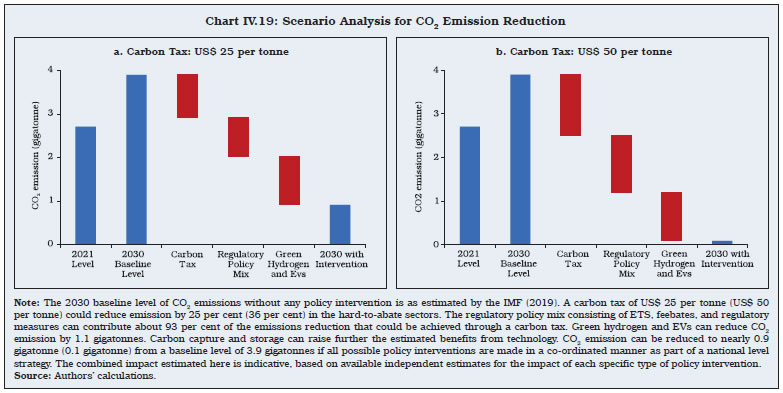

The enormous scale of the green transition challenge and the colossal cost of delayed policy actions warrant a comprehensive decarbonisation strategy, encompassing all carbon emitting sectors of the economy and all available policy levers – fiscal, technology, regulatory, trade and monetary. The policy mix needs to strike the right balance between a carbon tax, technology support for non-fossil fuel, green hydrogen, carbon capture and storage, standards for energy efficiency, regulatory tweaks incentivising flow of adequate resources for green projects and adoption of energy saving appliances at home and in business establishments. Estimates suggest that compared with a no policy action scenario that could increase India’s carbon emissions to 3.9 gigatonnes by 2030 (from 2.7 gigatonnes in 2021), a balanced policy intervention can lower carbon emissions to 0.9 gigatonne by 2030. 1. Introduction IV.1 A successful transition to a net zero economy would require a strategy of “deep decarbonisation” encompassing all carbon emitting sectors, ranging from power generation and transportation to industrial production processes, construction activity, agriculture, and above all, nudging the citizens to change their lifestyle habits and consumption preferences. India’s emphasis on the Mission LiFE (Lifestyle for Environment) aims at making individuals adopt sustainable lifestyles to minimise carbon footprints. Even as firms and households have progressively been adopting greener business practices and lifestyle changes, the enormous scale of the transition challenge and the colossal cost of delayed actions warrant comprehensive policy interventions using all feasible options as an integral part of the country’s decarbonisation strategy. India already has a long-term low-carbon development strategy in place (MoEFCC, 2022), which sets out clearly the country’s envisaged multi-pronged climate action plans. International experience and emerging risk mitigating policy options, however, suggest that the strategy may have to be dynamic to be effective, and there must be an unwavering commitment displayed through timely actions to achieve the net zero target. IV.2 An effective strategy would first need to recognise the dimension of the challenge. Of the current annual carbon emissions in India, about 40 per cent could be addressed by replacing fossil fuels with renewables, another 15 per cent by switching over to electric vehicles (EVs) and energy efficient electrical appliances in residences and business establishments. The remaining 45 per cent, however, relate to hard-to-abate sectors, viz., heavy industries, animal husbandry and agriculture (Mony, 2022). They are hard to abate because either technology to support the green transition is not available or the cost is prohibitive. A business-as-usual scenario can only increase the annual absolute size of carbon emissions by about 2.6 times between 2020 and 2050 (Paltsev et al., 2022). While use of more renewables and energy efficient practices can reduce emissions from the hard-to-abate sectors by 15-20 per cent by 2050, appropriate carbon pricing would be critical to reducing carbon emissions by 80 per cent by 2050. The Energy Conservation (Amendment) Act, 2022 recognises the importance of carbon pricing and aims at development of a carbon market or an emissions trading system (ETS), where the focus will be on reduction of carbon emissions rather than the current emphasis on energy efficiency under the Perform, Achieve and Trade (PAT) scheme. In the context of the forthcoming Carbon Border Adjustment Mechanism (CBAM) of the European Union (EU), an early attention to carbon tax/ETS in India has become necessary. IV.3 The second key dimension of the challenge is the scale of resources required for mitigation, adaptation and disaster management. Financial resources have two key components – cost and availability – but much of the current policy focus has been on keeping the cost low through greenium. The real challenge for India will be in arranging new investment, estimated to be in the range of US$ 7.2 trillion (baseline scenario) to US$ 12.1 trillion (accelerated scenario) till 2050 (Ghosh, 2023). One of the related challenges in financial planning would be managing the costs of decarbonisation – as several carbon emitting industries, buildings and firms would have already made large fixed investments, while also deploying considerable labour force, which may have to be re-trained to facilitate re-deployment in greener ventures. IV.4 The third dimension relates to access to technology and mineral resources at an affordable cost. Increasing dependence on new technologies used in batteries; solar panels and wind turbines; green hydrogen; carbon capture, utilisation and storage (CCUS); and e-waste management would require higher expenditure on research and development (R&D) and strategic collaboration. Currently, there is a high degree of concentration in the solar supply chain – polysilicon, silicon wafer, photovoltaic (PV) cells and PV modules – and access to strategic minerals such as lithium, rare earths, copper, zinc, chromium and graphite. Therefore, the goal of enhancing and securing the capacity for a successful green transition may have to contend with known and unknown impediments. Increasing geo-economic fragmentation of the world economy is amplifying uncertainty about access to technology, industrial raw materials and final products for individual countries, with a few major economies cornering disproportionately large shares of available global supplies. IV.5 Each sector of the economy faces formidable challenges that could potentially slow down the pace of green transition. Globally, rice farming, cattle rearing and biomass burning are estimated to account for more than a fifth of total methane emissions. While India has a National Mission for Sustainable Agriculture (NMSA) to promote climate-smart agriculture and climate-smart villages aimed at avoiding excessive use of water and electricity, adopting climate resilient cropping practices, and reducing carbon emissions; wider adoption on a sustained basis would be required going ahead. In the power sector, despite laudable progress in generating renewable energy, the country’s dependence on fossil fuels remains large, and the financial stress facing electricity distribution companies, though easing in recent years, continues. In the transportation sector, the state road transport companies have limited financial capacity to phase out old vehicles, and the cost of EVs needs to fall much more to enhance their attractiveness to the common man. While solar and wind energy generation costs are reducing, their uneven supply cycles pose a major challenge given the costs of storage technology. In the construction sector, despite known climate-smart building techniques and guidelines, most construction projects prefer extant low-cost techniques, in view of the large shortages of housing in urban areas and the rising cost of construction in the country. Despite sustained efforts of the Bureau of Energy Efficiency (BEE) and rising enforcement of efficiency norms, energy conservation practices are not widely adopted in businesses. The limited financial capacity of several municipal corporations has been a constraint for sewage and waste treatment in cities in sync with the national green transition plans. Therefore, a multi-pronged policy approach is necessary that recognises the trade-offs of each policy intervention and uses a mix of incentives and enforcement for optimal results that accelerate green transition. IV.6 Set against this context, this chapter explores the policy choices available to India today for transitioning to a greener and cleaner India over the coming decades. The broad available policy levers include fiscal policy, technology-enabled solutions, regulatory measures, trade policy, and monetary policy, besides energy conservation norms for wider voluntary adoption by the households and more effective interventions by firms under corporate social responsibility recognising the rising preference of investors, shareholders and other key stakeholders in every business for pro-planet realignment of business strategies. Governments, the world over, have been leading the fight against climate change risks by setting national climate action plans, coordinating across borders with key stakeholders, identifying national-level challenges to sustainable development and nudging individuals and firms to embrace climate-friendly lifestyles and business practices. Section 2 discusses fiscal policy initiatives and options, such as the current tax-subsidy mix and budgetary allocations, carbon taxes, ETS, and sovereign green bonds. Section 3 explores evolving innovations and technology-based solutions across various sectors that are essential for securing desirable progress towards a greener and cleaner India. Section 4 examines the scope in trade policy for accelerating the pace of green transition. Section 5 reviews and proposes a gamut of regulatory measures to support the green transition, while Section 6 delves into market-based solutions. Section 7 discusses the complementary role that monetary policy could play in supporting green transition. Section 8 examines ways to nudge consumers/businesses to contribute to green transition embracing the virtue that “green begins at home/self” and as part of people’s clean India movement (Swachh Bharat Abhiyan). Section 9 presents a scenario analysis to highlight the critical role of policy interventions in reducing carbon emissions compared with a business-as-usual scenario and recommends the need for concerted actions covering all spheres of policy making. The concluding section sets out specific policy recommendations, encompassing those that are already part of the animated debate at various stages of implementation, or are new and need greater attention. 2. Fiscal Policy Initiatives IV.7 For a policy-induced structural shift in the economy to achieve the net zero target, large scale reallocation of resources would be required from carbon-intensive to green industries/sectors, besides sizeable additional investment within a pre-set time frame. Fiscal policy, therefore, must play a prominent role, backed by an actionable and time-bound policy framework. Green fiscal policy encompasses the use of fiscal instruments such as taxes, subsidies, grants, and expenditures to help align the fiscal policy with climate and other environmental goals (Petrie, 2021). IV.8 The rationale for fiscal intervention is premised on the conflicting interface between public finances and the green transition goal. On the one hand, governments across the world subsidise fossil fuels – US$ 1 trillion in 2022 alone (IEA, 2023a) – on the other hand, they also spend large budgetary resources on protecting the environment, such as expenses on environmental R&D, incentivising adoption of greener technology, management of flora and fauna to protect natural habitats, and building disaster resilient infrastructure. Besides pro-active measures to mitigate climate change risks under a well-designed strategy, adapting to climate change would also entail large fiscal costs. Due to the potential effects of climate change on long-term economic growth, it has emerged as an important risk to public finance sustainability (Baur et al., 2021). IV.9 The Union Budget 2023-24 has identified ‘Green Growth’ as one of its seven priorities, which will guide the economy through the Amrit Kaal. Accordingly, the Government announced several measures to facilitate the transition of the economy to lower carbon intensity and reduced dependence on fossil fuels, such as building infrastructure to evacuate renewable energy from Ladakh and allocation for Green Hydrogen Mission, which targets annual production of 5 million metric tonnes (MMT) by 2030. Additionally, the Budget has also introduced new schemes such as GOBARdhan (Galvanizing Organic Bio- Agro Resources Dhan) scheme to set up 500 new ‘waste to wealth’ plants; PM PRANAM (Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth) to incentivise States and Union Territories (UTs) to promote alternative fertilisers and balanced use of chemical fertilisers, MISHTI (Mangrove Initiative for Shoreline Habitats & Tangible Incomes) scheme for mangrove plantation along the coastline and on salt pan lands through convergence between funds under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) and the Compensatory Afforestation Fund Management and Planning Authority (CAMPA); and the Amrit Dharohar scheme to encourage optimal use of wetlands, and enhance biodiversity, carbon stock, eco-tourism opportunities and income generation for local communities. IV.10 Climate change adaptation generally requires an increase in government spending to minimise the damage from climate-related disasters (Dabla-Norris et al., 2021). Climate change mitigation can be pursued through carbon pricing, as it helps generate revenues which can be invested in green projects and/ or used in providing incentives to the private sector for reducing emissions, including through innovation in green technologies (Ferdinandusse et al., 2022). IV.11 As of April 2022, 70 carbon pricing initiatives, covering 23.2 per cent of global greenhouse gas (GHG) emissions, have been put in place (Chart IV.1). Its potential, however, is still untapped as most carbon prices are below the levels needed to deliver significant decarbonisation (World Bank, 2022a). The EU has the largest and most vibrant ETS – the EU ETS – where prices have moved close to 100 per tonne of carbon dioxide (CO2) (Financial Times, 2023). This is higher than in several other countries but still lower than 120 per tonne of CO2 that would be required by 2030 to decarbonise by 2050 (Ferdinandusse et al., 2022).  IV.12 The commonly used fiscal policy measures to mitigate and adapt to climate change are: (i) A carbon tax or a green tax; a compulsory, unrequited payment to the government on tax bases deemed to be harming the environment. When the green taxes are introduced along with a reduction in other taxes (such as labour tax or social security), it is viewed as an environmental tax reform (ETR). ETRs were first introduced in the Nordic countries in the 1990s followed by other European countries, Australia (2011), Japan (2012) and Chile (2014) (Gramkow, 2020); (ii) ETS; a market-based solution, which enables carbon emitters to trade emission units to meet their targets. There are two main types of emission systems: (a) cap-and-trade, where an upper limit on emissions is fixed and emission permits are either auctioned or distributed – those exceeding the limit must buy carbon credits and those operating within the limit earn carbon credits (e.g., Kazakhstan, Switzerland, South Korea and Shanghai) and (b) baseline and credit system, in which baseline emission levels are defined but there is no fixed limit on emissions. Entities that reduce their emissions more than the mandated amount can earn carbon credits to sell to underachievers (e.g., Alberta and Tokyo); (iii) Feebates and Regulation; which include a sliding scale of fees (or rebates) for carbon emissions above (or below) certain rates. Examples include emission standards for vehicles, fuel quality standards for petrol and diesel (e.g., China, India, Japan, and Indonesia), tax rebates for EVs, and higher fees on high-emitting vehicles (e.g., Singapore and India). The structure of fees and rebates is usually set to make the system revenue neutral. While feebates and regulations may have limited mitigation impact, they can play an important role in fostering investment in green energy (IMF, 2019); and (iv) Public green investment; even as the private sector is likely to take the lead in undertaking additional green investment, the public sector will need to act as a catalyst for the transition, through direct investment, co-financing, public-private partnership (PPP) or state guarantees (Ferdinandusse et al., 2022). Governments may be incentivised to increase green investment by implementing a green golden rule, under which green investment expenditure is exempt from fiscal rules (Darvas and Wolff, 2022). IV.13 Fiscal authorities in emerging market economies (EMEs) need to carefully consider the pros and cons of these policy options, as well as the methods used to implement them when determining carbon pricing. For arriving at a suitable carbon pricing policy framework for India, it is necessary to understand how carbon taxes and subsidies have been used in other countries. IV.14 Countries that tax non-renewable energy sources, including transportation fuel are shown in Chart IV.2. India is not included in this group of countries because there is no explicit carbon price specifically imposed on fuels like gasoline and diesel. These petroleum products are, however, subject to substantial excise duty and value-added tax (VAT). The total contribution of the petroleum sector to the exchequer in 2021-22 stood at 3.3 per cent of GDP1. IV.15 Several countries subsidise fossil fuels, with the total amount of subsidies (both explicit and implicit) as a share of GDP high enough to disincentivise and constrain green transition efforts (Chart IV.3). Keeping in perspective the international experience, we explore next the scope of carbon taxes and ETS in India. Carbon Tax IV.16 Governments impose carbon tax on CO2 emitters to make them internalise the associated negative externalities and attain socially optimal production levels. CO2 emissions have increased between 2002 and 2022, particularly in Asian countries vis-à-vis the advanced economies (AEs) (Charts IV.4a and IV.4b). India is the third largest emitter of CO2 after China and the US, though, on a per capita basis, it is one of the lowest (Chart IV.4c). To date, very few Asian economies have incorporated carbon taxes into their climate risk-mitigation strategies.

