Press Release RBI Working Paper Series No. 06

Estimating Employment Elasticity of Growth for the Indian Economy

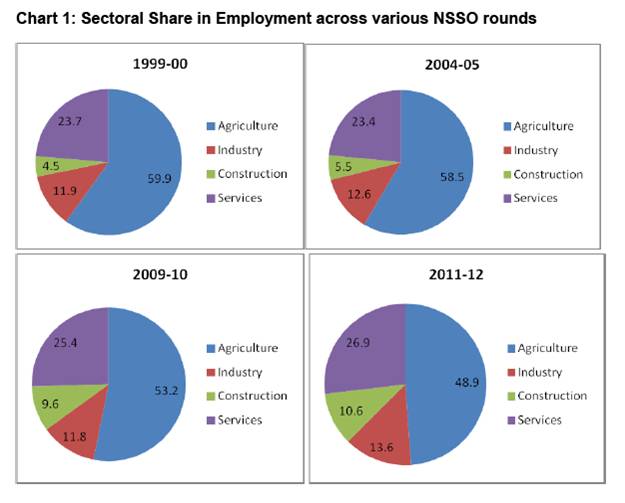

@Sangita Misra and Anoop K Suresh Abstract 1This paper provides updated estimates on employment elasticity - both aggregate as well as sector specific - using a variety of approaches. The aggregate employment elasticity estimates for India have declined over the decades and vary from 0.18 (arc elasticity) to 0.20 (point elasticity) during the post reform period. Sector-wise, while agriculture has witnessed negative elasticity, services including construction have generally been employment intensive. Manufacturing employment elasticity has hovered around 0.3. Within manufacturing, the employment elasticity for organized manufacturing sector based on various estimates is in the range of 0.4-0.5 for 2000s. Sectors which have been employment intensive during 2000s include wearing apparel, Furniture and Leather Products, Motor Vehicles, rubber products and Electrical Equipment. With growth moderating in 2012 and 2013, employment elasticity is likely to have lowered. Going forward, employment intensive growth is crucial for India to meet the demographic dividend challenge. Key Words: Employment Elasticity, Growth JEL Classification: E24, R23 I. Introduction Employment has always figured as an important element of the growth and development process of the Indian economy. India being a highly populated country, employment becomes a crucial element. Employment acts as a link between economic growth and poverty reduction. Employment serves as a significant variable in the attainment of inclusive and sustainable growth. The focus of employment in the overall development planning had emerged around second half of 1970s and 1980s when it was felt that unemployment was on a rise. With the initiation of reforms post 1990s, it has generally been analysed whether reforms driven growth of the Indian economy has been job creating or not. The great recession has further renewed the concerns about unemployment and job creation due to the slow down, both globally as well as in India. Against this backdrop, this paper aims to compute employment elasticity for the Indian economy, over the decades and more specifically for the 2000s using the latest available data. Employment elasticity is a measure of the percentage change in employment associated with a 1 percentage point change in economic growth. The employment elasticity indicates the ability of an economy to generate employment opportunities for its population as per cent of its growth (development) process. Employment elasticity measurement generally faces two sets of criticisms: (1) the relationship between employment and output need not be uni-directional and (2) the notion of employment elasticity is valid for a given state of technology, wage rate and policies. Notwithstanding these criticisms, employment elasticity represents a convenient way of summarising the employment intensity of growth or sensitivity of employment to output growth (Islam and Nazara, 2000). These are also commonly used to track sectoral potential for generating employment and in forecasting future growth in employment. In the empirical literature, there are two methodologies that have generally been used for calculation of employment elasticities. These are based on compound annual growth rate (CAGR) approach that gives the ‘arc’ elasticity and regression approaches that provide point elsticity. The formula for calculation of ‘arc’ elasticity of employment is generally as under: where L denotes employment and Y denotes GDP for the economy. The numerator refers to the percentage change in employment, while the denominator refers to the percentage change in income, which is essentially the GDP growth rate. While for other countries, simple percentage change is used, in case of India, since employment data is available once in five years, CAGR approach is used. An alternative way to compute the elasticity is to estimate a log linear regression equation between employment and GDP that generates the point elasticity of employment. The conventional form of the equation is where variables L and Y denote employment and GDP, respectively, and ln stands for the natural logarithm of the relevant variable2. Here, the regression coefficient β serves as the employment elasticity. In other words,  The existing estimates on aggregate employment elasticity covering all sectors are based on National Sample Survey Organisation (NSSO) employment data up to 2009-10. NSSO 2011-12 survey results got released in June 2013. As of now, neither the Planning Commission nor any other private researcher/research institutions have updated aggregate employment elasticity by using the 2011-12 NSSO survey results As regards organized manufacturing, ASI data for 2011-12 got released recently in January 2014. It is against this backdrop that this paper attempts to provide updated estimates on aggregate as well as sectoral employment elasticities for India by using latest NSSO and ASI data. The paper is