| 1. Introduction Background 1.1. The Reserve Bank has, from time to time, been receiving requests for extension of timings for certain markets such as currency futures and Over-the-Counter (OTC) foreign exchange market. Accordingly, it was announced as a part of the Statement on Developmental and Regulatory Policies dated August 01, 2018, to set up an internal group to comprehensively review the timings of various markets and the associated payment and settlement infrastructure. Accordingly, an Internal Working Group (IWG) was set up comprising officials of the relevant Departments of the Reserve Bank. Terms of Reference 1.2. The terms of reference for the Internal Working Group are as follows: -

To study the current timings of various financial markets regulated by the Reserve Bank, including instruments traded on exchanges, with respect to their trading, clearing and settlement cycles. The study would also cover a review of the arrangements of supporting payment and settlement systems. -

To examine cross-country practices in the matter including the support infrastructure, and their influence, if any, on market development in terms of participation, liquidity, volume and similar factors. -

To examine the implications, including benefits and costs, of revision in current timings for trading as well as for supporting payment and settlement arrangements. -

To make recommendations in respect of timing for trading, clearing and settlement arrangements and for any related aspect of market functioning that may be justified for improving efficiency. Approach/Methodology of the Group 1.3. The Group followed the following approach. -

It reviewed the relevant literature available in the public domain. -

Market timings in other emerging markets as well as advanced economies were studied. The Group also studied the experience of various markets (viz. Hong Kong, Tokyo and Canada) which have reviewed market timings for exchanges in their respective jurisdictions. -

A study on risk management during extended trading hours by major overseas exchanges/clearing houses located in Europe (Eurex) and Asia (Hong Kong Exchange (HKEx) and Singapore Exchange (SGX)) was also undertaken. -

Discussions were held with market bodies/associations (Foreign Exchange Dealers' Association of India (FEDAI), Fixed Income Money Market & Derivative Association of India (FIMMDA), Primary Dealers' Association of India (PDAI) and Association of Mutual Funds of India (AMFI)) as well as with the market participants (banks, clearing corporations and corporates) to obtain their views/ feedback. -

Market data for various dimensions like hourly and daily average trading volumes and rates across the segments, major participants, etc. were analysed. Additionally, data pertaining to National Electronic Funds Transfer (NEFT) and Real-time Gross Settlement (RTGS) transactions were also analysed to understand liquidity management by market participants. -

An empirical exercise to assess the impact of Rupee exchange rate in the Rupee Non-Deliverable Forwards (NDF) market on domestic exchange rate was undertaken. A similar exercise to assess the impact of rates in the non-deliverable Overnight Indexed Swaps (ND-OIS) market on yield of Government securities (G-sec) was also undertaken. Organisation of the Report 1.4. Following this introductory section, Section 2 gives an overview of the markets regulated by the Reserve Bank. Section 3 provides an overview of timings and the issues that merit review of timings followed by an analysis of various proposals examined by the Group and recommendations therein. 1.5. The report has four annexes. The results of empirical studies undertaken by the Group on linkages of rupee NDF and onshore exchange rate market are given in Annex-I. A summary of the literature studied by the Group is furnished in Annex-II. A few case studies related to extension of timing on exchanges in a few jurisdictions are given in Annex-III. An overview of risk management measures adopted in some of the major overseas exchanges/clearing houses for extended trading window is given in Annex - IV. 2. Market Structure 2.1. The Reserve Bank regulates money markets, Government Securities (G-Sec) market, foreign exchange (Forex) market and the markets for derivatives on interest rate, currency and credit derivatives. These markets have evolved in last 10-15 years in terms of participation, liquidity and venues of trading etc. Most of these markets are dominated by institutional players and corporates with low participation from retail participants. Technology has helped in further deepening of these markets, with most of the trading volumes in overnight money market and G-sec market now carried out on electronic platforms. This chapter discusses, in detail, the structure of each of these markets. Foreign Exchange Market 2.2. Forex market in India is predominantly a wholesale market, dominated by banks, forex brokers and corporate clients. Customers are priced off-market by banks. Trading in forex and related derivatives takes place OTC as well as on exchanges. Forex market is largely an OTC market with an average daily volume of about USD 33 billion. Exchange traded forex derivatives have an average daily volume of about USD 8 billion (Chart 2.1). 2.3. In the interbank market, spot trading is the dominant segment with a share of over 50 per cent in total turnover followed by swaps (Chart 2.2). In the client segment, forwards constitute about 58 per cent of total turnover, followed by spot at 42 per cent (Chart 2.3). 2.4. Major trading venues for interbank spot market are Reuters D2 and FX Clear, while forex swaps are largely transacted outside platform on a bilateral basis. However, almost all settlement in USD/INR markets (about 90-95 per cent) is guaranteed by CCIL. 2.5. Spot trading market is well distributed through the day, while in case of forex forwards, volumes typically increase gradually during the day, with the last two hours having relatively higher volumes (Chart 2.4). Exchange Traded Currency Derivatives (ETCD) Currency Futures and Currency Options, are traded on all three domestic exchanges (NSE, BSE and MSEI). Distribution of volume and open interest (OI) of currency futures across the exchanges is given in Charts 2.5 – 2.6. Participants in the ETCDs market are majorly institutions and are categorized as Proprietary Traders (Banks and Non-bank), Client and FPIs. Distribution of trading volume and OI for different categories of participants are given in Charts 2.7 – 2.8. Average daily volume in ETCDs is about USD 8 billion. Money Market 2.6. Overnight money market in India includes the call money market, tri-party repos (TREPS)1 and market repos (Chart 2.9). The call money market trades bilaterally as well as on an electronic platform, Negotiated Dealing System (NDS) – Call, managed by Clearing Corporation of India Limited (CCIL). Likewise, in market repo, trading takes place bilaterally as well as on an electronic trading platform – Clearcorp Repo Order Matching System (CROMS). TREPS is traded entirely through an electronic dealing platform. 2.7. TREPS accounts for about 60 per cent of the total daily trading volume, while the call market contributes about 10 per cent of the volume (Charts 2.10 and 2.11). 2.8. Participation across the three overnight markets varies. The call money market is purely an inter-bank market with the sole exception of primary dealers (PDs). Mutual Funds are the major lenders in TREPS (about 65 per cent of average daily lending). An overview of category-wise participation in the three segments is provided in the following charts (Chart 2.12 – Chart 2.17). 2.9. There is variation in hourly trading volumes as well. Call market and repo are active during the first hour of trade while TREPS sees concentrated trading during the last hour of trading for members settling through DSB. An overview of average hourly trading activity across all the three segments is provided below (Chart 2.18). Government Securities Market 2.10. Over the last two decades, the government securities (G-Sec) market has witnessed significant changes like introduction of an electronic screen-based trading system, dematerialised holding, straight through processing, establishment of the CCIL as the CCP for guaranteed settlement, new instruments, changes in the legal environment, etc. These changes have contributed to a rapid development of the market. 2.11. G-secs are currently traded on the Negotiated Dealing System – Order Matching (NDS-OM), or bilaterally in the OTC market. The NDS-OM platform contributes around 81 per cent of the total value of transactions, the remaining being in the OTC market (Chart 2.19). 2.12. Central Government dated securities (CGs) form a dominant share (around 88 per cent) in the total trading volume, followed by Treasury Bills (T-bills) and State Development Loans (SDLs) (Chart 2.20). 2.13. Primary Dealers and banks are the major participants in the Government securities market. The market share of participants is shown below (Chart 2.21 – Chart 2.22). 2.14. An overview of average hourly trading activity for 3 months is provided below (Chart 2.23). Settlement Mechanism in G-Sec, Market Repo, TREPS and Forex Market 2.15. Call is settled bilaterally through RTGS, throughout the day. All secondary market transactions in Government Securities, market repo and TREPS are settled through CCIL which acts as a central counterparty (CCP). CCIL also acts as a CCP for the forex markets. (Chart 2.24 – 2.25). 3. Review of Market Timing 3.1. While the decision of market timings is best left to market participants, there is a need to review market timings across all products and funding markets to ensure that they complement each other and thereby avoid unanticipated frictions. Further, extension of trading hours would depend on availability of an efficient and adequate support infrastructure in terms of trading, clearing and settlement. Issues like margin calls, posting of margins, line of credit etc., in an extended market timing scenario need to be considered. Since major payment systems in India (RTGS and NEFT) are available till 7 pm and funding markets (call, TREPS and repo) are all closed by 5 pm, any unanticipated margin calls or funding requirement beyond 5 pm could pose a challenge to the cash and risk management of exchanges or market participants. Similarly, it will have cost implications for various stakeholders such as banks, brokers, custodians, regulators etc., in terms of availability of infrastructure and manpower. This section discusses in detail the various aspects relating to extension of market timings, their implications, and the possible path ahead. 3.2. Foreign Exchange (Forex) Market Current Forex Market Timing 3.2.1. FEDAI has stipulated market timings for inter-bank USD/INR forex transactions from 9 am to 5 pm2 (Table 3.1). However, Authorised Dealers3 are permitted to accept retail transactions beyond these timings. There are no restrictions on timings for transactions in cross currencies. Banks can decide the trade timings based on their internal policies. | Table 3.1 - Market timing in interbank forex market in India | | Market | Settlement Type | Market Timings | | Forex Cash, Tom, Spot | T+0/ T+1/T+2 | 9:00 am | 5:00 pm | | Forex Forwards | Beyond T+2 | 9:00 am | 5:00 pm | | Currency Futures | | 9:00 am | 5:00 pm | | Currency Options | | 9:00 am | 5:00 pm | Broad Objectives of Market Hours 3.2.2. Market hours should facilitate two objectives: -

