On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (October 4, 2019) decided to: - reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 5.15 per cent from 5.40 per cent with immediate effect.

Consequently, the reverse repo rate under the LAF stands reduced to 4.90 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 5.40 per cent. - The MPC also decided to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Since the MPC’s last meeting in August 2019, global economic activity has weakened further. Heightened uncertainty emanating from trade and geo-political tensions continues to cloud the outlook. Among advanced economies (AEs), the slowdown in the US economy in Q2:2019 appears to have extended into Q3:2019, weighed down by softer industrial production. The Institute for Supply Management’s index for September indicates that manufacturing slipped further into contraction to touch its lowest reading in a decade; hiring by the private sector also slowed down. In the Euro area too, incoming data suggest that activity may have moderated further in Q3, with retail sales declining and manufacturing PMI remaining in contraction for the eighth consecutive month in September. The UK economy decelerated in Q2; the contraction in industrial production and soft retail sales in July suggest that the loss of speed has continued into Q3 as well. In Japan, the loss of momentum in Q2 spilled over into Q3, albeit cushioned by a fiscal stimulus and frontloaded consumer spending ahead of a planned sales tax hike. 3. The macroeconomic performance of major emerging market economies (EMEs) was weighed down by a deteriorating global environment in Q3. The Chinese economy appears to have slowed down in Q3 as well, with both retail sales and industrial production growth weakening in July-August and exports contracting in August; attention is now focussed on the efficacy of fiscal and monetary policy stimuli in averting a sharper deceleration. In Russia, economic activity ticked up in Q2, though still subdued consumer sentiment and weak industrial production may restrain momentum, going forward. Economic activity in both South Africa and Brazil rebounded in Q2, emerging out of contraction in the previous quarter; however, this nascent recovery faces both domestic and external headwinds. 4. Crude oil prices were pulled down by softer demand, amidst adequate supplies in early August. Prices remained range bound until mid-September when supply disruptions on account of an escalating geo-political conflict resulted in a spike which has abated faster than expected. Gold prices remained elevated on safe haven demand. Central banks became more accommodative with inflation remaining below targets across major AEs and EMEs. 5. Global financial markets have remained unsettled since the MPC’s early August meeting with bouts of volatility unleashed by protectionist policies and worsening global growth prospects. In the US, the equity market’s August losses were recouped by early September – investor sentiment was buoyed by signs of an easing in US-China trade tensions. Stock markets in EMEs fell, as the strong US dollar led to capital outflows, though they recovered partially in September. Bond yields in the US continued easing till August on growth worries, before a slight uptick was triggered in early September by better than expected US retail sales data and hopes of conciliatory trade negotiations between the US and China. In the Euro area, bond yields sank further into negative territory, propelled by the cut in the deposit rate by the European Central Bank (ECB) to (-) 0.5 per cent and the reintroduction of quantitative easing. In EMEs, bond yields exhibited mixed movements, driven by country-specific factors. In currency markets, the US dollar strengthened against currencies of other AEs. EME currencies, which were trading with a depreciating bias in August, appreciated in early September on country-specific factors and a revival of global risk-on sentiment. Domestic Economy 6. On the domestic front, growth in gross domestic product (GDP) slumped to 5.0 per cent in Q1:2019-20, extending a sequential deceleration to the fifth consecutive quarter. Of its constituents, private final consumption expenditure (PFCE) slowed down to an 18-quarter low. Gross fixed capital formation (GFCF) improved marginally on a sequential basis but remained muted as in the preceding quarter. Government final consumption expenditure (GFCE) cushioned the overall loss of momentum to some extent. 7. On the supply side, gross value added (GVA) growth decelerated to 4.9 per cent in Q1:2019-20, pulled down by manufacturing growth, moderating to 0.6 per cent. Agriculture and allied activities were lifted by higher production of wheat and oilseeds during the 2018-19 rabi season. Growth in the services sector was stalled by construction activity. 