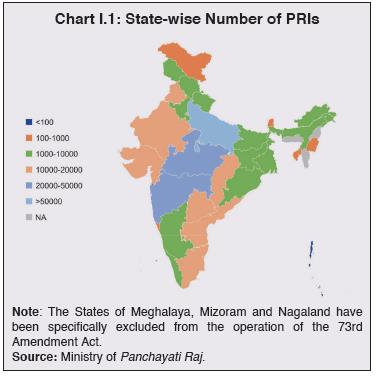

“Independence must begin at the bottom. Thus, every village will be a Republic or Panchayat having full powers”. - Mahatma Gandhi 1. Introduction 1.1 Since Vedic times, villages in India have served as fundamental administrative units. References to Panchayats can be found in ancient texts like Manusmriti, Arthashastra, and Mahabharata (Ananth, 2014). The role of Panchayats, however, waned due to factors such as the failure of kingdoms to adhere to decentralisation principles. The Panchayati Raj system got dismantled during British rule, with the establishment of the district collectorate, primarily for revenue collection. In 1870, the Bengal Chowkidar Act granted district magistrates the authority to establish Panchayats in villages comprising of appointed members for tax collection. In 1882, the British government passed a resolution, envisioning the formation of local boards with elected non-official members in substantial majority. This resolution also proposed the creation of rural local boards, with two-thirds of their members elected by the populace. Despite these early intentions, the progress in the formation of rural local self-governments remained stagnant until 1947 (Jothiramalingam, 2020). 1.2 The modern concept of Panchayati Raj received a boost from Mahatma Gandhi, who saw it as a means of promoting democracy at the grassroots level. He advocated Gram Swaraj or village self-governance - a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system. Following independence, Gram Panchayats were revitalised by entrusting them with essential functions of local government. Under the Directive Principles in Article 40 of the Constitution, it is stipulated that “the State shall take measures to organise Gram Panchayats and empower them with the necessary authority and powers to function as self-governing units.” In 1957, the Balwant Rai Mehta Committee, the first committee to address issues related to democratic decentralisation in the post-independence period, proposed a three-tier Panchayati Raj system consisting of Gram Panchayats, Panchayat Samitis and Zila Parishads, with Gram Panchayats consisting of directly elected representatives, and Panchayat Samitis and Zila Parishads comprising indirectly elected representatives. The Committee also recommended the allocation of resources to assist Panchayats in fulfilling their duties and responsibilities. In 1977, the Ashok Mehta Committee suggested a two-tier system consisting of Zila Parishads at the district level and Mandal Panchayats that would be responsible for a group of villages. It proposed granting these bodies the power to levy taxes to generate their own financial resources. In 1986, the L.M. Singhvi Committee recommended the constitutional recognition of the Panchayati Raj system, emphasising their significance and role in India’s governance structure. 1.3 In 1992, the 73rd Amendment1 to the Indian Constitution institutionalised the Panchayati Raj Institutions (PRIs) at three levels in rural India: Gram Panchayats at the village level, Mandal Panchayats at the intermediate/block level and Zila Parishad at the district level. There are a total of 2.62 lakh PRIs in India, with 2.55 lakh Gram Panchayats, 6,707 Mandal Panchayats and 665 Zila Parishads as of end-October 2023 (Chart I.1, MoPR, 2023). 1.4 With 68.8 per cent of India’s population residing in rural areas as per the 2011 Census, local governments at the Panchayat level assume a significant role in translating the vision and developmental policies of both the Central and State governments into action. They bridge the gap between the masses and higher levels of government and can be catalysts for grassroots development by encouraging community participation, fostering local stewardship, and advancing sustainability initiatives. PRIs are expected to play a vital role in achieving the Sustainable Development Goals (SDGs) set for the nation by 2030. They also serve as a crucial line of defence against climate change-induced risks in rural areas. The efficacy of the PRIs is, however, contingent upon factors such as the availability of adequate resources, nurturing of capabilities, political support, and active engagement of the local community.  