[Under Section 45ZL of the Reserve Bank of India Act, 1934] The thirty first meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held from October 6 to 8, 2021. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Mridul K. Saggar, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. This was the first face to face meeting of the MPC after February 2020. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: -

the resolution adopted at the meeting of the Monetary Policy Committee; -

the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and -

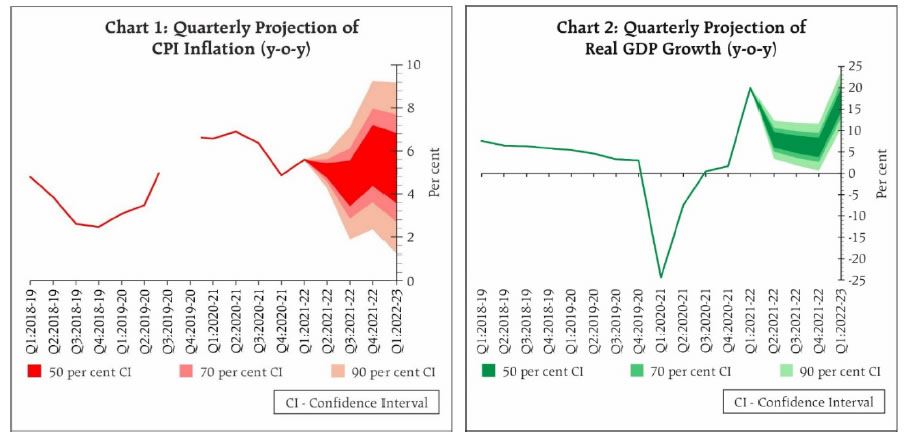

the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (October 8, 2021) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 per cent.

The reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent. - The MPC also decided to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Since the MPC’s meeting during August 4-6, 2021, the momentum of the global recovery has ebbed across geographies with the rapid spread of the delta variant of COVID-19, including in some countries with relatively high vaccination rates. After sliding to a seven-month low in August, the global purchasing managers’ index (PMI) rose marginally in September. World merchandise trade volumes remained resilient in Q2:2021, but more recently there has been a loss of momentum with the persistence of supply and logistics bottlenecks. 7. Commodity prices remain elevated, and consequently, inflationary pressures have accentuated in most advanced economies (AEs) and emerging market economies (EMEs), prompting monetary tightening by a few central banks in the former group and several in the latter. Change in monetary policy stances, in conjunction with a likely tapering of bond purchases in major advanced economies later this year, is beginning to strain the international financial markets with a sharp rise in bond yields in major AEs and EMEs after remaining range-bound in August. The US dollar has strengthened sharply, while the EME currencies have weakened since early-September with capital outflows in recent weeks. Domestic Economy 8. On the domestic front, real gross domestic product (GDP) expanded by 20.1 per cent year-on-year (y-o-y) during Q1:2021-22 on a large favourable base; however, its momentum was dragged down by the second wave of the pandemic. The level of real GDP in Q1:2021-22 was 9.2 per cent below its pre-pandemic level two years ago. On the demand side, almost all the constituents of GDP posted robust y-o-y growth. On the supply side, real gross value added (GVA) increased by 18.8 per cent y-o-y during Q1:2021-22. 9. The rebound in economic activity gained traction in August-September, facilitated by the ebbing of infections, easing of restrictions and a sharp pick-up in the pace of vaccination. The south-west monsoon, after a lull in August, picked up in September, narrowing the deficit in the cumulative seasonal rainfall to 0.7 per cent below the long period average and kharif sowing exceeded the previous year’s level. Record kharif foodgrains production of 150.5 million tonnes as per the first advance estimates augurs well for the overall agricultural sector. By end-September, reservoir levels at 80 per cent of the full reservoir level were above the decadal average, which is expected to boost rabi production prospects. 10. After a prolonged slowdown, industrial production posted a high y-o-y growth for the fifth consecutive month in July. The manufacturing PMI at 53.7 in September remained in positive territory. Services activity gained ground with support from the pent-up demand for contact-intensive activities. The services PMI continued in expansion zone in September at 55.2, although some sub-components moderated. High-frequency indicators for August-September – railway freight traffic; cement production; electricity demand; port cargo; e-way bills; GST and toll collections – suggest progress in the normalisation of economic activity relative to pre-pandemic levels; however, indicators such as domestic air traffic, two-wheeler sales and steel consumption continue to lag. Non-oil export growth remained strong on buoyant external demand. 11. Headline CPI inflation at 5.3 per cent in August softened for the second consecutive month, declining by one percentage point from the recent peak in May-June 2021. This was primarily driven by an easing in food inflation. Fuel inflation edged up to a new high in August. Core inflation, i.e. inflation excluding food and fuel, remained elevated and sticky at 5.8 per cent in July-August 2021. 12. System liquidity remained in large surplus in August-September, with daily absorptions rising from an average of ₹7.7 lakh crore in July-August to ₹9.0 lakh crore during September and ₹9.5 lakh crore during October (up to October 6) through the fixed rate reverse repo, the 14-day variable rate reverse repo (VRRR) and fine-tuning operations under the liquidity adjustment facility (LAF). Auctions of ₹1.2 lakh crore under the secondary market government securities acquisition programme (G-SAP 2.0) during Q2:2021-22 provided liquidity across the term structure. As on October 1, 2021, reserve money (adjusted for the first-round impact of the change in the cash reserve ratio) expanded by 8.3 per cent (y-o-y); money supply (M3) and bank credit grew by 9.3 per cent and 6.7 per cent, respectively, as on September 24, 2021. India’s foreign exchange reserves increased by US$ 60.5 billion in 2021-22 (up to October 1) to US$ 637.5 billion, partly reflecting the allocation of special drawing rights (SDRs), and were close to 14 months of projected imports for 2021-22. Outlook 13. Going forward, the inflation trajectory is set to edge down during Q3:2021-22, drawing comfort from the recent catch-up in kharif sowing and likely record production. Along with adequate buffer stock of foodgrains, these factors should help to keep cereal prices range bound. Vegetable prices, a major source of inflation volatility, have remained contained in the year so far and are likely to remain soft, assuming no disruption due to unseasonal rains. Supply side interventions by the Government in the case of pulses and edible oils are helping to bridge the demand supply gap; the situation is expected to improve with kharif harvest arrivals. The resurgence of edible oils prices in the recent period, however, is a cause of concern. On the other hand, pressures persist from crude oil prices which remain volatile over uncertainties on the global supply and demand conditions. Domestic pump prices remain at very high levels. Rising metals and energy prices, acute shortage of key industrial components and high logistics costs are adding to input cost pressures. Weak demand conditions, however, are tempering the pass-through to output prices. The CPI headline momentum is moderating with the easing of food prices which, combined with favourable base effects, could bring about a substantial softening in inflation in the near-term. Taking into consideration all these factors, CPI inflation is projected at 5.3 per cent for 2021-22; 5.1 per cent in Q2, 4.5 per cent in Q3; 5.8 per cent in Q4 of 2021-22, with risks broadly balanced. CPI inflation for Q1:2022-23 is projected at 5.2 per cent (Chart 1). 