IV.17 Carbon taxes have been introduced by 36 jurisdictions as of April 2022 (World Bank, 2022b). These are levied per unit of metric tonne of carbon dioxide equivalent (tCO2e). Finland was the first country to adopt a carbon tax, followed by Sweden and Norway. As of April 2022, the carbon tax rate of Finland stood at US$ 85 per tCO2e. Uruguay has the highest tax rate of US$ 137 per tCO2e, followed by Switzerland and Sweden at US$ 130 per tCO2e each. The adoption of carbon taxes significantly reduced GHG emissions in Finland, Sweden, and Norway (Andersson, 2019; Bruvoll and Larsen, 2004; Khastar et al., 2020). IV.18 Estimates based on data for the Asia and Pacific region suggest that a carbon tax of US$ 25 per tonne could reduce emissions by 21 per cent by 2030, with these nations outperforming their Paris Agreement targets and generating additional revenues of 0.8 per cent of GDP (Dabla-Norris et al., 2021). For India, a US$ 25 per tonne of carbon tax is estimated to reduce emissions by about 25 per cent by 2030 (IMF, 2019)2. Limiting global warming to 2 degree celsius, however, would require a carbon tax that may have to rise rapidly to US$ 75 per tonne of carbon dioxide by 2030. Carbon taxes are found to be more effective, but comparatively less used, whereas non-tax risk mitigation measures such as the ETS, feebates and regulations are less effective and therefore should be used as a complement to carbon taxes (Dabla-Norris et al., 2021). The proposed implementation of border carbon adjustments (BCAs)3 by some of the AEs to prevent their mitigation efforts from being undermined also strengthens the case for other nations to implement a carbon tax4. IV.19 India introduced a clean energy cess on coal at a rate of ₹50 per tonne in 20105. The tax proceeds were earmarked for the newly created National Clean Energy Fund (NCEF) to fund research and innovative clean energy technology projects. The utilisation of funds from NCEF was, however, low and disbursements were aligned more with ongoing programmes/missions of various ministries/departments than with the fund’s stated objectives (Pandey, 2013). In July 2017, the clean energy cess was replaced by the Goods and Services Tax (GST) compensation cess of ₹400 per tonne on coal production, which was meant to bridge the revenue shortfall of States due to the implementation of GST. Furthermore, with an excise tax of ₹19.9 per litre on petrol and ₹15.8 per litre on diesel by the Central Government and a VAT by the State Governments, the consumption of petrol and diesel is heavily taxed in India. It is estimated that 54.7 per cent of GHG emissions in India are subject to a positive net effective carbon rate (NECR).6 The NECR in India is the highest in the road transport sector and zero or negative in other sectors such as agriculture, industry and buildings (OECD, 2021a). IV.20 Carbon taxes on fossil fuels entail distributional consequences as they are generally regressive. The imposition of carbon taxes can reduce social welfare and is more likely to increase income inequality (Khastar et al., 2020). Revenue recycling, i.e., earmarking revenues from carbon taxes for spending on citizen welfare schemes can help enhance public support for carbon taxation. It is estimated that the introduction of carbon pricing without revenue recycling could increase the Gini coefficient by 0.59 per cent over the baseline scenario of business as usual in 2030 (Zhao et al., 2022). With a progressive recycling scheme (i.e., lower income groups receiving higher benefits), however, the Gini coefficient in 2030 would be 0.34 per cent lower than the baseline. IV.21 The impact of carbon taxes also depends on the utilisation of tax proceeds. There are three possible ways to utilise tax proceeds to reduce tax burdens and improve economic outcomes: (a) providing a lumpsum dividend to households, as in the United Kingdom and France, which can improve progressivity but may reduce employment and income by disincentivising work/search for work among the unemployed; (b) a corporate tax rate cut, which may increase output, productivity, and innovation but at the cost of likely reduction of progressivity; and (c) a reduction in income tax, as in Finland, which can improve progressivity, income, and employment (Pomerleau and Asen, 2019). Hence, the third strategy may be the preferred policy tool to reduce the adverse impact of a carbon tax. Table IV.1: Step-wise Considerations for Implementing a Carbon Tax | | | | | Utilisation of tax revenue | Implementation | • Revenues may be utilised for the promotion of clean technology and R&D spending on low-carbon technology.

