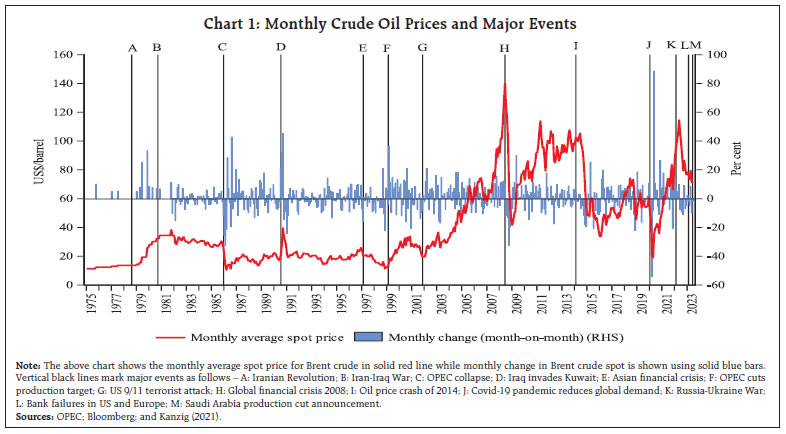

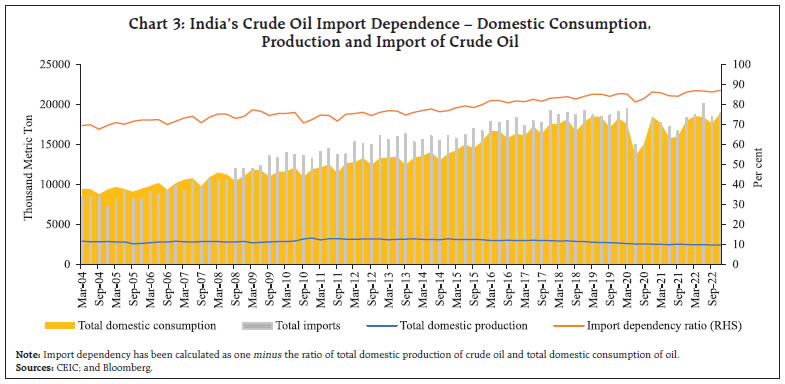

by Bhanu Pratap, Ramesh Kumar Gupta, Jessica M. Anthony, Deba Prasad Rath and Thangzason Sonna^ Recent research has shown that supply-related announcements by the Organisation of Petroleum Exporting Countries (OPEC) can affect oil prices and the macroeconomy even before such supply changes materialise. This study analyses the impact of such announcements on the Indian economy. Findings suggest that domestic crude oil basket, sectoral stock prices and bond yields are immediately impacted by OPEC’s announcement of its supply decisions. Further, such oil supply-related news shocks cause a sustained increase in consumer prices while reducing economic output, albeit for a short duration. These results have important implications for India – a net importer of crude oil – to deliver price stability. Introduction Dealing with uncertainty is an inherent part of central banking. Conducting monetary policy in today’s interconnected, globalised world requires constant vigilance – keeping eyes and ears to the ground – against potential shocks that may derail the economy from its targeted path. Shocks to the economy can arise from varied sources – one such source is the global crude oil market. The Russia-Ukraine war, which erupted in February 2022 even as the Covid-induced supply constraints had just started to ease, has again called our attention towards crude oil. Russia is amongst the leading suppliers in the global oil market with a share of about 14 per cent in total global oil supply as of 2021. Besides, it is also the world’s second largest producer of natural gas and holds the largest gas reserves globally. Thus, the implications of the war were visible on crude oil prices – brent crude oil hitting a price of US $125 per barrel in March 2022, highest since 2012 and almost six-folds above the bottom observed during April 2020. This gave way to an energy-induced cost-push inflation across the globe. As per the latest April 2023 issue of the World Economic Outlook (WEO) released by the International Monetary Fund (IMF), global inflation rose from 4.7 per cent in 2021 to 8.7 per cent in 2022. Although it is expected to decline to 7.0 per cent in 2023, it will still remain above the level seen in 2021. Central banks promptly reacted to this inflationary surge by hiking their policy rates and scaling back their accommodative policies to tame inflation. Although oil price dynamics and its macroeconomic impact have been well-studied in the literature, large and persistent shocks – first the Covid-19 pandemic and then the Russia-Ukraine War – have sparked renewed interest in analysing the effect of oil price changes on the macroeconomy. Within the global economic system, oil prices are determined endogenously as they react to global economic developments in addition to crude oil supply and demand (Arezki and Blanchard, 2015). Since crude oil is a highly traded commodity, oil prices are inherently forward-looking, such that not only current supply but expectations about the future also matter (Arezki and Matsumoto, 2015). Further, from a medium-term policy perspective, oil price shocks are particularly important as they tend to have a stagflationary impact on the economy (Filardo and Lombardi, 2014; Filardo et al., 2018). An established strand of the extant literature on macroeconomic impact of oil price shocks suggests that global oil supply, global demand for oil and expectations about future oil market conditions are fundamental drivers of oil price movements (Killian, 2009). From an empirical standpoint, the impact of these drivers has been disentangled using a variety of approaches nested within a structural vector autoregression (SVAR) framework, including zero restrictions, sign restrictions and narrative information methods (Kilian, 2009; Kilian and Murphy, 2012 and 2014; Lippi and Nobili, 2012; Baumeister and Peersman, 2013; Baumeister and Hamilton, 2019; Caldara et al., 2019; Zhou, 2020). In the context of global oil supply, conventional supply shocks are interpreted as sudden disruptions in the current supply of crude oil that gets reflected in an instantaneous fall in oil supply, an increase in oil price and a reduction in inventories (Hamilton, 2003; Kilian, 2008). In contrast, oil prices can also change if there are unanticipated changes in the expectations about oil