8. Turning to Q2:2019-20, the initial delay in the onset of the south-west monsoon rapidly caught up from July. By September 30, 2019, the cumulative all-India rainfall surpassed the long period average (LPA) by 10 per cent. The first advance estimates of major kharif crops for 2019-20 have placed production of foodgrains 0.8 per cent lower when compared with the last year’s fourth advance estimates. Looking ahead at the rabi season, the live storage of water in major reservoirs was 115 per cent of the live storage of the corresponding period of the previous year on September 26, 2019 and 121 per cent of average storage level over the last ten years. Abundant rains in August and September have led to improved soil moisture conditions in most parts of the country, particularly central India, compared to the corresponding period of the last year. Overall, the prospects of agriculture have brightened considerably, positioning it favourably for regenerating employment and income, and the revival of domestic demand. 9. Industrial activity, measured by the index of industrial production (IIP), weakened in July 2019 (y-o-y), weighed down mainly by moderation in manufacturing. In terms of uses, the production of capital goods and consumer durables contracted. Consumer non-durables, led by edible oils, and intermediate goods, mainly mild steel slabs, posted sustained expansion and have emerged as potential growth drivers. Infrastructure/construction sector activity turned around to register a growth of 2.1 per cent vis-à-vis (-)1.9 per cent in the previous month. The output of eight core industries contracted in August, pulled down by coal, electricity, crude oil and cement. Capacity utilisation (CU) in the manufacturing sector, measured by the OBICUS (order books, inventory and capacity utilisation survey) of the Reserve Bank, declined to 73.6 per cent in Q1:2019-20 from 76.1 per cent in the previous quarter. However, seasonally adjusted CU rose to 74.8 per cent in Q1:2019-20 from 74.5 per cent in Q4:2018-19. Manufacturing firms polled for the industrial outlook survey (IOS) expect capacity utilisation to moderate in Q2:2019-20. The Reserve Bank’s business assessment index (BAI) fell in Q2:2019-20 due to a decline in new orders, contraction in production, lower capacity utilisation and fall in profit margins of the surveyed firms. The manufacturing purchasing managers’ index (PMI) for September 2019 was unchanged at its previous month’s level; new orders and employment improved, albeit marginally, and new export orders declined. 10. High frequency indicators suggest that services sector activity weakened in July-August. Indicators of rural demand, viz., tractor and motorcycles sales, contracted. Of underlying indicators of urban demand, passenger vehicle sales contracted in July-August, while domestic air passenger traffic accelerated in August. The sales of commercial vehicles, a key indicator for the transportation sector, contracted by double digits in July-August. Of the two indicators of construction activity, finished steel consumption decelerated sharply in August and cement production contracted. The services PMI moved into contraction in September 2019, dragged down mainly by a decline in new business inflows. 11. Retail inflation, measured by y-o-y changes in the CPI, moved in a narrow range of 3.1- 3.2 per cent between June and August. While food inflation picked up, fuel prices moved into deflation. Inflation excluding food and fuel softened in August. 12. Food inflation in August was elevated by a spike in the rate of increase in vegetables prices, a pick-up in pulses inflation and persistently high meat and fish inflation. On the other hand, softer increases in prices of eggs, oils and fats, non-alcoholic beverages and prepared meals, and deflation in prices of fruits and sugar cushioned the rise in overall food inflation. 13. Deflation in the fuel group deepened in August largely due to the pass-through from a sharp decline in international prices of liquified petroleum gas (LPG). Subsidised kerosene prices, however, have been rising in a calibrated manner as oil marketing companies continued a gradual reduction in subsidies. 14. CPI inflation excluding food and fuel increased in July, but its roots were largely confined to prices of personal care and effects – mainly bullion prices, and transport and communication, reflecting rise in prices of petrol and diesel. By contrast, there was moderation in August, which was spread across most of the subgroups; however, gold prices spiked further on global uncertainties. 