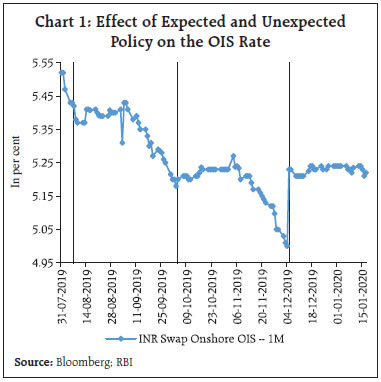

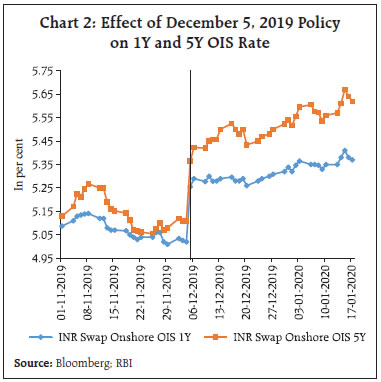

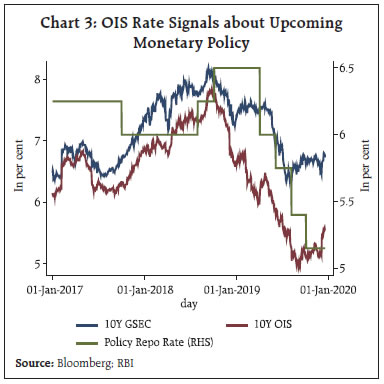

This article analyses two sets of special market operations recently undertaken by the Reserve Bank of India (RBI) – Operation Twist (OT) and Long-Term Repo Operations (LTRO) – designed to ensure comfortable liquidity and to facilitate monetary policy transmission. We use Overnight Indexed Swap (OIS) rates to separate out expected and unexpected components of monetary policy announcements and analyse the impact of monetary policy surprises and the special operations on government bond yields. Event study analysis around announcement days indicates that (i) Government Security (GSEC) yields generally react to monetary policy surprises, and (ii) OT and LTRO had significant impact on GSEC yields of some maturities. Introduction The key channel of transmission of monetary policy impulses to the real economy is the financial market spectrum, others being the balance sheet channel, exchange rate channel, asset prices channel and the confidence channel (Mishkin, 2012). In a typical sequence, changes in the policy rate are immediately reflected in the full continuum of money market rates. To the extent that these short-term rates serve as benchmarks, changes in the policy rate find their way to longer term rates such as GSEC yields and bank lending rates. In turn, GSEC yields are used as benchmarks for pricing corporate bonds and other fixed income instruments while bank lending rates provide reference points for interest rates charged by other financial intermediaries. While this synoptic view of the monetary policy propagation process appears intuitively logical and appropriate in the text book sense, it never obtains in real life. In practice, there are several impediments which render monetary policy transmission delayed, incomplete and sometimes broken, a subject on which there has been a proliferation of literature (Romer, 1989; and Romer, 2015; Bernanke and Gertler, 1995; Kahsyap et al., 1993), including in India (Mitra and Chattaphadhay, 2020). Consequently, monetary authorities frequently engage in smoothing, fixing and circumventing these impediments to transmission. Quantitative Easing (QE) is a recent, highly telegraphed illustration of such activities of central banks whereby, they seek to directly influence term premia and longer-term interest rates in the economy. Yield curve management policy of the Bank of Japan is another widely watched move belonging to the same genre of measures aimed at increasing the efficiency of monetary transmission. Against this backdrop, the motivation of this article is to study two sets of special market operations undertaken recently by the Reserve Bank of India (RBI) – OT and LTRO. OT involves buying of GSECs with longer term maturities (e.g. ten years and five years) and selling of shorter term GSECs of original/ residual maturities of one and three years. LTROs are repurchase agreements collateralised by government securities, by which the central bank lends money to the banks for one to three years at the policy repo rate. As such, they would facilitate monetary transmission by reducing the cost of funds (in case of LTRO) and reducing the term premia (with OT). While the cost of funds channel may facilitate credit offtake, the reduction in the term premia may manifest through lower rates across the term structure of the financial market spectrum. In totality, the objectives of both these operations is to ensure that comfortable liquidity is available to the system to facilitate the transmission of monetary policy. Accordingly, we analyse the relationship between the monetary policy stance and the overnight indexed swap (OIS) market, GSEC yields and GSEC-OIS spreads. Using OIS rates to filter out expected and unexpected components of monetary policy announcements, we analyse the impact of monetary policy surprises and the special operations on government bond yields by estimating the observed 1-day impact, buttressed by model-based estimate of the dynamic impact of such special operations. In summary, our results indicate that (i) GSEC yields generally react to monetary policy surprises, and (ii) OT and LTRO had significant impact on GSEC yields of