14. Domestic economic activity is gaining traction with the ebbing of the second wave. Going forward, rural demand is likely to maintain its buoyancy, given the above normal kharif sowing while rabi prospects are bright. The substantial acceleration in the pace of vaccination, the sustained lowering of new infections and the coming festival season should support a rebound in the pent-up demand for contact intensive services, strengthen the demand for non-contact intensive services, and bolster urban demand. Monetary and financial conditions remain easy and supportive of growth. Capacity utilisation is improving, while the business outlook and consumer confidence are reviving. The broad-based reforms by the government focusing on infrastructure development, asset monetisation, taxation, telecom sector and banking sector should boost investor confidence, enhance capacity expansion and facilitate crowding in of private investment. The production-linked incentive (PLI) scheme augurs well for domestic manufacturing and exports. Global semiconductor shortages, elevated commodity prices and input costs, and potential global financial market volatility are key downside risks to domestic growth prospects, along with uncertainty around the future COVID-19 trajectory. Taking all these factors into consideration, projection for real GDP growth is retained at 9.5 per cent in 2021-22 consisting of 7.9 per cent in Q2; 6.8 per cent in Q3; and 6.1 per cent in Q4 of 2021-22. Real GDP growth for Q1:2022-23 is projected at 17.2 per cent (Chart 2).  15. Inflation prints in July-August were lower than anticipated. With core inflation persisting at an elevated level, measures to further ameliorate supply side and cost pressures, including through calibrated cuts in indirect taxes on petrol and diesel by both Centre and States, would contribute to a more durable reduction in inflation and anchoring of inflation expectations. The outlook for aggregate demand is progressively improving but the slack is large: output is still below pre-COVID level and the recovery is uneven and critically dependent upon policy support. Compared to pre-pandemic levels, contact intensive services, which contribute around two-fifth of economic activity in India, still lag considerably. Capacity utilisation in the manufacturing sector is below its pre-pandemic levels and an early recovery to its long-run average is critical for a sustained rebound in investment demand. Even as the domestic economy is showing signs of mending, the external environment is turning more uncertain and challenging, with headwinds from slowing growth in some major Asian and advanced economies, steep jump in natural gas prices in the recent weeks and concerns emanating from normalisation of monetary policy in some major advanced economies. Against this backdrop, the ongoing domestic recovery needs to be nurtured assiduously through all policy channels. The MPC will remain watchful given the uncertainties surrounding the outlook for growth and inflation. Accordingly, keeping in mind the evolving situation, the MPC decided to keep the policy repo rate unchanged at 4 per cent and continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. 16. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 4.0 per cent. 17. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das, except Prof. Jayanth R. Varma, voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 18. The minutes of the MPC’s meeting will be published on October 22, 2021. 19. The next meeting of the MPC is scheduled during December 6 to 8, 2021. | Voting on the Resolution to keep the policy repo rate unchanged at 4.0 per cent | | Member | Vote | | Dr. Shashanka Bhide | Yes | | Dr. Ashima Goyal | Yes | | Prof. Jayanth R. Varma | Yes | | Dr. Mridul K. Saggar | Yes | | Dr. Michael Debabrata Patra | Yes | | Shri Shaktikanta Das | Yes | Statement by Dr. Shashanka Bhide 20. A number of indicators now point to recovery of economic activity from the severest shock of the second wave of the Covid 19 pandemic the country suffered in the first two months of the present financial year. The estimates of GDP for Q1: 2021-22 by the National Statistical Office (NSO) point to year-on-year (yoy) increase of 20.1 per cent in this period of the second wave. This sharp rise in GDP reflects a substantially smaller economic impact of the second wave than in the first wave as relative to Q1: 2019-20, GDP in the first quarter of the current financial year is lower by 9.2 per cent compared to the decline of 24.4 per cent in Q1: 2020-21 during the first wave. These patterns highlight the extent of the negative impact of the pandemic and the challenge of rebuilding the economy considering the fact that some sectors have suffered far more than others. 21. At a disaggregate level, all major components of GDP, the private final consumption expenditure (PFCE), gross fixed investment (GFCF) and exports have increased sharply by 19.3 per cent, 55.3 per cent and 39.1 per cent, respectively, in Q1: FY 2022, year on year basis. As in the case of aggregate GDP, PFCE and GFCF are below their pre-pandemic levels in Q1: 2019-20. The Government Final Consumption Expenditure (GFCE) declined in Q1: 2021-22 over the same period in 2020-21, as it had increased substantially in the latter period. Exports are now above the pre-pandemic level seen in Q1: 2019-20. Imports rose sharply in Q1: 2021-22 but remained below the level seen in Q1: 2019-20. 