Suggestions & feedback are welcome

Email

Foreword ';Take up one idea. Make that one idea your life; think of it; dream of it; live on that idea. ... This is the way to success.'; - Swami Vivekananda1. This Booklet is a narrative of how the carefully thought out steps taken by the Reserve Bank of India (RBI) have resulted in transforming India into a country riding the crest of a wave in the evolution of digital payments. Chief among those steps was the conceptualisation and establishment of institutions - Institute for Development and Research in Banking Technology (IDRBT), National Payments Corporation of India (NPCI) and Clearing Corporation of India Limited (CCIL) - that laid the foundation of India's payment systems. The bouquet of digital payment products that is now available in the country and that enriches the consumer experience with choices, convenience and confidence in the digital payment ecosystem, owes a lot to these institutions. Over the course of this journey, significant upgradation was achieved by way of enhancement of acceptance infrastructure, boost to financial inclusion and adoption of digital modes for Government payments backed by the national identity authentication, Aadhaar framework. To win the trust of customers, an expanding payment system was overlaid with a reliable supervision and settlement mechanism. Interoperability among payment systems facilitated unparalleled ease of transactions while robust customer protection measures have made India's retail payment system one of the safest in the world. The journey has only just begun, but India is already seen as a player at the global forefront in the domain of digital payments. This Booklet, which focusses on the decade 2010-20, gives the legal and regulatory environment underpinning the digital payment systems, the various payment system choices available to consumers, extent of usage and so on. The Booklet also takes up a self-analysis of the domains explored and territories not charted through the course of this journey. To place things in perspective, an exercise was undertaken in 2019 to benchmark India's payment systems with 20 other countries. While realising that 'well begun is half done', RBI is mindful of the challenges ahead. Various initiatives are underway to realise India's vision on payment systems. RBI seeks to usher in a payment ecosystem that enables safe, quick and affordable digital payments to everyone across the length and breadth of the country as well as in the universe of cross-border payments and transactions. I congratulate the efforts of the Department of Payment and Settlement Systems of RBI in bringing out this comprehensive Booklet which can even serve as a reference document for those interested in following payment system developments in the country. Shaktikanta Das

Governor

Reserve Bank of India _______________________________________________

Foreword Payment systems are not only the lifeline of an economy but are increasingly being recognised as a means of achieving financial inclusion and ensuring that economic benefits reach the bottom of the pyramid. In view of the above India has enacted a separate law for Payment and Settlement Systems which has enabled an orderly development of the payment eco-system in the country. The first Payment and Settlement Systems Vision announced by the Reserve Bank in 2001, and successive vision statements every three years later, have made sure that payment and settlement systems receive focussed attention. The present state-of-the-art payment systems that are affordable, accessible, convenient, efficient, safe and secure are a matter of pride for the nation. The systems and efforts have not only resulted in a rapid growth in digital payments, but have also led to unique innovations. Small steps taken over time have transformed into giant strides in respect of payment and settlement systems and retail payments space. To document these achievements for the wider public, the Reserve Bank has prepared this Booklet which contains payment systems managed by the country and developments in this sphere in the last one decade. The Booklet attempts to cover all payment systems in India, their enablers, institutions that run these systems and supporting infrastructure acceptance. The challenges encountered, and prospects are also touched upon. I congratulate the Department of Payment and Settlement Systems for undertaking this initiative. B. P. Kanungo

Deputy Governor

Reserve Bank of India

Foreword The decade of 2010-20 can be termed as the decade of payments in India. There have been many defining moments that transformed the payments ecosystem of the country and attracted international recognition. During the decade, the country has witnessed the introduction of innovative payment systems, entry of non-bank players, and a gradual shift in the customer behaviour from cash to digital payments. We have an unique secure and interoperable Unified Payments Interface (UPI) for retail payments, biometric based as well as the QR code-based payments. Throughout this journey, the Reserve Bank has played the role of a catalyst and facilitator, regulator and supervisor, as the occasion demanded, towards achieving its public policy objective of developing and promoting a safe, secure, sound and efficient payment system. Reserve Bank has always fostered innovation and growth of payment and settlement systems without deviating or losing its focus towards constant improvement in safety, security, soundness, efficiency and effectiveness. All these efforts have resulted in availability of a wide choice of 'anytime and anywhere' interoperable payment systems for the common man at reasonable rates. Reserve Bank had earlier come up with a Booklet on its payment systems in the years 1998 and 2008. Building on the earlier exercises, this Booklet is an attempt to spread awareness about the various developments around payments landscape in the country during the last decade. It gives an overview of the products, players, infrastructure and institutions in the payments ecosystem along with regulatory measures of Reserve Bank. It also offers the reader a peek into the future of the payment systems in the country. Efforts of the team in the Department of Payment and Settlement Systems to bring out this concise yet comprehensive Booklet deserve appreciation. T. Rabi Sankar

Executive Director

Reserve Bank of India

Preface India has been enjoying a healthy evolution of payment systems over the past three decades. This has been the result of the measured road maps periodically adopted by the Reserve Bank, as a developer in the initial years and as a catalyst and facilitator in later years. Though the advancements in the payment systems were gradual in the early days, the two decades of this century have truly witnessed a revolution. From barter system to Unified Payments Interface (UPI), payment systems in India have come a long way. Our payment systems are not only best-in-class, but also offer a bouquet of systems suited to serve every Indian. Proactive regulation and supervision with safety and customer centric initiatives have been the hallmark of developments in the retail payments systems arena and it is a proud feeling to be recognised as a leader across the globe in this sphere. Reserve Bank has been continuously setting goals and targets in the form of Payment Systems Vision document, every three years since 2001, presenting the road map for improving the payment systems of our nation. Empowering every Indian with access to a bouquet of e-payment options that is safe, secure, convenient, quick and affordable is Reserve Bank's Payment System's Vision for 2019-2021. This Booklet takes us through the amazing journey of payment systems in India in the previous decade. A journey which has transformed the way banking is done in the country today. As Brett King, the author of 'Bank 4.0', rightly puts it: ';Banking is no longer somewhere you go, it's something you do.'; I take this opportunity to convey my kudos to the thought leaders in Reserve Bank, earlier and present, for nurturing and guiding payment system development. I and my team remain committed to continue this catalytic and facilitating role for enabling innovations in payment systems, while unyieldingly performing our responsibilities as regulator and supervisor. We rededicate ourselves to pursue this mission relentlessly and place India at the highest pedestal amongst all countries in payments systems space for years to come. It has been my privilege and pleasure to be part of this memorable journey towards excellence. P. Vasudevan