• Since a carbon tax may increase the burden on low-income households as they may not be able to switch to low-carbon technology quickly, appropriate offsets may be required.

• Small industries using less carbon- efficient production technology may increase their final prices which may degrade their competitiveness. Hence identifying and subsidising these industries using the tax proceeds may be required. | Determination of tax rate | • Phased yet timely implementation is crucial, with institutional amendments. The tax base and rate may be gradually increased over time.

• Inclusion of carbon taxes in GST, Central Excise and State VAT, may help implementation in India. | | Determination of tax base | There are two approaches to determining the tax rate:

1) Social cost of carbon - tax rates are estimated based on the social cost due to emissions of CO2.

2) Abatement approach - carbon tax is imposed to meet specific emissions reduction targets committed at international fora. | All fuels that produce carbon should be considered as the universal tax base. | Source: EY (2018). | IV.22 At present, India does not have an explicit carbon tax system but it imposes taxes on the use of fossil fuels, as noted earlier. As and when a carbon tax is introduced, it is important to recognise that several considerations must predate its implementation (Table IV.1). Moreover, the World Bank recommends that countries imposing carbon taxes should target higher economic growth, spend more on clean technology, provide direct benefit transfers to low-income households and effectively regulate and monitor environmental objectives of carbon pricing. Feebates and Subsidies IV.23 Fiscal measures should also support investment in clean technologies through greater budgetary outlay on R&D for developing low-carbon technologies and by compensating losses arising from the transition to clean technologies to incentivise firms to adopt these technologies. Investment in climate resilient infrastructure and specifically earmarked resources for managing post-disaster losses must also be an integral part of the medium-term fiscal policy strategy. After decades of congressional stalemate, the Inflation Reduction Act (IRA) in the US was passed on account of two major strategic shifts. First, carrots score higher over sticks to build political support and hence the law subsidises clean energy rather than taxing carbon pollution. Second, the law explicitly favours US-made products (such as EVs) and clean energy, as part of a broader shift toward strategic intervention to promote and protect firms in targeted sectors such as production of semiconductors (Joselaw and Montalbano, 2022). Emissions Trading Systems (ETS) IV.24 Like a carbon tax, an ETS has its own challenges and benefits (Table IV.2). Adopting a new carbon pricing mechanism such as the ETS may necessitate overhauling the current carbon tax/subsidy framework. IV.25 India’s Energy Conservation (Amendment) Act, 2022 has drawn attention to the importance of carbon markets and green financing via green bonds for meeting the country’s decarbonisation targets. Its scope is substantial, and it gives the Government the authority to create a system for trading carbon credits, laying the foundation for a legitimate carbon market. Several EMEs (accounting for around half of the global GHG emissions) have so far implemented or are contemplating carbon pricing using ETS or carbon taxes (Table IV.3). | Table IV.2: Carbon Tax and ETS: Advantages and Disadvantages | | | Carbon Tax | ETS | | Advantage | Provides certainty about the price of carbon | Increases certainty about emission reductions and environmental benefits. | | Disadvantage | The outcome of emission reductions is unknown. | The costs of achieving the desired level of abatement are unknown. | | Source: Observer Research Foundation (2022). | IV.26 Mexico conducted several pilots involving specific enterprises before its three-year trial operational phase in 2020. China implemented its national ETS market in 2021 after trials in eight provinces. The federal structure of India could help in implementing ETS pilot programmes across states. The gradual enlargement of its scope into a more practical nation-wide ETS would require simulations and pilots. On July 15, 2019, the Gujarat Pollution Control Board (GPCB) introduced India’s first ETS and the world’s first cap-and-trade market in particulate pollution (Table IV.4). | Table IV.3: Carbon Pricing Mechanism in Emerging Market Economies | | Name | GHG Emissions (as per cent of World emission) | Status | Description | Scope (Share of GHG emissions covered) | | Argentina | 0.80 | Carbon Tax (Implemented) | Implemented a Carbon tax in 2018, replacing the fuel tax | 20 per cent | | Brazil | 2.92 | ETS (TBC) | National Climate Policy aims to promote ETS. Since 2013, a group of leading companies have participated in a voluntary ETS simulation | Not decided | | China | 24.23 | ETS (Implemented) | The world’s largest ETS, in terms of covered emissions, was implemented in 2021. | 33 per cent. | | Indonesia | 3.94 | Carbon Tax (Implemented) / ETS (TBC) | Passed a law to implement carbon tax in October 2021, Working towards a mandatory ETS in the power sector | 26 per cent using Carbon tax | | South Korea | 1.31 | ETS (Implemented) | Launched a cap-and-trade based ETS at a national level in 2015 | 73 per cent. | | Malaysia | 0.80 | ETS (TBC) | Considering between Domestic ETS and Carbon tax | Not decided | | Mexico | 1.35 | Carbon Tax (Implemented) / ETS (TBC) | Carbon tax is an excise tax under the special tax on production and services that was implemented in 2014 | 44 per cent. | | Poland | 0.64 | Carbon Tax (Implemented) | Part of the Environmental Protection Act that covers CO2 emission, dust, sewage, and waste. | 3.75 per cent. | | South Africa | 1.13 | Carbon Tax (Implemented) | Places a price on CO2 emissions from large businesses in the industry, power, and transport sectors. | 80 per cent. | | Thailand | 1.13 | ETS (TBC) | Following COP 26, the government is developing guidelines for ETS, expected to be released in 2022 | Not decided | | Türkiye | 1.31 | ETS (TBC) | Laws governing monitoring, reporting, and verification (MRV) were implemented in Türkiye in 2012, and monitoring of GHG emissions from large installations began in 2015. | Not decided | | India | 6.75 | Carbon Tax (TBC) | NA | NA | Note: TBC: To be confirmed.

Source: Our World in Data. |

| Table IV.4: Emissions Trading Model in Surat | | Key Areas | Details | | Background | • Pollution reached a high level in Surat in 2018.

• Surat was selected as the location for the pilot programme. | | ETS model in Surat | • ETS is a regulatory mechanism that aims to reduce pollution load in a region while simultaneously minimising the business compliance cost.

• Different types of businesses can buy and sell the rights to release particulate matter into the atmosphere by exchanging licences, measured in kilograms (kgs) that fall within this cap. | | Trading | • At the beginning of every month (during which the emission permit is valid), 80 per cent of the total cap of 280 tonnes for that period is distributed free to all participating units.

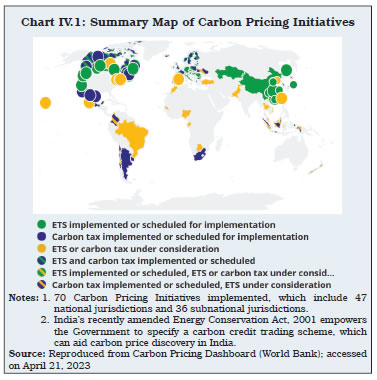

• GPCB will offer the remaining 20 per cent during the first auction of the compliance period at a floor price of ₹5/kg. | | Auctions | • Transactions like these take place on the trading platform known as ETS-PM, which is hosted by the National Commodities and Derivatives Exchange e-Market Limited (NeML), where all participants must register a trading account.

• There are two types of auctions: (i) Uniform price auction and (ii) Continuous market. To satisfy compliance responsibilities, units may acquire and sell leftover permits at the final auction price 2-7 days before the compliance period ends. | | Punitive Actions | • Environmental damage compensation to the amount of ₹200/kg will be assessed for emissions over a unit’s permit holdings when the compliance term ends.

