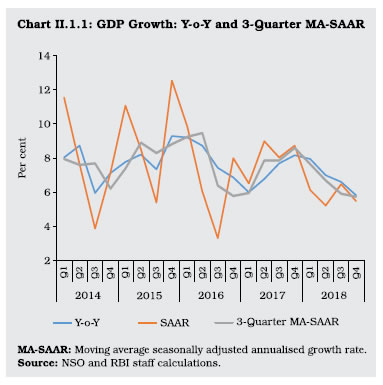

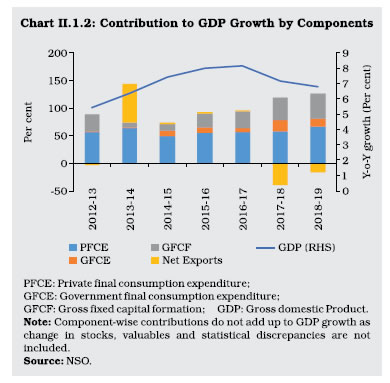

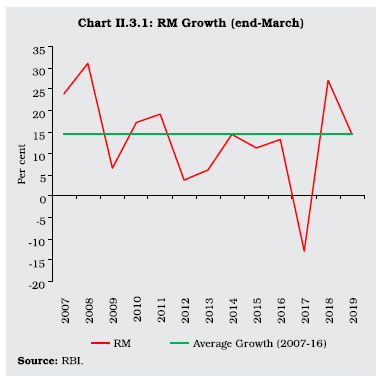

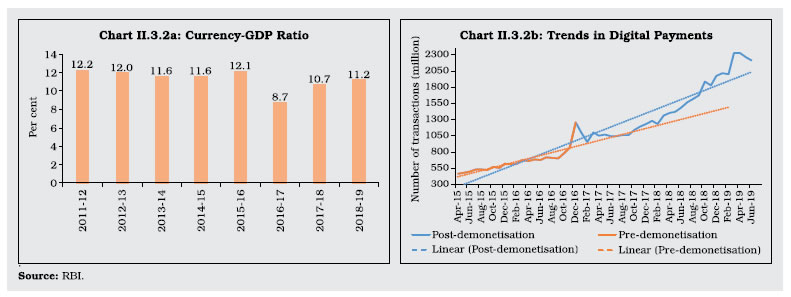

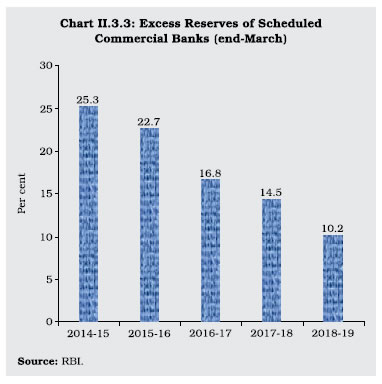

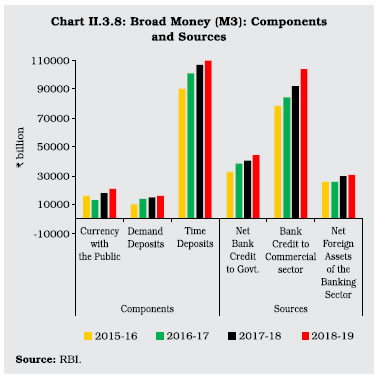

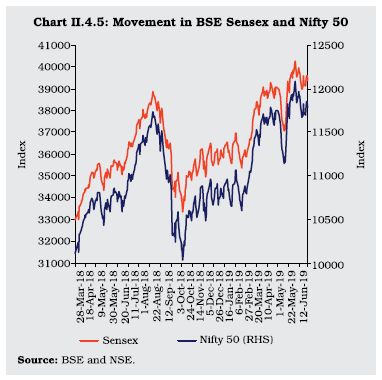

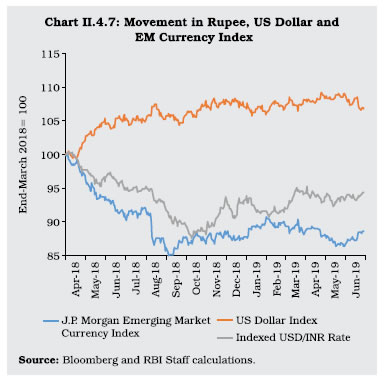

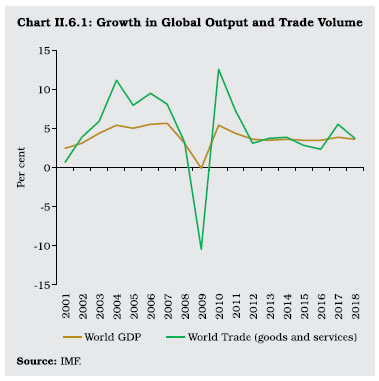

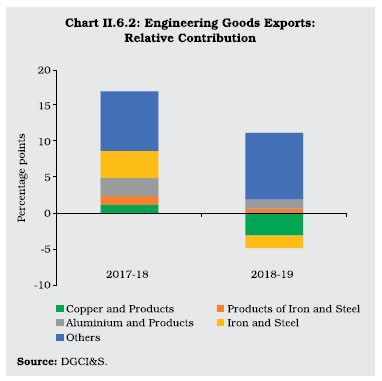

| Economic activity moderated during the financial year (FY) 2018-19 dragged down by subdued global demand and also some slack in government consumption expenditure. Inflation eased further to 3.4 per cent and undershot the target of 4 per cent for the second successive year, led by a sharp decline in food inflation. Monetary indicators such as currency, deposits and credit moved further towards their pre-demonetisation trend, reflecting underlying macroeconomic and financial developments. Financial markets exhibited resilience except sporadic volatility as evident from the buoyant equity market, two-way movement in INR and call money rate remained aligned to the policy repo rate albeit with downward bias. Public finances recorded modest deviations from budgetary targets of gross fiscal deficit across the general government. On the external front, net capital flows remained moderate relative to current account deficit, which led to depletion of foreign exchange reserves during the year. II.1 THE REAL ECONOMY II.1.1 Over the year gone by i.e., April 2018 to March 2019, macroeconomic and financial conditions underwent pronounced shifts that were largely unanticipated. Global growth, which had accelerated in a broad cyclical upswing through calendar year 2017 right up to the early part of 2018, began to shed momentum thereafter. By the second half of 2018, the weakening of the global expansion had spread across geographies, encircling advanced economies (AEs) and emerging market economies (EMEs) alike in its embrace. II.1.2 Several forces were at work, often in conjunction – the normalisation of monetary policy in the United States (US); escalation of trade tensions; volatile crude prices; uncertainty looming over Brexit; disruption in the auto sector in Germany due to stricter emission norms; the slowing down of the Chinese economy; macroeconomic crisis in some large EMEs; and the tightening of financial conditions. This cocktail of global spillovers stirred up turbulence in financial markets as risk on sentiment herded investors to safe havens, shunning EMEs as an asset class. In the event, these economies were confronted with capital outflows, currency depreciations and asset price volatility to which India too was not immune. In the second half of 2018-19 and especially in the early months of 2019, some global risks ebbed, with greater accommodation in monetary policies across the world, the easing of macroeconomic stress in the crisis-affected EMEs and some rekindling of investors’ risk appetite. Yet risks to global growth and its near-term outlook remain tilted to the downside. II.1.3 In this environment, real GDP growth in India which had weakened in 2017-18 after peaking in the year before, slid down to a five-year low in 2018-19 (Appendix Table 1). The loss of speed became evident from Q2 as some drivers of growth – notably investment – began to fade, albeit cushioned by still resilient consumption spending, both private and government. Through the second half of the year, high frequency indicators have flashed slowing sales growth among manufacturing and non-IT services sector corporations, with evidence of private consumption losing pace, especially in the fast-moving consumer goods (FMCG) segment. Financial conditions eased, but bank credit is yet to become broad-based and flow of resources from non-bank financial intermediaries has not yet gained its earlier traction. Abstracting from a brief surge in March 2019, export growth has decelerated and non-oil non-gold imports are in contraction mode, indicative of the underlying weakness of domestic demand. On the supply side, activity in manufacturing and in some categories of services, such as trade, transportation, communication and broadcasting moderated in the second half of the year and agricultural production remained modest, but in relation to the record levels achieved in the preceding two years. II.1.4 Overall the outlook appears clouded as the Indian economy begins its course through 2019-20. Against this backdrop, component-wise analysis of aggregate demand follows this Sub-section. Developments in aggregate supply conditions in terms of the performance of agriculture, value added in the industrial sector, and the resilient performance of services is sketched out in Sub-section 3, i.e., aggregate supply. An analysis of job creation in the economy based on high frequency indicators as also major policy initiatives in the area are covered in the last Sub-section. 2. Aggregate Demand II.1.5 The May 2019 release of the National Statistical Office (NSO) confirmed that aggregate demand, measured by year-on-year (y-o-y) growth of GDP at 6.8 per cent in 2018-19, weakened 0.4 percentage points in relation to the preceding year, and 0.3 percentage points below its decennial trend rate of 7.1 per cent. In fact, the GDP growth of 6.2 per cent in H2:2018-19 was the lowest in five years (Chart II.1.1). The slackening of demand in the economy was also evident in the opening of the negative output gap (i.e., deviation of actual output from its potential level) in Q3 and Q4 of 2018-19.  II.1.6 Over the period 2003-19, the performance of the economy reveals several interesting attributes (Table II.1.1). First, average GDP growth during 2014-19 has been robust by historical standards, but lower than the high growth phases of 2003-08 and 2009-11. Second, the expansion of aggregate demand in the 2014-19 phase was driven by robust consumption – both private and government – and could have buffered the economy from the transient shock of demonetisation. By contrast, burgeoning fixed investment was the driver of growth during 2003-08, and fiscal stimulus was the locomotive during 2009-11. As the stimulus wore off, growth slowed down in the next three years. | Table II.1.1: Underlying Drivers of Growth | | Components | Growth (per cent) | Contribution to Growth (per cent) | | 2003-08 | 2008-09 | 2009-11 | 2011-14 | 2014-19 | 2003-08 | 2008-09 | 2009-11 | 2011-14 | 2014-19 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | I. Total Consumption Expenditure | 6.1 | 5.5 | 6.5 | 6.1 | 7.8 | 53.7 | 118.2 | 53.5 | 71.5 | 69.8 | | Private | 6.2 | 4.5 | 5.9 | 6.7 | 7.6 | 46.3 | 81.9 | 40.4 | 66.2 | 57.5 | | Government | 5.8 | 11.4 | 9.7 | 2.6 | 9.0 | 7.4 | 36.3 | 13.1 | 5.3 | 12.3 | | II. Gross Capital Formation | 15.3 | -2.6 | 14.5 | 2.0 | 7.1 | 58.5 | -31.4 | 64.1 | 16.6 | 32.9 | | Fixed investment | 12.6 | 3.2 | 9.4 | 6.2 | 7.4 | 43.1 | 32.6 | 35.9 | 37.9 | 31.7 | | Change in stocks | 73.5 | -51.4 | 56.2 | -27.4 | 15.3 | 12.5 | -75.4 | 17.9 | -16.7 | 0.7 | | Valuables | 27.8 | 26.9 | 45.0 | -11.1 | 4.9 | 3.0 | 11.4 | 10.3 | -4.6 | 0.6 | | III. Net Exports | | | | | | -7.7 | -72.4 | -4.1 | 8.9 | -10.5 | | Exports | 17.8 | 14.8 | 7.3 | 10.0 | 3.7 | 36.1 | 99.0 | 16.2 | 42.3 | 10.9 | | Imports | 20.0 | 22.4 | 6.9 | 6.1 | 6.5 | 43.8 | 171.4 | 20.3 | 33.4 | 21.4 | | IV. GDP | 7.9 | 3.1 | 8.2 | 5.7 | 7.5 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | | Source: NSO and RBI staff calculations. | II.1.7 Compositional shifts in aggregate demand were evident during the year in terms of shares as well as weighted contributions (Chart II.1.2 and Appendix Table 2). Private final consumption expenditure (PFCE), the dominant component at 56.9 per cent of GDP, recorded a marginal increase in its share in 2018-19 in relation to a year ago, but its contribution to GDP growth in 2014-19 fell by 8.7 percentage points below its level in the preceding triennium, i.e., 2011-14. The resulting slack was partly filled by government final consumption expenditure (GFCE) – its contribution to GDP growth rose by 7 percentage points in 2014-19 vis-à-vis 2011-14. Even though gross fixed capital formation (GFCF) – the main constituent of investment in the economy – recorded an increase for the fifth successive year in 2018-19, its contribution to growth fell by 6.2 percentage points in 2014-19 in comparison with the preceding triennium. Notably, the drag from net exports came down significantly in 2018-19 on a year-on-year basis but their contribution to aggregate demand contracted sizeably in 2014-19 as against a positive contribution of 8.9 per cent in 2011-14. The evolution of net exports is covered in detail in Section II.6 on external sector.  Consumption II.1.8 Consumption expenditure moderated during 2018-19. Nonetheless, its contribution to GDP increased for the second successive year. Private final consumption expenditure, the major component of aggregate demand, accelerated in the first half of the year, supported by higher disposable income on account of lower food expenses. The pick-up in activity in labour intensive sectors like construction provided additional cushion to household consumption demand. Rural demand, however, was affected by moderation in agricultural growth as reflected in tractors and two wheelers sales. Indicators of urban demand revealed a mixed picture in contrast. Air passenger traffic recorded its lowest growth in the last five years. Passenger vehicles sales were the lowest in five years on account of increase in insurance costs, volatile fuel prices, and lack of financing options due to the liquidity stress in the non-banking sector. The production of consumer non-durables slumped to its lowest level in the past three years. Going forward, public expenditure directed to rural areas through the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) and farm loan waivers by some states are expected to hold up rural demand. The analysis of high frequency information in the form of coincident economic indicators in the absence of concurrent GDP data helps in early assessment of economic activity as an input for policy formulation (Box II.1.1). Box II.1.1

