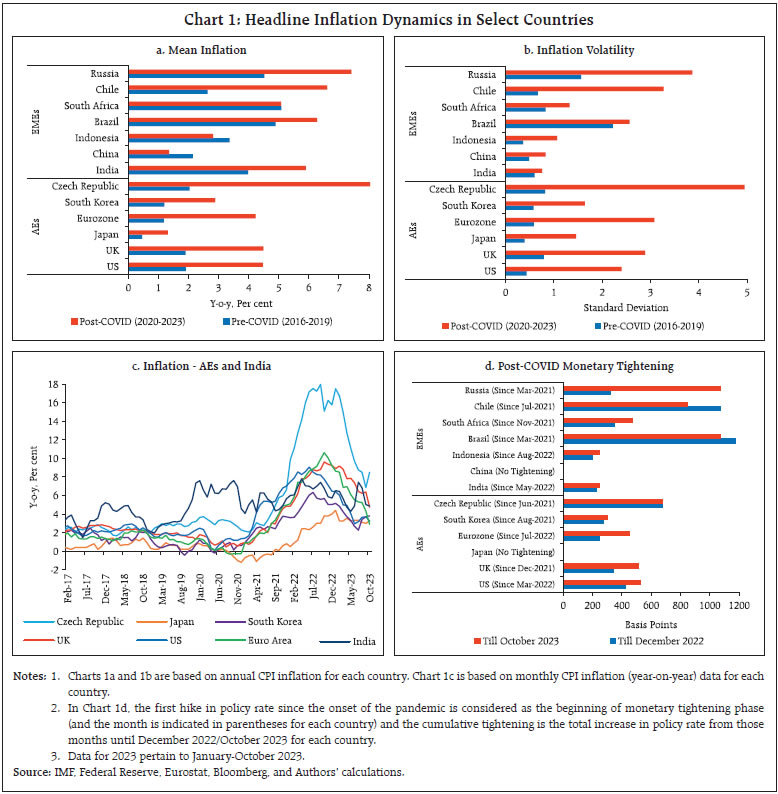

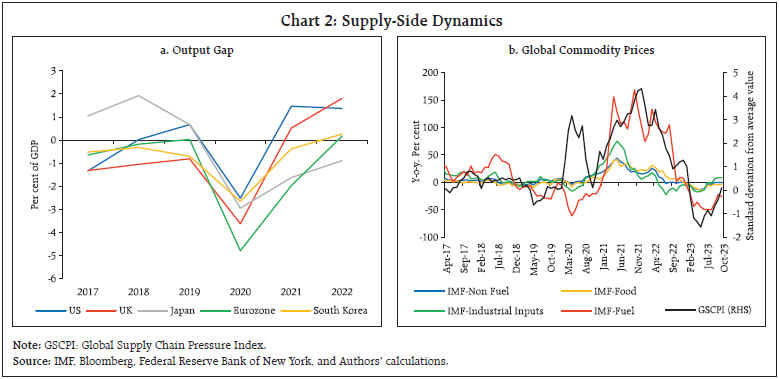

by Nishant Singh and Binod B. Bhoi^ The COVID-19 pandemic triggered large-scale policy stimulus across advanced economies (AEs) and emerging market economies (EMEs). Inflation, which softened initially on economic contraction in 2020 after the onset of the COVID pandemic, started rising in 2021 with the easing of COVID-time restrictions and reached multi-year highs in 2022 following the Russia-Ukraine conflict. Notwithstanding common global shocks, inflation surges varied across economies, both in terms of level and persistence. Using panel-data Phillips Curve framework, this study investigates the impact of pandemic-induced fiscal expansions on inflation in select AEs and EMEs, controlling for supply-side factors. The empirical analysis suggests that countries with larger fiscal stimulus, on average, experienced higher post-pandemic inflation. I. Introduction In an inter-connected world, economic shocks occurring at one place carry the potential to impact other economies across the globe through trade, finance, and confidence channels. Two successive black swan events, i.e., the outbreak of the COVID-19 pandemic1 and the Russia-Ukraine conflict2 have invoked large-scale adverse macroeconomic effects, including shocks to the trajectory of global inflation. Global output, after declining in 2020, recovered strongly in 2021 benefitting from quick vaccination development and the release of pent-up demand, with a further boost from massive policy support – both fiscal and monetary. The pandemic-induced health crisis along with supply-side disruptions and significant loss of economic output prompted governments across the globe to cushion the health and economic damage with large-scale fiscal measures encompassing additional spending or revenue forgone (10.2 per cent of world GDP) and liquidity support including contingent liabilities (6.2 per cent of world GDP) (IMF, 2021). Additionally, central banks infused massive liquidity through both conventional and unconventional measures and cut policy interest rates to multi-year lows, close to the zero-lower bound in AEs. However, the interventions varied across economies both in terms of size and composition, with the combined fiscal stimulus in AEs making up for more than 80 per cent of the worldwide fiscal response and being more inclined towards direct transfers like stimulus payments to individuals and families, unemployment benefits, direct tax rebates, and loans and credit guarantees to businesses. While sizeable fiscal support continued for longer in advanced economies (AEs) providing the base for a faster recovery, many emerging market and developing economies (EMDEs) faced a squeeze in their fiscal space due to reprioritisation of expenditure towards pandemic-related emergencies (IMF, 2021). With the reopening of economies and possibly the stimulative policy support, energy and food prices started increasing in 2021 (Blanchard and Bernanke, 2023). However, these price pressures were initially considered transitory in nature and the policy support continued (Walsh, 2022). Alongside economic recovery and the prolonging of the supply chain disruptions, the price pressures persisted and accentuated and the world witnessed a surge in Consumer Price Index (CPI) inflation beginning the second half of 2021. The outbreak of Russia-Ukraine conflict in February 2022 further amplified supply disruptions and created shortages in key food and energy products leading to sharp increase in global commodity prices. In an environment of stimulus-led economic recovery, this led to a further surge in inflation across economies above their targets to multi-year highs (IMF, 2022). Subsequently, this coupled with the realisation that the existing price pressures may not be transitory prompted central banks to pursue aggressive monetary policy tightening to contain inflation and anchor inflationary expectations. In India, as in the case of other countries, the pandemic-induced lockdowns and supply chain disruptions led to contraction in real GDP by 5.8 per cent in 2020-21. Unlike the case in other countries, CPI headline inflation in India3, however, had increased before the onset of the pandemic due to weather-induced food price shocks, which persisted reflecting supply chain disruptions and supply-demand imbalances in the economy following COVID-19 driven lockdowns and restrictions. The central government and the Reserve Bank of India (RBI) introduced a judicious mix of fiscal and monetary policies and announced a special economic and comprehensive package equivalent to 10 per cent of India’s GDP4 to mitigate the negative impact of the pandemic. Reflecting the contraction in GDP and fiscal stimulus announced, the gross fiscal deficit (GFD) of the central government rose to 9.2 per cent of GDP in 2020-21. Fiscal policy measures in India, however, were targeted at vulnerable segments with primary focus on social protection and healthcare during the early stages of the pandemic, aided by additional public investment and support schemes targeting specific sectors later. On the monetary policy front, the policy repo rate was reduced by a cumulative 115 basis points (bps) to 4.0 per cent in a short span of three months (March-May 2020), while liquidity provisions of around 8.7 per cent of GDP were made through both conventional and unconventional