The Reserve Bank continued its efforts to further develop and deepen various segments of the financial markets by broadening participation, easing access, improving financial market infrastructure and creating integrated surveillance systems for maintaining market integrity. In response to the pandemic, adequate liquidity in the system remained a dominant objective during the year. Concurrently, measures were undertaken to streamline regulations relating to foreign exchange to align them with the evolving business and economic environment, encompassing liberalisation of the capital account and rationalisation of reporting requirements. V.1 During 2020-21, the Reserve Bank continued to develop financial markets in terms of easing access and broadening participation, creation of integrated market surveillance systems and improving financial market infrastructure. Liquidity management operations involved both conventional and unconventional measures for ensuring the availability of adequate liquidity in the system. Policy measures were also undertaken to facilitate external trade and investments, and to alleviate stress due to COVID-19. V.2 Against this backdrop, the rest of the chapter is structured into four sections. Measures undertaken to develop financial markets are covered in Section 2. Liquidity management and foreign exchange market operations are the theme of Section 3. In Section 4, the focus is on measures undertaken to facilitate external trade and payments while promoting orderly development of the foreign exchange market. Concluding observations are set out in the last section. 2. FINANCIAL MARKETS REGULATION DEPARTMENT (FMRD) V.3 The Financial Markets Regulation Department (FMRD) is entrusted with the development, regulation and surveillance of money, government securities (G-secs), interest rate derivatives, foreign exchange and credit derivative markets. The Department undertook several measures in pursuance of this mandate to fulfil the objectives set for 2020-21. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 V.4 The Department had set out the following goals for 2020-21: -

A framework for exchange of initial and variation margin for non-centrally cleared derivative contracts, facilitated by legislation for bilateral netting of qualified financial contracts as announced in the Union Budget 2020-21 (Utkarsh) [Para V.5]; -

Review of directions on credit default swaps (CDS) with a view to broadening the base of CDS writers and simplifying operational guidelines in the light of the legislation on bilateral netting of qualified financial contracts (Utkarsh) [Para V.6]; and -

Review of the directions on interest rate derivatives with a view to easing access, removing segmentation between onshore and offshore markets and improving transparency (Para V.7). Implementation Status of Goals V.5 The Department issued draft directions on variation margin in September 2020 for public feedback. The passing of the Bilateral Netting of Qualified Financial Contracts Act in September 2020 is expected to facilitate the implementation of exchange of margin. In this regard, regulations under the Foreign Exchange Management Act (FEMA), 1999 and circular were issued in October 2020 and February 2021, respectively, to enable the exchange of margin between a resident and non-resident, for permitted derivative contracts. V.6 Directions on credit derivatives were reviewed in consultation with the concerned stakeholders, and draft CDS directions were issued in February 2021. V.7 Draft directions on rupee interest rate derivatives (IRD), proposing that all rupee IRD transactions of market makers and their related entities globally are to be accounted for in India, were issued in September 2020 for public feedback. This measure is aimed at encouraging higher non-resident participation, enhancing the role of domestic market makers in the offshore market, improving transparency, and achieving better regulatory oversight. Major Initiatives Easing Access and Broadening Participation in the Financial Market V.8 Regional Rural Banks (RRBs) have been allowed to participate in the call/notice/term money market as both borrowers and lenders, subject to prudential limits and other guidelines as prescribed for scheduled commercial banks. This is expected to facilitate more efficient management of liquidity at competitive rates by the RRBs. V.9 A well-functioning money market is a crucial link in the chain of monetary policy transmission by facilitating pricing and liquidity in other financial markets. Directions on call, notice and term money, certificates of deposit (CDs) and commercial papers (CPs), and non-convertible debentures (NCDs) with original maturity of less than one year were comprehensively reviewed and rationalised. The revised draft directions were released in early-December 2020 for public feedback. The aim is to bring in consistency across products in terms of issuers, investors and other participants. V.10 The Department initiated the process of international settlement of Indian government securities (G-secs) through International Central Securities Depository (ICSD) in consultation with the Government of India, ICSDs and other stakeholders. Clients of ICSDs would be able to invest in Indian G-sec without registering themselves as foreign portfolio investors (FPIs). Creation of Integrated Market Surveillance System V.11 Considering the importance of surveillance systems for financial markets, the Department decided to implement an information technology (IT)-enabled integrated market surveillance system (IMSS). After obtaining expression of interest (EoI) from interested vendors, a request for proposal (RFP) was floated for which interest from two bidders was received, which are being examined from a technical point of view, including surveillance requirements. The IMSS would augment the analytics and surveillance capabilities of the Department. Improving Financial Market Infrastructure V.12 With a view to increasing the operational efficiency and trading volume in illiquid government securities as also to decrease the cost of transactions, Clearcorp Dealing Systems (India) Ltd. (CDSL) was authorised to introduce a request for quote (RFQ) dealing mode in the Negotiated Dealing System-Order Matching (NDS-OM) platform for illiquid government securities. The RFQ mode is expected to enable market participants to directly and simultaneously seek/provide quotes from/to multiple counter parties through the NDS-OM platform. V.13 The CDSL was authorised to introduce FX-Forward in the FX-Retail module of their FX-Clear platform to widen access of forex derivatives to retail players. The FX-Retail module was introduced in 2019, with FX-cash/tom/spot products, to promote retail access to forex market. V.14 As part of efforts underway to increase access to government securities market for retail investors, the CDSL was granted in-principle approval to develop an IT-based solution for enabling retail investors to directly access the government securities market through their demat accounts. Ensuring High Standards of Governance and Conduct in OTC Derivative Market V.15 The comprehensive guidelines on derivatives were first issued in 2007 to focus on aspects of customer suitability and appropriateness, governance arrangements and risk management for OTC derivatives. The guidelines have been reviewed with a view to catering to the growing sophistication of financial markets, changes in regulations relating to interest rate and foreign exchange derivatives, increasing non-resident participation and in line with international best practices. The draft directions on market-makers in OTC derivatives were released in December 2020 for the public feedback. The revised directions seek to promote efficient access to derivative markets while ensuring high standards of governance and conduct in OTC derivative business by market-makers. Agenda for 2021-22 V.16 For the year 2021-22, the Department proposes the following goals: -

