|

Introduction

4.1 Co-operative banking in India has made substantial progress in dissemination of banking services based on co - operative principles. In view of the special thrust on financial inclusion, co-operative banking has acquired renewed significance in the Indian financial system. The focus of the recent policy measures, therefore, has once again shifted to the strengthening of co-operative banking in India. The review of the problems of rural cooperatives by the Task Force (2004) constituted by the Government of India and the Vision Document on urban co-operative banks (UCBs) released in March 2005 by the Reserve Bank, have provided a fresh framework with practical and implementable arrangements to rejuvenate the Indian co-operative banking structure. The emphasis of the recent initiatives has been to revitalise these institutions for reinstating the confidence of the public in the co-operative banking system. While designing the regulatory and supervisory framework, care is being taken to preserve their co-operative character and institutional specifics.

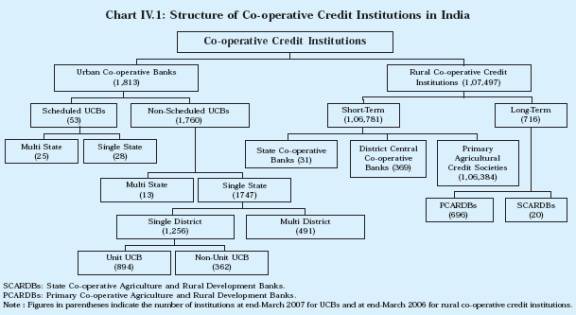

4.2 The co-operative banking structure in India comprises two main components, viz., urban co-operative banks and rural co-operative credit institutions. While urban co-operative banks have a single tier structure, rural cooperatives have a complex structure. Rural cooperative credit institutions have two distinct structures, viz., the short-term co-operative credit structure (STCCS) and the long-term cooperative credit structure (LTCCS). Within the STCCS, primary agricultural credit societies (PACS) at the village level form the base level, while district central co-operative banks (DCCBs) are placed at the intermediate level, and the State co-operative banks (StCBs) at the apex level. The STCCS mostly provide crop and other working capital loans primarily for a short period to farmers and rural artisans. The long-term structure of rural co-operatives comprises State co-operative agriculture and rural development banks (SCARDBs) at the State level, and primary co-operative agriculture and rural development banks (PCARDBs) at the decentralised district or block level. These institutions focus on providing typically medium to long-tem loans for making investments in agriculture, rural industries, and lately housing. The structure of rural co-operative banks is not uniform across the States of the country, and varies significantly from one State to another. Some States have a unitary structure with the State level banks operating through their own branches, while others have a mixed structure incorporating both unitary and federal systems (Chart IV.1).

4.3 Given the significant role played by urban co-operative banks in providing banking services to the middle and lower income people, the Reserve Bank continued to take initiatives to strengthen these banks. In June 2004, it was decided not to issue fresh licenses for setting up new banks or for opening new branches, until a suitable framework for regulation and supervision was put in place for the existing UCBs. In March 2005, the Reserve Bank prepared a draft Vision document for UCBs which, inter alia, discussed the problems of the sector and highlighted the issue of dual regulatory mechanism which restricted the ability of the Reserve Bank in handling the weaknesses of entities in the sector. In order to address the problem of dual control, Vision document proposed the adoption of a consultative approach for deciding the future set up of weak and sick banks in each State. In terms of the Vision document, the Reserve Bank approached the State Governments for signing MOU to ensure greater convergence of approach of the two agencies entrusted with the regulation and supervision of UCBs. As part of the MOU, it was decided to set up State level Task Force for Co-operative Urban Banks (TAFCUBs) comprising representatives of the Reserve Bank, State Government and federation/association of UCBs. The TAFCUB was entrusted to identify the potentially viable and non viable UCBs in the State and provide a revival path for the former and a non-disruptive exit route for the latter set of banks. The exit route could include merger/ amalgamation with stronger banks, conversion into societies or ultimately as a last resort, through liquidation. Till date MOUs have been signed with 13 State Governments and Central Government (in respect of multi-State UCBs), which encompass 1,511 UCBs, i.e., 83 per cent of the banks representing 92 per cent of deposits of the sector. The impact of the initiatives in the recent past is perceptible as there is enhancement of public confidence in the sector which is reflected in the increase of deposits during 2006-07 and 2005-06, reversing the declining trend of 2004-05.

4.4 Taking into account the comfort of coordinated supervision/regulation in the States that have signed MOU with the Reserve Bank, certain business opportunities have been extended to the eligible banks in such States as also to the multi-State UCBs. It was announced in the Annual Policy statement for the year 2006-07 that financially sound banks in such States would also be permitted to open new branches, a facility which was not available to UCBs from 2004. The focus for the sector now is, inter alia, on development of Human Resources (HR) and Information Technology (IT) infrastructure as also on several aspects of governance. Also, the consolidation of UCBs through the process of merger of weak entities with stronger ones has been set in motion providing transparent and objective guidelines for granting ’no objection’ to merger proposals. As on October 30, 2007, a total of 33 mergers had been effected upon the issue of statutory orders by the Central Registrar of Cooperative Societies/Registrar of Co-operative Societies (CRCS/RCS) concerned. In addition to the existing 1,813 UCBs at end-March 2007, 259 UCBs were under various stages of liquidation. Despite the reduction in the number of UCBs, their business operations expanded at a moderate rate. The asset quality of the UCBs also improved significantly.

4.5 The recommendations of the Task Force (Chairman: Prof. A.Vaidyanathan) appointed by the Government of India in 2004 to propose an action plan for reviving the short-term rural cooperative credit structure have been accepted in principle. The Government of India, in consultation with the State Governments, has approved a revival package for the STCCS which was communicated to the State Governments in January 2006. NABARD has been designated the Implementing Agency for implementing the Revival Package in all the States. The process of implementing the revival package in any State begins with the signing of the MoU among the GoI, the participating State Government and NABARD. A special audit of all PACS, DCCBs and StCB in every participating State would be undertaken to arrive at a true and fair assessment of the amount of accumulated losses as on March 31, 2004 as also a fair and acceptable proportion of such losses on the basis of the origin of such losses, i.e., losses due to credit business, public distribution (PDS) business, or other trading business. Every participating State would also promulgate an Ordinance as per para 9 of the MoU to amend the State Co-operative Societies Act to give effect to the institutional and legal reforms envisaged in the revival package or would enact the necessary legislation. Implementation of the package has begun in thirteen States, viz., Andhra Pradesh, Arunachal Pradesh, Bihar, Chhattisgarh, Gujarat, Haryana, Madhya Pradesh, Maharashtra, Orissa, Rajasthan, Uttarakhand, Uttar Pradesh and West Bengal, which have executed the MoUs with the Government of India and NABARD with conduct of special audits of PACS and HRD initiatives. These States have also initiated steps for bringing in necessary legal amendments to the respective Co-operative Societies Acts.

4.6 Balance sheets of all segments of the rural co-operative banking sector, except PACS, expanded during 2005-06 (Appendix Table IV.1). However, their financial performance worsened during the year. Wide variations were also observed in the financial performance of different segments of the rural co-operative banking sector. While the upper tier of both short-term and long-term rural co -operative credit institutions made profits during 2005-06, the lower tier (viz., PACS and PCARDBs) made overall losses. Asset quality of all types of rural co-operative banks deteriorated, except PACS, which improved their recovery performance. The recovery performance of DCCBs and PCARDBs also worsened during the year.

4.7 This chapter covers the developments in the co-operative banking sector, both rural and urban, as well as deals with the micro-finance initiatives of NABARD. The Chapter is organised into six sections. Section 2 deals with the policy measures as well as the business operations of urban co-operative banks, while Section 3 focusses on the policy developments and performance of rural co-operative banks. The developments in the area of micro credit, which has emerged as an important purveyor of credit in remote and rural areas, are discussed in Section 4. Section 5 delineates the role played by NABARD in shaping the developments in the rural co-operative sector during the year. Section 6 deals with the measures initiated for revival of the rural co-operative banking sector in the light of the Vaidyanathan Committee’s recommendations in this area.