measures to ensure adequate liquidity in the system, stimulate the economy, and maintain financial stability (Das, 2023a). Moreover, liquidity measures were targeted (at various market segments or meeting the sectoral credit needs) and time-bound (most measures had pre-specified sunset dates) in nature (Patra and Bhattacharyya, 2022). Given the heightened uncertainties associated with the evolution of the pandemic, the need for fiscal consolidation was recognised early even as fiscal policy continued to address pandemic time distress. In this regard, the Union Budget for 2021-22 announced in February 2021 provided for a gradual fiscal consolidation path to lower fiscal deficit to 4.5 per cent of GDP by 2025-26 (RBI, 2022). This was accompanied with a focus on capital expenditure to accelerate growth and place the ongoing recovery on a strong footing (RBI, 2023). On the monetary front also, it was realised early that an excessively expanded central bank balance sheet for long could have implications for macroeconomic and financial stability. Accordingly, the pandemic time unconventional liquidity support measures were allowed to expire as per the embedded sunset clauses. In fact, while designing the liquidity measures in response to the pandemic, it was kept in mind that what is being rolled out needs to be rolled back in time and in a non-disruptive manner (Das, 2023b). As a result, RBI’s balance sheet, which had increased to 28.6 per cent of GDP in 2020-21, moderated to 23.3 per cent of GDP in 2022-23. Thus, monetary and fiscal policies were coordinated in India during the pandemic. With both AEs and EMDEs experiencing a surge in inflation, there is a growing interest in understanding the underlying drivers of what is often termed as ‘globalisation of inflation’. The diverse inflation outcomes observed across economies have raised a research question about the potential link between size of fiscal stimulus and inflation, with several studies suggesting that fiscal stimulus played a significant role behind the inflation surge in 2021-2022 (Binici, et al., 2022; IMF, 2022; Bonatti, et al., 2022; De Soyres, et al., 2023). Against this backdrop, this paper attempts to investigate the potential association between pandemic-induced fiscal support and inflation in select economies using a panel data model in a Phillips Curve (PC)5 framework on annual data (calendar year) for the period 2001 to 2022. For the empirical exercise, this study covers a sample of 13 AEs and EMEs, including India, representing diverse geographical locations for better representation. The empirical analysis suggests a statistically significant and positive relationship between fiscal expansion and inflation for countries with higher than median fiscal gap during the post-COVID period. The rest of the paper is organised into five sections. Section II provides a description of the post-pandemic macroeconomic developments. Section III reviews the relevant literature which guides the choice of variables and specification of the model. Section IV provides information on methodology and empirical strategy, followed by results in Section V. Section VI concludes the paper. II. Stylised Facts II.1 Macroeconomic Conditions Headline inflation across several AEs reached decadal highs with post-COVID 4-year average (2020-2023) inflation turning significantly higher than the pre-COVID 4-year average (Chart 1a). Several EMEs also experienced multi-year highs in headline inflation during the same period. Along with the surge in inflation, the volatility6 also increased in the post-pandemic period, reflecting heightened macroeconomic uncertainty (Chart 1b). Across economies, the rise in inflation started largely in the second half of 2021 and persisted in 2022 (Chart 1c), which led to synchronised monetary policy tightening (Chart 1d). The outbreak of the COVID-19 pandemic resulted in a recession across economies. Localised and nation-wide lockdowns caused widespread disruption to the businesses, supply chains, and labour markets, and a sharp decline in economic activity leading to negative output gap across AEs (Chart 2a). With gradual opening of the economies from the lockdowns/restrictions following the vaccine rollout, economic activity began to recover, and commodity prices started rising in 2021 reflecting supply chain pressures including high shipping and transportation costs (Chart 2b). The Russia-Ukraine conflict created shortages and further escalated price pressures in food and energy commodities in 2022. II.2 Support Measures across Economies With the objective of supporting economic activities and protecting people from the adverse consequences of the pandemic, governments and central banks around the world responded with unprecedented fiscal and monetary policy actions, including large-scale fiscal stimulus measures, interest rate cuts and liquidity support. The pandemic time support measures across economies encompassed fiscal measures (grants, tax reliefs, tax deferrals, equity participations, loans, and guarantees) as well as conventional (interest rate and reserve requirement changes as well as financing operations) and unconventional (asset purchases) monetary policies, capital and non-capital prudential regulations targeting the banking sector, and other policies such as moratoria, prudential policies affecting non-banks, and market-based measures (Kirti, et al., 2022).

