Ramesh Golait and S. M. Lokare* |

| |

| Weakening impulse of capital formation in the face of surging capital intensity continues to be a binding constraint, impinging on the growth of Indian agriculture and remains a major cause of concern, particularly when viewed in the recent turbulent world of food crisis. It needs to be reiterated that investment is most important single factor in the growth process and agricultural public investment in less-favored areas not only offers the largest poverty reduction per unit of spending but also leads to the highest economic returns. Only step up in investments can provide a much needed structural break and lift the Indian agriculture from the world of stagnation, notwithstanding the fact that ICOR in agriculture sector continues to be high. While there is a pressing need for a more fundamental change in the strategy to raise resources and accelerate the pace of capital formation, nevertheless, it is also a critical input that needs to be appropriately structured, timed and well implemented to have the maximum impact. |

| |

JEL Classification : Q 10, Q12, 14

Keywords : Agriculture, Investment, Farm Inputs |

| |

| Introduction |

| |

| Agriculture continues to be a prime pulse of the Indian economy and is at the core of socio-economic development of the country. It accounts for around 19 per cent of GDP and about two-thirds of the population is dependent on the sector. Growth of other sectors and overall economy hinges on the performance of agriculture to a considerable extent through its backward and forward linkages. It is not only a source of livelihood and food security for a large population of India but also has a special significance for low income, poor and vulnerable sections. The Indian agriculture notwithstanding its importance, suffers from various constraints such as traditional methods of cultivation, heavy dependence on monsoon, fragmentation of land holdings, low productivity and low investment. Among others, declining investment over time has emerged |

| |

* Authors are working in the Department of Economic Analysis and Policy of the Reserve Bank of India. They are grateful to Shri KUB Rao, Adviser for encouragement and guidence. Usual disclaimer applies. |

| |

as a major binding constraint on the performance of agriculture and remains a cause of concern. Inadequacy of new capital formation has slowed the pace and pattern of technological change and the infrastructural development with adverse ramification on agricultural productivity. On the contrary, there has been a large increase in the capital intensity of agricultural production during the 1990s, doubling the incremental capital-output ratio (ICOR) from about 2 to 4, implying higher cost of production and lower profitability. In the era of globalisation, when agriculture is expected to satisfy not only the domestic demand but also to encash on its comparative advantages and contribute substantially to foreign exchange earnings by way of exports, upgradation and modernisation of technology and management practices are critical. Besides, attaining sustainable growth has become an imperative in order to meet the steadily rising need of food and fiber for the burgeoning population. Hence, the need for increasing investment in agriculture is being felt as never before. The issue of augmenting agricultural production on a sustainable basis assumes all the more importance when seen in the context of recent turbulent world of food crisis.

The National Agriculture Policy (2000) and the 11th Five Year Plan envisage an annual growth in agriculture of over 4 per cent. Investment in agriculture, the prime mover, therefore, needs to be accelerated to achieve the desired rate of growth. More importantly, this investment needs to be appropriately structured, timed and well implemented to have the maximum impact. Against this backdrop, this paper attempts to critically evaluate the investment scenario in agriculture. Section I underpins the role of investment in Indian agriculture and in poverty reduction and the types of investment undertaken by both public and private sectors. The analytics of trends in investment, its composition, trends in investment credit and plan outlay, both at the national and State level are set out in Section II. Section III discusess the quality and linkages between public and private investment, constraints to investment in agriculture and the extant policy measures. Section IV sets out the way forward, highlighting the complementarity between public and private sectors while Section V contains the concluding observations. |

| |

Section I

Nature and Criticality of Investment in Agriculture |

| |

The investments in any sector generate capital in the form of infrastructure, improvement in the quality of natural resources and assets, and lead to the creation of productive assets. The importance of capital in a country’s economic development is well recognised and documented. Several studies have found investment as the single most important factor in the growth process (Lewis, 1955; Rostow, 1960). Given the importance of investment in economic growth, there has been a considerable interest in the factors affecting investment during different periods and stages of development. While public investment is determined largely as a matter of policy and by the availability of funds, private investment is affected by a variety of factors, which differ over time and space.

Investment in agriculture is generally undertaken for realising the long-term potential by (i) augmenting natural resources, (ii) enhancing efficiency of use of existing resources and (iii) generating value addition. Thus, in simple terms, investment means acquiring physical assets that result in the creation of a stream of incremental income over a period of time. Capital formation through investment in agriculture helps in improving the stock of equipment, tools and productivity of natural resources, which, in turn, enables the farmers to use their resources, particularly land and labour, more productively. Creation of capital goods, thus, is necessary for raising productivity of existing resources and realising the long-term growth potential.

The relationship between capital formation and agricultural growth, and agricultural growth and poverty alleviation are very well articulated in literature. Given the positive impact of agricultural growth on poverty alleviation, the role of capital formation as one of the major engines of agricultural growth has been well placed in the development policy perspective. There are some major streams of research on capital formation that have sharpened this role in the development policy framework (FAO 2004).