2. Urban Co-operative Banks Policy Developments

4.8 In order to develop a consultative mechanism for regulation and supervision of UCBs, the process of signing of MoUs with the Reserve Bank progressed satisfactorily during the year. The Reserve Bank formulated less stringent prudential norms for smaller UCBs with deposit base of less than Rs.100 crore and having branches limited to a single district, i.e., Tier I banks, in line with the proposals in the Vision Document for UCBs. Besides, the Reserve Bank issued a number of guidelines relating to interest rates, prudential norms, disclosure and exposure norms and risk management. In view of the special dispensation of UCBs with respect to urban poor, the guidelines on credit delivery, customer service and financial inclusion were further fine-tuned.

Structural Initiatives

Vision Document

4.9 The Vision Document for UCBs highlighted the problems of the sector and outlined the broad measures to be adopted to enable the UCBs emerge as a sound and healthy network of banking institutions providing need based quality banking services, essentially to the middle and lower middle classes and marginalised sections of the society. In line with the proposals of the Vision Document, the Reserve Bank continued to take several initiatives during the year.

Two-tier Regulatory Structure

4.10 The Vision Document sets out the objective of rationalising the regulatory and supervisory framework for UCBs to enable the smaller UCBs gain in strength. In order to achieve this objective, banks were classified as Tier I banks, i.e., banks having branch/s within a single district and deposits below Rs.100 crore and Tier II banks, i.e., all other UCBs. Prudential norms for Tier I and Tier II banks were also revised. While Tier II banks are under the 90-days delinquency norm as applicable to commercial banks, the 180-day loan delinquency norm for Tier I banks has been extended up to March 31, 2008. This is intended to provide a measure of relief to the small UCBs as lower provisioning is required, which, in turn, would translate into higher profits that could be used to shore up the capital base of these banks. These banks are, however, required to build up adequate provisions in the intervening period to enable them to migrate to 90-day norms in future.

4.11 Further, the following differential asset classification and provisioning norms have been enunciated for Tier I banks : (i) the 12-month period for classification of a sub-standard asset in doubtful category will be effective from April 1, 2008; (ii) these banks would be required to provide 100 per cent on the secured portion of D-III advances (doubtful for more than 3 years) classified as doubtful more than 3 years on or after April 1, 2010; (iii) For the outstanding stock of D-III advances as on March 31, 2010, banks will be required to provide as under: (a) 50 per cent as on March 31, 2010; (b) 60 per cent as on March 31, 2011; (c) 75 per cent as on March 31, 2012; and (d) 100 per cent as on March 31, 2013. For Tier II banks, (i) 100 per cent provisioning for advances classified as D-III will apply to those classified as such on or after April 1, 2007 instead of those so classified on or after April 1, 2006; (ii) for the outstanding stock of D-III assets as on March 31, 2007, banks are required to provide as: (a) 50 per cent up to March 31, 2007; (b) 60 per cent as on March 31, 2008; (c) 75 per cent as on March 31, 2009; and (d) 100 per cent as on March 31, 2010.

4.12 In order to ensure that asset quality is maintained despite high credit growth, it was decided in respect of Tier II banks to increase the general provisioning requirement on standard advances in specific sectors, i.e., personal loans, loans and advances qualifying as capital market exposures and commercial real estate loans from the existing level of 1.0 per cent to 2.0 per cent.

4.13 Another relaxation extended to Tier I banks pertains to investments made in Government securities. In view of market risks associated with such investments, Tier I UCBs have been given exemption from maintaining SLR in government securities (up to 15 per cent of NDTL) to the extent of funds placed in interest bearing deposits with State Bank of India and its subsidiary banks and the public sector banks including Industrial Development Bank of India Ltd. Tier II banks have also been subjected to the stricter provisioning norms on ‘standard advances’ which can be 2 per cent for certain type of exposures. As a part of rationalisation of supervision, while the larger UCBs are placed under a composite off-site surveillance (OSS) reporting system comprising a set of eight prudential supervisory returns, a simplified reporting system consisting of five returns has been introduced for the smaller banks having deposits between Rs.50 crore and Rs.100 crore and whose branches are limited to a single district. The simplified OSS reporting framework would be extended to banks with deposits below Rs.50 crore in the near future.

Alternative Mechanism to Address the Problems of Dual Control

4.14 States having a large number of UCBs were approached by the Reserve Bank for signing Memorandum of Understanding (MoU) to develop a consultative mechanism for regulation and supervision of UCBs. So far, MoUs have been signed with 13 States, viz., Gujarat, Andhra Pradesh, Karnataka, Madhya Pradesh, Uttarakhand, Rajasthan, Chhattisgarh, Goa, Maharastra, Haryana, National Capital Territory of Delhi, West Bengal and Assam which together account for 1,511 out of 1,813 banks as at end-March 2007, i.e., 81.5 per cent of total number of UCBs and 67 per cent of total deposits of the sector. In addition, an MOU has also been signed between the Reserve Bank and the Central Government in respect of Multi-State UCBs that account for 25.5 per cent of deposits of the sector. As such, a total of 83 per cent of UCBs accounting for over 92 per cent of total deposits are covered under the MoU arrangements and the problems of all such banks are being addressed through consultation with other significant stakeholders such as State/Central Government and Federation/Association of UCBs.

4.15 As part of the arrangements under MoU, the Reserve Bank is committed to constituting State level Task Force for Cooperative Urban Banks (TAFCUB) comprising representatives of the Reserve Bank, State Government and the UCB sector. Accordingly, TAFCUBs have been constituted in all States with which MoUs have been signed. A Central TAFCUB has been constituted for the Multi-State UCBs. The TAFCUBs identify potentially viable and non-viable UCBs in the State and suggest revival path for the viable and non-disruptive exit route for the non-viable ones.

4.16 The exit of non-viable banks could be through merger/amalgamation with stronger banks, conversion into societies or ultimately as a last resort, through liquidation. This institutional arrangement for addressing issues of supervisory concern is not available for banks in States that are yet to sign MoU with the Reserve Bank.

4.17 Further, arising out of the comfort of coordinated supervision/regulation in States that have signed MoU with the Reserve Bank, certain additional business opportunities have been extended to the eligible banks in such States as also to the Multi – State UCBs. These facilities include permission to set up currency chests, sell mutual fund products, grant of Authorised Dealer category I and II license, permission to open new ATMs, relaxed norms for conducting insurance business on non-risk participation basis and conversion of extension counters into branches.

It was also announced in the Annual Policy 2006-07 that financially sound banks in such States would also be considered for being given licences to open new branches, a facility which was not available to the UCBs since 2004.

Merger /Amalgamation and Exit of Unviable Entities.

4.18 The process of mergers among UCBs was provided a fresh impetus with the issue of transparent guidelines for grant of ‘no objection’ to merger proposals by the Reserve Bank (Box IV.1).

Box IV.1: Merger and Amalgamation of UCBs

The consolidation of the sector through the process of merger of weak entities with stronger ones has been set in motion by providing transparent and objective guidelines for granting no-objection to merger proposals. The Reserve Bank, while considering proposals for merger/ amalgamation, confines its approval to the financial aspects of the merger taking into consideration the interests of depositors and financial stability. Almost invariably it is a voluntary decision of the banks that approach the Reserve Bank for obtaining no objection for their merger proposal. The guidelines on mergers are intended to facilitate the process by delineating the pre-requisites and steps to be taken for merger between banks.

Pursuant to the issue of guidelines on merger of UCBs, the Reserve Bank received 60 proposals for merger in respect of 52 banks. The Reserve Bank has issued no objection certificate (NOC) in 37 cases. Of these, 20 mergers became effective upon the issuance of statutory orders by the Central Registrar of Co-operative Societies (CRCS)/Registrar of Cooperative Societies (RCS) concerned. Fourteen proposals for merger were rejected by the Reserve Bank, while three proposals were withdrawn by the banks. The remaining six are under consideration (Table 1 and 2). Most of the target banks were loss-making UCBs. In a few cases, mergers were permitted even of profit making banks with the aim of consolidation and in some cases merger were permitted in respect of such banks, as they were not considered viable on a stand-alone basis in the long run.

The process of merger and amalgamation is elaborate. The merger proposal has to be submitted by the acquirer bank to RCS/CRCS and a copy of the proposal is also simultaneously forwarded to the Reserve Bank along with certain specified information. The Reserve Bank examines the proposals and places the same before an Expert Group for screening and recommendations. On evaluation, if the proposal is found to be suitable, the Reserve Bank issues NOC to the RCS/CRCS and the banks concerned. RCS/ CRCS then issues the order of amalgamation of the target UCB in compliance with the provisions of the Co-operative Societies Act under which the bank is registered.

