Acknowledgements The Report of the ‘Task Force on Offshore Rupee Markets’ was made possible with the support of a number of individuals and organisations. The Task Force would like to gratefully acknowledge representatives of various banks, financial institutions, large corporates in India and abroad, foreign portfolio investors, asset managers, industry bodies, experts and practitioners who interacted with the Task Force and provided their valuable inputs and suggestions. The Task Force greatly benefitted from the experience of Smt. Shyamala Gopinath, former Deputy Governor, Reserve Bank of India and Shri G. Padmanabhan, former Executive Director, Reserve Bank of India who took time out of their busy schedules to attend the meetings of the Task Force as special invitees. The Task Force benefitted from the interactions with Dr. T. V. Somanathan, IAS, Additional Chief Secretary, Government of Tamil Nadu; Shri R. Sridharan, Managing Director, CCIL; Dr. V. Anantha Nageswaran, Dean, IFMR Chennai; Shri Ananth Narayan, Associate Professor, SPJIMR Dr. A. K. Nag; Shri Himadri Bhattacharya and Shri Jamal Mecklai, CEO, Mecklai Financial Services. The Task Force invited submissions from members of the public and is grateful for several helpful suggestions received. The Task Force also places on record the assistance provided by Shri Subrat Kumar Seet, Director and Smt. Priyanka Sachdeva, Manager from Department of Economic and Policy Research, Reserve Bank of India and Shri Hiren Sanghvi, Director and Shri Saket Banka, Associate Director from HSBC India. The Task Force specifically acknowledges the contribution of Shri Harendra Behera, Assistant Adviser, Department of Economic and Policy Research, Reserve Bank of India in research on ‘Linkages between Offshore and Onshore Rupee Markets’, undertaken in collaboration with Shri Sajjid Chinoy, Chief Economist, J. P. Morgan India. Finally, the Task Force would like to commend the efforts put in by the Secretariat team from the Financial Markets Regulation Department, Reserve Bank of India led by Shri Supriyo Bhattacharjee, Deputy General Manager and supported by Shri Nitin Daukia, Manager. Meticulous organisation of meetings by Smt. Supriya Devalekar, Assistant Manager and Shri Kaivalya Sakalgaonkar, Assistant from the Secretariat team is also appreciated.

Preface Offshore markets in a non-convertible currency, usually referred to as non-deliverable forward (NDF) markets, enable trading of the non-convertible currency outside the influence of the domestic authorities. These contracts are settled in a convertible currency, usually US Dollars, as the non-convertible currency cannot be delivered offshore. Historically, NDF markets evolved for currencies with foreign exchange convertibility restrictions and controlled access for non-residents, beginning with countries in South America like Mexico and Brazil and thereafter moving on to emerging Asian economies, viz., Taiwan, South Korea, Indonesia, India, China, Philippines, etc. Apart from enabling trading in non-convertible currencies, NDF markets have also gained in prominence because of onshore regulatory controls and their ease of access. Reserve Bank has been guided by the objective of developing a deep and liquid on-shore foreign exchange market that acts as a price setter globally. With regard to non-resident entities having legitimate exposure to the Rupee, the focus of policy efforts has been to align incentives for non-residents to gradually move to the domestic market, with adequate safeguards to ensure the external stability of the value of the Rupee. The sharp growth in the offshore trading volumes in the Rupee NDF market in recent years likely even beyond the volumes in the onshore markets have raised concerns around the forces that are determining the value of the rupee and the ability of authorities to ensure currency stability. This necessitates a deeper understanding of the causes underlying the growth in those markets and identification of measures to reverse the trend. The Task Force on Offshore Rupee Markets was set up to address that concern. It was mandated to study the factors attributable to the growth of the offshore Rupee market, its effects on the Rupee exchange rate and onshore market liquidity, and formulate measures to redress the concerns. The Task Force was also charged to examine the role, if any, that International Financial Services Centres (IFSCs) can play in addressing these concerns. During its term, the Task Force interacted with a wide variety of stakeholders including banks, financial institutions, industry bodies, foreign portfolio investors, asset managers and academicians. I trust that the Reserve Bank of India will find the recommendations made in the report useful. Usha Thorat

Chairperson

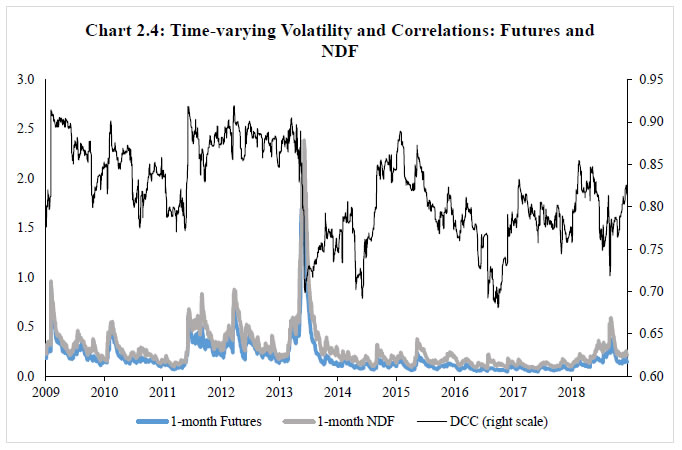

Executive Summary The origin of the NDF markets may be traced back to the 1990s when a wave of capital account liberalisation in emerging market economies (EMEs) triggered a surge in capital inflows to these economies and consequently heightened the currency risk faced by foreign investors. Under-developed domestic markets, especially the market for financial derivatives, as well as controlled access to onshore markets raised the demand for a currency market outside the reach of local regulations. Another trend that supported the growth of the NDF market was the sharp rise globally in the size of derivatives markets in the 1980s and 1990s. As derivatives markets evolved, the speculative search for underlying moved out of the developed world into more esoteric assets. Following the successful speculative attack on the Sterling in 1992, EME currencies became viable subjects for such speculative positioning. Such activity becomes particularly noticeable during times of stress as offshore risk spills over to the domestic exchange rate through entities that have a presence in both onshore and offshore markets, usually global banks but also corporates. A study of the degree and direction of such spillovers is important to understand the role of NDF markets and assess policy alternatives. The econometric study conducted by the Task Force observed that the influence between offshore and onshore exchange rate goes both ways in normal times, that is, it is bidirectional. The study also observed that during the last two stress episodes (the taper tantrum and the 2018 emerging markets crisis), the relationship turned unidirectional, with the NDF market driving onshore exchange rate. The study concludes that as NDF volumes have increased, they have begun to play an important role in both price discovery and driving volatility, particularly during heightened uncertainty period. The study also shows that periods of divergence are limited and the markets converge and that too fairly rapidly. Against this backdrop and in the light of available information, results of the statistical analysis, and most importantly, based on the feedback received during the various consultations, the Task Force is making following recommendations in accordance with the terms of reference: i. Onshore market hours may be suitably extended to match the flexibility provided by the offshore market and thereby incentivize non-residents to hedge in the onshore market. ii. Banks may be allowed to freely offer prices to non-residents at all times, out of their Indian books, either by a domestic sales team or by using staff located at overseas branches iii. Non-deliverable Rupee derivatives (with settlement in foreign currency) may be allowed to be traded in the IFSC and IBUs may be allowed to deal in such derivatives with a distinct FCY-INR position limit. To start with, exchange traded currency derivatives involving Rupee may be introduced and, with experience, non-deliverable OTC currency derivatives involving Rupee may be allowed subsequently. iv. While requirement of underlying exposure will continue for trading in the onshore market, users may be allowed to undertake positions up to USD 100 million in OTC as well as exchange traded currency derivative market without having to establish the underlying exposure. v. The TF endorses the principle-based regulatory approach adopted in the draft regulation on hedging by non-residents released by the RBI on February 15, 2019. Also, back-to-back hedging by non-residents proposed under these draft regulations is endorsed. Further, in case of hedging of anticipated exposures, gains from cancellation of contract may be allowed to be passed on even in cases where there are no cash flows, at the discretion of the bank, where the bank considers the cancellation of underlying cash flow is due to external factors which are beyond the control of the user. vi. For ease of entering into hedge transactions for non-residents, the TF recommends: -

Establishment of a central clearing and settlement mechanism for non-residents’ deals in the onshore market. -

Implementation of margin requirement for non-centrally cleared OTC derivatives in the onshore market at the earliest. -

Allow Indian banks to post margin outside India. - Wider access to FX-Retail trading platform to non-residents.

vii. A technology-based solution may be explored to centrally aggregate the investments of non-residents and derivative contracts entered into by them in the onshore market (both OTC and exchange traded) using LEI or any other unique identifier to start with. viii. The issue of taxation in respect of foreign exchange derivative contracts may be examined with the objective of overcoming gaps between tax regime in India and other major international financial centres to the extent possible. ix. KYC registration may be centralized across the financial market with uniform documentation requirement.

