The Reserve Bank’s endeavour to build a less-cash society continued with the large scale adoption of digital modes of payments in the country. In an era of rising means of electronic payment systems, the Bank focused its efforts on safety and security of digital transactions. Accordingly, the Bank worked towards building up a robust and resilient technology infrastructure which ensured smooth functioning of the critical and systemically important payment and settlement systems in the country. DEPARTMENT OF PAYMENT AND SETTLEMENT SYSTEMS (DPSS) IX.1 The Department of Payment and Settlement Systems (DPSS) continued to work on the strategic initiatives set in the ‘Payment and Settlement Systems in India: Vision 2018’ document. This resulted in achievement of the expected outcomes laid out in the vision through: (i) decrease in the share of paper-based clearing instruments; (ii) consistent growth in individual segments of retail electronic payment systems, viz., National Electronic Funds Transfer (NEFT), Immediate Payment Service (IMPS), card transactions and mobile banking; (iii) increase in registered customer base for mobile banking; and (iv) upscaling of the acceptance infrastructure for digital payments. Further, with the rapid adoption of digital payments across the country, aided by the introduction of innovative products in the payment space, the Bank focused on strengthening infrastructure and ensuring safety and security of digital transactions. Growth in Payment Systems IX.2 The payment and settlement systems recorded robust growth in 2017-18, with volume and value growing at 44.6 per cent and 11.9 per cent, respectively, on top of an increase of 56.0 per cent and 24.8 per cent, respectively, in 2016-17. The share of electronic transactions in the total volume of retail payments increased to 92.6 per cent in 2017-18, up from 88.9 per cent in the previous year with a corresponding reduction in the share of paper based clearing instruments from 11.1 per cent in 2016-17 to 7.4 per cent in 2017-18 (Table IX.1). Electronic Payments IX.3 Amongst the electronic modes of payments, the Real Time Gross Settlement (RTGS) system handled 124 million transactions valued at ₹1,167 trillion in 2017-18, up from 108 million transactions valued at ₹982 trillion in the previous year. At the end of March 2018, the RTGS facility was available through 1,37,924 branches of 194 banks. The NEFT system handled 1.9 billion transactions valued at around ₹172 trillion in 2017-18, up from 1.6 billion transactions valued at ₹120 trillion in the previous year, registering a growth of 20 per cent in terms of volume and 43.5 per cent in terms of value. At the end of March 2018, the NEFT facility was available through 1,40,339 branches of 192 banks, in addition to a large number of business correspondent (BC) outlets. IX.4 During 2017-18, the number of transactions carried out through credit cards and debit cards was 1.4 billion and 3.3 billion, respectively. Prepaid payment instruments (PPIs) recorded a volume of about 3.5 billion transactions, valued at ₹1,416 billion. Mobile banking services witnessed a growth of 92 per cent and 13 per cent in volume and value terms, respectively, while the number of registered customers rose by 54 per cent to 251 million at end-March 2018 from 163 million at end-March 2017. | Table IX.1 Payment System Indicators – Annual Turnover | | Item | Volume (million) | Value (₹ billion) | | 2015-16 | 2016-17 | 2017-18 | 2015-16 | 2016-17 | 2017-18 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Systemically Important Financial Market Infrastructures (SIFMIs) | | | | | | | | 1. RTGS | 98.3 | 107.8 | 124.4 | 8,24,578 | 9,81,904 | 11,67,125 | | Total Financial Markets Clearing (2+3+4) | 3.1 | 3.7 | 3.5 | 8,07,370 | 10,56,173 | 10,74,802 | | 2. CBLO | 0.2 | 0.2 | 0.2 | 1,78,335 | 2,29,528 | 2,83,308 | | 3. Government Securities Clearing | 1.0 | 1.5 | 1.1 | 2,69,778 | 4,04,389 | 3,70,364 | | 4. Forex Clearing | 1.9 | 1.9 | 2.2 | 3,59,257 | 4,22,256 | 4,21,131 | | Total SIFMIs (1 to 4) | 101.4 | 111.5 | 127.9 | 16,31,948 | 20,38,077 | 22,41,927 | | Retail Payments | | | | | | | | Total Paper Clearing (5+6) | 1,096.4 | 1,206.7 | 1,170.6 | 81,861 | 80,958 | 81,893 | | 5. CTS | 958.4 | 1,111.9 | 1,138.0 | 69,889 | 74,035 | 79,451 | | 6. Non-MICR Clearing | 138.0 | 94.8 | 32.6 | 11,972 | 6,923 | 2,442 | | Total Retail Electronic Clearing (7+8+9+10+11+12) | 3,141.5 | 4,222.9 | 6,382.4 | 91,408 | 1,32,324 | 1,93,112 | | 7. ECS DR | 224.8 | 8.8 | 1.5 | 1,652 | 39 | 10 | | 8. ECS CR | 39.0 | 10.1 | 6.1 | 1,059 | 144 | 115 | | 9. NEFT | 1,252.9 | 1,622.1 | 1,946.4 | 83,273 | 1,20,040 | 1,72,229 | | 10. IMPS | 220.8 | 506.7 | 1,009.8 | 1,622 | 4,116 | 8,925 | | 11. Unified Payment Interface | - | 17.9 | 915.2 | - | 69 | 1,098 | | 12. National Automated Clearing House (NACH) | 1,404.1 | 2,057.3 | 2,503.3 | 3,802 | 7,916 | 10,736 | | Total Card Payments (13+14+15) | 2,707.3 | 5,450.1 | 8,207.6 | 4,483 | 7,421 | 10,607 | | 13. Credit Cards | 785.7 | 1,087.1 | 1,405.2 | 2,407 | 3,284 | 4,590 | | 14. Debit Cards | 1,173.6 | 2,399.3 | 3,343.4 | 1,589 | 3,299 | 4,601 | | 15. Prepaid Payment Instruments (PPIs) | 748.0 | 1,963.7 | 3,459.0 | 488 | 838 | 1,416 | | Total Retail Payments (5 to 15) | 6,945.2 | 10,879.7 | 15,760.6 | 1,77,752 | 2,20,703 | 2,85,612 | | Grand Total (1 to 15) | 7,046.6 | 10,991.2 | 15,888.5 | 18,09,701 | 22,58,780 | 25,27,539 | Note: 1. Real Time Gross Settlement (RTGS) system includes customer and inter-bank transactions only.