some maturities. The rest of the article is divided into three sections. Section II provides evidence on the forward-looking nature of OIS contracts, enabling the use of OIS to measure the impact of monetary policy announcements on government bonds. Section III analyses the impact of RBI’s special operations on bond yields. Section IV concludes with some policy perspectives. II. OIS and the Effect of Monetary Policy on Government Securities Overnight indexed swaps are one of the most commonly used tools for interest rate risk management by financial institutions around the world. The floating leg of the swap is linked to an overnight interest rate, i.e., Mumbai Inter-Bank Offer Rate (MIBOR), which is compounded every day over the period of contract to obtain the fixed leg of the swap along with a term premium. Parties agree to exchange the difference in accrued interest computed on the notional principal amount according to fixed and floating interest rates at maturity.1  OIS contracts, by their design, act as a futures segment for the money market. The no-arbitrage condition ensures that the fixed leg of an OIS contract should be equal to the expected overnight rates compounded daily for the period of contract, plus a term premium. Therefore, if overnight rates are expected to increase (decrease) during the period of contract, the OIS rate should consequently move up (down). This feature of OIS is useful in isolating the “surprise” content of any announcement that can affect money market rates. Since all expected information is priced into the OIS rates, only an unexpected market sensitive news can affect it (Chart 1). The vertical bars indicate dates of monetary policy announcements (Chart 1). OIS markets generally provide leading indications of rate decisions by the Monetary Policy Committee (MPC). The announcements of August 7, 2019 and October 4, 2019 had no perceived surprise element for the market and therefore, the OIS rate didn’t move much on these days. However, after the December 5, 2019 MPC announcement of no rate cut, the 1-month OIS jumped 23 bps, indicating that the market was taken by surprise as it was expecting a rate cut. Thereafter, the 1-month OIS rate remained stable, indicating that the market was not expecting any rate change in the February 2020 meeting.  The 1-year and 5-year OIS rates factor in expectations about multiple policy rate announcements and, hence, provide for a market gauge of long-term policy rate expectations. We can see that both 1 and 5 Year OIS rates began gradually rising since the December 2019 announcement indicating an increase in future short-term rate expectations, after factoring in long-term inflationary expectations and anticipating bottoming out of GDP growth (Chart 2). The OIS rate moves in anticipation of upcoming monetary policy decisions well before the actual policy is announced and the GSEC market takes a cue from the OIS market. It indicates that expected policy changes are priced into the GSEC yield well in advance of the actual policy decision (Chart 3). This conjecture can be formally tested by regressing the 1-day change in the GSEC yield on the change in policy rate and 1-day change in OIS rate on the policy days.2 If the GSEC yield adjusts to the anticipated rate decisions before the actual rate decision happens, then most monetary policy decisions will not affect the GSEC yield on the policy announcement days as such anticipated policies will already be priced in the GSEC market. The GSEC yield will only react to policy decisions, which were not anticipated i.e. “surprise”, which can be captured by the change in OIS on the policy days. The OIS instruments, by their definition, are forward-looking and take into account all anticipated monetary policy decisions of the foreseeable future. In case of a “surprise” in monetary policy, the 1-day change in the OIS will give a measure of the surprise component of the policy as it will capture how far off the market expectations are from the actual policy. We consider the 33 policy days between the period May 2014 and December 2019. The result of the regression is presented in Table 1.

| Table 1: Effect of Monetary Policy on GSEC | | | 10Y GSEC Yield | 10Y GSEC Yield | | Effect of Policy Rate | -0.0150