Nowcasting India’s GDP Growth Globally, central banks rely on high-frequency economic indicators for a forward-looking assessment of the state of the economy, given the lags in the availability of official statistics. A Coincident Economic Indicator for India (CEII) is constructed using the single-index dynamic factor model (Stock and Watson, 1989) based on economic indicators which correlate strongly with the dynamics of GDP growth. Two indices are considered – a 6-indicator CEII comprising the production of consumer goods, non-oil non-gold imports, auto sales, rail freight, air cargo, and government receipts, and a 9-indicator CEII, which additionally includes IIP-core, exports, and foreign tourist inflows (Chart 1). A parsimonious autoregressive model of GDP growth augmented by CEII is used to nowcast quarterly GDP growth for the full period 2004:Q1-2019:Q1 (Table 1). The CEII emerges as statistically significant in explaining GDP growth, with the in-sample fit (adjusted R-squared) slightly higher for the 9-indicator model. However, the out-of-sample root mean squared error (RMSE) for the sample 2017:Q1-2019:Q1 is lower for the 6-indicator model. The nowcasts based on the 6-indicator and 9-indicator models along with the actual GDP growth are plotted in Chart 2A and 2B. It is observed that the nowcasts track GDP dynamics and turning points reasonably well over the estimation sample. In India, the first release of quarterly GDP is published approximately 7-8 weeks after the end of the reference quarter. To provide an early estimate, CEII is used to nowcast the current quarter GDP. Overall, the above findings indicate that the CEII based nowcasts help gauge the current state of the economy, thereby lending a greater degree of foresight to policy formulation. | Table 1: Nowcasting GDP Growth Using Coincident Economic Indicator for India | | Dependent Variable | GDP (Y-o-Y) | | Model 1 (6-Indicator) | Model 2 (9-Indicator) | | Constant | 3.05 | 2.81 | | CEII (Y-o-Y) | 2.91 | 3.96 | | GDP (Y-o-Y), Lag 1 | 0.38 | 0.32 | | Model Diagnostics | | | | Adjusted R-squared | 0.53 | 0.54 | | B-G Serial Correlation LM Test | 0.18 | 0.12 | | Out-of-Sample RMSE | 0.61 | 0.65 | Notes: 1. All coefficient estimates are significant at 1 per cent.

2. B-G test is for serial correlation in errors up to 12 lags.

3. Out-of-Sample RMSE pertains to 2017:Q1 to 2019:Q1. |

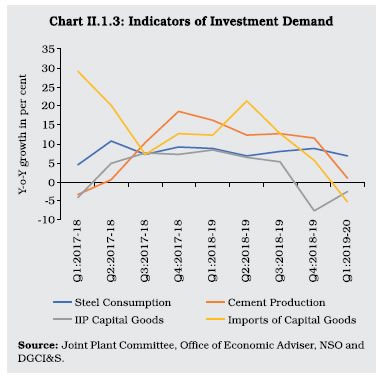

References: 1. Stock, J. H. and M. W. Watson (1989), ‘New Indexes of Coincident and Leading Economic Indicators’, NBER Macroeconomics Annual 1989, Vol. 4. 2. Gerlach, S. and M. S. Yiu (2004), ‘A Dynamic Factor Model for Current-Quarter Estimates of Economic Activity in Hong Kong’, Hong Kong Institute for Monetary Research, Working Paper No. 16. | Investment and Saving II.1.9 The rate of gross domestic investment in the Indian economy, measured by the ratio of gross capital formation (GCF) to GDP at current prices had risen to a peak of 39.8 per cent in 2010-11 before a prolonged slowdown set in taking it down to 30.9 per cent in 2016-17. A modest recovery took hold in the following year. Although data on gross domestic investment are not yet available for 2018-19, movement in its constituents suggest that the uptick could not be sustained. While the ratio of real gross fixed capital formation (GFCF) to GDP increased to 32.3 per cent in 2018-19 from 31.4 per cent in 2017-18, this upswing that started in Q3:2017-18 may have been a bounce-back from the transient impact of demonetisation and uncertainties related to the implementation of the GST that lasted for five consecutive quarters. However, growth in fixed investment collapsed to a fourteen-quarter low in Q4:2018-19 as production of capital goods registered a sharp contraction and imports nosedived in a coincident manner (Box II.1.2). Box II.1.2

