|

CONTENTS

December 30, 2005

Dr. Rakesh Mohan

Deputy Governor

Reserve Bank of India

Mumbai

Dear Sir,

Submission of the Report of the

Working Group on Compilation of State Government Liabilities

We are pleased to submit herewith

the Report of the Working Group on Compilation of State Government Liabilities.

(Narendra Jadhav)

Convenor

(K. R. Lakhanpal) (Yogesh

Khanna)

(Kavita Gupta)

Member Member Member

(V. S. Senthil) (K.G.

Mahalingam)

(M. J. Joseph)

Member Member Member

(R. H. Dholakia)

Member

ACKNOWLEDGEMENT

The Working Group gratefully acknowledges

the invaluable contributions and support of erstwhile members, Shri S.C. Garg,

then Joint Secretary (PF-I), Ministry of Finance, Government of India and Shri

Rahul Sarin, Principal Finance Secretary, Government of Jharkhand in the discussions

of the Group and in the preparation of the Report.

The Working Group places on record

its appreciation for the invaluable contributions of the special invitees, Shri

Prabal Sen, Chief General Manager-in-Charge, Department of Government and Bank

Accounts of the Reserve Bank of India (RBI) and Shri B. Mahapatra, then Chief

General Manager-in-Charge, Internal Debt Management Department (IDMD), RBI,

in the deliberations of the Group and in the preparation of the Report.

The Working Group acknowledges

the outstanding professional contributions of Dr. R.K. Pattnaik, Adviser, Department

of Economic Analysis and Policy (DEAP), and Shri Somnath Chatterjee, Director,

IDMD, RBI, who brought to bear their experience and expertise in the fiscal

area, in the discussions of the Group and in the preparation of the Report.

The Working Group would like to

place on record its appreciation for the arrangements made for its meetings

and the hospitality extended by Shri Ramesh Chander, then Regional Director,

RBI, New Delhi. The Working Group would also like to thank Shri Rajan Goyal,

Director and Smt. Sangita Misra, then Research Officer, DEAP, RBI, New Delhi

for logistical support in organizing the meetings of the Group at New Delhi.

The Working Group appreciates the

support of Shri P.D. Jeromi, Assistant Adviser, DEAP, Kochi and Shri Jai Chander,

Research Officer, Division of Central Finances, DEAP, of the RBI, in the preparation

of the Report. Helpful suggestions and analytical inputs provided by Shri A.K.

Mitra, Assistant Adviser, IDMD are gratefully acknowledged. The contributions

of the officers and staff of the Division of State and Local Finances, DEAP,

RBI, Central Office, in providing data and logistical support, and in particular,

of Shri Rajmal and Shri J.B. Singh, Research Officers, are also gratefully acknowledged.

EXECUTIVE SUMMARY

- The availability of reliable and comparable

data on debt is critical for assessing the sustainability of public finances

and for other analytical purposes.

- At present, there appears to be no unanimity

about the exact level, composition, and the methodology for compiling the

liabilities of State Governments in India. In fact, there is a great deal

of ad hocism in the compilation of debt statistics.

- The budget documents of the State Governments

do not provide data on their outstanding liabilities. Such data are, however,

provided in the ‘Finance Accounts’ of the State Governments, but these reports

are not available in respect of all State Governments on a timely basis. The

Combined Finance and Revenue Accounts of the Central and State Governments

are also released with a great deal of time lag. Moreover, some issues relating

to coverage of liabilities need to be addressed.

- Debt and liabilities should be considered as

synonymous. Accordingly, all borrowings which are repayable and/or on which

interest accrues, are to be considered as debt.

- Compilation of data on debt should be consistent

with the Gross Fiscal Deficit (GFD).

- Total budgetary liabilities of State

Governments may be decomposed in four categories viz. (i) Public Debt;

(ii) Ways and Means Advances and Overdrafts from the RBI or any other bank;

(iii) Public Accounts; and (iv) Contingency Fund. This treatment would be

in conformity with the international best practices.

- Public Debt would include open market

borrowings, borrowings from banks and financial institutions, Special Securities

issued to the National Small Savings Fund, Bonds/Debentures which are issued

by the State Government and loans from the Central Government.

- Public Accounts would include State Provident

Funds, Small Savings, Insurance and Pension Funds, Reserve Funds and Deposits

and Advances.

- The following items (under the Capital Account

of the State Government budget) should not be included in debt or GFD:

(i) Remittances; (ii) Suspense and Miscellaneous; (iii) Appropriation to Contingency

Fund (since all these are largely adjusting heads which eventually get cleared

within or across accounts); and (iv) Decrease in Cash Balances (since it does

not induce additional liability). These may, however, be shown as memo items.

- The implicit liabilities of State Governments

including guarantees, off-Budget Borrowings, Pension Fund and State Public

Sector Liabilities should be excluded from the definition of State

Government budgetary liabilities or debt.

- The information on the State Government liabilities

may be published in the State Government budget documents under the following

Statements: (1) Budgetary Liabilities of State Government (outstanding

at end-March) and their break-up; (2) Details of Guarantees given by the State

Governments (GASAB Format); (3) Assessed Fiscal Risk of State Government Guarantees;

(4) Off-Budget Borrowings of State Government; (5) Liabilities of State Government

Public Sector Undertakings; and (6) Other Implicit Liabilities of the State

Government (including pension liabilities). An additional Statement (7) on

Subsidies provided by the State Government may also be published.

- Four Annexes to Statement 1 may also

be published which would provide details (outstanding amount, rate of interest,

date of maturity, etc) of open market borrowings, loans from Centre,

borrowings from banks/financial institutions and special securities issued

to NSSF, respectively.

- The Group recognizes that there are widely differing

views on the inclusion of various implicit liabilities in order to obtain

the aggregate liabilities of the State Governments, on which a consensus may

emerge over a period time. Priority may, however, need to be accorded to the

task of collating and publishing data on the different parameters, as set

out in Statements 1 to 7, which should be available with the State Governments.

- Statements (1) alongwith the Annexes and (2)

above may be published in the budget documents of the State Governments with

effect from the fiscal year 2006-07. The remaining Statements should be published

by the State Governments as soon as possible. In case it is not possible to

bring out all the remaining Statements at the same time, a graduated approach

for publication could be adopted.

- The Government of India, RBI and other institutions

could help the States in creating necessary capacity, systems and processes

and acquiring technology to compile data on liabilities.

- The following arrangements may be made for compiling

the data: (a) RBI will provide the data on outstanding market borrowings to

the State Governments; (b) The Central Government may provide the details

regarding the loans from Centre to the State Governments and Special securities

issued by the States to NSSF; and (c) The data on borrowings from banks and

financial institutions and any other such transactions, may be provided by

the State Governments.

- For ensuring the consistency in the data, it

is desirable that a single agency compiles and disseminates the information

on outstanding liabilities of all the States. Although the State Governments

are the most reliable sources of such information, the task cannot be fully

entrusted to them unless it becomes an obligatory part of the State Budget

documents. RBI can then act as a single agency putting estimates of liabilities

of all States together in a single publication, as it does for the State Budgets.

- Timely availability of audited data on

State Government budgetary transactions continues to be beset with some difficulties,

which need to be addressed by the concerned entities at the earliest. The

CAG may also compile and publish the audited data on liabilities in addition

to the Finance Accounts of the States. The non-availability of audited data

should not delay the reporting of data on liabilities as per the ‘accounts’

(un-audited), revised estimates and budget estimates of the latest years,

on the basis of the recommended institutional arrangements.