Public investment reduces rural poverty through improved growth in agricultural production, agribusiness, rural non-farm employment and lower food prices. While there are often long time lags between investment and visible impact, investments in agricultural research, education, and rural infrastructure are often the most effective in promoting agricultural growth and poverty reduction (Table-1). Regional analysis within India also suggests that public investment in less-favoured areas not only offers the largest poverty reduction per unit of spending but also leads to the highest economic returns (Fan, Zhang, and Zhang 2002). |

| |

Table-1: Returns of Agricultural Public Investment and Impact on Poverty Reduction in China and India |

| |

Economic Returns@ |

Returns – Poverty$ |

| |

China |

India |

China |

India |

R & D |

9.59 |

13.45 |

6.79 |

84.5 |

Irrigation |

1.88 |

1.36 |

1.33 |

9.7 |

Roads |

8.83 |

5.31 |

3.22 |

123.8 |

Education |

8.68 |

1.39 |

8.80 |

41.0 |

Electricity |

1.26 |

0.26 |

2.27 |

3.8 |

Anti Poverty Programmes |

- |

1.09 |

1.13 |

17.8 |

@ : Return per Rupee spending in India and Yaun per spending in China.

$ : Average number poor reduced per million Rupee spending in India and average number of

poor reduced per 10,000 Yaun in China.

Adopted from Fan, Zhang and Zhang, 2002. |

|

| |

| Public vis-a-vis Private Investment in Agriculture |

| |

Investment in agriculture is undertaken by both public as well as by private sectors. While public sector investment in agriculture is undertaken for building necessary infrastructure, private investment in agriculture is made either for augmenting productivity of natural resources or for undertaking such activities, which supplement income sources of farmers. Private sector investment includes investments made by private corporates and households. The corporate sector investment includes investment by organised corporate bodies like big private companies and unorganised entities like sugar co-operatives and milk co-operatives. The household sector investment comprises investment on farm equipments, machinery, irrigation, land improvement and land reclamation. With about 90 per cent share, households dominate the private investment scene. These investments enable farmers to grow existing crops more productively and intensively and take up non-conventional/high value crops. |

| |

| |

Section II

Investment Trends in Indian Agriculture |

| |

| 1. Trends in Agriculture Investment |

| |

| An analysis of investment trends in agriculture over a span of last five decades brings out the following facts: |

| |

- Over the years, the share of agriculture investment in the total investment has declined, particularly more rapidly in the 1990s to 7.9 per cent of GDP and between 2000-01 to 2005-06 to 7.4 per cent of GDP as compared to the level of 1980s (11.4 per cent of GDP) (Table-2).

|

| |

Table-2: Trends in Investment in Agriculture and the overall Economy |

Decade/Year |

Average Annual Investment in Agriculture |

Average Annual Investment in the Overall Economy |

Share of Agriculture in Total Investment |

| |

Public |

Private |

Total |

Public |

Private |

Total |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1950s |

- |

- |

4,370 |

- |

- |

25,508 |

17.9 |

1960s |

2,904 |

3,929 |

6,833 |

21,281 |

27,577 |

48,858 |

13.9 |

1970s |

4,851 |

7,297 |

12,149 |

33,511 |

44,690 |

78,201 |

15.3 |

1980s |

6,443 |

7,840 |

14,283 |

57,539 |

71,914 |

1,29,454 |

11.4 |

1990s |

4,837 |

12,299 |

17,136 |

74,265 |

1,48,627 |

2,22,892 |

7.9 |

2000-2006 |

5,237 |

17,184 |

22,387 |

85,327 |

2,27,216 |

3,12,543 |

7.4 |

2000-01 |

4,435 |

15,574 |

19,809 |

81,718 |

1,80,428 |

2,62,146 |

7.6 |

2001-02 |

5,488 |

14,872 |

20,360 |

82,824 |

1,68,840 |

2,51,664 |

8.1 |

2002-03 |

4,760 |

16,740 |

21,500 |

75,469 |

1,64,485 |

2,39,954 |

9.0 |

2003-04 |

5,699 |

18,487 |

24,186 |

82,998 |

2,04,946 |

2,87,944 |

8.4 |

2004-05 |

4,832 |

18,028 |

22,860 |

87,311 |

2,93,569 |

3,80,880 |

6.0 |

2005-06 |

6,206 |

19,400 |

25,606 |

1,01,640 |

3,51,028 |

4,52,668 |

5.7 |

Source: Computed from National Accounts Statistics and Agricultural Statistics at a Glance,

Ministry of Agriculture, GOI. |

|

| |

● Following the above trend, the share of public sector in the total investment in agriculture has declined more sharply during the 1990s (6.5 per cent), as compared to the 1980s (11.6 per cent), while that of private sector investment has gone up simultaneously (Table 3).

● Notwithstanding an increase intermittently, the average share of public sector investment between 2000-01 to 2005-06 still remained below the level of 1990s.

|

| |

Table-3: Trends in Public vis-a-vis Private Investment in Agriculture |

Decade/Year |

Ratio of Public and Private Investment in |

Share of Public Investment in Agriculture |

Share of Agriculture in total GDP |

Ratio of Agri. GCF to Agri. GDP |

Agriculture |

Economy |

1 |

2 |

3 |

4 |

5 |

6 |

1950s |

- |

- |

- |

56.1 |

5.1 |

1960s |

43:57 |

44:56 |

13.7 |

47.8 |

6.4 |

1970s |

40:60 |

43:57 |

14.3 |

42.8 |

9.1 |

1980s |

45:55 |

45:55 |

11.6 |

36.4 |

8.0 |

1990s |

28:72 |

34:66 |

6.5 |

29.1 |

6.5 |

2000-2006 |

23:77 |

28:72 |

6.1 |

21.8 |

7.9 |

2000-01 |

22:78 |

31:69 |

5.4 |

23.9 |

6.4 |

2001-02 |

27:73 |

33:67 |

6.6 |

24.0 |

6.2 |

2002-03 |

22:78 |

31:69 |

6.3 |

21.5 |

7.1 |

2003-04 |

24:76 |

29:71 |

6.9 |

21.7 |

7.2 |

2004-05 |

21:79 |

23:77 |

5.5 |

20.2 |

10.0 |

2005-06 |

24:76 |

22:78 |

6.1 |

19.7 |

10.2 |

Source: Computed from National Accounts Statistics and Agricultural Statistics at a Glance, Ministry of Agriculture, GOI. |

