MICRO FINANCE Introduction

5.1 Micro finance is the provision of thrift, credit and other financial

services and products of very small amounts to the poor for enabling them to raise

their income levels and improve their living standards. It has been recognised

that micro finance helps the poor people meet their needs for small credit and

other financial services. The informal and flexible services offered to low-income

borrowers for meeting their modest consumption and livelihood needs have not only

made micro finance movement grow at a rapid pace across the world, but in turn

has also impacted the lives of millions of poor positively.

5.2 In the

case of India, the banking sector witnessed large scale branch expansion after

the nationalisation of banks in 1969, which facilitated a shift in focus of banking

from class banking to mass banking. It was, however, realised that, notwithstanding

the wide spread of formal financial institutions, these institutions were not

able to cater completely to the small and frequent credit needs of most of the

poor. This led to a search for alternative policies and reforms for reaching out

to the poor to satisfy their credit needs.

5.3 The beginning of the micro

finance movement in India could be traced to the self-help group (SHG) - bank

linkage programme (SBLP) started as a pilot project in 1992 by National Bank for

Agricultural and Rural Development (NABARD). This programme not only proved to

be very successful, but has also emerged as the most popular model of micro finance

in India. Other approaches like micro finance institutions (MFIs) also emerged

subsequently in the country. 5.4 Recognising the potential of micro finance

to positively influence the development of the poor, the Reserve Bank, NABARD

and Small Industries Development Bank of India (SIDBI) have taken several initiatives

over the years to give a further fillip to the micro finance movement in India.

5.5 The Chapter traces the evolution of micro finance movement in India,

the supporting policies and current status in this regard. The Chapter is orgainsed

into five Sections. Section 2 discusses various micro finance delivery models

in India. Section 3 discusses the various policy initiatives undertaken by Reserve

Bank, NABARD and SIDBI in the context of micro finance movement in India. Section

4 evaluates the progress of micro finance in India and Section 5 discusses impact

of micro finance movement in India.

2. Micro

Finance Delivery Models in India

5.6 The non-availability of

credit and banking facilities to the poor and underprivileged segments of the

society has always been a major concern in India. Accordingly, both the Government

and the Reserve Bank have taken several initiatives, from time to time, such as

nationalisation of banks, prescription of priority sector lending norms and concessional

interest rate for the weaker sections. It was, however, realised that further

direct efforts were required to address the credit needs of poor. In response

to this requirement, the micro finance movement started in India with the introduction

of SHG-bank linkage programme (SBLP) in the early 1990s. At present, there

are two models of micro finance delivery in India: the SBLPmodel and the MFI model.

The SBLP model has emerged as the dominant model in terms of number of borrowers

and loans outstanding. In terms of coverage, this model is considered to be the

largest micro finance programme in the world. The Reserve Bank, NABARD and SIDBI

have also taken a range of initiatives to provide a momentum to the micro finance

movement in India. The developments relating to evolution of various models of

the micro finance movement are detailed in the present section.

SHG-Bank

Linkage Programme 5.7 The micro finance sector started getting recognition

in India after the launch of the SBLP. Internationally however, a lot of

groundwork and consultative efforts had been in progress since the 1980s, which

set a backdrop for micro finance efforts in India. The field of micro finance

is diverse and still evolving. There is no single approach or model that fits

in all the circumstances. The concept of micro finance implies informal and flexible

approach to the credit needs of the poor. As such, each model has to be tailored

according to the circumstances and the local needs. It is in this context

that a study of different models of micro finance developed internationally becomes

interesting. One of the oldest and most successful models internationally has

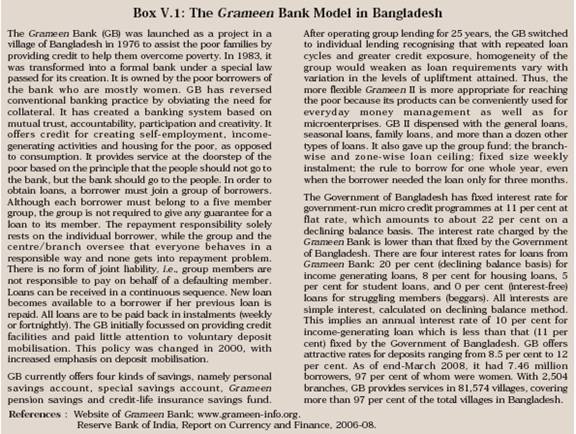

been the Grameen Bank Model in Bangladesh (Box V.1).