- Till such time that the State Governments are

not in a position to publish the requisite data on their outstanding liabilities

in their budget documents, all the above data may be furnished by the concerned

institutions to the RBI, as a transitional measure, to enable consolidation

and publication.

- The RBI should compile the (latest available)

‘accounts’ (un-audited) and (revised and budget) estimates of liabilities

of all the State Governments and publish the same in its regular annual

publication on State Budgets, from the viewpoint of data dissemination and

to facilitate academic and policy research. The CAG may provide the latest

available audited data on liabilities and the same could also be reported

by the RBI in its annual study on State budgets, alongwith the ‘accounts’

(un-audited), revised estimates and budget estimates of more recent years.

Report of the Working Group on

Compilation of State Government Liabilities

I. Introduction

Constitution of Group

1.1 Recognising the various problems

associated with the database of the State Government liabilities, the 14th

Conference of State Finance Secretaries held at RBI, Mumbai in August 2004,

considered and approved the proposal of constituting a working group on the

methodology and compilation of data on the liabilities of the State Governments.

As a follow up to this proposal, a Working Group was constituted with the following

members:

1. Shri. K.R. Lakhanpal, Principal

Secretary (Finance), Government of Punjab;

2. Shri Rahul Sarin,

Principal Secretary (Finance), Government of Jharkhand;

3. Shri Yogesh Khanna,

Additional Chief Secretary, Government of Himachal Pradesh;

4. Smt. Kavita Gupta,

Secretary (Accounts and Treasury) Government of Maharashtra;

5. Shri V. S. Senthil,

Joint Secretary, (PF-I), Ministry of Finance, Government of India;

6. Shri K.G. Mahalingam,

Director General (AE & C), Office of the Comptroller and Auditor General

of India;

7. Shri M.J. Joseph,

Joint Controller General of Accounts, Government of India;

8. Prof. R.H. Dholakia,

Indian Institute of Management, Ahmedabad – Co-opted Member;

9. Shri B. Mahapatra,

Chief General Manager-in-Charge, Internal Debt Management Department, RBI

– Special Invitee;

10. Shri Prabal Sen, Chief General

Manager-in-Charge, Department of Government and Bank Accounts, RBI – Special

Invitee;

11. Dr. Narendra Jadhav, Principal

Adviser and Chief Economist, RBI – Convenor.

1The Report reflects

the views of the members and not necessarily of the institutions to which they

belong.

2Shri Rahul Sarin was succeeded by Shri M. Singh in November 2005.

3Shri S.C. Garg, predecessor of Shri V.S. Senthil, was associated with the Working

Group till May 2005.

Terms of Reference

1.2 In the first meeting of

the Group, held on November 20, 2004, in Mumbai, the terms of reference were

set as under:

1. examine the extant methodologies

of compilation of State Government liabilities by various agencies viz.,

the office of the Comptroller and Auditor General of India (CAG) / Accountant

General (AGs) of State Governments, the Finance Commission, State Governments

and the Reserve Bank of India;

2. define and delineate the composition

of State Government liabilities on the basis of analytically sound principles

(including coverage), international best practices and country-specific pragmatic

considerations;

3. evolve a Model Compilation Methodology

for State Government Liabilities in a phased manner; and

4. make recommendations on the mechanism

and institutional arrangements for data collection and dissemination of State

Government liabilities on a regular and timely basis.

Structure of the Report

1.3 The remainder of the Report

is organised as follows. Section II while discussing the present status regarding

the compilation of the liabilities of the State Governments also highlights

the limitations of the existing estimates. Section III discusses the international

practices and definitions of the pubic debt. Section IV sets out the analytical

framework for defining the outstanding public debt. On the basis of the foregoing

discussion, Section V offers recommendations of the Group for compiling the

data on the liabilities of State Governments.

II. Present Status and Limitations

of Data on State Government Liabilities

Background

2.1 Transparency, reliability

and consistency in the fiscal data are crucial for successful management of

government finances. The time series data on the liabilities of government is

of particular importance as it affects future state of affairs of government

finances. At the policy making level as well as at the academic level, a need

to streamline the reporting of data on State Government liabilities is increasingly

felt. The number of studies making an assessment of the financial health, and

the mixed results generated by them, highlight, among other things, the need

for having reliable and credible statistics on public debt which are comparable

across States, countries and time period. In this regard, the methodology for

compiling the data on debt/liabilities of State Governments assumes considerable

importance.

2.2 At present, there appears

to be no unanimity about the exact level, composition, and the methodology for

compiling the liabilities of State Governments in India. The budget documents

of the State Governments do not provide data on their outstanding liabilities.

Such data are, however, provided in the ‘Finance Accounts’ of the State Governments,

but these reports are not available in respect of all State Governments on a

timely basis.

Present Status

2.3 A survey of the existing

important publications presenting data on fiscal liabilities shows substantial

differences in definition and coverage of liabilities among these sources. This

essentially reflects that debt statistics are compiled in an ad hoc manner.

This issue needs urgent attention and action.

Finance Accounts of the State Governments Published

by CAG

2.4 The State Governments in

their budget documents currently do not publish the data on outstanding liabilities.

The accounting information and other details relating to public debt and other

liabilities of the State Governments, as published in the Finance Accounts,

are compiled and audited by respective Accountants General under authority of

the CAG. Finance Accounts are generally made available in public domain with

a time lag of one year. The definition and coverage adopted by CAG is clear

from Statement No. 4 of Finance Accounts, which contains summary of totals of

public debt and other liabilities of the State Governments, as derived from

Statements No. 16 and 17, classified under the category of internal debt,

loans and advances from the Central Government, small savings and provident

funds and obligations like reserve funds and deposits, both interest and non-interest

bearing. On the other hand, Statement No.16 contains details of receipts,

disbursements and balances under heads of account relating to Debt, Contingency

Fund and Public Account. Similarly, Statement No.17 relates to detailed Statement

of Debt and Other Interest Bearing Obligations of Government. A close scrutiny

of Statements No. 16 and 17 would reveal that detailed information and statistics

about public debt and other liabilities of the State Governments are made available,

in parts, in both the Statements and the reader is expected to assimilate complete

position after studying them. The CAG also publishes consolidated details of

public debt and other liabilities of all State Governments as part of 'Combined

Finance and Revenue Accounts of Union and State Governments in India'.

At present, this document is being published after a time lag of two to three

years, which is expected to be brought down in line with Finance Accounts. A

Staff Paper published by CAG on the subject of ‘Fiscal Liabilities (Union and

States) – Growth and Sustainability’ has also used same definition as outlined

above. As far as Combined Finance Accounts are concerned, it is, however, observed

that the latest available issue pertains to the year 1999-2000 and does not

cover liabilities under Small Savings/National Small Savings Fund (NSSF). Since

the NSSF was constituted in 1999-2000, it is expected that future issues of

the Combined Finance Accounts would incorporate the same under the liabilities

of the State Governments. Furthermore, there are negative entries in

respect of the outstanding liabilities under negotiated loans of some of the

State Governments, as reported in the Combined Finance Accounts, which need

to be elucidated.

Reserve Bank of India

2.5 In order to provide the

consolidated position of the State Government liabilities, RBI publishes the

estimated data based on the State Government budget documents on a yearly basis,

but again with a lag of approximately a year largely due to the delay in preparation

of budget documents by the State Governments.

