| November 20, 2015 The Deputy Governor

Reserve Bank of lndia

Mumbai Submission of the Report of the Advisory Committee on Ways and Means Advances to State Governments In terms of the letter No. 1125/10.18.13/2014-15 dated November 24, 2014 constituting an Advisory Committee on Ways and Means Advances to State Governments, the report of the Committee is enclosed. We would like to place on record the outstanding contribution and assistance made by Shri L. Lakshmanan, Assistant Adviser, Internal Debt Management Department of the Reserve Bank of India in the preparation of the Report as also for the analytical inputs towards deliberations of the Committee. | | | Sd/-

(Sumit Bose)

Chairman | | | | |

Sd/-

(Rathin Roy)

Director, NIPFP | Sd/-

(Sudhir Shrivastava)

Add. Chief Secretary (Fin)

Govt. of Maharashtra | Sd/-

(K. Shanmugam)

Pr. Finance Secretary

Govt. of Tamil Nadu | | | | |

Sd/-

(D. P. Reddy)

Pr. Finance Secretary

Govt. of Punjab | Sd/-

(Temjen Toy)

Pr. Secretary & Finance

Commissioner

Govt. of Nagaland |

Sd/-

(N. K. Choudhary)

Pr. Finance Secretary

Govt. of Jammu & Kashmir | | | | | Sd/-

(L. N. Tochhawng)

Finance Commissioner &

Secretary

Govt. of Mizoram |

Sd/-

(G. C. Murmu)

Add. Secretary (PF-I), MoF

Govt. of India |

Sd/-

(R. Kausaliya)

Director, IDMD, RBI

Convenor & Member Secretary |

ACKNOWLEDGEMENT The Committee would like to thank all the State Finance Secretaries/ other Officials of the State Governments and Ministry of Finance, Government of India (GoI) for their participation in the meetings and valuable suggestions for the Report. The Committee wishes to place on record the contributions by the three resources persons, viz., Shri N.R.V.V.M.K. Rajendra Kumar, General Manager, Internal Debt Management Department (IDMD) for his deliberations and inputs, Shri A.K. Mitra, Director, Monetary Policy Department towards his analytical inputs on fiscal monetary coordination and Shri Brijesh Pazhayathodi, Assistant Adviser, Department of Economic and Policy Research (DEPR) for analytical material on State finances. The Committee acknowledges the untiring efforts and valuable support of the Officers and Staff of IDMD, RBI. In particular, the following deserves special mention: Shri Amit Kumar Meena, Assistant Adviser for his data compilation support and Shri Milind S. Phadke, Manager for his logistical and other administrative support in organising the meetings of the Committee as also officials attached to the Regional Offices of Kolkata and New Delhi for the arrangements made for conducting the meetings there and the hospitality extended. The Committee also recognises the contributions of Directors Smt. Deepa S. Raj and Shri I. Bhattacharya and other Officials of Fiscal Analysis Division of DEPR in particular Shri Anand Prakash Ekka, Research Officer for data support. The Committee acknowledges Smt. Rekha Warriar, Chief General Manager, IDMD for her guidance. The Committee immensely benefited from the discussions with Shri H.R. Khan, Deputy Governor and Shri P. Vijaya Bhaskar, Executive Director of the Reserve Bank of India.

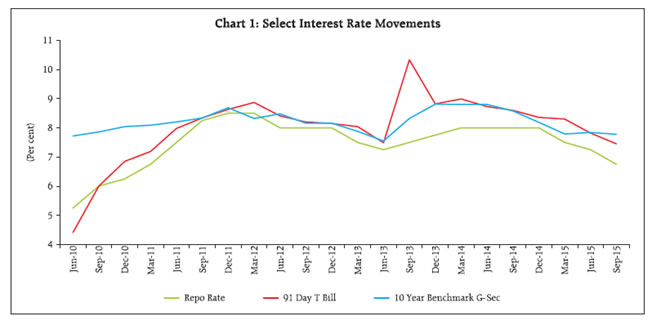

EXECUTIVE SUMMARY i. The State Finance Secretaries (SFS) conference held in August 2014 decided to set up a Committee to revisit the Ways and Means Advances (WMA) scheme for the State Governments. Accordingly, the Advisory Committee on WMA to State Governments was constituted in November 2014. For the first time, the composition of the Committee was extended to six SFSs and Joint Secretary, PF-I, GoI as Members in addition to two external fiscal experts including one as Chairman. Evolution of WMA Scheme ii. The Reserve Bank of India (RBI) provides financial accommodation to the States banking with it through agreement to tide over temporary mismatches in the cash flow of their receipts and payments as WMA. They are intended to provide a cushion to the States to carry on their essential activities and normal financial operations. iii. In addition to Normal WMA, Special Drawing Facility (SDF) (nomenclature changed from Special WMA) has also been in operation since April 1953. When the advances to the State Governments exceed their SDF and WMA limits, Overdraft (OD) facility is being provided. iv. Three Advisory Committees were constituted in the past under the chairmanship of (i) Shri B.P.R. Vithal (1998), (ii) Shri C. Ramachandran (2003), and (iii) Shri M.P. Bezbaruah (2005), in addition to the Informal Group of State Finance Secretaries (2000) to review the WMA scheme for the State Governments. State Finances and 14th Finance Commission (FC) Implications v. A brief review of State finances indicates that the ratio of revenue deficit to fiscal deficit improved significantly, declining from 36.8 per cent in 2004-05 to (-) 10.4 per cent in 2012-13. The surplus in the revenue account was, however, nearly wiped out in 2013-14. vi. Outstanding debt-GDP ratio of States declined steadily from 31.1 per cent in 2004-05 to 21.6 per cent in 2012-13. Freeing up resources for higher capital outlays, improving the quality of fiscal consolidation and setting the consolidated debt-GDP ratio of the States on a declining trajectory is crucial to the health of State finances. vii. The fiscal size of the States increased significantly after 2005-06 as the compound annual growth rate (CAGR) of revenue expenditure increased to 15.4 per cent during 2006-07 to 2013-14 as compared with 9.3 per cent during 2000-01 to 2005-06. viii. Reviewing the fiscal situation of States, the 14th FC noted that, at an aggregate level, fiscal indicators of States improved during 2004-05 to 2013-14. The 14th FC recommendations indicate compositional shift in transfers from grants to tax devolution with a view to meet the twin objectives of increasing the flow of unconditional transfers to the States and yet leave appropriate fiscal space for the GoI to carry out specific purpose transfers to the States. ix. As per the 14th FC, the aggregate corpus of State Disaster Response Fund (SDRF) works out to ₹61,219 crore during the award period of 2015-16 to 2019-20. As mentioned in the SDRF investment guidelines, if the State Executive Committee (SEC) earmarks specific amount for investment in Government securities, the Reserve Bank could manage the same on the lines of Consolidated Sinking Fund (CSF)/Guarantee Redemption Fund (GRF)/ Special Drawing Facility (SDF) investments. Liquidity Position of the State Governments and Availment of WMA x. Annual review of availment of WMA to ascertain the adequacy of the limit reveals that since 2008-09, only few States have been regularly availing SDF/ WMA, while some availed occasionally. States availing OD increased from 3 in 2008-09 to 6 in 2011-12 and further to 10 in 2014-15. Average peak utilisation of OD increased to ₹449 crore in 2014-15 from ₹199 crore in 2013-14. xi. The Committee studied the pattern of transfers from GoI to States during the recent period and observed that the cash flow mismatch on account of transfers from the Centre seems limited, except in Q4. xii. Notwithstanding the manyfold increase in the net RBI credit to State Governments, the contribution of WMA to reserve money growth remained relatively modest. xiii. Since the financial year 2012-13, it is observed that the peak availment of WMA and OD by the States together was much lower than the tolerable limit for monetary policy implications. xiv. Empirical evidence suggests that if increase in revenue expenditure is more than covered by higher revenue receipts, then the revenue deficit reduces over a period of time, and thereby preempts a lower access to WMA from the Reserve Bank. However, the growth of revenue receipts was not in tandem with the growth in revenue expenditure for all the States, which forced some States to resort to WMA/ OD. Conclusions and Recommendations xv. Taking into account the significant increase in fiscal size of the States, as also to provide some cushion to keep pace with the fiscal developments, the Committee felt that there is a need to revise the WMA limits at this stage. xvi. The Committee considered various scenarios/ basis for the revision of WMA, viz., GFD, GSDP, total expenditure, revenue receipts, total expenditure minus revenue deficit, etc., for devising the formula. Finally, the Committee decided to take total expenditure net of lotteries for the latest three years’ average as the base for deciding WMA limit (2011-12 to 2013-14 Accounts). xvii. Quantum increase in WMA limit of around 15 per cent was considered appropriate keeping in view the similar growth in expenditure between 2005-06 and 2013-14 and also bifurcation of quantum among Himalayan States & North Eastern States (HS&NES) and other States in the ratio of 12.81:87.19. Accordingly, the multiplying ratio has been arrived at 2.78 per cent and 2.03 per cent, respectively for HS&NES and other States. xviii. The revised WMA quantum works out to ₹32,225 crore for all the States. The increase in Statewise WMA limits is in the range of 70.6 per cent to 132 per cent. CSF Investment and SDF Eligibility xix. The CSF withdrawal and its impact on SDF eligibility was referred later to the Committee for its deliberation and recommendation. The Committee recommended that the present system of incremental investments in CSF/GRF will continue for deciding the eligibility of the SDF. As an incentive to invest in CSF and GRF liberally, all incremental investments (at present restricted to WMA limit) may be allowed for availing SDF without any limit in line with the eligibility available for investments in G-Secs and Auction Treasury Bills (ATBs). xx. If States avail of SDF against the collateral of GoI dated securities and ATBs, they will not be allowed to invest in any of these securities for the next 90 days. xxi. In case of second and subsequent investment in 91 day TBs and availing of SDF against such collateral, during the financial year, such availment would be treated as WMA after the first occasion. Future Guidance xxii. The 14th FC recommendations on devolution and the post devolution revenue deficit grants to 11 States are expected to eliminate structural revenue deficits. The Committee felt that since 14th FC recommendations were being implemented from FY 2015-16, States would require some transition time to adjust their finances in line with the new vertical and horizontal devolution. The limits proposed by the Committee will be implemented in the current financial year. These limits would continue for two years. However, the Committee recommends that a review be undertaken by the RBI in 2017-18 when final expenditure numbers for FY 2015-16 will be available. xxiii. From 2017-18, the WMA limits will be revised based on the total expenditure net of lotteries, revenue deficit and power bond expenses, if any. xxiv. Committee based next revision of WMA may be effected in 2020-21 taking into account the then fiscal positions of the States and the road map likely to be deliberated in the 15th FC report.