• An upper limit has been established so players cannot stockpile permits to gain an unfair advantage. | | Source: Gujarat Polltuion Control Board (GPCB): Emissions Trading Scheme (Pilot Project, 2019). | IV.27 An ETS provides a transformational alternative to command-and-control policies that are expensive, inflexible and could be enforced by imposing costly and time-consuming penalties. The ETS is anticipated to provide emissions reduction certainty without significantly altering the existing carbon tax or subsidies, and may be adopted in India for accelerating decarbonisation in industries like transportation. ETS may be politically more acceptable and relatively easier to implement (IMF, 2022a). IV.28 Public spending on climate change and related issues remains underreported in India, and hence, a consistent reporting template needs to be put in place to record climate-related expenditures and report them in a Climate Budget Report as a supplement to the annual budget. Even before that, an effective green taxonomy to limit the potential risk of greenwashing is needed. Starting with the first climate budget published by Nepal in 2013, several countries have followed suit, including Bangladesh, Indonesia, Moldova, Kenya, Norway, Sweden and France (Petrie, 2021). In India, Odisha became the first state to publish a climate budget report in 2020. IV.29 To meet its climate goals, India needs to introduce a broad-based carbon pricing system in line with the global best practices highlighted above. Furthermore, a variant of the NCEF may be instituted, to which all receipts from carbon taxes and proceeds from the recently introduced green bonds may be credited. Expenditure tagging must be undertaken to highlight separately expenditures that benefit the environment, and those that are harmful, to produce full-fledged climate budget reports, which may be instrumental in better identifying the green financing needs and attracting international financing (Petrie, 2021). Sovereign Green Bonds IV.30 Sovereign green bonds (SGBs) are similar to traditional Government securities except that they contain a “use of proceeds” clause which states that the funds will be utilized solely for green investments (Ando et al., 2022). The first ever SGBs were issued by Poland in 2016, followed by France, Fiji and Nigeria in 2017. While several EMEs have started issuing SGBs, advanced economies are the frontrunners in SGB issuances so far (Chart IV.5). India issued its first SGBs amounting to ₹16,000 crore in 2022-23. While SGBs are gaining popularity, their market remains shallow as they account for only 0.2 per cent of all Government debt securities issued in the OECD area and 12 per cent of total green bond issuances in EMEs (OECD, 2021b).  IV.31 Some of the benefits of SGBs include lower refinancing risk as these bonds are generally issued with a long maturity (Doronzo et al., 2021); and a green premium (or greenium) which occurs when the SGB exhibits a lower yield compared to the traditional Government bond, due to strong demand from investors following greater transparency on the use of bond proceeds, despite lower liquidity of SGBs (Ando et al., 2022). SGBs can be a stable source of financing for Government expenditure on climate related infrastructure and can facilitate the transition to a low-carbon economy which would, however, depend on how they perform relative to conventional bonds (Box IV.1). Box IV.1

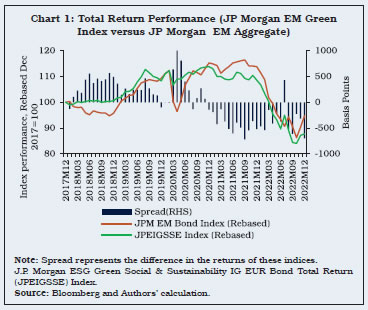

Emerging Market (EM) Green Bonds: The Significance of Greenium ‘Greenium’- a premium over vanilla bonds, is an integral feature of a successful green bond issuance strategy. JP Morgan’s EM Green Bond Index outperformed the comparable JP Morgan EM Bond Index in 2022, extending the cumulative over-performance since December 2017 to 790 basis points (bps) (IFC, 2021; Bloomberg, 2022). When the green bond index outperforms the conventional bond performance, the greenium widens (Chart 1). Global financial conditions have influenced the evolution of the spread between the return on EM green bonds and their non-green counterparts. A tighter global financial condition (proxied by the US financial conditions) is associated with an increase in the spread, and the association almost doubled from the pre-COVID to post- Covid period. For example, the correlation was 0.31 in the pre-COVID period (2018 M01- 2020 M02) and rose to 0.61 (2020 M03 – 2022 M12). Granger causality results between spread and financial conditions strongly support causality from the National Financial Conditions Index (NFCI) to spread at 1 per cent level of statistical significance (Chart 2 and Table 1).

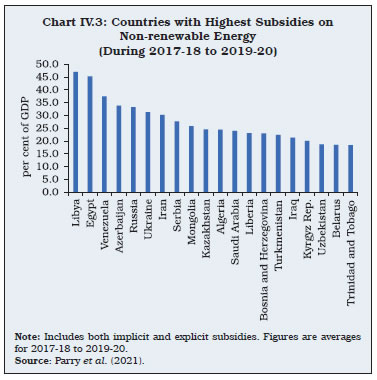

| Table 1: Granger Causality Test Results | | Null-Hypotheses | NFCI does not Granger Cause Spread | Spread does not Granger Cause NFCI | | Lags = 2 | 13.13*** | 2.15 | | | (0.00) | (0.13) | | Lags = 3 | 9.42*** | 1.49 | | | (0.00) | (0.23) | | Lags = 4 | 10.18*** | 1.24 | | | (0.00) | (0.31) | | Lags = 5 | 9.72*** | 1.07 | | | (0.00) | (0.39) | Note: All coefficients are F-Statistics; Terms in bracket are p-values.

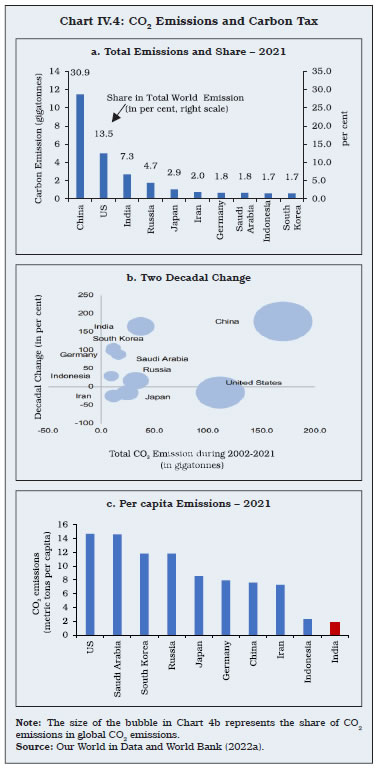

Sample: December 2017 to December 2022; Blue shaded region shows easy global financial conditions, whereas red shaded part represents tight financial conditions (post October 2021 tightening of global financial conditions is the outcome of high inflation and expected rise in the US fed funds rate).

Source: Authors’ calculations. |

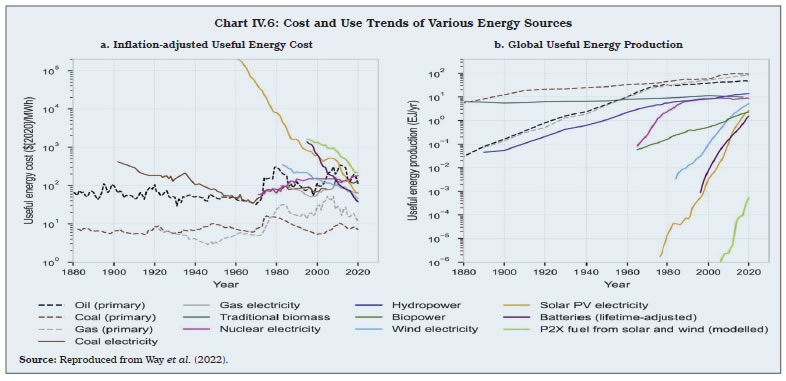

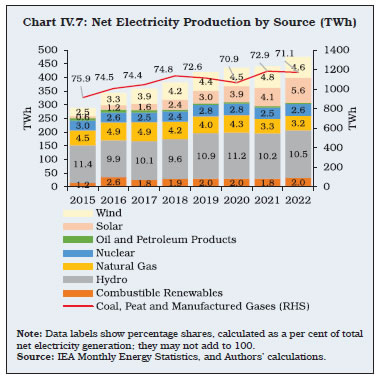

While assessing the pricing of SGBs, it would be important to recognise the significance of global financial conditions in shifting investor appetite, besides the role of a pool of savers, both domestic and foreign, who may accept lower returns on such bonds if the proceeds are clearly earmarked and used for green projects. References: IFC (2021). Emerging market green bonds report: On the road to green recovery. | 3. Innovation and Technology Adoption IV.32 Technical progress can be a key enabler to achieving a successful green transition. Besides increasing the productivity of resources, it can reduce the degradation of natural resources and curtail pollution. In most traditional economic models and growth theories, technology is modelled as an exogenous variable that appears as ‘manna from heaven’. Endogenous growth theories acknowledge that technological change occurs as a result of identifiable and deliberate processes, including R&D; investment, economies of scale and public policy changes. As per this view, public institutions have an important role in allowing efficient price discovery for desirable resource allocation and providing a conducive environment for environment-related innovation. Therefore, Governments have a more direct role in developing and diffusing technology for sustainable development and financing basic research for green innovation. In this context, this section explores alternative technology choices available to the policymakers today while pursuing the path to a clean, green and sustainable energy transition. Renewable Energy IV.33 Technology solutions have helped discover and exploit alternative energy sources, enhance energy efficiency of current and new systems, reduce risks arising from climate change, and lower renewable energy costs. IV.34 Most energy-economy models, in fact, historically underestimated the pace of deployment of renewable energy technologies and overestimated their costs (Way et al., 2022) (Chart IV.6). Compared to continuing with a fossil fuel-based system, a rapid green energy transition may result in significant savings. The price of electricity from utility-scale solar PVs has reduced by 89 per cent from 2009 to 2019, while prices of lithium-ion batteries have fallen by 97 per cent since their commercial introduction in 1991 (UNDP, 2022). IV.35 Renewables’ growth in 2022 was much faster than initially expected, driven by strong policy support in China, the EU and Latin America (IEA, 2022a). India has made significant strides towards a sustainable energy mix over the past few years, with an installed capacity from renewable sources of energy of more than 157 GW (PIB, 2022a), and the share of renewables in electricity generation increasing from around 16 per cent in CY2015 to 23 per cent in CY2022. This is in pursuance of India’s vision of achieving the Net Zero Emission target by 2070 and increasing renewables capacity to 500 GW by 2030. A granular analysis of India’s electricity generation mix shows that the share of solar energy has increased from 0.6 per cent in 2015 to 5.6 per cent in 2022 (Chart IV.7). Hydro-power share remains steady at approximately 10 per cent, while the share of wind energy has nearly doubled. The share of coal and natural gas in the electricity mix has reduced over the years. The key challenge in raising the share of renewable energy is not only incentivising domestic production of solar panels, wind turbines, batteries and EVs, but also facilitating research and technology extension for dealing with the fluctuating energy output from renewable energy sources like solar and wind, and securing the entire supply chain.