divided into various sections. Section II of the paper provides a brief on the existing estimates on employment elasticity in India. Section III gives a description of the NSSO and ASI database, which have been used in the paper. Section-IV gives employment elasticity estimates; both aggregate as well as sector specific using a variety of approaches so as to reinforce the robustness of the results. Conclusion and policy implications are given in Section V. II. Existing Estimates on Employment Elasticity for India The employment elasticity numbers as calculated by the Sub-Group on Employment/Unemployment Projections, set up by the Planning Commission for the 12th Five Year plan are given in Table 1. These were based on NSSO employment data up to 2009-10. As per the 12th Plan document, the employment elasticity in India in the last decade (2000s) declined from 0.44 in the first half of the decade i.e., 1999–2000 to 2004–05, to as low as 0.01 during the second half of the decade (2004–05 to 2009–10). Similar trends have been witnessed at the sectoral level as well, namely agriculture, service, and manufacturing sectors. Table 1: Sectoral Employment Elasticity as per Twelfth Five Year Plan | | Sector | 1999-2000 to 2009-10 | | Agriculture | 0.04 | | Manufacturing | 0.09 | | Mining & quarrying | 0.52 | | Utilities | 0.04 | | Construction | 1.13 | | Trade, Transport | 0.19 | | Finance, real estate | 0.66 | | Other services | 0.08 | | All sectors | 0.19 | | Source: 12th Five Year Plan document, Chapter 22. | Papola and Sahu (2012) have also estimated the employment elasticity to be 0.20 for the period 1999-00 to 2009-10, in line with the Planning Commission estimates based on Compound annual average growth (CAGR) approach. They have further shown that there has been a continuous decline in employment elasticity from the 1970s to 1980s to 1990s. During 2004-05/2009-10, it declined to almost zero. Rangarajan, Padma Iyer and Seema (2007) made an analysis of employment elasticity and their implication for economic growth. They also calculated sector-wise employment elasticity by utilising the data on sectoral employment growth rate and the sectoral growth rate of GDP. The study shows that there has been a continuous and drastic decline in aggregate employment elasticity from 0.53 during 1977-78/1983 to 0.41 during 1983/1993-94 to 0.15 during 1993-94/1999-00. However this trend has been reversed in the period 1999-00 to 2004-05. During 1999-00/2004-05, aggregate employment elasticity was estimated to be 0.48. The overall employment growth rate accelerated to a high of 2.8 per cent per annum during this period (Bhalla, 2008). In addition, there are many studies that have attempted to compute employment elasticity for organised manufacturing based on ASI data (Goldar, 2000, Nagaraj, 2000, Kannan and Ravindran, 2009). International organizations like ILO also estimate employment elasticity for different countries/regions. A cross country comparison of region- wise estimates is given in Table 2. “South Asia” that includes India recorded employment elasticity of 0.3 during 2004-08 that marks a slight decline from early 2000s. | Table 2: World and Regional Estimate of Employment Elasticity | | | Employment elasticity | Average annual GDP growth rate | | 1992-96 | 1996-00 | 2000-04 | 2004-08 | 1992-96 | 1996-00 | 2000-04 | 2004-08 | | WORLD | 0.3 | 0.4 | 0.3 | 0.3 | 3.1 | 3.7 | 3.3 | 4.4 | | Developed Economies & European Union | 0.3 | 0.3 | 0.2 | 0.5 | 2.4 | 3.3 | 1.9 | 2.2 | | Central & South-Eastern Europe (non-EU) | 0.2 | 0.2 | 0.2 | 0.2 | -5.5 | 3.2 | 6.0 | 6.7 | | East Asia | 0.1 | 0.2 | 0.1 | 0.1 | 10.2 | 7.0 | 7.8 | 9.3 | | South-East Asia & the Pacific | 0.3 | 0.1 | 0.3 | 0.4 | 7.8 | 1.6 | 4.9 | 5.8 | | South Asia | 0.3 | 0.4 | 0.4 | 0.3 | 6.0 | 5.4 | 5.5 | 8.4 | | Latin America & the Caribbean | 0.6 | 0.9 | 0.8 | 0.5 | 3.3 | 3.0 | 2.3 | 5.0 | | Middle East | 1.1 | 1.5 | 0.7 | 0.7 | 2.9 | 3.3 | 5.1 | 5.7 | | North Africa | 0.8 | 0.6 | 0.8 | 0.7 | 2.3 | 4.3 | 4.3 | 5.6 | | Sub-Saharan Africa | 0.7 | 0.7 | 0.5 | 0.5 | 2.9 | 3.0 | 6.0 | 6.1 | | Source: Employment Elasticities Indicator KILM 19 (2009), International Labour Organization (ILO) | Studies have also attempted to explain the cross country variations in employment elasticities in terms of various structural factors such as labour market policies, product market policies as well as government size. Macroeconomic policies that aim at reducing (output and price) volatility and increasing trade openness have been observed to have a significant effect in increasing employment elasticities (Crivelli et al, 2012). International literature is also supported by Indian literature which states that the determinants of employment elasticity can be classified into labour market variables such as labor supply, labour market reforms (tax GDP ratio) and trend in the share of wages as well as macro economic variables like economic stability, investment, public expenditures etc (Pattanaik and Nayak 2010; Mazumdar and Sarkar 2007). III. Employment Data: NSSO and ASI The All India employment and unemployment