I. INTRODUCTION The Reserve Bank of India (RBI) is the debt manager for 29 State Governments and the Union Territory of Puducherry as also the banker to the State Governments except Government of Sikkim1, in terms of their agreement with RBI under Section 21 A of the Reserve Bank of India Act 1934. Under this Section, the Reserve Bank shall undertake all money, remittance, exchange and banking transactions in India, including in particular, the deposit, free of interest, of all its cash balances with the Bank; and the management of the public debt of, and the issue of any new loans by, that State. Towards this endeavour, the Reserve Bank makes advances to State Governments to tide over mismatches in the cash flows of their receipts and payments. Such advances are termed as Ways and Means Advances (WMA), which are repayable in each case not later than three months from the date of the making of the advance in terms of Section 17 (5) of the RBI Act. The Reserve Bank has been extending such advances to State Governments since 1937 under this provision. The maximum amount of WMA by the Reserve Bank and the interest charged thereon are regulated by agreements with the State Governments as also based on the recommendations of various Committees/ Groups constituted, which are discussed in detail in Chapter II. 1.2 The WMA scheme was revised in April 2006 based on the recommendations of the Advisory Committee on Ways and Means Advances to State Governments (Chairman: Bezbaruah). In response to the requests made by some of the State Governments as also in accordance with the discussions held in the State Finance Secretaries’ (SFS) conference of 2013, the WMA limit was increased by 50 per cent for all States over their then existing limit since November 11, 2013. As discussed in the SFS conference held in August 2014 based on an agenda item to revisit the WMA scheme, an Advisory Committee was constituted in November 2014, with two external fiscal expert including one as Chairman, Joint Secretary, PF-I, GoI and six SFSs representing each zone of Indian States as members in addition to a Member Secretary from Internal Debt Management Department (IDMD) of the RBI. Accordingly, the initial composition2 of the Advisory Committee was as under: i. Shri Sumit Bose – Chairman (Member, Expenditure Management Commission, GoI and former Finance Secretary, GoI) ii. Dr. Rathin Roy, Director, National Institute of Public Finance and Policy (NIPFP) – Member iii. Shri Sudhir Shrivastava, Additional Chief Secretary of Govt of Maharashtra – Member iv. Shri K. Shanmugam, Principal Finance Secretary of Govt of Tamil Nadu - Member v. Smt Vini Mahajan, Principal Finance Secretary of Govt of Punjab - Member vi. Shri Temjen Toy, Principal Secretary & Finance Commissioner of Govt of Nagaland - Member vii. Shri B.B. Vyas, Principal Finance Secretary of Govt of Jammu & Kashmir - Member viii. Ms. L.N. Tochhawng, Finance Commissioner of Govt of Mizoram - Member ix. Shri Rajiv Kumar, Joint Secretary, PF-I, MoF, GoI - Member x. Smt R. Kausaliya, Director, IDMD, RBI – Convenor & Member Secretary TERMS OF REFERENCE OF THE COMMITTEE 1.3 The terms of reference (ToR) of the Committee broadly covers the following: i. To review the existing WMA scheme for the State Governments, particularly the formula for fixation of limits, and recommend modifications, if necessary, in the light of the recommendations of the 14th Finance Commission; ii. To examine the existing Overdraft regulations for the State Governments; iii. To examine the scheme of Special Drawing Facility (SDF) of the State Governments; and iv. Any other issues germane to the subject. As a fallout of the discussion in the SFS conference 2015, the CSF withdrawal and its impact on SDF eligibility was referred later to the Committee for its deliberation and recommendation. APPROACH OF THE COMMITTEE 1.4 The composition of the Committee was extended for the first time to include Finance Secretaries of select six State Governments as Members in addition to PF-I, GoI representation. The Secretarial and research support to the Committee was provided by the Internal Debt Management Department of the RBI. The Committee adopted a consultative approach and accordingly formalised its recommendations based on the discussion among Members as also non-member State representatives and fiscal experts. The Committee held three meetings. In the first meeting in Mumbai (Annex 9), it was decided to examine, among others: (i) the reasons for sudden and regular availment of WMA/ OD by some States; (ii) empirically study the relationship between Revenue Deficit (RD), cash surplus and availment of WMA for the recent period; (iii) analyse the 14th Finance Commission report and its implication on State finances; and also (iv) analyse the increase in WMA limit and its overall impact on money supply and other monetary policy related implications. 1.5 The second meeting was held in Kolkata, where Finance Secretaries of five State Governments of the region, were also invited to offer their views. In the meeting, it was decided to: (i) ascertain the status of implementation of e-receipts and e-payments model in the State Government transactions and its implications on cash management; (ii) study the tax forecast of the Union Budget vis-à-vis actual collection and its devolution to State Governments for the recent period; (iii) estimate the tolerable limit of WMA target as per Bezbaruah Committee formula adjusted for inflation and fiscal targets; (iv) study the cross country experience on sub-national cash management of few countries such as Brazil, Indonesia, South Africa and Germany; and (iv) study the feasibility of more number of auctions of SDLs to reduce the cash flow mismatches as also to avoid availing more WMA/ OD from the Reserve Bank. 1.6 In addition, Shri Sumit Bose, Chairman of the Committee was invited to the SFS conference held on May 25, 2015 to address the State Officials. Based on the discussion, Chairman requested all the State Governments to forward their views for the benefit of the Committee. Views received from State Governments were discussed and are summarised in Annex 8 of the Report. Further, in the SFS conference, an agenda item on withdrawal from CSF by States was discussed. As the incremental investment in CSF is eligible as collateral to avail SDF from the RBI, some of the State Governments suggested that their eligibility to avail SDF should not be curtailed after such withdrawal from the CSF. It was decided in the SFS conference that this issue may be referred to the Advisory Committee for further deliberation to arrive at an appropriate recommendation as part (iv) of ToR. 1.7 The Chairman, along with Dr. Rathin Roy, had discussions with select officials of the IDMD on August 31, 2015. The final meeting of the Committee was held at RBI, New Delhi on November 20, 2015, which finalised the recommendations, after due deliberations, and the letter of transmittal was signed by the Members. The follow-up actions on the issues raised in the Committee meetings as well as other issues discussed are appropriately included across the Report. STRUCTURE OF THE REPORT 1.8 Against this backdrop, the rest of the Report is organised into four Chapters. Though the evolution of the WMA scheme for the State Governments was given in the earlier Committees’ reports, a summary of the same is covered in Chapter II for ready reference and the detailed historical review of the minimum balance and the background of WMA scheme are elaborated in Annex 2. The 14th Finance Commission (FC) recommendations and its implications on State finances along with the recent fiscal position of the States are discussed in Chapter III. Chapter IV empirically evaluates the liquidity position of the States and analyses in detail the availment of WMA/ OD by the States. Further, the increase in WMA limit and its overall impact on the money supply in the context of monetary policy are also examined in this Chapter. Conclusions and recommendations of the Committee are set out in Chapter V. An update of the consolidated measures recommended by the earlier Committees is listed in Annex 1. Historical trend in interest rates on WMA and OD are codified in Annex 3. Annex 4 details the utilisation of WMA and consolidates the investment in Intermediate Treasury Bills (ITBs) and Auction Treasury Bills (ATBs) by the State Governments. Fiscal indicators, viz. , revenue expenditure, lottery expenditure and capital expenditure used as base for WMA calculation of the States is given in Annex 5. Annex 6 briefly sets out the operating procedures and liquidity management framework of the Reserve Bank. Annex 7 lists the various combinations of WMA formulas attempted for this Report. Annex 8 briefly summaries the views expressed by the State Governments on WMA/ OD. Annex 9 lists the officials who attended the Advisory Committee meetings II. EVOLUTION OF WAYS AND MEANS ADVANCES SCHEME 2.1 The Reserve Bank provides financial accommodation to the States banking with it through agreement to help the States to tide over temporary mismatches in the cash flow of their receipts and payments as WMA. They are intended to provide a cushion to the States to carry on their essential activities and normal financial operations. As mentioned earlier, the WMA provided by the RBI to the States are governed by Section 17(5) of the Reserve Bank of India Act, 1934. There are two types of Ways and Means Advances, viz., (i) Normal WMA or clean advance, which was introduced in 1937; and (ii) Special WMA instituted in 1953, which is secured advance provided against the collateral of GoI securities. As requested by the State Governments in the SFS conference held in May 2013, the nomenclature of Special WMA was changed to SDF since June 23, 2014 by amending the respective agreement with State Governments. In addition, an overdraft (OD) facility is also provided to the State Governments whenever RBI credit to the State Government exceeds the SDF and WMA limits. The maximum amount of such advances by the Reserve Bank and the interest charged thereon are, however, not specified in the RBI Act but are regulated by voluntary agreements with the State Governments as also based on the recommendations of various Committees. 