|

| |

● The loss in momentum in public sector investment in agriculture is more clearly noticed when it is juxtaposed with the private sector investment in the economy as a whole. Private sector investment in agriculture also showed a similar trend over the years. It could, therefore, be inferred that the decline in investment in agriculture is due to relatively lower shares of both public and private sector investments compared to their shares in total investment in the economy.

● The trends in the contribution of agriculture to the overall GDP reveals that the share of agriculture GDP in the total GDP has been declining over the years, the decline being sharper after 2001-02, implying relatively faster growth in sectors other than agriculture.

● The ratio of GCF to GDP is an important measure for the assessment of investment efficiency in a given sector. The ratio of GCF to GDP originating in agriculture declined to 6.5 per cent in the 1990s from 8 per cent in the earlier decade before showing a trend of gradual revival since 2002-03.

● Furthermore, the share of the agricultural sector investment in GDP declined from 2.2 per cent in the late 1990s to 1.9 per cent in 2003-04 and has remained unchanged upto 2005-06. This decline was partly due to the stagnation or fall in public investment in irrigation, particularly since the mid-1990s (Economic Survey, 2006-07) (Table 4).

|

| |

Table-4 : Gross Capital Formation in Agriculture |

|

Investment in Agriculture (Rupees crore) |

Share in Agriculture Gross Investment (per cent) |

Investment in Agriculture (per cent of GDP at constant prices) |

Year |

Total |

Public |

Private |

Public |

Private |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Old Series (at 1993-94 prices) |

1990-91 |

14836 |

4395 |

10441 |

29.6 |

70.4 |

1.9 |

1995-96 |

15690 |

4849 |

10841 |

30.9 |

69.1 |

1.6 |

1996-97 |

16176 |

4668 |

11508 |

28.9 |

71.1 |

1.5 |

1997-98 |

15942 |

3979 |

11963 |

25.0 |

75.0 |

1.4 |

1998-99 |

14895 |

3870 |

11025 |

26.0 |

74.0 |

1.3 |

1999-00 |

17304 |

4221 |

13083 |

24.4 |

75.6 |

1.4 |

New Series (at 1999-00 prices) |

1999-00 |

43473 |

7716 |

35757 |

17.7 |

82.3 |

2.2 |

2000-01 |

38176 |

7155 |

31580 |

18.5 |

81.5 |

1.9 |

2001-02 |

47043 |

8746 |

38297 |

18.6 |

81.4 |

2.2 |

2002-03 |

46823 |

7962 |

38861 |

17.0 |

83.0 |

2.1 |

2003-04 |

45132 |

9376 |

35756 |

20.8 |

79.2 |

1.9 |

2004-05 |

48576 |

10267 |

38309 |

21.1 |

78.9 |

1.9 |

2005-06* |

54539 |

13219 |

41320 |

24.2 |

75.8 |

1.9 |

* : Quick Estimates

Source: Central Statistical Orgianisation. |

|

| |

2. Trends in Investment Credit and Private Capital |

| |

Private investment in agriculture depends, among other things, on the availability of enabling infrastructure, investable resources and expected rate of return on investment. The expected rate of return to an investor is largely determined by the prices of agricultural inputs and output. It is in the context of availability of investable resources that credit from financial institutions becomes critically important.

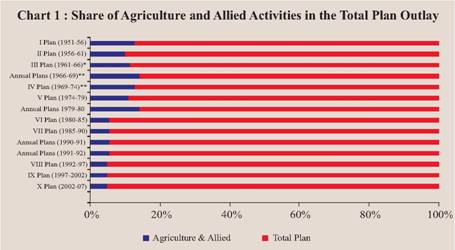

Inadequacy of farm credit continues to be one of the major bottlenecks hindering the growth in investment and growth in agriculture (Economic Survey 1997-98). The growth of direct finance to agriculture and allied activities witnessed a decline in the 1990s (12 per cent) as compared to the 1980s (14 per cent) and 1970s (around 16 per cent). The average share of long-term credit, which is important from the point view of capital formation has not only been much lower but has also decelerated (from over 38 per cent to around 36 per cent), impacting adversely the future growth process (Chart 1) . |

| |

|

| |

Continued higher proportion of short-term credit could probably be due to the relatively higher comfort level of those who demand and those who supply credit. Since expenditure on inputs is inevitable to sustain their agricultural operations, irrespective of the weather conditions obtaining in the field, farmers prefer to borrow short-term credit as it provides them necessary control over resources through continued liquidity. The suppliers on the other hand, favour short-term credit due to relatively lower lending and risk costs, supervision and monitoring costs and a better asset-liability management. |

