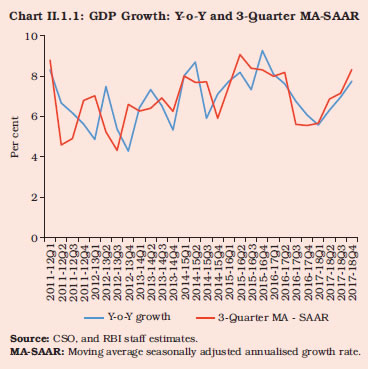

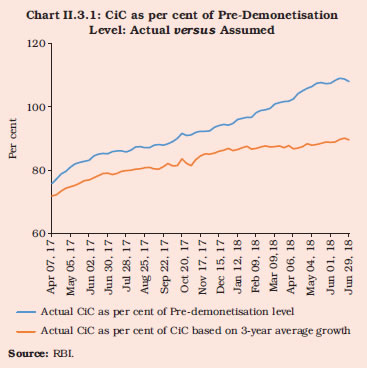

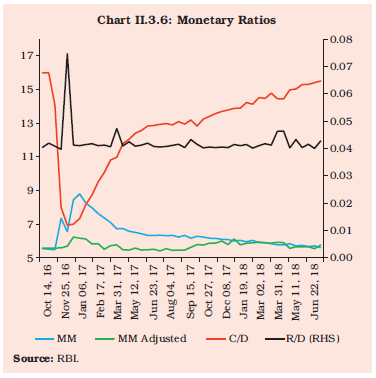

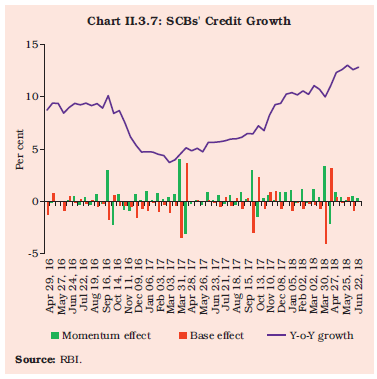

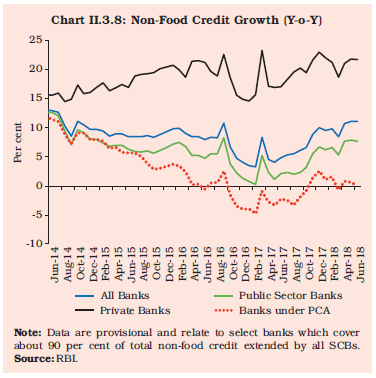

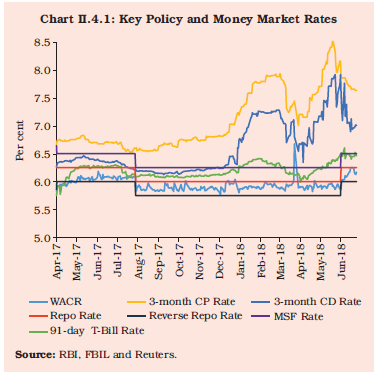

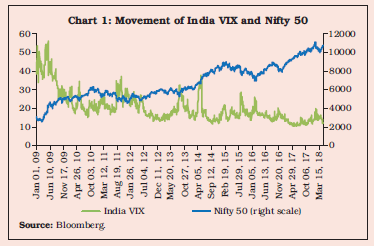

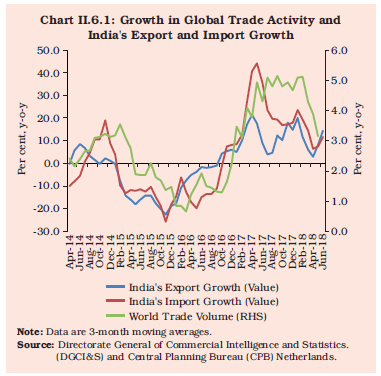

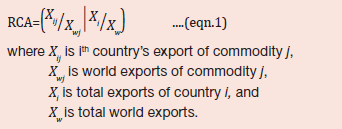

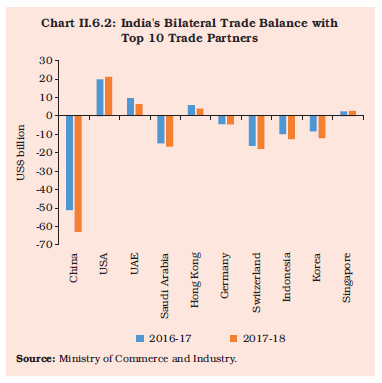

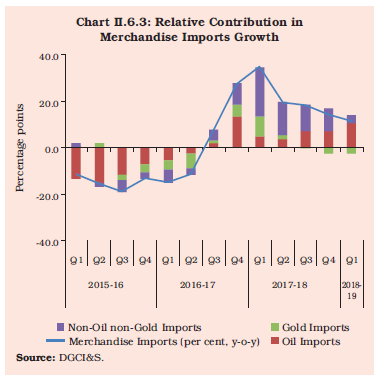

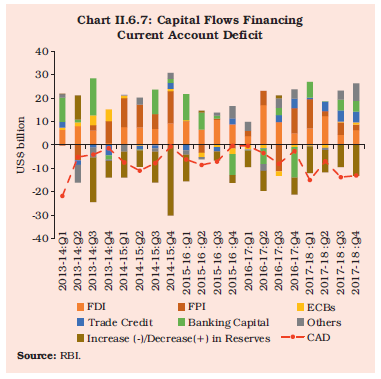

The Indian economy exhibited resilience during 2017-18, with upturns in investment and construction. Inflation eased on a year-on-year basis in an environment characterised by high variability. In the evolution of monetary aggregates, currency in circulation surpassed its pre-demonetisation level while credit growth revived to double digits from a historic low in the previous year. Domestic financial markets were broadly stable, with rallies in equity markets and intermittent corrections, hardening bond yields, the rupee trading with a generally appreciating bias except towards the close of the year and ample liquidity in money markets. The implementation of GST achieved another important milestone towards an efficient indirect tax structure. On the external front, the current account deficit was comfortably financed with accretions to foreign exchange reserves. II.1 THE REAL ECONOMY II.1.1 In an environment in which global growth gained traction and broadened across geographies with international trade outpacing it, the Indian economy rounded a turning point during Q2 of 2017-18 as it emerged out of a five-quarter slowdown. Aggregate demand picked up, with the four quarter phase of consumption-led activity giving way to a much-awaited upturn in investment. Fiscal support in the form of government final consumption expenditure (GFCE) on the demand side, and public administration, defence and other services (PADO), on the supply side, continued to cushion aggregate economic activity, but waned somewhat in 2017-18 in relation to the immediately preceding year. II.1.2 In the second half of the year, these impulses strengthened as manufacturing started recovering from sluggishness, accompanied by strong corporate sales growth, an uptick in capacity utilisation and drawdown of inventories of finished goods, an incipient starting up of the capital expenditure (capex) cycle and slow return of pricing power. In the services sector, construction exhibited remarkable improvement, accelerating to its fastest pace in recent years. The still unravelling picture of the performance of agriculture and allied activities brightens up the outlook considerably. While growth rates for 2017-18 will inevitably be obscured by a high base, advance estimates point to another record foodgrains output in 2017-18 and buffer stocks well above norms. II.1.3 These developments carry risks as well. First, firming of salient commodity prices are translating into worsening terms of trade for net importers like India and higher input costs. Consequently, the economy has to contend with the drag on aggregate demand from net exports and cost-push risks to inflation at the same time. In this context, it is worthwhile to note that India is not able to reap the healing effects of strengthening global trade by expanding exports commensurately, mainly due to constraints on domestic supply conditions and productivity. Second, muted as they are at this stage, risks to macroeconomic stability have edged up. The current account deficit is widening as imports increasingly replace domestic production in several items, besides the elevation in international crude prices. In this context, aggregate demand pressures emanating from a deviation from the budgeted fiscal deficit of the general government may spill over into higher external imbalances, contributing to a ‘twin deficit’ challenge. Equally worrisome is the emergence of hysteretic pressure patterns in recent inflation outcomes under the camouflage of a delayed winter season softening of vegetable prices that has started to reverse from May 2018. Third, financing conditions are tightening just as the nascent shoots of growth are taking root. Liquidity is gradually rebalancing while gilt and corporate bond yields are hardening and banks have begun raising their interest rates. Watchfulness is warranted in the context of the tentative pickup in credit growth that is gradually finding purchase. Fourth, global spillovers from markets repricing monetary policy normalisation by systemic central banks as well as geo-political and idiosyncratic risks remain contingent threats to macroeconomic and financial stability as well as to growth prospects. II.1.4 Aggregate demand, which is featured in the immediately following sub-section, decelerated due to a slowdown in consumption, both private and government, and a decline in net export as the surge in imports outpaced exports. Support came from growth in gross capital formation which pushed up the investment rate to 34.1 per cent of gross domestic product (GDP) in 2017-18, up from 33.2 per cent in 2016-17. The sub-section on aggregate supply, which follows, profiles its slower pace and the underlying movements of its constituents – robust performance of agriculture and allied activities on top of a high base, reinvigoration of industrial activity, and the resilience of services. Aggregate Demand II.1.5 Decomposing the evolution of aggregate demand – measured by year-on-year (y-o-y) growth of GDP – reveals that its slide into a thirteen-quarter low of 5.6 per cent in Q1:2017-18 was set off by a slowdown in fixed investment and decline in net exports. The turnaround in Q2, as GDP growth picked up to 6.3 per cent, was powered by a robust acceleration in momentum which was carried forward into the second half of the year. Enabled by favourable base effects, GDP growth has shown a consistent increase of 0.7 percentage points in each quarter. Three-quarter moving averages of seasonally adjusted annualised growth rates attest to the interplay of momentum and base effects in aggregate demand conditions (Chart II.1.1). For the year as a whole though, Central Statistics Office’s (CSO) provisional estimates (PE) indicate that there is room for a sizeable catch-up in aggregate demand – GDP growth at 6.7 per cent trailed 0.4 percentage points below the preceding year’s rate.