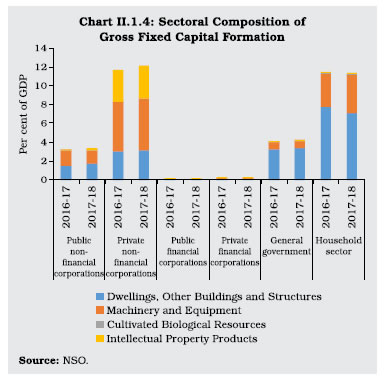

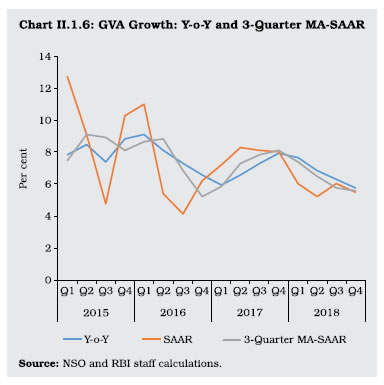

Policy Uncertainty Index for India – Big Data Analysis Uncertainty prompts consumers and producers to alter their behaviour in terms of spending, investing and hiring decisions. Unanticipated outcomes on GDP growth, employment, stock indices and corporate earnings and even statements, actions and decisions made by policymakers with respect to fiscal, monetary, structural and regulatory policies, can turn out to be sources of uncertainty for economic agents and the wider macroeconomic environment. As a result, uncertainty has emerged as a key input into the decision making framework of policymakers across the globe. Unlike risk, which has a well-defined distribution of expected probabilities, uncertainty is unobservable. In the post-global financial crisis (GFC) period, however, the effects of uncertainty on macroeconomic and financial conditions appears to have become more pronounced and pervasive – uncertainty shocks have translated into investment slowdowns, and declines in economic activity and asset prices. These developments have imparted urgency to empirically capture and quantify the impact of uncertainty on the economy. These efforts can be broadly classified (a) volatility-based measures (Bloom, 2007); (b) dispersion in forecasts (Bachman, et al. 2013); (c) sentiment-based analysis using newspaper coverage frequency (Baker, et al. 2016); and (d) internet-based search intensity exercises (Castelnuovo and Tran 2017). An index, following Baker, et al. 2016, is constructed by text mining of leading Indian business news dailies1 to pick up the frequency of usage of keywords pertaining to ‘economic’ (E), ‘policy’ (P) and ‘uncertainty’ (U) or EPU (a news article must contain at least one word each belonging to EPU in order to be classified as signaling uncertainty), and a Google Uncertainty Index (GUI) following Castelnuovo and Tran 2017, based on internet search intensity of 70 keywords pertaining to fiscal, monetary and trade policies via Google Trends for the period January 2004 to June 2019. These indices reveal reasonably close co-movement with key macroeconomic variables, especially those related to production and investment. The indices are able to capture major domestic and external events that were expected to have contributed to uncertainty in the economy (Chart 1). They also exhibit strong correlations with conventional market-based volatility and risk indicators (Chart 2), such as India VIX Index and risk premia (calculated as the spread between 5-year AAA-rated corporate bonds and 5-year G-sec yields). A vector autoregression (VAR) model with four variables, i.e., GUI, the risk premia, real weighted-average lending rate and gross fixed capital formation (GFCF) to GDP ratio for the period 2005:Q1 to 2018:Q4, is estimated to analyse the impact of uncertainty on economic activity in India. The results of the VAR model suggest that there is an instantaneous increase in risk premia following an uncertainty shock (Chart 3). On the other hand, a three-quarter lagged negative impact is observed in respect of GFCF. The impulse response of GFCF to lending rates turn statistically significant from the fourth quarter onwards implying the impact of monetary policy on investments in a delayed manner, working mainly through the interest rate channel. Overall results suggest that uncertainty negatively impacts investment activity in India. References: 1. Bachmann, R., S. Elstner, and E. R. Sims (2013), ‘Uncertainty and Economic Activity: Evidence from Business Survey Data’, American Economic Journal: Macroeconomics, 5(2), 217-49. 2. Bloom, N. (2007), ’Uncertainty and the Dynamics of R&D’, American Economic Review, 97(2), 250-255. 3. Baker, S. R., N. Bloom, and S. J. Davis (2016), ’Measuring Economic Policy Uncertainty’ The Quarterly Journal of Economics, 131(4), 1593-1636. 4. Castelnuovo, E., and T. D. Tran (2017), ‘Google it Up! A Google Trends-based Uncertainty Index for the United States and Australia’, Economics Letters, 161, 149-153. | II.1.10 Among the determinants of GFCF, construction activity remained ebullient in 2018-19, driven by the government’s focus on infrastructure and affordable housing, and registered its highest growth in the last seven years. This was also reflected in its proximate coincident indicators – steel consumption and cement production (Chart II.1.3). For the year as a whole, growth in cement production at 13.3 per cent was the highest in the past ten years. Steel consumption continued to grow at a robust pace of 7.6 per cent despite a slowdown in automobile production. However, private investment in machinery and equipment exhibited signs of weakness with both its proximate coincident indicators – imports and production of capital goods – registering deceleration. II.1.11 At a disaggregated level, fixed investment in dwellings, other buildings and structures had declined by 0.3 percentage points to 15.4 per cent of GDP in 2017-18, mainly due to the household sector (Chart II.1.4). On the other hand, fixed investment in machinery and equipment led by the non-financial corporations and the household sector had increased to 12.0 per cent of GDP in 2017-18 from 11.3 per cent in 2016-17. Investment in intellectual property products (IPP) – expenditure on research and development; mineral exploration; computer software; and other intellectual property products by non-financial corporations – both public and private, had also picked up in 2017-18. Limited information that has become available for 2018-19 suggests that investment in dwellings, other buildings and structures, and IPP may register an increase while investment in machinery and equipment may exhibit a fall.  II.1.12 As per the Order Books, Inventories and Capacity Utilisation Survey (OBICUS) of the Reserve Bank, capacity utilisation in manufacturing rose through 2018-19, peaking at 76.1 per cent in Q4:2018-19. However, seasonally adjusted capacity utilisation declined by over one percentage point in Q4:2018-19. Declining sales led to an increase in inventory to sales ratio. The Industrial Outlook Survey (IOS) points to a modest improvement in demand conditions in Q2:2019-20 than in preceding quarters based on sentiments expressed on various parameters such as production, employment, exports and imports, capacity utilisation, and inventory position. However, with moderation expected in the cost of raw materials and optimistic outlook on overall financial situation, manufacturers are upbeat about profit margins in Q2:2019-20, despite pessimism in selling prices.  II.1.13 The rate of gross domestic saving had increased marginally to 30.1 per cent of gross national disposable income (GNDI) in 2017-18 from declines in the previous two years (Appendix Table 3A). While the saving of private non-financial corporations had increased marginally, the general government’s dissaving had increased. The household financial saving – the most important source of funds – had increased by 0.3 percentage points of GNDI, though it had remained much lower than 7.3 per cent during 2011-16 (Appendix Table 3B). II.1.14 The saving-investment gap has come down over the years, indicating that a larger part of the requirement to fund investment is being met through domestic resources and conversely, the net inflow of resources from abroad has declined, which corresponds to the degree of openness of the economy. The household sector continues to remain the net supplier of funds to the deficit sectors, i.e., non-financial corporations and general government (Chart II.1.5). In recent years, however, it is evident that resource gap of non-financial corporations, both public and private, has got significantly reduced, indicating that their investment needs are met through their internal resources. The drawdown on saving by the general government sector continues to remain at an elevated level. Developments in GFCE are addressed in Section II.5 on government finances. 3. Aggregate Supply II.1.15 Aggregate supply, measured by gross value added (GVA) at basic prices, slowed to 6.6 per cent in 2018-19, 30 basis points (bps) lower from a year ago and 20 bps lower than its decennial rate of 6.8 per cent (Appendix Table 2). Disentangling momentum from base effects, GVA’s quarter-on-quarter (q-o-q) seasonally adjusted annualised growth rate (SAAR) exhibited a turning point in Q4:2017-18 and weakened thereafter, barring a transient improvement in Q3:2018-19, notwithstanding favourable base effects in H1:2018-19 (Chart II.1.6), and underlying loss of speed appears to be a slowing down of productivity (Box II.1.3). II.1.16 An analysis of the growth path of the economy over the last 16 years from the supply side reveals that growth is primarily driven by services sector which has exhibited resilience over the entire period, barring 2008-09 (Table II.1.2). Secondly, growth of agriculture, forestry and fishing is unpredictable reflecting reliance on monsoon, though the increasing share of allied activities which is relatively insulated from weather uncertainties has imparted some resilience to the sector. Consequently, agriculture has lost its share in overall GVA to services sector. Industrial GVA on the other hand, has been driven by its largest constituent – manufacturing – and has broadly sustained its share, reflecting its forward and backward linkages with other sectors.

Box II.1.3

Drivers of Factor Productivity in India The global economy experienced a productivity slowdown since the global financial crisis (GFC) of 2008, with notable declines in both output per worker (labour productivity) and total factor productivity or TFP (Adler, et al., 2017). In India too, TFP growth decelerated from 1.8 per cent during 2003-07 to 0.8 per cent during 2008-16 (Chart 1). Improvement in labour productivity is attributed to (a) capital deepening; (b) efficiency in the existing capital stock; (c) quality of labour supply; and (d) TFP. In a growth accounting framework, TFP is captured as a residual (ECB, 2007 and Jorgenson et al., 2007), after adjusting for growth in labour and capital inputs. Over the period of study, a compositional shift is evident in sync with the GDP growth trajectory: the contribution of agriculture to TFP growth has fallen while that of services has gone up and manufacturing’s share has remained stable. Growth in value added in the agricultural sector has closely co-moved with its TFP growth, reflecting the lower importance of factor inputs in shaping agricultural performance (Chart 2). On the other hand, divergence has become marked in respect of both manufacturing and services, with TFP growth slowing down persistently in both sectors and markedly so in case of the latter, compared to value added (Chart 3). The contribution of TFP to services sector2 growth has been lower than for manufacturing, especially in recent years (Chart 4). Using a Harberger Plot3, it is observed that there are some consistent contributors to TFP growth like chemical and chemical products, post and telecommunications, and transport and storage (Chart 5). The penetration of information and communication technologies (ICT) has greatly benefited sectors like telecommunications, financial services and business services, and their importance in TFP growth has increased in recent years. Some sectors have, however, remained laggards over the years. In order to check for convergence across sectors, a panel regression is estimated in the form given below (European Commission, 2014).

In this specification, TFPgap captures convergence between leading sector and other industries while TFPmax captures spillover effects from the leading sector. A negative sign of TFPgap implies a larger potential gain for laggard industries with higher distance from the TFP frontier by adopting enhanced technology and advanced managerial practices. On the other hand, a positive sign of TFPmax suggests the existence of spillover of TFP from leading sector with high penetration of ICT like financial services to others. The regression results support presence of TFP convergence and spillover channels in India (Table 1). The fastest convergence is witnessed in the last period, i.e., 2009-16, when financial services emerged as the sector with the highest TFP. | Table 1: Sectoral Convergence and Spillover of TFP | | Variables | 1981-2016 | 1981-1992 | 1992-1999 | 2003-2007 | 2009-2016 | | 1 | 2 | 3 | 4 | 5 | 6 | | TFPgap | -0.047* | -0.269*** | -0.274* | -0.304* | -0.428*** | | | (0.023) | (0.063) | (0.136) | (0.174) | (0.107) | | TFPmax | 0.144** | 0.374*** | 1.054 | -1.396 | 2.762*** | | | (0.619) | (0.111) | (0.668) | (0.833) | (0.577) | | Constant | -0.065** | -0.393*** | -0.338** | -0.363* | -0.568*** | | | (0.282) | (0.091) | (0.151) | (0.199) | (0.136) | | Year fixed effects | Yes | Yes | Yes | Yes | Yes | | Observations | 972 | 324 | 216 | 135 | 216 | | R-squared | 0.08 | 0.24 | 0.12 | 0.13 | 0.29 | | Number of Indcode | 27 | 27 | 27 | 27 | 27 | | Robust standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1 | Evidence from Harberger plot and convergence model suggests the need for higher investments in human capital through skilling and training to enable other sectors to adopt advanced technology and benefit through the convergence and spillover effects from industries using ICT technologies. References: 1. Adler, G., R. Duval, D. Furceri, S. K. Çelik, K. Koloskova, and M. Poplawski-Ribeiro (2017), ‘Gone with the Headwinds: Global Productivity’, IMF Staff Discussion Note, SDN/17/04. 2. ECB (2007), ‘Sectoral Patterns of Total Factor Productivity Growth in the Euro Area Countries’, European Central Bank Monthly Bulletin, pp. 57-61. 3. European Commission (2014), ‘The Drivers of Total Factor Productivity in Catching-up Economies’, Quarterly Report on the Euro Area, Vol.13(1), pp. 7-19. 4. Jorgenson, D. W., M. S. Ho, J. D. Samuels, and K. J. Stiroh (2007), ‘Industry Origins of the American Productivity Resurgence’, Economic Systems Research, 19(3), 229 –252. |