| |

3. Trends in Plan Outlay on Agriculture and Allied Activities |

| |

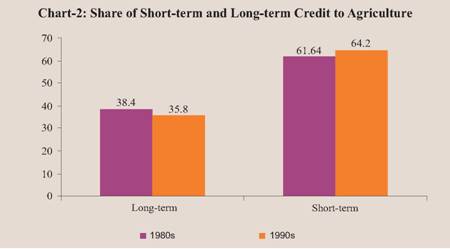

Another evidence of investment in agriculture could be the share of agriculture in the total Plan outlay. There has been a continuous decline in the share of plan outlays for agriculture and allied activities, over the years. The share of agriculture and allied sector in the total Plan outlay registered a fall from 5.8 per cent during the 6th Plan (1980-85) to 4.9 per cent during 9th Plan (1997-2002). According to the Mid-term Review of the Tenth Plan, the share of agriculture and allied activities during 10th Plan period (2002-07) came down further to 3.9 per cent lower than the earlier projected level (5.2 per cent) (Chart 2). |

| |

|

| |

4. Pace and Pattern of Investment in Agriculture and Allied Activities |

| |

National Level Trends |

| |

Composition |

| |

| An analysis of the composition of investment in terms of total outlay (Revenue and Capital Outlay) of the Government on different heads relating to agriculture and rural development during the period 1991 to 2004 (on an average) reveals that: |

| |

● The investment is concentrated and skewed in favour of irrigation and flood control, which accounts for a major share (around 12 per cent) in the total development expenditure, while the share of agriculture and allied activities (around 10 per cent) and rural development (7 per cent) is relatively low.

● Of the total development expenditure on agriculture and allied activities, crop husbandry occupies the largest share (27 per cent) followed by forestry/wild life (20 per cent) and animal husbandry (11 per cent).

● The other items such as dairy development, food storage and warehousing also account for a significant share (around 8 per cent). However, the share of expenditure on agriculture research and education (6 per cent) - an important component - stands on the lower side.

|

| |

Growth Pattern |

| |

| Analysis of available data relating to expenditure on agriculture and allied activities since 1991 up till the early part of current decade (2004) from the Handbook of Statistics on State Government Finances, RBI, reveals the following trends (Table 5): |

| |

- The total expenditure on agriculture and allied activities which recorded, on an average, a growth of around 13 per cent in the 1990s, dropped thereafter to around 10 per cent during the current decade (early part).

- Similarly, the growth of expenditure on irrigation and flood control slackened considerably to 10 per cent in the second half of the 1990s and further to 4 per cent in the subsequent period from the level of around 14 per cent during the first half of the 1990s.

- The expenditure on rural development, which recorded highest growth (among all) at around 18 to 19 per cent during the 1990s also came to register a decline at over 5 per cent.

- The only exception was special area programme, the expenditure on which witnessed continued growth momentum from around 8 per cent in the first half of 1990s to around 17 per cent in the subsequent period.

- Of the total expenditure on agriculture and allied activities, the growth in expenditure on crop husbandry, soil and water conservation, fishery, plantation was impressive in the second half of the 1990s, but lost the momentum during the current decade.

- On the other hand, investment in animal husbandry and dairy development witnessed a continuous decline over time. The only

exceptions were food storage/ warehousing and other agricultural programmes, which witnessed increase in the expenditure during the current decade.

|

| |

Table 5: Composition and Growth of Investment in Agriculture

and Allied Activities in India |

Items |

Composition |

Growth Rate |

Percentage share |

1991-92 to 1995-96 |

1996-97 to 1999-2000 |

2001-02 to

2003-04 |

Agriculture and Allied Activities |

|

|

|

|

Share as % of total expenditure |

5.9 |

14.4 |

15.3 |

11.7 |

Share as % of develop exp. |

10 |

13.2 |

13.2 |

9.9 |

Share as % of Exp on agri&allied |

|

|

|

|

Crop Husbandry |

27.4 |

9.5 |

13.8 |

3.6 |

Soil and Water Conservation |

6.9 |

11.7 |

14.8 |

3.6 |

Animal Husbandry |

11.1 |

15.9 |

12.8 |

-0.1 |

Dairy Development |

7.6 |

13.6 |

9.6 |

6.3 |

Fisheries |

2.6 |

5.5 |

15.6 |

-1.8 |

Forestry and Wildlife |

20.3 |

13.3 |

11.7 |

1.7 |

Plantations |

0.1 |

10.4 |

15.2 |

5.7 |

Food Storage and Warehousing |

7.9 |

-9 |

8.7 |

16.3 |

Agriculture Research And Education |

6.3 |

14.2 |

- |

5.3 |

Co-operation |

9.2 |

11.4 |

12.4 |

6.6 |

Other Agricultural Programmes |

0.9 |

1.7 |

-0.2 |

6.8 |

Rural Development |

7.1 |

19.1 |

18.1 |

5.3 |

Share as % of develop exp |

|

|

|

|

Special Area Programmes |

0.8 |

7.6 |

13.4 |

16.8 |

Share as % of develop exp |

|

10.7 |

13.4 |

10.2 |

Irrigation and Flood Control |

11.5 |

14.1 |

10.2 |

3.8 |

Share as % of develop exp. |

|

|

|

|

Source : Handbook of Statistics on State Government Finances, RBI, 2004 |

|

| |

State Level Trends |

| |

Composition |

| |

| The composition of investment in terms of the total outlay (Revenue and Capital) in the case of major agricultural States over the period from 1990-91 to 2003-04 brings out several issues of concern to the fore (Table 6). |

| |

● The share of agriculture and allied activities in the total development expenditure in the case of agriculturally important |

| |

Table-6: Average Share of Agriculture and Allied Activities in the Total Revenue and Capital Outlay of the States (1990-91 to 2003-04) |