2. Settlement of Collateralised Borrowing and Lending Obligation (CBLO), government securities clearing and forex transactions are through the Clearing Corporation of India Ltd. (CCIL). Government Securities include outright trades and both legs of repo transactions.

3. The figures for cards are for transactions at point of sale (POS) terminals only, which include online transactions.

4. Figures in the columns might not add up to the total due to rounding off of numbers.

5. ECS DR: Electronic Clearing System Debit, ECS CR: Electronic Clearing System Credit.

Source : RBI. | IX.5 The acceptance infrastructure also witnessed substantial growth with the number of Point of Sale (POS) terminals deployed increasing by 24 per cent from 2.53 million in 2016-17 to 3.14 million in 2017-18. However, during the same period, the ATMs deployed witnessed a marginal decline from 2,22,475 to 2,22,247. Authorisation of Payment Systems IX.6 Digital mode of payments was facilitated through 84 authorised payment system operators (PSOs) as against 87 in June 2017, comprising PPI issuers, cross-border money transfer service providers-in bound, White Label ATM Operators (WLAOs), Trade Receivables Discounting System (TReDS) operators, ATM networks, instant money transfer service providers, card payment networks and Bharat Bill Payment Operating Units (BBPOUs), besides the Clearing Corporation of India Limited (CCIL) and the National Payments Corporation of India (NPCI). The number of non-bank entities authorised for operating PPIs decreased to 49 from 55 in the previous year due to the merger/conversion of some entities into payment banks and voluntary surrender of license by the entities. While 58 banks were granted approval to issue PPIs, 430 banks were permitted to provide mobile banking services up to end-June 2018. Agenda for 2017-18: Implementation Status IX.7 In the ‘Payment and Settlement Systems in India: Vision 2018’, the Department had identified four strategic pillars for achieving its vision. The developments in each of the areas are detailed below. Responsive Regulation Policy Framework for CCPs IX.8 The Central Counterparties (CCPs) are critical components of Financial Market Infrastructures (FMIs). By providing guaranteed settlement services in the markets, the CCPs protect the participants from losses due to counterparty defaults, replacement-cost risk, and principal risk. In order to ensure efficient functioning of the CCPs, the Reserve Bank is in the process of issuing directions on (i) governance, (ii) net worth requirement and (iii) regulation of foreign CCPs. Review of WLA Guidelines IX.9 Guidelines for setting up and operating white label ATMs (WLA) in India were first issued in June 2012. Based on experience and industry representations, the guidelines have been amended from time to time. To further facilitate the utilisation of WLAs, WLAOs have been permitted to source cash from retail outlets. Notwithstanding this, the WLAOs have not been able to meet the targets prescribed under the respective schemes. In view of this, a complete review of WLA guidelines would be undertaken in 2018-19 from the perspective of entry point norms of WLA, deployment targets/ entry of new players, etc. Review of PPI Guidelines IX.10 The Reserve Bank released the ‘Master Direction on Issuance and Operation of Prepaid Payment Instruments (PPIs)’ on October 11, 2017. The major modifications made in the Master Direction relate to changes in entry point norms, KYC requirements, consolidation of various categories of PPIs, safety and security of transactions as well as systems, customer protection and grievance redressal mechanism, fraud prevention and risk management framework. In addition, the Master Direction prescribes a path for implementation of interoperability amongst PPIs issued by banks and authorised non-banks. Robust Infrastructure Rationalisation of MDR for Debit Card Transactions IX.11 In order to achieve the twin objectives of promoting debit card acceptance by a wider set of merchants (especially the small merchants) and ensuring sustainability of the business for the entities involved, the Merchant Discount Rate (MDR) framework was rationalised effective January 1, 2018. The revised