindful of the growth objective’. The empirical results show that through a proper co-ordination between monetary and macroprudential policies, the financial stability goals are implicitly met under the FIT regime without diluting the inflation targeting objective. Moreover, narrowly defining financial stability or absence thereof is difficult. Setting a financial stability objective for monetary policy, on top of already existing price and growth considerations, may be akin to going back to the earlier multiple indicators approach, which may seriously affect the price stability objective. It is, therefore, important to continue with the existing framework. References Adrian, T., Covitz, D., & Liang, N. (2014). Financial Stability Monitoring. Federal Reserve Bank of New York Staff Reports, June. Adrian, T., Dell’Ariccia, G., Haksar, V., & Mancini- Griffoli, T. (2018). Monetary Policy and Financial Stability. In Advancing the frontiers of monetary policy (pp. 69-82). Washington, D.C.: IMF. Akinci, O. & Olmstead-Rumsey, J. (2018). How effective are macroprudential policies? An empirical investigation. Journal of Financial Intermediation, 33(C), pp. 33-57 Aydin, B., & Volkan, M. E. (2011). Incorporating financial stability in inflation targeting frameworks. IMF working paper WP/11/224. International Monetary Fund. Bernanke, B., & Blinder, A. (1992). The Federal Funds Rate and the Channels of Monetary Transmission. American Economic Review, 82 (4) . Billi, R. M., & Vredin, A. (2014). Monetary policy and financial stability – a simple story. Sveriges Riksbank Economic Review, pp. 7-22. Blinder, A. (1999). General discussion: monetary policy and asset price volatility. Federal Reserve Bank of Kansas City Economic Review, 4, pp. 139-140. Bordo, M. D., Dueker, M. J., & Wheelock, D. C. (2000). Inflation shocks and financial distress: an historical analysis. Journal of Economic History, 534-535. Borio, C., & Lowe, P. (2002). Asset prices, financial and monetary stability: Exploring the nexus. BIS Working Papers. BIS, July. Borio, C., English, W., & Filardo, A. (2003). A tale of two perspectives: old or new challenges for monetary policy? . BIS Working Papers No 127. BIS, February. Brunnermeier, M. K., & Sannikov, Y. (2016). The I Theory of Money. NBER Working Paper Series. NBER, August. Brunoa, V., Shimb, I., & Shin, H. S. (2017). Comparative assessment of macroprudential policies. Journal of Financial Stability, 183-202. Caruana, J. (2011). Monetary Policy in a World with Macroprudential Policy. RBI Monthly Bulletin, July. Collard, F., Dellas, H., Diba, B., & Loisel, O. (2017). Optimal Monetary and Prudential Policies. American Economic Journal: Macroeconomics, 40–87. Dhal, S., Kumar, P., & Ansari, J. (2011). Financial Stability, Economic Growth, Inflation and Monetary Policy Linkages in India: An Empirical Reflection. Reserve Bank of India Occasional Papers. Evans, C. L. (2014). Thoughts on accommodative monetary policy, inflation and financial instability. Speech in Hong Kong. Federal Reserve Bank of Chicago, March 28. Gambacorta, L., & Murcia, A. (2017). The impact of macroprudential policies and their interaction with monetary policy: an empirical analysis using credit registry data. BIS Working Papers. BIS, May. Issing, O. (2017). Financial Stability and the ECB’s monetary policy strategy . ECB Legal Conference 2017 (pp. 340-348). European Central Bank. John, J., Mitra, A. K., Raj, J., & Rath, D. P. (2016). Asset Quality and Monetary Transmission in India. Reserve Bank of India Occasional Papers. Miyao, R. (2002). The effects of monetary policy in Japan. Journal of Money, Credit and Banking, 376-392. Peersman, G., & Smets, F. (2001). The monetary transmission mechanism in the euro area: more evidence from VAR analysis. ECB Working Paper, No. 91. ECB, December. Raj, J., Rath, D. P., Mitra, P., & John, J. (2020). Asset Quality and Credit Channel of Monetary Policy Transmission in India: Some Evidence from Bank-level Data. RBI Working Paper No. 14/2020. Shirakawa, M. (2012). Retrieved from www.lse.ac.uk: https://www.lse.ac.uk/assets/richmedia/channels/publicLecturesAndEvents/transcripts/20120110_1830_deleveragingAndGrowth_tr.pdf, January 10 Singh, B., & Pattanaik, S. (2012). Monetary Policy and Asset Price Interactions in India: Should Financial Stability Concerns from Asset Prices be Addressed Through Monetary Policy? Journal of Economic Integration, 167-194. Sinha, A. (2011). Macroprudential policies: Indian experience. Address delivered at Eleventh Annual International Seminar on Policy Challenges for the Financial Sector co-hosted by The Board of Governors of the Federal Reserve System, IMF and the World Bank. Washington, DC, June 2. Smets, F. (2014). Financial Stability and Monetary Policy: How Closely Interlinked? International Journal of Central Banking, 263-300. Svensson, L. E. (2012). The Relation between Monetary Policy and Financial Policy. International Journal of Central Banking, 293-295. Verma, R. (2018). Effectiveness of Macroprudential Policies in India. In J. Ansari, Macroprudential Policies in SEACEN Economies: An Integrative Report (pp. 31- 54). The SEACEN Centre. Woodford, M. (2011). Inflation Targeting and Financial Stability, November 10. Retrieved from http://www.columbia.edu: http://www.columbia.edu/~mw2230/ITFinStab.pdf Yellen, J. L. (2014). https://www.federalreserve.gov/newsevents/speech/yellen20140702a.htm, July 2. Retrieved from https://www.federalreserve.gov: https://www.federalreserve.gov/newsevents/speech/yellen20140702a.htm

| Annex A: FIT Countries with Financial Stability as Central Bank Mandate | | Central Bank | Central Bank Mandate | Institutional Structure for Financial Stability | | Reserve Bank of Australia (RBA) | Setting interest rate to ensure stability of currency, maintaining full employment, economic prosperity, financial stability | Council of Financial Regulators (CFR), chaired by the Governor, ensures co-ordination between the RBA, the Australian Prudential Regulatory Authority (APRA), the Treasury and the Australian Securities and Investments Commission (ASIC). Assistant Governor of RBA is also a member.