2.2 As a banker to the State Governments, the Reserve Bank is not entitled to any remuneration for the conduct of ordinary banking business other than the advantages, which may accrue to it from the holding of States’ cash balances free of obligation to pay interest thereon. The WMA limit was equal to the minimum balance in 1937, when these limits were instituted for the first time. A major change in the principles adopted for working out the WMA limits occurred in 1999 consequent to the recommendations made by an Informal Advisory Committee (IAC). WMA/ OD SCHEME: PERIODIC REVISIONS 2.3 The WMA scheme was periodically reviewed, keeping in view the States’ requirements, the evolving financial and institutional developments, as well as the objectives of monetary and fiscal management3. Ten revisions were made in the WMA limits till August 1996. In 1953, the WMA limits were fixed at twice the revised minimum balance. The WMA limits were increased to 12 times of the minimum balances in 1967 and further to 168 times in 1996. During the period October 1986 to March 1988, two intra-year WMA limits were specified - 52 times the minimum balance during the first half of the year and 48 times the minimum balance in the second half. Since 1999, the limits are being fixed based on the recommendations of the Advisory Committees set up periodically by the Reserve Bank. ADVISORY COMMITTEES CONSTITUTED BY THE RBI 2.4 In the past, three Advisory Committees were set up by the RBI, in addition to an informal Group of State Finance Secretaries (GSFS). Each Advisory Committee was headed by an expert with experience in State finances (Table 1). Each Committee had one fiscal expert as member along with the Chairman. The consolidated recommendations by these Committees on the WMA formula are tabulated briefly in Annex 1 and historical background is set out in Annex 2. VITHAL COMMITTEE (1998) 2.5 A major change in fixing the Normal WMA and Special WMA limits of States was effected by the Informal Advisory Committee (Chairman: Shri B.P.R. Vithal, Member, 10th Finance Commission). The Vithal Committee observed that fixing the WMA limits as multiples of an unchanged minimum balance did not capture the differing needs of the States as observed from the States budgetary transactions. This had resulted in wide inter-State variations in the WMA limits in relation to the size of the budget and it was felt that this needs to be corrected. | Table 1: Advisory Committees Constituted by the RBI | | Sl. No. | Year | Chairman | Member | Member Secretary | | 1 | 1998 | B.P.R. Vithal | Ashok Lahiri | CGM, IDMD | | 2 | 2003 | C. Ramachandran | Suman Bery | CGM, IDMD | | 3 | 2005 | M.P. Bezbaruah | D.K. Srivastava | CGM, IDMD | 2.6 Therefore, the Vithal Committee recommended delinking of the size of the WMA limit with the minimum balance and recommended that the WMA limits of the States be fixed as a multiple of their budgetary turnover to capture the differing needs of the States in line with the growth in their budgetary transactions. Separate multiplying ratios were specified for Special and Non-Special Category States. Accordingly, the WMA limits were fixed by applying the ratio of 2.25 per cent and 2.75 per cent, respectively for non-special and special category States to the three year average of revenue receipts plus capital expenditure (accounts) for the years 1994-95, 1995-96 and 1996-97, as published in the State Budgets. INFORMAL GROUP OF STATE FINANCE SECRETARIES (2000) 2.7 The Vithal Committee had recommended substantial enhancement of limits of WMA but had stated that these limits should remain unchanged for the period covered by the recommendations of the 11th Finance Commission (FC). However, based on the representations from the State Governments, Group of State Finance Secretaries (GSFS) was constituted by the Reserve Bank in November 2000. Certain modifications in the then existing scheme and further enhancements of WMA limits were recommended by that Group. Two years after adopting the recommendations of the GSFS, the Reserve Bank decided to review the entire formula of WMA in the light of the emerging fiscal conditions in State finances. Accordingly, an Advisory Committee was constituted to review the WMA scheme under the Chairmanship of Shri C. Ramachandran, former Secretary (Expenditure), GoI. RAMACHANDRAN COMMITTEE (2003) 2.8 The Ramachandran Committee recognized that, from the point of view of the States, it is the adequacy of the limit to accommodate likely mismatches that is relevant and important. Therefore, exclusion of capital expenditure from the base could be compensated by adopting a higher ratio to the revenue receipts than the ratio used to determine the WMA limits. Therefore, the Committee recommended multiplying ratios of 3.19 per cent and 3.84 per cent, respectively for non-special and special category States on the base of average of the latest three years revenue receipts - two years’ actuals and one year’s revised estimates approved by the Comptroller and Auditor General (C&AG). 2.9 In the 1990s, the WMA, in addition to meeting the temporary mismatches in cash flows, also emerged as one of the sources of financing the structural mismatches of the States. The Ramachandran Committee observed that the review of WMA limits can be linked with the Finance Commission’s award on resource transfer to the States. Further, the WMA formula remained generally valid during the award period of the Finance Commission and thus, recommended a review of the WMA formula after the receipt of the recommendations of the 12th FC. BEZBARUAH COMMITTEE (2005) 2.10 The last formula based WMA revision was made on the basis of the Bezbaruah Committee. The Bezbaruah Committee perceived that the formulation of WMA limits by the Reserve Bank over the medium term needs to take into consideration: (i) the adequacy of existing WMA limits to cover temporary mismatches in the cash flows of the State Governments; (ii) the size of expected temporary cash flow mismatches over the medium term particularly in the context of the recommendations of the 12th FC; and (iii) consistency with the objectives of monetary management. The Committee recommended that the base should be taken as the average of the latest three years’ total expenditure (actuals) excluding repayments and adjusted for onetime ad-hoc expenditures and lottery expenditures. While in the case of States having a revenue deficit, the base should exclude the revenue deficit. After approximation, the multiplying ratios were taken as 3.1 per cent for Non-Special Category States and 4.1 per cent for Special Category States. Accordingly, the WMA limit was revised since April 1, 2006. 2.11 The Committee observed that the WMA limits may be reviewed every year. The Committee expects that with the reduction in the revenue deficit over time, the limits as computed for 2006-07 may prove to be quite adequate, in which case annual revision of the limits may not be necessary. The Committee further recommended that the next review of the WMA/ OD scheme may be undertaken after the receipt of the recommendations of the 13th FC. 2.12 The Reserve Bank has been undertaking annual reviews of WMA availment by the States since the revision held in 2006-07. It was observed that since 2009-10, about 11 States have been regularly availing WMA/ OD, while few States availed WMA occasionally. Many States have not availed WMA despite substantial increase in their expenditure since 2006-07. Annual reviews of utilisation of WMA revealed that only few States were availing this facility frequently and also the total utilisation of WMA was not much. 2.13 As there were continuous requests from some of the State Governments to revise the WMA limits, as also requests made in the SFS conference held in May 2013, the cash flow analysis of many of the States was undertaken. It was decided to increase the WMA limits for the State Governments by 50 per cent of then existing limit of ₹10,240 crore to ₹15,360 crore with effect from November 11, 2013. Thereafter, this Advisory Committee was constituted to review the WMA/ OD scheme. State-wise current WMA limit is set out in Table 2. As banker, the RBI has to provide reasonable amount of temporary advances to States to tide over liquidity mismatches. However, the quantum of advances the Reserve Bank could provide without affecting