Items |

Bihar |

Gujarat |

Haryana |

Karnataka |

MP |

Maharashtra |

Punjab |

UP |

Agriculture and Allied Activities |

|

|

|

|

|

|

|

|

Share as % of total exp. |

3.7 |

4.3 |

6.0 |

6.5 |

8.6 |

8.4 |

3.9 |

4.8 |

Share as % of develop exp. |

6.2 |

6.0 |

10.0 |

9.6 |

12.8 |

13.3 |

7.7 |

8.7 |

Share as % of agr&allied exp |

|

|

|

|

|

|

|

|

Crop Husbandry |

30.9 |

29.9 |

15.6 |

21.3 |

21.0 |

13.5 |

19.0 |

36.8 |

Soil and Water Conservation |

4.0 |

8.1 |

6.3 |

8.2 |

4.4 |

8.2 |

6.7 |

14.0 |

Animal Husbandry |

20.5 |

8.6 |

16.8 |

10.2 |

10.7 |

5.6 |

19.5 |

10.3 |

Dairy Development |

1.3 |

0.4 |

0.9 |

0.6 |

1.2 |

33.6 |

1.2 |

1.5 |

Fisheries |

2.4 |

3.0 |

1.4 |

2.5 |

1.3 |

1.2 |

1.1 |

1.4 |

Forestry and Wildlife |

17.4 |

30.8 |

13.9 |

23.9 |

41.7 |

12.4 |

13.3 |

11.7 |

Plantations |

0.0 |

0.0 |

0.4 |

0.0 |

0.0 |

0.0 |

0.0 |

0.7 |

Food Storage and Warehousing |

0.0 |

1.5 |

26.6 |

19.4 |

8.2 |

7.9 |

9.9 |

12.1 |

Agriculture Research And Education |

9.2 |

10.1 |

10.9 |

6.4 |

3.0 |

6.2 |

16.7 |

5.0 |

Co-operation |

13.8 |

7.5 |

7.3 |

6.3 |

8.5 |

11.5 |

11.2 |

6.3 |

Other Agricultural Programmes |

0.4 |

0.2 |

0.3 |

1.8 |

0.0 |

0.0 |

1.6 |

0.4 |

Rural Development |

|

|

|

|

|

|

|

|

Share as % of develop exp. |

14.9 |

4.3 |

2.0 |

4.5 |

9.1 |

6.0 |

1.0 |

10.3 |

Special Area Programmes |

|

|

|

|

|

|

|

|

Share as % of develop exp. |

0.1 |

0.2 |

0.0 |

0.3 |

0.6 |

0.2 |

0.3 |

3.2 |

Irrigation and Flood Control |

|

|

|

|

|

|

|

|

Share as % of develop exp. |

10.0 |

18.5 |

13.0 |

15.7 |

8.8 |

14.7 |

13.6 |

12.0 |

Source: Computed based on the data from Handbook of Statistics on State Government Finances, RBI, 2004 |

|

| |

States such as Punjab, UP, Gujarat, Bihar and Karnataka is below the national average (10 per cent). Only Madhya Pradesh with over 18 per cent share followed by Maharashtra (13.3 per cent) and Haryana (10 per cent) fare better in this regard.

|

● Of the total outlay on agriculture and allied activities, crop husbandry stands out as one of the major items- occupying first or second place in most of the States under review.

● Animal husbandry also accounts for a major proportion in States such as Punjab, Haryana and Bihar, while forestry and wildlife account for the largest share in the States like MP, Gujarat and Karnataka.

● On the agriculture research and education front, Punjab (16.7 per cent) and Haryana (10.9 per cent) fare relatively better, while the share of other States stands below the level of 10 per cent.

● In terms of the share of irrigation and flood control in the total development expenditure, Gujarat (18.5 per cent) occupies the first place followed by Karnataka (15.7 per cent), Maharashtra (14.7 per cent), Punjab (13.6 per cent) and Haryana (13 per cent). |

| |

Growth Pattern |

| |

The analysis of growth pattern of investment in terms of total outlay (Revenue and Capital) on agriculture and allied activities since the 1990s in respect of major States brings out the following:

In terms of the growth pattern, the major States could be broadly classified into three categories (Table 7). |

| |

● In the first category are the States such as Punjab and Haryana, which recorded remarkable growth during the 1990s and continued the momentum in the subsequent period (2001-2006).

|

| |

Table-7: Growth in Outlay on Agriculture and Allied Activities in the Major States |

State |

Share of Agri. in GSDP* |

Average Growth in the Outlay on Agri and Allied |

1991-92 to 1995-96 |

1996-97 to 1999-00 |

2000-01 to 2005-06 |

1 |

2 |

3 |

4 |

5 |

Punjab |

37.2 |

26.8 |

109.8 |

193.1 |

Haryana |

28.9 |

4.1 |

19.1 |

40.4 |

UP |

30.3 |

8.4 |

36.6 |

-6.9 |

Maharashtra |

13.4 |

9.5 |

17.2 |

-5.5 |

MP |

21.7 |

4.7 |

13.9 |

3.1 |

Gujarat |

13.6 |

10.2 |

17.5 |

4.3 |

Bihar |

38.3 |

7 |

12.8 |

-11.8 |

Karnataka |

21.9 |

25.3 |

7.3 |

4.5 |

*: Share of agriculture in GSDP during 2002-03 at constant prices

Source: Computed based on the data from Handbook of Statistics on State Government Finances,

RBI, 2004 |

|

| |

● In the second category, States such as Madhya Pradesh, Gujarat and Karnataka, witnessed considerable growth in the second half of the 1990s, but lost the momentum thereafter.