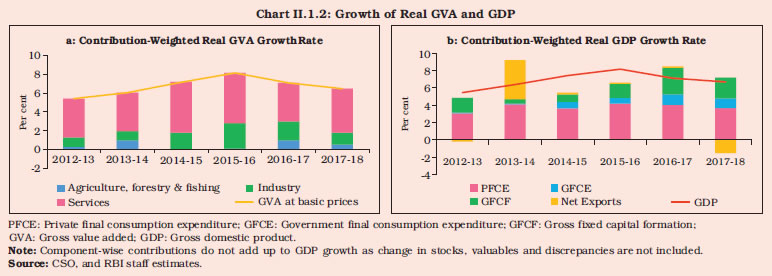

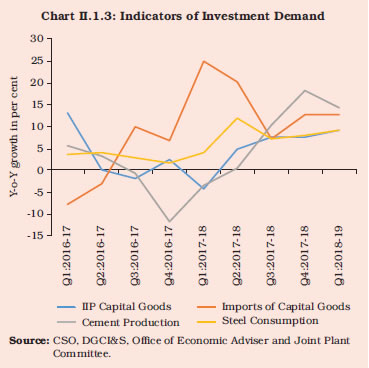

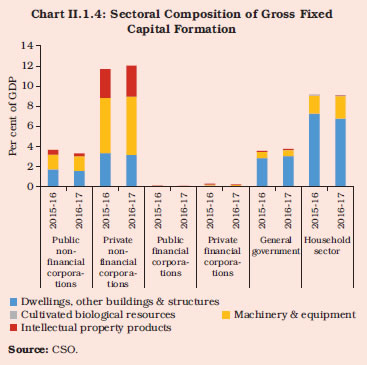

II.1.6 Underlying the inflexion in aggregate demand conditions in 2017-18 were compositional shifts among constituents. Private final consumption expenditure (PFCE), which accounted for close to 57 per cent of real GDP growth in 2016-17, ceded share and its weighted contribution fell to around 55 per cent in 2017-18 (Chart II.1.2). While support from government final consumption was maintained at the preceding year’s level, net exports depleted domestic demand after remaining in broad balance a year ago. Gross fixed capital formation (GFCF) shed 7.6 percentage points in 2017-18 from its weighted contribution of 43.2 per cent to GDP growth in 2016-17. Nonetheless, the steady increase in its share in GDP growth from the low of 8.4 per cent in 2013-14 is noteworthy in view of its historical catalysing role in stepping up the pace of growth and its longer-lasting multiplier effects relative to other constituents, on the overall activity in the economy, employment and welfare. Investment and Saving II.1.7 This firming up of GFCF during 2017-18 acquires significance in the context of the recent experience which saw the rate of fixed investment, measured by the GFCF/GDP ratio, worsening steadily from 34.3 per cent in 2011-12 to 30.3 per cent in 2015-16. In 2016-17, however, GFCF shrugged off its secular decline and green shoots of revival became visible, led by private non-financial corporations and general government. Fixed investment of the private non-financial sector increased primarily in the form of machinery and equipment closely followed by intellectual property products. After a transient slowdown in Q1:2017-18 due to the lingering impact of demonetisation and uncertainties ahead of the implementation of the goods and services tax (GST), fixed investment rebounded in Q2 and sustained momentum over the rest of the year. The coincident turnaround in the growth of GDP and GFCF bears out the empirically validated switching role of the latter in turning points in the path of the Indian economy (Box II.1.1). II.1.8 In terms of its determinants as employed by CSO, movements in GFCF appear to have been underpinned by the behaviour of domestic production of capital goods during the phase of a slowdown as well as the recent upturn from Q2:2017-18. As regards other drivers, viz., value added in construction turned up in the preceding quarter, but imports of capital goods lost strength from Q3 after a surge that started a year ago (Chart II.1.3). Box II.1.1

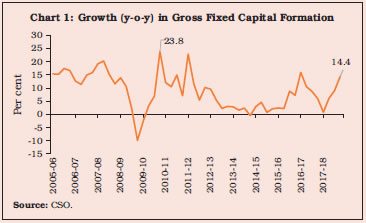

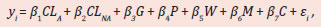

Investment Climate for Growth: What are the Key Enabling Factors? The revival in gross fixed capital formation (GFCF) in the second half of 2017-18, has aroused considerable interest, with questions around its turning points and durability given that several lead/coincident indicators – sales growth, capacity utilisation, inventory drawdown, pricing power are also pointing to a much awaited upturn in the investment cycle. Growth in GFCF scaled a peak of 23.8 per cent in Q4:2009-10 before slackening significantly over a prolonged period thereafter (Chart 1) from an average rate of 11.7 per cent during 2005-06 to 2009-10 to 7.0 per cent during 2010-11 to 2017-18, with some intervening quarters registering contraction. Since Q2:2017-18, however, the growth of GFCF has picked up and sustained in Q3 and Q4 averaging 11.7 per cent. This development warrants an empirical assessment of the factors influencing the investment climate. The investment climate represents a combination of factors that includes macroeconomic and political stability, physical infrastructure, availability of financial capital and human resources, and the institutional, policy, and regulatory architecture. A transparent, stable and predictable investment climate is essential for growth and requires “…proper contract enforcement and respect for property rights, embedded in sound macroeconomic policies and institutions, transparent and stable rules, and free and fair competition” (IFC, 2016). Consequently, the business regulatory environment, taxation laws, and governance/institutional capacity often influence the ease and cost of starting a business as well as normal day-to-day operations. Quantitative and qualitative determinants of the investment climate have been captured in the form of a single index that helps identify the relative rank of a country, such as the ease of doing business index of the World Bank, competitiveness index (WEF, 2017), policy uncertainty index (Baker, et al., 2016), corruption index (Transparency International, 2018) and the like.  For the empirical assessment, year-on-year (y-o-y) growth in real GFCF and the GFCF to GDP ratio were taken as dependent variables representing the realised investment climate, while y-o-y changes in the economic policy uncertainty index, the business expectations index in the RBI’s Industrial Outlook Survey and quarterly changes in the number of stalled projects are used as the measurable high frequency indicators of the investment climate. Drawing from the empirical literature, other determinants of the investment climate considered are the real interest rate representing the cost of finance, the real effective exchange rate as a proxy for competitiveness, and the profitability of current business indicating the return on investment (Table 1). The empirical estimation is based on the ordinary least square method, for the period 2001-02:Q1 to 2017-18:Q4 with heteroskedasticity and autocorrelation consistent (HAC) adjusted standard errors. A priori, it is posited that (a) greater the business optimism and lower the level of policy uncertainty, higher could be the appetite for new investment; (b) higher real interest rates and appreciation of the real effective exchange rate may dampen investment, unless the expected return on investment is high enough to improve the earnings outlook; (c) higher corporate profitability can drive higher investment; and (d) increase in the incidence of stalled projects can depress new investment activity. The empirical results point to persistence and gestation in the evolution of investment activity as evident in the statistically significant lagged dependent variable. This suggests that the investment climate is slow-moving and wields an influence on investment decisions. Consistent with expectations, policy uncertainties and bottlenecks (represented by stalled projects) have contributed to dampening of the investment climate. Corporate profitability, which is largely influenced by input costs and demand conditions that determine pricing power, emerges as a forward-looking driver of new investment. As current profits are expected to alter the earnings outlook or the expected return on new investment, higher profitability resulting from lower input costs, higher output prices or improved productivity could brighten the investment climate. Headwinds from factors like slow growth in demand represented by non-agricultural income, subdued business confidence, and higher real interest rates (i.e., the policy rate as well as the real weighted average lending rate) are seen to retard investment. An appreciation of the real exchange rate, which is an indicator of possible loss of external competitiveness, unless offset by higher productivity is found to adversely impact future investment demand (Table 1). | Table 1: Factors that Influence the Investment Climate | | | Investment (INV) | | Growth in Real GFCF (y-o-y) | GFCF to GDP Ratio | | 1 | 2 | 3 | 4 | | Constant | -3.70 (-1.72)* | 0.47 (0.22) | 5.07 (4.66)*** | | INVt-1 | 0.51 (4.80)*** | 0.39 (6.71)*** | 0.77 (18.59)*** | | NAG_Gr t-1 | 0.98 (3.06)*** | | | | NAG_Gr t | | 0.50 (1.82)* | | | Real_int t-2 | -1.55 (-3.03) *** | | | | Real_int t-4 | | -0.65 (-1.99)** | | | Real_walr t-2 | | | -0.09 (-2.81)*** | | DREER t-4 | -0.23 (-2.04)** | | | | DBEI t-1 | 0.44 (6.30)*** | 0.33 (8.37)*** | | | QBEI t-1 | | | 0.07 (5.14)*** | | DUNCRT t-4 | -0.02 (-1.92)** | | | | EBITDA t-1 | | 0.14 (3.88)*** | | | PROFIT t-1 | | | 0.18 (3.44)*** | | DSTALLED t-5 | | | -0.01 (-2.24)** | | R2 | 0.67 | 0.76 | 0.94 | | LB-Q (P-value) | 0.10 | 0.33 | 0.27 | Notes: 1. ***; **; *: indicate the statistical significance at 1 per cent, 5 per cent and 10 per cent, respectively.