| Table II.1.2: Real GVA Growth | | Sectors | Growth (per cent) | Contribution to Growth (per cent) | | 2003-08 | 2008-09 | 2009-11 | 2011-14 | 2014-19 | 2003-08 | 2008-09 | 2009-11 | 2011-14 | 2014-19 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | I. Agriculture, forestry and fishing | 4.5 | -0.2 | 4.0 | 4.5 | 2.9 | 12.0 | -1.2 | 8.7 | 14.6 | 6.1 | | II. Industry | 8.4 | 3.4 | 9.1 | 2.9 | 8.1 | 24.9 | 18.6 | 29.2 | 11.8 | 25.1 | | i. Mining and quarrying | 5.2 | -2.5 | 9.7 | -5.6 | 7.1 | 3.1 | -2.4 | 5.0 | -4.4 | 2.8 | | ii. Manufacturing | 9.6 | 4.7 | 9.3 | 4.5 | 8.4 | 19.7 | 18.5 | 22.2 | 14.1 | 20.0 | | ii. Electricity, gas, water supply and other utility services | 7.1 | 4.9 | 6.5 | 5.1 | 7.5 | 2.1 | 2.5 | 2.0 | 2.1 | 2.3 | | III. Services | 8.6 | 6.4 | 8.0 | 7.0 | 8.2 | 62.0 | 82.6 | 62.1 | 73.6 | 68.8 | | i. Construction | 12.8 | 5.6 | 6.4 | 5.4 | 5.7 | 13.4 | 11.6 | 7.9 | 9.0 | 6.5 | | ii. Trade, hotels, transport, communication and services related to broadcasting | 9.4 | 2.4 | 9.0 | 7.5 | 8.4 | 20.3 | 9.6 | 19.8 | 24.0 | 21.4 | | iii. Financial, real estate and professional services | 7.6 | 5.2 | 5.6 | 8.5 | 8.8 | 19.4 | 23.5 | 15.0 | 28.8 | 25.7 | | iv. Public administration, defence and other services | 6.3 | 15.8 | 11.8 | 5.1 | 8.8 | 8.9 | 37.8 | 19.4 | 11.7 | 15.2 | | IV. GVA at basic prices | 7.7 | 4.3 | 7.4 | 5.6 | 7.3 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | | Source: NSO and RBI staff calculations. | II.1.17 GVA by agriculture and allied activities grew by 2.9 per cent in 2018-19; while the increase in foodgrains and horticulture production turned out to be modest after two successive years of record production, final estimates may reveal a new record, going by the catch-up underway in moving from first to fourth advance estimates. The contribution of agriculture and allied activities to overall GVA growth declined to 6.6 per cent in 2018-19 but remained higher than that of 6.1 per cent during 2014-19. II.1.18 The south-west monsoon 2018 started off well but lost momentum during mid-July to mid-September, with uneven distribution of rainfall across states (Chart II.1.7a). Overall, the cumulative rainfall during the south-west monsoon season was 9 per cent below the Long Period Average (LPA). This took its toll on kharif sowing, initially exacerbated by delayed announcement of minimum support prices (MSPs), and persisting deflation in wholesale prices of kharif crops, but there was a catch up in the closing weeks of the season. As per the fourth advance estimates of the Ministry of Agriculture and Farmers’ Welfare, kharif foodgrains production increased by 0.9 per cent in 2018-19 over the final estimates for 2017-18. The production of rice increased by 5.1 per cent, buoyed by a 12.9 per cent hike in MSP for paddy. Output of pulses and coarse cereals, however, declined. Among the cash crops, growth in production of sugarcane at 5.3 per cent was higher than 2.8 per cent average growth of last five years, but cotton output fell by 12.5 per cent as compared to the previous year due to deficient rainfall in major growing states of Gujarat, Maharashtra, Telangana and Karnataka.  II.1.19 Rabi sowing was delayed due to late harvesting of the kharif crops and it could not catch up with the previous year’s level. In addition, it was hobbled by a deficiency in the north-east monsoon rainfall (44 per cent below the LPA) (Chart II.1.7b) and rabi foodgrains production declined by 0.9 per cent in 2018-19 over the final estimates for 2017-18. Wheat weathered the broad-based decline, however, exceeding the previous year’s bumper production (Table II.1.3). Overall, the foodgrains production in 2018-19 is estimated at 285 million tonnes – same as the record level achieved in 2017-18. While the production of rice and wheat set a record, the output of pulses and coarse cereals declined. | Table II.1.3: Agricultural Production 2018-19 | | (Million Tonnes) | | Crop | Season | 2017-18 | 2018-19 | 2018-19 Variation (Per cent) | | 4th AE | Final | Target | 3rd AE | 4th AE | Over 2017-18 | Over 2018-19 | | 4th AE | Final | 3rd AE | Target | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | Rice | Kharif | 97.5 | 97.1 | 99.0 | 101.7 | 102.1 | 4.7 | 5.1 | 0.4 | 3.2 | | | Rabi | 15.4 | 15.6 | 15.0 | 13.9 | 14.3 | -7.3 | -8.5 | 3.0 | -4.7 | | | Total | 112.9 | 112.8 | 114.0 | 115.6 | 116.4 | 3.1 | 3.2 | 0.7 | 2.1 | | Wheat | Rabi | 99.7 | 99.9 | 102.2 | 101.2 | 102.2 | 2.5 | 2.3 | 1.0 | 0.0 | | Coarse Cereals | Kharif | 33.9 | 34.0 | 35.7 | 32.5 | 31.0 | -8.6 | -8.9 | -4.6 | -13.2 | | | Rabi | 13.1 | 12.9 | 12.4 | 10.8 | 12.0 | -8.7 | -7.6 | 10.3 | -3.5 | | | Total | 47.0 | 47.0 | 48.1 | 43.3 | 43.0 | -8.6 | -8.6 | -0.9 | -10.7 | | Pulses | Kharif | 9.3 | 9.3 | 9.9 | 8.5 | 8.6 | -8.0 | -7.7 | 0.8 | -12.8 | | | Rabi | 15.9 | 16.1 | 16.1 | 14.7 | 14.8 | -6.9 | -8.1 | 0.7 | -8.1 | | | Total | 25.2 | 25.4 | 26.0 | 23.2 | 23.4 | -7.3 | -7.9 | 0.8 | -9.8 | | Foodgrains | Kharif | 140.7 | 140.5 | 144.6 | 142.8 | 141.7 | 0.7 | 0.9 | -0.7 | -2.0 | | | Rabi | 144.1 | 144.5 | 145.7 | 140.6 | 143.2 | -0.6 | -0.9 | 1.9 | -1.7 | | | Total | 284.8 | 285.0 | 290.3 | 283.4 | 285.0 | 0.0 | 0.0 | 0.6 | -1.8 | | Oilseeds | Kharif | 21.0 | 21.0 | 25.5 | 21.0 | 21.3 | 1.3 | 1.3 | 1.4 | -16.6 | | | Rabi | 10.3 | 10.5 | 10.5 | 10.4 | 11.0 | 6.5 | 5.0 | 5.3 | 4.6 | | | Total | 31.3 | 31.5 | 36.0 | 31.4 | 32.3 | 3.0 | 2.5 | 2.7 | -10.4 | | Sugarcane (Cane) | | 376.9 | 379.9 | 385.0 | 400.4 | 400.2 | 6.2 | 5.3 | -0.1 | 3.9 | | Cotton # | | 34.9 | 32.8 | 35.5 | 27.6 | 28.7 | -17.7 | -12.5 | 4.0 | -19.1 | | Jute & Mesta ## | | 10.1 | 10.0 | 11.2 | 9.8 | 9.8 | -3.6 | -2.6 | -0.3 | -12.8 | #: Lakh bales of 170 kgs. each. AE: Advance Estimates

# #: Lakh bales of 180 kgs. each.

Source: Ministry of Agriculture and Farmers Welfare, GoI. | II.1.20 The stock positions in respect of rice and wheat with the Food Corporation of India (FCI) during 2018-19 were on average higher by 2.9 times and 2.5 times, respectively, than the buffer norms. This has necessitated an increase in offtake through the open market sale of 4.12 per cent of annual production in 2018-19 compared to 0.87 per cent of production in the previous year. The surplus food stock and unusually depressed food prices contributed to agrarian distress, including rising indebtedness and sluggish rural wages which calls for proactive and effective supply management policies (Box II.1.4). Box II.1.4:

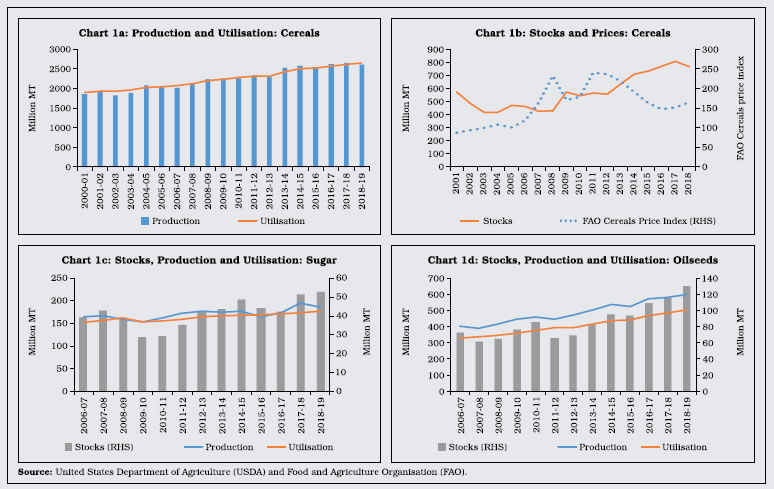

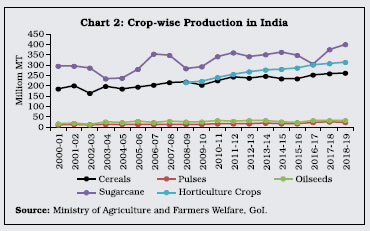

The Problems of Plenty Yield improvement and acreage expansion has boosted the production of cereals, oilseeds and sugar across the world. Wheat production increased significantly in the Black Sea region (Russian Federation, Ukraine and Kazakhstan), due to crop land expansion, crop intensification, investment in fertilisers, machinery and storage facilities by the big agricultural companies. Corn production received a boost in Alaska through area expansion, supported by innovations in hybrid seed technology (Reuters, 2017). As a result, world cereal production outstripped utilisation in most of the years during 2006-07 to 2018-19 (Chart 1a). Stockpiles of cereals, sugar and oilseeds are at all-time highs (Charts 1b, 1c, and 1d). In India, back-to-back years of bumper production of cereals, pulses, oilseeds and horticulture crops in 2016-17 and 2017-18 (Chart 2) has led to the build-up of comfortable stocks. Improvements in supply chains, access to low cost mobile phones, micro-finance and supply management, albeit reactive and inopportune, have all contributed to the rare emergence of excess supplies.

Disentangling the various factors at work in a panel data model [pooling crop level data, Singh et al. (2014)] for the period from 2006-07 to 2018-19, it is observed that the effects of expanding area under cultivation and boosting yield on the value of output are positive and significant – the ‘area’ effect in the period 2016-17 to 2018-19 is lower than during 2006-07 to 2012-13, but the yield effect is higher4. The effect of relative prices is lower in the recent period because domestic prices were higher than international prices, leading to erosion in the competitiveness of India’s farm exports and increased imports, which augmented domestic supply and depressed domestic prices. References: 1. Reuters, (2017), ‘Drowning in Grain - Reuters Special Report on the Global Grains Glut’, Reuters, accessed at https://farmpolicynews.illinois.edu/2017/09/drowning-grain-reuters-special-report-global-grains-glut/ 2. Singh, B.P., P.K. Joshi, D.S. Negi and S. Agarwal (2014), ‘Changing Source of Growth in Indian Agriculture: Implications for Regional Priorities for Accelerating Agriculture Growth’, Working Paper 01325, IFPRI, Washington, USA. | Horticulture II.1.21 Horticulture, with a share of 33 per cent in agricultural GVA, has outpaced the production of foodgrains since 2012-13. As per the second advance estimates, the production of horticulture crops at 314.9 million tonnes in 2018-19 is a record, driven mainly by spices, flowers and vegetables (Table II.1.4). Policy Initiatives II.1.22 MSPs announced in kharif 2018-19, were ranging between 3.7-52.5 per cent above those announced in the previous year. The government announced ‘Pradhan Mantri Annadata Aay SanraksHan Abhiyan’ (PM-AASHA), an umbrella scheme to ensure reasonable prices for the crops including cereals, pulses, oilseeds, jute and cotton, for effective implementation of MSP. The MSP increase was lower as compared to last year for all the major rabi crops. | Table II.1.4: Horticulture Production | | (Million Tonnes) | | Crops | 2017-18 | 2018-19 | Variation (Per cent) | | 2nd AE | Final Estimate (FE) | 1st AE | 2nd AE | 2018-19 2nd AE over 2017-18 2nd AE | 2018-19 2nd AE over the 2017-18 FE | 2018-19 2nd AE over the 2018-19 1st AE | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | Total Fruits | 94.4 | 97.4 | 96.8 | 97.4 | 3.2 | 0.0 | 0.6 | | Banana | 29.3 | 30.8 | 30.0 | 31.2 | 6.6 | 1.3 | 4.0 | | Citrus | 12.5 | 12.5 | 12.3 | 13.2 | 5.1 | 4.8 | 7.3 | | Mango | 20.5 | 21.8 | 22.4 | 21.0 | 2.1 | -4.0 | -6.3 | | Total Vegetables | 182.0 | 184.4 | 187.5 | 187.4 | 2.9 | 1.6 | -0.1 | | Onion | 21.8 | 23.3 | 23.6 | 23.3 | 6.6 | 0.1 | -1.4 | | Potato | 50.3 | 51.3 | 52.6 | 53.0 | 5.2 | 3.2 | 0.7 | | Tomato | 22.1 | 19.8 | 20.5 | 19.7 | -10.9 | -0.5 | -4.1 | | Plantation Crops | 18.5 | 18.1 | 18.0 | 17.7 | -4.3 | -2.3 | -1.8 | | Total Spices | 8.5 | 8.1 | 8.6 | 8.6 | 0.8 | 6.0 | 0.3 | | Aromatics and Medicinal | 1.1 | 0.9 | 0.9 | 0.8 | -20.2 | -2.3 | -4.8 | | Total flowers | 2.6 | 2.8 | 2.9 | 2.9 | 12.1 | 3.9 | 1.2 | | Total | 307.2 | 311.7 | 314.7 | 314.9 | 2.5 | 1.0 | 0.1 | FE: Final Estimate AE: Advance Estimate

