On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.5 per cent.

Consequently, the reverse repo rate under the LAF remains at 6.25 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. The decision of the MPC is consistent with the stance of calibrated tightening of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 2. Since the last MPC meeting in August 2018, global economic activity has remained resilient in spite of ongoing trade tensions, but is becoming uneven and the outlook is clouded by several uncertainties. Among advanced economies (AEs), the United States (US) economy appeared to have sustained pace in Q3:2018 as reflected in strong retail sales and robust industrial activity. In the Euro area, economic activity remained subdued due to overall weak economic sentiment, weighed down mainly by political uncertainty. The Japanese economy has so far maintained the momentum of the previous quarter, buoyed by recovering industrial production and strong business optimism. 3. Economic activity in major emerging market economies (EMEs) has been facing headwinds from both global and country-specific factors. In China, industrial production growth has moderated with slowing exports and the ongoing deleveraging of the financial system weighing on growth prospects. The Russian economy has been gathering steam with the manufacturing sector turning around, and the employment scenario remaining upbeat on rising oil prices. In Brazil, economic activity is recovering from the setback in Q2, supported by improving business and consumer sentiment, though weak domestic demand and the sluggish pace of recovery in manufacturing activity point to a slow revival. The South African economy slipped into recession in Q2:2018, pulled down by the negative contribution from agriculture on account of a strong unfavourable base effect. 4. Growth in global trade is weakening as reflected in export orders and automobile production and sales. Crude oil prices eased during the first half of August on concerns of reduced demand from EMEs due mainly to the spillover from country-specific turmoil, and accentuated by rising supplies. However, prices rebounded on expectation of reduced supplies due to sanctions on Iran and falling US stockpiles. Base metal prices witnessed selling pressure in anticipation of weak demand from major economies. Gold prices continued to slide lower on a strong US dollar, though they recovered somewhat on safe-haven demand from the mid-August lows. Inflation remained firm in the US, reflecting tightening labour market and elevated energy prices, while it persisted much below the central bank’s target in Japan. In the Euro area, inflation pressures have been sustained by elevated crude prices. Inflation in many key EMEs has risen on surging crude prices and currency depreciations, caused by a firm dollar and domestic factors. 5. Global financial markets continued to be affected by monetary policy stances in major AEs, the spreading of contagion risks from specific EMEs, and geopolitical developments. Among AEs, equity markets in the US touched a new high, driven by technology stocks, while in Japan, they were boosted by the weak yen. In contrast, stock markets in the Euro area suffered losses on signs of a slowdown and budget concerns in some member states. Sharp sell-offs have occurred on waning appetite of foreign portfolio investors for EME equities. The 10-year sovereign yield in the US has traded sideways, falling on dovish Fed guidance only to recover by end-September on robust economic data. Among other AEs, bond yields in the Euro area hardened in September on risk aversion following the sharp rise in financial market volatility in August. In contrast, bond yields in Japan moved in a narrow range, driven by the central bank’s yield curve management policy. In most EMEs, yields rose due to domestic factors and/or contagion effects from the stress in other EMEs. In currency markets, the US dollar witnessed selling pressures since August on reduced investor expectations of rate hikes by the US Fed. However, it recovered in the last week of September on a rate hike by the Fed and strong economic data. The euro remained in bearish territory due to fiscal risks in some member countries and expectations of weak growth. EME currencies continued to depreciate against the US dollar. 6. On the domestic front, real gross domestic product (GDP) growth surged to a nine-quarter high of 8.2 per cent in Q1:2018-19, extending the sequential acceleration to four successive quarters. Of the constituents, gross fixed capital formation (GFCF) expanded by double digits for the second consecutive quarter, driven by the government’s focus on the road sector and affordable housing. Growth in private final consumption expenditure (PFCE) accelerated to 8.6 per cent, reflecting rising rural and urban spending, supported by retail credit growth. However, government final consumption expenditure (GFCE) decelerated, largely due to a high base. The growth of exports of goods and services jumped to 12.7 per cent, powered by non-oil exports on the back of strong global demand. In spite of import growth continuing to surge, high exports growth helped reduce the drag from net exports on aggregate demand. 