supply in the future. Notwithstanding its declining share in global oil production, OPEC remains an important supplier of crude oil, in addition to having a major chunk of world’s proven oil reserves, such that OPEC’s communication of its decisions related to oil supply can lead to a revision in market expectations. Thus, if a surprise OPEC announcement leads oil market participants to expect a production shortfall in future, they will build up inventories today to cover up for lesser oil production tomorrow. Such surprises can be interpreted as oil supply news shocks (Kanzig, 2021)1. Until recently, only few studies have explored the effects of oil supply news shocks embedded within OPEC announcements on the macroeconomy. Moreover, no such analysis exists for emerging market economies (EMEs), including India. Therefore, this paper attempts to examine the impact of global oil supply-related announcements on domestic financial markets as well as the macroeconomy. Our analysis based on high-frequency data around OPEC announcement days shows that domestic crude oil basket, currency, equity prices of oil and gas sector firms as well as sovereign bond yields are more volatile around such announcements. This shows that financial markets react to the information embedded in OPEC communications about crude oil supply. Further, using an external instrument variable within a structural vector autoregression (SVAR-IV) framework, we provide empirical evidence on the causal impact of oil supply news shocks on the Indian macroeconomy. Our results suggest that oil supply news shocks lead to a rapid and persistent increase in domestic consumer prices. At the same time, economic output falls but reverts to mean within a short duration. For a rapidly growing emerging economy, these findings are crucial as India is not only the third largest consumer of crude oil (behind US and China) but also largely dependent on crude oil import with up to 85 per cent of domestic requirements being fulfilled by oil imports. These results also have important implications for macroeconomic performance, particularly price stability. Given the persistent cost-push effect of such shocks, monetary policy must stay vigilant towards OPEC communications to efficiently address the resultant price stability concerns. The rest of the article is structured as follows. In Section II, we make a brief review of literature, followed by highlighting the stylised facts about the global as well as domestic crude oil markets in Section III. In Section IV, we discuss our data and econometric methodology followed by a brief discussion of the main results. We conclude the paper in Section V. II. Literature Review There exist very few studies directly related to the announcement effects of OPEC decisions. While some of these studies (Lin and Tamvakis, 2010; Loutia et al., 2016) have found a significant impact of such announcements on oil prices, other studies (Demirer and Kutan, 2010; Guidi et al., 2006; Schmidbauer and Rösch, 2012) found that it is only announcements about production cuts that matter. Similarly, oil prices and financial markets typically tend to be more volatile around OPEC meetings and exhibit significantly abnormal returns following OPEC meetings announcing reduction in its production quota (Hyndman, 2008; Youssef, 2022). On the contrary, there exists a well-established literature on the impact of oil price shocks on economic activity. These studies have relied on using SVAR models to analyse the impact of oil price shocks, especially in the context of the US economy. Kilian (2009) is considered an influential contribution to this literature as it proposed a structural identification of oil price shocks distinguishing between the relative role of demand and supply in driving the price of oil. Such a distinction is crucial for policymakers as structural oil price shocks could be of different types and can have different implications. For instance, supply shocks shift the production and prices of oil in different paths, whereas an oil demand shock shifts the oil production and oil prices in the same direction. There is also an aggregate demand shock which is driven by global economic activity, and an oil-specific demand shock. The oil-specific demand shock is not driven by economic activity but rather encapsulates the precautionary effect on changes in demand that are particular to the