The Reserve Bank managed the market borrowing requirements of the central and state governments during 2022-23 in a non-disruptive manner, despite the initial market concerns surrounding the size of the borrowing programmes and headwinds from an uncertain global environment triggered by the war in Ukraine and synchronised monetary policy tightening by the major central banks. The weighted average yield of market borrowing for the central government hardened by 104 basis points (bps) during the year, as against a cumulative increase in the policy repo rate by 250 bps, amid a shift in the stance of monetary policy to withdrawal of accommodation. The maturity profile of outstanding dated securities was elongated to contain rollover risk. Sovereign Green Bonds were issued for the first time by the central government, proceeds of which would be used in public sector projects which help in reducing the emission intensity of the economy. VII.1 The Internal Debt Management Department (IDMD) of the Reserve Bank is entrusted with the responsibility of managing the domestic debt of the central government by statute vide Sections 20 and 21 of the RBI Act, 1934, and of 28 state governments and two Union Territories (UTs) in accordance with respective bilateral agreements as provided in Section 21A of the said Act. In terms of Section 17(5) of the RBI Act, 1934, short-term credit up to three months is provided to both central and state governments in the form of Ways and Means Advances (WMA) to bridge temporary mismatches in their cash flows. VII.2 In 2022-23, the fiscal deficit of the central government was budgeted lower than the previous year but it remained above the pre-pandemic levels. The size of the borrowing requirement accordingly remained high in an environment characterised by global inflation and aggressive tightening of monetary policy by the major central banks, that amplified spillover effects on the domestic financial markets. As the inflation outlook on India deteriorated following the war in Ukraine and high global food and commodity prices, the Reserve Bank raised the policy repo rate cumulatively by 250 bps and shifted the policy stance to withdrawal of accommodation. VII.3 Notwithstanding the impact of tightening global and domestic financial conditions on the Indian G-sec market, the Reserve Bank ensured completion of the market borrowing programme for both central and state governments in a non-disruptive manner, keeping in mind the three broad objectives of cost optimisation, risk mitigation and market development. The Reserve Bank continuously reviewed and adapted its debt management strategy in view of pressure on yields from global spillovers, the elevated domestic inflation and gradual withdrawal of excess liquidity. The weighted average yield of market borrowing for central government hardened by 104 bps during the year. The maturity profile of outstanding dated securities was elongated to contain the rollover risk. Pursuant to the government’s announcement in the Union Budget 2022-23, the Reserve Bank in consultation with the central government issued Sovereign Green Bonds (SGrBs) for an amount aggregating to ₹16,000 crore during 2022-23. VII.4 The remainder of the chapter is arranged under three sections. Section 2 presents the implementation status in respect of the agenda for 2022-23 along with major developments during the year in the areas of debt management for both central and state governments. Section 3 covers major initiatives to be undertaken in 2023-24, followed by a summary in the last section. 2. Agenda for 2022-23 VII.5 The Department had set out the following goals for 2022-23: -

Consolidation of debt through calendar driven, auction-based switches and buyback operations along with re-issuance of securities to augment liquidity in G-sec market and facilitate fresh issuances (Paragraph VII.6 - VII.9); -

The consolidated operational guidelines for primary dealers (PDs) issued in 2005 are updated from time to time. The guidelines relating to basic eligibility criteria, viz., net owned funds (NOF) requirement and targets, however, remain largely unchanged. It was proposed to undertake a comprehensive review of the extant operational guidelines for PDs (Paragraph VII.10); -

Taking appropriate measures for further popularisation of the ‘RBI Retail Direct Scheme’ for improving its overall reach for suitable retail investors across the country (Utkarsh) [Paragraph VII.11]; -

The Hon’ble Finance Minister in her budget speech on February 1, 2022 had announced that the government will issue SGrBs in the domestic market as a part of its overall market borrowing programme for the next financial year and the proceeds will be deployed in public-sector green projects. Accordingly, the Reserve Bank, as its debt manager, is providing necessary support to the Government of India (GoI) for formulation of the framework for issuance of SGrBs in line with the international standards. The issuance of SGrBs was envisaged to be taken up during the year after completing the preparatory work (Paragraph VII.12); -