the monetary policy operations and fiscal discipline are issues that need to be addressed. The reconciliation of these conflicting needs of providing adequate temporary financing and continuing a regime where fiscal discipline is maintained, as well as the difficulties of distinguishing between a temporary liquidity problem and a structural deficit problem, are the challenges, which the RBI has to face while dealing with the WMA, which are discussed in detail in Chapter IV. | Table 2: WMA Limit for State Governments | | (₹ Crore) | | Sl. No | States/UTs | Limit as per Bezbaruah Formula | Limit since Nov 11, 2013 | | 1 | Andhra Pradesh4 | 880 | 770 | | 2 | Arunachal Pradesh | 65 | 98 | | 3 | Assam | 300 | 450 | | 4 | Bihar | 425 | 638 | | 5 | Chhattisgarh | 190 | 285 | | 6 | Goa | 65 | 98 | | 7 | Gujarat | 630 | 945 | | 8 | Haryana | 295 | 443 | | 9 | Himachal Pradesh | 190 | 285 | | 10 | Jammu and Kashmir | 315 | 473 | | 11 | Jharkhand | 280 | 420 | | 12 | Karnataka | 625 | 938 | | 13 | Kerala | 350 | 525 | | 14 | Madhya Pradesh | 460 | 690 | | 15 | Maharashtra | 1160 | 1740 | | 16 | Manipur | 60 | 90 | | 17 | Meghalaya | 60 | 90 | | 18 | Mizoram | 55 | 83 | | 19 | Nagaland | 80 | 120 | | 20 | Odisha | 300 | 450 | | 21 | Punjab | 360 | 540 | | 22 | Rajasthan | 505 | 758 | | 23 | Tamil Nadu | 730 | 1095 | | 24 | Telangana * | - | 550 | | 25 | Tripura | 100 | 150 | | 26 | Uttar Pradesh | 1020 | 1530 | | 27 | Uttarakhand | 145 | 218 | | 28 | West Bengal | 545 | 818 | | 29 | Puducherry | 50 | 75 | | | Total | 10,240 | 15,360 | | * Reorganised from Andhra Pradesh since June 2, 2014. | SPECIAL DRAWING FACILITY (SDF) 2.14 In addition to the WMA, SDF5 has also been in operation, which is a secured advance and linked to the investments made by State Governments in the GoI securities. At the time of the initiation of the scheme in April 1, 1953, a uniform limit of ₹2 crore was allocated to each State. The sanctioned limits of Special WMA were linked to (six times) the minimum balance in 1967 and were periodically revised upwards to 64 times the minimum balance in 1996. Since March 1999, Special WMA limits of the State Governments have been linked exclusively to their holdings of GoI dated securities and Treasury Bills, adjusted for margin. The Reserve Bank also maintains two Funds - CSF and GRF - on behalf of the States and the incremental investments in these Funds also qualifies for SDF upto a ceiling equivalent to their WMA limit as recommended by the Bezbaruah Committee. A uniform hair cut margin of five per cent is being applied on the market value of the securities for determining the operating limit of the SDF. Accordingly, the SDF limit for the State Governments will undergo changes according to the valuation of outstanding securities. As at end-March, 2015, the SDF eligibility of the State Governments stood at ₹42,755 crore. OVERDRAFT FACILITY (OD) 2.15 When the advances to the State Governments exceed their SDF and WMA limits, OD facility is being provided. The limit on number of days was fixed at 7 consecutive working days in the initial period. Subsequently, based on the representations from certain State Governments, the Reserve Bank introduced some flexibility in the scheme by enhancing the period for which a State Government could run on OD from 7 to 10 consecutive working days with effect from November 1, 1993. As per IAC recommendation, in 1998 the Reserve Bank imposed a ceiling on the OD amount at 100 per cent of the WMA limit with the provision that any OD over 100 per cent of the WMA limit had to be cleared within three working days. Subsequently in 2001, based on the recommendations of the GSFS, the limit of 10 consecutive working days was extended to 12 consecutive working days and the restriction for bringing down the OD level within the level of 100 per cent of the WMA limit was relaxed to five consecutive working days. The Committee observed that even with enhancement in the WMA, resort to OD has not declined. It appears that when a State remains in OD for more than 200 days in a year, WMA becomes a resource and the OD becomes WMA. As a result, OD is used to manage the resource crunch between two spells of WMA, hence constraint is no longer financial limit but a time limit. Thus frequent resort to OD is a manifestation of structural imbalance or bad cash management. 2.16 The Ramachandran Committee observed that greater resort to OD is a clear indication of fiscal imbalance and unless regulated in time, it would lead to a situation where the corrections would become costly and difficult. However, the total number of days that a State can remain in OD has been extended to 14 consecutive working days by the Ramachandran Committee. The existing norm of restricting OD to 100 per cent of the WMA limit being continued, i.e., if the OD exceeds this limit continuously for 5 consecutive working days for the first time in a financial year, the State will be advised by the RBI to bring down the OD level and if such irregularity persists on a second or subsequent occasion in the financial year, the RBI will stop payments notwithstanding the provision of permitting OD upto 14 days. In a quarter, the OD availed should not exceed 36 days irrespective of 14 days & 5 days rules. The Bezbaruah Committee decided not to modify the existing time limits for OD at that stage. INTEREST RATE ON SDF, WMA & OD 2.17 Advances availed by the State Governments attract interest on the outstanding6. The interest rates on WMA and OD witnessed periodic revisions. Prior to May 1976, the interest rate on WMA did not exceed the Bank Rate. Thereafter the rate of interest on these advances was revised. From May 1976 to August 1996 a graduated scale of charges based on the duration of the advance was introduced to discourage the States from using the facility as a normal budgetary resource. Since then a single rate of interest is being applied on WMA. In general, while WMA were charged not above the Bank Rate, the interest rate on OD usually exceeded the Bank Rate. The details of historical interest rates charged on SDF, WMA and OD are listed in Annex 3. Based on the recommendations of the Bezbaruah Committee, the interest rate on WMA scheme has been revised as in Table 3. | Table 3: Interest Rate on SDF, WMA & OD | | Scheme | Days/Limit | Rate of Interest | | 1. SDF | – | Repo rate minus 1% | | 2. WMA | Up to 90 days | Repo rate | | 3. WMA | Above 90 days | Repo rate plus 1% | | 4. OD | Availment equal to WMA Limit | Repo rate plus 2% | | 5. OD | Availment is more than WMA Limit | Repo rate plus 5% | | Note: As on November 13, 2015, the Repo Rate was at 6.75%. | III. STATE FINANCES AND 14th FINANCE COMMISSION IMPLICATIONS Recent Trends in State Government Finances7 3.1 Before discussing the trends in availment of WMA/ OD by the States, as also the tolerance level of WMA by the Reserve Bank in view of monetary policy operations, it would be more appropriate to examine the recent developments in fiscal position of the States and the recommendations of the 14th FC on the State finances. At the consolidated level, key deficit indicators of the States for 2014-15 were budgeted to improve from the revised estimates (RE) of the previous year (Table 4). Budget estimates (BE) for 2014- 15 was based on a marked acceleration in revenue receipts to bring about an expansion in the surplus on the revenue account after erosion to near-balance in the preceding year. It may be observed that States taken together, moved into a revenue surplus position in 2006-07 and have maintained this since then, except for 2009-10 when the implementation of Pay Commission awards and reduced revenue buoyancy on account of the economic slowdown resulted in revenue deficit. The surplus in the revenue account was, however, nearly wiped out in 2013-14. Underlying this erosion was a reflection of slowdown in both own tax and non-tax revenues. Notwithstanding an improvement in the State VAT revenue growth, other major own tax revenues were affected by the sluggishness in the economy. At the same time, growth in revenue expenditure increased significantly over the previous year on account of increase in social sector expenditure. In addition, the capital outlay on food and warehousing had to be enhanced in preparation for the implementation of the National Food Security Act, 2012. While the overall GFD-GDP ratio in 2013-14 at 2.5 per cent was in line with the 13th FC target, State-wise position shows that 12 out of the 28 States could not meet the same. Most States reaffirmed their commitment to fiscal consolidation in 2014-15. | Table 4: Major Deficit Indicators of State Governments | | (As per cent of GDP) | | Item | 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 (RE) | 2014-15 (BE) | | GFD | 2.4 | 1.8 | 1.5 | 2.4 | 2.9 | 2.1 | 1.9 | 2.0 | 2.5 | 2.3 | | RD | 0.2 | -0.6 | -0.9 | -0.2 | 0.5 | 0.0 | -0.3 | -0.2 | 0.0 | -0.4 | | PD | 0.2 | -0.4 | -0.5 | 0.6 | 1.2 | 0.5 | 0.4 | 0.5 | 1.0 | 0.8 | 3.2 Decomposition of the consolidated GFD of the States indicates that the capital outlay exceeded the GFD in 2014-15, with the revenue surplus augmenting the required resources for financing the same (Table 5). In absolute terms, the GFD constituted on an average 52 per cent of the capital outlay during 2009-10 to 2014-15. | Table 5: Decomposition of Gross