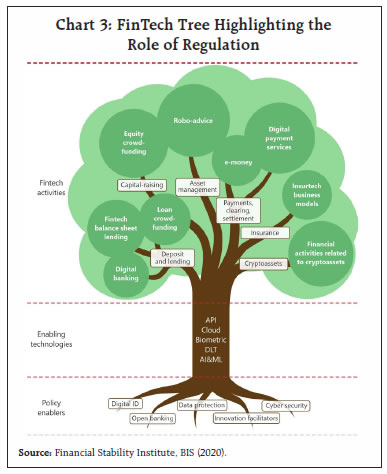

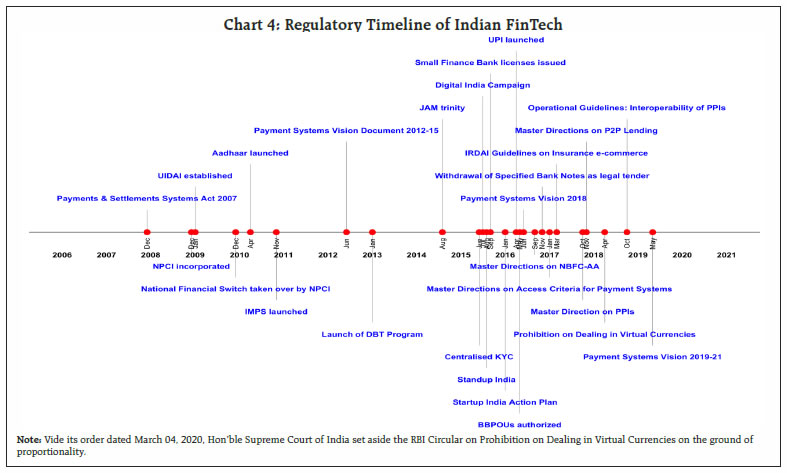

FinTech has the potential to fundamentally transform the financial landscape, provide consumers with a greater variety of financial products at competitive prices, and help financial institutions become more efficient. The rapid and transformational changes brought on by FinTech need to be monitored and evaluated so that regulators and society can keep up with the underlying technological and entrepreneurial flux. This article provides a succinct review of the sector, encompassing its evolution, characteristics and driving factors, both for the world and India. For a sustainable business ecosystem, FinTechs need to bridge the digital divide and promote equitable and broad-based customer participation. Introduction The landscape of banking and financial sector has undergone a phenomenal transformation since 2008 Global Financial Crisis (GFC), owing to financial technology firms, popularly known as ‘FinTechs’. Both as creative disruptors and facilitators, FinTechs have contributed to the modern banking and financial sector through various channels including cost optimisation, better customer service and financial inclusion. FinTechs have played an important role in unbundling banking into core functions of settling payments, performing maturity transformation, sharing risk and allocating capital (Carney, 2019). The information and telecommunications (IT) revolution is regarded as the fifth ‘Technological Revolution’ driving growth1, and FinTech is at the helm of this creative disruption (Hendrikse et al., 2018). The scope of operations of FinTechs has also broadened, moving from crypto assets to payments, insurance, stocks, bonds, peer to peer lending, robo-advisors, regtech and suptech. In India, FinTechs and digital players could function as the fourth segment of the Indian financial system, alongside large banks, mid-sized banks including niche banks, small finance banks, regional rural banks and cooperative banks (Das, 2020). This segment has the potential to fundamentally transform the financial landscape where consumers will be able to choose from broader set of alternatives at competitive prices, and financial institutions could improve efficiency through lower costs. India has emerged as the fastest growing FinTech market and the third largest FinTech ecosystem in the world (Mankotia, 2020). Today, we carry out complex financial actions like sending or receiving money, paying bills, buying goods and services, purchasing insurance, trading on stock markets, opening bank accounts and applying for personal loans online using smartphones, without ever physically interfacing with a bank employee. India has the opportunity of a digital payments market of $ 1 trillion (PIB, 2018). It recorded 3,435 crore digital payments in the year 2019-20 (Annex 1). The exciting, rapid and transformational changes in financial services brought on by FinTechs need to be continuously monitored and evaluated so that regulators and society can keep up with the underlying technological and entrepreneurial flux. Regulators need to be creative, nimble and tech savvy with their approach. They will have to further expand their focus from entities to activities, while also becoming experts in assessing the soundness and security of algorithms, which is easier said than done (Lagarde, 2017). Thus, for facilitating discussion and understanding that could be useful for policy and regulation purposes, this article attempts to provide a succinct review of FinTechs, encompassing their evolution, characteristics and driving factors. Our evaluation throws up sobering concerns regarding the future of FinTechs, such as the status of digital hygiene, data use and privacy. The article proceeds in five sections: the FinTech revolution in the global context, delving into its history, evolution, and adoption in Section II, the FinTech ecosystem in India, its enablers, diversity, funding and collaboration with banks in Section III, challenges for future development in Section IV, and the way forward in Section V. II. FinTech Revolution: The Global Context Definition of FinTech With no universally agreed upon definition, FinTech is generally described as an industry that uses technology to make financial systems and the delivery of financial services more efficient. It is “technologically enabled financial innovation that could result in new business models, applications, processes or products with an associated material effect on financial markets and institutions and the provision of financial services” (FSB, 2019). FinTechs are “start-ups and other companies that use technologies (Table 1) to conduct the fundamental functions provided by financial services, impacting how consumers store, save, borrow, invest, move, pay, and protect money” (McKinsey, 2016). | Table 1 : Key Enabling Technologies used by FinTechs | | Technology | Description | | API (Application Programming Interface) | APIs comprise a set of rules and specifications that software programmes use to communicate with each other. They allow new applications to be built on top of others. | | Cloud Computing | The use of an online network (‘cloud’) of hosting processors to increase the scale and flexibility of computing capacity, generating cost savings. | | Biometrics | The study of distinctive and measurable human characteristics that can be used to categorize and identify individuals. | | DLT (Distributed Ledger Technology) | A digital system for recording the transaction of assets in which details are recorded in multiple places at the same time. | | Big Data | Voluminous amounts of structured or unstructured