Chapter 1 Introduction Currency is a component of sovereign money, which is legal tender, issued by the state. The external value of the currency, the exchange rate, is one of the most important economic and policy variables, which affects economic incentives and activity. The exchange rate is determined mostly by market forces of supply and demand, which influence its flows across international borders. The exchange rate has critical information value in guiding financial and economic decisions, which affect real economic variables. The stability and predictability of the exchange rate also has a critical influence on growth and financial stability. Cross-border trade in goods, services and assets (or, capital) necessitates exchange of one currency into another; and can be thought of as the primary reason why currency markets exist. However, as in any other financial market, speculative elements – who take positions not for settling any underlying transactions but for benefitting from market movements – are important participants, who perform the function of imparting depth to the market. The aggregate actions of all participants – hedgers, arbitrageurs as well as speculators - determine the value and fluctuation of the exchange rate. The currency markets for rupee, especially for exchange against the USD, are fairly well-developed today. One can classify these markets in three categories: (a) spot versus derivatives, (b) over-the-counter (OTC) versus exchange-traded and (c) onshore versus offshore. Further, derivatives can be cash-settled or delivery-based. The most commonly referred benchmark exchange rate of the rupee is from the onshore, spot OTC market. Similarly, the commonly referred forward exchange rate of the rupee is from the onshore forward OTC market. Rupee futures and options are traded in some onshore as well as offshore exchanges. The classification of currency markets can also be in terms of the nature of contracts between buyers and sellers - spot, forwards (futures on exchanges) and options contracts. A spot contract is for standard settlement, i.e., the second working day after the date of transaction, whereas in case of forwards and futures (as well as options), the actual exchange or delivery of currency takes place in the future, at a date later than the spot settlement date. There are also non-deliverable forward contracts, which are discussed below. Forward and futures contracts are used as a risk management tool, or to hedge against possible adverse fluctuation in exchange rates. It is important to note that hedging implies risk transfer between the contracting parties; it is not elimination of risk. The category of the currency market that forms the focus of this report is the Offshore Rupee markets. The dominant segment of this market is the Non-Deliverable Forward (NDF) market – wherein foreign exchange forward contracts are traded in the OTC market at offshore locations, generally the International Finance Centres (IFCs) like Singapore, Hong Kong, London, Dubai and New York. These contracts do not involve a physical exchange of Rupees as Rupee is not deliverable offshore, and allow counter-parties to settle profit or loss in a convertible currency, usually the US Dollar, which is why it is called a non-deliverable market. NDF contracts are usually traded on currencies which are not readily available to trade globally or outside of sovereign boundaries. These are thus mainly currencies from countries which have partial or no capital account convertibility. There are also a few exchange-traded offshore rupee markets dealing in rupee futures and options in Chicago, Singapore and Dubai. Volumes in these markets have typically been far smaller in comparison to the offshore NDF OTC market. Data on transactions in exchange-traded currency markets can be ascertained with greater certainty whereas data on transactions in offshore OTC NDF market have to be gauged through surveys and the estimates on the same are less firm. Why do NDF Markets Exist? NDF markets are not a phenomenon peculiar to the Indian Rupee; they are common for currencies of many emerging market economies (EMEs). As per BIS data, NDFs in six currencies – Korean Won, Indian Rupee, Chinese Renminbi, Brazilian Real, Taiwanese Dollar and Russian Ruble – account for about two-thirds of the trade in NDFs globally. The total daily average volume in NDF markets is about USD 200 billion as per Bank of International Settlements (BIS) survey1. As per this survey the share of India was about 18.22 per cent of the trade in NDF’s globally (see Table 2, Chapter 2). The 2016 BIS survey (the next one will be released in the later part of 2019) showed that offshore trades in Indian rupee were more or less equal to deliverable onshore forwards; around $16 billion daily. The 2018 Bank of England reported $23 billion in offshore rupee trades, while RBI sources estimate deliverable daily onshore forwards at $21 billion for 20192. The size of an open economy is one of the primary determinants of international participation in its currency. If international participants do not have direct access to the on-shore currency market to meet their transaction needs, or to hedge their currency exposure, they are likely to use the offshore NDF market. The size, depth and liquidity of the offshore NDF is thus indicative of the non-resident interest in an emerging market economy. To some extent the offshore NDF market complements the need for a deep and liquid onshore currency market. What is the appropriate size of the forex market for an emerging market economy, with partially open capital account, is determined by its size, the share of foreign trade, and appetite for capital flows. One proxy for estimating how large the forex market ought to be, is the GDP of the economy. A better estimate could be the size of the open economy, the trade and investment sector. As India’s economy has grown over the past two and a half decades, it has seen a significant rise in openness (i.e. trade to GDP ratio has grown from 15% in 1990 to 43% in 2018) and in cross border capital flows. This has commensurately raised non-resident interest in the Rupee, whether for risk management purposes or for speculative ends. The growing size of the Rupee NDF market points to a need to widen participation in on-shore markets. The existence and size of offshore NDF markets is also a function of the degree of difficulty that participants in foreign exchange market (especially, non-residents) – both speculators and other participants with requirements arising from cross-border trade transactions – face in accessing the onshore markets. The difficulties in accessing onshore currency markets could span a variety of issues including the following: -

Restrictions on foreign exchange transactions, -

Cumbersome documentation and Know-Your-Customer (KYC) requirements for participants in the domestic market, -

Restrictions on market participants (especially, non-residents) in hedging activities such as transaction limits, tenor limits, other documentation etc., -

Restrictions on cancellation and re-booking of contracts, -

Restrictions on the kind of derivative products that are allowed by market regulators, and -

Inconvenient market hours for those in other time zones. These constraints exist either to curb excessive speculation or to maintain financial stability. Are Offshore Rupee Markets a Problem? When the offshore market volume is significant or larger than the onshore currency market volume, as is the case with many EME currencies, it leads to two fragmented markets, wherein the price discovery on the onshore market becomes vulnerable to influences from the price discovery in the offshore market. Empirical evidence (see Chapter 3) shows that while at most times, the direction of the influence runs both ways, i.e. from onshore market to offshore market and vice-versa, the direction of the influence is more dominant from offshore market to the onshore market in times of high volatility. This could happen, especially when tidal forces from global financial markets influence the currency markets in a synchronised manner, such as during times of Emerging Markets (EM) currency crises. There are essentially four issues with regard to offshore market that are critical for regulators – -

Effectiveness of exchange rate management: Many central banks, including the Reserve Bank, have exchange rate stability as one of their objectives, and resort to market intervention or other regulatory measures to control volatility of the exchange rate from time to time. Such influence, however, extends only to the onshore currency market. Presence of a large offshore market dilutes the effectiveness of the exchange rate management by the central bank. It also hinders the pursuit of the objective of financial stability in the domestic market. -

Disjointed price discovery: During periods of volatility in the currency market, when price discovery in the offshore market causes large movements in onshore currency markets, the onshore market could often open with a large gap over the previous close. For resident market participants who want to cover their positions, such gaps expose them to significant risk. -