framework categorises merchants on the basis of turnover, adopts a differentiated MDR for quick response (QR)-code based transactions and specifies a ceiling on the maximum permissible MDR for both ‘card present’ and ‘card not present’ transactions. Migration to CTS-2010 Standards IX.12 Banks are required to withdraw non- Cheque Truncation System (CTS) - 2010 Standard cheques in circulation by creating awareness among customers. The share of non-CTS-2010 cheques in total cheque volume has been brought down from 4 per cent in 2014 to below 0.25 per cent in 2018. In view of the declining trend in the volume of such instruments presented in clearing, the frequency of separate sessions for clearing of non-CTS-2010 cheques in the three CTS grid centres has been reduced to once a fortnight from July 1, 2018 (every alternate Wednesday beginning July 4, 2018). Banks have been advised to convert the existing post-dated cheques (debit mandates) to National Automated Clearing House (NACH) and not to accept additional post-dated cheques. Effective Supervision Oversight Framework for Authorised Payment Systems IX.13 To realise the stated goals in the ‘Payment and Settlement Systems in India: Vision 2018’ document under the changing payments ecosystem in the country, a review of the policy framework for oversight of payment systems was undertaken. The draft oversight framework for existing and new payment systems prescribing the intensity of oversight proportionate to systemic risks or system-wide risks posed by the participants of the payment system is being finalised. Data Reporting by PSOs in XBRL Format IX.14 As part of the off-site surveillance process, the PSOs periodically submit returns on the issuance and usage of payment instruments issued by them. The periodic returns are being migrated to the eXtensible Business Reporting Language (XBRL) system to facilitate automated reporting from entities and provide better quality of information for decision-making. Onsite Inspection IX.15 During 2017-18, onsite inspection of 21 entities, viz., CCIL, NPCI, 18 PPI issuers and 1 WLA operator was carried out by the Bank. In the NPCI inspection, special emphasis was laid on assessing the various risks (i.e., legal, operational, settlement and reputation) and steps/measures are being put in place by NPCI for mitigating the same. Issues related to governance and human resources were also covered during the inspection. IX.16 Inspection of CCIL was undertaken in September 2017. CCIL was assessed for its performance as a central counterparty and trade repository against the 24 principles for financial market infrastructures (PFMIs) using the ‘Committee on Payments and Market Infrastructures - International Organization of Securities Commissions (CPMI-IOSCO) - Assessment Methodology’. As a measure of enhanced transparency, CCIL continued to disclose its self-assessment in compliance with the PFMIs on an annual basis, as per the ‘Disclosure Framework and Assessment Methodology’, prescribed in the PFMIs. CCIL also published its quantitative disclosures on a quarterly basis as per the public disclosure standards for CCPs. IX.17 In view of the increased threat of wholesale payments fraud, the CPMI established a task force to look into the security of wholesale payments and develop a strategy with the aim to encourage and help focus industry efforts to reduce the risk of wholesale payments fraud and support financial stability. A gist of the elements of the strategy to reduce risks in wholesale payments relating to endpoint security is provided in (Box IX.1). Box IX.1 Endpoint Security in RTGS An endpoint in the wholesale payment ecosystem is defined to be a point in place and time at which payment instruction information is exchanged between two parties in the ecosystem. Endpoint security aims to adequately secure every endpoint connecting to a network to block access attempts and other risky activity at these points of entry. The CPMI has released a report titled, ‘Reducing the Risk of Wholesale Payments Fraud Related to Endpoint Security’ in which it has stressed the need for a holistic approach to counter the risk of frauds. The report highlighted the requirement for a coordinated effort to ensure the safety of wholesale payments that was essential due to the interconnectedness of the financial networks. The elements of the strategy to reduce risks in wholesale payments fraud relating to endpoint security were identified as under: • Element 1: Identify and understand the range of risks related to endpoint security that are faced by the participants individually and collectively. • Element 2: Establish endpoint security requirements for its participants for fraud prevention, detection and response. • Element 3: Promote adherence to the respective endpoint security requirements. • Element 4: Provide and use information and tools to improve fraud prevention and detection. • Element 5: Procedures and practices should be in place to respond to actual or suspected fraud in a timely manner. • Element 6: Support ongoing education, awareness and information-sharing. • Element 7: Monitor evolving endpoint security risks and risk controls, review and update the endpoint security requirements, procedures, practices and resources. |