5.8

As early as December 1984, the Fifth General Assembly of the Asia Pacific Regional

Agricultural Credit Association (APRACA) held at Bangkok exhorted the agricultural

and rural development finance institutions in the region to mobilise savings from

the rural areas with the objective of providing loanable funds for agriculture

and rural development. The experience in some of the countries where informal

self help groups (SHGs) of rural people which promoted savings among members and

used these resources for meeting their credit needs, were considered useful innovations.

Further, the Third Consultation on the Scheme for Agricultural Credit Development

(SACRED) held at Rome in 1985 called for active promotion of linkages between

banking institutions and SHGs as a mean of improving the access of low income

group to banking services. The Executive Committee Session of APRACA held at Seoul

in October 1985 approved the holding of a South-East Asian sub-regional workshop

to devise ways and means of improving such linkages. The APRACA Regional Workshop

held at Nanjing, China in May 1986 recommended national level consultation and

organisation of national surveys of SHGs in collaboration with APRACA and other

agencies. 5.9 The Sixth General Assembly of APRACA held at Kathmandu, Nepal

in December 1986 considered a project proposal on ‘promotion of linkages

between banking institutions and SHGs in rural savings mobilisation and credit

delivery to the rural poor’. It was decided that each member country would

form a Task Force to conduct a survey of SHGs and thereafter, formulate suitable

national level programmes. Consequent upon this, a Task Force was set up in India

in the Ministry of Agriculture, to identify the existing SHGs, undertake a survey

of the groups and draw a plan of action for channeling the flow of savings and

credit between the rural poor and banks through SHGs and identify concrete projects

for action research in this field. Accordingly, in February 1987, it was decided

that a study team led by NABARD and comprising of representatives from various

financial institutions, should be constituted to undertake the survey. The survey

was undertaken in September 1987 and the report discussed at the 18th Executive

Committee Session and 10th Foundation Anniversary of APRACA held at New Delhi

in November 1987. This survey report laid the foundation of the SHG-bank linkage

programme in India launched as a pilot project in 1992.

5.10 The pilot

project was launched by NABARD after extensive consultations with Reserve Bank,

commercial banks and nonGovernmental Organisations (NGOs) with the following objectives:

(i) to evolve supplementary credit strategies for meeting the credit needs of

the poor by combining the flexibility, sensitivity and responsiveness of the informal

credit system with the strength of technical and administrative capabilities and

financial resources of the formal credit institutions; (ii) to build mutual trust

and confidence between the bankers and the rural poor; and (iii) to encourage

banking activity, both on the thrift as well as on credit sides, in a segment

of the population that the formal financial institutions usually find difficult

to cover.

5.11 The SHGs were expected to facilitate collective decision

making by the poor and provide ‘doorstep banking’, the banks as wholesalers

of credit, were to provide the resources, while the NGOs were to act as agencies

to organise the poor, build their capacities and facilitate the process of empowering

them. It was expected that the pilot project would prove advantageous to both

banks as well as the SHGs. The banks would gain by a way of reduction in their

transaction costs due to reduction in work relating to appraisal, supervision

and monitoring of loans. The SHGs would benefit by getting access to a larger

quantum of resources, as compared to their meager corpus generated through thrift.

The banks were expected to provide credit in bulk to the group and the group,

in turn, would undertake on-lending to the members. The quantum of credit given

to the group by the bank would be in proportion to the savings mobilised by the

group and could vary from 1:1 to 1:4. It was prescribed that the purposes for

which the group would lend to its members should be left to the common wisdom

of the group. The rate of interest to be charged by the SHG to its members was

also left to the group to decide. The pilot project envisaged linking of only

500 SHGs to banks. By the end of March 1993, 225 SHGs were actually linked. With

the figure reaching 620 at the end of March 1994, the pilot project was a success.

5.12 The programme has since come a long way from the pilot project of financing

500 SHGs across the country. It has proved its efficacy as a mainstream programme

for banking with the poor, who mainly comprise the marginal farmers, landless

labourers, artisans and craftsmen and others engaged in small businesses such

as hawking and vending in the rural areas. The main advantages of the programme

are timely repayment of loans to banks, reduction in transaction costs both to

the poor and the banks, doorstep “saving and credit” facility for

the poor and exploitation of the untapped business potential of the rural areas.

