Acknowledgements The Task Force would like to gratefully acknowledge representatives of State Bank of India, Indian Bank, ICICI Bank, J.P. Morgan Chase Bank, Deutsche Bank AG, Bank of America and Edelweiss Asset Reconstruction for their valuable inputs and suggestions. The Task Force would like to thank the representatives of National Stock Exchange of India Ltd, National e-Governance Services Ltd, Clearing Corporation of India Limited, National Securities Depository Limited, Financial Benchmark India Pvt. Ltd (FBIL), CRISIL Ratings and Khaitan & Co for their suggestions and perspectives on the secondary market for the corporate loans. The Task Force immensely benefitted from the interactions held with the officials from Securities and Exchange Board of India and Pension Fund Regulatory and Development Authority and the inputs received from The Insurance Regulatory and Development Authority of India. The Task Force profusely acknowledge their gratitude to the representatives from Kirkland & Ellis and Varde Partners for sharing their perspectives related to development of secondary market in other countries. The Task Force places on record appreciation for the valuable inputs received during the discussions held with the representatives of various Industry Associations and large borrowers’ viz., Larsen Toubro, Mahindra & Mahindra (on behalf of FICCI), Murugappa Group and Vistra ITCL India (on behalf of ASSOCHAM). The Task Force would like to place on record commendation to Dr. P K Agrawal, Senior Advisor, IBA, Shri Mahesh M Pai, Deputy General Manager, Canara Bank, Shri Nilang T Desai and Ms Saloni Thakkar from AZB Partners who participated in all the meetings of the Task Force as special invitees and contributed extensively in the deliberations. Finally, last but not the least, the Task Force would like to convey its appreciation of the excellent support provided by the Committee’s secretariat comprising Shri J P Sharma, General Manager, Shri P Khabeer Ahmed, Assistant General Manager and Shri Ankur Gupta, Manager in drafting the Task Force’s Report, promptly responding to the complex information and analytical requirements of the Task Force, and efficiently coordinating the meetings, which greatly facilitated the work of the Task Force.

| Abbreviations | | List of Abbreviations used in the Report | | AIF | Alternate Investment Fund | | APLMA | Asia Pacific Loan Market Association | | ARC | Asset Reconstruction Company | | AUM | Asset Under Management | | BCI | Borrower Confidential Information | | BO | Beneficial Owner | | CD | Certificate of Deposits | | CERSAI | Central Registry of Securitisation Asset Reconstruction and Security Interest | | CLCR | Central Loan Contract Registry | | CLO | Collateralized Loan Obligations | | CRA | Credit Rating Agency | | DDE | Digital Documentation Execution | | DVP | Delivery Versus Payment | | ECB | External Commercial Borrowing | | EPFO | Employees' Provident Fund Organisation | | FBIL | Financial Benchmarks India Pvt Ltd | | FDI | Foreign Direct Investment | | FEDAI | Foreign Exchange Dealers Association of India | | FI | Financial Institution | | FIDC | Finance Industry Development Council | | FII | Foreign Institutional Investor | | FIMMDA | Fixed Income Money Market and Derivatives Association of India | | FPI | Foreign Portfolio Investor | | IBBI | Insolvency and Bankruptcy Board of India | | IBC | Insolvency and Bankruptcy Code | | IRDAI | Insurance Regulatory and Development Authority of India | | IU | Information Utility | | KYC | Know Your Customer | | LMA | Loan Market Association | | LSTA | Loan Syndications and Trading Association | | MCLR | Marginal Cost of funds based Lending Rate | | MF | Mutual Fund | | MHP | Minimum Holding Period | | MIBOR | Mumbai Interbank Offered Rate | | MNPI | Material Non Public Information | | MROR | Market Repo Overnight Rate | | MRR | Minimum Retention Requirement | | NAMA | National Asset Management Agency | | NBFC | Non-Banking Financial Company | | NCD | Non-Convertible Debentures | | NDA | Non-Disclosure Agreement | | NDS OM | Negotiated Dealing System-Order Matching | | NeSL | National E-Governance Services Limited | | NOF | Net Owned Fund | | NPA | Non-Performing Assets | | PF | Pension Fund | | PFRDA | Pension Fund Regulatory and Development Authority | | PSB | Public Sector Bank | | PTC | Pass Through Certificate | | RBI | Reserve Bank of India | | RCs | Reconstruction Companies | | RP | Resolution Plan | | RO | Registered Owner | | RoC | Registrar of Companies | | SCI | Syndicate confidential information | | SCs | Securitisation Companies | | SCRA | Securities Contract (Regulation) Act,1956 | | SEBI | Securities and Exchange Board of India | | SMA | Special Mention Account | | SNC | Shared National Credit | | SR | Security Receipt | | SRB | Self-Regulatory Body | | T-Bills | Treasury Bills | | U.K | United Kingdom | | UPSI | Undisclosed Price Sensitive Information | | USA | United States of America | | VRR | Voluntary Retention Route |

Executive Summary 1. Background 1.1. Historically, lending has been “relationship driven” and banks have often been viewed as partners of the borrower. This approach has proved beneficial for both the borrower and the lenders. In the last three decades, globally, lending has moved from involving a single lender to involving multiple lenders via syndicated lending. This has allowed preservation of the benefits of relationship lending, as the lead lender has typically been a relationship lender, while allowing for several additional advantages such as greater access to capital for borrowers, mitigating large exposure risk for banks, allowing non-bank players such as insurance and pension funds to access this market, allowing longer tenor loans, as well as allowing lower credit quality borrowers to access the market due to participation of alternate capital providers in this market. 1.2 As volumes in the primary syndication market increased, demand for secondary trading also developed to allow for liquidity and risk management. To cater to this demand, banks started secondary trading of loans and this market is now well developed in many countries across the world. Several associations like the Loan Syndications and Trading Association (LSTA) in the USA, the Loan Market Association (LMA) in Europe, Middle East and Africa, and the Asia Pacific Loan Market Association (APLMA) in the Asia Pacific region have played an active role in the development of the secondary market for corporate loans. 1.3. In the Indian context too, various regulatory measures aimed at promoting sale of corporate loans, both standard and Non-Performing Assets (NPAs) have been undertaken by the Reserve Bank of India (RBI), which include permitting transfer of borrowal accounts from one bank to another, take-out financing, inter-bank participation certificates, transfer of assets through securitization and direct assignment of cash flows, guidelines on sale of stressed assets by banks, and very recently, permitting banks to sell certain loans (availed domestically) through assignment to eligible External Commercial Borrowing (ECB) lenders. 2. Need for a Task Force 2.1 While banks have been successful in transferring a significant quantum of their stressed loan portfolio to Asset Reconstruction Companies (ARCs) in recent years, the inter-bank bilateral transactions of loan accounts have been relatively infrequent. As regards the securitization market, it has mostly evolved in the retail segment and there has been no major break-through in the corporate portfolio. 2.2. On April 4, 2019, in the First Bimonthly Monetary Policy Meeting for the year 2019-20, it was announced that RBI would constitute a Task Force to examine the development of secondary market for corporate loans in India and make recommendations to facilitate rapid development of this market. The Task Force was constituted under the Chairmanship of Shri T. N. Manoharan1. The Terms of Reference of the Task Force are to review the existing state of the market for loan sale/transfer in India as well as the international experience in loan trading and, to make recommendations on: (i) required policy/regulatory interventions for facilitating development of secondary market in corporate loans, including loan transaction platform for stressed assets; (ii) creation of a loan contract registry to remove information asymmetries between buyers and sellers, its ownership structure and related protocols such as standardization of loan information, independent validation and data access; (iii) design of the market structure for loan sales/auctions, including online platforms and the related trading and transaction reporting infrastructure; (iv) need for, and role of, third party intermediaries, such as servicers, arrangers, market makers, etc.; (v) appropriate measures for enhanced participation of buyers and sellers in loan sale/transfer; and, (vi) any other matter incidental to the issue. 2.3 The composition of the Task Force is as under: | 1 | Shri T.N. Manoharan,