data that can be generated, analysed and utilized by digital tools and information systems. | | AI (Artificial Intelligence) & ML (Machine Learning) | IT systems that can perform functions that would otherwise require human capabilities. ML entails computers learning from data without human intervention. | In today’s app-centric world, consumers are less concerned about receiving all their services from a single provider, and instead expect a seamless experience. FinTechs are realising this new value expectation and have started to ‘unbundle’ many of the traditional financial offerings (Basole and Patel, 2018). At the same time, the financial services provided by FinTechs are being re-bundled with a range of non-financial services, thereby allowing services to be provided seamlessly via application software (Bank of Japan, 2018). Illustratively, taxi aggregators bundle ride sharing with instantaneous fare payment upon arrival at destination. FinTech History and Evolution Technology-induced financial innovation has a long history. In the 1950s, credit cards appeared for the first time, followed by Automated Teller Machines (ATMs) in the 1960s, electronic stock trading and banks’ new data recording systems in 1970s and 1980s, and e-commerce and online brokering in 1990s (Basole and Patel, 2018). The online revolution in the last decade of the 20th century connected the world through the Internet, and enabled e-commerce, Internet banking and pioneering online payment platforms like PayPal. The next decade witnessed the emergence of smart technology. The smartphone materialised as a powerful computer in human palms, and the movement to app-based operating systems spurred innovation, unbundling and sharing of services. Bitcoin came as another important development in 2009. The present decade is dedicated to the ‘rise of the robots’, where the emergence of big and unconventional datasets has enabled AI to provide accurate predictions and personalise banking (King, 2019). The ‘new’ FinTech sector gained momentum in its modern incarnation after the GFC as FinTech entrepreneurs realised that banking services should be transparent, facilitative and economical (Hendrikse et al., 2018). After the GFC, public perception of banks had deteriorated, as savings were diverted to subprime borrowing without adequate consumer protection. Many finance professionals confronted job losses or pay cuts, which inspired enterprising innovation as FinTechs (Buckley et al., 2016). Also, tighter regulation of traditional banking after GFC supported the growth of the FinTech sector (Cortina et al., 2018). At present, FinTechs are diversifying into different sectors (Chart 1). Among the top 100 FinTechs, payment and lending companies are being replaced by wealth and brokerage, insurance and multi-sector companies2 (KPMG, 2019). Demand-side Push to FinTech Adoption Against the backdrop of globalisation and digitisation, users’ appetite for financial services has become increasingly diversified and sophisticated in line with their changing lifestyles. The rate of FinTech adoption is greater in jurisdictions where there is unmet demand for financial services, less competition from traditional finance, macroeconomic conditions are conducive, regulation is accommodative and demographics are favourable (Frost, 2020). According to the ‘Global FinTech Adoption Index 2019’, the adoption of FinTech services globally has progressed from 16 per cent in 2015 to 33 per cent in 2017 and 64 per cent in 2019. Despite concerns about data security, the respondents preferred FinTechs over the traditional sector due to low fees and ease of opening of accounts (EY, 2019). Supply-side Support to FinTech Reflecting on growing adoption over the past decade, many start-ups have come up with diverse and innovative FinTech products. They have been supported enthusiastically by investors, with investments in the sector increasing from $5 billion in 2010 to $78 billion in 2019 (Chart 2). Geographical Distribution of FinTechs A unique feature of FinTech has been its shifting geography; both in terms of the locus of activities and the area of influence. According to KPMG’s FinTech100, the new productive ground for FinTech companies is shifting from North America and Europe to the Asia-Pacific; 42 companies from the Asia-Pacific region (highest among all regions) were featured in 2019 as compared to 31 companies in 2017. Within the Asia-Pacific, China is facing stiff competition from countries like India, Vietnam and Korea. With a total of 8 companies on the FinTech100, India is emerging as a prominent FinTech force3. Benefits of FinTechs Efficiency enhancement FinTechs have played a key role in making the financial sector more efficient (Philippon, 2020). In the USA, FinTech lenders enhanced ease of borrowing by processing mortgages 15-30 per cent quicker than other lenders with no evidence of higher (conditional) default rates (Fuster et al., 2018). Financial inclusion By overcoming market failures such as information asymmetry or high transaction costs, FinTechs help enhance financial inclusion. In a survey of retail borrowers on a large Chinese platform, more than half reported that they had no prior borrowing history from a financial institution (Deer et al., 2015). Big data and machine learning techniques may even help reduce human biases against discriminated groups (Bartlett et al., 2018). Reduced credit risks By providing more choice of credit sources, proliferation of FinTechs could lower the risks an economy faces if credit provisioning is dominated by a few banks. FinTechs focused on credit could be beneficial for commercial banks as some of them rely on FinTech platforms’ credit assessment processes (Claessens et al., 2018). FinTech Regulation Fintechs can be viewed as double edged swords. Despite various benefits, these innovations can sometimes magnify existing threats to consumers such as likelihood of privacy breaches and cybersecurity risks, leaving behind digitally illiterate and unconnected consumers. Thus, while the role of regulation is undisputed for the financial system as such, it assumes greater importance for newer innovations such as FinTechs. A central bank’s interest in FinTech is not confined to its impact on the financial sector per se, but rather its implications for financial stability and monetary policy. The regulatory environment, like the roots that provide life to a tree, provides a solid foundation for FinTech activities (Chart 3). A survey-based study under the aegis of the Bank for International Settlements (BIS) summarises the responses of regulators across the world to rapidly emerging FinTech (Ehrehtraud et al., 2020). While most surveyed jurisdictions did not have a dedicated regulatory regime for FinTech lending, many had it in place for digital payments and crowdfunding. For insurance, existing regulations were broadly considered sufficient. Warnings and clarifications were the most common regulatory responses to crypto-assets, but a few respondent jurisdictions also reported emergence of crypto-specific licenses. With regards to enabling technologies, most regulators tweaked existing guidelines to include tech-specific elements. Regulators have been particularly active on application programming interfaces (APIs), cloud computing and biometric identification. With many FinTechs leveraging on cloud computing, it is becoming systemically important to the financial system. It is possible that going forward some future software could end up being exclusively available on cloud platforms. In such cases, central banks may have to opt for in-house cloud development or collaborate with various service providers. For instance, the US Federal Reserve has visited Amazon’s cloud facilities for on-site inspections, while the European Banking Authority has published guidelines for cloud outsourcing (King, 2019). However, for artificial intelligence, machine learning and DLT, regulatory action has been limited to risk assessments and issuance of general guidance.  Financial regulators are facing unprecedented challenges with the emergence of FinTechs. These firms come in new shapes and forms, so fitting them into buckets for prudential or risk-based supervision is not easy. As the scope of activities widens from national to global, regulation too has to reach out across borders. Furthermore, if the importance of traditional banks in the financial system declines, central banks might have to increase the number of counterparties to their operations in money markets for effective monetary transmission (Lagarde, 2017). III. Evolution of the FinTech Ecosystem in India The roots of Indian FinTechs lie in the groundwork done over the previous decade in developing key enablers. The Indian FinTech industry as it stands today is the result of a unique concoction of technological enablers, regulatory interventions and business opportunities as well as certain other characteristics unique to India. As the regulator of payment systems, the Reserve Bank has undertaken numerous measures to ensure increased efficiency and uninterrupted availability of secure, accessible and affordable payment systems and to serve segments of the population which are hitherto untouched by the payment systems. To achieve this, Reserve Bank’s Vision 2021 envisages four goal posts (4 Cs), i.e., Competition, Cost, Convenience and Confidence. Regulatory Environment India is one of the few jurisdictions with a specific Payments and Settlements law to “provide for regulation and supervision of payments and settlement systems in India and to designate the Reserve Bank as the authority for the purpose and the matters connected therewith or incidental hitherto”. The Reserve Bank regulates some FinTechs directly by granting them NBFC licenses (such as NBFC-P2P), or indirectly by regulating the banks and NBFCs associated with them. National Payments Corporation of India (NPCI) is the umbrella organisation for operating retail payments and settlement systems in India, as an initiative of the Reserve Bank and the Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007. The interventions in Payment and Settlement System proposed by the Reserve Bank in its various Monetary Policy Statements over the past year are presented in Annex 2. A regulatory timeline depicting India’s favorable policy moves to promote FinTech has been illustrated in Chart 4.  Major Enablers of Indian FinTech Penetration of internet and smart phones Propelled by massive strides in internet and smartphone penetration, FinTechs have expanded their reach rapidly in India (Table 2). Favourable Demography The Indian market is blessed with a higher proportion of young population, who are more likely to trust and adopt FinTech. There were 1157.75 million wireless subscribers in the country as on March 31, 2020, comprising 638 million urban and 519 million rural subscribers (TRAI, 2020). India and China lead the Global FinTech Adoption Index 2019 with an adoption rate of 87 per cent. While per capita internet usage has increased, tariffs have declined (Chart 5). | Table 2 : Telecommunications Indicators | | Parameter | Period | Cumulative amount | | Telephone Subscribers | 31-Mar-14 to 30-Apr-20 | 116.8 Crore | | Teledensity | 31-Mar-14 to 30-Apr-20 | 86.6 % | | Internet Subscribers | 31-Mar-14 to 31-Mar-20 | 74.3 Crore | | Broadband Subscribers | 31-Mar-14 to 31-Mar-20 | 68.7 Crore | | Wireless Data Usage | Q3 2019-20 | 21,402 Petabytes | | Telecom Usage (Monthly Wireless Average Revenue per User) | 31-Mar-14 to 31-Dec-19 | ₹ 78.7 | | Telecom Towers | 01-Sep-17 to 27-Jul-20 | 6,05,788 | | Gram Panchayats connected under BharatNet | 31-Aug-14 to 30-Jun-20 | 1,41,098 | | Telecom Licenses | 31-Mar-14 to 30-Jun-20 | 156 | | Source: Department of Telecommunications, Government of India (2020) |