Chief General Manager

Department of Payment and Settlement Systems

Reserve Bank of India

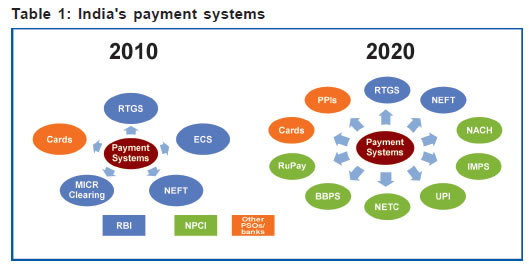

Chapter 1

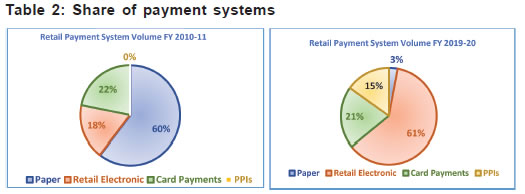

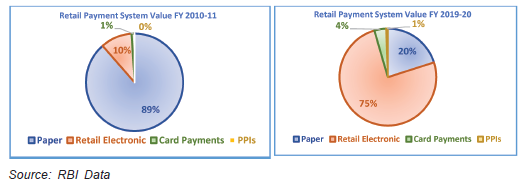

Introduction 1.1 The need for payments and settlements is as old as the need for goods and services. The earliest known Payment and Settlement System (PSS) was the barter system facilitating exchange through goods and / or services. With the concept of money, people progressed to settling their economic transactions using currency notes and coins. The evolution of the banking system and advent of bank accounts led to an easy and safe method for making payments by transfer of money through bank accounts. This transaction required a payment instrument, and cheque emerged as the primary instrument for payment transactions. Thus, started the tale of payment systems. 1.2 An efficient payment system promotes market efficiency and reduces the cost of exchanging goods and services. By the same token, its failure can result in loss of confidence in the financial system and in the very use of money. 1.3 In India, the oversight of the payment systems is entrusted to the Reserve Bank of India (RBI) where the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS), chaired by the Governor, RBI, spearheads this responsibility. The creation of a new department viz., Department of Payment and Settlement Systems (DPSS) by RBI in the year 2005 to focus exclusively on payment and settlement systems, and subsequent legislation of the Payment and Settlement Systems Act, 2007 (PSS Act) set the stage for a new era in the history of payment systems in the country. Payment and Settlement Systems Act, 2007 1.4 A sound and appropriate legal framework is a necessary requirement for efficient payment systems. The legal environment should include (i) laws and regulations of broad applicability that address issues such as insolvency and contractual relations between parties; (ii) laws and regulations that have specific applicability to payment systems (such as legislation on electronic signature, validation of netting, and settlement finality); and (iii) the rules, standards, and procedures agreed to by all participants of a payments system. Considering the importance of regulation for the development and orderly functioning of not only financial services but also payment systems, the Payment and Settlement Systems Act was legislated in 2007. India is one of the few countries that has a specific payment systems law to ';..provide for the regulation and supervision of payment systems in India and to designate RBI as the authority for the purpose and for matters connected therewith or incidental thereto.'; RBI's scope for regulation extends to the whole gamut of payment systems and instruments as also services provided by banks and non-banks. 1.5 In terms of Section 4 of PSS Act, no person other than RBI can commence or operate any payment system in India unless authorised by it. RBI has since authorised various Payment System Operators (PSOs) such as CCIL (financial market infrastructure - central counterparty), NPCI (retail payments organisation), card payment networks, cross-border inbound money transfers entities, ATM networks, PPI issuers, Instant Money Transfer operators, TReDS platform providers and Bharat Bill Payment Operating Units (BBPOUs) to operate payment systems in the country. PSS Act and the Payment and Settlement Systems Regulations, 2008 framed thereunder, provide necessary statutory backing to the RBI to exercise oversight over the payment and settlement systems in the country. Components of Payment and Settlement Systems 1.6 The Bank for International Settlements' (BIS) Committee on Payments and Market Infrastructures (CPMI) defines payment systems transactions to include the total transactions undertaken by all payment systems in the country. Considering this definition, payment systems transactions in India would comprise of transactions processed and settled through (a) Paper Clearing [Magnetic Ink Character Recognition (MICR), Non-MICR, Cheque Truncation System (CTS), Express Cheque Clearing System (ECCS)]; (b) Bulk electronic transaction processing systems like Electronic Clearing Service (ECS), with its variants Regional ECS and National ECS; National Automated Clearing House (NACH) - Debit and Credit; (c) Card Payments (Debit, Credit and Electronic); (d) Large Value [Real Time Gross Settlement (RTGS)]; (e) Retail [National Electronic Funds Transfer (NEFT)]; (f) Fast Payments [Immediate Payment Service (IMPS), Unified Payments Interface (UPI)]; and (g) e-Money [Prepaid Payment Instrument (PPI) Cards and Wallets). Except (a) above and cash transactions, all other payments constitute digital transactions. 1.7 In addition to the above payment and settlement systems, RBI has also institutionalised a well-established clearing and settlement system for Government Securities. 1.8 The digital revolution is taking the world by storm and no other area has witnessed a metamorphosis as has been seen in the payment and settlement arena, resulting in a myriad of payment options for the consumer. In the last 10 years, India has witnessed an exponential growth in payment systems and a significant shift in payment preference. 1.9 The shift in payment preference in the last 10 years is evidenced by the fact that the volume of paper clearing, which comprised of 60% of total retail payments in the financial year (FY) 2010-11, shrunk to 3% in the FY 2019-20. This striking shift in payment preference has been due to the creation of robust electronic payment systems such as RTGS, NEFT and ECS that has facilitated seamless real time or near real time fund transfers. In addition, this decade has witnessed introduction of innovative payment systems that provide instant credit to the beneficiary, with the launch of fast payment systems such as IMPS and UPI that are available to consumers round the clock for undertaking fund transfers, and introduction of mobile based payment systems such as Bharat Bill Payment System (BBPS), PPIs to facilitate payment of bills and purchase of goods and services and National Electronic Toll Collection (NETC) to facilitate electronic toll payments. The convenience of these payment systems ensured rapid acceptance as they provided consumers an alternative to the use of cash and paper for making payments. The facilitation of non-bank FinTech firms in the payment ecosystem as PPI issuers, BBPOUs and third-party application providers in the UPI platform have furthered the adoption of digital payments in the country.  1.10 The advent of innovative electronic payment systems that leverage on technology which can be used through internet and mobile, has led to electronic payment systems dominating the retail payment space with around 61% share in terms of volume and 75% share in terms of value during the FY 2019-20. Increased mobile and internet penetration in the country has resulted in significant shift towards use of mobile / internet-based payment systems for effecting payments for purchase of goods and services. Introduction of lightweight acceptance infrastructure (QR codes) has further facilitated the use of mobile based payments across the country. Data shows that low value payments dominate the volume / turnover, and products that afford real time, instantaneous transfers are the most preferred modes of payment.   1.11 The last decade, therefore, has seen an explosion of payment systems with consumers having multiple options to choose from. In the approach towards payment system development in the country, safety and security has been of paramount importance to RBI; followed by efficiency, accessibility, affordability and convenience. Payment systems have always been regarded as a public good and an ancillary activity of banks which can be leveraged as a base to provide various other services. Given the sizeable populace of the country, the endeavour is to make the payments space a large-volume, low-average-value and low-cost game for sustained presence and continuance. 1.12 A study on payment systems is incomplete without touching some of the institutions which contributed to the efficacy and efficiency of the systems, notable among them being the Institute for Development and Research in Banking Technology (IDRBT) and the National Payments Corporation of India (NPCI) which have contributed to making India's payments ecosystem the showpiece that it is today. It is with great foresight that RBI not only established these institutions but also nurtured them till they were able to stand on their feet.1 1.13 This booklet is the third in the series of booklets on payment systems published by RBI. The first was taken out in 1998 and the second one in 2008. This booklet covers the journey of India's payments journey during the past ten years. Major announcements during the ten year period are chronicled in Appendix 1. The trends in the payment systems in the past ten years are brought out in Appendix 2. In addition, the acronyms used through this booklet are referenced in Appendix 3.

Chapter 2

Institution Building Institute for Development and Research in Banking Technology,

Indian Financial Technology and Allied Services and

Clearing Corporation of India Limited Institute for Development and Research in Banking Technology (IDRBT) 2.1 During the initial reforms in the Indian banking and financial sector, a need was felt to develop an institute of higher learning, which would also provide information technology support to banks and financial institutions. Dr. Rangarajan Committee reports in the years 1984 and 1989 recommended computerisation of banking operations at various levels. Subsequently, a committee on ';Technology Upgradation in the Payment Systems'; was constituted in 1994 which recommended setting up of an Information Technology Institute for Research and Development as well as Consultancy in the application of technology to the banking and financial sector of the country. This led to the birth of IDRBT on June 10, 1996 as a Society under the Society Registration Act, with the objective to spearhead technology absorption in the banking and financial sector. 2.2 In its initial years, IDRBT primarily focused on developing and managing technology infrastructure for the banking and financial sectors. It developed the Indian Financial Network (INFINET), the Structured Financial Messaging System (SFMS), the Indian Banking Community Cloud (IBCC), the National Financial Switch (NFS), etc. These systems are the backbone around which PSS in India rally even today. IDRBT is also the Certifying Authority for digital certificates. Research and academic activities at this institute not only engendered the technical know-how for creation of these services, but also helped in training and updating skills in the banking sector. 2.3 IDRBT has recently undertaken focused initiatives on major areas of research on the systemic requirements of the banking system and has set up 6 state-of-the-art Research Centres for aiding and promoting research and development work in the areas of Analytics, Cyber Security, Mobile Banking, Affordable Technologies, Cloud Computing and Payment Systems. The Research Centres are being constantly upgraded with latest systems, devices and tools to keep pace with the ever-changing technology trends. IDRBT has also emerged as a premier institution for imparting training to banks in the payments arena.2 Indian Financial Technology and Allied Services (IFTAS) 2.4 RBI had constituted an External Expert Review Committee (EERC), headed by its former Governor, Dr. C. Rangarajan for evaluating the activities of IDRBT and re-defining its role and suggesting a roadmap for the future. The EERC, which submitted its report in July 2009, recommended that 'to function as a primary institute of excellence in research and development in banking technology, IDRBT should shed its functions of providing various services by hiving off these services.' This led to the creation of IFTAS as a wholly owned subsidiary of RBI. 2.5 Accordingly, IFTAS took over INFINET, SFMS and IBCC services from IDRBT and commenced operations with the aim of providing uninterrupted 24x7 high-quality IT-related services to the Indian banking and financial sector. 2.6 IFTAS was created with the mandate to provide critical infrastructure services to RBI, banks, cooperative societies and other financial institutions. IFTAS now provides the following services: -