Chairman, Canara Bank | Chairperson | | 2 | Shri V. G. Kannan,

Chief Executive, Indian Banks’ Association | Member | | 3 | Shri Bahram Vakil,

Founding Partner, AZB and Partners | Member | | 4 | Dr. Anand Srinivasan,

Additional Director (Research), CAFRAL | Member | | 5 | Dr. Sajjid Z. Chinoy,

Chief India Economist, J P Morgan | Member | | 6 | Shri Abizer Diwanji,

Head of Financial Services, EY India | Member | 3. Approach/ Methodology adopted by the Task Force The Task Force held eight meetings in Reserve Bank of India, Mumbai between June and August, 2019. Details of the meetings are given in Annex I. During these meetings, the Task Force interacted with all stakeholders including public sector, private sector and foreign banks, corporates, industry bodies, ARCs, other regulators (SEBI, IRDAI, PFRDA), investment management firms, law firms, stock exchange, clearing house, depositories, information utility entities and credit rating agencies.The Task Force also consulted with offshore law firms and investment management firms to get alternate perspectives related to development of secondary market in other countries. The task force has made recommendations to develop the secondary market keeping in mind the interests of two primary players in this market – banks & borrowers. In addition, the recommendations are guided by the goal of having new types of investors participate in this market – specifically insurance companies, pension funds and international funds focusing on investing in loans. Lastly, the Task Force’s recommendations are guided by international best practices suitably adapted for the Indian context. 4. Findings and Recommendations of the Task Force 4.1 The Task Force believes that an active secondary market will deliver significant benefits to banks, borrowers and other market participants. For banks, the principal benefits would be capital optimization, liquidity management and risk management. This would in turn lead to additional credit creation at the economy wide level. For borrowers, the principal benefits would inter alia be lower cost of capital, greater credit availability, and developing new relationships with bank and non-bank providers of capital. The development of a secondary loan market will also enable enhanced return opportunities for smaller banks, NBFCs, insurance companies, pension funds and hedge funds. Also, an active secondary market for corporate loans may result in a productive and optimal deployment of capital by banks which will have a consequential positive impact from a fiscal perspective for the Government. Thus, there is a strong economic case for a regulatory push to facilitate development of secondary market for corporate loans. Lastly, the Task Force foresees a huge potential for an institutionalised secondary market for corporate loans in India, especially given the heavy reliance on bank finance by large Indian borrowers. 4.2 The Task Force is of the view that the secondary market for loans in general has not evolved to the scale of its potential. Principal factors that have impeded development of this market are absence of a systematic loan sales platform, lack of standardization in documentation and legal factors. Additionally, there is a lack of active participants and lack of an effective price discovery mechanism. Developing the secondary market for corporate loans would require enablers both on the demand as well as supply side. Some of the important enablers include changes in the regulatory framework for loan sales, broad-basing of the participant base, development of specialised entities required for expansion of secondary market, creation of market infrastructure like sales platform, and standardisation of documents and practices. 4.3 The overall market microstructure of the corporate debt market in India is also yet to evolve. Both the primary and the secondary segments of the corporate debt market continue to be dominated by issuance of bonds by infrastructure and financial services companies while the share of manufacturing firms is negligible. The Task Force is of the opinion that a well-developed secondary loan market could result in an efficient price discovery mechanism, especially for lower rated entities including the manufacturing sector, as the loan gets churned multiple times during its lifetime thereby reflecting the prevailing market perceived price. Consequentially, this could further facilitate the development of the corporate bond market as well. 4.4 The Task Force has come out with several recommendations to promote the development of the secondary market for corporate loans in India. The important recommendations include (1) Setting up of a Self-Regulatory Body (SRB) (as commonly referred to as SRO – Self Regulatory Organisation in the overseas markets) of participants which will finalise detailed modalities and formulate guidelines for various market participants (2) Standardize documentation (3) Setting up a Central Loan Contract Registry (CLCR) (4) Enable virtual information sharing with various repositories to facilitate transactions and lastly, (5) Development of a suitable /appropriate menu of benchmark rates to be commissioned by the SRB along with FBIL. 4.5 The principal regulatory changes that have been recommended are (1) Amending /provision of clarifications with respect to the extant regulations applicable to, inter-alia, securitization, asset reconstruction, Foreign Portfolio Investors (FPI) and ECB (2) Amending regulations at SEBI, IRDA and PFRDA to enable broad basing the market with effective participation of non-banking entities such as mutual funds, insurance firms and pension funds and (3) Stamp duty exemptions/clarifications. To facilitate effective lender coordination, the Task Force recommends that the SRB may consider a minimum ticket size for trading as a percentage of the loan outstanding. 4.6 In addition to the above, RBI may introduce incentives to deepen the market from time to time. The Government of India can prescribe Key Performance Indicators (KPIs) for the Public Sector Banks (PSBs) which may encourage secondary sale of loans. The detailed recommendations are given in chapter J. 5. Transition Provisions 5.1 To enable implementation of various recommendations of the Task Force in a non-disruptive manner and at the same time to ensure that the platform to be established for facilitating sale of corporate loans has the requisite liquidity to be able to achieve its objectives, the task force recommends the following transition provisions: -

All new corporate loans and the existing corporate loans due for refinancing or renewal should comply with the standardisation of documents norms. In consultation with Indian Banks Association (IBA)/Finance Industry Development Council (FIDC), the SRB may specify standardized documents for all such loans with a notified date from which these loans shall be compliant to new standards. -

Within a reasonable period of setting up of the proposed sales platform as duly notified by the SRB, which shall not be more than 3 months, all the loan sales in respect of the above said loans should be mandated to be transacted on the said platform; -

All the other existing corporate loans which do not fall due for renewal or refinancing shall comply with the standardisation of documentation and other norms set by the SRB and shall be enabled to be transacted in the loan sales platform within the timeframe stipulated as under which shall run from the above-mentioned notified date | Category | Timeframe | | Aggregate single borrower exposures across banks and NBFCs above ₹1000 crores | 2 years | | Aggregate single borrower exposures across banks and NBFCs from ₹500 crores to ₹1000 crores | 3 years | | All other corporate loans which do not fall due for renewal or refinancing | 4 years | 5.2 For the optimal sequencing of the market, the Task Force recommends that term loans be prioritized for sale in the secondary market. Subsequently, depending upon the experience gained, other categories of loans like revolving credit facilities (cash credit, credit card receivables, etc.), assets with bullet repayment and non-fund based facilities should follow suit.