The programme, which started as an outreach programme has not only aimed at promoting

thrift and credit, but also contributed immensely towards the empowerment of the

rural women. 5.13 Under the SBLP, the following three different models have

emerged:

- Model I: SHGs promoted, guided and financed by banks.

- Model II: SHGs promoted by NGOs/ Government agencies and financed by banks.

- Model III: SHGs promoted by NGOs and financed by banks using NGOs/formal agencies

as financial intermediaries.

5.14 Model II has emerged as the most popular

model under the SBLP programme. Commercial banks, co-operative banks and the regional

rural banks have been actively participating in the SBLP.

Micro Finance

Institution Approach

5.15 While the SBLP model remains the most

widely used model of micro finance in India, the MFI model has also gained momentum

in the recent past. The MFI model in India is characterised by a diversity of

institutional and legal forms. MFIs in India exist in a variety of forms like

trusts registered under the Indian Trust Act, 1882/Public Trust Act, 1920; societies

registered under the Societies Registration Act, 1860; Co-operatives registered

under the Mutually Aided Cooperative Societies Acts of the States; and non-banking

financial companies (NBFC)-MFIs, which are registered under Section 25 of the

Companies Act, 1956 or NBFCs registered with the Reserve Bank. These MFIs are

scattered across the country and due to the multiplicity of registering authorities,

there is no reliable estimate of the number of MFIs. The most frequently used

estimate is that their number is likely to be around 800. Attempts have been made

by some of the associations of MFIs like Sa-Dhan to capture the business volume

of the MFI sector. As per the Bharat Micro Finance Report of Sa-Dhan, in March

2008, the 223 member MFIs of Sa-Dhan had an outreach of 14.1 million clients with

an outstanding micro finance portfolio of Rs.5,954 crore.

Bank Partnership

Model

5.16 Banks can use MFIs as their agent for handling credit,

monitoring, supervision and recovery. In this model, the bank is the lender and

the MFI acts as an agent for handling items of work relating to credit monitoring,

supervision and recovery, while the borrower is the individual. The MFI acts as

an agent – it takes care of all relationships with the client, from first

contact through final repayment.

5.17 Another variation of this model

is where the MFI, an NBFC, holds the individual loans on its books for a while,

before securitising them and selling them to the bank. Such refinancing through

securitisation enables the MFIs a greater funding access.

Banking

Correspondents

5.18 In January 2006, the Reserve Bank permitted

banks to utilise the services of NGOs, MFIs (other than NBFCs) and other civil

society organisations as intermediaries in providing financial and banking services

through the use of business facilitator and business correspondent (BC) models.

The BC model allows banks to do ‘cash in – cash out’ transactions

at a location much closer to the rural population, thus addressing the last mile

problem. The BC model uses the MFI’s ability to get close to poor clients

– a necessity for savings mobilisation from the poor – while relying

on the financial strength of the bank to safeguard the deposits. Pursuant to the

announcement made by the Union Finance Minister in the Union Budget 2008-09, banks

were permitted to engage retired bank employees, ex-servicemen and retired government

employees as business correspondents (BCs) with effect from April 24, 2008,

in addition to entities already permitted earlier, subject to appropriate due

diligence.

3. Policy Initiatives in India

5.19 Several initiatives have been taken by the Reserve Bank, NABARD and

also SIDBI with a view to giving a further fillip to the micro finance movement

in India. A summary of major initiatives is presented in the present section.

Policy Initiatives by the Reserve Bank

5.20 In January

1993, SHGs, registered or unregistered were allowed by the Reserve Bank to open

savings bank account with banks. Further, to study the potential of the micro

finance movement, the Reserve Bank constituted in 1994 a ‘Working Group

on NGOs and SHGs’ (Chairman: Shri S.K. Kalia). Based on its recommendations,

banks were advised, inter alia, that financing of SHGs should be included

by them as part of their lending to the weaker sections and that SHG lending should

be reviewed at the State level banker’s committee (SLBC) level and by the

banks at regular intervals.