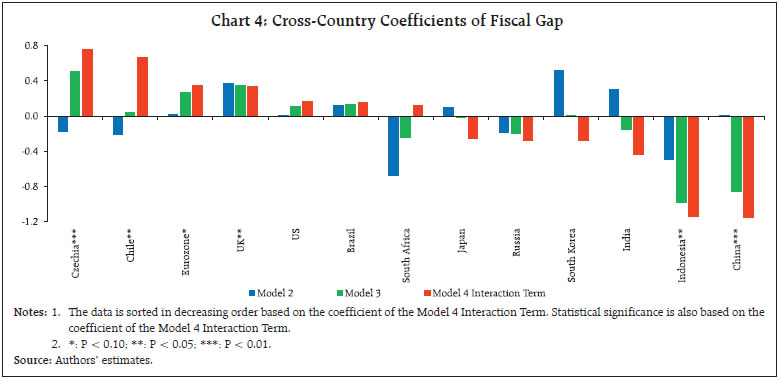

In India, the fiscal measures were calibrated to address the evolving healthcare needs of people, protecting the vulnerable sections of the society, and supporting businesses and households to tide over the unforeseen consequences of the pandemic. These measures, among other, include provision for the country’s COVID-19 vaccination program, distribution of free foodgrains for the poor, provision for interest-free loans to states, measures to ease the tax compliance burden, and adjustments in customs duties and other applicable taxes on health related items. Fiscal measures also included reduction in excise duties on fuel products to limit pass-through of higher international oil prices as well as allowing imports of inflation-sensitive food items at lower duties as also imposing restrictions on exports and prescribing stock limits for traders/wholesalers for a temporary period to augment domestic availability and contain price pressures. On the monetary side, apart from reducing the policy rate and enhancing provision of system level liquidity, targeted credit support was provided to specific sectors and entities in distress7. Across economies, the extent of direct fiscal stimulus and liquidity support varied with the size of total combined stimulus being higher in AEs than that of EMEs8 (Chart 3a). Compared to the pre-pandemic period, the association between fiscal intervention and inflation turns out to be stronger and more visible in the post-pandemic period (Chart 3b and 3c). There may be multiple reasons behind higher stimulus in AEs than EMEs: (1) higher prevalence and severity of the pandemic in AEs, (2) higher room for fiscal policy and lower financing costs in AEs, and (3) structural factors like stronger economic and institutional mechanisms allowing a forceful fiscal reaction (Alberola, et al., 2021). III. Literature Review Both fiscal and monetary policies impact inflation through various channels. Fiscal spending may impact prices when economic agents perceive that increase in public debt may not be matched by future budget surpluses (Cochrane, 2023). Expansionary fiscal policies can stoke inflation if they cause overheated labour market and positive output gap (Blanchard and Bernanke, 2023). Burriel et al., (2009) finds that inflation increases in response to government spending shocks. However, the impact of fiscal policy on inflation varies depending on factors such as potential supply-side dynamics (Jørgensen and Ravn, 2022), fiscal space, and prevailing economic conditions (Cevik and Miryugin, 2023). The inflationary impact of fiscal deficits is generally higher in regimes with less central bank independence (Banerjee, et al., 2022) and high level of public debt (Kwon, et al., 2009). However, a few studies find no clear evidence of fiscal expansion leading to inflation, such as Magazzino (2011) in case of Mediterranean countries and Canova and Pappa (2007) for the US and EU area. For India, government spending appears to have positive short-run impact on inflation, which is consistent with the Keynesian view (Nguyen, 2019). Fiscal interventions like subsidies in the form of direct cash transfers to final consumers could also be inflationary in the short run as increased demand may push up prices (RBI, 2013). Moreover, it is argued that in India, fiscal deficits would be inflationary only if the system is at full employment or is characterised by supply bottlenecks in certain sectors (RBI, 2003). The impact of monetary policy on inflation is more straightforward and well recognised in the literature (Gali, 2015). The literature (Jašová, et al., 2018) also supports the existence of cross-country Phillips curve (PC). The global surge in inflation since 2021 has also reignited interest in assessing the role of post-pandemic expansion in central bank balance sheet in fuelling inflation, against the backdrop of the missing inflation puzzle encountered after the global financial crisis (Pattanaik, et al., 2022). Since 2021, inflation has increased rapidly all over the world due to a strong post-pandemic recovery driven by fiscal and monetary accommodation, the presence of supply side disturbances, and the emergence of extraordinary cost-push shocks linked with the energy