crude market. Caldara et al. (2016) studied these different oil shocks identified in an SVAR model of the oil market concluding that oil supply and demand shocks account for 50 and 35 per cent of total oil price changes, respectively. Moreover, they find that a drop in oil prices driven by positive supply shocks boosts economic activity in advanced economies, while dampening activity in emerging markets. Studies such as those by Baumeister and Peersman (2013), Bodenstein, Guerrier, and Killian (2012), Kanzig (2021), Kilian and Murphy (2014), use structural VAR techniques to investigate the impact of supply and demand shocks to crude oil on macroeconomic aggregates in the US and price elasticities. Peersman and Van Robays (2009) studied the macroeconomic impact of various types of oil shocks and the diffusion of such shocks in the Euro area. Comparing the US and individual member countries of the Euro area, they find that the primary source of the oil price shift is critical in determining the ramifications on the economy. Taking a cross-country perspective, Peersman and Van Robays (2012) extended their previous analysis to study the macroeconomic impact of different types of oil shocks across a set of industrialised countries. More recently, Herwartz and Plodt (2016) have analyzed the dynamics in the global crude oil market; they investigated the collective contributions from various oil shocks on the drastic descent in oil prices at the end of 2008 and 2014, as well as the effects of different oil shocks on macroeconomic aggregates in the US, the Euro area, and China and concluded that oil price shocks have discrete macroeconomic consequences and that the overall macroeconomic effects of oil price shocks in the US are more similar to the Euro area than to that of China. Güntner and Linsbauer (2018) investigated how consumer sentiment in the US responds to shocks in crude oil prices. Oil supply shocks are found to play a very limited role, while the impact of aggregate demand shocks is positive for the first few months and negative later. Overall, the literature suggests that oil price dynamics can have a statistically and economically significant impact on an economy. By analysing the case of India, this study adds to the overall literature with its focus on the impact of oil price dynamics in the context of emerging market economies. Moreover, the paper also uses newly developed methods in empirical macroeconomics, namely an external instruments-based approach, for better identification and analysis of oil shocks. III. Stylised Facts III.1. Global Experience The modern world is powered by energy derived from crude oil. Since the 1970s, when OPEC oil embargo was first imposed, movements in crude oil prices along with its production and inventory built up have become important, strategically and geopolitically. Oil prices affect the macroeconomy through different channels and vice-versa. For oil importing countries, such as India, increases in global oil prices directly impact domestic prices by increasing the price of imported goods and indirectly through increasing transportation costs. It also burdens the current account deficit (CAD) and pressurises the exchange rate. On the other hand, for exporting countries such as Russia, Saudi Arabia and others, oil price increases add to their export revenue thereby lifting their economic output.  Chart 1 shows the historical evolution of crude oil prices from 1975 onwards. The plot also highlights major geopolitical and economic events that have affected the world oil market over the last few decades. As can be observed, oil prices often react to production-related announcements by OPEC, geopolitical situations such as the Iran-Iraq war or the Gulf war, and fluctuations in the global, especially the US, economy. The impact of such events is also immediately felt in the futures market based on crude oil. Chart 2 shows the oil market futures price curve around major economic shocks and OPEC meetings since 2020. The examples presented here underline the fact that surprises related to OPEC meetings as well as economic and geopolitical events can influence expectations in the crude oil market. For instance, on March 6, 2020, OPEC countries failed to strike a deal with their allies led by Russia on oil production cuts. At that time, markets expected an imminent price war within oil exporting countries. Consequently, oil