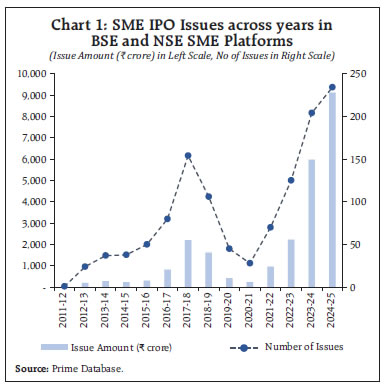

by Bhagyashree Chattopadhyay and Shromona Ganguly^ This study examines the performance and trends of SME IPOs in India during 2023-24 and 2024-25, with a focus on their evolution, market behaviour, and investor response. By analysing data from recent SME IPOs, the study explores the factors influencing subscription rates, listing gains, and post-listing performance. This study underscores the importance of due diligence, regulatory compliance, and data/fact/research driven investment decision in optimising IPO outcomes for both SMEs and investors. Introduction In a labour abundant country like India, small enterprises play a crucial role in economic development by creating jobs and facilitating export as well as ensuring balanced regional development. However, limited scale, lack of hard information on business model and high monitoring cost hinder their access to the formal credit and capital market (Saito and Villanueva, 1981). As per the World Bank Enterprise Survey (WBES) reports, the per cent of small firms considering lack of finance as their biggest obstacle stood at 18.7 per cent and 21.8 per cent globally and in India, respectively1. Access to finance is even more challenging for technology-based firms due to business uncertainties and lack of traditional collateral (Rajan & Zingales, 1998; Colombo & Grilli, 2007). For these innovative small businesses, capital market plays a crucial role, both in the form of fundraising through the initial public offering (IPO) in the public market or through venture capital/private equity/angel/incubation ecosystem in the private capital market. As India’s startup ecosystem grows, fundraising by technology-based companies in capital markets gains prominence2. The SME IPO market in India witnessed a strong surge during FY 2023-24 and FY 2024-25, driven by retail participation, and favourable market sentiment. A surge in SME listings on dedicated exchanges, coupled with strong oversubscription rates, highlighted investor enthusiasm for small and mid-sized enterprises’ IPO. Set at this backdrop, this study examines the performance and trends of SME IPOs in India during FY 2023-24 and FY 2024-25, focusing on their evolution, market behaviour, and investor response. The study is organised in six sections. Section II outlines the evolution and recent trends in fundraising by SMEs through IPO in the SME exchanges, followed by an attempt made in section III to identify the key macro-economic and policy drivers that contributed to the bull run in this segment during last two years. Section IV analyses sectoral composition, and key response indicators of the SME IPOs. Section V highlights some key features of recent SME IPOs, while Section VI compares their post-IPO performance with mainboard IPOs. Finally, Section VII presents concluding observations. II. SME IPO Market in India: Evolution and Recent Trends India’s support for small-scale industries (SSIs) began post-independence, with the Gandhi-Nehru model emphasising the role of handicrafts and cottage industries. For decades, India adopted a protectionist approach to support the SSI sector, reserving product lines for SSIs (Mohan, 2002). However, since the mid- 1980s, economic liberalisation and global market integration led to a shift from protectionist to market-based policies, driven by growing concerns over the impact of protection on Indian SSIs. Several economists and policymakers attributed the distorted size structure and “missing middle3” in Indian manufacturing to such protectionist measures (Mazumdar and Sarkar, 2009; Mohan, 2002; Krueger 2013). Despite policy shifts, the sector continues to be high in priority in the broader industrial policy during the last decade, with special mention in the Make in India, Startup India, Atal Innovation Mission, and AatmaNirbhar Bharat schemes. Industry 4.0 advancements have created both opportunities and challenges for Indian SMEs. The SAMARTH Udyog Bharat 4.0 scheme, though operationalised under the aegis of the Ministry of Heavy