Draft directions for implementing the exchange of initial margin for non-centrally cleared derivatives (NCCDs) in India shall be issued by the second quarter of 2021-22 (Utkarsh); -

A government securities lending and borrowing mechanism (GSLBM), which will augment the existing market for ‘special repos’, is expected to be launched by the Clearing Corporation of India Ltd. (CCIL) in the second quarter of 2021-22; and -

Continuing with its efforts towards better aggregation and transparency under the Legal Entity Identifier (LEI) requirements for reporting of derivative transactions, the Unique Transaction Identifier (UTI) framework shall be implemented in India in line with the international progress made in this regard. 3. FINANCIAL MARKETS OPERATIONS DEPARTMENT (FMOD) V.17 The Financial Markets Operations Department (FMOD) is entrusted with two primary responsibilities: conduct of liquidity management operations for maintaining an appropriate level of liquidity in the financial system for monetary policy transmission; and ensuring orderly conditions in the forex market through both onshore and offshore operations. Agenda 2020-21: Implementation Status Goals Set for 2020-21 V.18 During the year, the Department had set out the following goals: -

To carry out liquidity management operations effectively, including through additional liquidity management tools, in line with the stance of monetary policy (Utkarsh) [Para V.19]; -

To monitor and modulate evolving liquidity conditions to ensure alignment of the weighted average call money rate (WACR) with the policy repo rate (Para V.20-26); -

To conduct foreign exchange operations in an effective manner to curb undue volatility in the USD/INR exchange rate (Para V.30); and -