futures went down across all tenors on the next trading day i.e., March 9, 2020 (Chart 2, panel a). Similarly, when the World Health Organisation (WHO) declared Covid-19 as a global pandemic (March 11, 2020), market participants expected lower demand for crude only in the near future but negligible impact over the medium term. Reflecting this sentiment, on the very next day, futures price went down sharply for short-term contracts but only marginally in the case of longer term contracts (Chart 2, panel b). The meeting held on July 18, 2021 was also a consequential one. In this meeting, OPEC and non-OPEC allies reached an agreement to boost oil supply by September 2022 as prices had climbed to the highest levels in more than two years. This positive news surprise led to an immediate decline in crude futures across all tenors (Chart 2, panel c)2. Finally, the beginning of the Russia-Ukraine war on February 24, 2022 led market participants to expect that supply chain constraints will worsen and energy prices will go up in the near future as Russia is a major oil and gas supplier to the European market (Chart 2, panel d). As markets expected the invasion to be over within a short span, futures of longer tenor went down compared to shorter tenor. While OPEC announcements can lead to changes in spot and futures market for oil, it is important to note that OPEC’s share in world oil production has been declining in recent years. In fact, OPEC’s share in global oil production has dropped from 42.3 per cent in 2012 to 36.2 per cent in 2020 as per data from the US Energy Information Administration (EIA). The decline may have been caused by a number of factors, including the rise of shale oil production in the US, growth of non-OPEC oil producers, such as Russia and Brazil, as well as changes in the country-specific energy policies along with the rise in renewable energy and electronic vehicles (EVs). However, this may change going forward driven by economic growth and population in non-OECD countries, especially in Asia, which are primarily dependent on OPEC and its allies for their energy supply. Consequently, OPEC’s share in total global oil production is estimated to gradually rise from 36.8 per cent in 2021 to 42.2 per cent by 2050 ((EIA, 2021). III.2. Indian Experience Global consumption of petroleum and other liquids has increased three-folds from 34320 Mb/d in 1973 to 97165 Mb/d in 2021 (EIA). Within the same time span, India’s crude oil consumption has increased seven times accounting for about 5 per cent of world’s total crude oil consumption. This has been made possible by its track record as one of the fastest growing developing economies along with the world’s highest population. Comparatively in 1990, its consumption share was only one and half per cent while its production level was marginal at one per cent of global oil production. This gap has widened and reached around 4 per cent, which highlights India’s import dependence on global crude oil market (Chart 3).  At present, India is the fourth-largest global energy consumer behind China, the United States and the European Union. India is slated to overtake the European Union as the world’s third-largest energy consumer by 2030 according to the India Energy Outlook 2021, published by the International Energy Agency (IEA, 2021). India’s continued industrialisation becomes a major driving force for the global energy economy. Over the last three decades, India has accounted for about 10 per cent of global growth in industrial value-added (in PPP terms). By 2040, India is set to account for almost 20 per cent of global growth in industrial value-added. It is also expected to lead the growth in final industrial energy consumption, especially in the steelmaking industry. The economy will account for nearly one-third of global industrial energy demand growth by 2040. India’s oil demand is expected to rise by 74 per cent to 8.7 Mb/d by 2040 under the existing scenario. The natural gas requirement is projected to more than triple to 201 billion cubic meters (IEA, 2021). India’s energy outlook suggests that price of crude oil and other energy sources will have significant bearing on major financial and macroeconomic variables (Chart 4). IV. Empirical Methodology and Data There exist a vast literature on the macroeconomic impact of oil price shocks that suggests global oil supply, global demand