Source: Ministry of Agriculture and Farmers Welfare, GoI. | II.1.23 In order to increase milk production and overall development of the dairy sector, the government has set up a dairy processing and infrastructure development fund (DIDF). It has created a separate Department of Fisheries to provide sustained and focussed attention on the development of the sector. Besides, the government has also approved setting up of a dedicated Fisheries and Aquaculture Infrastructure Development Fund (FIDF) to fill the large infrastructure gaps in fisheries sector. It has also approved a scheme for controlling the foot and mouth disease of livestock. II.1.24 MSP announced for kharif 2019-20 has not changed significantly from the previous year. In continuation with the last year, MSPs have been fixed in such a way that it ensures a minimum return of 50 per cent over the cost of production. In order to provide income support to farmers, in the interim Union Budget 2019-20, the government announced the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), under which vulnerable farmers holding cultivable land up to 2 hectares will receive a direct income support of ₹6,000 per annum (in three instalments of ₹2,000 each) from the central government. Recently, the government has extended this scheme, benefitting around 14.5 crore farmers. Another recent initiative by the government is Pradhan Mantri Kisan Pension Yojana – under which small and marginal farmers of age between 18 to 40 years will get a minimum fixed pension of ₹3,000 per month on attaining the age of 60 years by contributing voluntarily, with government contributing an equal amount, to the pension fund. The scheme is expected to cover 5 crore small and marginal farmers in the first three years. The Union Budget 2019- 20 announced in July has recognised the need for forming new Farmer Producer Organisations (FPO), expansion of benefits of e-NAM (online agricultural trading platform) to larger number of farmers and introduction of Zero Budget Farming for increasing the farmers’ income. The Budget has also proposed to launch Pradhan Mantri Matsya Sampada Yojana (PMMSY) to establish a robust fisheries management framework. Further, the government has extended the benefit of interest subvention and the facility of prompt repayment incentive of 3 per cent for rescheduled loans to animal husbandry and fisheries.  Industrial Sector II.1.25 GVA growth in industry accelerated marginally on a y-o-y basis to 6.2 per cent in 2018-19 breaking the sequence of two consecutive years of deceleration. Cyclical component of industrial GVA growth (estimated through a univariate approach using Hodrick- Prescott filter) remained negative during the year while the capacity utilisation in manufacturing recovered sharply over 10-year average level (Chart II.1.8 a & b). On the other hand, the index of industrial production (IIP) growth decelerated during 2018-19 to a 3-year low of 3.8 per cent driven by deceleration in manufacturing. Among the sectoral components of IIP, the growth in mining and electricity generation has been relatively stable during the year. During Q1:2019-20, a sharp upsurge in the electricity growth was recorded while manufacturing and mining remained stable (Chart II.1.9).   II.1.26 Manufacturing GVA growth reached a 9-quarter high of 12.1 per cent during Q1:2018-19 helped by a favourable base and gain in momentum, before slowing down from Q2:2018-19. Headwinds emanating from subdued demand – both domestic and international, and higher input costs especially oil based, led to slowdown in manufacturing and a widening wedge between IIP and GVA growth. II.1.27 The deceleration in manufacturing during H2:2018-19 – which constitutes three-fourth of industry was on account of the contraction/deceleration in six out of eight broad industry groups constituting 84.2 per cent of manufacturing IIP, i.e., automobiles; electrical, electronics and machinery; chemicals and pharmaceuticals; metals; petroleum, plastic and rubber; and wood, stationery and others. Only two broad industry groups, i.e., food products and textiles registered acceleration (Chart II.1.10a). In terms of use-based classification, much of the deceleration in manufacturing IIP can be traced to the deceleration in intermediate goods, capital goods and consumer non-durables (also reflected in sales of FMCG companies) (Table II.1.5). In terms of weighted contributions, the fall in consumer non-durables was the heaviest, followed by intermediate goods and capital goods, respectively. Capital goods production remained subdued while intermediate and consumer non-durables recovered sharply in Q1:2019-20 (Chart II.1.10b). II.1.28 The improvement in the mining sector was on account of sharp pick-up in coal production that more than compensated for the contraction in crude oil and deceleration in natural gas production. Even with a sharp acceleration in coal production, thermal electricity generation slowed down which was partly compensated by strong growth in hydro and renewable generation. Slowdown in manufacturing activities also contributed to reduced demand of electricity by the industrial sector. Historically, IIP manufacturing and electricity generation co-move closely, indicating that a pick-up in manufacturing activities is essential for electricity demand to improve. The power sector, especially, the thermal segment – the mainstay of power supply with around 76 per cent share – at the current juncture is faced with multiple challenges – cheaper and rising share of renewable energy in the overall energy mix (from 3.7 per cent in 2008-09 to 9.2 per cent during 2018-19); market based short-term price discovery through energy exchange at lower price than long-term forward power purchase agreements (PPAs)5 and DISCOMs reeling with financial stress. | Table II.1.5: Index of Industrial Production (Base 2011-12) | | (Per cent) | | Industry Group | Weight in IIP | Growth Rate | | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | Apr-June 2018 | Apr-June 2019 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Overall IIP | 100.0 | 4.0 | 3.3 | 4.6 | 4.4 | 3.8 | 5.1 | 3.6 | | Mining | 14.4 | -1.4 | 4.3 | 5.3 | 2.3 | 2.9 | 5.4 | 3.0 | | Manufacturing | 77.6 | 3.8 | 2.8 | 4.4 | 4.6 | 3.9 | 5.1 | 3.2 | | Electricity | 8.0 | 14.8 | 5.7 | 5.8 | 5.4 | 5.2 | 4.9 | 7.2 | | Use-based | | | | | | | | | | Primary goods | 34.0 | 3.8 | 5.0 | 4.9 | 3.7 | 3.5 | 5.9 | 2.6 | | Capital goods | 8.2 | -1.1 | 3.0 | 3.2 | 4.0 | 2.7 | 8.6 | -2.2 | | Intermediate goods | 17.2 | 6.1 | 1.5 | 3.3 | 2.3 | 0.9 | 0.7 | 9.3 | | Infrastructure/Construction goods | 12.3 | 5.0 | 2.8 | 3.9 | 5.6 | 7.3 | 8.5 | 2.4 | | Consumer durables | 12.8 | 4.0 | 3.4 | 2.9 | 0.8 | 5.5 | 8.1 | -1.0 | | Consumer non-durables | 15.3 | 3.8 | 2.6 | 7.9 | 10.6 | 4.0 | 2.0 | 7.3 | | Source: NSO. | II.1.29 Indicators of financial performance of listed manufacturing firms also reveal that the sales growth and EBITDA margin peaked in Q1:2018-19 before declining in Q3-Q4:2018-19. As regards expectations, manufacturing firms polled in the Reserve Bank’s Industrial Outlook Survey turned optimistic in Q3-Q4:2018-19, but expectations dipped in Q1-Q2:2019-20 due to weaker prospects for production, order books, profit margins and overall financial situation. Services Sector II.1.30 In contrast to the industrial sector, the services sector growth decelerated on a y-o-y basis in 2018-19 extending a sequence beginning in 2015-16. Moreover, the cushion provided by public administration, defence and other services (PADO) waned. Excluding general government services embodied in PADO, services sector GVA accelerated from 6.7 per cent in 2017-18 to 7.4 per cent in 2018-19. Though some recovery was seen in the cyclical component of services GVA (excluding PADO) growth (estimated through a univariate approach using Hodrick- Prescott filter), it remained negative during the year (Chart II.1.11).