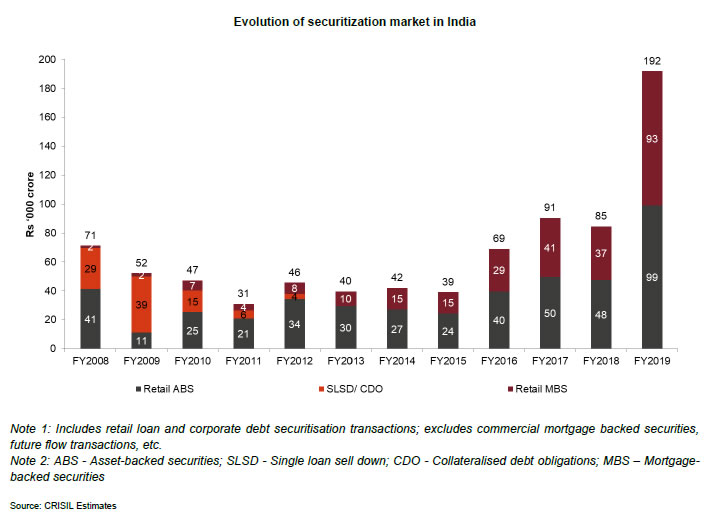

Chapter A – Introduction A.1. Current Ecosystem of Secondary Market for Corporate Loans 1. Presently, the secondary market for corporate loans in India involves inter-bank transactions including Financial Institutions (FIs) undertaken on an ad-hoc basis through transfer of borrowal accounts from one bank/FI to another, inter-bank participation certificates, take-out financing, securitisation/assignment transactions and sale of stressed assets by banks to ARCs. 2. Regulatory stipulations since 19882 allow banks to transfer the borrowal accounts from one bank to another subject to certain safeguards. Subsequently, in the light of the operational freedom granted to banks on the various aspects of credit management, banks have been advised vide circular dated May 10, 2012 to put in place a Board approved policy with regard to take-over of accounts from another bank. In addition, before taking over an account, the transferee bank should obtain necessary credit information from the transferor bank. 3. Further, vide circular dated December 31, 19883, the Reserve Bank issued guidelines on inter-bank participations with a view to provide an additional instrument for evening out short term liquidity within the banking system, provide some degree of flexibility in the credit portfolio of banks and to smoothen the working of consortium arrangements. The participation could be with or without risk sharing. As regard participations with risk sharing, the issuing bank will repay the amount of participations together with interest to the participant bank on the date of maturity, excepting when the risk has materialised. In the case of the issuing bank, the aggregate amount of participations would be reduced from the aggregate advances outstanding. Such transactions will not be reflected in the individual borrower's accounts but will be only netted out in the General Ledger. The participating bank would show the aggregate amount of such participations as part of its advances. 4. Subsequently, vide circular dated February 29, 20004, the Reserve Bank had permitted take-out financing by banks assuming either full or part credit risk, a mechanism designed to enable them to avoid asset-liability maturity mismatches that may arise out of extending long tenor loans to infrastructure projects. Under the arrangements, banks financing the infrastructure projects will have an arrangement with a FI for transferring to the latter the outstanding in their books. There are several variants of the take-out finance but typically they are either in the nature of unconditional take-out finance or conditional take-out finance though it may involve assuming full credit risk or part of the same. 5. The Reserve Bank has also issued guidelines on transfer of assets through securitization and direct assignment of cash flows vide circular dated May 7, 2012 read along with circular dated February 1, 20065, which involves pooling of homogeneous assets and the subsequent sale of the cash flows from these asset pools to investors. The securitization market is primarily intended to redistribute the credit risk away from the originators to a wide spectrum of investors who can bear the risk, thus aiding financial stability and provide an additional source of funding. Further, to ensure orderliness of the market and alignment of the interests of the originators and the investors, Minimum Holding Period (MHP) and Minimum Retention Requirement (MRR) have also been prescribed. The securitization market has evolved gradually over the last decade, although the growth has been mostly in retail asset backed and mortgaged backed securities as shown below.  6. As regards stressed assets, extant guidelines of RBI on sale of stressed assets by banks dated September 1, 2016 envisage the development of a vibrant market for stressed assets by facilitating the creation of a pool of prospective buyers through an auction process which results in a market determined price discovery mechanism. While inter-bank transactions in the secondary market for standard assets has not seen much liquidity, the ARC model for stressed assets has witnessed significant activity with banks off-loading their stressed assets to ARCs to clean up their balance sheets. The existing recovery ecosystem is fairly well diversified with around 24 ARCs registered with RBI which are currently operating in the market. This ecosystem has been gradually strengthened by a slew of effective regulatory measures to ensure a swift resolution of stressed assets. Some of the important facilitating regulations under the prevailing system are given below: i. The guidelines on sale of stressed assets facilitate debt aggregation by Securitisation Companies (SCs)/ Reconstruction Companies (RCs) through a Swiss Challenge Method, wherein the SC/RC which has already acquired the highest significant stake is given preference through the bidding mechanism. ii. There are no specific ceilings or flooring limits on the extent of debt an ARC can take over from banks. iii. Various resolution strategies adopted by an ARC include taking over or changing the management of the business of the borrower, sale or lease of the business of the borrower, restructuring or rescheduling of debt and enforcement of security interest, referring the borrowers under IBC, etc. iv. The extant guidelines do not prohibit banks from taking over standard accounts from SCs/RCs. Accordingly, in cases where SCs/RCs have successfully implemented a restructuring plan for the stressed assets acquired by them, banks may, at their discretion, with appropriate due diligence, take over such assets after the ‘specified period’ provided that the account performed satisfactorily during the ‘specified period’. However, a bank cannot at any point of time take over from SCs/RCs the assets they have themselves earlier sold. v. Further, keeping in view the greater role envisaged for ARCs in resolving stressed assets as also the recent regulatory changes6 governing sale of stressed assets by banks to ARCs, the minimum Net Owned Fund (NOF) requirement for ARCs has been stipulated at ₹100 crore on an ongoing basis. vi. The extant guidelines permit 100 per cent foreign direct investment (FDI) in ARCs under the automatic route. Also, Foreign Institutional Investors (FIIs) /Foreign Portfolio Investors (FPIs) are permitted to invest up to 100 per cent of each tranche in security receipts issued by ARCs. 7. Banks have been successful in transferring a significant quantum of their loan portfolio to ARCs through the course of time, with an enhanced trend evidenced in the recent years as given below. | (₹ in Cr) | | Book Value of Assets taken over by ARCs from banks/FIs | FY 2018-19 | FY 2017-18 | FY 2016-17 | FY 2015-16 | | 379383 | 323662 | 256653 | 225862 | | Source: Supervisory Returns | 8. As such, the ARCs which enjoy a collective market share of 90% or more in terms of Asset Under Management (AUM) have outstanding Security Receipts (SRs) aggregating to ₹1.01 lakh Cr (held by the Trusts and banks) which is reflective of the activeness of the ARC market. | Name of SC/RC | SRs Outstanding as on March 31, 2019