Industries and Public Enterprises, mentions adoption of industry 4.0 technology by both the large and the small-scale sector as its core vision. India’s effort to create a SME-focused exchange dates back to 1989, when the Over the Counter (OTCEI) exchange was set up specifically for the SMEs, followed by the INDO NEXT Platform of Bombay Stock Exchange (BSE) in 2005. Since these initial efforts achieved limited success, a more comprehensive step came with the launch of the BSE SME platform in March 2012 and National Stock Exchange (NSE) Emerge in September 2012, which simplified listing norms related to IPO size, post-issue paid-up capital, and reporting requirements, as compared to the BSE and NSE mainboards. In addition, Securities and Exchange Board of India (SEBI) had also put in place the Institutional Trading Platform (ITP) framework in 2015 [later renamed as Innovators Growth Platform (IGP) in 2019] with a view to facilitating fundraising by new age companies in sectors like e-commerce, data analytics, bio-technology and other startups without a public listing. However, this framework failed to gain traction due to several market-microstructure related issues (SEBI, 2018)4 and it remains a niche segment. In contrast, both BSE SME platform and NSE Emerge witnessed rapid growth in terms of number of companies and volume of funds raised over the years. Since its inception, both BSE and NSE SME segment witnessed a broadly rising trend of activities except a brief bout of downturn noticed during 2018- 2021 (Chart 1). As evident from Chart I, listings grew from 1 (₹7.25 crore) in FY 2011-12 to 80 (₹824.64 crore) in FY 2016-17. FY 2017-18 saw a significant increase with 154 issues totalling ₹2,213.39 crore. There were fluctuations in subsequent years, with lower activity in FY 2019-20 and FY 2020-21 (total issue amount at ₹435.64 crore and ₹244.29 crore, respectively) owing to the pandemic. In sync with the post-pandemic economic recovery, there was a surge in SMEs entering capital markets. FY 2023-24 witnessed a sharp rise with 204 issues opening up and fundraising to the tune of ₹5,971.19 crore.  FY 2024-25 marked a new development in the IPO market with NSE achieving record milestone of having highest number of IPOs in Asia and highest amount of equity capital raised in primary market globally (NSE press release, Jan 3, 2025). Total number of IPOs in NSE in CY 2024 stood at 268, as compared to 101 in China (Shanghai Stock Exchange), 66 in Hong Kong (Hong Kong Stock Exchange), and 93 in Japan (Japan Exchange Group). The IPO market buoyancy was partly attributed to democratisation of investment (NSE, 2024) whereby households increasingly channelise their savings to the capital market, strong fundamentals of the domestic economy as well as alluring market valuations. In sync with the buoyancy in the broader market, SME fund raising through IPOs has gained a lot of traction in the last two years. The number of SME IPOs listed in BSE and NSE SME platforms registed an increase of 87.2 per cent in 2024-25 as compared to 2022-23. Furthermore, in 2024-25, the total SME IPO issue amount grew at 52.7 per cent over the previous year. SME IPOs have been in the spotlight in recent times, with probe by the SEBI revealing certain market irregularities5. Comparing the SME IPO indices to broader market indices in the last two years (Chart 2), it is observed that the BSE SME IPO index6 outperformed the mainboard IPO index and the BSE Sensex registering significantly high returns. Following this ebullience, and increased interest of retail investors on SME IPOs (Chart 3), SEBI has warned retail investors to be careful and watchful about the SME IPO space and urged investors to exercise caution while investing in the SME IPOs7. In November 2024, SEBI in consultation with NSE, BSE, and merchant bankers, reviewed the framework for the SME segment and came up with a consultation paper relating to both facilitating and regulating IPOs by SMEs. On December 18th, 2024, the SEBI board approved some of these propositions (Annex E).