2.6 At present, data on outstanding

liabilities of State Governments for various years as published by the RBI are

compiled from (i) the outstanding debt (stock) data (under various categories)

reported in the CAG’s 'Combined Finance and Revenue Accounts of the Union

and State Governments in India' for the year 1986-87 and (ii) ‘flows’ data

(net of repayments) on the corresponding items reported in the budget documents

of the State Governments for the subsequent years. The estimates of outstanding

liabilities are obtained by progressively adding the ‘flow’ data for each year

to the stock data for 1986-87.

2.7 The items that are included

in the liabilities of State Governments are (i) Internal Debt (including

Special Securities issued to the National Small Savings Fund (NSSF) and WMA

from the Reserve Bank); (ii) Loans from the Central Government; (iii)

Small Savings, Provident Funds, etc (including State Provident Funds,

Insurance and Pension Funds, Trusts and Endowments, and Small Savings). The

following items are not included: Reserve Funds, Deposits and Advances, Suspense

and Miscellaneous, Contingency Fund and Remittances. The (item-wise) consolidated

and State-wise data on liabilities, as published in the latest Study of State

Government Budgets, 2004-05, are shown in Appendix

1 and 2,

respectively.

Finance Commissions

2.8 As stated in the Report

of the Twelfth Finance Commission (2004), 'Previous finance commissions

had followed the practice of excluding the short-term components of debt viz.,

ways and means advances and reserve funds and deposits.' Thus, the

broad definition followed by Finance Commissions includes the same heads as

that by the Office of CAG. Its narrow definition differs only in respect that

it excludes WMA and Overdrafts from RBI.

Individual Independent Studies

2.9 There are several studies

by individual scholars attempting to define and measure debt in India.

Buiter and Patel (1992) construct debt series aggregated across Centre

(including external liabilities), States and Central Public Sector Undertakings

(PSUs) after excluding monetized deficit from the total. Rajaraman

& Mukhopadhyay (1999) construct an aggregated debt series (Centre and

States) for the period 1951 to 1997. While they follow the Buiter and Patel

study in terms of excluding monetization (although their definition of monetization

differs from Buiter & Patel), external and PSU liabilities are, however,

excluded by them, because their objective was to obtain domestic non-monetized

deficit. The items included by them, relevant for the States, are: Internal

debt (excluding WMA and Overdrafts from RBI or other banks), Provident Funds

and Reserves and Deposits. Loans from the Centre, being inter-government loans,

are excluded from State Government debt because the objective was to obtain

an aggregate series. This study, however, does not attempt to link the non-monetized

component of Gross Fiscal Deficit to the increment in debt in any given year.

Gurumurthy (2002) breaks Gross Fiscal Deficit (GFD) in terms of the following

flow components: Loans from the Central Government (net), Market Borrowings

(net), Loans from Financial Institutions, Provident funds, Reserve funds, Deposits

and Advances, etc. However, while computing the stock of debt, he includes only

Internal Debt including Market Loans and WMA, loans from banks and other financial

institutions, loans from the Central government, Provident funds and Small Saving

in his definition of State government debt and excludes Reserve funds and Deposits

& Advances. Thus, in this study also, the linkage between GFD in a given

year and increment in liability for that year is not formally established. Rangarajan

and Srivastava (2003), while recognizing this linkage, compute ‘Derived

Fiscal Deficit’ (DeFD) as the difference between the total liabilities of the

Central government for any two consecutive years. They also note the growing

disparity between DeFD and reported GFD in the series constructed by them. They

follow the same definition as followed in Finance Accounts for the Centre by

the CAG Report on Union Government (No 1 of 2003, p 109) for calculating the

fiscal deficit. This includes External debt (at historical rates), Internal

debt, Small savings, Provident funds etc. and Reserve funds and Deposits.

2.10 Dholakia (2003)

and Dholakia and Karan (2004, 2005) are some of the comprehensive individual

research studies that have attempted to define and measure State Government

liabilities in recent years. The second study is more comprehensive and covers

25 States over the period 1989-2003. Compared to the CAG study, Dholakia and

Karan (2004, 2005) exclude WMA and OD from RBI, but include Suspense & Miscellaneous

and Contingency Fund in their definition of liabilities. Even more recently,

Rangarajan and Srivastava (2005) have published data on the combined

(Centre and States) debt-GDP ratio over the period 1951-52 to 2002-03. According

to the authors, 'The debt-GDP ratio has risen from 61.7 per cent in

1990-91 to about 76 per cent in 2002-03, when external debt is considered at

historical exchange rates and liabilities of states on account of reserve funds

and deposits are not included. When these are included and external debt is

evaluated at current exchange rates an upward adjustment of about 9 percentage

points of GDP is called for, consisting of 3 and 6 percentage points for the

two factors, respectively, taking government liabilities to about 85 per cent

of GDP at the end of 2002-03.'

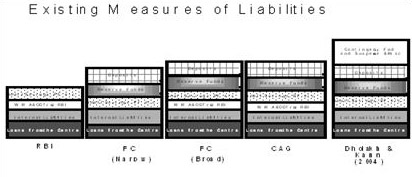

2.11 Figure 1 shows the components

included in the definition of liabilities by the above publications.

Figure 1: Comparison of various

definitions of Outstanding Liabilities of State Governments

Differences in sub-components between RBI and

CAG publications

2.12 When looked at the component-wise

details, the comparison is not without complications. This is apparently because

of different data sources. CAG, which prepares the Finance Accounts of

the State Governments and that of the Centre, has direct access to government

data. RBI draws on the receipts and expenditure statements in State Government

budget documents for its publications on State finances. However, a closer look

makes it clear that the difference arises on account of the classification of

sub-heads. Thus, the broad-based head of ‘Public Debt’ consisting of (i) Internal

Liabilities; and (ii) Loans & Advances from the Centre, provides

exactly the same estimates by RBI and CAG when considered together, but gives

substantially different estimates for its two components when considered separately.

In its estimates for accumulation in a given year, CAG considers WMA & OD

as a part of Internal Debt and provides a figure net of repayment (Statement

15, Finance Accounts). RBI, on the other hand, considers Internal

Debt gross of discharge of Internal Debt and excludes WMA & OD

from it (Annexure III, Handbook of Statistics on State Government Finances,

2004). Similarly, CAG considers Loans & Advances from the Centre

net of repayments, whereas RBI considers it gross. When we make these adjustments,

the ‘Public Debt’ (Net) as well as the two sub-components turn out to be identical

before 1999-2000 for most of the States. For the years 1999-2000 and thereafter,

while the aggregate estimates of ‘Public Debt’ are identical, individual components

sharply differ for almost all the States. This is because of the creation of

National Small Savings Fund (NSSF) on April 1, 1999, consequent of which the

small savings receipts from the Centre were shifted from the head Loans &

Advances from the Centre to the head Internal Debt.

4The difference, if any, arises

only on account of differing sources of data and the treatment of their sub-classification.

In some States, there is considerable time lag in finalizing State Accounts

and consequently RBI does not get the access to the actuals in time.

III. The International Experience

3.1 The availability of reliable

and comparable data on debt is critical for assessing the sustainability of

public finances and for other analytical purposes. Such data should be comparable

across countries and over the time period. The importance of having as broad

a coverage as possible has been well recognised in the literature (World Economic

Outlook 2003). A measure of debt, therefore, should include, in addition to

the Central Government liabilities, the liabilities of sub-national governments

and pubic sector enterprises as well as contingent liabilities of the government

(which may include loan guarantees, public sector pension liabilities, and even

the potential risk of bank recapitalisation). Due to the difficulties involved

the present data on public debt is not comparable across countries. There are

differences in the coverage, for instance, some countries include public sector

banks and central bank in the definition of public sector; others do not. Coverage

of extrabudgetary institutions, which are more important for the present purpose,

also varies across countries. For example, South Africa’s data exclude extrabudgetary

funds, while for Korea and Thailand the data include the debt of bank restructuring.