Revenue loss: Every unit of turnover in a market earns a certain revenue for the market-making financial firms. Thus, turnover in the offshore market can be viewed as a potential revenue loss for domestic financial firms and the domestic economy. -

Effectiveness of RBI regulations on capital account management: RBI’s policies on capital account have been geared towards managing the impossible trinity: a “managed” exchange rate, free capital movement and an independent monetary policy. RBI policies have been geared toward avoidance of undue volatility in foreign exchange markets by having restrictions on cancellation and rebooking, and excessive risk-taking by resident entities, including corporates. With this objective, RBI restricts participation of resident entities in currency derivatives to the extent of their underlying exposures. A large market, outside the influence of regulatory authorities, undermines their effectiveness. Constitution of the Task Force Against this backdrop, it was announced in the Statement on Developmental and Regulatory Policy dated February 7, 2019, the setting up of a Task Force on Offshore Rupee Markets. Accordingly, a Task Force, headed by Smt. Usha Thorat, was constituted with following terms of reference: -

Assess the causes behind the development of the offshore Rupee market; -

Study the effects of the offshore markets on the Rupee exchange rate and market liquidity in the domestic market; -

Recommend measures to address concerns, if any, arising out of offshore Rupee trading; -

Propose measures to generate incentives for non-residents to access the domestic market; -

Examine the role, if any, International Financial Services Centre (IFSC) can play in addressing these concerns; -

Any other relevant issue(s) the Task Force considers relevant to the context. The Task Force comprises of the following: -

Smt. Usha Thorat, former Deputy Governor, Reserve Bank of India – Chairperson -

Shri Anand Bajaj, Joint Secretary, Department of Economic Affairs, Ministry of Finance, Government of India – Member -

Shri G. Mahalingam, Whole Time Director, Securities & Exchange Board of India – Member -

Shri Ajit Ranade, Chief Economist of the Aditya Birla Group – Member -

Shri Sajjid Chinoy, Chief Economist, India, J.P. Morgan India – Member -

Shri Surendra Rosha, CEO, India, HSBC Bank – Member -

Shri Rajiv Ranjan, Adviser-in-charge, Department of Economic Policy and Research, Reserve Bank of India – Member -