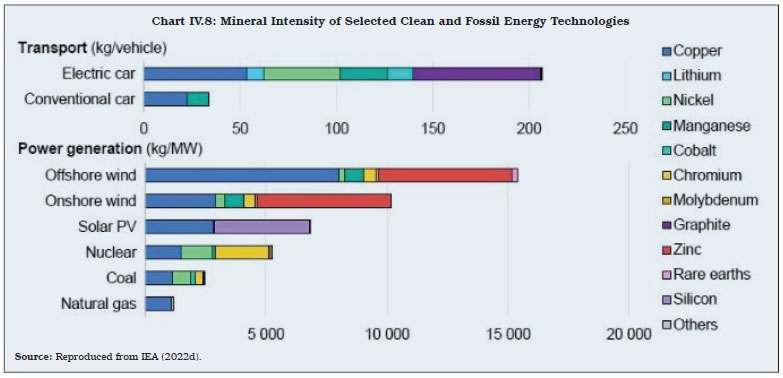

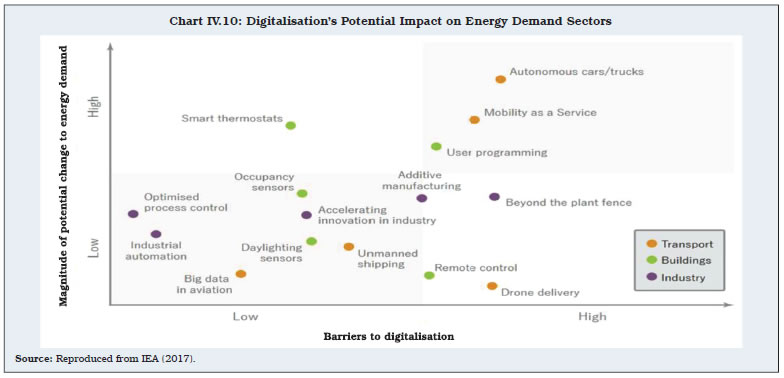

IV.36 Various policy steps have been taken by the Government towards a sustainable energy mix, including the new solar-powered toll plazas, development of Mass Rapid Transit Systems (MRTS) across cities, the National Smart Grid Mission and the Green Energy Corridor Project for an efficient transmission and distribution network for renewable energy and the Faster Adoption and Manufacturing of Hybrid Electric vehicles (FAME India) scheme. More recently, India submitted its long-term low greenhouse gas emission development strategies (LT-LEDS) at the 27th Conference of Parties (COP 27) of the United Nations Framework Convention on Climate Change (UNFCCC) at Sharm El Sheikh (MoEFCC, 2022). The LT-LEDS is a crucial policy tool that can help a country to place short-term climate actions in the context of the long-term structural changes required to transition to a low-carbon and climate-resilient economy. IV.37 As part of its LT-LEDS, India aims at carrying out a just, smooth and sustainable transition away from fossil fuels by making India a green hydrogen hub, increasing electrolyser-manufacturing capacity in the country, and undertaking a three-fold increase in nuclear power generation capacity by 2032. Additionally, the LT-LEDS focuses on low-carbon transportation, by increasing the use of biofuels through ethanol blending in petrol (which is envisaged to rise to 20 per cent by 2025 from 10 per cent under the Ethanol Blended Petrol programme), increase in EV penetration and promotion of green hydrogen fuel. Solar Power, Batteries and EVs IV.38 In line with international trends, the cost of solar power generation has come down in India in recent years, with the lowest auction winning tariffs hovering in the range of ₹2-3 per kilowatt-hour (kWh). Installed capacity is increasing in a mission mode, but the focus now needs to shift to addressing viability of solar power for use by all. Important sources of non-conventional energy, wind and solar, face two major challenges - high fluctuation in supply due to their dependence on environmental factors such as sunlight and wind speed, and inflexibility in scaling up or down in line with the demand. Hence, a grid with high solar and wind capacity needs stabilising mechanisms to manage fluctuations in demand. One solution could be supplementing the grid with readily variable sources like run-off-the-river hydro or geothermal energy. Another could be to manage demand through the use of smart grids that can monitor power flows from points of generation to points of consumption and control the power flow or curtail the load to match generation in real-time or near real-time. The National Smart Grid Mission is a step in this direction and is expected to inculcate dynamic pricing mechanisms to incentivise consumers to shift their usage over different times of the day in response to price signals. IV.39 The smart grid will also facilitate distributed generation, especially rooftop solar generation, by allowing movement and measurement of energy in both directions using control systems and net metering, which could help “prosumers” i.e., the consumers that both produce and consume electricity, to safely connect to the grid. Yet another option is developing Energy Storage Systems, which involve converting excess solar and wind power to potential energy in batteries, supercapacitors, compressed air energy storage systems, flywheels, and gravity storage or pumped hydro storage plants. Rapid technological progress and cost competitiveness have made batteries the mode of choice for most applications (ISGF, 2019). The research priorities for electrical batteries in India include new cell chemistries emerging from the lithium-ion family, such as lithium-air, lithium-sulphur or other metals, such as sodium and magnesium. The recent discovery of 5.9 million tonnes of lithium reserves should enhance the indigenous impetus for green transition and help India in reducing its import dependence for this crucial mineral. Nevertheless, research and innovation for exploring other battery technologies is a strategic requirement. IV.40 EVs have emerged as the next frontier in mobility, with global electric car sales exceeding 10 million units in 2022. Cumulatively, the number of electric cars on road exceeded 26 million in 2022 - more than five times the stock in 2018 (IEA, 2023c). According to the Vahan dashboard7, India achieved the milestone of one million EV registrations in 2022 – a substantial jump from 3,31,365 registrations a year ago. Globally, the success of EVs has largely been driven by sustained policy support through subsidies aimed at increasing EV sales and crowding–in charging infrastructure and manufacturing capacity. IV.41 In India, the FAME scheme has been extended to FAME-II till the end of 2024, which now includes a 50 per cent increase in purchase incentives for electric two-wheelers to ₹15,000 per kWh of battery capacity. This is important, given that India is the largest two-wheeler market in the world. The FAME-II scheme has provided subsidies to the tune of ₹1,000 crore to develop almost 2,900 charging stations across 25 states. Additionally, the National Highways Authority of India has set an objective to install EV charging stations every 40-60 km along national highways, covering 35,000-40,000 km of highways by 2023. Nineteen states in India offer some form of policy support for EVs, such as purchase incentives, exemptions from road taxes, and subsidies for investment in battery manufacturing and related components (IEA, 2022c). IV.42 The switch to EVs is bound to exert pressure on mines for supply of minerals such as copper, lithium, nickel, manganese and graphite and for rare earth elements that are used in EV manufacturing (Chart IV.8). This is true even for wind power. It is important that the environmental costs of mining and extraction are accurately factored in, and appropriate compensation mechanisms are devised. The prices of these metals surged in the aftermath of the war in Ukraine, and their supply chain remains highly concentrated.  IV.43 Three-fourths of worldwide lithium-ion battery production is centred in China, and over half of lithium, cobalt and graphite processing and refining capacity is located there. Central and South America and Africa hold a large share of reserves of minerals used in the renewable power supply chain (Chart IV.9). China currently dominates the processing, manufacturing and assembly phases of the supply chains of key renewable energy technologies. India needs to secure its supply chain, including through indigenous production and outward foreign direct investment (FDI), as being pursued by the European nations and the US. India neither has substantial reserves of such minerals (other than the recently discovered lithium), nor is it globally competitive in processing capacity. Hence, there is an urgent need to secure a steady supply of these minerals through diplomatic efforts recognising the benefits of South-South cooperation and at the same time, incentivising investment for creating large capacity for material processing, manufacturing and assembly of solar PVCs, wind turbines, EV batteries and related components. IV.44 The electrification of the road transport sector will have to be supported by subsidies, especially in the case of charging stations, until EV density is sufficient to sustain the charging infrastructure without any support. Incentivising the installation of home chargers in existing parking spaces, mandating EV readiness for new buildings and installation of chargers in existing buildings are the way forward. Recycling of metals involved in battery and EV production or moving to newer technologies such as lithium iron phosphate cathodes and manganese-rich cathodes may be necessary to combat metal shortages and encourage local battery production. Battery standardisation and developing a common set of standards for testing and evaluating second-hand batteries may be necessary for the effective recycling of old batteries. Green Hydrogen IV.45 Green hydrogen is the hydrogen produced by the electrolysis of water molecules using energy from renewables. India currently consumes about 6.17 MT of hydrogen annually, and this is expected to grow to 28 MT per annum by 2050 (TERI, 2022). Presently, most consumption is of grey hydrogen8 and its use is largely confined to the fertilizer and refinery sectors. Hard-to-abate sectors such as cement, steel and transport can be potential future hydrogen-consuming sectors. Green hydrogen can be an effective way of storing excess energy during times of low demand to be fed back into the grid when demand rises. The cost of green hydrogen is expected to be reduced by more than 50 per cent by 2030, largely driven by the decrease in the cost of renewables and electrolysers in India (TERI, 2022). The National Green Hydrogen Mission aims to make India a global hub for production, utilisation and export of green hydrogen and its derivatives. Moreover, it would reduce fossil fuel imports by more than ₹1 lakh crore by 2030, thereby bringing down the overall import bill. Various public sector enterprises and conglomerates have announced long-term investment commitments in the green hydrogen space. IV.46 Furthermore, the Green Hydrogen Mission could be a major catalyst for India’s decarbonisation, built on the government’s proactive policy focus, ambitious private sector partnership and advantageous production environment. With abundant renewable resources availability coupled with comparatively lower construction costs than competing regions, India is well positioned to take the lead in green hydrogen