2. Figures in parentheses are t-statistics.

3. LB-Q is Ljung-Box Q statistics for the test of null hypothesis of no serial correlation (up to 5 lags).

4. Dependent variable in Col. (2) and (3) is year-on-year growth in real GFCF while that in Col. (4) is GFCF to GDP ratio.

NAG_Gr : Non-agricultural real GDP growth (y-o-y)

Real_int : Change in real policy rate

Real_walr : Real weighted average lending rate

DREER : Change (y-o-y) in Real Effective Exchange rate

DBEI : Change (y-o-y) in Business Expectations Index (From RBI’s Industrial Outlook Survey)

QBEI : Deviation of Business Expectations Index from 100 level (From RBI’s Industrial Outlook Survey)

DUNCRT : Change (y-o-y) in economic policy uncertainty index (Source: www.PolicyUncertainty.com).

EBITDA : Change (y-o-y) in earnings before interest, taxes, depreciation and amortisation adjusted for inflation.

PROFIT : Net profits (profits after tax) to sales ratio.

DSTALLED : Quarterly change in stalled projects (numbers).

Source: RBI staff estimates. | These empirical findings indicate that a combination of factors work to ensure a durable improvement in the investment climate, and, in turn, the rate of investment in the economy. References: 1. Baker, S. R., N. Bloom and S. J. Davis (2016), “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics, Vol. 131, No. 4, pp. 1593–1636. 2. International Finance Corporation (IFC) (2016), “The Investment Climate”, Issue Brief Series, July, IFC. 3. Transparency International (2018), “Corruption Perceptions Index 2017”, Available at: https://www.transparency.org/news/feature/corruption_perceptions_index_2017. 4. World Economic Forum (2017), “The Global Competitiveness Report 2017–2018”, September, Geneva. | II.1.9 Construction activity remained subdued in 2016-17 with Q4:2016-17 recording a contraction. Recent structural reforms in the sector such as Real Estate (Regulation and Development) Act, 2016, might have produced some initial retardation before beneficial effects set in. However, this sector accelerated in Q3:2017-18 and grew by 11.5 per cent in Q4:2017-18, the highest in the 2011-12 base year series. This was also mirrored in proximate coincident indicators – steel consumption and cement production. Cement production, which contracted in seven successive months starting in December 2016, has started showing double digit growth since November 2017. Around two-thirds of cement demand emanate from the housing and real estate sector.

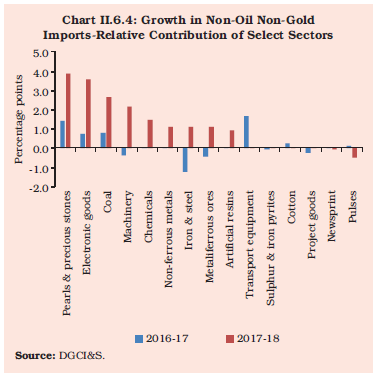

II.1.10 The share of fixed investment in dwellings, buildings and other structures dropped from 16.3 per cent of GDP in 2015-16 to 15.7 per cent in 2016-17, primarily in the household sector, followed by public non-financial corporations (Chart II.1.4). This was, however, compensated by fixed investment in machinery and equipment whose share rose from 10.6 per cent of GDP in 2015-16 to 11.9 per cent in 2016-17. Constrained by the rigidities confronting the domestic supply of capital goods cited above, domestic demand has increasingly spilled over into imports, resulting in the phenomenon of reverse substitution of domestic production by imports. II.1.11 The Reserve Bank’s Order Books, Inventories and Capacity Utilisation Survey (OBICUS) points to a pick-up in capacity utilisation in manufacturing alongside a drawdown in finished goods inventories from Q2:2017-18. The Industrial Outlook Survey (IOS) indicates that business optimism picked up relative to preceding quarters, mainly contributed by positive assessments on production, order books, capacity utilisation, employment, imports and exports. There has also been a gradual return of pricing power of manufacturing enterprises since Q3:2017-18. Stalled projects, both in numbers and value, declined in Q1:2018-19; however, new investments remained lukewarm uniformly across the government and the private sectors (Chart II.1.5). The plant load factor (PLF) in thermal power plants remained at the same level as in the previous year at about 60 per cent. Greater competition from renewable energy sources is increasingly evident. II.1.12 The infrastructure sector, which is a key barometer of the investment climate, reflects the green shoots of strengthening capital formation in the economy after a hiatus. First, the length of highway projects constructed during 2017-18 maintained its growth momentum by increasing to 9,829 km from 8,232 km in the previous year. The length of highway projects awarded during 2017-18 increased to 17,055 km from 15,949 km in the preceding year. Second, a large part of the railway capex in 2017-18 was devoted to doubling or trebling of lines, gauge conversion and electrification. A key development was the laying down of the foundation for the Mumbai-Ahmedabad bullet train project. Third, in order to cater to surging domestic air traffic, the government has awarded flight routes to various underserved and unserved airports along with viability gap funding. Fourth, re-rating of the capacities of major ports in India showed an increase in rated capacity from 1,066 to 1,359 million tonnes per annum. Fifth, the government has launched the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA) with the target of universal household electrification by March 2019.  Consumption II.1.13 As in the past, consumption remained the dominant component of aggregate demand in 2017-18, accounting for 66.6 per cent of GDP. Consumption expenditure has provided valuable support to aggregate demand through the recent slowdown, including by cushioning the shocks imparted by demonetisation and the implementation of GST. In fact, the period 2013-17 is characterised as one of consumption-led growth (RBI Annual Report, 2016-17) as it contributed 64.4 per cent of the change in GDP during these years. In particular, GFCE, buoyed by enhanced salaries, pensions and allowances under the 7th central pay commission’s award for central government employees and the one rank one pension award for defence personnel, has operated like a fiscal stimulus in a period of sluggish demand in the economy. If GFCE is excluded, the average growth of GDP of 6.9 per cent during 2016-18 would slump to 6.4 per cent. The evolution of GFCE is sketched out within a fuller analysis of public finances in section II.5. II.1.14 PFCE, the mainstay of aggregate demand in India, slowed down in 2017-18, with the deceleration more pronounced in the first half of the year. The loss of speed in PFCE reflected a combination of factors – the overhang of demonetisation, especially in respect of the unorganised sector; the initial disruptions associated with the implementation of GST; and some deceleration in rural wage growth. II.1.15 Domestic saving declined to 29.6 per cent of gross national disposable income (GNDI) in 2016-17 from 30.7 per cent in 2015-16 (Appendix Table 3). Household financial saving – the most important source of funds for investment in the economy declined to 6.7 per cent of GNDI in 2016-17, down from 8.1 per cent in 2015-16 (Table II.1.1). Saving of private non-financial corporations dropped marginally to 11.1 per cent of GNDI in 2016-17. At the same time, general government’s dissaving declined to 0.7 per cent in 2016-17 indicating sustained efforts to bring fiscal consolidation. As per the Bank’s preliminary estimates, net financial assets of the household sector increased to 7.1 per cent of GNDI in 2017-18 on account of an increase in households’ assets in the form of currency, despite an increase in households’ liabilities. | Table II.1.1: Financial Saving of the Household Sector | | (Per cent of GNDI) | | Item | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18# | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | A. Gross financial saving | 10.4 | 10.5 | 10.4 | 9.9 | 10.8 | 9.1 | 11.1 | | of which: | | | | | | | | | 1. Currency | 1.2 | 1.1 | 0.9 | 1.0 | 1.4 | -2.0 | 2.8 | | 2. Deposits | 6.0 | 6.0 | 5.8 | 4.8 | 4.6 | 6.3 | 2.9 | | 3. Shares and debentures | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | 0.2 | 0.9 | | 4. Claims on government | -0.2 | -0.1 | 0.2 | 0.0 | 0.5 | 0.4 | 0.0 | | 5. Insurance funds | 2.2 | 1.8 | 1.8 | 2.4 | 1.9 | 2.3 | 1.9 | | 6. Provident and pension funds | 1.1 | 1.5 | 1.5 | 1.5 | 2.1 | 2.0 | 2.1 | | B. Financial liabilities | 3.2 | 3.2 | 3.1 | 3.0 | 2.8 | 2.4 | 4.0 | | C. net financial saving (a-B) | 7.2 | 7.2 | 7.2 | 6.9 | 8.1 | 6.7 | 7.1 | GNDI: Gross National Disposable Income.

#: As per preliminary estimates of the Reserve Bank. The CSO will release the financial saving of the household sector on January 31, 2019 based on the latest information, as part of the ‘First Revised Estimates of National Income, Consumption Expenditure, Saving and Capital Formation for 2017-18’.