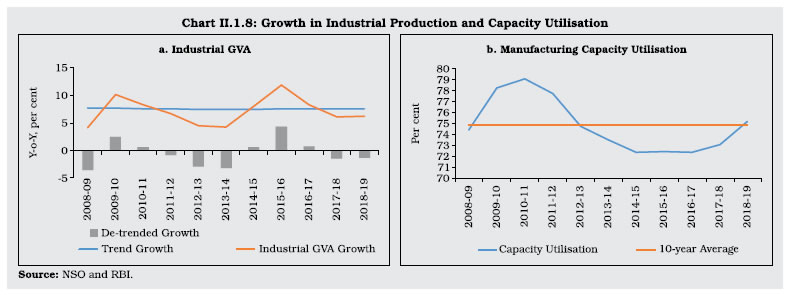

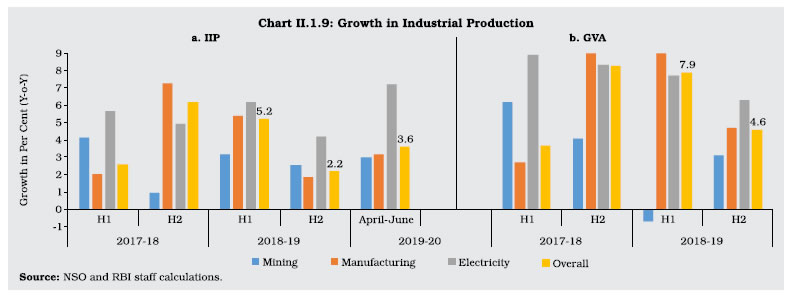

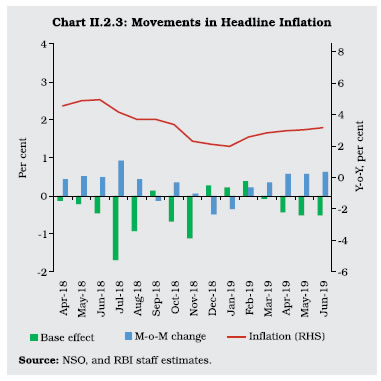

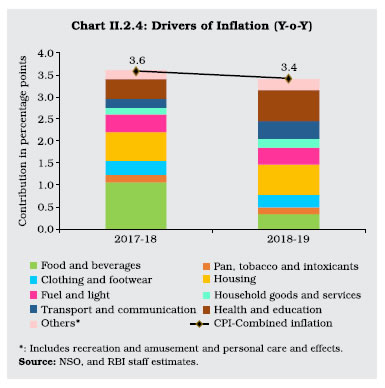

II.1.31 Among the components of services, GVA in the construction sector continued its trend of acceleration beginning 2012-13 (Chart II.1.12a), as reflected in strong growth in steel consumption and cement production during the year on the back of the support from government’s focus on infrastructure and affordable housing. II.1.32 In terms of weighted contributions to growth, financial, real estate and professional services showed improvement (Chart II.1.12b) with key indicators of financial services, i.e., aggregate deposits and bank credit growth picking up and EBITDA of IT services firms accelerating. Weighted contribution of trade, hotels, transport, communication and services related to broadcasting to services growth declined in 2018-19. Among the indicators of the road transport segment, sales of new commercial vehicles slowed down amid a broad-based deceleration in the automobile sector in H2:2018-19. The aviation sector also recorded deceleration from January 2019 primarily due to financial stress in one major airline reflected in domestic air passenger traffic, which had recorded a double-digit growth for 52 months in a row up to December 2018. Only rail transport witnessed marginal improvement in terms of growth of net tonne kilometres of freight. II.1.33 The Reserve Bank’s service sector composite index (SSCI), which combines information collated from high frequency indicators and leads GVA growth in the services sector, is indicating moderation in Q1:2019-20 (Chart II.1.13). 4. Employment II.1.34 The National Statistical Office (NSO) in May 2019 released the Periodic Labour Force Survey (PLFS) which indicates higher regularisation of work force in 2017-18 as compared to previous rounds of Employment and Unemployment Surveys (EUS). Among total workforce, the share of regular/salaried was higher at 45.7 per cent (43.4 per cent in 2011-12) and 52.1 per cent (42.8 per cent in 2011-12) for urban male and female, respectively. In rural areas also, the share of regular/salaried workforce increased in 2017-18, though their share was still low at 14 per cent for male (10.0 per cent in 2011-12) and 10.5 per cent for female (5.6 per cent in 2011-12). The usual status unemployment rate at 6.1 per cent (6.2 per cent for male and 5.7 per cent for female) in 2017-18, as per the PLFS, may not be strictly comparable with the previous rounds of EUS due to difference in methodology.  II.1.35 Information on formal sector employment, compiled from payroll6 data of Employees’ Provident Fund Organisation (EPFO), Employees’ State Insurance Corporation (ESIC) and National Pension System (NPS), indicates a mixed picture with regard to job creation in 2018-19 vis-à-vis 2017-187. Net new subscribers added to EPFO per month increased (0.56 million in 2018-19 from 0.19 million during 2017-18) while new subscribers to NPS slowed down. The number of members who paid their contributions to ESIC increased marginally during 2018-19. II.1.36 Several policy initiatives were taken by the government during the year to boost employment generation. Keeping in view the large employment potential in entertainment industry, single window clearance facility for ease of shooting films, currently available only to foreigners, will be made available to Indian filmmakers as well from 2019-20. The government has also undertaken several steps to strengthen the micro, small and medium enterprises (MSMEs) sector, which provides a lucrative avenue for employment. A scheme of sanctioning loans up to ₹10 million in 59 minutes was put in place for MSMEs. Further, over 10 million youth are being trained every year to help them earn a livelihood through Pradhan Mantri Kaushal Vikas Yojana. Employment for the youth is also being promoted through self-employment schemes including MUDRA, Start-up India and Stand-up India. II.1.37 To sum up, consumption demand remained resilient during 2018-19, albeit with some moderation vis-à-vis the previous year while gross fixed capital formation which sustained momentum in the first half of the year weakened thereafter in an environment of political uncertainty amidst general elections. External demand operated as a drag for the second successive year. Deficit south-west monsoon and depleted reservoirs dented the performance of agriculture sector. While the industrial sector posted resilient growth mainly driven by manufacturing in the first half, the momentum in construction and financial services sustained the healthy growth of overall services sector. The official estimates suggest more regularisation of employment in 2017-18 and various initiatives undertaken by the government are expected to create avenues for employment generation. Going forward, priority should be accorded to revive consumption and private investment while continuing with structural reforms. II.2 PRICE SITUATION II.2.1 Commodity price developments significantly shaped the global inflation environment during 2018 and the early months of 2019. Food prices, in particular, softened markedly in 2018, before a recovery took hold beginning 2019 on the back of firming prices of sugar, dairy products and animal proteins. Metal prices eased, especially from the second half of 2018, on weaker demand from China, although they turned up from February 2019, buoyed by improved global market sentiments and supply disruptions. Crude oil prices came off their October 2018 peak and fell by almost 30 per cent by December 2018, enabled by higher shale production in the US and weakening global demand. Production cuts by Organisation of the Petroleum Exporting Countries (OPEC) and other major producers along with supply disruptions in Venezuela firmed up crude prices in early 2019. II.2.2 In this milieu, retail inflation measured by consumer prices remained subdued across advanced and emerging market economies (EMEs). In the former, even core inflation remained below targets with wage growth sluggish and demand weakened by slowing global economic activity. In many EMEs, inflation pressures generally moderated, driven down by commodity prices and country-specific supply improvements, especially in respect of food items. II.2.3 In India, headline inflation8 eased significantly to average 3.4 per cent during 2018-19, the lowest annual reading in the new consumer price index (CPI) series (Table II.2.1). Accordingly, inflation has undershot the target of 4 per cent for the second financial year in succession under the remit of the monetary policy committee that was formally appointed in September 2016 under the new monetary policy framework. During Q1:2019-20, inflation has remained moderate, averaging at 3.1 per cent. II.2.4 A sharp decline in food inflation, and an elevated and sticky inflation excluding food and fuel were the defining features of price dynamics in 2018-19, with the persistent wedge between headline inflation and inflation excluding food and fuel becoming a subject of animated public debate (Chart II.2.1). Against this backdrop, Sub-section 2 assesses developments in global commodity prices and inflation. Sub-section 3 discusses movements in domestic headline inflation and major turning points. Sub-section 4 drills down into the granular aspects of price developments in respect of major components, viz., food, fuel, and inflation excluding food and fuel. Sub-section 5 discusses other indicators of prices and costs as well as movements in wages. | Table II.2.1: Headline Inflation – Key Summary Statistics | | (Per cent) | | Statistics | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | Mean | 10.0 | 9.4 | 5.8 | 4.9 | 4.5 | 3.6 | 3.4 | | Standard deviation | 0.5 | 1.3 | 1.5 | 0.7 | 1.0 | 1.2 | 1.1 | | Skewness | 0.2 | -0.2 | -0.1 | -0.9 | 0.2 | -0.2 | 0.1 | | Kurtosis | -0.2 | -0.5 | -1.0 | -0.1 | -1.6 | -1.0 | -1.5 | | Median | 10.1 | 9.5 | 5.5 | 5.0 | 4.3 | 3.4 | 3.5 | | Maximum | 10.9 | 11.5 | 7.9 | 5.7 | 6.1 | 5.2 | 4.9 | | Minimum | 9.3 | 7.3 | 3.3 | 3.7 | 3.2 | 1.5 | 2.0 | Note: Skewness and kurtosis are unit-free.

