Today, the Reserve Bank released data relating to India’s International Investment Position for end-March 2025[1]. Key Features IIP during January-March 2025: -

Net claims of non-residents on India declined by US$ 34.2 billion during Q4:2024-25 to US$ 330.0 billion as at end-March 2025. -

Higher rise in Indian residents’ overseas financial assets (US$ 60.0 billion) as compared to that in the foreign-owned assets in India (US$ 25.8 billion) led to the decline in net claims of non-residents during the quarter (Table 1). -

Increase in reserve assets accounted for over 54 per cent of the rise in Indian residents’ overseas financial assets, followed by currency & deposits and direct investments. -

Rise in loans (US$ 10.0 billion) and inward direct investment (US$ 9.7 billion) together accounted for over three-fourths of the rise in foreign liabilities of Indian residents during January-March 2025. -

Reserve assets accounted for 58.7 per cent of India’s international financial assets (Table 3). -

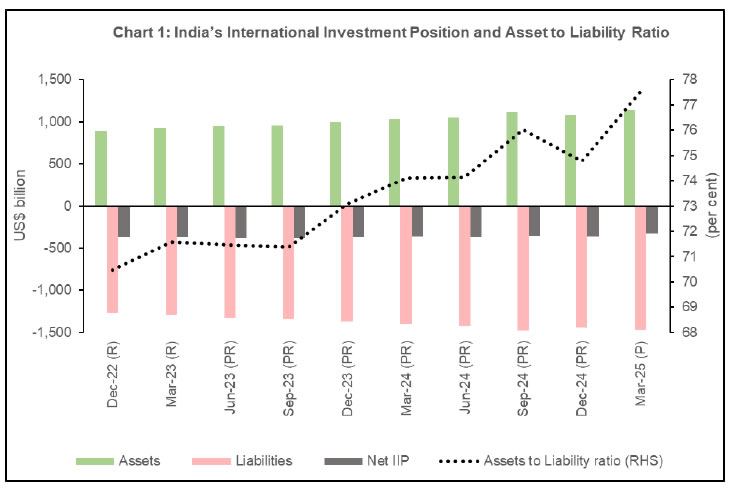

The ratio of India’s international assets to international liabilities increased to 77.5 per cent in March 2025 from 74.8 per cent a quarter ago (Chart 1 & Table 1). -

The share of debt liabilities in total external liabilities increased during the quarter and stood at 54.8 per cent (Table 4). IIP during April-March 2024-25: -

During 2024-25, the net claims of non-residents declined by US$ 31.2 billion on the back of higher rise in India’s external financial assets (US $ 105.4 billion) vis-à-vis external financial liabilities (US $ 74.2 billion) (Table 1). -

Over 72 per cent of the rise in India’s overseas financial assets was due to increase in overseas direct investment, currency & deposits, and reserve assets. -

Inward direct investments, loans as well as currency & deposits accounted for over three-fourths of the rise in foreign liabilities during the year. -

The ratio of India’s international financial assets to international financial liabilities increased to 77.5 per cent in March 2025 from 74.1 per cent a year ago (Chart 1 & Table 1). Ratio of International Financial Assets and Liabilities to Gross Domestic Product (GDP): -

As a ratio to GDP (at current market prices), residents’ overseas financial assets increased and external financial liabilities declined during 2024-25 (Table 2). -

The ratio of net claims of non-residents on India to GDP improved to (-)8.7 per cent in March 2025 from (-)10.1 per cent a year ago, and (-)14.1 per cent five years ago. (Puneet Pancholy)

Chief General Manager Press Release: 2025-2026/616

| Table 1: Overall International Investment Position of India | | (US$ billion) | | Period | Mar-24 (PR) | Jun-24 (PR) | Sep-24 (PR) | Dec-24 (PR) | Mar-25 (P) | | Net IIP (A-B) | -361.2 | -366.9 | -353.0 | -364.2 | -330.0 | | A. Assets | 1,033.8 | 1,052.0 | 1,119.4 | 1,079.2 | 1,139.2 | | 1. Direct Investment | 242.3 | 246.6 | 254.5 | 260.8 | 270.5 | | 1.1 Equity and investment fund shares | 153.4 | 156.6 | 162.4 | 166.5 | 173.6 | | 1.2 Debt instruments | 88.9 | 90.0 | 92.1 | 94.3 | 96.9 | | 2. Portfolio Investment | 12.5 | 12.4 | 12.5 | 12.2 | 13.7 | | 2.1 Equity and investment fund shares | 11.0 | 10.7 | 11.2 | 9.4 | 8.7 | | 2.2 Debt securities | 1.5 | 1.7 | 1.3 | 2.8 | 5.0 | | 3. Other Investment | 132.6 | 141.0 | 146.6 | 170.5 | 186.7 | | 3.1 Trade Credits | 33.4 | 32.8 | 32.9 | 33.2 | 33.4 | | 3.2 Loans | 17.6 | 20.8 | 22.1 | 22.5 | 25.9 | | 3.3 Currency and Deposits | 53.5 | 57.8 | 56.1 | 68.6 | 79.3 | | 3.4 Other Assets | 28.1 | 29.6 | 35.5 | 46.2 | 48.1 | | 4. Reserve Assets | 646.4 | 652.0 | 705.8 | 635.7 | 668.3 | | B. Liabilities | 1,395.0 | 1,418.9 | 1,472.4 | 1,443.4 | 1,469.2 | | 1. Direct Investment | 542.9 | 552.8 | 555.3 | 547.1 | 556.8 | | 1.1 Equity and investment fund shares | 511.1 | 520.6 | 522.8 | 513.0 | 521.9 | | 1.2 Debt instruments | 31.8 | 32.2 | 32.5 | 34.1 | 34.9 | | 2. Portfolio Investment | 277.3 | 277.4 | 294.3 | 276.6 | 272.0 | | 2.1 Equity and investment fund shares | 162.1 | 160.9 | 170.9 | 155.6 | 141.9 | | 2.2 Debt securities | 115.2 | 116.5 | 123.4 | 121.0 | 130.1 | | 3. Other Investment | 574.8 | 588.7 | 622.8 | 619.7 | 640.4 | | 3.1 Trade Credits | 123.7 | 125.9 | 131.3 | 135.6 | 131.2 | | 3.2 Loans | 221.4 | 224.6 | 239.4 | 240.6 | 250.6 | | 3.3 Currency and Deposits | 154.8 | 160.6 | 164.1 | 165.7 | 167.6 | | 3.4 Other Liabilities | 74.9 | 77.6 | 88.0 | 77.8 | 91.0 | | of which: | | | | | | | Special drawing rights (Net incurrence of liabilities) | 21.9 | 21.8 | 22.4 | 21.6 | 22.0 | | Memo Item: Assets to Liability ratio (%) | 74.1 | 74.1 | 76.0 | 74.8 | 77.5 | Notes (applicable for all tables):