crisis (Bonatti, et al., 2022). Using cross-country data, Hale et al. (2023) finds that consumer-targeted fiscal measures were inflationary. In the US, large fiscal stimulus was successful at boosting consumption which, coupled with relatively inelastic supply, led to the price pressures (De Soyres, et al. 2023). Further, it is argued that larger fiscal stimulus packages and tighter labour markets are associated with greater inflation acceleration across countries (Hobijn, et al., 2022). IV. Methodology and Empirical Strategy Given the cross-country differences in the size and nature of pandemic-induced policy interventions, the objective of this article is to examine whether such differences were a factor in the observed differences in inflation across economies. The study, therefore, undertakes a cross-country panel Phillips Curve (PC) based empirical analysis covering thirteen AEs and EMEs and using annual data for 2001-2022 (calendar year). The United States (US), United Kingdom (UK), Japan, South Korea, Czech Republic and Euro Area (19 countries) represent AEs, while India, China, Indonesia, Brazil, South Africa, Chile, and Russia represent EMEs. To account for the cross-country differences, the study pursues a fixed effects panel regression model. In order to properly identify the impact of the pandemic-time fiscal policy stimulus along with their cross-country differences on inflation, the study controls for other potential determinants such as exchange rate and global commodity prices. The form of fiscal variable used in the empirical exercise is guided by the post-pandemic literature. To represent fiscal stimulus, De Soyres (2023) and Hobijn, et al. (2022) use shocks to government spending (gap or deviation from pre-pandemic trend or projection), Hale et al. (2023) uses cumulative fiscal support as per cent of GDP, Cevik and Miryugin (2023) uses budget balance (or fiscal deficit) as per cent of GDP, while Banerjee et al. (2022) uses changes in fiscal deficits as per cent of GDP. We use shocks (gap or deviation from respective country trend) to fiscal deficits as per cent of GDP to account for the counter-cyclical behaviour of fiscal support as a response to the state of the economy (depending on economic growth and inflation). The target variable, i.e., headline inflation (y-o-y) is found to be stationary for the panel sample used in the study (Annex Table A1). Granger causality test suggests unidirectional causality from fiscal deficit gap (deviation from its trend) to inflation and not vice versa (Annex Table A2). The study uses annual data on economic variables from alternative official sources – CPI, GDP, GFD and global commodity prices from the IMF and exchange rates from the BIS (Annex Table A3). V. Results Alternative PC-based panel models (with and without the fiscal variable) were estimated, controlling for supply shocks (Table 1). The empirical results support the existence of cross-country PC across all models - Model 1 for the pre-pandemic period, which holds even when the fiscal gap is introduced in Model 2. Model 3 confirms the existence of PC for the post-pandemic period as well. While the fiscal gap is insignificant in both the pre-pandemic period (Model 2) and the post-pandemic period (Model 3), the same turns out to be significant in Model 4, which captures the interaction of the fiscal gap with the country-specific dummy (used to identify the countries with high fiscal intervention in the post-pandemic period). This suggests that the fiscal gaps were positively associated with inflation in economies with high fiscal intervention in the post-pandemic period. In other words, the deviation of fiscal deficit as per cent of GDP from its trend played a key role in the inflation surge in the post-pandemic period. The country-specific coefficients extracted from the panel estimates indicate that the association between fiscal gaps and inflation in the post-pandemic period is stronger mainly in countries with higher fiscal intervention (Chart 4). In the case of India, statistically insignificant coefficient suggests that the post-pandemic fiscal support was not associated with higher inflation. | Table 1: Panel Regression Results | | Dependent Variable: Headline Inflation (y-o-y) | | | Pre-pandemic (2004-2019)