(₹ in Cr) | | Edelweiss Asset Reconstruction Company Limited | 46423.59 | | JM Financial Asset Reconstruction Company Limited | 14043.83 | | Asset Reconstruction Company (India) Ltd | 11901.5 | | Asset Care Enterprise Ltd | 9320.48 | | Phoenix ARC Pvt Ltd., Mumbai | 7890.58 | | Invent Assets Securitisation & Reconstruction Pvt Ltd | 4231.2 | | Suraksha Asset Reconstruction Private Limited | 3943.88 | | Reliance Asset Reconstruction Co Ltd | 2113.58 | | Alchemist Asset Reconstruction Company Ltd. | 2084.58 | | Total | 101953.22 | | Source: Supervisory Returns | 9. Further, the Prudential Framework for Resolution of Stressed Assets issued by Reserve Bank on June 7, 20197 stipulates that the Resolution Plan (RP) put in place by the lenders may involve any action including sale of the exposures to other entities / investors. Hence, the prudential framework enables sale of stressed standard assets, which are in default, as part of the resolution process. 10. Very recently, the Reserve Bank vide circular dated July 30, 2019 has permitted banks to sell, through assignment, certain loans (availed domestically for capital expenditure in manufacturing and infrastructure sector if classified as Special Mention Account (SMA)-2 or NPA, under any one time settlement with lenders) to eligible ECB lenders provided, the resultant external commercial borrowing complies with all-in-cost, minimum average maturity period and other relevant norms of the ECB framework. 11. As may be seen, the Reserve Bank has undertaken several initiatives over the years to facilitate sale of borrowal accounts through various channels. However, despite the above measures, the secondary market for loans has not fully evolved owing to various factors mentioned in the next paragraph. A.2. Impediments for the growth of the Secondary Market 1. The Task Force is of the view that the secondary market in its present form faces some major challenges as given below, some of which are also experienced by the corporate bond market: a) lack of a sufficient number of active participants, b) lack of an effective, reliable and diligent price discovery mechanism, c) absence of a systematic loan sales platform, d) lack of standardisation in loan and transfer documentation, e) information asymmetry, f) issues of stamp duty during diligence and transfer, processes for recreation or re-perfection of security, etc, g) Issues in registration process, h) Regulatory restrictions and i) Lack of adequate incentives for stakeholders 2. The secondary market for loans in general has not fully evolved to the scale of its potential owing to the above mentioned factors. As regards the securitization market, it has mostly evolved in the retail segment and there is no significant activity in relation to corporate loans. Further the prevailing securitisation/assignment guidelines8 do not permit transactions in NPAs. The inter-bank bilateral transactions of loan accounts are very few. Further, the ARC model for stressed assets encounters certain other major challenges like capital constraints, pricing, market related constraints in aggregation of loans from all the creditors, availability of expertise to enable turnaround of the acquired stressed entities, etc. A.3. Benefits of an active Secondary Market The various benefits envisaged by the Task Force for the various stakeholders through an active secondary market include the following: 1. Benefits for Lenders i. Capital Optimisation: Banks can unlock their capital by down selling their exposures towards certain identified borrowers which may help them in taking advantage of new lending opportunities. As such, the secondary market can serve as an effective tool to actively manage their loan portfolios to comply with regulatory capital requirements on an ongoing basis. Further, this will facilitate transferring exposures post-implementation in the case of project finance loans to providers of long term capital outside the banking system. ii. Liquidity Management: The secondary market can help banks in managing their asset liability mismatches by facilitating liquidation of a long term exposure and deployment of those funds to meet unforeseen obligations. iii. Price Discovery Mechanism: A well-developed secondary loan market could result in an efficient price discovery mechanism as the loan gets churned multiple times during its lifetime thereby reflecting the prevailing market perceived price. This would in turn facilitate appropriate pricing of future loan assets of same borrower/sector. iv. Exposure management: An effective secondary market for corporate loans could enable adherence by banks to the large exposure framework prescribed by the Reserve Bank of India9. v. Risk Management: The banks can mitigate their potential concentration risk in respect of a specific borrower group, sector, geography, maturity duration etc. which was not initially envisaged at the time of loan origination. vi. Opportunities for Smaller banks: All banks may not get the opportunity to participate in large and highly creditworthy lending exposures at the time of origination. However, the secondary market can enable them participate in such exposures at a later stage. vii. Crystallizing losses: In respect of potentially stressed borrowers, the secondary market helps the banks in reducing the overall cost related to recovery proceedings as the lenders can go for an immediate realization of value even before the borrower defaults. 2. Benefits for Borrowers i. Widening of lenders base: It enables the larger borrowers to widen their lenders base thereby avoiding funding uncertainties associated with having banking relationship with one or few lenders. It helps the borrowers to have better access to market participants with different risk appetites by multiple trenching of loans basis security coverage, maturity, etc. ii. Ease of Borrowing: The secondary market for corporate loans helps the borrower by enabling a single point of contact for their borrowing needs (Facility Agent) and quicker loan tie-ups. iii. Refinancing Options: A borrower can also use this mechanism to retire the existing loans and avail funds/debt at a lower cost. 3. Benefits for the Government of India i. Optimal capital infusion in PSBs: As the overall quality of credit administration process at banks will improve through an active secondary market for corporate loans, the same may result in a productive and optimal deployment of capital by banks which will have a consequential positive impact from a fiscal perspective for the Government of India in optimizing the capital infusion in PSBs. ii. General positive impact on the economy: A better secondary market will widen the sources of capital, raise transaction volumes, allow skilled/specialist capital to get involved, provide replacement capital with time horizons that match the revised reality of the underlying borrower, all of which may improve the health of the financial and real sector of the economy. 4. Other Benefits Envisaged i. Development of Corporate Bond Market: An effective price discovery mechanism through the secondary market for corporate loans may consequentially facilitate the development of a deep bond market. Such price discovery would spur innovations in the securitisation market as well as invigorate dormant markets such as corporate Credit Default Swaps (CDS). ii. Acquisition of Controlling Stake: The secondary market may provide a platform for the specialist investors who may buy a large portion of a distressed borrower’s debt, potentially with a view to acquire controlling stake in the company. iii. Opportunities in Stressed Entities: An investor may participate in the loan obligation of a stressed entity through the secondary market to influence the borrower’s insolvency or resolution process based on its assessment of the probability of reviving the company and make profit from any upside value of the business. In some cases, the investor may also take a view that the recovery through breakup value of assets or via insolvency will be sufficient to give a decent return on the original investment. iv. Improving origination standards: A robust secondary market would provide with early warning signals regarding riskiness of the debt being held by the banks which would incentivize improving the underwriting and origination standards. v. Positive impact on performance: Further, empirical research10 has established that the borrowers of traded loans of reputed arrangers perform better than the borrowers of non-traded loans, which can be possibly attributed to the fact that the data on traded loans is accessible to all the interested stakeholders thereby incentivizing the borrowers of traded loans to improve performance. A.4. Major Enablers for the development of a Secondary Market 1. Supervisory data of the RBI indicates that 96,303 borrowers have an aggregate credit exposure of ₹5 cr and above from the banking system, with 266 of them having an aggregate exposure of ₹5000 cr or above. Granular data is as given below. | Ticket-wise Exposure Details | Aggregate Credit Exposure from the Banking System

(as on June 30, 2019) | Number of Borrowers | Aggregate Exposure to Banking System by these borrowers

(₹ in cr) | | ₹5 cr to ₹250 cr | 91995

(95.53%) | 21,66,801

(22.11%) | | ₹250 cr to ₹500 cr | 1883

(1.95%) | 6,57,927

(6.71%) | | ₹500 cr to ₹1000 cr | 1118

(1.16%) | 7,77,586

(7.94%) | | ₹1000 cr to ₹2000 cr | 641

(0.67%) | 8,81,337

(8.99%) | | ₹2000 cr to ₹5000 cr | 400

(0.41%) | 12,53,644

(12.79%) | | >₹5000 cr | 266

(0.28%) | 40,61,710

(41.46%) | | Source: CRILC | In India, the corporates continue to predominantly depend on banks for their financial needs. Notwithstanding the various steps taken by the government, Reserve Bank of India and various other regulators to augment alternative sources of credit flow to the economy, the desired results have not been significantly visible and the corporate sector’s over-reliance on bank borrowing appears to continue. 2. The Task Force foresees a huge potential for an institutionalised secondary market for corporate loans in India, especially given the heavy reliance by borrowers on bank finance as mentioned above. Developing the secondary market for corporate loans would require enablers both on the demand as well as supply side. Some of the important enablers would include the steps to remove the impediments as listed at para A.2 above. These issues are dealt with in detail in subsequent chapters. Chapter B – International Experience B.1. Genesis of the Secondary Market 1. Historically, banks have originated loans and held them to maturity. Lending has been “relationship driven” and banks are viewed as partners of the borrower. This approach has historically proved beneficial for both the borrower and the lenders. In the last three decades, globally, lending has moved from involving a single lender to involving multiple lenders via syndicated lending. This has allowed preservation of the benefits of relationship lending, as the lead lender has typically been a relationship lender while allowing for several additional advantages of loan syndication. As volumes in the primary syndication increased, demand for secondary trading also developed to allow for liquidity and risk management. Realizing this, banks started secondary trading of loans and it is now instituionalised in international financial markets. 2. Under the originate-to-distribute models, banks originate loans, earn fees in the process, and then distribute the loans to other investors through securitization, syndication or outright sale. Several associations like the Loan Syndications and Trading Association (LSTA) in the USA, the Loan Market Association (LMA) in Europe, Middle East and Africa, and the Asia Pacific Loan Market Association (APLMA) in the Asia Pacific region have played an active role in the development of the secondary market. B.2. Evolution of the Secondary Market in US 1. Initially, like any other market, banks in US too held the loans in their books till maturity. The secondary market for leveraged loans (loans to companies with non-investment grade ratings) started evolving during the 1990s as the default rates for these loans started rising sharply owing to recession. In the process, a new distressed secondary market for leveraged loans evolved and loans emerged as an institutional asset class and were not only held by banks but were also sold to other banks, mutual funds, insurance companies, structured vehicles, pension funds and hedge funds. The broader investor base resulted in a significant growth in the volumes of the loans being originated in the primary market and subsequently traded in the secondary market. Thereafter, to facilitate the drafting of standard trading documentation and standard market practices, the Loan Syndication and Trading Association (LSTA) was formed in 1995. 2. The market has continuously evolved with the annual secondary loan trade volumes recorded as high as USD 720 bn during 201811. In terms of traded asset classes, the market in US can be segregated into leveraged loans (non-investment grade) constituting 46%, investment grade loans constituting 38% and middle market loans (upto $500mn) constituting the remaining 16% of the traded loans. The outstanding leveraged loans traded in the LSTA has been significantly higher over the years as depicted below: 3. The primary participants in the secondary loan market of the US are banks, Loan Mutual Funds (MFs), Insurance Companies, High Yield Funds and participants through Collateralized Loan Obligations (CLOs)12. The participant base has significantly shifted towards CLOs and MFs over the last few years as shown below.