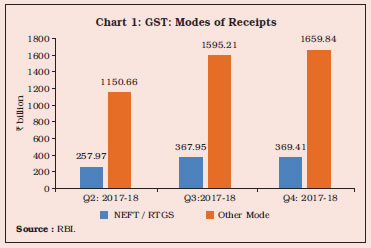

Customer Centricity Harmonisation of Customer Grievance Redressal Mechanism (CGRM) IX.18 The Bank held discussions with various stakeholders in the payments ecosphere to harmonise the CGRM across various products. The proposed harmonisation will bring uniformity in various aspects, viz., dispute redressal mechanism, cost structure, turn-around time for redressal of customer grievances and refund process for failed / rejected transactions. The inputs so received are being examined and consolidated. Meanwhile, a robust CGRM has been put in place for PPI issuers. Disclosure Framework for PSOs IX.19 In order to bring in further transparency in customer charges, the Bank initiated measures to ensure that the PSOs clearly disclose the fees and terms and conditions of their services to the customers. Confirmation of Payment in NEFT IX.20 The feature of sending positive confirmation to remitters regarding the completion of funds transfer is already live in the NEFT system and almost all banks are now sending the positive confirmation message to the remitter. As envisaged in the ‘Payment and Settlement Systems in India: System Vision 2018’ document, the feature is being further strengthened by continuously monitoring the bank-wise percentage of positive confirmation messages sent. The issue is also being taken up with banks having low percentage. Data Storage IX.21 As announced in the First Bi-Monthly Monetary Policy Statement for 2018-19, in order to ensure unrestricted supervisory access to data of all payment systems operating in the country, all system providers were advised to ensure that the entire data relating to payment systems operated by them are stored in a system only in India. However, the data pertaining to the foreign leg of the payment transaction can be stored abroad as well. Other Developments FSAP Assessment IX.22 The second comprehensive Financial Sector Assessment Program (FSAP), a joint programme of the International Monetary Fund (IMF) and the World Bank, was conducted for India in 2017. For the FMIs, the FSAP team assessed the Bank-designated qualified central counterparty, CCIL, which plays a critical role in money, G-sec, forex and derivative market transactions. The assessment against the PFMIs concluded that CCIL systems observe or broadly observe 21 out of the 24 principles, with the remaining three principles being not applicable. The report has been made public. Unified Payments Interface (UPI) – Additional Features IX.23 To further widen the scope and to increase digital payments, various new features have been approved in UPI. The major additional features include increasing the per transaction limit of an UPI transaction to ₹2.0 lakh from the existing limit of ₹1.0 lakh, allowing mandate with blocking of funds, overdraft account as an underlying account, processing of domestic leg of foreign inward remittance, and inclusion of State Cooperative Banks (StCBs) and District Central Cooperative Banks (DCCBs) as issuers, through sub-membership route. Agenda for 2018-19 Responsive Regulation Regulation of Payment Gateway Service Providers and Payment Aggregators IX.24 The growth of electronic payments for online transactions has led to an increasing role of payment gateway service providers. The current guidelines on payment gateway operations (monitored through banks) are indirect and address only a few specific aspects of their functioning. Given the increasing role of payment gateways, the guidelines will be reviewed for the payment related activities of these entities. Robust Infrastructure Adoption of ISO for Messaging in NEFT IX.25 The Bank will examine the feasibility and timeline for implementation of the International Organization for Standardization (ISO) standard for messaging in NEFT. Effective Supervision Framework for Testing Resilience IX.26 With the introduction of alternate modes of electronic payments for financial markets as also for businesses and individuals, the resiliency of the payment systems has gained importance. Here, resiliency refers to the ability to continue to operate even if a system has failed completely by switching activity to a separate system or process or a combination of both. A framework to test the resilience of both retail and large value systems in the country would be formulated. Collection of Data on Frauds in Payment Systems IX.27 The Bank currently collects data on frauds from the PSOs. In order to further strengthen