Note: Figures may not add up to total due to rounding off.

Source: CSO and RBI. | Aggregate Supply II.1.16 Aggregate supply, measured by gross value added (GVA) at basic prices expanded at a slower y-o-y pace in 2017-18, 0.6 percentage points down from 7.1 per cent in the preceding year and 0.9 percentage points below the decennial trend rate of 7.4 per cent (Appendix Table 2). Disentangling momentum from base effects, it is interesting to observe that while momentum registered an uptick in Q2, providing a much needed thrust to growth, base effects also came into play in H2. For the year 2017-18 though, annual growth rates obscure an important turning point that is picked up in quarterly changes. In terms of y-o-y quarterly growth rates, a loss of speed is discernible from Q1:2016-17 which persisted right up to a thirteen-quarter low in Q1:2017-18. In Q2, however, a turnaround – essentially powered by a surge in industrial activity – took hold, and as the agriculture and services sector joined in, GVA growth continued to accelerate in Q3 and Q4. GVA momentum, measured in terms of q-o-q seasonally adjusted annualised growth rate (SAAR), showed a marked improvement from Q2:2017-18. Services, which comprise over three-fifths of GVA rebounded in 2017-18 with a broad-based growth across sub-sectors (Table II.1.2). II.1.17 The disconnect between annual and quarterly growth rates in capturing the shifts in GVA in 2017-18 is evident in each constituent. In respect of agriculture and allied activities, GVA grew by 3.4 per cent in 2017-18 on top of record levels of foodgrains and horticulture output that fuelled a growth of 6.3 per cent a year ago. In terms of quarterly growth rates, however, a pick-up is evident in H2:2017-18. The reasonably satisfactory rabi harvest is reflected in the growth of agriculture GVA at 4.5 per cent in Q4:2017-18. Nonetheless, the contribution of agriculture and allied activities to real GVA growth declined to 7.9 per cent from 13.6 per cent in 2016-17. | Table II.1.2: Real GVA Growth (2011-12 Prices) | | (Per cent) | | | 2016-17 | 2017-18 | | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | I. Agriculture, forestry and fishing | 4.3 | 5.5 | 7.5 | 7.1 | 3.0 | 2.6 | 3.1 | 4.5 | | II. Industry | 10.2 | 7.8 | 8.8 | 8.1 | -0.4 | 7.1 | 7.3 | 8.0 | | i. Mining and quarrying | 10.5 | 9.1 | 12.1 | 18.8 | 1.7 | 6.9 | 1.4 | 2.7 | | ii. Manufacturing | 9.9 | 7.7 | 8.1 | 6.1 | -1.8 | 7.1 | 8.5 | 9.1 | | iii. Electricity, gas, water supply and other utility services | 12.4 | 7.1 | 9.5 | 8.1 | 7.1 | 7.7 | 6.1 | 7.7 | | III. Services | 8.5 | 7.4 | 6.0 | 4.9 | 8.5 | 6.4 | 7.5 | 8.2 | | i. Construction | 3.0 | 3.8 | 2.8 | -3.9 | 1.8 | 3.1 | 6.6 | 11.5 | | ii. Trade, hotels, transport, communication and services related to broadcasting | 8.9 | 7.2 | 7.5 | 5.5 | 8.4 | 8.5 | 8.5 | 6.8 | | iii. Financial, real estate and professional services | 10.5 | 8.3 | 2.8 | 1.0 | 8.4 | 6.1 | 6.9 | 5.0 | | iv. Public administration, defence and other services | 7.7 | 8.0 | 10.6 | 16.4 | 13.5 | 6.1 | 7.7 | 13.3 | | IV. GVA at basic prices | 8.3 | 7.2 | 6.9 | 6.0 | 5.6 | 6.1 | 6.6 | 7.6 | | Source: CSO. | II.1.18 To situate this assessment in some perspective, the southwest monsoon arrived two days ahead of schedule in 2017 and ten days earlier than last year, but it lost momentum during mid-July and August and this took a toll on sowing acreage in the season as a whole. Eventually, precipitation for the season as a whole was only 5 per cent below the long period average (LPA), but knock-on effects of the mid-season dry spell led to merely 0.3 per cent growth over the last year in kharif foodgrain production. Yet, it is important to note that the output level achieved in 2016-17 was an all-time record. If the 2017-18 kharif performance is evaluated against that backdrop, all crops grew by more than 10 percentage points over the average of the last 10 year production. Among cash crops, sugarcane and cotton production exceeded the preceding year’s level but jute and mesta output dropped marginally. II.1.19 Turning to the rabi season, the delayed retreat of the southwest monsoon led to late sowing. Moreover, the progress of rabi sowing was hindered by the uncertainty surrounding stubble burning and the sudden onset of cold conditions during January 2018. The deep deflation in the prices of pulses, oilseeds and several perishables also dis-incentivised acreage expansion in these crops. Ultimately, the northeast monsoon season ended with a rainfall deficiency of 11 per cent below the LPA, but supported by comfortable levels of water in major reservoirs, sowing managed to survive the vicissitudes of weather and was just 0.8 percentage points lower than last year’s level. II.1.20 Overall, India is set for a record foodgrain output in the crop year ending June 2018 increasing by 1.6 per cent y-o-y to a level of 279.5 million tonnes (Table II.1.3). The output of rice, wheat, pulses and coarse cereals is expected to have achieved record levels in 2017-18, while oilseeds production declined on account of lower production of soyabean. | Table II.1.3: Agricultural Production 2017-18 | | (Million Tonnes) | | Crop | 2016-17 | 2017-18 | Variation in 3rd of AE of 2017-18 (Per cent) | | 3rd AE | Final Estimates | Target | 2nd AE | 3rd AE | Over 2nd AE 2017-18 | Over 3rd AE 2016-17 | Over Final 2016-17 | | 1 | 2 | 3 | 4 | 5 | 6 | 8 | 7 | 9 | | Food grains | 273.4 | 275.1 | 274.6 | 277.5 | 279.5 | 0.7 | 2.2 | 1.6 | | Rice | 109.2 | 109.7 | 108.5 | 111.0 | 111.5 | 0.5 | 2.1 | 1.6 | | Wheat | 97.4 | 98.5 | 97.5 | 97.1 | 98.6 | 1.5 | 1.2 | 0.1 | | Coarse Cereals | 44.4 | 43.8 | 45.7 | 45.4 | 44.9 | -1.1 | 1.1 | 2.5 | | Pulses | 22.4 | 23.1 | 22.9 | 24.0 | 24.5 | 2.1 | 9.4 | 6.1 | | Tur | 4.6 | 4.9 | 4.3 | 4.0 | 4.2 | 5.0 | -8.7 | -14.3 | | Moong | 2.1 | 2.2 | 2.3 | 1.7 | 1.9 | 11.8 | -9.5 | -13.6 | | Urad | 2.9 | 2.8 | 2.6 | 3.2 | 3.3 | 3.1 | 13.8 | 17.9 | | Oilseeds | 32.5 | 31.3 | 35.5 | 29.9 | 30.6 | 2.3 | -5.8 | -2.2 | | Cotton # | 32.6 | 32.6 | 35.5 | 33.9 | 34.9 | 2.9 | 7.1 | 7.1 | | Jute & mesta ## | 10.3 | 11.0 | 11.7 | 10.5 | 10.6 | 1.0 | 2.9 | -3.6 | | Sugarcane (cane) | 306.0 | 306.1 | 355.0 | 353.2 | 355.1 | 0.5 | 16.0 | 16.0 | #: Million bales of 170 kgs each. ##: Million bales of 180 kgs each. AE: Advance Estimates.