INFINET, the communication backbone of the Indian banking and financial sector. -

SFMS, a robust messaging platform used in the RBI operated payment systems, i.e., RTGS and NEFT. -

IBCC, a specialised community cloud for the banking and financial sector. -

Global Interchange for Financial Transactions (GIFT), a one-stop integrated PSS providing an end-to-end straight-through processing (STP) of payment messages (inter-bank transactions) between the source bank & destination through the Central Bank. Clearing Corporation of India Limited (CCIL) 2.7 CCIL is a Financial Market Infrastructure (FMI), authorised by RBI under the PSS Act, to operate various payment systems and function as a Trade Repository (TR) for specified instruments. CCIL has been granted the status of a Qualified Central Counterparty (QCCP) in the Indian jurisdiction. 2.8 CCIL was setup in April 2001 to provide guaranteed clearing and settlement for transactions in money, government securities, forex and derivative markets. CCIL also provides non-guaranteed settlements for rupee interest rate derivatives and cross currency forex transactions (through CLS Bank). CCIL is, therefore, authorised to operate the following payment systems, (i) securities (outright, repo and tri-party repo), (ii) forex [USD-INR (cash, tom, spot) and cross currency CLS], (iii) forex forward (USD-INR), and (iv) rupee derivatives [rupee interest rate swaps (IRS) and forward rate agreements (FRA)]. 2.9 CCIL acts as a TR for all over the counter (OTC) transactions in the forex, interest rate and credit derivatives segments. CCIL also acts as a TR for (i) secondary market trades in Certificates of Deposit / Commercial Papers (ii) market repo / reverse repo transactions in Corporate Bonds / Certificates of Deposit / Commercial Papers / NCDs of original maturity of less than one year and (iii) primary market issuances of Commercial Paper by the respective Issuing and Paying Agent (IPA). 2.10 CCIL also acts as a reference point for important benchmarks used by the market under the aegis of the benchmark administrator, Financial Benchmarks India Limited (FBIL) like MTM prices, ZCYC rates and Spot rates. 2.11 The operations of CCIL are covered in detail in Chapter 14.

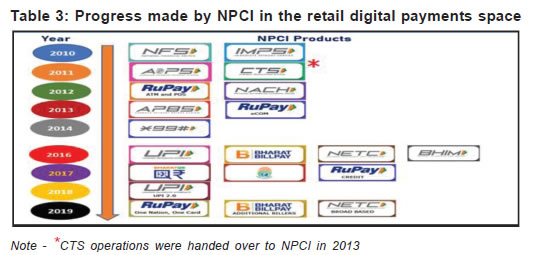

Chapter 3

Institution Building - Umbrella Organisation National Payments Corporation of India (NPCI) 3.1 RBI, in its Vision for Payment Systems 2005-08, envisioned the need for an umbrella organisation for all the retail payment systems in the country, with the objective of optimally using the resources through consolidation of existing infrastructure and building new infrastructure to enable national reach in a seamless manner. It envisaged constituting an umbrella organisation to have a robust technology platform and provide service of high quality to customers at an affordable price structure. 3.2 Thus, NPCI was set up, with guidance and support of RBI and the Indian Banks' Association (IBA), as an umbrella organisation for retail payments system in India. It was incorporated in December 2008 as a Section 25 company (not-for-profit company) under Companies Act, 1956 (now Section 8 of Companies Act, 2013) with the aim to operate for the benefit of all member banks and their customers, create infrastructure for operating pan-India systems with high availability and scalability to process increasing volumes of retail electronic payments, etc. India is one of the few jurisdictions to have attempted this and over the period of 10 years, the share of transactions handled by NPCI is a testimony to the success and criticality of this initiative, probably the first of its kind across the globe! 3.3 NPCI started with 10 core promoter banks (State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank N. A. and HSBC) as shareholders. In the year 2016, the shareholding of NPCI was broad-based to include more banks representing all sectors. As on date, the number of shareholders of NPCI is 67, comprising 11 public sector banks, 18 private sector banks, 5 foreign banks, 10 cooperative banks, 7 Regional Rural Banks (RRBs), 4 Small Finance Banks (SFBs), 2 Payment Banks (PBs) and 10 PSOs. 3.4 In December 2013, NPCI was entrusted with the task of operating CTS on behalf of RBI. It also took over from IDRBT in December 2009, the task of managing NFS which operated an ATM network having 37 members with 50,000 ATMs. It has grown to a network of 112-member banks connecting over 2.3 lakh ATMs as at end-December 2020. These two activities are the main revenue source for NPCI on the strength of which it has been able to expand its operations and invest in innovative ideas and systems. 3.5 The retail payments space has further developed and matured with a variety of systems introduced and operated by NPCI. With the aim of touching lives of every Indian, NPCI has rolled out a variety of innovative retail payment products viz., IMPS, RuPay card scheme, UPI, NACH, Aadhaar-enabled Payments System (AePS), Aadhaar Payments Bridge System (APBS), NETC, *99# (USSD based) and BBPS. Further, NPCI's alliance with international network partners (Discover Financial Services, Japan Credit Bureau and China Union Pay) has paved the way for international acceptance of RuPay.  3.6 Widespread adoption of NPCI's retail payment products has made NPCI truly an umbrella organisation for retail payment systems. NPCI's retail payment products have also provided an impetus to RBI's vision of a 'less-cash' society and of empowering every Indian with access to a bouquet of e-payment options that is safe, secure, convenient, quick and affordable. NPCI has been yet another successful experiment and experience in the Indian payment systems space. NPCI International Payments Limited 3.7 Over the years, the retail payment systems of NPCI have gained widespread acceptance across the country and generated enormous interest from other jurisdictions as well. In order to bestow undivided attention to the global outreach of NPCI payment systems, a subsidiary, viz., NPCI International Payments Limited (NIPL), was established in April 2020. NIPL is tasked with the responsibility of exporting, in consultation and co-ordination with RBI, NPCI's indigenously developed offerings to foreign markets. To begin with, the primary focus of NIPL is the internationalisation of RuPay and UPI.