4. The development and deepening of the secondary market appears to have benefitted the primary market in improving the loan origination standards. The trend in the overall credit facilities and commitments under the Shared National Credit (SNC) Portfolio in the USA reflected significant growth over the years. The SNC Program is governed by an interagency agreement among the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency. The program enables review of risk in the largest most complex credits shared by multiple regulated financial institutions. The decline in SNC facilities during 2018 was mainly on account of the increase in the minimum commitment prescription from USD 20 mn to USD 100 mn with effect from January 1, 2018. B.3. Evolution of the Secondary Market in Europe 1. The growth in borrowing requirements in Europe during the 1970s had witnessed loan facilities traditionally provided on a bilateral basis, increasingly replaced by larger credit lines from a pool of lenders, and then by loan facilities syndicated to the wider market. Up to the mid-1990s, participation in the secondary loan market in Europe was dominated by a small number of US banks, predominantly investment banks, specialist debt traders and vulture funds, with activity focused on the distressed market. However, from the mid-1990s onwards, institutional investors and other non-bank financial institutions increasingly looked to the secondary loan market to invest their money. Today's secondary loan market is utilised by a diverse and vast number of participants, including investment banks, commercial banks, hedge funds, pension funds, private equity funds and specialist loan brokers, each looking to transact in par, near par and/or distressed debt. In addition, government agencies, such as the Irish National Asset Management Agency (NAMA), were set up to buy non-performing debt as a result of the 2007-2009 financial crisis. 2. In order to address the issues of standardization of practices, a group of banks formed the Loan Market Association (LMA) in 1996. The loan volumes have since increased significantly and stood at Euro 1000 bn during 201813. 3. While LSTA prescribes more of standards/recommendations which do not have a binding character, LMA follows a rule based approach. The time taken for settlement in LMA is 10 to 20 days and the enforcement mechanism adopted by LMA in penalising defaulters has led to a highly disciplined market as against the recommendatory nature of approach adopted by LSTA. While due diligence is mostly undertaken before execution of the trade, the time taken in settlement is reportedly on account of documentation processes. 4. Membership of the LMA currently stands at over 600, covering more than 50 nationalities, and consists of banks, non-bank lenders, borrowers, law firms, rating agencies and service providers. The LMA has expanded its activities to include all aspects of the primary and secondary syndicated loan markets. B.4. Evolution of the Secondary Market in Asia Pacific Region 1. The Asia Pacific Loan Market Association (APLMA) is a pan-Asian association to promote growth and liquidity in the primary and secondary loan markets of the Asia-Pacific region. Founded in 1998 by a core group of founding member banks, the APLMA together with the LMA, LSTA and other associations monitors global market trends as part of its effort to more closely integrate the Asian loan markets into an increasingly globalized loan market. 2. The APLMA has been focusing on the creation, promotion and updation of the documentation for syndicated loan transactions. The APLMA also assists the market participants in their day to day loan market activities viz., term sheets, mandate letters, confidentiality letters, templates for secondary market transactions, etc. The traded volumes in Asia Pacific Region are given below. Chapter C – Proposed Anatomy of a Secondary Market Transaction The origination of the loan transaction takes place in the primary market; it is where the lenders lend directly to the borrowers. Following the completion of the transaction, the loan becomes 'free for sale', subject to the terms and conditions contained in the credit facility agreement and applicable law. The secondary loan market refers to the sale of the loans by the originating lenders to purchasers of the loan and subsequent sales. The proposed changes to the secondary market system are expected to significantly augment the market depth. The various stages involved in a sale process along with proposed architecture of the secondary loan market are detailed in the subsequent paragraphs. C.1. Posting of an identified asset for sale 1. The sale shall commence when a prospective seller decides to sell an identified asset. The selling bank shall post the identified asset along with the bid document setting out details of borrower, exposure proposed to be sold, process for bidding, timelines etc. on a sale platform proposed to be built by the Central Loan Contract Registry (CLCR). Sellers can also specify if bidding is via Swiss challenge method or any other method in accordance with internal board approved policies and applicable laws. Anyone who accesses the Platform will first see an annotated list of invitations to offer sale of loan contracts which will be put up by prospective sellers. It is not necessary that a sale on the platform must take place via an auction process (whether one or multiple rounds) – the manner of sale (including a bilateral arrangement) may be determined entirely by the seller and where relevant, the buyer. 2. The prospective buyers shall express interest in the particular loan through the sale platform. Once a prospective buyer expresses interest in a particular loan contract, the proposed buyer will be required to provide Know Your Customer (KYC) details to the seller via the platform. Upon receipt of the buyer’s expression of interest and furnishing of KYC details, the seller will have the option to accept or reject such expression of interest. If accepted, the buyer will be required to enter into a non-disclosure agreement (“NDA”) with the seller. 3. The parties must be aware of any restrictions contained in the underlying credit facility agreement regarding the type of entity to whom loans can be transferred. However, these would be addressed through inclusion of standardized enabling covenants in the loan document at the time of origination itself. Banks must be required to adopt standardized enabling covenants in the underlying credit facility agreement at the time of origination of loan. C.2 Due Diligence 1. The prospective buyer may wish to undertake due diligence on the loan asset proposed to be acquired. Upon signing the Non-Disclosure Agreement (NDA), the prospective buyer will be provided access to a data room / server where execution versions of the underlying contracts and relevant information and documents are stored. With access to the information on loan contracts, the buyer will conduct a due diligence on the documents. 2. Information sharing between the Registrar of Companies (RoC), Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI), Information Utility (IU) and the Platform should be facilitated such that the buyer can verify details of security interests and perfection related filings with the ROC, CERSAI, IU via / access through the Platform. The other specific issues in respect of due diligence and confidentiality aspects have been discussed in subsequent chapters. C.3 The Bidding Process 1. If satisfied with the information on the underlying contract, bid process as prescribed under the Bid Document shall be followed, including detailed negotiations regarding the underlying terms and conditions, the pricing, the facility and specific tranche, the form of purchase and other related aspects etc. A deal ticket containing the term sheet to be issued both by the designated official of the buyer and the seller shall be independently confirmed by another designated official of the same two parties. This is a usual practice in international markets to avoid execution of unauthorized deals. Post negotiations, the parties shall confirm intention to complete the transaction by execution of a term sheet followed by final transfer documentation. Accordingly, the transaction shall be confirmed by both the parties on the sales platform as well. 2. If more than one potential buyer express interest, provide KYC details and undertake due diligence, then the ‘best bid’ as determined by bid process on the sales platform may be selected for execution of the transaction. The transfer documentation shall be standardised by the self-regulatory body to avoid any ambiguity in the transfer process. C.4 Consent from the Parties 1. The standardized credit facility agreement and transfer documentation shall contain comprehensive provisions in which all relevant parties (including the borrower’s consent, if required) agree that, subject to other conditions to any transfer set out in the said credit facility agreement being complied with, they consent to the sale transaction. 2. There could be cases where borrower consent is deemed in the credit facility agreement, for sale in the secondary market. The agreement may also provide for intimation to the borrower whose consent cannot be withheld beyond a stipulated reasonable period. There can be cases, where borrower consent is deemed so long as the sale in the secondary market is only to identified buyer or to an institution within a designated class or where the sale is to any buyer other than those mentioned (Negative list). 3. In the context of Indian law, where no borrower consent requirement is expressly prescribed, the transfer of contractual rights and obligations would not require borrower consent. International practice indicates that generally the borrower consent is deemed. However, in certain cases, borrowers who have the negotiation leverage may ensure incorporation of a restrictive covenant in the credit facility agreement (Negative list). The Task Force expects the Indian market to develop in a similar manner. C.5 The Transaction Mechanism 1. The transaction shall result in the lender disposing of its loan commitment (fully or partially depending upon the extent of sale), with the new lender assuming a direct contractual relationship with the borrower. Internationally, the secondary market transaction of the loans take place through novation, assignment, funded participation and unfunded risk participation. In a funded participation agreement, the buyer takes a participating interest in the selling lender’s commitment. The lender remains the official holder of the loan, with the participant owning the rights to the amount purchased. Unfunded risk participation is a type of off-balance sheet transaction in which a bank sells its exposure in respect of a contingent obligation to another financial institution. Final movement of principal funds in case of risk participation takes place only in the event of default, like in the case of credit default options. 2. In the Indian context, extant guidelines already permit banks to transfer assets through direct assignment of cash flows vide circular dated May 7, 2012 read along with circular dated February 1, 200614, which involves single standard asset or a part of such an asset or a portfolio of such assets. 3. In view of the foregoing, the Task Force recommends the following forms of transfer mechanisms in the proposed secondary market for corporate loans to transfer the loan from the seller to the buyer. a) Assignment Assignment is understood to be a transfer from one person to another (respectively the transferor and the transferee) the whole or part of an existing right or interest in intangible property presently owned by the assignor. As a matter of legal principle, there can only be an assignment of rights but not the “burden of a contract”. Under this mechanism, the selling banks can transfer the asset in full or part or a portfolio of such assets to the purchasing entity through an assignment document. The transfer through assignment should be absolute (.i.e., an unconditional transfer), duly executed by the existing lender, the new lender and notified in writing to the borrower and any other agent under the credit facility agreement. b) Novation In legal parlance, a transaction can be said to be a “novation” if there is transfer of rights and obligations from one party to another. As a rule, obligations cannot be assigned without the consent of the promisee and when such consent is given, it is a novation resulting in substitution of liabilities (along with transfer of rights). In other words, ‘Novation’ is a mechanism through which a lender can effectively 'transfer' all its rights and obligations under the credit facility agreement. The process of transfer by novation effectively cancels the existing lender's obligations and rights under the loan, while the new lender assumes identical new rights and obligations in its place. The contractual relationship between the transferring lender and the parties to the credit facility agreement ceases and the new lender enters into a direct relationship with the borrower, the agent and the other lenders. At the time when the new lender becomes a party to the facility agreement, the loan could be either fully or partially drawn, if it is a term loan facility. The transfer by way of novation may be effected by the execution of appropriate documents (including Transfer Certificate) and must provide for transfer of rights and liabilities. The approach of novation would be most relevant in case of transfer of non-fund based facilities. 4. In both the above transfer mechanisms, the sale shall be only on cash basis and the consideration shall be received not later than at the time of transfer of assets which shall be effected within the stipulated time limit from the date of execution of the term sheet. In the initial phase, only assignment and novation modes of sale of asset are recommended. As the market matures, the other modes of transfers such as funded and unfunded risk participation may also be considered. C.6 Execution of Transaction: The final stage of the transaction involves execution of the transaction documents, completion of conditions including receipt of consent from borrower, facility agent and security trustee (if stipulated under the underlying credit documentation), effecting the change in the record of ownership at the CLCR and funds settlement at the settlement bank. The borrower/ seller/ Security Trustee shall make filings with the relevant registries (including IU, ROC, CERSAI, Sub-Registrar of Assurances) for perfecting and the transfer of underlying security interests wherever applicable. It is, however, recommended that the security be created in favour of a security trustee such that on assignment of loans, no security transfer/perfection requirements with registry bodies is required C.7 Post Sale Aspects: 1. The sale consideration should be market-based and arrived at in a transparent manner. The sale shall result in immediate legal separation of the selling bank from the assets which are sold, to the extent of sale transaction and / or except to the extent of MRR. The assets should stand completely isolated from the selling bank (to the extent of sale transaction and / or except to the extent of MRR), after its transfer to the buyer, i.e., put beyond the selling bank’s as well as its creditors' reach, even in the event of bankruptcy of the selling/assigning/transferring bank. 2. The selling bank should effectively transfer all risks/ rewards and rights/ obligations pertaining to the asset and shall not hold any beneficial interest in the asset after its sale (to the extent of sale transaction and / or except to the extent of MRR). The buyer should have the unfettered right to pledge, sell, transfer, assign or exchange or otherwise dispose of the assets free of any restraining condition. The selling bank shall not have any economic interest in the assets after the sale and the buyer shall have no recourse to the selling bank for any expenses or losses that may materialize subsequent to the transaction. 3. Any re-schedulement, restructuring or re-negotiation of the terms of the underlying agreement/s effected after the transfer of assets to the buyer, shall be binding on the buyer and not on the selling bank except to the extent of MRR. The transfer of assets from selling bank must not contravene the terms and conditions of any underlying agreement governing the assets and all necessary consents from obligors (including from third parties, where necessary) should have been obtained. C.8 Process Flow The proposed process flow of a sale transaction with indicative timelines is given below: Sr.