Sample Size = 208 | Full Sample (2004-2022)

Sample Size = 247 | | | Model 1 | Model 2 | Model 3 | Model 4 | | Explanatory Variables | Coefficient | Coefficient | Coefficient | Coefficient | | Constant | 1.44*** | 1.40*** | 1.51*** | 1.55*** | | Inflationt-1 | 0.33*** | 0.33*** | 0.47*** | 0.45*** | | Trend Inflationt | 0.18* | 0.19* | 0.07 | 0.06 | | Output Gapt-1 | 0.22*** | 0.19*** | 0.20*** | 0.20*** | | NEER Growtht | -0.10*** | -0.11*** | -0.08*** | -0.07*** | | IMF Fuel Price Index Growtht | 0.02*** | 0.02** | 0.03*** | 0.02*** | | IMF Non-Fuel Price Index Growtht | 0.03** | 0.03** | -0.00 | 0.00 | | FDGDP Gapt-1 | | -0.08 | 0.04 | -0.07 | | FDGDP Gapt-1 * DUMMYHigh Fiscal | | | | 0.37*** | | R2 | 0.77 | 0.77 | 0.68 | 0.69 | | Adjusted R2 | 0.75 | 0.75 | 0.65 | 0.67 | Notes: 1. FDGDP: Fiscal Deficit as per cent of GDP; NEER: Nominal Effective Exchange Rate.

2. Trend inflation is estimated using Hodrick Prescott (HP) filter.

3. FDGDP Gap is calculated as deviation of actual FDGDP from its trend, where trend is previous 4-year average. DUMMYHigh Fiscal is a dummy variable, used to identify the countries with high fiscal intervention, i.e., above-median fiscal gap, in the post-pandemic period.