7. On the supply side, growth of gross value added (GVA) at basic prices accelerated in Q1, underpinned by double-digit expansion in manufacturing activity which was robust and generalised across firm sizes. Agricultural growth also picked up, supported by robust growth in production of rice, pulses and coarse cereals alongside a sustained expansion in livestock products, forestry and fisheries. In contrast, services sector growth moderated somewhat, largely on account of a high base. Construction activity, however, maintained strong pace for the second consecutive quarter. 8. The fourth advance estimates of agricultural production for 2017-18 released in August placed foodgrains production at a high of 284.8 million tonnes, 1.9 per cent higher than the third advance estimates (released in May 2018) and 3.5 per cent higher than the final estimates for the previous year. The progress of the south-west monsoon has been marked by uneven spatial and temporal distribution, with an overall deficit of 9 per cent in precipitation. However, the first advance estimates of production of major kharif crops for 2018-19 have placed foodgrains production at 141.6 million tonnes, 0.6 per cent higher than last year’s level. The live storage in major reservoirs (as on September 27) rose to 76 per cent of the full capacity, which was 17 per cent higher than last year and 5 per cent higher than the average of the last 10 years. This bodes well for the rabi sowing season. 9. Industrial growth, measured by the index of industrial production (IIP), accelerated in June-July 2018 on a year-on-year (y-o-y) basis, underpinned mainly by high growth in consumer durables, notably two-wheelers, readymade garments, stainless steel utensils, auto components and spares, and accessories. Growth in consumer non-durables also accelerated in July. The infrastructure and construction sector continued to show solid growth. Primary goods growth accelerated, driven by mining, electricity and petroleum refinery products. Growth in capital goods production spiked in June, but decelerated sharply in July. The output of eight core industries growth remained strong in July, driven by coal, petroleum refinery products, steel and cement, but moderated in August. Capacity utilisation (CU) declined from 75.2 per cent in Q4:2017-18 to 73.8 per cent in Q1:2018-19, while seasonally adjusted CU increased by 1.8 percentage points to the long-term average of 74.9 per cent. Based on the Reserve Bank’s business expectations index (BEI), the assessment for Q2:2018-19 improved, led by enhanced production, order books, exports and capacity utilisation. The August and September manufacturing purchasing managers’ index (PMI) remained in expansion zone; the September print rebounded close to the July level confirming robustness of manufacturing activity. 10. High-frequency indicators of services in July and August present a mixed picture. Indicators of rural demand, viz., growth in tractor and two-wheeler sales, slowed down. Passenger vehicle sales, an indicator of urban demand, declined possibly due to rising fuel prices. However, growth in air passenger traffic – another indicator of urban demand – remained robust. Transportation sector indicators, viz., commercial vehicle sales and port cargo, expanded at an accelerated pace. Steel consumption and cement production, indicators of construction activity, showed strong growth. The services PMI remained in expansion zone in August and September, though it decelerated from July, with slower expansion in new business and employment. 11. Retail inflation, measured by the y-o-y change in the CPI, fell from 4.9 per cent in June to 3.7 per cent in August, dragged down by a decline in food inflation. Some softening of inflation in items other than food and fuel also contributed to the decline. Adjusting for the estimated impact of an increase in house rent allowance (HRA) for central government employees, headline inflation was at 3.4 per cent. 12. Inflation in the food and beverages group declined sharply in the absence of seasonal uptick in prices of fruits and vegetables. Of the three key vegetables, the prices of tomatoes declined due to strong mandi arrivals, while those of onions and potatoes remained muted. Continued deflation in prices of pulses and sugar accentuated the decline in food inflation. Inflation in other items of food – cereals, meat and fish, milk, spices and non-alcoholic beverages – remained benign. 