No. | Steps | Description | Timelines | | 1. | Posting of potential loan asset on CLCR/Sales Portal along with Bid Document | • Prospective sellers (referred to as sellers) to post details of portfolio / loan accounts proposed to be sold along with a bid document setting out details of borrower, exposure proposed to be sold, process for bidding, timelines etc. (“Bid Document”) to be standardised and prescribed by the self-regulatory body.

• Prospective buyers (referred to as buyers) who access the Platform will first see an annotated list of invitations to offer sale of loan contracts which will be put up by prospective sellers.

• The prospective buyers may express interest in the particular loan through the portal.

[Note: Sellers can specify terms and process of bidding including if bidding is via Swiss challenge method etc in accordance with internal board approved policies and applicable laws. Any specified bidding terms – standard terms and conditions for bidding as prescribed by the self-regulatory body would be universally applicable on the transactions undertaken in the sales platform.] | T-X1 | | 2. | Prospective buyer’s expression of interest | • Once a buyer expresses interest in a particular loan contract, it will be required to provide KYC details to the seller via the Platform.

• Upon receipt of the buyer’s expression of interest and KYC details, the seller will have the option to accept or reject such expression of interest.

• If accepted, the buyer will be required to enter into a non-disclosure agreement (“NDA”) with the seller.

[Note: Template NDAs to be provided on the Platform] | T-X2 | | 3. | Access to data room | Upon signing the NDA, the prospective buyer will be provided access to a data room / server where execution versions of the underlying contracts and relevant information and documents are stored.

[Note: As there may be stamp duty implications for storing and accessing these documents outside the State in which these documents are stamped, it is recommended that – (1) parties should be exempt from payment of stamp duty for documents accessed for conducting a due diligence; or (2) execution versions should be shared with appropriate representations and warranties by the seller in the transfer documentation about the authenticity and completeness of such documents] | T-X3 | | 4. | Buyer due diligence | • With access to the information on credit facility agreement, the buyer will conduct a due diligence on the documents and information available in the public domain.