Chapter 4

Paper Clearing 4.1 The Banking Regulation Act, 1949 defines ';banking'; as the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise. Payment by means of cheque is, therefore, embedded in the very definition of banking. Paper-based payment systems historically occupy an important place in any country's payment landscape as initially, apart from cash, cheque payment was the only available alternative. 'Clearing' of cheques required a centralised payment and settlement system, which facilitated payments made through cheques by netting through participating member banks, without going through the tedious task of individually settling each and every cheque / instrument. Magnetic Ink Character Recognition (MICR) 4.2 The cheque clearing systems have evolved from manual clearing system to MICR clearing systems in mid 1980s, which brought in automation, standardisation and efficiency in cheque clearing process. MICR instruments with Magnetic Media Based Clearing Systems (MMBCS) technology facilitated carrying out of 'clearing' activity electronically, wherein clearing data was processed electronically with physical cheques exchanged alongside. To further ease up the process, High Value Clearing (HVC) was introduced during the eighties for clearing cheques of value of Rupees one lakh and above. This clearing was available at select large centres in the country till it was discontinued in the year 2009. 4.3 Following implementation of Core Banking Systems (CBS) in banks, Speed Clearing was launched in the year 2008, for local clearance of outstation cheques drawn on core-banking enabled branches of banks, which drastically reduced the turnaround time for clearing of outstation cheques. Cheque Truncation System (CTS) 4.4 CTS enables use of the image of cheque for payment processing thereby eliminating the need for physical movement of cheques, with concomitant benefits of reduced turnaround time for clearing of cheques, particularly more so in case of outstation cheques. During the year 2008, RBI conducted a pilot study in New Delhi on the possibility of introducing CTS. Based on the learnings and outcomes of this pilot study, in February 2010, CTS-2010 standards were framed to enhance and standardise the security features on cheque forms. Mandatory features were specified including paper & watermark (at manufacturing stage), void pantograph and bank's logo with UV ink (at printing stage), field placements of a cheque, colours and clutter-free background, prohibiting alterations / corrections on cheques, pre-printed account number, etc. Apart from these, banks were given the leeway to include suitable desirable features provided the mandatory security features are not compromised. Banks were advised to issue only CTS-2010 standard cheques henceforth. After the successful run in New Delhi, CTS was introduced in the rest of the country, at Chennai in September 2011, to cover CTS clearing in southern and eastern zones, and Mumbai in April 2013 covering the western zone, with New Delhi covering CTS clearing in the northern zone. 4.5 In CTS, the presenting bank / collecting bank captures the MICR data and scans the images of the cheque as per CTS specifications and instruments are cleared on the basis of these digitally signed encrypted images. To facilitate CTS clearing, amendments were made to the Negotiable Instruments Act, 1881 to legalise electronic movement of cheques, retention of cheque by the presenting banker and placing the onus of verifying prima facie genuineness of the cheque to be truncated on the bank receiving the payment. 4.6 All sixty-six MICR centres operating across the country were subsumed in grid-based CTS clearing and MICR clearing was discontinued with effect from July 2014. As on date, all 1219 non-MICR clearing houses have been migrated to CTS. 4.7 The concept of a panel for resolution of disputes (PRD) for speedy and timely resolution of disputes between member banks was drawn up by RBI in September 24, 2010 to handle disputes. Each grid has its PRD; the President of the Grid is ex-officio chairman of PRD who is assisted by four other members representing member banks. The scope of the dispute resolution mechanism is limited to interpretation, scrutiny and resolution of disputes within the ambit of rules, regulations, operational and procedural guidelines relating to the payment products, various instructions issued by the system providers, instructions and directions issued by RBI. The resolution given by PRD is binding on the disputing banks, unless an appeal is made to the Appellate Authority against judgement of PRD. 4.8 To further augment customer safety in cheque payments and reduce instances of fraud occurring on account of tampering of cheque leaves, a mechanism of Positive Pay for all cheques of value of ₹ 50,000 and above was announced in September 2020. Under this mechanism, cheques will be processed for payment by the drawee bank based on information passed on by its customer at the time of issuing the cheque. In the Centralised Positive Pay System (CPPS), customers, after issuance of cheques will provide details of issued instrument/s to their banks. The data received will be uploaded in NPCI's CPPS system by the member bank. During the presentment, cheques presented will be validated by clearing house against CPPS data base. If any difference is observed while matching results, the clearing house will put a specified flag with the cheque data. Since CPPS will be the central repository for all participating banks, validation and provision of the flag at the time of clearing process will enable banks to save time in clearing process. It will be an add-on facility to contain any occurrence of fraud. The facility was implemented from January 01, 2021. 4.9 To conclude, India has a fast and efficient cheque processing system. Standardisation of cheque forms and the cheque clearing system in the country made it the most efficient and best in the world in terms of its T+1 clearing and settlement cycle across the length and breadth of the country. Cheque truncation eliminated the associated cost and time for movement of physical cheques, reduced the time for collection and brought in efficiency to the entire activity of cheque processing.

Chapter 5

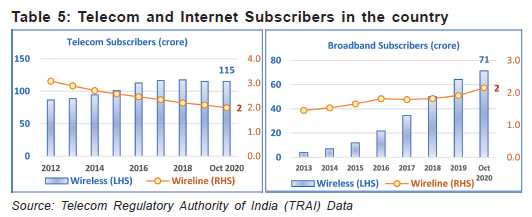

Digital Payments Enablers 5.1 RBI has always been the primary enabler of digital payments in India. From conceptualisation to execution, investment in knowledge and technology for payment systems involving large scale capital expenditure {MICR, CTS, ECS, large value payments (RTGS), retail payments (NEFT), etc.}, RBI has donned many hats, that of owner, operator, catalyst, regulator, et al. 5.2 India has followed the ';bank-led'; model with banks at the fore-front of payment systems operations, as it was felt that being adequately regulated, banks were better placed to take the payment systems forward.3 The approach has been to involve banks where float is involved, while non-banks can participate with fee as their income source. Easy access, swift absorption / adoption of new technology and innovation, quality of infrastructure, etc., are crucial elements for ensuring safe and quick payments which help in building confidence in the payment systems. The dual model followed in India combined the ';trust'; that the banks offered with the innovations of non-banks to upscale digital payments. Mobile Phones and Internet 5.3 The growth of infrastructure in India has been phenomenal over the past decade, most notably in the spread of mobile cellular network. The increasing mobile density and mobile internet users are being leveraged upon by payment systems providers, both banks and non-banks, to offer payment services which is accessible over mobile and internet. Along with internet banking, banks have been offering mobile banking services through all three channels - short message service (SMS), Unstructured Supplementary Services Data (USSD) and mobile applications.  5.4 As at end of October 2020, India had over 115.1 crore wireless telephone subscribers resulting in a tele-density of 84.90%. The urban tele-density and rural tele-density was 136.65% and 58.72%, respectively, which is growing. Increase in smartphone usage has also helped accelerate the adoption of digital payments. Further, it has led to numerous innovations in payment mechanisms, such as tokenisation and scanning of Quick Response (QR) code for making payments using smartphones. 5.5 Internet usage is on the rise in India. While the average Indian, until 2013, spent more on voice services than on mobile data services, a significant share of an average mobile bill now pertains to data charges according to a report by the Internet and Mobile Association of India (IAMAI). As at the end of October 2020, there were over 71.3 crore and 2.1 crore wireless and wireline broadband subscribers, respectively. The increase in internet penetration has facilitated and also accelerated the adoption of digital modes of payments. With rapidly increasing penetration of 3G and 4G, even in remote areas, India is witnessing a ';Digital Revolution'; which is surely but steadily evolving into a ';Digital Payments Revolution.'; Recent evidence indicates that Indians consume on an average about 10 GB data every month. Bank Accounts 5.6 The number of deposit accounts has grown to 235 crore as at end March 2020. These include deposit accounts in all commercial banks including Local Area Banks (LABs), PBs, SFBs, RRBs and Cooperative Banks in the country. The availability of bank accounts played a key role in initiating digital payments from / to such accounts. Aadhaar 5.7 Since its launch in 2009, Aadhaar, a unique identification number has been issued to over 127 crore individuals across the country. ';Aadhaar'; enabled e-KYC (electronic-Know Your Customer) has resulted in an exponential growth of digital payments in India. The use of Aadhaar has also been leveraged for authenticating payments to merchants as well as transactions made through Business Correspondents (BCs). The coverage of Aadhaar biometric identification has witnessed increased use in Government to Person (G2P) payments and has helped reduce leakages from the system by expunging fake beneficiaries. These payment systems have helped migrate cash payments to electronic form.4 Aadhaar has been subject to many a legal tussle and its acceptance and use in payments has seen a see-saw battle over the years. Ironically though, many other jurisdictions see Aadhaar as a successful experiment. Availability of biometric identification (fingerprints) with face and iris scans can be leveraged to push digital payments to exponential levels, of course privacy and other concerns have to be given due consideration. Debit and Credit Cards 5.8 In India, credit cards are considered taboo and viewed more as products for the elite. Over the past 10 years, during the period between FY 2010-11 and FY 2019-20, the number of debit cards issued increased from 22.78 crore to 82.86 crore, of which around 30 crore comprised of RuPay debit cards issued to Basic Savings Bank Deposit (BSBD) account holders. During the same period, the number of credit cards issued also increased from 1.80 crore to 5.77 crore. Increase in cards has facilitated growth in both online and physical PoS terminal based card payments resulting in an increase in digital transactions. 5.9 Banks issued new cards to comply with the requirement to convert all existing Magstripe cards to Europay Master Visa (EMV) Chip and Personal Identification Number (PIN) compliant cards by December 31, 2018 and subsequently removed deactivated cards from their systems, resulting in a reduction of debit cards outstanding in the FY 2019-20. The consolidation of public sector banks also contributed to this reduction.