To continue policy-oriented research on financial markets (Para V.31). Implementation Status of Goals Money Market and Liquidity Management V.19 System liquidity continued to be in surplus mode during 2020-21 on account of various liquidity augmenting measures undertaken by the Reserve Bank in the post-COVID-19 period, and large capital inflows. The Reserve Bank used several instruments, viz., term repo, reverse repo, variable rate reverse repo and MSF under the liquidity adjustment facility (LAF), open market operations (OMOs), OMOs in state development loans (SDLs) and special OMOs of simultaneous sale and purchase of G-secs. V.20 With regard to provision of durable liquidity, the Reserve Bank conducted 27 OMO auctions during 2020-21 (April-March), which included combination of outright purchase OMOs, special OMOs and OMO purchase auctions in SDLs (3 auctions conducted on October 22, November 5 and December 23, 2020 for aggregate amount of ₹30,000 crore). During 2020-21, the Reserve Bank made net purchase of ₹3,13,295 crore through OMOs. V.21 Banks that had availed funds under Long-Term Repo Operation (LTRO) in 2019-20 (April-March), and Targeted LTRO (TLTRO) and TLTRO 2.0 in 2019-20 and 2020-21, were allowed to reverse these transactions before maturity and avail new funds at the prevailing lower repo rate. An aggregate amount of ₹1,23,572 crore and ₹37,348 crore was repaid by banks under the LTRO and TLTRO schemes, respectively. V.22 Focusing on revival of activity in specific sectors by providing sufficient liquidity, on tap TLTROs with tenors of up to three years for a total amount of up to ₹1.0 lakh crore at a floating rate linked to the policy repo rate were introduced in October 2020, with the facility made available up to March 31, 2021 and further extended up to September 30, 2021. Effective December 4, 2020, it was decided to expand on tap TLTROs to other stressed sectors in synergy with the credit guarantee available under the Emergency Credit Line Guarantee Scheme (ECLGS 2.0) of the government. With effect from February 5, 2021, banks were permitted to provide funds under the on tap TLTRO scheme to Non-Banking Financial Companies (NBFCs) for incremental lending to specified stressed sectors. V.23 To assuage liquidity pressures on account of advance tax outflows, two 56-day term repo auctions for a total amount of ₹1.0 lakh crore were conducted at the existing repo rate in mid-September, involving total liquidity injection to the tune of ₹1,000 crore. In order to manage year-end liquidity pressure, two fine-tuning variable rate repo operations of 11-day and 5-day tenors were conducted in end-March 2021, involving total liquidity injection to the tune of ₹500 crore. V.24 As part of the AatmaNirbhar Bharat package announced by the Government of India (GoI) in May 2020, a scheme was introduced by the Reserve Bank through a special purpose vehicle (SPV) to improve the liquidity position of specific financial entities - non-banking financial companies (NBFCs); micro-finance institutions (MFIs); and housing finance companies (HFCs). An aggregate amount of ₹7,126 crore (principal amount) was invested by the Reserve Bank through this scheme. V.25 The Reserve Bank introduced the automated sweep-in and sweep-out (ASISO) facility on its e-Kuber system on August 6, 2020 in order to provide eligible LAF/MSF participants greater flexibility in managing their end of the day cash reserve ratio (CRR) balances. V.26 The Reserve Bank decided to allow select RRBs to access the LAF and MSF facilities with a view to facilitate better liquidity management. G-sec Market V.27 The limit under the held-to-maturity (HTM) category was increased from 19.5 per cent to 22.0 per cent of NDTL until March 31, 2023, in respect of SLR securities acquired between September 1, 2020 and March 31, 2022, to engender orderly market conditions and ensure congenial financing conditions with a clear glide path for restoration of HTM limits. V.28 OMO operations undertaken during the year helped to keep the 10-year G-sec yield anchored, despite concerns arising from higher government debt supply, higher CPI inflation and continued foreign portfolio investment (FPI) outflows in the debt segment (Box V.1). Box V.1

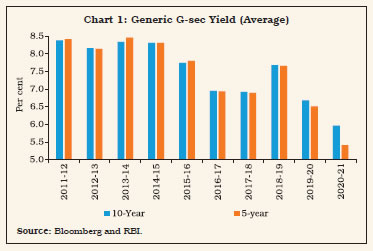

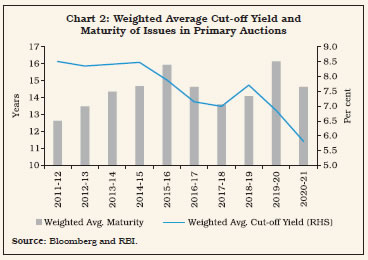

Mitigating COVID-19 Impact on Bond Market through Dynamic Approach in Open Market Operations The Reserve Bank embarked upon a multi-pronged approach to ensure that financial conditions remain congenial while implementing the enlarged market borrowing programme of the Government of India (GoI) in a non-disruptive manner. The average generic G-sec yields for 5-year and 10-year were at decadal lows (Chart 1), which facilitated record GoI borrowing at the lowest weighted average yield1 (Chart 2).