• There should be information sharing between the ROC, CERSAI, IU and the Platform such that the buyer can verify details of security interests and perfection related filings with the ROC, CERSAI, IU via / access through the Platform. | T-X4 | | 5. | Submission of Bid and Bid process | • If satisfied with the information on the underlying contract, the buyer will propose a purchase consideration amount through the portal.

• Bid process as prescribed under the Bid Document to be followed – including detailed negotiations etc. | T | | 6. | Acceptance of Bid | Post negotiations, the parties may concur to execute the transaction or may decline to proceed. In the event of concurrence, the parties will confirm intention to complete the transaction by execution of the term sheet – this can be binding or non-binding (as indicated by the seller under the Bid Document- unless the parties subsequently agree differently). | T+1 | | 7. | Request for Consent | Facility Agent sends request for consent from all the relevant stakeholders | T+2 | | 8. | Receipt of Consent | Consent received from all the stakeholders | T+5 | | 9. | Execution of transaction documents and assignment | The final stage will involve-

• execution of transaction documents,

• Effecting the change in the record of ownership at the CLCR, documents exchange via a regulated settlement agent and funds settlement at the settlement bank on DVP 1 basis respectively. | T+7 (for standard assets)

T+15 (for stressed assets) | | 10. | Perfection of novation/ assignment of loan and security | Borrower/ seller/ Security Trustee to make filings with the relevant registries (including IU, ROC, CERSAI, Sub-Registrar of Assurances) for perfecting assignment of the loan and underlying security interests | T+10 (for standard assets)

T+20 (for stressed assets) | Chapter D - Proposed Architecture for the Secondary Market D.1 Transferrable Asset Classes 1. For the optimal sequencing of the market, the Task Force recommends that term loans be prioritized for sale in the secondary market. Subsequently, depending upon the experience gained, other categories of loans like revolving credit facilities (cash credit, credit card receivables, etc.), assets with bullet repayment and non-fund based facilities should follow suit. 2. In order to widen the horizon of participants, both standard and non-performing loans may be permitted for sale under the secondary market. 3. In the overseas markets, there is no threshold determined for trading in corporate loans. However, in the Indian context, it is considered necessary to restrict the overall number of holders of a corporate loan at any given point of time. Therefore, it is recommended that the SRB may stipulate the minimum ticket size that shall be eligible for sale. The Task Force is of the view that 5% or 10% of the loan outstanding can be a reasonable threshold limit in this regard. D.2. Self-Regulatory Body (SRB) 1. The Reserve Bank may facilitate, within three months from the date of acceptance of the recommendations of this Task Force, the formation of a SRB, similar to LSTA, LMA or APLMA, which may be assigned the following responsibilities to: a) specify standard documentation and covenants, b) periodically review the documentation and covenants, c) ensure standardization of practices, d) implementation of transition provisions for existing corporate loans, e) promote growth, liquidity, efficiency and transparency of the secondary market for corporate loans in alignment with the broad regulatory objectives, f) review and notify the minimum threshold eligible for sale on the basis of granular data available from time to time, g) evolve detailed guidelines for the facility agents, h) devise the disclosure standards for the borrowers and also to address the issue of confidentiality, MNPI, NDA and related aspects, i) initiate discussion with banks and IU to establish the CLCR by working out the detailed design structure, infrastructure, technological aspects, nature of incorporation, ensuring legal sanctity of its operations, executing agreements with other agencies, etc., j) work out the eligibility criteria for accreditation of various market intermediaries like facility agents, security trustees, investment bankers, arrangers, law firms, valuation agencies, etc. Applications may be invited for the above roles from interested entities and accreditation may be granted after appropriate due diligence of their financials, past track record, fit and proper criteria, etc., k) notify a small menu of external benchmarks in consultation with FBIL, to be adopted by all the lenders to facilitate standardization, l) collate, analyze and disseminate relevant market data to stakeholders and m) providing training and education to member banks & other stake holders on secondary markets. 2. The SRB may be an association set-up by Scheduled Commercial Banks, Public Financial Institutions and other related entities, and may be incorporated as a Section 8 Company under the Companies Act, 2013 similar to FIMMDA or FEDAI. All the initial activities undertaken by the SRB shall be in close consultation and concurrence with the Reserve Bank of India. It is suggested that the SRB may interact with LMA, LSTA or APLMA as deemed appropriate to commence its operations and carry out its mandate in a time bound manner. D.3. Market Participants 1. Banks and NBFCs are currently the only participants in the primary and secondary loan market. Additionally, domestic and foreign investors participate in distress debt via ARCs. Internationally, secondary loan market is utilized by diverse and vast number of participants including investment banks, commercial banks, hedge funds, pension funds, loan mutual funds, insurance companies, private equity funds and specialist loan brokers. In the Indian context, with a view to boost the secondary market, it is essential to widen the spectrum of participants. The recommendations of the Task Force in this regard are discussed below. 2. While scheduled commercial banks are expected to actively participate in the proposed secondary market, other players including RBI registered Non-Banking Financial Companies (NBFCs), ARCs (for stressed assets), Public Financial Institutions, Insurance Companies registered with IRDAI, Pension Funds registered with PFRDA, Mutual Funds, Alternate Investment Funds (AIFs) and FPIs registered with SEBI may also be permitted to participate in the market to provide liquidity and ensure orderly development of the market. 3. Currently, securitization is permitted only for pool of homogenous assets. RBI may consider permitting single loan securitization to incentivize investors to acquire loans through secondary market mechanism. 4. Foreign Portfolio Investors (FPIs) are presently allowed to invest in stressed assets through SRs issued by ARC or they directly invest in Non-Convertible Debentures (NCDs)/bonds issued by borrowers. FPIs are not permitted to acquire any NPAs directly from banks / NBFCs. These FPIs have to come through the ARCs to participate in the distressed loan market. These prescriptions limit competition and interest in NPA sales by banks and probably results in lower recoveries for banks and create other related issues. The Task force is of the opinion that there is an urgent need to address this dichotomy. Many industry participants with whom the Task force interacted also observed that this structure limits participation by FPIs due to the following reasons: -

Only a handful of ARCs are active and have the necessary expertise and resources to engage in the market for acquisition and restructuring of NPAs. These handful of ARCs dominate the market and they may have strong tie ups with a few FPIs which perceivably restricts entry of new investors. -

Credit risk assessment by FPIs and ARCs may vary. By requiring ARC participation, ARCs are elevated to a second investment committee for the FPI and ARCs effectively get a “veto” on credit investments in NPAs by FPIs (including having a veto as to the acquisition price). In fact, the extant structure has the effect of forcing a “partnership” between an ARC and an FPI, even if the risk appetite and commercial objectives of these entities may vary distinctly. -

Such “veto” right of ARCs is creating a bottle-neck in the market, reducing transparency, competition and thereby prejudicing recoveries by lenders including public sector banks. Effectively if an FPI must bid for NPAs through one of the few ARCs rather than directly, the number of bidders are reduced to such number of active ARCs. -

Despite having extensive experience in NPA restructuring, distressed asset FPIs are denied ability to control decisions regarding the loan assets as ARCs can often control much of the process. -

ARCs are required to invest 15% acquisition price to ensure skin in the game, but capital availability is a constraint that acts as an impediment thereby restricting number of transactions. -