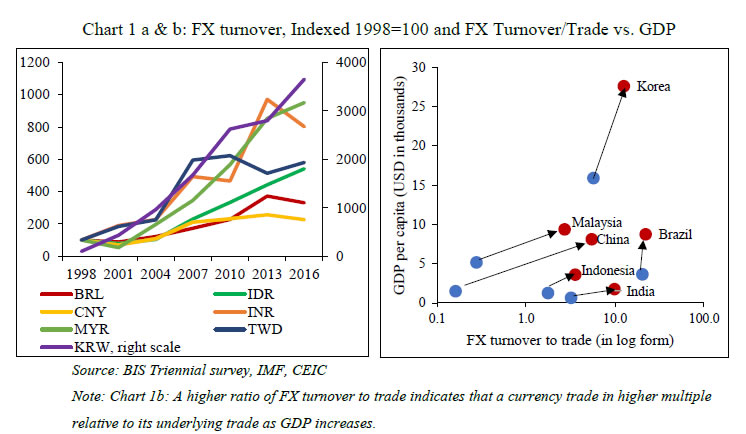

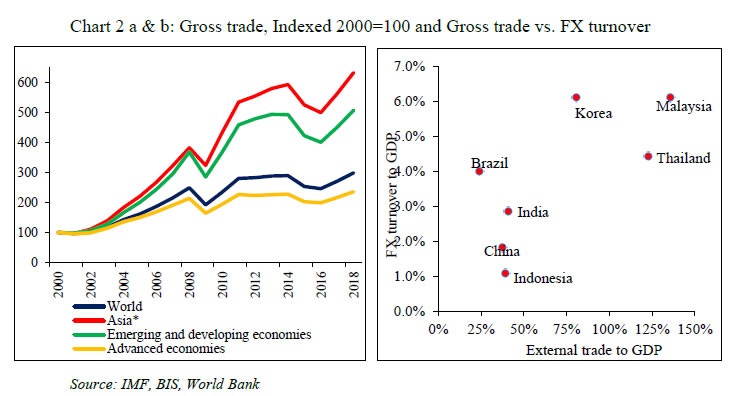

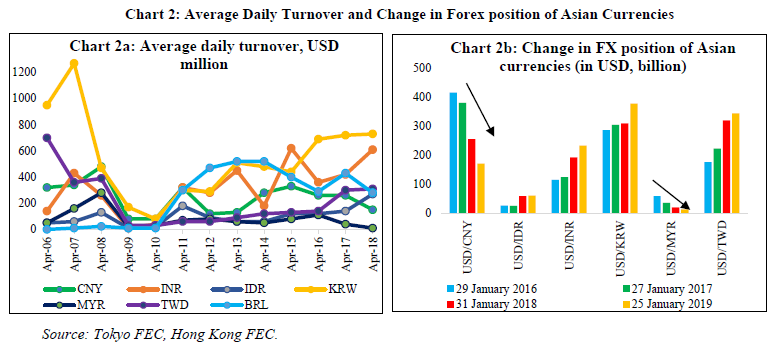

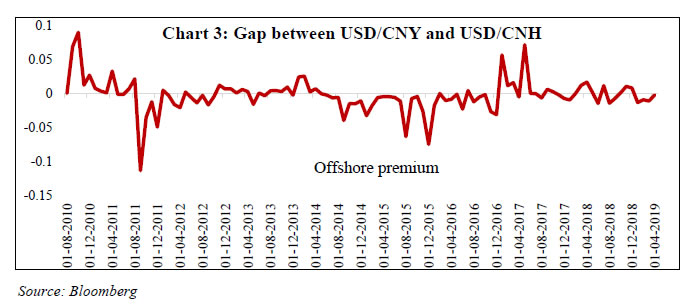

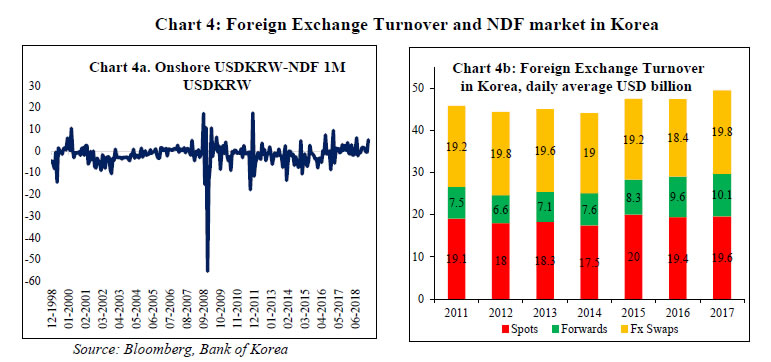

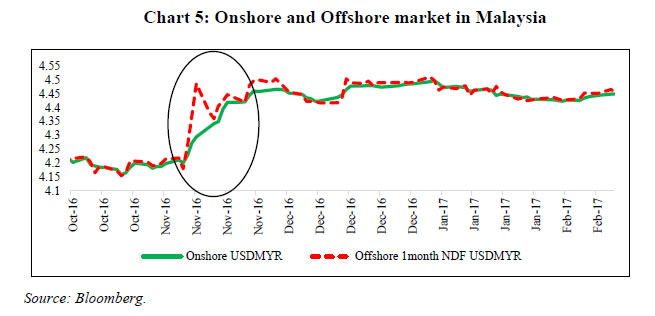

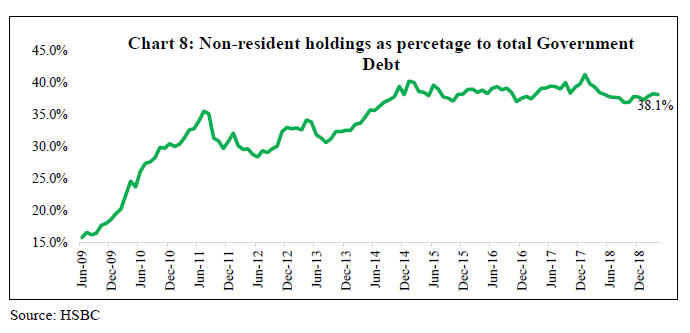

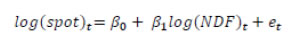

Shri T. Rabi Sankar, Chief General Manager, Financial Markets Regulation Department, Reserve Bank of India – Member Secretary Approach of the Task Force Among the different issues relating to offshore markets, the argument concerning revenue loss is perhaps the most simplistic, and an obvious response could be for India to develop non-deliverable Rupee derivative market in an International Finance Service Centre (such as the GIFT City) located within the geographical boundary of India. However, such a market will be virtually no different from the markets located in Singapore or London; and hence, the objective of bringing volumes to the onshore market will remain unaddressed. From the standpoint of addressing the concerns arising out of the existence of large offshore markets, it would make sense to incentivise movement of as much currency market transactions from such markets to onshore currency markets as possible. However, theoretically, one needs to recognise that there is a trade-off between the size/prominence of the offshore market and the extent of regulations/restrictions that are placed on cross-border transactions and foreign exchange markets/participants. It is also important to note that even if all non-residents with underlying exposure move their hedging transactions to onshore markets, offshore markets would continue to exist to meet the demand of participants who take a view on the exchange rate without any underlying exposure, i.e. the speculative demand. At one extreme of the above-mentioned trade-off, if India opts for a full rupee convertibility – by removing all restrictions on current and capital account transactions – along with removal of all restrictions on currency derivatives, then offshore markets would no longer be a relevant concept. Capital account convertibility has been a hotly debated issue in the discourse on public policy both in India and globally. The received consensus in the last couple of decades endorsed by the International Monetary Fund (IMF) in 2012, is that while capital flows are an important aspect of the international monetary system, providing significant benefits for countries, they also carry risks for macroeconomic and financial stability, especially if they are large and volatile, and thus pose a challenge for policy. Hence, capital flows management measures are justified to help harness the benefits while managing the risks. More generally, some restrictions to the capital account are necessary for India to avoid the “impossible trinity”. With an economy as large and diverse as India’s, which is therefore expectedly not completely synchronous to the global cycle, retaining the independence of monetary policy is imperative. Similarly, having some control over the exchange rate is necessary given its occasional propensity to be excessively volatile and overshoot, with attendant feedback loops to the macro-economy. Therefore, capital flow management measures become necessary to avoid the trilemma and ensure simultaneous fulfilment of the other two objectives. Based on this received consensus as well as the experiences of some emerging market economies through the last two decades, the Task Force has proceeded on the basis that the existing framework of capital account management followed by the Government and the RBI will continue. There is also the issue of de-jure capital account convertibility. Even when speculators, arbitrageurs and traders do not have direct access to forex markets to exploit persistent interest rate differentials, or perceived mispricing of the currency, there are alternative channels available in the system, which make the actual arbitrage opportunities much lower. Some examples of such instruments is the Overnight Indexed Swaps (OIS) market, or the use of Mumbai Interbank Forward Offer Rate (MIFOR). Hence the de-jure level of capital account convertibility (CAC) could be much higher than implied by the existence of capital controls. A related issue is the internationalisation of rupee. According to McCauley (2011), a currency is internationalised when market participants – residents and non-residents alike – conveniently use it to trade, invest, borrow and invoice in it. Based on the experience of China to internationalise Renminbi and the evidence of the narrowing of the gap between onshore forward rate and NDF rates for Renminbi, internationalisation of currency has been sometimes advocated as a way to reduce the influence of offshore markets. While one has witnessed issuance of rupee-denominated bonds (“Masala Bonds”) in some offshore markets in the recent past, internationalisation of rupee is still a distant goalpost given the persistent current account deficit and the negative net international debt position. Thus, internationalisation of rupee is not an explicit goal guiding the recommendations of the Task Force. Further, the Task Force believes that India’s approach to the trade-off between deregulation of currency markets and tolerance of offshore market must be shaped by the specific considerations of the Indian economy rather than following any global template blindly. Compared to countries like Korea, Taiwan or China, India’s macroeconomic structure is significantly different. India is a structurally an economy with twin deficits – both fiscal and current account. Nearly half of India’s consumer price index (CPI) basket comprises of food items, making India’s inflation more vulnerable to supply shocks. Although India’s macroeconomic stability has improved considerably in the last few years, considering the above factors, the Task Force feels that India cannot risk macroeconomic instability through potential exchange rate shocks by drastically lifting the restrictions on foreign exchange markets and participants. On the other hand, large volumes in the offshore market also reflect the fact that the interest in Rupee is far larger than what is evident in onshore currency markets. This reflects the growing size of the Indian economy, greater role of India in the global economy and growth in trade and capital flows. Over time, therefore, it would be imperative for the Indian regulators to take steps to expand the role of onshore currency markets gradually, lest the disjointed price discovery issue flares up more frequently and in larger degrees. The balanced approach of the Task Force, therefore, is to look at each of the difficulties faced by market participants in accessing onshore currency markets and prioritise their resolution in such a way that prudent regulatory considerations are least compromised. For instance, certain market micro-structure issues (such as extending the market hours of onshore currency markets) can be addressed relatively quickly without any regulatory compromise. On issues related to documentation and KYC requirements, smart application of ease-of-doing-business principles needs to be followed. Economic entities which need to undertake hedging of their foreign exchange exposure on account of genuine underlying exposures need to be given greater flexibility in undertaking such transactions in domestic currency markets. While the need for underlying exposure in order to operate in the forward markets cannot be eliminated, the way in which it is evidenced and monitored can be simplified. The Task Force has proceeded on the basis of the existing principles of regulations of foreign exchange markets. Of course, the Task Force recognises that the recommendations will not do away with the economic imperatives for which trading of rupee forward contracts exists in offshore markets. With our recommendations, the Task Force believes that regulatory concerns arising out of the offshore markets can be reduced though not eliminated. The Task Force held nine meetings between March 2019 and July 2019. The details of the meetings are given in Annex V. Chapter 2 The Evolution of NDF Markets and Cross-country Experience The foreign exchange market in India during 1970s and 1980s was heavily controlled and closed in nature with various kinds of restrictions in place. The Indian foreign exchange market started deepening with the transition to a market-determined exchange rate system in March 1993 and the subsequent liberalisation of restrictions on various external transactions leading up to current account convertibility under Article VIII of the Articles of