Trading hours should be adequate for corporate, retail and institutional customers including non-resident participants, to meet their daily business requirements. Inter-bank participants, consequently, should be able to cover their positions after meeting the requirements of customers. -

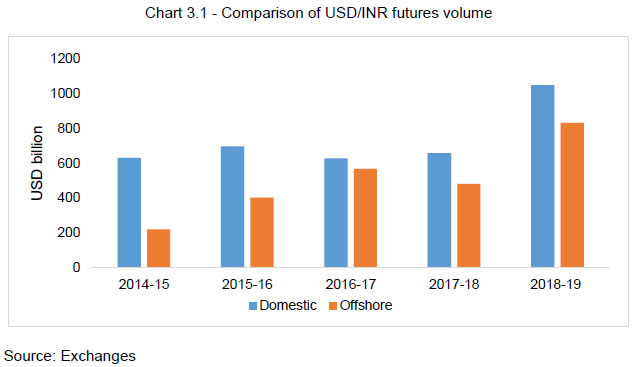

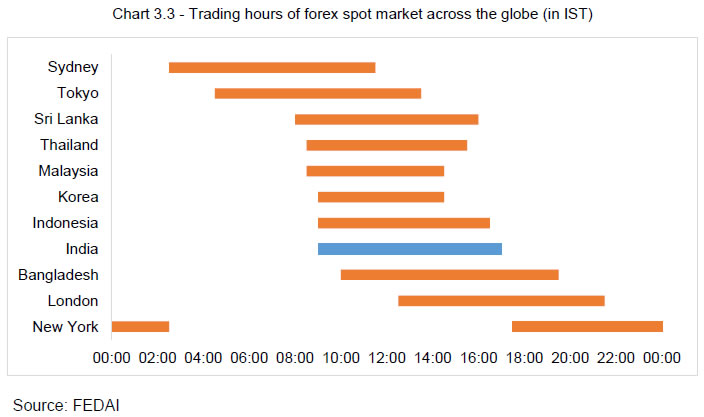

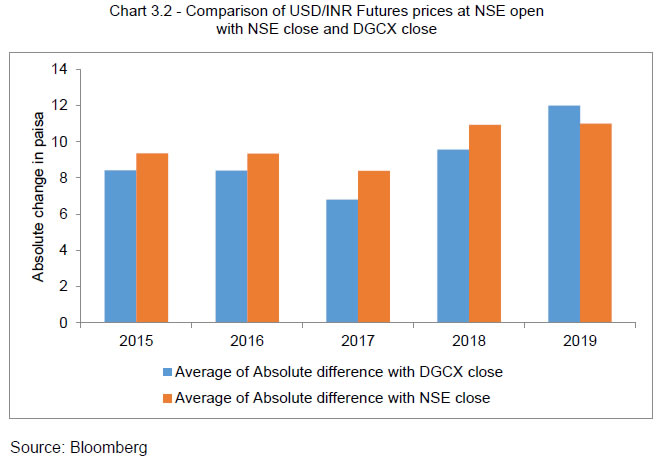

Market hours should facilitate adequate market liquidity and enable prices to adjust to evolving information, and facilitate efficient price discovery. In case of foreign exchange markets , the timing should be reasonably adequate to price in relevant off-shore information. Need for Review of Timings 3.2.3. A comprehensive review of timings in the forex market is considered desirable for the reasons discussed here. 3.2.3.1. Increased volume in offshore markets: Gradual integration of the Indian economy with the global economy and increased interest of foreign investors in Indian markets aided by a liquid USD/INR forex market, have led to growing volumes in Rupee trades in the offshore markets. Volumes in the offshore currency futures markets, have steadily increased during last 3-4 years vis-à-vis on-shore exchanges (Chart 3.1). Market share of domestic exchanges in USD/INR futures has come down from about 74 per cent in 2014-15 to 56 per cent in 2018-19. Similarly, offshore markets for non-deliverable forward (NDF) in financial centres such as Singapore, Hong Kong, Dubai and London have seen sizable growth and, as per BIS Triennial Survey 2016, NDF turnover stands at about USD 16 billion on a daily basis. Several enablers such as ease of capital flows, conducive tax environment, operational/ administrative convenience, enabling regulatory environment (onboarding of investors, product design and offerings) longer trading windows, etc., have facilitated growth of NDF markets in various currencies in international financial centres. Offshore markets provide several advantages over onshore markets. The capital control regime requires that entities with Rupee exposure can access the onshore market for hedging. Even for hedgers, administratively, there is a natural incentive to operate in the offshore market so as to leverage their existing settlement as well as collateral arrangements through centralised treasuries. Product related restrictions in the onshore market e.g., swaps and structured options are not allowed to non-residents for hedging, may also limit the product choices for non-resident. Offshore Rupee derivative market is virtually a 24 hour market and, therefore, non-residents have the flexibility to execute and unwind hedge contracts during their working hours. However, onshore market timings may not be a suitable window as per their time zone. Thus, the ability to dynamically manage risk in the offshore market, makes NDF markets attractive for non-residents. Apart from this favourable tax laws may also be an important determinant in choice of trading market.  3.2.3.2. Longer trading window in offshore markets: Total investment by Foreign Portfolio Investors (FPIs)/Foreign Direct Investors (FDIs) in India has grown significantly in the last 15-20 years. However, onshore hedging activities of non-residents have been low with forward outstanding currently at around USD 6 billion as compared to the investment at USD 80 billion. There is a possibility that non-residents prefer offshore markets to hedge their Rupee risk, because of centralised treasuries, ease of regulatory and taxation requirements, non-availability of onshore markets during their time zone, etc. Trading hours of onshore forex markets, especially the exchanges, are shorter in comparison to offshore exchanges which offer Rupee contracts (like DGCX, SGX, CME, ICE, etc.) (Table 3.2). These exchanges are located at major financial centres and offer a variety of products. Incidentally, although Rupee trades for 17-23 hours on these exchanges, the majority of the volume (72-87 per cent) takes place during Indian trading hours (Table 3.3). | Table 3.2 - Comparison of Rupee trading hours | | Trading Venue | Trading Hours

