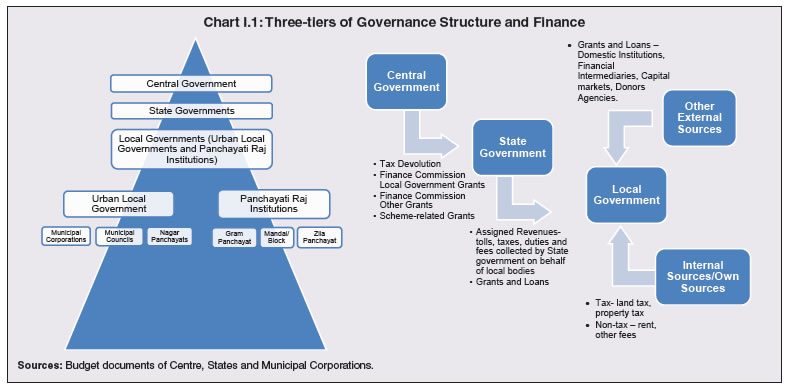

1.1 Local governments constitute a critical tier in India’s three-level governance system. They provide social and economic benefits directly to citizens relative to other levels of governance. With India’s rapid urbanisation - 17 of the 20 fastest growing cities in the world between 2019 and 2035 are expected to be from India (Oxford Economics, 2018) - a quantum rise in spending by Local governments is expected in order to meet the demand for affordable housing, integrated transport systems, basic infrastructure like water, electricity supply, schools and hospitals, and law and order. More recently, COVID-19 has underscored the need for upgrading urban health infrastructure and disaster management response systems to improve our cities’ resilience to such shocks. Climate change induced risks – rise in sea level, cyclones, flooding, and heat waves – would also warrant climate adaptation and risk mitigation plans with demarcated roles for all levels of governments. Accordingly, strengthening the governance structures of civic bodies, and financially empowering them through a combination of generation of own resources and greater transfers are critical for effective public policy interventions at the grass-root level (RBI, 2021)1. 1.2 Urban Local Bodies (ULBs) and the Panchayati Raj Institutions (PRIs) constitute Local governments in India. Information on their fiscal position is scanty. Most municipalities in India do not have balance sheets in public domain and many of them continue to follow cash accounting system. Municipal laws do not prescribe any uniform accounting standard to be followed, rendering municipal accounts largely incomparable across States and even within a State. Most municipalities only prepare budgets and review actuals against budgeted plans but do not use their audited financial statements for balance sheet and cash flow management, resulting in significant inefficiencies. This Report, the first of its kind, seeks to bridge this data gap, through compilation of available budgetary data of 201 municipal corporations in India across all States2. 1.3 As a prelude to the analytical chapters that follow, this chapter provides an overview of municipal finances in India. Section 2 of this chapter delineates the role, responsibilities, and accounting practices of municipal corporations in India. Section 3 presents a brief review of the existing but sparse literature for municipal finances in India. Section 4 discusses the role of Central and State Finance Commissions in determining inter-governmental transfers to Local bodies and summarizes the findings. 1. Role, Responsibilities and Accounting Practices of Local Governments in India 1.4 In 1992, the 73rd and 74th Amendments to the Constitution institutionalised the structure of local governance in India. Urban Local governments include municipal corporations, municipal councils and Nagar panchayats. Municipal corporations are created for providing community services like health care, education, housing, and transport in the million-plus cities in India. In contrast, municipal councils and Nagar Panchayats govern smaller urban agglomerations and transition areas (from rural to urban), respectively. The 74th Amendment (through the 12th Schedule) provides an illustrative list of 18 functions which the State governments may assign to the municipalities, partly or wholly, through their municipal laws (Table I.1). 1.5 The 74th Amendment Act also entrusted the Finance Commission with the task of reviewing the finances of municipalities and recommend principles for: (1) determining taxes which may be assigned to them; (2) sharing of taxes between the State and municipal corporations; and (3) grants-in-aid to municipalities from the Consolidated Fund of the State. Audits of accounts of municipal corporations are carried out by the Comptroller and Auditor General (CAG) of India and these reports are laid before the Legislature of the respective State. 1.6 The 74th Constitutional Amendment Act marked a watershed in the evolution of municipalities as it granted them constitutional status with a clear mandate for democratic decentralisation through self-governing local authorities in urban areas. This did not, however, result in a structural shift in the way municipal corporations functioned. Out of the 18 functions listed in Schedule 12 of the 74th Amendment Act, 11 already formed a part of municipal functions. The remaining functions can be traced back to either the state list or the concurrent list. The issue of revenue sources of ULBs was left entirely to State governments (Chart I.1). 