In general, data for Latin American countries tend to have the widest coverage

of the public sector, and data for Middle Eastern countries the narrowest. This

section provides the internationally accepted practice for compiling public

debt statistics, particularly in respect of the sub-national governments.

Definition of Debt – IMF

3.2 In its Manual on Government

Finance Statistics (GFS), 1986, IMF describes government debt as ‘a stock

of liabilities with different time dimensions accumulated by government operations

in the past and scheduled to be extinguished by the government operations in

futures’. The Manual has listed out the characteristics pertaining to government

debt which are important for the debt management. These are: (1) the schedule

of maturing debt indicates when domestic or foreign funds will be needed for

its repayments. (2) Because the stock of outstanding is not homogeneous, plans

for sale of additional debt require additional information: on whether the existing

debt is negotiable or nonnegotiable, in bearer form or registered, placed by

compulsion or voluntary, sold by auction or by subscription, with interest payable

by coupon or through discount, indexed or unindexed, redeemable at maturity

only or at penalty before maturity, and finally, on what interest it carries

and by whom the debt is held. (3) Plans for servicing outstanding debt through

interest payment must also be based on the size and coupon rate of issues being

serviced. It may be noted that the information currently being provided by many

countries is limited to only a few of the above characteristics.

3.3 The IMF’s GFS Manual 1986

specifies that only the recognised direct financial obligations of the government

which are serviced through interest payments and/or redemption should be included

in debt. Government guarantees of the debts of others should be excluded, along

with any other contingent liabilities, unless and until the government is called

upon to take over and service that debt. The contingent or actuarial liabilities

of government insurance schemes or social security systems are also excluded

from the totals of recognised, fixed-term direct government debt. The monetary

authorities’ obligations – for currency issues, for example are excluded from

government debt, as monetary authorities’ functions are considered to be not

a part of government but of financial institutions sector. The floating debt

of unpaid government obligations is also excluded from government debt figures

unless recognised and converted into fixed-term contractual obligations. Floating

debt statistics may usefully supplement government debt data, however, and are

covered by memorandum items in expenditure.

3.4 On measurement side the

Manual specifies that the basis for measurement of outstanding debt should be

the amount that will have to be repaid by government and not the amount of money

received when the debt arose. The amount to be repaid may differ from the actual

amount of government borrowing receipts by discounts or premia.

Definition of Liability - IASC

3.5 The International Accounting

Standards Committee (IASC) Framework for the Preparation and Presentation of

Financial Statements defines Liability as:'.. a present obligation of

the enterprise arising from past events, the settlement of which is expected

to result in an outflow from the enterprise of resources embodying economic

benefits.'

3.6 Based on the IASC definition,

the International Federation of Accountants (IFAC) identifies certain fundamental

characteristics of liabilities:

- the existence of a present obligation arising

from past events. That is, a transaction or other event in the past has given

rise to a duty or responsibility to a third party, which has not yet been

satisfied; and

- that liabilities have adverse financial consequences

for the reporting entity. That is, the entity has to incur additional liabilities,

or dispose of cash or other assets to settle the obligation.

3.7 IFAC finds these characteristics

present in the definition of Liability used by most countries.

|

I. COMPARISON OF DEFINITIONS

OF A LIABILITY

|

|

Australia

|

Liabilities are the future sacrifices of

service potential or future economic benefits that the entity is presently

obliged to make to other entities as a result of past transactions or

other past events. (Statement of Accounting Concepts 4, 46 and AAS

29, Financial Reporting by Government Departments)

|

|

Canada

|

Liabilities are financial obligations to

outside organizations and individuals as a result of transactions and

events on or before the accounting date. They are the result of contracts,

agreements and legislation in force at the accounting date that require

the government to repay borrowings or to pay for goods and services acquired

or provided prior to the accounting date. They also include transfer payments

due even where no value is received directly in return. (Public Sector

Accounting and Auditing Handbook, Section PS 1500 .37, 1986)

|

|

Italy

|

No specific definition given. However, the

recognition criteria for liabilities provide the relevant characteristics.

|

|

Netherlands

|

No formal definition exists. In practice,

all commitments of a year lead to a liability item in the trial balance

of that year and subsequently to an item in the state balance sheet, if

not settled at the balance sheet's date. The commitments regarding the

public debt (payments, repayments and interest) are stated in the national

operating statement and in the operating statement and trial balance of

the Ministry of Finance only.

|

|

New Zealand

|

Liabilities are the future sacrifices of

service potential or of future economic benefits that the entity is presently

obliged to make to other entities as a result of past transactions or

other past events. (NZSA Statement of Concepts for General Purpose

Financial Reporting, 1993, 7.10)

|

|

Taiwan

|

No clear definition is provided in the Law

of Accounting, Budget Law or Annual Reporting Law. In practice, liabilities

refer to obligations incurred on past transactions or other events for

which amounts can be reasonably measured and will be paid by using economic

resources or by providing services.

|

|

United Kingdom

|

A liability is an obligation to transfer

economic benefits as a result of past transactions or events. (ASB,

FRS 5 'Reporting the Substance of Transactions')

|

|

United States

|

A liability is a probable future outflow

or other sacrifice of resources as a result of past transactions or events.

(Statement of Recommended Accounting Standards #4, 'Accounting for

Liabilities of the Federal Government', 1995)

|

|

Source: IFAC

|

INTOSAI's Guidelines on Public

Debt Reporting

3.8 The Public Debt Committee

of the International Organisation of Supreme Auditing Institution (INTOSAI)

published the guidelines and other information for by Supreme Audit Institutions

(SAIs) to encourage the proper reporting and sound management of the public

debt.

3.9 The Committee in its guidelines

on definition of public debt has specified that the preparers of reports on

public debt need to ensure that any definitions used are precise, clear, consistent,

appropriate and comprehensive. The elements of liabilities and other commitments

incurred by public bodies or by corporations sponsored by such bodies can be

shown as lying on a spectrum that extends from direct borrowing through a range

of other financial obligations from trade accounts payable to various contingencies

and commitments. These commitments may or may not be recorded as liabilities

in financial statements. However, they may have a significant effect on future

borrowing needs and, therefore, future demands on the country's economic resources.

3.10 The public debt is characterised

as an obligation on a public body to make payments to third party at some future

date, subject to the occurrence of one or more uncertain future events if it

constitutes a contingent liability. Measuring public debt means to assign a

value, in monetary terms to the total amount due.

3.11 The Public Debt Committee

of INTOSAI underscores the importance of the regular disclosure of country's

public debt as it will reveal whether debt levels have been kept within the

country's ability to support them and can help ensure that potential problems

visible. The disclosure requirements in the United Kingdom ensure that the public

sector makes following disclosure in connection with public debt. The explanation

of risk profile and risk management policies should give information on the

nature and purpose for which financial instruments are held/issued, interest

rate policies, accounting policies for derivatives, and hedging policies. The

numerical disclosures requirements, inter alia, include interest rate

profile, debt maturity analysis and liquidity, currency risk, and fair values

of debt instruments.