5.21 To further promote the SHG momentum

in the country, banks were advised by the Reserve Bank in 1998 that SHGs which

were engaged in promoting the savings habits among their members would be

eligible to open savings bank accounts and that such SHGs need not necessarily

have availed of credit facilities from banks before opening savings bank accounts.

Subsequent to the Monetary and Credit Policy announcement for the year 1999-2000,

banks were also advised that interest rates applicable to loans given by banks

to micro credit organisations or by the micro credit organisations to SHGs/ member

beneficiaries, would be left to their discretion.

5.22 A Task Force on

Supportive Policy and Regulatory Framework for micro finance was set up by NABARD

in 1999 of which the Reserve Bank was a member. The Task Force looked into the

entire gamut of issues related to micro finance, particularly regulatory issues.

Recognising the growing importance of micro finance, the Reserve Bank constituted

a micro credit special cell in the Bank in 1999 to suggest measures for mainstreaming

micro credit and accelerating flow of credit to MFIs. The special cell has since

been converted into a micro finance and financial inclusion division in the Reserve

Bank.

5.23 Several non-banking finance companies (NBFCs) and residuary

non-banking companies (RNBCs) also started entering the micro finance sector,

gradually recognising the potential in the sector. In order to further facilitate

the process, in January 2000, all NBFCs and RNBCs were advised by the Reserve

Bank that those NBFCs which were engaged in micro financing activities, licensed

under Section 25 of the Companies Act, 1956, and which were not accepting public

deposits were exempted from the purview of Sections 45-IA (registration), 45-IB

(maintenance of liquid assets) and 45-IC (transfer of a portion of profits

to Reserve Fund) of the Reserve Bank of India Act, 1934.

5.24 Based on

the reports of the special cell constituted in the Reserve Bank and the Task Force

on Supportive Policy and Regulatory Framework, the Reserve Bank issued comprehensive

guidelines to banks in February 2000 for mainstreaming micro credit and enhancing

the outreach of micro credit providers. These guidelines, inter alia,

stipulated that micro credit extended by banks to individual borrowers directly,

or through any intermediary, would from then onwards be reckoned as part of their

priority sector lending. Banks were given freedom to formulate their own model/s

or choose any conduit/intermediary for extending micro credit. Banks were also

permitted to prescribe their own lending norms so as to provide maximum flexibility

with regard to micro lending. Such credit was to cover not only consumption and

production loans for various farm and non-farm activities of the poor, but also

include their other credit needs. Banks were asked to delegate adequate sanctioning

powers to branch managers and to keep the loan procedures and documents simple

for providing prompt and hassle free micro credit.

5.25 The rapid development

of the sector necessitated addressing the various issues associated with the sector.

In October 2002, the Reserve Bank set up four informal groups to look into issues

relating to: (i) structure and sustainability; (ii) funding; (iii) regulations;

and (iv) capacity building of micro finance institutions. Taking into consideration

the recommendations of the groups, banks were advised that they should provide

adequate incentives to their branches for financing the SHGs and that the group

dynamics of working of the SHGs should be left to them.

5.26 Based on

the recommendations of the Advisory Committee on Flow of Credit to Agriculture

and Related Activities from the Banking System (Chairman: Prof. V S Vyas), which

submitted its final report in June 2004, it was announced in the Annual Policy

Statement for the year 2004-05 that in view of the need to protect the interest

of depositors, MFIs would not be permitted to accept public deposits unless they

complied with the extant regulatory framework of the Reserve Bank. However, as

an additional channel for resource mobilisation, the Reserve Bank in April 2005

enabled NGOs engaged in micro finance activities to access the external commercial

borrowings (ECBs) up to US$ 5 million during a financial year for permitted end

use, under the automatic route.

5.27 In order to examine issues relating

to rural credit and micro finance, an internal group (Chairman: Shri H.R. Khan)

was set up in 2005. Based on the recommendations of the group and with the objective

of ensuring greater financial inclusion and increasing the outreach of the banking

sector, banks were permitted in January 2006 to use the services of NGOs/SHGs,

MFIs (other than NBFCs) and other civil society organisations as intermediaries

in providing financial and banking services through business facilitator and business

correspondent models.