15. The Reserve Bank’s September 2019 round of inflation expectations survey indicates that households expect inflation to rise by 40 basis points over a 3-month ahead horizon and 20 basis points over a one-year ahead horizon, possibly responding adaptively to the rise in food prices in recent months. The Reserve Bank’s consumer confidence survey shows weak consumer sentiment and tepid consumption demand, especially relating to non-essential items. Manufacturing firms see weakening of demand conditions in Q2:2019-20 and Q3 and expect their output prices to soften, going forward, as the cost of finance and salary outgoes remain muted. 16. Overall liquidity remained surplus in August and September 2019 despite expansion of currency in circulation and forex operations by the Reserve Bank draining liquidity from the system. Net daily average absorption under the LAF amounted to ₹1,40,497 crore in August, essentially on account of spending by the government, which resulted in availment of ways and means advances (WMA) and intermittent overdraft facilities from the beginning of the month (till August 25, 2019). In September, with a steady build-up of cash balances, particularly with advance tax inflows around September 15, surplus liquidity moderated, and the Reserve Bank undertook daily net absorption of ₹1,22,392 crore in September. Reflecting easy liquidity conditions, the weighted average call rate (WACR) traded below the policy repo rate (on an average) by 8 basis points (bps) in August and by 6 bps in September. 17. Monetary transmission has remained staggered and incomplete. As against the cumulative policy repo rate reduction of 110 bps during February-August 2019, the weighted average lending rate (WALR) on fresh rupee loans of commercial banks declined by 29 bps. However, the WALR on outstanding rupee loans increased by 7 bps during the same period. 18. Net exports had contributed to aggregate demand in Q1:2019-20 on account of a deeper contraction in imports relative to exports. In Q2, merchandise exports remained weak in July and August 2019, caused by lower shipments of engineering goods, petroleum products, gems and jewellery and cotton yarn. Imports contracted faster during the period mainly due to lower international crude oil prices downsizing the oil import bill and a large fall in the volume of gold imports. Non-oil non-gold imports were pulled down into contraction by coal, pearls and precious stones and transport equipment. These developments led to a narrowing of the trade deficit during July-August 2019. Higher net services receipts and private transfer receipts helped contain the current account deficit to 2.0 per cent of GDP in Q1:2019-20 from 2.3 per cent a year ago. On the financing side, net foreign direct investment rose to US$ 17.7 billion in April-July 2019 from US$ 11.4 billion a year ago. Net foreign portfolio investment (excluding the voluntary retention route) was of the order of US$ 3.3 billion during April-September 2019 as against net outflow of US$ 11.5 billion in the same period of last year. Net disbursals of external commercial borrowings rose to US$ 8.2 billion during April-August 2019 as against net repayments of US$ 0.2 billion during the same period a year ago. India’s foreign exchange reserves were at US$ 434.6 billion on October 1, 2019 – an increase of US$ 21.7 billion over end-March 2019. Outlook 19. In the third bi-monthly resolution of August 2019, CPI inflation was projected at 3.1 per cent for Q2:2019-20, 3.5-3.7 per cent for H2:2019-20 and 3.6 per cent for Q1: 2020-21 with risks evenly balanced. The actual inflation outcomes for Q2 so far (July-August) at 3.2 per cent have been broadly in line with these projections. 20. Going forward, several factors are likely to shape the inflation trajectory. First, the outlook for food inflation has improved considerably since the August bi-monthly policy. Kharif production is estimated at close to last year’s level, auguring well for the overall food supply situation. Vegetable prices may remain elevated in the immediate months but are likely to moderate as winter supplies enter the market. Prices of pulses are expected to remain contained by adequate buffer stocks. Secondly, forward looking surveys conducted by the Reserve Bank point to weak demand conditions persisting, with indications of softening of output prices in Q3:2019-20. Accordingly, price pressures in CPI excluding food and fuel are likely to be muted. Thirdly, crude oil prices may remain volatile in the near-term; while global demand is slowing down, the persisting geo-political uncertainties pose some upside risks to the inflation outlook. Fourthly, threemonth and one-year ahead inflation expectations of households polled by the Reserve Bank have risen in the current round reflecting near-term price pressures. Finally, financial markets remain volatile with currencies of several emerging market economies trading with a depreciating bias in the recent period. Taking into consideration these factors and the impact of recent policy rate cuts, the CPI inflation projection is revised slightly upwards to 3.4 per cent for Q2:2019- 20, while projections are retained at 3.5-3.7 per cent for H2:2019-20 and 3.6 per cent for Q1:2020-21, with risks evenly balanced (Chart 1). 