1.7 Article 243X of the Constitution entrusts State governments the power to impose taxes, duties, tolls, and fees and allows them to assign revenues from specific sources to ULBs. Article 243Y assigns State Finance Commissions (SFCs) the task of reviewing and recommending devolution of tax revenues and grants-in-aids to ULBs. Effective devolution and transfer of revenue sources under these provisions has, however, been limited. 1.8 Indian cities are emaciated financially and are far from being able to generate the resources required for providing good quality infrastructure and services to their citizens. Accordingly, the availability of basic urban infrastructure in India lags behind the levels achieved in the OECD and other BRICS nations (Chart I.2 a and b). | Table I.1: Functions Listed in the 12th Schedule of the Constitution | | 1 | Urban planning including town planning | 10 | Slum improvement and upgradation | | 2 | Regulation of land-use and construction of buildings | 11 | Urban poverty alleviation | | 3 | Planning for economic and social development | 12 | Provision of urban amenities and facilities - parks, gardens and playgrounds | | 4 | Roads and bridges | 13 | Promotion of cultural, educational and aesthetic aspects | | 5 | Water supply - domestic, industrial and commercial | 14 | Burials and burial grounds, cremations, cremation grounds and electric crematoriums | | 6 | Public health, sanitation, conservancy and solid waste management | 15 | Cattle pounds, prevention of cruelty to animals | | 7 | Fire services | 16 | Vital statistics including registration of births and deaths | | 8 | Urban forestry, protection of environment and ecology | 17 | Public amenities including street lighting, parking lots, bus stops and public conveniences | | 9 | Safeguarding the interests of weaker sections of the society including the handicapped and mentally retarded | 18 | Regulation of slaughterhouses and tanneries | | Source: Constitution of India. |

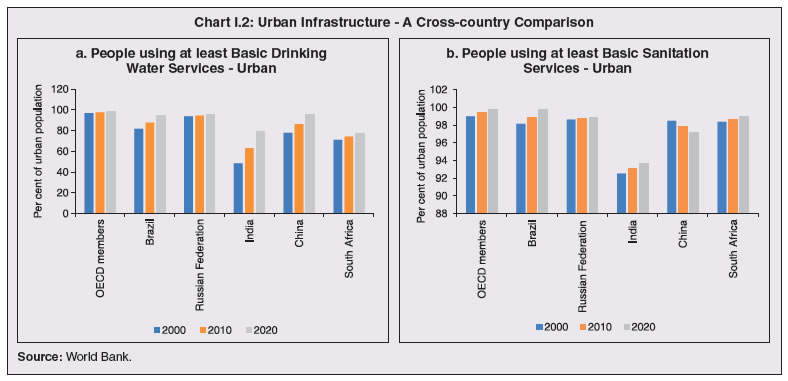

1.9 Due to limited sources of revenue generation, municipal corporations in India are largely dependent on grants from the Central and State governments for meeting their expenditure needs. Among own revenue sources, over-reliance on property tax has constrained exploiting other avenues of funding, such as trade licences, entertainment taxes, taxes from mobile towers, solid waste user charges, water charges, and value capture financing.3 ULBs in India also need to improve collection efficiencies in respect of property tax, user charges, lease rentals, advertisement tax and parking fees (Chapter 6, Third State Finance Commission Report, Uttarakhand 2018-19).  1.10 In order to ensure correct, complete and timely recording of municipal transactions and to produce accurate and relevant financial reports, a Task Force on accounting format for Urban Local Bodies was constituted by the CAG in February 2002, based on the recommendations of the Eleventh Finance Commission (2000-2005).4 The Task Force recommended (December 2002) accrual accounting system for municipalities, which led to the formulation of the National Municipal Accounts Manual (NMAM) in December 2004. State governments are expected to implement an accounting framework consistent with the NMAM in all ULBs. Only in nine of the fourteen States (for which information pertaining to adoption of State municipal accounts manual is available in the CAG reports), a municipal accounts manual has been approved by the respective State government.5 No uniform accounting code has been prepared for municipal corporations till date. There is thus an urgent need to devise and implement a uniform pattern of budgetary and accounting practices for compilation/reporting/dissemination of financial data relating to ULBs (Khan, 2013). 