for oil and expectations about future oil market conditions are fundamental drivers of oil price (Killian, 2009). From an empirical standpoint, the impact of these drivers has been disentangled using a variety of approaches, including zero restrictions, sign restrictions and narrative information methods (Kilian, 2009; Kilian and Murphy, 2012 and 2014; Lippi and Nobili 2012; Baumeister and Peersman, 2013; Baumeister and Hamilton, 2019; Caldara et al., 2019; Zhou, 2020). In the context of global oil supply, traditional supply shocks can be interpreted as sudden disruptions to current supply of crude oil reflected in an instantaneous fall in oil supply, increase in oil price and reduction in inventories (Hamilton, 2003; Kilian, 2008). In contrast, oil supply news shocks can be interpreted as surprise changes to the expectations about oil supply in the future. If a surprise OPEC announcement leads oil market participants to expect a production shortfall in the future, they will build up inventories today to cover up for lesser oil production tomorrow. Thus, the reaction of oil inventories is the differentiating feature between oil supply news shocks and traditional oil supply shocks. As a first attempt to understand the impact of OPEC announcements on domestic financial markets, we consider the daily change in various financial indicators around such meetings. In total, we study 81 OPEC meetings between 2000-2022, out of which fresh supply increases were announced 13 times while new supply cuts were announced 16 times. The remaining 52 meetings concluded with the announcement of status-quo. We analyse both the mean and standard deviation (S.D.) of daily changes on OPEC meeting days as opposed to all other non-announcement days. Table 1 below shows the mean and standard deviation of daily change in the spot price of brent crude, India crude basket, 10-year and 1-year sovereign bond yields, Nifty 50 and NSE Energy equity price index and nominal US dollar to Indian Rupee exchange rate. | Table 1: Financial Market Movement on OPEC Announcement Days | | Daily Change (t+1 and t-1 days) | Announcement Days | Non-announcement Days | | Mean | S.D. | Mean | S.D. | | Brent Crude | -0.001 | 0.062*** | 0.000 | 0.033 | | India Basket Crude | 0.002 | 0.045*** | 0.000 | 0.032 | | India 10y G-Sec | -0.015 | 0.095** | -0.001 | 0.082 | | India 1y G-Sec | 0.006 | 0.114 | -0.001 | 0.110 | | INR/USD | 0.000 | 0.004*** | 0.000 | 0.006 | | Nifty 50 | 0.001 | 0.026*** | 0.001 | 0.022 | | NSE Energy Index | 0.002 | 0.031*** | 0.001 | 0.023 | Note: ***, ** indicates statistical significance at 1% and 5% level, respectively.

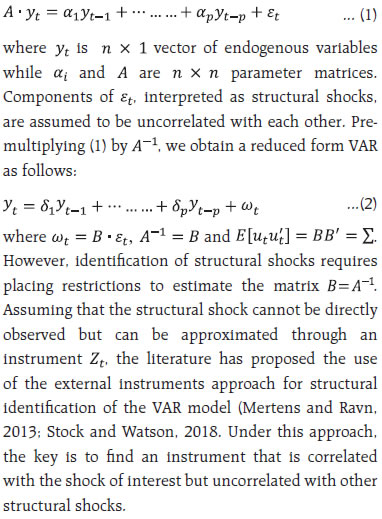

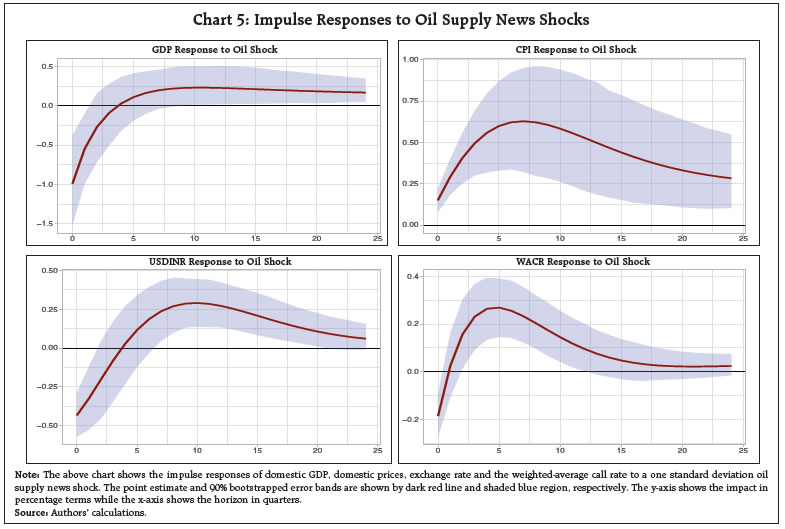

Sources: Bloomberg; and Authors’ calculations. | Although the differences in mean daily change on meeting and non-meeting days is not statistically different than zero, most domestic financial indicators exhibit significantly higher volatility on OPEC announcement days. Inter alia, this means that financial markets react to the information revealed in OPEC communications on its production decisions. To formally analyse the dynamic impact of oil supply news shocks on the domestic macroeconomy, we rely on a structural vector autoregression (SVAR) model identified using an instrument variable approach briefly described below. Consider the following SVAR model:  Kanzig (2021) proposes using oil futures – market-based proxy for oil price expectations – in a high-frequency identification setup around OPEC announcements to identify oil supply news shocks. This is done in a two-step process. In the first step, a high-frequency identification framework is applied to measure the change in price of oil futures around OPEC meetings. For this purpose, a daily window is used to compute the change in price (in logs) of oil futures of 6-month maturity before and after the announcement of OPEC decisions3. The shock series at quarterly frequency is constructed by aggregating the daily changes for all meetings in a given quarter. If there was no meeting in a quarter, the surprise equals zero. Kanzig (2021) suggests using this oil supply news surprise series as an external instrument rather than as a direct shock measure. Therefore, in the second step, an SVAR model with external instruments is used to identify the impact of oil supply news shocks on the macroeconomy. The SVAR model consists of