(0.0438) | 0.0237

(0.0221) | Effect of 10Y OIS

(Unexpected Component of Policy) | | 0.4496***

(0.0631) | | N | 33 | 33 | Standard errors in parentheses

*p<0.10, **p<0.05, ***p<0.01 | The regression reported in the table is the following The sample consists of policy days from May 2014 to December 2019. The first column shows that the GSEC yields do not seem to have a statistically significant relationship with policy decisions. However, if we regress the GSEC yield on the unexpected component of monetary policy or “surprise”, which is captured by the change in the 10-year OIS rates on policy days, it shows that unexpected policy decisions do have a significant relationship with GSEC yields. This implies that policy decisions, which are anticipated ahead of the policy announcement days are already accounted for in the GSEC yield before the announcement and only policy surprises affect the GSEC yield on the policy days. Next, we measure the magnitude and the persistence of the effect of such surprises on the GSEC yield. As indicated above, the OIS captures the effect of unanticipated events on the GSEC market. The empirical evidences indicate that larger the 1-day change in OIS, larger is the surprise factor of an event. Such events can be monetary policy surprises, unanticipated fiscal policy changes, unanticipated GDP growth rates, unanticipated inflation, and unanticipated revenue of the Government, etc.3 We use a Local Linear Projection (LLP) method to measure the impact of large 1-day changes in OIS rates on the GSEC yield. The Local Linear Projection Model is given by the following Equation: Here the “Surprise” component is defined as large daily change in OIS rate. We consider the largest 2.0 per cent of such changes, which gives us 31 such “Surprise” events. We consider the period between 2014 and 2019. The results are presented in the form of an impulse response function (Chart 4). We can see that a large surprise has a large and persistent impact on the GSEC market. It affects the GSEC yield for the next 15-16 days, with a magnitude of above 0.5, throughout. The coefficients imply that a one per cent OIS rate change in a day will cause GSEC yields to be higher by 0.5 per cent, on average, for up to 16 days. Spread between GSEC and OIS It may be mentioned that the spread between 10-year GSEC yield and OIS rates started widening since January 2019 (Chart 3). Also, it shows that the GSEC market has seen decent transmission of monetary policy till August 2019, and thereafter rate cuts seem to have had muted impact on the GSEC yield and the spread has widened further. To explain such a widening of spread in terms of demand and supply of securities, we analyse GSEC auctions and net open market operation (OMO) purchases. It may be observed that 2019 witnessed an increase in 10-year GSEC supply and a consequent upward pressure on GSEC yields. OMO purchases that increase demand for such securities were lower in 2019 compared to 2018. While supply and demand mismatches culminated in rather sticky GSEC yield, OIS rate followed the policy easing cycle and headed south, accentuating the spread (Chart 5). III. Effect of RBI’s Special Market Operations The Reserve Bank conducted two types of special market operations – OT and LTRO, to improve transmission and to assure banks about the availability of durable liquidity at a reasonable cost relative to prevailing market conditions. The objective of these operations is to encourage banks to undertake maturity transformation and augment credit flows to productive sectors. A. Operation Twist The Reserve Bank announced and conducted simultaneous purchase and sale of government securities under OMOs on four occasions in December 2019 and January 2020. The programme, popularly known as Operation Twist, involved purchasing GSEC of longer maturities and selling equal amount of GSEC of shorter maturities. The corporate bonds are benchmarked to the yields in the longer-term GSEC segment. The aim of OT is to improve transmission of the current accommodative policy stance to the corporate bond market by softening the yields on government securities at the longer end. The announcement date and security purchase/sale details of the Reserve Bank’s OMOs are listed in the Annex (Table 1). We conducted a high frequency event study analysis around the announcement day for these four special OMOs by the Reserve Bank (Swanson, et al. (2011) and Jones (1998)). Under the rational expectations hypothesis, asset prices should completely incorporate all information from a public announcement shortly after the announcement. Studying 1-day change in rates should provide an unbiased estimate of the effect of an announcement on asset returns in question. We look at 1-day change in OIS rates after the announcements by the Reserve Bank. The announcement of all these four OMOs by the Reserve Bank came in the form of press releases that were posted on its website after the closure of financial markets. Hence, the 1-day change in rates is calculated as the change in OIS rates between the day of announcement and the next business day. For this analysis, we consider 1-month, 3-month, 6-month, 1-year, 5-year and 10-year OIS rates4. The statistical significance of each of these responses is measured relative to the unconditional standard deviation of the corresponding rates over similarly sized windows over a period of one year preceding the month of announcement of these special OMOs. The corresponding months of announcements are excluded from the calculation of standard deviation to avoid the standard deviations being unduly affected by the event itself. The null hypothesis for this analysis is that OT announcements had no effect on OIS rates of any maturity. The alternative hypothesis suggests that announcements may provide an indication to financial markets on future course of monetary policy. The event study results indicate that the impact of OT announcements on OIS rates is mixed and insignificant across all maturities (Table 2). The cumulative impact of announcement of all four OMO announcements on 10-year OIS rates is insignificant. This is on expected lines. The OIS rates capture market expectations about future course of monetary policy. Special OMOs are aimed at better transmission operating through GSEC yields and as such, have limited capacity to influence OIS markets. OIS rates are likely to be affected only to the extent of OT announcements acting as a signal for long-run expectations of future policy rate cuts and these effects are likely to be small.5 Further, we undertake an exercise similar to the one presented in Table 2 to measure the impact of the policy on the 10-year benchmark GSEC yield (Table 3). The results indicate that there was a statistically significant 1-day impact of the OT on the GSEC yields during the December 2019 announcements. The cumulative impact on the GSEC yield is about 21 basis points. We found an insignificant impact of OT announcements on 1-year GSEC yields, which hints at a flattening of the slope of GSEC yield curve. | Table 2: Impact of Operation Twist Announcements on OIS Rates | | 1-day change | Maturity | | 1-month | 3-month | 6-month | 1-year | 5-year | 10-year | | Estimated Responses to Announcements (in basis points) | | January 16, 2020 - January 17, 2020 | 1.00 | 0.00 | -1.00 | -1.00 | -2.00 | -8.00 | | January 2, 2020 - January 3, 2020 | 0.00 | 2.50 | 1.00 | 1.75 | 4.13 | 6.00 | | December 26, 2019 - December 27, 2019 | 1.00 | 2.00 | 1.00 | 0.87 | 2.00 | 2.00 | | December 19, 2019 - December 20, 2019 | 0.00 | 3.00 | -1.00 | -3.00 | -6.63 | -7.00 | | Cumulative, all four announcements (in bps) | 2.00 | 7.50 | 0.00 | -1.38 | -2.50 | -7.00 | | Unconditional Std. Dev of 1-day OIS rate changes | 3.96 | 3.29 | 3.04 | 3.40 | 5.08 | 5.21 |