1.5 In view of these factors, an analysis of the finances of the PRIs is critical for an overall assessment of public finances in the country. In this context, it is relevant to note that the G20 Data Gaps Initiative2 has emphasised the necessity of addressing data gaps that are relevant to policymaking. As India gradually aligns itself with the G20 Data Gaps Initiative, particularly regarding the accessibility of general government fiscal data, the need to bridge data disparities concerning local government finances within the country will become crucial (RBI, 2022). At present, the primary source of Panchayat budget information on a national scale is eGramSwaraj maintained by the Ministry of Panchayati Raj (MoPR). However, the available budget documents vary in terms of content and format across States and districts. Information regarding capital accounts is limited, and the revenue accounts of the Panchayats lack sufficient detail. 1.6 Against this backdrop, this Report presents and analyses aggregate budgetary details related to village Panchayats in India. As an introduction to the subsequent chapters, this chapter presents an outline of Panchayat finances within the Indian context. Section 2 provides an overview of the cross-country experience on local government finances. Section 3 offers an insight into the functional and financial aspects of PRIs in India. Section 4 delves into the topics of transparency and e-governance initiatives at the Panchayat level and Section 5 concludes the Chapter. 2. Cross-Country Experience in Local Government Finances 1.7 The extent of devolution of powers and functions to local governments varies across countries, with decentralisation being more pronounced in the developed world than in developing countries (Gadenne, 2014). On average, 10 per cent of total tax revenues accrue to local governments worldwide, albeit with considerable variations across countries. For instance, in Finland, Iceland, Switzerland, Estonia, and Bolivia, local governments account for more than 20 per cent of total tax revenues. On the other hand, it is not even 2 per cent in Jamaica, Malta, Greece, Swaziland and Argentina (Brulhart, 2015).3 1.8 Indonesia decentralised land and building taxes in favour of local governments between 2010 and 2014. The local governments were also granted autonomy with respect to setting tax rates, provided they did not exceed 0.3 per cent of property valuation. Consequently, property tax collections increased; however, the potential remains underutilised across cities (Haldenwang, 2015). Local governments in China have relied heavily on off-budget borrowings for financing their expenditures and investments (Chen, 2020). Municipalities in Brazil enjoy autonomy with respect to setting their own tax policies. Nonetheless, they depend on government transfers for more than two-thirds of their revenues (Carvalho, 2017). 1.9 Revenue autonomy is severely limited in Africa, Asia, the Middle East, and West Asia (Paul et al., 2011). For instance, in Tanzania, own revenue sources of the local governments cover just 10 per cent of their overall spending (Malangalila, 2019). While the situation is somewhat better in Eurasia and Latin America, the local governments in these regions often have no power to introduce new taxes or make decisions regarding some or all tax rates, fees, and user charges (Paul et al., 2011). 1.10 The responsibilities of local governments vary across countries. In Nordic countries like Sweden and Denmark, they have more than 50 per cent share in public spending. Finnish local governments are responsible for providing a wide range of services, including education, vocational training, basic and specialised health care, social services, water supply, and waste management (Andre, 2014). In Australia, the functions of local governments include health, security, education, planning and environmental management. The responsibilities of local governments in China include the provision of public services like education, administration, and public safety. In India, local government expenditures are primarily centred on local services such as water supply, sewage, waste management, and municipal administration. 