Disclosure of Contingent Liabilities

3.12 Public Debt Committee of

INTOSAI recommends that the contingent liabilities may be included in the total

liabilities of the government by assigning some value based on estimates. The

degree of uncertainty in respect of these items of debt implies that different

items need to be assigned values on the basis of different estimates. However,

IMF’s GFS Manual (1986) recommends exclusion of such contingent liabilities

from public debt. There is, therefore, a difference in the practice followed

across countries for disclosing the extent of contingent debt as opposed to

actual debt. In Canada, for instance, a note to the statements concerning public

debt is appended. This note is audited, but the value of individual contingent

liabilities is not included within the overall public debt totals. In the United

Kingdom, contingent liabilities are also excluded from public debt totals but,

where possible, individual liabilities are identified and disclosed. In Portugal,

public debt (actual and some contingent amounts) is disclosed in financial statements

and is audited. However, only contingent liabilities relating to guarantees

are disclosed and with less information than for actual debt.

Where to Disclose the Public Debt

Information?

3.13 Financial information about

public debt may be reported in a wide variety of documents, for instance, budgets,

central bank bulletins and a variety of other reports to legislatures. Several

countries disclose their planned and actual public debt periodically as part

of the ongoing budget decision-making and accountability process.

IV. The Analytical Framework

4.1 From the above discussion,

it is clear that the concepts of public debt and liabilities need clearer definition

to avoid confusion and erroneous use. For policy purposes, we can consider them

as synonymous. The concept must have grounding in the analytical framework for

its effective use in policy making. The most important use of debt or liabilities

of a State Government is for assessing its fiscal sustainability. All the available

alternative measures of fiscal sustainability require correct measurement of

debt and liability of a State Government. The famous Domar Equation and its

derivation from first principles provide the basic analytical framework where

the difference between growth of income and effective interest rate on the State’s

debt plays the determining role.

4.2 Now total interest payment

is the same irrespective of the definition of debt we choose to follow. However,

the weighted average interest rate, which is also calculated as the ratio of

total interest payment to debt, will depend on the value of debt. Broader definitions

of debt would be expected to yield smaller average interest rates, thus raising

the differential between income growth and interest rate. A definitional change

might reverse the conclusions about sustainability if the differential changes

sign (see, Dholakia, 2003 for an illustration with Gujarat data).

4.3 Another critical element

in the analytical framework is the relationship between fiscal deficit and change

in debt. Fiscal deficit in any given year has to be financed either by additional

borrowings or by creating new liquidity. Since States’ access to money finance

is severely limited in India, there is a strong link between fiscal deficits

and the stock of debt for a State. Thus, the analytically correct definition

of debt would be one which satisfies the following:

Dt+1 = Dt

+ (Debt Increase)t+1

Dt+1 = Dt

+ DFDt+1 ; Where DFD: Deficit financed by borrowings

Now, GFDt+1 = DFDt+1

+ MFDt+1; Where MFD: Monetized Deficit

Therefore, Dt+1 = Dt

+ (GFD- MFD)t+1

=> ΔDt+1

= GFDt+1 - MFDt+1

4.4 The monetised deficit is

that part of deficit which is financed through WMA & OD and reduction in

cash balances of the State government. The remaining part of the deficit could,

thus, be referred to as deficit financed through borrowings (DFD).

4.5 None of the compilations

of State liabilities discussed in section II above satisfy this basic criterion

of analytically sound definition of debt. Moreover, since the correct measurement

of debt critically hinges on fiscal deficit, the latter should be measured correctly.

Measurement of Fiscal Deficit

4.6 RBI defines fiscal deficit

as per the well-accepted prevalent concept in the country:–

GFD = Total Expenditure (TE) (including

repayment of debt) – Revenue Receipts (RR) – Non-Debt Creating Capital Receipts

(NDCR) – Recovery of Loans and Advances – Repayment of debt

4.7 The above definition of

the gross fiscal deficit is followed with some variation by various agencies

including State Governments. The main source of the variance of actual calculation

of GFD from the above definition has its roots in the classification of some

of the capital receipts items. Thereby, the practice followed by various agencies

presently is normally characterised by the following discrepancies:

1.At present, Remittances, Suspense

and Miscellaneous and Inter-State settlement are treated as financing items

of GFD. The transactions relating to Remittances and Suspense & Miscellaneous,

however, embrace merely adjusting heads under which appear such transactions

such as remittances of cash between treasuries and currency chests, transfers

between different accounting circles, etc. The initial debits or credits to

these heads are cleared eventually by corresponding receipts or payments either

within the same circle of accounts or in another account circle. Of late,

it has been found that settlements under Remittances are unduly delayed by

some of the State Governments. The Group acknowledged the need for greater

transparency with respect to transactions under Remittances and Suspense and

Miscellaneous. The Group is, however, of the opinion that since Remittances

and Suspense and Miscellaneous are adjusting heads, these may be shown as

memo items among liabilities. Inter-State Settlement may also be excluded

from liabilities on similar grounds, but it may not be shown as a memo item,

since that amounts reported under this head are usually not very significant.

2. Inclusion of Miscellaneous Capital

Receipts (MCR) in NDCR is not consistent across States. Except Orissa, MCR

is excluded in other States. Hence, the Group recommends that MCR may be treated

as NDCR.

3. The head ‘Deposits and Advances’

among capital receipts in Finance Accounts shows ‘Advances’ as a debit

entry, which means an outgo. These ‘Advances’ include forest advances, departmental

advances, etc, which are recoverable. In accordance with the head ‘Loans and

Advances’, which are rightly taken as capital expenditure, ‘Advances’ under

the head ‘Deposits and Advances’ should also be taken as capital expenditure.

On the contrary, RBI considers these ‘Advances’ as a capital receipt. If this

correction is made, fiscal deficit of a State would increase to that extent.

5The Introductory on page V of

Finance Accounts 2001-02 for Kerala (common to all State Finance Accounts) says

'In the Public Account, the transactions relating to 'Debt' (other than those

included in Part I), 'Deposits', 'Advances', 'Remittances' and ' Suspense' are

recorded. The transactions under 'Debt', 'Deposits' and 'Advances', in this

part are those in respect of which Government incurs a liability to repay the

moneys received or has a claim to recover the amounts paid, together with the

repayments of the former ('Debt', and 'Deposits') and the recoveries of the

latter ('Advances'). The transactions relating to 'Remittances' and 'Suspense'

in this part embrace merely adjusting heads under which appear such transactions

as remittances of cash between treasuries and currency chests, transfers between

different accounting circles, etc. The initial debts or credits to these heads

will be cleared eventually by corresponding receipts or payments either within

the same circle of account or in another account circle.'

4.8 Fiscal deficit should, therefore,

be computed as follows:

GFD = Total Expenditure (TE) including

Repayment of Debt + Civil Advances (net) [CAG data] – Revenue Receipts (RR)

– MCR – Inter-State Settlement – Recovery of Loans and Advances – Repayment

of Debt.

Measurement of Liabilities

4.9 This GFD will be financed

by additional borrowings and monetization. As explained above, GFD = DFD + MFD.

Since the extent of monetization is reasonably limited in case of State Governments,

we replace the term MFD and call the items included therein as Memo Items.

The following items would fall under this head:

(i) Reduction in Cash Balances:

Drawing on the existing cash balances to meet the fiscal deficit does not

induce additional liability.

(ii) Appropriation to Contingency

Fund: According to explanatory note 4, statement 8 of finance accounts, Appropriation

to Contingency Fund is an ‘amount closed to government accounts (ACGA)’.

While it shows up as a part of fiscal deficit in a given year, it is

not carried to the next year and is, therefore, ‘closed’ that same year. It

is, thus, only a flow item and is classified as a memo item, as per our terminology.

(iii) Suspense & Miscellaneous;

and

(iv) Remittances.