Table 1: State-wise Break up of Acquirer Banks |

(as on May 21, 2007) |

Sr. |

Act Under |

No. of |

No. of |

No. of |

No. of |

No. of |

Proposals |

No. |

Which |

Acquirer |

Proposals |

NOC |

Proposals |

Proposals |

Under |

|

Registered |

Banks |

Submitted |

Issued |

Rejected |

Withdrawn |

Processing |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

1. |

Multi-State |

7 |

20 |

15 |

4 |

1 |

Nil |

2. |

Maharashtra |

11 |

18 |

8 |

6 |

Nil |

4 |

3. |

Gujarat |

8 |

11 |

9 |

1 |

1 |

Nil |

4. |

Andhra Pradesh |

3 |

3 |

2 |

1 |

Nil |

Nil |

5. |

Karnataka |

3 |

3 |

2 |

1 |

Nil |

Nil |

6. |

Rajasthan |

1 |

1 |

Nil |

1 |

Nil |

Nil |

7. |

Punjab |

1 |

1 |

1 |

Nil |

Nil |

Nil |

8. |

Uttarakhand |

3 |

3 |

Nil |

Nil |

1 |

2 |

Total (1 to 8) |

37 |

60 |

37 |

14 |

3 |

6 |

Table 2: State-wise Break up of Acquired Banks |

(as on May 21, 2007) |

Sr. |

Act Under Which Registered |

No. of Acquired |

No. of Proposals |

No. of NOC |

No. of |

Merged |

No. of Proposals |

Proposals |

Under |

No. |

|

Banks |

Submitted |

Issued |

|

Banks |

Withdrawn |

Rejected |

process |

1 |

2 |

3 |

4 |

5 |

|

6 |

7 |

8 |

9 |

1. |

Multi-State |

1 |

2 |

1 |

|

1 |

Nil |

1 |

Nil |

2. |

Maharashtra |

17 |

21 |

11 |

|

5 |

1 |

6 |

3 |

3. |

Gujarat |

14 |

15 |

13 |

|

6 |

1 |

1 |

Nil |

4. |

Andhra Pradesh |

7 |

7 |

6 |

|

5 |

Nil |

1 |

Nil |

5. |

Karnataka |

3 |

5 |

3 |

|

1 |

Nil |

2 |

Nil |

6. |

Goa |

1 |

1 |

1 |

|

1 |

Nil |

Nil |

Nil |

7. |

Rajasthan |

1 |

1 |

Nil |

|

Nil |

Nil |

1 |

Nil |

8. |

Delhi |

1 |

1 |

Nil |

|

Nil |

Nil |

1 |

Nil |

9. |

Punjab |

1 |

1 |

1 |

|

1 |

Nil |

Nil |

Nil |

10. |

Madhya Pradesh |

3 |

3 |

1 |

|

Nil |

Nil |

1 |

1 |

11. |

Uttarakhand |

3 |

3 |

Nil |

|

Nil |

1 |

Nil |

2 |

Total (1 to 11) |

52 |

60 |

37 |

|

20 |

3 |

14 |

6 |

Interest Rates / Maintenance of CRR

Interest Rates on Non-Resident Deposits

4.19 Urban co-operative banks were prohibited from granting fresh loans in excess of Rs.20 lakh against NRE and FCNR(B) deposits, either to depositors or to third parties. Banks were also advised not to undertake slicing of the loan amount to circumvent the ceiling.

4.20 In keeping with the announcement made in the Review of Annual Policy Statement 2006-07, UCBs, which are authorised dealers in foreign exchange, were advised that in respect of FCNR (B) deposits of all maturities contracted effective from the close of business in India as on January 31, 2007, interest shall be paid within the ceiling rate of LIBOR/ SWAP rates for the respective currency/corresponding maturities minus 25 basis points. From close of business as on April 24, 2007, the rates on FCNR (B) deposits were further revised to the ceiling rate of LIBOR/SWAP rates for the respective currency/corresponding maturities minus 75 basis points. On floating rate deposits, interest can be paid within the ceiling of SWAP rates for the respective currency/maturity minus 25 basis points. For floating rate deposits interest can be reset once in every six months. The interest rates were further revised to the ceiling of SWAP rates for the respective currency/ maturity minus 75 basis points.

Interest Rates on Non-Resident (External) Rupee (NRE) Deposits

4.21 UCBs were advised that with effect from the close of business in India as on April 24, 2007, the interest rates on fresh Non-Resident (External) Rupee term deposits for one to three years maturity should not exceed the LIBOR/SWAP rates, as on the last working day of the previous month, for US dollar of corresponding maturities

Policy on CRR/SLR

4.22 The cash reserve ratio (CRR) for scheduled primary (urban) co-operative banks as a percentage of net demand and time liabilities (NDTL) was increased from 5 per cent to 7.0 per cent in seven stages (Table IV.1).

4.23 The Reserve Bank also exempted those banks from payment of penal interest which had breached the statutory minimum CRR level of 3.0 per cent during the period from June 22, 2006 to

Table IV.1: Changes in CRR |

|

Effective date* |

CRR on NDTL |

|

|

(per cent) |

|

1 |

2 |

1. |

23-Dec-06 |

5.25 |

2. |

6-Jan-07 |

5.50 |

3. |

17-Feb-07 |

5.75 |

4. |

3-Mar-07 |

6.00 |

5. |

14-Apr-07 |

6.25 |

6. |

28-Apr-07 |

6.50 |

7. |

4-Aug-07 |

7.00 |

* : From the fortnight beginning. |

|

March 2, 2007. The Government of India in the Extraordinary Gazette notification dated March 9, 2007 notified Section 3 of the Reserve Bank of India (Amendment) Act, 2006 and fixed April 1, 2007 as the date on which the related provisions would come into force. Pending notification, it was also decided that the Reserve Bank will also pay interest to all scheduled primary (urban) cooperative banks on the eligible CRR balances maintained with the Reserve Bank at the rate of (a) 3.50 per cent per annum from the fortnight beginning June 24, 2006 to December 8, 2006; (b) 2.00 per cent from the fortnight beginning from December 9, 2006 to February 16, 2007; (c) 1.00 per cent from the fortnight beginning from February 17, 2007. It was also decided that with effect from the fortnight beginning April 14, 2007, all scheduled UCBs would be paid interest at the rate of 0.50 per cent per annum on eligible cash balances maintained with the Reserve Bank (instead of 1 per cent as hitherto).

4.24 The Extraordinary Gazette notification dated January 9, 2007 of the Government of India, however, notified January 9, 2007 as the date on which all the provisions, except Section 3, of the Reserve Bank of India (Amendment) Act, 2006 would come into force. Section 3 of the Reserve Bank of India (Amendment) Act, 2006 provided for the removal of the ceiling and floor on the CRR to be prescribed by the Reserve Bank as also the provisions for interest payment on eligible CRR balances. Pending the notifications of the relevant provisions, the floor and ceiling on CRR were restored and the Reserve Bank decided to pay interest on eligible CRR balances but consistent with the monetary policy stance and measures at relevant periods of time. Consistent with the amendment, it was decided that with effect from the fortnight beginning March 31, 2007, the Reserve Bank will not be paying any interest on the CRR balances maintained by scheduled primary (urban) co-operative banks.

Regulatory Initiatives

Risk Management

4.25 Tier II banks are required to increase the general provisioning requirement on standard advances in specific sectors, i.e., personal loans, loans and advances qualifying as capital market exposures and commercial real estate loans from the existing level of one per cent to two per cent. Risk weight on exposure to commercial real estate was increased from 100 per cent to 150 per cent.

4.26 UCBs were advised that the bills purchased/discounted/negotiated under LC (where the payment to the beneficiary is not made ‘under reserve’) should be treated as an exposure on the LC issuing bank and not on the borrower. All clean negotiations as indicated above are required to be assigned the risk weight, as is normally applicable to inter-bank exposures, for capital adequacy purpose. In the case of negotiations ‘under reserve’, the exposure should be treated as on the borrower and risk weight assigned accordingly.

4.27 In the backdrop of a booming stock market, UCBs were advised to monitor on a continuous basis, the end use of funds sanctioned by them. Banks were further advised to submit the reports of the findings of the audit examinations for discussion before the Audit Committee of the Board and with their comments put up the report to the board of directors.