21. Turning to the growth outlook, real GDP growth for 2019-20 in the August policy was projected at 6.9 per cent – in the range of 5.8-6.6 per cent for H1:2019-20 and 7.3-7.5 per cent for H2 – with risks somewhat tilted to the downside; GDP growth for Q1:2020-21 was projected at 7.4 per cent. GDP growth for Q1:2019-20 was significantly lower than projected. Various high frequency indicators suggest that domestic demand conditions have remained weak. The business expectations index of the Reserve Bank’s industrial outlook survey shows muted expansion in demand conditions in Q3. Export prospects have been impacted by slowing global growth and continuing trade tensions. On the positive side, however, the impact of monetary policy easing since February 2019 is gradually expected to feed into the real economy and boost demand. Several measures announced by the Government over the last two months are expected to revive sentiment and spur domestic demand, especially private consumption. Taking into consideration the above factors, real GDP growth for 2019-20 is revised downwards from 6.9 per cent in the August policy to 6.1 per cent – 5.3 per cent in Q2:2019-20 and in the range of 6.6-7.2 per cent for H2:2019-20 – with risks evenly balanced; GDP growth for Q1:2020-21 is also revised downwards to 7.2 per cent (Chart 2).  22. The MPC notes that the negative output gap has widened further. While the recent measures announced by the government are likely to help strengthen private consumption and spur private investment activity, the continuing slowdown warrants intensified efforts to restore the growth momentum. With inflation expected to remain below target in the remaining period of 2019-20 and Q1:2020-21, there is policy space to address these growth concerns by reinvigorating domestic demand within the flexible inflation targeting mandate. It is in this context that the MPC decided to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target.  23. All members of the MPC voted to reduce the policy repo rate and to continue with the accommodative stance of monetary policy. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Michael Debabrata Patra, Shri Bibhu Prasad Kanungo and Shri Shaktikanta Das voted to reduce the repo rate by 25 basis points. Dr. Ravindra H. Dholakia voted to reduce the repo rate by 40 basis points. 24. The minutes of the MPC’s meeting will be published by October 18, 2019. 25. The next meeting of the MPC is scheduled during December 3-5, 2019. Statement on Developmental and Regulatory Policies This Statement sets out various developmental and regulatory policy measures for strengthening regulation and supervision; broadening and deepening financial markets; and improving the payment and settlement systems. I. Regulation and Supervision 1. Non-Banking Financial Company – Micro Finance Institution (NBFC-MFI) In the wake of the Andhra Pradesh micro finance crisis in 2010, a Sub-Committee of the Central Board of the Reserve Bank (Chairman: Shri Y. H. Malegam) was constituted to study issues and concerns in the MFI sector. Based on the recommendations of the Committee, it was decided to create a separate category of NBFC, viz., Non-Banking Financial Company- Micro Finance Institution (NBFC-MFI) and a detailed regulatory framework for NBFC-MFIs was put in place in December 2011. The income and loan limits to classify an exposure as eligible asset were last revised in 2015. Taking into consideration the important role played by MFIs in delivering credit to those in the bottom of the economic pyramid and enable them to play their assigned role in a growing economy, it is proposed to revise these criteria as under: i. Increase the household income limit for borrowers of NBFC-MFIs from the current level of ₹1.00 lakh for rural areas and ₹1.60 lakh for urban/semi urban areas to ₹1.25 lakh and ₹2.00 lakh, respectively. ii. Raise the lending limit from ₹1.00 lakh to ₹1.25 lakh per eligible borrower. Detailed guidelines in this regard will be issued shortly. II. Financial Markets 2. Offshore Rupee Markets The Task Force on Offshore Rupee Markets (Chairperson: Smt. Usha Thorat) in its report submitted on July 30, 2019 recommended several important measures to incentivize non-residents to access the onshore foreign exchange market. The Reserve Bank has examined the recommendations and it is proposed to accept the following recommendations: i. Allowing domestic banks to freely offer foreign exchange prices to non-residents at all times, out of their Indian books, either by a domestic sales team or through their overseas branches; and ii. Allowing rupee derivatives (with settlement in foreign currency) to be traded in International Financial Services Centres (IFSCs). The directions for implementing the above two recommendations will be issued in consultation with the Central Government and other regulators. Other recommendations of the Committee are under consideration and the decision thereon will be announced in due course. 