4. *: P < 0.10; **: P < 0.05; ***: P < 0.01.

Source: Authors’ estimates. |

For a robustness check, an alternative measure of fiscal gap, i.e., actual fiscal deficit as per cent of actual GDP minus cyclically adjusted fiscal deficit as per cent of potential GDP published by the IMF was also used for estimation and the results were found to be broadly similar (Annex Table A4). As another robustness check, the Phillips curve model is estimated controlling explicitly for monetary and liquidity support provided during the pandemic captured through monetary base (M0) of the central bank (over and above what is explained through the output gap channel) and the results still hold (Annex Table A5). VI. Conclusion Global macroeconomic situation has become uncertain in the post-pandemic period. With the surge in CPI headline inflation in the second half of 2021 across both AEs and EMEs, an assessment of pandemic-induced fiscal policy actions has become an emerging area of discussion. Using cross-country panel data analysis in a PC-based framework, this study attempts to investigate the impact of pandemic-induced fiscal interventions on headline inflation across economies, controlling for supply side factors and also the monetary and liquidity support measures. The empirical results suggest that larger fiscal expansion (relative to trend) have been associated with higher inflation outcomes in the post-pandemic period. This is also corroborated by the signs and significance of the coefficients extracted from the panel regression results for countries with larger fiscal stimulus. Conversely, countries with moderate fiscal support have experienced relatively moderate inflation outcomes. References Alberola, E., Arslan, Y., Cheng, G., & Moessner, R. (2021). Fiscal Response to the COVID-19 Crisis in Advanced and Emerging Market Economies. Pacific Economic Review, October 26(4): 459-468. Banerjee, R., Boctor, V, Mehrotra, A., & Zampolli, F. (2022). Fiscal Deficits and Inflation Risks: The Role of Fiscal and Monetary Regimes. BIS Working Papers, No. 1028, Bank for International Settlements (BIS). Blanchard, O.J., & Bernanke, B.S. (2023). What Caused the Pandemic-Era Inflation? NBER Working Papers, No. 31417, June. Binici, M., Centorrino, S., Cevik, S., and Gwon, G. (2022). Here Comes the Change: The Role of Global and Domestic Factors in Post-Pandemic Inflation in Europe. IMF Working Papers, WP/22/241, IMF. Bonatti L., Fracasso A., & Tamborini R. (2022). Tackling Global Inflation at a Time of Radical Uncertainty. Publication for the Committee on Economic and Monetary Affairs, Policy Department for Economic, Scientific and Quality of Life Policies, European Parliament, Luxembourg. Burriel, P., Castro, F., Garrote, D., Gordo, E., Paredes, J., and Perez, J. J. (2009). Fiscal Policy Shocks in the Euro Area and the US: An Empirical Assessment. ECB Working Papers, No. 1133, European Central Bank (ECB). Canova, F., & Pappa, E. (2007). Price Differentials in Monetary Unions: The Role of Fiscal Shocks. Economic Journal, Royal Economic Society, Vol. 117(520), April. Cevik, S., & Miryugin, F. (2023). It’s Never Different: Fiscal Policy Shocks and Inflation. IMF Working Papers, WP/23/98, International Monetary Fund (IMF). Cochrane, J. H. (2023). The Fiscal Theory of the Price Level. Princeton University Press. Das, Shaktikanta (2023a). Art of Monetary Policy Making: The Indian Context. RBI Bulletin, September. https://www.rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1381. Das, Shaktikanta (2023b). Central Banking in Uncertain Times: The Indian Experience. Opening Plenary Address Delivered at the Summer Meetings organised by Central Banking, London, UK on June 13, 2023. https://www.bis.org/review/r230622l.pdf De Soyres, F., Santacreu, A. M., and Young, H. (2023). Demand-Supply Imbalance During the COVID-19 Pandemic: The Role of Fiscal Policy. Federal Reserve Bank of St. Louis Review, First Quarter 2023, Federal Reserve. Gali, J. (2015). Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework and its Applications. Princeton University Press. Hale, G., Leer, J. C., and Nechio, F. (2023). Inflationary Effects of Fiscal Support to Households and Firms. Federal Reserve Bank of San Francisco Working Papers, No 2023-02, Federal Reserve. Hobijn, B., Miles, R., Royal, J, & Zhang, J. (2022). What Is Driving U.S. Inflation Amid a Global Inflation Surge? Chicago Fed Letter, No. 470, August 2022, Federal Reserve Bank of Chicago. IMF. (2021). IMF Fiscal Monitor; Policy Tracker; Database of Country Fiscal Measures in Response to the COVID-19 Pandemic, International Monetary Fund. IMF. (2022). Countering The Cost-of-Living Crisis. World Economic Outlook, October 2022, IMF. Jašová, M., Moessner, R., & Takáts, E. (2018). Domestic and Global Output Gaps as Inflation Drivers: What Does the Phillips Curve Tell? BIS Working Papers, No. 748. Jørgensen, P. L. & Ravn, S. H. (2022). The Inflation Response to Government Spending Shocks: A Fiscal Price Puzzle? European Economic Review, Vol. 141(C). Kirti, D., Liu, Y., Peria, S. M., Mishra, P., & Strasky, J. (2022). Tracking Economic and Financial Policies During COVID-19: An Announcement-Level Database. IMF Working Papers, WP/22/114, IMF. Kwon, G., McFarlane, L., & Robinson, W. (2009). Public Debt, Money Supply, and Inflation: A Cross-Country Study. IMF Staff Papers, Vol. 56, IMF. Magazzino, C. (2011). The Nexus Between Public Expenditure and Inflation in the Mediterranean Countries, Theoretical and Practical Research in Economic Fields, II, 1(3). Nguyen, T. D. (2019). Impact of Government Spending on Inflation in Asian Emerging Economies: Evidence from India, China, and Indonesia. The Singapore Economic Review, Vol. 64, No. 05, pp. 1171-1200. Patra, M. D. and Bhattacharyya. I. (2022). Priming Monetary Policy for the Pandemic. Economic & Political Weekly, Vol. LVII No. 20, May 14. Pattanaik, S., Bhoi, B. B. and Behera, H. K. (2022). Central Bank Balance Sheet Size and Inflation: Unravelling the Fuzzy Dynamics. RBI Bulletin, June, Reserve Bank of India. RBI. (2003). Report on Currency and Finance 2001-02, pp IV-23, Reserve Bank of India. RBI. (2013). Report on Currency and Finance 2009-12: Fiscal-Monetary Co-ordination, Reserve Bank of India. RBI. (2022). Annual Report 2021-22, Reserve Bank of India. RBI. (2023). Annual Report 2022-23, Reserve Bank of India. Walsh, C. E. (2022). Inflation Surges and Monetary Policy (No. 22-E-12). Institute for Monetary and Economic Studies, Bank of Japan.