● In the last category, the States such as UP, Maharashtra and Bihar, which posted significant growth during the second part of the 1990s, came to register a sharp negative growth in the subsequent period.

|

| |

| International Trends: Investment in Agricultural Science and Technology |

| |

| At the international level, the data on investment in agriculture are not available in the public domain. However, the limited investment data available (2000) in the case of agricultural science and technology particularly in research and development activities indicate that the share of public sector is predominant (94 per cent) in respect of developing countries (Table 8). Conversely, in the case of developed countries, private sector (55 per cent) dominates the scene, implying that as countries progressively develop, public sector should give way to private sector by creating an enabling policy environment. |

| |

Table-8: Public and Private Agricultural Research and Development Expenditure (2000) |

| |

Expenditure ($ 2000 million) |

Share (Per cent) |

Public |

Private |

Total |

Public |

Private |

Total |

Developing Countries |

12,816 |

869 |

13,688 |

93.7 |

6.3 |

100 |

Developed Countries |

10,191 |

12,577 |

22,767 |

44.8 |

55.2 |

100 |

Total |

23,010 |

13,446 |

36,456 |

63.1 |

36.9 |

100 |

Adopted from Pardey et al., 2000. |

|

| |

Interestingly, the rate of return to investment in agricultural research (based on studies carried out from 1953 to 1997) is found to be highest in the case of Asian region (50 per cent), higher compared not only to the developing countries as a whole (43 per cent) but also developed countries (46 per cent) (Alston et al., 1998) (Table 9). Investments in agricultural |

Table-9: Estimated Rates of Return to Investment in Agricultural Research (based on studies carried out from 1953 to 1997) |

Region |

Number of estimates |

Median Rate of Return (%) |

Africa |

188 |

34 |

Asia |

222 |

50 |

Latin America |

261 |

43 |

Middle East/North Africa |

11 |

36 |

All Developing Countries |

683 |

43 |

All Developed Countries |

990 |

46 |

All |

1,772 |

44 |

Adopted from Alston et al. 1998 |

|

research and development (R&D) from both the public and private sectors can lead to technology generation and productivity improvements. The impact of investment on agricultural research can be seen most clearly from Rosegrant, Agcaoili-Sombilla, and Perez (1995). In their global food projections for 2020, they assumed a baseline scenario of US$10 thousand million public investment in national agricultural research and extension services. The low-investment scenario, which assumed an annual cut of US$1.5 billion to the current level of public investment, resulted in a fall of 15 per cent in crop and livestock yield growth rates by 2020. In contrast, if funding of national and international research were to rise by US$750 million per year, crop yield growth would be six percent higher in 2020 than under the baseline scenario. Although these figures are projections and their accuracy is subject to underlying assumptions, they indicate strongly the negative effects of reduced public investment in research and extension, and the crucial role of investment in increasing agricultural productivity.

The growth of public expenditure on research and extension, at constant prices, decade-wise for four decades upto 2006 indicates that the growth has slowed since 1990. In the case of extension services the slowdown is particularly sharp. It is interesting to note that for this category the growth of expenditure was highest by far in the sixties the period of the last acceleration in the agricultural growth rate, suggesting that extension is a crucial component of an enabling policy. The rate of growth of expenditure on extension services has declined three-fold since the nineties (Table 10). |

Table-10: Growth in Public Expenditure on Research and Extension |

(Per cent) |

Year |

Research and Education |

Extension and Training |

1960s |

6.5 |

10.7 |

1970s |

9.5 |

-0.1 |

1980s |

6.3 |

7.0 |

1990-2005 |

4.8 |

2.0 |

Source : DRG study no.27, RBI, 2008. |

|

| |

| |

Section III |

Linkages Between Public and Private Investment:

Policy Implications |

| |

| Policy support for private investment could be placed in the proper perspective. |

● First, during post-reform regim, since the early 1990s the rate of increase in the share of private sector in total agriculture investment has been less than what it was during the pre-reform period, unlike the other areas, where private sector has increased its stake.

● Second, it may be recalled that the impact of public investment on private investment is found to be asymmetric. An increase in public investment is found to have positive impact on private investment, but a decline in public investment is found to have increased private investment (S. Bisaliah, 2001). The Government has to create a favourable policy and development support environment for private sector (both domestic and foreign agri-business investors) to fill the investment gap in agriculture. Increased share of private investment in agriculture tends to improve the efficiency of capital use.

● Third, there has to be a shift of emphasis from the present situation where the infrastructure investment is dominated by the public sector towards a system where public-private partnership functions.

● Fourth, institutional transformation through social capital formation has high potential for increasing the efficiency ofcapital use (lowering the capital requirement for achieving a targeted output growth).

● Fifth, while designing policy options to stimulate private farm investment, the interaction between technology, terms of trade and private investment has to be kept in view.