| Table 3: Impact of Operation Twist Announcements on GSEC Yields on the Day of Announcement | | 1-day change | 10 Year Benchmark | | January 16, 2020 - January 17, 2020 | 0 | | January 2, 2020 - January 3, 2020 | 0 | | December 26, 2019 - December 27, 2019 | -8* | | December 19, 2019 - December 20, 2019 | -13** | | Cumulative, all four announcements (in bps) | -21** | | Unconditional Standard Deviations of 1-day change in GSEC yield | 4.56 | | *p<0.10, **p<0.05, ***p<0.01 | We have already shown that OT had no significant announcement effect on OIS rates but had a statistically significant negative impact on 10-year GSEC yields (Table 2 and Table 3). Therefore, we expect to find a softening of the GSEC – OIS spread due to OT. We use the same event study technique to analyse the 1-day impact of OT related announcements on the GSEC – OIS spread of 10-year maturity (Table 4). Overall, the cumulative impact of OT on the 10-year GSEC – OIS spread is 14 bps, which is statistically significant at 10 per cent6. | Table 4: Impact of Operation Twist Announcements on Spreads between GSEC and OIS | | 1-day change | Effect on Spread between GSEC and OIS (10Y) | | January 16, 2020 - January 17, 2020 | 8* | | January 2, 2020 - January 3, 2020 | -6 | | December 26, 2019 - December 27, 2019 | -10** | | December 19, 2019 - December 20, 2019 | -6 | | Cumulative, all four announcements (in bps) | -14* | | Unconditional Standard Deviations of 1-day change in GSEC yield | 4.25 | | *p<0.10, **p<0.05, ***p<0.01 | B. Long Term Repo Operations (LTRO) The Reserve Bank announced its intention to carry out LTRO in its Statement on Developmental and Regulatory Policies, which was released along with the Monetary Policy Statement on February 6, 2020. Under LTRO, the Reserve Bank announced that it would make repurchase contracts worth ₹ 1 lakh crore on GSECs of 1 year and 3 years maturities. The repurchase contracts were to be undertaken at the policy repo rate. As the policy repo rate is much lower than the GSEC yields of these maturities, such an announcement is likely to create arbitrage opportunities for banks and other financial institutions, which are holding excess government bonds. Such an arbitrage could bring down yields of government and corporate bonds of comparable maturities and reduce lending rates, which are benchmarked to government bonds. The Statement released on February 6, 2020 specified the magnitude of the operation and the maturities, which are to be targeted. It did not, however, specify the amount of each security to be purchased, and the dates on which it will be done. The Statement was released to the public during the market hours, and therefore it is expected that bond markets would have reacted, at least partially on 6th February itself. On February 7, 2020, the Reserve Bank announced the dates to carry out the first tranche of these transactions. As part of the first tranche, it was to purchase ₹ 25,000 crores of GSECs with residual maturity of 3 years on February 17,2020 and ₹ 25,000 crores of GSECs with residual maturity of 1 year on February 24, 2020. This announcement was made public at 5.30 PM (i.e., after-market hours). Therefore, the full impact of this announcement could only be realised on the following trading day, which was February 10, 2020. Given the staggering of LTRO announcements over two subsequent days, we analyse the 3-day change in the yield of the securities selected under LTRO, as well as the 3-day change in the spread of these securities over OIS of respective maturities. | Table 5: Impact of LTRO on GSEC and GSEC – OIS Spreads | Estimated Responses to Announcements