production. Indigenisation of technological processes and industry-led R&D for breakthrough technology would be the key to enhancing electrolysis capacity for green hydrogen production. Carbon Capture Utilisation and Storage (CCUS) IV.47 Leading US tech companies9 have pledged US$ 925 million to remove CO2 from the atmosphere (known as carbon capture) to arrest global warming. Globally about six gigatonnes of CO2 a year is required to be removed from the atmosphere by 2050 to avert any disastrous effects of climate change (McKinsey & Company, 2022). The inclusion of Carbon Capture Utilisation and Storage (CCUS) as one of the 13 activities that qualify for carbon trading in India’s upcoming carbon trading market may provide a more diversified toolkit for India to tackle CO2 emissions (PIB, 2023). Moreover, the Ministry of Petroleum and Natural Gas (MoPNG) received ₹35,000 crore grant in the 2022-23 budget, which is expected to be deployed in carbon sequestration technologies such as CCUS. Thus, CCUS can play a crucial role in achieving India’s goal of reducing CO2 emissions by 50 per cent by 2050 by decarbonising hard-to-abate industries such as steel, cement, and petrochemicals (NITI Aayog, 2022a). However, its expensive cost structure and unproven technology pose certain downside risks. Nuclear Energy IV.48 According to the World Nuclear Industry Status Report 2022, the share of nuclear energy in global commercial gross electricity generation in 2021 dropped to 9.8 per cent – the lowest in four decades – and 40 per cent below the peak of 17.5 per cent attained in 1996. Nuclear energy generation in India accounted for 2.6 per cent of total electricity generation in 2022. India has 19 of the world’s total 411 functioning nuclear reactors with eight of them under construction as of October 2022. The declining trends are largely in response to the Fukushima disaster in 2011, after which even firm believers in nuclear power as the viable path to sustainable energy security, such as France, decided to scale down. Post-pandemic energy shortages and the energy crisis in Europe on account of the war in Ukraine, however, have led to a revival of interest in nuclear power. IV.49 New technologies, such as very small reactors, are emerging, which are sealed and do not require regular refueling, making them well-suited for applications in which the entire reactor can be plugged into a grid or dropped into a remote location where they can operate for many years till refueling is required. In a bid to reduce its dependence on imported Uranium, India is tilting towards thorium based nuclear reactors in the long run, since this fuel is available in the monazite sands of the eastern and western coasts of the country. Artificial Intelligence (AI) and Machine Learning (ML) for Sustainable Energy Transition IV.50 In recent years, a large volume of data has been unlocked through the Internet of Things (IoT) enabled sensors, satellite data and drones, with scope for using AI, ML, and blockchain to identify and propagate climate solutions. These technologies can help measure, understand and evaluate challenges and make forecasts, enable informed policy choices, permit the automation of responses, optimise resource use, and provide smart infrastructure. Moreover, AI can also help integrate renewables of fluctuating supply by enabling smart grids that partially match electricity demand to times of high sunshine and wind speed. AI is estimated to have the potential to enable the fulfilment of 93 per cent of the environmental Sustainable Development Goals (Rolnick et al., 2023). Various ML technologies have immense potential to provide green solutions in domains such as electricity systems, transportation and climate prediction (Table IV.5). IV.51 With technology expected to shape the progress on green transition, it is important to prioritise an innovation-supportive policy regime accompanied by a large and sustained increase in R&D expenditure (Box IV.2). | Table IV.5: Machine Learning and its Deployment for Climate Change Solutions | | Solution Domain | Causal Inference | Computer Vision | Interpretable Models | Natural Language Processing | Reinforcement Learning and Control | Time-Series Analysis | Transfer Learning | Uncertainty Quantification | Unsupervised Learning | | Electricity systems | | | | | | | | | | | Enabling low-carbon electricity | | ✓ | ✓ | | ✓ | ✓ | | ✓ | ✓ | | Reducing current-system impacts | | ✓ | | | | ✓ | | ✓ | ✓ | | Ensuring global impact | | ✓ | | | | | ✓ | | ✓ | | Transportation | | | | | | | | | | | Reducing transport activity | | ✓ | | | | ✓ | | ✓ | ✓ | | Improving vehicle efficiency | | ✓ | | | ✓ | | | | | | Alternative fuels & electrification | | | | | ✓ | | | | ✓ | | Buildings and cities | | | | | | | | | | | Optimising buildings | ✓ | | | | ✓ | ✓ | ✓ | | | | Urban planning | | ✓ | | | | ✓ | ✓ | | ✓ | | The future of cities | | | | ✓ | | | ✓ | ✓ | ✓ | | Industry | | | | | | | | | | | Optimising supply chains | | ✓ | | | ✓ | ✓ | | | | | Improving materials | | | | | | | | | ✓ | | Production & energy | | ✓ | ✓ | | ✓ | | | | | | Farms & forests | | | | | | | | | | | Remote sensing of emissions | | ✓ | | | | | | | | | Precision agriculture | | ✓ | | | ✓ | ✓ | | | | | Monitoring peatlands | | ✓ | | | | | | | | | Carbon dioxide removal | | | | | | | | | | | Direct air capture | | | | | | | | | ✓ | | Sequestering CO2 | | ✓ | | | | | | ✓ | ✓ | | Climate prediction | | | | | | | | | | | Uniting data, ML & climate science | | ✓ | ✓ | | | ✓ | | ✓ | | | Forecasting extreme events | | ✓ | ✓ | | | ✓ | | ✓ | | | Source: Rolnick et al. (2023). | Digitalisation and Energy Efficiency IV.52 Digitalisation could prove to be a potent means to enhance energy efficiency, saving energy in the major energy-intensive sectors such as transportation, buildings and industry (Chart IV.10). At the policy design stage, digital tools can provide access to more granular and real-time data, and advanced analytics and modelling capabilities can help predict the impact and cost-effectiveness of programmes. Digitalisation can be an effective communication tool to enable more user-centred policies during programme implementation (Table IV.6). Transportation Sector IV.53 The transportation sector accounts for about 28 per cent of global final energy demand and 23 per cent of global CO2 emissions from fuel combustion (IEA, 2017). The dynamics and net effects of Automated, Connected, Electric and Shared (ACES) mobility will play a key role in shaping the overall transport sector’s future energy and emissions trajectory. In cities with high population density and good public transport networks, digitalisation could contribute to a shift away from the traditional paradigm of vehicle ownership towards the provision of Mobility as a Service (MaaS), which could simplify shared mobility services by offering a unified routing and payment platform. Box IV.2

Innovation for Sustainable Energy Transition Innovation is central to putting the world on a sustainable energy path. It creates value by improving existing processes and generating new ways of doing business. Innovation augments the portfolio of policy options available and the potential strategies to meet goals. Over time, it brings down the costs of achieving set goals (Kobos et al., 2006). Using a panel dataset of 12 AEs and EMEs (including India) with annual frequency between 1996 and 2020, the factors influencing the share of renewable energy in total energy consumption is assessed (Table 1). The analysis incorporates per-capita CO2 equivalent emissions and per capita GDP to control for common but differentiated responsibilities in climate change mitigation, and the levels of oil and natural gas reserves – since availability of such reserves domestically may influence the preferred local energy mix. Gross domestic expenditure on R&D consists of the total expenditure (current and capital) on R&D by all resident companies, research institutes, universities, and Government laboratories. It is found that higher the R&D related expenditure as a per cent of GDP, greater is the shift to renewable energy. This effect may be experienced with a lag (of about two years, as in Models 2 and 3). Hence, the fruits of innovation may take time to yield results, extend to the commercial space and finally percolate into the actual energy mix. Technology innovation does not evolve in a vacuum: the market structure, public support for entrepreneurship, and direct government investment all influence how rapidly new technologies emerge and are adopted. This is true for energy as for other sectors of the economy. These findings suggest that enhancing and incentivising the flow of resources for innovation is essential to achieve a greener energy mix in the future. | Table 1: Panel Data Analysis Results | | Variable | Model (1) Share of Renewable Energy | Model (2) Share of Renewable Energy | Model (3) Share of Renewable Energy | | Per Capita CO2 Emissions | 0.004 | -0.001 | -0.002** | | (0.005) | (0.009) | (0.001) | | Coal Dependence for Electricity | -0.001*** | -0.001** | -0.001*** | | (0.000) | (0.000) | (0.000) | | R&D Expenditure Share in GDP | 0.042** | -0.095*** | -0.075** | | (0.018) | (0.021) | (0.034) | | 2-year lag of R&D Expenditure Share in GDP | | 0.141*** | 0.105*** | | | (0.039) | (0.037) | | Log GDP per capita | | 0.005 | 0.003** | | | (0.014) | (0.002) | | Log Oil Reserves | | | 0.016*** | | | | (0.002) | | Log Gas Reserves | | | 0.010 | | | | (0.007) | | Intercept | -0.041 | -0.053 | -0.027 | | (0.055) | (0.175) | (0.019) | | R2 | 0.62 | 0.74 | 0.96 | | Observations | 129 | 75 | 73 | | Countries | 12 | 7 | 5 | Notes: ***: p<0.01, **: p<0.05, *: p<0.1; Robust standard errors in parenthesis.