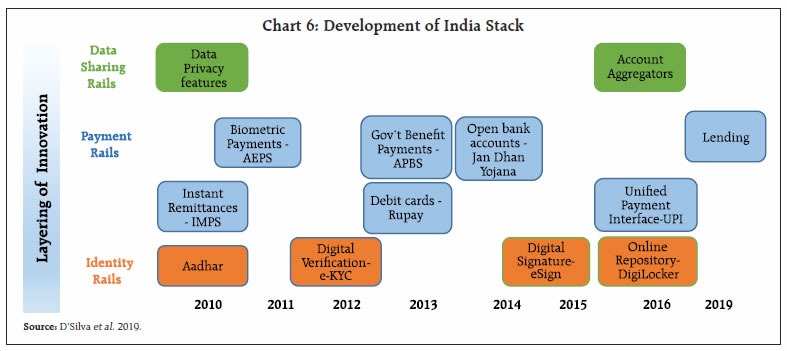

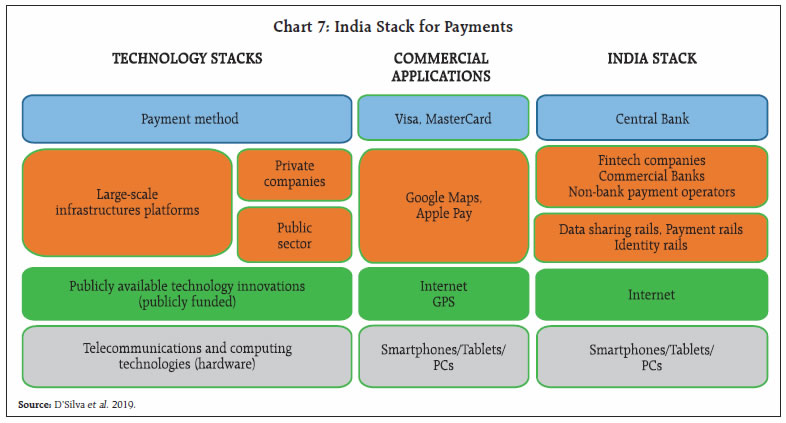

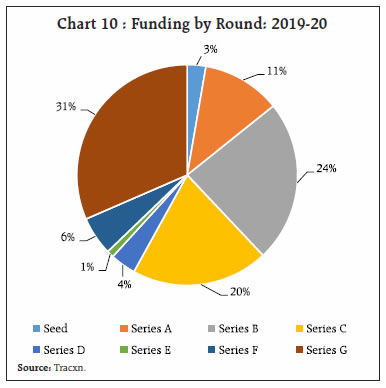

India Stack India’s evolution as a progressive FinTech nation happened on the back of the ‘India Stack’ – an indigenous set of technologies and policies that act as enablers to innovation (Chart 6)  The ‘India Stack’ encompasses two core principles - building digital platforms as public goods and incorporating data privacy and security in the design of digital public goods (D’Silva et al., 2019). An example of the India Stack for payment systems is shown in Chart 7. The cornerstone of the India Stack is the Aadhaar enabler, used to access a unique, verifiable identity at low marginal cost by FinTechs. Over 1.25 billion residents of India have been issued Aadhaar, and 30 million authentication requests are processed daily (UIDAI, 2019). Various publicly provided platforms for verification (e-KYC), digital signature (e-sign), cloud storage (DigiLocker) and payments have been developed over Aadhaar, which can be used by innovators to create and exchange value, obviating the need to build their own digital infrastructure. Unified Payments Interface (UPI) is a pivotal enabler, which virtualises accounts and facilitates customers to undertake merchant payments and fund transfers. Data sharing framework Wider access to data generated by online activity could be beneficial since they are often obtained at zero marginal cost and are non-rival4. Open access to data could also lower switching costs for customers and generally foster competition and financial inclusion. In 2016, the Reserve Bank established a legal framework for a class of regulated data fiduciary entities, called Account Aggregators (NBFC-AA), enabling customer data to be shared within the regulated financial system with the customer’s knowledge and consent. Access to data will be granted to regulated entities (under the RBI, SEBI, IRDA and PFRDA) for a limited time for a specific purpose. Innovation facilitators are also important FInTech enablers. The Reserve Bank has set up a ‘Regulatory Sandbox’ for issuing facilitative regulation to help the fast-developing FinTech sector, allowing live testing of new products in a controlled regulatory environment to generate evidence on the benefits and risks of financial innovations (RBI, 2019). The first cohort of applications considered for the Regulatory Sandbox was under the operational theme ‘retail payments’ (RBI 2019a).  Indian FinTechs: Strength in Diversity The hallmark of India’s FinTech ecosystem is diversity of markets and applications. It is seen that emerging industries often concentrate regionally to benefit from agglomeration effects, but FinTech does not follow this trend (Basole and Patel, 2018). Though concentrated in major metropolitan cities such as Mumbai, Bangalore, Delhi-NCR, and Hyderabad, FinTech is also expanding to smaller cities (Chart 8). Mumbai and Bangalore lead the FinTech momentum and account for 42 per cent of the startup headquarters. Other cities like Jaipur, Pune, and Ahmedabad are also emerging as centers of FinTechs (Medici & Pisabazaar: India FinTech Report 2019). According to the Tracxn database, there are a total of 4,680 companies in India classified as FinTechs, which can be grouped broadly into fifteen business models (Annex 3). Equity Funding Startups tend to raise money through equity, since they usually have no history of demonstrated earnings or collateral to offer to banks, which are generally conservative in lending. Lending to a startup requires assessment of novel parameters like the future earnings potential of the unconventional business model, motivation and suitability of the founders, business climate, domain knowledge, etc. Also, specialised equity investors like Venture Capital firms can be more ‘hands-on’ and guide startups to make them more successful in the long run. Equity funding also allows startups to take a long view of their business, since they are freed from immediate loan repayment obligations. According to Tracxn database, 211 Indian FinTechs raised $ 3.18 billion (in equity rounds and from angel investors) over 2019-20 (Chart 9). 25 FinTechs over and above these 211 also raised funding but did not provide details. Fundraising activity took a hit in April 2020 due to the spread of COVID-19 and the enforcement of a nationwide lockdown. The distribution of the funding of $3.18 billion raised during 2019-20 was highly skewed with the top 10 companies (by equity funding) accounting for approximately two-thirds of the total funding (Annex 4). Of this, $ 1 billion was raised by Paytm alone in November 2019. Most of the top FinTech fundraisers operate in the payments arena. Seed and Series A, Series B and Series C funding5 constituted 14, 24 and 20 per cent of the equity pie respectively (Chart 10). Almost a third of the entire year’s FinTech funding was obtained in the late Series G round by Paytm. FinTechs and Banks: Collaboration FinTech firms are no longer viewed by banks as disruptive forces. There is evidence that FinTechs are acting as enablers in banking and finance. Banks are relying on a number of strategies to embrace technological innovation; ranging from investing in FinTech companies and launching FinTech subsidiaries, to collaborating with FinTechs for various operational functions. Banks and non-banks are partnering to offer the combination of trust and innovation to the Indian consumer (Das, 2020). For enhancing revenues and profits, they are diversifying into newer areas such as insurance, asset management, brokerage and other services supported by financial technologies.  