the confidence in the payment systems and minimise instances of frauds, there is a need to monitor the types of frauds that may be taking place in various payment systems. Accordingly, a comprehensive framework for collection of data on frauds in the payment systems would be drawn up in consultation with the industry. Customer Centricity Customer Surveys IX.28 The Bank will engage with the stakeholders to conduct customer surveys on specific aspects of the payments systems to ascertain customer habits with respect to payment choices. The same would help in framing regulatory framework and policies apart from empowering users through awareness intervention. Framework to Limit Customer Liability for Nonbank Authorised PPI Issuers IX.29 The framework for limiting liability of customers in unauthorised electronic payment transactions in PPIs issued by banks is already in place. The proposed roll-out of interoperability among bank and non-bank PPIs will further strengthen the case of having similar instructions for non-bank PPIs as well. The guidelines for enabling the same for PPIs issued by non-banks will be put in place during the year. DEPARTMENT OF INFORMATION TECHNOLOGY (DIT) IX.30 The main focus of the Department of Information Technology (DIT) continued to be working towards ‘service with security’ through the provision of robust technology infrastructure to ensure smooth functioning of the critical and systemically important payment and settlement systems in the country. With the emerging threat landscape, where organised cyber-crime and cyber warfare are gaining prominence, the Department is working towards ensuring continuous protection against the changing contours of cyber security threat. Agenda for 2017-18: Implementation Status e-Kuber for GST IX.31 The Reserve Bank’s e-Kuber system has been assigned the responsibility of functioning as an ‘aggregator’ for all-India collections under the Goods and Services Tax (GST) regime. To develop it into a one-stop source of data reporting, server-to-server integration was established with central government, all the 36 state governments and union territories, 25 agency banks and GST Network (GSTN) (Box IX.2). e-Kuber for Government e-Receipts and e-Payments IX.32 The standardised e-receipt and e-payment models were rolled out for various states and government departments. The standardised e-payment model, based on ISO 20022 messaging formats, envisages straight-through-processing (STP) of electronic payment instructions, sent by state governments through the interface with e-Kuber. By end-March 2018, 11 state governments, viz., Andhra Pradesh, Assam, Bihar, Karnataka, Kerala, Odisha, Telangana, Tripura, Uttarakhand, Uttar Pradesh, and West Bengal have adopted this model to disburse payments electronically using e-Kuber. During 2017-18, an aggregate of ₹3.9 trillion was disbursed to 88.6 million beneficiaries by the state governments through e-Kuber as against ₹3.2 trillion to 74.3 million beneficiaries during 2016-17. By end-March 2018, a total of 14 state governments, viz., Andhra Pradesh, Bihar, Chhattisgarh, Gujarat, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Tamil Nadu, Telangana, Uttarakhand and West Bengal, have adopted the e-receipt model. Box IX.2 Role of the Reserve Bank in GST Payments Infrastructure The Sub-Committee on GST Payment Process, set up by the Empowered Committee of State Finance Ministers had recommended in April 2015 that the Reserve Bank’s e-Kuber system could be designated as an all-India aggregator for GST collections. Accordingly, the Reserve Bank commissioned and successfully implemented an end-to-end automated system for flow of taxation data, payments and reporting using ISO 20022 message formats from July 01, 2017. A Service Gateway with advanced security features has also been implemented for secured exchange of information amongst the stakeholders, viz., Central Board of Excise & Customs (CBEC), Government of India; all the 36 states and union territories, 25 agency banks and GSTN. The e-Kuber infrastructure has also been enhanced considerably for handling GST transactions. As a result, the GST payers may now remit the tax directly to the government account/s maintained with the Reserve Bank, through their banks using NEFT and RTGS. Under NEFT/RTGS mode, credit of tax to the government account happens directly on the same day, whereas in other modes of GST payments, the government account is credited on T+1 basis. Further, under the earlier tax collection system, only agency banks were authorised to collect taxes on behalf of governments, whereas under the new system, GST payers can remit the tax directly to the government account/s from their account in any bank (including other than authorised agency banks). The new process is expected to facilitate improved operational efficiency, both for the tax payers and the government.  On an average, about 18-19 per cent of the GST collections, both in terms of value and volume, are received directly in government account through NEFT/RTGS payment modes, facilitating better cash management for the governments (Chart 1). An online reconciliation mechanism for GST transactions, called Memorandum of Errors (MoE), has been designed in coordination with the CBEC, Government of India. This process is undergoing testing among all the stakeholders including the Reserve Bank, the GSTN, agency banks and CBEC. The MoE process would facilitate paperless processing and resolution of reconciliation issues among the stakeholders with the Reserve Bank’s e-Kuber system as the fulcrum. |