Review of medium-term debt management strategy (MTDS) for management of public debt of the government with an objective to mobilise market borrowings at low cost over the medium to long-term, with prudent levels of risk and a stable debt structure, while also developing a liquid and well-functioning domestic debt market (Paragraph VII.13); -

Around one-third of general government debt pertains to sub-national governments. However, a document outlining the strategy of debt management for efficient and effective management at sub-national government was lacking. Therefore, a pilot MTDS for a few states was proposed to be drafted reflecting the state governments’ plan for financing their activities, while taking due cognisance of the constraints and potential risks (Utkarsh) [Paragraph VII.14]; and -

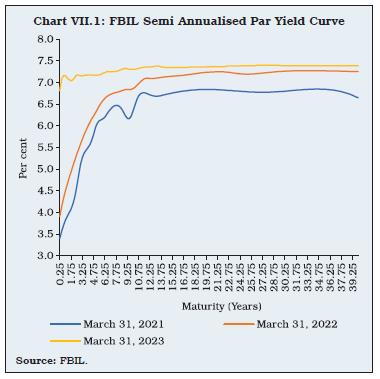

Conduct capacity building programmes for sensitising the state governments about prudent practices in cash and debt management (Paragraph VII.15). Implementation Status VII.6 The Reserve Bank successfully completed the combined gross market borrowings of the central and the state governments to the tune of ₹21,79,392 crore during the year, which was 19.2 per cent higher than the previous year. VII.7 The Reserve Bank continued with its policy of passive consolidation by way of reissuances and active consolidation through buyback/switches. During 2022-23, 161 out of 177 issuances of G-sec were re-issuances (91 per cent) as compared with 142 re-issuances out of 154 issuances (92.2 per cent) in the previous year. VII.8 The active form of debt consolidation through switching of government securities maturing in the near-term with the long-dated government securities is generally conducted once in a month. Accordingly, switches amounting to ₹1,05,489 crore, were completed during 2022-23 as against the budgeted amount of ₹ 1,00,000 crore. VII.9 During 2022-23, securities ranging from 2 to 40 years tenor (original maturity) were issued with the objective of catering to the demand from various investors in different maturity buckets. Floating Rate Bonds (FRBs) of 7-year and 13-year tenors (original maturity) were also re-issued during the year. The share of FRBs in total issuances during 2022-23 was 2.5 per cent as compared to 7.8 per cent in the previous year. VII.10 The Master Directions - Operational Guidelines for Primary Dealers were published on July 1, 2016. The Reserve Bank is in the process of comprehensively reviewing the guidelines. VII.11 During the year, several public awareness campaigns, and investor awareness programmes were undertaken across the country to improve the overall reach of the ‘RBI Retail Direct Scheme’. Further, the user interface features of the ‘Retail Direct Portal’ have been enhanced to make the portal more user friendly. These initiatives have resulted in significant growth in the number of accounts opened as well as the total investments made under the scheme during the year. VII.12 Issuance of SGrBs of ₹16,000 crore was notified in the half-yearly issuance calendar for marketable dated securities for H2:2022-23. Subsequently, the GoI notified the framework for SGrBs on November 9, 2022. The framework was rated as ‘Medium Green’ with a ‘Good’ Governance’ score by CICERO1, the second party opinion provider. The auction for issuance of SGrBs was held in two tranches of ₹ 8,000 crore each during January - February 2023 (Box VII.1). VII.13 Inputs on the Medium-Term Debt Management Strategy (MTDS) for the GoI were provided to the Public Debt Management Cell, GoI. The MTDS has been articulated for the medium-term for a period of three years (i.e., 2022-23 to 2024-25), which is generally reviewed annually with a roll-over period of next three years. VII.14 Two states, viz., Maharashtra and Telangana agreed for preparation of pilot MTDS. A presentation on the objectives/rationale and structure of MTDS for states was made in the 32nd Conference of the State Finance Secretaries held in July 2022. The importance and the benefits of MTDS for the states were also covered during the capacity building programmes (CBPs) on cash and debt management conducted for the states during the year. In consultation with the respective state governments, the pilot MTDS are being prepared. VII.15 State-wise CBPs for sensitising state governments about prudent cash and debt management were conducted for eight states, viz., Andhra Pradesh, Haryana, Punjab, Himachal Pradesh, Jharkhand, Karnataka, Tamil Nadu, Telangana and for the UT of Puducherry. Further, a two-day CBP on cash and debt management was conducted in the Reserve Bank’s College of Agricultural Banking (CAB), Pune in December 2022 for 14 state governments and the UT of Jammu and Kashmir. Box VII.1