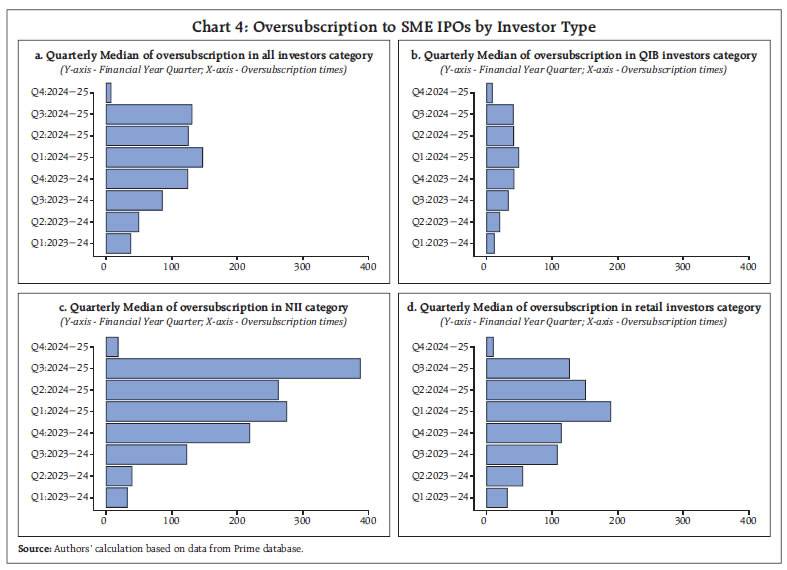

III. Major Drivers of the SME IPO Exuberance III.1 Strong market sentiment and confidence In FY 2023-24, India’s stock market demonstrated remarkable performance, driven by a combination of strong economic growth, enabling government policies, and robust investor sentiment. This growth was supported by India’s consistent GDP expansion, making it one of the fastest growing economies among G20 nations. Investor confidence was further bolstered by government reforms aimed at enhancing growth of infrastructure and manufacturing, along with strong corporate earnings growth in FY 2023-24 (RBI Annual Report, 2023-24). The Indian stock market also partially benefitted from substantial foreign inflows during FY 2023-24, with cumulative net FPI in equity segment reaching ₹2.08 lakh crore8, as compared to a net outflow in the previous year9. Additionally, India attracted a broad base of investors, with a record 1.8 crore new investors joining the market in FY 2023-24, reflecting growing domestic participation10. The market’s strength and investor confidence signalled a bullish outlook despite global uncertainties. III.2 Strong Demand by Retail Investors The strong interest from retail investors in the SME IPOs have been noteworthy, partly reflecting absence of lock-in period for retail investors, and easier availability of trading facilities nowadays. In sync with the above trend, the median number of retail participants in SME IPOs rose significantly during the period Q3: 2022-23 to Q3: 2024-25 (Chart 3). Additionally, Indian stock market is now dominated by young investors, aged below 30 years (NSE, 2025). In March 2019, this age group accounted for only 22.6 per cent of the total investor base. By July 2025, their share had grown significantly to 38.9 per cent, reflecting a rapid rise in the participation of young investors in the stock market. The median age of investors in the stock market reduced to 33 years in July 2025 from 38 years in March 2019 (NSE, 2025). Young investors typically have higher appetite for risk, which, coupled with advancement of technology facilitating trading partly explains this trend. III.3 Increased investors’ convenience through advancement in payment and settlement mechanism Unlike the traditional IPO process where the application amount was debited immediately, the Application Supported by Blocked Amount (ASBA) system now allows the funds to remain in the investor’s account, earning interest until the allotment process is completed. This means that there is no waiting for a refund in case of no allotment and no upfront payment is needed from the investor. The introduction of the use of United Payment Interface (UPI) as an additional payment mechanism within the ASBA framework in 2018 further facilitated retail investors' participation in IPO market. Recently, SEBI has nudged the Qualified Stock brokers (QSBs) in the secondary market (cash segment) to offer either of the UPI-block facility or a 3-in-1 trading facility to investors11. III.4 State Government Incentives Some state governments like Tamil Nadu, and Gujarat have introduced schemes to incentivise fund raising through IPOs (Annex D). These incentives have aimed to reduce entry barriers for SMEs into equity markets, promote formalisation and encourage entrepreneurial growth. During the last two years, Maharashtra led the number of listings followed by Gujarat and Delhi. Maharashtra and Gujarat dominate the SME listings reflecting rapid infrastructure growth, industrial diversity, supportive policies, and ease of doing business in these states (Table 1). | Table 1 : Top States/UT in terms of Number of SME IPOs | | | FY 2023-24 | FY 2024-25 | Total | | Maharashtra | 65 | 65 | 130 | | Gujarat | 53 | 49 | 102 | | Delhi | 30 | 35 | 65 | | West Bengal | 8 | 20 | 28 | | Tamil Nadu | 10 | 14 | 24 | | Rajasthan | 5 | 12 | 17 | | Source: Prime Database; Prowess, Centre for Monitoring Indian Economy (CMIE) | IV. Sectoral Composition The manufacturing sector led SME IPO listings in terms of issue size due to its capital-intensive nature and scalability, followed by services (Table 2). Within services, wholesale trade led by a significant margin amidst policy boost supporting India’s supply chain ecosystem. While the traditional sectors like metals, infrastructure and chemicals had a strong presence in the SME IPO segment, there was also an increasing participation in digital driven sectors. Sector-wise key response data indicates high oversubscription in utilities, clean energy, travel services, automobile manufacturing, and environmental management indicating a preference for companies aligned with long-term infrastructure, mobility, and sustainability themes (Annex B). A surge in SME listing in travel, logistics and education indicates post-pandemic pick up of growth in these sectors. V. Salient Features of Recent SME IPOs V.1 Strong retail interest in SME IPOs The number of applicants for SME IPOs has surged significantly from 4 per allottee in FY 2022-23 to 245 applicants per allottee in FY 2024-25. One reason behind this surge is the active involvement of retail investors. During January-June 2023, 7 SME IPOs were oversubscribed over 100 times. From July 2023 onwards, this trend corroborated as 32 SME IPOs surpassed the 100x subscription mark, gaining even more momentum since early November 2023. Oversubscription was primarily driven by non-institutional investors and retail investors12 (Chart 4). | Table 2: Sector-wise SME IPOs in FY 2023-24 and FY 2024-25 | | Sector | Total No. of SME IPOs | Issue size of sector (₹ cr) | NIC Division (Top 5, in terms of issue size) | No. of SME IPOs | Issue Size (₹ crore) | | Agriculture | 11 | 270 | Crop and animal production and related activities | 11 | 270 | | Manufacturing | 209 | 7875 | Civil engineering | 23 | 974 | | | | | Manufacturing of electrical equipment | 14 | 898 | | | | | Manufacture of basic metals | 28 | 865 | | | | | Manufacture of fabricated metal products | 11 | 647 | | | | | Manufacture of chemicals and chemical products | 19 | 604 | | Services | 220 | 6935 | Wholesale trade, except of motor vehicles and motorcycles | 85 | 2248 | | | | | Computer programming, consultancy, and related activities | 23 | 799 | | | | | Telecommunications | 11 | 761 | | | | | Retail Trade | 12 | 356 | | | | | Human health activities | 11 | 287 | | Source: Authors’ calculation based on data from Prime database and Prowess, CMIE. |