1.11 Another constraint on the working of local bodies is that there are very few institutions or platforms at the global level where local governments can connect with each other and learn from best practices across countries. International Council for Local Environmental Initiatives (ICLEI), a global network of more than 2,500 local and regional governments across more than 125 countries committed to sustainable urban development, creates connections among the local, regional, and national governmental levels and drives local action for equitable, resilient and circular development. ICLEI has played a key role in fostering collaborative creation of strategies, facilitating the exchange of knowledge and communication among cities worldwide in the context of urban biodiversity development (Frantzeskaki, 2019). 1.12 Similarly, United Cities and Local Governments (UCLG) represents the voices of local and regional governments. UCLG and C40 Cities4 convened the Urban 20 (U20) initiative to reinforce the role of cities in promoting sustainable agenda. U20, one of the engagement groups of G20, was chaired by the city of Ahmedabad in 2023 under India’s G20 presidency. C40 has fostered diversity in local climate actions, leading to development of innovative solutions in member cities (Nguyen, 2020). 1.13 Overall, the finances and functions of the local bodies vary significantly across countries, with local governments in many countries lacking adequate powers and resources. 3. Functions and Finances of the PRIs in India 1.14 Until 1992, the responsibilities of the PRIs were primarily focused on sanitation efforts, conservancy services, building and maintaining fair-weather roads, access to domestic water supply, and street lighting. In 1992, the 73rd Amendment introduced a significant change, specifying 29 subjects for which Panchayats were entrusted with the responsibility of devising and executing plans aimed at fostering local economic development and social justice. These subjects are outlined in the Eleventh Schedule of the Constitution and encompass a wide range of areas, including agriculture, animal husbandry, water management, rural housing, road infrastructure, rural electrification, healthcare, sanitation, poverty alleviation programs, family welfare, women and child development, public distribution systems, social welfare, and more (Table I.1). 1.15 Wide inter-State variations, however, exist in the devolution of these subjects to the Panchayats (Table I.2). 1.16 The functions assigned to PRIs depend on their respective tiers (Chart I.2). At the Gram Panchayat level, the responsibilities encompass sanitation, provision of drinking water, management of village roads, rural electrification, formulation of annual budgets and development plans, upkeep of cattle sheds and ponds, agricultural initiatives, minor irrigation projects, support for small-scale industries, engagement in rural development programs, involvement in educational and cultural affairs, preservation of heritage, and participation in public health initiatives. State governments and Zila Parishads may also delegate further tasks to Gram Panchayats (Chak, 2017). 1.17 The primary role of the Mandal Panchayat is to oversee and coordinate the activities of multiple Panchayats operating within its jurisdiction. It involves supervising the operations of these Panchayats, reviewing their budgets, and proposing enhancements to optimise their functioning. Additionally, Mandal Panchayats are responsible for formulating and executing development plans related to agriculture, animal husbandry, fisheries, small-scale and cottage industries, rural healthcare, and other such areas. | Table I.1: Functions Listed in the 11th Schedule of the Constitution | | 1 | Agriculture, including agricultural extension | 16 | Poverty alleviation program | | 2 | Land improvement, implementation of land reforms, land consolidation, and soil conservation | 17 | Education, including primary and secondary schools | | 3 | Minor irrigation, water management, and watershed development | 18 | Technical training and vocational education | | 4 | Animal husbandry, dairying, and poultry | 19 | Adult and non-formal education | | 5 | Fisheries | 20 | Libraries | | 6 | Social forestry and farm forestry | 21 | Cultural activities | | 7 | Minor forest produces | 22 | Markets and fairs | | 8 | Small-scale industries, including food processing industries | 23 | Health and sanitation, including hospitals, primary health