Annex | Table A1: Panel Unit Root Tests | Variable: Headline Inflation (y-o-y)

Null Hypothesis: Presence of Unit Root | | Test | P-Value | | Levin, Lin & Chu t* | 0.08 | | LM, Pesaran and Shin W-Stat*** | 0.00 | | ADF - Fisher Chi-square*** | 0.00 | | PP - Fisher Chi-square*** | 0.00 | Notes: *: P < 0.10; **: P < 0.05; ***: P < 0.01.

Source: Authors’ estimates. |

| Table A2: Dumitrescu-Hurlin Panel Causality Test | | Null Hypothesis | P-Value | | Fiscal Deficit gap does not cause Inflation*** | 0.00 | | Inflation does not cause Fiscal Deficit gap | 0.45 | Notes: *: P < 0.10; **: P < 0.05; ***: P < 0.01.

Source: Authors’ estimates. |

| Table A3: Data Sources | | Information | Source | Variables Used | | Consumer Price Index (CPI) | IMF | CPI Inflation (y-o-y, per cent)

CPI Trend Inflation (y-o-y, per cent) | | Gross Domestic Product (GDP) | IMF | GDP Gap from Trend (per cent) | | Fiscal Deficit (FD) | IMF | FD as per cent of GDP

(FDGDP, Gap from Trend) | | Exchange Rates | BIS | NEER Growth (y-o-y) | | Global Commodity Prices | IMF | IMF Fuel Price Index Growth (y-o-y)

IMF Non-Fuel Price Index Growth (y-o-y) | | Monetary Base (M0) | CEIC, IMF | Monetary Base (M0) Growth (y-o-y) | Notes: 1. Y-o-y: Year-on-Year; NEER: Nominal Effective Exchange Rate.