India’s Sovereign Green Bonds Thematic bonds are fixed-income securities issued in capital markets to raise financing for projects and activities related to a specific theme, such as climate change, education, housing, ocean and marine conservation, and the sustainable development goals (World Bank, 2022). Green bonds are a kind of thematic bonds, the other categories being social bonds, sustainability bonds and sustainability linked bonds. In case of green bonds, the proceeds are exclusively used to finance or re-finance new and/or existing projects that are expected to have a positive impact on the environment and/or climate. While the green bond issuance is supported by several internationally recognised standards/principles, International Capital Markets Association’s (ICMA’s) green bond principles (GBP) are widely accepted as voluntary process guidelines, which recommend transparency and disclosure and promote integrity in the development of the green bond market. The first green bond was issued by the World Bank in 2008. The global market for sustainable finance has registered a considerable growth since 2014 mainly led by issuances of green bonds. As per the data published (Climate Bonds Initiative, November, 2022), cumulative green bond issuances as on September 30, 2022 have surpassed US$ 2.0 trillion, which includes sovereign green bonds (SGrBs) issued by 26 sovereigns aggregating to US$ 230.9 billion. European nations are the major issuers of SGrBs with 5-year and 10-year tenors being the preferred tenors of issuance. At COP26 Summit2 in November 2021, India announced to achieve net zero emission by 2070. India’s revised nationally determined contributions (NDCs) include targets to achieve 50 per cent of the energy requirements from renewable energy by 2030 and reduction of the carbon intensity of the economy by 45 per cent by 2030 over 2005 levels. A significantly higher amount of resources will be required by the Government of India to achieve the NDC targets. In the Union Budget 2022-23, the Government of India announced that SGrBs would be issued in the domestic market during 2022-23 as part of the overall market borrowing programme. The proceeds will be deployed in public sector projects, which will help in reducing the carbon intensity of the economy. The Government of India, in consultation with the Reserve Bank, finalised the sovereign green bond framework on the lines of ICMA’s GBP and notified the same on November 9, 2022. The framework was subject to an external review by CICERO. It rated India’s green bond framework as ‘medium green’ with ‘good’ governance. The framework lists nine broad categories of eligible green projects to fulfil various environmental objectives such as reducing greenhouse gas emissions, encouraging energy efficiency, promoting climate adaptations and improving natural ecosystems. The government has constituted a ‘Green Finance Working Committee’ for evaluation and selection of various eligible green projects and other relevant work related to the framework. The framework provides for publication of an annual report regarding allocation of proceeds and its environmental impact. The allocation and utilisation of proceeds from issuance of green bonds would also be subject to audit. The total issuance of SGrBs during 2022-23 was kept at ₹16,000 crore, with the issuance spread over two tranches of ₹8,000 crore each on January 25, 2023 and February 9, 2023, comprising 5-year and 10-year SGrBs for ₹4,000 crore in each tranche. The auctions of both tranches of SGrB registered robust demand from the market participants with average bid-to-cover ratio of 3.04 for the 5-yr SGrB and 3.93 for the 10-yr SGrB. The average cut-off yields for the 5-year and 10-year SGrBs were 4.26 bps and 3.53 bps, respectively, below the prevailing secondary market yields of the conventional government securities of the respective tenors. References: 1. World Bank (2022), ‘Sovereign Green, Social and Sustainability Bonds: Unlocking the Potential for Emerging Markets and Developing Economies’, World Bank, October 2022. 2. Harrison, C., MacGeoch, M. (2022), ‘Sustainable Debt Market Summary’, Climate Bond Initiative, November 2022. | Major Developments Debt Management of the Central Government VII.16 During 2022-23, the gross market borrowings of GoI through dated G-secs were higher by 26.04 per cent as compared with the previous year. Net market borrowings through dated G-secs increased by 28.4 per cent as compared with the previous year. Net market borrowings through dated G-secs financed 63.1 per cent of the central government’s gross fiscal deficit (GFD) [Revised Estimates] as against 54.5 per cent of GFD (Actuals) in the previous year. The net market borrowings through dated securities and T-Bills taken together increased by 26.4 per cent as compared with the previous year (Table VII.1). Debt Management Operations VII.17 The weighted average yield (WAY) of G-sec issuances during the year increased by 104 bps as compared to the previous year. The weighted average coupon on the entire outstanding debt stock also increased by 15 bps. The weighted average maturity (WAM) of primary issuances (excluding issuances under switch auction) stood at 16.05 years as compared to 16.99 years in the previous year. The WAM of the outstanding debt increased from 11.71 years to 11.94 years (Table VII.2). | Table VII.1: Net Market Borrowings of the Central Government | | (₹ crore) | | Item | 2019-20 | 2020-21 | 2021-22 | 2022-23 | | 1 | 2 | 3 | 4 | 5 | | Net Market Borrowings (i to iv) | 5,11,500 | 13,75,654 | 9,29,351 | 11,74,375 | | i) Dated Securities@ | 4,73,972 | 11,43,114 | 8,63,103 | 11,08,261 | | ii) 91-day T-Bills | -9,600 | 10,713 | 45,439 | -23,798 | | iii) 182-day T-Bills | 38,354 | -18,743 | 71,252 | 52,426 | | iv) 364-day T-Bills | 8,774 | 2,40,570 | -50,444 | 37,487 | @: Without adjusting for buyback/switches. After adjusting for buyback/switches, net market borrowings during 2022-23 stood at ₹11,71,951 crore, ₹9,29,060 crore in 2021-22, ₹11,46,739 crore in 2020-21 and ₹4,73,990 crore in 2019-20.