(India Time) | Duration

(approx.) | | NSE,BSE,MSE | 9:00 am to 5:00 pm | 8 Hours | | DGCX | 8:30 am to 1:30 am | 17 Hours | | SGX | 4:30 am to 2:15 am | 21 Hours | | CME | 3:30 am to 2:30 am | 23 Hours | | ICE | 6:30 am to 4:30 am | 22 Hours |

| Table 3.3 - Trading of Rupee Futures across exchanges | | Venue | During Indian Trading Hours | Beyond Indian Trading Hours | | DGCX (Normal) | 72% | 28% | | DGCX USDINR (Mini) | 80% | 20% | | DGCX USDINR (Quanto) | 72% | 28% | | Total-DGCX | 72% | 28% | | SGX | 87% | 13% | | Source: Exchanges | The current market hours for USD/INR spot/ forward/ options, starts at 9 am and closes at 5 pm, with customers being able to access the USD/INR market till 4:30 pm. These current timings overlap with the trading hours of Asian markets (including their closing) as well as first half of a European trading day. This allows Indian markets to have a reasonably good price discovery based on news in global markets during these hours. There are, however, some market hours, especially the US market opening (after India closes) and Asia opening (before India opens), during which the Indian markets are shut, which have a bearing on the prices in Indian markets. Further, domestic OTC markets in most economies have regulated market hours and a review of the spot market timings data for emerging Asian economies indicates that the trading hours vary in the range of 6-9 hours (Chart 3.3). Indian forex markets remain open for 8 hours which is similar to most Asian markets. Even in case of major currencies (G-10 currencies) which are traded 24 hours across the globe, domestic markets in each country are open for a limited time period and activity is transferred from one place to another. For instance, activity for EUR/USD, for an internationally active bank, would shift from its London desk to NY desk after close of trading (in London). Further, as mentioned earlier, USD/INR volumes on the off-shore exchanges are also concentrated during Indian trading hours. As a corollary, any extension of domestic market hours might lead to higher volumes in off-shore exchanges.  3.2.3.3. Onshore markets fail to capture major international events: Domestic markets are closed during important currency trading sessions such as New York time and Tokyo time. Hence, any major domestic or international event or data release during hours when the Indian markets are closed, are not priced in by the residents and this may impact the opening rates of the Rupee. In extreme cases, it may manifest in a gap-up or gap-down at market opening, on the next day. While traders in offshore markets are able to price the information as and when it is released, an onshore trader is at a disadvantage. Commodity hedging market in India operates till 11.30 pm and hence prices in international developments completely. This enables commodity hedging domestically, but the corresponding currency exposures remain unhedged as forex market is closed. As seen in Chart 3.2, the opening price of USD/INR (near month contract) on NSE is generally closer to the previous closing price on DGCX than the previous end of day price on NSE. This is understandable as trades in DGCX price in information generated after NSE closes. Quick and effective assimilation of information is likely to make markets more efficient in terms of price discovery, reduction in volatility and impact cost. However, based on a study spanning the period from 1998 to 2018, the average intra-day volatility (Closet+0 – Opent+0) is 13 paise while the average overnight volatility (Opent+1 – Closet+0) is 6 paise. More significantly, there are substantially more days of high intra-day volatility than high overnight volatility. Roughly, 85 per cent of exchange rate volatility occurs during domestic market hours; perhaps even more because off-shore volatility is exaggerated due to relative illiquidity post Indian trading hours.  3.2.3.4. Offshore NDF markets impact on onshore price: Over a period, regulations have been liberalised to permit Rupee invoicing of trades, Rupee borrowings under the External Commercial Borrowings (ECB) route, issue of Masala Bonds, centralised hedging etc., which have increased Rupee exposure of non-residents. There is evidence that onshore exchange rate, especially in times of volatility, is guided by the price movements in offshore markets. A 2013 RBI working paper4 on inter-linkages between onshore and offshore NDF markets shows that when Rupee is appreciating, there is a bi-directional relationship between the two markets, while there is a unidirectional impact of NDF market on onshore market when the Rupee is depreciating. The results indicate that with increasing volumes of NDF market, the rupee is likely to become more prone to shocks emanating from overseas markets. The Group also carried out an empirical analysis to assess the impact of NDF closing prices on the forex opening prices in the domestic market for the period 2010 – 2018 (Annex I). The assessment indicated a strong bi-directional causality between NDF prices and onshore forex prices, which is statistically significant. The dynamic relationship between the NDF closing prices and domestic forex opening prices are also estimated through an unrestricted vector auto regression (VAR). The estimated impulse response shows that a one standard deviation shock in NDF closing prices results in an increase of about 22 basis points in forex opening prices on the following day which gets muted after one day and peters out thereafter. Extension of domestic market timings could help domestic markets to become less prone to external price fluctuations. However, for this to happen, along with extension of market hours, other complementary measures which are underway viz. flexibility to non-residents to access onshore interest rate market and forex hedging markets, need to be expedited. Impact of Extension of Trading Hours 3.2.4. Impact of extension of trading hours, primarily for USD/INR trades, are discussed here. 3.2.4.1. Impact on price discovery Advantages a) Globally, OTC forex markets in major currencies (G10 currencies) are open round the clock. The growing volumes in Rupee on offshore exchanges (Chart 3.1 above) indicate that there is reasonable offshore demand for Rupee exposure. Further, internationally forex markets are quite active when New York and London times overlap, but the domestic Rupee market is closed during these hours. Extension of trade timing could help in effective assimilation of international developments and help make the domestic markets less prone to the to external price fluctuations in Rupee. This would also imply effective exchange rate management policy. b) Prices would reflect significant developments during extended hours enabling domestic entities to manage risk more efficiently. Disadvantages a) There could be less informed price discovery during extended hours due to lower liquidity and lower number of active market participants. b) Efficient pricing in futures markets requires live spot market in the underlying. If the OTC market is closed, inefficient pricing and their illiquidity could lead to volatility, price overshoots and the associated costs. c) Keeping the spot market open would involve costs for participant banks, brokers etc. It may also require that the funding markets are kept open, further raising market costs. All these cost increases, since they are eventually passed on to customers, raise the cost of market access in the long run. 3.2.4.2. Impact on Cost Advantages a) Though there will be initial costs, there are long term benefits in terms of market development. Banks may minimise the cost through review of process flows, centralisation of activities, etc. Banks may decide to participate in extended trading hours based on their internal policy. Further, with improved liquidity in the market over time, the costs may get reduced. Further, calibrated extension may help in limiting costs to some extent. Disadvantages a) Any extension of trading hours could entail costs for various banks, brokers, custodians, regulators, etc. in terms of infrastructure, back office processing and human resource. Not only Treasury Front Office, but various other supporting departments of banks (e.g. Clearing, B/O, M/O, Trade Finance, IT) may need to remain open during extended hours. There could be a need for keeping the branches open to process the documentation and related activities. The attendant costs could outweigh the benefits. A similar analysis by Tokyo Stock Exchange (TSE) suggested that the early opening or extension of trading hours may have higher cost than benefits. Thus, TSE reduced the noon recess to allow additional trading time instead of extension of market timing. (Annex III). b) .(To be discussed) The extent of additional cost due to extended business hours could not be quantified. However, as per market feedback, extension may not have benefits commensurate with increase in costs, at least initially. 3.2.5. Proposals for domestic Forex market timings 3.2.5.1. Discussion with market participants indicate that market has a mixed view on the benefits of extension in market timing. While, the large corporates believe that extension in market timing may enable them to manage their risk efficiently, the smaller corporates appear to be indifferent to the same. The feedback from banks, which are the major market makers, is also not unanimous. Some of them believe that extension in market timing need not impact volumes substantially and may lead to spreading of the volumes across extended hours. Extension in market timing could entail higher infrastructure cost to stakeholders, viz., banks, brokers, exchanges and regulators. With, most of the turnover in offshore exchange traded rupee derivative market taking place during onshore market hours and limited market hours in most of the other emerging markets, suggests that any extension in market timings needs to be calibrated carefully. As discussed in para 3.2.3.1, though several factors contribute to growth in NDF markets, availability of longer market hours is one of the major determinants. The current forex market regulations are being reviewed and rationalised to allow greater flexibilities to both residents and non-residents in terms of products choice, positions, purpose and participation etc.. Recently the Reserve Bank has also constituted a Task Force to examine the offshore Rupee market and recommend measures to incentivize the non-residents to hedge in the onshore market. It is felt that extension in market timing will complement these policy measures aimed towards improving access to onshore markets and better position onshore markets vis-à-vis offshore markets in terms of efficiency, liquidity and price discovery for non-residents. This assumes importance as growth in the external sector and increased internationalisation of rupee, likely to increase trading interest and investor base in Rupee going forward. This is evident from introduction of Rupee products in several offshore exchanges. Extension of market timings may enable shift of some of the offshore volumes to onshore markets thereby improving domestic market liquidity, if not immediate but over medium to long term period. Experience from some of the exchanges viz., Hong Kong Exchange (HKEx), points to positive impacts on the volume on account of extension of market timing. Further, from the perspective of residents, the benefits could be in form of improved price discovery, reduction in volatility during opening hours, efficient hedging, etc., due to improved assimilation of international development. Better price discovery coupled with improved liquidity over a medium to long term horizon, may allow domestic market prices to become less prone to external price fluctuations in Rupee. It is therefore desirable to explore calibrated opening of markets to gauge demand and potential benefits. 