1. P: Provisional; PR: Partially Revised; and R: Revised.

2. The sum of the constituent items may not add to the total due to rounding off. |

| Table 2: Ratios of External Financial Assets and Liabilities to GDP | | (per cent) | | Period | Mar-23 (R) | Mar-24 (PR) | Mar-25 (P) | | Net IIP (A-B) | -11.3 | -10.1 | -8.7 | | A. Assets | 28.2 | 28.5 | 29.3 | | 1. Direct Investment | 6.8 | 6.7 | 6.9 | | 1.1 Equity and investment fund shares | 4.3 | 4.2 | 4.4 | | 1.2 Debt instruments | 2.5 | 2.5 | 2.5 | | 2. Portfolio Investment | 0.5 | 0.3 | 0.3 | | 2.1 Equity and investment fund shares | 0.3 | 0.3 | 0.2 | | 2.2 Debt securities | 0.2 | - | 0.1 | | 3. Other Investment | 3.2 | 3.6 | 4.8 | | 3.1 Trade Credits | 0.8 | 0.8 | 0.8 | | 3.2 Loans | 0.4 | 0.5 | 0.7 | | 3.3 Currency and Deposits | 1.0 | 1.5 | 2.1 | | 3.4 Other Assets | 1.0 | 0.8 | 1.2 | | 4. Reserve Assets | 17.7 | 17.9 | 17.3 | | B. Liabilities | 39.5 | 38.6 | 38.0 | | 1. Direct Investment | 16.0 | 15.0 | 14.4 | | 1.1 Equity and investment fund shares | 15.1 | 14.1 | 13.5 | | 1.2 Debt instruments | 0.9 | 0.9 | 0.9 | | 2. Portfolio Investment | 7.5 | 7.7 | 7.1 | | 2.1 Equity and investment fund shares | 4.3 | 4.5 | 3.7 | | 2.2 Debt securities | 3.2 | 3.2 | 3.4 | | 3. Other Investment | 16.0 | 15.9 | 16.5 | | 3.1 Trade Credits | 3.8 | 3.4 | 3.4 | | 3.2 Loans | 6.2 | 6.1 | 6.5 | | 3.3 Currency and Deposits | 4.3 | 4.3 | 4.3 | | 3.4 Other Assets | 1.7 | 2.1 | 2.3 | | of which: | | | | | Special drawing rights (Net incurrence of liabilities) | 0.7 | 0.6 | 0.6 |

| Table 3: Composition of International Financial Assets and Liabilities of India | | (per cent) | | Period | Mar-24 (PR) | Jun-24 (PR) | Sep-24 (PR) | Dec-24 (PR) | Mar-25 (P) | | A. Assets | | 1. Direct Investment | 23.4 | 23.4 | 22.7 | 24.2 | 23.7 | | 2. Portfolio Investment | 1.2 | 1.2 | 1.1 | 1.1 | 1.2 | | 3. Other Investment | 12.9 | 13.4 | 13.1 | 15.8 | 16.4 | | 4. Reserve Assets | 62.5 | 62.0 | 63.1 | 58.9 | 58.7 | | Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | | B. Liabilities | | 1. Direct Investment | 38.9 | 39.0 | 37.7 | 37.9 | 37.9 | | 2. Portfolio Investment | 19.9 | 19.5 | 20.0 | 19.2 | 18.5 | | 3. Other Investment | 41.2 | 41.5 | 42.3 | 42.9 | 43.6 | | Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| Table 4: Share of External Debt and Non-Debt Liabilities of India | | (per cent) | | Period | Mar-24 (PR) | Jun-24 (PR) | Sep-24 (PR) | Dec-24 (PR) | Mar-25 (P) | | Non-Debt Liabilities | 48.3 | 48.0 | 47.1 | 46.3 | 45.2 | | Debt Liabilities | 51.7 | 52.0 | 52.9 | 53.7 | 54.8 | | Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

| |