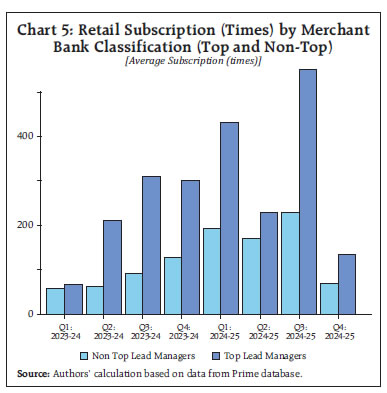

Oversubscription levels in Q4:2024-25 saw a noticeable decline across investor segments, marking a shift from the peak exuberance observed in previous quarters. This moderation aligns with regulatory actions introduced by SEBI in December 2024, aimed at curbing speculative excesses and bringing greater discipline to the SME IPO market. V.2 Relatively tepid response from Qualified Institutional Investors Subscriptions from qualified institutional buyers (QIBs) boost retail investors’ confidence in IPOs while also bringing expertise that benefits companies long-term. SEBI has introduced several initiatives to encourage QIBs to participate in SME IPOs. However, QIB oversubscription in the SME segment has remained limited, with demand staying stable across quarters (Chart 4b). Additionally, only a few foreign portfolio investors have acted as anchor investors in SME IPOs. Notably, a few domestic firms have emerged as key players, serving as anchor investors in over 30 SME IPOs in 202413. V.3 Reputation of merchant bankers as a key determinant of demand Merchant banks are crucial intermediaries in the SME IPO process, as they also play the role of mandatory market maker during the initial years after IPO. Reputed merchant banks are typically more trusted by investors due to their strong track record, global presence, and market expertise. To analyse the effect of merchant banks' reputation on subscription rates, the lead merchant banks were divided into two groups – top and non-top. The top category included seven banks managing over 50 per cent of total IPO issue (value) in FY 2023-24 and FY 2024-25, while the remaining banks were classified as non-top. Analysis shows that subscription rates of IPOs managed by the top merchant banks/Lead Managers are on an average twice as those managed by others (non-top lead managers) (Chart 5). This demonstrates the importance of the reputation of the merchant bank for attracting potential investors. Their extensive networks, strategic distribution, and strong ties with institutional investors help generate demand even before the IPO launches, significantly increasing the likelihood of oversubscription.  V.4 Listing Premiums SME IPOs in India have been witnessing massive oversubscription, with listing at significant premiums. Some SME IPOs have surged by 100 per cent post-listing, attracting retail investors primarily seeking listing gains. During FY 2023-24 and FY 2024-25 (till October 15, 2024), 224 out of 255 SME IPOs on NSE listed at a premium, while 31 debuted at a discount. Similarly, on BSE, 91 out of 100 SME IPOs saw listing gains, with only 9 listing below issue price14. SME IPOs’ listing premiums (measured as percentage gain of closing price on listing date over the issue price) in India tend to range from 0 to 400 per cent on the listing day (Chart 6), depending on factors like demand, merchant banker reputation, and the market sentiment. In contrast, mainboard IPOs, involving larger, established companies, undergo stricter regulatory scrutiny and attract a broader investor base, including institutional investors, high net worth individuals and mutual funds. As a result, their listing premiums tend to be more stable, typically averaging between 10 to 40 per cent.

Chart 7 highlights a positive correlation between SME IPOs' subscription levels and listing day returns. This underscores the crucial role of retail and institutional demand in influencing IPO performance. Higher oversubscription levels often indicate strong market sentiment, leading to substantial listing gains. V.5 Use of IPO proceeds by SMEs An analysis of the type of capital15 in the SME IPO market in FY 2023-24 and FY 2024-25, reveals that in both the years, the issue of fresh capital dominates, comprising over 90 per cent of the total issue (Table 3). This indicates that companies are raising funds for growth and operational needs rather than allowing existing shareholders’ exit16. The proceeds from an IPO are typically allocated to various strategic areas, reflecting the company’s short-term and long-term priorities. Chart 8 depicts the primary reasons of fundraising by SMEs in FY 2023-24 and FY 2024-25. It is observed that capital enhancement/working capitals has the largest proportion, indicating the companies’ primary focus on improving liquidity or ensuring the availability of funds for operational requirements. The second-highest requirement is for ‘expansion/new projects/plant & machinery’, suggesting a strong emphasis on growth and scaling operations through new infrastructure or capacity expansion. The allocation to general corporate purpose reflects miscellaneous expenses or flexibility in using funds for general business purposes. A smaller yet significant portion of the IPO proceeds was used for reducing financial leverage, indicating the intent of these companies to diversify funding sources. | Table 3: Type of Issue (Fresh Capital / Offer for Sale) in SME IPOs | | Period | Total Issue Amount (₹ cr) | Offer for Sale (₹ cr) | OFS as percentage of Total Issue Amount | Fresh Capital (₹ cr) | Fresh Capital as percentage of Total Issue Amount | | FY 2023-24 | 5,971.19 | 310.26 | 5.19 | 5,660.93 | 94.80 | | FY 2024-25 | 9,119.97 | 775.6 | 8.5 | 8,344.37 | 91.5 | | Source: Authors’ calculation based on data from Prime database. |