3.2.5.2. Markets segments to be extended: Clients generally prefer the OTC market for hedging their risks as it gives flexibility in terms of size and tenor of contracts. The IWG examined the potential issues of extending the timing of exchanges only, leaving the OTC market unchanged. It is operationally easier to extend timings on exchanges as they already have some segments open in extended hours. However, longer market timings for currency futures over OTC (spot) market will create asymmetry between the underlying market and the futures market, which could possibly lead to higher volatility during the non-overlap timing. This is because in the absence of OTC (spot) markets, the price discovery in futures market could be purely based on the trading interests of entities dealing in extended hours. Such prices therefore may not be a true reflection of the underlying interest. Similarly, while the future market would rapidly converge to the spot plus carry at the next spot open, when the spot market resumes its role as a price setter, it could still influence the opening on the next date. Further, banks are active participants on both - exchange and OTC currency markets; they hedge their economic positions in both OTC (options and forwards) and exchange traded (futures and options) segments within the assigned limits. Extension of exchange timings without corresponding extension in the OTC market could subject overnight positions of banks to excess valuation changes. Besides, the presence of customers, sensitive to volatile prices, would ensure that the banks stay active on exchanges also. Therefore, it is desirable to extend trading hours for both OTC and Exchanges. 3.2.5.3. Preferred revised timings: In the event of extension of forex trading hours, the trading hours may be such that they cover EU and US sessions’ overlap as this will facilitate to sufficiently capture movements in European markets and part of US markets (Table 3.4). This would also be beneficial from the perspective of limiting infrastructural costs, human resource cost and administrative costs. | Table 3.4 - Overlapping of trading timings (IST) | | Window start (IST) | Window close (IST) | Overlap | | 5:30 pm | 9:30 pm | Most appropriate time for considering extension of market hours – London and NY markets are open simultaneously during these hours. Most Europe and US data released during this time. | | 5:30 pm | 1:30 pm | New York and Singapore | | 4:30 pm | 11:30 pm | Tokyo and Sydney | | 12:30 pm | 1:30 pm | Tokyo and London | IWG was of the opinion to extend the OTC forex and exchange traded currency derivatives markets till 9 pm. 3.2.5.4. Need for aligning corporate and inter-bank trading hours: Currently, inter-bank trading hours in USD/INR are longer than customer window by 30 minutes (till 5 pm). This arrangement has worked well for banks. The Reserve Bank has been receiving suggestions to allow banks to extend USD/INR trading window to corporates beyond 4.30 pm. The IWG explored the feasibility of aligning inter-bank and customer window. Banks are of the view that the gap between inter-bank and customer window is needed to cover customer positions in the inter-bank market. Banks will find it difficult to cover, in case there are large customer transactions at the closing moments of market. Further, this window allows banks to manage NOPL and regulatory requirements. Hence, banks are of the view that for efficient management of risks, inter-bank trading hours should be slightly greater than the customer timings. In several jurisdictions there is no gap between inter-bank and customer window. Currently also, AD banks are permitted to accept retail transactions in USD/INR beyond 5 pm. There are no time restrictions for transactions in cross currencies. However, the market may still force banks to a uniform time-line as customers may shift to banks with larger trading window. The IWG suggests that the current structure of client and inter-bank timings - i.e. longer inter-bank timings by 30 minutes - may be continued as this window allows banks to manage their risks. 3.3. Money Market Current money market timings 3.3.1. Timing of overnight money markets is provided in Table 3.5. | Table 3.5 - Money market timings for different settlements | | Market | Trading System | Settlement type | Market Timings | Remarks | | Call money market | NDS-CALL | T+0 | 9:00 am | 5:00 pm | - | | Market repo | CROMS | T+0 | 9:00 am | 2:30 pm | - | | Tri-party Repo Dealing | Tri-party Repo Order Matching Platform | T+0 | 9:00 am | 2:30 pm | Entities settling funds at Settlement Bank | | T+0 | 9:00 am | 3:00 pm | Entities settling funds at RBI | Cross Country Comparison 3.3.2. For many other Asian economies, like Indonesia, Malaysia, South Korea and Hong Kong, interbank money markets are open till about 4 pm to 6:30 pm (local time), akin to that in India. The cut-off timings for payment systems (for customer transactions), in many of these jurisdictions, is before closure of money markets. However, in certain jurisdictions, including China, Thailand and Vietnam, retail payment systems remain open post closure of money markets. Review of timings 3.3.3. The committee reviewed the money market timings from the perspective of – 1) alignment of timings across various segments; 2) alignment of timing for members settling at RBI and members settling at DSBs; 3) intraday liquidity challenges due to sequencing of settlements; and 4) challenges for benchmark calculation. Alignment of timings across various segments 3.3.4. It is desirable that the various segments of money markets remain open for a similar time window so that participants have options to access collateralised or uncollateralised funding as per their need. It may also alleviate pressure on any particular segment that remains open after closure of other market segments, which could happen in case of separate timings for different funding markets. However, different settlement mechanisms for collateralised (market repo and TREPS) segments and uncollateralised (call) segment pose challenges in alignment of timings. The settlement of transactions in market repo and TREPS takes place along with secondary market transactions in securities segment. Multilateral netting of funds and securities results in high degree of netting benefits for market participants in terms of liquidity requirement. Further, sufficient time is also required after completion of securities settlement so as to facilitate market participants to repay their intra-day credit lines availed from banks. Thus, availability of large value payment systems, such as RTGS, is essential for efficient functioning of the collateralised funding markets. Currently, funding markets in India remain open for about six to eight hours, which is comparatively on par with most emerging Asian economies. However, with the extension in customer RTGS timings till 6 pm and collateralised funding markets available till 3 pm, high value customer payments may entail liquidity management issues for banks. Extension of RTGS customer window provides scope for extension of collateralised money markets. Taking into account the need for settlement in collateralised segment prior to closure of RTGS customer window, IWG suggests that market repo and TREPS may be extended till 4 pm. As call market transactions are settled bilaterally through RTGS, extension would not require any modifications in the supporting payment and settlement systems. Hence, IWG recommends that the call market timings may be extended till at 6 pm co-terminus with RTGS customer window, by which time high value payments are expected to get over. Banks may manage unanticipated their liquidity, post 6 pm, by accessing RBI’s MSF window or reverse repo facility. Alignment of timing for members settling at RBI and members settling at DSBs 3.3.5. Market repo and TREPS close at 2:30 pm and 3 pm respectively. However, entities settling their fund positions at Reserve Bank have an additional 30 minutes in the TREPS market beyond 2:30 pm. To increase synergy between the collateralised funding segments, timings for all participants may be aligned. Alignment in timings may, however, pose some operational challenges in current DSB structure. Thus, IWG recommends that the current difference in timings for DSB members may be continued. This may be reviewed once clearing member structure is introduced by CCIL. Intraday liquidity challenges due to sequencing of settlements 3.3.6. Primary auctions and OMOs settle at about mid-day while securities settlement takes place at the end of the day. This sequencing of settlements may increase the intraday liquidity needs of the system as some market participants may have payable position in one settlement and receivable in another. Hence, IWG recommends that settlement time of primary auction/OMO may be shifted from current (around 12 pm) to a later time (afternoon) of around 4 pm. Alternatively, the option of merging the settlement for OMOs (non-guaranteed basis) with that of secondary market in G-sec (guaranteed), may also be explored by taking into account various legal and operational issues. This would help in reducing the overall liquidity requirement and improving the netting efficiency. Challenges for Benchmark Calculation 3.3.7. Secondary market trading in Commercial Papers (CPs) and Certificate of Deposits (CDs) take place OTC and are reported on CCIL’s F-TRAC platform. Currently, Financial Benchmark India Private Ltd (FBIL) calculates the benchmark rates for CDs and takes the cut-off time as 5 pm. To streamline benchmark rate calculation, cut-off time for CP, CD secondary market trading should be fixed at 5 pm, thereby aligning it with other segments. FBIL may be accordingly advised to take trades reported till 5:15 pm on the F-TRAC platform for benchmark rates calculation. 3.4. Government Securities Market Current G-Sec market timings 3.4.1. Currently, the dealing hours for the secondary market transactions on NDS-OM and OTC are from 9 am to 5 pm for all the members and the settlement is usually on T+1 basis (FPIs are permitted to settle on T+1 or T+2 basis). Settlement is completed by 4 pm on DvP III basis. Settlement of primary auction and OMO takes place in RBI at about 12 pm. Daily trading volumes are well distributed during the day with slightly higher share in the first and the last hour of the trading. Trading data for (old) 10-year benchmark (7.17 per cent GS 2028) for the month of March 2019 is as below (Table 3.6). | Table 3.6 - Trading data for (old) 10 – year benchmark (March 2019) | | Time Slot | Traded Volume