centers, and dispensaries | | 9 | Khadi, village, and cottage industries | 24 | Family welfare | | 10 | Rural housing | 25 | Women and child development | | 11 | Drinking water | 26 | Social welfare, including welfare of handicapped and mentally retarded | | 12 | Fuel and fodder | 27 | Welfare of weaker sections, in particular, scheduled castes and scheduled tribes | | 13 | Roads, culverts, bridges, ferries, waterways, and other means of communication | 28 | Public distribution system | | 14 | Rural electrification, including distribution of electricity | 29 | Maintenance of community assets | | 15 | Non-conventional energy sources | | | | Source: Constitution of India. | 1.18 Zila Parishads mainly assume a supervisory role, overseeing and coordinating the activities of the Mandal Panchayats falling under their purview. In some States, the Zila Parishads have the authority to sanction the budgets of the Mandal Panchayats. Additionally, they are entrusted with maintaining and administrating primary and secondary schools, hospitals, dispensaries, minor irrigation projects and related functions (Chak, 2017). 1.19 The ability of PRIs to effectively fulfil these functions hinges on access to sufficient financial resources. Prior to 1992, PRIs had limited sources of revenue. Their primary income streams consisted of a small number of mandatory taxes, including property taxes, land revenue or rent cess, taxes on animals and vehicles, and professional taxes. They also relied on various optional taxes and fees such as octroi, taxes on shops and markets, pilgrim taxes, fees on goods displayed for sale, drainage fees, lighting charges and water fees. These revenue streams were insufficient to sustain the Panchayats without financial aid from the State Governments, as highlighted in the Balwant Rai Committee Report of 1957. The 73rd Constitutional Amendment in 1992 provides for the devolution of funds from the upper tiers of government to the PRIs, apart from their own sources of revenue like taxes, duties, fees and user charges (Chart I.3). | Table I.2: Status of State-wise Devolution of 29 Subjects to the Panchayats | | S.No. | States | No. of subjects devolved | | 1 | Andhra Pradesh | 25 | | 2 | Assam | 21 | | 3 | Bihar | 26 | | 4 | Chhattisgarh | 20 | | 5 | Goa | - | | 6 | Gujarat | 21 | | 7 | Haryana | 29 | | 8 | Himachal Pradesh | 29 | | 9 | Jharkhand | 18 | | 10 | Karnataka | 29 | | 11 | Kerala | 29 | | 12 | Madhya Pradesh | 14 | | 13 | Maharashtra | 29 | | 14 | Manipur | 5 | | 15 | Odisha | 21 | | 16 | Punjab | 9 | | 17 | Rajasthan | 25 | | 18 | Sikkim | 29 | | 19 | Tamil Nadu | 28 | | 20 | Telangana | 14 | | 21 | Tripura | 12 | | 22 | Uttar Pradesh | 26 | | 23 | Uttarakhand | 11 | | 24 | West Bengal | 28 | | Source: Ministry of Panchayati Raj. |

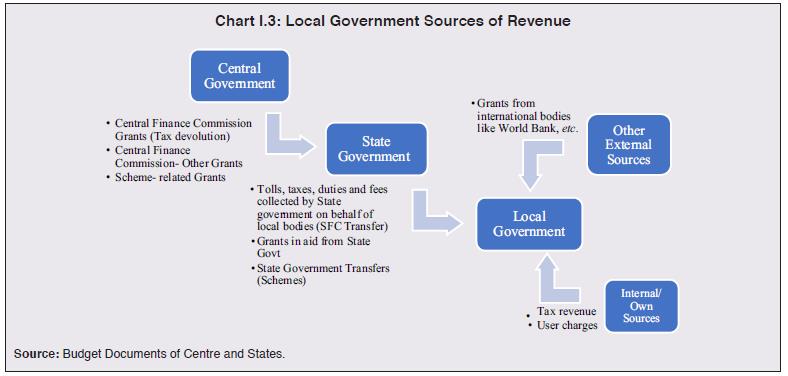

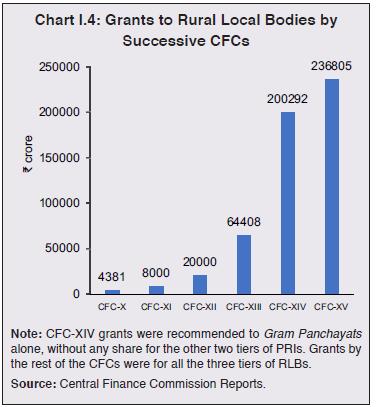

1.20 Successive Central Finance Commissions (CFCs) have recommended a consistent increase in grants to PRIs - from ₹4,381 crore by the Tenth CFC to ₹2.37 lakh crore by the Fifteenth CFC (Chart I.4). Furthermore, the Central Finance Commissions have recommended making audited accounts and budgets of PRIs publicly accessible. 1.21 Article 243-I of the Constitution stipulates the establishment of a State Finance Commission (SFC) every five years to assess the financial status of Panchayats and propose a framework for sharing taxes between the State and Panchayats. The formation of these SFCs has, however, not been consistent across different States. 1.22 Article 243-H of the Constitution empowers Panchayats to impose, collect, and allocate taxes, duties, tolls, and fees. The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures. Additionally, compared to the other two tiers (Zila Parishads and Mandal Panchayats), Gram Panchayats have been granted more authority to levy taxes in rural areas. In addition to these revenue sources, Panchayats also receive funds for executing Centrally Sponsored Schemes (CSSs) like the Rashtriya Gram Swaraj Abhiyan, the SVAMITVA (Survey of Villages Abadi and Mapping with Improvised Technology in Village Areas) Scheme, the National Rural Employment Guarantee Programme, the Mid-day meal scheme, the National Horticulture Mission, and the like. Furthermore, PRIs obtain grants from external agencies, including the World Bank.