Chapter 6

Standards and Identifiers 6.1 Standardisation is vital in payment systems as the adoption of identifiers, uniform standards and formats help eliminate frictions and inefficiencies in processes. Considering the importance of standards in the payments space, RBI has prescribed standards for many payments and has been instrumental in developing a few others. Adoption of these standards and identifiers have contributed in making the payment systems the force they are today. Magnetic Ink Character Recognition (MICR) 6.2 MICR, is a character recognition technology used in the banking industry to streamline the processing and clearance of cheques and other documents. MICR code is a 9-digit code printed on cheques using technology that uniquely identifies the bank and branch participating in an Electronic Clearing System (ECS). The MICR code comprises, (i) the first three digits representing the city (city code) - they are aligned with the PIN code used for postal addresses; (ii) the next 3 digits representing the bank (bank code); and (iii) the last 3 digits representing the branch (branch code). Cheques with MICR code are run through MICR reader and sorter machines, thereby enabling faster processing, sorting and clearing. 6.3 MICR clearing was introduced in India in mid 1980s and this standardisation aided in automating the cheque clearing process thereby making it efficient. INdian FInancial NETwork (INFINET) 6.4 In order to upgrade the country's payment and settlement systems, RBI had taken the initiative of providing a communication backbone in the form of the satellite based INFINET using VSAT technology to the banking and financial sectors. The task of designing and developing the communication network was entrusted to IDRBT. The Closed User Group (CUG) Network uses VSAT technology and is a Time-division multiplexing (TDM) / Time-division multiple access (TDMA) network with STAR topology for Data and with Demand Assigned Multiple Access-Single Channel Per Carrier (DAMA-SCPC) overlay with mesh topology for voice and video traffic. 6.5 The primary objective of INFINET for the banking and financial sector was to enhance efficiency and productivity on the one hand and provide state-of-the-art customer services through innovative delivery channels such as internet banking, home banking, etc., on the other. Structured Financial Messaging System (SFMS) 6.6 SFMS, developed by IDRBT, is a domestic messaging standard used for financial messaging in India. SFMS is an Electronic Data Interchange (EDI) for banks and it uses INFINET as the communication medium. Various intrabank applications use the SFMS to improve efficiency and speed in fund transfer, MIS reports, information reports, etc. SFMS is also the universal platform for carrying messages pertaining to the centralised payment systems, thus, meeting the requirements of both retail and large value fund transfers. 6.7 The basic architecture of SFMS is a 4-tiered with hub connected to bank gateways, which are connected to bank servers. The bank servers in turn are connected to offline branches. The SFMS messages from a bank branch to another bank branch will be delivered via bank gateways and the hub. Intra-bank messages are however, switched at the bank gateway level and are not required to be routed to the hub. Indian Financial System Code (IFSC) 6.8 Indian Financial System Code (or more commonly known as IFSC) is a 11-digit alpha-numeric code used to uniquely identify a bank and its branches with (i) the first 4 digits representing the bank; (ii) the 5th character is zero; and (iii) the last 6 digits representing the specific branch code. The IFSC is mandatory for fund transfers through various payment systems (RTGS, NEFT, IMPS), as it helps to identify the destination of the beneficiary bank and branch. 6.9 Since the implementation of core-banking systems by banks with all branches connected to a centralised system, RBI now allocates only the primary IFSC representing bank code, and banks can create / modify / delete additional IFSCs for their own branches through IFTAS. The updates are circulated by IFTAS to all member banks to ensure the same reflects in their systems. 6.10 There are discussions on whether MICR has outlived its purpose of existence and whether there is scope for two sets of identifiers to exist - MICR and IFSC. ISO 20022 6.11 ISO 20022 is a multi-part International Standard prepared by ISO Technical Committee TC68 Financial Services. ISO 20022 is an emerging global and open standard for payments messaging. It creates a common language and model for payments data across the globe. India's RTGS was the first large value payment system in the world to be implemented adopting the ISO 20022 standard for messaging. Society for Worldwide Interbank Financial Telecommunication (SWIFT) 6.12 SWIFT is the world's leading provider of secure financial messaging services. SWIFT has become the industry standard for syntax in financial messages. Messages formatted to SWIFT standards are read and processed by many financial processing systems, whether the message travelled over the SWIFT network or not. SWIFT standards have been used across the globe for domestic and international financial messaging services. In India, the SWIFT messaging standards are used for all cross-border payment transactions. Legal Entity Identifier (LEI)5 6.13 LEI is a 20-character, alpha-numeric code (based on the ISO 17442 standard), to uniquely identify legally distinct entities that engage in financial transactions. It points to key reference information that enables clear and unique identification of legal entities participating in financial transactions and also contains information about an entity's ownership structure and thus answers the questions of 'who is who' and 'who owns whom'. 6.14 LEI was first made mandatory in India by RBI in June 2017 for all participants in OTC derivative markets (rupee interest rate derivatives, foreign currency derivatives and credit derivatives). Following a gradual approach for adoption of LEIs in India, RBI has further mandated LEIs for non-derivative markets (government securities markets, money markets and non-derivative forex markets) and for large corporate borrowers (with total exposure of more than ₹ 50 crore to banks). The implementation for OTC derivative markets and large corporate borrowers has been completed. In case of non-derivative markets, it was implemented in a phased manner. 6.15 As of now, around 16 lakh LEIs have been issued across the world. LEIs can be issued to an Indian Company by any Local Operating Unit (LOU) across the world including Legal Entity Identifier Limited (the local LOU). As on December 31, 2020, 47,677 Indian Companies have been issued LEIs (32,008 by LEIL and 15,669 by other LOUs).