(Rs. Cr.) | Cover

(Rs. Cr.) | Short sell

(Rs. Cr.) | Net Cover

(Rs. Cr.) | % Share of Traded volume vis-à-vis Grand total

(Rs. Cr.) | | 9 - 10 am | 47,987 | 7,805 | 8,980 | -1,175 | 19% | | 10 - 11 am | 25,013 | 4,160 | 5,113 | -953 | 10% | | 11 - 12 pm | 24,634 | 4,695 | 4,840 | -145 | 10% | | 12 - 1 pm | 27,130 | 4,885 | 4,955 | -70 | 11% | | 1 - 2 pm | 23,532 | 3,480 | 3,600 | -120 | 10% | | 2 - 3 pm | 34,050 | 7,070 | 6,895 | 175 | 14% | | 3 - 4 pm | 34,725 | 6,940 | 5,685 | 1,255 | 14% | | 4 - 5 pm | 30,225 | 6,240 | 5,650 | 590 | 12% | | Grand Total | 2,47,298 | | | | | | Source: RBI calculations | Cross Country Comparison 3.4.2. IWG examined the G-sec market trading hours in other comparable Asian markets. The current trading hours in Indian markets are comparable, or longer compared to the trading hours in some of these Asian bonds’ markets. Interestingly, some of the markets have an intraday break in between (Table 3.7). | Table 3.7 - Bond market timings in other jurisdictions | | Country | Local Currency Bond Market Timings | | China | 9:00 am -12:00 noon and 13:30-17:00 pm | | Taiwan | 9:00 am - 15:00 pm | | Hong Kong | 9:00 am - 17:00 pm | | Indonesia | 9:00 am - 17:00 pm | | Korea | 9:00 am - 15:30 pm (OTC: 08:30 am - 15:00 pm) | | Malaysia | 8:00 am - 17:00 pm | | Philippines | 9:00 am - 12:00 noon, then 14:00 pm - 16:00 pm | | Singapore | 9:00 am - 11:30 am, then 14:00 pm - 16:30 pm | | Thailand | 8:00 am - 12:00 noon, then 13:00 pm - 17:00 pm | | Vietnam | 9:00 am - 17:00 pm | | Source: Information from various market participants and public sources | Review of Timings Review of G-sec market was undertaken mainly from the perspective of 1) better integration of market moving news/information and ease of participation for non-residents in G-Secs, 2) impact of ND-OIS prices on on-shore prices and 3) Occasional requests for permitting T+0 settlement for secondary market transactions. 3.4.3. Major data in respect of US market (NFP data, FOMC minutes, etc.), which lead to movement in treasury yields, are released post the closing of domestic G-Sec market. Current market timings do not allow market participants, especially the FPIs, to adjust their investments immediately based on the news/events in international markets. Further, there is a growing non-deliverable overnight indexed swaps (ND-OIS) offshore market, which may influence the onshore market. Empirical study by the IWG indicated that there is a strong unidirectional causality from ND-OIS closing rates to domestic opening rates. On settlement side, there have been occasional requests to permit T+0 settlement for secondary market transactions which may facilitate funding unanticipated requirements. 3.4.4. There have been no requests from any market participants seeking extension of market hours for G-sec trading. Most of the FPIs investing in India already have Asian base and therefore extending the timings may not lead to larger volume. The feedback from the market is that current timings are more than adequate. Therefore, IWG recommends to retain the current market timings. 3.4.5. T+0 transactions can be supported by NDS-OM platform and may be undertaken. But, introduction of T+0 settlement on the NDS-OM platform may result in fragmentation of the liquidity between segments. This may impact the pricing of the securities and result in wide bid-ask spreads. However, the committee discussed exploring the feasibility of allowing market participants to transact in G-sec on T+0 basis on DvP 1 mode for meeting their funding requirement. This facility could be provided by linking the securities settlement system (e-Kuber) and RTGS. 4. Impact on clearing, settlement and risk management 4.1.1. Post-trade services like clearing and settlement play a crucial role in ensuring that the obligations on account of entering into a trade are properly discharged. Further, the risk management systems and processes are integral in eliminating (or minimising) risks associated with trading. This chapter examines the impact of the recommendations by the IWG on underlying post-trade and risk management processes and systems. 4.1.2. Forex market 4.1.2.1. The revised forex market timings as recommended by the IWG have been provided in Table 4.1. | Table 4.1 - Market timing (current and revised) in interbank forex market | | Market | Settlement | Current Market Timings | Revised Market Timings | | Forex Cash | T+0 | 9:00 am - 5:00 pm | 9:00 am - 5:00 pm | | Forex Tom/Spot | T+1/T+2 | 9:00 am - 5:00 pm | 9:00 am - 9:00 pm | | Forex Forwards | Beyond T+2 | 9:00 am - 5:00 pm | 9:00 am - 9:00 pm | | Currency Futures | | 9:00 am - 5:00 pm | 9:00 am - 9:00 pm | | Currency Options | | 9:00 am - 5:00 pm | 9:00 am - 9:00 pm | 4.1.2.2. In the OTC segment, as the deals during the extended hours would be for value date Tom and beyond, there would be little impact on current settlement process. However, extension in market timings will lead to corresponding increase in CCIL’s (CCP’s) day end processing like MTM valuation and margin calls etc. As supporting payment systems will not be available during this extended hours, CCIL will be required to review its risk management framework and processes, especially those relating to margin calls. 4.1.2.3. Exchanges may also have to suitably amend their settlement systems to tackle longer hours. Exchanges with longer trading hours, like HKEx (Annex III), consider trades executed during the extended hours as T+1 trades which are cleared and settled the following day. Currently the clearing house of exchanges levy initial margin and other margins at the time of transactions. Margins on a portfolio client level are computed on a real time basis and adjusted from the collateral of clearing members. Post extension of timing, margin requirement for portfolio change may have to be planned in advance and provided by the clearing members, as payment systems (NEFT and RTGS) will not be available post 7 pm. 4.1.3. Money market 4.1.3.1. The group has recommended extension of timings for both collateralised and uncollateralised segments of the money market. The revised timings, along with the current timings are provided in the Table 4.2. | Table 4.2 - Market timing (current and revised) in money market (T+0 settlement) | | Market | Trading system | Current Market Timings | Revised Market Timings | | Call money market | NDS-Call | 9:00 am – 5:00 pm | 9:00 am – 6:00 pm | | Market repo | CROMS | 9:00 am – 2:30 pm | 9:00 am – 3:30 pm | | Tri-party Repo Dealing | Tri-party Repo Order Matching Platform | 9:00 am – 2:30 pm / 3:00 pm | 9:00 am – 3:30 pm / 4:00 pm | 4.1.3.2. Extension in timing for collateralised segments of the money market, for T+0 settlement, will concurrently extend the entire securities settlement process. Settlement process, which currently gets over by 4:00 pm currently, will be completed by around 5:00 pm, post extension. However, the availability of large value payment system (RTGS), till 6:00 pm, will ensure that members availing intraday credit lines, from settlement banks, have an hour (5:00 – 6:00 pm) window to close those lines. 