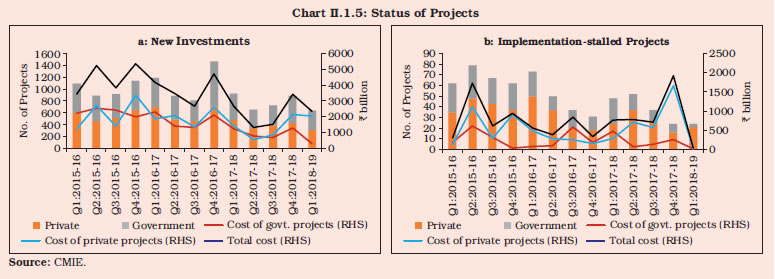

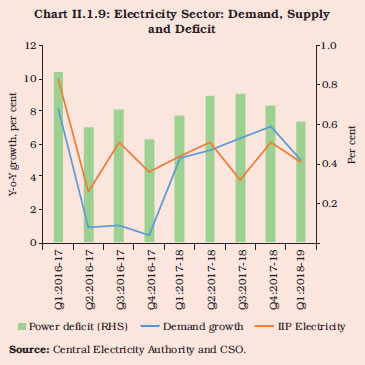

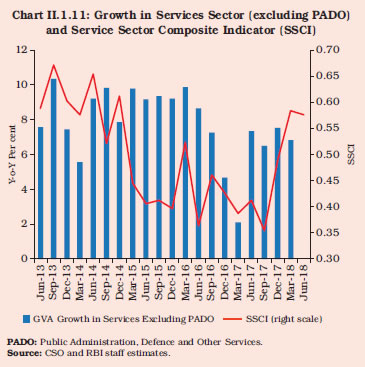

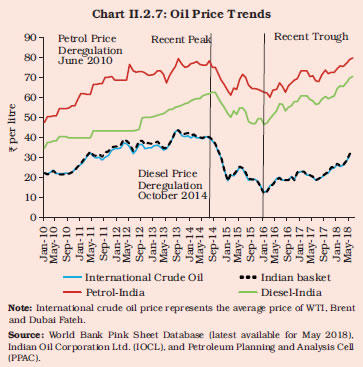

Source: Ministry of Agriculture and Farmers’ Welfare, GoI. | II.1.21 In the current southwest monsoon season so far (upto August 17, 2018), rainfall was 8 per cent below the LPA and 26 subdivisions covering 78 per cent of the area received excess/ normal rainfall. As a result, water level in 91 major reservoirs in the country replenished and turned out higher than the previous year’s level. However, the kharif sowing so far is lower by 1.5 per cent compared to the last year’s acreage. Horticulture II.1.22 Horticulture output has expanded significantly over the last few years. Accounting for 34 per cent of the value of output from crops (average over 2011-16), horticulture has imparted stability to agricultural output. In 2017-18, horticulture production touched a record level of 307.2 million tonnes, up by 2.2 per cent over the level in 2016-17. The production of fruits and vegetables increased y-o-y by 1.6 per cent and 2.2 per cent, respectively. Among the three key vegetables, the production of potato and tomato increased, while the production of onion declined during the year, mainly on account of lower acreage. The rise in horticulture productivity was not sustained in 2017-18, with the per acre production decreasing marginally by 0.06 per cent. Allied Activities II.1.23 Allied activities, which include forestry, fishing and livestock contribute around 39 per cent of the gross output in agriculture and allied activities. In order to promote allied activities, the government has set up an Animal Husbandry and Infrastructure Development Fund (AHIDF) for financing infrastructure requirements of the animal husbandry sector. The facility of Kisan Credit Card has been extended to the fisheries and livestock farmers. A National Mission on Bovine Productivity helps to reach the benefits of animal husbandry to farmers directly. The five year average growth (2012-13 till 2016-17) of allied activities has stepped up to 5.6 per cent, well above the quinquennial average growth of 2.7 per cent for the sector of agriculture and allied activities as a whole. e-NAM II.1.24 In order to create a unified national market for agricultural commodities, e-NAM, the e-trading platform for the National Agriculture Market was launched in April 2016 and its reach has been expanded considerably over the last two years. The platform now covers 585 markets across 16 states and two Union Territories (UTs) as on June 30, 2018 (Chart II.1.6). The total cumulative value of trade under e-NAM since the time of its launch has reached ₹482.15 billion, and 10.7 million farmers, 63,059 commission agents and over 0.1 million traders have registered on the e-NAM platform so far. II.1.25 The scheme has immense potential to transform the agricultural marketing structure through smoother inter-state movements, more efficient price discovery and removal of intermediaries. The adoption process, however, has been slow and gradual with a majority of traders/farmers still continuing with the manual auction method for selling their products. Recent initiatives to boost e-NAM include: (a) simplifying registration of farmers on the portal, (b) expanding payment options (addition of Unified Payment Interface) and (c) extending e-NAM trading in six languages. Measures such as third-party assaying, quality certification mechanisms, dispute settlement mechanisms and digital infrastructure will improve the adoption of e-NAM considerably. Union Budget 2018-19 Proposals II.1.26 The Union Budget 2018-19 has proposed a number of measures to enhance rural income and promote agriculture, viz., (i) setting the minimum support prices (MSPs) for crops at 1.5 times the cost of production; (ii) setting up an Agri-Market Infrastructure Fund with a corpus of ₹20 billion for developing and upgrading agricultural marketing infrastructure in the 22,000 Grameen Agricultural Markets (GrAMs) and 585 Agricultural Produce Market Committees (APMCs); (iii) creation of a Fisheries and Aquaculture Infrastructure Development Fund (FAIDF) and the AHIDF; (iv) launching a re-structured National Bamboo Mission with an outlay of ₹12.9 billion to promote the bamboo sector in a holistic manner; (v) launching an ‘‘Operation Greens’’ along the lines of ‘‘Operation Flood’’ to promote Farmer Producers Organisations (FPOs), agri-logistics, processing facilities and professional management; (vi) further expansion of the ground water irrigation scheme under the Pradhan Mantri Krishi Sinchayee Yojana - Har Khet ko Pani; and (vii) providing health protection cover of ₹0.5 million each for 100 million poor and vulnerable families. II.1.27 Currently MSPs for 23 agricultural commodities of kharif and rabi seasons are announced by the government, based on recommendations of the Commission for Agricultural Costs and Prices (CACP). Procurement at MSP is, however, largely restricted to rice (kharif season) and wheat (rabi season). As a result, the weighted average mandi prices trade below the MSP for many of the crops, e.g., urad, tur, chana, lentil, maize, groundnut, soyabean, bajra, rapeseed and mustard, causing loss to farmers. In line with the announcement in the Union Budget, the Government has recently fixed MSP for several kharif crops for the sowing season of 2018-19 which ensures a return of at least 50 per cent over the cost of production (as measured by A2 plus FL1). A few state governments have also launched their own price support schemes/financial assistance for farmers. Farm Loan Waivers II.1.28 In order to address growing farmers’ distress, several state governments, viz., Uttar Pradesh, Punjab, Maharashtra, Rajasthan and Karnataka have announced farm loan waivers. While waivers may cleanse banks’ balance sheets in the short-term, they may dis-incentivise banks from lending to agriculture in the long-term (EPW Research Foundation 2008; Rath 2008)2. Industrial Sector II.1.29 GVA growth in industry decelerated on a y-o-y basis to 5.5 per cent in 2017-18 in a sequence that commenced a year ago when it came off a recent peak of 12.1 per cent in 2015-16. Consequently, the weighted contribution of industry to overall GVA growth declined from 33.5 per cent in 2015-16 to 20.0 per cent in 2017-18. Also, the cyclical component of growth (estimated through a univariate approach using the Hodrick-Prescott filter) turned negative in 2017-18 and capacity utilisation in the manufacturing sub-sector remained below the 10-year average (Chart II.1.7 a and b). II.1.30 On a seasonally adjusted three-quarter moving average annualised basis, industrial GVA growth recovered sharply in Q2 and maintained an upward trajectory thereafter. Similarly, seasonally adjusted industry GVA showed that the revival in industrial activity in 2017-18:Q2-Q4 was primarily driven by momentum. II.1.31 As stated earlier, annual changes mask the inflexion points in the evolution of industrial output during the course of the year. Quarterly growth rates reflected a protracted slowdown that started during Q2:2016-17 and slid into a contraction in Q1:2017-18. In Q2, however, there was a rebound driven by manufacturing and electricity generation, which helped the overall value added to shrug off the drag from mining. Over H2:2017-18, the tempo of expansion in industrial GVA was sustained on the shoulders of an acceleration in manufacturing, despite the support from the electricity sub-sector moderating and a slump in mining output. II.1.32 The deceleration in the growth of GVA in industry in 2017-18 in relation to the preceding year is also reflected in the index of industrial production (IIP), although intra-year movements in industrial output reflected an underlying improvement gathering (Table II.1.4). At a sectoral level, the recovery was witnessed in the manufacturing sector, while mining and electricity sectors decelerated. In 2018-19 so far (April-June), industrial activity improved on the back of manufacturing and mining even though electricity generation expanded at a subdued pace. In terms of use based activity, primary goods, capital goods, consumer durables and infrastructure/construction goods contributed to the acceleration in the IIP growth. II.1.33 While mining and quarrying output has been considerably volatile in recent years on account of commodity-specific constraints, favourable base effects enabled a pick-up in Q2 from a flatter outcome in the preceding quarter. The upturn was short-lived, however, as coal and natural gas production fell off and crude oil output declined. Coal output decelerated for three successive years (2015-16 to 2017-18). Consequently, the reliance on imported coal for thermal power plants has reduced only marginally. The planned production ramp-up by Coal India Limited (CIL) has been hit by ageing mines, depleting resources and rising output costs with a progressively increasing strip ratio3. Recent initiatives to allocate additional coal mines and easing regulations for coal-bed methane extraction could boost CIL’s output. The output of fossil fuels, viz., crude oil and natural gas, has been constrained by the natural decline in extraction from ageing oil fields and factors like uncertain price policy, power shut downs, water cuts, and labour related frictions. Iron ore has been the clear bright spot in mining commodities in recent years, and its output growth in 2017-18 remained strong despite disruptions in the major mining states of Odisha and Goa. The growth in iron ore mining was helped by the underlying growth of steel demand, both domestic and global; favourable commodity prices and trade policy interventions. | Table II.1.4: Index of Industrial Production (Base 2011-12) | | (Per cent) | | Industry Group | Weight in