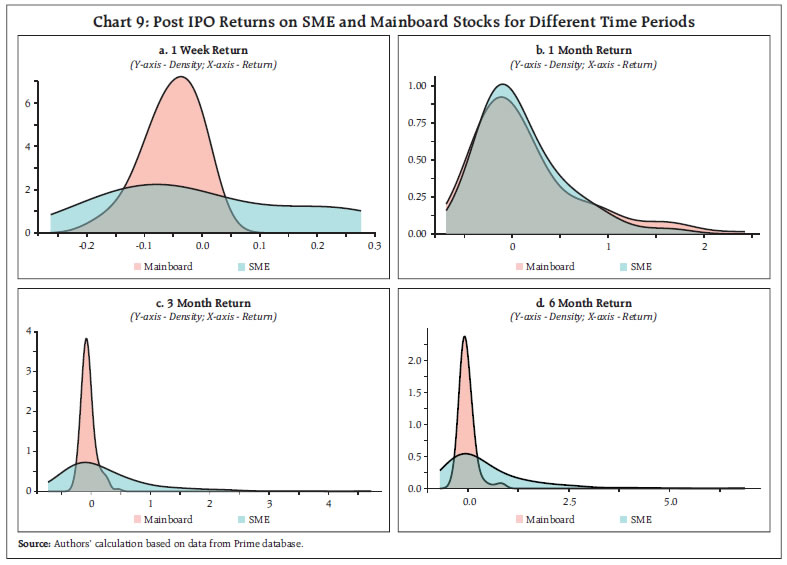

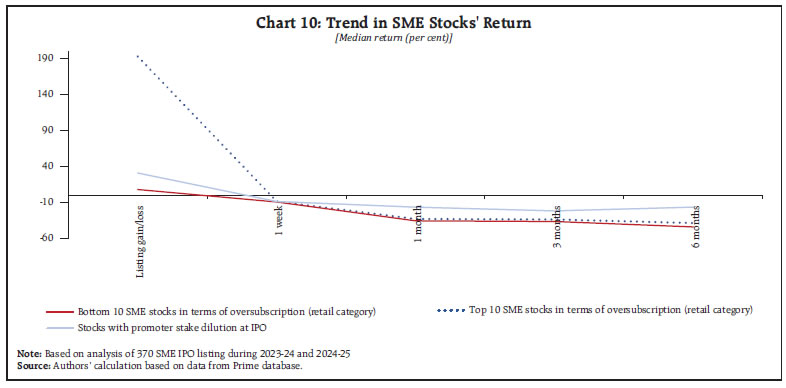

VI. Aftermarket Performance of SME Stocks The return distribution of the companies which underwent IPOs in the last two financial years is analysed in this section to track the post listing performance of the stock prices of the companies. Chart 9 depicts the return characteristics of the SME IPOs over 4-time horizons: 1 week, 1 month, 3 months and 6 months. Density plots showing the distribution of returns across different horizons are observed and compared against the distribution of returns of companies listed on the mainboard in the same period. The charts exhibit the differences in risk and return profiles and performance dynamics of IPOs in the the two segments over different time periods. The return distributions of mainboard and SME IPOs reveal notable differences across various time horizons. Over one week, both mainboard and SME IPOs show returns centred near zero, but SME IPOs exhibit a flatter and wider distribution, indicating higher variance. At the one-month horizon, both groups display positively skewed distributions, with many companies experiencing negative returns while a few achieve very high positive returns, and differences between the two groups become less pronounced. At the three-month horizon, mainboard IPOs show a narrow distribution with returns concentrated near zero, reflecting lower variability and more predictable outcomes. In contrast, SME IPOs demonstrate a much wider spread, including some extreme high-return outliers, suggesting greater variability and the potential for both higher risks and rewards. By six months, the divergence becomes even more evident, with mainboard IPOs maintaining a tight distribution around small positive returns, while SME IPOs show a long tail driven by a few very high-return outliers. However, zero/negative return is observed in a large number of SME stocks. Overall, mainboard IPOs consistently exhibit narrower and more stable return distributions, while SME IPOs present higher variability, with greater potential for both significant gains and losses, particularly over longer time horizons.  A notable trend in recent SME IPOs is the sharp listing gains, followed by negative returns within a short period. This decline is even more pronounced in IPOs that drew strong interest from retail investors (Chart 10). The inability of many SMEs to sustain positive returns post-listing coupled with sharp listing gains following increased interest from retail investors in these stocks prompted SEBI to initiate regulatory measures aimed at restoring stability in the SME IPO segment (Annex E). High demand for certain stocks, combined with limited allotment, often leads to inflated prices as investors compete to acquire shares. Retail investors, drawn by the potential for quick listing gains, often overlook fundamentals, leading to inflated valuations. A comparison of the price-to-earnings ratios of 100 SMEs listed in FY 2023-24 and FY 2024-25 to their respective industry averages reveals signs of over-valuation in some of these stocks. Around 20 per cent of these stocks have price-to-earnings ratios in excessive multiples when compared to their industry peers. Table 4 shows possible overvaluation in a few stocks which were oversubscribed heavily by retail investors during listing. Following such exuberance, some stocks had substantially higher price to earnings (P/E) ratios compared to their industry medians (Table 4 and Annex C).