4.1.3.3. Further, extension of call market timings (to 6:00 pm) will not require any modifications in the supporting clearing and settlement systems, since transactions are settled bilaterally through interbank RTGS. As call market is uncollateralised, risks arising from counterparty exposure is borne by members. Hence, no additional risks will arise only because of extension in timings. 4.1.3.4. The group has recommended that settlement time of Primary auction/OMO may be shifted from current (around 12:00 noon) to a later time (afternoon) of around 4:00 pm. Settlement of OMO is on DvP basis. Thus, in case a counterparty fails to deliver the securities/funds, it will be excluded from the settlement process. Hence the change in timings may not require any system changes. 4.1.4. G-sec market The group has not recommended any revision in timings for the G-sec market. 5. Summary of recommendations 5.1.1. Forex market 5.1.1.1. As discussed in para 3.2.5.1, market has mixed views on the benefits of extension of market timing. While the extension of market timings is expected to provide benefits such as better pricing of post market hours information/data, improved onshore price discovery, and possible shift of offshore volumes to onshore, there is a view that it may entail higher costs to stakeholders. However, since RBI is in the process of reviewing and rationalising foreign exchange regulations to provide flexibility in terms of choice of products, participation, positions, etc., both for residents and non-residents, extension of market hours would complement these policy measures. Thus, calibrated extension of market hours, and to begin with revised market timings of 9 am - 9 pm, may be considered to gauge demand and potential benefits. (Para 3.2.5.1 and 3.2.5.3) 5.1.1.2. It is operationally easier to extend timings on exchanges as they are already offering extended market hours for commodity and derivative segment. However, foreign exchange market in India is predominantly over-the-counter (OTC) and hence prices in thinly traded exchanges could be more volatile in the absence of OTC market. Extension of exchange timings without corresponding extension in the OTC market could pose risk management issues (valuation and open position) for banks operating in both markets. Therefore, it is desirable to extend trading hours for both OTC and Exchanges. (Para 3.2.5.2) 5.1.1.3. Timings for both inter-bank and client segments may be extended and the current gap of 30 minutes between inter-bank and client segments may be maintained to allow banks to manage their risks. (Para 3.2.5.4) 5.1.2. Money market 5.1.2.1. With extension in RTGS customer window till 6:00 pm, the timings for collateralized money market segments (market repo and TREPS) may be extended till 4:00 pm. (Para 3.3.4) 5.1.2.2. Call market timings may be extended till 6:00 pm, co-terminus with RTGS customer window, to facilitate liquidity management by banks. (Para 3.3.4) 5.1.2.3. To increase synergy between the collateralised funding segments, timings for all participants (members settling at settlement banks and members settling at RBI) may be reviewed and synchronised, once clearing member structure is introduced by CCIL. (Para 3.3.5) 5.1.2.4. To reduce intra-day liquidity requirement, settlement time of primary auction/open market operations (OMO) may be shifted from current (around 12:00 p.m.) to a later time (afternoon) of around 4 PM. Alternatively, the option of merging the settlement for OMOs (non-guaranteed basis) with that of secondary market in G-sec (guaranteed), may also be explored by taking into account various legal and operational issues. (Para 3.3.6) 5.1.2.5. To streamline benchmark rate calculation, cut-off time for Commercial Paper (CP) and Certificate of Deposits (CD) secondary market trading should be fixed at 5:00 pm, thereby aligning it with other segments. (Para 3.3.7) 5.1.3. G-sec market 5.1.3.1. The current market timings for G-sec markets may be retained, on account of lack of demand from participants. (Para 3.4.4) 5.1.3.2. The feasibility of facilitating securities transactions on T+0 basis on a DvP I mode may be examined for facilitating funding needs of market participants. (Para 3.4.5)

Annex I Empirical Results on Market Timings - Impact Analysis5 a) Impact of NDF closing prices on onshore forex opening prices: The empirical exercise to assess the impact of NDF closing prices on the forex opening prices in the domestic market is based on pair-wise Granger Causality tests on daily data with one period lag covering from January 1, 2010 to October 12, 2018. The estimated results reveal strong bi-directional causality, which is statistically significant at 1 per cent level of significance (Table 1). | Table 1: Pairwise Granger Causality Tests | | Null Hypothesis: | Obs | F-Statistic | Prob. | | DINRUSDO does not Granger Cause D1MNDFC | 2289 | 17.72 | 0.00 | | D1MNDFC does not Granger Cause DINRUSDO | | 4554.14 | 0.00 | The dynamic relationship between the NDF closing prices and forex opening prices are also estimated through an unrestricted vector auto regression (VAR). The estimated impulse response shows that a one standard deviation shock in NDF closing prices results in an increase of about 22 basis points in forex opening prices on the following day which gets muted after one day and peters out thereafter. The impulse response function is also statistically significant as it lies within the standard error band (Chart 1). b) Impact of ND-OIS closing rate on onshore G-sec opening rate: A similar exercise to assess the impact of ND-OIS closing rate on the opening yield of benchmark 10-year G-sec paper, based on pair-wise Granger Causality test (on daily data covering from January 2, 2012 to October 12, 2018), reveals strong unidirectional causality (with one period lag) running from ND-OIS closing rate to opening yield of benchmark 10-year G-sec (Table 2). | Table 2: Pairwise Granger Causality Tests | | Null Hypothesis: | Obs | F-Statistic | Prob. | | DGESCO does not Granger Cause DNDOISC | 1768 | 0.76 | 0.38 | | DNDOISC does not Granger Cause DGESCO | | 47.45 | 0.00 | The strength of the relationship between the ND-OIS closing rate and the opening yield of benchmark 10-year G-sec as estimated from an unrestricted VAR shows that a one standard deviation shock in ND-OIS closing rate leads to a marginal increase of around 1.5 basis points in the opening yield of G-sec the following day, which dies down after three days. This response is also found to be statistically significant (Chart 2).