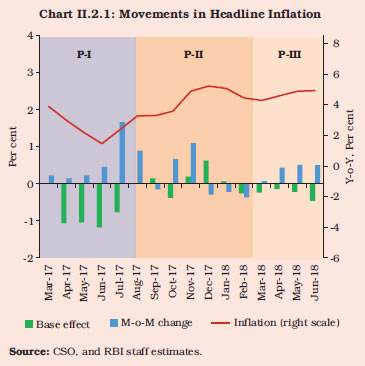

IIP | Growth Rate | | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | Apr-June 2017-18 | Apr-June 2018-19 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | Overall IIP | 100.0 | 3.4 | 4.0 | 3.4 | 4.6 | 4.3 | 1.9 | 5.2 | | Mining | 14.4 | -0.1 | -1.4 | 4.3 | 5.3 | 2.3 | 1.1 | 5.4 | | Manufacturing | 77.6 | 3.6 | 3.9 | 3.0 | 4.4 | 4.5 | 1.6 | 5.2 | | Electricity | 8.0 | 6.1 | 14.8 | 5.7 | 5.8 | 5.4 | 5.3 | 4.9 | | Use-Based | | | | | | | | | | Primary goods | 34.0 | 2.3 | 3.8 | 5.0 | 4.9 | 3.7 | 2.2 | 5.9 | | Capital goods | 8.2 | -3.6 | -0.8 | 2.1 | 3.2 | 4.4 | -4.2 | 9.5 | | Intermediate goods | 17.2 | 4.5 | 6.2 | 1.5 | 3.3 | 2.2 | 1.0 | 1.6 | | Infrastructure/Construction goods | 12.3 | 5.7 | 5.0 | 2.8 | 3.9 | 5.5 | 1.7 | 7.7 | | Consumer durables | 12.8 | 5.7 | 4.0 | 4.2 | 2.9 | 0.6 | -1.2 | 7.3 | | Consumer non-durables | 15.3 | 3.7 | 4.1 | 2.7 | 7.9 | 10.3 | 7.8 | 1.8 | | Source: CSO. | II.1.34 The recovery in manufacturing was broad-based with production in 15 industry groups out of the total of 23 industry groups expanding during H2:2017-18 vis-à-vis only 10 industries during H1. By Q3, the combined contribution of items that registered expansion had decisively reversed the five preceding quarters of decline. II.1.35 Among the major industry groups, coke and refined petroleum, chemical and chemical products, food products, machinery and equipment and other non-metallic mineral products together accounted for 33.8 per cent of the IIP, which witnessed a turnaround in performance. Pharmaceuticals registered the highest growth rates driven by digestive enzymes and antacids (DEAs). Electrical equipment has remained in contraction mode through Q1-Q4:2017-18. II.1.36 Indicators of financial performance of listed manufacturing firms reveal that the deceleration in sales growth in Q1:2017-18 – possibly due to GST-induced de-stocking by downstream distribution channels – reversed thereafter and sales growth rebounded in Q2-Q4. Moreover, a slow return of pricing power is also taking root amidst rising input cost pressures; consequently, profit margins are improving (Chart II.1.8a). Indicators of operational performance from the RBI’s OBICUS survey point to a reduction in inventory levels for manufacturing firms in Q4:2017-18. Also, the capacity utilisation level improved in Q2-Q4:2017-18 after deteriorating marginally in Q1:2017-18 (Chart II.1.8b). II.1.37 As regards expectations, manufacturing firms polled in the RBI Industrial Outlook Survey turned optimistic in Q3-Q4:2017-18, though the expectations for Q1-Q2:2018-19 dipped due to weaker prospects for production, order books, profit margins and overall financial situation. II.1.38 Electricity generation began on a strong note with sequential acceleration in H1 of 2017-18 on the back of a revival in demand from Distribution Companies (DISCOMs). Demand accelerated in Q3 as a strong pick-up in manufacturing joined a situation in which supply was unable to keep pace, increasing the power deficit. In Q4 though, supply accelerated, reducing the power deficit (Chart II.1.9). Demand-supply dynamics were reflected in spot prices peaking in Q3:2017-18 on the Indian Energy Exchange, when the power deficit was the highest.  II.1.39 In terms of sources, thermal power, which has the highest share, was beset with challenges impacting both demand and supply. On the demand side, financial vulnerability of DISCOMs has constrained offtake and led to aversion to enter into new long-term power purchase agreements (PPAs). Some DISCOMs have defaulted on such existing agreements, substituting them with lower cost spot-market purchases. Ujwal DISCOM Assurance Yojana (UDAY) has yielded some results in bridging the gap between aggregate cost of supply and aggregate revenue realised through interventions in lowering finance costs, reducing aggregate technical and commercial losses, and increasing prices for the domestic segment. However, the progress has been uneven across states with spillover effects for power generation companies – particularly for thermal power plants with high-cost PPAs. Excess capacity continues to persist in the thermal power sector (especially in the private sector) with plants operating at sub-optimal plant load factor (PLF) that in turn could undermine their financial viability going forward. II.1.40 Renewable energy has seen higher consistent growth during the year. Over the last 10 years, installed capacity increased almost 6 times – from 11.1 GW in 2007-08 to 65.5 GW in 2017-18 – and its share in power generation increased from 3.0 per cent in 2007-08 to 7.1 per cent in 2017-18. The composition of renewable energy itself is undergoing structural change, with the share of solar rising sharply to around 24 per cent in 2017-18 from a negligible level in 2007-08. The higher growth in renewables is in part driven by emissions targets committed under the Paris Climate Accord. Photo-Voltaic (PV) cell costs have declined sharply with increasing technology maturity and scale of production. The renewable energy target set by the government (175 GW installed capacity by 2022) gives the highest priority to solar energy (100 GW installed capacity). India has taken the lead in international co-operation for solar energy development, by taking a leadership role in establishing the International Solar Alliance (ISA), a platform for sharing affordable technology and mobilising low-cost finance among member nations. The ISA has set a target of 1 Terawatt (TW) of solar energy by 2030. As the host and secretariat to ISA, India will provide 500 training slots for ISA member countries and start a solar tech mission to lead research and development (R&D). II.1.41 On a use-based classification, IIP growth in H1:2017-18 was primarily attributable to primary goods and consumer non-durables. By contrast, the acceleration in H2 was driven by capital goods, infrastructure/construction goods and intermediate goods. II.1.42 Capital goods output – considered an indicator of capital formation/investment – recovered from contraction mode since September 2016 (barring expansion in November 2016 and March 2017) and expanded for seven successive months since August 2017. Transportation and manufacturing sector related investment goods like commercial vehicles and vehicle parts, tyres, ship building, separators and sugar machinery were the drivers. Infrastructure/construction goods expanded in H1, with strong growth in iron and steel related products outweighing the contraction in cement production. The segment regained strength and posted acceleration in H2 due to a sharp pick-up in cement production and continued strong growth in iron and steel on progress in government driven infrastructure projects, including affordable housing. II.1.43 Consumer non-durables, the strongest driver from the use-based side was heavily influenced by pharmaceuticals, in particular, DEAs. Excluding DEAs, this category would have contracted in H1, although components within the food and beverages industry group like sugar, milk, poultry meat and shrimps revived activity in the category in H2. Consumer durables output resumed growth from November 2017 onwards after contraction in 9 out of previous 11 months. In the case of intermediate goods, output growth closely followed that of manufacturing. Services Sector II.1.44 In contrast to the industrial sector, the services sector growth accelerated on a y-o-y basis to 7.6 per cent in 2017-18 breaking the sequence of two years of deceleration. Also, excluding the government driven PADO component, service sector growth rate accelerated from 5.7 per cent in 2016-17 to 7.0 per cent in 2017-18. Nevertheless these growth rates remain significantly lower than the recent high of 9.3 per cent (2014-16). II.1.45 On a seasonally adjusted three-quarter moving average annualised basis, services GVA growth (excluding PADO) recovered sharply in Q1, influenced by the acceleration in trade and real estate segments due to the push to clear inventories before the GST launch. Seasonally adjusted and decomposed into momentum (q-o-q changes) and base effects, the momentum achieved in Q1 weakened in the subsequent quarters. II.1.46 The recovery in services GVA was fairly broad-based across constituent sub-sectors (Chart II.1.10a). In terms of weighted contribution to growth, that of PADO declined marginally in 2017-18, while all other sub-sectors witnessed improvement (Chart II.1.10b). II.1.47 The CSO’s initial GVA estimates of the services sector are based on the benchmark-indicator method. Construction GVA accelerated in 2017-18 with steel consumption growing at a sustained pace throughout and cement production accelerating in Q3-Q4. The key drivers were government infrastructure projects. II.1.48 Trade, hotels, transport, communication and services related to broadcasting posted robust growth which was sustained through the year, visible also in the performance of coincident indicators4. Trade and transport are the biggest components, accounting for 59 per cent and 26 per cent, respectively, of this sub-sector. In the transport segment, railways, road and services incidental to transport are the biggest sub-components with shares of 15 per cent, 66 per cent and 16 per cent, respectively. Under rail transport, net tonne kilometres (70 per cent weight) registered significant acceleration in H2 while passenger traffic (30 per cent weight) growth remained subdued throughout the year. In the road transport segment, the stock of commercial vehicles on road accelerated from Q2:2017-18 onwards, with sales of new commercial vehicles showing robust growth. The acceleration observed in transport sector indicators during 2017-18 continued in Q1:2018-19, reflected in both rail freight traffic and commercial vehicle sales. II.1.49 The major components of financial, real estate and professional services sub-sector are ownership of dwellings (29 per cent), financial services (28 per cent share) and IT services (21 per cent). Under financial services, bank credit accelerated significantly in H2 after a subdued performance in the preceding half. Aggregate deposits, in contrast, decelerated sharply in H2 after registering strong growth in H1:2017-18. In the case of IT services, the resilient EBITDA posted a growth of 5.7 per cent while the growth in staff costs was broadly positive in 2017-18. Exports of software services showed improvement though they faced uncertainties from visa policies in the United States and Australia. PADO continued to provide an upward thrust to the sector.  II.1.50 The Reserve Bank’s service sector composite index (SSCI), which extracts and combines information collated from high frequency indicators and statistically leads GVA growth in the services sector turned up in Q3:2017-18 (Chart II.1.11). A downward tendency in SSCI for Q1:2018-19, may be indicative of subdued services sector activity. Employment II.1.51 Formal sector employment, compiled from payroll data (Employees’ Provident Fund Organisation, Employees’ State Insurance Corporation and National Pension System) points towards an improvement in jobs created in 2017-18 vis-à-vis 2016-17. Total new subscribers (combined for the aforementioned three schemes) added per month improved from 1.6 million in 2016-17 to 1.8 million in 2017-18. Further, the Labour Bureau Quarterly Employment Survey, which measures addition to employment in the organised sector across eight sectors, indicates an incremental employment of 0.2 million in 2017-18 (up to September) which was higher than Q1-Q2:2016-17 by 0.9 lakhs. II.1.52 The Union Budget 2017-18 had emphasised on energising of the youth through education, skills and jobs. The Skill India Mission launched in July 2015 to maximise the benefits of a huge demographic advantage was intensified by the Skill Acquisition and Knowledge Awareness for Livelihood Promotion Programme (SANKALP) launched at a cost of ₹40 billion in 2017-18. It is expected to provide market relevant trainings to around 35 million youth. Further, the next phase of Skill Strengthening for Industrial Value Enhancement (STRIVE), launched at a cost of ₹22 billion in 2017-18 with a focus on improving the quality and market relevance of vocational trainings provided in it, would strengthen the apprenticeship programmes through an industry cluster approach. A special scheme for creating employment in the textile sector has already been launched, and a similar scheme was to be implemented for leather and footwear industries in 2017-18. II.1.53 Going forward, the focus of Union Budget 2018-19 on certain sectors such as agriculture, infrastructure, small and medium enterprises (SMEs) and also rural areas in general may provide a further fillip to consumption demand. The expected normal southwest monsoon in 2018 may also facilitate in keeping rural demand at an elevated level. II.1.54 To sum up, economic activity in the Indian economy exhibited resilience in the face of several shocks during the year – demonetisation’s after effects; GST implementation; spillovers from global sell-offs in bonds and equities; bouts of capital outflows; frauds in domestic banking system amidst mounting loan delinquencies and capital constraints; and the ongoing terms of trade erosion. In this setting, loss of speed in GDP growth of 0.4 percentage points in relation to the preceding year notwithstanding, India’s real GDP growth at 6.7 per cent was still among the highest for major continental-sized economies in the world. In the second half of the year, the impact of these drag factors started gradually dissipating and average real GDP growth accelerated to 7.4 per cent, exceeding the annual pace of growth in 2016-17. Importantly from a forward looking perspective, several turning points were passed in various quarters during the year – notably, gross fixed investment on the demand side, and on the supply side, manufacturing in industrial activity and construction in services. If these inflexions take firmer hold, they should support an enduring acceleration of momentum in the economy and spur an expansion into employment and incomes all around. II.1.55 Agriculture and allied activities have provided a solid foundation to the Indian economy, especially in a year marked by several shocks (as alluded to earlier). A second successive year of bumper production of foodgrains and horticulture on the back of reasonably good monsoons has not, however, translated adequately into a boost to farm and rural incomes. Adverse and worsening terms of trade and high variability in the access to international markets has sapped away the large gains in production. II.2 PRICE SITUATION II.2.1 A distinctive feature of the evolution of headline inflation5 during 2017-18 has been its high variability, notwithstanding lower average inflation relative to its history through the new series (Table II.2.1). Against this backdrop, sub-section 1 discusses the movements in headline inflation through three phases during the year, with food inflation playing an important role in both disinflationary and reflationary periods. Sub-section 2 assesses global inflation developments, which is followed by a detailed analysis of the major constituents of inflation in sub-section 3, with an emphasis on the drivers of food, fuel, and excluding food and fuel inflation. Sub-section 4 discusses other indicators of inflation such as sectoral consumer price index (CPI), wholesale price index (WPI), and GDP deflators as well as movements in wages – both rural wages and corporate staff costs. Sub-section 5 provides some concluding observations. | Table II.2.1: Headline Inflation – Key Summary Statistics | | (Per cent) | | Statistics | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2017-18