13. Inflation in the fuel and light group continued to rise on the back of a significant increase in liquefied petroleum gas prices, tracking international product prices. Kerosene prices rose as oil marketing companies reduced subsidies in a calibrated manner. While remaining elevated, CPI inflation excluding food and fuel moderated due to softening in inflation in housing; pan, tobacco and intoxicants; personal care; and transportation. 14. While the September round of the Reserve Bank’s survey of households reported a sharp uptick of 50 basis points in three-month ahead inflation expectations over the last round, one-year ahead expectations moderated by 30 basis points. Inflation expectations for both input prices and selling prices of manufacturing firms, polled by the Reserve Bank’s industrial outlook survey, firmed up in Q2:2018-19. The manufacturing and services PMIs also reported an increase in input costs and selling prices in Q2, reflecting a pass-through of higher costs to clients. On the other hand, growth in wages in the rural and organised manufacturing sectors remained contained. 15. Systemic liquidity alternated between surplus and deficit during August-September 2018, reflecting the combined impact of expansion of currency in circulation, Reserve Bank’s forex operations and movements in government cash balances. From a daily net average surplus of ₹201 billion during August 1-19, 2018, liquidity moved into deficit during August 20-30. After turning into surplus during August 31-September 10 due to increased government spending, the system again moved into deficit during September 11-29 on the back of an increase in government cash balances and Reserve Bank’s forex interventions. Based on an assessment of the evolving liquidity conditions, the Reserve Bank conducted two open market purchase operations in the second half of September to inject ₹200 billion of durable liquidity. LAF operations absorbed, on a daily net average basis, ₹30 billion in August, but injected ₹406 billion in September. The weighted average call rate (WACR), on an average, traded below the repo rate by 15 basis points (bps) in August and by 4 bps in September. 16. Exports maintained double digit growth in July and August 2018, driven mainly by petroleum products (which benefitted from elevated crude oil prices), engineering goods, gems and jewellery, drugs and pharmaceuticals, and chemicals. However, imports grew faster than exports, reflecting not only a higher oil import bill, but also higher imports of gold, coal, electronic goods and machinery. This led to a widening of the trade deficit to US$ 35.3 billion in July-August 2018 from US$ 24.6 billion a year ago over and above the expansion in Q1:2018-19. However, higher net services receipts and private transfer receipts helped contain the current account deficit to 2.4 per cent of GDP in Q1:2018-19 from 2.5 per cent a year ago. On the financing side, net foreign direct investment (FDI) flows improved in April-July 2018. By contrast, foreign portfolio investors have been net sellers in both the equity and debt segments so far on a cumulative basis in 2018-19 due to higher US interest rates, risk-off sentiment in EMEs and escalation of trade wars. India’s foreign exchange reserves were at US$ 400.5 billion on September 28, 2018. Outlook 17. In the third bi-monthly resolution of August 2018, CPI inflation was projected at 4.6 per cent in Q2:2018-19, 4.8 per cent in H2 and 5.0 per cent in Q1:2019-20, with risks evenly balanced. Excluding the HRA impact, CPI inflation was projected at 4.4 per cent in Q2:2018-19, 4.7-4.8 per cent in H2 and 5.0 per cent in Q1:2019-20. Actual inflation outcomes, especially in August, were below projections as the expected seasonal increase in food prices did not materialise and inflation excluding food and fuel moderated. 18. Going forward, the inflation outlook is expected to be influenced by several factors. First, food inflation has remained unusually benign, which imparts a downward bias to its trajectory in the second half of the year. Inflation in key food items such as pulses, edible oils, sugar, fruits and vegetables remains exceptionally soft at this juncture. The risk to food inflation from spatially and temporally uneven rainfall is also mitigated, as confirmed by the first advance estimates that have placed production of major kharif crops for 2018-19 higher than last year’s record. An estimate of the impact of an increase in minimum support prices (MSPs) announced in July has been factored in the baseline projections. Secondly, the price of the Indian basket of crude oil has increased sharply, by US$ 13 a barrel, since the last resolution. Thirdly, international financial markets remained volatile with EME currencies depreciating significantly. Finally, the HRA effect came off its peak in June and is dissipating gradually on expected lines. Taking all these factors into consideration, inflation is projected at 4.0 per cent in Q2:2018-19, 3.9-4.5 per cent in H2 and 4.8 per cent in Q1:2019-20, with risks somewhat to the upside (Chart 1). Excluding the HRA impact, CPI inflation is projected at 3.7 per cent in Q2:2018-19, 3.8 - 4.5 per cent in H2 and 4.8 per cent in Q1:2019-20. 