surveys conducted by the National Sample Survey Office (NSSO) are the primary source of various indicators of labour force at national and state levels, which are used for planning and policy formulation by various government organizations as well as researchers. They are in fact the major as well as most comprehensive source of data on employment-unemployment situation in the country. NSS surveys on employment & unemployment with large samples of households was conducted quinquenially (once in five years) for the first time in 27th round (October 1972-September 1973) survey. The concepts and definitions recommended by Dantwala committee (set up by the Indian Planning Commission) formed the basis of this survey. Since then, eight comprehensive quinquennial surveys on employment and unemployment situation in India have so far been carried out by the NSSO3. The concepts, definitions and procedures in these surveys are based primarily on the recommendations of the Dantwala Committee. The results of these surveys are being brought out in the form of NSS reports. The latest NSSO survey on employment is the 68th Round for the year 2011-12, released in June 2013. As per UPSS basis, the latest survey reveals that the work force was about 472.9 million (rural male: 234.6, rural female: 101.8, urban male: 109.2 and urban female: 27.3) as on 1st January 2012 whereas the number of persons in the labour force was reported to be 483.7 millions (rural male: 238.8, rural female: 103.6, urban male: 112.5 and urban female: 28.8). The unemployment rate in 2011-12 was recorded to be 2.2 per cent on usual principal subsidiary basis (UPSS) basis (Table 3). | Table 3: Comparison of employed persons and unemployment rate (UPSS) | | Indicator/Year | 1999-2000 | 2004-05 | 2009-10 | 2011-12 | | Employment (millions) | 396.76 | 457.46 | 460.18 | 472.9 | | Unemployment rate (per cent) | 2.2 | 2.3 | 2.0 | 2.2 | A comparison of the 68th round survey results vis-a-vis previous rounds reveals certain interesting facts. There has been consistent increase in absolute employment across various sectors from 396.8 million in 1999-00 to 460 million in 2009-10 to 472.9 million in 2011-12. Notwithstanding an absolute increase in employment, the unemployment rate which was rising till 2004-05 fell in 2009-10 but has again risen slightly in 2011-12 to 2.2 per cent raising apprehensions of jobless growth4. The work participation rate (WPR) fell from 392 in 2009-10 (66th NSSO survey) to 386 in the 68th round NSSO survey in 2011-12 in line with the fall in labour force participation rate (LFPR)5. The fall in WPR was mainly due to fall in rural areas for both males and females, whereas in urban areas, the WPR has gone up for both males and females (Annex Table 1). An analysis of sectoral share in employment over the years reveals that there has been a shift in employment away from agriculture towards manufacturing, construction and service activities. The share of agriculture has declined continuously from 59.9 per cent in 1999-00 to 48.9 per cent in 2011-12 whereas the share of construction sector has consistently risen from 4.5 per cent in 1999-00 to 10.6 per cent in 2011-12. The industrial sector saw a reasonable increase in its share from 11.9 per cent in 1999-00 to 13.6 per cent in 2011-12, notwithstanding a slight dip in 2009-10. Services have also seen an increase in its share, particularly in sub sectors such as transport, banking, storage and communications and education services (Chart 1). Another source of employment data is the Annual Survey of Industries (ASI) which is the principal source of industrial statistics, particularly for the organised manufacturing sector in India. The major advantage of ASI data (released by the Ministry of Statistics and Programme Implementation, MOSPI) is that since it is conducted annually, time series information is available unlike that of NSSO. The ASI was launched in 1960 with 1959 as the reference year and is continuing since then except for 1972. The scope and coverage of ASI survey has been modified from time to time. From ASI 2000-01 to ASI 2003-04, the census sector was modified to include units employing 100 and more workers instead of 200 and more workers and to some extent because of this, ASI data since 2000-01 are not strictly comparable with that of previous ASI rounds. In ASI 2004-05, National Industrial Classification (NIC) 2004 was introduced and from 2008-09, the latest classification NIC-2008 was introduced. Given the fact that industrial sector occupies an important position in the Indian economy, job creation in the industrial sector, particularly manufacturing sector is the key to achieving the employment challenge as envisaged in the 12th Plan. An analysis of the employment elasticity for manufacturing sector based on ASI data has also, therefore, been attempted in this study.  