2. The Received Wisdom on Local Government Finances 1.11 Local government finance has been a keenly debated issue in fiscal decentralisation, with no specific model in the cross-country experience that can be regarded as a best practice. The vertical division of functions and responsibilities among various tiers of governments vary across countries as well as across historical periods. Consequently, the search for criteria for the allocation of responsibilities among different tiers of government that ensure efficiency, redistributive equity and development has engaged the profession (Epple et al., 2004; Arzaghi and Henderson, 2005; Kotsogiannis and Schwager, 2008; Tanzi, 2008). In addition, accountability in financial reporting of Local governments has been emphasised in response to concerns about mismanagement of resources, inefficiency and ineffectiveness (Mazibuko and Fourie, 2013; Basri and Nabiha, 2014). 1.12 While in many of the advanced economies, the government financial architecture allows for greater fiscal decentralisation, the concept is relatively new in developing countries. In many countries, the decentralisation of responsibilities from the national and subnational governments to Local governments has not been accompanied by a commensurate decentralisation of financial power (Bird, 2001). In most countries, taxation power lies with upper tiers of the government, with only a few exceptions like the Nordic countries where Local governments have substantial access to large and elastic tax bases such as the income tax (Bird and Vaillancourt, 1998). 1.13 The sources of revenue for Local governments vary across countries but generally include taxes, user fees and charges and inter-governmental transfers. Other revenues include investment income, property sales, licenses and permits. Property tax is regarded as one of the most important tools for raising revenue at the Local government level around the world (UN-Habitat, 2009; McMillan and Dalby, 2014). Other local taxes include income tax, general sales taxes on fuel, liquor, tobacco, hotel occupancy, and vehicle registration. Often, these taxes are collected at the State level and shared with the local bodies (Vitkovic and Kopanyi, 2014). Cross-country experience reveals that Local governments in major advanced economies like Australia, Belgium, Canada, Czech Republic, France, Iceland, Latvia, New Zealand, Spain, Sweden and Switzerland largely depend on their own tax and non-tax revenue sources while those in Austria, Estonia, Greece, Ireland, Lithuania, Luxembourg, Mexico, Netherlands, Slovakia, Turkey and United Kingdom tend to rely more on general government grants for their revenue (Chart I.3a). Among the BRICS nations, Local governments in Brazil and Russia rely on general government grants while those in China and South Africa generate their own tax and non-tax revenues (Chart I.3b). The share of own revenue (both tax and non-tax) in the total revenue of ULBs in India has declined over time while that of government transfers has increased, indicating growing fiscal dependency (Chart I.3c). Empirical evidence has shown that greater dependency of Local governments on upper tiers for meeting their expenditure needs makes them more vulnerable and less efficient (Stansel, 2005; Thießen, 2003; Akai and Sakata, 2002).  1.14 In India, studies on municipal finances and Finance Commission reports have regularly highlighted the financing needs of the ULBs. They recommend grants to local bodies from the Central government as well as scheme-specific grants (Bhargava, 1969; Bhagwan, 1983; Pethe and Lalvani, 2005; Venkatachalam, 2007; Mohapatra and Misra, 1991). In line with the Central Finance Commissions (CFCs), SFC reports have also assessed Local government budgets and arrived at a formula for devolution of funds with due consideration to: (i) distribution of tax proceeds between State governments and municipalities; (ii) allocation of revenue across all levels of municipal governments; (iii) taxes, duties and tolls to be assigned or appropriated by municipalities; and (iv) measures to improve the financial position of municipalities. 1.15 An analysis of the structure and composition of revenue and expenditure of 35 metropolitan municipal corporations6 for the period 1999-00 to 2003-04 reveals that there is a mismatch between functions and finances of ULBs, which primarily explains the vertical imbalance. Out of 18 functions to be performed by municipal bodies in India, less than half have a corresponding financing source. Own taxes and user charges of the ULBs in India are grossly inadequate to meet their expenditure needs (Mohanty, et. al., 2007). ULBs in India are amongst the weakest globally in terms of fiscal autonomy with elaborate State government controls on their authority to levy taxes and user charges, setting of rates, granting of exemptions, and borrowing of funds as well as on the design, quantum and timing of inter-governmental transfers (Ahluwalia et. al., 2019). The absence of buoyant revenue handles, excessive reliance on grants from the Central and State governments, and inability to autonomously access capital markets have weakened the ability of ULBs to fulfil their mandated functions (Pethe, 2013). 