Source: RBI. |

| Table VII.2: Market Loans of Central Government - A Profile* | | (Yield in Per cent/Maturity in Years) | | Years | Range of Cut Off Yield in Primary Issues | Issued during the Year^ | Outstanding Stock# | | Under 5 Years | 5-10 Years | Over 10 Years | Weighted Average Yield | Range of Maturities @ | Weighted Average Maturity | Weighted Average Maturity | Weighted Average Coupon | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 2016-17 | 6.85-7.46 | 6.13-7.61 | 6.46-7.87 | 7.15 | 5-38 | 14.76 | 10.65 | 7.99 | | 2017-18 | 7.23-7.27 | 6.42-7.48 | 6.68-7.67 | 6.97 | 5-38 | 14.13 | 10.62 | 7.76 | | 2018-19 | 6.56-8.12 | 6.84-8.28 | 7.26-8.41 | 7.77 | 1-37 | 14.73 | 10.40 | 7.81 | | 2019-20 | 5.56-7.38 | 6.18-7.44 | 5.96-7.77 | 6.85 | 1-40 | 16.15 | 10.72 | 7.71 | | 2020-21 | 3.79-5.87 | 5.15-6.53 | 4.46-7.19 | 5.79 | 1-40 | 14.49 | 11.31 | 7.27 | | 2021-22 | 4.07-5.10 | 4.04-6.78 | 4.44-7.44 | 6.28 | 1-40 | 16.99 | 11.71 | 7.11 | | 2022-23 | 5.43-7.45 | 5.21-7.52 | 5.65-7.90 | 7.32 | 1-40 | 16.05 | 11.94 | 7.26 | @: Residual maturity of issuance and figures are rounded off.

*: Excluding special securities. ^: Excluding switch auction. #: Including switch auction.