5.28 All Regional Directors of the Reserve Bank

were advised in April 2006 that whenever issues relating to micro finance were

noticed in the areas under their jurisdiction, they may offer to constitute a

coordination forum comprising representatives of SLBC convenor banks, NABARD,

SIDBI, State Government officials, and representatives of MFIs (including NBFCs)

and NGOs/SHGs to facilitate discussion on the issues affecting the operations

in the sector and find local solutions to the local problems.

5.29 In

May 2006, a joint fact-finding study was conducted by Reserve Bank and a few major

banks. It was observed during the study that some of the MFIs financed by banks

or acting as their intermediaries/partners were focussing on relatively better

banked areas and trying to reach out to the same set of poor, resulting in multiple

lending and overburdening of rural households. Further, many MFIs supported by

banks were not engaging themselves in capacity building and empowerment of the

groups to the desired extent and banks did not appear to be engaging them with

regard to their systems, practices and lending policies with a view to ensuring

better transparency and adherence to best practices. Guidelines were, therefore,

issued to banks in November 2006, advising them to take appropriate corrective

action.

5.30 The Union Budget for the year 2008-09 announced that banks

would be encouraged to embrace the concept of total financial inclusion. The Government

would request all scheduled commercial banks to follow the example set by some

public sector banks and meet the entire credit requirements of SHG members, namely:

(a) income generation activities; (b) social needs like housing, education, marriage:

and (c) debt swapping. Consequent upon this, in April 2008, banks were advised

by the Reserve Bank to meet the entire credit requirements of SHG members, as

envisaged in the Union Budget.

Recent Initiatives by NABARD

5.31 NABARD has been playing a crucial developmental role for the micro finance

sector in India. NABARD has been organising/ sponsoring training programmes and

exposure visits for the benefit of bank officials, NGOs, SHGs and Government agencies

to enhance their effectiveness in the field of micro finance. The best practices

and innovations with respect to the sector are widely circulated among Government

agencies, banks and NGOs. NABARD also provides support for capacity building,

exposure and awareness building of the SHGs and NGOs.

5.32 NABARD launched

the ‘Micro-Enterprise Development Programme’ (MEDP) for skill development

in March 2006. The basic objective was to enhance the capacities of matured SHGs

to take up micro enterprises through appropriate skill upgradation. The programme

envisaged development of enterprise management skills in existing or new livelihood

activities, both in farm and non-farm sectors. The duration of training can vary

between 3 to 13 days depending upon the objective and the nature of training.

During the year 2007-08, 394 MEDPs were conducted covering 9,182 SHG members on

activities like bee-keeping, mushroom cultivation, horticulture and floriculture,

vermi-compost/ organic manure preparation and dairy. As on March 31, 2008, 674

MEDPs had been conducted covering 16,761 participants. 5.33 In 2005-06,

a pilot project for ‘promotion of micro-enterprises’ was launched

among members of matured SHGs. This is being implemented by 14 NGOs acting as

‘micro-enterprise promotion agency’ (MEPA) in nine districts, viz.,

Ajmer (Rajasthan), Chandrapur (Maharashtra), Kangra (Himachal Pradesh), Madurai

(Tamil Nadu), Mysore (Karnataka), Panchmahal (Gujarat), 24 north Pargana (West

Bengal), Puri (Orissa) and Rae Bareli (Uttar Pradesh). The project is being implemented

by each NGO in two blocks in each of the selected district. As on March 31, 2008,

2,759 micro-enterprises were established under the project involving bank credit

of Rs.238 lakh.

5.34 NABARD also provides marketing support to the SHGs

for exhibiting their products. During the year 2007-08, NABARD supported three

exhibitions of products prepared by various SHGs at Bhopal, Chennai and Navi Mumbai

involving grant of Rs.3.8 lakh. In addition, NABARD also provides

promotional grant support to NGOs, RRBs, DCCBs, farmer’s clubs and individual

volunteers and assists in developing capacity building of various partner agencies.

NABARD has been making efforts to increase the number of partner institutions

as self-help promoting institutions (SHPIs).