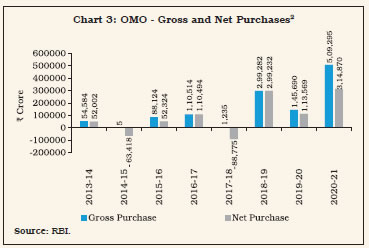

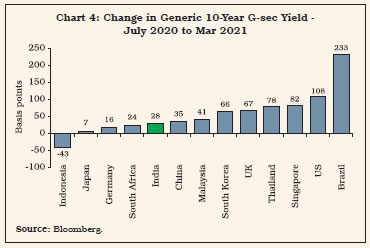

In the backdrop of surplus system liquidity, liquidity neutral special OMOs (19) were conducted in conjunction with outright OMOs (5). The scope of OMOs was further extended to State Development Loans (3) to improve liquidity and facilitate efficient pricing therein. During April 2020 - March 2021, the Reserve Bank made a record gross purchase of securities amounting to ₹5,09,295 crore (₹3,02,132 crore through 27 auctions and ₹2,07,163 crore through other operations2) [Chart 3]. The gross and net purchase amount stood at ₹3,78,821 crore and ₹1,94,396 crore, respectively, during July 2020 - March 2021.  In order to provide effective support to the market, and to avoid disruptive effects on interest rates in the economy, OMOs by Reserve Bank were stepped up both in terms of frequency and quantum from September 2020 onwards. Consequently, the gross securities purchased through OMOs as a percentage of gross GoI issuances jumped from 8 per cent in July 2020 to 63 per cent in March 2021, while in case of the 10-year and above securities, the share jumped from 5 per cent in July 2020 to a high of 59 per cent in March 2021. This made a pivotal contribution toward keeping interest rates in alignment with the formulated monetary policy.  Purchase of a mix of liquid and illiquid securities in the OMOs smoothened the distribution of liquidity in specific tenors of the yield curve. Additionally, the Reserve Bank’s support through dynamic usage of OMOs helped retain appetite of market participants amid continuous supply of government securities. This not only assured the market of the Reserve Bank’s support leading to a resilient and stable government securities market, but also engendered congenial conditions for other segments of financial markets that price financial instruments off the government securities’ yield curve. The active participation in various OMOs can be gauged from the fact that the average offer to cover ratio remained at 5.16 in July 2020-March 2021 as against 3.85 in July 2019 - June 2020 period. A comparison of change in generic 10-year government bond yields of emerging market peers and specific developed markets during July 2020 to March 2021 reveals that Indian yields hardened by around 28 basis points (bps) as against hardening of 78 bps for Thailand, 66 bps for South Korea and 35 bps for China (Chart 4). | Foreign Exchange Market V.29 During the year, the rupee traded with a generally appreciating bias amidst broad-based weakness in the US dollar on the back of reversal of risk sentiments, owing to the improvement in COVID-19 pandemic situation globally. A record amount of foreign investment inflows into Indian equity markets also supported the rupee. V.30 The Reserve Bank intervened in the forex market through operations in the onshore/offshore OTC and exchange traded currency derivatives (ETCD) segments in order to maintain orderly market conditions by containing excessive volatility in the exchange rate. Research/Analytical Studies V.31 The Department carried out research/analytical studies on issues such as the relationship between the Reserve Bank’s liquidity operations and money market volumes; effects of the Reserve Bank’s communication on financial markets; volatility in the Indian rupee (INR) market; the impact of the Reserve Bank’s special open market operations on G-sec and corporate bond markets; and liquidity management in the time of COVID-19. Agenda for 2021-22 V.32 During the year 2021-22, the Department plans to achieve the following goals: -

To carry out liquidity management operations effectively through all available liquidity management tools, in line with the stance of monetary policy (Utkarsh); -

To continue to conduct foreign exchange operations in an effective manner to curb undue volatility in the USD/INR exchange rate; and -