1.23 With internal revenue sources constituting only a minimal portion of the financial resources, the Panchayats primarily rely on fiscal transfers provided by State governments through shared taxes and grants. There are, however, a few successful cases of Gram Panchayats, such as the Velpur Gram Panchayat (GP) in the Nizamabad district in Telangana that have demonstrated effective revenue generation from internal sources (NIRDPR, 2018). In the Indian context, two concerns exist regarding the delegation of taxing powers to the Panchayats. First, none of the available tax sources is particularly substantial in revenue generation, except for the property tax (Rao et al., 2011). Second, the challenges faced by PRIs in raising local tax revenue include a limited tax base, shortage of administrative infrastructure and adequately trained staff for tax collection and lack of clear guidelines for introducing new taxes. Consequently, some local bodies refrain from imposing and collecting taxes that they can levy (Jha, 2002). 4. Transparency and e-Governance 1.24 At the core of decentralisation lie two fundamental principles: participation and transparency, coupled with accountability. Various initiatives have been taken to increase digitisation and people’s participation in local governance, as discussed below: • Successive CFCs have emphasised the importance of making audited accounts and budgets of local bodies publicly accessible, including as prerequisites for obtaining grants. • In line with Article 243-G5 of the Constitution, Panchayats have been mandated to prepare a Gram Panchayat Development Plan (GPDP) for economic development and social justice; GPDP aims to facilitate local-level planning and development by bringing together all the stakeholders, including citizens and Gram Panchayats, in the decentralised planning framework through the People’s Plan Campaign (PPC) to enable Panchayats to recognise the necessities and aspirations of the village community, including that of marginalised segments, and to structure their projects accordingly6. • To enhance e-governance in PRIs, the eGramSwaraj platform was introduced in 2020 as a simplified, work-based accounting application to address various aspects of Panchayat operations, such as planning, accounting, budgeting, and facilitating online payments through the eGramSwaraj-PFMS (Public Financial Management System) interface. It serves as a platform for more effective monitoring by higher authorities. • As of September 2023, more than 2.5 lakh PRIs have adopted eGramSwaraj for accounting purposes7, while more than 2.4 lakh PRIs have integrated the eGramSwaraj-PFMS Interface for online transactions, with about 2.3 lakh Panchayats making online payments of ₹25,694 crore during H1:2023-24, via the eGramSwaraj-PFMS Interface. • The Audit Online application by the MoPR facilitates online audits of Panchayat accounts by maintaining comprehensive records of both internal and external audits, thereby strengthening financial management and transparency, and simplifying various audit procedures such as audit inquiries, draft local audit reports and draft audit paras. As of July 2023, 2.56 lakh Panchayats have been registered, and 2.11 lakh reports were generated for the audit period of 2021-22. • In accordance with the operational guidelines of the XV CFC, starting 2023-24, States are obligated to ensure that all tiers of Panchayats, encompassing 100 per cent of RLBs, possess audited accounts for 2021-22. The MoPR has enhanced the online audit process by introducing the Action Taken Report (ATR) Module. • The PRIASoft-PFMS interface enables Gram Panchayats to make online payments to vendors and service providers, a feature integrated into the eGramSwaraj application. • A mobile app called mActionSoft allows PRIs to upload geo-tagged photos of the works and assets created using CFC grants. 5. Conclusion 1.25 Panchayati Raj Institutions bridge the gap between the rural population and the higher levels of government. They are the most appropriate institutions for grassroots development. The recommendations of the Central Finance Commissions and the recent digital initiatives have collectively enhanced transparency and accountability at the Panchayat level, thereby contributing significantly to the empowerment of Panchayats. These institutions continue to rely heavily on grants from the higher levels of government. They need to devise innovative approaches for generating adequate own revenues.

|