IV. Employment Elasticity Estimates IVa. Aggregate Employment Elasticity This section attempts to compute the employment elasticities (both ‘arc’ and ‘point’ elasticities) based on the compound annual growth rate (CAGR) approach and the regression approach and taking into account the NSSO 2011-12 employment data. CAGR approach The compound annual growth rate (CAGR) approach is the most widely used approach in India to estimate employment elasticities (GoI, 2012; Papola et al (2012), Rangarajan et al (2007)). Official estimates on employment elasticity were provided by the Planning Commission in the Twelfth Five Year Plan document for the time period 1999-2000 to 2009-10. In this paper, the employment elasticities have been computed by further extending the employment data series up to 2011-12. Also back data on employment based on all the old NSSO surveys have also been used to get the employment elasticity since 1972-73. The employment elasticity numbers based on the CAGR approach during 1972-73 to 2011-12 are reported in Table 4. As can be seen, there has been a continuous decline in employment elasticity from the 1970s to 1980s to 1990s. During the 2000s till date (i.e., 1999-2000 to 2011-12), employment elasticity was about 0.20 (a shade higher than that of 0.19 per cent as estimated by Planning Commission till 2009-10). Employment elasticity was high (about 0.5 per cent) for the first half of 2000s. It declined significantly during the second half of 2000s. Notwithstanding an improvement during 2009-10 to 2011-12, it has remained lower than that of the first half of 2000s. For the post reform period as a whole (1993-94 to 2011-12), employment elasticity was placed at 0.18. | Table 4: Employment Elasticity: CAGR approach | | Year | Employment Growth (CAGR) | GDP growth (CAGR) | Employment Elasticity | | 1972-73 to 1977-78 | 2.6 | 4.6 | 0.57 | | 1977-78 to 1983 | 2.1 | 3.9 | 0.54 | | 1983 to 1988-87 | 1.7 | 4.0 | 0.42 | | 1988-87 to 1993-94 | 2.4 | 5.6 | 0.43 | | 1993-94 to 1999-2000 | 1.0 | 6.8 | 0.15 | | 1999-2000 to 2004-05 | 2.8 | 5.7 | 0.50 | | 2004-05 to 2009-10 | 0.1 | 8.7 | 0.01 | | 2009-10 to 2011-12 | 1.4 | 7.4 | 0.18 | | 1999-00 to 2011-12 | 1.5 | 7.3 | 0.20 | | 1993-94 to 2011-12 | 1.1 | 6.0 | 0.18 | It may be noted that the fall in employment elasticity has been accompanied by a fall in unemployment rate as well between 2004-05 and 2009-10. This is essentially due to a fall in labour force participation rate (LFPR), across all ages in 2009-10 vis-à-vis 2004-05. Labour force participation rate, which reflects the persons who express their willingness to work has been declining from 430 per thousand persons in 2004-05 to 400 per thousand persons in 2009-10 and further to 395 per thousand persons in 2011-12. The decline in LFPR is visible in case of rural females, possibly on account of greater number of persons opting for education/skill development. Studies using NSSO data show that there has been a steady increase in the ratio of students to total population from 20.5 per cent in 1993-4 to 24.3 per cent in 2004-5 and further to 26.6 per cent in 2009- 10 (Thomas, 2012). The students to population ratio increased faster in rural areas and more so for females (GoI, 2013). Consequently, the unemployment rate that is the difference between people who are willing to work (indicated by LFPR) and who are actually working/employed (indicated by WPR) as a proportion of the former also went down implying that relatively larger proportions of people who were willing to work were actually employed in 2009-10. NSSO provides only sector wise ‘Work participation rates’ (WPR), not sector wise number of people employed. Using the aggregate employment numbers for the country as a whole and applying the WPR proportions across sectors, sector-wise employment numbers have been arrived for the period 1999-2000 to 2011-12. Then using the sector-wise GDP numbers as provided by CSO, sector-wise employment elasticity has been computed (Table 5). Sector-wise, employment elasticity is in the negative zone for agriculture sector indicating the movement of people out of agriculture to other sectors in search for productive and gainful employment. Since 2000, employment elasticity is the highest for utilities, followed by construction sector. The manufacturing sector that had witnessed negative employment elasticity in the second half of 2000s has seen a turnaround during the period 2009-10 to 2011-12 with the overall employment elasticity in manufacturing being at 0.33 for the period 1999-00 to 2011-12. Table 5: Sectoral Employment Elasticity – CAGR Approach | | Sector | 1999-2000 to 2004-05 | 2004-05 to 2009-10 | 2009-10 to 2011-12 | 2004-05 to 2011-12 | 1999-00 to 2011-12 | | Agriculture | 1.09 | -0.39 | -0.44 | -0.41 | -0.08 | | Manufacturing | 0.80 | -0.27 | 1.74 | 0.10 | 0.33 | | Mining & quarrying | 0.87 | 0.20 | -1.76 | -0.14 | 0.34 | | Utilities | 0.67 | -0.27 | 7.60 | 1.42 | 1.17 | | Construction | 0.88 | 1.63 | -0.25 | 1.12 | 1.01 | | Trade, Transport, hotels | 0.45 | -0.02 | 0.54 | 0.13 | 0.25 | | Finance, real estate | 1.40 | 0.34 | -2.32 | -0.45 | 0.06 | | Other services | 0.46 | -0.11 | 2.96 | 0.48 | 0.47 | | All sectors | 0.50 | 0.01 | 0.17 | 0.06 | 0.20 | Note: 1. Sector-wise classification has been kept the same as used by Planning commission for comparability.