Chapter 7

Digital Payments 7.1 6More digital payment options are now available to consumers. Systems that offer near instant person-to-person retail payments are increasingly available around the world. Many payment systems in India now operate 24 hours a day, seven days a week. All these developments have nudged the consumer towards digital payments because of the convenience they offer. Electronic Clearing Service (ECS) 7.2 In the mid-eighties and the early-nineties, RBI took various initiatives to bring in technology-based solutions to the banking system. One such initiative introduced in 1990 was the ECS (Credit) scheme for handling bulk and repetitive payment requirements like salary, interest, dividend payments, etc. of corporates and other institutions. RBI later introduced an ECS (Debit) scheme to provide a faster method of effecting periodic and repetitive collections of utility payments by companies. To consolidate the ECS system, RBI introduced the National Electronic Clearing Service (NECS) and the Regional Electronic Clearing Service (RECS). 7.3 With introduction of NACH by NPCI, most of the ECS centres migrated to it barring a few locations. The last remaining ECS centres were also fully migrated to NACH by January 31, 2020. The shift from ECS to NACH was smooth and non-disruptive. With this, the glorious life of ECS and its variants (RECS and NECS) came to an end, after having served the nation with distinction for 25 years. National Automated Clearing House (NACH) 7.4 NACH is a centralised ECS system operated by NPCI. NACH was formed to consolidate multiple ECS systems running across the country into one centralised system. It operates both NACH Credit and NACH Debit payment systems. NACH credit, like ECS credit, is used for making one-to-many credit transfers, such as payment of dividend, interest, salary, pension, distribution of subsidies, etc. NACH Debit operates to collect transaction from many accounts to one destination account e.g., collection of various utility payments pertaining to telephone, electricity, water and gas charges, etc. It also facilitates collection of periodic instalments towards loans, investments in mutual funds, insurance premium, etc. 7.5 The destination banks and accounts are identified based on account number, IFSC or MICR codes. NACH works on the strength of mandates given by customers for allowing debit to their accounts at specified frequency. Apart from paper mandates, paperless mandates can also be created electronically. The system also identifies the destination account based on Aadhaar number, through APBS leg of NACH. NACH is the most popular and prominent mode of direct benefit transfer (DBT) credits to beneficiaries. Card (debit and credit) Payments 7.6 Card payment is an important payment instrument which has replaced the use of cash at least at retail outlets and e-commerce sites. Like in other parts of the world, Indian consumers are now frequently using cards for payments, even for smaller transactions. This is driven, in part, by more people holding cards and greater availability of PoS terminals. In comparison to credit cards, debit cards are much more popular in India. Some of the reasons for this exhibited partiality towards debit cards have been identified to be, (a) low demand due to Indian households being traditionally oriented towards savings, rather than credit culture; (b) supply concerns, especially with majority of the labour force occupied in the unorganised sector and card issuers less keen to take higher credit risks; and (c) the Indian ethos to pay for goods and services on purchase instead of running up credit lines. Yet another cultural observation is, people do not wait for the credit period to be over; instead pay ahead of the deadline, and in many cases, even keep a favourable (credit) balance in a credit card account. 7.7 Debt and credit card based payments registered a CAGR of 35% and 33% in terms of volume and value, respectively over the last 10 years. To encourage usage of cards, card infrastructure is required to be robust, strong and secure. Mandating the issue and use of only EMV chip and PIN-based cards has helped build public confidence as it provides more security than the 'Magstripe only' cards. The adoption of card payments has also been supported by innovations in the form of contactless payments and tokenisation technologies. Contactless Cards 7.8 One of the innovations in the card payments ecosystem is the use of contactless technology, which allows cardholders to ';Tap and Go';. These cards are becoming increasingly popular. To provide convenience in use of such cards, RBI permitted relaxation in Additional Factor of Authentication (AFA) in case of Card Present (CP) transactions using Near Field Communication (NFC)-enabled EMV Chip and PIN cards for small values (up to ₹ 2,000/-). Transactions beyond this limit can be processed in contactless mode, but with AFA. This relaxation in AFA is, however, not applicable for ATM transactions (irrespective of transaction value) and Card Not Present (CNP) transactions, i.e., online transactions. The limit was subsequently revised to ₹ 5,000/- effective from January 01, 2021. National Common Mobility Card (NCMC) 7.9 NCMC was launched in March 2019, as a combo card offering a combination of a Debit / Credit with a prepaid card where the Debit / Credit component would be used in the online environment whereas the prepaid component would be used in the offline environment, wherever offline payments are permitted. The offline prepaid transactions would be affected without AFA which was permitted only for the transit payments to begin with, owing to the fast checkout time required for such transactions. Combo cards, while offering convenience of not having to carry multiple cards in your wallet, raise issues relating to uncertain regulatory turf because of multiple masters (government, RBI, metro operators, et al) which have to be addressed through coordination. RuPay Cards 7.10 RuPay is a home-grown card payment network which was introduced in the year 2012 through NPCI. The drive for a less cash economy in the wake of demonetisation in 2016 and issue of RuPay cards for BSBD accounts has increased user acceptance in the interiors of the country where paying with a card was a novelty just five years back. RuPay has its popular debit card and its increasingly accepted credit version as well. 7.11 Countries that encourage domestic cards have been observed to be faster in moving away from cash. India is a late entrant to the domestic card market and in 2017, the share of RuPay was only 15% of the total cards issued in India. However, as on November 30, 2020, with about 60.36 crore RuPay cards issued by nearly 1,158 banks, the market share of RuPay has increased to more than 60% of total cards issued. A significant proportion of RuPay cards is in the nature of debit cards with only 9.7 lakh credit cards issued as on November 30, 2020. 7.12 RuPay started its international foray through its acceptance and issue in Bhutan achieved with the integration of the Bhutan Financial Switch with NFS. To increase its acceptance around the world, RuPay has tied up with other payment networks like Union Pay (China), JCB (Japan), NETS (Singapore), BC Card (South Korea), Elo (Brazil) and DinaCard (Serbia), in addition to Discover and Diner Club and has thus made its presence felt across 195 countries across the globe. Large Value Payment System (LVPS) - Real Time Gross Settlement (RTGS) 7.13 Large value systems are the most critical component of the national payment systems as they can generate and transmit disturbances of a systemic nature to the financial sector. Large value payment systems are, therefore, systemically important FMIs and critical for smooth functioning of the financial system. 7.14 India's LVPS, the RTGS system was introduced in March 2004 and is owned and operated by RBI. RTGS was subsequently enhanced to the Next Generation-RTGS (NG-RTGS) built on the ISO 20022 standards with advanced features such as hybrid functionality, liquidity management functions, future date functionality, scalability, etc. NG-RTGS was a pioneer in implementing ISO 20022 standards. 7.15 As the name sounds, the transactions settle real-time on a gross basis in the books of RBI. RTGS also settles Multilateral Net Settlement Batch (MNSB) files emanating from ancillary payment systems such as CCIL and NPCI. RTGS accounts for majority of value of transactions settled in Indian payment systems; average value of a RTGS transaction has always hovered around a crore of rupee, if not more. RTGS is available for customer transactions between 7:00 am and 6:00 pm and for inter-bank payments from 7:00 am to 7:45 pm. RTGS is available round the clock with effect from December 14, 2020. Implementation of RTGS 24x7 is expected to facilitate global integration of Indian financial markets, support India's efforts to develop international financial centers and provide wider payment flexibility to domestic corporates and institutions. 7.16 Access to RTGS is decided on the basis of the Access Criteria guidelines issued by RBI. The entities have to comply with specific requirements like, (i) membership of INFINET / SFMS / domestic SWIFT network; (ii) maintenance of current account and settlement account with RBI; (iii) maintenance of Subsidiary General Ledger (SGL) account with RBI. Membership of RTGS is open to all licensed banks and any other institution as may be decided by RBI. Members that may not be in a position to comply with the membership requirements can access the system through sub-membership route. 7.17 There are primarily four types of participants in RTGS viz. (i) central bank - exclusively for RBI (ii) regular participant - all types of facilities to be provided (e.g. banks), (iii) restricted participant - some particular type(s) of facilities to be provided (e.g. Primary Dealers) and (iv) clearing house for settlement of MNSB file. Domestically located banks, domestically located non-banks, domestically located broker-dealer, domestically located FMIs and branches of foreign banks located in India have direct access to RTGS in India. 