(in basis points) | 3-Year GSEC | GSEC - OIS Spread (3Y) | 1-Year GSEC | GSEC - OIS Spread (1Y) | 3-day change, February 5, 2020

- February 10, 2020 (February 8 and 9 weekends) | -27.9*** | -9.65 | -8.5 | 2.5 | | Standard Deviation (4-day) | 7.1 | 6.1 | 5.7 | 5.8 | | *p<0.10, **p<0.05, ***p<0.01 | The results show that the announcement of LTRO had a statistically significant negative impact on the 3-Year GSEC but not on 1-Year GSEC or the spreads over the respective OIS rates (Table 5). C. Dynamic Impact of Special OMOs We have estimated the one-day impact of announcements related to OT in Table 2 and Table 3. However, our local linear projection model defined by equation 3 shows that a surprise announcement in monetary policy can affect the GSEC yield for up to next 16 business days (Chart 4). The surprise is defined in our model as 1-day change in OIS, which is among the top 2 per cent of all such changes. The decision to hold policy rates unchanged in the MPC decision of December 5, 2019 came as a large surprise to the OIS market and, as a result, the OIS of all maturities show a steep jump (Chart 1 and Chart 2). In fact, the one-day change in OIS on December 5, 2019 is the largest single day change in OIS in our sample. As discussed in Section II, any unanticipated change in OIS rate leads to a significant change in GSEC yields in the same direction. Therefore, it can be expected that the large rise in OIS would have led to an increase in GSEC after December 5, 2019. We use the model in Equation 3 to plot a predicted GSEC based on the surprise effect of December 5 policy announcement. We also plot the actual GSEC along with it (Chart 6). The rise in actual 10-year GSEC yield was more than the model predicted one, though both rose after the December 5 policy announcement (Chart 6). We also see that the two OT announcements on December 19 and 26, 2019 brought down the GSEC yields significantly. Since this model does not account for the special OMOs (our sample of analysis ends before the special OMOs begin), the model-predicted GSEC is not affected by the OT announcements. Our model shows that the two OMOs brought down the GSEC yield below levels predicted by the model in the absence of special OMOs. IV. Conclusion This article analyses the effect of monetary policy announcements and special market operations by the Reserve Bank on GSEC yields. We use the OIS rate to isolate surprise element of monetary policy announcements and show that for most of our sample period, GSEC market takes signal from the forward looking OIS market and adjusts yield even before the formal policy rate announcements are made. A surprise in policy decision, on the other hand, has an immediate and persistent impact on the GSEC yields. We also find that this mechanism of transmission of monetary policy to GSEC yields has weakened since the latter half of 2019-20, which could be due to excess supply and lack of demand in the GSEC market. The weakening of the transmission mechanism of monetary policy to GSEC yields has dampened the transmission of rate cuts into corporate bond yield and lending rates as GSEC yields act as a benchmark for these rates. This might have necessitated the Reserve Bank to intervene using special market operations, namely, OT and LTRO. We analyse the impact of these special interventions on GSEC yield and find that OT and LTRO had significant transmission that got reflected in select maturities of GSEC yields. Our analysis indicates that special operations such as OT and LTRO, which directly intervene in the bond market can be useful tools in facilitating transmission of monetary policy when the regular mechanism of transmission does not perform as expected. References: Bernanke, Ben S. and Mark Gertler (1995). “Inside the Black Box: The Credit Channel of Monetary Policy Transmission”. The Journal of Economic Perspectives 9.4, pp. 27–48. Ghosh, S., & A. Acharya (2010). Determinants of Overnight Index Swap (OIS) Rates: Some Empirical Findings from an Emerging Market Economy, India. Reserve Bank of India Occasional Papers, Vol. 31. Swanson, E. T., Reichlin, L., & Wright, J. H. (2011). Let’s Twist Again: A High-Frequency Event-Study Analysis of Operation Twist and Its Implications for QE2 [with Comments and Discussion]. Brookings Papers on Economic Activity, 151-207. Jones, C. M., Lamont, O., & Lumsdaine, R. L. (1998). Macroeconomic news and bond market volatility. Journal of financial economics, 47(3), 315-337. Kashyap A.K., Stein J.C. and D.W. Wilcox (1993). “Monetary policy and credit conditions: evidence from the composition of external finance”. American Economic Review 83.1, pp. 73–98. Kenneth N. Kuttner (2001). Monetary policy surprises and interest rates: Evidence from the Fed funds futures market. Journal of Monetary Economics, Vol 47 Edwin Prabu A, Partha Ray (2019). “Monetary Policy Transmission in Financial Markets”. Economic and Political Weekly 54.13, pp. 68–74. Mishkin, Frederic (2012). “The Economics of Money, Banking, and Financial Markets”. Prentice Hall ISBN 9781408200728. Mitra A. K. and S. Chattaphadhay (2020), Monetary policy transmission in India – recent trends and impediments, Reserve Bank of India Bulletin, Vol. LXXIV No. 3 Romer, C. and D. Romer (2015). “New evidence on the monetary transmission mechanism”. Brookings Paper on Economic Activity 3.1, pp. 149–213. Romer, Christina D. and David H. Romer (1989). “Does Monetary Policy Matter? A New Test in the Spirit of Friedman and Schwartz”. NBER Working Paper Series 2966.