| Table 4: P/E ratios of Select SME IPOs in FY 2023-24 and FY 2024-25: One Week after Listing | | Stock | Ratio of Oversubscription (Retail) to Median Oversubscription* | P/E Ratio | Median P/E Ratio of Peer Group Companies | | 1 | 14.28 | 104.92 | 35.44 | | 2 | 14.28 | 32.66 | 34.34 | | 3 | 11.58 | 111.94 | 53.52 | | 4 | 11.24 | 62.32 | 41.75 | | 5 | 9.65 | 77.95 | 43.78 | | 6 | 8.52 | 57.47 | 44.74 | | 7 | 7.41 | 25.51 | 34.15 | | 8 | 7.27 | 38.72 | 40.34 | | 9 | 7.15 | 36.49 | 51.49 | | 10 | 6.19 | 45.56 | 39.37 | Note: *: Oversubscription numbers are relative to average oversubscription for SME IPOs during the period under consideration. A higher P/E ratio compared with the industry average indicates possible overvaluation of the stock. Selected companies are from top 100 in terms of oversubscription (retail). Peer group companies are selected from listed companies pertaining to the same industry and similar size categories. For determining size category, the decile-wise classification of the Prowess database is used.

Sources: Prime Database, and Prowess, CMIE. | VII. Conclusion The saying, “Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria”, serves as a crucial reminder for investors in the SME IPO segment. While the buzz around SME IPOs may seem exciting, investing solely on market sentiment can be risky. During bullish phases in the market, enthusiasm and investors’ appetite may cause investors overlook due diligence. In this phase, demand for IPOs surge, and expectations of substantial listing gains can lead to inflated valuations. However, market reversals can quickly dampen this optimism. SME IPOs may offer impressive gains in favourable conditions but carry higher volatility and risk during downturns, making due diligence indispensable. Investors should carefully evaluate the company’s fundamentals, growth prospects, and risk factors before committing capital. Overall, SME exchanges offer a unique challenge from the regulatory perspective, where there is a need to balance the objective of market development with that of investors’ protection. Given the strong growth of start-ups in India, most of which have innovative business models, the provision of risk capital for these firms becomes crucial. Keeping in view the spurt of SME IPOs in recent months and the associated challenges from the perspective of investor protection, SEBI in consultation with NSE, BSE and merchant bankers, had initiated the review of the IPO framework for the SME segment. These measures aim to reduce information asymmetry and regulatory arbitrage, ensure proper utilisation of IPO proceeds, prevent market manipulation, and protect retail investors. The reforms are expected to foster transparency and stability in the SME IPO segment going forward. References Bhattacharya, A. (2017). Innovations in new venture financing: Evidence from Indian SME IPOs. Global Finance Journal, 34, 72-88. Colombo, M. G., & Grilli, L. (2007). Funding gaps? Access to bank loans by high-tech start-ups. Small Business Economics, 29, 25-46. Krueger, A. O. (2013). The Missing Middle. Economic reform in India: Challenges, prospects, and lessons, 299. Mazumdar, D., & Sarkar, S. (2009). The employment problem in India and the phenomenon of the missing middle. Indian Journal of Labour Economics, 52(1), 43-55. Mohan, R. (2002). Small-scale industry policy in India. Economic policy reforms and the Indian economy, 213. NSE Press Release Mumbai, 03 January 2025. National Stock Exchange achieves record milestones of highest numbers of IPOs within ASIA & highest equity capital raised in primary market globally in calendar year 2024 NSE (2024). Indian Capital Markets: Transformative shifts achieved through technology and reforms NSE (2025). Market Pulse Report. Volume 7. Issue 9. September 2025 Rajan, R., & Zingales, L. (1998). Financial development and growth. American economic review, 88(3), 559- 586. Securities and Exchange Board of India (SEBI). (2024). Consultation paper on review of SME segment framework under SEBI (ICDR) Regulations, 2018, and applicability of corporate governance provisions under SEBI (LODR) Regulations, 2015 on SME companies to strengthen pre-listing and post-listing SME provisions. Saito, K. A., & Villanueva, D. P. (1981). Transaction costs of credit to the small-scale sector in the Philippines. Economic Development and Cultural Change, 29(3), 631-640. SEBI (2018). Consultation Paper-Review of framework for Institutional Trading Platform. Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018. World Bank.(2024). “World Bank Enterprise Surveys: ‘Biggest Obstacle’ Indicator.

| Annex A: | | Top IPOs in India (in terms of Size) in FY 2024-25 | | Mainboard | SME | | Name | IPO Size (₹ crore) | Name | IPO Size (₹ crore) | | Hyundai Motor India Pvt. Ltd. | 27,858.75 | Danish Power Ltd. | 188 | | Swiggy Ltd. | 11,327.43 | Sahasra Electronic Solutions Ltd. | 176.83 | | NTPC Green Energy Ltd. | 10,000 | Capital Numbers Infotech Ltd. | 160.69 | | Hexaware Technologies Ltd. | 8750 | Rajesh Power Services Ltd. | 152.29 | | Vishal Mega Mart Ltd | 8000 | Ganesh Green Bharat Ltd. | 118.94 | | Source: Prime Database. |