Source: RBI. | VII.18 Partial devolvement on PDs took place on eight instances amounting to ₹23,053 crore during 2022-23 as compared with seventeen instances for ₹97,938 crore in 2021-22. No bid was accepted on four instances for a total notified amount of ₹16,000 crore as compared to nine instances for a total notified amount of ₹99,000 crore in the previous year. VII.19 G-sec yields hardened during the year primarily in response to the increase in domestic inflation following surge in global food and commodity prices and the successive policy rate hikes, as also spillovers from monetary policy tightening by major central banks. The 10-year benchmark yield rose by 47 bps from 6.84 per cent as at end-March 2022 to 7.31 per cent as at end-March, 2023. Yields rose sharply in Q1:2022-23 driven by the off-cycle rate hike of 40 bps and CRR hike of 50 bps by the Reserve Bank in May 2022 and rate hike of 50 bps in June along with the change in monetary policy stance to withdrawal of accommodation. Higher CPI inflation prints for April and May also weighed on the yields. The 10-year benchmark yield hardened by 61 bps in Q1 to close at 7.45 per cent as on June 30, 2022. In Q2, the yields generally declined during July and August, tracking sharp fall in the US yields and crude prices due to rising growth concerns in the advanced economies, and also on expectation of inclusion of Indian G-secs in global bond indices. The yields, however, reversed the trend and rose in September, tracking the US Fed’s rate hike of 75 bps and its hawkish guidance which led to spike in the US treasury yields. The 10-year benchmark yield declined marginally by 5 bps during Q2 to close at 7.40 per cent. In Q3, the yields rose initially, tracking higher than expected domestic CPI inflation for September. The yields, however, declined sharply in November as the US yields softened significantly following the release of lower-than-expected US CPI print and decline in crude prices amid concerns about global demand slowdown. Yields hardened during December as the US Fed raised its terminal interest rate projection for 2023. The 10-year benchmark yield softened by 7 bps in Q3 to close at 7.33 per cent. In Q4, the yields declined initially after the Union Budget announcement of lower than expected government market borrowing for 2023-24. The yields hardened following the Monetary Policy Committee’s decision to increase the policy repo rate by 25 bps and continue with the stance of withdrawal of accommodation. The yields declined in March, tracking fall in US treasury yields. The 10-year benchmark yield declined marginally by 2 bps in Q4 to close at 7.31 per cent as on March 31, 2023. (Chart VII.1). VII.20 During 2022-23, about 48.9 per cent of the market borrowings was raised through issuance of dated securities with a residual maturity of 10 years and above as compared with 58.2 per cent in the previous year. Further, the 30-year and 40-year tenor securities were issued/re-issued during the year with the objective of catering to the demand from long-term investors such as insurance companies and provident funds (Table VII.3).

| Table VII.3: Issuance of Government of India Dated Securities – Maturity Pattern | | (Amount in ₹ crore) | | Residual Maturity | 2020-21 | 2021-22 | 2022-23 | | Amount Raised | Percentage to Total | Amount Raised | Percentage to Total | Amount Raised | Percentage to Total | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | Less than 5 Years | 3,91,990 | 28.6 | 2,29,255 | 20.3 | 2,70,000 | 19.0 | | 5 - 9.99 Years | 3,07,405 | 22.4 | 2,41,865 | 21.5 | 4,56,000 | 32.1 | | 10-14.99 Years | 3,76,766 | 27.5 | 3,20,639 | 28.4 | 2,86,000 | 20.1 | | 15 -19.99 Years | - | - | - | - | - | - | | 20 Years & Above | 2,94,162 | 21.5 | 3,35,621 | 29.8 | 4,09,000 | 28.8 | | Total | 13,70,324 | 100.0 | 11,27,382 | 100.0 | 14,21,000 | 100.0 | - : Nil

Note: Figures in the columns might not add up to the total due to rounding off of numbers.