7.18 Access to RTGS is available through any of the three options viz., thick-client, Web-API (through INFINET or any other approved network) and Payment Originator (PO) module. The choice of options for connecting to RTGS is based on the volumes and business requirements of a member. 7.19 To overcome short-term requirement of funds (during RTGS business day) for settlement of the transactions, RBI also grants access to intraday liquidity (IDL) to RTGS members for settlement of their payment transactions in RTGS. IDL is invoked automatically for eligible participants as and when they do not have the required funds in their settlement account. However, participants are required to ensure availability of eligible collaterals with RBI. IDL facility availed by a participant is automatically reversed by the RTGS system on availability of sufficient funds in the settlement account of the participant (above a threshold level). 7.20 RTGS can be accessed by customers through web-based portal and proprietary network and transactions can also be initiated physically at participants' locations. These features make the system robust and have led to its acceptability and usability. With effect from July 1, 2019, RBI waived the processing charges and time varying charges levied by it on banks for outward transactions undertaken using RTGS. National Electronic Funds Transfer (NEFT) 7.21 NEFT, as part of the Centralised Payment Systems (CPS), is a retail payment system owned and operated by RBI. At the time of its implementation in November 2005, NEFT was started with only eight member banks. As at the end of December 2020, NEFT system covers a network of 222 member banks and their 1,70,996 branches. These member banks also extend NEFT facility to customers through sub-members. There is no floor or ceiling for the amount that can be transferred in a single transaction, because of which NEFT has emerged as a popular hybrid payment system, with average transaction value of approximately ten lakh rupees. 7.22 In alignment with RBI's Payment System Vision 2019-2021, to provide uninterrupted availability of safe, secure, accessible and affordable payment systems, NEFT was made available as a round the clock fund transfer facility without any holiday with effect from December 2019. NEFT is a straight through process, which operates in 48 half hourly batches 24x7, and credits are made into destination account based on beneficiary's unique account number. As laid down in the NEFT procedural guidelines, the beneficiary's account must be credited, or transaction returned to the originating bank within 2 hours of settlement of the respective batch. In case of delays in either credit to the beneficiary account or return of the transaction to the originating bank, penal interest at repo rate plus 2% has to be paid to destination account. NEFT has led the way for other payment systems to operate and is expected to change the entire facet of Indian banking with multiple products designed around it to cater to the round-the-clock users. 7.23 In addition to fund transfers, customers of member banks use NEFT for purchase of goods and services, utility bill payments, payment of statutory dues, etc. Walk-in customers can also avail of NEFT fund transfer facility, against cash payment up to ₹ 50,000/-. NEFT is a unique hybrid payment system as it carries with it the characteristics of both a retail and a large value payment system, offering round the clock transfers with no floor or ceiling on the amounts that can be transferred. 7.24 The member banks maintain current account with RBI which is used to settle inter-bank settlement obligations. The banks are eligible for intra day liquidity facility and liquidity support against eligible securities in an event of shortfall. 7.25 The Indo Nepal Remittance Scheme uses NEFT as the channel for one-way transfers of funds to Nepal in partnership with State Bank of India (SBI) and is intended to help Nepali migrant workers in India to send remittances back home. 7.26 The banks are required to send positive confirmation messages to the originator conveying successful credit of the transaction. 7.27 With effect from July 01, 2019, RBI waived NEFT processing charges which was collected from member banks. In addition, with effect from January 1, 2020 member banks were mandated not to levy any charge on NEFT transactions initiated online using mobile apps or internet banking by savings bank account holders. Fast Payments 7.28 Payment systems are becoming faster and more convenient. Notwithstanding its many features, NEFT is not tagged as a 'fast payment' system. Fast payments are defined by two key features, speed and continuous service availability, wherein transmission of the payment message and the availability of final funds to the payee occur in real time or near-real time and are available on as near to a 24-hour and 7-day (24/ 7) basis as possible. Currently, IMPS and UPI are the two existing 'fast payments' in India with the latter driving the retail payments volume; the two systems handle 8.35 crore transactions on a daily basis for value of ₹ 22,854 crore in December 2020. This excludes the transactions handled by NEFT, though the debate continues as to why these cannot get included as a fast payment system since the processing and final settlement in NEFT is handled on a batch basis with half hourly settlements. Immediate Payment Service (IMPS) 7.29 IMPS is a 24*7 'fast payments' system that was introduced in 2010. India was the fourth country after South Korea, UK and South Africa to introduce such a payment system. The system provides for real time transfer of funds between the remitter and beneficiary with a deferred net settlement between banks. The system facilitates push transactions with a per-transaction limit of ₹ 2 lakh. 7.30 IMPS is a multi-channel system that can be accessed using mobile, ATM, internet banking, bank branches, BCs, etc. Besides banks, the system allows non-bank entities such as PPI issuers to participate and facilitate remittances from wallets to the recipient bank accounts. Initially, the system required both the remitter and the beneficiary to be registered for mobile banking which was inhibiting the growth. Hence, the system was upgraded to enable remittance of funds by using other parameters such as account number and IFSC (like NEFT) or by using bank account linked Aadhaar number. Unified Payments Interface (UPI) 7.31 UPI is a mobile based, 365x24x7 'fast payment' system wherein users can send and receive money instantly using a Virtual Payment Address (VPA) set by the user itself. The unique feature of VPA based transaction is the secure aspect of UPI architecture as it obviates the need for sharing account or bank details to the remitter. It supports person to person (P2P) and person to merchant (P2M) payments and can be used over smart phone (app based), feature phone (USSD based) and at merchant location (app based). 7.32 UPI facilitates immediate money transfer through pull and push payments, merchant payments, utility bill payments, QR code (scan and pay) based payments, etc. Non-financial transactions such as mobile banking registration, balance enquiry, etc., can also be carried out using UPI. It powers multiple bank accounts into a single mobile application of any participating bank / non-bank Third Party Application Provider (TPAP). Funds can be transferred using VPA or account number with bank code (IFSC). 7.33 The framework of UPI comprises of NPCI as network and settlement service provider, banks as Payment System Providers (PSPs), and as issuer banks and beneficiary banks; apart from TPAPs such as Google Pay, Truecaller, WhatsApp, etc. Non-bank PPI issuers have also been allowed to provide this facility in an interoperable manner to their PPI wallet holders. 7.34 Transactions are carried out through mobile devices with two factor authentication using device binding and a UPI PIN as security. The UPI PIN is encrypted using Public Key Infrastructure (PKI) technology while the transaction data is stored in encrypted format in app provider's system. The system that went live in September 2016 with a transaction limit of ₹ 1 lakh was upgraded to UPI 2.0 in 2018 with a per transaction limit of ₹ 2 lakh and a few additional features to enhance customer convenience, safety and security of transactions. UPI has grown to be the fastest payment system in the world with many jurisdictions eager to replicate the system. Given its popularity and acceptance, there are many innovations possible to extend UPI to desktop browers, feature phones, offline payments as well as recurring payments. Aadhaar Enabled Payment System (AePS) 7.35 AePS is operational since January 2011. It allows online interoperable transactions at Micro-ATM through the BCs of any bank using Aadhaar authentication. Under this system, Aadhaar number is used not only to identify the beneficiary but also to authenticate transactions. The biometric based authentication is done by Unique Identification Authority of India (UIDAI) while NPCI does the switching, clearing and settlement of financial transactions. 7.36 The financial services offered through AePS include cash withdrawal, cash deposit, balance enquiry, Aadhaar to Aadhaar fund transfer. The non-financial transactions include - Demographic Authentication, Best Finger Detection (BFD) and e-KYC. e-Money 7.37 e-Money is prepaid value stored electronically, which represents the liability of the e-money issuer (a bank, an e-money institution or any other entity authorised or allowed to issue e-money in the local jurisdiction) and which is denominated in a currency backed by an authority. In India, e-Money is PPIs issued as Wallets and Cards. 7.38 PPIs are instruments that facilitate purchase of goods and services, remittance facilities, etc., against the value stored in / on such instruments. Banks and non-bank entities can issue PPIs in the country after obtaining necessary approval / authorisation from RBI under the PSS Act. The Master Direction issued in 2017 and subsequent revisions, lays down the eligibility criteria and the conditions for operation of PSOs involved in the issuance of semi-closed and open system PPIs in the country. 7.39 In India, PPIs which can be issued are of three types: -