Fiscal Deficit | | (per cent) | | Item | 2005-06 | 2006-07 | 2007-08 | 2008-09 | 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 RE | 2014-15 BE | | GFD=(1+2+3-4) | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | | 1. Revenue Deficit | 8 | -32 | -57 | -9 | 16 | -2 | -14 | -10 | -1 | -18 | | 2. Capital Outlay | 86 | 127 | 158 | 106 | 79 | 94 | 102 | 99 | 94 | 114 | | 3. Net Lending | 6 | 8 | 9 | 4 | 5 | 9 | 13 | 12 | 8 | 5 | | 4. Non-Debt Capital Receipts | 0 | 2 | 9 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 3.3 The notable features of financing the GFD during the recent period is that the market borrowing emerged as the major financing source as the compound annual growth rate (CAGR) increased to 31.7 per cent during 2006-07 to 2013-14 as compared with 8 per cent of CAGR during 2000-01 to 2005-06. Contribution of national small savings fund (NSSF) investments in State Governments’ special securities in financing GFD continued to remain negative due to redemptions exceeding fresh investments (Table 6). State provident fund is another source of financing of the GFD of the States. | Table 6: Financing of Gross Fiscal Deficit | | (Per cent) | | Year | Market Borrowings | Loans from Centre | Special Securities issued to NSSF | Provident Fund, etc. | Others | | 2005-06 | 17.0 | 0.0 | 81.9 | 11.6 | -10.5 | | 2006-07 | 16.9 | -11.5 | 72.3 | 13.4 | 8.9 | | 2007-08 | 71.5 | -1.2 | 7.8 | 16.4 | 5.7 | | 2008-09 | 77.3 | -0.6 | 1.1 | 11.6 | 10.5 | | 2009-10 | 59.7 | -0.9 | 12.8 | 12.3 | 16.2 | | 2010-11 | 55.0 | 0.4 | 23.9 | 17.2 | 3.4 | | 2011-12 | 80.4 | 0.1 | -4.8 | 15.8 | 8.4 | | 2012-13 | 74.8 | 0.9 | -0.1 | 13.2 | 11.2 | | 2013-14 (RE) | 70.8 | 2.6 | -1.3 | 9.0 | 18.9 | | 2014-15 (BE) | 77.7 | 4.4 | -0.6 | 9.1 | 9.4 | 3.4 The outstanding liabilities of the State Governments recorded double-digit growth during the period 2012-13 to 2014-15 (BE). The proposed transition from the present origin-based indirect tax regime to a destination-based tax regime under the goods and services tax (GST) from April 1, 2016 should create a buoyant source of revenue in the medium term. Freeing up resources for higher capital outlays, improving the quality of fiscal consolidation and setting the consolidated debt-GDP ratio of the States on a declining trajectory is crucial to the health of State finances. 3.5 A brief review of State finances shows that the ratio of revenue deficit to fiscal deficit, an indication of the extent to which borrowing is used for meeting revenue expenditures, showed a marked improvement, declining from 36.8 per cent in 2004-05 to (-) 10.4 per cent in 2012-13. The outstanding debt-GDP ratio declined steadily from 31.1 per cent in 2004-05 to 21.6 per cent in 2012-13. Most aggregate indicators of revenue receipts on the whole showed improvement till 2007-08 and deteriorated thereafter for 2008-09 and 2009-10. The trend seems to have reversed again from 2010-11, with revenue receipts showing significant increases. The States’ aggregate own revenues (the sum total of own tax revenues and own non-tax revenues) as a percentage of GDP showed an upward trend, increasing from 7.0 per cent in 2004-05 to 7.6 per cent in 2012-13. Aggregate own tax revenues increased more or less steadily from 5.6 per cent in 2004-05 to nearly 6.5 per cent in 2012-13 (with marginal decrease in 2008- 09 and 2009-10). However, aggregate own non-tax revenues decreased from 1.4 per cent in 2004-05 to about 1.2 per cent in 2012-13, thus partly offsetting the buoyancy of own tax receipts. The VAT constituted around 61 per cent of aggregate own tax revenues of the States and remained almost unchanged throughout the period 2004-05 to 2012-13. Overall improvement in State finances was driven by States’ own initiatives to increase revenues and rationalise expenditure, higher tax devolution because of buoyancy in Central taxes, and increased collections from VAT. By 2012-13, most States became revenue surplus, with their combined GFD being well below the target of 3 per cent of GSDP. 3.6 The fiscal size of the States has increased significantly after the 2005-06 revision of WMA as the CAGR of revenue expenditure increased to 15.4 per cent during 2006-07 to 2013-14 as compared with 9.3 per cent of CAGR during 2000-01 to 2005-06 (Table 7). Similarly, revenue receipt increased by 15.6 per cent during the period as compared with 13.4 per cent increase during the previous period. However, the capital expenditure recorded a slower growth of 12.9 per cent after 2005-06 as compared with 16.1 per cent earlier to cope up with the fiscal discipline prescribed by the FCs as also the FRBM restrictions. Also the capital receipts increased by 8.6 per cent during 2006-07 to 2013-14 compared with 8.3 per cent during the earlier period. Taking into account the significant increase in fiscal size of the States, compared with the position during the last revision as also to provide some cushion to keep pace with the fiscal developments, the Committee felt that there is a need to revise the WMA formula at this stage. | Table 7: Annual Compound Growth of Fiscal Parameters (%) | | Indicator | 2000-01 to 2005-06 | 2006-07 to 2013-14 | | Revenue Receipts | 13.4 | 15.6 | | Revenue Expenditure | 9.3 | 15.4 | | Capital Receipts | 8.3 | 8.6 | | Capital Expenditure | 16.1 | 12.9 | | Total Receipts | 11.8 | 13.9 | | Total Expenditure | 10.5 | 14.9 | | Total Gap | 3.7 | 12.6 | | Market Borrowings | 8.0 | 31.7 | 3.7 Some of the challenges for States on the fiscal front are: (i) efficient utilisation of the enhanced resources through tax devolution under the 14th FC award; (ii) efforts to mobilise non-tax revenue; (iii) impact of seventh pay commission awards; (iv) realistic capital outlays; and (v) an appropriate measurement of debt to include off-budget high risk liabilities. 3.8 While reviewing the fiscal position of States, RBI publication titled “State Finances: A Study of Budgets of 2014-15” highlighted the necessity to improve the predictive power of budget estimates with respect to actual outcomes. Improvement in fiscal marksmanship is important for delivering on fiscal consolidation intentions. In this regard, States need to improve the reliability of their forecasts of key fiscal parameters like tax, expenditure, macroeconomic aggregates, etc. 14TH FC RECOMMENDATIONS AND ITS IMPLICATIONS ON STATE FINANCES 3.9 The 14th FC (Chairman: Dr. Y.V. Reddy) submitted its Report in December 2014, which was placed before the Parliament on February 24, 2015. Reviewing the fiscal situation of States, the 14th FC noted that, at an aggregate level, fiscal indicators of States improved during the period from 2004-05 to 2013-14 (RE). Some of the major recommendations of the 14th FC relating to State Finances are in the following paras. Vertical Distribution 3.10 With a view to minimising discretion, improving the design of transfers, avoiding duplication and promoting co-operative federalism, the 14th FC suggested a review of existing arrangements for transfers outside the recommendations of the FC. Accordingly, it suggested that a new institutional arrangement may be evolved which can, inter alia, make recommendations regarding sector-specific and area-specific grants. The FC recommended increase in tax devolution to 42 per cent from 32 per cent of the divisible pool and sector-specific FC grants to be dispensed with - reflecting compositional shift in transfers from grants to tax devolution with a view to meet the twin objectives of increasing the flow of unconditional transfers to the States and yet leave appropriate fiscal space for the Union to carry out specific purpose transfers to the States. 3.11 Sector-specific FC grants to be dispensed with include grants-in-aid to be given for local bodies (53.5 per cent share in total grants); disaster management (10.2 per cent share) and post devolution revenue deficit grant where devolution alone could not cover the assessed gap (36.3 per cent share). Accordingly, 11 States qualified to receive such grants. States such as Andhra Pradesh, Himachal Pradesh, Jammu and Kashmir, Manipur, Mizoram, Nagaland and Tripura will need a revenue deficit grant for each of the years of the award period. In addition, four States, viz., Assam, Kerala, Meghalaya, and West Bengal will need a revenue deficit grant for at least one of the years of the award period. The post devolution revenue deficit as calculated by the 14th FC has been fully covered by the recommended revenue deficit grant. Horizontal Distribution 3.12 Inter-state devolution attempts to mitigate the impact of the differences in fiscal capacity and cost disability among States. The 14th FC has not used the distinction between non-special and special category states. Grants for Local Bodies 3.13 Grants distribution to States for local bodies are on the basis of the 2011 population data (weight of 90 per cent) and area (weight of 10 per cent). The grants are to be divided into two broad categories on the basis of rural and urban population - Gram Panchayats and Municipal Bodies. The share of Gram Panchayats is to be 69.6 per cent of the total grants during the award period 2015-2020; further, grants to be of two types – basic grant and performance grant, which depends on (i) making available reliable data on local bodies’ receipt and expenditure through