Agreement of the International Monetary Fund in 1994. Notwithstanding various measures taken to further deepen and broaden the foreign exchange market in India, various restrictions are still in place to limit market access to only those with underlying exposure and prevent undue speculation. As India gets increasingly integrated with the global markets, and the exchange rate is increasingly market determined, a combination of capital flows management measures and currency trading restrictions in the on shore markets are used to manage the ‘impossible trinity’ external value of the rupee. These measures and restriction are under constant review to ensure that the overall objective of growth through foreign trade and investment are served. Against this backdrop, this chapter attempts to highlights evolution in section II; a brief review of literature on the reasons behind increase in turnover in NDF market in Asian countries has been given in Section III. Section IV highlights the developments in NDF market. The country experiences such as nature of restrictions on non-residents operating in domestic currency forwards market, liberalisation measures taken by countries and its impact in curbing offshore market discussed in Section V. I. Introduction NDFs are foreign exchange derivative instruments on non-convertible or restricted currencies traded over the counter (OTC) mainly at offshore centres i.e., outside the direct jurisdiction of the respective national authorities. It is essentially a forward contract with different settlement process. Unlike the standard forward contract which involves exchange of underlying currencies on maturity, the NDF contract is typically settled as the difference between an exchange rate agreed months before and the actual spot rate at maturity in an international currency (deliverable) mainly the US dollars. And the other currency which is usually emerging market currency is non-deliverable. The settlement of the transaction is not by delivering the underlying pair of currencies, but by making a net payment in a convertible currency equal to the difference between the agreed forward exchange rate and the subsequent spot rate (Ma et al, 2004). NDF contracts can either be traded over the counter market or at exchanges at offshore financial centres such as Hong Kong, Singapore and London. Lately they have become popular derivative instruments catering to the offshore investors’ demand for hedging, arbitraging and speculating including by those who look upon currency as an asset class. The major participants in NDF market could include foreign businesses and investors doing business in countries with complex requirements for hedging currency risk in the local markets, arbitragers who have access to both on shore and offshore markets, pure speculators like hedge funds and others who take positions in the NDF market. While these are the end users there are also market intermediaries like banks dealers and brokers who provide quotes for trading in these currencies and custodians who provide settlement arrangements. While the multinational companies deal in both the long and short end of the market, the short end of the market is particularly dominated by the hedge funds (Misra and Behera, 2006). The pricing is influenced by a combination of factors such as interest rate differential between the two currencies, supply and demand, future spot expectations, foreign exchange regime and central bank policies. NDF market primarily evolved in response to under-developed onshore forward markets and limited access to non-residents to currencies with foreign exchange convertibility restrictions. An important advantage that enhances the demand for NDF is reduced credit risk compared to onshore counterparts, since there is no exchange of principal and only the difference amount is settled thus allowing investors to circumvent limits associated with onshore activity. Other reasons which also favoured the emergence of NDF market includes convenience of time zones, location of customer business operating from a global treasury for multinational companies, short-trading hours in onshore forex market, capital controls by individual central banks, position limits, frictions like registration norms and know your customer norms, frequent and significant changes in regulations and guidelines in the domestic exchanges and OTC markets. Moreover, credit risk is also less relevant since mostly large foreign banks are engaged as a counterparty in NDF trading. Further, offshore centres in some cases are better placed to offer competitive services compared to the onshore market on account of various factors ranging from tax treatment, less onerous regulations and documentation to operational efficiency. II. Evolution of NDF Markets The origin of NDF market traces back to the 1990s when a wave of capital account liberalisation in emerging market economies (EMEs) triggered surge in capital inflows to these economies and consequently increased currency risk faced by the investors. However, under-developed domestic forward market or restricted access to onshore forward market paved the way for evolution of NDF market as an alternative hedging tool to these investors. The widely shared concern amongst local monetary authorities was that easy access to onshore market and availability of domestic currency to non-residents will encourage speculative activity leading to greater exchange rate volatility and eventually the loss of monetary control. Consequently, some international banks, began offering NDF contracts to meet the demand of investors willing to hedge their EM currencies exposure during early 1990s (Higgins and Humpage, 2005). One of the earliest NDF market developed during early 1990s was in Mexican peso to speculate on the currency ahead of the devaluation from its then fixed exchange rate against the US Dollar. The increase in trading turnover during that time was facilitated by the entrance of voice brokers as intermediaries between inter-bank trading activities (Lipscomb, 2005). The NDF market for some Asian economies like Korean Won, Taiwanese Dollar, Indian rupee and Chinese Renminbi existed since mid-1990s due to either restricted or no access to onshore forward markets by non-residents (BIS, 2004). In case of New Taiwan Dollar, only onshore entities had access to onshore markets while it was subjected to underlying requirements in case of Korean Won, Indian rupee and Chinese Renminbi. For other currencies like Indonesian rupiah, NDF market evolved after the Asian financial crisis in response to re-imposition of capital restrictions which were liberalised in early 1990s. In Indonesia, rapid liberalisation beginning as early as 1970s and further internalisation of Indonesia rupiah enabled the development of deliverable offshore market for rupiah. Following the currency crisis, initial measures were directed at curbing non-trade and investment related forward transactions with non-residents and broader measures prohibiting banks from extending loans, conducting derivative transactions and transferring rupiah to non-residents were introduced in early 2001. While Malaysia also imposed cross border restrictions after the crisis, evolution of NDF market in Ringgit was initially inhibited by comprehensiveness of regulations as well as its effective enforcement by the authorities (Ishii, 2001). McCauley (2011) showed that as income per capita rises, a currency trades in ever greater multiples of the home economy’s underlying international trade (“financialisation”) and trades to an even greater extent outside its home market (“internationalisation”). The increasing economic interest in emerging market economies as a result of upbeat growth scenario from 2000s spurred greater participation in currencies of these economies (Chart 1). In this context, increasing turnover in the Indian rupee, Chinese Renminbi and other Asian currencies like Indonesian rupiah, Malaysian Ringgit, Korean Won and New Taiwanese Dollar is consistent with increased investment in these economies amidst restricted access to onshore markets. Both India and China recorded phenomenal growth rates translating into increased businesses (trade and investments) with rest of the world and resulting exposures facilitated offshore trading of their currencies (Chart 2 a & b). During 1990s, mostly non-residents with genuine exposure used NDF market to hedge their exposures in Indian rupee. However, with the development of onshore market providing reasonable hedging facilities to foreign investors amidst gradual relaxation of controls, most of the market activity seems to be driven by speculators and arbitrageurs and those who are looking at the rupee as a separate asset class to diversify their portfolios in view of its growing international importance. As a result the size of NDF market has grown over time. In the China’s case, the emergence of offshore deliverables market for Renminbi (CNH) since 2010 was mainly due to internationalisation of Renminbi which gradually substituted the NDF market.   