4.28 The issue of correct and realistic valuation of fixed assets owned by banks and those accepted by them as collateral for a sizable portion of their advances portfolio assumes significance in view of its implications for correct measurement of capital adequacy position. Accordingly, guidelines were issued to banks, which they should follow while formulating a policy on valuation of properties and appointment of valuers for the purpose.

4.29 The Government of India and the National Security Council has taken a view that disbursement of forged notes through ATMs would be treated as an attempt to circulate forged notes. Accordingly, UCBs were advised to establish a ‘Forged Note Vigilance Cell’ at their Head Office to perform the function of (i) dissemination of Reserve Bank instructions on forged notes to their branches; (ii) monitoring its implementation; and (iii) compilation of data on detection of forged notes and follow up of such cases filed with police.

4.30 Based on directions of Delhi High Court, UCBs were advised to ensure that housing loans are sanctioned only for authorised structures and the banks have to obtain an undertaking on an affidavit from the loan applicants that the building/s will be constructed as per sanctioned plans, which are to be attached with the undertaking.

KYC Norms/AML Standards/Combating of Financing of Terrorism

4.31 UCBs were advised to ensure that they are fully compliant with anti money laundering standards. Chief Executive Officers (CEOs) of UCBs were required to personally monitor the progress in implementing the KYC guidelines and AML procedures in letter and spirit and put in place a system of fixing responsibility for breach of instructions issued. They were also required to furnish a compliance certificate in this regard.

4.32 As wire transfer is an instantaneous and most preferred route for transfer of funds across the globe, there is a need for preventing terrorists and other criminals from having unfettered access to wire transfers for moving their funds and for detecting any misuse when it occurs. UCBs were, therefore, advised to invariably ensure certain information about all wire transfers. All cross-border wire transfers must be accompanied by accurate and meaningful information about the originator, i.e., name and address of the originator, details of the existing account or unique reference number as prevalent in the country. Complete originator information, i.e., name, address, account number, etc., must be accompanied/made available to the beneficiary bank for all domestic wire transfers of Rs.50,000 and above. If a bank has reason to believe that a customer is intentionally structuring wire transfers to below Rs.50,000 to several beneficiaries in order to avoid reporting or monitoring, the bank must insist on complete customer identification before effecting the transfer. In case of non-co-operation from the customer, efforts should be made to establish his identity and suspicious transaction report (STR) should be made to Financial Intelligence Unit – India (FIU-IND). When a credit or debit card is used to effect money transfer, necessary information of the originator should be included in the message. Inter-bank transfers and settlements where both the originator and beneficiary are banks or financial institutions are exempted from the above requirements.

4.33 An ordering bank where the wire transfer originates must ensure that qualifying wire transfer contains complete originator information and intermediary bank should ensure that the same is retained with the transfer. The record of such information should be preserved for a period of 10 years. A beneficiary bank should have effective risk-based procedures in place to identify wire transfers lacking complete originator information. The lack of complete originator information may be considered as a factor in assessing whether a wire transfer or related transactions are suspicious and whether they should be reported to the FIU-IND.

Corporate Governance

4.34 In terms of the Joint Parliamentary Committee Report on Stock Market Scam and Matters Related thereto, UCBs were prohibited from October 1, 2003, to extend any loans and advances (both secured and unsecured) to the directors, their relatives and the firms/ concerns/ companies in which they are interested. However, on reconsideration it was decided on October 6, 2005, with the approval of Government of India, to exclude (i) regular employee – related loans to staff directors on the board of UCBs; (ii) normal loans, as applicable to members, to the directors on the boards of salary earners’ co-operative banks; and (iii) normal employee-related loans to managing directors of multi-state co-operative banks from the purview of the above instructions. As a further measure of relaxation, UCBs were permitted, in consultation with the Government, to allow the directors and their relatives to avail loans against fixed deposits and life insurance policies standing in their own name.

Credit Delivery and Financial Inclusion

Priority Sector Lending

4.35 With a view to rationalising banks’ investment under priority sector lending and to encourage the banks to increasingly lend directly to priority sector borrowers, investments made by banks in the bonds issued by NHB/HUDCO on or after April 1, 2007 are not considered eligible for classification under priority sector lending.

4.36 UCBs have been allowed to extend individual housing loans up to the limit of Rs.25 lakh per beneficiary of a dwelling unit. However, housing finance to borrowers availing loans above Rs.15 lakh is not treated as priority sector lending.

4.37 An important objective of the Prime Minister’s 15 Point Programme for the Welfare of Minorities is to ensure that an appropriate percentage of priority sector lending is targeted for the minority communities and that the benefits of various government sponsored schemes reach the under-privileged. UCBs were, therefore, advised to ensure that within the overall target for priority sector lending and the sub-target of 25 per cent for the weaker sections, sufficient care is taken to ensure that the minority communities also receive an equitable portion of the credit.

4.38 The definition of micro, small and medium enterprises was modified and was required to be implemented by the banks with immediate effect. UCBs were advised about the definitions of micro, small and medium enterprises engaged in manufacturing or production and in providing or rendering services as under: (i) Enterprises engaged in the manufacture or production, processing or preservation of goods – (a) where investment in plant and machinery does not exceed Rs.25 lakh is a micro enterprise; (b) where the investment in plant and machinery is more than Rs.25 lakh but does not exceed Rs.5 crore is a small enterprise; (c) where the investment in plant and machinery is more than Rs.5 crore but does not exceed Rs.10 crore is a medium enterprise; and (ii) Enterprises engaged in providing or rendering services – (a) where the investment in equipments does not exceed Rs.10 lakh is a micro enterprise; (b) where the investment in equipment is more than Rs.10 lakh but does not exceed Rs.2 crore is a small enterprise; (c) where the investment in equipment is more than Rs.2 crore but does not exceed Rs.5 crore is a medium enterprise (also refer Box II.4). Bank’s lending to medium enterprises is not reckoned for the purpose of lending to priority sector.

Guidelines for Relief to Poultry Industry

4.39 Owing to the outbreak of Avian Influenza (bird flu) in some parts of the country, poultry units were facing severe constraints. According to the guidelines issued to UCBs the principal and interest due on working capital loans as also instalments and interest on term loans fallen due for payments on or after February 1, 2006 were to be converted into term loans which should be recovered in instalments based on projected future inflows over a period of three years with an initial moratorium of up to one year. The relief was extended to all poultry accounts classified as standard as on March 31, 2006. Instructions were issued to UCBs about the scope and manner of calculation and disbursement of interest subvention to poultry industry.

Package of Relief Measures to the Vidarbha Region in Maharashtra

4.40 In order to mitigate distress of farmers in the debt-ridden districts of Vidarbha, banks were advised to implement the rehabilitation package in respect of agricultural credit as announced by the Hon’ble Prime Minister. The package is applicable to the districts of Amaravati, Wardha, Yeotmal, Akola, Washim and Buldhana. The entire interest on overdue loans to farmers as on July 1, 2006 is required to be waived for farmers in the above mentioned six districts and they should have no past interest burden as on that date. The overdue loans as on July 1, 2006 are required to be rescheduled over a period of 3-5 years with a one-year moratorium. After rescheduling as above, fresh need based credit facility can be extended to the farmers.

Relief to be Extended by Banks in Areas Affected by Natural Calamities

4.41 In the context of the recent floods that have affected various parts of the country, banks were advised to ensure accessibility to customers to their bank accounts with alternate arrangements like operating the branches from temporary premises, extension counters, satellite offices and restoration of functioning of ATMs.

4.42 To facilitate opening of new accounts by persons affected by natural calamities, especially for availing various reliefs given by Government / other agencies, banks were advised to open accounts with alternative arrangements for ensuring KYC procedures, in case where the balance in the account does not exceed Rs.50,000, or the amount of relief granted (if higher) than Rs.50,000 and the total credit in the account does not exceed Rs.1,00,000, or the amount of relief, (if higher than Rs.1,00,000) in a year.

4.43 To ensure continuity in clearing service, banks were advised for ‘on-city back-up centres’ in 20 large cities and effective low-cost settlement solutions for the remaining cities. Banks were advised to consider discounting cheques for higher amounts to meet customers’ requirement of funds. They could also consider waiver of fees for EFT, ECS or mail services so as to facilitate inward transfer of funds to accounts of persons affected by a natural calamity.