The Payments System Board within RBA has explicit authority for payments system safety and stability. | | Banco Central Do Brasil (BCB) | Purchasing power stability of the domestic currency and the soundness and efficiency of the national financial system. | Members of the Financial Stability Committee (Comef) are Board of Directors of the BCB, who meet on a quarterly basis when Comef also decides on the countercyclical capital buffer rate. | | South African Reserve Bank (SARB) | Price stability in the interest of balanced and sustainable economic growth. Mandate revised to include responsibility for financial stability. | Internal Financial Stability Committee headed by the Governor as Chairperson—also includes the Deputy Governors, all members of the Monetary Policy Committee and a maximum of seven other SARB officials.

Committee meets every second month, alternate to the MPC meetings. | | Bank of England | Stable and low inflation, maintaining financial stability | Financial Policy Committee (FPC) has 13 members- 6 internal (including Governor, 4 DGs and ED responsible for financial stability) and external (academics and business people), which meets four times a year. It is responsible for macroprudential policies and has the power to direct regulators and make recommendations to anyone to reduce risks to financial stability.

Prudential Regulation Authority (PRA) - responsible for prudential regulation and supervision of banks, building societies, credit unions, investment firms and insurance companies. | | Bank of Japan | Price stability and contributing to financial system stability | Policy Board, consisting of Governor, two Deputy Governors, and six other members decides on- site examination policy, asset purchases, among others. | | Source: Compiled from Central Banks’ websites. |

| Annex B: Monetary Policy Stance and Macroprudential Policies of the Reserve Bank of India | | (Changes in basis points) | | | Monetary tightening | Monetary easing | Monetary tightening | Monetary easing | Monetary tightening | Monetary easing | Monetary tightening | Monetary easing | | September 2004 - August 2008 | October 2008 - April 2009 | October 2009 - October 2011 | January 2012 - June 2013 | July 2013 - January 2014 | January 2015 - May 2018 | June 2018 - January 2019 | February 2019 - September 2021 | | Monetary measures | | Repo rate | 300 | -425 | 375 | -125 | 75 | -200 | 50 | -250 | | Reserve repo rate | 125 | -275 | 425 | -125 | 75 | -125 | 50 | -290 | | Cash reserve ratio | 450 | -400 | 100 | -150 | 0 | 0 | 0 | -100 | | Provisioning Norms | | Capital market exposures | 175 | -160 | - | - | - | - | - | - | | Housing loans | 75 | -60 | 160 | -160 | | -15 | - | - | | Other retail loans | 175 | -160 | - | - | - | - | - | - | | Commercial real estate loans | 175 | -160 | 60 | -25 (for CRE-RH) | | - | - | - | | Non-deposit taking systemically important non-financial companies | 175 | -160 | - | - | - | - | - | - | | Risk Weights | | Capital market exposures | 25 | - | - | - | - | - | - | - | | Housing loans | -25 to 25 | - | 0-50 | 0 to -50 | | 0 to -25 | - | - | | Other retail loans | 25 | - | - | - | - | - | - | -25 | | Commercial real estate loans | 50 | -50 | - | -25 (for CRE-RH) | | - | - | - | | Non-deposit taking systemically important non-financial companies | 25 | -25 | - | - | - | - | - | As per ratings assigned by rating agencies | | Source: Reserve Bank of India and Sinha (2011). |

| Annex C: Granger Causality Tests | | Sample (1997-98 Q1 to 2019-20 Q4) | | Null Hypothesis | F statistic | p value | | Credit growth does not Granger cause business cycle | 6.07 | 3*10-4 | | Business cycle does not Granger cause credit growth | 6.61 | 1*10-4 | | Financial cycle does not Granger cause business cycle | 2.51 | 0.06 | | Business cycle does not Granger cause financial cycle | 6.83 | 9*10-5 | | Monetary cycle does not Granger cause business cycle | 0.65 | 0.03 | | Business cycle does not Granger cause monetary cycle | 10.91 | 4*10-7 | | Price cycle does not Granger cause business cycle | 2.54 | 0.05 | | Business cycle does not Granger cause price cycle | 2.01 | 0.10 | | Financial cycle does not Granger cause credit growth | 4.31 | 3*10-3 | | Credit growth does not Granger cause financial cycle | 7.36 | 4*10-5 | | Monetary cycle does not Granger cause credit growth | 7.71 | 3*10-5 | | Credit growth does not Granger cause monetary cycle | 6.13 | 2*10-4 | | Price cycle does not Granger cause credit growth | 2.74 | 0.05 | | Credit growth does not Granger cause price cycle | 4.17 | 4*10-3 | | Monetary cycle does not Granger cause financial cycle | 3.17 | 0.04 | | Financial cycle does not Granger cause monetary cycle | 4.08 | 2*10-4 | | Price cycle does not Granger cause financial cycle | 9.16 | 4*10-3 | | Financial cycle does not Granger cause price cycle | 6.10 | 2*10-3 | | Price cycle does not Granger cause monetary cycle | 7.59 | 3*10-5 | | Monetary cycle does not Granger cause price cycle | 3.48 | 0.01 | Note: Lag length of 4 selected based on Akaike Information Criterion.

Source: Authors’ calculations. |

|