There are synergies to be explored between FinTechs and banks. FinTechs, while possessing vast technological knowhow and new ideas, lack a large client base and the expertise to navigate the regulations and licensing discipline of the finance industry. Traditional banks possess a major strength - reputation for trustworthiness built over several decades. Banks have capital and can weather intense competition. They also have the benefit of experience and tried-and-tested infrastructure alongside specific knowledge of risk management, local regulations and compliance. In fact, banks’ on-the-ground market and customer knowledge and pre-existing client base can be of immense value to FinTech projects. In a nutshell, banks and FinTech firms have different comparative advantages and a strategic collaborative partnership between the two would liberate them to focus on their respective core competencies (Mundra, 2017). IV. Challenges for Future Development FinTechs will confront several opportunities and challenges in the future. Broadly, they need to address six concerns to become more efficient, reliable, equitable and resilient. First, despite immense scope for innovation, cross-border payments are still unchartered territory for FinTechs. Availing remittance services burdens migrant workers due to steep costs associated with such remittances (D’Silva et al,. 2019). A high share of cross-border payments flows through correspondent banks, whose dwindling numbers could result in even higher costs and retrogression to informal, unregulated payment networks (Carstens, 2020). In India, cross-border transactions are slow compared to domestic payments and few alternatives are available, despite heavy inward personal remittances (RBI, 2019). To make payment systems in different jurisdictions interoperable, payment instructions need to be translated to a common language. For this, standards and practices across jurisdictions must be coordinated, and mutual confidence in each domestic network’s Know Your Customer (KYC) and Anti-Money Laundering (AML) frameworks must be established. Recently, UPI was connected with Singapore’s Network for Electronic Transfers (NETS) on a pilot basis at the Singapore FinTech Festival 2019 (ET, 2019), suggesting that significant advances could be made within the existing setup. The UPI system settles in fiat money within the regulated financial system perimeter and therefore, poses less risk than systems such as stable-coins which are usually managed by BigTechs. Second, the increasing popularity of FinTechs could exacerbate data use, protection and privacy concerns if the statutory rights and obligations of service providers are not clearly delineated. Machine learning algorithms could reproduce and perpetuate existing patterns of discrimination and exclude vulnerable sections. As the Indian population becomes data-rich with increasing Internet and mobile coverage, the next challenge is empowering consumers with the data generated by them through adequate legal and regulatory interventions. Citizens should be able to exercise control of their data like any other personal asset. There is an emerging demand for data localisation from various jurisdictions. In this context, a solution could be a model where data is stored locally, and only binary (Yes or No) queries are allowed on it from abroad, from a specified and globally agreed upon set of permitted queries. Third, there is a need to ascertain the impact of FinTech on financial stability, due to higher potential for system-wide risk with its expansion. Lending standards could weaken due to wider credit access and higher competition. Since FinTech lenders give advances from debt and equity rather than from deposits, such credit could be more procyclical and volatile due to lack of standard credit guidelines. Further, credit activity outside the prudential regulation space could render credit-related countercyclical policies less effective. Reputational, cyber and third-party risks may arise for banks interacting with FinTechs. Fourth, there is inequality of access to FinTech services. Despite having the world’s second largest Internet user base, the access to Internet is still highly biased towards the urban, male and affluent population segments. Trust in the online marketplace is low and a typical user takes 3-4 months to make their first online transaction. Most users use online platforms for product research, but prefer subsequent offline purchase (Bain & Company, 2018). Though ‘micro-merchants’ in India account for an overwhelming proportion of sales, they have been left out of the cashless revolution especially in smaller cities. Despite high penetration of mobile-data and smartphones, use for financial transactions is low due to behavioral reasons like lack of trust, misconceptions about taxation, lack of applied knowledge in using digital payment modes and perceived security threats (IFMR, 2017). Fifth is the issue of consumer protection and digital education. Regulators need to stress on pre-emptive fraud detection, while also integrating digital literacy into financial literacy to dispel misconceptions. Safety provisions and grievance redressal mechanisms need to be simplified and publicised to encourage participation by low-income