22. The supply side disruptions during the second wave of the pandemic were slightly less stringent from the first wave as these disruptions were not at the national level but state level or even more localised. This helped reduce the constraints on the supply side but the demand side weakness remained slower to overcome due to the significant income and employment losses. Some of these differences in the nature of economic recovery are reflected in the present uneven pattern of growth. 23. While return to the pre-pandemic level of economic activity is to be expected when the restrictions on the supply side are liberalised, pace of this return to normalcy would depend on the factors affecting supply as well as demand. On the supply side, in the presence of adequate demand, expansion may be constrained by the supply of inputs, rise in the prices of inputs besides the need for new investments to do business in the new environment. If the pace of this recovery is slower on the supply side, prices would rise if demand grows more quickly. If the supply rises more quickly, price rise may be muted, although in both the cases, the exogenous price shocks from the external sector including crude oil and commodity markets impart upside risks to the outlook. 24. Excluding the data for April 2021, for which the yoy growth rates were exceptionally high, the Index of Industrial Production (IIP-General), while registering double digit growth rates in May and June of 2021, was still below the level of 2019 for the same two months. However, in July 2021, the IIP was above the level two years back in the case of mining and electricity and the IIP-General was only 0.3 per cent below the level in July 2019. The trend is clearly one of catching up with the pre-pandemic levels of industrial activity. There are patterns that also suggest weaker output growth in certain sectors. In July 2021, IIP for Consumer goods was lower than in July 2019, particularly for Consumer durables; it was marginally higher than the pre-pandemic levels of July 2019 for primary and capital goods; between 2 and 2.5 per cent in the case of intermediate goods and infrastructure/ construction sectors. 25. It is also important to recognise sectors in the non-IT services that are in the early stages of recovery. The MSME and informal sector enterprises face greater challenges in operating in conditions in which input price pressures are significant and consumer demand is still recovering. 26. While rural demand is expected to be buoyant in the light of higher Kharif crop output projected in the First Advance Estimates for 2021, the sales of tractors and motor cycles – proxies for rural demand conditions - show divergent pattern for April-August 2021 over the levels seen in 2019 for the same period. Tractor sales have increased sharply and motor cycle sales show a negative growth. In the case of urban demand, domestic air passenger traffic, passenger vehicles sales and consumer durables sales show divergent trends. While some of this pattern is related to supply side restrictions (air traffic) or supply chain disruptions (automobile sector), the recovery of overall consumption demand to the pre-pandemic levels is uneven. 27. RBI’s Consumer Confidence Survey for September 2021 shows that a larger proportion of the respondents reported improvement in the general economic situation compared to the July 2021 survey. But a large majority of the respondents - more than 72 per cent - perceive the overall situation to have worsened compared to a year back. A larger proportion of the respondents expect improvement in the overall economic situation a year ahead, as compared to the results of the July 2021 survey. But this proportion is lower than the survey results a year back. The concerns exhibited in the consumer sentiments appear to mirror the assessment of employment and income conditions. A larger proportion of respondents are now spending more now than a year back, but the improvement is in spending on ‘essentials’ as compared to ‘discretionary spending’. A positive pattern is the decline in unemployment rates and increase in the labour force participation rates in the rural and urban areas from the peak levels seen in May 2021, as brought out by the surveys of the Centre for Monitoring Indian Economy (CMIE). 28. Investment activity has picked up over the levels seen 2020-21 but yet to reach the 2019-20 levels. Accelerated progress in vaccinations and a number of economic policy initiatives to open up opportunities for investment are among the factors constituting positive stimulus to fresh investments. Some of the positive investment sentiments are reflected in the strong FDI inflows and successful IPOs in the current financial year. The survey of enterprises conducted by the RBI mainly in August-September 2021 shows sharp improvement in demand conditions compared to the decline in the previous quarter, especially in the manufacturing sector. The demand conditions are expected to improve steadily in the next two quarters of the current financial year. Input cost pressures remain the main concern for the enterprises, leading to higher selling prices to achieve profitability. Overall business situation is expected to improve in Q3: 2021-22 and remain robust in Q4 and Q1: 2022-23, particularly for manufacturing and services. 29. The indicators such as the PMI were in expansionary zone in July-September 2021 in the case of manufacturing and August-September 2021 for services. A number of high frequency indicators point to recovery in economic activities, from the trough seen during July-August 2020. Air passenger traffic and consumption of transportation fuels show significant growth in July-August 2021, year on year basis. Broader recovery in economic activity is reflected in the steady rise in railway freight traffic, pickup in port traffic, air cargo, e-way bills and GST collections. Non-food credit has continued modest expansion although below the rate of expansion in bank deposits. The overall trends point to emerging growth momentum, some of it from the relaxation of administrative restrictions imposed in the face of the pandemic as vaccination drive is gaining acceleration across the country and reduction in the number of active cases of infection. 30. One of the key drivers of the aggregate demand in 2021-22 so far has been the exports, both merchandise and services. Imports have also increased reflecting pick-up in domestic demand. Revival of external demand on the back of pick-up of economic growth in the advanced economies has been an important factor supporting export performance. The supply chain constraints and persistence of pandemic conditions globally, particularly in some of the advanced economies are a concern. 