Source: RBI. | Treasury Bills VII.21 Short-term cash requirements of the central government are met through issuance of Treasury Bills (T-Bills). The net short-term market borrowing of the government through T-Bills (91, 182 and 364 days) marginally decreased to ₹66,114 crore during 2022-23 as against ₹66,248 crore in the previous year. Ownership of Securities VII.22 Commercial banks remained the largest holders of government securities [including T-Bills and state government securities3 (SGSs)] accounting for 37.5 per cent as at end-March 2023, followed by insurance companies (25.2 per cent), provident funds (9.8 per cent) and the Reserve Bank (9.2 per cent). The share of the foreign portfolio investors (FPIs) was 0.9 per cent. The other holders of government securities (including T-Bills and SGSs) include mutual funds, state governments, financial institutions (FIs) and corporates. Primary Dealers (PDs) VII.23 The number of PDs stood at 21 [14 Bank- PDs and 7 standalone PDs (SPDs)]. The PDs have the mandate to underwrite primary auctions of dated G-sec while they have a target of achieving bidding commitment and success ratio in respect of primary auctions of T-Bills/cash management bills (CMBs). The PDs individually achieved the stipulated minimum success ratio of 40 per cent in primary auctions of T-Bills. The share of PDs in auctions of T-Bills/CMBs was 68.98 per cent during 2022-23 as compared with 71.4 per cent in the previous year. The commission paid to PDs, excluding GST, for underwriting primary auctions of dated G-sec during 2022-23 was ₹91.08 crore, as compared to ₹412.7 crore during 2021-22. Sovereign Gold Bond (SGB) Scheme VII.24 The Reserve Bank, in consultation with the GoI, had announced a calendar comprising four tranches of SGB for 2022-23. The aggregate sum raised during the financial year amounted to ₹6,551 crore (12.26 tonnes). Since inception of the SGB Scheme in November 2015, a total of ₹ 45,243 crore (102.63 tonnes) has been raised through 63 tranches. Cash Management of the Central Government VII.25 The central government started the year 2022-23 with a cash balance of ₹40,352 crore. In the beginning of the financial year, the WMA limit of the centre was fixed at ₹1,50,000 crore for the first half of 2022-23. Further, the WMA limit for the second half was set at ₹50,000 crore. The central government resorted to WMA/overdraft (OD) for 9 days during 2022-23 vis-à-vis nil WMA/ OD in the previous year. During most part of the year, the cash balance of the central government remained comfortable with robust tax inflows (Chart VII.2). Investments under Foreign Central Bank Scheme VII.26 Under the Foreign Central Bank (FCB) scheme, the Reserve Bank invests in Indian G-secs on behalf of select FCBs and multilateral development institutions in the secondary G-sec market. Total volumes transacted on behalf of these institutions stood at ₹4,805 crore (face value) during 2022-23 as compared to ₹3,285 crore (face value) in the previous year. Debt Management of State Governments VII.27 Following the recommendations of the 14th Finance Commission to exclude states from the National Small Savings Fund (NSSF) financing facility (barring Delhi, Madhya Pradesh, Kerala and Arunachal Pradesh), market borrowings of states have been increasing over the last few years. The share of market borrowings in financing GFD of states rose to 78.1 per cent in 2022-23 (BE) from 68.1 per cent in 2021-22 (RE). VII.28 The gross and net market borrowings of states were higher than the previous year. The gross market borrowings of states in 2022-23 stood at 76 per cent of the amount indicated in the quarterly indicative calendar for market borrowings by the state governments. There were 605 issuances in 2022-23, of which 45 were re-issuances (608 issuances in 2021-22, of which 60 were re-issuances) [Table VII.4]. VII.29 The weighted average cut-off yield (WAY) of SGSs issuances during 2022-23 was higher at 7.71 per cent than 6.98 per cent in the previous year. The weighted average spread (WAS) of SGSs issuances over comparable maturity central government securities was lower at 31 bps in 2022-23 as compared with 40.95 bps in the previous year. In 2022-23, twenty-one states and two UTs issued dated securities of tenors other than 10-year, ranging from 2 to 35 years. Seven states and one UT rejected all bids in one or more of the auctions. The average inter-state spread on securities of 10-year tenor (fresh issuances) was 3 bps in 2022-23 as compared with 4 bps in 2021-22. | Table VII.4: Market Borrowings of States through SGSs | | (Amount in ₹ crore) | | Item | 2019-20 | 2020-21 | 2021-22 | 2022-23 | | 1 | 2 | 3 | 4 | 5 | | Maturities during the Year | 1,47,067 | 1,47,039 | 2,09,143 | 2,39,562 | | Gross Sanctions under Article 293(3) | 7,12,744 | 9,69,525 | 8,95,166 | 8,80,779 | | Gross Amount Raised during the Year | 6,34,521 | 7,98,816 | 7,01,626 | 7,58,392 | | Net Amount Raised during the Year | 4,87,454 | 6,51,777 | 4,92,483 | 5,18,830 | | Amount Raised during the Year to Total Sanctions (per cent) | 89.0 | 82.4 | 78.4 | 86.1 | | Outstanding Liabilities (at the end of period)# | 32,65,989 | 39,25,555 | 44,29,957 | 49,29,079 | #: Including Ujjwal DISCOM Assurance Yojana (UDAY) and other special securities.