All models use the random effects specification (as supported by the Hausman test) and incorporate year fixed effects.

Notes on variables: Renewable energy consumption (exajoules); Per Capita CO2 emissions (million tonnes of CO2 equivalent per 1 billion population); Coal Dependence for electricity (coal share in total electricity generation); R&D Expenditure as a share of GDP (per cent); GDP per capita (2017 US$ PPP); Proven Oil Reserves (thousand million barrels); Proven Gas Reserves (trillion cubic metres). Data from BP Statistical Review and World Bank. | References: Kobos, P.H., Erickson, J.D. and Drennen, T.E. (2006). Technological learning and renewable energy costs: implications for US renewable energy policy. Energy Policy. Volume 34, Issue 13. Pages 1645-1658. |

| Table IV.6: Digital Tools Used for Promoting Energy Efficiency | | Tool | Country | Project | Description | | Geographic Information System (GIS) mapping and remote sensing | Europe | Hot Maps Project | Open-source tool allowing city planners to visualise geographical areas with potentially high heating or cooling loads, which could then be prioritised for energy efficiency upgrades as part of heating or cooling action plans. | | Virtual buildings and digital twin cities | Singapore | Virtual Singapore | 3D digital replicas of every building in the city providing the capability to accurately simulate how new developments and planning changes in the city might affect a range of energy-related indicators, road and foot traffic flows, heating and cooling needs, etc. | | Digital certification and compliance | EU, China | QR codes coupled with smartphones and apps | With QR codes attached on appliances and linked to a database, consumers can easily check and compare the energy efficiency of appliances | | Digital communication and networking | US | Building Performance Database | Online tool created to help people access and browse data on building energy performance, from governments, utilities, energy efficiency programmes, building owners and private companies. | | Natural language processing | US | US Department of Energy | Scan through texts and numerical data on energy investments and company information to track innovation and clean energy progress. | | Web search analytics | Sweden, Denmark, Finland, Iceland | NordCrawl Project | Web scraping provides an alternative method for regulators to assess whether models are being sold that do not meet Minimum Energy Performance Standards. Using automated tools, regulators can quickly scan online shopping websites to assess which models are being offered for sale in their country. | | Source: IEA (2021b). | Green Buildings IV.54 In 2021, buildings accounted for nearly 30 per cent of global final energy consumption and 27 per cent of total energy sector emissions (IEA 2022e). Digitalisation has significant potential to enhance user comfort in buildings while reducing overall energy use. The energy load of a building can be managed using active control systems that use real-time data from sensors. Wherever feasible, active controls should also integrate intelligently with building energy services sharing information to and from the grid, facilitating better electricity supply and demand management. Similarly, smart lighting in public places, notably street lighting, may also cut down energy use beyond the direct energy savings from the use of light emitting diode (LED) lamps, and by connecting streetlights to traffic lights and other traffic management tools. Policymakers and companies need to ensure that devices are able to provide and receive information using open-source or compatible software to allow for interoperability across technologies. Supportive policy frameworks, such as bulk procurement of energy-efficient technologies and white certificates10 can help by driving down product costs and ensuring that those technologies deliver energy savings. Industries IV.55 Industry accounts for 38 per cent of global final energy consumption and around one-fourth of total CO2 emissions (IEA, 2022f). Proactive Government policies in this regard may help small and medium-sized enterprises, that may not have had so far sufficient exposure to these technologies. The adoption of energy management systems such as ISO 50001 – the global standard for energy management – is driven by Government policies or incentives in many countries. Climate-resistant Agriculture/Infrastructure IV.56 Agriculture globally accounts for 25 per cent of GHG emissions, with four per cent contribution to global GDP. Adapting suitable technologies for climate change mitigation measures in agriculture is important as it still accounts for a large share of income in many low-income countries, absorbing a sizeable proportion of the labour force. Climate Smart Agriculture (CSA) practices have been recognised globally for developing sustainable agri-food systems, in line with the Food and Agriculture Organisation (FAO) Strategic Framework 2022-2031. IV.57 Technological advancements in agriculture at various phases of the crop life cycle through Integrated Pest Management (IPM), Conservation Tillage and Enhanced Nutrient Management are crucial and should be promoted through public investment for long-term sustainability. Furthermore, awareness about the role of precision agriculture techniques for mass agricultural production should be further enhanced as empirical studies show that it can reduce the amount of chemicals required for optimum cultivation and reduce the level of nitrogen residue (Bongiovanni et al., 2004). IV.58 The relevance of these new agricultural technologies has increased in India due to growing climatic events like erratic rainfall, cloudbursts and heat waves. Many start-ups in the agri-tech space are providing sustainable solutions for improving farm productivity, reducing crop losses, better crop storage and lowering dependence on water and weedicides. The advancements in methods of agricultural practices may bring about substantial environmental benefits such as increased water retention capacity and accumulation of organic carbon. IV.59 Enhanced usage of technologies such as mapping and surveying, airborne laser scanning, satellite remote sensing, tide gauges, satellite altimetry and GPS could help develop robust climate change adaptation mechanisms to minimise the impact of these shocks. Building a climate-resistant infrastructure network is also important given its spillovers to other sectors of the economy. A study on the potential impact of a major flood in Paris found that the infrastructure sector could bear 30 to 55 per cent of the direct cost of flood damage (OECD, 2018). Resilient infrastructure networks are key for reducing direct losses and negating the challenges posed by climate vulnerabilities. India’s aspirations to build a strong infrastructure network are reflected in recent initiatives such as the National Infrastructure Pipeline, the National Logistics Policy and GATI Shakti. India has spearheaded the global initiative for robust regional disaster management systems by launching the Coalition for Disaster Resilient Infrastructure (CDRI) (Das, 2023). 4. Trade Policy IV.60 Since the mid-1980s, with the rise of globalisation, EMEs have seen a rapid increase in production-related carbon emissions, in part due to production for exports (Chart IV.11). International carbon emission transfers (from AEs to EMEs) increased much faster than growth in international trade and GDP in the 1990s and early 2000s; however, they have been declining since 2006 (Peters et al., 2011). Notwithstanding the distinct deglobalisation since 2018 driven by geo-economic forces, emission transfers through trade remain a major challenge. IV.61 International trade leads to GHG emissions in multiple ways and measuring the overall impact of trade on carbon emissions is a complex task. Over the past decades, GHG emissions from production and transport of traded goods and services have increased. There has been growing evidence suggesting that increasing global trade may lead to environmental degradation (Abman and Lundberg, 2020). It is estimated that 20-30 per cent of GHG emissions have been due to international trade (WTO, 2021). Economic growth and productivity increases have been regarded as the potential gains from trade liberalisation, but the impact of such liberalisation on the environment is debatable (Grossman and Krueger, 1995).  IV.62 While AEs tend to be net importers of GHG emissions, EMEs and commodity-dependent economies tend to be net exporters (WTO, 2021). Policy initiatives and advancements in environmental and energy efficiency technologies can reduce GHG emissions associated with production for exports and their transportation. In this context, international trade can play a crucial role in diffusing green technologies and improving carbon efficiency by (i) focusing on green and clean energy products in regional trade agreements; (ii) reducing the carbon content of international trade and (iii) promoting environmental quality standards and eco-labelling. Climate change focus in regional trade agreements IV.63 Regional trade agreements (RTAs) have generally proliferated with the recent geo-economic shifts and the preference for friend-shoring. Currently, 355 RTAs are in force worldwide, covering more than half of total international trade (WTO, 2022). Traditionally, the primary focus of RTAs has been on lowering tariff and non-tariff barriers to trade; however, there has been an increasing tendency towards the inclusion of environment-related provisions. RTAs, by including environmental provisions, can serve twin objectives – avoid adverse impact of trade liberalisation on the environment and promote trade of green goods. IV.64 Broadly, the following areas have been identified for inclusion of necessary environmental provisions in trade agreements – removal of tariff and non-tariff barriers on green goods and services; clauses regarding environmentally harmful/beneficial subsidies; border adjustment carbon taxes; green procurement; international cooperation on climate change goals; and regulatory coherence (The Economist, 2019; J Ferrante, 2016). Almost 97 per cent of all RTAs notified to the WTO include at least one environmental provision (WTO, 2022a). IV.65 India has so far signed 14 Free Trade Agreements (FTAs) with its trading partners. In addition, it has signed 6 limited coverage Preferential Trade Agreements (PTAs). The TREND database covers PTAs signed up to 2021 and includes information on 16 agreements signed by India. On average, each PTA in India contains around 12 environmental provisions. An examination of the environmental provisions in India’s PTAs reveals that around 70 per cent of these provisions are only in 3 PTAs, with Singapore, Japan and South Korea. Most of the Indian PTAs include provisions on the conservation of natural resources, general exceptions for trade in goods if they are related to the life (health) of animals and/or plants, etc. Many relevant environmental provisions, such as commitments to enforce domestic environmental measures, promote production of renewable energy and energy efficiency and dispute settlement mechanisms which are present in most of the other countries’ PTAs are either missing or are present only in one or two of India’s PTAs (Table IV.7). IV.66 India’s recently signed PTAs are more comprehensive and include provisions relating to the environment. For instance, a reference to environmental protection is included in the preamble to India’s agreements with the UAE and Mauritius. Going forward, India’s future agreements are expected to cover more detailed climate and sustainable development provisions, given the emphasis being put by potential FTA countries/regions such as the UK, Canada, and the EU on climate change. Environmental provisions in trade agreements can be effective in improving environmental welfare, but they need to be specific and legally binding (Brenton and Chemutai, 2021). | Table IV.7: Environmental Provisions in Most of the Global PTAs | | | Description of Provision | Presence in India’s PTAs | | 1 | Conservation of natural resources | ✓ | | 2 | General exceptions for trade in goods if relate to the life (health) of animal/plant | ✓ | | 3 | Norms relating to technical barriers to trade | ✓ | | 4 | Sanitary and phytosanitary measures and environment | ✓ | | 5 | Implementation of obligations found in other environmental agreements (such as commitments at the Rio Summit, Millennium Development Goals, etc.) | ✓ | | 6 | Environment reference in preamble | ✓ | | 7 | Coherence with domestic trade or investment policies | ✓ | | 8 | Level of environmental protection such as not relaxing environmental measures to encourage trade | × | | 9 | Sovereignty in determining own environmental policies | × | | 10 | Conservation of forests | × | | 11 | Promote production of renewable energy and energy efficiency | × | | 12 | Interaction between energy policies/agriculture/transport and environment | × | | 13 | Binding obligations such as commitment to enforce domestic environmental measures | × | | 14 | Pesticides, fertilisers, toxic or hazardous products and chemicals | × | | 15 | Contact point on environmental matters | × | | 16 | Establishment of an inter-Governmental committee | × | | 17 | Dispute settlement mechanisms | × | | 18 | Education or public awareness for environmental protection | × | | 19 | Joint scientific cooperation on environment protection including monitoring/assessment | × | | 20 | General obligation to exchange information related to the environment including provision of information when taking measures to protect the environment | × | | 21 | Exclusion of environmentally harmful inventions from patentability | × | | 22 | Technical assistance, training or capacity-building provided to another party for environmental protection | × | | Source: TRade and ENvironment Database (TREND). Morin, JF, A. Dür and L. Lechner (2018), “Mapping the trade and environment nexus: Insights from a new dataset”, Global Environmental Politics, vol. 18(1). | IV.67 India needs to use its RTAs to facilitate and promote export of goods and services required in the clean energy sector, where it has a comparative advantage. India is the highest ranked G20 country according to the Climate Change Performance Index 2023 and is also the fifth best performing country globally (RBI, 2023). Many Indian companies have aggressively expanded their investment in green sectors such as solar equipment manufacturing, green hydrogen production and energy storage, thereby increasing India’s export potential in a world that is increasingly becoming averse to importing carbon-intensive products. The Government’s Production Linked Incentive (PLI) scheme also promotes green investment by incentivising manufacturing of electric vehicles, solar photovoltaics, and automotive cell company (ACC) batteries. There is a need to link such incentive schemes with environment-related performance parameters (Box IV.3). Additional policy support through trade agreements would foster these efforts to increase green exports of the country. IV.68 EMEs face the challenge of identifying and avoiding the incorporation of protectionist measures under the pretext of environmental policy by their AE trade partners (The Economist, 2019). Therefore, EMEs, including India, need to develop and employ expertise while finalising future trade agreements so that effective provisions can be incorporated in the areas where synergies between trade and environmental objectives can be established while retaining autonomy on domestic environmental policy. Another daunting challenge for EMEs may emerge from the proposal to introduce a carbon border tax (CBT) by some of the AEs to restrict imports from countries having less stringent environment protection laws. Besides progressively reducing the carbon content of India’s export basket, FTAs should emphasise transfer of technologies that could facilitate green transition. Box IV.3