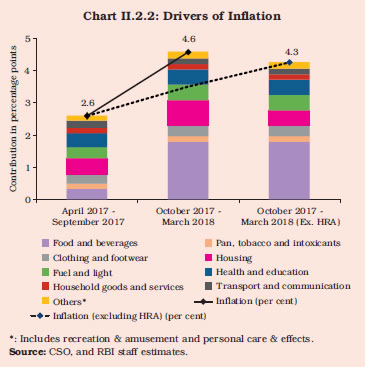

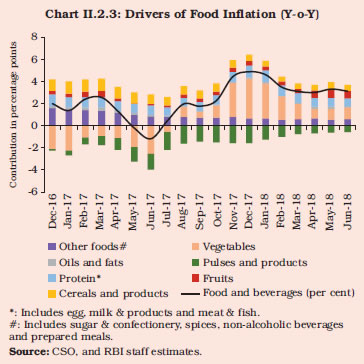

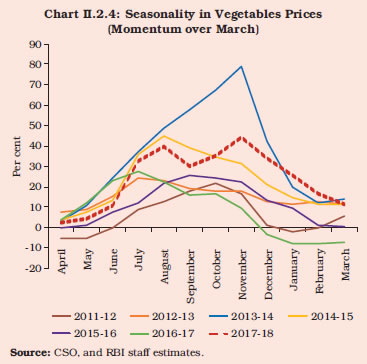

(excluding HRA)* | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | Mean | 10.0 | 9.4 | 5.8 | 4.9 | 4.5 | 3.6 | 3.4 | | Standard deviation | 0.5 | 1.3 | 1.5 | 0.7 | 1.0 | 1.2 | 1.1 | | Skewness | 0.2 | -0.2 | -0.1 | -0.9 | 0.2 | -0.2 | -0.2 | | Kurtosis | -0.2 | -0.5 | -1.0 | -0.1 | -1.6 | -1.0 | -0.8 | | Median | 10.1 | 9.5 | 5.5 | 5.0 | 4.3 | 3.4 | 3.3 | | Maximum | 10.9 | 11.5 | 7.9 | 5.7 | 6.1 | 5.2 | 4.9 | | Minimum | 9.3 | 7.3 | 3.3 | 3.7 | 3.2 | 1.5 | 1.5 | *: Excluding the impact of house rent allowance (HRA) for central government employees under the 7th Central Pay Commission (CPC) award.

Note: Skewness and kurtosis are unit-free.

Source: Central Statistics Office (CSO), and RBI staff estimates. | 1. Headline CPI Inflation II.2.2 In a surprise relative to expectations and consensus forecasts, inflation fell off the precipice in Q1 under the weight of overhang of the supply glut in inflation-sensitive food items, notably pulses and oilseeds, as well as higher mandi arrivals of some vegetables such as potatoes and onions. In the event, instead of the usual pre-monsoon upturn, food prices sank into deflation, taking headline inflation down into a temporary breach of the tolerance floor of the inflation target band. At 1.5 per cent in June 2017, it was the lowest reading in the new CPI series. Moreover, continuing deflation in the prices of pulses and spices (during June-March, 2017-18), along with moderation in prices of overall food and miscellaneous components imparted a negative skew to headline inflation, as against a positive skew during 2016-17. II.2.3 From July, a confluence of domestic and global developments propelled headline inflation up by 375 basis points (bps) to 5.2 per cent in December 2017, a 17-month high (Chart II.2.1). Just as in the disinflation phase, the reflation was led by prices of vegetables, particularly of tomatoes and onions. The disbursement of house rent allowance (HRA) for central government employees under the 7th Central Pay Commission’s award added momentum. In particular, the prices of vegetables surged in an unseasonal spike during October-November due to the late withdrawal of southwest monsoon leading to the damage of some crops. The usual seasonal softening in food prices with the arrival of the winter harvest finally occurred with a delay in December which, together with pro-active supply management measures adopted by the government – import of onions and imposition of a minimum export price (MEP) – helped contain price pressures and headline inflation ebbed to 4.3 per cent in March 2018. Excluding the effect of the HRA, it was even lower at 3.9 per cent. Strikingly, the weighted contribution of inflation excluding food and fuel to headline inflation jumped up in Q3:2017-18 and persisted at elevated levels through March 2018 with signs of a closing output gap and rising capacity utilisation.  II.2.4 For the year as a whole, inflation came down on an annual average basis to 3.6 per cent in 2017-18, around 90 bps lower than a year ago. Excluding the impact of HRA, annual average inflation during 2017-18 stood at 3.4 per cent (Table II.2.1). The decline was not broad-based though, with housing and fuel inflation increasing in 2017-18 (Appendix Table 4). On several occasions during the year, households looked through transient falls in their inflation expectations formation, suggesting that adaptivity is slowly giving way to forward-looking behaviour, in line with the broad consensus in the literature6. II.2.5 According to the March 2018 round of the Reserve Bank’s survey, inflation expectations remained elevated for both three months ahead and a year ahead horizons. This is also corroborated by more forward-looking professional forecasters in the Reserve Bank’s March 2018 round of the survey of professional forecasters. II.2.6 Beginning 2018-19, headline inflation picked up during Q1:2018-19 largely led by increase in prices within food, fuel and miscellaneous sub-groups. While price pressures were broad-based in case of miscellaneous component, within food group upside pressures primarily emanated from vegetables and select protein-rich items like meat and fish. 2. Global Inflation Developments II.2.7 Domestic inflation developments acquire contextual relevance when they are situated in a global perspective. Globally, prices of agricultural commodities, especially of food items such as cereals, sugar and edible oils like soyabean remained broadly soft during the year, reflecting abundant supply. In the non-food category, metal prices hardened due to strong demand from China, which accounts for more than half of global consumption. Global crude oil prices were supported by the decision of the Organisation of the Petroleum Exporting Countries (OPEC) and non-OPEC producers – led by Russia – in November 2017 to extend the cut in oil production by 1.8 million barrels per day till the end of 2018. The price of the Indian basket of crude oil moved in tandem and rose to US$ 64 per barrel in March 2018 from US$ 51 per barrel in March 2017. II.2.8 Against this backdrop, an interesting development has been that even as inflation has picked up with economic recovery in advanced economies during 2017, it has eased in emerging and developing Asia despite stable economic growth and rising global commodity prices, suggesting an important role for inflation targeting (IT) as a monetary policy framework and its gradual refinements over the years in a number of Asian economies (Box II.2.1). 3. Constituents of CPI Inflation in India II.2.9 Circling back to the domestic price front, intra-year movements in headline inflation were underpinned by significant shifts at the sub-group level (Chart II.2.2). Subsequent paragraphs will profile the key drivers of the collapse of food inflation in the first half of the year and its surge in the second half, the sustained increase in fuel inflation from Q2 albeit with some moderation in Q4, and the upturn in inflation in ‘excluding food and fuel category’ during the second half of the year causing it to exceed 5 per cent from December 2017 and to rule above headline all through March 2018.