Annex II Literature Survey Several studies exploring the impact of periodical market closures suggest that such closure may induce delay in incorporation of information into stock prices, which can widen the divergence between stock prices and fundamental values (price efficiency). It may also cause excessive volatility in stock returns on an intra-day basis, especially at the beginning and end of the trading session (Kyle, 1985; Glosten and Milgrom,1985; and Easlay and O’Hara, 1992). Moreover, a skewed trading pattern in NASDAQ i.e., high trading volume – especially at the open and close of the regular-hours – calls for extension of trading hours to mitigate market inefficiencies (Jain and Joh, 1988). Furthermore, it is found that trading after regular business hours introduces noise resulting in higher bid-ask spreads and inefficient price discovery. Thus, announcements after market hours are likely to generate greater price volatility (Barclay and Hendershott, 2003).

Annex III Case Studies related to Extension Case Study 1: After-Hours Trading (AHT) at Hong Kong Exchanges and Clearing Limited In May 2011, Hong Kong Exchanges & Clearing Limited (HKEx) released a Consultation Paper in which it proposed to introduce an after-hours trading session for its futures market (T+1 Session), which would begin at 4:45 pm (30 minutes after the close of regular trading session or T Session) and end at 11:15 pm Some of the reasons which were cited were: -

Investors will benefit from having an after-hours futures trading platform to hedge or adjust their positions in response to market news and events in the European and US time zones; -

With Hong Kong becoming a Renminbi (RMB) offshore centre, after-hours trading will enable HKEx to serve international trading interest relating to RMB products in the future; -

The capability for after-hours trading is a prerequisite for HKEx to support asset classes traded on a global basis including commodities and foreign exchange; -

Given overseas exchange experience, after-hours futures trading should be a source of business growth; and -

Over time, after-hours futures trading can attract European and US investors to participate in HKEx’s derivatives market both during and after their working hours. The HKEx proposed that after the close of the T+1 Session, 30 minutes will be allowed for performing post-trade activities. Further, all trades transacted in the T+1 Session would be registered as T+1 trades and would be cleared and settled on the following trading day. The Exchange also mentioned that it did not have any intention of introducing after hours trading in the cash market as it is not a common practice among major stock exchanges. The After-Hours Trading Session was launched on 8 Apr 2013. The closing time for the AHT was fixed at 11 pm. The AHT has been well received and in the 6 years since its inception: -

The Exchange has extended the timings of AHT, in phases, to close at 1:00 am. -

The instruments which could be traded during AHT were also increased and today include equity index futures, currency futures, commodity futures, gold futures and iron ore futures. -

After-hours derivatives trading volume increased by nearly 12 times to more than 83,000 contracts. -

Session’s volume rose from about 4 per cent of the day trading volume in 2013 to about 20 percent (till Apr, 2018). -

Eighty-five per cent of HKFE participants participated in the after-hours session. Case Study 2: Tokyo Stock Exchange - Extension of Trading Session The Tokyo Stock Exchange is the fourth largest stock exchange in the world and largest in Asia, by total market capitalisation. Till 2010, the normal daily trading hours comprised a morning session (9:00 am - 11:00 am) and afternoon session (12:30 pm - 3:00 pm). The trading hours were extended in 2010 when the noon recess was shortened from one and a half hours to one hour by extending the close of morning session from 11:00 am to 11:30 am. In July, 2010 a discussion paper regarding the extension of trading hours was released by the TSE, in which four approaches were proposed for extending the trading hours: (1) Abolishing/ shortening the noon recess; (2) Introduction of night-hour trading for the equities market; (3) Extension of the evening session hours for the derivatives market (an evening session, apart from morning and afternoon session was in existence for the derivatives market); and (4) Early opening of the morning session. The probable impact of the changes on factors like liquidity, trading practices, price discovery, system adjustments etc. were analysed. The impact on consistency between cash and futures markets was also discussed. Based on the analysis and feedback of market participants, the decision to shorten the noon recess was taken while not making any other changes. The major reasons cited were as follows: -

The trading hours of the TSE were relatively shorter than those of other major exchanges. For instance, in 2010 the TSE was open for a total of four and a half hours, while NYSE and LSE were open for six and a half hours and eight and a half hours respectively. Hence, TSE felt it imperative to seriously look into extending trading hours. -

However, due to the costs outweighing the benefits, proposal 2, 3 and 4 were discarded. -

The noon session was shortened. However, it was not abolished due to high demand for trading executions by the ‘Itayose’ method at the closing of the morning session and the opening of the afternoon session. The Itayose is a kind of call auction which generates a certain amount of liquidity during the aforementioned intervals. -

The morning session for derivatives trading was aligned with the cash market and its closing time was extended from 11:00 am to 11: 30 am. Further, citing the reason that the equity index futures were already being traded during the noon recess, the afternoon session opening time was revised to 11:45 am from 12:30 pm. Case Study 3: Montreal Exchange In November, 2017 the Montreal Exchange proposed an extension in the trading hours for interest rate derivative products. It noted the increasing demand internationally for Canadian securities. It observed that international and Canadian clients could not hedge Canadian assets at non-Canadian business hours, while international events could affect asset values at all hours. Hence, it proposed preponing the exchange opening time by 4 hours to align it with the London opening. The clearing process was reviewed and it was proposed that the Canadian Derivatives Clearing Corporation (CDCC) will add an intra-day margin call at 7:15 am. The Exchange expressed its concerns about liquidity during the extended hours in the initial days. It mentioned that it was open to partnership with domestic and international firms for developing liquidity through a slew of approaches such as market making, volume rebates etc. Additionally, the Exchange also discussed that the surveillance and operations departments will be adequately staffed to remain open during the extended hours, in order to ensure market integrity. A phased approach was proposed for extension in timing and in October, 2018 the first phase was launched, which covered 9 IRD products.

References |

Annex IV Global Case Studies - Risk Management during Extended Trading Window Forex Futures in EUREX Rationale for extended hours Forex trading takes place around the clock worldwide, starting on Monday morning New Zealand time and closing Friday afternoon New York time. In order to offer a competitive trading environment, EUREX has extended the trading hours to cover a trading time of 23 hours. Forex futures market was extended in Feb 2017 and forex options market was extended with effect from 2 July 2018. Clearing and risk management Calculation of initial margins for forex futures is unaffected and completely integrated into the margin methodology called Eurex Clearing Prisma. Margin offsets will be granted between forex options and forex futures within the same liquidation group. Margin figures for Clearing Members who are exposed to forex products are calculated as well between 00:00 and 07:00 CET in the morning. During this time span, Eurex Clearing will issue margin reports to the affected Clearing Members on a 10-minute interval showing the margin shortfall and surplus. Clearing Members who are actively clearing forex futures should be aware that the Intra Day Margin call process is applicable during the complete trading day. Margin calls issued between 00:00 and 07:00 CET can be fulfilled using cash payments in Australian dollars. Margin settlement Margin calls are always called against the Clearing Member. However, margin calls arising from shortfalls on client accounts are calculated separately, with auto allocation of the cash collateral received to the client collateral pool. For cash collateral under all clearing models, the Clearing Member’s existing payment infrastructure may be used. All Clearing Members should have access to a USD account for late margin calls. Intra-day margin settlement If there is a margin shortfall on a client account under a Clearing Member, Eurex Clearing will issue and process individual margin calls for the collateral pool in which the margin shortfall has occurred. Eurex Clearing may issue an intra-day margin call between 7:00 CET and 22:30 CET. Once an intra-day margin call has been issued, the Clearing Member has 30 minutes to: -