Both Indonesia and Malaysia have witnessed sharp increase in non-resident participation in local currency bond market particularly in the aftermath of global financial crisis 2008, while these countries local forward markets imposed restrictive conditions that restricted use of these markets for hedging; this led to the increased use of NDF market. Non-resident ownership of government debt in Indonesia and Malaysia as share of total outstanding government debt stood at 38.3 per cent and 24.3 per cent as at the end of March 2019, respectively, highest amongst other Asian economies. However, foreign participation in equity market is higher for Korea and Taiwan. While Taiwan has limits on investments in domestic bonds by non-residents, foreign investors are not subject to any investment ceiling for both aggregate and individual holdings in a listed company, except for a few restricted industries. Additionally, the reason for growing NDF market could be increased carry trade activities for high yielding currencies. After examining the returns of carry trades with deliverable and non-deliverable forwards, Doukas and Zhang (2013) found that carry trades for currencies with NDF contracts perform better compared to carry trades for currencies with deliverable forward contracts. This excess return is attributed to the compensation of risks emanating from currency convertibility and capital controls. For the Brazilian Real (BRL) derivatives, offshore NDFs in particular are the main vehicle for investors looking to implement carry trades (BIS Santaelaa, 2015). NDF market evolved mainly for emerging market economies witnessing increased economic interest in the process of transition to high growth phase since 1990s, whilst restrictions persisted in accessing onshore markets for hedging currency risk arising out of these exposures. The NDF market also provided an opportunity to speculate on currencies which underwent notable shift in their exchange rate regime. During periods of global uncertainties like in 2013 during “taper tantrum”, the NDF market is used for speculative purposes arguably causing disruptions in domestic forex market. III. Size of the NDF market Given that NDF is an over the counter (OTC) traded instrument, the turnover data relies on various surveys conducted by institutions at different time intervals. In view of this, issues like comparability and continuity in data often arises. However, these surveys still provide useful information to gauge the growth of NDF market over time. Results from the semi-annual turnover survey for the Foreign Exchange Joint Standing Committee chaired by Bank of England (BoE) suggests that growth of NDF market has outpaced the forward market as well as overall foreign exchange market. In London, the average daily NDF turnover surged to USD 139 billion as per the latest survey in October 2018 from as low as USD 21 billion in 2008. During this period, NDF turnover quadrupled and its share increased to 5.3 per cent of overall forex turnover and comprised nearly 34 per cent of both onshore and offshore forwards compared to nearly 10 per cent in 2008. | Table 1: NDF trading in London (Average daily turnover in billions of US dollars) | | NDFs | All forwards | NDF, % of all forwards | All FX | NDF as % of all FX | | Apr-08 | 23 | 200 | 11.5 | 1832 | 1.3 | | Oct-08 | 19 | 230 | 8.3 | 1699 | 1.1 | | Apr-09 | 16 | 162 | 9.9 | 1356 | 1.2 | | Oct-09 | 26 | 191 | 13.6 | 1522 | 1.7 | | Apr-10 | 25 | 186 | 13.4 | 1687 | 1.5 | | Oct-10 | 37 | 188 | 19.7 | 1787 | 2.1 | | Apr-11 | 42 | 192 | 21.9 | 2042 | 2.1 | | Oct-11 | 37 | 192 | 19.3 | 2038 | 1.8 | | Apr-12 | 36 | 192 | 18.8 | 2014 | 1.8 | | Oct-12 | 45 | 211 | 21.3 | 2017 | 2.2 | | Apr-13 | 60 | 265 | 22.6 | 2547 | 2.4 | | Oct-13 | 43 | 205 | 21.0 | 2234 | 1.9 | | Oct-14 | 62 | 304 | 20.4 | 2711 | 2.3 | | Apr-15 | 64 | 295 | 21.7 | 2481 | 2.6 | | Oct-15 | 54 | 253 | 21.3 | 2111 | 2.6 | | Apr-16 | 60 | 275 | 21.8 | 2225 | 2.7 | | Oct-16 | 62 | 292 | 21.2 | 2179 | 2.8 | | Apr-17 | 78 | 332 | 23.5 | 2401 | 3.2 | | Oct-17 | 90 | 330 | 27.3 | 2380 | 3.8 | | Apr-18 | 111 | 407 | 27.3 | 2727 | 4.1 | | Oct-18 | 139 | 409 | 34.0 | 2611 | 5.3 | | Source: BIS, London Foreign Exchange Joint Standing Committee. | A similar survey is conducted by Hong Kong trade repository (HKTR) under the mandatory reporting obligations imposed since July 2015. According to the HKTR survey, daily average NDF turnover in Hong Kong has also exhibited significant growth and daily average turnover increased to USD 55-60 billion in 2018 from nearly USD 8 billion in 2015. The BIS publishes data on foreign exchange and derivatives trading activity every three years and also prepare a separate report on NDF covering global market since 2013. The latest 2016 BIS triennial survey reported that average daily turnover in global NDF market has increased by 5.3 per cent to USD 134 billion as compared to April 2013. Further, NDF share in outright forward and overall foreign exchange trading remained stable at 19.0 per cent and 2.6 per cent, respectively (Table 1). This is in contrast to the decline in average daily turnover in global FX markets to USD 5.1 trillion in 2016 from USD 5.4 trillion in 2013 survey conducted by BIS. The currency composition suggests that the Asian currencies dominate the NDF trading activity with the highest turnover recorded by Korean Won as Korea generally has open capital account and there are limits on non-residents borrowings in Korean Won from banks in Korea, therefore, it is not deliverable offshore (BIS Survey, 2016). Survey results from London, Hong Kong and Tokyo foreign exchange committees (FEC) as well as the BIS triennial survey points toward increased NDF trading activity in Korean Won. The Tokyo survey, which is available from the year 2006 suggest that the growth in NDF trading activity for Korean Won has shown significant growth outperforming other major currencies. The momentum in major currencies picked up ahead of the global financial crisis 2008 before faltering during the crisis period owing to deteriorating financial conditions. Subsequently, the NDF activity has deepened over time with the Indian rupee and Brazilian Real constituting higher proportion of total global turnover after the Korean Won, as corroborated by the London survey also. During the five-year period from 2008-13, the increase in NDF turnover is largely consistent with the FX turnover in emerging market economies (BIS, 2013). Since 2013, greater demand for hedging in anticipation of monetary policy normalisation seems to be the driving factor for increase in NDF activity given that lot of capital flows to emerging markets was funded using low cost dollar liquidity (BIS, 2013). The BIS 2016 survey identified that developments associated with higher volatility in Renminbi during August 2015 and January 2016 has also boosted Asian NDFs, even as trading activity in Renminbi NDF has faded. According to the BIS 2016 survey, during 2013 and 2016, trading in Renminbi NDF contracted by 39.4 per cent, while that of Korean Won and Taiwanese Dollar expanded by 53.7 per cent and 29.9 per cent, respectively. The decline in the NDF activity for Indian rupee reflects the depreciation of rupee against the US dollar, however, daily average turnover was up by 16.7 per cent between 2013 and 2016 in unadjusted terms. Hong Kong (HKTR) survey indicates continued decline in NDF activity for Chinese Renminbi and Malaysian Ringgit (Table 2 and Chart 2 a & b). In case of China, this was due to the Renminbi internationalisation policy followed after 2011. | | Table 2: Daily average turnover (USD billion) | Spread | | BIS 2013 | BIS 2016 | Oct- 2018 (London Survey) | | Bid-Ask (Latest) | | NDF | DF | NDF | DF | NDF | DF (Latest*) | Onshore | Offshore | | Chinese Renminbi | 17.1 | 2.4 | 10.4 | 28.1 | 8.8 | 65.0 | 0.001-0.002 | 0.003-0.005 | | Indian Rupee | 17.2 | 3.1 | 16.4 | 16.3 | 23.03 | 21.4 | 0.01 | 0.02 | | Korean Won | 19.6 | 1.1 | 30.1 | 14.5 | 29.5 | 30.0 | 0.10 | 0.30 | | Taiwanese Dollar | 8.9 | 0.2 | 11.5 | 7.8 | - | 19.3 | 0.005-0.010 | 0.010-0.020 | | Brazilian Real | 15.9 | 2.7 | 18.7 | 3.0 | 15.4 | - | - | - | | Russian Ruble | 4.1 | 0.5 | 2.9 | 18.6 | 4.0 | - | - | - | Source: BIS, London FEC, BoK, RBI, China Foreign Exchange Trading Center, Central bank of Taiwan, HSBC