4.44 UCBs were advised that the present limit for sanction of consumption loans may be enhanced to Rs.5,000 without any collateral and such loans may be provided even if no risk fund has been constituted by the State Governments. While restructuring existing loans, the principal amount outstanding in the crop loans and agricultural term loans as well as accrued interest thereon may be converted into term loans. The restructured period for repayment may be 3 to 5 years. Where the damage is very severe, banks may extend the repayment period up to 7 years and in extreme hardship cases may be prolonged up to 10 years without additional collateral security.

Relief for Stressed Farmers in Andhra Pradesh, Karnataka and Kerala

4.45 The Union Government had approved a package of relief measures for debt stressed farmers from 25 specified districts in the States of Andhra Pradesh, Karnataka and Kerala. Accordingly, all UCBs in these States and multi-state co-operative banks were advised to ensure that all the farmers’ loan-accounts in the specified districts, which are overdue as on July 1, 2006 are rescheduled over a period of 3-5 years with a one-year moratorium and the interest thereon (as on July 1, 2006) is fully waived. Fresh finance could also be extended to such farmers.

Relief Measures to Assist Distressed Farmers

4.46 As per announcement made in the Mid-term Review of Annual Policy Statement for the year 2006-07, it was decided to extend the benefits of one time settlement (OTS) schemes to such distressed farmers whose accounts had earlier been rescheduled/converted on account of natural calamities as also such farmers defaulting on their loans due to circumstances beyond their control. All multi-state UCBs were advised to frame transparent OTS policies for such farmers, with the approval of their boards.

4.47 UCBs were advised to ensure that full address/telephone numbers of the branch is invariably mentioned in the pass book/statement of accounts issued to account holders in order to improve the quality of service available to customers in branches.

Customer Services

4.48 To enable banks to provide better customer service, UCBs were allowed to undertake following limited transactions at the extension counters: (i) deposit/withdrawal transactions; (ii) Issue and encashment of drafts and mail transfers; (iii) issue and encashment of travellers’ cheques; (iv) collection of bills; (v) advances against fixed deposits of their customers (within the sanctioning power of the concerned official at the Extension Counter); and (vi) disbursement of other loans (only for individuals) sanctioned by the head office/ base branch up to the limit of Rs.10 lakh only.

4.49 UCBs were advised to implement the recommendations of the Working Group on ‘Formulating a Scheme for Ensuring Reasonableness of Bank Charges’ as accepted by the Reserve Bank. They were also advised to ensure that customers are made aware of the service charges upfront and are implemented only with the prior notice to the customer.

4.50 In terms of the existing instructions, the decision to prescribe service charges is left to the discretion of the boards of individual banks. Banks are normally expected, while fixing the service charges, to ensure that charges are reasonable, consistent with the cost of providing these services and that the customers with low value/volume of transactions are not penalised. All UCBs have been advised to display and update in their offices/ branches, as also on their website, the details of various service charges in the prescribed format. This is also to be displayed in the local languages.

4.51 Scheduled UCBs have also been advised to display and update on the homepage of their websites the details of certain service charges and fees at a prominent place under the title of ‘Service Charges and Fees’ so as to facilitate easy access to the bank customers. They were also advised to provide on the homepage itself a complaint form along with the name of the nodal officer for complaint redressal. The form should indicate that the first point for redressal of complaint is the bank itself and that the complainant may approach Banking Ombudsman only if the complaint is not resolved at the bank within a month.

4.52 UCBs are required to ensure that duplicate DDs are issued within a fortnight from the receipt of such requests. For delays beyond this stipulated period, UCBs were advised to pay interest to compensate the customers for such delay.

4.53 In view of the complaints received by the Reserve Bank/Banking Ombudsmen, UCBs were advised not to compel their customers to drop cheques in drop boxes and to invariably display on the cheque drop box itself that: ‘Customers can also tender the cheques at the counter and obtain acknowledgement on the pay-in-slip.’

4.54 UCBs were advised to invariably offer passbook facility to all their savings bank account holders (individuals), as it is more convenient than statement of account for small customers. Further, they should not recover the cost of providing such passbooks from the customers.

4.55 UCBs were advised to ensure that cheques/ drafts issued by clients containing fraction of a rupee are not rejected or dishonoured by them. Banks were also advised to ensure that the concerned staffs are well versed with these instructions so that general public does not suffer. They should also ensure that appropriate action is taken against members of their staff who refuse to accept cheques/drafts containing fraction of a rupee. Banks were also advised to note that violation of aforesaid instructions would be liable to be penalised under the provisions of Banking Regulation Act, 1949 [as applicable to co-operative societies (AACS)].

4.56 In keeping with a recent Allahabad High Court judgment, UCBs were advised to generally insist that a person opening a deposit account makes a nomination. The bank should explain the advantages of nomination facility to the depositor and if the person still does not want to nominate, the bank should ask him to give a specific letter to the effect that he does not want to make nomination. In case the person declines to give such a letter, the bank should record the fact on the account opening form and proceed with the opening of the account, if otherwise found eligible.

4.57 Though interest rates charged by UCBs were deregulated, rates of interest beyond a certain level were seen to be usurious and were not conforming to normal banking practice. UCBs were, therefore, advised to lay down appropriate internal principles and procedures, so that usurious interest, including processing and other charges, are not levied by them on loans and advances.

Other Policy Initiatives

Distribution of Units of Mutual Funds

4.58 UCBs registered in States which have signed MoU and those registered under Multi-State Co-operative Societies Act, 2002 were permitted to enter into agreement with mutual funds for marketing their units, subject to certain prescribed norms.

Conduct of Foreign Exchange Business by UCBs

4.59 UCBs registered under the Co-operative Societies Act of a State, which has signed MoU, or under the Multi-State Co-operative Societies Act, 2002, were permitted for Authorised Dealer (AD) Category I and II licence, subject to compliance with certain prescribed norms. In addition to existing two UCBs having AD category I license, two more banks were given AD category I license. Banks having AD category II licence are permitted to release/remit foreign exchange for certain specified non-trade current account transactions. It was also decided not to give any fresh authorisation to UCBs to function as Full Fledged Money Changers (FFMCs).

Installation of Automated Teller Machines (ATMs)

4.60 Sound scheduled and non-scheduled UCBs were permitted to set up select off-site/ on-site ATMs, subject to prescribed eligibility norms. Banks permitted to have ATMs can also issue ATM-cum-debit cards. Prior approval of the Reserve Bank for network connectivity and/or sharing of the ATMs was also dispensed with.

Conversion of Extension Counters into Full-Fledged Branches

4.61 Consequent to the regulatory coordination brought about by signing of MoU with some of the State Governments, it was decided that the Reserve Bank would consider permitting financially sound UCBs registered in States, which have signed MoU with the Reserve Bank and those registered under the Multi-State Cooperative Societies Act, 2002 to convert existing extension counters into full-fledged branches, subject to certain conditions.

Insurance Business

4.62 As announced in the Annual Policy Statement for the year 2007-08, UCBs registered in States that have entered into MoU with the Reserve Bank or those registered under Multi-State Co-operative Societies Act, 2002 were allowed to undertake insurance agency business as corporate agents without risk participation, subject to compliance with the following eligibility norms: (a) UCB should have a minimum net worth of Rs.10 crore; and (b) It should not have been classified as Grade III or IV. In case of UCBs registered in States which have not signed MoUs with the Reserve Bank, the existing norms continue.

Norms for maintaining NRE/NRO accounts

4.63 Banks registered in States that have entered into Memorandum of Understanding (MoU) with the Reserve Bank for supervisory and regulatory co-ordination and those registered under the Multi State Co-operative Societies Act, 2002 were permitted to open NRE account subject to compliance with the certain eligibility norms. In terms of extant instructions, UCBs are not permitted to accept NRO deposits. They were also required to close these accounts, within a given timeframe. It has now been decided that banks may maintain NRO accounts, arising from their re-designation such as upon the account holders becoming non-resident. Opening of fresh NRO accounts is not permitted. Further, no fresh credits, barring periodical credit of interest, are allowed in these accounts. However, these restrictions are not applicable to UCBs holding AD Category - I licence.