Even if majority of the capital (85%) is invested by the FPIs, ARCs charge fees which could have gone to Indian lenders as part of their recoveries. 5. All of the above concerns would be rectified if it is stipulated that securitization trusts can be used by FPIs for acquisition of NPAs also. This should not impact the general business of ARCs and partnerships between ARCs and FPIs can continue where it adds value and there are genuine business synergies and commonality of goals. Instead, ARCs can be permitted to act as debt arrangers to help fill a void currently seen in the Indian market in this regard in respect of NPAs. ARCs are in many ways perfectly placed to perform this role for NPAs. However, presently they are not permitted to charge for this service. It is recommended that ARCs be permitted to do this role and charge for the service. 6. Further, FPI Investors may also be allowed to directly purchase distressed loans from banks within permissible annual prudential limits defined by RBI in consultation with the Government of India. Incidentally, as mentioned earlier, the Reserve Bank vide circular dated July 30, 2019 has partially liberalized this position by permitting banks to sell, through assignment, certain loans (availed domestically for capital expenditure in manufacturing and infrastructure sector if classified as SMA-2 or NPA, under any one time settlement with lenders) to eligible ECB lenders provided, the resultant external commercial borrowing complies with all-in-cost, minimum average maturity period and other relevant norms of the ECB framework. For all other Non-performing loans, the issue remains. FPIs and ECB lenders may be permitted to purchase distressed loans across sectors directly from banks 7. Further, exemptions and benefits currently granted under extant regulations to ARCs to better assist with effective restructuring and resolution of stressed assets should also be made available to FPIs investing in NPAs via securitization trusts. Specifically, provisions applicable to enable aggregation of debt by ARCs and any exemptions under SEBI guidelines may be extended to FPIs as well. 8. In order to address the issue of possible volatility that may emerge by allowing foreign players to purchase Indian debt more freely, a scheme similar to that of Voluntary Retention Route (VRR) recently introduced by RBI to enable FPIs to invest in debt markets in India may be envisaged. Broadly, investments through the Route are free of the macro-prudential and other regulatory norms applicable to FPI investments in debt markets, provided FPIs voluntarily commit to retain a required minimum percentage of their investments (75%) in India for a period of three years. It is understood from market participants that the VRR has created a positive impact in the market and hence can be adapted for enabling offshore market participate in the secondary market for corporate loans, within the extant aggregate FPI limits. 9. While Mutual Funds may be permitted to launch special loan assets schemes, a separate category of AIFs may be devised to allow investment in secondary loan market for standard as well as distressed loans. 10. Pension funds registered with PFRDA invest in securities (bonds/debentures, etc.) issued by corporates but they do not participate in corporate loans. They may be permitted to participate in corporate loans also through either the primary market and/ or the secondary market route. 11. In terms of IRDAI (Investment) Regulations, 2016, insurance companies invest mainly in Government securities and debentures/ bonds issued by corporates (within the exposure/prudential norms specified by IRDAI). They cannot participate in corporate loans as part of “Approved Investments”. Hence, Insurance Companies may be permitted to participate in corporate loans also through either the primary market and/ or the secondary market route. 12. A pictorial representation of presently permitted and potential participants is given below. RBI may engage with the respective regulators to allow participation of the other regulated entities in the secondary market. D.4 Schematic Representation of the market architecture A schematic representation of the proposed architecture for the secondary market for corporate loans is given below: D.5. Central Loan Contract Registry/Repository (CLCR) 1. Benefits envisaged in a CLCR: Currently there is no centralized/ public credit registry. Also, the current norm is for individual lenders to auction loan assets using their individual websites / public notices / invitations for EOIs etc. There is no centralized platform for auction and sale of loan assets. A centralized registry would, in effect, facilitate standardization with respect to information sharing, due diligence process and verification, and book-keeping. A centralized platform would facilitate interested purchasers to identify at one place all assets which are currently available. Improved access would likely result in increased participation by potential buyers and therefore enable better price discovery. A centralized platform could also lead to consistency in pricing thereby ensuring similar recoveries for all lenders. The platform will also help lenders justify the sale price should transaction commercials be questioned in the future. 2. Setting up of a CLCR: Accordingly, the Task Force recommends the setting-up of a Central Loan Contract Registry (CLCR). The CLCR may be set up by an agency accredited by the proposed SRB or RBI to enable participants transact in a transparent manner. This will help in building liquidity in the secondary market through a smooth, reliable and timely process and wider participation. The registry may serve as a ‘one stop shop’ for all the information about the loans which are proposed to be sold such as loan structure, loan servicing history, asset classification status, financial information about the borrower, key details about the project documents, status of the project, information about the borrower’s group, etc. Additionally, information related to typical bid offer spreads on traded loans, which will help anchor price discovery for market participants, may also be published. The platform can maintain the entire data in a digitized form including indicative pricing, past trade data, etc. 3. Segregation of Ownership: Registration of charges at various registrar offices is an essential feature of Indian charge registration process. However, the registration of charge by the beneficial owners at various registrar offices where the property is situated poses a challenge which needs to be addressed. In order to enable seamless transfer of the loan portfolio amongst the participants, and ensure ease of doing the transactions in the secondary market, it is imperative to segregate the ownership of the security interest as ‘Registered Owner’ (RO) and ‘Beneficial Owner’ (BO). While the security trustee shall be deemed to be the RO for the security interest connected to the underlying loan asset transacted in the secondary market, the lenders/participants will be treated as BOs of the said security interest. Accordingly, while the BO changes with every transaction in a given loan asset, the RO will remain the same. Such segregation of the registration versus eventual beneficial interest helps in avoiding additional documentation/process/costs on transfer of the asset from one lender to another lender as the RO remains the same. 4. IUs as CLCR: It is understood that the information stored with the Information Utilities (IUs, as constituted under the Insolvency and Bankruptcy Code (IBC) and allied regulations) is required to be authenticated by all parties to a debt/loan, even where the financial information including the loan details and security structure are submitted with the concerned IU by any other financial creditor. Such all-party authentication of information about an existing debt including the security structure helps achieve transparency, confidence as well as efficiency in the credit decisions of lenders. Hence, instead of adopting any new mechanism for independent verification of the above loan information, it is suggested that the database of IUs may be allowed to be used for secondary loan market transactions. As such, an IU may be better placed to establish the Central Loan Contract Registry/Repository considering the above synergies. In case, it is perceived that more than one agency needs to be recognised for performing such role, it may be acted upon accordingly. 5. Digital Documentation Execution (DDE): The CLCR shall also serve as a repository for all digitally executed contracts. Till the time the physical documents are transitioned to a digital format, the Security Trustee may continue to hold the physical documents and the Registry/Repository (CLCR) may have electronic links with Trustee for verification. This will help the CLCR serve as single point for verified information required during secondary market transactions. Incidentally, it is understood that Digital Document Execution integrated with digital stamp duty payment and receipt (from SHCIL) is being launched by National E-Governance Services Limited (NeSL), an IU towards dematerialization of financial contracts. 6. Legal Sanctity: The information with the IUs relating to the assets and liabilities of a person is currently considered as a valid legal evidence for the purposes of the insolvency resolution process under the IBC. 7. Information Symmetry: Availability of the key information of the loan along with the notification of initiating sale process helps in solving the problem of information asymmetry at the very first level itself. Such a platform will enable the selling bank to find the investors quickly and arrive at a best price discovery through quotes received from multiple participants. The CLCR may also generate a unique identifier for all loans reported to it. 8. Transition Provisions: To enable implementation of various recommendations of the Task Force in a non-disruptive manner and at the same time to ensure that the platform to be established for facilitating sale of corporate loans has the requisite liquidity to be able to achieve its objectives, the task force recommends the following transition provisions: -

All new corporate loans and the existing corporate loans due for refinancing or renewal should comply with the standardisation of documents norms. In consultation with Indian Banks Association (IBA)/Finance Industry Development Council (FIDC), the SRB may specify standardized documents for all such loans with a notified date from which these loans shall be compliant to new standards. -

Within a reasonable period of setting up of the proposed sales platform as duly notified by the SRB, which shall not be more than 3 months, all the loan sales in respect of the above said loans should be mandated to be transacted on the said platform; -