Note

1. DF= Deliverable forwards and include forwards and FX swaps traded onshore.

2. Chinese Renminbi volumes on offshore segment are negligible after development of CNH market.

3. BIS DF and DF (latest) are not directly comparable since latest numbers are taken from country sources.

* Chinese Yuan is for Jun-19, Indian rupee and Taiwanese Dollar is for Apr-19, Korean Won is for 2017. |

Based on latest surveys conducted by London and Hong Kong FEC which are major offshore centres, clearly, it showed that the global NDF activity has surged led by Korean Won, Indian rupee, Brazilian Real and Taiwanese Dollar. The trend is likely to be validated by BIS 2019 survey which encompasses global turnover and is due to release later this year. IV. Review of Literature In view of the noticeable rise in NDF activity with potential to engender distortions in local market, there exist varied literature, on the emergence of NDF market and its spill-overs to onshore counterparts. One of the earliest attempts was made by Park (2001) which investigated the impact of financial deregulation on relationship between onshore and offshore prices. A key finding was that Korean Won NDF influenced onshore prices after a shift to floating exchange rate regime coupled with liberalisation of capital controls. As part of liberalisation measures following the Asian financial crisis in 1997, excessive regulations pertaining to foreign exchange market were removed and measures were undertaken to improve efficiency of market by increasing liquidity and broadening participation base (Chung et al., 2000). Amongst these measures, onshore entities were allowed to participate in offshore market. In this regard, Lipscomb (2005) suggested that transition to a more convertible exchange rate regime and permissible participation of onshore counterparties in NDF transactions contributed to the increase in offshore liquidity which begets liquidity in domestic market as well. A classic example is Korean Won where both onshore and offshore market co-exist with arbitrage opportunity exploiting any incipient price discrepancy. However, NDF markets tend to disappear as the currency becomes fully convertible as stated earlier. Wang et al (2007) also corroborated the finding that NDF market seems to be the driver for the domestic spot market of Korean Won, while the information flow is reverse for Taiwanese Dollar where the spot market was found to have influence on NDF market. Adding to this literature, Colaveccchio and Funke (2008) found Renminbi NDF to be the key driver of Asian currency markets with varied degree of heterogeneity contingent on real and financial inter-linkages. Amongst the country specific study, the one by Cadarajat and Lubis (2012) demonstrated that Indonesia rupiah NDF tends to have influence on domestic spot and forward return. Studies by Hutchison (2009), Mihajek and Packer (2010) and McCauley and Scatigna (2011) asserted that offshore trading becomes increasingly important with growing economic interest in a particular currency amidst limited access to onshore markets and convertibility restrictions. A study by BIS (2013) analysed the directional impact for nine currencies including the Indian rupee for the period 2005-13 along with separate analysis for 2008-09 crisis and May-August 2013. It found the presence of two way causation for most currencies for the full sample period, however noted the increase in NDF influence during market stress. Both the stress period saw noticeable impact of NDF particularly during May-August 2013 with major exception of Malaysian Ringgit where NDF played dominant role and there was no case of deliverable forward influencing NDF. In the Indian context, the earliest study with regard to spill-overs impact was undertaken by Misra and Behera (2006). They found onshore prices to have directional impact on NDF prices even as volatility spillovers could exist from NDF to onshore market. The subsequent research on this subject during the period 2000-09 by Behera (2011) demonstrated the change in dynamics with evidence of greater volatility spillover from NDF to spot market. A similar finding was outlined by Guru (2009) on the relationship between the NDF and onshore market for Indian rupee. It is argued that dynamics of relationship between onshore and offshore markets has undergone a change with the introduction of the currency future market in 2008 and returns in NDF market seem to be influencing the domestic spot as well as forward market. A study by Darbha (2012) finds that offshore markets plays an important role in price discovery mechanism, particularly in India and China. Goyal et al. (2013), after examining the period 2006-13 found the existence of bi-directional relationship between onshore and NDF market for Indian rupee over the long term, however, the directional impact turns one way from NDF to onshore during periods of depreciating pressures i.e., movements in NDF markets drives adjustment in onshore market when the currency is under depreciation pressures This asymmetric behaviour is attributed to the fact that the Reserve bank intervenes in the foreign exchange market to stem excessive volatility during periods of rupee depreciation. McCauley et al. (2014) described two paths for evolution of the NDF markets. The first one is being followed by Chinese Renminbi which has become deliverable after the emergence of offshore market. The Indian rupee falls under the second where the NDF market has grown amidst continued restrictions on foreign participation. The report of the Standing Council (Standing Council on International Competitiveness of the Indian Financial System, 2015 by Ministry of Finance, Government of India enumerated factors including capital controls, position limits, frictions like registration norms and know your customer norms, frequent and significant changes in regulations and guidelines in the domestic exchanges and OTC markets as deterrent to foreign investors participation in the onshore market. IGIDR Finance Research Group (2016) made an important recommendation that domestic entities should be permitted to participate in NDF market after outlining factors driving offshore activity compared to onshore segment. In respect of the internationalisation of rupee as one of the debated recommendation, Kumar and Patnaik (2018) argued the case for gradual internationalisation of rupee on analysing the role of the Indian rupee in terms of official sector currency, reserve currency and trade invoicing currency. V. Country Experience China The Chinese Renminbi (RMB) forward market can be segmented into offshore NDF market (since 1990s), an onshore Renminbi market (since 2007) and the CNH market (offshore deliverable). In the current scenario, RMB NDF has been gradually replaced by offshore deliverables after the creation of CNH market since mid- 2010 as a by-product of promotion of international role of RMB since 2009. China’s exchange rate regime has evolved from fixed to managed floating rates followed by internationalisation of Renminbi (RMB). In early 1990s, reforms started with the unification of multiple exchange rate in 1994 and in 1996, China allowed the full convertibility of Yuan under current account transactions. Eventually, the People’s Bank of China (PBoC) announced the implementation of managed floating exchange rate against basket of currencies in July 2005 ending the dollar peg prevalent since 1994. Over the last decade, China’s strong economic performance and growing linkages with rest of the world prompted authorities to promote the international role of RMB. The idea of internationalisation of RMB gained prominence following the financial crisis of 2008, which revealed the fragilities of dollar dominated global financial system. The thrust of early initiatives was RMB trade settlement premised on China’s deeper trade links and its central role within Asia’s supply chain that supported the demand for its currency for trade invoicing. In this regard, a pilot scheme permitting cross border trade settlement in RMB was launched in 2009, which was widened to cover all current account transactions over the course of next three years. Capital account liberalisation was undertaken at a more gradual pace with the Chinese RMB becoming officially deliverable at offshore centres in 2010. While Hong Kong banks were permitted to accept RMB deposits as part of personal accounts in 2004, an important milestone was the sign of Memorandum of cooperation between HKMA and PBoC in July 2010, which eliminated restrictions on Hong Kong banks in establishing Renminbi accounts and providing related services i.e., payments and transfers in RMB to individuals and corporations. Moreover, financial institutions were permitted to offer Yuan denominated products. As a result, CNH (offshore Renminbi) began to trade actively amongst other range of products and prompted investors to switch to deliverable market in place of NDF which was used previously. Whilst, CNH can be transferred freely between offshore accounts; transfer of RMB between onshore and offshore is still confined to regulated channels to fend off potential adverse impact on onshore markets. Moreover, these restrictions are skewed towards outflows form the mainland to offshore centres. With Renminbi internationalisation, the offshore CNH market has shown exponential growth displacing the NDFs. The BIS Triennial Survey showed significant decline in RMB NDF which fell nearly 40 per cent between 2013 and 2016, driving its share in total RMB trading to 5 per cent from 14 per cent earlier (BIS, 2016). The rapid expansion of offshore market is clearly discernible in rising FX turnover for CNH which has nearly doubled between 2013 and 2016 and forms around 67 per cent of the total RMB turnover. Of the total CNH turnover, average daily turnover in the DFs in April 2016 was estimated to increase to USD 16.4 billion from USD 8.4 billion in 2013 (Table 3). | Table 3: RMB market turnover, average daily turnover in USD billion | | | OTC spot | OTC FX swaps | OTC DFs | OTC NDF | Options | Futures | OTC currency swaps | Total | | CNY | | | | | | | | | | 2013 | 20.1 | 10.5 | 2.6 | 0 | 0.3 | 0 | 0 | 33.5 | | 2016 | 24.9 | 27 | 1.3 | 0 | 2 | 0 | 0.2 | 55.4 | | % change | 23.9 | 156.5 | -51.4 | | 569.3 | | | 65.1 | | CNH | | | | | | | | | | 2013 | 13.9 | 29.4 | 8.4 | | 16.8 | 0 | 0.5 | 69 | | 2016 | 42.7 | 59 | 16.4 | | 15.8 | 0.3 | 2.5 | 136.7 | | % change | 207.9 | 100.8 | 94.3 | | -5.6 | 578.4 | 383.6 | 98.1 | | NDF | | | | | | | | | | 2013 | | | | 17.1 | | | | 17.1 | | 2016 | | | | 10.4 | | | | 10.4 | | % change | | | | -39.4 | | | | -39.4 | | Source: BIS | Since the inception of CNH, pricing gaps tend to persist between onshore and offshore exchange rates, however, it has narrowed over last couple of years. This pricing gap arises on account of different economic conditions in mainland China and Hong Kong amidst imperfect arbitrage (Funke, 2015). While central bank intervention can constrain the movement of CNY at onshore centres, CNH is more market determined and hence closely follows the global swings (Chart 3). Since September 2015, PBOC has reportedly taken action in the offshore market when the onshore-offshore gap was large (McCauley & Shu, 2018).  