31. With the present growth momentum, GDP in 2021-22 is expected to exceed the level achieved in 2019-20. The uneven pace of ongoing recovery across sectors highlights that the protection against the Covid infections through vaccination, practice of Covid appropriate behaviour and availability of health services to mitigate any fresh wave of the infections would be essential to achieve a broad based sustained growth. 32. Revival of economic growth has also been accompanied by inflationary pressures. Sources of inflation include price pressures from international markets and also domestic markets. Restricted supply conditions have added to the price pressures in the domestic markets. Sharp price increases in a few critical items of production and consumption also have cascading effects. The present outlook for CPI inflation has been driven by the rise in petroleum fuel prices, and international commodity prices leading to increase in raw material costs, transportation costs and energy costs, even when the recovery in demand conditions has been modest. The fiscal and administrative measures to ease infrastructure constraints by the government have helped in reducing the potential impact of price impulses from external markets. But fuller capacity utilisation, new investments to improve productivity are needed to meet the rising aggregate demand without further price pressures. Monetary and fiscal measures to support supply response to the rising demand would be needed at this crucial juncture. 33. The headline CPI inflation (yoy) during June-August 2021 averaged 5.7 per cent, well below 6.5 per cent seen during June-August 2020. Drivers of inflation were indeed different between the two years. In June-August 2020, it was food inflation and in the same period in 2021, it has been fuel inflation. The CPI for fuel rose by 12.6 per cent during June-August 2021 compared to 2.1 per cent in June-August 2020; CPI for food rose by 4.6 per cent in June-August 2021 and in the same period of 2020, the increase was 8.2 per cent. Core CPI inflation in June-August 2021 was 5.9 per cent and 5.5 per cent in the same period in 2020. Besides the spill over effects from food and fuels, core inflation is affected by the prices of transport fuels and transport services that are directly affected by the crude oil price shocks. Improving efficiency of logistics services and reduction in indirect taxes would play an important role in easing such exogenous shocks on the cost of transport services and overall inflation. 34. Going forward, external factors such as international commodity prices including petroleum crude would play an important role in the evolution of CPI. Improved demand conditions would also mean upward pressure on the price front unless supply expands with improved productivity. The projected CPI inflation rate for Q2, Q3 and Q4 in FY 2021-22 are 5.1, 4.5 and 5.8 per cent, respectively, with an average of 5.3 per cent for FY 2021-22 considering the actual rate of 5.6 per cent for Q1. This projected inflation rate for 2021-22 is lower by 40 basis points compared to the projected 5.7 per cent in August, still above the target but within the tolerance band of the inflation target. RBI’s Survey of Professional Forecasters (SPF) for September 2021 provides a median forecast of 5.3 per cent for FY 2021-22, taking actual rate of 5.6 per cent for Q1. A clear driver of this decline in projections is the food inflation. Reduction in the core CPI inflation rate from the present level will require, inter alia, reduction in petroleum fuel prices. 35. Taking into account the recent trends in output the GDP growth for FY 2021-22 has been retained at 9.5 per cent. The projections of yoy GDP growth for Q2 have been revised upward from 7.3 per cent in the MPC meeting of August to 7.9 per cent, Q3 from 6.3 to 6.8 per cent, with the Q4 growth remaining unchanged at 6.1 per cent. The SPF for September 2021 provides a median forecast for FY 2021-22 of 9.4 per cent, revised upward from its July survey. 36. The projected moderation in the headline inflation rate and unchanged GDP growth rate for FY 2021-22 reflect improving underlying macroeconomic conditions. However, in the context of the uncertainties in the external demand and price conditions and an uneven sectoral growth pattern an accommodative monetary policy stance and broader policy support are necessary at this juncture for strengthening the growth momentum and reducing inflation pressures. 37. Accordingly, I vote in favour of keeping the policy repo rate unchanged at 4.0 per cent. I also vote in favour of continuing with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward. Statement by Dr. Ashima Goyal 38. We have navigated a difficult year well so far with strong recoveries. Headline inflation is also softening towards the target. 39. The theory that temporary Covid-19 related supply shocks are largely responsible for inflation seems to have held out well, although repeated commodity price shocks are an issue. There is some pass through to other items but it is not generalized as yet. In addition to oil prices, inflation is higher for electronic goods and consumer durables affected by Covid-19 global shortages and supply chain issues; retail perishables supply chains were able to resolve faster. Inflation, as well as household and business inflation expectations rose during peak waves and fell thereafter. Global price shocks have turned out to be more persistent, contributing to sticky core inflation. Tax cuts on petroleum products are essential to break the upward movement that could impart persistence to domestic inflation. Government initiatives have contributed to the fall in food inflation. This, and relative fiscal conservatism, enables monetary policy to remain accommodative, keeping the real interest rate well below the growth rate, stimulating the recovery and reducing public debt ratios. The transmission to output growth from low real rates combined with surplus liquidity is well established. 