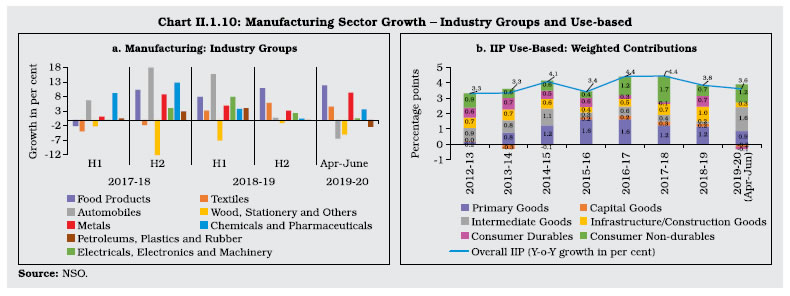

Source: National Statistical Office (NSO), and RBI staff estimates. |

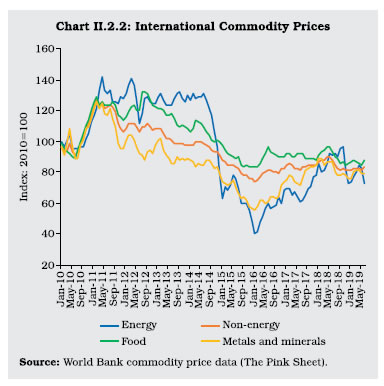

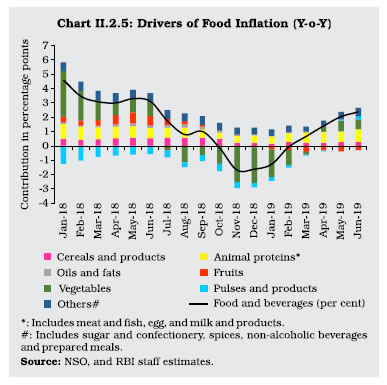

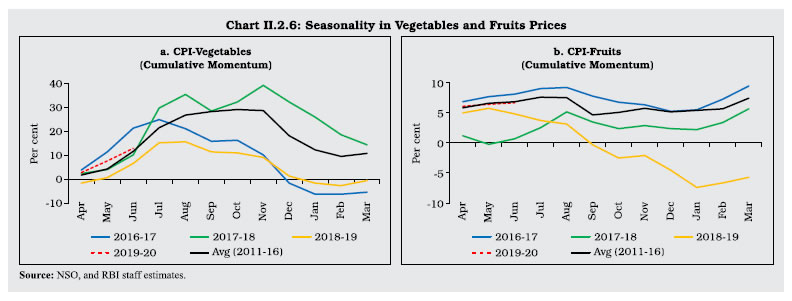

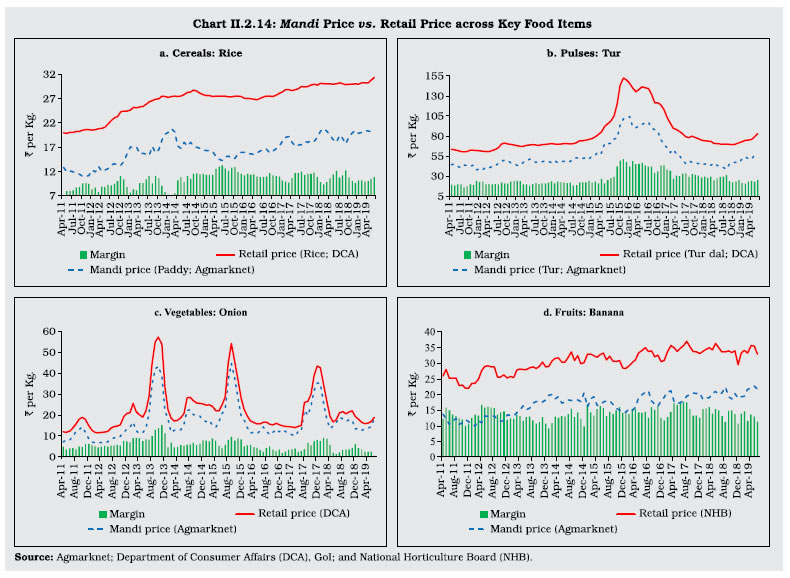

2. Global Inflation Developments II.2.5 International food prices, especially of sugar, dairy products and edible oils, remained generally soft during 2018, reflecting abundant supply (Chart II.2.2). In the non-food category, price pressures in metals remained largely weak due to US-China trade tensions and weak global demand. Global crude oil prices reached US$ 77 per barrel9 in October 2018 – the highest level since December 2014 – following the decision of the OPEC and non-OPEC producers, led by Russia, in November 2017 to extend cuts in oil production by 1.8 million barrels per day till the end of 2018, and US sanctions on exports from Iran. The price of the Indian basket of crude oil moved in tandem and rose to US$ 80 per barrel in October 2018. However, global crude oil prices softened sharply during November-December 2018 on concerns of oversupply amidst weakening of global growth and heightened trade tensions. Prices picked up again during January-March 2019 due to stricter compliance by OPEC members to voluntary reductions in production and increasing crude oil supply disruptions. The price of the Indian basket also increased to US$ 67 per barrel in March 2019 from US$ 58 per barrel in December 2018 in line with global prices.  II.2.6 Reflecting generally soft global commodity price conditions, consumer price inflation remained benign during 2018 and 2019 so far in a number of economies, both advanced and emerging markets. Wage growth remained sluggish despite lower unemployment, effectively muting potential price-wage feedback loops. Accordingly, inflation expectations also remained contained. Many EMEs also experienced easing of inflation pressures, except in countries like Argentina and Turkey faced with country-specific idiosyncrasies. In the second half of 2018, a number of global macro-economic developments such as escalation of US-China trade tensions, regulatory tightening in China to rein in debt, and tightening of financial conditions in line with monetary policy normalisation in some major advanced economies adversely impacted growth and thereby added to the downward pressure on commodity prices and inflation. 3. Headline CPI Inflation in India II.2.7 Headline inflation in India eased during 2018-19 along with a marginal fall in its dispersion (Table II.2.1). The intra-year distribution of inflation was also more balanced relative to preceding year as reflected in the near zero positive skew. Furthermore, the higher negative kurtosis than a year ago suggests fewer instances of large deviations from mean inflation during the year, which is also reflected in the reduced gap between maximum and minimum inflation during the year. This change in the distribution of inflation was essentially brought about by movements in its constituents, mainly food, within a narrow range during the year. II.2.8 At a disaggregated level, price pressures in food, and excluding food and fuel groups drove up headline inflation to an intra-year peak of 4.9 per cent in June 2018. Food price inflation eased thereafter, aided by favourable base effects. Contrary to usual historical price movements, the momentum of food prices turned negative from September 2018, dragging food prices into deflation in October 2018. The onset of the usual winter easing in prices of vegetables and fruits accentuated the decline to (-) 1.7 per cent in November 2018, the lowest in the new CPI series, and extended the deflation till February 2019. By January 2019, headline inflation had fallen from its intra-year peak by 295 basis points (bps) to 2.0 per cent, the lowest in 19 months (Chart II.2.3). Prices of fuel and light as well as those of excluding food and fuel group remained at elevated levels through the greater part of the year reflecting, inter alia, the hardening of international crude oil and natural gas prices and one-off surprises in respect of prices of some miscellaneous goods and services under the categories of health and education. Notably, inflation excluding food and fuel peaked at 6.4 per cent in June 2018 – the highest in almost four years.  II.2.9 An early pre-monsoon uptick in food prices set in from March 2019 and returned food inflation to positive territory. With prices of fuel and light rising and partly offsetting the modest easing of inflation excluding food and fuel, headline inflation moved up to 2.9 per cent in March 2019. II.2.10 For the year 2018-19 as a whole, inflation eased by 17 bps from its level a year ago and by about 430 bps from its decennial average10. Households’ inflation expectations (median) moderated during the second half of 2018-19 by 160 bps for three months ahead and 170 bps for one year ahead horizons. A decline in inflation expectations is also corroborated by more forward-looking assessments by professional forecasters and in consumer confidence surveys. 4. Constituents of CPI Inflation II.2.11 The composition of CPI inflation underwent significant shifts during 2018-19 (Chart II.2.4). Subsequent paragraphs discuss the key drivers of the sharp decline in food inflation, the volatile nature of fuel inflation, and the sharp upturn in inflation excluding food and fuel during 2018-19 as well as its easing in the closing months of the year. Food II.2.12 Inflation in food and beverages prices (weight: 45.9 per cent in CPI) plunged during the year, with its contribution to overall inflation dropping to 9.6 per cent in 2018-19 from 29.3 per cent a year ago. Bumper production levels during 2016-18 muted the pre-monsoon uptick in April-August 2018 and food prices began declining from September 2018 and went into deflation during October 2018-February 2019 (Chart II.2.5). Several factors stand out in this remarkable easing: first, the extended winter easing in vegetables prices from December 2017 through April 2018; second, the unprecedented fall in prices of fruits from June 2018 up to January 2019; third, the unusual easing of inflation in respect of cereals, and milk and products during the second half of the year; fourth, continuing deflation in pulses and products prices; and fifth, sugar price deflation becoming more pronounced during the year.  II.2.13 Drilling down into these key drivers, it is observed that as in the previous two years, prices of vegetables (weight: 13.2 per cent in CPI-food and beverages) became pivotal to the overall food inflation trajectory during 2018-19. The extended winter easing in vegetables prices was primarily driven by higher market arrivals of onions and tomatoes, aided by imports and the imposition of a minimum export price (MEP) for onions in November 2017. The pre-monsoon upturn in vegetables prices was less pronounced than in the past and was delayed till May 2018, but it peaked in July in sync with the historical pattern. Price pressures started easing from August, after which vegetables prices moved into contraction, led by a rise in market arrivals of potatoes, onions and tomatoes. A timely winter contraction in prices took overall food group prices into deflation from October 2018, which continued up to February 2019. Barring prices of tomatoes, which were impacted by delayed harvesting in Maharashtra, fungus led crop-damage in Karnataka and cyclone Gaja driven crop loss in Tamil Nadu, prices of onions, potatoes and other major vegetables remained soft, until sharp recovery set in during March 2019 (Chart II.2.6a).  II.2.14 In the case of prices of fruits (weight: 6.3 per cent in CPI-food and beverages), summer upside pressures (April-May 2018) dissipated from June 2018 on account of robust domestic arrivals of mangoes and bananas (30.4 per cent of the total weight of CPI-fruits) and imports of apples and citrus fruits, and negative price momentum continued till January 2019. The downward trend in cumulative momentum from August 2018 defied the historical pattern and contributed considerably to the overall fall in food inflation during the year (Chart II.2.6b). Excluding vegetables and fruits, average food inflation would have been higher by around 92 bps at 1.6 per cent during 2018-19 (0.7 per cent including vegetables and fruits).

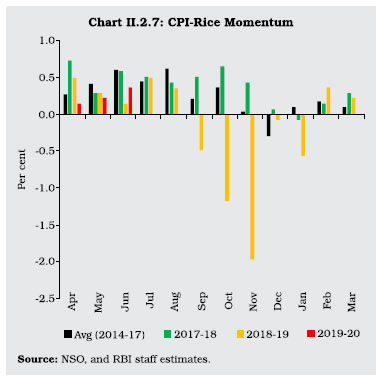

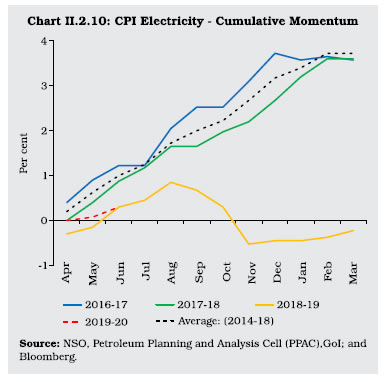

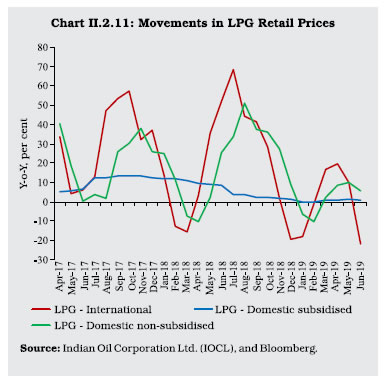

II.2.15 Among the other major food items, inflation in cereals and products prices (largest weight of 21.1 per cent in CPI-food and beverages), almost halved to 1.4 per cent in H2:2018-19. Notably, rice prices contracted for five consecutive months from September 2018, reflecting higher domestic production and adequate stocks (Chart II.2.7). The momentum of wheat prices generally remained strong during the year partly due to a fall in wheat imports caused by hike in import duty to 30 per cent in May 2018 from 20 per cent earlier. Inflation in milk and products prices (weight: 14.4 per cent in CPI-food and beverages) eased to 0.8 per cent in H2:2018-19 from 2.9 per cent in H1, reflecting adequate domestic availability (Chart II.2.8).  II.2.16 Deflation in prices of pulses (weight: 5.2 per cent in CPI-food and beverages) persisted through 2018-19 due to sizeable excess supply (Chart II.2.9). The negative contribution of pulses to overall inflation decreased from (-) 17.9 per cent during 2017-18 to (-) 5.7 per cent in 2018- 19 as mandi prices of arhar and urad edged towards their minimum support prices (MSPs). II.2.17 Prices of sugar and confectionery (weight: 3.0 per cent in CPI-food and beverages) remained in deflation since February 2018 reflecting excess supply conditions including increased open market sales. Domestic sugar prices have also closely tracked movements in global sugar prices. Price pressures in oils and fats (weight: 7.8 per cent in CPI-food and beverages) generally remained weak during the year in line with subdued international edible oils prices. Higher production of soybean and mustard during 2018-19 along with the reduction in import duty on crude palm oil, and refined, bleached and deodorised (RBD) palmolein imports from Malaysia and Indonesia, effective January 1, 2019, helped contain prices. II.2.18 Prices of protein-rich items such as meat and fish (weight: 7.9 per cent in CPI-food and beverages) faced some upside pressures during H2:2018-19, largely reflecting higher prices of maize, which is a key input for poultry and animal feed. Fuel II.2.19 The contribution of the fuel group (weight: 6.8 per cent in CPI) to headline inflation remained unchanged at the previous year’s level (11.3 per cent). Two distinct phases are discernible: first, a steep and sustained rise during H1:2018-19 to a peak of 8.6 per cent in September 2018; and second, a sharp softening in inflation during H2:2018-19 to touch a low of 1.2 per cent in February 2019. Domestic LPG and non-subsidised kerosene prices picked up during H1:2018-19 in line with the rise in international prices. Oil marketing companies also raised administered kerosene prices in a calibrated manner to phase out the kerosene subsidy. These dynamics, however, reversed during the second half of the year. The cumulative momentum in electricity prices began easing post-August 2018 and turned negative from November (Chart II.2.10). Firewood and chips price pressures remained muted throughout the second half of the year. Domestic LPG prices contracted during December 2018-February 2019, primarily tracking global LPG price movements (Chart II.2.11).