variables describing the global oil market, namely global crude oil production, inventories, global industrial production and crude oil price as well as other macroeconomic variables of interest. We follow the same approach in this study. In particular, we consider the impact of oil supply news shocks on domestic economic activity measured in terms of real gross domestic product (GDP), domestic prices measured using the headline consumer price index (CPI), nominal exchange rate proxied by the bilateral rate between US Dollar and Indian Rupee (USD-INR rate). As is standard practice, the weighted-average call money rate (WACR) is taken as the monetary policy indicator. For global oil market indicators, nominal crude oil price (WTI crude oil spot price in US$ per barrel), total world crude oil production, total world crude inventory and global index of industrial production (GIIP) are included in the model.  The data are obtained from OPEC, Bloomberg, and the Reserve Bank of India (RBI). All variables are seasonally adjusted using the X-13 ARIMA procedure and converted into natural logarithms before estimation. The data sample used for model estimation consists of quarterly data from 2004 to 2021. Optimal number of lags were selected through the Bayesian Information Criteria (BIC). The impulse responses of the domestic macroeconomic variables to oil supply news shocks are shown in Chart 5. The estimated model satisfies the F-test condition (F-stat > 10) for the first-stage regression results of oil price residual from the VAR model on the instrument variable (Olea et al., 2016). The impulse responses underline the dynamic causal impact of oil supply news shocks on the Indian economy. While domestic currency appreciates against the dollar on the impact of the shock, surprise changes in expectations about future oil supply are expected to lead to an increase in oil inventories raising the domestic demand for US dollars to purchase available crude oil in the market. This leads to a depreciation of the domestic currency over time as seen in the medium-term response of exchange rate to oil supply news shocks. At the same time, there is a persistent increase in domestic consumer prices in response to an oil supply news shock. The sustained increase in prices is expected to lead to a lower aggregate demand as households and firms are left with less disposable incomes to spend on non-energy goods. Moreover, surprise changes in oil prices can also influence the price and wage-setting in the economy by altering the inflation expectations of firms and households. Thus, domestic economic activity falls on impact of such a shock. However, the impact is felt only for a short duration as it reverts to mean quickly. Lastly, while the immediate reaction of monetary policy is seen to be accommodative on impact perhaps to cushion the short-term fall in economic activity, monetary policy is gradually tightened to counter the increase in prices. Thus, the impulse response analysis underlines the cost-push effect of oil supply surprises – causing an increase in consumer prices and a fall in economic output – on the Indian economy. V. Conclusion Amidst tense geopolitical situations where weaponisation of energy has become the norm, maintaining domestic energy security and macroeconomic stability is a key challenge for emerging market economies. Given the importance of crude oil for India, we show that oil supply news shocks can have serious consequences for the domestic economy. Not only do financial markets react to supply-related announcements by the OPEC, domestic output falls and consumer prices increase as a result of oil supply news shocks. These findings are important from the point of view of an inflation targeting central bank to deal with the deleterious impact of such shocks on the domestic economy. References Arezki, R., & Blanchard, O. (2015). The 2014 oil price slump: Seven key questions. VoxEU, January 13. Arezki, R., & Matsumoto, A. (2015). Metals and oil: A tale of two commodities. Washington, DC: Brookings Institution. Baumeister, C., & Hamilton, J. D. (2019). Structural interpretation of vector autoregressions with incomplete identification: Revisiting the role of oil supply and demand shocks. American Economic Review, 109(5), 1873-1910. Baumeister, C., & Peersman, G. (2013). Time-varying effects of oil supply shocks on the US economy. American Economic