40. Causality is normally from core inflation to headline but this need not be so if rise in core inflation is due to reversible supply shocks. There is large uncertainty built into current prices because of the speculative element that seeks to profit from aggravated shortages. Large sudden falls are therefore possible. Oil prices have shown high volatility. The climate change activism that is partly responsible for current spikes will also reduce oil demand in the future. There are signs of container prices softening as exports from China reduce. Policy has to be data based, since inflation may fall faster than guidance, or supply-side issues may cause new spikes. 41. Demand is also uncertain beyond pent up demand and the festival season. Some slowdown in global growth and more surprises from Covid-19 are possible, although vaccination is progressing well. Data lags mean we do not as yet know the extent of scarring in small and medium enterprises (SMEs), contact intensive services and in employment. 42. The current situation warrants that monetary-financial conditions remain accommodative. In times of great uncertainty it is important that policy remains steady and supportive. Therefore, a pause in the repo rate and an accommodative stance is required and I vote for these. Even so, policy has to continuously adapt in line with changing circumstances. Over-stimulus as after the global financial crisis, with delay resulting in sharp adjustment, has to be avoided. 43. What is the quantity of excess liquidity required? Large inflows have led to a rise in liquidity over the past two months. In advanced countries exit normally starts by stopping fresh injections of liquidity although existing levels are only allowed to reduce slowly and naturally as securities mature. The experience is markets react well to transparent changes in policy rates that follow the data. For example, if rates rise as growth is well-established, stock markets continue to do well. 44. India, however, has an informal sector as well as a modern sector that are differently served by existing arrangements for short term liquidity. Only banks have access to repo and reverse repo windows. There are also large shocks from foreign flows, government cash balances and currency leakages. Therefore, liquidity needs to be kept in sufficient surplus to absorb these shocks even as the excess is reduced allowing the reverse repo to rise gradually and arrangements for non-banks remain in place. A higher fixed reverse repo rate for banks could be linked to raising their interest rates on deposit accounts. The ECB has done this. 45. With some growth recovery, but more to go, and one year ahead inflation expected at about 5%, a real policy rate of about -1% is appropriate. 46. As the LAF band was widened last year short rates fell much more than long rates. Spreads widened for 10-year G-secs, although rates fell to their lowest in many years. Market expectations in current forward rates see short rates rising over the next year with little change in 10-year G-secs rates. As uncertainty reduces, the inflation target is well internalized, and government borrowing requirements reduce, spreads should fall further. Long rates are important for investment and as benchmarks for private borrowing. The yield curve is likely to flatten, although oil price uncertainty is a risk. 47. Given India’s foreign exchange reserves and strong external fundamentals, India is well placed to absorb any volatility as advanced economy central banks begin their exit or if financial shocks spread from China. It is important that policy remains aligned to the domestic cycle and any external shocks are smoothed. Statement by Prof. Jayanth R. Varma 48. Several of the arguments that I made in my August statement continue to be valid, and I will summarize them quickly without repeating the detailed analysis underpinning them. First, the Covid-19 pandemic has mutated into a human tragedy rather than an economic crisis, and monetary policy is not the right instrument to deal with this. Second, the ill effects of the pandemic are now concentrated in narrow pockets of the economy, and monetary policy is much less effective than fiscal policy for providing targeted relief to the worst affected segments of the economy. Third, inflationary pressures are beginning to show signs of greater persistence than anticipated earlier. 49. Since August, I have become increasingly concerned about two other risks that have become salient globally in recent weeks. The first is that the ongoing transition to green energy worldwide poses a significant risk of creating a series of energy price shocks similar to that in the 1970s. This means that the upside risks to long term inflation and to inflation expectations are now more aggravated. My second recent concern is about the tail risk to global growth posed by emerging financial sector fragility in China reminiscent of Japan of the late 1980s. Both of these risks - one to inflation and the other to growth - are well beyond the control of the MPC, but they warrant a heightened degree of flexibility and agility. A pattern of policy making in slow motion that is guided by an excessive desire to avoid surprises is no longer appropriate. 50. For these reasons, I am not in favour of the decision to keep the reverse repo rate at 3.35%, and vote against the accommodative stance. Raising effective money market rates quickly towards 4% would demonstrate the MPC’s commitment to the inflation target, help anchor expectations, reduce risk premia, enhance macroeconomic stability, and allow lower long-term interest rates to be sustained for longer thereby aiding the economic recovery. 51. On the other hand, I vote for maintaining the repo rate at 4% for the following reasons. Economic growth was unsatisfactory long before the pandemic, and even if the economic ill effects of the pandemic abate to some extent, substantial monetary accommodation is warranted. The repo rate of 4% corresponds to a negative real rate in the range of 1-1.5% based on forward looking inflation forecasts. In my view, this level of rates is currently appropriate for reviving economic growth without excessive risk of an inflationary spiral. Needless to say, the MPC needs to remain data driven so that it can respond rapidly and adequately to any unforeseen shocks that may arise in future. Statement by Dr. Mridul K. Saggar 52. Since we last met, real economic activity is on track to gradual normalisation, inflation spike has turned out to be transitory, fiscal position appears to be back on budgetary track and external balance remains under control. In short, macroeconomic