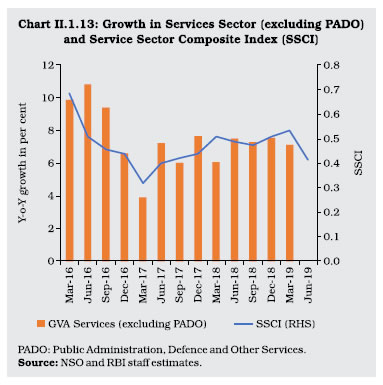

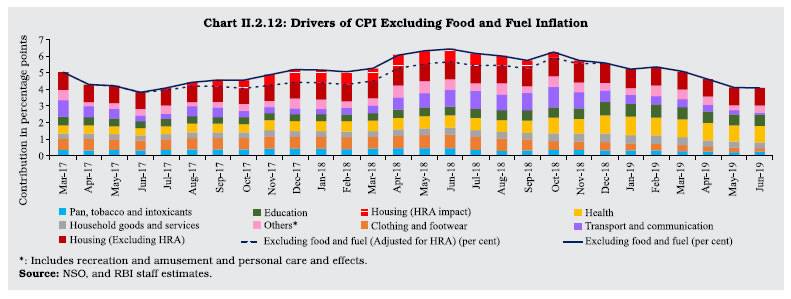

Inflation Excluding Food and Fuel II.2.20 After remaining moderate at 4.6 per cent during 2017-18 (4.7 per cent during 2015-18), inflation excluding food and fuel surged to 5.8 per cent during 2018-19 (Appendix Table 4), with an intra-year peak of 6.4 per cent in June 2018 (highest since August 2014) (Chart II.2.12). In this category, the momentum of increase in prices of miscellaneous goods and services, which comprise 60 per cent of the category, was noteworthy. Within this sub-category, health and education prices surprised on the upside especially in rural areas during October- December 2018 and in respect of medicines, hospital and nursing home charges, prices of books and journals, and fees of private tutors and coaching centres.  II.2.21 Among other items within the miscellaneous category, price pressures remained strong in respect of household goods and services, and transport and communication, the latter impacted by the increase in domestic petrol and diesel prices in line with international price movements (Chart II.2.13). In order to contain price pressures, the central government announced a cut in petrol and diesel prices by ₹2.5 per litre on October 4, 2018 by reducing excise duty by ₹1.5 per litre and asking oil companies to absorb ₹1.0 per litre. Several state governments also announced matching cuts by lowering local taxes. During November-December 2018, however, domestic petrol and diesel prices fell in line with international prices, thus containing transport and communication inflation. Prices of recreation and amusement – particularly, charges of cable television connection – and those of personal care and effects (particularly, prices of gold and silver and fast moving consumer goods like toiletries and cosmetics) posed upside pressures in February 2019. In March 2019, an unexpected softening in the momentum of housing prices, fall in gold prices and a favourable base effect pulled down inflation in the category as a whole. As a result, inflation excluding food and fuel fell from 6.2 per cent in October 2018 to 5.2 per cent in January 2019 and further to 5.1 per cent in March 2019, after a marginal uptick in February.  II.2.22 Net of housing, inflation excluding food and fuel averaged 5.6 per cent in 2018-19, up from 4.1 per cent in the previous year. The statistical impact of the increase in house rent allowance (HRA) for central government employees under the 7th Pay Commission started waning from July 2018 and dissipated completely by December 2018. Reflecting this, housing inflation followed a downward trajectory from July 2018 onwards to reach 4.9 per cent in March 2019, from a five-year peak of 8.5 per cent in April 2018. II.2.23 Clothing and footwear inflation also saw substantial easing to an intra-year low of 2.5 per cent in March 2019, reflecting the impact of lower export of readymade garments to UAE and Saudi Arabia subsequent to the imposition of a value added tax (VAT) of 5 per cent for the first time in January 2018. In terms of the Cotton A index, international prices of cotton, a major input into clothing production, also fell during the major part of the year (particularly July 2018-February 2019) barring some recovery in March 2019. 5. Other Indicators of Inflation II.2.24 During 2018-19, sectoral CPI inflation based on Consumer Price Index of Industrial Workers (CPI-IW) increased significantly to 7.7 per cent in March 2019 from 4.0 per cent in April 2018, largely due to housing. The housing index under the CPI-IW is adjusted twice a year – in January and July (in contrast to the continuous adjustment under CPI-Combined). Inflation based on the Consumer Price Index of Agricultural Labourers (CPI-AL) and the Consumer Price Index of Rural Labourers (CPI-RL), which do not have housing components, eased during June-November 2018 before picking up during December 2018-March 2019. II.2.25 Inflation measured by the Wholesale Price Index (WPI) showed mixed movements during 2018-19. It reached an intra-year peak of 5.7 per cent in June 2018 due to price pressures emanating from all the three major groups (i.e., primary articles, fuel and power, and manufactured products) before easing to 4.6 per cent in August 2018. It picked up again during September-October 2018, driven by a sharp uptick in prices of all three major groups, however, it moderated to 3.1 per cent in March 2019, led by a significant softening of price pressures in fuel and power during November 2018-January 2019, which track international prices. On an annual average basis WPI inflation picked up to 4.3 per cent in 2018-19 from 2.9 per cent in 2017-18. A similar rising trend was also visible in the GDP deflator, which picked up to 4.1 per cent in 2018-19 from 3.8 per cent in 2017-18. II.2.26 Major increases in MSPs were announced during 2018-19 for kharif crops, in line with the provisions of the Union Budget, 2018-19, to ensure at least 50 per cent return over costs (A2+FL)11. As a result, MSP of paddy (common) was hiked by 12.9 per cent (from ₹1,550 per quintal in 2017-18 to ₹1,750 per quintal in 2018- 19). The extent of MSP increases varied across crops, ranging from 3.7 per cent in the case of urad to 52.5 per cent for ragi. While the impact of MSP increases was reflected in mandi prices of many crops, there was no commensurate increase in consumer prices owing to abundant domestic availability across major food items. Secondary data reveal that mark-ups (i.e., the difference between retail and mandi prices) vary across crops and over time (Chart II.2.14). In view of data gaps impeding a full tracking of wholesale/mandi price changes into retail inflation, a primary survey was undertaken to understand the behaviour of multi-stage margins over the supply chain for key agricultural commodities in India (Box II.2.1). II.2.27 Wage growth for agricultural and non-agricultural labourers generally remained subdued during the year, averaging around 4.0 per cent, reflecting low food inflation. In the case of the corporate sector, pressures from staff costs largely remained range-bound during the year. II.2.28 In sum, headline inflation softened during 2018-19, mainly reflecting significantly low food inflation. With the domestic and global demand-supply balance of key food items expected to remain favourable, the short-term outlook for food inflation remains benign. Spike in vegetables prices from their lows in 2018-19, especially during the summer months, poses some upside risk. The spatial and temporal distribution of monsoon will have a bearing too, although the recent catch-up in rainfall may likely mitigate the risk. The outlook for global crude oil prices is hazy, both on the upside and downside. Should the recent slowdown in domestic economic activity accentuate, it may have a bearing on the outlook for inflation.

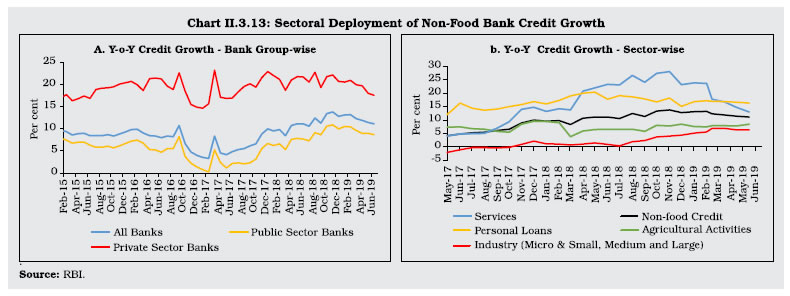

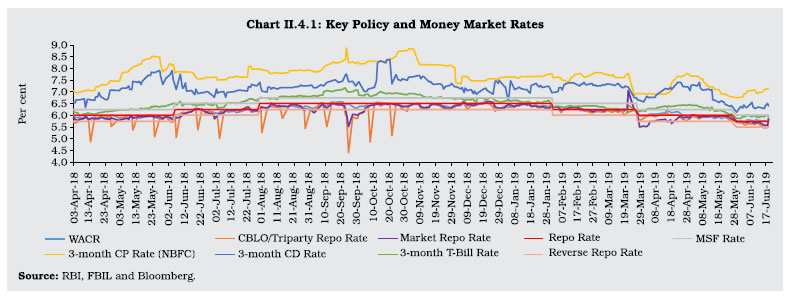

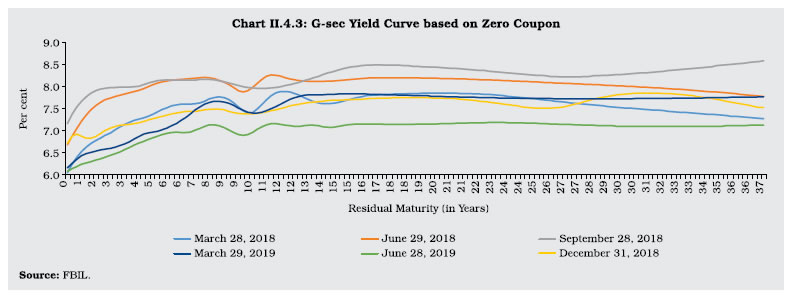

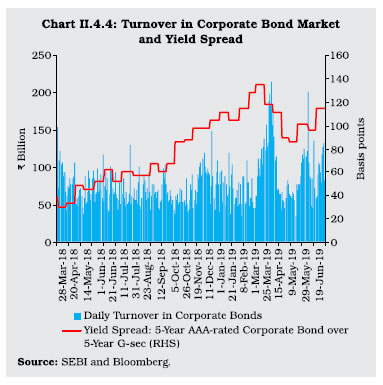

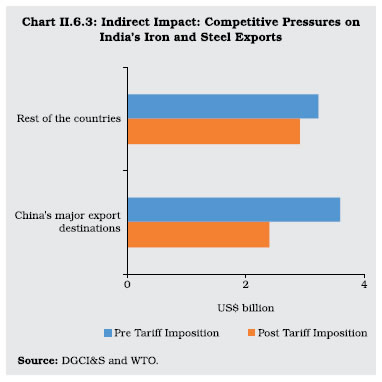

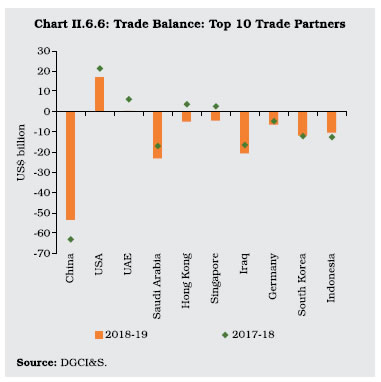

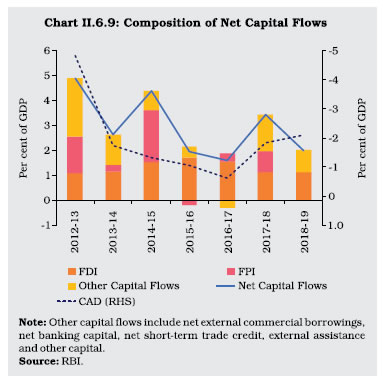

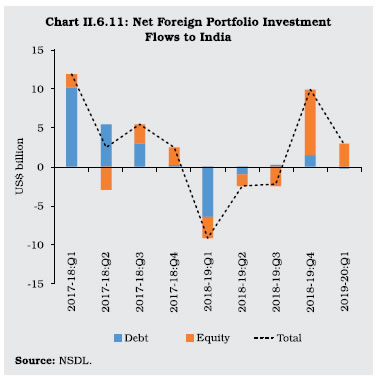

Box II.2.1