Guidelines on One-time Settlement (OTS) Scheme for SME Accounts

4.64 Guidelines for settlement of chronic NPAs in small and medium enterprises sector, were forwarded to the State Governments with a request to notify the scheme to the UCBs under their jurisdiction, keeping in view the legal position obtaining in the State Co-operative Societies Acts/ Rules of the respective States. Similar guidelines were also forwarded to Multi-State UCBs. These guidelines do not cover loans availed of/guaranteed by directors/ their relatives/ firms or companies in which directors are interested and cases of wilful defaults, frauds and malfeasance.

Grant of Loans for Acquisition of Kisan Vikas Patras

4.65 Grant of loans for investing in KVPs does not promote fresh savings. It rather channelises the existing savings in the form of bank deposits to small saving instruments and thereby defeat the very purpose of such schemes. Banks were, therefore, advised not to sanction loans for acquisition of/investing in small savings instruments, including KVPs.

Augmenting Capital of UCBs

4.66 Share capital and retained earnings constitute the owned funds of co-operative banks. Share capital can be withdrawn by members after the minimum lock-in period and does not have the permanence of equity. Co-operative banks are also not allowed to issue shares at a premium. In order to explore various options for raising regulatory capital, it was proposed to constitute a Working Group comprising representatives of the Reserve Bank, State Governments and the UCB sector to examine the issues involved and identify alternate instruments/avenues for augmenting the capital funds of urban co-operative banks (Box IV.2).

Bank and Branch Licensing

4.67 Consequent upon easing of the licensing norms in May 1993, more than 800 banking licenses were issued, up to June 2001. It was, however, observed that close to one third of these newly licensed UCBs became financially weak within a short period. There was, thus, a need to moderate the pace of growth of this sector. Accordingly, it was decided to stop further bank and branch licensing until a suitable framework for regulation and supervision was put in place for the existing large number of UCBs. As at the end of March 2007, out of 1, 813 banks, 925 were unit banks, which were functioning as Head Office-cum-Branch. In the States that have signed MoU with the Reserve Bank, it was decided to consider application for grant of branch licenses from eligible licensed banks, whose net worth was not less than Rs.10 crore and average networth per bank, including the proposed ones was not less than Rs.2 crore in ‘A’ and ‘B’ category centres and Rs.1 crore in ‘C’ and ‘D’ category centres. The eligibility of the banks is decided on the basis of their audited balance sheet for the financial year ended March 2007.

UCBs under Directions

4.68 Directions are issued to UCBs based on the framework of Graded Supervisory Action (GSA) or due to sudden developments like run on bank, among others. These include restriction on acceptance/withdrawal of deposits, restriction or ban on expansion of loans, incurring of expenditure other than minimum establishment expenses required for day to day running of the bank. The banks placed under directions are monitored and decision on removing restrictions depends upon the ability of banks to rectify its inadequacies. During 2006-07, 23 UCBs were placed under directions as against 7 UCBs during the previous year. The total number of UCBs placed under directions at end-March, 2007 was lower at 73, compared with that of 75 at end-March 2006 (Appendix Table IV.2).

UCBs under Liquidation

4.69 As at end-March 2007, 254 UCBs were under various stages of liquidation compared with 226 banks at end-March 2006 (Appendix Table IV.3). As a result of the consultative process adopted in States that have signed MoUs with the Reserve Bank, the process for liquidation has become smooth and quicker, as the decisions are based on the recommendations of the TAFCUBs. Earlier, the requisition for liquidation of a bank was protested by the bank, the sector and often resulted in delay in implementation of the requisition by the State Governments.

Off-site Surveillance

4.70 An off site surveillance (OSS) software has been developed for UCBs to facilitate the preparation and submission of all supervisory and regulatory (including OSS) returns to the Reserve Bank electronically. The returns are e-mailed by UCBs to the respective Regional Offices (ROs) of the Reserve Bank, which are automatically uploaded to the RO database, and the same are transmitted to Central Office server at night over INFINET. As part of efforts towards continuous supervision, data are subjected to analysis using business intelligence software. Analysis is done, inter alia, with the objective of tracking incipient indicators of stress faced by banks as also for identifying outlier banks, i.e., banks that do not fall within reasonable limits in respect of important parameters such as capital adequacy, quality of assets, liquidity, earnings, etc. The OSS

Box IV.2: Report of the Working Group on Issues Concerning Raising of Capital by UCBs

The urban cooperative banking sector has witnessed phenomenal growth during the last one and a half decades. Certain infirmities have, however, manifested in the sector resulting in erosion of public confidence and causing concern to the regulators as also to the well-functioning units in the sector. One of the factors significantly affecting the financial health of the urban co-operative banks (UCBs) was their inability to attract equity/quasi equity investments. At present, UCBs have limited avenues for raising such funds and even their share capital can be withdrawn. Against this backdrop, an announcement was made in the Annual Policy Statement for the year 2006-07 to constitute a Working Group to examine the issue of share capital of UCBs and identify alternate instruments / avenues for augmenting the capital funds of UCBs. Accordingly, a Working Group (Chairman: N.S. Vishwanathan) was constituted.

The major recommendations of the Group are as under:

• Where UCBs with low capital or negative net worth are able to identify potential investors, the monetary ceiling prescribed in the Acts on individual share holding comes in the way of shoring up the share capital through this route. In such cases, the State Governments be requested to exempt the UCBs from the existing monetary ceiling on individual shareholding either through a notification or through amendment to the Act, where necessary.

• To provide instruments and avenues for raising stable and long-term funds having equity or quasi equity characteristics:

i) UCBs may be permitted to issue unsecured, subordinated (to the claims of depositors), non-convertible, redeemable debentures/bonds, which can be subscribed to by those within their area of operations and outside. Funds raised through such instruments may be treated as Tier II capital, subject to the instruments conforming to certain prescribed features. These bonds could be transferable by endorsement and delivery.

ii) UCBs be allowed to issue special shares on specific terms and conditions. Banks can also be allowed to issue these shares at a premium, which could be approved by the respective RCS, in consultation with the Reserve Bank. The special shares will be non-voting, perpetual and transferable by endorsement and delivery. They would rank senior to only the ordinary shares and be treated as Tier I capital.

iii) The Reserve Bank may make an exception with regard to rating requirement to enable the commercial banks to invest in the special shares and Tier II bonds issued by UCBs within the ceiling prescribed for investment in unlisted securities. UCBs may also be permitted to invest in Tier II bonds of other UCBs. The Reserve Bank may prescribe an appropriate limit linked to the investing bank’s and recipient bank’s net owned funds.

iv) UCBs be allowed to issue redeemable cumulative preference shares on specific terms and conditions with the prior permission of the respective RCS, granted in consultation with the Reserve Bank. They may be treated as Tier II capital subject to conforming to certain prescribed features.

v) There is a need to amend the Multi-State Co-operative societies Act to remove the limit prescribed on raising of funds by way of non-convertible debentures/bonds.

Wherever such limits are prescribed in other State Acts, necessary amendments may be made.

vi) UCBs be permitted to raise deposits of over 15 year maturity and such deposits can be considered as Tier II capital, subject to their meeting certain conditions, which, inter alia, include that they shall be subordinate to other deposits and ineligible for DICGC cover.

vii) Where banks with negative net worth raise Tier II capital by way of bonds, preference shares and long maturity deposits, through conversion of existing deposits, the Reserve Bank may, as an exception to the general rule, treat these as part of regulatory capital even though Tier I capital is negative.

As retained earnings form the only source of owned funds, the Reserve Bank could suggest to the Government of India to defer the application of income tax on UCBs for a period of three years by which time the alternative instruments may also take concrete shape.

Since UCBs are brought under the regime of linking capital adequacy in terms of a ratio to risk assets, prescribing a share to loan ratio on a borrower-to-borrower basis may not be necessary and hence the extant instructions on share linking to loans may be dispensed with.

As for International Accounting Standard Board’s proposed standard requiring share capital of cooperatives to be treated as outside liabilities, the Working Group recommended that it may continue to be treated as equity and reckoned as Tier I capital for regulatory purposes in view of the restrictions placed on withdrawal of capital in the Co-operative Societies Acts and taking into account the empirical evidence of share capital of UCBs being by and large stable.

The Working Group has observed that a federated structure can be a lasting solution for the sector. However, it will not only require amendments to the Co-operative Societies Acts, but also entail changes to the supervisory and regulatory practices. The Group has, therefore, recommended that the entire issue of creating an appropriate legislative and supervisory framework for the purpose be separately examined taking into consideration the international experiences and systems.