audited accounts; and (ii) improvement in own revenues. State Governments should strengthen State Finance Commissions (SFC), including timely constitution, and adequate resources for smooth functioning and timely placement of the SFC report before State legislature. Goods and Services Tax 3.14 The compensation for revenue loss to the States for implementation of GST is to be 100 per cent for first 3 years, 75 per cent in the fourth year and 50 per cent in the fifth year. An autonomous and independent GST Compensation Fund is to be created. Fiscal Discipline and FRBM 3.15 The 14th FC recommended that the States’ annual GFD-GSDP ratio is to be anchored at 3 per cent of GSDP and will have the flexibility of upto 0.5 per cent provided the following conditions are met. Making a marked departure, the 14th FC has linked fiscal discipline to borrowing criteria rather than devolution criteria and the States are eligible for additional borrowings if: (i) the debt-GSDP ratio is less than or equal to 25 per cent; and/ or (ii) the interest payments are less than or equal to 10 per cent of the revenue receipts in the preceding year. Availing additional borrowing is conditional on the State having no revenue deficit in the year in which borrowing limit is to be fixed as also in the preceding year. Further, States to be given the option to carry forward unutilised borrowing limit in the following year during the award period. Thus, a State can have a maximum GFD-GSDP limit of 3.5 per cent in any given year during the award period. This may enable fiscally well managed States to borrow more for undertaking developmental capital expenditure. 3.16 The 14th FC has recommended that the Union Government should consider making an amendment to the FRBM Act to omit the definition of effective revenue deficit from April 1, 2015. Moreover, it recommended an amendment to the FRBM Act mandating the establishment of an independent fiscal council to undertake ex-ante assessment of the fiscal policy implications of budget proposals and their consistency with fiscal policy and rules. 3.17 In continuation with the disintermediation principle advocated by the 13th FC, the 14th FC has recommended that States may be excluded from the operations of the NSSF with effect from April 1, 2015, and their involvement be limited to discharging the liabilities already incurred. However, Union Budget 2015-16 has made a provision of ₹103.4 billion for NSSF’s investment in State Government securities, indicating that NSSF would continue to finance State Governments’ fiscal deficit. The 14th FC recommended that all the States should target improving the quality of fiscal management encompassing receipts and expenditures. Further, State Governments are to provide statutory ceiling on the sanction of new capital works to an appropriate multiple of the annual budget provision. However, some of the above recommendations are yet to be considered by the Union Government. Implications for State Government Finances 3.18 On the issue of tax devolution, the 14th FC’s recommendation of 42 per cent tax devolution may not significantly alter the aggregate resource transfers from the Centre, although it may give more untied transfers to the States, thus providing greater fiscal autonomy. To address horizontal imbalance, 14th FC has accorded greater importance to fiscal capacity, with the indicators of cost and revenue disabilities being assigned a combined weight of 72.5 per cent as against 57.5 per cent assigned by the 13th FC. 3.19 It may be noted that as per the recommendations of the 14th FC, the Centre-State funding pattern of some of the Centrally Sponsored Schemes (CSS)/ Programmes is already being modified in the Union Budget 2015-16 in view of the larger devolution of tax resources to States. The Union Budget proposed that eight CSS be delinked from support from the Centre. In respect of various other CSS, the sharing pattern will undergo a change with States sharing a higher fiscal responsibility in terms of scheme implementation. 3.20 In terms of 14th FC recommendations, all States are required to contribute 10 per cent to the SDRF during the award period of 2015-16 to 2019-20, and the remaining 90 per cent will be contributed by the Union Government. Accordingly, the aggregate corpus of SDRF works out to ₹61,219 crore during the award period. In view of huge proposed corpus in the SDRF, if the State/ State Executive Committee (SEC) earmarks specific amount to be invested in Government securities, the Reserve Bank could manage the same on behalf of the State Governments, provided the investment operation procedures would be similar as followed in case of CSF/ GRF/ SDF managed by the Reserve Bank. IV. LIQUIDITY POSITION OF THE STATE GOVERNMENTS AND AVAILMENT OF WMA: AN EMPIRICAL ANALYSIS Trends in availment of WMA/ OD 4.1 The Reserve Bank has undertaken annual review of availment of WMA/ OD by the States after the revision in 2006-07 to ascertain the adequacy of the limit. It is observed that since 2008-09, few States have been regularly availing SDF/ WMA, while some availed occasionally. Many States have not availed WMA despite substantial increase in their expenditure since 2006-07. The number of States that availed WMA increased from 6 in 2010-11 to13 in 2013-14, which declined to 12 in 2014-15 (Table 8). States availing OD also increased from 3 in 2008-09 to 6 in 2011-12 and further to 10 in 2014-15. | Table 8: Availment of SDF, WMA & OD by States | | (No. of States) | | Year | SDF | WMA | OD | | 2008-09 | 8 | 6 | 3 | | 2009-10 | 10 | 10 | 4 | | 2010-11 | 8 | 6 | 4 | | 2011-12 | 8 | 9 | 6 | | 2012-13 | 10 | 9 | 8 | | 2013-14 | 13 | 13 | 8 | | 2014-15 | 13 | 12 | 10 | | 2015-16 * | 8 | 11 | 7 | | * Upto September 2015 | 4.2 In view of the requests from some of the State Governments to revise the WMA limits, as also requests made in the SFS conference, the Reserve Bank reviewed the utilisation in alignment with State’s cash flow projections during 2013. Based on the above, it was observed that due to substantial increase in budget size of the States, it was considered to raise the WMA limit. Accordingly, the WMA limit was raised for all States by 50 per cent of the then existing limit with effect from November 11, 2013 and was decided that an Agenda on this would be placed in the SFS conference 2014 to look into the WMA scheme. Accordingly, the total limit was increased to ₹15,360 crore from ₹10,240 crore. In response to the increase in limits, utilization of WMA and OD increased substantially by select States (Annex 4.1). Thus, the dependence of select States on WMA continued in the post revision period also. 4.3 The average utilisation of WMA by the States put together against the total limits fixed stood at 2.1 per cent of the total limits in 2010-11, which increased to 3.2 per cent in 2012-13 and declined thereafter to 2 per cent in 2013-14 (Table 9). During 2014-15, however, the average utilisation of WMA by the States together stood at 4.79 per cent of the total limits for all States. Average utilisation of WMA and OD put together doubled during 2014-15 as compared to the previous year. Since March 2015, the monthly average utilisation of WMA/ OD by the States has been high upto October 2015 (Annex 4.1). Though States were encouraged to maintain positive cash balance at the end of the financial year, the utilisation of OD during March 2015 is a cause of concern despite increase in WMA limits in November 2013. Thus, linking enhanced WMA limit with increase in volume of transaction would not serve the purpose, as upto certain limits, the cash flow mismatches should be managed within the exiting WMA limit. Increase in volume does not automatically lead to an increase in the mismatch. | Table 9: Utilisation of SDF, WMA and OD by States | | (₹ Crore) | | Year | SDF | WMA | OD | | Peak Utilisation | Daily Average Utilisation | Peak Utilisation | Daily Average Utilisation | Average Utilisation as % to Total Limits | Peak Utilisation | Daily Average Utilisation | | 2007-08 | 1791.14 | 281.59 | 968.90 | 258.63 | 2.61 | 1292.99 | 108.72 | | 2008-09 | 1578.56 | 282.76 | 1111.42 | 54.11 | 0.55 | 700.56 | 12.41 | | 2009-10 | 1034.63 | 203.17 | 814.12 | 109.07 | 1.10 | 425.80 | 25.22 | | 2010-11 | 1323.34 | 414.71 | 985.00 | 212.46 | 2.14 | 1283.16 | 83.57 | | 2011-12 | 1149.46 | 294.36 | 1298.80 | 243.44 | 2.38 | 3073.19 | 82.03 | | 2012-13 | 1234.64 | 237.01 | 1220.00 | 326.76 | 3.19 | 999.19 | 121.70 | | 2013-14 | 1159.89 | 277.10 | 1265.90 | 313.93 | 2.04 | 1141.33 | 103.44 | | 2014-15 | 4594.75 | 487.89 | 3005.88 | 736.01 | 4.79 | 4204.95 | 246.69 | | Source: RBI records | Relationship between RD, Availment of WMA/ OD and Cash Surplus – An Empirical Analysis 4.4 Since 2011, the annual average availment of SDF/ WMA/ OD by the State Governments has increased year after year due to structural issues faced by some of the fiscally stressed States. Number of States availing WMA/ OD as at end-March increased from 3 in 2011 to 6 in 2015, which reveal that some part of these States’ GFD has been financed by borrowings from the RBI through WMA. Annual average overall liquidity mismatches (as measured by the utilization of NWMA, SDF and OD (NSO) has increased to ₹133.16 crore, ₹74.21 crore and ₹134.5 crore, respectively during 2014-15 from ₹72.94 crore, ₹60.19 crore and ₹62.82 crore during 2013-14. 