groups. However, financial literacy and digital hygiene alone may be insufficient. Cross-country evidences suggest that paying with cash is a habit, generally slow to change. In China, street vendors, buskers, and even beggars accept electronic payments (Jenkins, 2018). However, in Tokyo, six of ten restaurants require cash payment (Lewis, 2019). Cash use increases as concerns about privacy rise, while it declines as confidence in banks rises (Png and Tan, 2020). Thus, policies to promote electronic payments need to address fundamental concerns about privacy and confidence in financial institutions. Finally, regulators need to conduct themselves neutrally. The Report of the Working Group on FinTech and Digital Banking (RBI, 2018a) cautions that regulators should neither overprotect incumbents, nor unduly favour newcomers by applying differential regulatory treatment. With increasing dominance of big firms in digital payments, there will emerge a tradeoff between data-fueled oligopoly for cheap services and the need for re-aligning incentives to foster smaller, more innovative firms for a competitive ecosystem. However, to follow the principle of neutrality, “authorities may have to contend with stricter treatment for certain types of activity, such as where a claim on the platform’s balance sheet is generated or where retail investors and consumers are involved” (Claessens et al., 2018). V. The Way Forward As a facilitative regulator, the Reserve Bank has broadened the scope of priority sector lending to include start-ups. In order to overcome internet connectivity problems as major hurdle for digital payments in rural areas and encourage innovations that enable offline digital transactions, the Reserve Bank has announced a pilot scheme under which, authorised Payment System Operators (PSOs) including banks and non-banks, will be able to provide offline payment solutions using cards, wallets or mobile devices for remote or proximity payments (RBI 2020b). Over the years, the Reserve Bank has prioritised security measures for digital payments such as the requirement of Additional Factor of Authentication and online alerts for every transaction. These measures have significantly increased customer confidence and safety leading to increased adoption of digital payments. Going ahead, FinTechs need to prioritise regulatory compliance and the management of cyber risks. They should design and implement cyber-risk prevention frameworks and regularly conduct penetration tests. Indian FinTechs are now witnessing one of their biggest challenges till now - the COVID-19 pandemic. A survey of 250 Indian startups confirms that largely, the pandemic had a negative impact on business, though the FinTech startups among these reported the lowest operational disruptions (FICCI-IAN, 2020). Experts foresee that new firms are bound to lose out and established, well-funded startups and BigTechs in favorable sectors such as payments, e-commerce and online learning will tide through the business disruptions. Ensuring a high degree of interoperability among startups is key to ensure a coordinated response to market demand and changing attitudes. The pandemic also challenges the belief that FinTechs promote financial inclusion; a topic of future research is to ascertain whether Indian FinTechs helped their vulnerable customers when they most needed them, or were they helpless in servicing their needs. For a healthy and sustainable business ecosystem, FinTechs need to bridge the digital divide and promote equitable, broad-based customer participation across urban and rural areas and the various producing and consuming sectors. References Aldasoro, I., Gambacorta, L., Giudici, P., and Leach, T., (2020), “Operational and Cyber Risks in the Financial Sector”, BIS Working Paper, February Bain & Company., (2018), “Unlocking Digital for Bharat: $50 Billion Opportunity” Bank of Japan., (2018), “FinTech Special Edition – Financial Innovation and FinTech”, Payment and Settlement Systems Report Annex Series, September Bartlett, R., A. Morse, R. Stanton, and N. Wallace, (2018), “Consumer-lending Discrimination in the Era of FinTech” Working paper Basole R., and Patel, S. (2018), “Transformation through Unbundling: Visualizing the Global FinTech Ecosystem”, Service Science, Vol. 10, No. 4, pp. 1-18, December Buckley, R., A. W. Douglas and B.N. Janos, (2016), “The Evolution of FinTech: A New Post-Crisis Paradigm?”, SSRN Electronic Journal 47(4):1271-1319, January Carney, M. (2019), “Enabling the FinTech Transformation: Revolution, Restoration or Reform?”, BIS Central Bankers’ Speeches Carstens, A., (2020), “Shaping the Future of Payment”, BIS Quarterly Review, March Claessens, S., Frost, J., Turner, G., Zhu, F., (2018), “FinTech Credit Markets across the World: Size, Drivers and Policy Issues”, BIS Quarterly Review, September Cortina, J. and Schmukler, S., (2018), “The FinTech Revolution: A Threat to Global Banking?”, World Bank Group Chile Centre and Malaysia Hub, April 14 Das, S. (2019), “Opportunities and Challenges of FinTech”, Keynote Address Delivered at the NITI Aayog’s FinTech Conclave, March 25 Das, S. (2020), “Banking Landscape in the 21st Century”, Speech Delivered at the Mint Annual Banking Conclave, 2020, February 24 Deer, L., J. Mi and Y. Yuxin, (2015), “The Rise of Peer-to-Peer Lending in China: An Overview and Survey Case Study”, Association of Chartered Certified Accountants DoT (2020), Online Dashboard of Department of Telecommunications, Government of India, accessed on July 31, 2020 D’Silva, D., Filková, Z., Packer, F., and Tiwari, S., (2019), “The Design of Digital Financial Infrastructure: Lessons from India” BIS Papers, December