conditions have improved and the economy looks stable. However, this should not lull us into assuming a goldilocks scenario. Significant headwinds have started blowing from the shifting global macro-economic conditions. Rising geopolitical risks complicate the scenario further. The expectations of a red piping-hot recovery have been belied. Global growth expectations are getting scaled down on account of likely taper, China slowdown, scaling back of US fiscal stimulus on back of uncertainties surrounding infrastructure bill and debt ceiling and adverse impact on activity of gas and energy shortages in Europe and elsewhere. These can have significant spillovers and spillbacks running through trade, financial and market expectations channels. They can alter the domestic macroeconomic balances and cause spells of volatility clustering over a year or more, even though the buffers so assiduously built in the recent past are likely to see the economy through without any growth collapse. 53. How do we frame monetary policy in the backdrop of the emerging new challenges? First and foremost, we need to remain data dependent. Financial markets are characterised by multiple equilibria. Capital flows can turn volatile in either direction if taper paths come with surprises. Within the flexible inflation targeting framework, we need to be conscious about exchange rate dynamics originating from exogenous shocks and incorporate those in risks though not in baseline. Amid these uncertainties, policies will need to respond with alacrity and should be untangled from any pre-commitments. If at all some guidance is needed at this stage, it has to be a soft one; with the Reserve Bank preparing markets that while policy stance is likely to remain accommodative till growth is revived on a durable basis, liquidity levels will be adjusted dynamically to appropriate lower levels that are still consistent with accommodative stance. Second, we need to reinforce our commitment to the assigned inflation target guided by data inflows on growth, inflation and other parameters. The central bank needs to remain committed to goal dependence and instrument independence as it has a statutory foundation and is also consistent with general worldwide practice amongst inflation targeting central banks. Third, we need now to focus more on risks to both inflation and growth and calibrate policies as the situation evolves. Considerable uncertainty about output gap in pandemic times remains, with filtering techniques guiding much faster closure than structural models that capture scarring better. However, in my judgement, if no new disruptions to growth emerge, output gap will close sometime in 2022-23 and monetary policy should start to gradually reposition to lowering underlying inflation and inflation expectations next year, especially if inflation edges up from the energy and services side amid sticky goods core inflation. Fourth, an Arjuna’s eye needs to be kept on commodity prices and we need to consider different scenarios according to which we can calibrate our policies. I will explain this point in some details later. 54. Let me now revisit growth and inflation landscape for the next 12-months. Growth recovery after the second wave remains nebulous and there is anecdotal evidence that the wave deepened scarring on small businesses. Of the industries at NIC 5-digit level, 55 per cent of the 404 industries for which data is available, are operating at below 2019-20 levels and 63.4 per cent are operating at below 2018-19 levels, indicating need for not only to support demand revival and ameliorate pandemic supply disruptions but also address the structural malaise that appears to be causing an industrial stagnation. After an encouraging sequential improvement in high frequency indicators in July, there was a loss of momentum in August, when only about three-fifths of the indicators registered improvement over the preceding month. As of now, only about half the indicators have normalised to pre-pandemic levels and only a fifth of indicators to levels achieved in March 2021 before the second wave derailed the normalisation process. However, the activity levels can normalise faster in H2:2021-22 and reach pre-pandemic levels before fiscal year-end on back of vaccinations ramp-up and considerable re-opening of the economy with removal of most Covid-related movement restrictions. 55. Investment intentions, as revealed by the phasing details of projects financially assisted by the financial intermediaries or funded through oversees borrowings or equity raising, show investment retrenchment in 2020-21 and a rather weak pipeline for 2021-22 with a 47.5 per cent year-on-year drop. Seasonally adjusted capacity utilisation rate that was at 66.6 per cent in Q4:2020-21 had dipped to 61.7 per cent in Q1:2021-22 marred by the second wave, but the dip was much lower than in the first wave when the rate had dropped to 48.9 per cent. Investment demand is lagging consumption demand but has started to look up. Net responses of Industrial Outlook Survey (IOS) shows that capacity utilisation rebounded in Q2:2021-22 and further improvement is expected. While in recent years capex has been essentially led by power and roads, there are signs that true investment may be getting somewhat understated given the recent spurt in intangible investments that are not getting fully reflected in national accounts. There are also signs that on the back of PLI scheme investment will get more broad-based in near-term. Monetary policy has already lowered the hurdle rates since 2019-20. Fiscal policy has cut the effective corporate tax rates by nearly 39 per cent in September the same year. This means that the user cost of capital has dropped markedly. However, investment has not responded much till now because of huge pandemic related uncertainty that has affected consumer and business confidence, depressed aggregate demand and posed execution and cash flow difficulties. Corporates chose to deleverage, and their investment intentions have fallen. Consumer confidence improved sequentially in Q2:2021-22 but remains gap down compared to normal levels pre-pandemic. Debt/Equity ratio of corporates has already declined from above 60 per cent in 2015-16 to around 35 per cent in 2020-21. Once structural policies work and animal spirits revive on back of reduced uncertainties, investment will turnaround. In the interim, the current accommodative policy is helping in shoring up consumption demand. With rising global uncertainties, at this juncture, it important that we preserve macro-financial stability, so as to be able to nurture growth rebound. 