4.5 A panel regression exercise was conducted in order to ascertain the linkages between structural/fiscal imbalances and economic growth on the one hand and liquidity imbalances of the State Governments on the other, over the period from 2007-08 to 2014-15. The dependent variable was overall liquidity mismatch, as given by the sum of the annual averages of NWMA, SDF and OD, which was also normalized by the aggregate (revenue plus capital) expenditure (NSO_TEXP). The independent variables were revenue deficit (RD), RD as a ratio of GSDP (RD_GSDP), RD as a ratio of GFD (RD_GFD), States investment in ITBs and the rate of growth of GSDP (GGSDP). Consolidated data on States’ availment of SDF/ WMA/ OD during 2007-08 to 2014-15 have been taken together for this exercise. In the panel data framework, both fixed effect and random effect models were attempted. 4.6 In the fixed effect model, the variables such as RD_GFD, the growth of GSDP and ITBs were found to be statistically significant (Table 10). The overall fit of the above equations are fairly good. In the fixed effect model, the RD_GFD is statistically significant at 1 per cent level. The positive sign in RD_GFD indicates that overall liquidity mismatches, as a ratio to aggregate expenditure (NSO_TEXP) would increase with an increase in RD. Alternatively, with a reduction in RD_ GFD, reflecting an improvement in the quality of fiscal adjustment, overall liquidity mismatches would decline. This seems likely, since a large part of revenue expenditure is committed and directed towards non-developmental purposes such as salary, pension, etc. If increase in revenue expenditure is more than covered by an enhancement of revenue receipts, then the revenue deficit would get reduced over a period of time, and would, thus, preempt a lower proportion of borrowings from the RBI. This, in turn, is likely to reduce the day-to-day mismatches in the cash flows of receipts and expenditures. 4.7 The coefficient of the rate of growth of GSDP (GGSDP) is negative and statistically significant at 5 per cent level in both the models. This indicates that an increase in the rate of growth of GSDP is associated with a reduction in overall liquidity mismatches. This is again on expected lines, since the size and regularity of cash inflows are likely to enhance during a phase of buoyant economic growth. The coefficient of investment in ITBs is negative and statistically significant at 10 per cent level in fixed effect model and at 5 per cent level in random effect model. This indicates that increase in availment of WMA/ OD from RBI will reduce States’ investment in ITBs. | Table 10: States Availment of NSO- Fixed effect model | | DEP. VAR | R2 | F | IND. VARs | COEFF | T-STAT | SIGNIFICANCE | | NSO_TEXP | 0.45 | 5.15 | RD_GFD | 1.15 | 3.37 | 0.001 | | | | | GGSDP | -1.11 | -2.084 | 0.039 | | | | | ITBs | -2.48 | -1.86 | 0.0649 | 4.8 In the random effect model also, variables such as ITBs, RD, growth rate of GSDP and RD_GFD were significant (Table 11). An attempt has also been made to segregate the data of special category and non-special category States. The fit of the non-special category States was statistically insignificant as many of them availed WMA/ OD occasionally while few States have availed WMA/ OD regularly. However, majority of the special category States have been availing WMA/ OD regularly and the result of the panel data regression under random effect model showed statistical significance at 1 per cent level for RD-GFD and 10 per cent level for other variables. | Table 11: States Availment of NSO- Random effect model | | DEP. VAR | R2 | F | IND. VARs | COEFF | T-STAT | SIGNIFICANCE | | NSO_TEXP | 0.14 | 6.14 | RD_GFD | 1.16 | 1.78 | 0.0773 | | | | | GGSDP | -3.99 | -2.113 | 0.0362 | | | | | RD | -7.62 | -2.78 | 0.0061 | | | | | ITBs | -1.16 | -2.505 | 0.0133 | STATES’ CASH FLOWS AND GOI TRANSFERS 4.9 Transfers from the GoI in the form of grants-in-aid and share in central taxes constituted about 40 per cent of the revenue receipts of all the States during 2009-10 to 2013-14 and in the case of special category States, it constituted about 75 per cent during 2013-14. Therefore, transfers from the Centre are also an important factor that determines the cash flows of the State Governments. To understand the impact on cash flows of States, tax transfers to States from GoI are analysed, both quarter-wise and month-wise. 4.10 Under quarter-wise analysis, usual trend in GoI transfers is observed where the last quarter of the year always receives the maximum tax receipts compared to the first three quarters. It is assumed that the gross tax revenue (GTR) collection of the GoI would be 40 per cent in the last quarter and 20 per cent each for the first three quarters. Accordingly, the budgeted GTR is bifurcated across four quarters as per the above ratio. On similar logic, it is also assumed that transfer from GoI to States is also as per the above ratio, i.e., 20 per cent each for Q1 to Q3 and 40 per cent for Q4. Against the budget estimates, the actual receipt of GTR by the GoI as reported in the monthly Government Accounts has been juxtaposed to ascertain the shortfall in collection at the GoI level. 4.11 The major observations at the GoI level reveal that GTR was ₹11,40,064 crore on an average during 2012-13 to 2014-15 and the same was distributed according to the ratio of 20 per cent for Q1 through Q3 and 40 per cent for Q4 (Table 12). The actual receipt of GTR as percentage to BE for GoI, on an average, worked out to 93.2 per cent during 2012-13 to 2014-15 and on a quarterly basis, it was at 72.5 per cent, 114.9 per cent, 115.4 per cent and 81.5 per cent for Q1 through Q4. It is observed that, GoI collection of GTR fell short of the estimate in Q1 and Q4 while around 15 per cent more than the assumed estimate was seen in Q2 and Q3. | Table 12: Gross Tax Revenue - Average of 2012-13 to 2014-15 | | Amt in ₹ Crore | | Item | Average of 2012-13 to 2014-15 | Average of 2012-13 to 2014-15 | | Q1 | Q2 | Q3 | Q4 P | | GoI | | 20% | 20% | 20% | 40% | | 1 | BE of Gross Tax Revenue by GoI | 1,226,002 | 245,200 | 245,200 | 245,200 | 490,401 | | 2 | Actual Gross Tax Revenue | 1,140,064 | 176,696 | 281,200 | 282,351 | 399,817 | | 3 | Tax Revenue receipt by GoI as a Percentage to BE (%) | 93.2 | 72.5 | 114.9 | 115.4 | 81.5 | | Assignments to States | | 20% | 20% | 20% | 40% | | 4 | Budget Estimate of GTR by States | 343,710 | 68,742 | 68,742 | 68,742 | 137,484 | | 5 | Actual Tax Revenue transfer from GoI to States | 315,862 | 76,956 | 76,452 | 75,796 | 93,184 | | 6 | Tax Revenue receipt by States as a Percentage to BE (%) | 92.2 | 111.9 | 111.2 | 110.3 | 68.6 | | P: provisional for Q4 of 2014-15 | | Source: http://cga.nic.in/ monthly account & Union Budget 2015-16. | 4.12 At the States level, it is observed that States received (transfer of tax revenues) marginally more than the estimates in the first three quarters, i.e., 111.9 per cent, 111.2 per cent, 110.3 per cent against 68.6 per cent in Q4, respectively. This shows that during Q1 through Q3, States received more than the estimates. In other words, keeping in view the assumptions, Central transfers to States was as per estimates and no uncertainties were observed except in the last quarter when overall collection of GoI itself was much lower than the estimates. Rather the shortfall in transfers in the last quarter was compensated with higher transfers in the first three quarters in spite of GoI collection being less than the estimates. On the whole, the GoI transfer to States was as per the estimates and no uncertainties were observed except in the last quarters. Accordingly, cash flow mismatch on account of transfers from the Centre seems limited, except in Q4. Assignments to States in excess of 100 per cent in the initial quarters would imply an automatic lower eligibility in the fourth quarter and that per se may not be a sign of uncertainty. INCREASE IN WMA LIMIT – OVERALL IMPACT ON MONEY SUPPLY AND MONETARY POLICY 4.13 The Reserve Bank, a unique central bank, has agreements with the sub-national Governments to act as banker. As a banker, the Reserve Bank is providing temporary advances to State Governments to facilitate normal financial operations. Loans and advances to State Governments in the form of SDF/ WMA/ OD is a unique scheme to tide over their cash flow mismatches. As once WMA limits are prescribed, States have the full freedom to access it and it becomes an autonomous component of liquidity over which the central bank has least control. Liquidity forecasting exercise becomes simpler for the central bank if the Governments maintain a targeted balance in their single treasury account (STA) with the central bank and pursue active cash management to ensure that they hit the targeted balance at the end of the day. While such a high degree of sophistication is not envisaged for the State Governments in the near future, they should ensure that the current WMA discipline is not weakened. 