19. Turning to the growth outlook, the GDP print of Q1:2018-19 was significantly higher than that projected in the August resolution. Private consumption has remained robust and is likely to be sustained even as the recent rise in oil prices may have a bearing on disposable incomes. Improving capacity utilisation, larger FDI inflows and increased financial resources to the corporate sector augur well for investment activity. However, both global and domestic financial conditions have tightened, which may dampen investment activity. Rising crude oil prices and other input costs may also drag down investment activity by denting profit margins of corporates. This adverse impact will be alleviated to the extent corporates are able to pass on increases in their input costs. Uncertainty surrounds the outlook for exports. Tailwinds from the recent depreciation of the rupee could be muted by the slowing down of global trade and the escalating tariff war. Based on an overall assessment, GDP growth projection for 2018-19 is retained at 7.4 per cent as in the August resolution (7.4 per cent in Q2 and 7.1-7.3 per cent in H2), with risks broadly balanced; the path in the August resolution was 7.5 per cent in Q2:2018-19 and 7.3-7.4 per cent in H2. GDP growth for Q1:2019-20 is now projected marginally lower at 7.4 per cent as against 7.5 per cent in the August resolution, mainly due to the strong base effect (Chart 2).   20. While the projections of inflation for 2018-19 and Q1:2019-20 have been revised downwards from the August resolution, its trajectory is projected to rise above the August 2018 print. The outlook is clouded with several uncertainties. First, the government announced in September measures aimed at ensuring remunerative prices to farmers for their produce, although uncertainty continues about their exact impact on food prices. Secondly, oil prices remain vulnerable to further upside pressures, especially if the response of oil-producing nations to supply disruptions from geopolitical tensions is not adequate. The recent excise duty cuts on petrol and diesel will moderate retail inflation. Thirdly, volatility in global financial markets continues to impart uncertainty to the inflation outlook. Fourthly, a sharp rise in input costs, combined with rising pricing power, poses the risk of higher pass-through to retail prices for both goods and services. Firms covered under the Reserve Bank’s industrial outlook survey report firming of input costs in Q2:2018-19 and Q3. However, global commodity prices other than oil have moderated, which should mitigate the adverse influence on input costs. Fifthly, should there be fiscal slippage at the centre and/or state levels, it will have a bearing on the inflation outlook, besides heightening market volatility and crowding out private sector investment. Finally, the staggered impact of HRA revision by the state governments may push up headline inflation. While the MPC will look through the statistical impact of HRA revisions, there is need to be watchful for any second-round effects on inflation. The inflation outlook calls for a close vigil over the next few months, especially because the output gap has virtually closed and several upside risks persist. 21. Against this backdrop, the MPC decided to keep the policy repo rate unchanged. The MPC reiterates its commitment to achieving the medium-term target for headline inflation of 4 per cent on a durable basis. 22. The MPC notes that global headwinds in the form of escalating trade tensions, volatile and rising oil prices, and tightening of global financial conditions pose substantial risks to the growth and inflation outlook. It is, therefore, imperative to further strengthen domestic macroeconomic fundamentals. 23. Regarding the policy repo rate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of keeping the policy repo rate unchanged. Dr. Chetan Ghate voted for an increase in the policy rate by 25 bps. 24. Regarding the stance, Dr. Pami Dua, Dr. Chetan Ghate, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of changing the stance to calibrated tightening. Dr. Ravindra H. Dholakia voted to keep the neutral stance unchanged. The minutes of the MPC’s meeting will be published by October 19, 2018. 25. The next meeting of the MPC is scheduled from December 3 to 5, 2018. Jose J. Kattoor

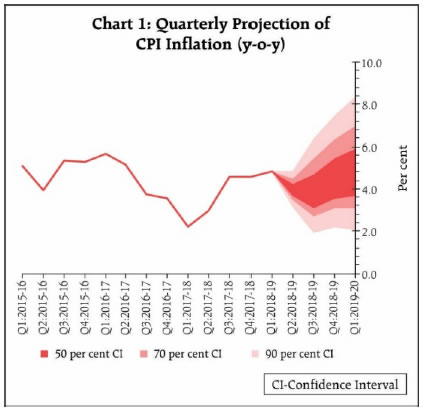

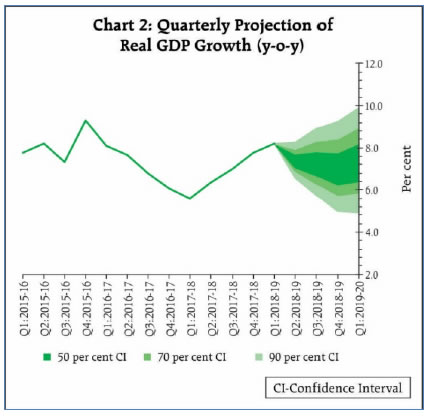

Chief General Manager Press Release: 2018-2019/795 |