Closed System PPIs: These are PPIs issued by an entity for facilitating purchase of goods and services from that entity only. The issuance and operation of such instruments is not classified as a payment system and does not require approval / authorisation from RBI. -

Semi-closed System PPIs: These PPIs are used for purchase of goods and services, including financial services, remittance facilities, etc., at a group of clearly identified merchant locations / establishments which have a specific contract with the issuer (or contract through a payment aggregator / payment gateway) to accept PPIs as payment instruments. These instruments do not permit cash withdrawal, irrespective of whether they are issued by banks or non-banks. To provide further flexibility, semi-closed PPIs are further classified as, (i) PPIs up to ₹ 10,000/- where minimum details of PPI holder are obtained (minimum-detail PPI); (ii) PPIs up to ₹ 10,000/- with loading only from bank account; and (iii) PPIs up to ₹ 1,00,000/- where know your customer (KYC) of PPI holder is completed (full-KYC PPI). -

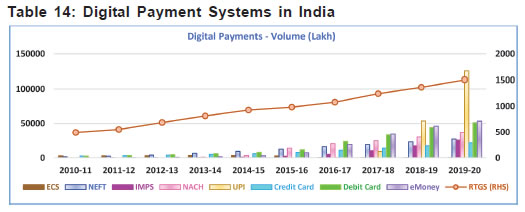

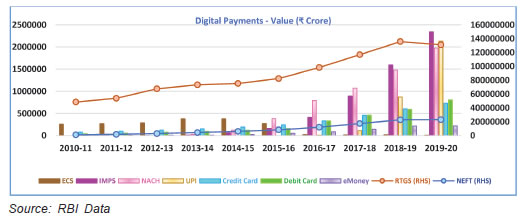

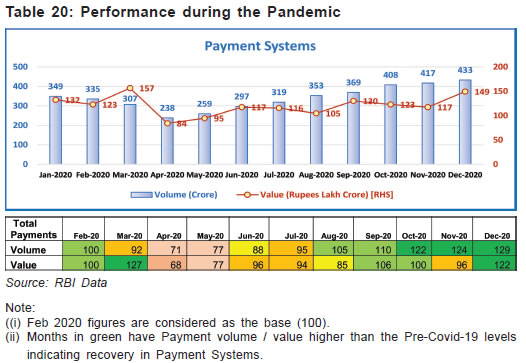

Open System PPIs: These are PPIs issued only by banks (approved by RBI) and are used at any merchant for purchase of goods and services, including financial services, remittance facilities, etc., and permit cash withdrawal at ATMs / PoS / BCs. Open System PPI can be of one type i.e., KYC compliant PPIs with balance up to ₹ 1,00,000 at any point of time. 7.40 A new type of PPI was introduced in December 2019, which can be loaded / re-loaded only from a bank account and / or a credit card, and can be issued based on essential minimum details sourced from the customer. Such PPIs can be used only for purchase of goods and services and not for funds transfer. The amount loaded in such PPIs during any month should not exceed ₹ 10,000 and the amount outstanding at any point of time should not exceed ₹ 10,000. Further, the total amount loaded in such PPI during the financial year shall not exceed ₹ 1,20,000. 7.41 Interoperability has been allowed among PPIs which provides access to a wide number of merchants among the PPI holders and vice-versa, without the need for multiple on boarding by various issuers and acquirers. While consumers have benefited from convenient payment option and pricing benefits (cashback / discounts), it is the 'cost-effectiveness' that appeals to the merchants as the cost associated with e-Money acceptance including setting-up infrastructure and transaction fees is much lower compared to traditional card-based payment system. 7.42 Demonetisation in November 2016 was a game-changer for e-Money as people switched to electronic-modes of payments resulting in a year on year growth of 162.5% in the year 2016. While medium to large-value transactions continue to be made through digital banking channels and cheques, the low-value day-to-day transactions shifted to e-Money. The trend continued in succeeding years, viz., an increase of 76%, 33% and 15% in volume in FYs 2017-18 and 2018-19 and 2019-20 respectively, showing a perceptible shift towards e-Money. Unstructured Supplementary Services Data (USSD) 7.43 With growing mobile density, banks started offering mobile banking services to their customers using the USSD channel through bilateral tie-ups with individual telecom providers. To obviate the need for multiple bilateral tie-ups and to ensure interoperability across banks and telecom providers so that all customers / subscribers could benefit from USSD-based services, a common platform offering USSD-based mobile payments services was set-up through NPCI in 2013. 7.44 With the launch of USSD 2.0 along with BHIM on December 30, 2016, UPI is now available for non-internet based mobile devices (smartphone as well as basic phones) in the form of dialling option (*99#). Currently, financial, non-financial and certain value-added services (Aadhaar linking status & PMJDY A/C Overdraft Status) are offered through this service. The USSD has since been subsumed into the broader UPI platform. Interoperability 7.45 Interoperability is the technical compatibility that enables a payment system to be used in conjunction with other payment systems. Interoperability allows the issuers, the system providers and the system participants in different systems to undertake, clear and settle payment transactions across systems without participating in multiple systems. 7.46 Interoperability is the corner stone of payment systems in India. Interoperability across instruments, networks and infrastructure as evidenced in the interoperability of ATMs, PoS, Mobile Banking, PPIs, QR codes, BBPS, etc., has enabled use of any card on any PoS or ATMs, use of mobile banking products independent of mobile network operator, enabled QR code payments and bill payments irrespective of app provider and many more such instances resulting in optimum and efficient use of available infrastructure, decreased cost and increased convenience. Growth of digital payments 7.47 The acceptance and growth of digital payments has been exponential over the years. From 498 crore transactions with a value of 96 lakh crore handled during FY 2010-11, digital payments have grown to 1623 crore transactions with a value of 3435 lakh crore in the FY 2019-20. This represents a CAGR of 12.54% and 43.01% in terms of volume and value, respectively. 7.48 Global Data, a data and analytics company, in its 2017 Consumer Payments Insight Survey, observed that India is one of the top markets globally in terms of digital cash adoption with 55.4% survey respondents indicating usage of digital cash. India is followed by China and Denmark. The adoption level in India is much higher compared to many of the developed markets such as the US and the UK, where consumers predominantly use cards. 7.49 Within the digital payments, retail electronic payments comprising credit transfers {NEFT, fast payments (IMPS and UPI)} and direct debits (ECS, NACH) have shown a rapid growth over the past ten years at a CAGR of 55% and 43% in terms of volume and value, respectively. e-Money issued in the form of wallets and prepaid cards demonstrated an increased adoption with a CAGR of 91% and 56% in terms of volume and value, respectively in the past 9 years.   7.50 The most effective way to exponentially increase the digital payments is to target the generation which is most responsive to technology and digital age7. Since India has a large population of millennium children (individuals born between 1982 and 2004) or currently referred to as the ';heads down'; generation, the aptitude for digital products is large. This generation has little brand loyalty and is ready to try out new payment systems / channels when the rewards are good. PSPs will have to design products and plans which would help drive and sustain mass adoption and engagement.

Chapter 8

Acceptance Infrastructure 8.1 Infrastructure is the key requirement facilitating both cash dispensation and electronic payments. While it is true that bank branches and ATMs facilitate cash transactions, the former also facilitate electronic payments and the latter acts as a confidence factor that cash is available when required and there is no need to keep or hoard physical cash. PoS terminals and mobile phones directly aid electronic transactions. Bank Branches 8.2 The last 10 years have witnessed a CAGR of 6% in the number of branches of SCBs across the country. The increase in branches, especially in rural and semi-urban areas has been an enabler for instilling banking practices in these areas which aids digital payments. Automated Teller Machines (ATMs) 8.3 Equivalent to cash, ATMs are terminals that allow authorised users, typically by using a card, to access a range of services such as cash withdrawals, balance enquiries, transfers of funds and / or acceptance of deposits. ATMs primarily form a part of cash infrastructure, but their deployment is necessary to ensure that cash is available when needed. 8.4 ATMs have progressed from being only cash dispensing machines as they also facilitate digital bill payments and card to card transfers. Banks can now offer all their products and services through ATM channel, provided adequate checks are put in place to prevent the channel from being misused to perpetuate frauds on banks / genuine customers. In addition, features like interoperable cash deposit and card to card funds transfer are enabled at ATMs. Bill payments have also been enabled by some banks at their own ATMs (i.e., for ';on-us'; transactions). A pilot on QR code-based cash withdrawals from ATMs is underway. White Label ATMs (WLAs) 8.5 ATMs registered a healthy growth in numbers but their deployment was predominantly in Tier I & II centres. To facilitate expansion of ATMs in Tier III to VI centres, it was decided in 2012 to permit non-bank entities to set up, own and operate ATMs and such ATMs were called WLAs. The WLA operator's role is confined to acquisition of transactions of all banks' customers by establishing technical connectivity with the authorised shared ATM Network Operators / Card Payment Network Operators. The criteria for distribution of these WLAs in various tiers was fine-tuned in 2019 to provide more thrust on remote centres by stipulating a revised proportion of deployment of ATMs in the ratio of 1:2:3 for Metro & Urban: Semi-Urban: Rural Regions. As on November 30, 2020, there were 2.34 lakh ATMs and 0.25 lakh WLAs. Micro-ATMs 8.6 Micro-ATM is a device used by a BC to connect to his / her bank, authenticate customers and perform transactions. Although, it is called micro-ATM, it does not have cash storage or dispensation facilities. The cash balances are reflected online but physical cash is deposited with or handed out by the BC. 8.7 Micro-ATMs are based on a bank-led model for financial inclusion, where the Aadhaar infrastructure is an overlay on the existing banking and payments infrastructure. The basic interoperable transaction types that a micro-ATM supports are deposit, withdrawal, funds transfer, balance enquiry and mini-statement. The means of authentication supported by a micro-ATM are (i) Aadhaar + Biometric; (ii) Aadhaar + OTP; (iii) Card + Biometric; (iv) Card + OTP; and (v) Card + PIN. An account holder can access his bank account through a micro-ATM using any of these methods and perform transactions supported by it. 8.8 The roles of various participants in deployment of a micro-ATM network are as follows: -

Issuing bank: The issuing bank is the bank that owns the customer relationship, and stores account details in its CBS. The customer banks with the issuing bank and interacts with it for any queries, it serves as a touch point for dispute resolution. It authorises transactions and carries out transactions that the customer initiates. -

Acquiring bank: The acquiring bank is the bank that owns the BC relationship at the transaction point. -

Business Correspondent (BC): A BC is appointed by the bank providing access to basic banking services using micro-ATM. Banks may either appoint an individual BC or a corporate BC, who further can appoint sub-agents. -

Technology Service Provider (TSP): TSP provides technology to the Acquiring Bank to support BC operations. -

Multilateral switch: The multilateral switch is used in the case of 'off-us' transactions to provide interoperability. It routes transactions from the acquiring bank to the issuing bank, and routes the authorisation, settlement and reconciliation messages. An 'off-us' transaction in case of funds transfer may involve multiple banks, viz., the acquiring bank, the issuing bank, and the recipient's bank and the process is put through by the multilateral switch. This multilateral switch is operated by NPCI and other interbank switch vendors. -