5.35 NABARD launched a pilot

project in December 2003 to link post-offices with the SHGs with the objective

of examining the feasibility of utilising the vast network of post offices in

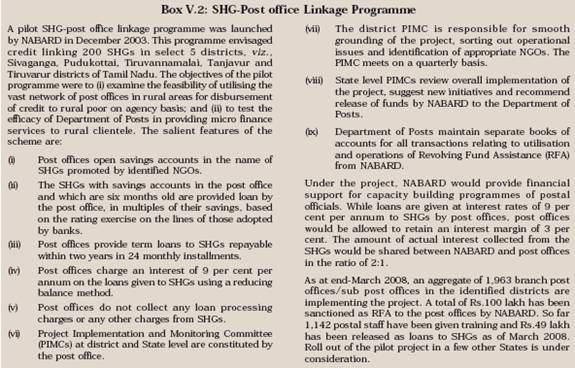

rural areas for disbursement of credit to rural poor on an agency basis (Box

V.2).

5.36 The SHG Federations are emerging as important players

in nurturing SHG, increasing the bargaining power of group members and livelihood

promotion. The features and functions of SHG federation models promoted in the

country vary, depending on the promoting agencies. Recognising the growing role

of the SHG Federations and their value addition to SHG functioning, NABARD, during

the year 2007-08 decided to support the Federations on a model neutral basis.

Support is extended to the Federation by way of grant assistance for training,

capacity building and exposure visits of SHG members. NABARD has also formulated

the broad norms for deciding the grant of financial assistance to SHG Federations.

During the year 2007-08, grant assistance amounting to Rs 10 lakhs was sanctioned

to two federations.

5.37 Recognising the role played by MFIs, in extending

micro finance services in the unbanked areas, NABARD extends support to these

institutions through grant and loan based assistance. NABARD has been selectively

supporting MFIs for experimenting with various micro finance models such as replication

of Grameen Model, NGO networking (bigger NGOs supporting smaller NGOs), credit

unions and SHGs federations, among others, to meet credit requirements of the

unreached poor. NABARD provides loan funds in the form of revolving fund

assistance (RFA) on a selective basis to MFIs to be used by them for on-lending

to SHGs or individuals. This loan has to be repaid along with service charge,

within a period of 5 to 6 years. During the year 2007-08, RFA amounting

to Rs.8 crore was sanctioned to six agencies taking the cumulative credit sanctioned

to Rs.36 crore covering 35 agencies.

5.38 In order to identify, classify and rate MFIs, NABARD introduced a scheme

for commercial banks and RRBs to enable them to avail the services of accredited

rating agencies for rating of MFIs. Banks can avail the services of credit rating

agencies like CRISIL, M-CRIL, ICRA, CARE and Planet Finance for rating of MFIs

and avail financial assistance by way of grant to the extent of 100 per cent of

the total professional fees of the credit rating agency, subject to a maximum

of Rs. one lakh. The assistance is available for the first rating of MFIs with

a minimum loan outstanding of Rs.50 lakh and maximum loan outstanding of Rs.500

lakh. During the year 2007-08, rating support amounting to Rs 3 lakh to four agencies

was provided.

5.39 Recognising the need for upscaling the micro finance

intervention in the country, the Union Finance Minister, in the budget for the

year 2000-01, announced creation of a Micro Finance Development Fund (MFDF). The

objective of the MFDF is to facilitate and support the orderly growth of the micro

finance sector through diverse modalities for enlarging the flow of financial

services to the poor, particularly for women and vulnerable sections of society,

consistent with sustainability. Consequently MFDF with a corpus of Rs.100 crore

was established in NABARD. The Reserve Bank and NABARD contributed Rs.40 crore

each to the fund, while the balance was contributed by eleven select public sector

banks.

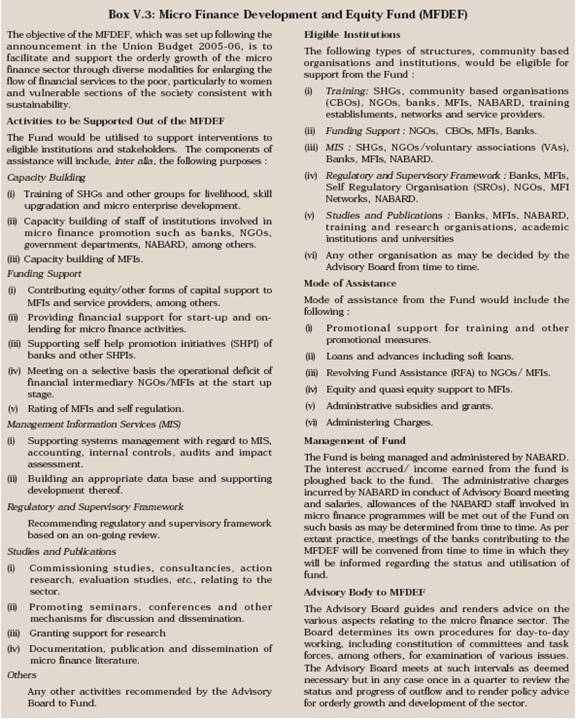

5.40 As per the Union Budget announcement for the year 2005-06,

the MFDF was re-designated as ‘Micro Finance Development and Equity Fund’