| Annex | | Table 1: Announcement of Special OMOs by the Reserve Bank | | Announcement Date | Purchase/ Sale Date | Details of Securities Purchase | Details of Securities Sale | | Sr. No | Security | Date of Maturity | Aggregate Amount | Sr. No | Security | Date of Maturity | Aggregate Amount | | 19-Dec-19 | 23-Dec-19 | 1 | 6.45% GS 2029 | 07-Oct-29 | ₹ 10,000 crores | 1 | 6.65% GS 2020 | 09-Apr-20 | ₹10,000 crores

(No security-wise notified amount) | | 2 | 7.80% GS 2020 | 03-May-20 | | 3 | 8.27% GS 2020 | 09-Jun-20 | | 4 | 8.12% GS 2020 | 10-Dec-20 | | 26-Dec-19 | 30-Dec-19 | 1 | 6.45% GS 2029 | 07-Oct-29 | ₹ 10,000 crores | 1 | 6.65% GS 2020 | 09-Apr-20 | ₹ 10,000 crores

(No security-wise notified amount) | | 2 | 7.80% GS 2020 | 03-May-20 | | 3 | 8.27% GS 2020 | 09-Jun-20 | | 4 | 8.12% GS 2020 | 10-Dec-20 | | 02-Jan-20 | 06-Jan-20 | 1 | 7.32% GS 2024 | 28-Jan-24 | ₹ 10,000 crores

(No security-wise notified amount) | 1 | 6.65% GS 2020 | 09-Apr-20 | ₹ 10,000 crores

(No security-wise notified amount) | | 2 | 7.27% GS 2026 | 08-Apr-26 | 2 | 7.80% GS 2020 | 03-May-20 | | 3 | 6.45% GS 2029 | 07-Oct-29 | 3 | 8.27% GS 2020 | 09-Jun-20 | | 4 | 8.12% GS 2020 | 10-Dec-20 | | 16-Jan-20 | 23-Jan-20 | 1 | 7.32% GS 2024 | 28-Jan-24 | ₹ 10,000 crores

(No notified amount) | 1 | 7.80% GS 2021 | 11-Apr-21 | ₹ 10,000 crores

(No notified amount) | | 2 | 6.45% GS 2029 | 07-Oct-29 | 2 | 7.94% GS 2021 | 24-May-21 |

| Annex Table 2: Impact of Fed’s Operation Twist Announcements on US OIS rates | | 1-day change | Maturity | | 1-Year | 5-years | 10-years | | Estimated Responses to Announcements (in bps) | | 1-day change, Sep 21, 2011 - Sep 20, 2011 | -2 | -3 | -4 | | 1-day change, Jun 20, 2012-Jun 19, 2012 | -2 | 1 | 4 | | Unconditional Standard Deviations of 1-day OIS rate changes | 1.92 | 4.22 | 5.54 |

|