2. Utilities include electricity, gas, water supply, sewerage and waste management.

3. 2009-10 being a ''non-normal year'' because of a bad agricultural year, NSSO survey was conducted just after two years in 2011-12. Hence, sectoral elasticities have been reported for the 7-year period 2004-05 to 2011-12. | Regression approach While the Twelfth Plan document does talk of using the regression approach for estimating elasticity, results have been reported only for the CAGR approach. The reason why regression approach is not very popular in India is that while time series data on GDP is available, the continuous time series for employment is not available in India. Given this data limitation, some approximation/interpolation of the labour data has to be done to arrive at time series information on employment. The most common approach of deriving these data is as follows: NSSO rounds provide the work participation rates (WPR) per thousand of population for the years 1999-00, 2004-05, 2009-10 and 2011-12. Assuming the WPR to remain unchanged between the two quinquennial surveys and multiplying the WPR with the corresponding population, one gets employment numbers in millions for the period 1999-2000 to 2011-12. It may be mentioned that although population census is conducted only decennially, the interpolated annual population figures, as given in the Census document, are generally used. The information on WPR as available from NSSO major rounds is used as the control variable and the series is then interpolated using annual population figures to obtain the time series data on employment. The information available from NSSO thin rounds for some of the mid-years are also used to do necessary adjustments. This approach has been used to arrive at the time series data for labour input in the KLEMS project6. However, this information from the project is available only up to 2008. Based on NSSO’s last two major rounds, 2009-10 and 2011-12, the KLEMS series has been extended up to 2011-12 using the same approach. Employment elasticity has then been calculated by running a log-log regression of employment figures so generated on observed real GDP figures (independent variable) from 1993–1994 to 2011-12. The long run employment elasticities (point elasticities) as computed using this methodology are reported in Table 6. The employment elasticity at the aggregate level is observed to be about 0.20 which is in line with some of the previous estimates7. Elasticity is observed to be the highest for construction sector at 1.03. It is also observed to be significant for manufacturing and mining and quarrying. Table 6: Employment Elasticity based on log-log regression:

1993-94 to 2011-12 | | Sector | Log-log OLS regression coefficients | | All sectors | 0.20** | | Agriculture | -0.02 | | Mining and Quarrying | 0.22** | | Manufacturing | 0.29** | | Utilities | 0.28 | | Construction | 1.03** | | Services | 0.30 | Note: 1. ** and * indicate significance at 1 per cent and 5 per cent, respectively.