Multi Netted Settlement Batch (MNSB) Module in RTGS system IX.33 The infrastructure relating to critical payment system of RTGS was augmented during the year by allowing non-RTGS members to process and settle in RTGS. Payment and Settlement System Applications IX.34 In order to improve customers’ convenience and enhance the efficiency of the NEFT system, additional settlements at half-hour intervals were introduced, which took the total number of half hourly settlement batches to 23. The half hourly settlements had accelerated the funds transfer process and provided faster credit to the destination accounts. The change in the NEFT application software for accommodating additional settlements was carried out in all the banks simultaneously without disrupting operations. IX.35 During 2017-18, both RTGS and NEFT hosted at the Data Centres functioned without any disruptions with record per-day processing volumes. The RTGS recorded an all-time high of 0.91 million transactions on March 31, 2018 as against 0.74 million in the previous year. The NEFT registered 15.4 million transactions on March 31, 2018 as against 12.5 million transactions last year, followed by the highest volume of 18.8 million so far on April 3, 2018. These systems have proven to be scalable and shown the ability to handle increasing volumes. Enhanced Security at Data Centres IX.36 In order to ensure security of the Bank’s IT infrastructure against rising cyber threats, an Information Security Operation Centre (iSOC) was made operational to monitor, detect, prevent and mitigate various types of information and cyber security risks. The establishment of iSOC and its 24×7 vigil and monitoring resulted in the detection of attempts of cyber-attacks like unauthorised login, distributed denial of service (DDoS), and traffic to/fro malicious command and control sites. Vulnerability alerts received from various agencies were appropriately dealt with. Augmentation of IT Infrastructure IX.37 IT infrastructure at the Bank’s Data Centres was augmented to handle the increasing volumes of e-Kuber, NEFT and government transactions in a safe and secure environment. Both hardware and software systems were upgraded to provide additional layers of security for IT operations. Security Awareness and Cyber Drills IX.38 The department has been conducting awareness programmes across offices through awareness sessions, circulars / advisories and cyber security drills. Agenda for 2018-19 Improvement in the Currency Management System IX.39 The Integrated Computerised Currency Operations Management System (ICCOMS), currently in use for currency management, will be migrated to the currency module of e-Kuber. Presently, the pilot run of the currency module at the Bank’s offices is underway. The enhancement to e-Kuber would enable the Bank to have a near real-time view of the balances in the currency chests and facilitate efficient management of currency with the automation of processes. The system would also have linkage with note printing presses and provision to track currency in transit. IX.40 The next-generation currency management portal version 2.0 is under development and is expected to be launched with the currency management functionalities during 2018-19. The currency management and other services running on the existing portal will be migrated to the new portal in phases. Resolving Reconciliation Issues in GST Transactions IX.41 An automated reconciliation mechanism for GST transactions is being worked out to reduce reconciliation issues and pave the way for a nil reconciliation era. The Memorandum of Errors (MoE) process is currently under test phase before deployment. Access Control Management System (ACMS) IX.42 A new enhanced ACMS including visitor and vendor management will be implemented at all offices of the Bank by integrating the Active Directory and SAMADHAN for attendance. Efforts towards a Better Security Culture IX.43 The Bank will proactively initiate the process of developing a cyber-security culture, endeavour to make cyber security a responsibility and ensure confidentiality, integrity and availability of information system and resources. |