Ehrentraud, J., Ocampo, D., Garzoni, L., and Piccolo, M., (2020), “Policy Responses to FinTech: A Cross Country Overview”, BIS, January EY Global Financial Services, (2019), “Global FinTech Adoption Index” FICCI and IAN, (2020), “Survey on the Impact of Covid-19 on Indian Start-ups”, June Frost, J., (2020), “The Economic Forces Driving FinTech Adoption Across Countries”, BIS Working Paper, February FSB, (2019), “FSB Report Assesses FinTech Developments and Potential Financial Stability Implications”, Press Release, Financial Stability Board, February 14 Fuster, A., M. Plosser, P. Schnabl, and J. Vickery, (2019), “The Role of Technology In Mortgage Lending” The Review of Financial Studies 32(5), 1854–1899 G7 Working Group on Stablecoins, (2019), “Investigating the Impact of Global Stablecoins”, October Government of India, (2019), “The Personal Data Protection Bill” Hendrikse, R., Bassens, D., and Meeteren, M., (2018), “The Appleization of Finance: Charting Incumbent Finance’s Embrace of FinTech”, Finance and Society 4(2): 159-80 IFMR, (2017), “The Evolving Financial Ecosystem for Micro-Merchants in India”, IFMR LEAD and Mastercard Centre for Inclusive Growth, September Jenkins, P (2018), “We Don’t Take Cash: Is this the Future of Money?”, Financial Times, May 10. King, R. (2019), “2020: FinTech and Beyond”, Central Banking, December 31 KPMG and H2 VENTURES, (2019), “Fintech100 Leading Global FinTech Innovators” KPMG, (2020), “Pulse of FinTech H2 2019”, February Lagarde, C., (2017), “Central Banking and FinTech – A Brave New World?”, Speech, IMF, September 2017 Lewis, L (2019), “Japan’s Cash Addiction will not be Easily Broken”, Financial Times, January 9 Libra Association Members, (2020), “The Libra Blockchain”, White Paper Mankotia, A., (2020), “FinTech and Financial Services”, BFSI Mckinsey and Company, (2016), “Fintechnicolor – The New Picture in Finance” Mckinsey Global Institute, (2019), “Digital India”, March Ministry of Finance, Government of India, (2019), “Report of the Steering Committee on Fintech Related Issues” Mundra, S., (2017), “Financing MSMEs: Banks & FinTechs – Competition, Collaboration or Competitive Collaboration?”, Speech delivered at the NAMCABS Seminar organised by the College of Agricultural Banking, February 20 NPCI, (2018), “NPCI Statement pertaining to Whatsapp BHIM UPI Beta Launch”, Press Release, February 16 NPCI, (2019a), “Rationalisation of BHIM UPI MDR”, Press Release, August 30 NPCI, (2019b), “Big Push to Digital Payments through Debit Cards - Rationalization of Merchant Discount Rate (MDR) for RuPay Debit Card”, Press Release, September 13 Parthasarathy, S., (2020), “Decoding the Supreme Court’s Cryptocurrency Judgment”, BloombergQuint, March 11 Perez, C., (2002), “Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages”, Elgar Publishing, Inc. Philippon, T., (2020), “On FinTech and financial Inclusion”, BIS Working Papers, February PIB, (2018), “Digital Payments Set to Become a Trillion-Dollar Market in Next Five Years : NITI Aayog”, July 31 Png, I. and Tan, C., (2020), “Privacy, Trust in Banks, and Use of Cash”, MAS Macroeconomic Review, April RBI, (2018a), “Report of the Working Group on FinTech and Digital Banking”, February 08 RBI, (2018b), “Prohibition on Dealing in Virtual Currencies”, Notification, April 6 RBI, (2019a), “Reserve Bank Announces Opening of the First Cohort under the Regulatory Sandbox”, Press Release, November 4 RBI (2019b), “Technical Specifications for All Participants of the Account Aggregator (AA) Ecosystem”, Notification, November 8 RBI (2019c), “Benchmarking India’s Payment Systems”, Report, June RBI, (2020), “Master Direction on Issuance and Operation of Prepaid Payment Instruments”, February 28 RBI, (2020b), “Statement on Developmental and Regulatory Policies”, August 6 The Economic Times, (2019), “BHIM UPI goes International; QR Code-Based Payments Demonstrated at Singapore FinTech Festival”, November 13 TRAI (2020), “Highlights of Telecom Subscription Data as on 31 March 2020”, Press Release no. 49/2020, Telecom Regulatory Authority of India UIDAI (2019), “Now 125 Crore Residents of India have Aadhaar”, Press Release, Unique Identification Authority of India, December 31

| Annex 1 : Digital Transactions | | | Volume (Lakhs) | Value (₹ Crores) | | 2017-18 | 2018-19 | 2019-20 | 2017-18 | 2018-19 | 2019-20 | | 1. Large Value Credit Transfers (RTGS – Customer and Interbank) | 1,244 | 1,366 | 1,507 | 11,67,12,478 | 13,56,88,187 | 13,11,56,475 | | 2. Retail Credit Transfers (AePS, APBS, ECS, IMPS, NACH, NEFT, UPI) | 58,793 | 1,18,750 | 2,06,661 | 1,88,14,287 | 2,60,97,655 | 2,85,72,100 | | 3. Debit Transfers and Direct Debits (BHIM Aadhaar Pay, ECS, NACH, NETC) | 3,788 | 6,382 | 8,957 | 3,99,300 | 6,56,232 | 8,26,036 | | 4. Card Payments (Credit and Debit cards at PoS terminals and Online transactions) | 47,486 | 61,769 | 73,012 | 9,19,035 | 11,96,888 | 15,35,765 | | 5. Prepaid Payment Instruments (PPIs) | 34,591 | 46,072 | 53,318 | 1,41,634 | 2,13,323 | 2,15,558 | | Total Digital Payments | 1,45,902 | 2,34,339 | 3,43,455 | 13,69,86,734 | 16,38,52,285 | 16,23,05,934 | | Source: RBI Annual Report, 2019-20. |