4.14 In the ultimate analysis, WMA to State Governments entails injection of liquidity to the financial system. Liquidity deficit of the Centre and the States adds to the liquidity in the financial system. This can, in principle, conflict with the primary monetary policy objective of achieving price stability. On an incremental basis, the increase in the net RBI credit to State Governments accounted for 1.9 per cent of accretion to reserve money during 2014-15, up from 0.4 per cent in 2013-14. Notwithstanding the many-fold increase, the contribution of WMA of State Governments to reserve money growth remained relatively modest. 4.15 In the absence of any means to forecast the WMA of State Governments, the day-to-day volatility can complicate making assessment of the system level expected liquidity mismatch on a daily/ intra-day basis. The resort to WMA by State Governments from the Reserve Bank represents an autonomous injection of liquidity to the banking system to meet temporary cash flow mismatches (and not to fund structural deficit) of State Governments that, ceteris paribus, needs to be offset by withdrawing liquidity through its liquidity management tools. However, in practice, WMA of State Governments, has been a small element in the overall liquidity exercise. If, however, all States are in WMA, and the amount varies significantly on a daily basis, it can have significant implications for liquidity management of the Reserve Bank. It is, therefore, imperative that State Governments continue to limit their recourse to WMA to minimise the spillover effects to the RBI’s monetary policy operations for the purpose of ensuring monetary stability. The increased utilisation of WMA at the year-end by the State Governments during the recent period (comparing end-March position of 2013, 2014 and 2015) is a cause of some concern. TOLERANCE LEVEL 4.16 The broad objectives of the Reserve Bank’s liquidity management operations are to ensure that liquidity conditions do not hamper the smooth functioning of financial markets and disrupt flow of funds to the real economy (Annex 6). The WMA to the State Governments results in an increase in liquidity in the financial system. The WMA, however, has historically remained a minor component in the reserve money expansion. Different States have different temporal patterns of liquidity gaps. It is the net position at the aggregate level that matters for liquidity management of the Reserve Bank. The increase in net Reserve Bank credit (WMA) to State Governments accounted for less than 2 per cent of the accretion to reserve money in 2014-15. This has been mainly because the WMA scheme provides for a strict discipline in cash management, involving in the extreme, suspension of payments to State Governments. Further, even when different States access the WMA facility across the year, they do not access WMA window at the same points of time. 4.17 While the WMA limits need to be arrived at as per the past practice adopted by the various Advisory Committees to provide for discipline in cash management and ensure fiscal prudence, the implications for monetary and liquidity management also have to be borne in mind. In view of the above, keeping in view the need for State Governments to continue with their progress in achieving fiscal consolidation, and taking note of the devolution that has been recommended by the 14th FC, as an outer limit in a year, the maximum share of incremental WMA in incremental reserve money should not exceed 2 per cent (i.e., ₹4,000 crore per annum) till the current WMA limit is exhausted, and contained within 1 per cent (₹2,000 crore per annum) thereafter. Since the financial year 2012-13, it is observed that the peak availment of WMA and OD by the States together was at ₹2,463 crore for 2012-13, ₹1,822 crore in 2013-14 and ₹5,455 crore during 2014-15. Thus, the incremental WMA in the incremental reserve money has been well within the tolerable limit. Keeping States’ past usage of WMA record, it is envisaged that States as a whole will not take recourse to the WMA facility at any given point of time, which would otherwise have severe monetary implications. IMPLICATIONS OF SURPLUS CASH BALANCES OF STATE GOVERNMENTS 4.18 Over the past decade, State Governments have accumulated sizeable surplus cash balances. The surplus cash balances of State Governments are invested automatically in ITBs of the GoI and form part of its liabilities. Though States are encouraged to maintain positive cash balance at the end of the financial year, about 4-6 States have availed WMA during the past four years (Annex 4.2). However, on an average, State Governments have been maintaining about ₹76,300 crore in the ITBs for the past five years (Annex 4.3). In addition, some States have invested in ATBs to the tune of about ₹53,800 crore, on an average, for the past three years (Annex 4.4). 4.19 At present, States cash balances are automatically invested in the ITBs of the GoI where the rate of interest is 5 per cent per annum, which is lower than other forms of borrowings, which are market determined rate. The revenue loss to the States is evident from the difference in the ITB rate and the market rate for their borrowings. Many States have expressed concern on this negative carry (Annex 8). States have suggested that the Bezbaruah Committee had changed the bench mark interest rate on WMA/ OD from the Bank rate to Repo rate, thus the return on States’ investment in ITBs should also have been linked ideally to the Repo rate. 4.20 The 14th FC observed that State Governments, in aggregate, have reported sizeable cash balances during the recent period. While it is necessary for the States to keep adequate cash balances to cover risks, excessive balances entail costs, both in terms of interest payments and lower capital expenditures. There is merit in analysing the reasons that led to holding of such costly large cash balances during the period and addressing the relevant issues such as negative carry in the cash balance of the States. Overall, State Governments should undertake prudent measures to improve their cash management practices and attempt to minimize the access to WMA facility, if not fully eliminated. V. CONCLUSIONS AND RECOMMENDATIONS 5.1 As observed from the discussions in the preceding chapters, the fiscal position of the States during the very recent period is different from the situation that prevailed before 2006-07, when the report of the last Advisory Committee (Chairman: Bezbaruah) was disseminated. First, States have been adhering to fiscal discipline envisaged by the 13th FC, which has been reiterated by the 14th FC. Second, overall availment of WMA/ OD by the States has decreased significantly as compared with the position before 2006-07. Only few States availed WMA/ OD from the Reserve Bank frequently while some States resorted to WMA occasionally to meet their temporary cash flow mismatches. Third, States’ investments in ITBs and ATBs have increased significantly during the recent period due to prudent cash management by the States. Fourth, financing of GFD of the States are mainly from market borrowings than small savings and other sources of financing as seen earlier. The 14th FC has recommended for exclusion of State Governments from the operations of the NSSF, which may further increase the share of market borrowings in financing the fiscal deficit. Fifth, financing of GFD through borrowings from the Reserve Bank has declined significantly as only six States availed WMA at the end of the financial year 2014-15 compared to 20 States at the end of March 2005. Finally, the fiscal size of the State budgets has increased significantly since the last Committee based WMA revision as the revenue receipts, revenue expenditure, capital outlay and loans and advances increased by over 15 per cent on a CAGR basis. Against this backdrop, this Committee has attempted to formulate WMA and OD schemes best suited to the requirements of the States while keeping in view the need for appropriate fiscal discipline. RECOMMENDATIONS OF THE COMMITTEE NORMAL WMA LIMITS 5.2 The WMA Scheme has been periodically reviewed, keeping in view the States’ requirements; the evolving fiscal, financial and institutional developments as well as the objectives of monetary and fiscal management. As stated earlier in the report, the formula for Normal WMA limits were last revised in 2006-07 on the basis of Bezbaruah Committee recommendations, which proposed that the base should be taken as the average of the latest three years total expenditure excluding repayments and adjusted for one-time ad-hoc expenditures and lottery expenditures (Accounts). It is observed that previous three Advisory Committees/ Group recommended increase in WMA limits ranging between 34.1 per cent and 76.4 per cent during 1998- 2005 (Table 13). While the Vithal Committee adopted revenue receipt and capital expenditure as the base, the Ramachandran Committee fixed the WMA limits based on revenue receipts, and the Bezbaruah Committee took the total expenditure with some adjustments for revenue deficit and one-time expenditure as the base to fix the WMA limits. This Committee deliberated on the current WMA limits, adequacy of the limits, utilization of the WMA by the States, size of temporary mismatches as also macroeconomic issues such as States’ fiscal position, fiscal-monetary coordination, etc., while formulating the formula. | Table 13: Increase in WMA Limits over the Period | | Limits recommended by | Non-Spl. Category States

(₹ Cr) | Spl. Category States

(₹ Cr) | Total

(₹ Cr) | Increase