4.71 Scheduled UCBs were advised to submit the structural liquidity statement and interest rate sensitivity statement through the ALM Module provided in the OSS software. The statement of structural liquidity is required to be prepared at fortnightly intervals beginning with the last reporting Friday of June 2007, i.e., June 22, 2007 and that of interest rate sensitivity on a monthly basis as on last reporting Friday of the month starting with the month of June 2007.

4.72 As there is greater convergence in the supervisory process between the commercial banks and UCBs, the rating model for UCBs was revised to align it with the revised rating model for commercial banks. The new rating models for Tier I and Tier II UCBs have been approved by the Board for Financial Supervision to be adopted with the inspection cycle beginning March 2008 (Box IV.3).

Operations and Financial Performance of Urban Co-operative Banks

A Profile of UCBs

4.73 The urban co-operative banking sector comprises a number of institutions which vary in terms of their size, nature of business and their geographic spread. Primary (Urban) co-operative banks (UCBs) account for about 4.4 per cent of deposits and 3.9 per cent of advances of the banking system, and have 7.1 million borrowers and over 50 million depositors.

4.74 The total number of Grade I and II banks increased consistently during the last three years, while those in Grade III and IV declined. The number of UCBs in Grade III and Grade IV declined to 563 (31 per cent of the total number of UCBs) at end-March 2007, from 677 (37 per cent of the total) at end-March 2006 (Tables IV.2 and IV.3). The improvement in the position of banks signified by an increase in the Grade I and II banks and a decline in Grade III and IV banks, was witnessed in most of the centres. The general improvement in the Grade I and II banks largely reflects the salubrious impact of the consultative process under TAFCUBs.

4.75 The improvement in public confidence in this sector is reflected in the rise in deposit base of the UCBs. The total deposits of UCBs increased by 6.1 per cent during 2006-07, on top of an increase of 8.6 per cent during 2005-06. Besides a few large banks, most of the UCBs are of small

Box IV.3: Revised CAMELS Rating Model for UCBs

At present, a supervisory rating model based on ‘CAMELS’ (similar to commercial banks) and a simplified rating model based on ‘CAEL’ are in vogue for scheduled and non-scheduled UCBs, respectively. A system of supervisory grading of UCBs into grades I to IV based on financial parameters, viz., CRAR, Net NPA, Net Profit and compliance with CRR/SLR is also in place for both scheduled and non-scheduled UCBs. While the supervisory ratings of UCBs are disclosed to the Board level functionaries only, the grades are advised to the banks concerned and the RCS (except in case of banks classified as Grade I, where grade is not advised to the bank/RCS).

In order to bring about supervisory and regulatory convergence between co-operative and commercial banks, without missing out on the governance structure and the level of MIS and risk management systems obtaining in the UCBs, the rating models for UCBs have been revised. The revised rating model for UCBs is on the lines of revised rating model for commercial banks with suitable adaptation in the parameters rated so as not to unduly raise the bar in respect of UCBs vis-à-vis commercial banks keeping in view their overall financial health, the level of MIS and risk management systems prevailing. These apart, the dissimilarities in the structure of management, the size of the regulated entities, the regulations presently applicable to them, the level of use of banking technology, among others, have also been taken into account while adapting the model. Suitable modifications have been made considering the fact that UCBs, as compared to commercial banks, have larger average gross and net NPAs, particularly hardcore NPAs and larger cost-income ratios.

Under the Management head, suitable adaptation has been made keeping in view the election on democratic principle and corporate governance aspects obtaining in the UCB sector. Suitable modifications have also been made under the head Management for UCBs working under Administrators, where the boards have been superceded. (A significant number of UCBs are functioning under Administrators, their boards having been superceded due to various reasons).

Keeping in view the existing twin-track regulatory regime, the revised CAMELS model, which is more akin to the revised model adopted for commercial banks, would be adopted for UCBs with deposits of Rs.100 crore and above and the revised simplified version thereof would be adopted for UCBs with deposits of less than Rs.100 crore. As against the present system of rating of UCBs in four scales under A to D, UCBs would be rated in ten scales under A+ to D, using both positive and negative connotations to the principal rating. For instance, A+, A, A-. All UCBs with deposits of Rs. 100 crore and above would be brought under ALM discipline. The revised rating model will be made applicable to UCBs from the inspection cycle beginning from the year April 2008, i.e., with reference to their financial position as on March 31, 2008 and the existing grading system would be dispensed with.

Table IV.2: Centre-wise Gradation of Urban Co-operative Banks |

Centre |

Grade I |

Grade II |

Grade III |

Grade IV |

Total |

|

|

2006 |

2007 |

2006 |

2007 |

2006 |

2007 |

2006 |

2007 |

2006 |

2007 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

Ahmedabad |

136 |

114 |

50 |

88 |

67 |

42 |

43 |

40 |

296 |

284 |

Bangalore |

90 |

99 |

76 |

92 |

85 |

55 |

46 |

42 |

297 |

288 |

Bhopal |

16 |

12 |

28 |

24 |

17 |

15 |

14 |

9 |

75 |

60 |

Bhubaneswar |

1 |

2 |

6 |

4 |

3 |

4 |

4 |

4 |

14 |

14 |

Chandigarh |

10 |

9 |

1 |

3 |

1 |

– |

4 |

4 |

16 |

16 |

Chennai |

54 |

69 |

32 |

34 |

39 |

22 |

7 |

6 |

132 |

131 |

Dehradun |

– |

4 |

– |

– |

– |

1 |

– |

2 |

– |

7 |

Guwahati |

6 |

6 |

4 |

6 |

4 |

4 |

4 |

1 |

18 |

17 |

Hyderabad |

48 |

65 |

43 |

33 |

18 |

7 |

15 |

11 |

124 |

116 |

Jaipur |

25 |

24 |

10 |

13 |

3 |

1 |

1 |

1 |

39 |

39 |

Jammu |

2 |

3 |

– |

– |

2 |

1 |

– |

– |

4 |

4 |

Kolkata |

30 |

31 |

11 |

10 |

3 |

1 |

7 |

9 |

51 |

51 |

Lucknow |

47 |

44 |

13 |

17 |

9 |

4 |

8 |

5 |

77 |

70 |

Mumbai |

173 |

117 |

128 |

178 |

84 |

76 |

71 |

80 |

456 |

451 |

Nagpur |

53 |

17 |

45 |

76 |

43 |

39 |

33 |

39 |

174 |

171 |

New Delhi |

12 |

12 |

1 |

1 |

– |

– |

2 |

2 |

15 |

15 |

Patna |

3 |

5 |

1 |

– |

1 |

– |

– |

– |

5 |

5 |

Raipur |

– |

5 |

– |

5 |

– |

– |

– |

4 |

– |

14 |

Thiruvananthapuram |

10 |

14 |

11 |

14 |

28 |

23 |

11 |

9 |

60 |

60 |

Total |

716 |

652 |

460 |

598 |

407 |

295 |

270 |

268 |

1,853 |

1,813 |

– : Nil. |

|

|

|

|

|

|

|

|

|

|

Note : As at end-March 2006, data for Bhopal include Raipur and data for Lucknow include Dehradun. |

to medium size (Table IV.4). As at end-March 2007, of the total 1,813 UCBs, 34.5 per cent of UCBs had deposits less than Rs.10 crore. However, they accounted for only 3.1 per cent of total deposits. At the other end of the spectrum, 77 banks with deposits of Rs.250 crore and above accounted for half of the total deposits. Of these, 15 banks with deposits Rs.1,000 crore and above accounted for 27.1 per cent of total deposits of UCBs at end-March 2007. In all, 95.8 per cent banks had a deposit base of less than Rs.250 crore and accounted for 50 per cent of deposits, while 4.2 per cent banks with a deposit base of Rs.250 crore and above accounted for remaining 50 per cent of the deposits of the UCB sector, reflecting highly skewed distribution of deposits across UCBs.

4.76 Fifty-three UCBs, which were accorded scheduled status constituted a sizeable section of the UCB sector in terms of their share in assets/ deposits/investments/loans and advances which was a little over 40 per cent. On the other hand, 1,760 non-scheduled UCBs accounted for the remaining share (Table IV.5).