(MFDEF) with an increased corpus of Rs.200 crore. The fund is being managed by

a board consisting of representatives of NABARD, commercial banks and professionals

with domain knowledge. The Reserve Bank is a member of the Advisory Committee

of the MFDEF.

5.41 The MFDEF maintained by NABARD is used for promotion

of micro finance through scaling-up of the SHG-bank linkage programme, extending

RFA and capital support to MFIs and undertake various promotional initiatives.

During 2007-08, Rs.27 crore was utilised from the fund towards micro finance related

activities (Box V.3).

5.42

The North-Eastern Council (NEC), Shillong parked a fund of Rs.50 lakh with NABARD

during the year 2007-08 for facilitating miscellaneous training programmes involving

Government/bank officials, NGOs, SHGs from States in the NER and Sikkim. During

the year 2007-08, 73 programmes were sanctioned out of the fund involving a total

grant assistance of Rs.45 lakh.

Micro Finance Initiatives by SIDBI

5.43 SIDBI launched its micro finance programme in February 1994 on a pilot

basis. The programme provided small doses of credit funds to the NGOs all across

the country. NGOs acted as financial intermediaries and on-lent funds to their

clients. Limited amount of capacity building grant was also provided to the NGOs.

5.44 With a view to reducing the procedural bottlenecks, expanding the outreach,

meeting the huge unmet demand of the sector and striving towards its formalisation,

SIDBI reoriented its policy and approach to create a sustainable micro finance

model that would significantly increase the flow of credit to the sector. To take

the agenda forward, the SIDBI Foundation for Micro Credit (SFMC) was created in

January 1999. SFMC’s mission is “to create a national network of strong,

viable and sustainable Micro Finance Institutions from the informal and formal

financial sector to provide micro finance services to the poor, especially women’’.

5.45 SIDBI was one of the first institutions that identified and recognised

NGO/MFI route as an effective delivery channel for reaching financial services

to those segments of the population not reached by the formal banking network.

As a result of bulk lending funds provided, coupled with intensive capacity building

support to the entire micro finance sector, it has come to occupy a significant

position in the Indian micro finance sector. Today, SIDBI is one of the largest

providers of micro finance through the MFIs.

5.46 SIDBI’s pilot

programme of 1994 brought out one of the major shortcomings in micro finance lending

programme. It showed that collateral-based lending does not work insofar as micro

finance is concerned. NGOs/ MFIs acting as financial intermediaries do not have

tangible collateral to offer as security for the loans. Doing away with collateral-based

lending in MF necessitated that a mechanism be developed which would minimise

the risks associated with lending. With a view to catering to this objective,

SIDBI pioneered the concept of capacity assessment rating (CAR) for the MFIs.

As part of its developmental agenda, SIDBI encouraged a private sector development

consulting firm to develop a rating tool for the MFIs which was rolled out in

1999. Today, rating is a widely accepted tool in this sector. SIDBI has also succeeded

in developing a market for rating services. Two mainstream rating agencies, viz.,

CRISIL and CARE have also started undertaking micro finance ratings, besides M-CRIL.

SIDBI has also adopted the institutional capacity assessment tool (I-CAT) of access

development services (ADS), a private sector consulting organisation, for rating

of start-up/small and mid-sized MFIs.

5.47 SIDBI introduced a product

called ‘transformation loan’ in 2003 to enable the MFIs to transform

themselves from an informal set up to more formal entities. This loan is a quasi-equity

product with longer repayment period and features for conversion into equity at

a later date, when the MFI decides to convert itself into a corporate entity.

Consequently, a number of MFIs went ahead with the transformation and some of

them have now grown significantly and are serving millions of clients across several

states. Recognising the need to offer the MFIs |