Box II.2.1

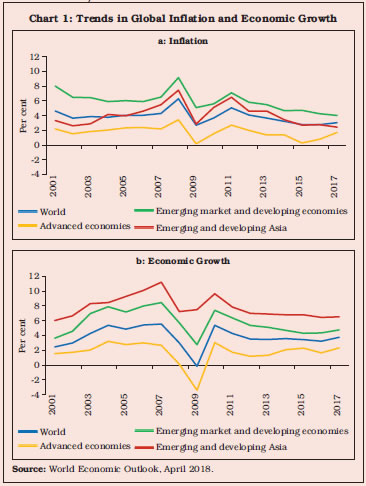

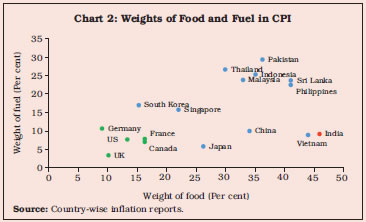

Inflation in Asia after the Global Financial Crisis - How is it Different from the Rest of the World? While the advanced economies have witnessed a pick-up in inflation along with economic recovery, after a prolonged period of deflationary risks, emerging market and developing economies (EMDEs) as a group, and emerging and developing Asia7 in particular, have continued to record moderation in inflation (Charts 1.a & 1.b). A cross-country comparison of weights of fuel and food in the CPI shows that the weights are generally higher in select Asian economies than in advanced economies (Chart 2). Therefore, the impact of rising global fuel and food prices since 2015 should have resulted in rising inflation (instead of moderation) in Asia.

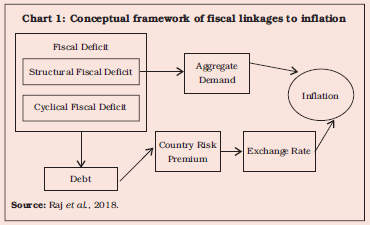

Against this backdrop, the underlying drivers of inflation in Asia were examined in a panel framework. The data set included eleven Asian economies of which six are inflation targeters8 and five advanced economies among which Canada, UK, Germany and France (as part of the euro area) are inflation targeters. Drawing from the literature (Fraga et al, 2003; Mishkin and Hebbel, 2001), a dynamic panel data model in equation (1) with the Arellano-Bover/Blundell-Bond system generalised method of moments (GMM) estimation was carried out on a panel comprising annual data for the 16 economies for the period 1990 to 20179. The base model (1) aims at analysing the impact of the adoption of inflation targeting (IT) (modelled as a dummy variable taking the value 1 from the adoption year of IT and value 0 in the pre-IT years) on inflation for the entire set of countries while controlling for factors like the output gap and its lag, the fiscal deficit, the exchange rate (expressed in local currency unit per US$), global energy prices and import share in GDP. While the IT dummy, import share and global energy price inflation were considered to be exogenous variables in the model, the output gap, the fiscal deficit and the exchange rate were treated as endogenous10:

| Table 1: Results of the Dynamic Panel Data Models11 | | Explanatory Variables | 16 Countries: 1990-2017

Dependent Variable: Inflation | 11 Asian Countries: 2001-2017

Dependent Variable: Inflation | | Coefficient | Z-value | Coefficient | Z-value | | 1 | 2 | 3 | 4 | 5 | | inflationi,t-1 | 0.36 | 2.73** | 0.45 | 4.25*** | | ITdummyit | -1.36 | -1.76* | -2.17 | -1.79* | | exchange rateit | 0.32 | 1.30 | 0.71 | 2.35** | | fiscal deficitit | 0.11 | 2.24** | 0.03 | 0.27 | | output gapit | -0.36 | -0.90 | 0.10 | 1.31 | | output gapi,t-1 | 0.68 | 1.54 | 0.21 | 2.69** | | global energy inflationt | 0.02 | 2.72** | 0.02 | 3.06** | | import share in GDPit | 0.004 | 0.64 | 0.02 | 1.72* | | constant | 1.94 | 3.15** | -0.20 | -0.31 | | No. of observations | 406 | 172 | | Wald chi2(8) | 835.18*** | 687.09*** | Note: *, ** and *** indicate 10 per cent, 5 per cent and 1 per cent levels of significance, respectively.

Source: RBI staff estimates. | where, i stands for country, t stands for year and ϵit is the error term. The results show the IT dummy to be statistically significant with the expected negative sign, indicating the role of inflation targeting in lowering inflation (Table 1). Interestingly, the coefficients of past inflation (ρ) also turned out to be statistically significant, along with the exogenous shock of global energy price inflation and the fiscal deficit. It seems that while inflation targeting has acquired some success, factors like supply shocks (such as global oil price shock) and inflation inertia or history (which can adaptively drive inflation expectations) still continue to play a role in shaping inflation dynamics. The base model was run with a truncated set of countries and time period (11 Asian economies and for 2001-2017). This time the IT dummy variable was set up to take the value 1 in case of inflation targeters and 0 otherwise. Also, the starting year of the truncated sample period was considered from 2001, taking into account China’s entry into the World Trade Organisation (WTO) and its potential role in influencing regional and global inflation dynamics. While the coefficient associated with the IT dummy turned out to be statistically significant with a larger negative value, the results also suggested an increasing role of inflation persistence (lagged inflation) along with factors like supply shocks in terms of global energy price inflation, exchange rate depreciation and import share in GDP in determining inflation dynamics. Also, interestingly, the lagged output gap coefficient turned out to be statistically significant with a positive sign, which was not the case in the full sample model. This suggests that while inflation targeting has been and is an important factor in the moderation of inflation in Asian countries, other factors like exchange rate, energy prices as well as domestic demand conditions also play a role. | Table 2: Evolution of Inflation Targeting in Select Asian Economies | | Country | Year of Adoption | Target Measure | Target Horizon | Initial Target | Target Measure in 2018 | Target Horizon

(Year of Change) | Target 2018 | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | South Korea | 1998 | Headline CPI | Annual | 9%±1%

(Range) | Headline CPI** | Medium term - 3 years (2004) | 2.0%

(Point) | | Thailand | 2000 | Core CPI | Quarterly | 0 - 3.5%

(Range) | Headline CPI

(Since 2015) | Medium term and Annual (2016) | 2.5%±1.5%

(Point + Tolerance) | | Philippines | 2002 | Headline CPI | Annual | 4.5%-5.5%

(Range) | Headline CPI | Medium term - 3 years (2010) | 3%±1%

(Point + Tolerance) | | Indonesia | 2005 | Headline CPI | Annual targets

announced

at once for 3

years | 6%±1% | Headline CPI | Medium term - 3 years (2014) | 3.5%±1% | | Japan | 2013 | Headline CPI | Annual | 2% | Headline CPI | Annual | 2% | | India | 2016* | Headline CPI | 5 years

(2016-21) | 4%±2% | Headline CPI | 5 years | 4%±2% | *: Prior to May 2016, the flexible IT framework was governed by the Agreement on Monetary Policy Framework of February 20, 2015.

**: 2000-changed to core CPI, 2007-changed back to headline CPI.