As explained in para 4.7, items

(iii) and (iv) above are merely adjusting heads which eventually get cleared

either within the same circle of accounts or in another accounting circle.

They may, therefore, be termed as memo items.

4.10 On the other hand, DFD

would include those heads in respect of which a State Government incurs a liability

to repay the money received. Thus, within our framework, there is no difference

between Debt and Liabilities. The following heads are included in DFD, grouped

under the Consolidated Fund, Public Accounts and Contingency Fund:

1. Consolidated Fund

I. Public Debt

(a) Open Market Borrowings (Net

SLR based market borrowing)

(b) Borrowings from Banks and Financial

Institutions (Negotiated Loans)

(c) Special Securities Issued to NSSF

(d) Bonds/Debentures which are issued

by the State Government

(e) Loans from the Centre

(f) Others (To be specified)

II. Ways and Means Advances and

Overdrafts from the RBI/other banks

(a) Ways and Means Advances

(b) Overdrafts

2. Public Accounts

(a) State Provident Funds

(b) Small Savings, Insurance and Pension

Funds, Trust and Endowments, etc

(c) Other Items

Of Which:

(i) Deposits (Bearing and Not Bearing

Interest)

(ii) Reserve Fund/Sinking Fund (Bearing

Interest and Not Bearing Interest)

6Please see para 4.11.

4. Contingency Fund.

4.11 The treatment to Ways &

Means Advances and Overdrafts from RBI warrants attention. It is a form of money

finance and should ideally be included among memo items. However, in keeping

with the international practice, as outlined above (Section III), that the sources

of finance on which interest is payable should be taken as debt (or liabilities),

WMA & OD have been included among liabilities of the State Government.

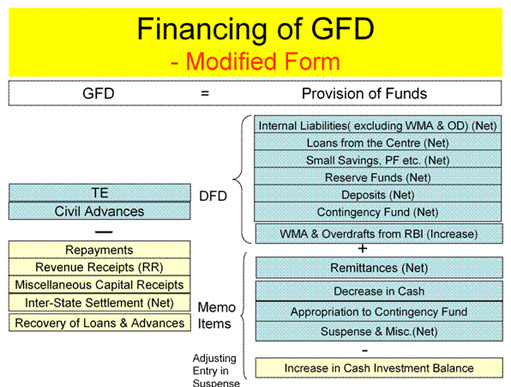

4.12 Figure 2 shows

the sub-components of DFD and Memo Items, and how these together go to meet

the fiscal deficit.

Figure 2: Financing of GFD

Other Implicit Liabilities

4.13 The present report mainly

deals with compilation of debt statistics regarding explicit liabilities of

the State Governments. For assessing the sustainability of finances of State

Governments, however, the implicit commitments and contingent liabilities are

equally important. The contingent liabilities are those commitments where government

faces liabilities if a specific event occurs. These liabilities should include

the guarantees given by a State government, provision of relief in the event

of natural disaster and the financial commitments of institutions involved in

quasi-fiscal activities which the State Government may have to honour in specific

events. It may be noted that at present, only guarantees given by State

Governments are published by some of the State Governments in their budget documents

and the same is published by the Reserve Bank in its reports/documents on the

relevant subject. These, however, are excluded from the purview of liabilities

of the State Governments. In order to assess the sustainability of the State

Government finances, the fiscal risk involved in the guarantees should be identified

and quantified. The quantification of the fiscal risks of guarantees implies

that a part of them will enter into the total liabilities of the State Governments.

4.14 The State Governments in

India have been assigned the larger responsibilities of health services which

implies that the States Governments have implicit liabilities in terms of health

expenditure. Pensions are another important form of liabilities of the

State Governments. This is particularly important as some of the State Governments

are having pay-as-you-go systems and also the Old Age Pensions schemes. The

assessment of liabilities on account of the pensions could be made from the

total amount of funds an employee should contribute so that his pension is completely

financed from the funds he has contributed and income earned from the investment

of the same. Thus, the total estimates of pensions liabilities could be made

in the form of funds that would be sufficient to finance the current pensions

which are paid on pay-as-you-go system.

7Please refer to the Report of

the Group to Assess the Fiscal Risk of State Governments Guarantees (published

in the RBI Bulletin, June 2003) and the Report of the Group on Model Fiscal

Responsibility Legislation at State Level (published in the RBI Bulletin, March

2005), for further details. It may be also mentioned that the RBI has so far

organized three workshops on the subject of fiscal risk of guarantees, for the

benefit of State Government officials.

Off-Budget Borrowing and Contingent

Liabilities

4.15 Apart from the confirmed

liabilities of the State Governments discussed so far, there is a rising phenomenon

of the Off-Budget Borrowing by some State Governments through their Special

Purpose Vehicles (SPVs) where the respective State Governments give guarantee.

Thus, in principle, such liabilities are contingent liabilities. However, in

practice, since SPVs do not have any independent source of own revenue generation,

such liabilities are actual liabilities of the respective State Governments.

In particular, in case the liability is incurred for a purpose or project without

a revenue stream, leaving no surplus to service the liability (indicating complete

absence of due diligence), the fiscal risk of the State Government guarantee

would have to be very high and in that sense, such liabilities would be more

‘explicit’ than ‘contingent’. The Group also notes that liabilities could arise

in the future on account of externalities from developmental projects. The budgetary

provision in this regard would be restricted only to the outlays for the projects

and not incorporate future liabilities arising from externalities. These are

technical aspects of the measurement of such liabilities, which are beyond the

scope of examination of the present Group. At this stage, it may be noted that

all such liabilities are not created through any State budget process and hence

do not appear as a part of the fiscal deficit of the State during the year they

were incurred. Under the existing practice, the State either redeems the liability

through injecting equity to SPVs and repaying the loans on behalf of the SPVs

or contributes to the reserve fund specially created for meeting all such contingent

liabilities in future at the time of their redemption. Under both these cases,

the fiscal deficit of the current year will increase, leading to a corresponding

increase in the debt or liabilities of the State in the next year. It has also

been felt by some that certain subsidies that are provided under existing policies

and that result in committed liabilities to the State Government (as for example

power provided at concessional rates) also need to be reported in a separate

Statement detailing their nature and amounts, from the viewpoint of enhancing

fiscal transparency.

4.16 A Group of State Finance

Secretaries to assess the fiscal risk of State Government Guarantees had examined

the problem and submitted its report in July 2002. The Group recommended exercise

of financial prudence by financial institutions like NABARD, HUDCO, PFC etc.

while lending for project-based financing to SPVs with prior concurrence of

Government of India (GoI) since all borrowings by the State Governments on the

strength of guarantees have been brought under Article 293 (3) of the Constitution.

Moreover, the Group also recommended State-specific caps on the levels of borrowings

as prescribed under the (erstwhile) MTFRP and the creation of a sinking fund

with a suitable contribution from the annual net small savings collections realizable

to States. Such a fund would be managed by RBI and States contributing to the

fund would be eligible for assistance therefrom. The creation of the Guarantee

Redemption Fund is a step in the right direction because it formally incorporates

future contingent liabilities in the present budgets. The Twelfth Finance Commission

has, in fact, recommended that States should set up guarantee redemption funds

through earmarked guarantee fees, which should be preceded by risk weighting

of guarantees.

4.17 In line with the practice

recommended and followed by IMF (Section III), the Group recommends that these

contingent liabilities may be excluded from the formal definition of

liabilities. In order to incorporate this dimension, however, the Group recommends

the reporting of these liabilities on an annual basis under a separate head.

