Today, the Reserve Bank released its web publication entitled ‘Quarterly Basic Statistical Return (BSR)-1 on Credit by Scheduled Commercial Banks (SCBs)1- September 20252 on its ‘Database on Indian Economy’ portal (https://data.rbi.org.in > Homepage > Publications). It captures various classificatory characteristics of bank credit such as occupation/activity/organisational sector of the borrower, types of accounts and their interest rates based on account-level reporting. Data reported by SCBs {excluding Regional Rural Banks (RRBs)} are presented across bank groups, population groups3 and States. Highlights: -

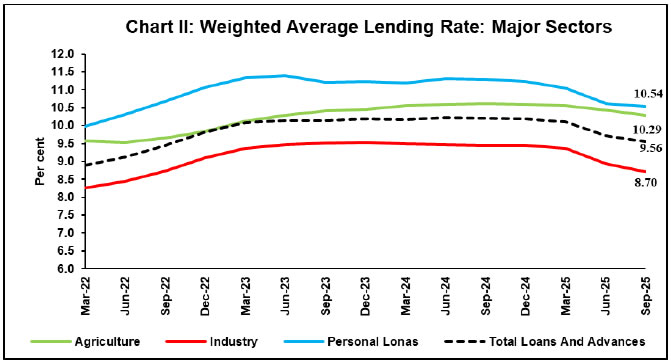

The weighted average lending rate (WALR) on outstanding credit exhibited a notable decline of 64 basis points (bps) from 10.20 per cent in September 2024 to 9.56 per cent in September 2025 (Chart-II). Among major loan categories, housing loans witnessed a decline of 92 bps in WALR during the same period.  -

Private sector banks' credit growth remained lower than that of public sector banks since September 2024, resulting in marginal increase in the share of later to 53.9 per cent in September 2025 from 53.2 per cent in September 2024. -

Personal loans grew (y-o-y) by 12.5 per cent in September 2025, higher than overall credit growth. All major categories of personal loans viz., housing, education, vehicle, and other personal loans, however, witnessed moderation in growth when compared to the previous year. -

Consistent with overall decline in credit growth compared to the previous year, credit growth in agriculture decelerated to 10.4 per cent in September 2025 from 13.2 per cent in September 2024; similar trend in industrial sector has also been observed as its growth declined to 8.4 per cent from 10.4 per cent during the same period. -

The household sector's5 share in total credit increased to 58.5 per cent in September 2025 from 57.4 per cent a year ago. Credit to individuals grew by 12.3 per cent in the said period and the same for other household segments expanded by 14.9 per cent. -

The private corporate sector accounted for one-fourth of total credit, with annual growth increased to 9.0 per cent in September 2025 from 7.9 per cent in the last quarter. Ajit Prasad

Deputy General Manager

(Communications) Press Release: 2025-2026/1583

|

|