2. Trend GDP has been calculated using Hodrick-Prescott (HP) filter.

3. FDGDP (Gap from Trend) is calculated as deviation of actual FDGDP from its trend, where trend is based on previous 4-year average. |

| Table A4: Panel Regression Results | | Dependent Variable: Headline Inflation (y-o-y) | | | Pre-pandemic (2004-2019)

Sample Size = 208 | Full Sample (2004-2022)

Sample Size = 247 | | Model 1 | Model 2 | Model 3 | Model 4 | | Explanatory Variables | Coefficient | Coefficient | Coefficient | Coefficient | | Constant | 1.44*** | 1.41*** | 1.35*** | 1.46*** | | Inflationt-1 | 0.33*** | 0.34*** | 0.47*** | 0.46*** | | Trend Inflationt | 0.18* | 0.18* | 0.09 | 0.07 | | Output Gapt-1 | 0.22*** | 0.24*** | 0.25*** | 0.24*** | | NEER Growtht | -0.10*** | -0.10*** | -0.08*** | -0.07*** | | IMF Fuel Price Index Growtht | 0.02*** | 0.02*** | 0.03*** | 0.02*** | | IMF Non-Fuel Price Index Growtht | 0.03** | 0.03** | -0.00 | 0.00 | | FDGDP Gapt-1 | | 0.06 | 0.17* | 0.07 | | FDGDP Gapt-1 * DUMMYHigh Fiscal | | | | 0.27** | | R2 | 0.77 | 0.77 | 0.68 | 0.69 | | Adjusted R2 | 0.75 | 0.75 | 0.66 | 0.66 | Notes: 1. FDGDP: Fiscal Deficit as per cent of GDP; NEER: Nominal Effective Exchange Rate.

2. Trend inflation is estimated using Hodrick Prescott (HP) filter.

3. FDGDP Gap is calculated as actual FDGDP minus IMF-published cyclically adjusted fiscal deficit as per cent of potential GDP. DUMMYHigh Fiscal is a dummy variable, used to identify the countries with high fiscal intervention i.e., above-median fiscal gap, in the post-pandemic period.

4. *: P < 0.10; **: P < 0.05; ***: P < 0.01.

Source: Authors’ estimates. |

| Table A5: Panel Regression Results | | Dependent Variable: Headline Inflation (y-o-y) | | | Pre-pandemic (2004-2019)

Sample Size = 208 | Full Sample (2004-2022)

Sample Size = 247 | | Model 1 | Model 2 | Model 3 | Model 4 | | Explanatory Variables | Coefficient | Coefficient | Coefficient | Coefficient | | Constant | 1.35*** | 1.31*** | 1.45*** | 1.49*** | | Inflationt-1 | 0.37*** | 0.37*** | 0.47*** | 0.45*** | | Trend Inflationt | 0.16* | 0.17* | 0.06 | 0.05 | | Output Gapt-1 | 0.23*** | 0.19*** | 0.20*** | 0.21*** | | NEER Growtht | -0.10*** | -0.10*** | -0.08*** | -0.07*** | | IMF Fuel Price Index Growtht | 0.02** | 0.02** | 0.03*** | 0.02*** | | IMF Non-Fuel Price Index Growtht | 0.03** | 0.03** | -0.00 | 0.00 | | M0 Growtht-1 | 0.01* | 0.01* | 0.01 | 0.01 | | FDGDP Gapt-1 | | -0.08 | 0.04 | -0.07 | | FDGDP Gapt-1 * DUMMYHigh Fiscal | | | | 0.36*** | | R2 | 0.78 | 0.78 | 0.68 | 0.70 | | Adjusted R2 | 0.75 | 0.75 | 0.65 | 0.68 | Notes: 1. FDGDP: Fiscal Deficit as per cent of GDP; NEER: Nominal Effective Exchange Rate.

2. Trend inflation is estimated using Hodrick Prescott (HP) filter.

3. FDGDP Gap is calculated as deviation of actual FDGDP from its trend, where trend is previous 4-year average. DUMMYHigh Fiscal is a dummy variable, used to identify the countries with high fiscal intervention, i.e., above-median fiscal gap, in the post-pandemic period.

4. *: P < 0.10; **: P < 0.05; ***: P < 0.01.

Source: Authors’ estimates. |

|