In some cases, it is indicated a priori that the liability for repayment

of principal and/or interest payment of the borrowings of SPVs would be met

by the State Government from the provisions in its Consolidated Fund. Such borrowings

of SPVs should be included under the explicit liabilities of the State Government.

Pension Fund and State Public Sector

Liabilities

4.18 Similar issues can be raised

regarding the liabilities of a State Government regarding the pension to its

employees in future and the State PSUs liabilities. It may be, however, noted

that there is no clear-cut policy to calculate the pension liabilities for employees

who entered in service till end-December 2003. Moreover, under the National

Pension Scheme, which came into effect from January 2004, the Central Government

has not extended any guarantee on the returns to the new entrants. If the same

logic were to be extended, then there would not be any liability with the State

Governments on this account. As far as PSU liabilities are concerned, there

is a suggestion that an index on the rating of each State PSU needs to be worked

out, on the basis of which the PSU liabilities could be computed and published.

These are again real problems and appropriate provisions for them need to be

made in the State budget. These will invariably increase the current and future

fiscal deficits of the State. However, if account is taken of these liabilities

as existing now and merged with the other liabilities of the State Government,

the same problem of consistency with past fiscal deficits of the State Government

would arise. Thus, in line with the practice followed by IMF (Section III),

we may exclude the Pension Fund and Public Sector Liabilities from our

formal definition of Liabilities. In order to incorporate this dimension, however,

we recommend the reporting of these liabilities on an annual basis under a separate

head. These estimates can be prepared over time when the required data are

properly compiled.

V. Recommendations

a. Defining State Government Liabilities

5.1 It is proposed that debt

and liabilities be considered synonymous. Accordingly, all borrowings which

are repayable and on which interest accrues are recommended to be considered

as debt. Alternatively, the practice followed in the Government of India budget

may be adopted by the States as well. Thus, total budgetary liabilities are

recommended to be decomposed in four categories viz. (i) Public Debt;

(ii) Ways and Means Advances and Overdrafts from the RBI; (iii) Public Accounts;

and (iv) Contingency Fund. The above treatment would be in conformity with the

international best practice. As alluded to earlier, the IMF Manual on Government

Finance Statistics, 1986, IMF describes government debt ‘a stock of liabilities

with different time dimensions accumulated by government operations in the past

and scheduled to be extinguished by the government operations in future.’

5.2 It may be noted that the

above definition of liabilities brings about a closer alignment with that of

GFD, as discussed in Chapter IV. The remaining discrepancy between computation

of GFD and liabilities is essentially on account of certain ‘Memo items’ (i.e.

withdrawal of cash balances, Appropriation to Contingency Fund, Suspense and

Miscellaneous and Remittances) which are treated as financing items of the GFD,

but excluded from liabilities. The Group recommends that withdrawal of cash

balances may continue to be taken as a financing item of GFD. Cash balances,

in any case, do not form part of liabilities. The remaining memo items viz.,

‘Appropriation to Contingency Fund’, ‘Suspense and Miscellaneous’ and ‘Remittances’

may, however, be treated as non-debt items and excluded from the computation

of GFD and liabilities, with a view to maintaining consistency between the definitions

of GFD and liabilities.

5.3 The implicit liabilities

that include Off-Budget Borrowings, Contingent Liabilities, Pensions and State

Public Sector Liabilities should be excluded from the definition of State Liabilities

or Debt. However, it is recommended that they may be disclosed in the financial

statement along with estimates of debt. In those cases, however, where it is

indicated a priori that the liability for repayment of principal and/or

interest payment of the borrowings of SPVs would be met by the State Government

from the provisions in its budget, the same should be included under the explicit/budgetary

liabilities of the State Government.

b. Coverage

5.4 As discussed earlier, the

coverage of debt should be consistent with GFD. The break-up of GFD is then

used to construct a measure of debt in annual flow i.e. Increase in Debt = Increase

in [Internal debt (including WMA & OD) (net) + Loans & Advances

from the Centre (net) + Small Savings & PF etc. + Deposits (net) + Reserve

Funds (net) + Contingency Fund (net) While both stock and flow components are

available from finance accounts- Statements 15 & 16, albeit with a delay

of two years, the flow components can be obtained from budget documents or RBI

reports on State Finances as shown in the following item exhibit.

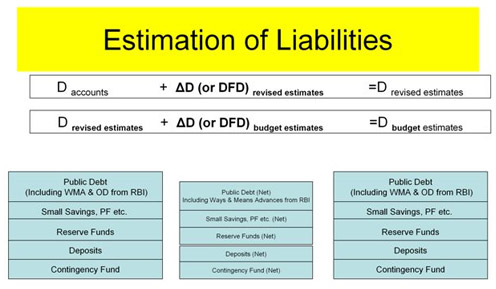

5.5 It is also felt that the

demarcation of Public Debt into Internal Debt and Loans & Advances

from the Centre can be done away with. It is instead proposed to report

a single major head viz. Public Debt and include all items currently

reported under Internal Debt and Loans & Advances from the Centre

as minor heads within it. Figure 3 gives the final definition of Liabilities,

as proposed by this working group.

Figure 3: Debt built-up – Stock

and flow components of debt

c. Proposed Scheme for Compilation

of State Government Liabilities

5.6 There could be many sources

of the data as many agencies are involved in the transaction and reporting of

all the items included in the State Government Liabilities. For ensuring the

consistency in the data, it is desirable that a single agency compiles and disseminates

the information on outstanding liabilities of all the States. Although

the State Governments are the most reliable sources of such information, the

task cannot be fully entrusted to them unless it becomes an obligatory part

of the State Budget documents. The Government of India, RBI and other institutions

could help the States in creating necessary capacity, systems and processes

and acquiring technology to compile data on liabilities. RBI can then

act as a single agency putting estimates of liabilities of all States together

in a single publication, as it does for the State Budgets. The proposed

scheme for the publication of liabilities is set out below.

Format for publishing the information

of State Government liabilities

5.7 It is proposed to publish

in the State Government Budget documents the information of the State Government

liabilities under the following statements:

(1) Budgetary Liabilities of State

Government (outstanding at end-March) and their break-up. This Statement would

have four Annexes providing details of:

a) Open Market Borrowings

b) Loans from the

Centre

c) Details of borrowings

from banks/financial institutions

d) Special Securities

issued to NSSF

(2) Details of Guarantees given

by the State Governments (GASAB Format)

(3) Assessed Fiscal

Risk of State Government Guarantees

(4) Off-Budget Borrowings

of State Governments

(5) Liabilities of

State Government Public Sector Undertakings

(6) Other Implicit

Liabilities of State Governments (including pension liabilities).

An additional Statement on Subsidies

provided by the State Government may also be provided as indicated in para 4.15.

5.8 The format of Statements

1 to 7 is given below. It is recommended that Statements (1) (alongwith the

Annexes) and (2) may be published in the budget documents of the State Governments

with effect from the fiscal year 2006-07. The remaining Statements

should be published by the State Governments as soon as possible. In case it

is not possible to bring out all the remaining Statements at the same time,

a graduated approach for publication could be adopted. Information provided

in the format of Statements 1 to 7 would ensure uniformity of practices of compiling

data on liabilities across State Governments as well as enhance fiscal transparency.