● Sixth, public sector investment with proper project portfolio would be crucial for inducing private investment. Further, public investment alone cannot be expected to fill the investment gap in agriculture. Hence, the role of private investment could be placed in the perspective of huge investment gap.

|

| |

Traditionally, most agricultural research is publicly funded. However, in recent years, the costs of agricultural technology generation and transfer are shared increasingly with the private sector, particularly in more advanced countries. The proportion of privately funded research is in the order of 30 to 40 per cent of all research expenditures in developed countries (nearly two-thirds in the United States) and about five percent in the less-developed countries. Thus, the relationship between public and private investment in agriculture is complementary.

Private research is attracted to sectors of the market where research results exist and benefits can be privately appropriated (Alston, Norton and Pardey, 1995). This is typically the case in more developed countries where intellectual property rights are well established and protected for inputs such as agrichemicals, agricultural machinery and seeds. |

| |

Constraints to Investment in Agriculture |

| |

| There are several factors, which impede the flow and pattern of investment in agriculture, the major being: |

| |

● Meagre growth in minor irrigation and farm mechanisation, which are the major sub-sectors in agriculture;

● Declining public sector investment in the basic infrastructure;

● Limited credit absorptive capacity;

● Lack of effective mechanism for technology transfer and poor extension services

● Limited infrastructure for agro-processing, storage, warehousing, value addition and marketing;

● Restrictions on purchases outside the mandis;

● Weather aberrations and output price fluctuations;

● Inadequate risk mitigation mechanism; and

● Absence of proper land records.

|

Some of the reasons for slower growth particularly in public investment in agriculture are: i) diversion of resources from the investment to current expenditure in the form of subsidies (Economic Survey, 1997-98), ii) large expenditure incurred on maintenance of existing projects, iii) inordinate delays in completing the projects on hand, iv) relatively lower allocation for irrigation, v) poor rural infrastructure and research, and vi) belated growth in private investment in agriculture.

Besides, there are several factors in particular constraining the banking institutions in deployment of investment credit: (i) high transaction costs; (ii) structural deficiencies in rural credit delivery system resulting in limited outreach; (iii) issues relating to credit worthiness; lack of collateral or low asset base of farmers; (iv) low volume of loans associated with high risk; (v) high manpower requirement, etc. |

| |

Policy Initiatives |

| |

Recognising the importance of adequate investment in agriculture, both the Government and the Reserve Bank have taken several policy initiatives. As a response to inadequate private investment in agriculture, the Rural Infrastructure Development Fund (RIDF) was set up way back in 1995. The fund is financed by the scheduled commercial banks to the extent of their shortfall in meeting the stipulated target of 18 per cent of adjusted net bank credit to agriculture.

The Committee on Capital Formation in Agriculture, (Chairman: B.B. Bhattacharya) set up by the Government of India in 2003 called for devising a conscious, implementable strategy for increasing investment in the agriculture sector. Furthermore, with a view to address the issues and to suggest a road map for banks to increase investment in agriculture, the RBI constituted an Expert Group on Investment Credit to Agriculture in 2005 under the Chairmanship of Shri Y .S. P. Thorat. |

| |

The National Agriculture Policy adopted in July 2000 and various committees appointed earlier had highlighted the need for adequate and timely supply of institutional credit to farmers. There is a wide gap in supply of credit, requiring a large increase in credit, particularly investment credit, to facilitate capital formation in agriculture and to achieve the stipulated growth rate. The Government of India had emphasised the need for doubling of credit flow to agriculture during the three-year period, viz., 2004-05 to 2006-07. In 2005, the Government of India launched the Bharat Nirman Programme, a time-bound plan for action in rural infrastructure for the four years (2005-2009). The Union Budget 2005-06 also stepped up public investment significantly for rural infrastructure development.

In the recent period, several measures have also been taken for augmenting capital formation in agriculture such as: i) a roadmap for agriculture diversification has been prepared with focus on horticulture, floriculture, animal husbandry and fisheries; ii) strengthening of agriculture marketing infrastructure; iii) national scheme for the repair, renovation and restoration of water bodies; iv) focus on micro-irrigation, micro-insurance and rural credits; and v) setting up a national fund for strategic agriculture research. |

| |

| |

Section IV

Way Forward |

| |

| Given the importance of agriculture in India, in terms of its contribution to GDP, employment and income, a low growth rate and agriculture will have an adverse impact on the growth of the economy. According to the Approach Paper for the 10th Plan, the objective of doubling the growth rate of agricultural GDP to 4 per cent per annum is critical to ensure the inclusiveness of growth. This, however, poses major policy challenges in the immediate future. It is necessary to adopt region specific strategies focusing on the scope for increasing yields with known technologies and the scope for viable diversification. Investment, the prime mover, therefore, needs to be accelerated to achieve the desired level of growth. |

| |

The public investment in agriculture has been declining and is one of the main reasons behind the declining productivity and low capital formation in the agriculture sector. With the burden on productivity-driven growth in the future, this worrisome trend needs a reversal. Private investment in agriculture has also been slow and must be stimulated through appropriate policies. |

| |

The broad thrust areas for increasing investment and investment credit in agriculture could be as follows: |

● Traditional investments on land development, irrigation and farm mechanisation and integration of small and marginal farmers in the mainstream in the case of marketing and exports deserve renewed attention.