Enter risk reducing trades -

Instruct Eurex Clearing to process a direct debit in any eligible currency against the segregated pool in shortfall- considering cut-off times -

Deliver security collateral to the collateral pool in shortfall If no action is taken within the 30 minutes then Eurex Clearing will automatically instruct a debit against the Clearing Member’s cash account. If the margin shortfall is a result of a shortfall from a client account, then the cash will be automatically allocated to the segregated pool in which the shortfall occurred. End of day margin settlement: Eurex Clearing’s system closes at 22:30 CET and any overnight margin shortfalls are automatically debited the following morning. Auto-debits are instructed by 07:00 CET and must be funded at the latest by 08:00 CET for EUR and USD and by 09:00 CET for CHF and GBP. If the margin deficit is a result of a shortfall from a client account, then the cash will be automatically allocated to the segregated collateral pool in which the shortfall occurred. Credits are instructed thereafter, 08:00 CET for EUR and USD and 09:00 CET for CHF and GBP. Proposed Extension of Market Eurex plans to extend its trading and clearing hours for selected equity index, fixed income and MSCI futures into the Asian time zone starting from 10 December 2018. Brief on Risk Management for the same is given below: Existing procedures for Clearing Members shall remain unchanged as far as possible. Overnight margin calls will continue to be debited in the European morning. Moreover, the overnight margin calls will be considered as fulfilled during the extended service hours, i.e. each collateral pool starts into the extended service hours without a shortfall. An intra-day margin call during the extended service hours shall only be issued under the following conditions: a. in case of positions changes during the extended service hours due to trading and/or clearing activities (e.g. position transfer, Give-Up/Take-Up etc.) and b. when the intra-day risk limit of the Clearing Member is exceeded (10 percent of the Clearing Member’s Total Margin Requirement). In case an intra-day margin call needs to be fulfilled during the extended service hours, U.S. dollar (USD) and Australian dollar (AUD) are offered as currencies to cover such margin call. Already existing USD payment infrastructures can be utilised. Initially, it will not be possible to provide securities collateral during the extended service hours. Source: i. EUREX Circular6 ii. EUREX Website7 SGX Clearing Process SGX-DC (SGX Derivatives Clearing) runs a settlement cycle for all derivatives products daily. During the settlement cycle, margins for outstanding positions are calculated. To reduce SGX-DC’s exposure to intra-day price changes, SGX-DC performs 3 intra-day margin cycles daily: - once in the late morning and once in the afternoon for current day trades and positions; and - once immediately after the end-of-day settlement cycle that includes trades for next day clearing. At each intra-day cycle, trades and positions are marked-to-market and margin requirement re-calculated. The computed profits and losses for futures and OTC swaps, and premium for option trades are collateralized together with margin requirement. At the end of each clearing cycle, SWIFT debit instructions are sent to SGX-DC’s settlement banks to debit Clearing Members’ accounts for margin calls. Settlement banks are required to confirm the banking instructions within a stipulated time via SWIFT. SWIFT system facility is also available after closure of banking hours. Source: SGX website8 Note - on SGX website, after opening the link above, please check the “Clearing Process” option provided. Risk management arrangement for After Hours Trading (AHT) at HKEX In the absence of a level of banking support to facilitate intra-day call capability during the T+1 Session similar to that during the T Session, the following additional risk management measures will be implemented to mitigate the counterparty risks associated with AHT. Perform monitoring of CPs’ net capital-based position limit (CBPL) based on both the current market prices and positions at regular intervals during the T+1 Session, supplemented by ad-hoc CBPL monitoring. CPs breaching their CBPL will be requested to reduce their exposure to ensure their CBPL compliance. CPs may be disconnected from the HKEX trading system and subject to closing out action by HKEX should they fail to comply with such request or further increase their exposure. A mandatory variation adjustment (VA) and margin call to markets (based on the morning Calculated Opening Prices (COP) or market price shortly after the market open if COP is not available) with T+1 Session will be introduced following the market open of each T Session. Unlike the current ad-hoc intra-day call which includes VA only, this mandatory call will include both VA and margin of all positions as of thirty minutes before the relevant market open of the morning trading session. The call will be issued to CPs by 10:00 a.m. and the payment shall be settled by 12:00 noon. The Calculated Opening Price is the equilibrium market price derived from the price discovery period of thirty minutes before the opening of the morning trading session. There will be no intra-day variation adjustment or margin call during the T+1 Session. Source: HKEX FAQ9 Global Practices Four major overseas exchanges/clearing houses located in USA, Europe and Asia, the mark-to-market and margin of the trades executed during the T+1 Session are in general collected within one day after execution Moreover, it is common amongst overseas clearing houses to conduct multiple variation adjustments and margin calls on their CPs each day. Overseas risk management measures to manage the intra-day risk of afterhours trading vary. Some of the overseas exchanges are able to rely on intra-day call(s) to mitigate the risk as their banking support is still available during their afterhours trading while others impose position limits on their CPs instead as we are proposing to do. Source: HKEX Consultation paper10

| List of Abbreviations | | AD | Authorised Dealer | | AMFI | Association of Mutual Funds of India | | BSE | Bombay Stock Exchange | | CBLO | Collateralised Borrowing and Lending Obligation | | CCIL | The Clearing Corporation of India Ltd. | | CCP | Central Counterparty | | CDs | Certificate of Deposits | | CGS | Central Government Securities | | CME | Chicago Mercantile Exchange | | CPI | Consumer Price Index | | CPs | Commercial Papers | | CROMS | Clearcorp Repo Order Matching System | | CRR | Cash Reserve Ratio | | CSGL | Constituents' Subsidiary General Ledger | | DGCX | Dubai Gold & Commodities Exchange | | DSB | Designated Settlement Bank | | DvP | Delivery versus Payment | | ECB | External Commercial Borrowing | | EM | Emerging Market | | EU | European Union | | EUR | Euro | | FBIPL | Financial Benchmark India Private Ltd. | | FDI | Foreign Direct Investment | | FEDAI | Foreign Exchange Dealers' Association of India | | FIA | Futures Industry Association | | FIMMDA | Fixed Income Money Market & Derivative Association of India | | FOMC | Federal Open Market Committee | | FPIs | Foreign Portfolio Investors | | Forex | Foreign Exchange | | GDP | Gross Domestic Product | | G-sec | Government securities | | HKEx | Hong Kong Exchange | | ICE | Intercontinental Exchange | | INR | Indian Rupee | | ISIN | International Security Identification Number | | IST | Indian Standard Time | | IWG | Internal Working Group | | MSEI | Metropolitan Stock Exchange of India | | MSF | Marginal Standing Facility | | MTM | Mark-to-Market | | NDF | Non-Deliverable Forwards | | ND-OIS | Non-deliverable Overnight Indexed Swaps | | NDS | Negotiated Dealing System | | NDS-OM | Negotiated Dealing System – Order Matching | | NEFT | National Electronic Funds Transfer | | NFP | Non-Farm Payroll | | NOOP | Net Overnight open Position | | NOPL | Net Open Position Limit | | NSE | National Stock Exchange | | NY | New York | | OI | Open Interest | | OMO | Open Market Operations | | OTC | Over-the-Counter | | PDAI | Primary Dealers' Association of India | | PDs | Primary Dealers | | PvP | Payment-versus-Payment | | RBI | Reserve Bank of India | | RTGS | Real-time Gross Settlement | | SDLs | State Development Loans | | SGL | Subsidiary General Ledger | | SGX | Singapore Exchange | | SPDs | Standalone Primary Dealers | | T-bills | Treasury Bills | | TREPS | Tri-party Repo | | US | United States of America. | | USD | US Dollars | | VAR | Vector Auto Regression | | WACR | Weighted Average Call Rate |

|