56. Coming to inflation, while one expects further disinflation in near months, the baseline reverses thereafter despite base effects being moderately on the favourable side. The momentum is expected to pick up in H2:2021-22 and there are upside risks and stickiness of core that warrant attention. In my assessment, the probability that oil prices may touch or cross US$85/barrel before the year ends and could average US$80/barrel or more in H2 are not insignificant. It can have significant impacts that are hard to precisely quantify due to non-linearities and uncertainties but, on a ballpark from the baseline, can be expected to raise inflation by 15-20 bps, lower growth by 13-15 bps, have negligible effects on fiscal subsidies and widen CAD by about 0.25% of GDP. Unless cooperative solutions are found, the underlying gas shortages in Europe are going to get worse in the winters and as they might enervate climate change commitments. The increased dependence on fossil fuels can structurally lift energy inflation and its passthrough to general price level. High imported coal prices are already affecting power generation in some coastal plants in India. Chips delivery time has gone up to 21 weeks from 12 weeks in the pre-pandemic period. Automakers are compelled to cut down production. Container freight rates are still on the rise having risen 2-8 times on various global routes. In general, supply constraints persist and if demand revives fast, it can add to inflation. So, managing supply side will be critical. While there are some signs that price rise broadened during August CPI, the spread is moderate at best and not reflective of generalisation of price rise. Inflation expectations remain high but are not unanchored yet and have dampened by 50-60 bps in the latest round. While this does afford solace, further dampening of inflation expectations will be needed as output levels gets normalised. Interestingly, some recent research from an influential central bank has casted scepticism over long-run inflation expectations being an important factor driving inflation dynamics. To my view, introducing such new paradigms in monetary policy is playing with fire and carry dangers that central banks will lose control over inflation as the economies recover. 57. In sum, we have broadly been right in averting premature tightening and allowing economy to recover. With complementary actions in calibrating liquidity, negative real rates to savers can now be corrected in period ahead. Considering the above, I vote for keeping the stance unchanged and for keeping policy rate unchanged in line with the resolution. Statement by Dr. Michael Debabrata Patra 58. The assessment made in August 2021 that inflation would ease in the third quarter of 2021-22 has been happily overtaken by actual outcomes in the form of a decline in food inflation. Looking ahead, specific supply measures are working to address demand-supply mismatches in this category. With agricultural production prospects looking bright, further easing of food inflation may take down the headline in the third quarter more than initially expected. On the other hand, the formation of inflation is being buffeted by repeated shocks that have taken fuel inflation to an all-time high and turned core inflation persistent, with risks to the upside. Accordingly, it is important to remain on guard about second order effects from these transitory perturbations that gives these components of inflation a resistant character by their recurring incidence. At this time, however, pressures from wages and rentals remain muted. Staff costs in the organised sector are rising again as hiring and normal work processes resume. There is also some evidence forming that cost pressures may not be able to be absorbed any longer and selling prices may turn up. Thus, while the trajectory of inflation may undershoot the projections made in August, it is likely to be uneven, sluggish and prone to interruptions. 59. Beginning in August, various indicators are suggesting that the economy is negotiating a potential gravitational swing-by from the retarding forces unleashed by COVID-19. Pre-pandemic levels of output are being sighted. Agriculture and allied activities look set to achieve and even exceed last year’s record production; manufacturing – the laggard among the components of industry – is just short of 2019-20 levels; and contact-based services are healing fast. Exports can become a force multiplier that accelerates the pace of growth. They provide the avenue for the economy to break out of the limits imposed by the size of the domestic market which is still struggling with pent-up demand becoming more durable. By the end of September, the half-way mark of an ambitious export target for the year is about to be crossed. 60. Even as domestic macroeconomic configurations are improving, the risks from global developments are rising and warrant a close watch as they could stifle the recovery that is underway in India. Exports are directly at risk from logistics bottlenecks, shortages of containers and personnel in international shipping, and elevated freight rates. Policy interventions, including coordinated multilateral efforts, are needed urgently to prevent global trade from choking. More broadly, global growth is losing steam, circumscribing the strength of the recovery with shortages of key intermediates such as chips and semi-conductors. And inflation is now everywhere and raging, with implications for the revival of consumption demand. This is precipitating diverse monetary policy actions which are accentuating the fissures in the global economy. Recent financial developments amidst a sea of froth highlight the excesses of indebtedness and the potential contagion for the real economy, especially if financial conditions tighten. In my view, the biggest risks to India’s macroeconomic prospects are global and they could materialise suddenly. 