The Group recognizes that there are widely differing views on the inclusion

of various implicit liabilities in order to obtain the aggregate liabilities

of the State Governments, on which a consensus may emerge over a period

time. Priority may, however, need to be accorded to the task of collating

and publishing data on the different parameters, as set out in Statements 1

to 7, which should be available with the State Governments. Once the

modalities for collating and publishing information on the various liabilities

(both explicit/budgetary and implicit) of the State Governments as well as on

the associated fiscal risks of the implicit liabilities get firmly entrenched,

policy makers and researchers would be provided the option of progressively

including various implicit liabilities (guarantees, off-budget borrowings, pensions,

etc), or their risk-weighted component, in order to obtain a more comprehensive

picture of the overall liabilities of State Governments. Efforts to build up

a consensus on the inclusion of such implicit liabilities could then be expedited.

|

Statement 1: Budgetary Liabilities

of the State Government (outstanding at end-March)

|

|

|

|

Accounts @

|

Accounts @

|

Revised Estimate

|

Budget Estimate

|

|

|

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

|

|

|

|

|

|

|

|

1

|

Consolidated Fund

|

|

|

|

|

|

I

|

Public Debt

|

|

|

|

|

|

a

|

Open Market Borrowings (Net SLR based market

borrowings)

|

|

|

|

|

|

b

|

Borrowings from Banks and FIs/Negotiated

Loans

|

|

|

|

|

|

c

|

Special Securities issued to NSSF

|

|

|

|

|

|

d

|

Bonds/Debentures which are issued by the

State Government

|

|

|

|

|

|

e

|

Loans from the Centre (net)

|

|

|

|

|

|

|

Plan

|

|

|

|

|

|

|

Non-Plan

|

|

|

|

|

|

f

|

Others (Specify) *

|

|

|

|

|

|

II

|

Ways & Means Advances & Overdrafts

from RBI or any other bank

|

|

|

|

|

|

a

|

- WMA

|

|

|

|

|

|

b

|

- OD

|

|

|

|

|

|

2

|

Public Accounts

|

|

|

|

|

|

a

|

State Provident Funds

|

|

|

|

|

|

b

|

Small Savings, Insurance and Pension Funds,

Trust and Endowments, etc.

|

|

|

|

|

|

c

|

Other Items in Public Accounts

|

|

|

|

|

|

|

of which:

|

|

|

|

|

|

i

|

Deposits

|

|

|

|

|

|

|

-Bearing Interest

|

|

|

|

|

|

|

- Not bearing interest

|

|

|

|

|

|

ii

|

Reserve Funds/Sinking Fund

|

|

|

|

|

|

|

- Bearing Interest

|

|

|

|

|

|

|

- Not bearing interest

|

|

|

|

|

|

3

|

Contingency Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

TOTAL LIABILITIES (1+2+3)

|

|

|

|

|

|

|

|

|

|

|

|

|

5

|

Memo Items

|

|

|

|

|

|

a

|

Remittances

|

|

|

|

|

|

b

|

Suspense and Miscellaneous

|

|

|

|

|

|

c

|

Appropriation to Contingency Fund

|

|

|

|

|

|

d

|

Decrease in Cash Balance

|

|

|

|

|

@ It may be noted that ‘Accounts’

data are un-audited. The same footnote applies in the case of the remaining

Statements.

* This should include liabilities

of SPVs in respect of which it is a priori indicated that the repayment

and/or interest payment would be met by the State Government from the provisions

in its budget (Please see para 5.3 of the Report). This could also include the

risk-weighted component of guaranteed liabilities of the State Government.

|

ANNEX 1: Open Market Borrowings

|

|

Name of Loan

|

Date of Maturity

|

Outstanding Amount

|

Original Maturity (years)

|

Residual Maturity (years)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 % State Development Loan

2010

[The International Securities Identification

Number (ISIN) may also be indicated]

|

1.05.2010

|

500

|

8

|

5

|

|

|

(for illustration)

|

|

|

|

|

|

|

|

|

|

|

ANNEX 2: Loans from the Centre |

|

|

|

|

|

|

|

|

Name of Loan |

Date of Maturity |

Outstanding Amount |

Purpose of Loan |

Original Maturity(yrs) |

Residual Maturity (yrs) |

|

|

|

|

|

|

|

|

Plan Loans |

|

|

|

|

|

|

11 % Loan 2010 |

1.05.2010 |

500 |

Central Plan Scheme |

8 |

5 |

|

|

(for illustration) |

|

|

|

|

|

|

|

|

|

|

|

|

Non-Plan Loans |

|

|

|

|

|

|

|

|

|

|

|

|

|

11 % Loan 2010 |

1.05.2010 |

500 |

Relief for Natural |

8 |

5 |

|

|

(for illustration) |

|

Calamities |

|

|

|

|

|

|

|

|

|

|

ANNEX 3: Details of Borrowings from Banks/Financial Institutions

|

|

Distinguishing Loan

Number and Rate of Interest

|

Name of Institutions

Extending the loan

|

Date of Maturity

|

Amount

|

Purpose of Loan

|

Status of consent from

Centre under Article 293 (3)

|

|

|

|

|

|

|

|

|

11 % Loan 2010

|

IDBI

|

1.05.2010

|

500

|

Irrigation

|

Yes/No

|

|

|

(for illustration)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNEX 4: Details of Special Securities Issued to NSSF |

|

Year |

Amount Issued

During the Year

|

Rate of Interest |

Amount Repaid

During the Year

|

Outstanding Amount

at the end of the Year

|

|

|

500 |

12.0 % |

100 |

1400 |

|

|

(for illustration) |

|

|

|

|

|

|

|

|

|

Statement 2: Details of Guarantees

Issued by the State Government (GASAB Format)

|

Ministry/ Department/

Beneficiary

|

Loan holder etc.

|

Authority for guarantee

|

Amount & Purpose

of loan etc.

|

Extent of guarantee -

principal interest etc. *

|

Period of validity

|

Details of

reschedule etc.

|

Details of securities pledged

|

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

| |

|

|

|

|

|

|

|

|

Guarantees

outstanding

at the beginning

of the period

|

Addit

-ions

|

Deletion

(other than

invoked)

|

Invoked

Disch-arged|

Not dis-char-ged

|

Outstanding Principal,

interest, etc.

at the end of the

period*

|

Guarantee

Commission

Recei- vable

Received

|

Other conditions

& compliance

|

|

9

|

10

|

11

|

12 13

|

14

|

15

|

16

|

17

|

| |

|

|

|

|

|

|

|

* Rate of interest guaranteed in

case of loans, debentures, etc. is to be given.

Statement 3: Assessed Fiscal Risk

of the Guaranteed Liabilities of the State Government

|

Ministry/Department/

Beneficiary

|

Amount

|

Period of

Validity

|

Risk Category/

Weight

|

Present Value of Likely

Devolvement of Guarantee

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement 4: Off-Budget Borrowings

of the State Government

|

|

Accounts @

|

Accounts @

|

Revised Estimate

|

Budget Estimate

|

|

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

|

|

|

|

|

|

Statement 5: Liabilities of State

Government Public Sector Undertakings

|

|

Accounts @

|

Accounts @

|

Revised Estimate

|

Budget Estimate

|

|

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

|

|

|

|

|

|

Statement 6: Other Implicit Liabilities

of the State Government (Including Pension Liabilities)

|

|

Accounts @

|

Accounts @

|

Revised Estimate

|

Budget Estimate

|

|

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

|

|

|

|

|

|

Statement 7: Subsidies provided

by State Government

|

|

Accounts @

|

Accounts @

|

Revised Estimate

|

Budget Estimate

|

|

|

Year 1

|

Year 2

|

Year 3

|

Year 4

|

|

|

|

|

|

|

d. Institutional arrangements

5.9 It is proposed that all

the data relating to the liabilities of State Governments may be published in