● Public investment needs to be channelled appropriately in agricultural infrastructure should get a greater priority especially in poorer states, viz., Eastern and North Eastern regions for facilitating greater private investment.

● Public investment in research and development of varieties of crops, breeds of livestock, strains of microbes and efficient packages of technologies, particularly those for land and water management, for obviating biotic, socio-economic and environmental constraints also calls for increased attention.

● Effective and credible technology, procurement, assessment and transfer and extension system involving appropriate linkages and partnerships; again with an emphasis on reaching the small farmers also remain the other thrust areas.

|

| |

In this context, the need for augmenting term credit to agriculture cannot be overemphasised. In view of the structural weaknesses of co-operative banks and the limited presence of RRBs, commercial banks may have to shoulder the responsibility of supporting private investment in agriculture. As observed by the Mid-Term Policy for 10th Five Year Plan, there is a need to step up public investment, particularly in irrigation and water resources management; watershed development and reclamation of waste/ degraded land; and provision of essential infrastructure such as roads, markets and electricity.

From the point of agricultural production, the single most effective supply side constraint is that irrigation coverage still extends to only about 40 per cent of net sown area. In particular, slow expansion of surface irrigation through investment in major and medium projects has been the main reason why public investment in agriculture has declined since the early 1980s. While there are genuine problems that make it difficult to initiate new irrigation projects quickly, a concerted effort is required to expedite ongoing but unfinished projects. |

| |

| |

Section V |

Conclusion |

| |

Over time, agriculture investment has been loosing its share, more rapidly since the 1990s led by loss in momentum of public sector and compounded by inadequacy of farm credit. Not only the pace of investment has been slow, but even the pattern of investment has skewed. The share of agriculture and allied activities in the total development expenditure in the case of agriculturally important States such as Punjab, UP, Gujarat, Bihar and Karnataka is below the national average. Inadequacy of new capital formation has slowed the pace and pattern of technological change and the infrastructural development with adverse effects on agricultural productivity.

The need of the hour is to step up domestic investment in agriculture sector, notwithstanding the fact that the ICOR of agriculture sector is very high. The idea is to modernise the agriculture sector through conscious investments and bring down the ICOR and thereby allow the agriculture sector to perform well like industrial sector. Investment in agriculture, the prime mover needs to be accelerated to achieve the desired level of growth of over 4 per cent per annum as

envisaged by the 11th Five Year Plan. More importantly, this investment needs to be appropriately structured, timed and well implemented to have the maximum impact. |

| |

| There is a pressing need for a more fundamental change in the strategy to raise resources and accelerarate the pace of capital formation in agriculture through targeting and downsizing of subsidies and ploughing back the resources so generated to agriculture sector as investment in irrigation and other infrastructure activities, selling off the public sector enterprises to partially finance the resources for agriculture investments. The public investment with a proper choice of project portfolio would be crucial for inducing private investment. Furthermore, public investment alone cannot be expected to fill the investment gap in agriculture. Therefore, the Government has to create a favourable policy and development support environment for private sector (both domestic and foreign agri-business investors) to fill the investment gap in agriculture. It needs to be emphasised that institutional transformation through social capital formation has high potential for increasing the efficiency of capital use There is also a need to encourage the banking sector to view the new changes witnessed in entire value chain of agriculture as potential business opportunities and extend more investment credit to these areas. Thus, accelerating the pace of investment holds the key to provide a much-needed structural break and lift the Indian agriculture from the world of stagnation. |

| |

NOTE |

| |

| 1 Investment in agriculture has two components viz., the Gross Fixed Capital Formation (GFCF), which includes primarily the investment in physical assets in agriculture, and the stocks which are presently in the form of inventories but which are not actually used for further production, although they could be used. The two components taken together constitute the Gross Capital Formation (GCF). The relative shares of the two components viz., GFCF and GCF indicate that investment in agriculture is predominantly in the form of physical assets and that stocks (which include livestock) are relatively less important. |

| |

| References |

| |

Alagh, Y.K. (2000), "Macro Policies for Indian Agriculture", in G.S. Bhalla (edited) ‘Economic Liberalisation and Indian Agriculture', New Delhi: Institute for Studies in Industrial Development.

Alston, J. M., B. J. Craig, and P. G. Pardey. (1998), “Dynamics in the Creation and Depreciation of knowledge, and the Returns to Research.” EPTD Discussion Paper No. 35. International Food Policy Research Institute, Washington, D.C

Devarajan, S., Swaroop, V. and H. Zou. (1996), “The Composition of Public Expenditure and Economic Growth”, Journal of Monetary Economics,

Fan, S., Hazell, P. and S. Thorat (2000), “Government Spending, Growth and Poverty in Rural India”, American Journal of Agricultural Economics,

Fan, S., Zhang, L. and X. Zhang. (2002), “Growth, Inequality and Poverty in Rural China: The Role of Public Investments”. Research Report 125, IFPRI: Washington, DC.

Government of India, Economic Survey, various issues

Mohan, Rakesh (2006) “Agricultural Credit in India: Status, Issues and Future Agenda” Economic and Political Weekly.

Pulapre B, R.Golait and P.Kumar (2008) “Agricultural Growth in India since 1991” DRG Study No. 27, Reserve Bank of India, Mumbai.

Reddy, Y.V. (2008) “Agriculture: Emerging Issues and Possible Approaches” 40th Convocation Address of the Acharya N.G. Ranga Agricultural University, Hyderabad on June 5. |

|