A systemic risk survey (SRS), the nineteenth in the series1, was conducted during October-November 2020, to capture the perceptions of experts, including market participants, on the major risks faced by the Indian financial system. The survey results, based on 31 respondents, are encapsulated below. Outlook on Major Risk Categories 2. In the broad category of risks to the financial system, respondents rated select institutional risks (viz., asset quality deterioration; additional capital requirements; level of credit growth; and cyber risk) as ‘high’ (Figure 1 and 2). Global risks, macroeconomic risks and financial market risks were perceived as ‘medium’ in magnitude but certain components therein (viz., global and domestic growth; domestic inflation; fiscal deficit; corporate vulnerabilities; infrastructure development; and equity price volatility) remain high (Figure 2). 3. This represents a clear shift from the SRS for April 20202, which was conducted during the early months of the pandemic and risks for all the major groups were rated as ‘high’. Also, unlike in the previous survey round in which risks to economic growth (global and domestic) and fiscal deficit were assessed ‘very high’, none of the risks were categorised ‘very high’ by the respondents this time around.

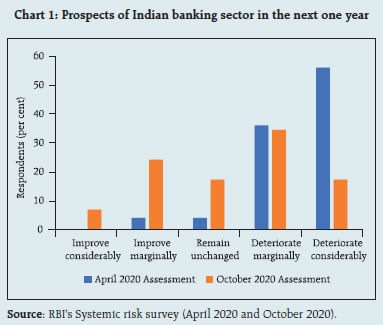

Outlook on Financial System 4. Over a third of the respondents expected marginal deterioration in the prospects of the Indian banking sector over the next one year on account of the negative impact on earnings, lower net interest margins, elevated asset quality concerns and a possible increase in provisioning requirements. On the other hand, about 24 per cent of the respondents felt that prospects are going to improve marginally (Chart 1). Even as the respondents expecting deterioration exceeded those expressing optimism over the next one year, the overall responses indicate a better outlook as compared with the previous round of the survey.  5. The majority of the respondents expect a ‘medium’ probability of occurrence of a high impact event in the financial system, in India as well as globally, in the medium term (one to three years). In the short-term (up to one year), the possibility of occurrence of a high impact event was assessed as low for India and ‘medium’ globally. These assessments contrasted with the previous round of the survey in which a high/ very-high probability was assigned to the occurrence of a high impact event in the Indian/global financial system in the short-term. 6. Respondents also expressed higher confidence about financial stability than in the previous round of the survey. The share of respondents who were ‘fairly confident’ about the stability of the global and the Indian financial system stood at 71 per cent and 61.3 per cent, respectively (Chart 2). 7. The majority of the respondents felt that credit demand would increase marginally over the next three months with better economic prospects. Average credit quality is expected to deteriorate marginally over this period (Chart 3) as the impact of the moratorium and lockdown is yet to play out completely in the books of banks. Poor repaying capacity of borrowers in many sectors, coupled with a decline in collection efficiency due to localised lockdowns, may also translate into a lower quality book. COVID-19 Pandemic and Recovery 8. The survey respondents felt that tourism and hospitality, construction and real estate, aviation, automobiles and retail were the major sectors adversely affected by the COVID-19 pandemic (Table 1). Compared to the last survey round, more respondents expected recovery prospects for tourism and hospitality, aviation and automobile sectors. The slow pace of overall economic recovery and lingering uncertainty about the duration of the pandemic is, however, likely to moderate the revival prospects for the travel, tourism and hospitality sectors. Demand and pricing pressures are expected to continue for the real estate sector (particularly for residential and retail sub-segments) over the next six months. For other sectors, gradual reduction in pandemic related restrictions may lead to marginal improvements.

| Table 1: Sectors adversely affected by COVID-19 and their future prospects | | (per cent of respondents) | | Sector | Prospects of recovery in the next 6 months | | Good | Moderate | No change | Bleak | | Tourism and Hospitality | | 29 | 16.1 | 54.8 | | Construction and Real Estate | 5 | 30 | 35 | 30 | | Aviation | 5.3 | 36.8 | 10.5 | 47.4 | | Automobiles | | 71.4 | 14.3 | 14.3 | | Retail | | 66.7 | 16.7 | 16.7 | | Source: RBI's Systemic risk survey (October 2020). | 9. Participants were asked to rank the major impediments to a robust economic recovery post COVID-19 in India (Table 2). Lack of robust private sector investment emerged as the topmost concern, followed by declining consumer spending/ confidence. | Table 2: Major Impediments to a Robust Economic Recovery post COVID-19 | | Concern | Rank | | Lack of robust private sector investment | 1 | | Declining consumer confidence/spending | 2 | | Supply chain disruptions | 3 | | Financial impact on operations and/or liquidity and capital | 4 | | Workforce reduction/Employee stress | 5 | | Lack of information for decision making | 6 | | Impact on tax and trade issues | 7 | | Lower productivity | 8 | | Source: RBI's Systemic risk survey (October 2020). | 10. Over 60 per cent of the respondents predicted that the post COVID-19 economic recovery is likely to be U-shaped, i.e., immediate fall followed by a longer period to recovery (Chart 4), which was similar to the findings of the last survey. Another 16 per cent of the respondents expected a quick V-shaped recovery, which was not expected by any respondent in the previous survey round. Risks to Domestic Financial Stability 11. The survey participants cited the following major factors as posing risks to domestic financial stability, going forward: -

Inflationary pressures coupled with poor GDP growth could limit the policy space for rate cuts and keep yields under pressure. -

The continuing adverse impact on MSMEs due to lack of cash flows, low demand, lack of man power and lack of capital could lead to prolonged stress in the sector and large-scale permanent closure of units with associated implications for employment. -

Real estate prices and cash flows in commercial real estate could undergo a major structural correction due to transformation in the model of conducting work, resulting in further pressure on real estate developers and lending to the sector. -

Ongoing stress in specific segments of the service economy, viz., hotels, entertainment, travel, tourism and taxi services could lead to credit stress on corporate and retail assets in the financial system. -

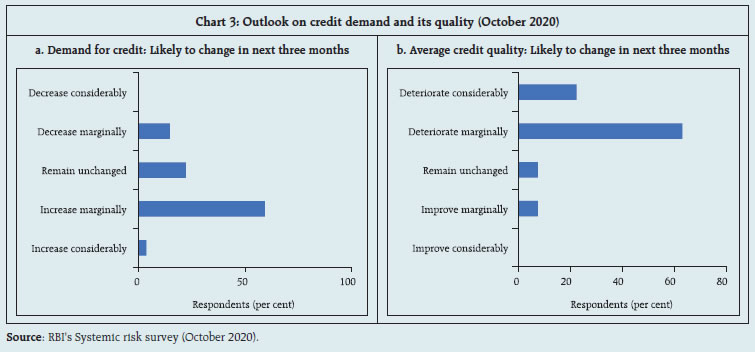

For NBFCs, growth prospects in the immediate future could be affected by the dampened outlook for housing and vehicle finance, funding challenges especially for lower rated NBFCs in a confidence-sensitive scenario and tightening underwriting standards on expectation of increasing delinquencies. -

India is among the top three nations identified by investors as likely to suffer from significant debt distress. A global risk aversion towards EM assets could lead to massive capital outflows and create pressure on the rupee as well as on bond yields. In this context, uncertainty on the roadmap for tapering unconventional measures taken by the regulators could impact investor confidence.

|