2. The sectoral break up here does not exactly match with the CAGR approach, particularly for services as the regression database follows classification of KLEMS database and the CAGR is directly from NSSO database.

3. The long run elasticities have been computed in a co-integration framework. The presence of co-integration has been tested using unit root tests on the residuals based on Augmented Dickey Fuller Tests. | While for agriculture, elasticity turns out to be negative, it is not statistically significant. While this result is in line with the CAGR approach that also reveals that agricultural growth has not been employment intensive in India in 2000s8, it is possible that inter-state differences exist. For certain states that have had high agricultural growth, this picture could be different. Although at aggregate level, services elasticity is not coming to be significant, it may be interesting to analyse this trend at a more disaggregated level, namely, for trade, hotels, transportation, finance, real estate, social sector, defence, public administration etc. Both state-wise and sub-sector-wise analysis could be an area of further research. IVb. Employment Elasticity for Organised Manufacturing Unlike all other sectors, time series information on employment is available for the organised manufacturing sector based on Annual Survey of Industries (ASI) data. This enables us to further firm up our elasticity numbers, particularly for the organised manufacturing sector. There is more or less consensus that organised industrial sector growth during the 1980s was “jobless”. During the decade of 1990s, while the immediate post-reforms period (first half of 1990s) was characterised by employment boom, the second half witnessed some job losses (Goldar, 2000, Nagaraj, 2000, Kannan and Ravindran, 2009). Using the ASI data, it is observed that during the 2000s, about 5.4 million jobs got created in the organised manufacturing sector, with a large proportion of these in the second half of 2000s. Annual average Growth rate Approach ASI provides time series information on Gross Value added (GVA) and total employment since 1970s. Since data on GVA is in nominal terms, it is deflated using two indicators: (1) Manufacturing Output deflator and (2) WPI manufacturing index. Employment elasticity is then computed taking the ratio of the average annual growth rates for total employment and real GVA9. Looking at the employment elasticity estimates, it is observed that unlike the 1990s that practically witnessed jobless growth in the organised manufacturing sector, 2000s have been job creating with the employment elasticity being above 0.4 (Table 7). Even during the crisis time that witnessed retrenchment among most developed nations, Indian industrial sector witnessed positive employment elasticity, albeit with some moderation. | Table 7: Employment Elasticity of Growth in Organised Manufacturing | | (In annual average and percent) | | | Using Manufacturing Output Deflator on GVA | Using WPI manufacturing to deflate GVA | | 1981-82 to 1990-91 | 0.07 | 0.06 | | 1991-92 to 2000-2001 | -0.04 | -0.03 | | 2001-02 to 2011-12 | 0.44 | 0.42 | | Source: Computed from ASI data | Panel Regression Approach Given that time series information is available across industries for organised manufacturing, a more efficient estimate of organised manufacturing employment elasticity can be obtained by simply pooling the industry-wise data across time. The additional efficiency comes from the larger number of observations available for estimation process (Islam and Nazara, 2006). Thus, for organised manufacturing, the following equation is estimated in a panel framework where variables L and Y are defined as before. i denotes the particular sub-sector of organized manufacturing and t denotes time period. The analysis is done for the different sub-sectors as given by ASI data over the period 2001-02 to 2011-12 during which comparable ASI data is available. Given that both the deflators – manufacturing Output and WPI manufacturing – give broadly similar results, from here on, real GVA have been arrived only by deflating using the WPI manufacturing sub-sector indices. Estimation results are reported in Table 8. Employment elasticity with respect to real GDP is observed to be 0.57. Table 8: Organised Manufacturing Employment Elasticity:

Panel Regression Coefficients | | Log employment on | Equation 4 | | Constant | 4.60** | | Log Output | 0.57** | | R square | 0.22 | | N | 220 | Note: 1. ** and * indicate significance of coefficient at 1 per cent and 5 per cent levels, respectively.