Green PLI: Exploring India’s Export Potential in Climate Friendly Goods (CFGs) On April 7, 2021, the government approved the Production Linked Incentive (PLI) scheme for high-efficiency solar PV modules. This is an important step towards gradually replacing fossil-fuel-derived energy with renewable energy. To explore India’s trade opportunities in 64 climate-friendly goods (CFGs) with India’s major trade partners, the CFGs are identified under 6-digit HS code following the Dinda (2013) approach. The sub-groups under CFGs are classified under various categories related to (i) clean coal technologies, (ii) wind energy; (iii) solar PV systems and (iv) energy-efficient lighting. The optimal mix of trade partners and product categories in CFGs is identified for boosting India’s export potential. India’s major trading partners since 2007 are examined using centroid clusters that best fit the data, applying the K-means clustering algorithm. By minimising within-cluster variation, the clustering method attempts to determine the centroid position from a cluster of data points.  The centroid coordinates are identified as (2.69, 0.07) and (-0.30, -0.01). In the case of cluster 1, it is observed that India’s exports share of CFGs is relatively high for those importing countries with whom India has a relatively lower overall export share. Whereas cluster 2 analysis reveals that, India exports share of CFGs is low with importing countries with whom India has a high overall exports share (Chart 1). The trade cluster analysis can provide insights on developing effective trade engagements to enhance India’s export prospects in a world that is increasingly differentiating imports based on their carbon content. References: Dinda, Soumyananda (2013): Climate Change Creates Trade Opportunity in India. Working Paper at A.K.Dasgupta Centre, Visva Bharati | Reducing carbon content of international trade IV.69 The amount of GHG emissions embedded in an economy’s international trade is determined by a broad range of factors, including the size of the economy, the sectoral composition of its foreign trade, its level of participation in global value chains (GVCs), the modes of transportation used for its imports and exports, and the energy efficiency of its production system, which depends in part on environmental and energy policies. IV.70 Carbon emissions embedded in production differ considerably across economies. EMEs tend to emit more emissions per unit of output than AEs (Box IV.4). With a few exceptions, indirect emissions embedded in production tend to be greater than direct emissions embedded in production. The amount of indirect emissions embedded in production tends to be higher in such economies that are particularly active in downstream supply chains. Conversely, economies active in upstream supply chains tend to have lower indirect emissions embedded in production. Box IV.4

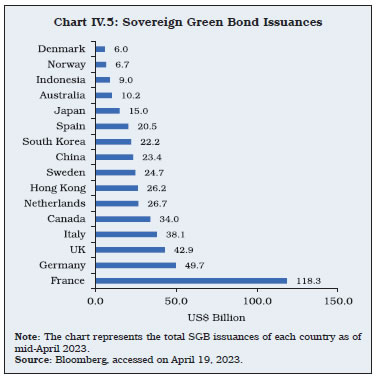

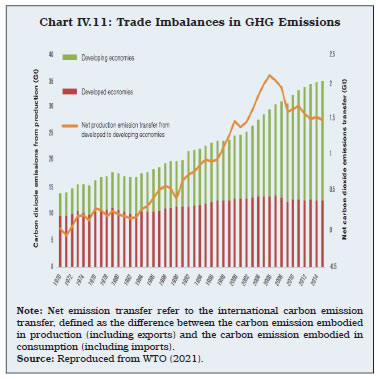

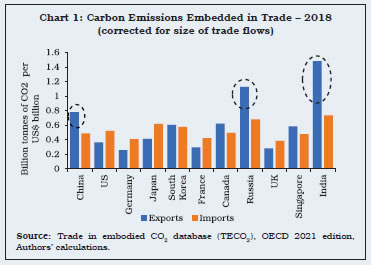

Carbon Emissions Embedded in International Trade – India’s Perspective Total carbon emissions embedded in gross exports (around 9.7 gigatonnes of CO2) accounted for around 29 per cent of global emissions in 2018 (Source: TECO2 database, 2021 edition, OECD). While global carbon emissions have increased by approximately 57.3 per cent between 1995 and 2018, global emissions embedded in exports have risen by about 90 per cent over that period. Considering the carbon content of global trade, corrected for the size of trade flows, it is observed that CO2 emissions per unit of exports are considerably higher for the EMEs, while their imports emit comparatively less CO2 (Chart 1). An in-depth analysis of the sources of trade-related emissions and their evolution can help in devising efficacious emission-abatement policies. Net CO2 emission of exports are calculated as the difference between domestic CO2 emissions embedded in a country’s exports (EEE) and foreign CO2 emissions embedded in its imports (EEI) (Kim and Tromp, 2021). Further, a comparison between CO2 emissions and value-added in India’s trade can indicate the environmental costs and economic benefits of trade (Table 1). Net value-added is the difference between domestic value-added in the country’s exports (VAX) and foreign value-added in the country’s imports (VAM).