1.16 Municipalities in India need to balance their budgets by law, and any municipal borrowing needs to be approved by the State government (Ahluwalia et. al., 2019). Municipal revenues/expenditures in India have stagnated at around 1 per cent of GDP for over a decade. In contrast, municipal revenues/ expenditures account for 7.4 per cent of GDP in Brazil and 6 per cent of GDP in South Africa. It has been stated that in order to improve the buoyancy of municipal revenue, the Centre and the States may share one-sixth of their GST revenue with the third tier (Kelkar and Shah, 2019). 3. Role of Central and State Finance Commissions 1.17 CFCs, which are constituted every five years, make extensive recommendations on the magnitude and sectoral allocation of net proceeds of the Centre and the States. The 74th Amendment to the Constitution added the responsibility of recommending measures to augment the consolidated funds of States to supplement the resources of municipalities. Since then, based on the recommedations of successive CFCs, the grants-in-aid to ULBs have increased steadily over time, both in absolute terms and as share of the divisible pool of the Centre. The conditionalities for the release of grants-in-aid, however, have varied considerably over time, with the recent CFCs focusing on data transparency as well as improvement in own revenues of municipal bodies (Box I.1). Box I.1:

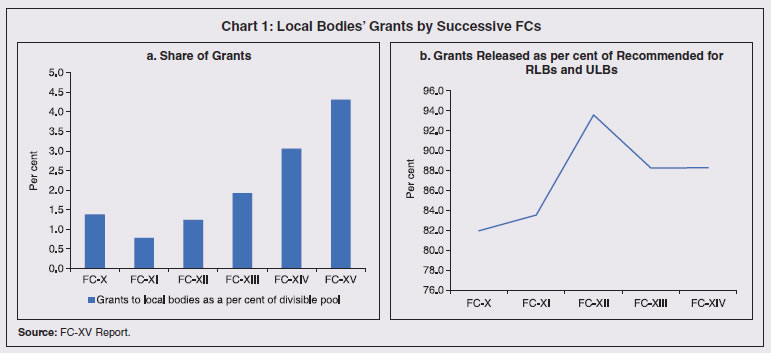

FC-XV Recommendations for Local Governments The 15th Finance Commission (FC-XV) report released on February 1, 2021 has recommended ₹4.36 lakh crore as grants to Local governments for the period 2021-22 to 2025-26 - the largest share of grants to be assigned for local bodies (Chart 1a). The FC-XV’s preference for a fixed amount rather than a proportion of divisible pool adds predictability to the quantum and timing of fund flow, thus reducing revenue uncertainty. Generally, the actual release to the local bodies has been lower than the recommended amount by about 15 per cent, primarily due to their failure to meet different conditionalities (Chart 1b). Within the overall grants recommended by FC-XV, the largest share is for rural local bodies (RLBs), with the inter se distribution among RLBs and ULBs from the total allocation of grants in each State being based on the ratio of 67:33 for the first two years (2021-22 and 2022-23), 66:34 in the next two years (2023-24 and 2024-25); and 65:35 in the last year of the award, namely 2025-26. Of the total grants of ₹4.36 lakh crore, ₹8,000 crore has been earmarked for incubation of new cities and ₹450 crore is for shared municipal services. In view of the current pandemic, FC-XV has decided to provide grants of ₹70,051 crore to strengthen and plug critical gaps in healthcare systems (Table 1). Inter se distribution among States is based on a weight of 90 per cent for population and 10 per cent for area of States. The FC-XV’s focus on transparency is high regarding eligibility criteria to avail of grants. For availing full grants in the first and second year of the award period, States need to ensure that at least 25 per cent of RLBs make available online (in public domain) both their provisional accounts for the previous year and their audited accounts for the year before that. From the third year onwards, States will receive grants equivalent to the share of RLBs that have these two transparency requirements fulfilled. For ULBs, the additional conditions of notifying a floor rate for property tax for the first two years of the award period, followed by improvement in collection of property taxes in tandem with growth in States’ own GSDP, are added. This focus on incentive/performance-based grants to Local governments aimed at enhanced transparency and improved revenue mobilisation can be regarded as seeds of change for overall fiscal federalism.