2. Hausman test has been used to decide on the appropriate panel models.

3. Introducing a slope dummy for the second half of 2000s, it is observed that the coefficient of slope dummy is small negative in both the cases implying a decline in employment elasticity in the second half of 2000s. However, it was not observed to be statistically significant. | Sector wise employment elasticity for organised manufacturing during 2000s Notwithstanding gains in employment during the 2000s in the organised manufacturing sector, differences persist across industries. And panel results also indicate that industry-wise variations are significant. Recognising this, a preliminary attempt is made here to estimate the industry-wise employment elasticities during 2000s. The GVA for the majority of the sub-sectors (accounting for about 88 per cent of total) is deflated by the corresponding WPI. For example, GVA for ‘Basic Metals’ has been deflated by WPI for ‘Basic Metals, Alloys and Metal Products’ to arrive at the real GVA for that sub-sector. Results are reported in Table 9 (next page). Some industries have been employment creating in a larger way and have higher elasticity than all-India average. These include manufacture of furnitures, Leather and Leather Products, Wearing Apparel, Motor Vehicles and Trailers, rubber and plastic products and Manufacturing of Computer electronic and optical products. Clearly, two industries that have witnessed job displacing growth in the 2000s are chemical and chemical products and tobacco products. Table 9: Employment elasticity of Manufacturing Industries during 2000s | | (Annual Average in per cent) | | | Employment Elasticity | | Basic Metals | 0.43 | | Coke and Refined Petroleum Products | 0.36 | | Chemical and Chemical Products | -0.04 | | Food Products and Beverages | 0.31 | | Machinery and Equipment N.E.C. | 0.38 | | Motor Vehicles and Trailers | 0.58 | | Textiles | 0.35 | | Other Non-metallic Mineral Products | 0.59 | | Electrical Equipment | 0.53 | | Rubber and Plastic products | 0.58 | | Fabricated Metal Products Except Machinery | 0.48 | | Other Transport Equipments | 0.47 | | Manufacturing of Computer electronic & optical products | 0.57 | | Wearing Apparel | 0.79 | | Tobacco Products | -0.23 | | Paper and Paper Products | 0.48 | | Printing and Publishing | 0.56 | | Leather and Leather Products | 0.64 | | Manufacture of Furniture | 0.89 | | Wood and Wood Products and Cork except Furniture | 0.25 | | Total | 0.41 | Note: 1. The Table covers the period from 2001-02 to 2011-12.

2. The industry-wise classification matches with NIC-2008. NIC 2004 and NIC 1998 have been suitably mapped into NIC 2008 to arrive at the industry-wise classification for years prior to 2008.

3. The annual average employment elasticity has not been calculated for certain sub sectors like crop & animal production and hunting, waste collection, treatment & disposal activities; recycling, other mining & quarrying as well as other industries due to unavailability of suitable WPI deflator for these sub sectors.

Source: Computed from ASI data | V. Conclusion and Policy Implications The aggregate employment elasticity estimates for India vary from 0.18 (arc elasticity) to 0.20 (point elasticity) during the post reform period (1993-94 to 2011-12). This implies that for every 10 per cent change in real GDP, there is about 1.8-2 per cent change in employment. Also, this employment elasticity marks a significant decline from the 1970s and 1980s. Elasticities vary considerably across sectors. While agriculture has witnessed negative elasticity, services including construction have generally been employment intensive. Manufacturing employment elasticity has hovered in the range 0.29-0.33. Within manufacturing, the employment elasticity for organized manufacturing sector based on various estimates seems to be higher, in the range 0.42-0.57 for 2000s and it has risen over the previous two decades. Given the huge productivity and wage differentials between organised and unorganised sectors, greater employment generation in organised manufacturing is crucial as it has larger multiplier effects10. The employment elasticity estimates of this study cover the period up to 2011-12. Subsequent to this, India has seen significant moderation in its GDP growth rates, particularly during 2012-13 and 2013-14. While employment numbers are not yet available for these years, Labour Bureau quarterly surveys as well as various private agencies’ information point towards moderation in employment generation. If these data sources are any hint, then one might see some changes employment elasticity depending upon the relative pace of moderation in employment generation vis-à-vis growth. Going forward, it is the relative cost of capital vis-à-vis labour and the nature of investment demand that will determine to what extent growth would be job-creating. Increased capital to labour ratio in the organised sector for a labour abundant country like India is a concern that has been well-highlighted (GoI, 2013). If India has to meet the demographic dividend challenge, focus should be on industries where employment elasticity is higher. On a rough basis, about 10 million people would need a job every year for the next 15 years (Chakraborty, 2013). Finding productive jobs for such huge numbers is a big challenge, and clearly the answer lies in stepping up growth, and importantly, stepping up the employment intensity of growth. Also, these additional jobs will have to be created keeping in mind the overall structural changes that Indian labour market has been going through, particularly in terms of movement of people away from agriculture and reduction in women labour force as they move towards education. The non-farm sector has to gear up to shoulder the burden of agriculture. Amongst the non-farm sector, while the services sector has led India’s growth and employment story for some time now, it is the manufacturing sector, particularly the organised manufacturing that has to play a more important role in creating jobs in the coming times as envisaged in the 12th Plan. Each of the approaches used in the paper has limitations that are well known. While the CAGR approach has the limitation that it measures only the arc elasticity i.e., between two time periods rather than point elasticity, it is used more often in the official circles. The regression method to compute the aggregate elasticity, despite its known advantages over the CAGR method, suffers from a major drawback in the Indian case due to the interpolation exercise required to arrive at time series information on employment11. The main aim of the paper has been to provide updated and revised estimates for employment elasticity in India at the aggregate level as well as for the broad sectors through different possible approaches recognizing the fact that individually each of these approaches has its own limitations, particularly in the Indian context. Computing employment elasticities at greater disaggregation – sector wise and state-wise - could be an area of future research. Building on this study, one could also explore what are the various macroeconomic and structural factors that have influenced employment elasticity in India.