Table IV.3: Summary of Grade-wise Position of UCBs |

End- |

No. of |

Grade I |

Grade II |

Grade III |

Grade IV |

Grade |

Grade |

Grade |

Grade |

March |

UCBs |

|

|

|

|

I+II |

III+IV |

(I+II) |

III+IV |

|

|

|

|

|

|

|

|

as a |

(as a |

|

|

|

|

|

|

|

|

percent |

percent |

|

|

|

|

|

|

|

|

to Total |

to Total) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

2005 |

1,872 |

807 |

340 |

497 |

228 |

1,147 |

725 |

61 |

39 |

2006 |

1,853 |

716 |

460 |

407 |

270 |

1,176 |

677 |

63 |

37 |

2007 |

1,813 |

652 |

598 |

295 |

268 |

1,250 |

563 |

67 |

31 |

|

(End-March 2007) |

Sr. No. |

Deposit Base

(Rs. crore) |

No. of UCBs |

Deposits |

|

|

No. |

Share in |

Amount |

Share in |

|

|

|

Total |

|

Total |

|

|

|

(per cent) |

(Rs. crore) |

(per cent) |

|

1 |

2 |

3 |

4 |

5 |

1. |

> 1,000 |

15 |

0.8 |

32,748 |

27.1 |

2. |

500 to < 1,000 |

17 |

0.9 |

11,897 |

9.8 |

3. |

250 to < 500 |

45 |

2.5 |

16,152 |

13.4 |

4. |

100 to < 250 |

143 |

7.9 |

22,042 |

18.1 |

5. |

50 to < 100 |

206 |

11.4 |

14,948 |

12.4 |

6. |

25 to < 50 |

315 |

17.4 |

11,283 |

9.3 |

7. |

10 to < 25 |

446 |

24.6 |

8,198 |

6.8 |

8. |

< 10 |

626 |

34.5 |

3,715 |

3.1 |

|

Total |

1,813 |

100.0 |

1,20,983 |

100.0 |

Operations, Financial Performance and Asset Quality of Urban Co-operative Banks

Operations of UCBs

4.77 The business operations of UCBs expanded at a much lower rate of 5.9 per cent during 2006-07, compared with a growth of 24.8 per cent by scheduled commercial banks (SCBs) during the same period (Table IV.6). As a result, the relative asset size of UCBs at end-March 2007 declined to around 4.0 per cent of assets of SCBs from the level of 5.0 per cent a year ago. The composition of the assets and liabilities of the UCBs remained broadly on the lines of the last year. Deposits, the main item on the liabilities side, accounted for nearly 75.7 per cent of total resources. Borrowings registered a sharp increase of 46.1 per cent while ‘other liabilities’ registered a modest rise (1.8 per cent) during 2006-07. Capital and reserves increased at a higher rate of 11.4 per cent and 3.6 per cent during 2006-07 compared with 8.3 per cent and 1.0 per cent, respectively, in the previous year Loans and advances and investments, the major constituents on the asset side, constituted 49.2 per cent and 29.6 per cent of the total assets, respectively. While deposits grew by 6.1 per cent during the year, loans and advances increased by 9.8 per cent and investments declined by 6.1 per cent during 2006-07.

Table IV.6: Liabilities and Assets of Urban |

Co-operative Banks |

(Amount in Rs. crore) |

Item |

|

As at |

Percentage |

|

|

end-March |

Variations |

|

|

2006 |

2007 P |

2006-07 |

1 |

|

2 |

3 |

4 |

Liabilities |

|

|

|

1. |

Capital |

3,488 |

3,884 |

11.4 |

|

|

(2.3) |

(2.4) |

|

2. |

Reserves |

10,485 |

10,867 |

3.6 |

|

|

(6.9) |

(6.8) |

|

3. |

Deposits |

1,14,060 |

1,20,983 |

6.1 |

|

|

(75.6) |

(75.7) |

|

4. |

Borrowings |

1,781 |

2,602 |

46.1 |

|

|

(1.2) |

(1.6) |

|

5. |

Other Liabilities |

21,140 |

21,515 |

1.8 |

|

|

(14.0) |

(13.5) |

|

|

|

|

|

|

Total Liabilities/Assets |

1,50,954 |

1,59,851 |

5.9 |

|

|

(100.0) |

(100.0) |

|

Assets |

|

|

|

1. Cash in Hand |

1,558 |

1,639 |

5.2 |

|

|

(1.0) |

(1.0) |

|

2. Balances with Banks |

9,037 |

9,806 |

8.5 |

|

|

(6.0) |

(6.1) |

|

3. |

Money at Call and Short Notice |

1,835 |

1,859 |

1.3 |

|

|

(1.2) |

(1. 2) |

|

4. Investments |

50,395 |

47,316 |

-6.1 |

|

|

(33.4) |

(29.6) |

|

5. Loans and Advances |

71,641 |

78,660 |

9.8 |

|

|

(47.5) |

(49.2) |

|

6. Other Assets |

16,488 |

20,571 |

24.8 |

|

|

(10.9) |

(12.9) |

|

P : Provisional.

Note : Figures in parenthesis are percentages to total liabilities/assets.

Source: Balance sheets of respective UCBs. |

Table IV.5: A Profile of UCBs |

(End-March 2007) |

(Amount in Rs. crore) |

Category |

No. of UCBs |

Assets |

Deposits |

Investments |

Loans and Advances |

1 |

2 |

3 |

4 |

5 |

6 |

1. |

All UCBs |

1,813 |

1,59,851 |

1,20,983 |

47,316 |

78,660 |

|

|

(100.0) |

(100.0) |

(100.0) |

(100.0) |

(100.0) |

2. |

Scheduled UCBs |

53 |

71,562 |

51,173 |

20,279 |

32,884 |

|

|

(2.9) |

(44.8) |

(42.3) |

(42.9) |

(41.8) |

3. |

Non-Scheduled |

1,760 |

88,290 |

69,810 |

27,037 |

45,776 |

|

|

(97.1) |

(55.2) |

(57.7) |

(57.1) |

(58.2) |

Note :

1. Figures in parentheses represent percentages to total of all UCBs.

2. Data are provisional. |

Priority Sector Lending

4.78 As against the stipulated target of 60.0 per cent of their total loans and advances to the priority sector and 25.0 per cent of priority sector lending towards weaker sections, UCBs extended 56.0 per cent of total credit to the priority sector and 25.9 per cent of total priority sector loans to the weaker section. Thus, although the UCBs fell short of meeting the priority sector target by a thin margin, they were able to meet the requirements for lending to the weaker sections. (Table IV.7).

4.79 SLR investments constituted bulk of investment (93.1 per cent) of UCBs as at end-

Table IV.7: Priority Sector and Weaker |

Section Advances by Urban Co-operative |

Banks - 2006-07 |

Segment |

Priority Sector |

Weaker Sections |

|

Amount |

Share in |

Amount |

Share in |

|

(Rs. crore) |

Total |

(Rs. crore) |

Total |

|

|

Advances |

|

Advances |

|

|

(Per cent) |

|

(Per cent) |

1 |

2 |

3 |

4 |

5 |

Agriculture and Allied |

|

|

|

|

Activities |

2,190 |

2.8 |

1,010 |

1.3 |

Cottage and Small |

|

|

|

|

Scale Industries |

12,125 |

15.4 |

1,397 |

1.8 |

Road and Water |

|

|

|

|

Transport Operators |

2,147 |

2.7 |

497 |

0.6 |

Private Retail Trade |

|

|

|

|

(Essential Commodities) |

2,034 |

2.6 |

761 |

1.0 |

Retail Trade (Others) |

4,699 |

6.0 |

1,069 |

1.3 |

Small Business |

|

|

|

|

Enterprises |

6,079 |

7.7 |

1,698 |

2.2 |

Professional and |

|

|

|

|

Self Employed |

2,685 |

3.4 |

927 |

1.2 |

Educational Loans |

628 |

0.8 |

232 |

0.3 |

Housing Loans |

10,247 |

13.0 |

3,092 |

3.9 |

Consumption Loans |

1,169 |

1.5 |

709 |

0.9 |

Software Industries |

55 |

0.1 |

7 |

0.0 |

Total |

44,058 |

56.0 |

11,399 |

14.5 |

Note : Data are provisional. |

Table IV.8: Investments by Urban |

Co-operative Banks |

(Amount in Rs. crore) |

Item |

As at |