61. In this milieu, I vote to maintain the policy rate and the accommodative stance of policy unchanged, awaiting stronger evidence on demand-led inflationary pressures. Until then, congenial financial conditions need to be in place. Statement by Shri Shaktikanta Das 62. The COVID-19 pandemic, an unprecedented crisis, that led to record output and employment losses combined with bouts of financial market volatility and supply disruptions, has rendered the job of central bankers across the globe even more challenging. In India also, we had to deal with sharp meltdown in growth, rise in inflation and threat to financial stability, all at once. Given the complexity of the challenges, the policy responses had to be geared not just towards short-term stabilisation, but also to potential long-term implications. During the last eighteen months, therefore, our priority has been to revive growth and preserve financial stability, even as we remain steadfastly committed to keep inflation closer to the target. 63. The global economy now is on a more difficult tangent of slowing growth momentum with entrenching inflationary tendencies. As the classical trade-off that central banks face between slowing growth and higher inflation is getting edgier, their actions have been in response to their domestic macroeconomic circumstances. India’s policy has also been driven by domestic factors. 64. As per our assessment, while the recovery is gaining traction and aggregate demand is rebounding, the economy still operates below the pre-pandemic level. Despite the projected 9.5 per cent GDP growth for 2021-22, there is still slack in the economy as the level of GDP will only be moderately above its pre-COVID level of 2019-20 GDP. In fact, the recent data release of GDP on August 31, 2021 suggests that the real GDP in Q1:2021-22 was well below the Q1:2019-20 level as well as the Q1:2018-19 level. We expect to exceed the pre-pandemic level of output only in Q3:2021-22. The second wave amplified the impact of COVID-19 pandemic on contact-intensive activities and the informal sector. With increased pace of vaccination, however, contact-intensive activities which were earlier lagging in recovery are now catching up. Informal sector is likely to take even longer to recoup as the impact of the second wave on this sector was relatively more pronounced. The demand for MGNREGA – notwithstanding the sequential moderation in September – remains high partly reflecting persisting weakness in the informal sector. Durable recovery in manufacturing and services sectors should support revival in the informal economy. The future trajectory of growth, however, is strewn with many challenges, most notably from how the pandemic will evolve. Overall, growth remains critically dependent on policy support and needs nurturing for sustained recovery. 65. In its August 2021 meeting, the MPC was faced with the challenges posed by headline inflation exceeding the upper tolerance threshold for the second successive month. The MPC then judged the inflation spike during May-June as transitory, driven largely by pandemic-induced supply bottlenecks and elevated commodity prices, and expected it to ease in the subsequent months. The actual inflation outcomes for July-August, with inflation registering a substantial moderation to move within the tolerance band, have vindicated the MPC’s outlook and monetary policy stance. The MPC was faced with a similar dilemma in September-October last year due to food price shocks; and its judgement to see them as transitory and to look through it had proved to be right. Such an approach has been contributing significantly to the economic recovery and stability in the financial markets. Thus, the medium-term focus of the MPC has successfully moderated undue expectations of a possible reversal of the monetary policy stance and is helping anchor expectations in the right direction, while navigating the economic recovery from the crisis. 66. The more than expected softening of inflation in July and August this year was underpinned by the significant lowering in food price momentum, especially in August. Several factors have contributed to this. The summer seasonal vegetable price build-up this year was unusually low, close to a third of historical patterns. Supply side measures announced by the Government in recent months to meet the demand-supply gaps have helped to stabilise food prices. Core inflation, i.e., CPI excluding food and fuel, however, remained elevated and sticky primarily on account of persistent inflationary pressures in transport and communication, health, clothing and footwear. 67. Going forward, if there are no spells of unseasonal rains, food inflation is likely to register significant moderation in the immediate term, aided by record kharif production, more than adequate food stocks, supply-side measures and favourable base effects. Volatile crude oil prices, particularly the resurgence since mid-September, is pushing pump prices to new highs, raising risk of further spillover of high transportation cost into retail prices of goods and services. On balance, the outlook on inflation has improved and inflation projection for 2021-22 has been revised downward by 40 bps to 5.3 per cent. 68. Against this backdrop, it is felt that continued monetary support is necessary as the economic recovery process even now is delicately poised and growth is yet to take firmer roots. The external environment, which had been supportive of aggregate demand over the past few months, may lose momentum for a variety of reasons such as – surge in infections; the persistence of pandemic-related supply bottlenecks; a binding shortage of key inputs like semi-conductors; and the spike in gas prices. Given an ever evolving and dynamic environment, with the outlook overcast by several uncertainties including the fact that the pandemic is far from over, we need to ensure that the nascent revival of economic activity shows signs of durability and sustainability. At this critical juncture, our actions have to be gradual, calibrated, well-timed and well-telegraphed to avoid any undue surprises. We are reaching the shore after sailing through a very turbulent journey, and we cannot afford to rock the boat at this crucial stage. We must ensure that we reach safely to begin the journey beyond the shore. I, therefore, vote to keep the policy rate unchanged and to continue with the accommodative stance as spelt out by the MPC in its August 2021 meeting. In parallel, we remain laser-focused to bring back the CPI inflation to 4 per cent over a period of time in a non-disruptive manner. (Yogesh Dayal)

Chief General Manager Press Release: 2021-2022/1086 |