References: Bhalla G.S (2008) ‘Globalisation and Employment Trends in India’, The Indian Journal of Labour Economics, vol 51, no 1. Chakravarty K.C (2013) ‘Environmental & Social Sustainability: Key Issues & concerns’, Yes Bank–GIZ–UNEP Sustainability Series event on Environment and Social Risk Management, Mumbai, April. Crivelli E., D. Furcerri and J.Toujas – Bernate (2012), “Can policies affect employment intensity of Growth? A Cross Country Analysis”, IMF Working paper, August. Goldar B (2000) ‘Employment growth in organized manufacturing in India’, Economic and Political weekly , vol 35, no 14, April 1-7, pp 1191-1195. Government of India (2012), 12th Plan document, Chapter 22 on Employment and Skill Development, 2012. --------(2013), Economic Survey, February. --------Report of the Subgroup on employment for the 12th five year Plan, December, 2011. Islam Iyanatul and Suahasil Nazara (2000), “Estimating employment elasticity for the Indonesian economy”, International Labour Office, Jakarta. Kannan K P and Raveendran G (2009) ‘A quarter century of jobless growth in India’s organized manufacturing’, Economic and Political weekly, vol 44, no 10, March. Kelly, G.M. (2000) ‘Employment and Concepts of Work in the New Global Economy’, International Labour Review, vol.139, no.1, pp. 5-32 Mazumdar Deepak and Sarkar Sandip (2007), ‘Employment Elasticity in organised manufacturing in India’, University of Toronto, Canada. Nagaraj R (2001) ‘Organised manufacturing employment’, Economic and political weekly, September 16,vol 35, No-38, pp 3445-3448. National Sample Survey 55th, 61th, 64th, 66th and 68th Round Papola T.S. and Partha Pratim Sahu (2012), “Growth and Structure of Employment in India: Long-Term and Post-Reform Performance and the Emerging Challenge’’, Institute for Studies on Industrial Development, New Delhi, March. Pattanaik Falguni and Nayak N C (2010), ‘Employment Intensity of service sector in India: Trends and determinants”, International conference on Business and Economics Research, Kuala Lumpur, Malaysia. Rangarajan C, Padma Iyer kaul and Seema (2007), “Revisiting Employment and Growth”, Money and Finance, September. Thomas Jose Jayan(2012) ‘India’s Labour Market during the 2000s- Surveying the changes’, Economic and Political Weekly, vol 67, no 51, December 22. United Nations (2009), Employment Elasticities Indicator (KILM 19), ILO Trends Econometric Models, International Labour Organisation (www.ilo.org/kilm). Economic and Political weekly Research Foundation database. KLEMS database (www.rbi.org.in) Website- www.mospi.gov.in (Ministry of Statistics and programme implementation) www.rbi.org.in (Reserve Bank of India).

Annex Table 1 | Table 1: Labour Force and work force participation rates (UPSS) | | | 1999-00 | 2004-05 | 2009-10 | 2011-12 | | LFPR(per 1000 persons) | | Rural Male | 540 | 555 | 556 | 553 | | Rural Female | 302 | 333 | 265 | 253 | | Urban Male | 542 | 570 | 559 | 563 | | Urban Female | 147 | 178 | 146 | 155 | | All India | - - | 430 | 400 | 395 | | WFPR(per 1000 persons) | | Rural Male | 531 | 546 | 547 | 543 | | Rural Female | 299 | 327 | 261 | 248 | | Urban Male | 518 | 549 | 543 | 546 | | Urban Female | 139 | 166 | 138 | 147 | | All India | - - | 420 | 392 | 386 | | Source-Various rounds of NSSO | |