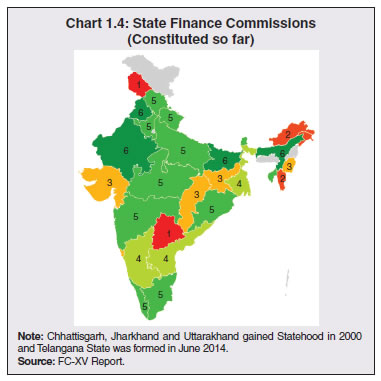

| Table 1: Grants to Local Governments by FC-XV (₹ Crore) | | | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2021-26 | | 1 | Total Grants for Rural and Urban Local Bodies (a+b+c) | 80207 | 82613 | 85091 | 89997 | 90003 | 4,27,911 | | | a. Grants for primary health care | 13192 | 13192 | 13851 | 14544 | 15272 | 70,051 | | | b. Grants for RLBs | 44901 | 46513 | 47018 | 49800 | 48573 | 2,36,805 | | | c. Grants for ULBs | 22114 | 22908 | 24222 | 25653 | 26158 | 1,21,055 | | 2 | Grants for Incubation of New Cities | - | 2000 | 2000 | 2000 | 2000 | 8,000 | | 3 | Grants for shared Municipal Services | 90 | 90 | 90 | 90 | 90 | 450 | | Total (1+2+3) | 80,297 | 84,703 | 87,181 | 92,087 | 92,093 | 4,36,361 | | Source: FC-XV Report. | | 1.18 SFCs, being the constitutional counterpart of CFCs, are expected to spell out the principles to be applied for determining the allocation of funds to Local governments and the range of taxes and non-taxes to be devolved to them. With the implementation of GST, a few of the taxes which were the prerogative of municipal corporations earlier, have been subsumed into it, resulting in greater dependence of municipal corporations on transfer of funds from the upper tiers of the government. Thus, SFCs assume importance in the post-GST arrangement for resetting the principles for the devolution of taxes and non-taxes to municipal corporations. Besides arbitrating on the claims to resources by the State governments and Local governments, their recommendations could also impart greater stability and predictability to the transfer mechanism and flow of resources to the third tier. 1.19 State governments have not set up SFCs in a regular and timely manner even though they are required to be set up every five years (Chart I.4). Accordingly, in most of the States, SFCs have not been effective in ensuring rule-based devolution of funds to Local governments (Gupta and Chakraborty, 2019). There are several resaons for delay in setting up of SFCs: (i) SFCs on an average take around 32 months to submit their reports, resulting in an average delay of about 16 months; and (ii) State governments take considerable time in tabling the action taken report (ATR) in State legislatures (the average time taken by State governments to table the ATR is around 11 months) (Gupta and Chakraborti, 2019). Resultantly, the flow of funds to Local governments is not steady and predictable, hindering the delivery of basic services to the citizens.  1.20 Overall, despite institutionalisation of the structure of local governance in India, there has been no appreciable improvement in the functioning of municipal corporations. The availability and quality of essential services for urban population in India has consequently remained poor. The rapid rise in urban population density, however, calls for better urban infrastructure, and hence, requires greater flow of financial resources to Local governments. With own revenue generation capacity of municipal corporations declining over time, dependence on the devolution of taxes and grants from the upper tiers has risen. This calls for innovative financing mechanisms.

|