To continue policy-oriented research on financial markets. 4. FOREIGN EXCHANGE DEPARTMENT (FED) V.33 During the year, the Department continued its endeavour to frame simple yet comprehensive, time consistent and principle-based policies to facilitate external trade and payments. Several steps were taken for enhancing ease of doing business, including aligning the regulatory framework to the needs of the evolving business practices and economic environment. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 V.34 The Department had set out the following goals for 2020-21: -

A complete review of the reporting requirements under various regulations in order to make reporting aligned with specific requirements, simple and efficient (Utkarsh) [Para V.36-40]; -

Rationalisation of Overseas Direct Investment (ODI) regulations to make them simpler and more principles-based (Utkarsh) [Para V.41]; -

Introduction of late submission fee for delayed reporting of ODI by Indian Parties/Resident Indians (Utkarsh) [Para V.41]; -

Rationalisation of various provisions on foreign exchange and currency under Foreign Exchange Management Regulations, 2015, such as export and import of currency; realisation, repatriation and surrender of foreign exchange; possession; and retention of foreign currency unified under a single regulation (Para V.42); and -

Conduct of awareness programmes and creation of digital content on an ongoing basis (Utkarsh) [Para V.43). Implementation Status of Goals Liberalisation and Rationalisation of Trade Guidelines V.35 Automatic caution-listing of the exporters was discontinued from October 9, 2020 to make the system more exporter friendly. The revised system is expected to provide flexibility to exporters and to improve their negotiating power with overseas buyers. Under the revised norms, exporters will be caution-listed by the Reserve Bank on the recommendations made by the authorised dealer (AD) banks based on the track record of the exporter or in cases where the exporter had come to the adverse notice of a law enforcement agency or other serious grounds. Similarly, AD banks would make recommendations to the Reserve Bank for de-caution-listing an exporter as per a laid down procedure. V.36 AD banks were allowed to regularise cases of dispatch of shipping documents by the exporter directly to the consignee or his agent resident in the country of final destination of goods, irrespective of the value of export shipment, but subject to certain conditions. V.37 The procedure of write-off of unrealised export bills was revised whereby AD banks might, on the request of the exporter, write-off unrealised export bills without any limit, in addition to the existing delegated powers. V.38 AD banks were permitted to set off outstanding export receivables against outstanding import payables of their exporters/importers with their overseas group/associate companies, either on net or gross basis, through an in-house or outsourced centralised settlement arrangement, in addition to bilateral settlement. V.39 AD banks through whom export proceeds were originally realised were allowed to consider requests for refund of export proceeds of goods exported from India without insisting on the requirement of re-import of goods where the exported goods have been auctioned or destroyed by the port/customs/health authorities/any other accredited agency in the importing country, subject to submission of satisfactory documentary evidence. Review of Reporting Requirements under FEMA V.40 The Reserve Bank had earlier prescribed various reports and forms to be submitted by/through Authorised Persons for the effective administration of FEMA and the rules and regulations framed thereunder. Considering the latest technological advancements as well as the recent changes in FEMA regulations on account of rationalisation of various notifications, it was decided to carry out a comprehensive review of the extant reporting requirements under FEMA. Accordingly, an Internal Committee was formed in January 2020 to review all returns/reports prescribed under FEMA and recommend suggestions for rationalisation. A total number of 67 returns were reviewed by the Committee with respect to their relevance, mode of filing, format and frequency. Based on the recommendations made by the Committee, 17 returns/reports were discontinued with immediate effect vide circular dated November 13, 2020. The discontinuation of the above returns has decreased the total number of reports/returns to be submitted under FEMA, thereby reducing the cost of compliance for the reporting entities and improving thereby the ease of doing business. Rationalisation of Overseas Investment Regulations V.41 The review of overseas investment regulations, including a proposal to introduce late submission fee for delayed reporting of ODI by Indian Parties/Resident Indians, has been initiated in consultation with the government. Authorised Persons and Remittances V.42 The Foreign Exchange Management (Export and Import of Currency) Regulations, 2015 were amended and the changes were notified on August 18, 2020. Conducting Awareness Programmes and Creation of Digital Content V.43 The conduct of FEMA awareness programmes during the year was limited due to COVID-19 pandemic. Regional offices, however, conducted some workshops for Authorised Persons and FEMA exhibition-cum-townhall events during the year. Major Initiatives Skill Development and Necessary IT Systems Upgradation V.44 The Software Platform for External Commercial Borrowings and Trade Credits Reporting and Approval (SPECTRA) encompassing the complete lifecycle from the receipt of application to communication of decision and reporting of transactions is under implementation, and is presently in the user acceptance test phase. V.45 The online package for full-fledged money changers (FFMCs)/upgraded FFMCs (AD Category II) relating to licensing, renewal, reporting, cancellation and inspection is under implementation, and is presently in the user acceptance test phase. Administration of Foreign Exchange Management (Non-Debt Instruments) Rules V.46 Amendments were made to the FEMA 1999 through the Finance Act, 2015 enabling the central government to frame rules for any class or classes of capital account transactions not involving debt instruments, while the Reserve Bank would continue to regulate capital account transactions involving debt instruments. Furthermore, the government will make rules laying down the instruments to be determined as debt instruments. The amendments and the non-debt instrument (NDI) rules were notified in October 2019. An amendment notification dated July 27, 2020 was issued by the government whereby the Reserve Bank has been entrusted with the administration of the NDI rules. Establishment of Branch Office (BO)/Liaison Office (LO)/Project Office (PO) V.47 Consequent to the Hon’ble Supreme Court’s judgement that advocates enrolled under the Advocates Act 1961 alone are entitled to practice law in India and that foreign law firms/companies or foreign lawyers cannot practice the profession of law in India, AD Category - I banks have been directed not to grant any approval to any foreign legal firm for setting up an office or other place of business in India under FEMA for practicing the legal profession in India. Measures Undertaken to Alleviate COVID-19 Related Stress V.48 Due to the COVID-19 pandemic and considering the difficulties being faced in submitting returns, external commercial borrowing (ECB) returns were allowed to be submitted by borrowers through email without chartered accountant (CA)/company secretary (CS) certification, till resumption of normal operations. Similarly, considering the difficulties expressed by applicants in submitting payment instruments for paying compounding amount within 15 days of compounding order during the lockdown, payment of compounding amount beyond time limit was permitted. Customer Service V.49 The Department has strengthened its communication with stakeholders, especially AD banks, through frequent updation of frequently asked questions (FAQs) and taking feedback. The Foreign Investment Reporting and Management System (FIRMS) application for reporting of foreign inward investment has been made more robust and user friendly. Furthermore, the standard operating procedure (SOP) for dealing with requests relating to waiver of late submission fee (LSF) has been issued to the regional offices (ROs). Agenda for 2021-22 V.50 The Department’s strategy for 2021-22 is to focus on consolidating and carrying forward all the initiatives which were undertaken in the previous year. The emphasis will remain on ensuring that the FEMA operating framework is in conformity with the needs of the evolving macroeconomic environment. Accordingly, the Department has formulated the following strategic action plan for 2021-22: -