Journal: Macroeconomics, 5(4), 1-28. Bodenstein, M., Guerrieri, L., & Kilian, L. (2012). Monetary policy responses to oil price fluctuations. IMF Economic Review, 60(4), 470-504. Caldara, D., Cavallo, M., & Iacoviello, M. (2019). Oil price elasticities and oil price fluctuations. Journal of Monetary Economics, 103, 1-20. Demirer, R., & Kutan, A. M. (2010). The behavior of crude oil spot and futures prices around OPEC and SPR announcements: An event study perspective. Energy Economics, 32(6), 1467-1476. EIA. (2021). International Energy Outlook 2021. U.S. Energy Information Administration (EIA), Washington D.C., USA. Available at: https://www.eia.gov/outlooks/ieo/ Filardo, A. J., & Lombardi, M. J. (2014). Has Asian emerging market monetary policy been too procyclical when responding to swings in commodity prices? BIS Paper, (77j). Filardo, A. J., Lombardi, M. J., Montoro, C., & Ferrari, M. (2018). Monetary policy spillovers, global commodity prices and cooperation. Guidi, M. G., Russell, A., & Tarbert, H. (2006). The effect of OPEC policy decisions on oil and stock prices. OPEC review, 30(1), 1-18. Güntner, J. H., & Linsbauer, K. (2018). The effects of oil supply and demand shocks on US consumer sentiment. Journal of Money, Credit and Banking, 50(7), 1617-1644. Herwartz, H., & Plödt, M. (2016). The macroeconomic effects of oil price shocks: Evidence from a statistical identification approach. Journal of International Money and Finance, 61, 30-44. Hyndman, K. (2008). Disagreement in bargaining: An empirical analysis of OPEC. International Journal of Industrial Organisation, 26(3), 811-828. IEA. (2021). India Energy Outlook 2021. International Energy Agency (IEA), Paris, France. Available at: https://www.iea.org/reports/india-energy-outlook-2021. Känzig, D. R. (2021). The macroeconomic effects of oil supply news: Evidence from OPEC announcements. American Economic Review, 111(4), 1092-1125. Kilian, L. (2008). Exogenous oil supply shocks: how big are they and how much do they matter for the US economy? The Review of Economics and Statistics, 90(2), 216-240. Kilian, L. (2009). Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. American Economic Review, 99(3), 1053-69. Kilian, L., & Murphy, D. P. (2012). Why agnostic sign restrictions are not enough: understanding the dynamics of oil market VAR models. Journal of the European Economic Association, 10(5), 1166-1188. Kilian, L., & Murphy, D. P. (2014). The role of inventories and speculative trading in the global market for crude oil. Journal of Applied econometrics, 29(3), 454-478. Lin, S. X., & Tamvakis, M. (2010). OPEC announcements and their effects on crude oil prices. Energy Policy, 38(2), 1010-1016. Lippi, F., & Nobili, A. (2012). Oil and the macroeconomy: a quantitative structural analysis. Journal of the European Economic Association, 10(5), 1059-1083. Loutia, A., Mellios, C., & Andriosopoulos, K. (2016). Do OPEC announcements influence oil prices?. Energy Policy, 90, 262-272. Mertens, K., & Ravn, M. O. (2013). The dynamic effects of personal and corporate income tax changes in the United States. American economic review, 103(4), 1212-47. Olea, J. L. M., Stock, J. H., & Watson, M. W. (2021). Inference in structural vector autoregressions identified with an external instrument. Journal of Econometrics, 225(1), 74-87. Peersman, G., & Van Robays, I. (2009). Oil and the Euro area economy. Economic Policy, 24(60), 603-651 Peersman, G., & Van Robays, I. (2012). Cross-country differences in the effects of oil shocks. Energy Economics, 34(5), 1532-1547. Schmidbauer, H., & Rösch, A. (2012). OPEC news announcements: Effects on oil price expectation and volatility. Energy Economics, 34(5), 1656-1663. Stock, J. H., & Watson, M. W. (2012). Disentangling the Channels of the 2007-2009 Recession (No. w18094). National Bureau of Economic Research. Stock, J. H., & Watson, M. W. (2018). Identification and estimation of dynamic causal effects in macroeconomics using external instruments. The Economic Journal, 128(610), 917-948. Youssef, M. (2022). Do oil prices and financial indicators drive the herding behavior in commodity markets?. Journal of Behavioral Finance, 23(1), 58-72. Zhang, X., Zhou, J., & Du, X. (2022). Impact of oil price uncertainty shocks on China’s macro-economy. Resources Policy, 79, 103080. Zhou, X. (2020). Refining the workhorse oil market model. Journal of Applied Econometrics, 35(1), 130-140.

|