| Annex B: | | Oversubscription in SME IPOs: Sector-wise in FY 2023-24 and FY 2024-25 | | Sector | Total No of Companies in sector | Median Subscription times | NIC Division (Top 5 in terms of times subscibed) | No of Companies | Median over- subscription | | Agriculture | 11 | 68 | Crop and animal production | 11 | 68 | | Manufacturing | 209 | 82 | Electricity, gas, steam, and air conditioning supply | 1 | 770 | | | | | Manufacture of motor vehicles, trailers, and semi-trailers | 5 | 239 | | | | | Manufacture of beverages | 1 | 216 | | | | | Manufacture of other non-metallic mineral products | 3 | 156 | | | | | Manufacture of fabricated metal products | 11 | 145 | | Services | 220 | 69 | Travel agency, tour operator, reservation service, and related activities | 3 | 387 | | | | | Environmetal and Waste Management | 2 | 219 | | | | | Education | 3 | 210 | | | | | Activities auxiliary to financial services and insurance activities | 4 | 196 | | | | | Telecommunications | 11 | 161 | | Source: Authors' calculation based on data from Prime database and Prowess, CMIE. |

Annex C: Valuation of Listed SMEs in Comparison with Peer Group

Annex D: State Government Initiatives to boost SME Fund Raising • Government of Maharashtra and BSE have signed a Memorandum of Understanding (MoU) in 2024 to help state MSMEs list on the BSE SME board. BSE and the Maharashtra government, under the MoU, were to carry out collaborative programs and activities to sensitise the investor network about the advantages of listing for SMEs and startups. Under the MoU, BSE would help potential businesses in connecting with intermediaries like merchant bankers, registrar, transfer agent, depositories and others apart from guiding MSMEs on capital markets, capital raising mechanism, regulatory compliance and requirements. A similar MoU was signed with NSE as well. • Subsidy for Fund Raising from SME Exchange was introduced by the Tamil Nadu State Government with the objective to facilitate high growth potential SMEs in the state to raise equity capital through SME Exchange, in both the manufacturing and services sector. The government would provide assistance for listing and raising money in the SME stock exchange. Various expenses like merchant banker fees, due diligence fees, registrar and transfer agent fees, peer review auditor fees, exchange fees, and listing charges would be eligible for reimbursement. • Assistance for raising capital through SME Exchange scheme was launched by Government of Gujarat in 2020 whereby 25 per cent of eligible expenditure incurred on raising of fund through SME Exchange is reimbursed by the State Government. • Rajasthan, in its MSME policy 2024, mentioned that the state government has signed a MoU with the NSE to facilitate public listing of the state’s SMEs in NSE Emerge. In addition, the state shall provide one-time support to SMEs up to a maximum of ₹15 lakh towards expenses incurred for raising of funds through NSE’s/ BSE’s SME exchange, subject to terms and conditions. • The Uttar Pradesh government has signed a MoU with the NSE to facilitate capital raising for the state’s SMEs. This is in addition to the state’s existing policy of reimbursement of 20 percent (maximum ₹5 lakh) of the expenditure incurred on raising equity funds through the stock exchange (Uttar Pradesh MSME Policy 2022). • The Government of Kerala has the scheme to provide reimbursement of 50 per cent expenses subject to a maximum of ₹1 crore incurred on floating IPOs through the SME platform of NSE or BSE, provided the funds thus raised are utilised for setting up/expanding enterprise in the state, in any of the priority sectors as outlined in the Kerala Industrial Policy 2023.