Continue rationalisation of the FEMA regulations by consolidating existing regulations of similar subjects, remove hard-coding to obviate frequent issuance of amendment notifications and aligning definitions across notifications/regulations; -

Take the exercise of rationalising the overseas investment regulations forward; -

Timely completion of ongoing software projects, viz., SPECTRA and Authorised Person (AP) connect (Utkarsh); -

A rationalised master direction for non-debt instruments will be issued as Foreign Exchange Management (Non-debt Instruments) Rules have been notified by the government; and -

Conduct awareness programmes and create digital content on an ongoing basis (Utkarsh). 5. CONCLUSION V.51 In sum, the Reserve Bank undertook several conventional and unconventional measures for liquidity management in the wake of COVID-19. The Reserve Bank’s asset purchases remained limited to purchases of risk-free sovereign bonds and, therefore, its unconventional measures did not dilute its balance sheet quality. Hence, it succeeded in infusing liquidity to unfreeze the markets without compromising on the core principles of central banking, that could otherwise have impaired market forces and discipline. Further, Reserve Bank’s proactive communication strategy through forward guidance ensured cooperative outcomes. The Reserve Bank’s response to the pandemic illustrated that central banks, ready to walk an extra mile, can aid the recovery process through the provision of ample liquidity in the system, while maintaining financial stability, dispelled illiquidity fears and thereby bolstered market sentiments. Going forward, unwinding of monetary stimulus through a well-calibrated and sequenced manner is needed to nurture green shoots until recovery gains traction.

|