Source: RBI. | VII.30 On a review of the existing WMA limits and keeping in view the gradual lifting of COVID-19 restrictions, it was decided to revise the WMA limits and timelines for Overdraft (OD) for state governments/UTs as recommended by the Advisory Committee on ‘Ways and Means Advances to State Governments’ (Chairman: Shri Sudhir Shrivastava), effective April 1, 2022. Accordingly, the WMA limit for state governments/ UTs was fixed at ₹47,010 crore. State governments/ UTs can avail overdraft on 14 consecutive days and can be in OD for a maximum number of 36 days in a quarter. During 2022-23, seventeen states/UTs availed Special Drawing Facility (SDF), twelve states/UTs resorted to WMA and eleven states/UTs availed OD. VII.31 Over the years, states have been accumulating sizeable cash surplus in the form of intermediate treasury bills (ITBs). The outstanding investments of states in ITBs and auction treasury bills (ATBs) moderated during the year 2022-23 (Table VII.5). Investments in Consolidated Sinking Fund (CSF) / Guarantee Redemption Fund (GRF) VII.32 The Reserve Bank manages two reserve fund schemes on behalf of states - the consolidated sinking fund (CSF) and the guarantee redemption fund (GRF). So far, 24 states and one UT, i.e., Puducherry have set up CSF. Currently, 19 states are members of the GRF. States can avail of funds through the SDF at a discounted rate from the Reserve Bank against their incremental annual investment in CSF and GRF. Outstanding investments by member states in the CSF and GRF as of March 31, 2023 were ₹1,84,029 crore and ₹10,839 crore, respectively, as against ₹1,54,255 crore and ₹9,399 crore as at end-March 2022. | Table VII.5: Investments in ITBs and ATBs by State Governments/UTs | | (₹ crore) | | Item | Outstanding as on March 31 | | 2019 | 2020 | 2021 | 2022 | 2023 | | 1 | 2 | 3 | 4 | 5 | 6 | | 14-Day (ITBs) | 1,22,084 | 1,54,757 | 2,05,230 | 2,16,272 | 2,12,758 | | ATBs | 73,927 | 33,504 | 41,293 | 87,400 | 58,913 | | Total | 1,96,011 | 1,88,261 | 2,46,523 | 3,03,672 | 2,71,671 | | Source: RBI. | VII.33 On a request received from the Government of Odisha, a Budget Stabilisation Fund has been established which would cater to the needs of the state in mitigating the risk of revenue shocks on the state budget. The fund aims at reducing the impact of volatile revenue on the state’s economy. 3. Agenda for 2023-24 VII.34 In the Union Budget 2023-24, the gross market borrowing through dated securities for 2023-24 is budgeted at ₹15,43,000 crore as compared with ₹14,21,000 crore in 2022-23 (RE). Net market borrowing (including T-bills) is budgeted at ₹12,30,911 crore, financing 68.89 per cent of GFD in 2023-24. VII.35 During the year 2023-24, the market borrowing programme is proposed to be conducted with the following strategic milestones so as to achieve the overall goals of debt management: -

Consolidation of debt through calendar driven, auction-based switch operations along with reissuance of securities to augment liquidity in the G-sec market and facilitate fresh issuances; -

Development of a mobile application for improving the ease of access for retail investors under the ‘Retail Direct Scheme’; -

Taking appropriate measures for enhancing retail investor awareness about the RBI ‘Retail Direct Scheme’; -

Implementation of Society for Worldwide Interbank Financial Telecommunications (SWIFT) module for putting through transactions of Foreign Central Banks (FCBs); -

Expansion of the coverage of government debt statistics in RBI’s Data Warehouse System; and -

Conduct of capacity building programmes for sensitising the state governments about prudent practices in cash and debt management. 4. Conclusion VII.36 Amidst persisting uncertain macroeconomic conditions on account of the global surge in inflation, synchronised tightening of monetary policy by the central banks, and lingering impact of the war in Ukraine on commodity prices, market borrowings of the central and state governments were conducted successfully during 2022-23. As the global uncertainties continue, the challenges for market borrowings are expected to persist notwithstanding the lower size of the budgeted fiscal deficit of the centre. The Reserve Bank would endeavour to ensure smooth completion of the government borrowing programme in line with the guiding principles of debt management while ensuring stable debt structure for the governments.

|