3. Non-resident Rupee Account – A Review of Policy The Reserve Bank has been taking steps for popularising the cross-border transactions in Indian rupee (INR), especially in respect of external commercial borrowing (ECB), trade credit and exports and imports, thereby reducing the exchange risk for persons resident in India. Continuing these efforts, it has been decided, in consultation with the Government of India, to enhance the scope of non-interest bearing Special Non-resident Rupee (SNRR) Account by permitting persons resident outside India to open such accounts to facilitate rupee denominated ECB, trade credit and trade invoicing. Further, restriction on the tenure of SNRR account, which is currently 7 years, is also proposed to be removed for the aforesaid purposes. Guidelines in this regard would be issued within a month. III. Payment and Settlement System 4. Liquidity Support for the Proposed 24x7 National Electronic Funds Transfer (NEFT) System It was announced in the third bi-monthly Monetary Policy of August 7, 2019 that the Reserve Bank of India will make available the facility of National Electronic Funds Transfer on 24x7 basis for members of public from December, 2019. In order to facilitate smooth settlement of these transactions in the accounts of the banks maintained with the Reserve Bank, it has been decided that the Reserve Bank will extend the collateralised liquidity support, which is currently available till 7.45 pm on NEFT working days, round the clock. This will help in better funds management by banks. 5. Internal Ombudsman by large non-bank Prepaid Payment Instrument (PPI) Issuers In order to provide a robust mechanism for redressal of customer complaints, the Reserve Bank had set up an Ombudsman Scheme for Digital Transactions in January 2019 as announced in the Monetary Policy Statement of December 5, 2018. To further strengthen the grievance redressal mechanism at the entity level itself, it has been decided to institutionalise an internal ombudsman scheme at the large non-bank PPI issuers (entities who have more than 10 million prepaid payment instruments outstanding). The internal ombudsman is intended to facilitate a swift and costeffective complaint redressal mechanism within the entity and provide an additional tier for grievance redressal. Instructions in this regard will be issued by October 15, 2019. 6. Payment System Data Dissemination The Reserve Bank publishes data (in the RBI Bulletin and on the RBI Website) on various payment and settlement system indicators. In line with the recommendation of the Committee on Deepening of Digital Payments (Chairperson: Shri Nandan Nilekani) and given the rapid developments in the digital payments space, it has been decided to disseminate more granular information on payment data covering the payment systems authorised by the Reserve Bank. With this, the entire gamut of payment systems data will be available in the RBI Bulletin/Website. 7. Acceptance Development Fund (ADF) With the rapid growth in the issuance of cards in the country, there is a need to ensure growth of acceptance infrastructure across the country, especially in Tier III to Tier VI centres. In order to increase digitisation in these areas, as indicated in the Payment System Vision Document 2021 of RBI and also recommended by the Committee on Deepening of Digital Payments (Chairperson: Shri Nandan Nilekani), it has been decided to create an ‘Acceptance Development Fund’ (ADF) in consultation with the stakeholders. The framework will be operationalised by December 2019. 8. Expanding and Deepening of Digital Payments Ecosystem With a view to expanding and deepening the digital payments ecosystem, it has been decided that State/ UT Level Bankers Committees (SLBCs/ UTLBCs) shall identify one district in their respective States/UTs on a pilot basis in consultation with banks and stakeholders. The identified district may be allocated to a bank with significant footprint which will endeavour to make the district 100 per cent digitally enabled. This would enable every individual in the district to make/receive payments digitally in a safe, secure, quick, affordable and convenient manner. Guidelines in this regard will be issued shortly.

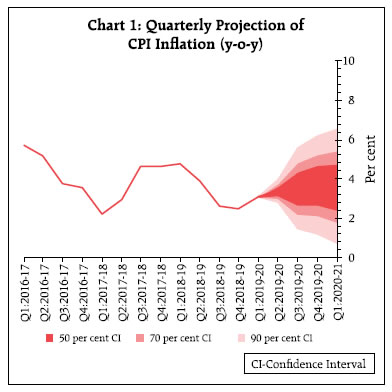

|