| Annex 2: Statement on Developmental and Regulatory Policies: Decisions regarding Payment and Settlement System | | Date | Decision Taken | | Feb 07, 2019 | Regulation of Payment Gateways and Payment Aggregators | | Apr 04, 2019 | A report to benchmark India’s payment systems would be prepared. | | Apr 04, 2019 | A Framework for Harmonising Turn Around Time for the Resolution of Customer Complaints and Compensation to be put in place for all authorised payment systems. | | Jun 06, 2019 | Removing charges levied by the RBI for RTGS and NEFT transactions | | Jun 06, 2019 | Committee to Review the ATM Interchange Fee Structure | | Aug 07, 2019 | 24x7 availability of NEFT | | Aug 07, 2019 | Expansion of Biller Categories for Bharat Bill Payment System (BBPS) | | Aug 07, 2019 | ‘On-tap’ Authorisation for Bharat Bill Payment Operating Unit (BBPOU), Trade Receivables Discounting System (TReDS), and White Label ATMs (WLAs). | | Aug 07, 2019 | Creation of Central Payments Fraud Information Registry | | Oct 04, 2019 | Internal Ombudsman by large non-bank Prepaid Payment Instrument (PPI) Issuers (more than 1 crore outstanding PPIs) | | Oct 04, 2019 | Dissemination of granular payments data | | Oct 04, 2019 | Payments Infrastructure Development Fund (PIDF) to increase digitisation through cards in Tier III-VI centres | | Oct 04, 2019 | 100 per cent digitally enabled districts | | Dec 05, 2019 | Introduction of a new PPI only for purchases up to ₹10,000, with loading only from a bank account and usage only for digital payments. Only minimum customer details required. | | Dec 05, 2019 | Previously, NBFC-P2P aggregate limits for both borrowers and lenders were ₹10 lakh, whereas exposure of a single lender to a single borrower was capped at ₹50,000. It was proposed to increase the aggregate exposure limit of a P2P lender to all borrowers to ₹50 lakh. | | Dec 05, 2019 | Baseline cyber security controls shall be mandated by regulated entities in contractual agreements with ATM Switch application service providers | | Feb 06, 2020 | Publication of a “Digital Payments Index” (DPI) | | Feb 06, 2020 | A framework for establishing a Self-Regulatory Organisation (SRO) for the digital payment system to be prepared to foster best practices on security, customer protection and pricing etc. | | Feb 06, 2020 | A pan India Cheque Truncation System to be operationalized. | | Aug 06, 2020 | Broadening the scope of Priority Sector Lending to include start-ups | | Aug 06, 2020 | Scheme of Offline Retail Payments Using Cards and Mobile Devices | | Aug 06, 2020 | Online Dispute Resolution (ODR) for Digital Payments | | Aug 06, 2020 | Positive Pay Mechanism for Cheques | | Aug 06, 2020 | Creation of Reserve Bank Innovation Hub | | Oct 09, 2020 | Round-the-Clock availability of Real Time Gross Settlement System (RTGS) | | Oct 09, 2020 | Perpetual Validity for Certificate of Authorisation (CoA) issued to Payment System Operators (PSOs) | | Note: Updates on the above may be found in the RBI Annual Report 2019-20 |

| Annex 3 : Indian FinTechs by Business Model | | Business Model | No. of Firms* | Description | | Investment Tech | 990 | Platforms for retail and institutional investors to research and invest in multiple financial assets. | | Payments | 978 | Companies which participate in traditional web based and offline payment cycle; provide alternative mode of payment, and support the payment companies in terms of security, analytics, platform, etc. | | Finance and Accounting Tech | 906 | Automate functions of finance and accounting departments of organisations. | | Alternative Lending | 702 | Online lending platforms (including balance sheet lenders, marketplaces, P2P lenders as well as lead generators) and enablers. | | Banking Tech | 369 | Tech solutions for banking industry including software, hardware, and Tech-enabled services. | | Cryptocurrencies | 342 | Bitcoin and other digital currency products and services. | | Crowdfunding | 185 | Online platforms where people, organisations raise money from the masses. | | Internet First Insurance Platforms | 161 | Tech platforms to consumers for purchasing and managing their insurance | | Insurance IT | 98 | Software products and data solutions primarily for the insurance industry | | RegTech | 95 | Tech products primarily for financial institutions and regulators for efficient implementation and monitoring of regulations | | Robo advisory | 68 | Automated, low-cost investment services to retail investors and technological solutions for automated investments. | | Remittance | 46 | Cross-border money transfer solutions & services | | Forex Tech | 32 | Tech solutions, including internet-first platforms and software for forex market. | | Islamic FinTech | 7 | Internet-first platforms and software for sharia-compliant finance | | Employer Insurance | 6 | Solutions for managing employee insurance benefits. | | * Source: Tracxn database. The total is more than 4,680 as some companies have multiple business models. |

| Annex 4: Top Indian FinTechs by Funding Raised in 2019-20 | | Rank | Company | Founded | Funding Rounds | Total Amount Raised

($ Million) | Description | | 1 | Paytm | 2010 | Series G | 1000 | App-based wallet for consumer payments | | 2 | BharatPe | 2017 | Series A, B, C | 154.3 | QR code based payment app | | 3 | Policybazaar | 2008 | Series F | 150 | Online insurance comparison platform | | 4 | CRED | 2018 | Series A, B | 145.6 | Rewards-based platform for credit card bill payments | | 5 | KhataBook | 2016 | Angel, Seed, Series A, Series B | 140.6 | Digital ledger account book | | 6 | Acko | 2017 | Series C | 101.6 | Tech-enabled automotive insurance | | 7 | ZestMoney | 2015 | Series B | 30.47 | Online platform for point-of-sale financing | | 8 | Lendingkart | 2014 | Series C, D | 87.87 | Online platform providing working capital for SMEs | | 9 | InCred | 2016 | Series A | 85.9 | Alternative lending platform focusing on SME, consumer & personal, home and education loans. | | 10 | Pine Labs | 1998 | Series C | 85 | PoS software solutions for offline retailers | | 11 | Billdesk | 2000 | Series C | 84.8 | Payment Gateway | | 12 | Digit Insurance | 2016 | Series C | 84.35 | Insurance platform for individuals | | Source: Tracxn database. |

|