Annex E: Key Reforms Proposed by SEBI for Orderly Evolution of the SME IPO Market Reducing information asymmetry and scope for regulatory arbitrage: Keeping in mind the difficulty faced by the investors, especially the retail investors, in obtaining correct and timely information about the IPO bound SMEs, SEBI has proposed the following regulatory changes: a) IPO-bound SMEs were not mandated to make their offer documents public, unlike their mainboard counterparts. SEBI has proposed that the Draft Red Herring Prospectus (DRHP) of the SME IPO filed with the stock exchanges must be made available to public for a period of at least 21 days from the date of IPO (in one English, Hindi and regional newspaper, apart from posting in websites of stock exchanges/lead managers for the issue). b) In terms of Regulation 27 of the Listing Obligations and Disclosure Requirements (LODR) Regulations, a listed entity on mainboard is required to submit a quarterly compliance report. The said report mandates disclosure of composition of directors, attendance details of directors, number of meetings held etc. No such requirement was applicable to SME listed entities. SEBI has proposed that such disclosure now be made mandatory for SME IPOs. c) Shareholding pattern, Statement of deviation(s) or variation(s) and financial results are required to be submitted half-yearly by SME listed entities and quarterly by mainboard listed entities. SEBI has proposed to make quarterly submission of these information mandatory for SME listed companies. d) Like mainboard IPOs, it will be mandatory for the merchant banker managing the SME IPO to submit the due diligence report to the exchange at the time of filing the draft offer document. This will include site visit report by the merchant banker. e) SME to disclose details about senior management along with their experiences, number of employees registered in Employees' Provident Fund (EPF) portal, delay in payment of due in last three years17. f) Keeping in mind the importance of investor protection, SEBI has proposed that post-listing exit opportunity will be extended to dissenting shareholders of the SME IPOs, in case of change in objects or variation in the terms of contract related to objects referred to in the offer document. Earlier, this option was available only for investors in mainboard IPOs. Tightening the grip on usage of IPO proceeds: In recent times, probe by SEBI has found misuse of IPO proceeds by few SMEs. To increase the vigil in this respect, SEBI has proposed the following changes: a) SME IPO proceeds cannot be used for the purpose of loan repayment of promoter, promoter group or any other related party. b) In cases where the SME mentions the object of IPO as working capital, statutory auditor’s certificate on a half-yearly basis certifying use of funds would be required, if issue size exceeds ₹5 crore. c) If the project for which IPO proceeds to be used is co-financed by any bank/FI, then details regarding sanction letter of the bank/FI to be disclosed in draft/final offer document. d) SEBI has also proposed major changes in the related party transaction (RPT) regulations. It may be noted that the SME IPOs were governed by RPT regulations as per the Companies Act, 2013, whereas the mainboard IPOs need to comply the RPT regulations as per LODR Regulations, SEBI, which is stricter. SEBI has proposed to extend RPT norms as per LODR to SMEs, subject to certain terms and conditions. e) Earlier, SMEs could utilise 25 per cent of their total IPO proceeds for “general corporate purpose (GCP)18”. In order to increase scrutiny on usage of funds, this ceiling is now proposed to be reduced to 10 per cent, with an absolute limit of 10 crores. This will prevent the tendency of misutilisation of IPO proceeds by SMEs. Curbing the possibility for market manipulation: In order to prevent market manipulation and ensure that promoters of the SMEs have enough skin in the game, SEBI has proposed to increase lock-in period for promoters of SMEs along with tweaking the existing criteria for determining the minimum promoters’ contribution (MPC). There was a lock-in period of three years for the MPC and one year for anything in excess of the MPC. However, in few cases, SEBI has observed that promoters’ stake comes down drastically after the SME IPO. To prevent the possibility for market manipulation, SEBI has proposed to increase the lock-in period for MPC for SME IPOs from three to five years. Additionally, excess shareholding by promoters over and above MPC can be diluted only in a phased manner. Furthermore, to eliminate the possibility whereby promoters of SMEs purchase stock of the company at cheaper price pre-IPO and sell the stocks at IPO at a higher price to the public, SEBI has proposed to change the definition regarding eligibility of securities for MPC. SEBI has proposed that price per share for determining securities ineligible for MPC shall be adjusted for corporate actions, like split/bonus. Another important proposal in this regard is restricting the offer for sale (OFS) as percentage of issue size in the SME IPOs. This follows the trend that in many SME IPOs, promoters dilute their stake instead of raising fresh capital for expansion purpose. Protecting investors’ interest: As analysed in earlier section of this note, retail investors’ participation in the SME IPOs have increased rapidly over the years. It is in this context that protecting investors’ interest has gained utmost prominence when it comes to investing in SME stocks. Keeping in view the above issue, SEBI has proposed to increase the minimum application size in the case of SME IPOs from ₹1 lakh to ₹ 2 lakh19, so that only informed and skilled investors enter the SME IPO segment. Also, requirement of minimum allottees in SME IPOs is proposed to be increased from 50 to 200, to ensure that SMEs which have investors’ interest are only listed. This will also enhance aftermarket liquidity in SME exchanges, which is generally found to be lower (Bhattacharya, 2017). Following the release of the consultation paper and the consideration of public comments on the above proposals, in its 208th board meeting on Dec 18, 2024, SEBI approved several of these proposals to enhance transparency, governance, and investors’ protection in SME IPO segment20. Key approved reforms – • Profitability Requirements – SMEs are now required to have a minimum operational profit (EBITDA) of ₹ 1 crore in at least two of the preceding three financial years to be eligible for an IPO. • Offer for sale (OFS) Limitations – The portion of shares offered by existing shareholders in an IPO is capped at 20 per cent of the total issue size. • Usage of Issue Proceeds – SMEs cannot use IPO proceeds to repay loans to promoters, promoter groups or related parties. Usage of IPO proceeds for general corporate purposes is capped at 15 per cent of IPO size or ₹ 10 crore, whichever is lower. • Allocation Methodology for NIIs – Allocation methodology for NIIs in SME IPOs is to be aligned with mainboard IPO procedure, whereby proportional allotment will be replaced by “draw of lots” method. • Pre-Listing Disclosures – The DRHP filed with exchanges is to be made available for 21 days for public to provide comments, by making public announcement in newspaper. • Lock-in on promoters’ holding – Lock-in on promoters’ holding held more than the minimum promoter contribution (MPC) is to be released in phased manner. 50 per cent of promoters’ holding more than the MPC shall be released after 1 year and the remaining 50 per cent promoters’ holding can be released after 2 years. • Related party transaction (RPT) norms, as applicable to listed entities on main board, to be extended to SME listed entities, provided that the threshold for considering RPTs as material shall be 10 per cent of annual consolidated turnover or ₹ 50 crore, whichever is lower.

|