Further liberalisation of the onshore FX market along with allowance of offshore deliverable market has made the CNY NDF market almost non-existent, despite maintaining the ‘need basis’ principle. Notwithstanding, the existence of basis between CNY and CNH due to the band range trading in CNY and market determined pricing in CNH, the spread has been contracting over years with ample liquidity available in onshore and offshore markets. Further, the creation of offshore market has made various options available to offshore investors to both hedge their exposures on underlying investments and also generate RMB risk in their portfolios via various products and offshore deliverable market. Korea With an average daily turnover of USD 30 billion as per the BIS survey 2016 and USD 29.5 billion in the latest London survey of October 2018, Korean Won (KRW) NDF boasts of the most active and liquid NDF market amongst most emerging market currencies. Further, permissible participation of local banks in the NDF market ensures close integration of onshore and offshore forex markets, allowing for quick sentiment spillovers between the two markets. Turnover in NDF market is substantially higher than onshore forwards mainly on account of higher documentation requirements for accessing onshore market. In the onshore market, average daily turnover was reported at USD10.1 billion in 2017 for forwards, which increased from USD 9.6 billion during the previous year (Chart 4 a &b).  Korea embarked on liberalisation reforms in 1980s, however, took big strides post Asian financial crisis in 1997-98 in line with the IMF adjustment programme. As part of these measures, foreign exchange transactions were liberalised, which allowed the local banks to engage in NDF transactions with non-residents. Prior to this, the development of the onshore currency derivatives market was constrained by legal requirements such as any forward transaction had to be certified as a hedge against future current account flows, the so-called “real demand principle”, which also spurred the development of a liquid offshore “non-deliverable” forward (NDF) market in the Korean Won. In 1999, as part of liberalisation measures, this restriction was lifted and a lot of activity moved onshore, leading to the convergence of the offshore and onshore prices (IMF, 2004). This resulted in sharp increase in NDF transactions between onshore banks and non-residents for both hedging as well as speculative purposes. Amidst likely possibility of turmoil in foreign exchange market, the central bank implemented regulations in January 2004 governing Korean banks NDF positions with the non-residents directed at restraining any potential selloffs. However, these restrictions were abolished in April 2004 as speculative activity was assessed to have reduced significantly. KRW is almost a non-restricted currency, provided the investor holds an Investment Registration Certificate (IRC) issued by the Financial Supervisory Services (FSS) in Korea. The IRC allows an offshore investor to invest in onshore securities and provides near non-restricted currency rights, barring any holding of short selling position in onshore KRW account. For non-residents investors who do not hold IRS, USD/KRW remains a highly regulated market. Any onshore/offshore transactions need to be approved by the appropriate authorities and must have proof of underlying. For multinational clients that repatriate dividends, documentation with proof of underlying must be in place. Further, ceilings are imposed on foreign exchange derivatives transactions of foreign as well as local banks, which came into existence as a prudential measure to mitigate the adverse impact of volatile capital flows. Ahead of the 2008 financial crisis, Korean economy experienced huge build-up of short-term external debt led by foreign exchange derivatives positioning of banks on account of over-hedging undertaken by Korean corporations as well as likely carry trades in anticipation of appreciation of domestic currency. Both these activities were funded using offshore dollar borrowing and posed serious difficulties at the time of global dollar liquidity crunch during financial crisis. With a view to prevent recurrence of the any such episode triggered by volatile capital flows which resurged from 2009, over-hedging was specifically prohibited, and limits were imposed on Foreign exchange derivatives activity of banks in relation to their capital. Liberalization in KRW has been continuing for decades with the last one completed in December 2007 whereby prior approval requirements for some capital account transactions was abolished. Even onshore participants can freely participate in the NDF markets thereby providing onshore liquidity to Non-Residents as long as the hedges are booked as NDF. Essentially, KRW is a fully convertible currency but is only tradable on NDF basis offshore. Malaysia Malaysia had liberal foreign exchange policies until Asian financial crisis with regard to cross border transactions involving Malaysian Ringgit (MYR). Following the crisis, offshore trading of MYR was banned. However, grace period was notified for depositors to repatriate their offshore deposits back to Malaysia and the adoption of fixed exchange rate policy in 1998 - a significant move, whilst imposing selective capital controls. All these measures were intended at ceasing offshore activity which contributed to the excessive pressure on currency despite relatively stronger fundamentals. Although, Malaysia imposed cross border restrictions after the Asian crisis, evolution of NDF market in MYR was initially inhibited by comprehensiveness of regulations as well as its effective enforcement by the authorities (Ishii, 2001). Further, absence of reference rate for settlement of NDF contracts and stringent controls on domestic bank to undertake forward foreign exchange transactions with offshore counterparties also hindered the development of NDF market (EMEAP discussion paper, 2002). As the economy began to recover, capital controls were gradually relaxed and finally the currency was floated in 2005. Generally, Malaysia has opened up its domestic markets for non-resident investors with no restrictions on non-residents investing in local bond markets, except having to appoint a local custodian. Most of the sectors are open for non-resident portfolio equity flows as well in Malaysia. Over the years since 2005, non-resident investors’ participation in the onshore market picked up substantially reaching record high of 39.7 per cent of total outstanding government bonds from nearly 14 per cent in 2005 and in the process contributed to the growth of NDF market as well. McCauley (2013) analysed the direction of influence for nine currencies in 2005-13 as well as separately for the 2008-09 crisis and May-August 2013. Granger causality tests point to two-way causation for most currencies for the full sample. The exception is the Malaysian Ringgit, where the NDF influences the deliverable forward market. The central bank expressed concerns over the adverse impact of increased activities in the ringgit NDF market after wide gap was observed between the NDF and onshore rate in 2016 following the US presidential election. Bank Negara Malaysia’s (BNM) Governor emphasised that ringgit NDF market is used by non-resident investors mostly for speculative purposes rather than genuine demand for hedging. As the NDF trading activity intensified during volatile period in 2016, ringgit-denominated NDF implied much larger depreciation which further exacerbated the then prevailing depreciating pressure on the currency (Chart 5).  Assessing the overwhelming impact of NDF activities which has the potential to undermine financial stability, BNM took a number of measures in 2016 to eliminate speculative transactions in order to ensure appropriate price discovery and orderly functioning of onshore market. These measures includes reinforcement of non-internationalisation policy for Ringgit, steps to improve the onshore pricing mechanism and deepen the domestic forex market. After prohibiting banks from quoting fixing orders used to settle offshore trades, the central bank revised the methodology to compute onshore reference rate to account for transacted deals from mid-2016. Further, BNM imposed a ban on ringgit NDF trading in November 2016 and reminded local banks that ringgit remains a non-internationalised currency and therefore any offshore trading is not recognized. At the same time, BNM strengthened its monitoring to ensure compliance to Foreign exchange administration rules (FEA) rules by market participants on non-involvement in facilitating NDF transactions. Subsequently, financial markets committee (FMC) instituted in mid-2016 laid down a series of developmental measures for onshore market aimed at allowing better market access and greater hedging facilities to market participants (Table 5). | Table 5: Developmental Measures Relating to Foreign Exchange Market | | Jul-16 | Dec-16 | Apr-17 | Adopting global best practices - Transaction based KL USD/MYR reference rate,

- Extension of official closing hour for onshore Ringgit rate.

| Rebalance onshore FX demand and supply - 25% retention of export proceeds in foreign currency,

- Trade settlement among residents in Ringgit only,

- Streamline onshore and offshore foreign currency investment limit.

Promote FX risk management onshore - Active hedging below RM6t million of net open position,

- Active hedging for institutional investors,

- Expansion of appointed overseas office framework.

| Additional FX risk management practices - Streamline passive and dynamic hedging flexibilities for investors,

- Active hedging for corporations.